INVESTOR PRESENTATION Nasdaq: SNBR December 2025

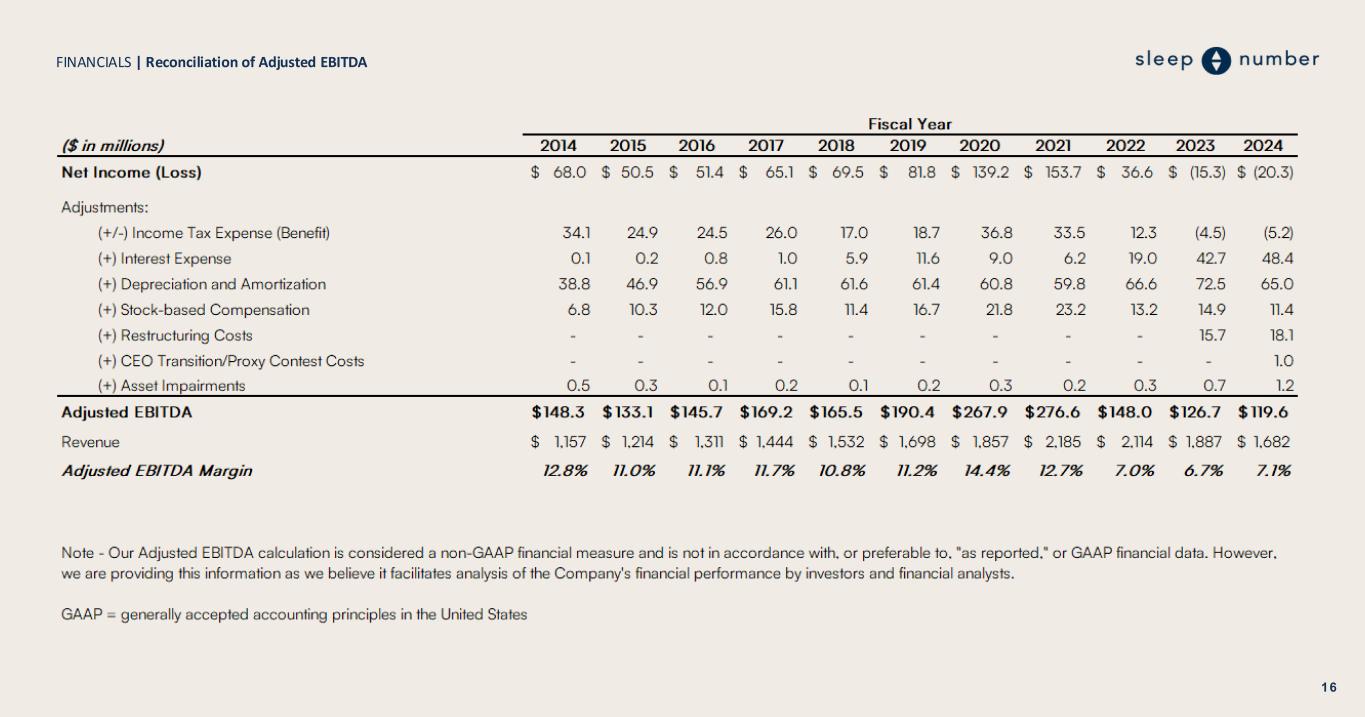

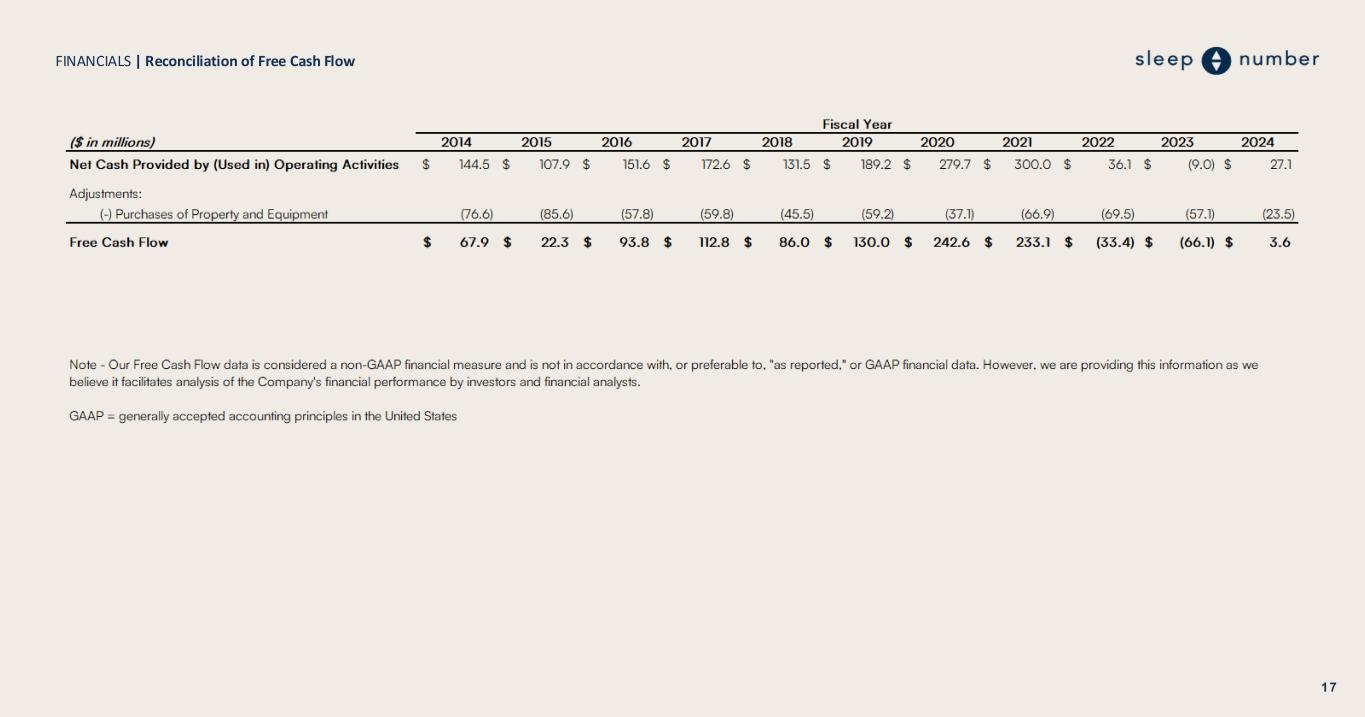

This investor presentation contains statements regarding the company’s expectations, future plans, events, financial results or performance, such as the following statements that are forward-looking statements subject to certain risks and uncertainties which could cause the company’s results to differ materially: the company has initiated a comprehensive financial and operational transformation, setting a clear vision for growth, new opportunities, and lasting shareholder value; the company’s gross margin profile and reduced fixed cost structure is anticipated to result in strong free cash flow as growth returns; the company expects to generate positive free cash flow in 2026 and beyond, creating the opportunity to de-lever the balance sheet; the recently amended and extended credit agreement provides the company with the financial flexibility to execute the business turnaround; with expected improvements in financial results from the turnar ound, the company is positioned to restructure the balance sheet with longer-duration debt to drive long-term shareholder value creation; the company’s simpler and differentiated product offering in 2026 will improve shop-ability, conversion, margins, and efficiency; and the company has certain expectations for full year 2025 adjusted EBITDA and 2025 exit rate of profitability. The most important risks and uncertainties are described in the Company’s filings with the Securities and Exchange Commission, including in Item 1A of the Company’s Annual Report on Form 10-K and other periodic reports. Forward-looking statements speak only as of the date they are made, and the Company does not undertake any obligation to update any forward-looking statement. USE OF NON-GAAP FINANCIAL MEASURES INFORMATION The company defines earnings before interest, taxes, depreciation and amortization (adjusted EBITDA) as net income (loss) plus: income tax expense (benefit), interest expense, depreciation and amortization, stock-based compensation, restructuring costs, other non-recurring items, and asset impairments. Management believes adjusted EBITDA is a useful indicator of the company’s financial performance and its ability to generate cash from operating activities. The company's definition of adjusted EBITDA may not be comparable to similarly titled definitions used by other companies. FORWARD LOOKING STATEMENTS 2

3 WHY NOW, WHY SLEEP NUMBER | The company has initiated a comprehensive financial and operational transformation, setting a clear vision for growth, new opportunities, and lasting shareholder value EXPECTED RETURNS AND TIMELINE UNIQUE POSITION ADVANTAGE CLEAR VALUE CREATION PATHWAY SHAREHOLDER VALUE PROPOSITION • New CEO and management team in place in Q2 2025 immediately began activating a turnaround plan focused on the consumer • Modernized marketing engine is already driving efficiency • Revised loan covenants and maturity extension create space to invest in marketing and product • A simpler and differentiated product offering in 2026 will improve shop-ability, conversion, margins, and efficiency • Building on HSN activation, additional distribution pilots to be executed in 2026 • Sleep is recognized as a key element of overall individual