| Exhibit 11.1 Regulatory Compliance Operational Policy Market Abuse & Inside Information Chapter 5 – PAD 1 |

| Background Who is this Regulatory Compliance Operational Policy applicable to? The Market Abuse & Inside Information (MARII) Regulatory Compliance Operational Policy is aligned to the Compliance & Conduct Level 1 Policy and Level 2 MARII Risk Standard. It is applicable to all franchises, functions, and legal entities (FFLEs) within the NatWest Group (NWG). Each FFLE isrequired to manage the material obligations laid out in the MARII Regulatory Compliance Operational Policy and understand the scope of this Policy and its relevance to them. There is expectations for FFLEs to create addendums to this MARII Regulatory Compliance Operational Policy as per specific regulatory, legislative, or jurisdictional requirements that require to go further than the documented MARII Risk Standard and its associated Regulatory Compliance Operational Policies. Note – A separate Personal Account Dealing policy applies to all US full-time employees, temporary staff, and NatWest Markets employees based outside of the US who maintain a permissive registration, and all staff who are deemed to be Associated Persons (“APs”) of NatWest Markets Securities Inc., the US broker-dealer, and their related and other persons (“Related Persons”) including: - The spouse of the associated person. - A child of the associated person or of the associated person’sspouse, provided that the child residesin the same household as or isfinancially dependent upon the associated person. - Any other related individual over whose account the associated person has control. - Any other individual over whose account the associated person has control and to whose financial support the associated person materially contributes. Please click here forthe NWM US Personal Account Dealing Policy What is the purpose of this Regulatory Compliance Operational Policy? The MARII Regulatory Compliance Operational Policy outlinesthe high-level minimum expectationsfor FFLEs to ensure that they have an adequate and effective control framework in place to manage market abuse risks in line with applicable regulatory requirements as detailed within appendix 1 of the Risk Standard All permanent colleagues, contractors and agency staff must adhere to the requirements within this Regulatory Compliance Operational Policy and comply with their obligations under the Market Abuse Regulation ('MAR') and related requirements for 'Inside Information'. If you see or hear something that could be wrongdoing or misconduct that breaches: - anything contained in this Regulatory Compliance Operational Policy or in the documents listed in the ‘Need more information’ section below; and/or - anything contained in our other policies or procedures, then you can raise a concern with Compliance & Conduct, or confidentially (or anonymously) through Speak Up. For more information, visit the Speak Up intranet page, or contact the internal Speak Up Team: ~ Speak Up Guidance & Support. |

| Minimum Standards At a glance…’what’ needs to be considered? The purpose of this operational policy is to ensure that all staff and their Closely Associated Persons (CAPs) comply with their obligations in relation to personal account dealing, that is personal trading in financial instruments (for example, shares and corporate bonds). Protecting the integrity of financial markets is critical to promoting fair and efficient markets and investor confidence. The regulatory framework is designed to ensure a level playing field where everyone trading in financial markets has access to the same information and those with confidential or inside information do not inappropriately use this for their personal advantage. Failure to comply with this Policy can have serious consequences for the Group, its Staff and customers and, in some circumstances, can be a criminal offence called ‘insider dealing’. Insider dealing is punishable by a fine and/or imprisonment. Individuals may also be banned from working in the financial services industry All Staff must be aware of this Policy and understand their personal responsibilities under it by - undertaking training on personal account dealing as part of their induction - PDMRs, NWG, NWM and NWM NV Insiders and Staff designated as Private Side or with a Special Status undertaking regular on-going training This Operational policy makesreference to in-scope colleagues, contractors, agency staff and their CAPs. These are defined as: - Staff designated as Public side - Persons Discharging Managerial Responsibility ('PDMRs') - NWG permanent Insiders and Staff at higher risk of handling Group Inside Information - Staff designated as Private Side and Staff designated with a Special Status FFLEs may mandate additional requirements for their Staff over and above these minimum requirements. Where this applies, FFLEs must: - provide detailsto the Control Room; - create, document and maintain local personal account dealing procedures; - communicate the requirements to impacted Staff; and - oversee their Staff’s compliance with local procedures. |

| Mandatory Requirements Building upon the high-level key control requirements within the L2 MARII Risk Standard, we clarify below the mandatory requirements to be in place. General Staff Requirements What All in scope permanent colleagues, contractors, agency staff and their CAPs must receive trading approval prior to placing instructions in financial instruments. All in scope permanent colleagues, contractors, agency staff and their CAPs will be prevented from trading where inside information for the issuer wishing to be traded is held within NatWest Group (Via use of PAD system). Why By seeking approval prior to executing a trade, approval will not be granted where inside information is held for the financial instrument be requested to trade. How i. FFLEs must ensure staff do not undertake personal account dealing if this would create a potential or actual conflict of interest or detract from their ability to carry out their role within the Group. This includes, but is not limited to, Staff being in receipt of inside information about the issuer ii. Other than in the normal course of their employment, FFLEs must ensure Staff do not advise, encourage or recommend any person to undertake personal account dealing, if they would not be permitted to undertake it themselves. iii. FFLEs must ensure their staff personal account dealing does not involve: - shortselling activity - excessive risk - financialspread-betting Persons Discharging Managerial Responsibility ('PDMRs') - PDMRs are notified of their status by Legal, Governance & Regulatory Affairs(LG&RA) What Prior to all in scope permanent colleagues, contractors, agency staff and their CAPs being allowed to trade, we must ensure all designated permanent colleagues, contractors, agency staff and their CAPs have disclosed their broker accounts. Why With all in scope permanent colleagues, contractors, agency staff and their CAPs disclosing their brokerage accounts, via monitoring, we can ensure that no unauthorised trading within financial instruments are executed by those where inside information is held, that would result in insider dealing. |

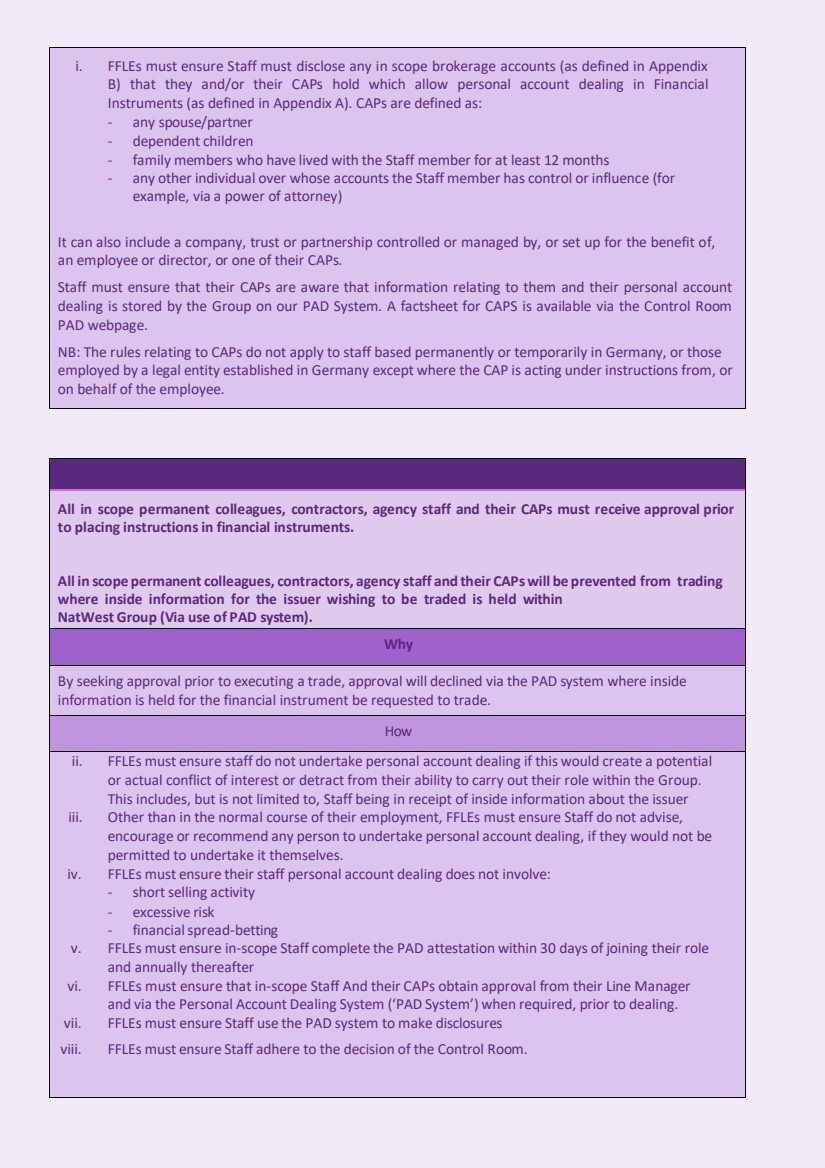

| How i. FFLEs must ensure Staff disclose any in scope brokerage accounts (as defined in Appendix B) that they and/or their CAPs hold which allow personal account dealing in Financial Instruments(as defined the non-exhaustive list in Appendix A). CAPs are defined as: - any spouse/partner - dependent children - family members who have lived with the Staff member for at least 12 months - any other individual over whose accountsthe Staff member has control or influence (for example, via a power of attorney) It can also include a company, trust or partnership controlled or managed by, or set up for the benefit of, an employee or director, or one of their CAPs. Staff must ensure that their CAPs are aware that information relating to them and their personal account dealing is stored by the Group on our PAD System. A factsheet for CAPS is available via the Control Room PAD webpage. NB: The rules relating to CAPs do not apply to staff based permanently or temporarily in Germany, or those employed by a legal entity established in Germany except where the CAP is acting under instructions from, or on behalf of the employee. What All in scope permanent colleagues, contractors, agency staff and their CAPs must receive approval prior to placing instructions in financial instruments. All in scope permanent colleagues, contractors, agency staff and their CAPs will be prevented from trading where inside information for the issuer wishing to be traded is held within NatWest Group (Via use of PAD system). Why By seeking approval prior to executing a trade, approval will declined via the PAD system where inside information is held for the financial instrument be requested to trade. How ii. FFLEs must ensure Staff do not undertake personal account dealing if this would create a potential or actual conflict of interest or detract from their ability to carry out their role within the Group. This includes, but is not limited to, Staff being in receipt of Inside Information about the issuer iii. Other than in the normal course of their employment, FFLEs must ensure Staff do not advise, encourage or recommend any person to undertake personal account dealing, if they would not be permitted to undertake it themselves. iv. FFLEs must ensure their Staff personal account dealing does not involve: - shortselling activity - excessive risk - financialspread-betting v. FFLEs must ensure in-scope Staff complete the PAD attestation within 30 days of joining their role and annually thereafter vi. FFLEs must ensure that in-scope Staff And their CAPs obtain approval from their Line Manager and via the Personal Account Dealing System (‘PAD System’) when required, prior to dealing. vii. FFLEs must ensure Staff use the PAD system to make disclosures unless they are a PDMR |

