Exhibit 10.43

FORM OF PERFORMANCE ADJUSTED

RESTRICTED STOCK UNIT AWARD AGREEMENT

(CEO and Executive Team)

THIS AGREEMENT is entered into and effective as of __________, 20____ (the “Date of Grant”), by and

between Sleep Number Corporation (the “Company”) and (the “Grantee”).

Unless defined in this Agreement, capitalized terms used in this Agreement shall have the meanings

established in the Sleep Number Corporation 2020 Equity Incentive Plan (the “Plan”).

The Company has adopted the Plan, which authorizes the grant of Restricted Stock Unit Awards to

Employees, Non-Employee Directors, and Consultants. The Company desires to give the Grantee a proprietary

interest in the Company and its Subsidiaries in recognition of the Grantee’s contributions and as an added

incentive to advance the interests of the Company and its Subsidiaries by granting to the Grantee a Restricted

Stock Unit Award pursuant to the Plan.

Accordingly, the parties agree as follows:

1.Grant of Award Units and Performance Adjustments.

1.1Grant of Award Units. The Company hereby grants to the Grantee a Restricted Stock Unit Award

(the “Award”) consisting of __________ units (the “Award Units”) that will be settled in shares of the Company’s

common stock, par value $0.01 per share (the “Common Stock”), subject to the terms, conditions, and

restrictions set forth below and in the Plan. Reference in this Agreement to the Award Units or the Adjusted

Award Units (as defined in Section 1.2 of this Agreement) will be deemed to include the Dividend Proceeds (as

defined in Section 3.3 of this Agreement) with respect to such Award Units or Adjusted Award Units as provided

in Section 3.3 of this Agreement.

1.2Performance Adjustments. The number of Award Units granted hereunder is subject to

adjustment based on the Company’s level of achievement versus annual Net Sales goals and annual NOP goals

for the _____, _____, and ____ fiscal years (the “Performance Period”). (For purposes of this Agreement, “NOP”

will be defined as Net Operating Income). The Net Sales growth goals and NOP growth goals will be equally

weighted.

The annual Net Sales and NOP goals and the corresponding performance adjustment multiples are as

follows:

Payout Multiple | Net Sales | NOP | |

Annual growth Target | Annual Growth Target | ||

Threshold | 0.5X | ||

Target | 1.0X | ||

Maximum | 2.0X |

Exhibit 10.43

The calculation of the “Adjusted Award Units” based on performance versus these annual goals will be

determined as follows:

(a)The Company’s actual percent achievement of AOP for _____ or achievement of annual

growth for _____ and ______ will be measured for each of the two (2) performance measures and for

each of the three (3) fiscal years of the Performance Period;

(b)A payout multiple will be determined for each performance goal and for each fiscal year,

based on interpolation between the performance goals in the foregoing table (performance relative to a

performance goal that is below the threshold for a fiscal year will result in a payout multiple of zero (0)

for that performance goal for that fiscal year); and

(c)The mean, or average, of the resulting six (6) payout multiples will be applied to the

number of Award Units to determine the number of “Adjusted Award Units.”

For example, if the annual Net Sales growth rate achieved for _____ is 5%, the multiple for that

performance goal for that year will be 1.0X; and if the annual NOP growth rate achieved for ____ is 12%, the

multiple for that performance goal for that year will be 2.0X. Similar multiples will be determined for each

performance goal and for each of the following fiscal years. The resulting six (6) payout multiples will then be

averaged to determine the final payout multiple. This final payout multiple times the number of Award Units

originally granted results in the number of Adjusted Award Units that would vest, subject to all of the other

proration and vesting provisions set forth in this Agreement.

The “Adjusted Award Units” will be subject to reduction for failure to generate Return on Invested

Capital (“ROIC”) that exceeds Weighted Average Cost of Capital by at least 300 basis points (“bps”), as outlined

in the table below. The measurement will be based on an average of the basis points difference between annual

ROIC and WACC for the three fiscal years _____, ______, and ______.

