.3 Investor Day 2025 New York Proven Growth Capabilities Built for Growth Powered by Performance

Disclaimer Unless the context otherwise provides, “we,” “us,” “our,” “CRH”, the “Company” and like terms refer to CRH plc and its consolidated subsidiaries. Forward-Looking Statements In order to utilize the “Safe Harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, CRH is providing the following cautionary statement. This presentation contains statements that are, or may be deemed to be, forward-looking statements with respect to the financial condition, results of operations, business, viability and future performance of CRH and certain of the plans and objectives of CRH. These forward-looking statements may generally, but not always, be identified by the use of words such as “will”, “anticipates”, “should”, “could”, “would”, “targets”, “aims”, “may”, “continues”, “expects”, “is expected to”, “estimates”, “believes”, “intends” or similar expressions. These forward-looking statements include all matters that are not historical facts or matters of fact at the date of this presentation. In particular, the following, among other statements, are all forward-looking in nature: plans and expectations regarding megatrends and growth with respect to each, including infrastructure, transportation, water and reindustrialization; statements regarding the expected impacts of CRH’s capital allocation; statements regarding anticipated financial capacity and optionality for, and results of, capital deployment; expectations regarding economic and population growth, public funding and secular tailwinds; statements regarding growth opportunities as a result of replicating at scale; statements regarding CRH's long-term return prospects and capital compounding; statements regarding CRH’s prioritization of high-growth markets and ability to build market-leading positions; and statements regarding CRH’s pipeline of growth opportunities. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that may or may not occur in the future and reflect the Company’s current expectations and assumptions as to such future events and circumstances that may not prove accurate. You are cautioned not to place undue reliance on any forward-looking statements. These forward-looking statements are made as of the date of this presentation. The Company expressly disclaims any obligation or undertaking to publicly update or revise these forward-looking statements other than as required by applicable law. A number of material factors could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements, certain of which are beyond our control, and which include, among other factors, the risks and uncertainties described herein and under “Risk Factors” in our 2024 Form 10-K and in our other filings with the SEC. Non-GAAP Financial Information This presentation includes discussion of Adjusted EBITDA and Adjusted EBITDA margin generated by CRH’s operations in Texas and by certain operating companies, assets and quarries, each of which is financial information that is not calculated in accordance with U.S. generally accepted accounting principles (‘GAAP’). Non-GAAP financial information should not be considered a replacement for GAAP measures. Investor Day 2025 1

Today’s Speakers JP San Agustín Tim Ortman Group Executive, Strategic Planning, President, CRH Americas Innovation and Venturing Building Products Investor Day 2025 2

Our Growth Algorithm Growing CRH Leading Megatrends Winning Way Compounder of Capital Infrastructure Transportation x = Water Proven long-term delivery 1 Double-digit earnings growth Reindustrialization Investor Day 2025 3 For footnoted information, refer to Appendix.

Proven Growth Capabilities A deeply embedded mindset throughout our organization • Empowered teams & local relationships … the acquirer of choice >1,250 Acquisitions since 1970 • Disciplined & value-focused approach • Unmatched acquisition, integration & synergy delivery capabilities 30 transactions on average every year • Greater optionality for capital deployment … over last decade underpinned by a connected portfolio … building platforms of scale in attractive markets … Investor Day 2025 4

Building Growth Platforms of Scale A deliberate & strategic customer centric approach Attractive growth markets … South & West U.S., Central & Eastern Europe, Australia Aggregates Cementitious Roads Water Leveraging benefits of scale & our uniquely connected portfolio Inv Inves estor tor Day Day 2025 2025 5 5

Building a Growth Platform in a High Growth Region (Texas) Investor Day 2025 6

Superior Strategy Deliberate approach to capital allocation CRH identified Texas as a key growth opportunity Strong fundamentals … … with megatrend drivers Robust Growing Strong Public Significant Water Re- Economy Population Funding Road Infra Needs industrialization Demand Inv Inves estor tor Day Day 2025 2025 7 7