health • Strong brand awareness and reputation • Highly differentiated product that offers the most personalized mattress on the market • 900+ patents and patents pending creates product innovation moat • Established fleet of 600+ high-quality retail stores • New leadership with deep experience in consumer products and marketing • Clear focus on the consumer through a simple turnaround strategy – Sleep Number Shifts: • Product – simplifying the offering with a focus on consumer benefits • Marketing – modernization of tactics and focus on funnel optimization and ROI • Distribution – opportunity to expand distribution into both physical and digital channels • Underpinned by significant reductions to the fixed cost structure and financing secured to support the turnaround • Gross margin profile and reduced fixed cost structure is anticipated to result in strong free cash flow as growth returns • Expect to generate positive free cash flow in 2026 and beyond, creating the opportunity to de-lever the balance sheet • With expected improvements in financial results from the turnaround, the company is positioned to restructure the balance sheet with longer-duration debt to drive long-term shareholder value creation

Leading with Speed and a Clear Vision Sleep Number is in a turnaround. Since I joined in April 2025, every part of the business has been impacted by change. We: • Created a more streamlined operation to ensure quicker decision making, • Reduced costs across the business by more than $135M as compared to 2024, excluding restructuring and other non-recurring costs, and • Executed an amendment and extension of our bank agreement through the end of 2027. We are now in a position where we can implement our strategy to further shareholder, consumer, and team member value. We call it Sleep Number Shifts – a focused, company-wide effort to reposition our brand, expand our reach to new customer groups, and reignite growth. We still have a lot of work ahead of us, and I am optimistic about Sleep Number. This is a powerful brand, with a highly differentiated product. We have more than 3,200 dedicated team members with a renewed passion for fast action and a commitment to our purpose of improving lives by personalizing sleep. I believe that our leaner cost structure will stabilize the business and our 2026 plans are achievable. We appreciate your support and will keep you updated as we move forward. Linda Findley, President and CEO, Sleep Number December 2025

5 Stabilizing the foundation and positioning for growth Immediate Actions Taken Since April 2025 • Streamlined organization for faster decision-making across all business units • Achieved >$135M in cost savings in 2025 vs. 2024 (excluding restructuring and non-recurring costs), with more to come • Successfully amended and extended bank agreement through 2027 • ~3,200 team members with renewed focus on execution speed Strategic Framework Established: "Sleep Number Shifts" • Company-wide effort to strengthen market position • Targeting new customer segments to broaden reach • Focused initiatives to reignite revenue growth Set a Path Forward • Build back to profitable growth leveraging brand strength and differentiated technology • Cash generation focus to reduce debt and strengthen balance sheet • Value creation for shareholders, customers, and team members