ROIC Basis Points difference versus WACC (e.g., ROIC of 12% vs. WACC of 10% = +200 bps) | Reduction to Final Payout |

0 bps or lower (i.e., ROIC at or below WACC) | -20% of target award |

1 to 99 bps | -15% of target award |

100 to 199 bps | -10% of target award |

200 to 299 bps | -5% of target award |

300 bps or greater | No reduction |

For the purpose of this calculation, ROIC shall be defined as detailed in the annual 10-K disclosure.

For the purpose of this calculation, WACC shall be defined as detailed in Attachment A.

The Company’s actual performance relative to the performance goals set forth above and the

calculation of the Adjusted Award Units shall be determined by the Management Development and

Compensation Committee (the “Committee”) of the Board of Directors following the conclusion of the

Performance Period. The Committee’s determination shall be final and conclusive for all purposes under this

Agreement. The number of Award Units resulting after adjustment as described above will be referred to herein

as the “Adjusted Award Units.”

Exhibit 10.43

1.3Restrictive Covenant Agreement. In consideration for the grant of this Award, the Grantee

agrees to execute and be bound by the terms of the Employee Inventions, Confidentiality, Non-Compete and

Mutual Arbitration Agreement (the “Non-Compete Agreement”) attached hereto, and the Grantee

acknowledges that the Grantee’s failure to execute the Non-Compete Agreement will cause this Award to

automatically terminate and be forfeited without any further action.

2.Grant Restriction.

2.1Restriction and Forfeiture. The Grantee’s right to the Award Units or the Adjusted Award Units

and the shares of Common Stock issuable under the Award Units or Adjusted Award Units will be subject to the

Grantee remaining in continuous employment or service with the Company or any Subsidiary for a period of

three (3) years (the “Vesting Period”) following the Date of Grant; provided, however, that such employment or

service period restrictions (the “Restrictions”) will lapse and terminate prior to end of the Vesting Period as set

forth in Section 2.2 below (or as otherwise set forth in the Plan for any circumstance not contemplated by the

terms of Section 2.2).

2.2Death, Disability, or other Termination of Employment or Service.

(a)Death. In the event that the Grantee’s employment or service is terminated prior to the

end of the Vesting Period due to the Grantee’s death, the Restrictions applicable to the Award Units or

Adjusted Award Units will immediately lapse and terminate, and the shares of Common Stock to be

issued in settlement of the Award Units will be issued within 90 days of the Grantee’s death, with the

performance adjustment determination related to any incomplete fiscal year(s) within the Performance

Period deemed to be satisfied at the target level, with no reduction based on ROIC performance.

(b)Disability. In the event that the Grantee’s employment or service is terminated prior to

the end of the Vesting Period due to the Grantee’s Disability, the Grantee will become fully vested in the

Award Units pending completion of the Performance Period and final determination of the Adjusted

Award Units. The shares of Common Stock to be issued in settlement of the Adjusted Award Units will

be retained and held by the Company pending the final determination of the Adjusted Award Units and

will be issued within 90 days of the end of the Vesting Period.

(c)Termination Due to Retirement.

(i)In the event that the Grantee’s employment or other service is terminated prior

to the end of the Vesting Period by reason of the Grantee’s retirement at or beyond age fifty-

five (55) and the Grantee has five (5) or more years of service with the Company prior to such

retirement, the Grantee will become vested in a pro rata portion of Award Units based on the

number of calendar days elapsed in the Vesting Period as of the date of retirement (e.g., If the

Grantee was granted 1,200 Award Units, and if retirement occurs 730 calendar days into the

1,095 calendar days vesting period, then the Grantee will become vested with respect to an

aggregate of 800 Award Units and the remaining 400 Award Units will immediately terminate

and be forfeited without notice of any kind) pending completion of the Performance Period and

final determination of the Adjusted Award Units.

(ii)In the event that the Grantee’s employment or other service with the Company

and all Subsidiaries is terminated prior to the end of the Vesting Period by reason of the

Grantee’s retirement prior to age fifty-five (55) or the Grantee has fewer than five (5) years of

service with the Company prior to retirement, all rights of the Grantee under the Plan and this

Agreement relating to all Award Units with respect to which the Restrictions have not lapsed will

immediately terminate and be forfeited without notice of any kind.

