Please wait

0000822416falseDEF 14Aiso4217:USD00008224162024-01-012024-12-3100008224162023-01-012023-12-3100008224162022-01-012022-12-3100008224162021-01-012021-12-3100008224162020-01-012020-12-31000082241612024-01-012024-12-310000822416ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2024-01-012024-12-310000822416ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberphm:PHMRyanMarshallMember2024-01-012024-12-310000822416ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberphm:PHMRyanMarshallMember2024-01-012024-12-310000822416ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2024-01-012024-12-310000822416ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2024-01-012024-12-310000822416ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2024-01-012024-12-310000822416ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2023-01-012023-12-310000822416ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberphm:PHMRyanMarshallMember2023-01-012023-12-310000822416ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberphm:PHMRyanMarshallMember2023-01-012023-12-310000822416ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2023-01-012023-12-310000822416ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2023-01-012023-12-310000822416ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2023-01-012023-12-310000822416ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2022-01-012022-12-310000822416ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberphm:PHMRyanMarshallMember2022-01-012022-12-310000822416ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberphm:PHMRyanMarshallMember2022-01-012022-12-310000822416ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2022-01-012022-12-310000822416ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2022-01-012022-12-310000822416ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2022-01-012022-12-310000822416ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2021-01-012021-12-310000822416ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberphm:PHMRyanMarshallMember2021-01-012021-12-310000822416ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberphm:PHMRyanMarshallMember2021-01-012021-12-310000822416ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2021-01-012021-12-310000822416ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2021-01-012021-12-310000822416ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2021-01-012021-12-310000822416ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2020-01-012020-12-310000822416ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberphm:PHMRyanMarshallMember2020-01-012020-12-310000822416ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberphm:PHMRyanMarshallMember2020-01-012020-12-310000822416ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2020-01-012020-12-310000822416ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2020-01-012020-12-310000822416ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberphm:PHMRyanMarshallMember2020-01-012020-12-310000822416ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000822416ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310000822416ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-01-012024-12-310000822416ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000822416ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000822416ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000822416ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000822416ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310000822416ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310000822416ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000822416ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000822416ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000822416ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000822416ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310000822416ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310000822416ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000822416ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000822416ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000822416ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000822416ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310000822416ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310000822416ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000822416ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000822416ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000822416ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000822416ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-01-012020-12-310000822416ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-01-012020-12-310000822416ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000822416ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000822416ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-31000082241622024-01-012024-12-31000082241632024-01-012024-12-31000082241642024-01-012024-12-31000082241652024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

PulteGroup, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

March 14, 2025

Dear Shareholders of PulteGroup:

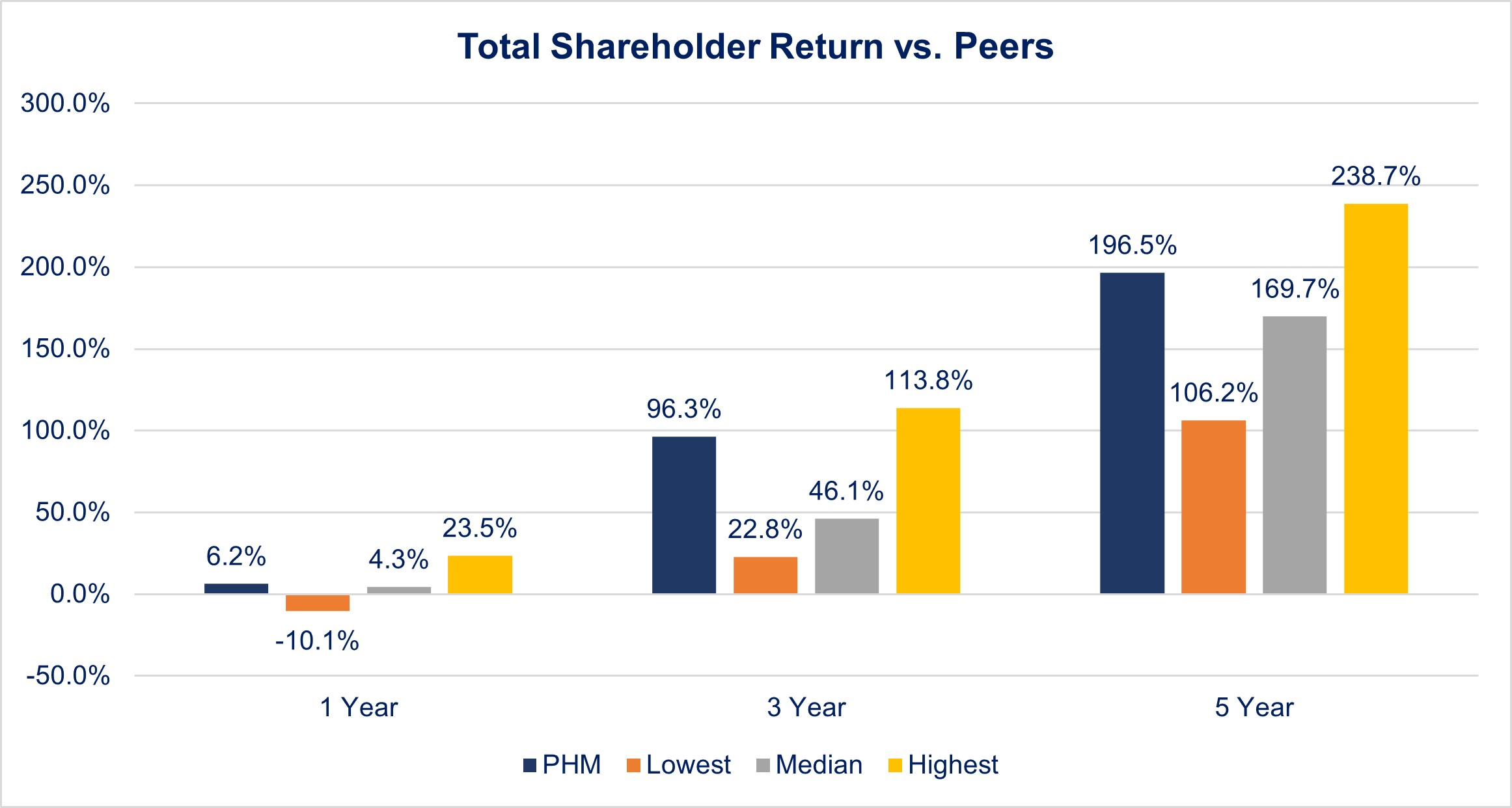

In speaking for the entire Board of Directors, I want to affirm our commitment to providing diligent oversight of PulteGroup’s management team as they work to build shareholder value through ongoing execution of the Company’s long-term strategic plan. Operating against this plan, PulteGroup continues to deliver high returns while allocating capital to its business, to shareholders and to maintaining an outstanding balance sheet.

We are pleased to report that our PulteGroup management team delivered another year of exceptional operating and financial results that are in alignment with its strategic initiatives:

•Driven by a 9% year-over-year increase in home closings, the Company reported record 2024 home sale revenues of $17 billion and record earnings of $14.69 per share on a diluted basis. Record net income helped drive cash flow from operations of $1.7 billion, after investing $5.3 billion into the business through land acquisition and development.

•Generated a return on equity of 27.5%* for 2024, helping to raise its average annual ROE to just shy of 22% over the past decade. Returned $1.4 billion to shareholders through share repurchases and dividends. The Company also brought in over $300 million in outstanding debt, as it lowered its debt-to-capital ratio to 11.8%.

•Organizationally, completed a seamless leadership transition as Jim Ossowski, SVP Finance, was promoted to CFO following Bob O’Shaughnessy announcing his plan to retire after a successful 13-year career. Also, filled a critical technology role with the hiring of Mike Guhl to be Senior Vice President and CIO. Mike joined us from HD Supply, one of the largest industrial distributors in North America, and now oversees the Company’s entire IT function.

Given the interest rate volatility of 2024, and resulting impact on affordability and buyer demand, we want to recognize the exceptional job the entire PulteGroup organization did to navigate the dynamic market conditions.

We look forward to your participation in PulteGroup’s 2025 Annual Meeting of Shareholders which will be held on April 30, 2025, at 1:00 p.m. ET. Our board of directors has fixed the close of business on March 6, 2025, as the record date for determining those holders of our common stock entitled to notice of, and to vote at, the Annual Meeting of Shareholders and any adjournments or postponements thereof.

Given the opportunity for expanded shareholder participation, PulteGroup’s 2025 Annual Meeting will again be held virtually. You will be able to access the live audio webcast of the meeting by visiting www.virtualshareholdermeeting.com/PHM2025. At the time of the meeting, you will be able to vote your shares electronically and submit your questions through the virtual meeting platform. To participate in the meeting, you must have your 16-digit control number that is shown on your Notice of Internet Availability of Proxy Materials or on your proxy card if you elected to receive proxy materials by mail. Please note that in-person attendance at the 2025 Annual Meeting cannot be accommodated.

The Notice of Annual Meeting of Shareholders and Proxy Statement, both of which accompany this letter, provide details regarding the business to be conducted at the meeting, including proposals for: the election of directors; the ratification of the appointment of Ernst & Young LLP as our independent registered accounting firm for 2025; an advisory vote to approve the compensation of our name executive officers; and two shareholder proposals, if properly presented at the meeting.

Our board of directors recommends that you vote “FOR” the ten director nominees named in this Proxy Statement, “FOR” each of Proposals 2 and 3, and “AGAINST” each of Proposals 4 and 5. Each proposal is described in more detail in this Proxy Statement.

Your vote is very important, so please vote your shares promptly, whether or not you expect to attend the meeting. You may vote over the Internet, as well as by telephone, or, if you requested to receive printed proxy materials, by mailing a proxy card or voting instruction form, as applicable.

