1 WSFS Financial Corporation 3Q 2025 Earnings Release Supplement October 2025 .2

2 Forward Looking Statements & Non-GAAP Trade names, trademarks and service marks of other companies appearing in this presentation are the property of their respective holders. Forward Looking Statements: This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company's predictions or expectations of future business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and management's outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. The words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project” and similar expressions, among others, generally identify forward-looking statements. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company's control) and are subject to significant risks and uncertainties (which change over time) and other factors, including volatile market conditions and uncertain economic trends in the United States generally and in financial markets, particularly in the markets in which the Company operates and in which its loans are concentrated, including potential recessionary and other unfavorable conditions and trends related to housing markets, costs of living, unemployment levels, trade, monetary and fiscal policies, interest rates, supply chain issues, inflation, economic growth, the uncertain effects of geopolitical instability, armed conflicts, public health crises, inflation, interest rates and actions taken in response thereto on our business, results of operations, capital and liquidity, which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties are discussed in detail in the Company’s Form 10-K for the year ended December 31, 2024, Form 10-Q for the quarter ended March 31, 2025, and Form 10-Q for the quarter ended June 30, 2025, and other documents filed by the Company with the Securities and Exchange Commission from time to time. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date on which they are made, and the Company disclaims any duty to revise or update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company for any reason, except as specifically required by law. As used in this presentation, the terms "WSFS", "the Company", "registrant", "we", "us", and "our" mean WSFS Financial Corporation and its subsidiaries, on a consolidated basis, unless the context indicates otherwise. Non-GAAP Financial Measures: This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). The Company’s management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Company’s management believes that investors may use these non-GAAP measures to analyze the Company’s financial performance without the impact of unusual items or events that may obscure trends in the Company’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. For a reconciliation of these non-GAAP measures to their comparable GAAP measures, see the Appendix.

3 $3.27 $3.79 $0.00 $0.80 $1.60 $2.40 $3.20 $4.00 YTD24 YTD25 YTD Core EPS Financial Highlights 1 These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 2 This measure is on a pre-allocation basis 3 This constitutes net income attributable to WSFS; excludes net income attributable to noncontrolling interest 4Represents shares outstanding as of December 31, 2024 5Tax-equivalent 6 Reflects ACL on loans and leases over the amortized cost of the total portfolio 7 Capital ratios reflect corporate-level metrics Reported Core1 $ in millions (except per share amounts) 3Q25 2Q25 3Q24 3Q25 2Q25 3Q24 EPS $1.37 $1.27 $1.08 $1.40 $1.27 $1.08 ROA 1.44% 1.39% 1.22% 1.48% 1.38% 1.22% Net Income3 $76.4 $72.3 $64.4 $78.3 $72.1 $64.4 PPNR1 $107.4 $108.2 $103.9 $109.8 $107.8 $103.9 ROTCE1 18.31% 18.08% 16.96% 18.73% 18.03% 16.96% NIM5 3.91% 3.89% 3.78% 3.91% 3.89% 3.78% Fee Revenue $ $86.5 $88.0 $90.2 $88.0 $88.0 $90.1 Fee Revenue %5 31.9% 32.8% 33.6% 32.3% 32.8% 33.6% Efficiency Ratio 60.2% 59.5% 61.1% 59.5% 59.6% 61.1% ACL Ratio6 1.41% 1.43% 1.48% 1.41% 1.43% 1.48% CET17 14.39% 14.07% 13.56% 14.39% 14.07% 13.56% $1.08 $1.40 $0.00 $0.30 $0.60 $0.90 $1.20 $1.50 3Q24 3Q25 QTD Core EPS +16% • Core ROA of 1.48%, up 10bps QoQ and 26bps YoY • NIM of 3.91%, up 2bps QoQ and 13bps YoY • Wealth and Trust core fee revenue up 13% YoY2 • Notable improvements in asset quality metrics including problem assets, nonperforming assets, and delinquencies • Returned $206.2mm of capital to shareholders YTD, including $178.3mm from share repurchases (5.8% outstanding shares)4 +30%

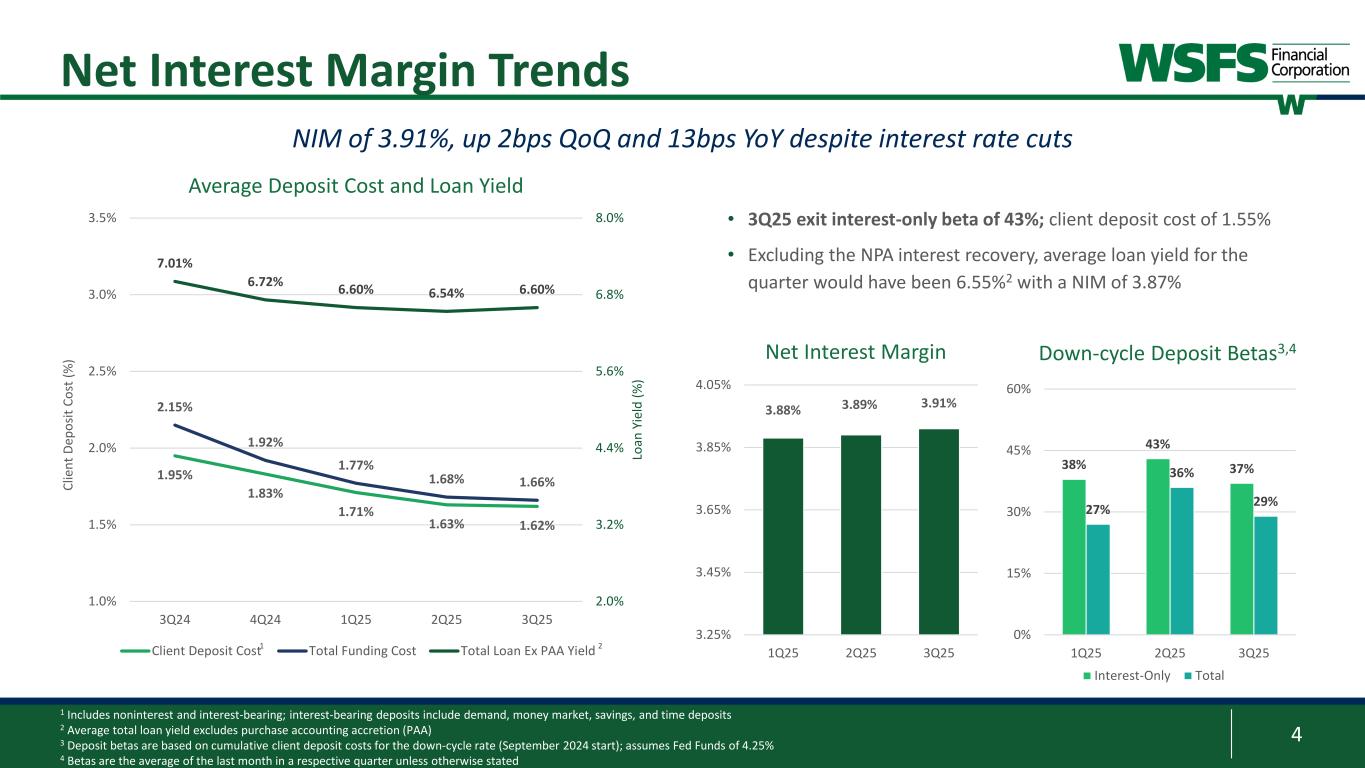

4 Net Interest Margin Trends NIM of 3.91%, up 2bps QoQ and 13bps YoY despite interest rate cuts 1 Includes noninterest and interest-bearing; interest-bearing deposits include demand, money market, savings, and time deposits 2 Average total loan yield excludes purchase accounting accretion (PAA) 3 Deposit betas are based on cumulative client deposit costs for the down-cycle rate (September 2024 start); assumes Fed Funds of 4.25% 4 Betas are the average of the last month in a respective quarter unless otherwise stated • 3Q25 exit interest-only beta of 43%; client deposit cost of 1.55% • Excluding the NPA interest recovery, average loan yield for the quarter would have been 6.55%2 with a NIM of 3.87% Down-cycle Deposit Betas3,4 1.95% 1.83% 1.71% 1.63% 1.62% 2.15% 1.92% 1.77% 1.68% 1.66% 7.01% 6.72% 6.60% 6.54% 6.60% 2.0% 3.2% 4.4% 5.6% 6.8% 8.0% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 3Q24 4Q24 1Q25 2Q25 3Q25 Lo an Y ie ld (% ) Cl ie nt D ep os it Co st (% ) Client Deposit Cost Total Funding Cost Total Loan Ex PAA Yield Average Deposit Cost and Loan Yield 1 2 3.88% 3.89% 3.91% 3.25% 3.45% 3.65% 3.85% 4.05% 1Q25 2Q25 3Q25 Net Interest Margin 38% 43% 37% 27% 36% 29% 0% 15% 30% 45% 60% 1Q25 2Q25 3Q25 Interest-Only Total