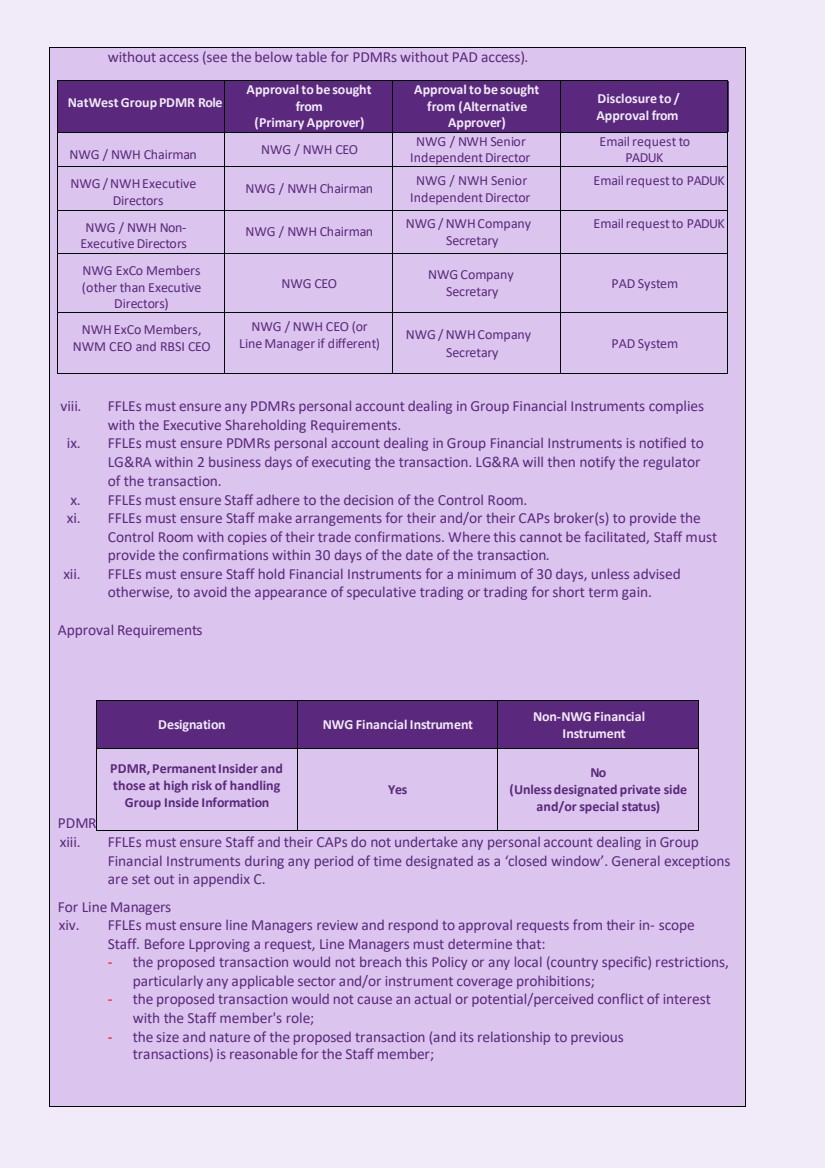

| without access(see the below table for PDMRs without PAD access). viii. FFLEs must ensure any PDMRs personal account dealing in Group Financial Instruments complies with the Executive Shareholding Requirements. ix. FFLEs must ensure PDMRs personal account dealing in Group Financial Instruments is notified to LG&RA within 2 business days of executing the transaction. LG&RA will then notify the regulator of the transaction. x. FFLEs must ensure Staff adhere to the decision of the Control Room. xi. FFLEs must ensure Staff make arrangements for their and/or their CAPs broker(s) to provide the Control Room with copies of their trade confirmations. Where this cannot be facilitated, Staff must provide the confirmations within 30 days of the date of the transaction. xii. FFLEs must ensure Staff hold Financial Instruments for a minimum of 30 days, unless advised otherwise, to avoid the appearance ofspeculative trading or trading for short term gain. Approval Requirements PDMRs who are also Permanent Insiders or at higher risk of handling NWG Inside Information xiii. FFLEs must ensure Staff and their CAPs do not undertake any personal account dealing in Group Financial Instruments during any period of time designated as a ‘closed window’. General exceptions are set out in appendix C. For Line Managers xiv. FFLEs must ensure line Managers review and respond to approval requests from their in- scope Staff. Before Lpproving a request, Line Managers must determine that: - the proposed transaction would not breach this Policy or any local (country specific) restrictions, particularly any applicable sector and/or instrument coverage prohibitions; - the proposed transaction would not cause an actual or potential/perceived conflict of interest with the Staff member's role; - the size and nature of the proposed transaction (and itsrelationship to previous transactions) isreasonable for the Staff member; NatWestGroup PDMR Role Approvalto be sought from (Primary Approver) Approvalto be sought from (Alternative Approver) Disclosure to / Approval from NWG / NWH Chairman NWG / NWH CEO NWG / NWH Senior IndependentDirector Emailrequest to PADUK NWG /NWHExecutive Directors NWG / NWH Chairman NWG / NWH Senior IndependentDirector Emailrequestto PADUK NWG / NWH Non-ExecutiveDirectors NWG / NWH Chairman NWG /NWHCompany Secretary Emailrequestto PADUK NWG ExCo Members (other than Executive Directors) NWG CEO NWGCompany Secretary PAD System NWHExCo Members, NWM CEO and RBSI CEO NWG / NWH CEO (or Line Managerif different) NWG /NWHCompany Secretary PAD System Designation NWG Financial Instrument Non-NWGFinancial Instrument PDMR, PermanentInsider and those at high risk of handling Group Inside Information Yes No (Unless designated private side and/orspecialstatus) |

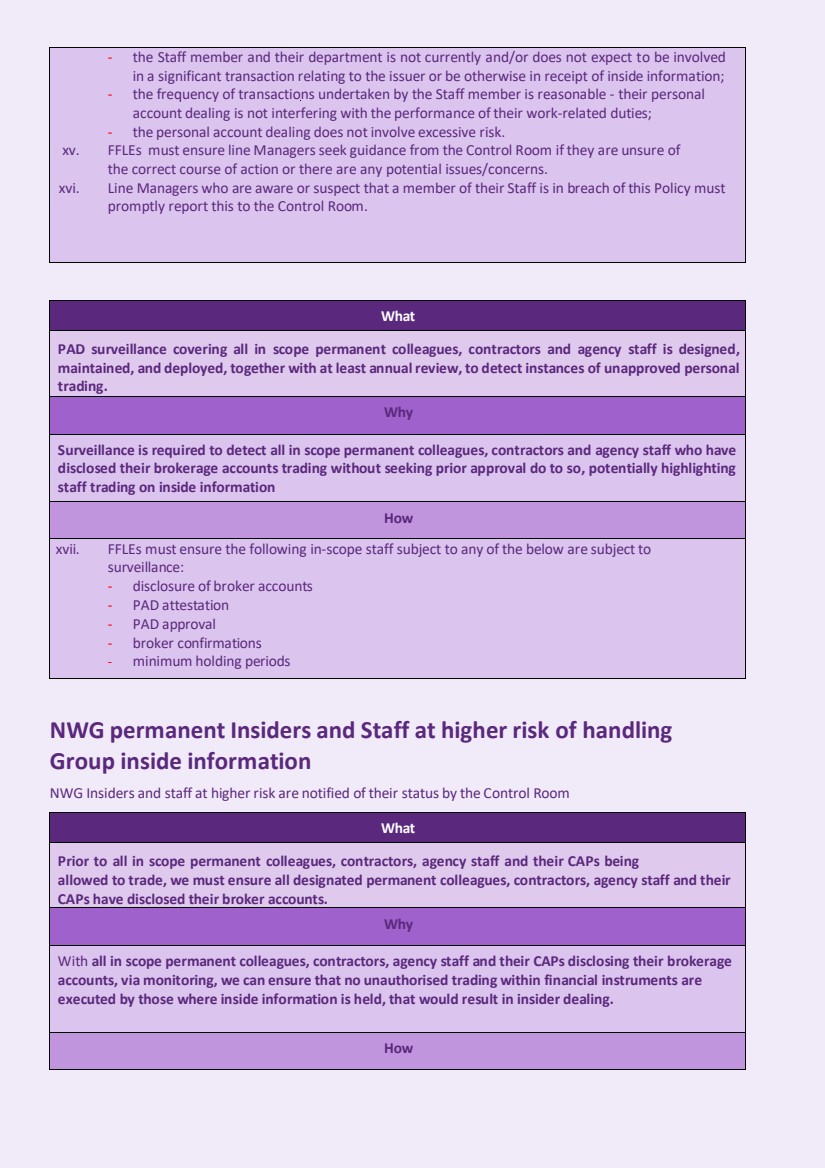

| - the Staff member and their department is not currently and/or does not expect to be involved in a significant transaction relating to the issuer or be otherwise in receipt of inside information; - the frequency of transactions undertaken by the Staff member is reasonable - their personal account dealing is not interfering with the performance of their work-related duties; - the personal account dealing does not involve excessive risk. xv. FFLEs must ensure line Managersseek guidance from the Control Room if they are unsure of the correct course of action or there are any potential issues/concerns. xvi. Line Managers who are aware or suspect that a member of their Staff is in breach of this Policy must promptly report this to the Control Room. What PAD surveillance covering all in scope permanent colleagues, contractors and agency staff is designed, maintained, and deployed, together with at least annualreview,to detect instances of unapproved personal trading. Why Surveillance is required to detect all in scope permanent colleagues, contractors and agency staff who have disclosed their brokerage accounts trading without seeking prior approval do to so, potentially highlighting staff trading on inside information How xvii. FFLEs must ensure the following in-scope staff subject to any of the below are subject to surveillance: - disclosure of broker accounts - PAD attestation - PAD approval - broker confirmations - minimum holding periods NWG permanent Insiders and Staff at higher risk of handling Group inside information NWG Insiders and staff at higher risk are notified of their status by the Control Room What Prior to all in scope permanent colleagues, contractors, agency staff and their CAPs being allowed to trade, we must ensure all designated permanent colleagues, contractors, agency staff and their CAPs have disclosed their broker accounts. Why With all in scope permanent colleagues, contractors, agency staff and their CAPs disclosing their brokerage accounts, via monitoring, we can ensure that no unauthorised trading within financial instruments are executed by those where inside information is held, that would result in insider dealing. How |