Sincerely,

Thomas J. Folliard

Non-Executive Chairman of the Board of Directors

* The Company's return on equity is calculated as net income for the trailing twelve months divided by average shareholders' equity, where average shareholders' equity is the sum of ending shareholders' equity balances of the trailing five quarters divided by five.

| | | | | | | | |

| PULTEGROUP, INC. | 2025 PROXY STATEMENT | i |

| | | | | | | | | | | | | | |

| NOTICE OF 2025 ANNUAL MEETING OF SHAREHOLDERS |

| | | | | |

| When: | Wednesday, April 30, 2025 at 1:00 P.M., Eastern Time |

| | |

| Where: | Via the internet at: www.virtualshareholdermeeting.com/PHM2025 |

| | |

Items of Business: | Proposal 1 – Election of ten nominees for director named in this Proxy Statement

Proposal 2 – Ratification of appointment of Ernst & Young LLP as our independent registered public accounting firm for 2025

Proposal 3 –Say-on-pay: Advisory vote to approve executive compensation

Proposals 4-5 – Two shareholder proposals, each only if properly presented at the meeting

In addition, any other business as may properly come before the meeting |

| | |

Who Can Vote: | Shareholders of record at the close of business on Thursday, March 6, 2025 |

| | |

Who Can Participate: | Shareholders who wish to attend the virtual meeting should review pages 76 - 78. To be admitted electronically to the annual meeting, you must go to the meeting website at www.virtualshareholdermeeting.com/PHM2025, and enter the 16-digit control code included in your proxy materials. Shareholders participating in the virtual meeting are deemed to be present in person at the annual meeting. Further instructions on how to participate in and vote at the annual meeting are available at www.virtualshareholdermeeting.com/PHM2025. |

| | |

Date of Mailing: | On or about Friday, March 14, 2025, a Notice of Internet Availability of Proxy Materials and Notice of Annual Meeting are being mailed or made available to our shareholders containing instructions on how to access this Proxy Statement and our 2024 Annual Report on Form 10-K and vote online, as well as instructions on how to receive paper copies of these documents for shareholders who so elect. |

| | |

Shareholder

List: | A list of shareholders entitled to vote at the annual meeting will be available at www.virtualshareholdermeeting.com/PHM2025 for examination during the annual meeting. Shareholders will need their 16-digit control code to access the list. |

| | | | | |

| Questions: | You may submit questions online during the annual meeting at www.virtualshareholdermeeting.com/PHM2025. The Company reserves the right to edit or reject any questions deemed duplicative, profane or inappropriate. |

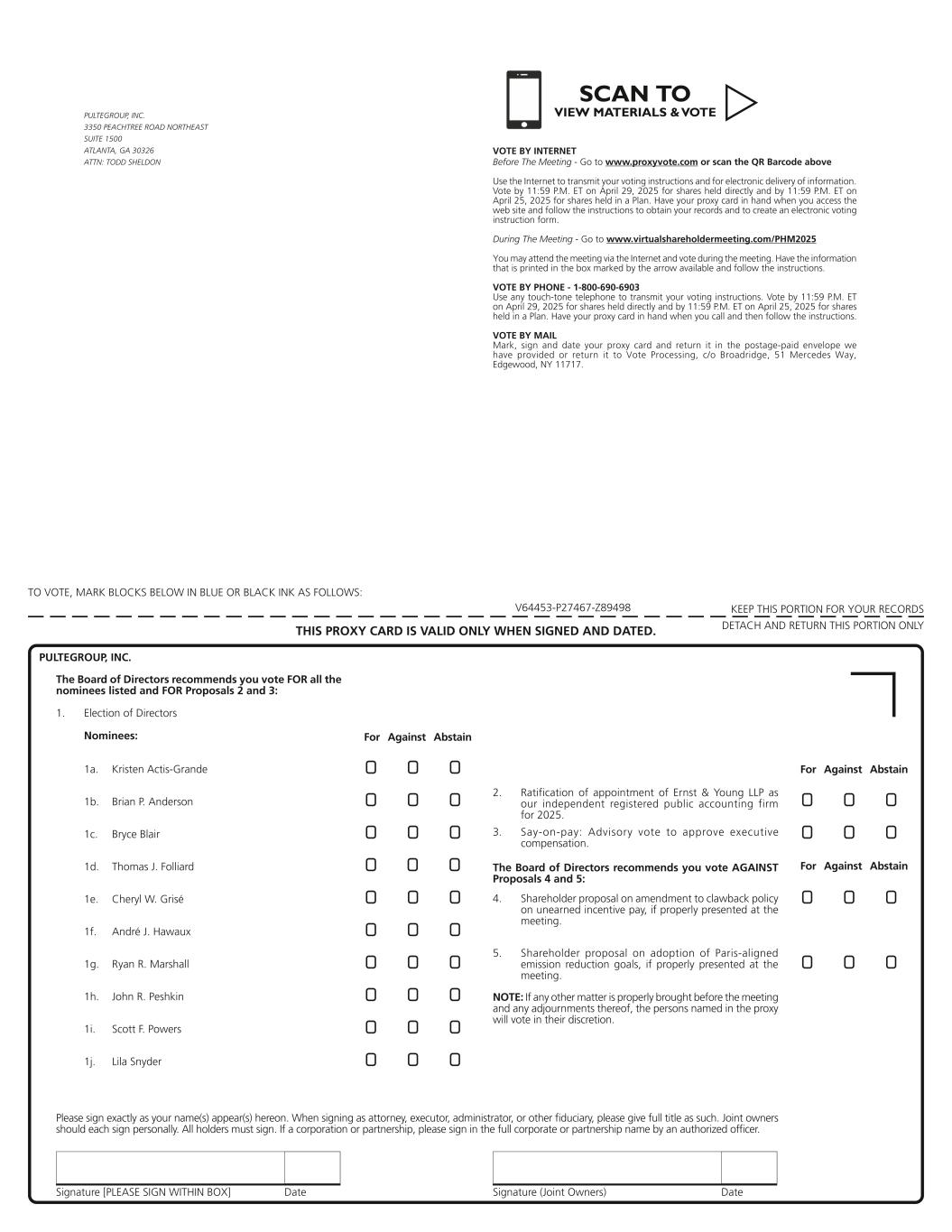

How To Vote In Advance

Your vote is important. We encourage you to vote promptly, whether or not you plan to attend the meeting. In accordance with the rules and regulations adopted by the Securities and Exchange Commission, instead of mailing a printed copy of our proxy materials, we are furnishing proxy materials to our shareholders over the internet. Make sure to have your proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials and Notice of Annual Meeting in hand and follow the instructions.

| | | | | |

| By Telephone: You can vote your shares by calling 1-800-690-6903 within the USA, US territories and Canada on a touchtone phone |

| | |

| By Internet: You can vote your shares online at www.proxyvote.com |

| | |

| By Mail: If you received a proxy card by mail, you can vote your shares by signing and returning the proxy card in the postage-paid envelope. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 30, 2025. The Company’s Proxy Statement for the 2025 Annual Meeting of Shareholders and the Annual Report on Form 10-K for the fiscal year ended December 31, 2024 are available at: www.virtualshareholdermeeting.com/PHM2025.

By Order of the Board of Directors

TODD N. SHELDON

Executive Vice President, General Counsel and Corporate Secretary

Atlanta, Georgia

March 14, 2025

| | | | | | | | |

ii | PULTEGROUP, INC. | 2025 PROXY STATEMENT | |

This summary highlights selected information about the items to be voted on at the 2025 annual meeting of shareholders (“annual meeting”) of PulteGroup, Inc. (“PulteGroup,” the “Company,” “we” or “our”). This summary does not contain all of the information that you should consider in deciding how to vote. You should read the entire Proxy Statement before voting. Meeting Agenda and Voting Recommendations

| | | | | | | | |

| | |

| PROPOSAL ONE | |

| | Election of Directors | |

| | |

| | | | | | | | | | | |

| | The Board recommends a vote FOR each of the director nominees named in this Proxy Statement. • Slate of directors with broad and diverse leadership experience • Significant experience in relevant industries (including real estate and consumer markets) and public company leadership experience, among other key competencies • Ongoing refreshment and succession process of Board composition • Proactive shareholder engagement | |

|

| See pages 4 - 10 for further information |

|

DIRECTOR NOMINEES | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Current Committee Memberships |

Name | Principal Professional Experience | Years of

Tenure | Independence | Audit | Comp | Finance | Nom/ Gov |

|

| | | | | | | |

| KRISTEN ACTIS-GRANDE | Executive Vice President and Chief Financial Officer, MSC Industrial Direct Co., Inc. | 1 | | ● | | ● | |

| | | | | | | |

| BRIAN P. ANDERSON | Former Chief Financial Officer, Baxter International Inc. | 20 | | ● | | ● | |

| | | | | | | |

| BRYCE BLAIR | Former Chairman of the Board and Chief Executive Officer, AvalonBay Communities, Inc. | 14 | | | | ● | C |

| | | | | | | |

THOMAS J. FOLLIARD Non-Executive Chairman | Non-Executive Chairman of the Board and Former President and Chief Executive Officer, CarMax, Inc. | 13 | | | | | |

| | | | | | | |

| CHERYL W. GRISÉ | Former Executive Vice President, Northeast Utilities (now known as Eversource Energy) | 17 | | ● | C | | |

| | | | | | | |

| ANDRÉ J. HAWAUX | Former Executive Vice President, Chief Financial Officer and Chief Operating Officer, Dick’s Sporting Goods, Inc. | 12 | | C | | | ● |

| | | | | | | |

| RYAN R. MARSHALL | President and Chief Executive Officer, PulteGroup, Inc. | 9 | | | | ● | |

| | | | | | | |

| JOHN R. PESHKIN | Founder and Managing Partner,

Vanguard Land, LLC | 9 | | | ● | C | |

| | | | | | | |

| SCOTT F. POWERS | Former President and Chief Executive Officer, State Street Global Advisors | 9 | | | | ● | ● |

| | | | | | | |

| LILA SNYDER | Chief Executive Officer, Bose Corporation | 7 | | | ● | ● | |

| | | | | |

Audit = Audit Committee | Finance = Finance and Investment Committee |

Comp = Compensation and Management Development Committee | Nom/Gov = Nominating and Governance Committee |

