January 17, 2025

VIA EDGAR

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549

| Re: | WSFS Financial Corporation |

Form 10-K for Fiscal Year Ended December 31, 2023

Form 8-K filed October 24, 2024

File No. 001-35638

Dear Mr. Henderson and Ms. Lubit:

Set forth below is the response of WSFS Financial Corporation (the “Company”), to the comment received from the staff (the “Staff”) of the U.S. Securities and Exchange Commission by letter dated December 19, 2024, with respect to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and Current Report on Form 8-K, filed by the Company October 24, 2024 (the “Current Report”) (File No. 001-35638). For your convenience, we have reproduced the text of the Staff’s comments in bold text followed by the Company’s response.

Form

8-K filed October 24, 2024

Exhibit 99.2 3Q 2024 Earnings Release Supplement, page 17

| 1. | We note your presentation of the Non-GAAP measures Tangible common equity ex-AOCI, Tangible common book value per share ex-AOCI, Tangible common equity ex-AOCI, and Tangible common book value per share ex-AOCI. These exclude the impact of accumulated other comprehensive income / loss (“AOCI”) and represent individually tailored accounting measures given that the adjustments to exclude AOCI have the effect of changing the recognition and measurement principles required to be applied in accordance with GAAP. Therefore, please remove the presentation of these non-GAAP measures from your future filings. Refer to Question 100.04 of the Division of Corporation Finance’s Compliance & Disclosure Interpretations on Non-GAAP Financial Measures and Rule 100(b) of Regulation G. |

The Company’s Response:

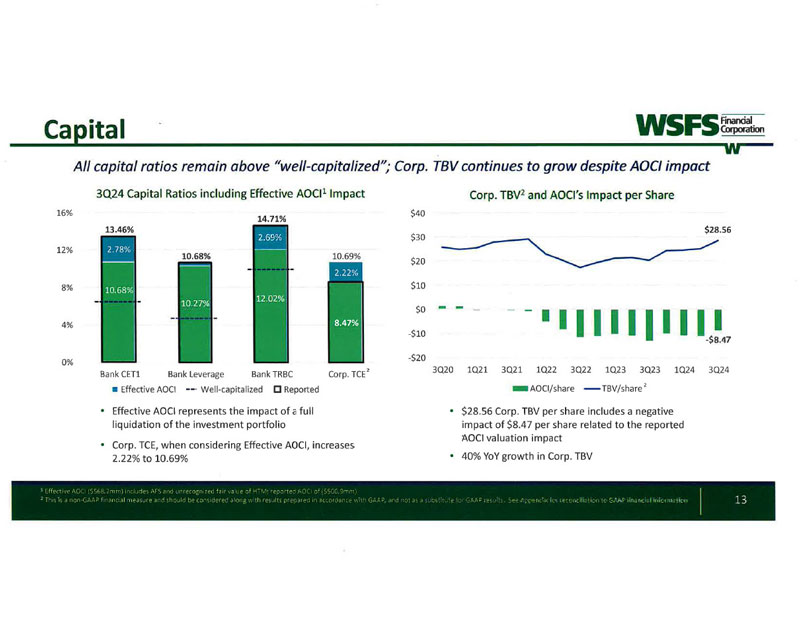

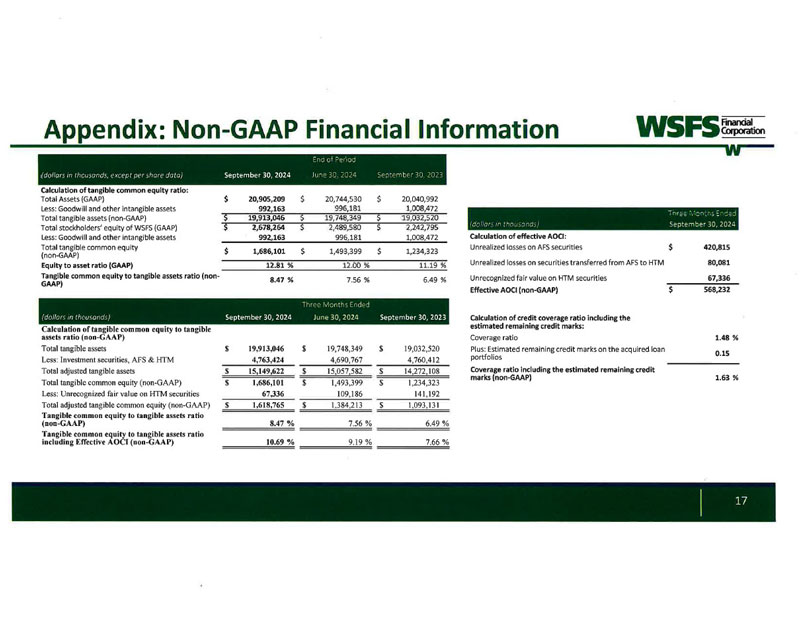

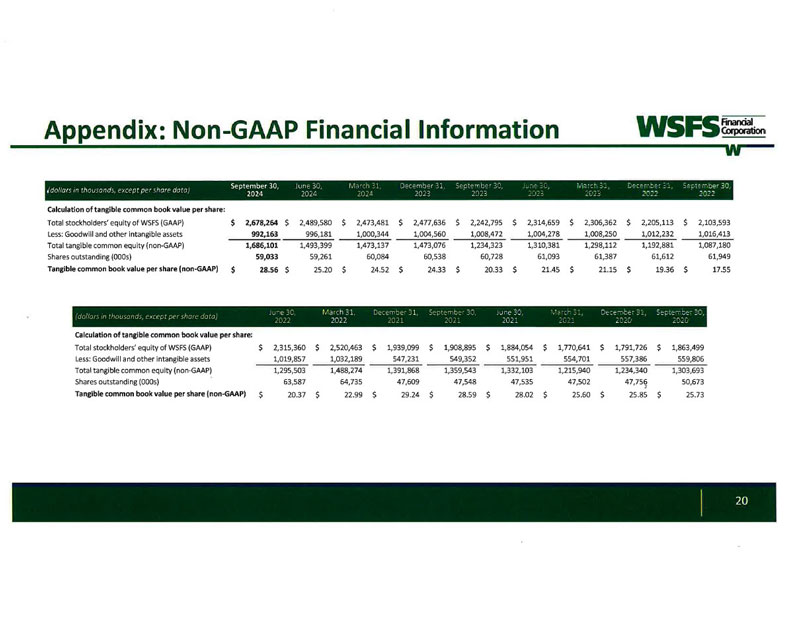

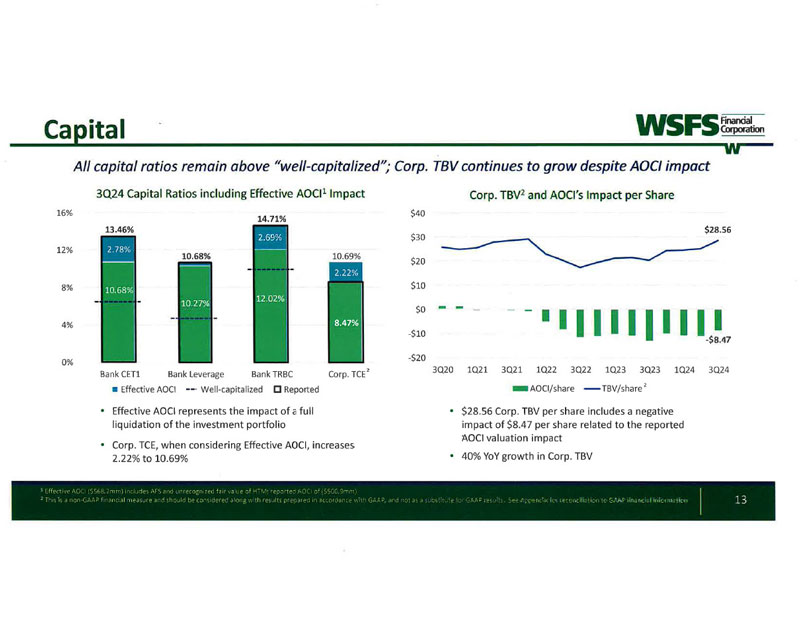

The Company respectfully acknowledges the Staff’s comment. In regard to the presented calculation of Tangible Common Equity (“TCE”) ex-AOCI, management is proposing revising its disclosure going forward to provide the Staff and users a better understanding of the information being presented. These revisions are intended to clarify that the Company is not excluding AOCI, but rather including the impact of “effective AOCI,” which we define as a full liquidation of the Company’s entire investment securities portfolio with recognition of the losses through the Company’s total equity. Further, the Company proposed revising its non-GAAP reconciliations, such as those included on pages 17 and 20 of the Earnings Release Supplement included in the Current Report, to better show the components of this calculation and remove any reference to TCE ex-AOCI. Although not requested, we are attaching demonstrative revised disclosure from such Earnings Release Supplement to assist the Staff. We will reflect these changes in future filings.

Division of Corporation Finance

U.S. Securities and Exchange Commission

January 17, 2025

Page 2

The Company respectfully acknowledges the Staff’s comment related to Tangible Book Value (“TBV”) ex-AOCI and will remove the presentation of such non-GAAP information from future filings, as requested. Additionally, as the Company believes the impact of AOCI in relation to TBV is important to investors, the Company has revised its disclosures to separately reflect the per share impact from AOCI. This will allow investors who review the Company’s disclosures to see this frequently requested information while complying with Rule 100(b) of Regulation G.

If you have any questions or comments regarding this response, please call the undersigned at 302-571-6833. Thank you very much for your attention to this matter.

| Very truly yours, | |

| /s/ David Burg | |

| David Burg | |

| Executive Vice President, | |

| Chief Financial Officer |

| cc: | Michael P. Reed, Esq., Covington & Burling LLP |