| i. FFLEs must ensure Staff must disclose any in scope brokerage accounts (as defined in Appendix B) that they and/or their CAPs hold which allow personal account dealing in Financial Instruments (as defined in Appendix A). CAPs are defined as: - any spouse/partner - dependent children - family members who have lived with the Staff member for at least 12 months - any other individual over whose accountsthe Staff member has control or influence (for example, via a power of attorney) It can also include a company, trust or partnership controlled or managed by, or set up for the benefit of, an employee or director, or one of their CAPs. Staff must ensure that their CAPs are aware that information relating to them and their personal account dealing is stored by the Group on our PAD System. A factsheet for CAPS is available via the Control Room PAD webpage. NB: The rules relating to CAPs do not apply to staff based permanently or temporarily in Germany, or those employed by a legal entity established in Germany except where the CAP is acting under instructions from, or on behalf of the employee. All in scope permanent colleagues, contractors, agency staff and their CAPs must receive approval prior to placing instructions in financial instruments. All in scope permanent colleagues, contractors, agency staff and their CAPs will be prevented from trading where inside information for the issuer wishing to be traded is held within NatWest Group (Via use of PAD system). Why By seeking approval prior to executing a trade, approval will declined via the PAD system where inside information is held for the financial instrument be requested to trade. How ii. FFLEs must ensure staff do not undertake personal account dealing if this would create a potential or actual conflict of interest or detract from their ability to carry out their role within the Group. This includes, but is not limited to, Staff being in receipt of inside information about the issuer iii. Other than in the normal course of their employment, FFLEs must ensure Staff do not advise, encourage or recommend any person to undertake personal account dealing, if they would not be permitted to undertake it themselves. iv. FFLEs must ensure their staff personal account dealing does not involve: - shortselling activity - excessive risk - financialspread-betting v. FFLEs must ensure in-scope Staff complete the PAD attestation within 30 days of joining their role and annually thereafter vi. FFLEs must ensure that in-scope Staff And their CAPs obtain approval from their Line Manager and via the Personal Account Dealing System (‘PAD System’) when required, prior to dealing. vii. FFLEs must ensure Staff use the PAD system to make disclosures viii. FFLEs must ensure Staff adhere to the decision of the Control Room. |

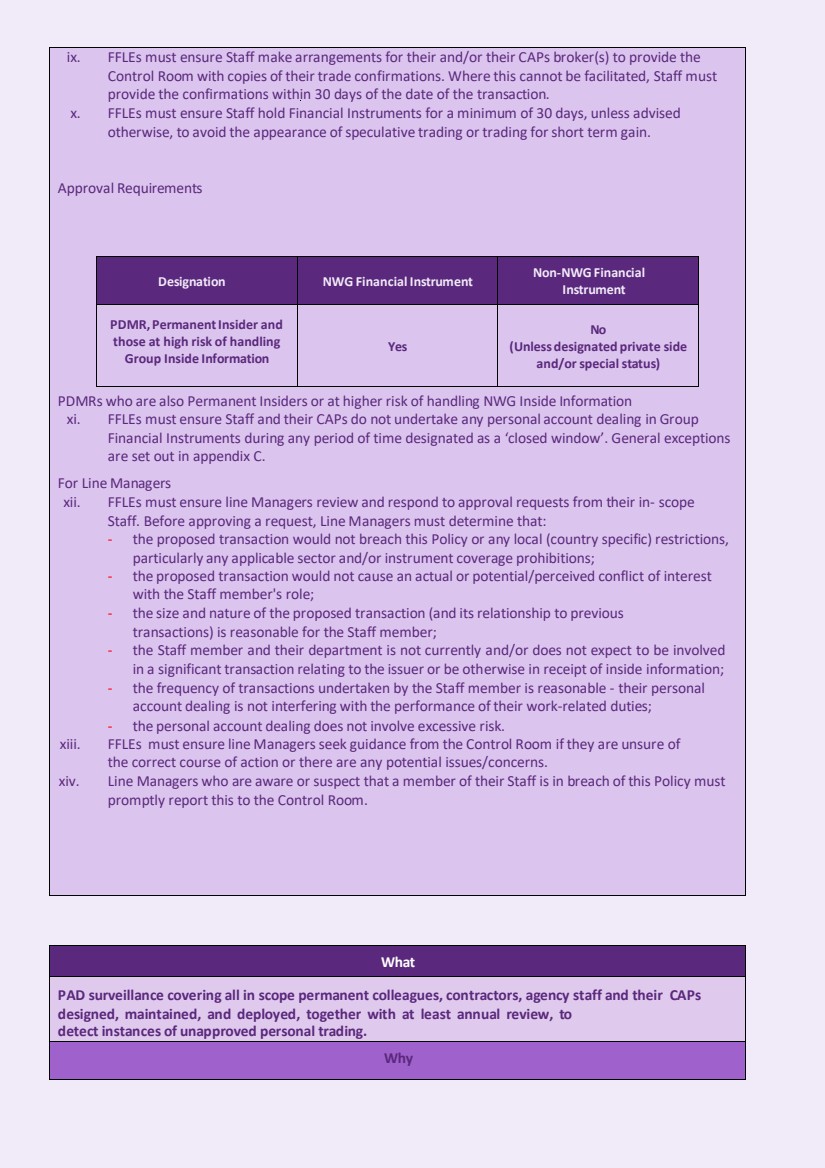

| ix. FFLEs must ensure Staff make arrangements for their and/or their CAPs broker(s) to provide the Control Room with copies of their trade confirmations. Where this cannot be facilitated, Staff must provide the confirmations within 30 days of the date of the transaction. x. FFLEs must ensure Staff hold Financial Instruments for a minimum of 30 days, unless advised otherwise, to avoid the appearance ofspeculative trading or trading for short term gain. Approval Requirements PDMRs who are also Permanent Insiders or at higher risk of handling NWG Inside Information xi. FFLEs must ensure Staff and their CAPs do not undertake any personal account dealing in Group Financial Instruments during any period of time designated as a ‘closed window’. General exceptions are set out in appendix C. For Line Managers xii. FFLEs must ensure line Managers review and respond to approval requests from their in- scope Staff. Before approving a request, Line Managers must determine that: - the proposed transaction would not breach this Policy or any local (country specific) restrictions, particularly any applicable sector and/or instrument coverage prohibitions; - the proposed transaction would not cause an actual or potential/perceived conflict of interest with the Staff member's role; - the size and nature of the proposed transaction (and itsrelationship to previous transactions) is reasonable for the Staff member; - the Staff member and their department is not currently and/or does not expect to be involved in a significant transaction relating to the issuer or be otherwise in receipt of inside information; - the frequency of transactions undertaken by the Staff member is reasonable - their personal account dealing is not interfering with the performance of their work-related duties; - the personal account dealing does not involve excessive risk. xiii. FFLEs must ensure line Managersseek guidance from the Control Room if they are unsure of the correct course of action or there are any potential issues/concerns. xiv. Line Managers who are aware or suspect that a member of their Staff is in breach of this Policy must promptly report this to the Control Room. What PAD surveillance covering all in scope permanent colleagues, contractors, agency staff and their CAPs designed, maintained, and deployed, together with at least annual review, to detect instances of unapproved personal trading. Why Designation NWG Financial Instrument Non-NWGFinancial Instrument PDMR, PermanentInsider and those at high risk of handling Group Inside Information Yes No (Unless designated private side and/orspecialstatus) |