C = Chair of Committee | |

| | | | | | | | |

| PULTEGROUP, INC. | 2025 PROXY STATEMENT | iii |

| | | | | | | | | | | | | | | | | | | | |

Significant corporate leadership experience at public companies in relevant industries | | | Broad governance experience by service on other public company boards | | | Mix of seasoned directors and fresh perspectives |

| | | | | |

n n n n n n n n n n | | | n n n n n n n n n n | | | n n n n n n n n n n |

| | | | | |

SIX OF OUR NOMINEES HAVE

EXPERIENCE IN THE REAL ESTATE

OR CONSUMER MARKETS | | | EIGHT OF OUR NOMINEES

HAVE OTHER PUBLIC COMPANY

BOARD EXPERIENCE | | | FIVE OF OUR NOMINEES

HAVE JOINED THE BOARD

IN THE LAST NINE YEARS |

GOVERNANCE HIGHLIGHTS

PulteGroup has a long-standing commitment to strong corporate governance and throughout the years has evolved its governance framework to align with evolving best practices. In particular, we believe that the following corporate governance features help us best serve the interests of our shareholders:

| | | | | | | | |

Shareholder Rights  Annual election of all directors Annual election of all directors  Majority vote standard in uncontested director elections Majority vote standard in uncontested director elections  Right to call a special meeting for shareholders with 20% or more of outstanding shares Right to call a special meeting for shareholders with 20% or more of outstanding shares  Right to take action by written consent for shareholders Right to take action by written consent for shareholders  Active engagement with the Company’s top 20 largest shareholders Active engagement with the Company’s top 20 largest shareholders | Independent Oversight  Strong Non-Executive Chairman role Strong Non-Executive Chairman role  Audit Committee, Compensation and Management Development Committee and Nominating and Governance Committee each comprised solely of independent directors Audit Committee, Compensation and Management Development Committee and Nominating and Governance Committee each comprised solely of independent directors  All directors are independent except the Chief Executive Officer All directors are independent except the Chief Executive Officer  Committees have authority to retain independent advisors Committees have authority to retain independent advisors | Good Governance  Frequent cross-committee and Board communications Frequent cross-committee and Board communications  Regular Board, committee and director evaluation processes Regular Board, committee and director evaluation processes  Code of ethical business conduct and code of ethics Code of ethical business conduct and code of ethics  Director orientation and continuing education programs Director orientation and continuing education programs  Meaningful share ownership guidelines for executive officers and directors Meaningful share ownership guidelines for executive officers and directors  Prohibition against hedging and pledging Company securities by all employees and directors Prohibition against hedging and pledging Company securities by all employees and directors  Charter of Nominating and Governance Committee expresses strong commitment to inclusion of diverse knowledge, experience and viewpoints in selection of Board nominees Charter of Nominating and Governance Committee expresses strong commitment to inclusion of diverse knowledge, experience and viewpoints in selection of Board nominees |

| | | | | | | | |

iv | PULTEGROUP, INC. | 2025 PROXY STATEMENT | |

| | | | | | | | |

| | |

| PROPOSAL TWO | |

| | Ratification of Appointment of Ernst & Young LLP as the Independent Registered Public Accountant for 2025 | |

| | |

| | | | | | | | | | | |

| | The Board recommends a vote FOR the ratification of the appointment of Ernst & Young LLP as the independent registered public accountant for 2025. • Independent firm with a reputation for integrity and competence • Provides significant financial reporting expertise | |

| • Few ancillary services and reasonable fees | See pages 62 - 62 for further information | |

| | | | | | | | |

| | |

| PROPOSAL THREE | |

| | Say-on-Pay: Advisory Vote to Approve Executive Compensation | |

| | |

| | | | | | | | | | | |

| | The Board recommends a vote FOR this proposal. • Ongoing review of compensation practices by Compensation and Management Development Committee with assistance from an independent compensation consultant • Compensation programs designed to reward executives for performance against established performance objectives and improving shareholder returns | |

| • Adherence to commonly viewed executive compensation best practices | See pages 63 - 64 for further information | |

| | | | | | | | |

| | The Board recommends a vote AGAINST shareholder proposals four and five.