1 CRH in Texas Strengthening our connected portfolio through acquisition … Since 2014 Certain assets Eco of Capitol Ash Grove Angel East Texas Aggregates Cement Brothers Asphalt Material May-14 Jun-18 Mar-21 Dec-22 Sep-25 >25 acquisitions Oct-15 Dec-20 Apr-22 Feb-24 >1,000bps Asphalt Martin Certain assets Hunter assets of Enterprises of Rinker Cement plant Adj. EBITDA 2 Martin Materials & margin expansion Marietta 20 RMC plants … maintaining & leveraging strong local brands & leadership teams Inv Inves estor tor Day Day 2025 2025 8 8 For footnoted information, refer to Appendix.

Building from Aggregates … 7.5m Tons annual production Aggregates Cementitious ~3x Revenue growth 1 since acquisition Marble Falls Quarry Roads Water 2014 Acquisition ~7x Adj. EBITDA growth 1 since acquisition Inv Inves estor tor Day Day 2025 2025 9 9 For footnoted information, refer to Appendix.

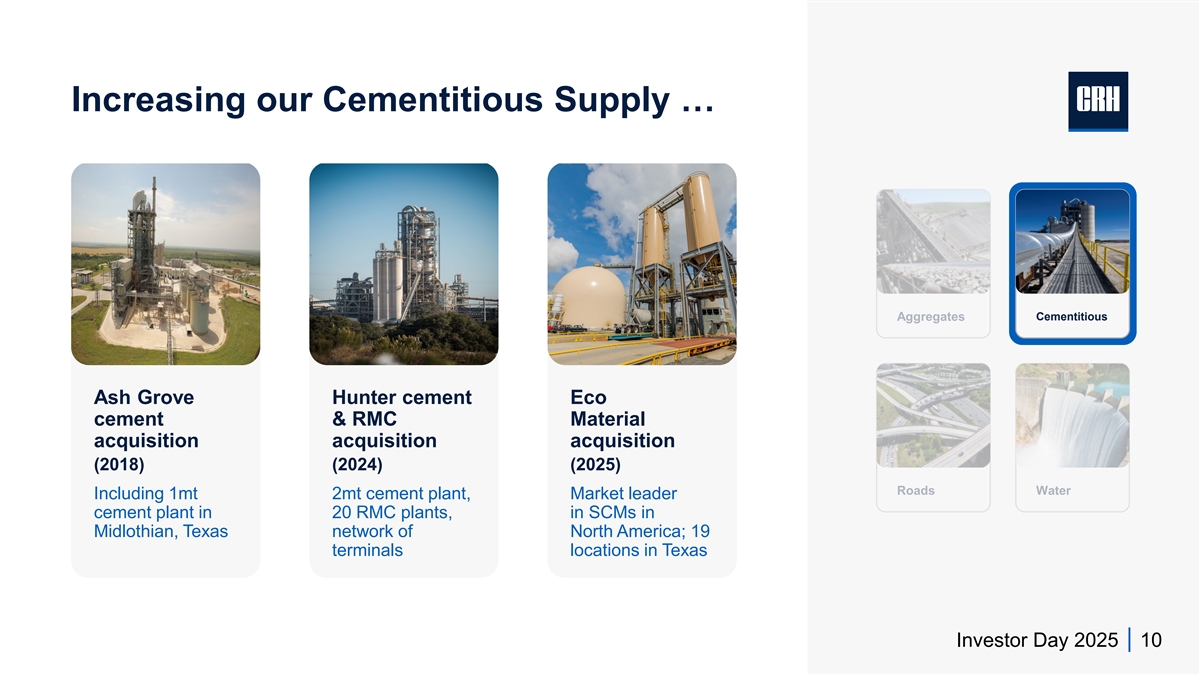

Increasing our Cementitious Supply … Aggregates Cementitious Ash Grove Hunter cement Eco cement & RMC Material acquisition acquisition acquisition (2018) (2024) (2025) Roads Water Including 1mt 2mt cement plant, Market leader cement plant in 20 RMC plants, in SCMs in Midlothian, Texas network of North America; 19 terminals locations in Texas Inv Inves estor tor Day Day 2025 2025 10 10

Connected to Roads … 2021 2022 Roads acquisition with Roads acquisition with Aggregates Cementitious operations in Houston, operations in East Texas San Antonio & Austin & Louisiana +350bps +730bps Adj. EBITDA margin Adj. EBITDA margin 1 2 expansion since acquisition expansion since acquisition Roads Water Aggregates, Aggregates, Asphalt & Paving Asphalt & Paving Inv Inves estor tor Day Day 2025 2025 11 11 For footnoted information, refer to Appendix.