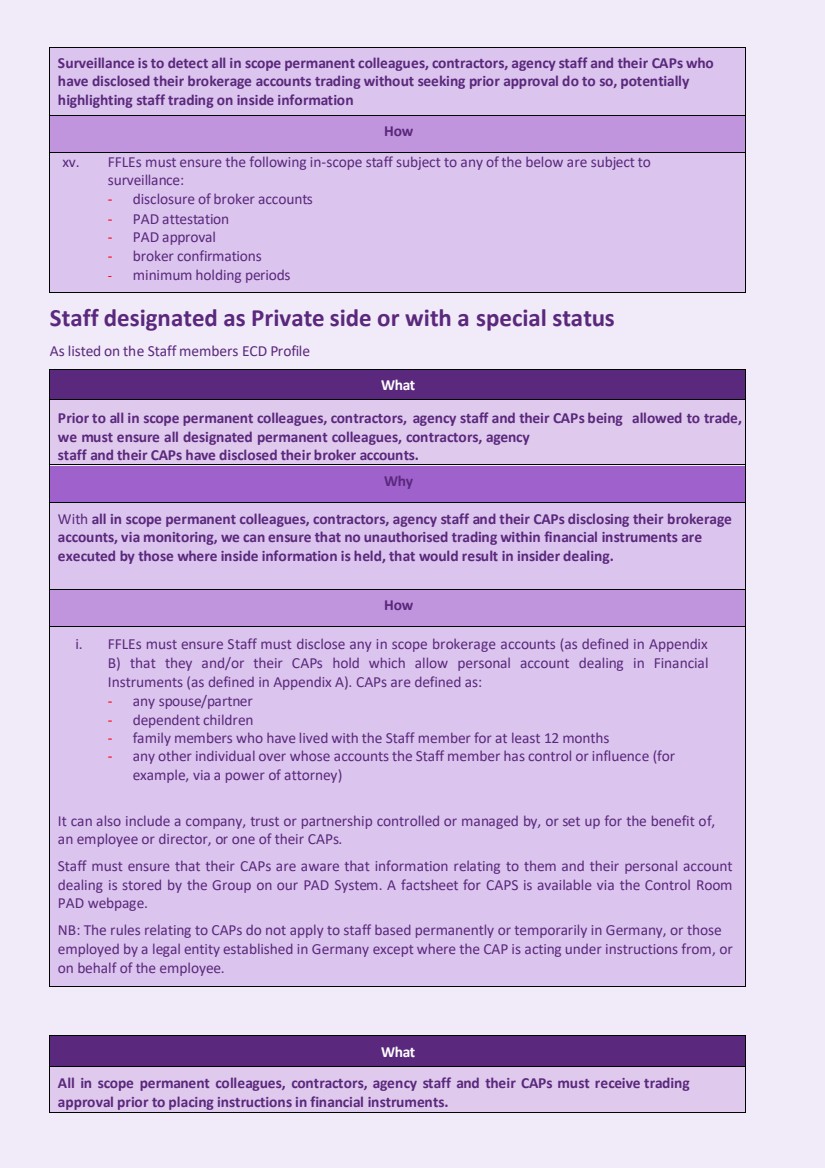

| Surveillance isto detect all in scope permanent colleagues, contractors, agency staff and their CAPs who have disclosed their brokerage accounts trading without seeking prior approval do to so, potentially highlighting staff trading on inside information How xv. FFLEs must ensure the following in-scope staff subject to any of the below are subject to surveillance: - disclosure of broker accounts - PAD attestation - PAD approval - broker confirmations - minimum holding periods Staff designated as Private side or with a special status Aslisted on the Staff members ECD Profile What Prior to all in scope permanent colleagues, contractors, agency staff and their CAPs being allowed to trade, we must ensure all designated permanent colleagues, contractors, agency staff and their CAPs have disclosed their broker accounts. Why With all in scope permanent colleagues, contractors, agency staff and their CAPs disclosing their brokerage accounts, via monitoring, we can ensure that no unauthorised trading within financial instruments are executed by those where inside information is held, that would result in insider dealing. How i. FFLEs must ensure Staff must disclose any in scope brokerage accounts (as defined in Appendix B) that they and/or their CAPs hold which allow personal account dealing in Financial Instruments (as defined in Appendix A). CAPs are defined as: - any spouse/partner - dependent children - family members who have lived with the Staff member for at least 12 months - any other individual over whose accountsthe Staff member has control or influence (for example, via a power of attorney) It can also include a company, trust or partnership controlled or managed by, or set up for the benefit of, an employee or director, or one of their CAPs. Staff must ensure that their CAPs are aware that information relating to them and their personal account dealing is stored by the Group on our PAD System. A factsheet for CAPS is available via the Control Room PAD webpage. NB: The rules relating to CAPs do not apply to staff based permanently or temporarily in Germany, or those employed by a legal entity established in Germany except where the CAP is acting under instructions from, or on behalf of the employee. What All in scope permanent colleagues, contractors, agency staff and their CAPs must receive trading approval prior to placing instructions in financial instruments. |

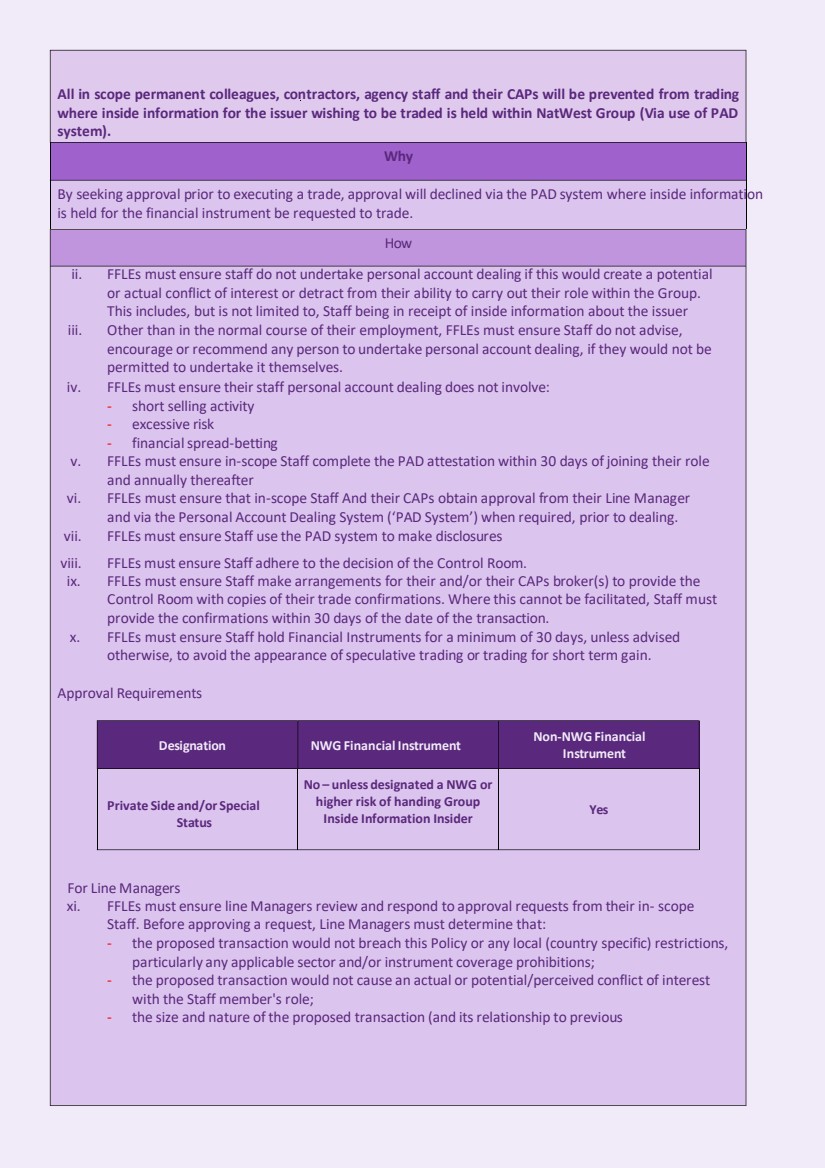

| All in scope permanent colleagues, contractors, agency staff and their CAPs will be prevented from trading where inside information for the issuer wishing to be traded is held within NatWest Group (Via use of PAD system). Why By seeking approval prior to executing a trade, approval will declined via the PAD system where inside information is held for the financial instrument be requested to trade. How ii. FFLEs must ensure staff do not undertake personal account dealing if this would create a potential or actual conflict of interest or detract from their ability to carry out their role within the Group. This includes, but is not limited to, Staff being in receipt of inside information about the issuer iii. Other than in the normal course of their employment, FFLEs must ensure Staff do not advise, encourage or recommend any person to undertake personal account dealing, if they would not be permitted to undertake it themselves. iv. FFLEs must ensure their staff personal account dealing does not involve: - shortselling activity - excessive risk - financialspread-betting v. FFLEs must ensure in-scope Staff complete the PAD attestation within 30 days of joining their role and annually thereafter vi. FFLEs must ensure that in-scope Staff And their CAPs obtain approval from their Line Manager and via the Personal Account Dealing System (‘PAD System’) when required, prior to dealing. vii. FFLEs must ensure Staff use the PAD system to make disclosures viii. FFLEs must ensure Staff adhere to the decision of the Control Room. ix. FFLEs must ensure Staff make arrangements for their and/or their CAPs broker(s) to provide the Control Room with copies of their trade confirmations. Where this cannot be facilitated, Staff must provide the confirmations within 30 days of the date of the transaction. x. FFLEs must ensure Staff hold Financial Instruments for a minimum of 30 days, unless advised otherwise, to avoid the appearance ofspeculative trading or trading for short term gain. Approval Requirements Designation NWG Financial Instrument Non-NWGFinancial Instrument Private Side and/or Special Status No – unless designated a NWG or higher risk of handing Group Inside Information Insider Yes For Line Managers xi. FFLEs must ensure line Managers review and respond to approval requests from their in- scope Staff. Before approving a request, Line Managers must determine that: - the proposed transaction would not breach this Policy or any local (country specific) restrictions, particularly any applicable sector and/or instrument coverage prohibitions; - the proposed transaction would not cause an actual or potential/perceived conflict of interest with the Staff member's role; - the size and nature of the proposed transaction (and itsrelationship to previous |