See pages 65 - 70 for further information | |

| | | | | | | | |

| PULTEGROUP, INC. | 2025 PROXY STATEMENT | v |

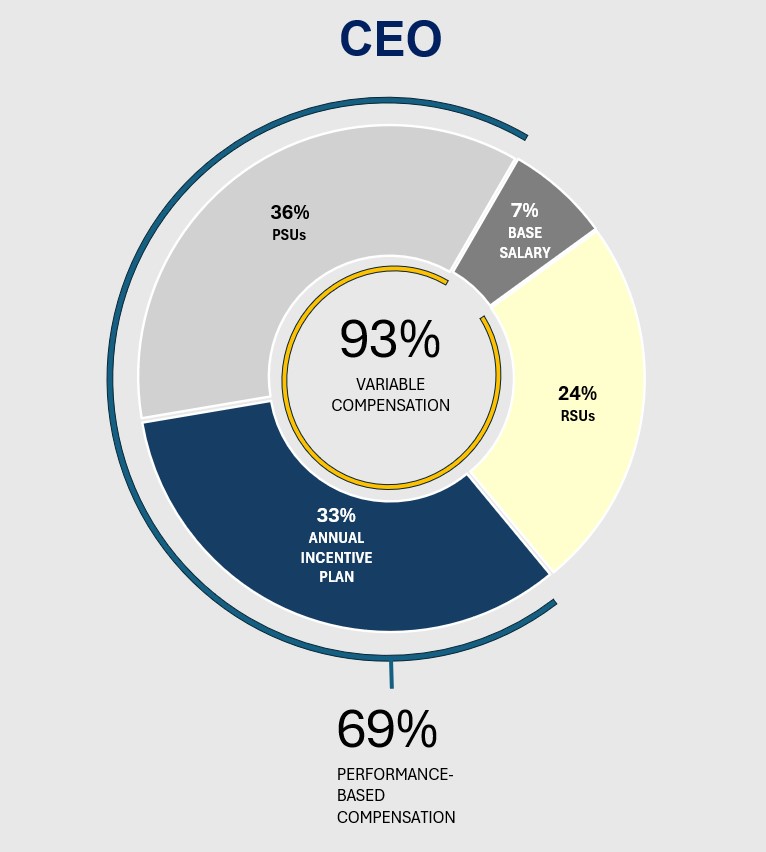

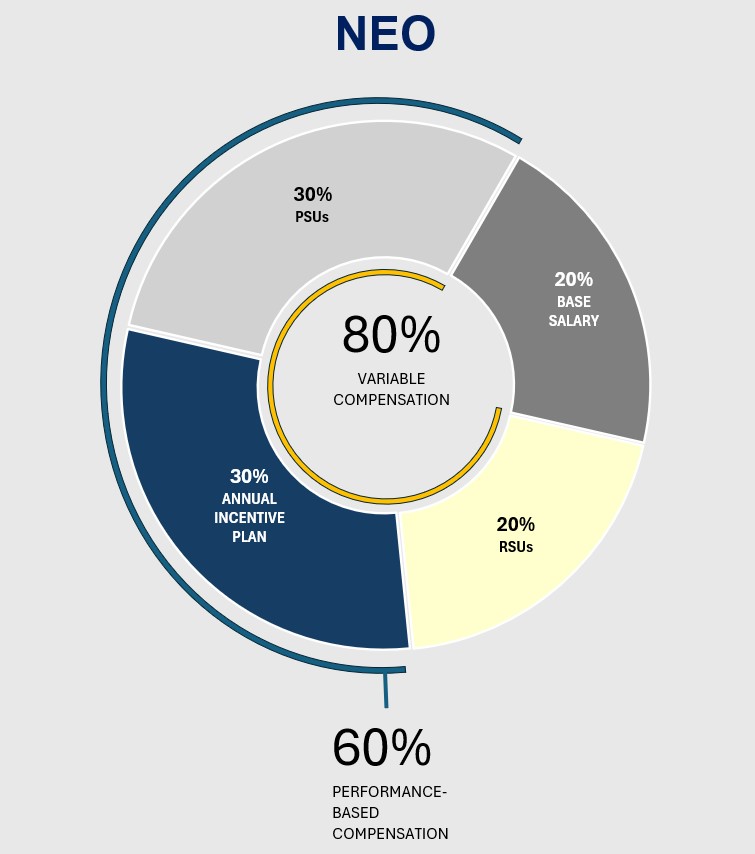

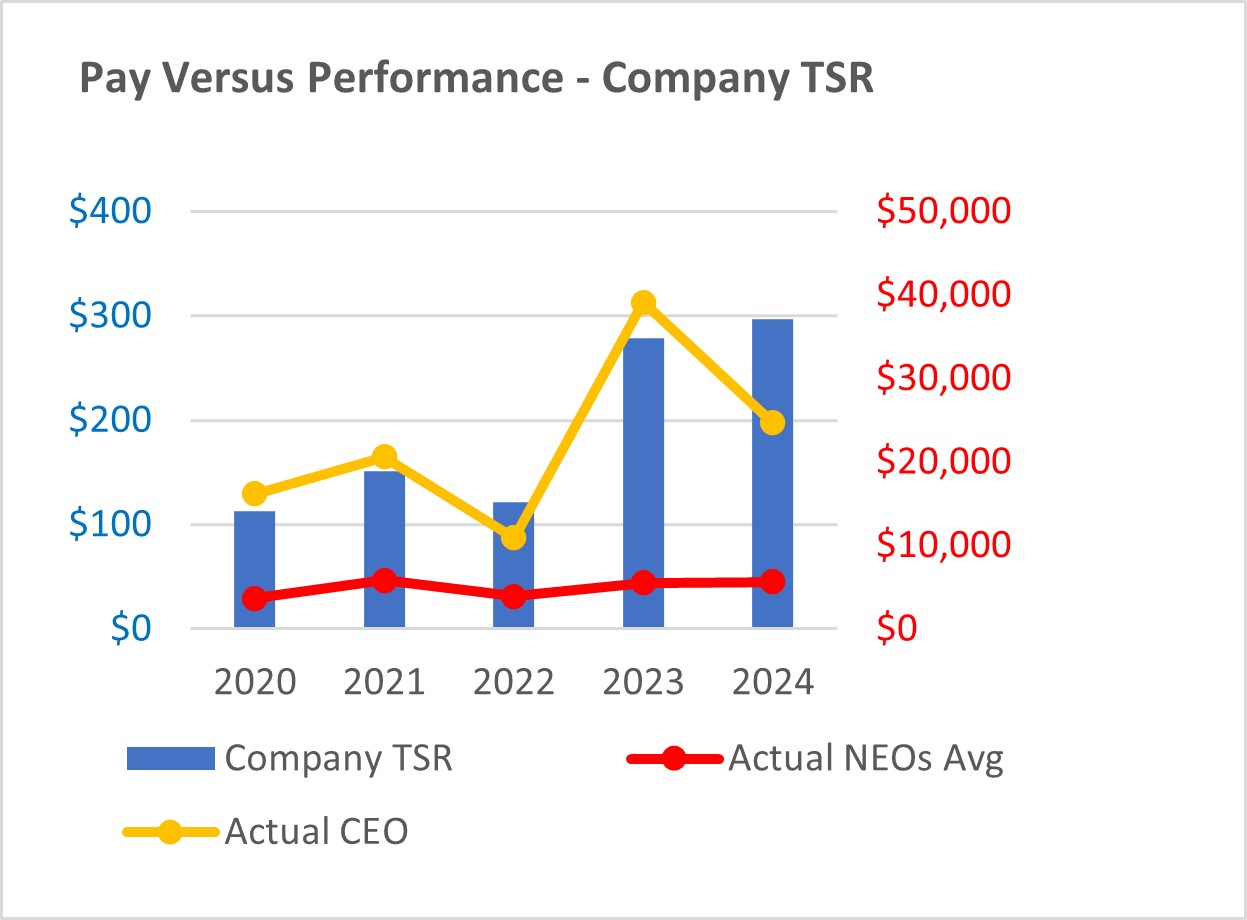

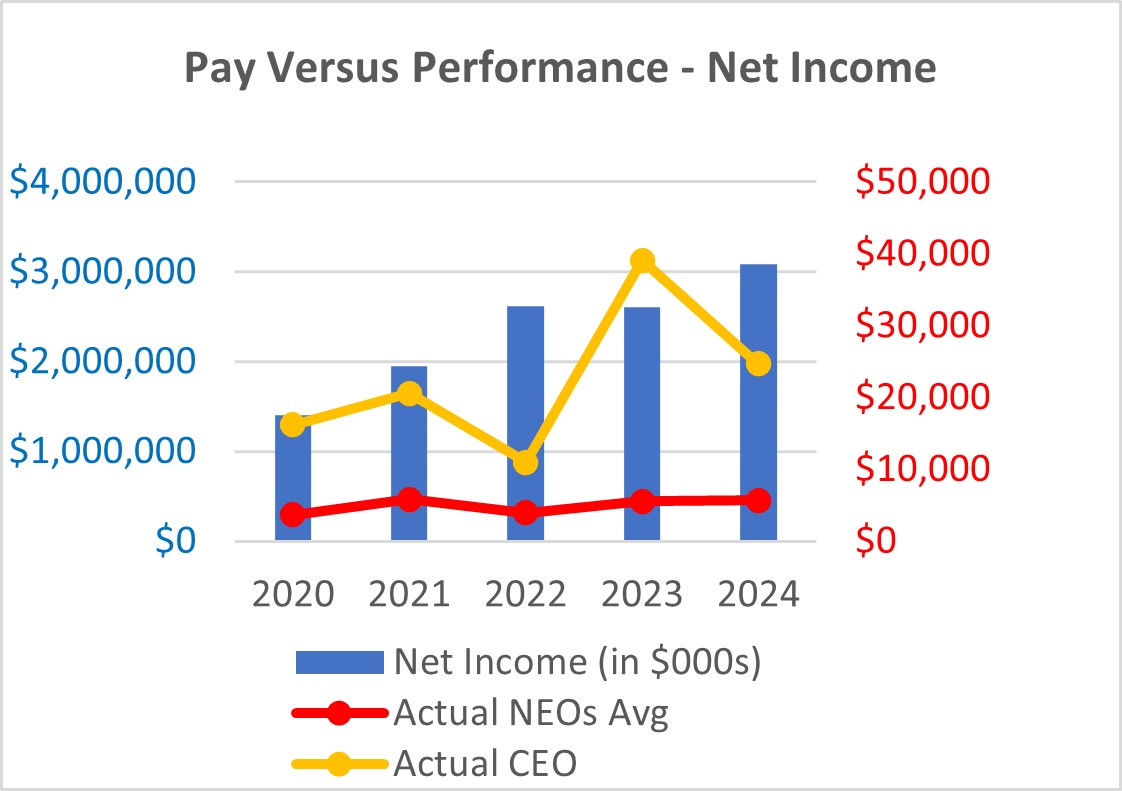

EXECUTIVE COMPENSATION HIGHLIGHTS

Our executive compensation program is designed to reward executives for producing sustainable growth and improving shareholder returns consistent with our strategic plan and to align compensation with the long-term interests of our shareholders. In accordance with this pay for performance philosophy, PulteGroup compensates its named executive officers using a mix of cash and equity compensation elements with an emphasis on short-term and long-term performance:

| | | | | | | | |

Element | Description | Further

Information

(pages) |

| | |

| BASE SALARY | Provides base pay levels that are competitive with market practices to attract and retain top executive talent. | |

| | |

| ANNUAL INCENTIVE | Provides annual incentive opportunities competitive with market practices to attract, motivate and retain top executive talent. Rewards executives for annual performance results relative to pre-established goals deemed critical to the success of the Company and its strategy and for relative performance in adjusted pre-tax income. Focuses on key annual results that we believe will position the Company for success over time, in keeping with the interests of shareholders. Retention of talent over performance period | |

| | |

| LONG-TERM INCENTIVE PROGRAM | Provides equity incentives competitive with market practices in order to attract, motivate and retain top executive talent. Focuses executives on long-term performance of the Company. Directly aligns interests of executives with those of our shareholders. Retention of talent over performance / vesting period. All performance metrics are based on relative performance to peer group | |

| | |

| RESTRICTED SHARE UNITS | Provides equity incentives competitive with market practices in order to attract, motivate and retain top executive talent. Focuses executives on long-term performance of the Company. Directly aligns interests of executives with those of our shareholders. Retention of talent over performance / vesting period. | |

PulteGroup is also committed to having strong governance standards with respect to our executive compensation program, policies and practices. Consistent with this focus, we maintain the following policies and practices that we believe demonstrate our commitment to executive compensation best practices.

| | | | | | | | |

vi | PULTEGROUP, INC. | 2025 PROXY STATEMENT | |

| | | | | | | | |

| PULTEGROUP, INC. | 2025 PROXY STATEMENT | vii |

| | | | | | | | |

| PULTEGROUP, INC. | 2025 PROXY STATEMENT | |

The board of directors (the “Board” or “Board of Directors”) of PulteGroup, Inc. (“PulteGroup,” the “Company,” “we” or “our”) is soliciting proxies on behalf of the Company to be used at the annual meeting of shareholders (the “annual meeting”) to be held on Wednesday, April 30, 2025, at 1:00 P.M. Eastern Time, via the internet at: www.virtualshareholdermeeting.com/PHM2025. The annual meeting will be held in a virtual meeting format only, and you will not be able to attend the annual meeting in person. See pages 76 - 78 for additional information on attending the annual meeting. In accordance with rules adopted by the Securities and Exchange Commission (the “SEC”), the Company is making this Proxy Statement and the Company’s Annual Report on Form 10-K (“Annual Report”) available to our shareholders electronically via the internet. In addition, the Company is using the SEC’s Notice and Access Rules to provide shareholders with more options for receipt of these materials. Accordingly, on or about March 14, 2025, the Company will mail a Notice of Internet Availability of Proxy Materials and Notice of Annual Meeting (the “Notice”) to our shareholders containing instructions on how to access this Proxy Statement and the Company’s Annual Report on the internet, how to vote online or by telephone, and how to receive paper copies of the documents and a proxy card.

| | | | | | | | |

| PULTEGROUP, INC. | 2025 PROXY STATEMENT | 1 |

| | | | | | | | | | | | | | |

| BOARD OF DIRECTORS INFORMATION |

Board of Directors Qualifications and Attributes The Board annually reviews the skills and experiences that it believes should be represented on the Board. As a result of this ongoing review, the Board developed the following matrix, which sets forth the collective experiences and qualifications of the director nominees that the Board believes are critical in order to continue to drive effective oversight of the Company:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | Public Company Leadership | Public Company Board Experience | Real Estate and Housing | Financial Expertise | Consumer Markets Experience | Corporate Governance | Human Capital | Strategic Risk Management |

| | | | | | | | | |

| KRISTEN ACTIS-GRANDE | | | | | | | | |

| | | | | | | | |

| BRIAN P. ANDERSON | | | | | | | | |

| | | | | | | | |

| BRYCE BLAIR | | | | | | | | |

| | | | | | | | | |

| THOMAS J. FOLLIARD | | | | | | | | |

| | | | | | | | | |

| CHERYL W. GRISÉ | | | | | | | | |

| | | | | | | | | |

| ANDRÉ J. HAWAUX | | | | | | | | |

| | | | | | | | | |

| RYAN R. MARSHALL | | | | | | | | |

| | | | | | | | | |

| JOHN R. PESHKIN | | | | | | | | |

| | | | | | | | | |

| SCOTT POWERS | | | | | | | | |

| | | | | | | | | |

| LILA SNYDER | | | | | | | | |

In addition to these competencies and experiences, the Board also believes that integrity, business judgment, leadership skills, dedication, and collaboration are personal attributes that are vital to the Board’s ability to effectively oversee the Company and act in the best interests of the Company’s shareholders. In addition to these personal characteristics and qualifications, PulteGroup highly values the collective experience and qualifications of the directors. PulteGroup believes that the diverse set of collective experiences, viewpoints, and perspectives of its directors results in a Board with the commitment and energy to advance the interests of PulteGroup’s shareholders. The Nominating and Governance Committee has committed to the inclusion of diverse groups, knowledge, and viewpoints in its selection of Board nominees. When adding new Board members or filling vacancies, the Nominating and Governance Committee will conduct its search consistent with this commitment. All searches conducted since this commitment was adopted have been conducted in a manner consistent with this commitment.

The Board also continues to maintain policies that help to enhance its Board refreshment efforts. For example, our Corporate Governance Guidelines provide that no director shall stand for election after the age of 75. This policy promotes refreshment of the Board, providing more vacancies and therefore more opportunities to enhance the collective experiences and qualifications of our Board.