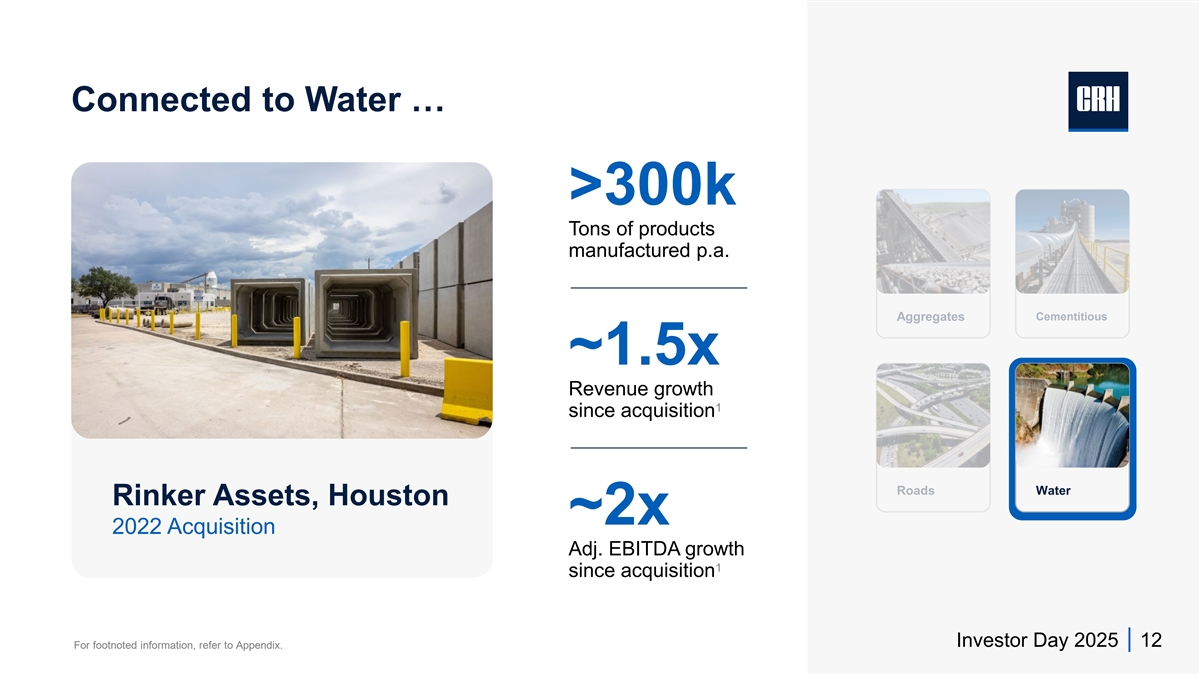

Connected to Water … >300k Tons of products manufactured p.a. Aggregates Cementitious ~1.5x Revenue growth 1 since acquisition Roads Water Rinker Assets, Houston ~2x 2022 Acquisition Adj. EBITDA growth 1 since acquisition Inv Inves estor tor Day Day 2025 2025 12 12 For footnoted information, refer to Appendix.

Creating a Connected Platform in Texas … The Leading Building Materials Business in Texas Connected Portfolio Aggregates Cementitious Products Roads Aggregates Cementitious Water Building Products Roads Water Inv Inves estor tor Day Day 2025 2025 13 13

… With Significant Growth Over the Last Decade CRH Texas in 2014 CRH Texas in 2025 1 1 (FY14) (TTM Q2’25) $0.6B +16% $3.0B Revenues CAGR Revenues $0.1B +24% $0.8B Adj. EBITDA CAGR Adj. EBITDA 60 181 2 Locations Locations Inv Inves estor tor Day Day 2025 2025 14 14 For footnoted information, refer to Appendix.