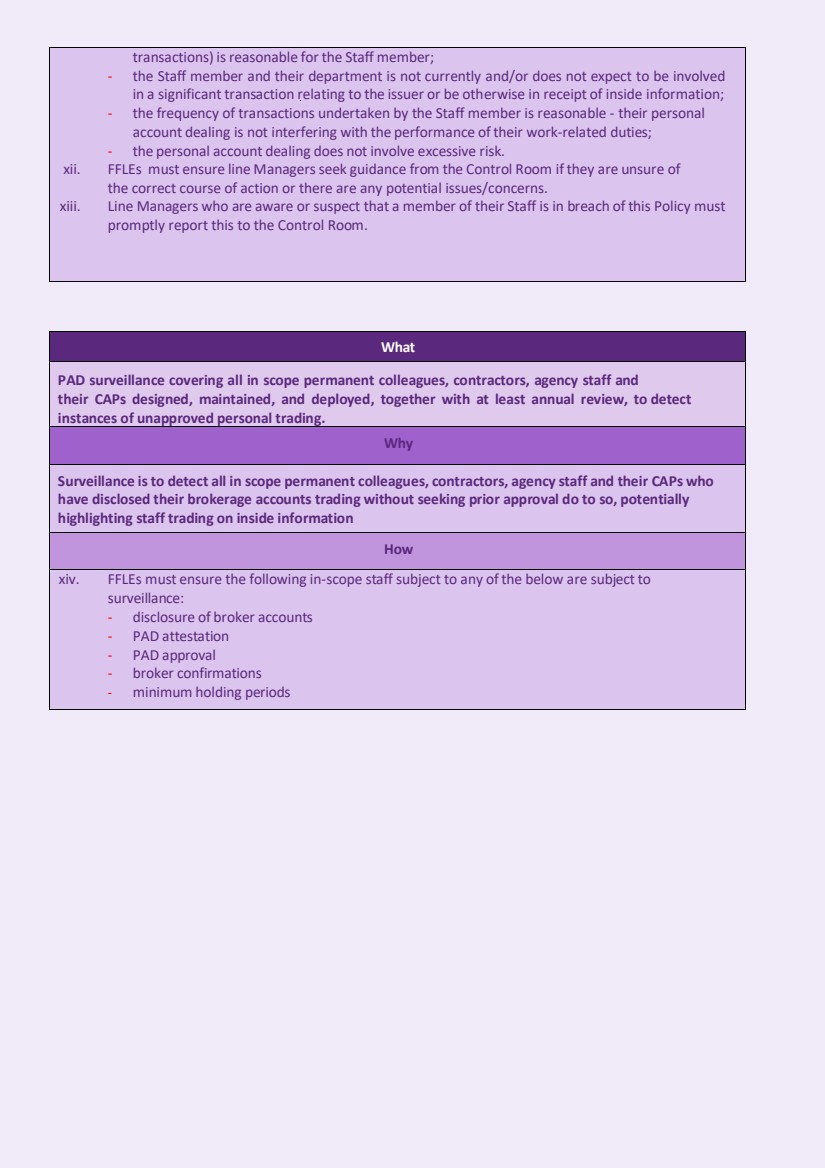

| transactions) isreasonable for the Staff member; - the Staff member and their department is not currently and/or does not expect to be involved in a significant transaction relating to the issuer or be otherwise in receipt of inside information; - the frequency of transactions undertaken by the Staff member is reasonable - their personal account dealing is not interfering with the performance of their work-related duties; - the personal account dealing does not involve excessive risk. xii. FFLEs must ensure line Managersseek guidance from the Control Room if they are unsure of the correct course of action or there are any potential issues/concerns. xiii. Line Managers who are aware or suspect that a member of their Staff is in breach of this Policy must promptly report this to the Control Room. What PAD surveillance covering all in scope permanent colleagues, contractors, agency staff and their CAPs designed, maintained, and deployed, together with at least annual review, to detect instances of unapproved personal trading. Why Surveillance isto detect all in scope permanent colleagues, contractors, agency staff and their CAPs who have disclosed their brokerage accounts trading without seeking prior approval do to so, potentially highlighting staff trading on inside information How xiv. FFLEs must ensure the following in-scope staff subject to any of the below are subject to surveillance: - disclosure of broker accounts - PAD attestation - PAD approval - broker confirmations - minimum holding periods |

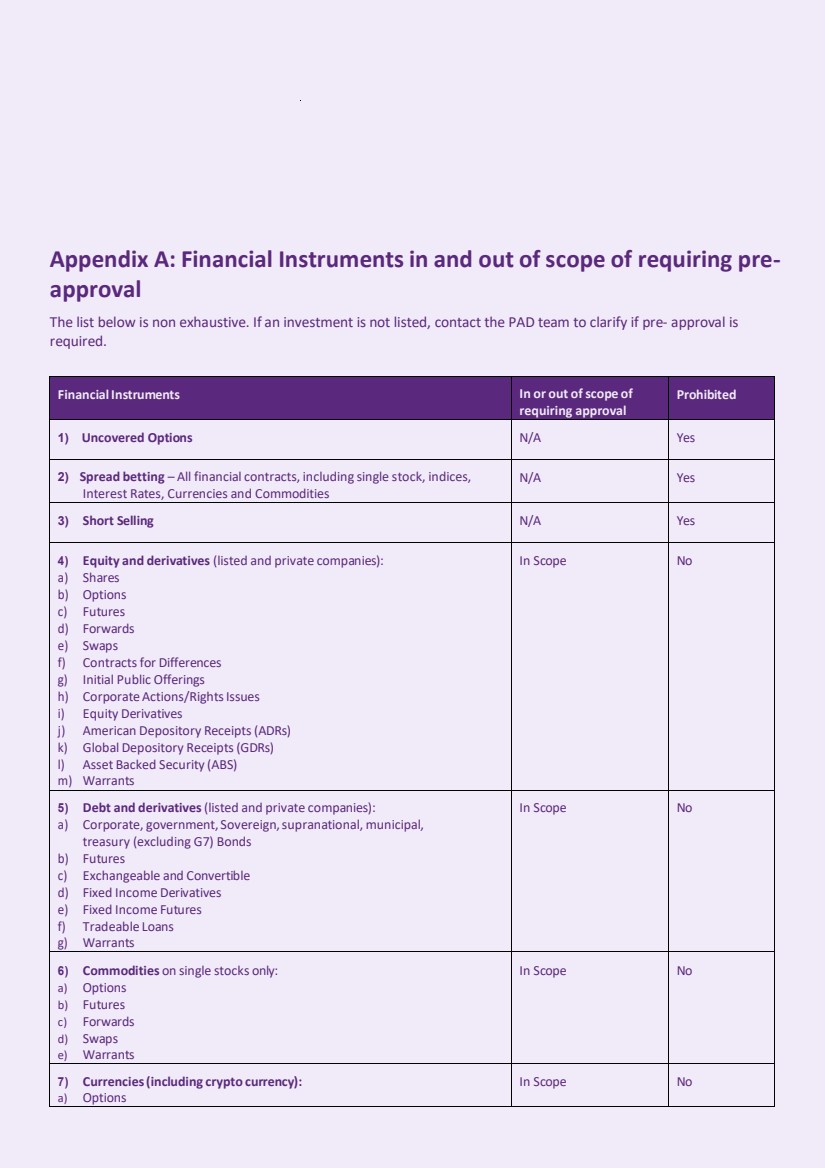

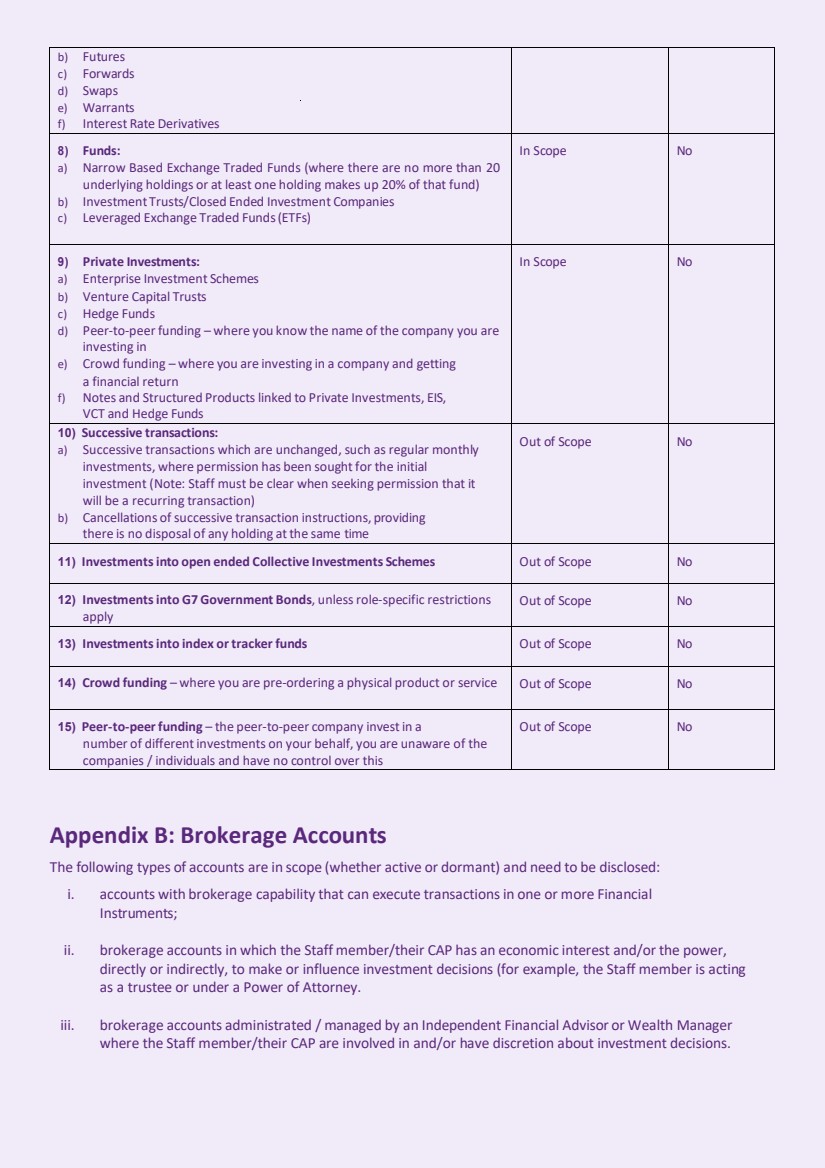

| Appendix A: Financial Instruments in and out of scope of requiring pre-approval The list below is non exhaustive. If an investment is not listed, contact the PAD team to clarify if pre- approval is required. Financial Instruments In or out ofscope of requiring approval Prohibited 1) Uncovered Options N/A Yes 2) Spread betting – All financial contracts, including single stock, indices, Interest Rates, Currencies and Commodities N/A Yes 3) Short Selling N/A Yes 4) Equity and derivatives (listed and private companies): a) Shares b) Options c) Futures d) Forwards e) Swaps f) Contractsfor Differences g) Initial Public Offerings h) Corporate Actions/RightsIssues i) Equity Derivatives j) American Depository Receipts(ADRs) k) Global Depository Receipts(GDRs) l) Asset Backed Security (ABS) m) Warrants In Scope No 5) Debt and derivatives(listed and private companies): a) Corporate, government, Sovereign,supranational, municipal, treasury (excluding G7) Bonds b) Futures c) Exchangeable and Convertible d) Fixed Income Derivatives e) Fixed Income Futures f) Tradeable Loans g) Warrants In Scope No 6) Commodities on single stocks only: a) Options b) Futures c) Forwards d) Swaps e) Warrants In Scope No 7) Currencies(including crypto currency): a) Options In Scope No |