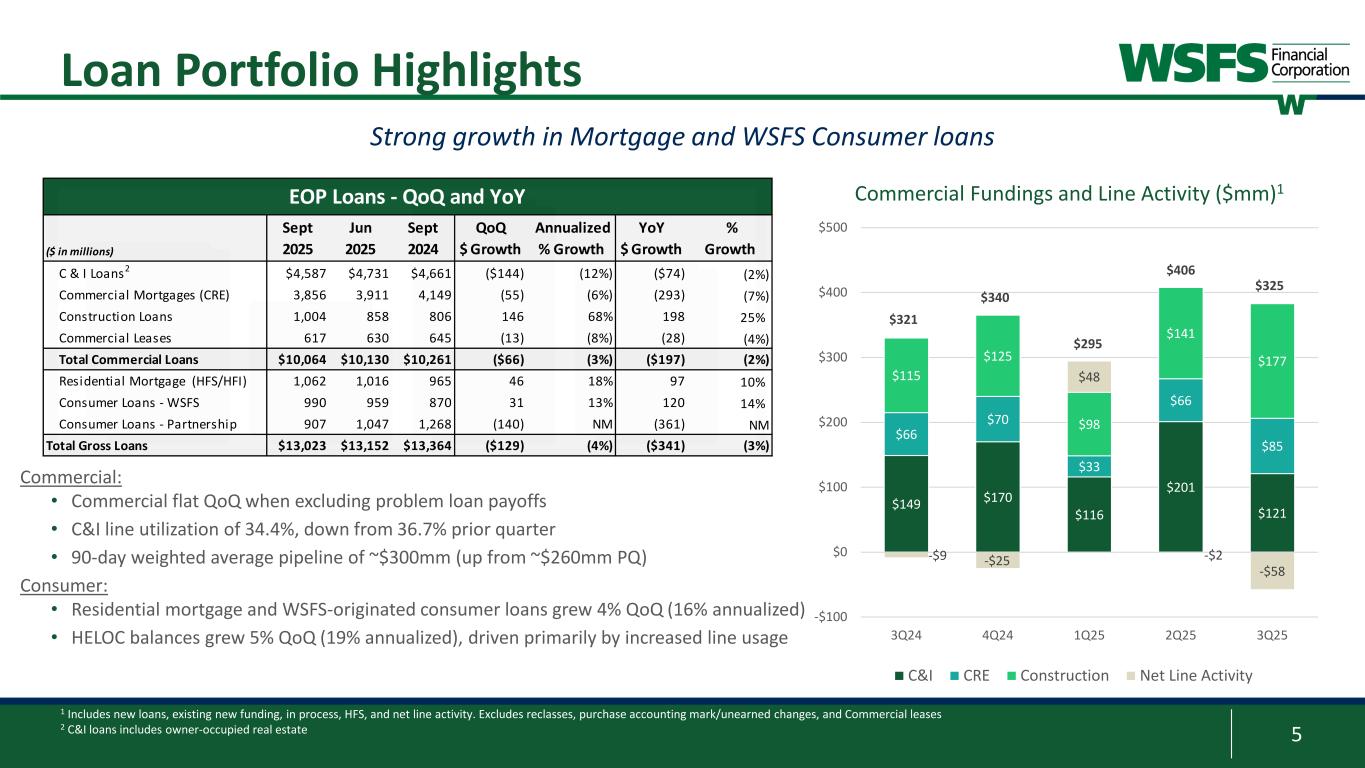

5 Loan Portfolio Highlights Strong growth in Mortgage and WSFS Consumer loans 1 Includes new loans, existing new funding, in process, HFS, and net line activity. Excludes reclasses, purchase accounting mark/unearned changes, and Commercial leases 2 C&I loans includes owner-occupied real estate ($ in millions) Sept 2025 Jun 2025 Sept 2024 QoQ $ Growth Annualized % Growth YoY $ Growth % Growth C & I Loans2 $4,587 $4,731 $4,661 ($144) (12%) ($74) (2%) Commercial Mortgages (CRE) 3,856 3,911 4,149 (55) (6%) (293) (7%) Construction Loans 1,004 858 806 146 68% 198 25% Commercial Leases 617 630 645 (13) (8%) (28) (4%) Total Commercial Loans $10,064 $10,130 $10,261 ($66) (3%) ($197) (2%) Residential Mortgage (HFS/HFI) 1,062 1,016 965 46 18% 97 10% Consumer Loans - WSFS 990 959 870 31 13% 120 14% Consumer Loans - Partnership 907 1,047 1,268 (140) NM (361) NM Total Gross Loans $13,023 $13,152 $13,364 ($129) (4%) ($341) (3%) EOP Loans - QoQ and YoY Commercial: • Commercial flat QoQ when excluding problem loan payoffs • C&I line utilization of 34.4%, down from 36.7% prior quarter • 90-day weighted average pipeline of ~$300mm (up from ~$260mm PQ) Consumer: • Residential mortgage and WSFS-originated consumer loans grew 4% QoQ (16% annualized) • HELOC balances grew 5% QoQ (19% annualized), driven primarily by increased line usage $149 $170 $116 $201 $121 $66 $70 $33 $66 $85 $115 $125 $98 $141 $177 -$9 -$25 $48 -$2 -$58 $321 $340 $295 $406 $325 -$100 $0 $100 $200 $300 $400 $500 3Q24 4Q24 1Q25 2Q25 3Q25 C&I CRE Construction Net Line Activity Commercial Fundings and Line Activity ($mm)1

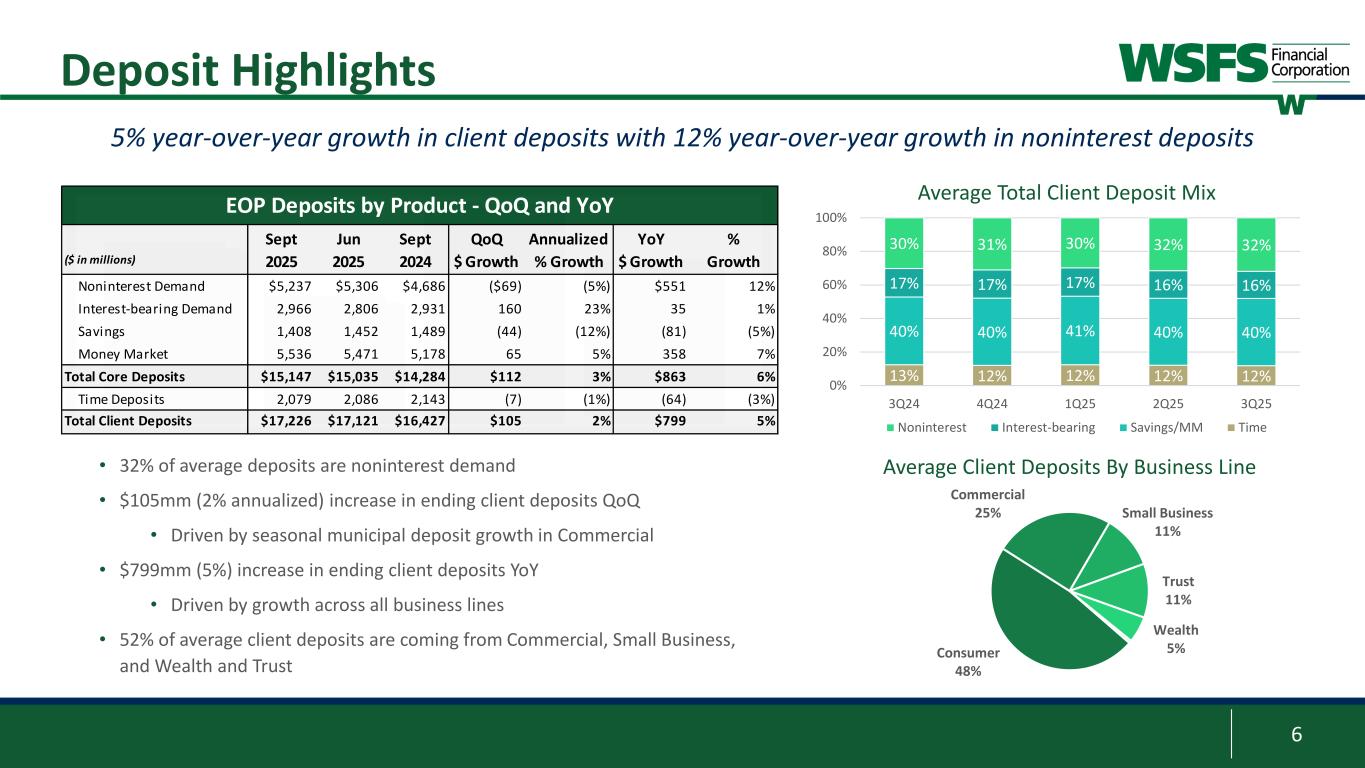

6 Deposit Highlights • 32% of average deposits are noninterest demand • $105mm (2% annualized) increase in ending client deposits QoQ • Driven by seasonal municipal deposit growth in Commercial • $799mm (5%) increase in ending client deposits YoY • Driven by growth across all business lines • 52% of average client deposits are coming from Commercial, Small Business, and Wealth and Trust 5% year-over-year growth in client deposits with 12% year-over-year growth in noninterest deposits Consumer 48% Commercial 25% Small Business 11% Trust 11% Wealth 5% Average Client Deposits By Business Line 13% 12% 12% 12% 12% 40% 40% 41% 40% 40% 17% 17% 17% 16% 16% 30% 31% 30% 32% 32% 0% 20% 40% 60% 80% 100% 3Q24 4Q24 1Q25 2Q25 3Q25 Noninterest Interest-bearing Savings/MM Time Average Total Client Deposit Mix ($ in millions) Sept 2025 Jun 2025 Sept 2024 QoQ $ Growth Annualized % Growth YoY $ Growth % Growth Noninterest Demand $5,237 $5,306 $4,686 ($69) (5%) $551 12% Interest-bearing Demand 2,966 2,806 2,931 160 23% 35 1% Savings 1,408 1,452 1,489 (44) (12%) (81) (5%) Money Market 5,536 5,471 5,178 65 5% 358 7% Total Core Deposits $15,147 $15,035 $14,284 $112 3% $863 6% Time Deposits 2,079 2,086 2,143 (7) (1%) (64) (3%) Total Client Deposits $17,226 $17,121 $16,427 $105 2% $799 5% EOP Deposits by Product - QoQ and YoY