(iii)In the event that the Grantee’s employment or other service with the Company

and all Subsidiaries is terminated prior to the end of the Vesting Period by reason of the

Grantee’s retirement at or beyond age sixty (60) and the Grantee has five (5) or more years of

service with the Company prior to retirement, the Grantee will become fully vested in the Award

Units pending completion of the Performance Period and final determination of the Adjusted

Award Units if the following criteria are met: Grantee provides written notice of Grantee’s

Exhibit 10.43

intention to retire three months before Grantee’s actual retirement date. Provided, however,

and only to the extent permitted by applicable law, that as a condition of Grantee becoming

vested in the Award Units at completion of the Performance Period, Grantee cannot have

engaged in competitive activities to Company’s business in the United States during the period

between the Grantee’s termination date and the end of the Vesting Period, up to any duration

limitation under applicable law.

(iv)The shares of Common Stock to be issued in settlement of the Adjusted Award

Units pursuant to paragraphs (i) or (iii) above will be retained and held by the Company pending

the final determination of the Adjusted Award Units and will be issued within 90 days of the end

of the Vesting Period.

(d)Termination for Reasons other than Death, Disability, or Retirement. In the event the

Grantee’s employment or other service with the Company and all Subsidiaries is terminated prior to the

end of the Vesting Period for any reason other than death, Disability, or retirement as provided above,

or if the Grantee is in the employ or service of a Subsidiary and the Subsidiary ceases to be a Subsidiary

of the Company (unless the Grantee continues in the employ or service of the Company or another

Subsidiary), all rights of the Grantee under this Agreement relating to Award Units with respect to which

the Restrictions have not lapsed will immediately terminate and be forfeited without notice of any kind.

3.Issuance of Shares.

3.1Timing. Vested Award Units or Adjusted Award Units shall be converted to shares of Common

Stock on a one-for-one basis, and such shares shall be issued as soon as reasonably possible, but not more than

90 days, after the end of the Vesting Period, subject to the provisions set forth above applicable to vesting

events that occur prior to the end of the Vesting Period.

3.2Limitations on Transfer. Award Units or Adjusted Award Units will not be assignable or

transferable by the Grantee, either voluntarily or involuntarily, and may not be subjected to any lien, directly or

indirectly, by operation of law or otherwise. Any attempt to transfer, assign, or encumber the Award Units or

Adjusted Award Units, other than in accordance with this Agreement and the Plan, will be null and void and will

void the Award, and all Award Units or Adjusted Award Units for which the Restrictions have not lapsed will be

forfeited and immediately returned to the Company.

3.3Dividends and Other Distributions. The Award Units are being granted with an equal number of

dividend equivalents. Accordingly, the Grantee is entitled to receive an additional award unit with a value equal

to any dividends or distributions (including, without limitation, any cash dividends, stock dividends or dividends

in kind, the proceeds of any stock split, or the proceeds resulting from any changes or exchanges described in

Section 6 of this Agreement, all of which are referred to herein collectively as the “Dividend Proceeds”) that are

paid or payable with respect to one share of Common Stock for each Award Unit, which will be subject to the

same rights, restrictions, and performance adjustments under this Agreement as the Award Units to which such

dividends or distributions relate. The number of additional award units to be received as dividend equivalents

for each Award Unit shall be determined by dividing the cash dividend per share by the Fair Market Value of one

share of Common Stock on the dividend or distribution payment date. All such additional award units received

as dividend equivalents will be subject to the same restrictions and performance adjustments as the Award Units

to which such Dividend Proceeds relate.

3.4Fractional Shares. The Grantee acknowledges that the Company will not issue or deliver

fractional shares of Common Stock under this Agreement. All fractional shares will be rounded up to the nearest

whole share.

4.Rights of Grantee.

4.1Employment or Service. Nothing in this Agreement will interfere with or limit in any way the

right of the Company or any Subsidiary to terminate the employment or service of the Grantee at any time, nor

confer upon the Grantee any right to continue in the employment or service with the Company or any Subsidiary

at any particular position or rate of pay or for any particular period of time.