Independence

Under the Company’s Corporate Governance Guidelines, which are available to shareholders at https://www.pultegroupinc.com/investor-relations/corporate-governance/governance-documents/default.aspx, a substantial majority of the members of our Board must be independent. The Company has established director qualification standards to assist the Nominating and Governance Committee in determining director independence, which either meet or exceed the independence requirements of the NYSE corporate governance listing standards. The Board will consider all relevant facts and circumstances in making an independence determination. To be considered “independent”, the Board must affirmatively determine that the director has no material relationship with the Company, directly or as an officer, shareholder or partner of an organization that has a relationship with the Company, and that the director is otherwise independent under NYSE listing standards. In each case, the Board shall broadly consider all relevant facts and circumstances and shall apply the standards set forth below. A director will be determined to be independent if (in addition to having no material relationship with the Company, director or as an officer, shareholder or partner of an organization that has a relationship with the Company, and satisfying the independence requirements under the NYSE listing standards) the director:

has not been an employee of the Company for at least three years;

has not been an employee of the Company for at least three years;

| | | | | | | | |

2 | PULTEGROUP, INC. | 2025 PROXY STATEMENT | |

| | | | | | | | |

| | |

| BOARD OF DIRECTORS INFORMATION | | |

has not, during the last three years, been employed as an executive officer by a company for which an executive officer of the Company concurrently served as a member of such company’s compensation committee;

has not, during the last three years, been employed as an executive officer by a company for which an executive officer of the Company concurrently served as a member of such company’s compensation committee;  has no immediate family members (i.e., spouse, parents, children, siblings, mothers and fathers-in-law, sons and daughters-in-law, brothers and sisters-in-law and anyone (other than employees) who shares the director’s home) who did not satisfy the foregoing criteria during the last three years; provided, however, that such director’s immediate family member may have served as an employee but not as an executive officer of the Company during such three-year period so long as such immediate family member shall not have received, during any twelve-month period within such three-year period, more than $120,000 in direct compensation from the Company for such employment;

has no immediate family members (i.e., spouse, parents, children, siblings, mothers and fathers-in-law, sons and daughters-in-law, brothers and sisters-in-law and anyone (other than employees) who shares the director’s home) who did not satisfy the foregoing criteria during the last three years; provided, however, that such director’s immediate family member may have served as an employee but not as an executive officer of the Company during such three-year period so long as such immediate family member shall not have received, during any twelve-month period within such three-year period, more than $120,000 in direct compensation from the Company for such employment;  is not a current partner or employee of the Company’s internal or external audit firm, and the director was not within the past three years a partner or employee of such a firm who personally worked on the Company’s internal or external audit within that time;

is not a current partner or employee of the Company’s internal or external audit firm, and the director was not within the past three years a partner or employee of such a firm who personally worked on the Company’s internal or external audit within that time;  has no immediate family member who (i) is a current partner of a firm that is the Company’s internal or external auditor, (ii) is a current employee of such a firm and personally works on the Company’s internal or external audit or (iii) was within the past three years a partner or employee of such a firm and personally worked on the Company’s audit within that time;

has no immediate family member who (i) is a current partner of a firm that is the Company’s internal or external auditor, (ii) is a current employee of such a firm and personally works on the Company’s internal or external audit or (iii) was within the past three years a partner or employee of such a firm and personally worked on the Company’s audit within that time;  has not received, and has no immediate family member who has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the Company (other than (i) director and committee fees, and (ii) pensions and other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service));

has not received, and has no immediate family member who has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the Company (other than (i) director and committee fees, and (ii) pensions and other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service));  is not a current employee, and has no immediate family member who is a current executive officer, of a company that made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues;

is not a current employee, and has no immediate family member who is a current executive officer, of a company that made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues;  does not serve, and has no immediate family member who has served, during the last three years as an executive officer or general partner of an entity that has received an investment from the Company or any of its subsidiaries, unless such investment is less than the greater of $1 million or 2% of such entity’s total invested capital in any of the last three years; and

does not serve, and has no immediate family member who has served, during the last three years as an executive officer or general partner of an entity that has received an investment from the Company or any of its subsidiaries, unless such investment is less than the greater of $1 million or 2% of such entity’s total invested capital in any of the last three years; and  has not been, and has no immediate family member who has been, an executive officer of a charitable or educational organization for which the Company contributed more than the greater of $1 million or 2% of such charitable organization’s consolidated gross revenues, in any of the last three years.

has not been, and has no immediate family member who has been, an executive officer of a charitable or educational organization for which the Company contributed more than the greater of $1 million or 2% of such charitable organization’s consolidated gross revenues, in any of the last three years. In addition, Audit Committee members may not have any direct or indirect financial relationship whatsoever with the Company other than as directors.

Furthermore, in affirmatively determining the independence of any director who will serve on the Compensation and Management Development Committee, the Board will consider all factors specifically relevant to determining whether a director has a relationship to the Company which is material to that director’s ability to be independent from management in connection with the duties of a member of the Compensation and Management Development Committee, including, but not limited to, (i) the source of compensation of such director, including any consulting, advisory or other compensatory fee paid by the Company to such director and (ii) whether such director is affiliated with the Company, a subsidiary of the Company or an affiliate of a subsidiary of the Company.

The Board considered all relevant facts and circumstances in assessing director independence. In connection with this assessment, the Board affirmatively determined that Kristen Actis-Grande, Brian P. Anderson, Bryce Blair, Thomas J. Folliard, Cheryl W. Grisé, André J. Hawaux, J. Phillip Holloman, John R. Peshkin, Scott F. Powers, and Lila Snyder are independent in accordance with the Company’s Corporate Governance Guidelines. In reaching this determination, the Board considered the relationship with respect to Mr. Folliard described in the section entitled “Certain Relationships and Related Transactions” and determined that such relationship is immaterial as it relates to Mr. Folliard’s independence. The Board further determined that Ryan R. Marshall, who is a current PulteGroup employee, is not independent within the meaning of the Company’s categorical standards and the NYSE listing standards.

| | | | | | | | |

| PULTEGROUP, INC. | 2025 PROXY STATEMENT | 3 |

| | |

PROPOSAL 1 - ELECTION OF DIRECTORS |

| | | | | | | | | | | |

| | The Board recommends a vote FOR each of the director nominees named in this Proxy Statement. • Slate of directors with broad and diverse leadership experience • Significant experience in relevant industries (including real estate and consumer markets) and public company leadership experience, among other key competencies • Ongoing refreshment and succession process of Board composition • Proactive shareholder engagement | | The Restated Articles of Incorporation, as amended, of the Company (the “Articles of Incorporation”), require that we have at least three, but no more than 15, directors. The exact number of directors is set by the Board and is currently eleven. All directors will be elected on an annual basis for one-year terms. The eleven directors comprising the Board, all of whose terms are expiring at the annual meeting, are Kristen Actis-Grande, Brian P. Anderson, Bryce Blair, Thomas J. Folliard, Cheryl W. Grisé, André J. Hawaux, J. Phillip Holloman, Ryan R. Marshall, John R. Peshkin, Scott F. Powers, and Lila Snyder. On March 13, 2025, Mr. Holloman informed the Board that he will not stand for re-election at the annual meeting due to other time commitments. The Board and the Company wish to thank Mr. Holloman for his years of dedicated service on the Board. The size of the Board will be reduced from eleven to ten as of the annual meeting. Proxies cannot be voted for a greater number of persons than the nominees named. The Amended and Restated By-laws of the Company (the “By-laws”) provide that a nominee for director at the annual meeting shall be elected by the affirmative vote of a majority of the votes cast with respect to that director’s election. A majority of votes cast means that the number of votes cast “for” a director’s election exceeds the number of votes cast “against” that director’s election (with “abstentions” and “broker non-votes” not counted as a vote cast either “for” or “against” that director’s election). If a nominee for director, who is an incumbent director, is not elected, the director shall promptly tender his or her resignation to the Board. The Nominating and Governance Committee will make a recommendation to the Board as to whether to accept or reject the resignation of such incumbent director, or whether other action should be taken. The Board shall act on the resignation, taking into account the committee’s recommendation, and publicly disclose (by a press release, a filing with the Securities and Exchange Commission or other broadly disseminated means of communication) its decision regarding the tendered resignation and the rationale behind the decision within 90 days following certification of the election results. The director who tenders his or her resignation will not participate in the recommendation of the committee or the decision of the Board with respect to his or her resignation. The ten persons listed below are the nominees to serve a one-year term expiring at the Company’s 2026 annual meeting of shareholders, and each has agreed to be named in this Proxy Statement and to serve the one-year term for which he or she has been nominated, if elected. Each director will hold office until his or her successor is elected and qualified or until the director’s earlier death, resignation, retirement, disqualification or removal. Please see below for a description of the occupations and recent business experience of all director nominees. In addition, the specific experience, qualifications, attributes, or skills that led the Nominating and Governance Committee to conclude that each of the director nominees should serve as a director of the Company are included in the descriptions below. |

| | |

| |

| BOARD NOMINEE EXPERIENCE AND SKILLS |

| | | | | | | | |

4 | PULTEGROUP, INC. | 2025 PROXY STATEMENT | |

| | | | | | | | |

| | |

| PROPOSAL 1 - ELECTION OF DIRECTORS | |

| | | | | |

| Nominees to Serve a One-Year Term Expiring at the 2026 Annual Meeting of Shareholders | u |

| | | | | | | | | | | |

| Kristen Actis-Grande |

Director Since: 2024 Age: 44 Committees: • Audit • Finance and Investment

| | Biography Ms. Actis-Grande has significant financial experience as a chief financial officer of a large public company and through serving in increasing roles of responsibility within the finance function of a large public multi-national manufacturer of products used in residential, commercial and industrial applications. Ms. Actis-Grande has extensive knowledge of the preparation and review of complex financial reporting statements as well as experience in internal controls, risk management and risk assessment. Her experience as a senior executive for one of the largest manufacturers of heating and cooling systems for residential applications gives her unique insights into the homebuilding industry and the broader economy. Relevant Business Experience: Since 2020 Ms. Actis-Grande has served as Executive Vice President and Chief Financial Officer of MSC Industrial Direct Co., Inc., a leading North American distributor of a broad range of metalworking and maintenance repair and operations (MRO) products and services. At MSC, in addition to the leadership of all finance related functions, Ms. Actis-Grande is also responsible for corporate strategy, mergers and acquisitions, and investor relations. Prior to joining MSC, Ms. Actis-Grande served in various finance-related roles for seventeen years at Ingersoll Rand Inc., a provider of flow creation and industrial products, including as Chief Financial Officer for their Compression Technologies and Services Division from 2018 to 2020 and Chief Financial Officer for their Residential HVAC and Supply division from 2016 to 2018 which included the Trane and American Standard brands. Ms. Actis-Grande is an audit committee financial expert for purposes of the SEC’s rules. |

| | | |

| Brian P. Anderson |

Director Since: 2005 Age: 74 Committees: • Audit • Finance and Investment

| | Biography Mr. Anderson has significant experience as a chief financial officer of two large multinational companies and as a director of several large public companies. In addition, he has held finance positions including chief financial officer, corporate controller and vice president of audit and was an audit partner at an international public accounting firm. Mr. Anderson has significant experience in the preparation and review of complex financial reporting statements as well as experience in risk management and risk assessment. Mr. Anderson also previously served on the board of directors of Stericycle, Inc., and W.W. Grainger, Inc., among other public companies.

