1st Quarter Fiscal 2026 Earnings Presentation .2

Safe-Harbor Statement © 2026 Lindsay Corporation This presentation contains forward-looking statements that are subject to risks and uncertainties, and which reflect management’s current beliefs and estimates of future economic circumstances, industry conditions, Company performance, financial results and planned financing. You can find a discussion of many of these risks and uncertainties in the annual, quarterly and current reports that the Company files with the Securities and Exchange Commission. Investors should understand that a number of factors could cause future economic and industry conditions and the Company’s actual financial condition and results of operations to differ materially from management’s beliefs expressed in the forward-looking statements contained in this presentation. These factors include those outlined in the “Risk Factors” section of the Company’s most recent annual report on Form 10-K filed with the Securities and Exchange Commission, and investors are urged to review these factors when considering the forward-looking statements contained in this presentation. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. For additional financial statement information, please see the Company’s earnings release dated January 8, 2026.

© 2026 Lindsay Corporation Key Highlights Improved Irrigation operating margin despite lower revenues in North America and international markets Increased Infrastructure revenues 17 percent on higher sales of road safety products Secured $80 million irrigation and technology project in the MENA region subsequent to quarter-end Completed share repurchases of $30 million during the quarter

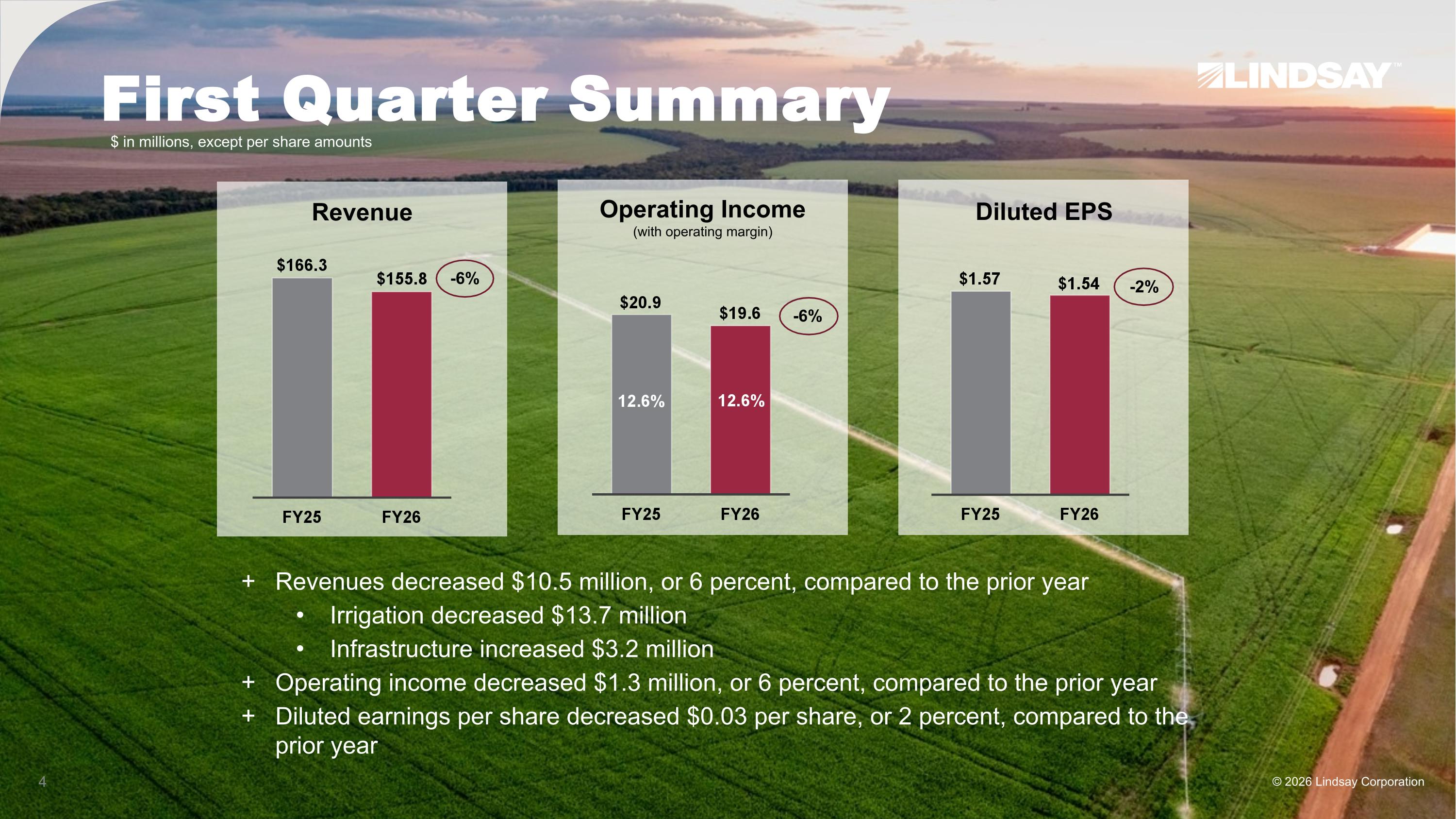

First Quarter Summary © 2026 Lindsay Corporation Revenues decreased $10.5 million, or 6 percent, compared to the prior year Irrigation decreased $13.7 million Infrastructure increased $3.2 million Operating income decreased $1.3 million, or 6 percent, compared to the prior year Diluted earnings per share decreased $0.03 per share, or 2 percent, compared to the prior year -6% -6% -2% Revenue Operating Income (with operating margin) Diluted EPS $ in millions, except per share amounts