Exhibit 10.43

4.2Rights as a Shareholder. The Grantee will have no rights as a shareholder until the Grantee

becomes the holder of record of shares of Common Stock issued in settlement of the Adjusted Award Units. As

soon as reasonably possible after the satisfaction of any conditions to the effective issuance of shares of

Common Stock in settlement of the Adjusted Award Units, the shares will be issued by the Company.

5.Withholding Taxes. The Company is entitled to (i) withhold and deduct from future wages of the

Grantee (or from other amounts that may be due and owing to the Grantee from the Company), or to withhold

from the shares of Common Stock that would otherwise be determined to be paid to the Company out of

Dividend Proceeds, or make other arrangements for the collection of all amounts the Company determines are

legally required to satisfy any federal, state, or local withholding and employment-related tax requirements

attributable to the receipt of the Award, the receipt of dividends or distributions on Award Units or Adjusted

Award Units, or the lapse or termination of the Restrictions applicable to Award Units or Adjusted Award Units,

or (ii) require the Grantee promptly to remit the amount of such withholding to the Company. In the event that

the Company is unable to withhold such amounts, for whatever reason, the Grantee agrees to pay to the

Company an amount equal to the amount the Company would otherwise be required to withhold under federal,

state, or local law.

6.Adjustments. In the event of any reorganization, merger, consolidation, recapitalization, liquidation,

reclassification, stock dividend, stock split, combination of shares, rights offering, or divestiture (including a spin-

off), or any other change in the corporate structure or shares of the Company, the Committee (or, if the

Company is not the surviving corporation in any such transaction, the board of directors of the surviving

corporation), in order to prevent dilution or enlargement of the rights of the Grantee, will make appropriate

adjustment (which determination will be conclusive) as to the number and kind of securities or other property

(including cash) subject to this Award.

7.Subject to Plan. The Award and the Award Units granted pursuant to this Agreement have been granted

under the Plan and, except as otherwise expressly provided in this Agreement, are subject to all of the terms and

conditions of the Plan. In addition, the Grantee, by execution hereof, acknowledges having received a copy of

the Plan and acknowledges that the Company, or a third party vendor designated by the Company, may deliver

to the Grantee any documents related to the Grantee’s participation in the Plan by electronic means, including

through email, the Company’s website, and through the website of the third party vendor designated by the

Company. The provisions of this Agreement will be interpreted as to be consistent with the Plan, and any

ambiguities in this Agreement will be interpreted by reference to the Plan. In the event that any provision of

this Agreement is not authorized under the Plan, the terms of the Plan will prevail.

8.Forfeiture, Clawback or Recoupment. This Award is subject to the forfeiture and clawback provisions

pursuant to the Plan. Additionally, the Grantee may be subject to the Company’s policy regarding clawback and

forfeiture of certain compensation, as in effect at such time. In addition to the other rights of the Committee

under the Plan, if Grantee is determined by the Committee, acting in its sole discretion, to have taken any action

that would constitute Adverse Action or Cause or that is subject to any other or additional “clawback,”

forfeiture, or recoupment policy adopted by the Company, either prior to or after the date of this Agreement, or

to have violated the Non-Compete Agreement, as defined in Section 1.3, (i) all of Grantee’s rights under the Plan

and any agreements evidencing an award granted under the Plan, including this Agreement evidencing this

Award, then held by Grantee shall terminate and be forfeited upon the effectiveness of such Committee action,

and without notice of any kind, and (ii) the Committee, in its sole discretion may require Grantee to surrender

and return, transfer, or assign to the Company all or any portion of the shares of Common Stock received, or to

disgorge all or any profits or any other economic value (however defined by the Committee) made or realized by

Grantee or Grantee’s affiliate, during the period beginning two (2) years prior to your termination of

employment or service with the Company, in connection with any awards granted under the Plan, including this

Award, or any shares of Common Stock issued upon the exercise or vesting of any awards, including this Award.

This Section 8 shall not apply and shall automatically become void ab initio following a Change of Control.

9.Miscellaneous

9.1Binding Effect. This Agreement will be binding upon the heirs, executors, administrators, and

successors of the parties to this Agreement.