The Growth Opportunity: Replicating at Scale Investor Day 2025 15

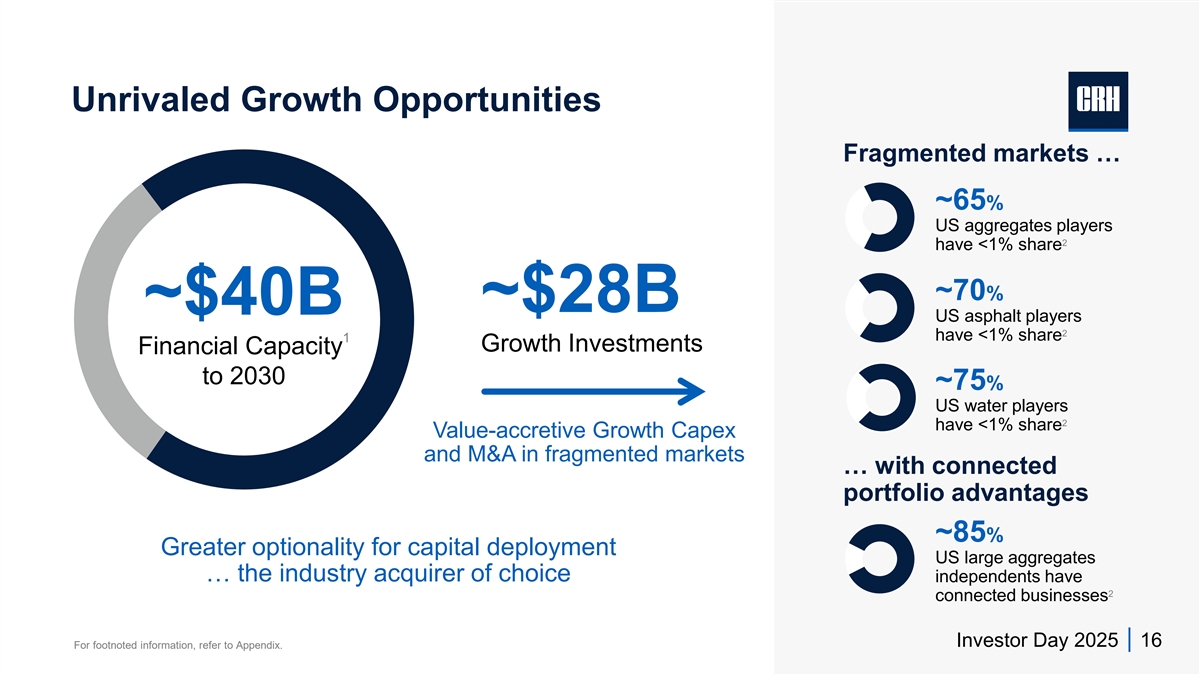

Unrivaled Growth Opportunities Fragmented markets … ~65% US aggregates players 2 have <1% share ~70% ~$28B ~$40B US asphalt players 2 have <1% share 1 Growth Investments Financial Capacity to 2030 ~75% US water players 2 have <1% share Value-accretive Growth Capex and M&A in fragmented markets … with connected portfolio advantages ~85% Greater optionality for capital deployment US large aggregates … the industry acquirer of choice independents have 2 connected businesses Investor Day 2025 16 For footnoted information, refer to Appendix.