Relevant Business Experience: Mr. Anderson is the former Executive Vice President of Finance and Chief Financial Officer of OfficeMax Incorporated, a distributor of business-to-business and retail office products. Prior to assuming this position in 2004, Mr. Anderson was Senior Vice President and Chief Financial Officer of Baxter International Inc., a global diversified medical products and services company, a position he assumed in 1998. Mr. Anderson has extensive experience sitting on and chairing the audit committees of public companies. Mr. Anderson also brings to the Board meaningful experience based on his service as the former Lead Director of W.W. Grainger, Inc. and former Chairman of A.M. Castle & Co., as well as his service as a Governing Board Member at the Center for Audit Quality. Mr. Anderson is an audit committee financial expert for purposes of the SEC’s rules.

Public Company Board Experience: |

| • W.W. Grainger, Inc. (1999 - 2022) • James Hardie Industries plc (2006 - 2020) | • Stericycle, Inc. (2017 - 2024) • A.M. Castle & Co. (2005 - 2016) |

| | | | | | | | |

| PULTEGROUP, INC. | 2025 PROXY STATEMENT | 5 |

| | | | | | | | |

| | |

| PROPOSAL 1 - ELECTION OF DIRECTORS |

| | | | | | | | | | | |

| Bryce Blair | | |

Director Since: 2011 Age: 66 Committees: • Finance and Investment • Nominating and Governance Committee (Chair)

| | Biography Mr. Blair has substantial experience in real estate development and investment, including having spent over ten years as Chairman and Chief Executive Officer of a public real estate investment trust. In addition, in his former role as chief executive officer of AvalonBay Communities, Inc., Mr. Blair was responsible for day-to-day operations, and he was regularly involved in the preparation and review of complex financial reporting statements. Mr. Blair also brings to the Board meaningful experience based on his service on the boards of directors of AvalonBay Communities, Inc., Regency Centers Corp., and Invitation Homes, Inc., where he served as Non-Executive Chairman of the board. Relevant Business Experience: Mr. Blair is the Manager of Harborview Associates, LLC, a company that holds and manages investments in various real estate properties. Mr. Blair is also the former Chairman of the Board and the former Chief Executive Officer of AvalonBay Communities, Inc. In addition, Mr. Blair served in a number of senior leadership positions with AvalonBay Communities, Inc., including Chief Executive Officer from February 2001 through December 2011, President from September 2000 through February 2005 and Chief Operating Officer from February 1999 to February 2001. He is a member of the Advisory Board of Navitas Capital, a venture capital firm focused on technology for the real estate sector. Mr. Blair also serves on the Advisory Board of the Boston College Center for Real Estate and Urban Action. Mr. Blair is also a past member of the National Association of Real Estate Investment Trusts, where he served as Chairman and was on the Executive Committee and the Board of Governors, and the Urban Land Institute, where he is past Chairman of the Multifamily Council and is a past Trustee. Public Company Board Experience: |

| • Invitation Homes Inc. (2017 - 2021) • Regency Centers Corp. (2014 - present) | • AvalonBay Communities, Inc. (2002 - 2013) |

| | | |

| Thomas J. Folliard | | |

Director Since: 2012 Age: 60 Committees: None (Mr. Folliard is the Non-Executive Chairman)

| | Biography Mr. Folliard has extensive experience as Chief Executive Officer of a large, consumer-focused public company. In connection with that role, Mr. Folliard has significant experience in operational matters and business strategy, which adds a valuable perspective for the Board’s decision-making. Mr. Folliard also brings to the Board of Directors meaningful experience based on his service on the board of directors of CarMax, Inc., currently as Non-Executive Chairman, and as a member of the Chairman of the Board of Trustees of both Baron Investment Funds and Baron Select Funds. Relevant Business Experience: Mr. Folliard currently serves as a Trustee to Baron Investment Funds Trust and Baron Select Funds and has been in such positions since August 2017. Mr. Folliard served as President and Chief Executive Officer of CarMax, Inc., the largest retailer of used autos in the United States, from 2006 until his retirement on August 31, 2016. He continues to serve CarMax as Non-Executive Chairman of the board. He joined CarMax, Inc. in 1993 as the Senior Buyer and became the Director of Purchasing in 1994. Mr. Folliard was promoted to Vice President of Merchandising in 1996, Senior Vice President of Store Operations in 2000 and Executive Vice President of Store Operations in 2001. Public Company Board Experience: |

| • Baron Investment Funds Trust (2017 - present) • Baron Select Funds (2017 - present) | • CarMax, Inc. (2006 - present) |

| | | | | | | | |

6 | PULTEGROUP, INC. | 2025 PROXY STATEMENT | |

| | | | | | | | |

| | |

| PROPOSAL 1 - ELECTION OF DIRECTORS | |

| | | | | | | | | | | |

| Cheryl W. Grisé |

Director Since: 2008 Age: 72 Committees: • Compensation and Management Development (Chair) • Audit

| | Biography Ms. Grisé has significant experience as a director of several large public corporations and as a former executive officer of a public utility holding company. Ms. Grisé’s substantial executive and operational experience, along with earlier experience as general counsel, corporate secretary and chief human resources executive, provide her with a unique perspective on the complex legal, governance, human capital and other issues that affect companies in regulated industries, as well as the effective functioning of the Company’s corporate governance structures. Ms. Grisé also brings to the Board meaningful experience based on her service as Lead Director of MetLife, Inc. and her service on the boards of directors of several other public companies, including her current service as Chair of the Compensation Committee of Dollar Tree, Inc.

Relevant Business Experience: Ms. Grisé was Executive Vice President of Northeast Utilities (now Eversource Energy), a public utility holding company, from December 2005 until her retirement effective July 2007; Chief Executive Officer of its principal operating subsidiaries from September 2002 to January 2007; President of the Utility Group of Northeast Utilities Service Company from May 2001 to January 2007; and Senior Vice President, Secretary and General Counsel of Northeast Utilities from 1998 to 2001.

Public Company Board Experience: |

• MetLife, Inc. (2004 - present) • ICF International, Inc. (2012 - 2024) | • Dollar Tree, Inc. (2022 - present) • Pall Corporation (2007 - 2015) |

| | | |

| André J. Hawaux | |

|

Director Since: 2013 Age: 64 Committees: • Audit (Chair) • Nominating and Governance

| | Biography Mr. Hawaux has significant experience serving as a senior officer of several corporations, including as executive vice president and chief financial officer of a large, consumer-focused public company. In connection with that role, Mr. Hawaux has extensive experience in operational matters and business strategy, which adds a valuable perspective for the Board’s decision-making. In addition, Mr. Hawaux has significant experience in the preparation and review of complex financial reporting statements as well as experience in risk management and risk assessment. Mr. Hawaux also serves on the boards of directors of Lamb Weston Holdings, Inc. where he is a Chair of the audit and finance committees and Tractor Supply Company where he is a member of the audit and nominating & governance committees. Relevant Business Experience: Mr. Hawaux is the Former Executive Vice President, Chief Financial Officer, and Chief Operating Officer of Dick’s Sporting Goods, Inc. Mr. Hawaux joined Dick’s Sporting Goods, Inc., a leading omni-channel sporting goods retailer, in June 2013 as Executive Vice President, Finance Administration and Chief Financial Officer and also served as its Executive Vice President, Chief Operating Officer through August 2017. Mr. Hawaux served as president of the Consumer Foods business of ConAgra Foods, Inc. (now ConAgra Brands Inc.), one of North America’s leading packaged food companies, from 2009 until May 2013. He joined ConAgra as Executive Vice President and Chief Financial Officer in 2006, and prior to ConAgra, he served as general manager of a large U.S. division of PepsiAmericas. Mr. Hawaux also previously served as Chief Financial Officer for Pepsi-Cola North America and Pepsi International’s China business unit. Mr. Hawaux is an audit committee financial expert for purposes of the SEC’s rules. Public Company Board Experience: |

| • Lamb Weston Holdings, Inc. (2017 - present) | • Tractor Supply Company (2022 - present) |

| | | | | | | | |

| PULTEGROUP, INC. | 2025 PROXY STATEMENT | 7 |

| | | | | | | | |

| | |

| PROPOSAL 1 - ELECTION OF DIRECTORS |

| | | | | | | | | | | |

| Ryan R. Marshall | | |

Director Since: 2016 Age: 50 Committees: • Finance and Investment

| | Biography Mr. Marshall brings significant insight to the Board from his tenure at PulteGroup, including in his position as President and Chief Executive Officer and his management of many of the Company’s largest operations. Mr. Marshall’s extensive experience at the Company through various financial and operational roles prior to his appointment as the Chief Executive Officer of the Company provides an in-depth understanding of PulteGroup’s operations and complexity and adds a valuable perspective for Board decision-making. Mr. Marshall also serves on the board of directors of Floor & Decor Holdings, Inc. where he sits on the audit committee. Relevant Business Experience: Mr. Marshall is President and Chief Executive Officer of PulteGroup, Inc. Mr. Marshall has served as the President and Chief Executive Officer of PulteGroup, Inc. since September 8, 2016, and as the President since February 15, 2016. Prior to becoming CEO, Mr. Marshall most recently had the responsibility for the Company’s homebuilding operations and its marketing and strategy departments. Prior to being named President, Mr. Marshall was Executive Vice President of Homebuilding Operations since May 2014. Other previous roles included Area President for the Company’s Southeast Area since November 2012, Area President for Florida, Division President in both South Florida and Orlando and Area Vice President of Finance. In those roles, he has managed various financial and operating functions including financial reporting, land acquisition and strategic market risk and opportunity analysis. Public Company Board Experience: • Floor & Decor Holdings, Inc. (2020 - present) |