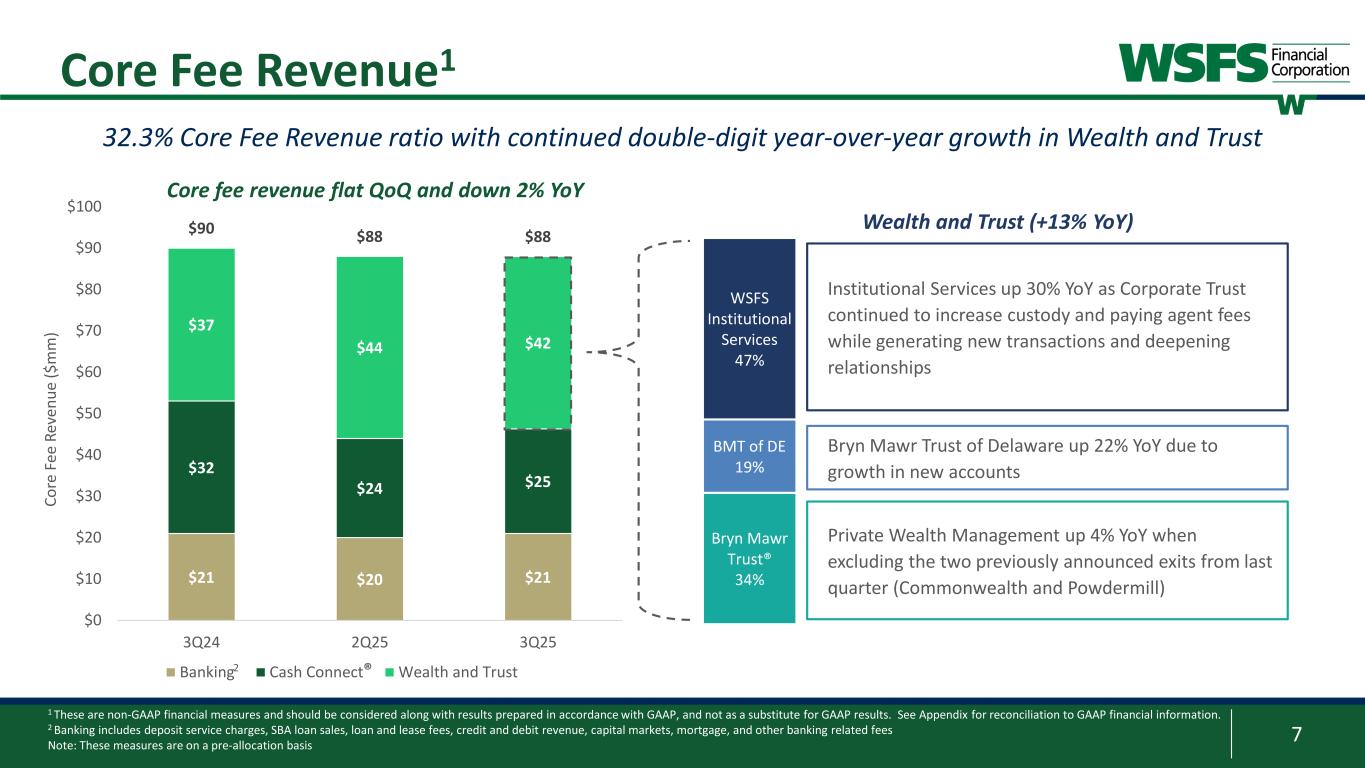

7 $21 $20 $21 $32 $24 $25 $37 $44 $42 $90 $88 $88 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 3Q24 2Q25 3Q25 Co re F ee R ev en ue ($ m m ) Banking Cash Connect Wealth and Trust Core Fee Revenue1 32.3% Core Fee Revenue ratio with continued double-digit year-over-year growth in Wealth and Trust 1 These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 2 Banking includes deposit service charges, SBA loan sales, loan and lease fees, credit and debit revenue, capital markets, mortgage, and other banking related fees Note: These measures are on a pre-allocation basis ® Core fee revenue flat QoQ and down 2% YoY Wealth and Trust (+13% YoY) Bryn Mawr Trust® 34% BMT of DE 19% WSFS Institutional Services 47% Institutional Services up 30% YoY as Corporate Trust continued to increase custody and paying agent fees while generating new transactions and deepening relationships Private Wealth Management up 4% YoY when excluding the two previously announced exits from last quarter (Commonwealth and Powdermill) Bryn Mawr Trust of Delaware up 22% YoY due to growth in new accounts 2

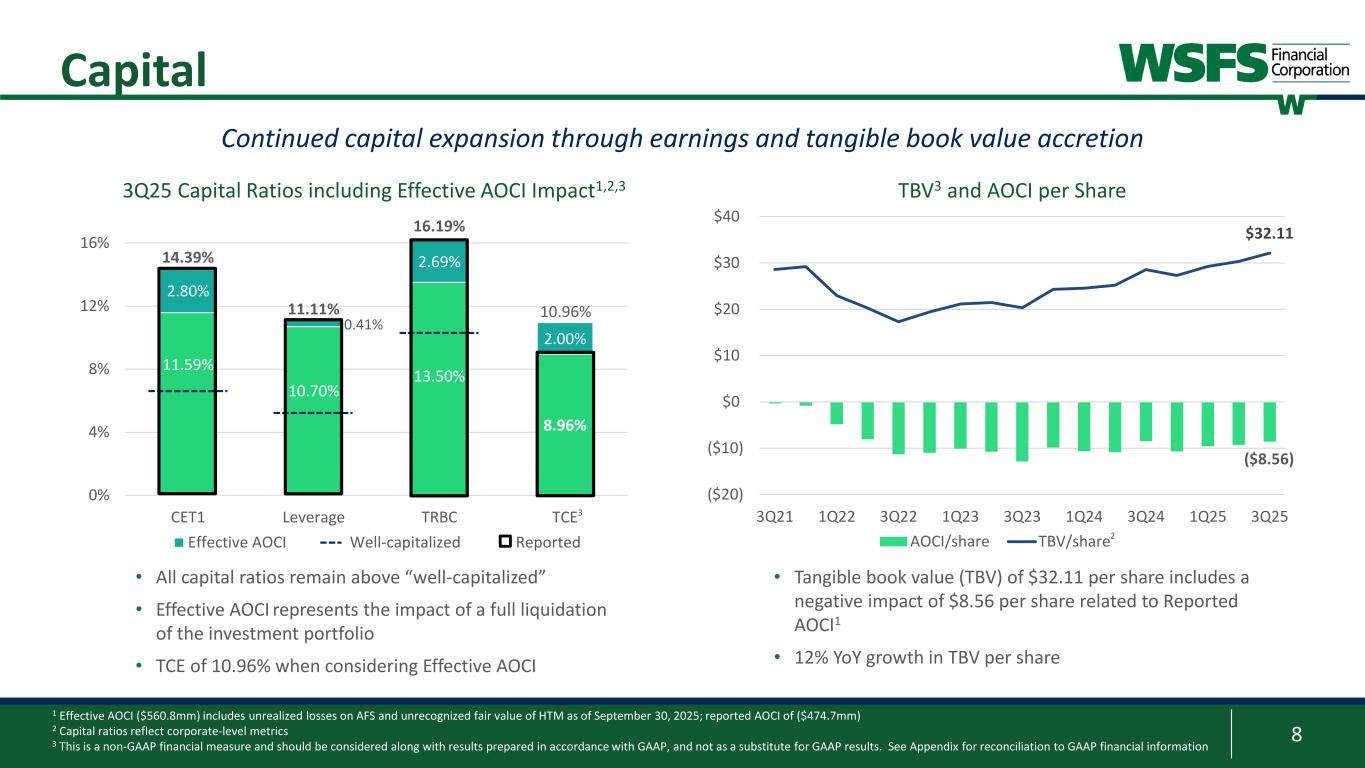

8 11.59% 10.70% 13.50% 8.96% 2.80% 0.41% 2.69% 2.00% 14.39% 11.11% 16.19% 10.96% 0% 4% 8% 12% 16% CET1 Leverage TRBC TCE Effective AOCI Well-capitalized Reported ($8.56) $32.11 ($20) ($10) $0 $10 $20 $30 $40 3Q21 1Q22 3Q22 1Q23 3Q23 1Q24 3Q24 1Q25 3Q25 TBV3 and AOCI per Share AOCI/share TBV/share Capital Continued capital expansion through earnings and tangible book value accretion 3Q25 Capital Ratios including Effective AOCI Impact1,2,3 1 Effective AOCI ($560.8mm) includes unrealized losses on AFS and unrecognized fair value of HTM as of September 30, 2025; reported AOCI of ($474.7mm) 2 Capital ratios reflect corporate-level metrics 3 This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information 2 • Tangible book value (TBV) of $32.11 per share includes a negative impact of $8.56 per share related to Reported AOCI1 • 12% YoY growth in TBV per share • All capital ratios remain above “well-capitalized” • Effective AOCI represents the impact of a full liquidation of the investment portfolio • TCE of 10.96% when considering Effective AOCI 3