1. Trailing-twelve months Total Retail comparable sales per store open at least one year as of September 27, 2025. See Appendix for reconciliations. 2. Enterprise value as of September 27, 2025. 3. Trailing-twelve months as of September 27, 2025. See Appendix for reconciliations. 4. Leverage ratio as of September 27, 2025, under revolving credit facility calculated as total debt including operating lease l iabilities / consolidated EBITDAR. Covenant maximum of 5.25x. COMPANY AT-A-GLANCE | A sleep wellness company and market leader in design, manufacturing, marketing and distribution of innovative sleep solutions • The leader in premium personalized sleep through the design, engineering, manufacturing, distribution and marketing of innovative sleep solutions • Our beds integrate physical and digital innovations for unparalleled comfort; they automatically respond to the needs of each sleeper with ideal firmness, position and temperature benefits • Our beds with integrated biosignal technology collect billions of data points nightly from millions of sleepers, generating comprehensive longitudinal data • Our products are awarded the industry's top recognitions, including ranked #1 in customer satisfaction for mattresses purchased in-store and online, including #1 in comfort, by J.D. Power and one of TIME's Best Inventions of 2025 • By leveraging our data and engagement tools, we deliver personalized digital sleep and health insights to sleepers, driving greater loyalty, repeat purchases, and referrals • We have developed an industry-leading IP portfolio supported by 900+ patents and patents pending worldwide • Our ~3,200 mission-driven team members seamlessly integrate our digital and physical experiences to achieve a value-added retail experience through our experiential stores, online, phone and chat channels 6 $1.2 $1.2 $1.3 $1.4 $1.5 $1.7 $1.9 $2.2 $2.1 $1.9 $1.7 $1.4 ’14 ’15 ’16 ’17 ’18 ’19 ’20 ’21 ’22 ’23 ’24 3Q ’25 LTM 611 Stores $1.4B Net Sales3 900+ Patent Assets 2.3M Average Sales per Store1 $85M Adjusted EBITDA3 3.1M Smart Sleepers $743M Enterprise Value2 5.0x Net Leverage Ratio Under RCF4 16M+ Improved Lives by Higher Quality Sleep Net Sales ($B) $148 $133 $146 $169 $166 $190 $268 $277 $148 $127 $120 $85 ’14 ’15 ’16 ’17 ’18 ’19 ’20 ’21 ’22 ’23 ’24 3Q ’25 LTM Adjusted EBITDA1 ($M)

7 sleep number shifts OUR TURNAROUND STRATEGY | Sleep Number Shifts, a focused, company-wide effort REPOSITION OUR BRAND By highlighting our core value proposition: helping people get a great night of sleep, tonight EXPAND CUSTOMER REACH By offering what they want most: comfort, value and durability REIGNITE GROWTH By ensuring we have the right infrastructure to deliver on our priorities