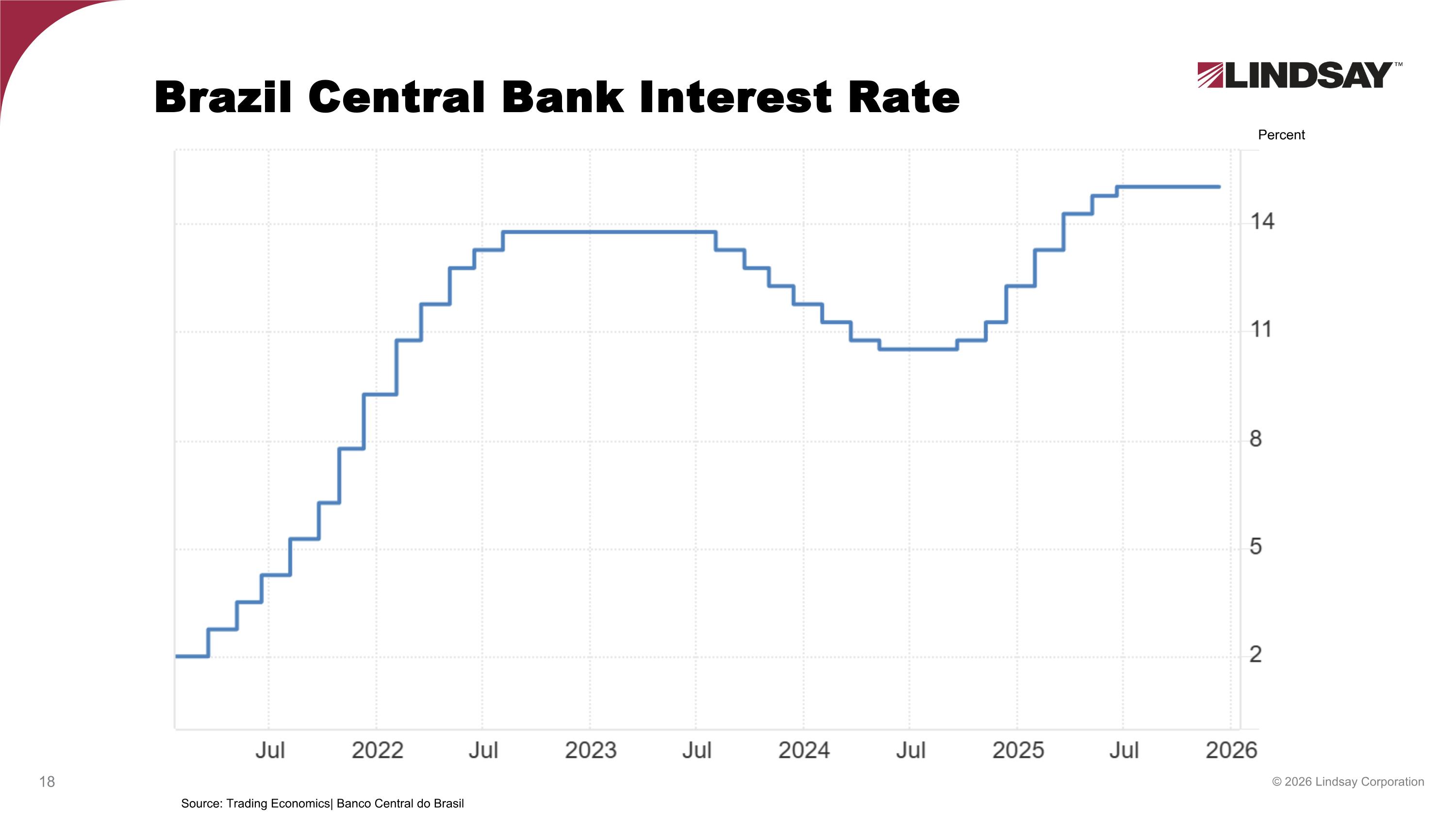

Irrigation – Current Market Factors © 2026 Lindsay Corporation In September, the USDA estimated 2025 U.S. net farm income to be $179.8 billion, an increase of 41 percent from 2024 U.S. net farm income of $127.8 billion The projected increase is based mainly on higher government support payments Cash receipts for crops are projected to decline by 3 percent while cash expenses have increased In December, $12.0 billion Farm Bridge Assistance Program announced $11.0 billion to support row crop farmers with payments beginning in February 2026 U.S. trade disruption with China negatively impacts export market for U.S. commodities The One Big Beautiful Bill Act was signed into law July 4, 2025 Extends provisions of the 2017 Tax Act, including accelerated depreciation of equipment purchases Extends key commodity support programs under the Farm Bill, which expired September 30, 2025 Demand for irrigation equipment in Brazil remains stable High interest rates and ongoing credit constraints remain as headwinds The market continues to benefit from increased commodity exports to China Commodity price pressure remains due to record harvests Pipeline of project opportunities in developing international markets continues to be robust, driven by secular megatrends of food security and water conservation