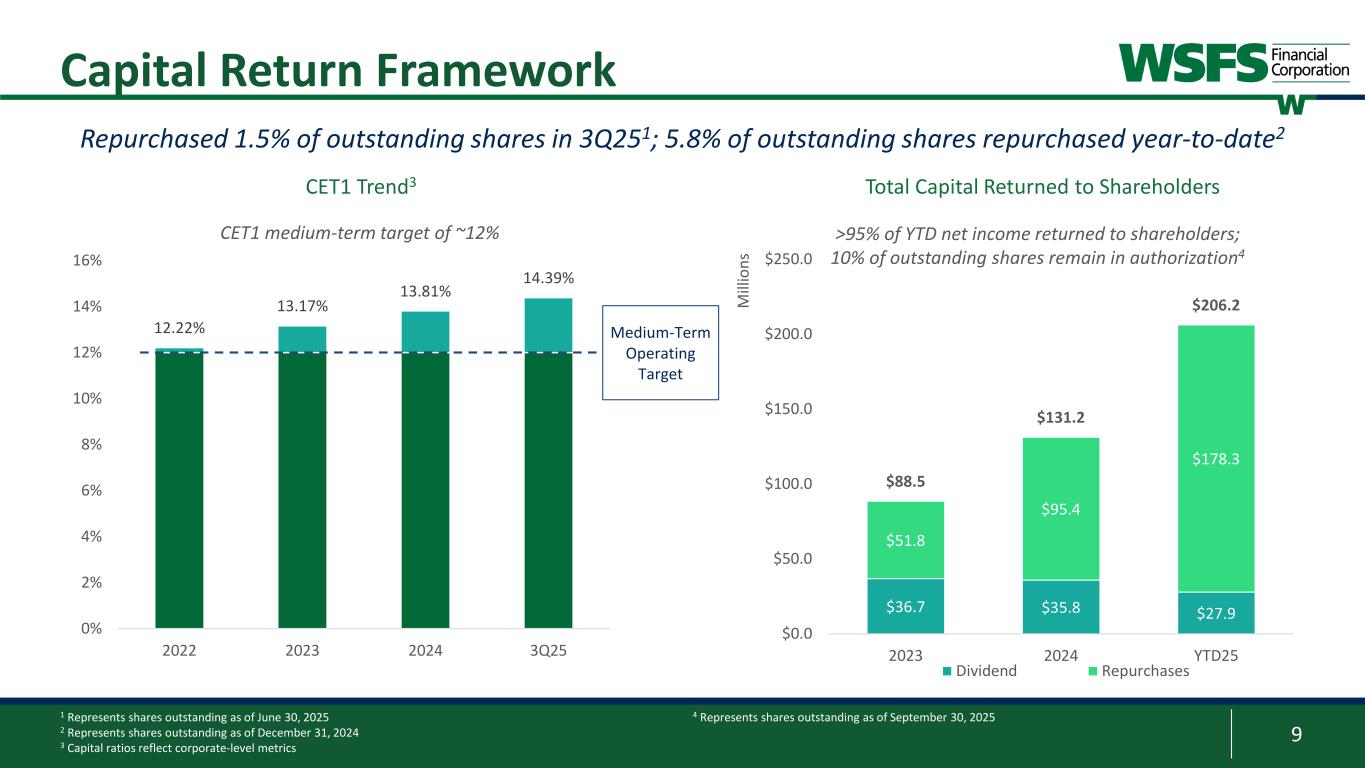

9 >95% of YTD net income returned to shareholders; 10% of outstanding shares remain in authorization4 $36.7 $35.8 $27.9 $51.8 $95.4 $178.3 $88.5 $131.2 $206.2 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 2023 2024 YTD25 M ill io ns Dividend Repurchases Medium-Term Operating Target 12.22% 13.17% 13.81% 14.39% 0% 2% 4% 6% 8% 10% 12% 14% 16% 2022 2023 2024 3Q25 Capital Return Framework Repurchased 1.5% of outstanding shares in 3Q251; 5.8% of outstanding shares repurchased year-to-date2 Total Capital Returned to ShareholdersCET1 Trend3 1 Represents shares outstanding as of June 30, 2025 2 Represents shares outstanding as of December 31, 2024 3 Capital ratios reflect corporate-level metrics CET1 medium-term target of ~12% 4 Represents shares outstanding as of September 30, 2025

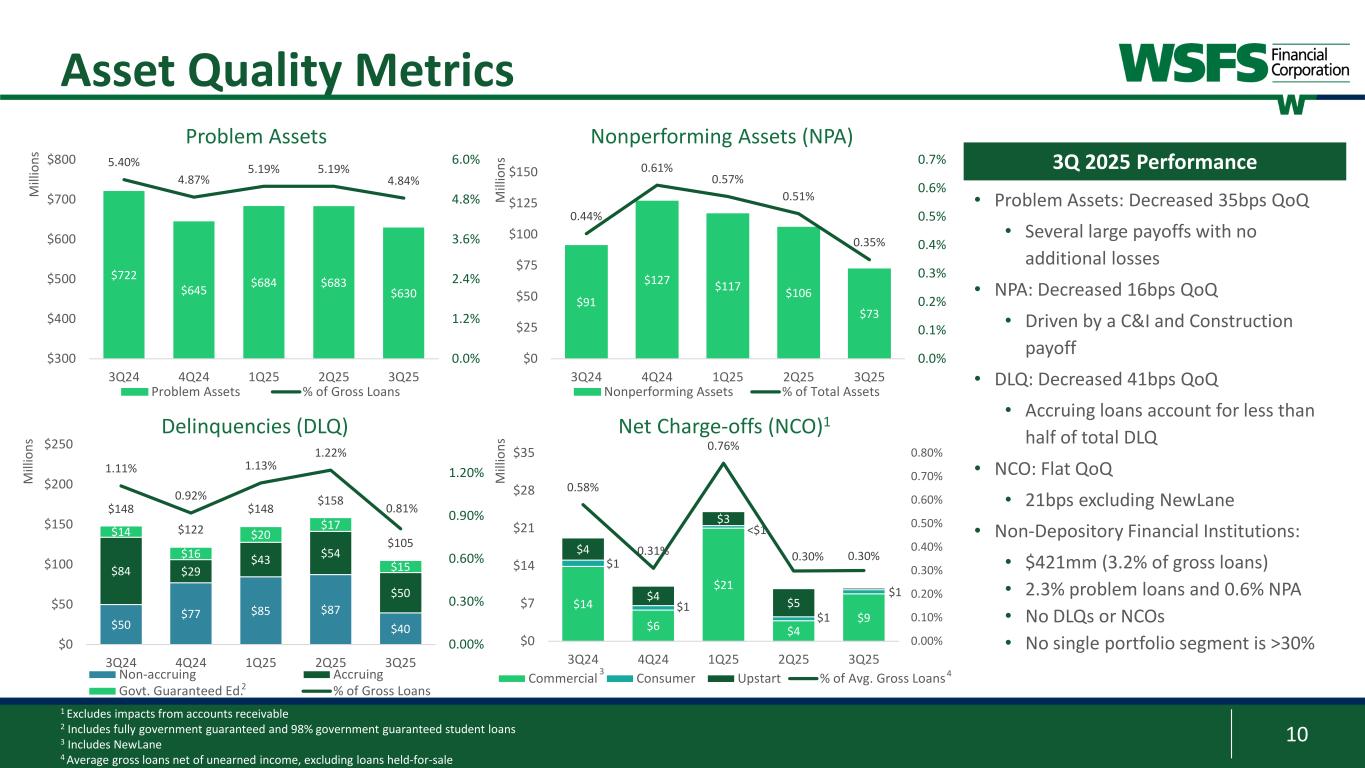

10 $50 $77 $85 $87 $40 $84 $29 $43 $54 $50 $14 $16 $20 $17 $15 $148 $122 $148 $158 $105 1.11% 0.92% 1.13% 1.22% 0.81% 0.00% 0.30% 0.60% 0.90% 1.20% $0 $50 $100 $150 $200 $250 3Q24 4Q24 1Q25 2Q25 3Q25 M ill io ns Non-accruing Accruing Govt. Guaranteed Ed. % of Gross Loans Asset Quality Metrics Problem Assets Nonperforming Assets (NPA) Delinquencies (DLQ) Net Charge-offs (NCO)1 $722 $645 $684 $683 $630 5.40% 4.87% 5.19% 5.19% 4.84% 0.0% 1.2% 2.4% 3.6% 4.8% 6.0% $300 $400 $500 $600 $700 $800 3Q24 4Q24 1Q25 2Q25 3Q25 M ill io ns Problem Assets % of Gross Loans $14 $6 $21 $4 $9 $1 $1 $1 $1 $4 $4 $3 $5 0.58% 0.31% 0.76% 0.30% 0.30% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% $0 $7 $14 $21 $28 $35 3Q24 4Q24 1Q25 2Q25 3Q25 M ill io ns Commercial Consumer Upstart % of Avg. Gross Loans $91 $127 $117 $106 $73 0.44% 0.61% 0.57% 0.51% 0.35% 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 0.7% $0 $25 $50 $75 $100 $125 $150 3Q24 4Q24 1Q25 2Q25 3Q25 M ill io ns Nonperforming Assets % of Total Assets • Problem Assets: Decreased 35bps QoQ • Several large payoffs with no additional losses • NPA: Decreased 16bps QoQ • Driven by a C&I and Construction payoff • DLQ: Decreased 41bps QoQ • Accruing loans account for less than half of total DLQ • NCO: Flat QoQ • 21bps excluding NewLane • Non-Depository Financial Institutions: • $421mm (3.2% of gross loans) • 2.3% problem loans and 0.6% NPA • No DLQs or NCOs • No single portfolio segment is >30% 3Q 2025 Performance 1 Excludes impacts from accounts receivable 2 Includes fully government guaranteed and 98% government guaranteed student loans 3 Includes NewLane 4 Average gross loans net of unearned income, excluding loans held-for-sale 3 4 2 <$1

