.4 Investor Day 2025 New York Leading Performance Built for Growth Powered by Performance

Disclaimer Unless the context otherwise provides, “we,” “us,” “our,” “CRH”, the “Company” and like terms refer to CRH plc and its consolidated subsidiaries. Forward-Looking Statements In order to utilize the “Safe Harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, CRH is providing the following cautionary statement. This presentation contains statements that are, or may be deemed to be, forward-looking statements with respect to the financial condition, results of operations, business, viability and future performance of CRH and certain of the plans and objectives of CRH. These forward-looking statements may generally, but not always, be identified by the use of words such as “will”, “anticipates”, “should”, “could”, “would”, “targets”, “aims”, “may”, “continues”, “expects”, “is expected to”, “estimates”, “believes”, “intends” or similar expressions. These forward-looking statements include all matters that are not historical facts or matters of fact at the date of this presentation. In particular, the following, among other statements, are all forward-looking in nature: plans and expectations regarding megatrends and growth with respect to each, including infrastructure, transportation, water and reindustrialization; statements regarding the expected impacts of CRH’s capital allocation; statements regarding the impact of certain enablers on CRH’s growth and financial delivery; statements regarding CRH’s integration process and impact on financial results and growth opportunities; and statements regarding CRH’s ability to repeat and scale its model and to deliver synergies. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that may or may not occur in the future and reflect the Company’s current expectations and assumptions as to such future events and circumstances that may not prove accurate. You are cautioned not to place undue reliance on any forward-looking statements. These forward-looking statements are made as of the date of this presentation. The Company expressly disclaims any obligation or undertaking to publicly update or revise these forward-looking statements other than as required by applicable law. A number of material factors could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements, certain of which are beyond our control, and which include, among other factors, the risks and uncertainties described herein and under “Risk Factors” in our 2024 Form 10-K and in our other filings with the SEC. Non-GAAP Financial Information This presentation includes discussion of certain operating companies’ Adjusted EBITDA, cash gross profit per ton and Adjusted EBITDA margin, each of which is financial information that is not calculated in accordance with U.S. generally accepted accounting principles (‘GAAP’). Non-GAAP financial information should not be considered a replacement for GAAP measures. Investor Day 2025 1

Today’s Speakers Peter Buckley Liz Haggerty President, CRH International Executive Vice President, CRH Americas Investor Day 2025 2

Our Growth Algorithm Growing CRH Leading Megatrends Winning Way Compounder of Capital Infrastructure Transportation x = Water Proven long-term delivery 1 Double-digit earnings growth Reindustrialization Investor Day 2025 3 For footnoted information, refer to Appendix.

CRH Winning Way Investor Day 2025 4

Leading Performance Safety Culture Locally Globally Leading Owned Performance Enabled ‘Best-in-class’ performance teams A key enabler to our growth and financial delivery … Investor Day 2025 5