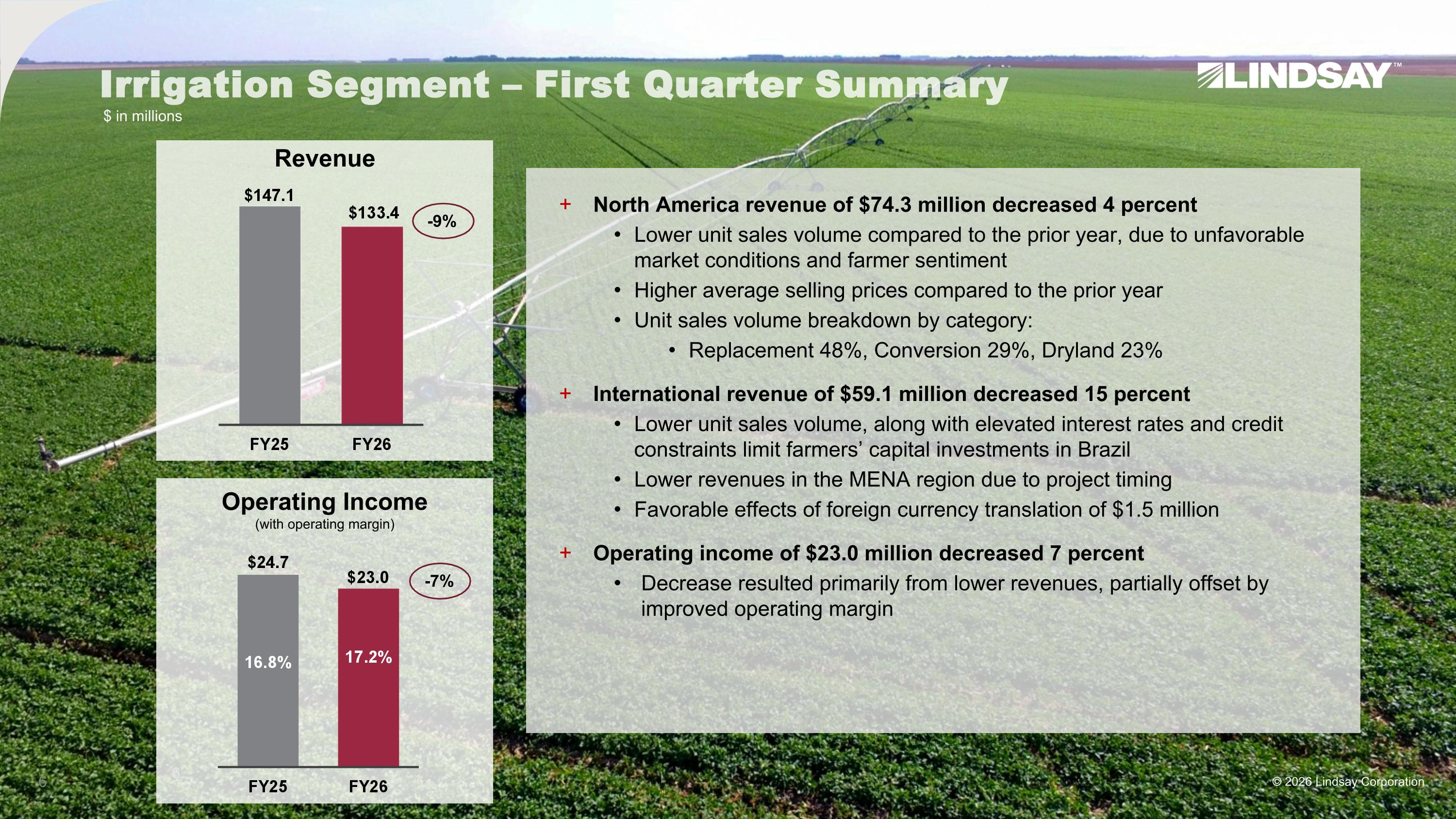

Irrigation Segment – First Quarter Summary © 2026 Lindsay Corporation North America revenue of $74.3 million decreased 4 percent Lower unit sales volume compared to the prior year, due to unfavorable market conditions and farmer sentiment Higher average selling prices compared to the prior year Unit sales volume breakdown by category: Replacement 48%, Conversion 29%, Dryland 23% International revenue of $59.1 million decreased 15 percent Lower unit sales volume, along with elevated interest rates and credit constraints limit farmers’ capital investments in Brazil Lower revenues in the MENA region due to project timing Favorable effects of foreign currency translation of $1.5 million Operating income of $23.0 million decreased 7 percent Decrease resulted primarily from lower revenues, partially offset by improved operating margin Revenue -7% -9% Operating Income (with operating margin) 6 $ in millions

Infrastructure – Current Market Factors Infrastructure Investment and Jobs Act (IIJA) funding includes $110 billion in incremental federal funding for roads, bridges, and other transportation projects and runs through September 2026 Inflation on material prices and labor costs have offset some of the impact of incremental funding Through November 2025, 88 percent of the IIJA funds have been committed to the states, and 58 percent of the funds have been reimbursed to the states* The value of state and local government contract awards increased 11.5 percent year to date versus 2024 driven by bridges, tunnels and the rail sector* The Road Zipper ™ project pipeline continues to be actively managed, and project timing remains challenging to predict © 2026 Lindsay Corporation *Source: American Road and Transportation Builders Association