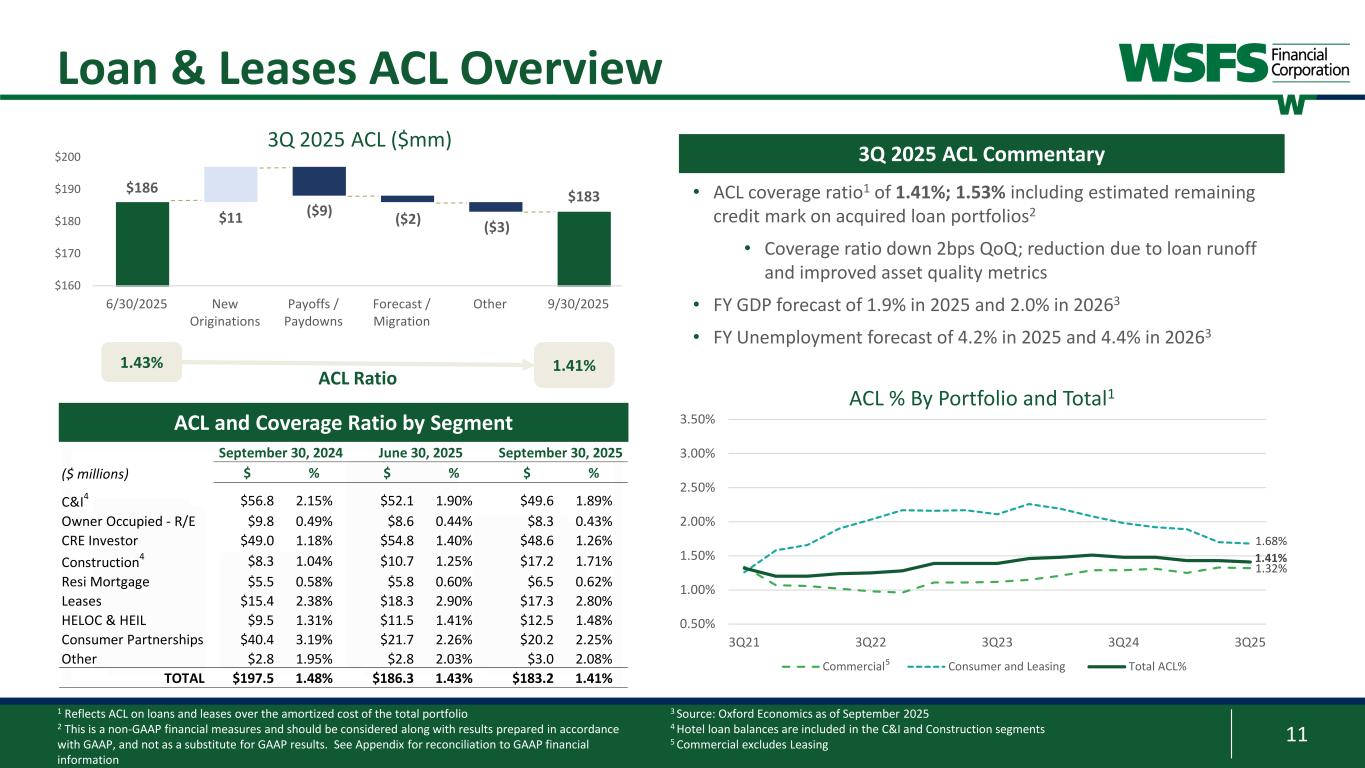

11 $160 $170 $180 $190 $200 6/30/2025 New Originations Payoffs / Paydowns Forecast / Migration Other 9/30/2025 ACL Ratio 3Q 2025 ACL ($mm) $183 1 Reflects ACL on loans and leases over the amortized cost of the total portfolio 2 This is a non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information Loan & Leases ACL Overview ACL and Coverage Ratio by Segment 3Q 2025 ACL Commentary 1.41% • ACL coverage ratio1 of 1.41%; 1.53% including estimated remaining credit mark on acquired loan portfolios2 • Coverage ratio down 2bps QoQ; reduction due to loan runoff and improved asset quality metrics • FY GDP forecast of 1.9% in 2025 and 2.0% in 20263 • FY Unemployment forecast of 4.2% in 2025 and 4.4% in 20263 1.43% 1.32% 1.68% 1.41% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 3Q21 3Q22 3Q23 3Q24 3Q25 ACL % By Portfolio and Total1 Commercial Consumer and Leasing Total ACL%5 3 Source: Oxford Economics as of September 2025 4 Hotel loan balances are included in the C&I and Construction segments 5 Commercial excludes Leasing $186 $11 ($9) ($2) ($3) ($ millions) $ % $ % $ % C&I4 $56.8 2.15% $52.1 1.90% $49.6 1.89% Owner Occupied - R/E $9.8 0.49% $8.6 0.44% $8.3 0.43% CRE Investor $49.0 1.18% $54.8 1.40% $48.6 1.26% Construction4 $8.3 1.04% $10.7 1.25% $17.2 1.71% Resi Mortgage $5.5 0.58% $5.8 0.60% $6.5 0.62% Leases $15.4 2.38% $18.3 2.90% $17.3 2.80% HELOC & HEIL $9.5 1.31% $11.5 1.41% $12.5 1.48% Consumer Partnerships $40.4 3.19% $21.7 2.26% $20.2 2.25% Other $2.8 1.95% $2.8 2.03% $3.0 2.08% TOTAL $197.5 1.48% $186.3 1.43% $183.2 1.41% September 30, 2024 June 30, 2025 September 30, 2025

12 Investment Portfolio High-quality investment portfolio providing consistent cash flows and borrowing capacity 1 Investment portfolio value includes market value AFS and book value of HTM 2 Weighted average duration and yield of the MBS portfolio 3 This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information 4 Effective AOCI ($560.8mm) includes unrealized losses on AFS and unrecognized fair value of HTM as of September 30, 2025; assumes all securities, including HTM, are sold at market prices • Forecasting P&I cash flows of $1bn+ over the next 24 months • Anticipated cash flows could fund ~3.5% annualized loan growth • Reported AOCI improved $47.5mm or 9% quarter-over-quarter Investments Investment Portfolio1 $4.48bn % of Total Assets 22% Portfolio Duration2 6.0yrs Portfolio Yield2 2.36% Agency MBS/Notes % >95% Reported AOCI ($474.7mm) Effective AOCI3,4 ($560.8mm) AFS Agency MBS Agency CMOs GNMA MBS/CMOs Agency Debent. HTM Agency MBS Munis $3.50bn $0.98bn $500 $625 $549 $522 $475 $0 $150 $300 $450 $600 $750 3Q24 4Q24 1Q25 2Q25 3Q25 M ill io ns Reported AOCI Trend

13 Non-GAAP Information This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (GAAP). This presentation may include the following non-GAAP measures: • Adjusted Net Income (non-GAAP) attributable to WSFS is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the realized/unrealized gains on equity investments, net, Visa derivative valuation adjustment, FDIC special assessment, loss on debt extinguishment, and corporate development and restructuring expense; • Core noninterest income, also called Core Fee Revenue, is a non-GAAP measure that adjusts noninterest income as determined in accordance with GAAP to exclude the impact of realized/unrealized gains on equity investments, net, and Visa derivative valuation adjustment; • Core fee revenue ratio (%) is a non-GAAP measure that divides (i) Core Fee Revenue by (ii) Core Net Revenue (tax-equivalent); • Core net interest income is a non-GAAP measure that adjusts net interest income to exclude the impact of certain dividends; • Core Earnings Per Share (EPS) is a non-GAAP measure that divides (i) Adjusted Net Income (non-GAAP) attributable to WSFS by (ii) weighted average shares of common stock outstanding for the applicable period; • Core Net Revenue is a non-GAAP measure that adds (i) core net interest income and (ii) Core Fee Revenue; • Core Net Revenue (tax-equivalent) is a non-GAAP measure that adjusts core net revenue to include the impact of tax-equivalent income; • Core noninterest expense is a non-GAAP measure that adjusts noninterest expense as determined in accordance with GAAP to exclude FDIC special assessment, loss on debt extinguishment, and corporate development and restructuring expenses; • Core Efficiency Ratio is a non-GAAP measure that divides (i) core noninterest expense by (ii) the sum of core interest income and Core Fee Revenue; • Core Return on Average Assets (ROA) is a non-GAAP measure that divides (i) Adjusted Net Income (non-GAAP) attributable to WSFS by (ii) average assets for the applicable period; • Effective AOCI is a non-GAAP measure that adds (i) unrealized losses on AFS securities, (ii) unrealized holding losses on securities transferred from AFS to HTM, and (iii) unrecognized fair value losses on HTM securities; • Tangible Common Equity (TCE) is a non-GAAP measure and is defined as total stockholders’ equity of WSFS less goodwill and other intangible assets; • TCE Ratio is a non-GAAP measure that divides (i) TCE by (ii) tangible assets; • Tangible assets is a non-GAAP measure and is defined as total assets less goodwill and other intangible assets; • Adjusted tangible assets is a non-GAAP measure that adjusts tangible assets to include the impact of the liquidation of our investment securities portfolio; • Return on average tangible common equity (ROTCE) is a non-GAAP measure and is defined as net income allocable to common stockholders divided by tangible common equity; • Core ROTCE is a non-GAAP measure that is defined as adjusted net income (non-GAAP) attributable to WSFS divided by tangible common equity; • Net tangible income is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of the amortization of intangible assets; • Core net tangible income is a non-GAAP measure that adjusts adjusted net income (non-GAAP) attributable to WSFS to exclude the impact of the amortization of intangible assets; • Tangible common book value per share (TBV) is a non-GAAP financial measure that divides (i) TCE by (ii) shares outstanding; • Tangible common equity including effective AOCI is a non-GAAP measure that adjusts tangible common equity to include effective AOCI; • Pre-provision Net Revenue (PPNR) is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impacts of (i) income tax provision and (ii) provision for credit losses; • Core PPNR is a non-GAAP measure that adjusts PPNR to exclude the impact of realized/unrealized gain on equity investments, net, Visa derivative valuation adjustment, FDIC special assessment, loss on debt extinguishment, and corporate development and restructuring expenses; • Core Return on Average Equity (ROE) is a non-GAAP measure that divides (i) Adjusted Net Income (non-GAAP) attributable to WSFS by (ii) average stockholders’ equity for the applicable period; • Adjusted risk weighted assets is a non-GAAP measure that adjusts the Corp’s risk weighted assets determined in accordance with GAAP to include the impact of the liquidation of our investment securities portfolio; • Adjusted average assets is a non-GAAP measure that adjusts the Corp’s average assets determined in accordance with GAAP to include the impact of the liquidation of our investment securities portfolio; • Adjusted tangible assets is a non-GAAP measure that adjusts tangible assets to include the impact of the liquidation of our investment securities portfolio; • Adjusted total risk-based capital is a non-GAAP measure that adjusts total risk-based capital determined in accordance with GAAP to include effective AOCI; • Adjusted total risk-based capital ratio is a non-GAAP measure that divides (i) adjusted total risk-based capital by (ii) adjusted risk weighted assets; • Adjusted common equity Tier 1 capital is a non-GAAP measure that adjusts common equity Tier 1 capital determined in accordance with GAAP to include effective AOCI; • Adjusted common equity Tier 1 capital ratio is a non-GAAP measure that divides (i) adjusted common equity Tier 1 capital by (ii) adjusted risk weighted assets; • Adjusted Tier 1 capital is a non-GAAP measure that adjusts Tier 1 capital determined in accordance with GAAP to include effective AOCI; • Adjusted Tier 1 leverage ratio is a non-GAAP measure that divides (i) adjusted Tier 1 capital by (ii) adjusted average assets; and • Coverage ratio including the estimated remaining credit marks is a non-GAAP measure that adjusts the coverage ratio to include the impact of the estimated remaining credit marks on the acquired loan portfolios.

