Filed by Banco Bilbao Vizcaya Argentaria, S.A.

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Banco de Sabadell, S.A.

Commission File No.: 333-281111

|

PRESS RELEASE 09.22.2025 |

BBVA Increases Offer to Banco Sabadell Shareholders by 10% and Improves the

Tax Treatment of the Transaction

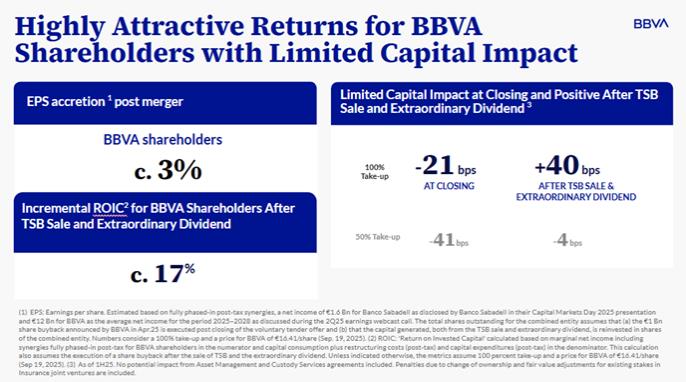

The BBVA Board of Directors has agreed to improve the offer to Banco Sabadell shareholders by 10 percent1. In addition, the consideration will now be entirely in shares, so shareholders with capital gains would not be subject to taxation in Spain, if acceptance exceeds 50 percent of Banco Sabadell’s voting rights, as the transaction would qualify as tax neutral in that case. The Board of Directors has also agreed to waive both the possibility of making further improvements to the consideration and of extending the acceptance period.

“With this improved offer, we are putting an extraordinary proposal in the hands of Banco Sabadell shareholders —one that combines a historic valuation and price with the opportunity to participate in the substantial value generated by the integration. All of this will result in a significant increase in the expected earnings per share in the future, if they tender their shares” BBVA Chair Carlos Torres Vila said.

10% increase of the offer

The new offer, which entails one new BBVA share for every 4.8376 Banco Sabadell shares, represents an increase of 10 percent¹ and offers a exceptionally attractive proposition for Banco Sabadell shareholders:

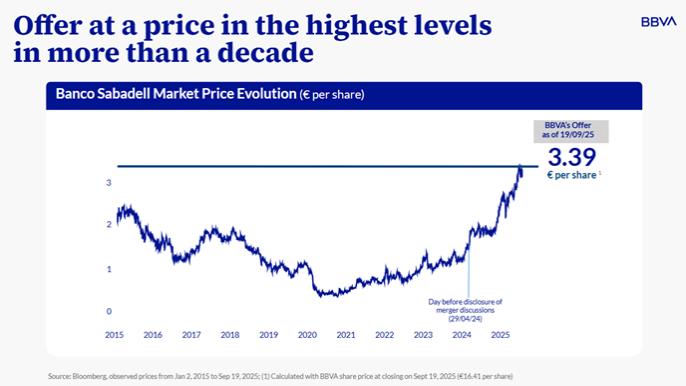

| ● | The offer values Banco Sabadell shares at 3.39 euros per share¹, at its highest levels in more than a decade. |

1 Calculated with BBVA share price at closing on Sept 19, 2025 (€16.41 per share).

The improved consideration of the offer for Banco de Sabadell, S.A. and the corresponding annex to the prospectus are subject to the authorization by the Spanish National Securities Market Commission (CNMV).