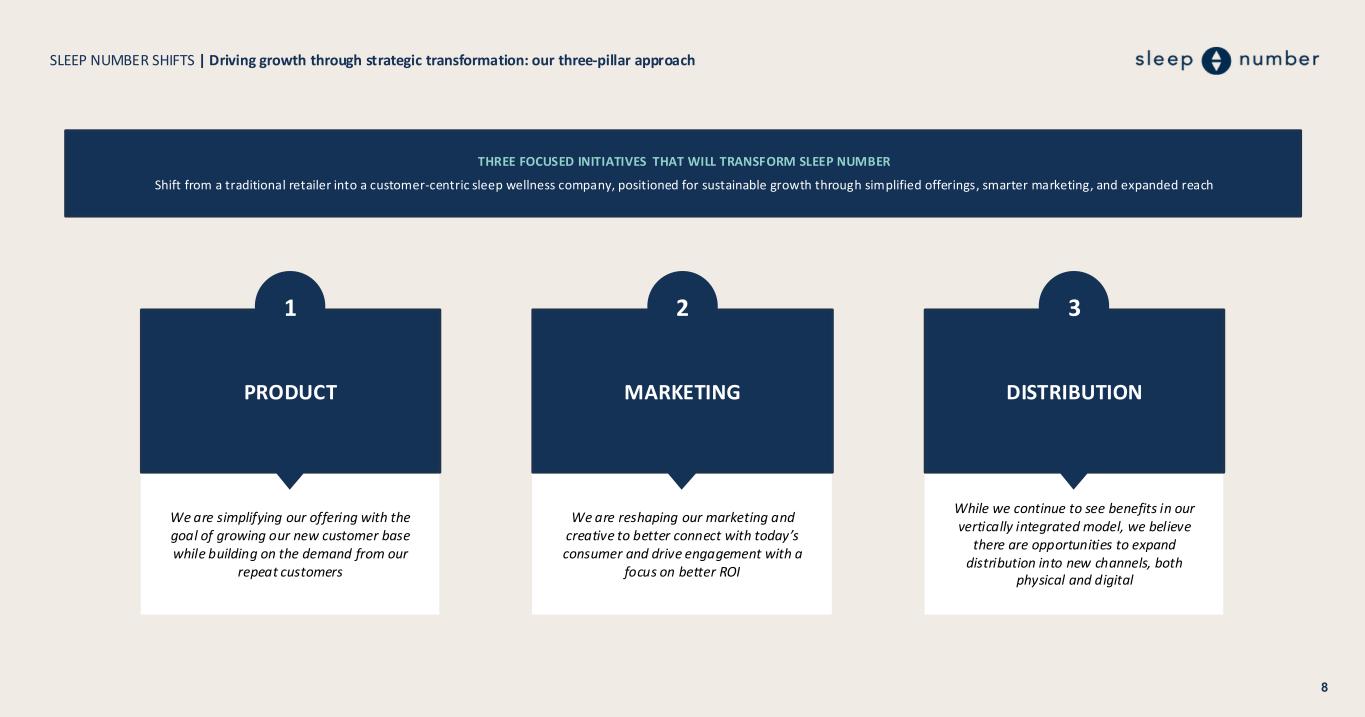

8 SLEEP NUMBER SHIFTS | Driving growth through strategic transformation: our three-pillar approach While we continue to see benefits in our vertically integrated model, we believe there are opportunities to expand distribution into new channels, both physical and digital DISTRIBUTION 3 We are reshaping our marketing and creative to better connect with today’s consumer and drive engagement with a focus on better ROI MARKETING 2 We are simplifying our offering with the goal of growing our new customer base while building on the demand from our repeat customers PRODUCT 1 THREE FOCUSED INITIATIVES THAT WILL TRANSFORM SLEEP NUMBER Shift from a traditional retailer into a customer-centric sleep wellness company, positioned for sustainable growth through simplified offerings, smarter marketing, and expanded reach

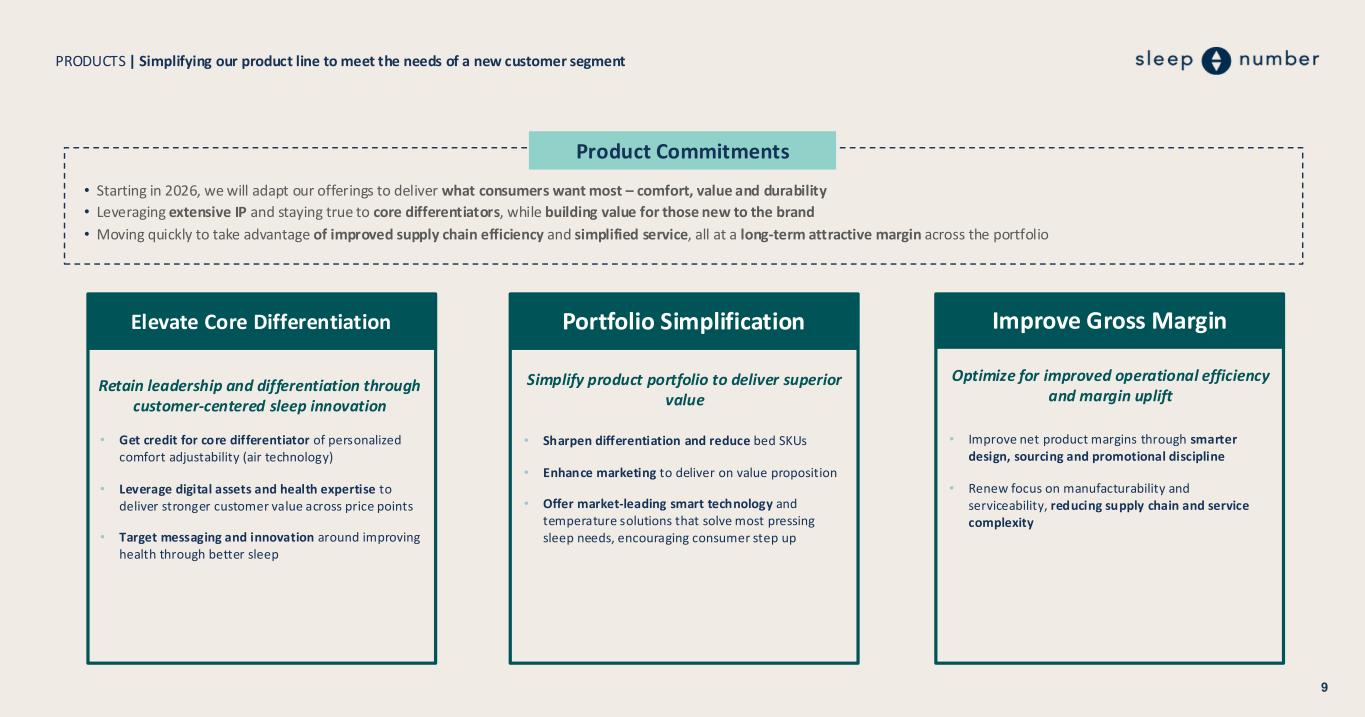

PRODUCTS | Simplifying our product line to meet the needs of a new customer segment 9 • Starting in 2026, we will adapt our offerings to deliver what consumers want most – comfort, value and durability • Leveraging extensive IP and staying true to core differentiators, while building value for those new to the brand • Moving quickly to take advantage of improved supply chain efficiency and simplified service, all at a long-term attractive margin across the portfolio Product Commitments Portfolio Simplification • Sharpen differentiation and reduce bed SKUs • Enhance marketing to deliver on value proposition • Offer market-leading smart technology and temperature solutions that solve most pressing sleep needs, encouraging consumer step up Simplify product portfolio to deliver superior value Improve Gross Margin • Improve net product margins through smarter design, sourcing and promotional discipline • Renew focus on manufacturability and serviceability, reducing supply chain and service complexity Optimize for improved operational efficiency and margin uplift Elevate Core Differentiation Retain leadership and differentiation through customer-centered sleep innovation • Get credit for core differentiator of personalized comfort adjustability (air technology) • Leverage digital assets and health expertise to deliver stronger customer value across price points • Target messaging and innovation around improving health through better sleep