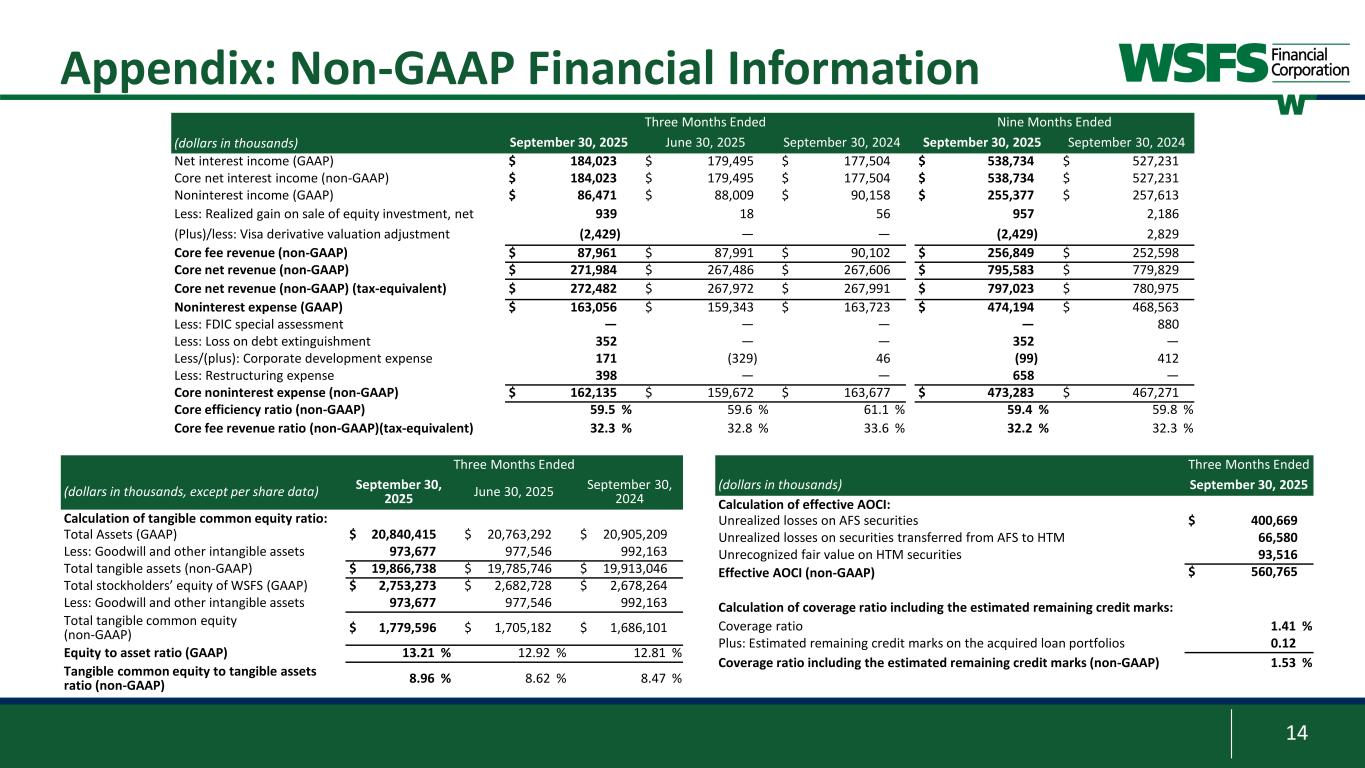

14 Appendix: Non-GAAP Financial Information Three Months Ended Nine Months Ended (dollars in thousands) September 30, 2025 June 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Net interest income (GAAP) $ 184,023 $ 179,495 $ 177,504 $ 538,734 $ 527,231 Core net interest income (non-GAAP) $ 184,023 $ 179,495 $ 177,504 $ 538,734 $ 527,231 Noninterest income (GAAP) $ 86,471 $ 88,009 $ 90,158 $ 255,377 $ 257,613 Less: Realized gain on sale of equity investment, net 939 18 56 957 2,186 (Plus)/less: Visa derivative valuation adjustment (2,429) — — (2,429) 2,829 Core fee revenue (non-GAAP) $ 87,961 $ 87,991 $ 90,102 $ 256,849 $ 252,598 Core net revenue (non-GAAP) $ 271,984 $ 267,486 $ 267,606 $ 795,583 $ 779,829 Core net revenue (non-GAAP) (tax-equivalent) $ 272,482 $ 267,972 $ 267,991 $ 797,023 $ 780,975 Noninterest expense (GAAP) $ 163,056 $ 159,343 $ 163,723 $ 474,194 $ 468,563 Less: FDIC special assessment — — — — 880 Less: Loss on debt extinguishment 352 — — 352 — Less/(plus): Corporate development expense 171 (329) 46 (99) 412 Less: Restructuring expense 398 — — 658 — Core noninterest expense (non-GAAP) $ 162,135 $ 159,672 $ 163,677 $ 473,283 $ 467,271 Core efficiency ratio (non-GAAP) 59.5 % 59.6 % 61.1 % 59.4 % 59.8 % Core fee revenue ratio (non-GAAP)(tax-equivalent) 32.3 % 32.8 % 33.6 % 32.2 % 32.3 % Three Months Ended (dollars in thousands, except per share data) September 30, 2025 June 30, 2025 September 30, 2024 Calculation of tangible common equity ratio: Total Assets (GAAP) $ 20,840,415 $ 20,763,292 $ 20,905,209 Less: Goodwill and other intangible assets 973,677 977,546 992,163 Total tangible assets (non-GAAP) $ 19,866,738 $ 19,785,746 $ 19,913,046 Total stockholders’ equity of WSFS (GAAP) $ 2,753,273 $ 2,682,728 $ 2,678,264 Less: Goodwill and other intangible assets 973,677 977,546 992,163 Total tangible common equity (non-GAAP) $ 1,779,596 $ 1,705,182 $ 1,686,101 Equity to asset ratio (GAAP) 13.21 % 12.92 % 12.81 % Tangible common equity to tangible assets ratio (non-GAAP) 8.96 % 8.62 % 8.47 % Three Months Ended (dollars in thousands) September 30, 2025 Calculation of effective AOCI: Unrealized losses on AFS securities $ 400,669 Unrealized losses on securities transferred from AFS to HTM 66,580 Unrecognized fair value on HTM securities 93,516 Effective AOCI (non-GAAP) $ 560,765 Calculation of coverage ratio including the estimated remaining credit marks: Coverage ratio 1.41 % Plus: Estimated remaining credit marks on the acquired loan portfolios 0.12 Coverage ratio including the estimated remaining credit marks (non-GAAP) 1.53 %