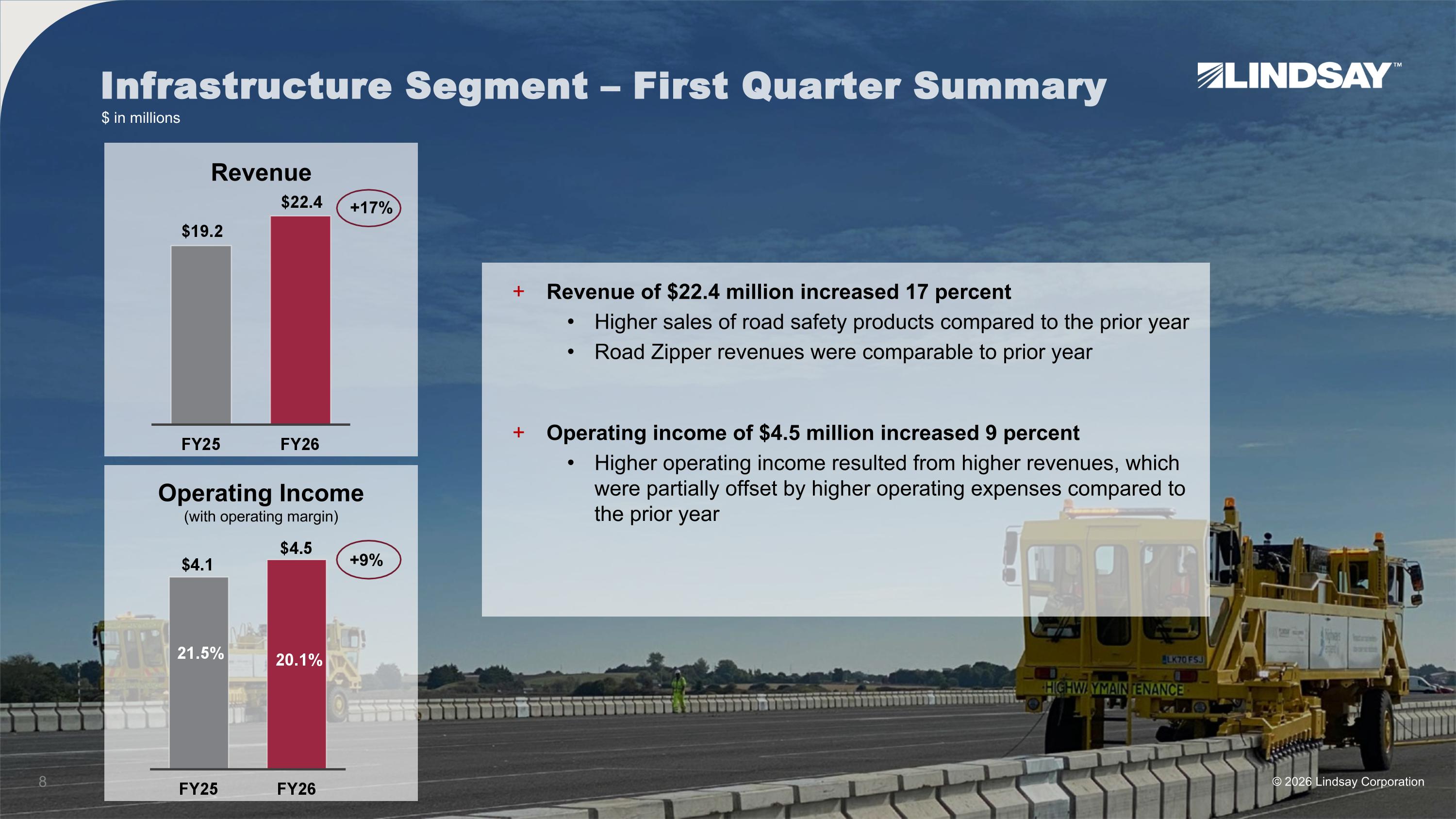

Infrastructure Segment – First Quarter Summary © 2026 Lindsay Corporation Revenue of $22.4 million increased 17 percent Higher sales of road safety products compared to the prior year Road Zipper revenues were comparable to prior year Operating income of $4.5 million increased 9 percent Higher operating income resulted from higher revenues, which were partially offset by higher operating expenses compared to the prior year Revenue +9% Operating Income (with operating margin) +17% $ in millions

© 2026 Lindsay Corporation Ample Liquidity to Execute Capital Allocation Priorities $250M Available liquidity Current Liquidity 0.9x Gross Debt to EBITDA leverage Substantial Room to Add Leverage No Near-Term Debt Maturities $115M Total Debt 2030 Maturity

Capital Allocation Priorities © 2026 Lindsay Corporation Working capital to support sales growth New product development Capacity and productivity investments Align with strategic growth priorities Leverage or add to existing capabilities Deliver incremental return on invested capital Increase annual dividends Opportunistic share repurchase Support Growth and Profitability of Current Businesses Acquisitions Return Capital to Shareholders

Innovation Leadership: Addressing Global Megatrends © 2026 Lindsay Corporation Capitalizing on global megatrends Megatrends Innovation Leadership Innovative sustainable solutions for growers across the globe Mobilizing global populations safely and sustainably Food Security Water Scarcity Land Availability Aging Infrastructure Mobility Safety Increased Safety Standards