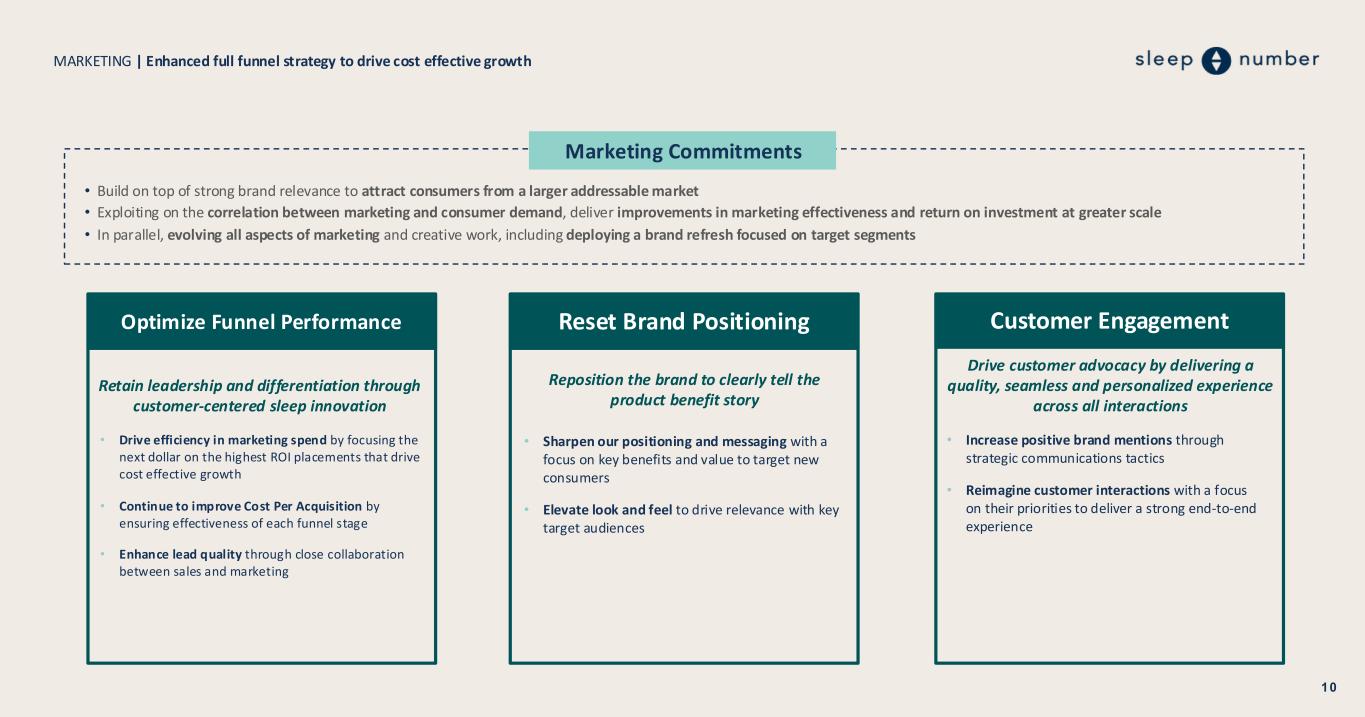

MARKETING | Enhanced full funnel strategy to drive cost effective growth 10 • Build on top of strong brand relevance to attract consumers from a larger addressable market • Exploiting on the correlation between marketing and consumer demand, deliver improvements in marketing effectiveness and return on investment at greater scale • In parallel, evolving all aspects of marketing and creative work, including deploying a brand refresh focused on target segments Marketing Commitments Reset Brand Positioning • Sharpen our positioning and messaging with a focus on key benefits and value to target new consumers • Elevate look and feel to drive relevance with key target audiences Reposition the brand to clearly tell the product benefit story Customer Engagement • Increase positive brand mentions through strategic communications tactics • Reimagine customer interactions with a focus on their priorities to deliver a strong end-to-end experience Drive customer advocacy by delivering a quality, seamless and personalized experience across all interactions Optimize Funnel Performance Retain leadership and differentiation through customer-centered sleep innovation • Drive efficiency in marketing spend by focusing the next dollar on the highest ROI placements that drive cost effective growth • Continue to improve Cost Per Acquisition by ensuring effectiveness of each funnel stage • Enhance lead quality through close collaboration between sales and marketing