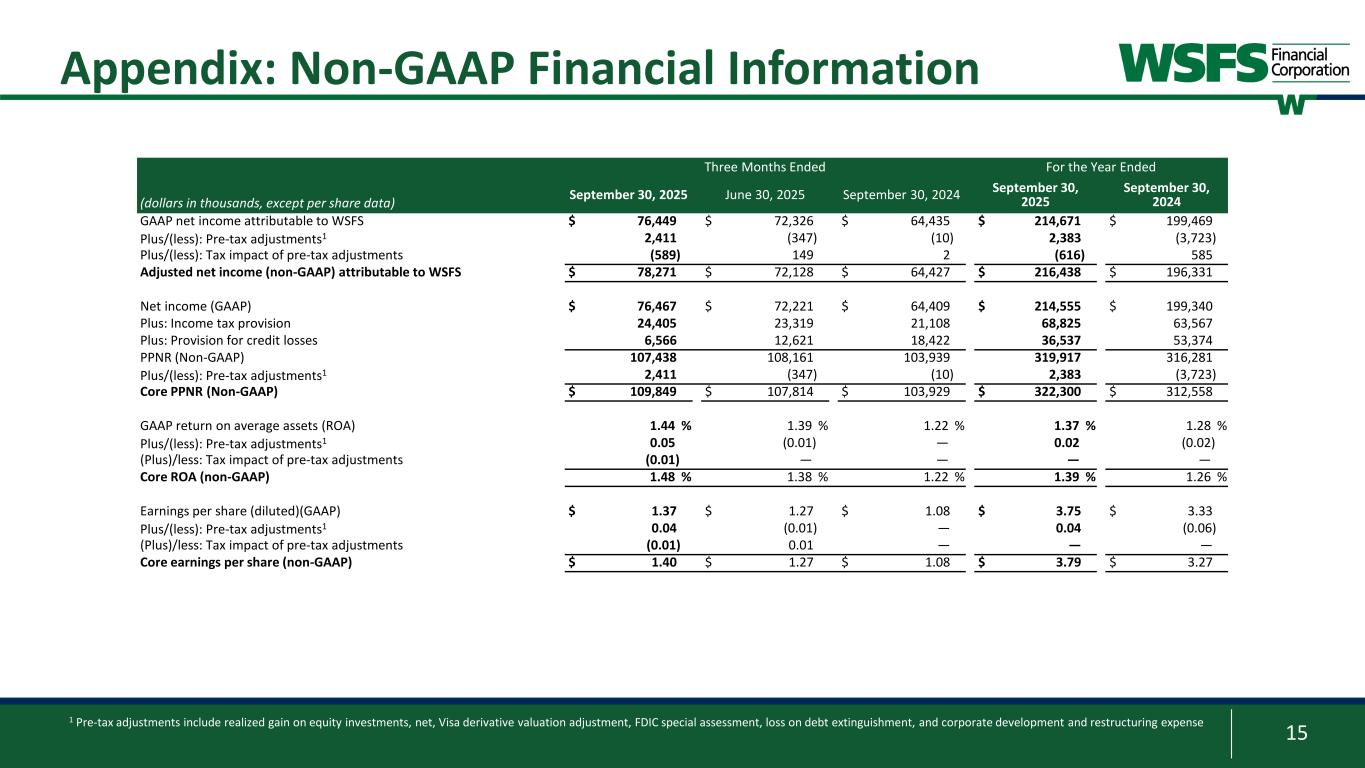

15 Appendix: Non-GAAP Financial Information Three Months Ended For the Year Ended (dollars in thousands, except per share data) September 30, 2025 June 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 GAAP net income attributable to WSFS $ 76,449 $ 72,326 $ 64,435 $ 214,671 $ 199,469 Plus/(less): Pre-tax adjustments1 2,411 (347) (10) 2,383 (3,723) Plus/(less): Tax impact of pre-tax adjustments (589) 149 2 (616) 585 Adjusted net income (non-GAAP) attributable to WSFS $ 78,271 $ 72,128 $ 64,427 $ 216,438 $ 196,331 Net income (GAAP) $ 76,467 $ 72,221 $ 64,409 $ 214,555 $ 199,340 Plus: Income tax provision 24,405 23,319 21,108 68,825 63,567 Plus: Provision for credit losses 6,566 12,621 18,422 36,537 53,374 PPNR (Non-GAAP) 107,438 108,161 103,939 319,917 316,281 Plus/(less): Pre-tax adjustments1 2,411 (347) (10) 2,383 (3,723) Core PPNR (Non-GAAP) $ 109,849 $ 107,814 $ 103,929 $ 322,300 $ 312,558 GAAP return on average assets (ROA) 1.44 % 1.39 % 1.22 % 1.37 % 1.28 % Plus/(less): Pre-tax adjustments1 0.05 (0.01) — 0.02 (0.02) (Plus)/less: Tax impact of pre-tax adjustments (0.01) — — — — Core ROA (non-GAAP) 1.48 % 1.38 % 1.22 % 1.39 % 1.26 % Earnings per share (diluted)(GAAP) $ 1.37 $ 1.27 $ 1.08 $ 3.75 $ 3.33 Plus/(less): Pre-tax adjustments1 0.04 (0.01) — 0.04 (0.06) (Plus)/less: Tax impact of pre-tax adjustments (0.01) 0.01 — — — Core earnings per share (non-GAAP) $ 1.40 $ 1.27 $ 1.08 $ 3.79 $ 3.27 1 Pre-tax adjustments include realized gain on equity investments, net, Visa derivative valuation adjustment, FDIC special assessment, loss on debt extinguishment, and corporate development and restructuring expense

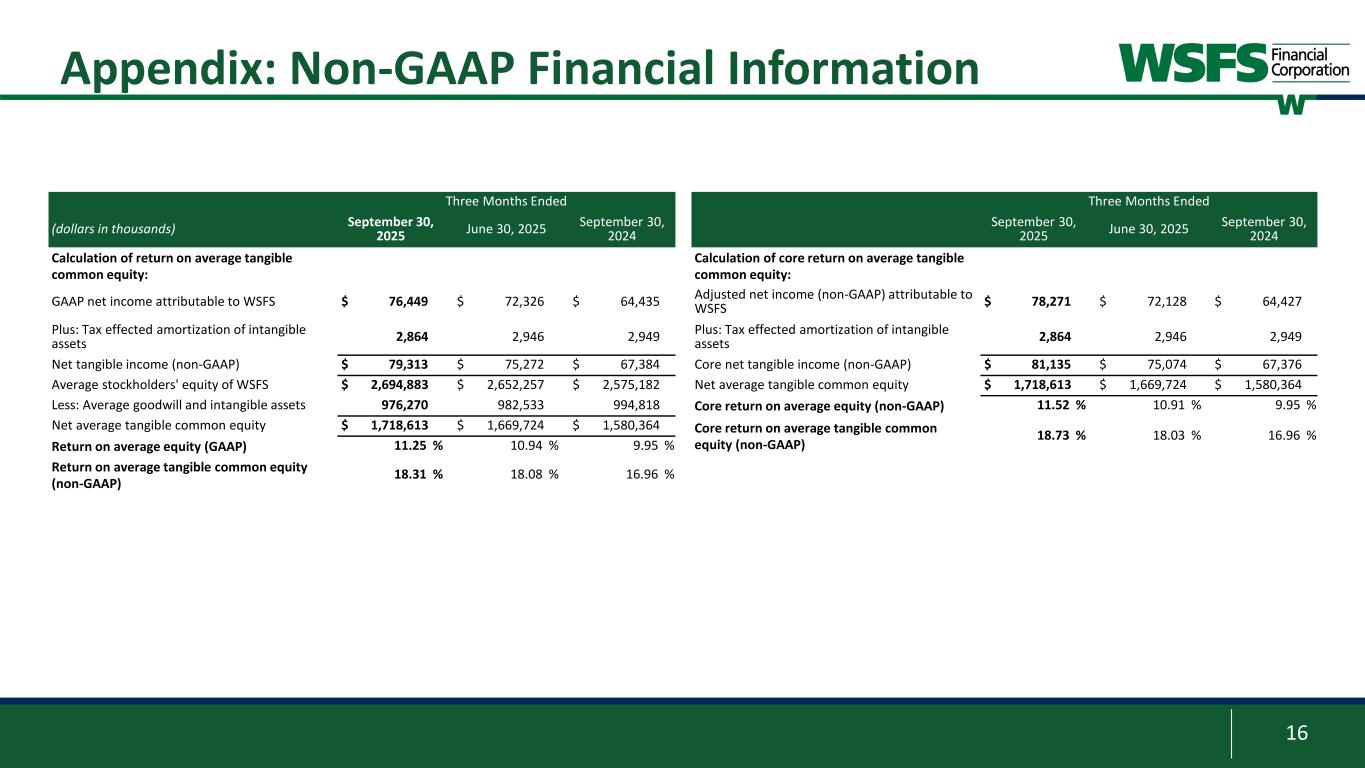

16 Appendix: Non-GAAP Financial Information Three Months Ended Three Months Ended (dollars in thousands) September 30, 2025 June 30, 2025 September 30, 2024 September 30, 2025 June 30, 2025 September 30, 2024 Calculation of return on average tangible common equity: Calculation of core return on average tangible common equity: GAAP net income attributable to WSFS $ 76,449 $ 72,326 $ 64,435 Adjusted net income (non-GAAP) attributable to WSFS $ 78,271 $ 72,128 $ 64,427 Plus: Tax effected amortization of intangible assets 2,864 2,946 2,949 Plus: Tax effected amortization of intangible assets 2,864 2,946 2,949 Net tangible income (non-GAAP) $ 79,313 $ 75,272 $ 67,384 Core net tangible income (non-GAAP) $ 81,135 $ 75,074 $ 67,376 Average stockholders' equity of WSFS $ 2,694,883 $ 2,652,257 $ 2,575,182 Net average tangible common equity $ 1,718,613 $ 1,669,724 $ 1,580,364 Less: Average goodwill and intangible assets 976,270 982,533 994,818 Core return on average equity (non-GAAP) 11.52 % 10.91 % 9.95 % Net average tangible common equity $ 1,718,613 $ 1,669,724 $ 1,580,364 Core return on average tangible common equity (non-GAAP) 18.73 % 18.03 % 16.96 % Return on average equity (GAAP) 11.25 % 10.94 % 9.95 % Return on average tangible common equity (non-GAAP) 18.31 % 18.08 % 16.96 %