| | | |

| John R. Peshkin |

Director Since: 2016 Age: 64 Committees: • Compensation and Management Development • Finance and Investment (Chair)

| | Biography Mr. Peshkin has significant experience as a founder and managing partner at a leading real estate investment group. In addition, Mr. Peshkin also has significant experience in the real estate and home building industries as a successful senior executive, as an investor and as a board member at two of the nation’s top builders, which brings valuable industry knowledge and insight to the Board. Mr. Peshkin also brings to the Board meaningful experience based on his service on the board of directors of for-profit companies and non-profit institutions. Relevant Business Experience: Mr. Peshkin is the founder and Managing Partner at Vanguard Land, LLC, a private real estate investment group focused on the acquisition and development of residential and commercial properties throughout Florida since 2008. He was previously the founder and Chief Executive Officer of Starwood Land Ventures, an affiliate of Starwood Capital Group Global, a real estate private equity firm, until 2008. Mr. Peshkin spent 24 years with Taylor Woodrow plc, a national homebuilder, serving as its North American CEO and President from 2000 to 2006. Mr. Peshkin is an audit committee financial expert for purposes of the SEC’s rules. Public Company Board Experience: |

• Standard Pacific Corp. (subsequently CalAtlantic Group, Inc., which was then acquired by Lennar Corporation) (2012 - 2015) | |

| | | | | | | | |

8 | PULTEGROUP, INC. | 2025 PROXY STATEMENT | |

| | | | | | | | |

| | |

| PROPOSAL 1 - ELECTION OF DIRECTORS | |

| | | | | | | | | | | |

| Scott F. Powers | | |

Director Since: 2016 Age: 65 Committees: • Finance and Investment • Nominating and Governance

| | Biography Mr. Powers has significant experience as a financial services executive executing growth strategies, managing operations and leading efforts in risk and crisis management. Mr. Powers brings additional skills to the Board honed through a career of managing through financial industry change. Mr. Powers also has public company board experience as a current member of the boards of directors of Sun Life Financial, Inc., where he also serves as Non-Executive Chairman of the Board, and Automatic Data Processing, Inc. where he serves as a member of the Nominating Committee / Corporate Governance Committee and Chair of the Compensation and Management Development Committee. Relevant Business Experience: Mr. Powers is the Former President and Chief Executive Officer of State Street Global Advisors. Mr. Powers held leadership positions at State Street Corporation, a financial holding company that performs banking services through its subsidiaries, from 2008 to 2015, most recently as Executive Vice President of State Street Corp, President and Chief Executive Officer of State Street Global Advisors. Mr. Powers also served as a member of the State Street Management Committee. In addition, he previously served as President and Chief Executive Officer of Old Mutual USA and Old Mutual Asset Management from 2001 to 2008. He also held executive roles at Mellon Financial Corporation and Boston Company Asset Management. Public Company Board Experience: |

| • Automatic Data Processing, Inc. (2018 - present) • Sun Life Financial, Inc. (2015 - present) | • Whole Foods Market, Inc. (2017) |

| | | |

| Lila Snyder |

Director Since: 2018 Age: 52 Committees: • Compensation and Management Development • Finance and Investment

| | Biography Ms. Snyder has significant experience as a consultant and corporate executive in a wide variety of industries. Ms. Snyder has advised on and led innovation initiatives in the areas of digital technology, media, cybersecurity and communications. Ms. Snyder also brings significant skills to the Board relating to strategy, operations, marketing and sales as a current chief executive officer of a large multi-national private company and as a former C-level executive of a Fortune 1000 Company. Relevant Business Experience: Ms. Snyder has served as Chief Executive Officer of Bose Corporation, a manufacturer of audio equipment, since August 2020. Prior to her current role, Ms. Snyder held numerous senior leadership positions at Pitney Bowes, Inc., including Executive Vice President and President, Commerce Services from October 2017 to August 2020, President of Global Ecommerce from June 2015 to October 2017, and President of Document Messaging Technologies from November 2013 to June 2015. Prior to joining Pitney Bowes, Inc., Ms. Snyder was a partner at global consultancy firm McKinsey & Company, Inc., where she led McKinsey’s Stamford office and served clients in the technology, media and communications sectors. |

| | | | | | | | |

| PULTEGROUP, INC. | 2025 PROXY STATEMENT | 9 |

| | | | | | | | |

| | |

| PROPOSAL 1 - ELECTION OF DIRECTORS |

| | | | | | | | |

| The Board of Directors recommends that shareholders vote “FOR” the election of these ten nominees. If a nominee is unable to stand for election, the Board may reduce the number of directors or choose a substitute. If the Board chooses a substitute, shares represented by proxies will be voted for the substitute. If a director retires, resigns, dies or is unable to serve for any reason, the Board may reduce the number of directors or appoint a new director to fill the vacancy. The new director would serve until the Company’s next annual meeting of shareholders. | |

| | | | | | | | |

10 | PULTEGROUP, INC. | 2025 PROXY STATEMENT | |

| | |

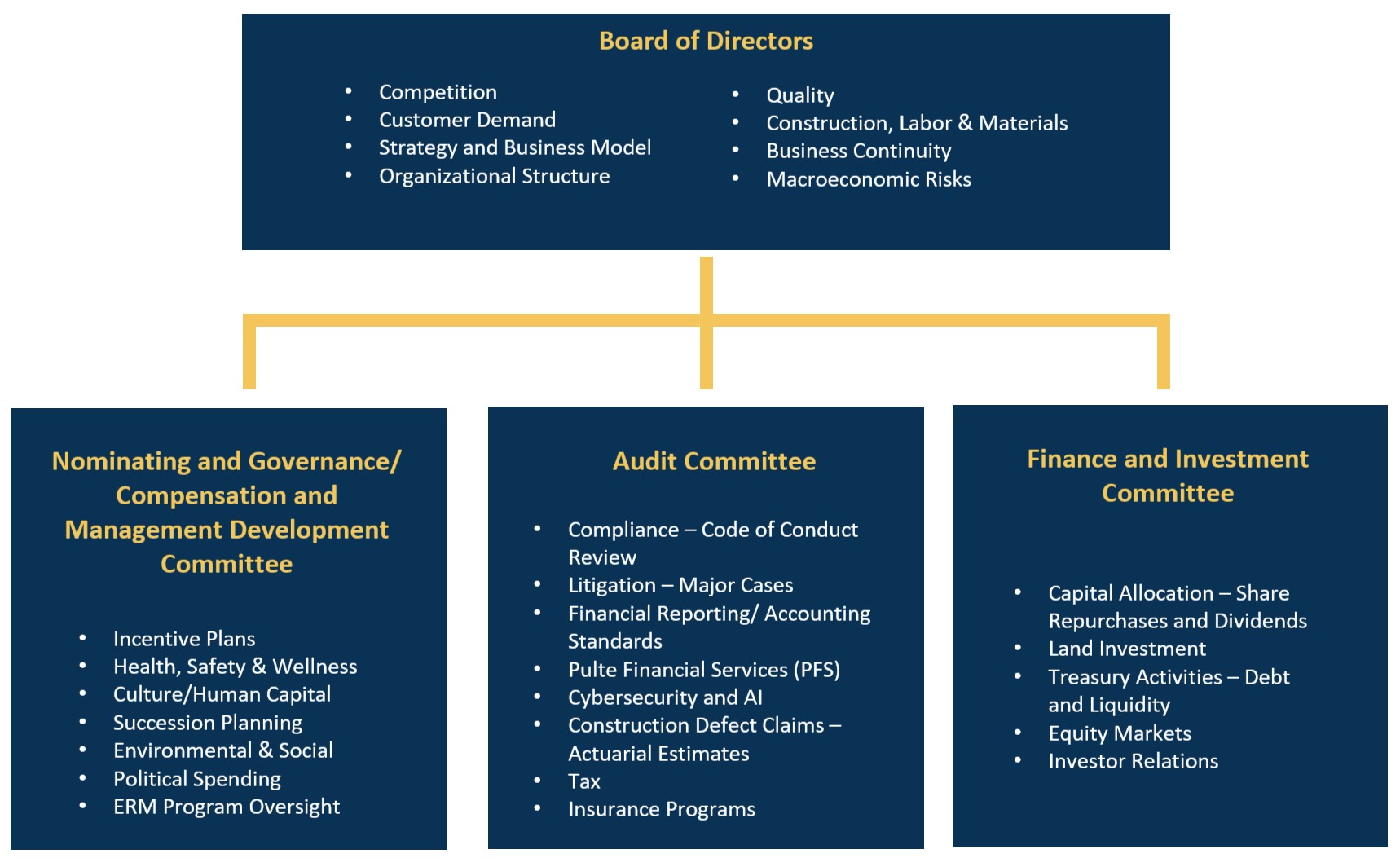

| COMMITTEES OF THE BOARD OF DIRECTORS |

The Board has four standing committees to facilitate and assist the Board in the execution of its responsibilities. The committees are currently the Audit Committee, Compensation and Management Development Committee, Nominating and Governance Committee and Finance and Investment Committee. Charters for all of these committees are available on the Company’s website at www.pultegroupinc.com. The table below shows current membership for each of the standing Board committees.

| | | | | | | | | | | | | | |

Director Name | Audit Committee | Compensation and Management Development Committee | Nominating and Governance Committee | Finance and Investment Committee |

| KRISTEN ACTIS-GRANDE | ● | | | ● |

| | | | |

| BRIAN P. ANDERSON | ● | | | ● |

| | | | | |

| BRYCE BLAIR | | | C | ● |

| | | | | |

| THOMAS J. FOLLIARD* | | | | |

| | | | | |

| CHERYL W. GRISÉ | ● | C | | |

| | | | | |

| ANDRÉ J. HAWAUX | C | | ● | |

| | | | |

J. PHILLIP HOLLOMAN+ | ● | ● | | |

| | | | | |

| RYAN R. MARSHALL | | | | ● |

| | | | | |

| JOHN R. PESHKIN | | ● | | C |

| | | | | |

| SCOTT F. POWERS | | | ● | ● |

| | | | | |

| LILA SNYDER | | ● | | ● |

C = Chair

* Non-Executive Chairman

+ Mr. Holloman is not standing for re-election at the annual meeting.