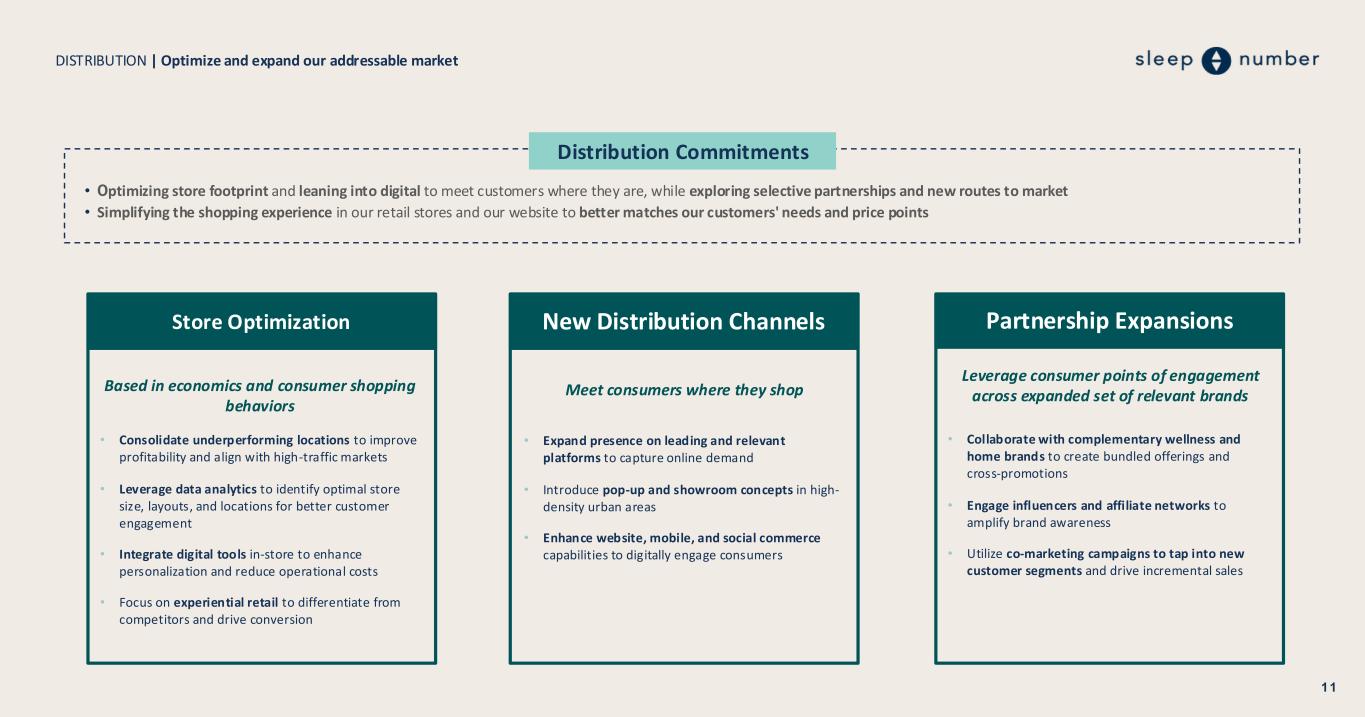

DISTRIBUTION | Optimize and expand our addressable market 11 • Optimizing store footprint and leaning into digital to meet customers where they are, while exploring selective partnerships and new routes to market • Simplifying the shopping experience in our retail stores and our website to better matches our customers' needs and price points Distribution Commitments New Distribution Channels • Expand presence on leading and relevant platforms to capture online demand • Introduce pop-up and showroom concepts in high- density urban areas • Enhance website, mobile, and social commerce capabilities to digitally engage consumers Meet consumers where they shop Partnership Expansions • Collaborate with complementary wellness and home brands to create bundled offerings and cross-promotions • Engage influencers and affiliate networks to amplify brand awareness • Utilize co-marketing campaigns to tap into new customer segments and drive incremental sales Leverage consumer points of engagement across expanded set of relevant brands Store Optimization Based in economics and consumer shopping behaviors • Consolidate underperforming locations to improve profitability and align with high-traffic markets • Leverage data analytics to identify optimal store size, layouts, and locations for better customer engagement • Integrate digital tools in-store to enhance personalization and reduce operational costs • Focus on experiential retail to differentiate from competitors and drive conversion