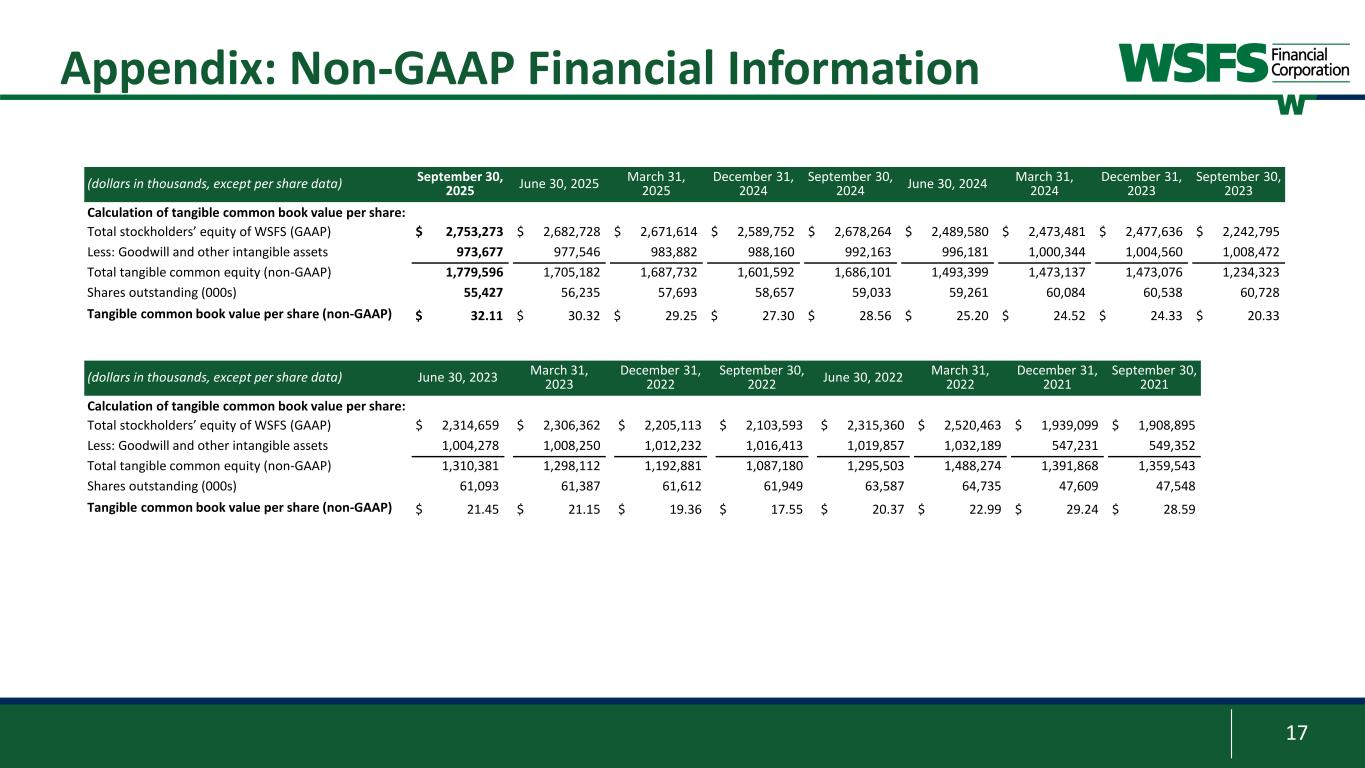

17 Appendix: Non-GAAP Financial Information (dollars in thousands, except per share data) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 September 30, 2023 Calculation of tangible common book value per share: Total stockholders’ equity of WSFS (GAAP) $ 2,753,273 $ 2,682,728 $ 2,671,614 $ 2,589,752 $ 2,678,264 $ 2,489,580 $ 2,473,481 $ 2,477,636 $ 2,242,795 Less: Goodwill and other intangible assets 973,677 977,546 983,882 988,160 992,163 996,181 1,000,344 1,004,560 1,008,472 Total tangible common equity (non-GAAP) 1,779,596 1,705,182 1,687,732 1,601,592 1,686,101 1,493,399 1,473,137 1,473,076 1,234,323 Shares outstanding (000s) 55,427 56,235 57,693 58,657 59,033 59,261 60,084 60,538 60,728 Tangible common book value per share (non-GAAP) $ 32.11 $ 30.32 $ 29.25 $ 27.30 $ 28.56 $ 25.20 $ 24.52 $ 24.33 $ 20.33 (dollars in thousands, except per share data) June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 September 30, 2021 Calculation of tangible common book value per share: Total stockholders’ equity of WSFS (GAAP) $ 2,314,659 $ 2,306,362 $ 2,205,113 $ 2,103,593 $ 2,315,360 $ 2,520,463 $ 1,939,099 $ 1,908,895 Less: Goodwill and other intangible assets 1,004,278 1,008,250 1,012,232 1,016,413 1,019,857 1,032,189 547,231 549,352 Total tangible common equity (non-GAAP) 1,310,381 1,298,112 1,192,881 1,087,180 1,295,503 1,488,274 1,391,868 1,359,543 Shares outstanding (000s) 61,093 61,387 61,612 61,949 63,587 64,735 47,609 47,548 Tangible common book value per share (non-GAAP) $ 21.45 $ 21.15 $ 19.36 $ 17.55 $ 20.37 $ 22.99 $ 29.24 $ 28.59

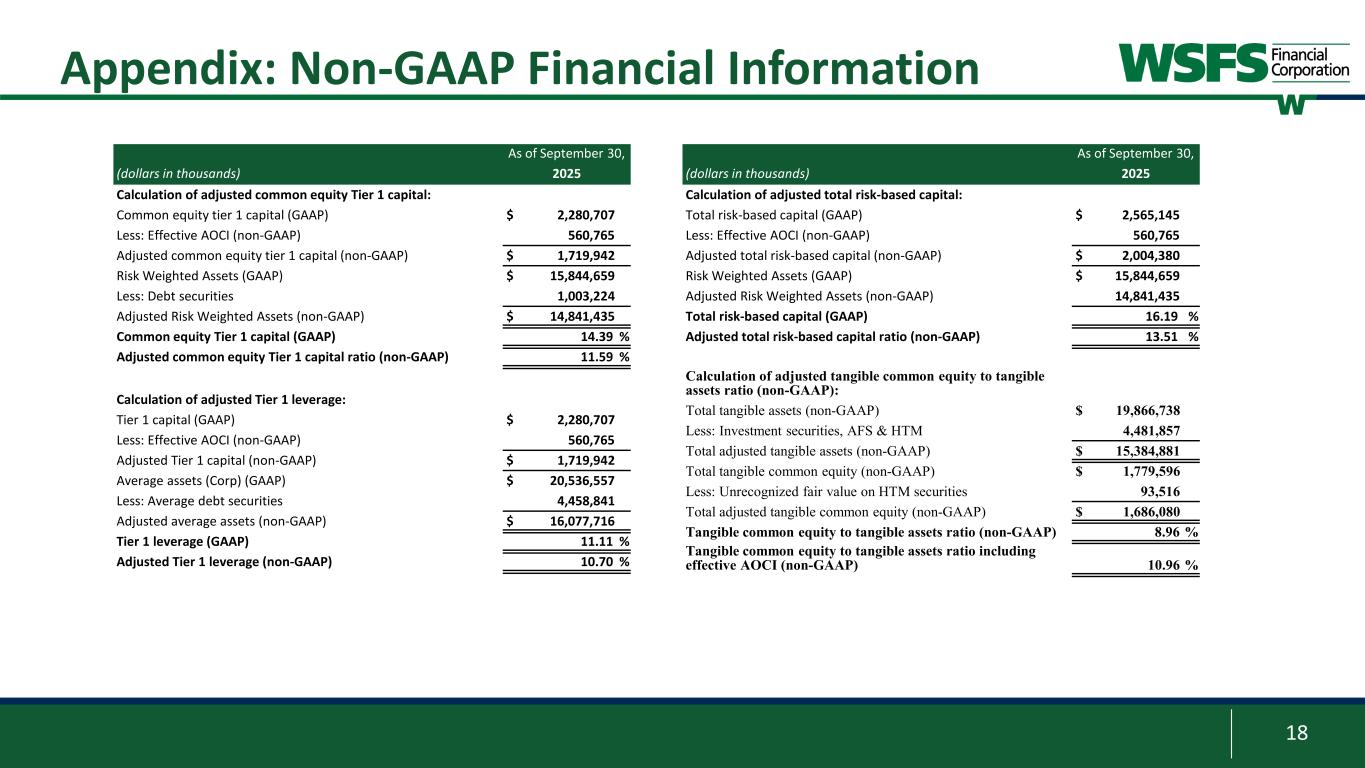

18 Appendix: Non-GAAP Financial Information As of September 30, (dollars in thousands) 2025 Calculation of adjusted common equity Tier 1 capital: Common equity tier 1 capital (GAAP) $ 2,280,707 Less: Effective AOCI (non-GAAP) 560,765 Adjusted common equity tier 1 capital (non-GAAP) $ 1,719,942 Risk Weighted Assets (GAAP) $ 15,844,659 Less: Debt securities 1,003,224 Adjusted Risk Weighted Assets (non-GAAP) $ 14,841,435 Common equity Tier 1 capital (GAAP) 14.39 % Adjusted common equity Tier 1 capital ratio (non-GAAP) 11.59 % Calculation of adjusted Tier 1 leverage: Tier 1 capital (GAAP) $ 2,280,707 Less: Effective AOCI (non-GAAP) 560,765 Adjusted Tier 1 capital (non-GAAP) $ 1,719,942 Average assets (Corp) (GAAP) $ 20,536,557 Less: Average debt securities 4,458,841 Adjusted average assets (non-GAAP) $ 16,077,716 Tier 1 leverage (GAAP) 11.11 % Adjusted Tier 1 leverage (non-GAAP) 10.70 % As of September 30, (dollars in thousands) 2025 Calculation of adjusted total risk-based capital: Total risk-based capital (GAAP) $ 2,565,145 Less: Effective AOCI (non-GAAP) 560,765 Adjusted total risk-based capital (non-GAAP) $ 2,004,380 Risk Weighted Assets (GAAP) $ 15,844,659 Adjusted Risk Weighted Assets (non-GAAP) 14,841,435 Total risk-based capital (GAAP) 16.19 % Adjusted total risk-based capital ratio (non-GAAP) 13.51 % Calculation of adjusted tangible common equity to tangible assets ratio (non-GAAP): Total tangible assets (non-GAAP) $ 19,866,738 Less: Investment securities, AFS & HTM 4,481,857 Total adjusted tangible assets (non-GAAP) $ 15,384,881 Total tangible common equity (non-GAAP) $ 1,779,596 Less: Unrecognized fair value on HTM securities 93,516 Total adjusted tangible common equity (non-GAAP) $ 1,686,080 Tangible common equity to tangible assets ratio (non-GAAP) 8.96 % Tangible common equity to tangible assets ratio including effective AOCI (non-GAAP) 10.96 %