| b) Futures c) Forwards d) Swaps e) Warrants f) Interest Rate Derivatives 8) Funds: a) Narrow Based Exchange Traded Funds (where there are no more than 20 underlying holdings or at least one holding makes up 20% of that fund) b) Investment Trusts/Closed Ended Investment Companies c) Leveraged Exchange Traded Funds(ETFs) In Scope No 9) Private Investments: a) Enterprise Investment Schemes b) Venture Capital Trusts c) Hedge Funds d) Peer-to-peer funding – where you know the name of the company you are investing in e) Crowd funding – where you are investing in a company and getting a financial return f) Notes and Structured Productslinked to Private Investments, EIS, VCT and Hedge Funds In Scope No 10) Successive transactions: a) Successive transactions which are unchanged, such as regular monthly investments, where permission has been soughtfor the initial investment (Note: Staff must be clear when seeking permission that it will be a recurring transaction) b) Cancellations ofsuccessive transaction instructions, providing there is no disposal of any holding atthe same time Out of Scope No 11) Investmentsinto open ended Collective Investments Schemes Out of Scope No 12) Investmentsinto G7 Government Bonds, unlessrole-specific restrictions apply Out of Scope No 13) Investmentsinto index or tracker funds Out of Scope No 14) Crowd funding – where you are pre-ordering a physical product or service Out of Scope No 15) Peer-to-peer funding – the peer-to-peer company investin a number of different investments on your behalf, you are unaware of the companies / individuals and have no control over this Out of Scope No Appendix B: Brokerage Accounts The following types of accounts are in scope (whether active or dormant) and need to be disclosed: i. accounts with brokerage capability that can execute transactionsin one or more Financial Instruments; ii. brokerage accounts in which the Staff member/their CAP has an economic interest and/or the power, directly or indirectly, to make or influence investment decisions (for example, the Staff member is acting as a trustee or under a Power of Attorney. iii. brokerage accounts administrated / managed by an Independent Financial Advisor or Wealth Manager where the Staff member/their CAP are involved in and/or have discretion about investment decisions. |

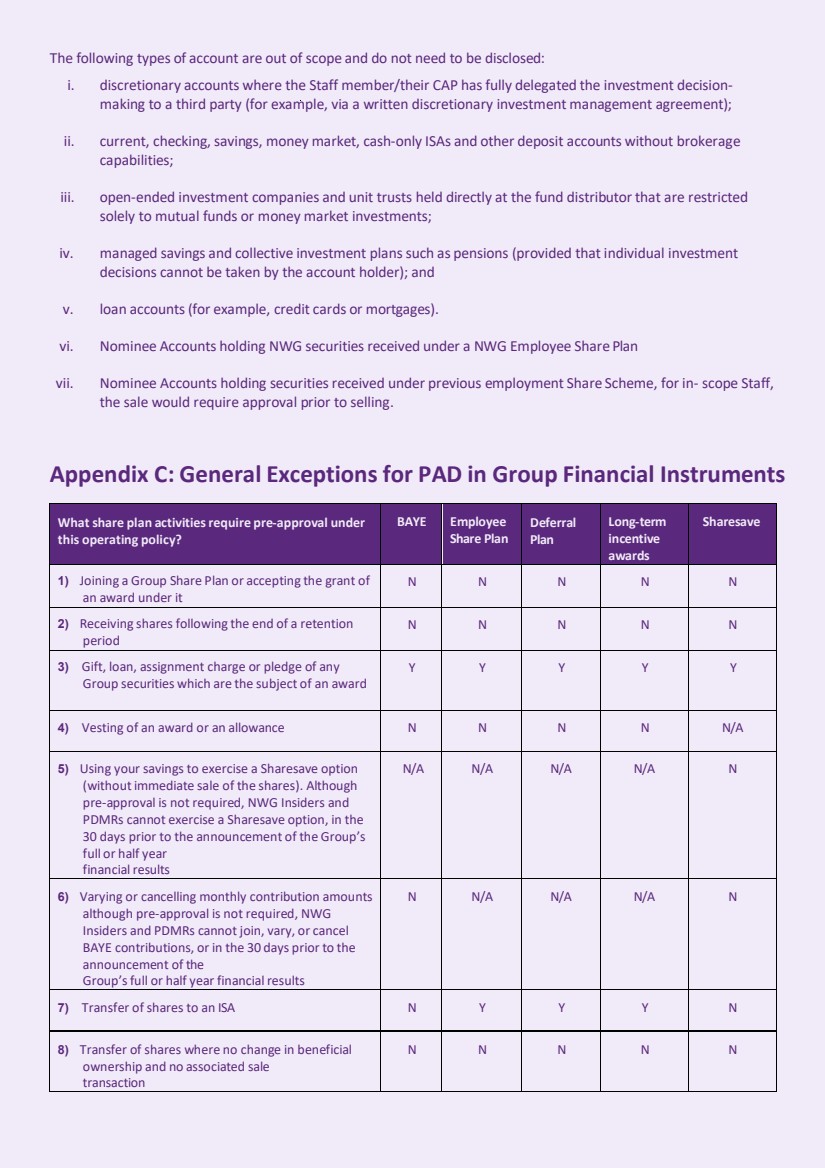

| The following types of account are out of scope and do not need to be disclosed: i. discretionary accounts where the Staff member/their CAP hasfully delegated the investment decision-making to a third party (for example, via a written discretionary investment management agreement); ii. current, checking, savings, money market, cash-only ISAs and other deposit accounts without brokerage capabilities; iii. open-ended investment companies and unit trusts held directly at the fund distributor that are restricted solely to mutual funds or money market investments; iv. managed savings and collective investment planssuch as pensions (provided that individual investment decisions cannot be taken by the account holder); and v. loan accounts(for example, credit cards or mortgages). vi. Nominee Accounts holding NWG securitiesreceived under a NWG Employee Share Plan vii. Nominee Accounts holding securitiesreceived under previous employment Share Scheme, for in- scope Staff, the sale would require approval prior to selling. Appendix C: General Exceptions for PAD in Group Financial Instruments Whatshare plan activitiesrequire pre-approval under this operating policy? BAYE Employee Share Plan Deferral Plan Long-term incentive awards Sharesave 1) Joining a Group Share Plan or accepting the grant of an award under it N N N N N 2) Receiving sharesfollowing the end of a retention period N N N N N 3) Gift, loan, assignment charge or pledge of any Group securities which are the subject of an award Y Y Y Y Y 4) Vesting of an award or an allowance N N N N N/A 5) Using your savings to exercise a Sharesave option (without immediate sale of the shares). Although pre-approval is not required, NWG Insiders and PDMRs cannot exercise a Sharesave option, in the 30 days prior to the announcement of the Group’s full or half year financialresults N/A N/A N/A N/A N 6) Varying or cancelling monthly contribution amounts although pre-approval is not required, NWG Insiders and PDMRs cannot join, vary, or cancel BAYE contributions, or in the 30 days prior to the announcement of the Group’sfull or half year financialresults N N/A N/A N/A N 7) Transfer of shares to an ISA N Y Y Y N 8) Transfer of shares where no change in beneficial ownership and no associated sale transaction N N N N N |

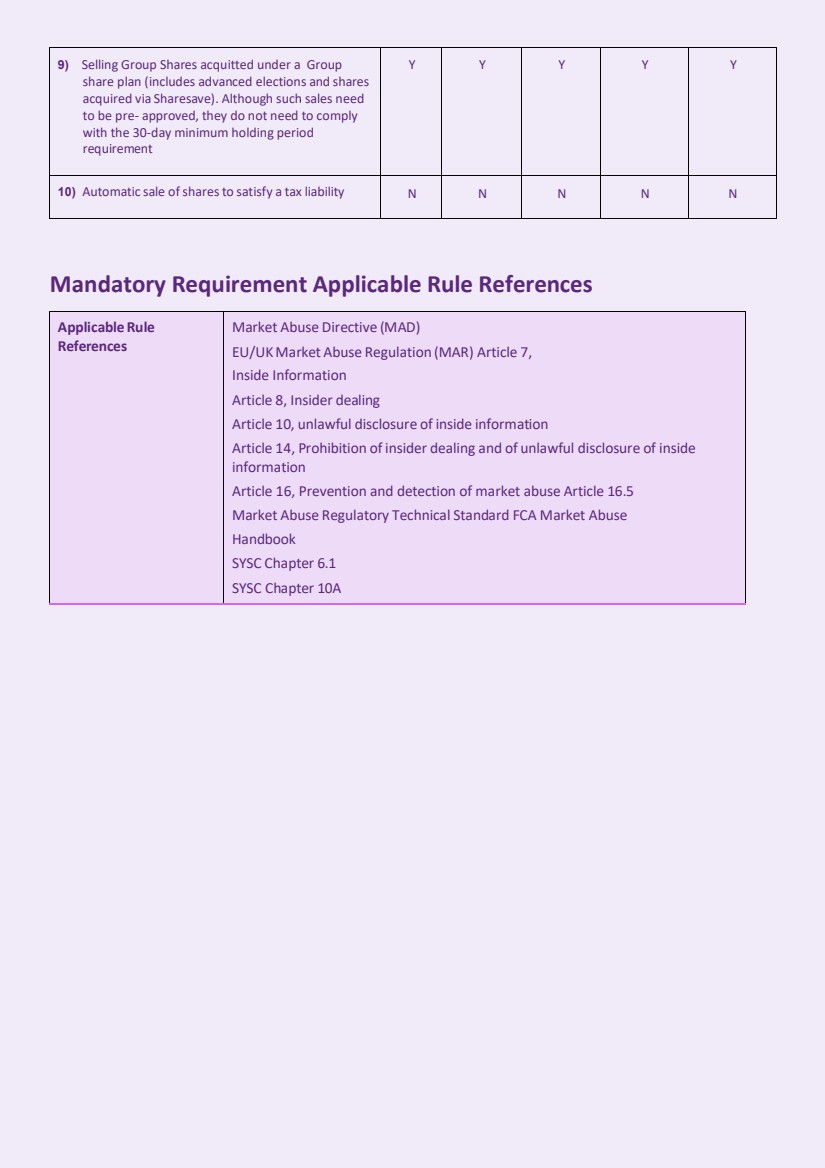

| 9) Selling Group Shares acquitted under a Group share plan (includes advanced elections and shares acquired via Sharesave). Although such sales need to be pre- approved, they do not need to comply with the 30-day minimum holding period requirement Y Y Y Y Y 10) Automatic sale ofsharesto satisfy a tax liability N N N N N Mandatory Requirement Applicable Rule References Applicable Rule References Market Abuse Directive (MAD) EU/UKMarket Abuse Regulation (MAR) Article 7, Inside Information Article 8, Insider dealing Article 10, unlawful disclosure of inside information Article 14, Prohibition of insider dealing and of unlawful disclosure of inside information Article 16, Prevention and detection of market abuse Article 16.5 Market Abuse Regulatory Technical Standard FCA Market Abuse Handbook SYSC Chapter 6.1 SYSC Chapter 10A |