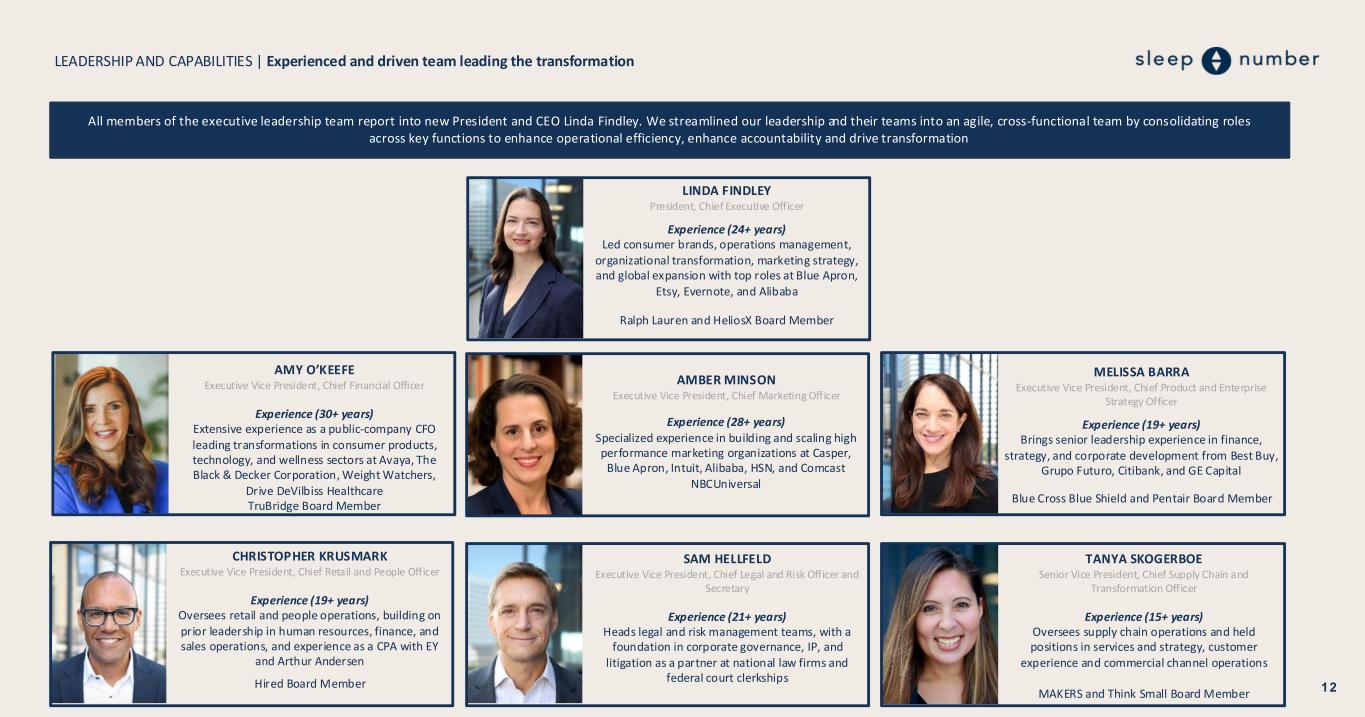

12 LEADERSHIP AND CAPABILITIES | Experienced and driven team leading the transformation All members of the executive leadership team report into new President and CEO Linda Findley. We streamlined our leadership and their teams into an agile, cross-functional team by consolidating roles across key functions to enhance operational efficiency, enhance accountability and drive transformation LINDA FINDLEY President, Chief Executive Officer Experience (24+ years) Led consumer brands, operations management, organizational transformation, marketing strategy, and global expansion with top roles at Blue Apron, Etsy, Evernote, and Alibaba Ralph Lauren and HeliosX Board Member AMY O’KEEFE Executive Vice President, Chief Financial Officer Experience (30+ years) Extensive experience as a public-company CFO leading transformations in consumer products, technology, and wellness sectors at Avaya, The Black & Decker Corporation, Weight Watchers, Drive DeVilbiss Healthcare TruBridge Board Member CHRISTOPHER KRUSMARK Executive Vice President, Chief Retail and People Officer Experience (19+ years) Oversees retail and people operations, building on prior leadership in human resources, finance, and sales operations, and experience as a CPA with EY and Arthur Andersen Hired Board Member AMBER MINSON Executive Vice President, Chief Marketing Officer Experience (28+ years) Specialized experience in building and scaling high performance marketing organizations at Casper, Blue Apron, Intuit, Alibaba, HSN, and Comcast NBCUniversal MELISSA BARRA Executive Vice President, Chief Product and Enterprise Strategy Officer Experience (19+ years) Brings senior leadership experience in finance, strategy, and corporate development from Best Buy, Grupo Futuro, Citibank, and GE Capital Blue Cross Blue Shield and Pentair Board Member SAM HELLFELD Executive Vice President, Chief Legal and Risk Officer and Secretary Experience (21+ years) Heads legal and risk management teams, with a foundation in corporate governance, IP, and litigation as a partner at national law firms and federal court clerkships TANYA SKOGERBOE Senior Vice President, Chief Supply Chain and Transformation Officer Experience (15+ years) Oversees supply chain operations and held positions in services and strategy, customer experience and commercial channel operations MAKERS and Think Small Board Member

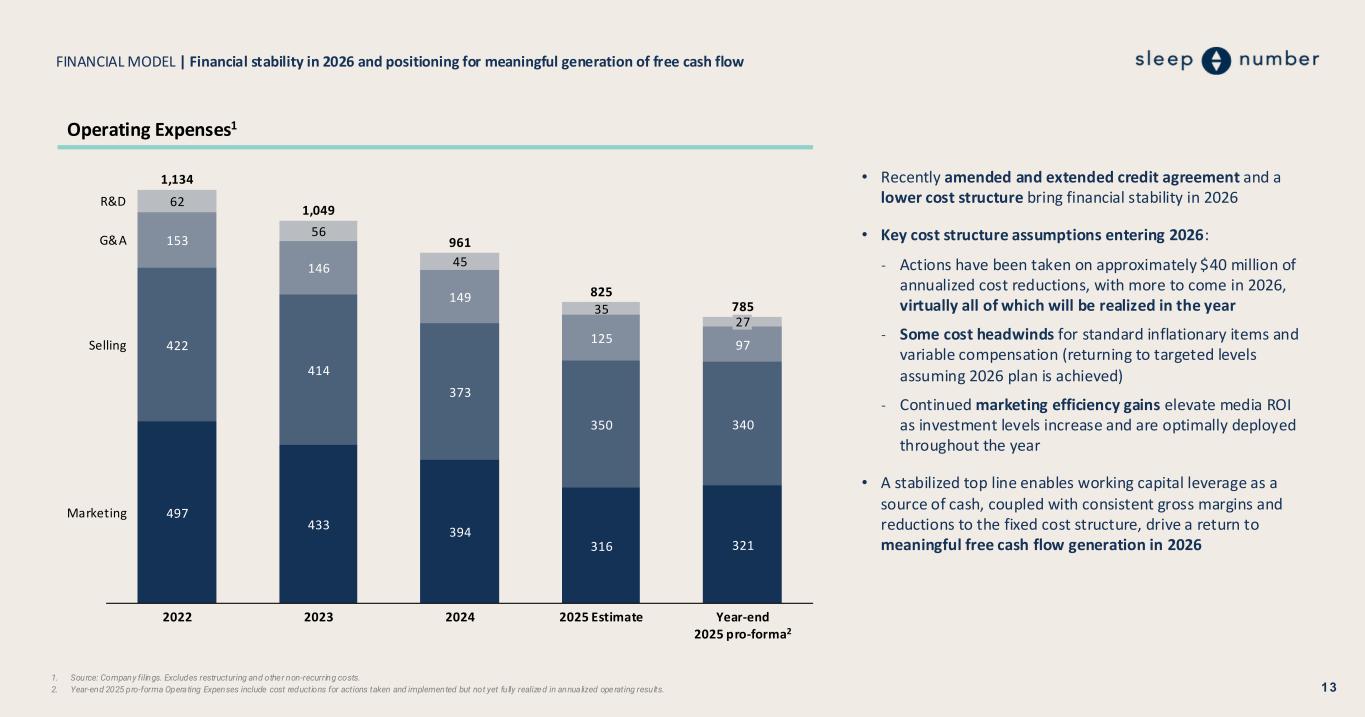

FINANCIAL MODEL | Financial stability in 2026 and positioning for meaningful generation of free cash flow 1. Source: Company filings. Excludes restructuring and other non-recurring costs. 2. Year-end 2025 pro-forma Operating Expenses include cost reductions for actions taken and implemented but not yet fully realized in annualized operating results. 13 • Recently amended and extended credit agreement and a lower cost structure bring financial stability in 2026 • Key cost structure assumptions entering 2026: ˗ Actions have been taken on approximately $40 million of annualized cost reductions, with more to come in 2026, virtually all of which will be realized in the year ˗ Some cost headwinds for standard inflationary items and variable compensation (returning to targeted levels assuming 2026 plan is achieved) ˗ Continued marketing efficiency gains elevate media ROI as investment levels increase and are optimally deployed throughout the year • A stabilized top line enables working capital leverage as a source of cash, coupled with consistent gross margins and reductions to the fixed cost structure, drive a return to meaningful free cash flow generation in 2026 497 433 394 316 321 422 414 373 350 340 153 146 149 125 97 62 56 45 35 2022 2023 2024 2025 Estimate Year-end 2025 pro-forma2 R&D G&A Selling Marketing 1,134 1,049 961 825 785 27 Operating Expenses1