Strong Commitment to Sustainable Practices © 2026 Lindsay Corporation Our mission is to conserve natural resources, expand our world’s potential, and enhance the quality of life for people. Investing in sustainable technologies Improving our operational footprint Empowering and protecting our people Engaging in our local communities Operating with integrity

Appendix © 2026 Lindsay Corporation

U.S. Corn Prices Source: Trading Economics © 2026 Lindsay Corporation USD/BU

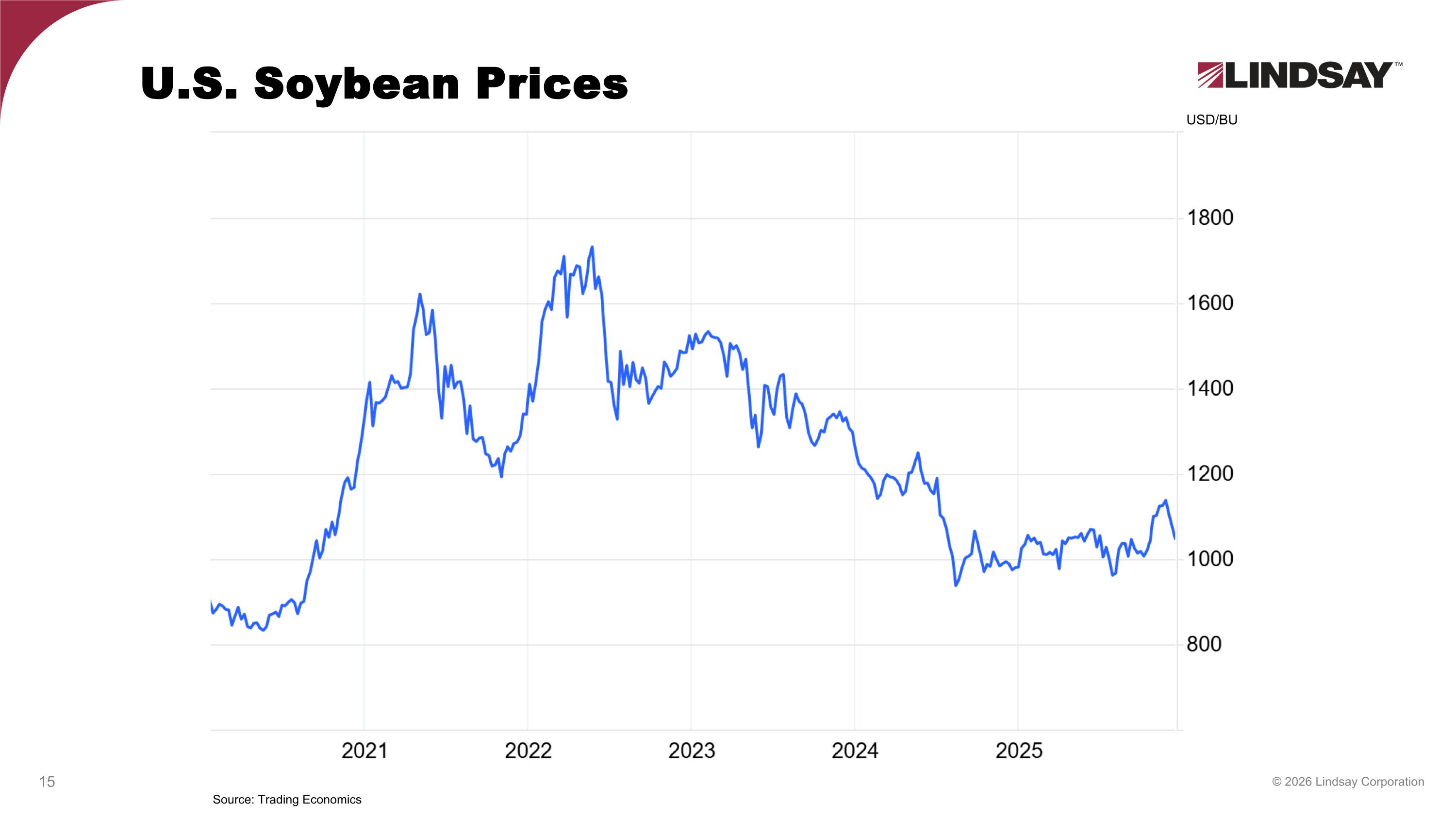

U.S. Soybean Prices © 2026 Lindsay Corporation USD/BU Source: Trading Economics

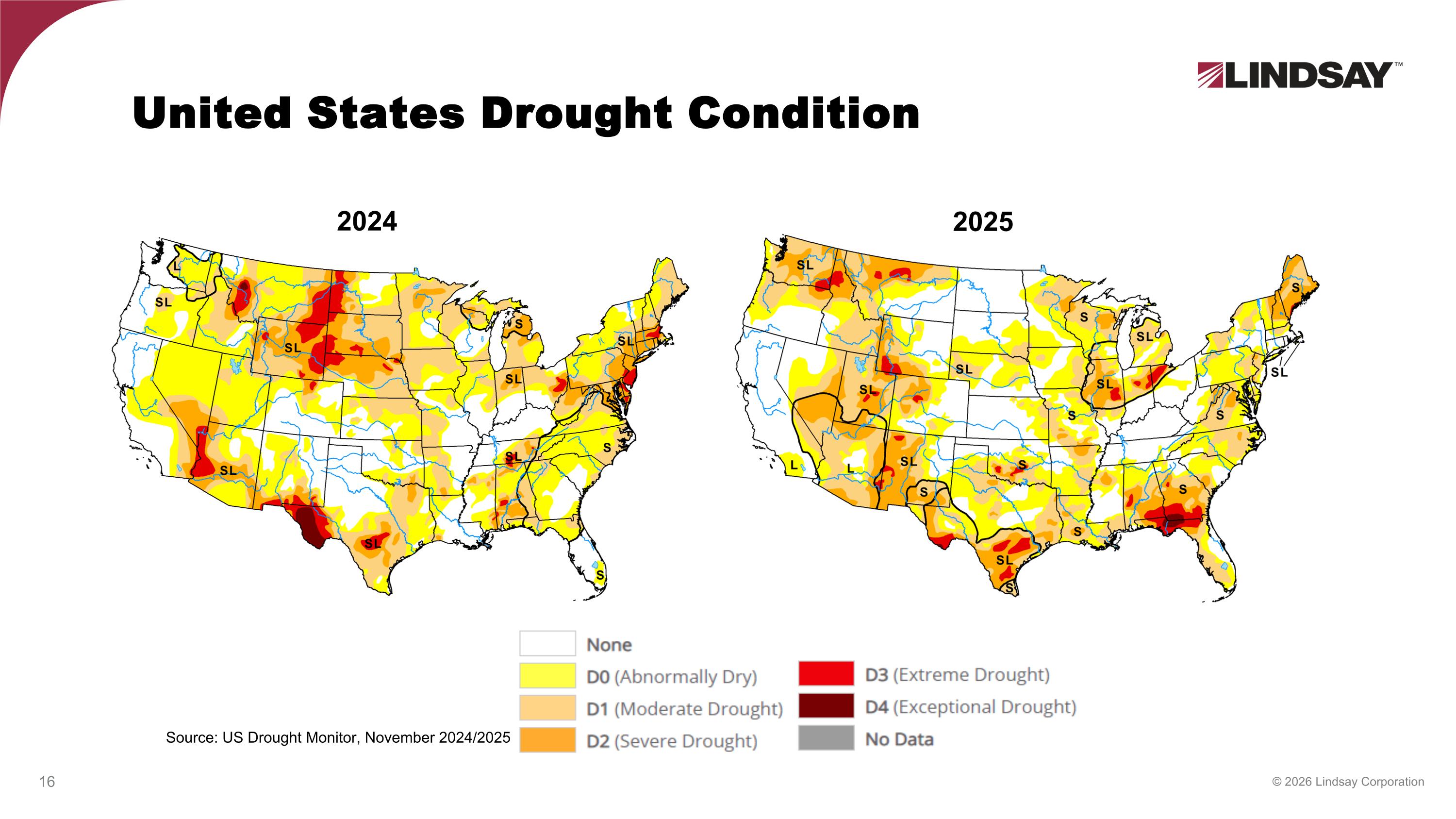

United States Drought Condition Source: US Drought Monitor, November 2024/2025 2024 2025 © 2026 Lindsay Corporation