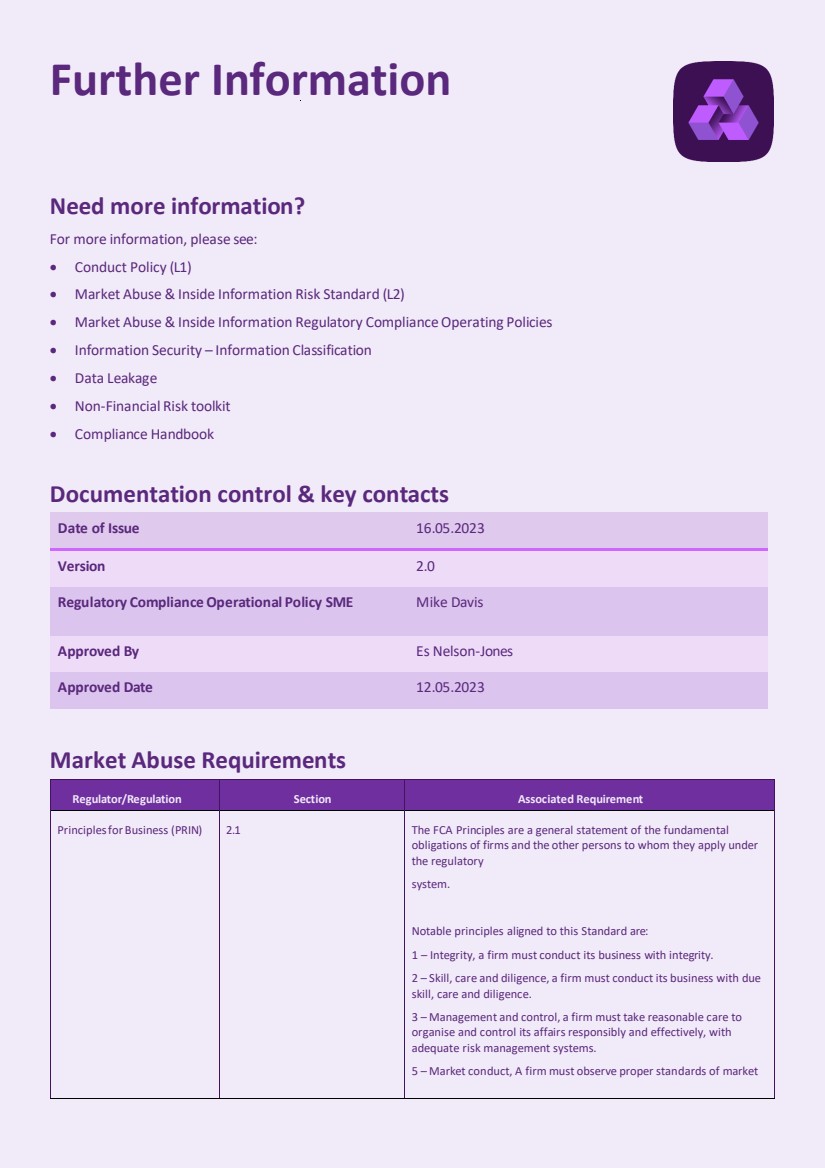

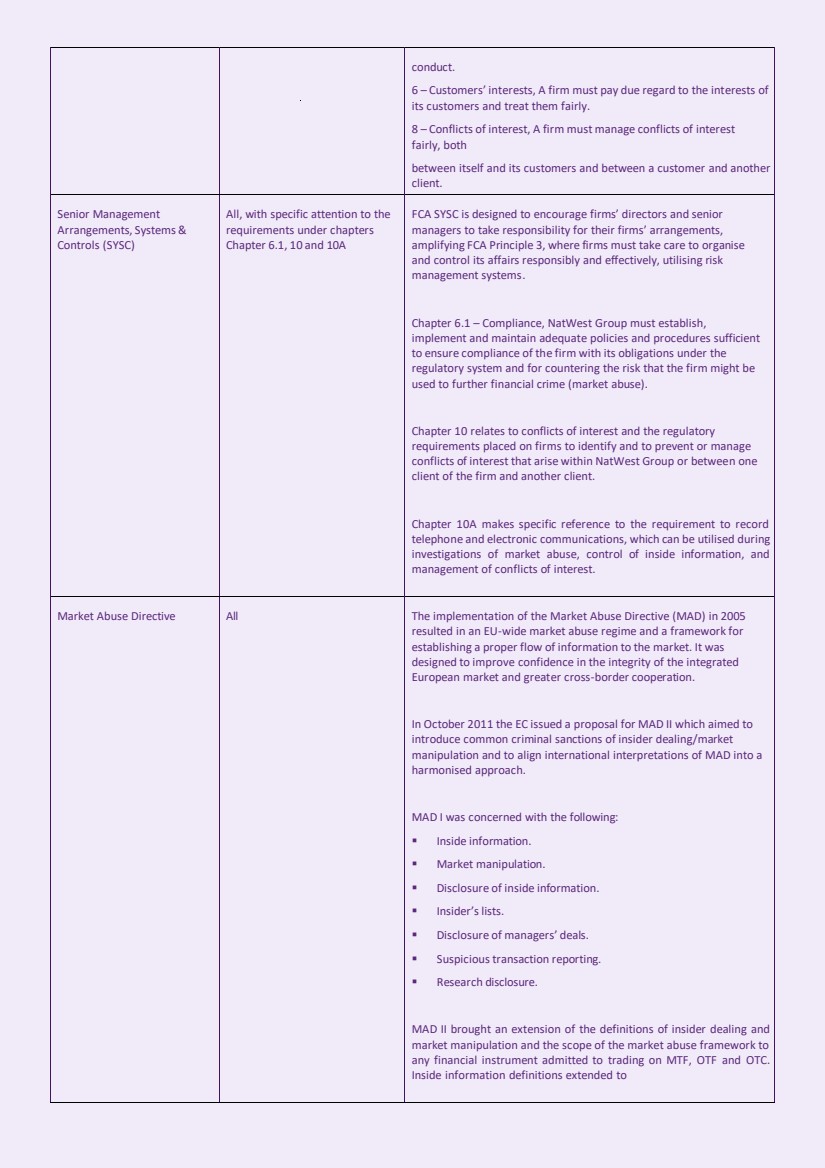

| Further Information Need more information? For more information, please see: • Conduct Policy (L1) • Market Abuse & Inside Information Risk Standard (L2) • Market Abuse & Inside Information Regulatory ComplianceOperating Policies • Information Security – Information Classification • Data Leakage • Non-Financial Risk toolkit • Compliance Handbook Documentation control & key contacts Date of Issue 16.05.2023 Version 2.0 Regulatory Compliance Operational Policy SME Mike Davis Approved By Es Nelson-Jones Approved Date 12.05.2023 Market Abuse Requirements Regulator/Regulation Section Associated Requirement PrinciplesforBusiness (PRIN) 2.1 The FCA Principles are a general statement of the fundamental obligations of firms and the other persons to whom they apply under the regulatory system. Notable principles aligned to this Standard are: 1 – Integrity, a firm must conduct its business with integrity. 2 – Skill, care and diligence, a firm must conduct its business with due skill, care and diligence. 3 – Management and control, a firm must take reasonable care to organise and control its affairs responsibly and effectively, with adequate risk management systems. 5 – Market conduct, A firm must observe proper standards of market |