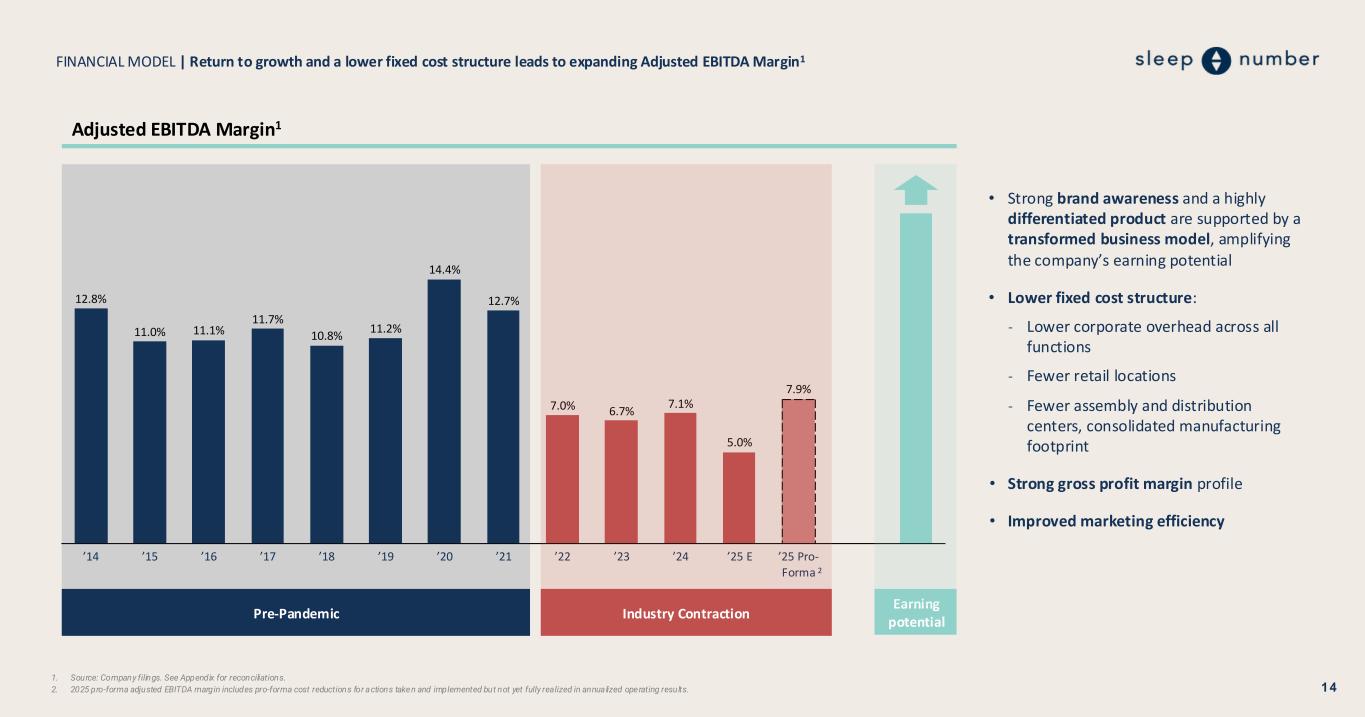

FINANCIAL MODEL | Return to growth and a lower fixed cost structure leads to expanding Adjusted EBITDA Margin1 12.8% 11.0% 11.1% 11.7% 10.8% 11.2% 14.4% 12.7% 7.0% 6.7% 7.1% 5.0% 7.9% ’14 ’15 ’16 ’17 ’18 ’19 ’20 ’21 ’22 ’23 ’24 ’25 E ’25 Pro- Forma Adjusted EBITDA Margin1 1. Source: Company filings. See Appendix for reconciliations. 2. 2025 pro-forma adjusted EBITDA margin includes pro-forma cost reductions for actions taken and implemented but not yet fully realized in annualized operating results. 14 Pre-Pandemic Industry Contraction Earning potential • Strong brand awareness and a highly differentiated product are supported by a transformed business model, amplifying the company’s earning potential • Lower fixed cost structure: ˗ Lower corporate overhead across all functions ˗ Fewer retail locations ˗ Fewer assembly and distribution centers, consolidated manufacturing footprint • Strong gross profit margin profile • Improved marketing efficiency 2

Why Now, Why Sleep Number Our leaner cost structure and gross margin profile is expected to create stabilization, regardless of industry trends Unique Position Advantage • Strong and recognizable brand • Unique and innovative product Clear Value Creation Pathway • New leadership team driving the business turnaround • Clear focus on the consumer: product, marketing, and distribution Shareholder Value Creation • Gross margin profile and reduced fixed cost structure leads to strong cash flow generation with growth • New marketing efficiencies will produce return on growth at stable spend • Free cash flow used to reduce balance sheet leverage Expected Returns and Timeline • Modernization of marketing is underway, supported by stabilized investments in demand generation • Simpler and differentiated product offering launching in 2026, supported by expanded distribution

FINANCIALS | Reconciliation of Adjusted EBITDA 16

FINANCIALS | Reconciliation of Free Cash Flow 17

18 For more information, visit ir.sleepnumber.com