Board Committee Refreshment

On at least an annual basis, the Nominating and Governance Committee reviews committee assignments and discusses whether rotation of committee members and committee chairs is appropriate to introduce fresh perspectives and to broaden and diversify the views and experiences represented on the Board’s Committees. The Board made the following committee changes effective May 2024: (i) Ms. Actis-Grande began serving on the Audit Committee and the Finance and Investment Committee, (ii) Ms. Grisé became chair of the Compensation and Management Development Committee and a member of the Audit Committee, (iii) Mr. Powers and Mr. Blair became members of the Finance and Investment Committee, (iv) Mr. Hawaux became a member of the Nominating and Governance Committee, and (v) Mr. Holloman and Mr. Peshkin became members of the Compensation and Management Development Committee.

Audit Committee

The Audit Committee met eight times in 2024. The Audit Committee represents and assists the Board with the oversight of the integrity of the Company’s financial statements and financial reporting process, the Company’s system of internal accounting and financial controls, the performance of the Company’s internal audit function, the annual independent audit of the Company’s financial statements, the engagement of the independent auditors, the evaluation of the independent auditor’s qualifications, independence and performance, the Company’s compliance with legal and regulatory requirements, and the Company’s management of significant financial and technological risks. The Audit Committee is also responsible for preparing the report of the Audit Committee required to be included in the Company’s annual proxy statement.

The Audit Committee is responsible for selecting (subject to ratification by our shareholders) the independent auditor as well as setting the compensation for and overseeing the work of the independent auditor and approving audit services to be provided by the independent auditor. The Board has determined that each of the members of the Audit Committee is independent within the meaning of the Company’s categorical standards and the applicable NYSE and SEC rules and financially literate as defined by the NYSE rules, and

| | | | | | | | |

| PULTEGROUP, INC. | 2025 PROXY STATEMENT | 11 |

| | | | | | | | |

| | |

| COMMITTEES OF THE BOARD OF DIRECTORS |

that Kristen Actis-Grande, Brian P. Anderson and André J. Hawaux are audit committee financial experts for purposes of the SEC’s rules.

Compensation and Management Development Committee

The Compensation and Management Development Committee met four times in 2024. The Compensation and Management Development Committee is responsible for the review, approval and administration of the compensation and benefit programs for the Chief Executive Officer and the other named executive officers. It also reviews and makes recommendations regarding the Company’s general compensation philosophy and incentive plans and certain other compensation plans; reviews the Company’s leadership development programs and initiatives; discusses performance, leadership development and succession planning for key officers with the Chief Executive Officer, as appropriate; develops and implements policies with respect to the recovery or “clawback” of any excess incentive-based compensation paid to any of the Company’s officers as required by law and in other circumstances deemed to be appropriate by the Compensation and Management Development Committee; and reviews the Company’s strategies and policies related to human capital management, including with respect to matters such as employee engagement and talent development. The Compensation and Management Development Committee has the power to form subcommittees and delegate responsibility to them. The Board has determined that each of the members of the Compensation and Management Development Committee is independent within the meaning of the Company’s categorical standards and the NYSE rules.

Ms. Grisé is currently the Chair of the Compensation and Management Development Committee. Ms. Grisé works with the Company’s Executive Vice President, and Chief People Officer, or other senior leadership in our human resources department, to establish meeting agendas and determine whether any members of PulteGroup’s management or outside advisors should attend meetings. The Compensation and Management Development Committee also meets regularly in executive session. At various times during 2024 at the request of the Compensation and Management Development Committee, Ryan R. Marshall, the President and Chief Executive Officer of the Company; Robert T. O’Shaughnessy, the Executive Vice President and Chief Financial Officer of the Company; Todd N. Sheldon, the Executive Vice President, General Counsel and Corporate Secretary of the Company; and Kevin A. Henry, Executive Vice President and Chief People Officer of the Company, may attend Compensation and Management Development Committee meetings, or portions of Compensation and Management Development Committee meetings, to provide the Compensation and Management Development Committee with information regarding the Company’s operational performance, financial performance or other topics requested by the Compensation and Management Development Committee to assist it in carrying out its responsibilities.

The Chief Executive Officer annually reviews the performance of each member of senior management (other than our Chief Executive Officer’s performance, whose performance is reviewed by the Compensation and Management Development Committee). Recommendations based on these reviews, including salary adjustments, annual bonuses, long-term incentives and equity grants, are presented to the Compensation and Management Development Committee. Recommendations regarding salary adjustments, annual bonuses, long-term incentives and equity grants for our Chief Executive Officer are made by the Compensation and Management Development Committee and approved by the full Board. All decisions for 2024 made with respect to the executives listed in the Summary Compensation Table (other than the Chief Executive Officer) were made after deliberation with Mr. Marshall.

The Compensation and Management Development Committee is also responsible for overseeing the development of the Company’s succession plan for the President and Chief Executive Officer and other key members of senior management, as well as the Company’s leadership development programs.

The Compensation and Management Development Committee receives and reviews materials provided by the Compensation and Management Development Committee’s consultant and the Company’s management. These materials include information that the consultant and management believe will be helpful to the Compensation and Management Development Committee, as well as materials the Compensation and Management Development Committee specifically requests.

The Compensation and Management Development Committee has the authority to engage its own outside compensation consultant and any other advisors it deems necessary. Since May 2019, the Compensation and Management Development Committee has engaged Semler Brossy to act as its independent consultant. Semler Brossy regularly provides the Compensation and Management Development Committee with information regarding market compensation levels, general compensation trends and best practices. The Compensation and Management Development Committee also regularly asks Semler Brossy to opine on the reasonableness of specific pay decisions and actions for the named executive officers, as well as the appropriateness of the design of the Company’s executive compensation programs.

The activities of Semler Brossy are directed by the Compensation and Management Development Committee, although Semler Brossy may communicate with members of management, as appropriate, to gather data and prepare analyses as requested by the Compensation and Management Development Committee. During 2024, the Compensation and Management Development Committee asked Semler Brossy to review market data and advise the Committee on setting executive compensation and the competitiveness and reasonableness of the Company’s executive compensation program; review and advise the Compensation and Management Development Committee regarding the Company’s pay for performance, equity grant and dilution levels, each as relative to the Company’s peers; review and advise the Compensation and Management Development Committee regarding regulatory, disclosure and other technical matters; and review and advise the Compensation and Management Development Committee regarding the

| | | | | | | | |

12 | PULTEGROUP, INC. | 2025 PROXY STATEMENT | |

| | | | | | | | |

| | |

| COMMITTEES OF THE BOARD OF DIRECTORS | |

Company’s compensation risk assessment procedures. The Compensation and Management Development Committee also asked Semler Brossy to provide opinions on named executive officer pay decisions.

In 2024, Semler Brossy did not provide any other services to the Company. The Compensation and Management Development Committee assessed the independence of Semler Brossy pursuant to SEC rules and concluded that the work of the compensation consultants for the Compensation and Management Development Committee does not raise any conflict of interest. The Compensation and Management Development Committee has determined that Semler Brossy is independent because it does no work for the Company other than that requested by the Compensation and Management Development Committee. The Chair of the Compensation and Management Development Committee reviews the consultant’s invoices, which are paid by the Company.

Nominating and Governance Committee

The Nominating and Governance Committee met seven times in 2024. The Nominating and Governance Committee establishes criteria for the selection of new members of the Board and makes recommendations to the Board based on qualified identified individuals, including any qualified candidates nominated by shareholders, as described in “Director Nomination Recommendations” below. The Nominating and Governance Committee is also responsible for matters related to the governance of the Company and for developing and recommending to the Board the criteria for Board membership, the selection of new Board members, and the assignment of directors to the committees of the Board. The Nominating and Governance Committee assures that a regular evaluation is conducted of the performance, qualifications, and integrity of the Board and the committees of the Board. Please see “Corporate Governance—Board Assessments” for further information regarding the regular evaluations. The Nominating and Governance Committee also reviews and makes recommendations with respect to the compensation of members of the Board.

The Nominating and Governance Committee is also responsible for reviewing the Company’s environmental sustainability, social responsibility and governance policies, practices and disclosures, reviewing the Company’s cultural metrics, and assessing and monitoring the Company’s enterprise risk management initiatives. With respect to our reporting on these matters, the Nominating and Governance Committee oversaw our Company’s process of beginning to report sustainability metrics consistent with the Sustainability Accounting Standards Board for Home Builders along with other disclosures related to our environmental and social initiatives. Sustainability-related metrics and initiatives have been included in our CEO’s performance objectives since 2023. With respect to our Company’s culture initiatives, the Nominating and Governance Committee reviews, at least twice annually, key company metrics with regard to workforce stability, health and safety, as well as our compliance policies relating to employee conduct and anti-harassment.

The Board has determined that each of the members of the Nominating and Governance Committee is independent within the meaning of the Company’s categorical standards and the NYSE rules.

Finance and Investment Committee

The Finance and Investment Committee met six times in 2024. The Finance and Investment Committee reviews key aspects of the Company’s policies that relate to the management of the Company’s financial affairs. The Finance and Investment Committee also reviews the Company’s long-term strategic plans and annual budgets, capital commitments budget, certain land acquisition and sale transactions, and the Company’s cash needs and funding plans.

| | | | | | | | |

| PULTEGROUP, INC. | 2025 PROXY STATEMENT | 13 |

| | | | | | | | |

| | |