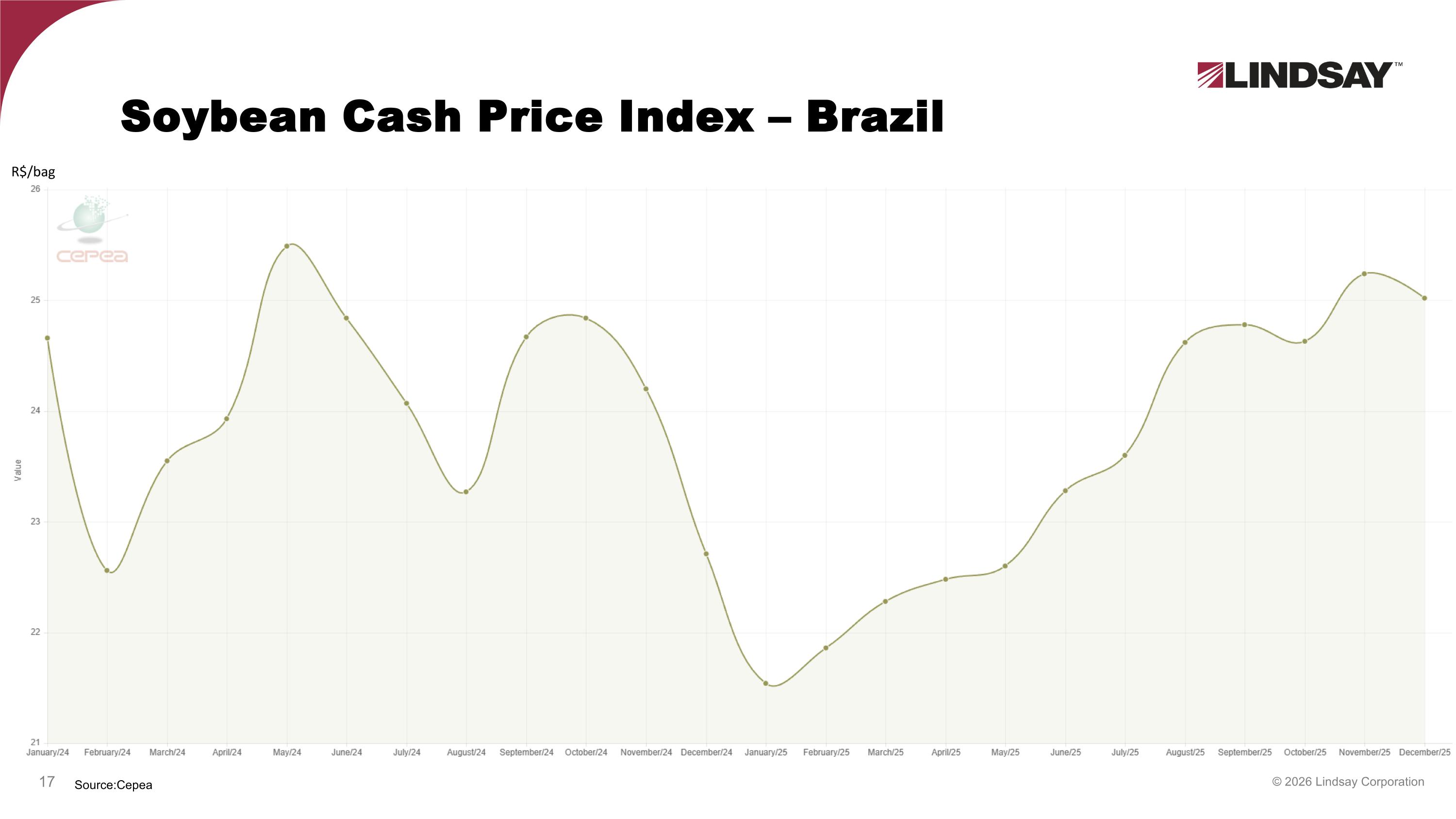

Soybean Cash Price Index – Brazil Source:Cepea © 2026 Lindsay Corporation R$/bag

Brazil Central Bank Interest Rate Source: Trading Economics| Banco Central do Brasil Percent © 2026 Lindsay Corporation