Exhibit 10.43

9.2Governing Law. This Agreement and all rights and obligations under this Agreement will be

construed in accordance with the Plan and governed by the laws of the State of Minnesota, without regard to

conflicts of laws provisions. Any legal proceeding related to this Agreement will be brought in an appropriate

Minnesota court, and the parties to this Agreement consent to the exclusive jurisdiction of the court for this

purpose.

9.3Entire Agreement. This Agreement and the Plan set forth the entire agreement and

understanding of the parties to this Agreement with respect to the grant and vesting of this Award and the

administration of the Plan and supersede all prior agreements, arrangements, plans, and understandings relating

to the grant and vesting of this Award and the administration of the Plan.

9.4Amendment and Waiver. Other than as provided in the Plan, this Agreement may be amended,

waived, modified, or canceled only by a written instrument executed by the parties to this Agreement or, in the

case of a waiver, by the party waiving compliance.

9.5Code Section 409A. Payments of amounts under this Agreement are intended to comply with

the requirements of Code section 409A, and this Agreement shall in all respects be administered and construed

to give effect to such intent. The Committee, in its sole discretion, may accelerate or delay distribution of any

shares in payment of amounts due under this Agreement if and to the extent allowed under Code section 409A.

Exhibit 10.43

The parties hereto have executed this Agreement effective the day and year first above written.

SLEEP NUMBER CORPORATION

(Signature)

(Title)

By execution of this Agreement,GRANTEE

the Grantee acknowledges having

received a copy of the Plan.

(Signature)

(Name and Address)

____________________________________

[Attachments omitted]

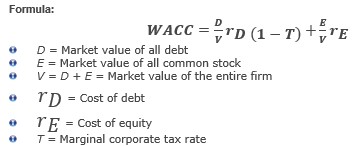

ATTACHMENT A: Definition for the Company’s Weighted Average Cost of Capital (WACC)

WACC is an approximation of the average rate of return a company expects to compensate all of its different

investors. The WACC formula and key assumptions used in the Company’s WACC calculation are outlined below:

•The market value of all debt reflects the capitalization of our operating leases as debt, plus any other

outstanding debt. We calculate our capitalized operating lease obligations as part of our Return on Invested

Capital (ROIC) calculation. The market value of all debt (including capitalized operating lease obligations) for

each fiscal year within the Performance Period will equal the amounts included in our publicly reported ROIC

calculations.

•The market value of all common stock for each fiscal year within the Performance Period is

calculated based on the 5-quarter average (the first day of the first quarter and the last day of each

of the 4 quarters) of our common shares outstanding multiplied by the respective closing share

price at the end of each quarter.

•Cost of debt is the effective interest rate a company would pay for its debt. Our research indicates our debt

would receive a rating of approximately BB (high-yield corporate debt). We base our cost of debt on the JP

Morgan Chase Domestic High Yield 7-10 Year Corporate Bond Index rates computed on a five-quarter

average (the first day of the first quarter and the last day of each of the 4 quarters) for each fiscal year

within the Performance Period.

•Cost of equity

̶Risk-free rate is the theoretical rate of return of an investment with no risk of financial loss. In practice,

a bond issued by a government with a negligible risk of default is used. We base our risk-free rate on the

five quarter average (the first day of the first quarter and the last day of each of the four quarters) 10-

year U.S. treasury bill rate during each fiscal year within the Performance Period

̶Risk premium is the return in excess of the risk-free rate that an investment (as adjusted for risk) is

expected to yield. We use the risk premium by industry/sector as annually reported by the Stern School

of Business at New York University. For the purposes of this calculation, we use the average of the

annual risk premium estimates for the Furniture/Home Furnishings, Retail (Special Lines), and Retail

(Building Supply) industry sectors for the period that most closely corresponds to each fiscal year within

the Performance Period

•Marginal corporate tax rate is our effective tax rate before discrete adjustments for each fiscal year within

the Performance Period

•If any benchmark or index referenced above is unavailable at the time of the performance

measurement, we will substitute with a substantially similar benchmark or index approved by the Compensation

Committee.