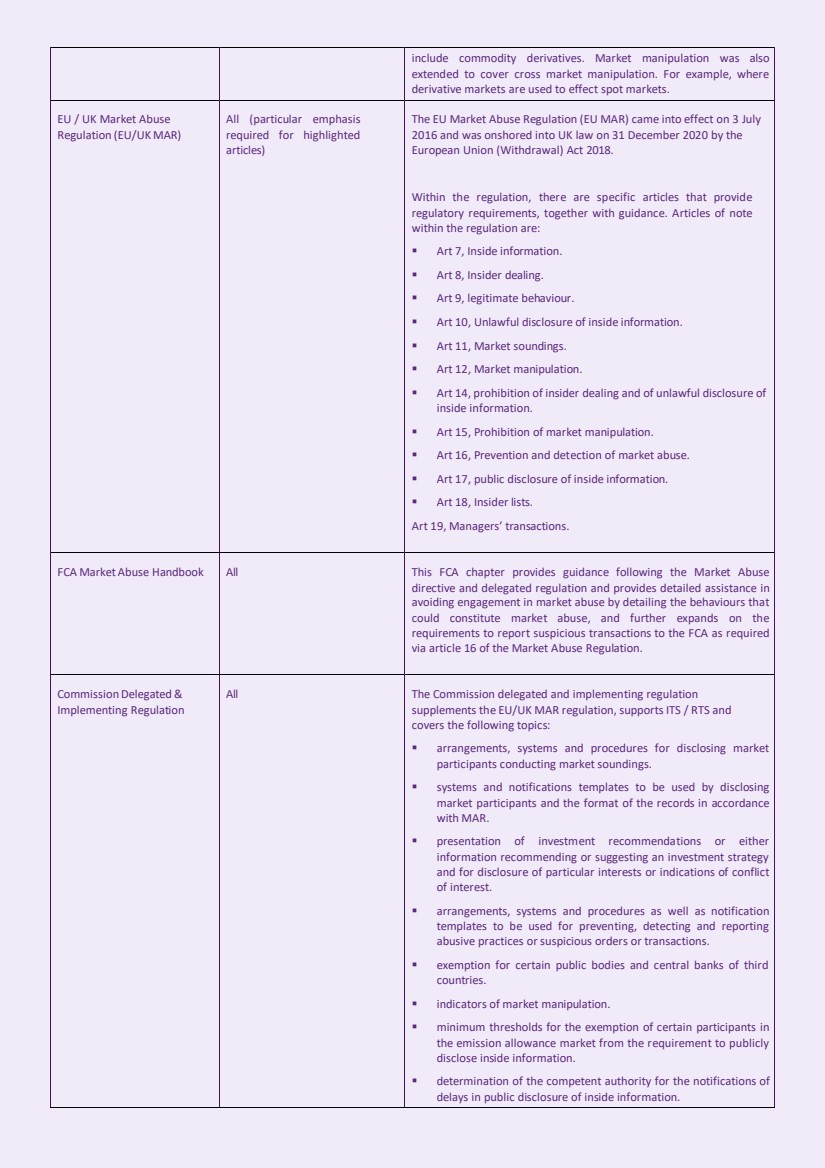

| conduct. 6 – Customers’ interests, A firm must pay due regard to the interests of its customers and treat them fairly. 8 – Conflicts of interest, A firm must manage conflicts of interest fairly, both between itself and its customers and between a customer and another client. Senior Management Arrangements, Systems & Controls (SYSC) All, with specific attention to the requirements under chapters Chapter 6.1, 10 and 10A FCA SYSC is designed to encourage firms’ directors and senior managers to take responsibility for their firms’ arrangements, amplifying FCA Principle 3, where firms must take care to organise and control its affairs responsibly and effectively, utilising risk management systems. Chapter 6.1 – Compliance, NatWest Group must establish, implement and maintain adequate policies and procedures sufficient to ensure compliance of the firm with its obligations under the regulatory system and for countering the risk that the firm might be used to further financial crime (market abuse). Chapter 10 relates to conflicts of interest and the regulatory requirements placed on firms to identify and to prevent or manage conflicts of interest that arise within NatWest Group or between one client of the firm and another client. Chapter 10A makes specific reference to the requirement to record telephone and electronic communications, which can be utilised during investigations of market abuse, control of inside information, and management of conflicts of interest. Market Abuse Directive All The implementation of the Market Abuse Directive (MAD) in 2005 resulted in an EU-wide market abuse regime and a framework for establishing a proper flow of information to the market. It was designed to improve confidence in the integrity of the integrated European market and greater cross-border cooperation. In October 2011 the EC issued a proposal for MAD II which aimed to introduce common criminal sanctions of insider dealing/market manipulation and to align international interpretations of MAD into a harmonised approach. MAD I was concerned with the following: ▪ Inside information. ▪ Market manipulation. ▪ Disclosure of inside information. ▪ Insider’s lists. ▪ Disclosure of managers’ deals. ▪ Suspicious transaction reporting. ▪ Research disclosure. MAD II brought an extension of the definitions of insider dealing and market manipulation and the scope of the market abuse framework to any financial instrument admitted to trading on MTF, OTF and OTC. Inside information definitions extended to |

| include commodity derivatives. Market manipulation was also extended to cover cross market manipulation. For example, where derivative markets are used to effect spot markets. EU / UK Market Abuse Regulation (EU/UK MAR) All (particular emphasis required for highlighted articles) The EU Market Abuse Regulation (EU MAR) came into effect on 3 July 2016 and was onshored into UK law on 31 December 2020 by the European Union (Withdrawal) Act 2018. Within the regulation, there are specific articles that provide regulatory requirements, together with guidance. Articles of note within the regulation are: ▪ Art 7, Inside information. ▪ Art 8, Insider dealing. ▪ Art 9, legitimate behaviour. ▪ Art 10, Unlawful disclosure of inside information. ▪ Art 11, Market soundings. ▪ Art 12, Market manipulation. ▪ Art 14, prohibition of insider dealing and of unlawful disclosure of inside information. ▪ Art 15, Prohibition of market manipulation. ▪ Art 16, Prevention and detection of market abuse. ▪ Art 17, public disclosure of inside information. ▪ Art 18, Insider lists. Art 19, Managers’ transactions. FCA Market Abuse Handbook All This FCA chapter provides guidance following the Market Abuse directive and delegated regulation and provides detailed assistance in avoiding engagement in market abuse by detailing the behaviours that could constitute market abuse, and further expands on the requirements to report suspicious transactions to the FCA as required via article 16 of the Market Abuse Regulation. Commission Delegated& Implementing Regulation All The Commission delegated and implementing regulation supplements the EU/UK MAR regulation, supports ITS / RTS and covers the following topics: ▪ arrangements, systems and procedures for disclosing market participants conducting market soundings. ▪ systems and notifications templates to be used by disclosing market participants and the format of the records in accordance with MAR. ▪ presentation of investment recommendations or either information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflict of interest. ▪ arrangements, systems and procedures as well as notification templates to be used for preventing, detecting and reporting abusive practices or suspicious orders or transactions. ▪ exemption for certain public bodies and central banks of third countries. ▪ indicators of market manipulation. ▪ minimum thresholds for the exemption of certain participants in the emission allowance market from the requirement to publicly disclose inside information. ▪ determination of the competent authority for the notifications of delays in public disclosure of inside information. |

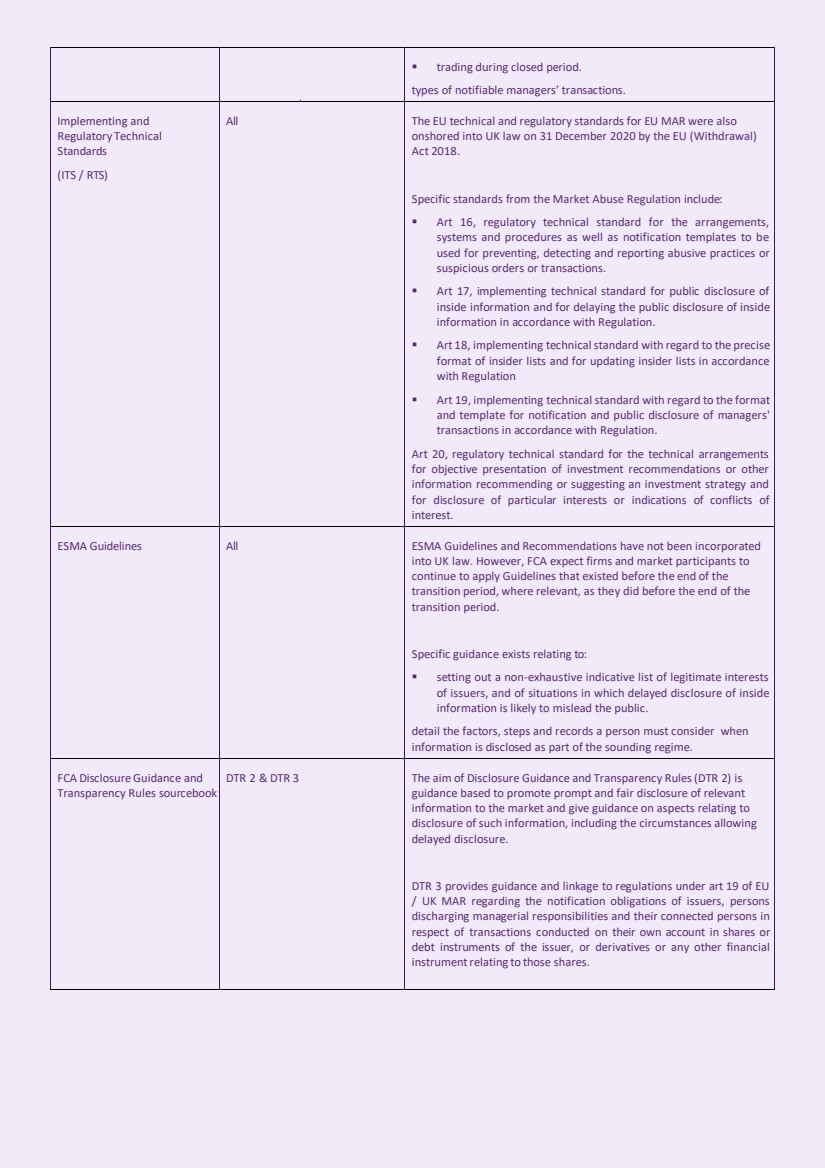

| ▪ trading during closed period. types of notifiable managers’ transactions. Implementing and Regulatory Technical Standards (ITS / RTS) All The EU technical and regulatory standards for EU MAR were also onshored into UK law on 31 December 2020 by the EU (Withdrawal) Act 2018. Specific standards from the Market Abuse Regulation include: ▪ Art 16, regulatory technical standard for the arrangements, systems and procedures as well as notification templates to be used for preventing, detecting and reporting abusive practices or suspicious orders or transactions. ▪ Art 17, implementing technical standard for public disclosure of inside information and for delaying the public disclosure of inside information in accordance with Regulation. ▪ Art 18, implementing technicalstandard with regard to the precise format of insider lists and for updating insider lists in accordance with Regulation ▪ Art 19, implementing technical standard with regard to the format and template for notification and public disclosure of managers' transactions in accordance with Regulation. Art 20, regulatory technical standard for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest. ESMA Guidelines All ESMA Guidelines and Recommendations have not been incorporated into UK law. However, FCA expect firms and market participants to continue to apply Guidelines that existed before the end of the transition period, where relevant, as they did before the end of the transition period. Specific guidance exists relating to: ▪ setting out a non-exhaustive indicative list of legitimate interests of issuers, and of situations in which delayed disclosure of inside information is likely to mislead the public. detail the factors, steps and records a person must consider when information is disclosed as part of the sounding regime. FCA DisclosureGuidance and Transparency Rules sourcebook DTR 2 & DTR 3 The aim of Disclosure Guidance and Transparency Rules(DTR 2) is guidance based to promote prompt and fair disclosure of relevant information to the market and give guidance on aspects relating to disclosure of such information, including the circumstances allowing delayed disclosure. DTR 3 provides guidance and linkage to regulations under art 19 of EU / UK MAR regarding the notification obligations of issuers, persons discharging managerial responsibilities and their connected persons in respect of transactions conducted on their own account in shares or debt instruments of the issuer, or derivatives or any other financial instrumentrelating to those shares. |