Building CRH’s Future Growth Platforms Deliberate & strategic approach … Strong Market Dynamics Attractive Target Companies Driving Superior Value #1 + x Secular Growth Tailwinds Market-Leading Positions Leading Performance Attractive Markets Strong Local Brands Connected Portfolio Synergies … superior long-term returns & compounding of capital Inv Inves estor tor Day Day 2025 2025 17 17

Proven Growth Capabilities We apply a deliberate & strategic approach as we build growth platforms … CRH has unmatched scale & M&A experience Our connected portfolio provides higher synergy potential & greater avenues for growth, positioning CRH as the acquirer of choice CRH has significant financial capacity with a pipeline of growth opportunities unrivaled in size & breadth Investor Day 2025 18 Key Takeaways

Appendix: Endnotes Slide 3 1. ‘Double-digit earnings growth’ refers to CRH’s compound annualized growth rate of Adjusted EBITDA for the period from December 31, 2014 to December 31, 2024. Metrics from the financial year ended December 31, 2014 are based on IFRS. 2014 EBITDA (as defined) has been modified to exclude contributions from subsequently divested businesses. The adjustments required to reflect these metrics under U.S. GAAP have not been quantified. No material differences have been identified that would impact trends calculated in accordance with U.S. GAAP in comparison to IFRS. For source data of this 2014 metric, please refer to the Appendix of the main September 2025 Investor Day presentation. Metrics from the financial year ended December 31, 2024 are based on U.S. GAAP as reported in our 2024 Form 10-K Slide 8 1. Through September 2025; includes acquired entities with operations within the State of Texas. 2. Management estimates derived from financial information relating to the State of Texas as a destination for the trailing twelve months ended June 30, 2025, which was based on U.S. GAAP financial reporting, compared with the financial year ended December 31, 2014, which was based on IFRS financial reporting. The nature of the adjustments for purposes of Adjusted EBITDA is consistent with CRH’s consolidated presentation. No material differences have been identified that would impact trends calculated between the relevant periods. Slide 9 1. Management estimates derived from financial information comparing results from materials produced at the Marble Falls Quarry from the twelve months ended December 31, 2024, which was based on U.S. GAAP financial reporting, with the pre-acquisition results prepared in accordance with the acquiree’s accounting policies for the twelve months ended December 31, 2014. This comparison is intended to illustrate directional performance improvement and should not be interpreted as an audited historical financial comparison. Slide 11 1. Management estimates derived from operating company-level financial information comparing results from Angel Brothers for the twelve months ended December 31, 2024 which was based on U.S. GAAP financial reporting, with the pre-acquisition results prepared in accordance with the acquiree’s accounting policies for the twelve months ended December 31, 2020. This comparison is intended to illustrate directional performance improvement and should not be interpreted as an audited historical financial comparison. 2. Management estimates derived from operating company-level financial information comparing results from East Texas Asphalt for the twelve months ended December 31, 2024, which was based on U.S. GAAP financial reporting, with the pre-acquisition results prepared in accordance with the acquiree’s accounting policies for the twelve months ended December 31, 2021. This comparison is intended to illustrate directional performance improvement and should not be interpreted as an audited historical financial comparison. Slide 12 1. Management estimates derived from financial information comparing results from materials produced by the Rinker Assets operations for the twelve months ended December 31, 2024, which was based on U.S. GAAP financial reporting, with the pre-acquisition results prepared in accordance with the acquiree’s accounting policies for the twelve months ended December 31, 2021. This comparison is intended to illustrate directional performance improvement and should not be interpreted as an audited historical financial comparison. Slide 14 1. Management estimates derived from financial information relating to the State of Texas as a destination for the trailing twelve months ended June 30, 2025, which was based on U.S. GAAP financial reporting, compared with the financial year ended December 31, 2014, which was based on IFRS financial reporting. The nature of the adjustments for purposes of Adjusted EBITDA is consistent with CRH’s consolidated presentation. No material differences have been identified that would impact trends calculated between the relevant periods. 2. Locations shown are pro forma for the completion of the Eco Material Technologies transaction which closed on September 15, 2025. Financial results do not include Eco Material Technologies. Slide 16 1. Financial capacity is defined as the anticipated cash and debt financing available (after maintenance capex) for growth investments and cash returns to shareholders. The information is indicative only and any capital deployment will be dependent on the value creation opportunities arising over the period. The Company’s ability to deliver on these capital allocation priorities may be negatively impacted by the factors set out in the disclaimer on slide 1. 2. Management estimates. Investor Day 2025 19