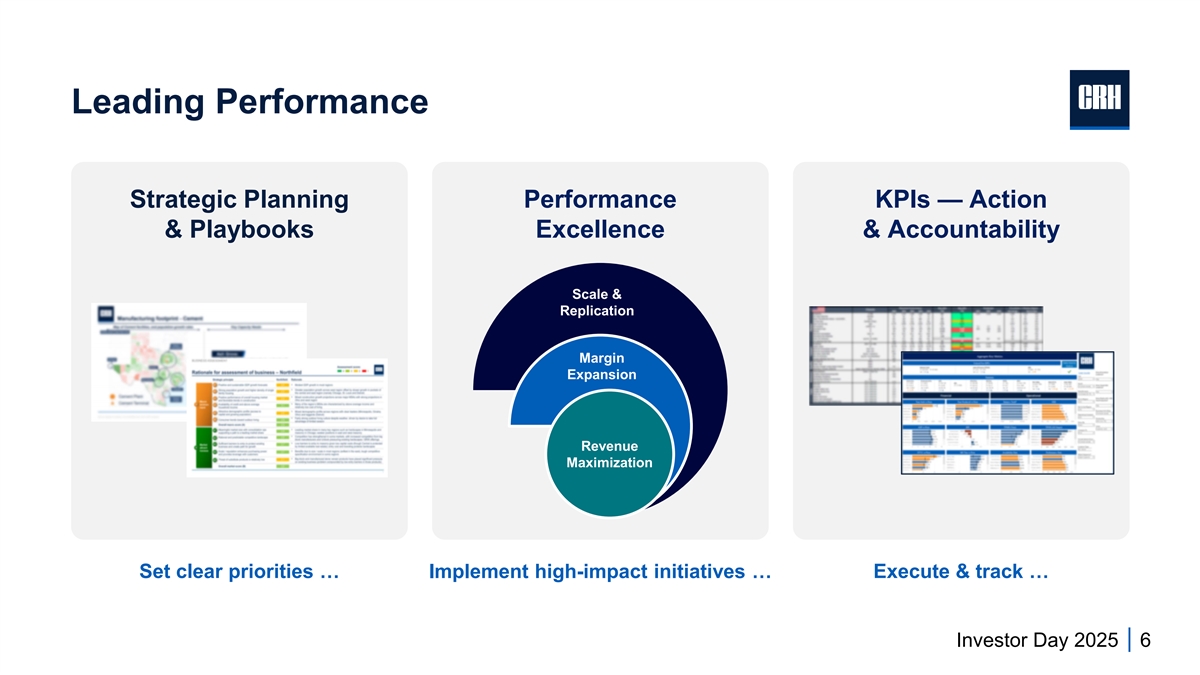

Leading Performance Strategic Planning Performance KPIs — Action & Playbooks Excellence & Accountability Scale & Replication Margin Expansion Revenue Maximization Set clear priorities … Implement high-impact initiatives … Execute & track … Investor Day 2025 6

Performance Excellence Unrivaled scale & resources Scale & to further accelerate Replication Margin Expansion Benchmarking globally to deliver best-in-class Revenue Maximization Utilizing the power of our local brands to develop deep customer relationships Investor Day 2025 7

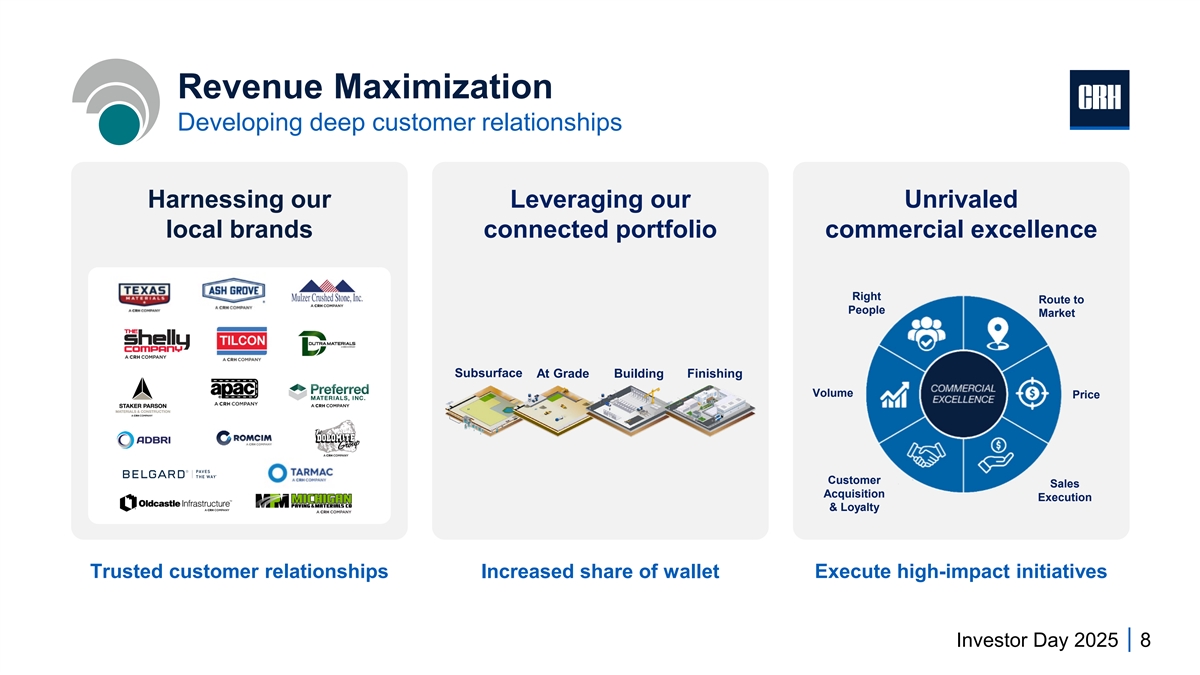

Scale and Replication Expanding Revenue Maximization Margin Revenue Maximizatio Developing deep customer relationships n Harnessing our Leveraging our Unrivaled local brands connected portfolio commercial excellence Right Route to People Market Subsurface At Grade Building Finishing Volume Price Customer Sales Acquisition Execution & Loyalty Trusted customer relationships Increased share of wallet Execute high-impact initiatives Investor Day 2025 8

Margin Expansion Relentless focus on operational performance Operational Transport Growth Optimization & Logistics Capex Benchmarking across Providing seamless service Deploying capital global assets to customers in attractive projects Investor Day 2025 9

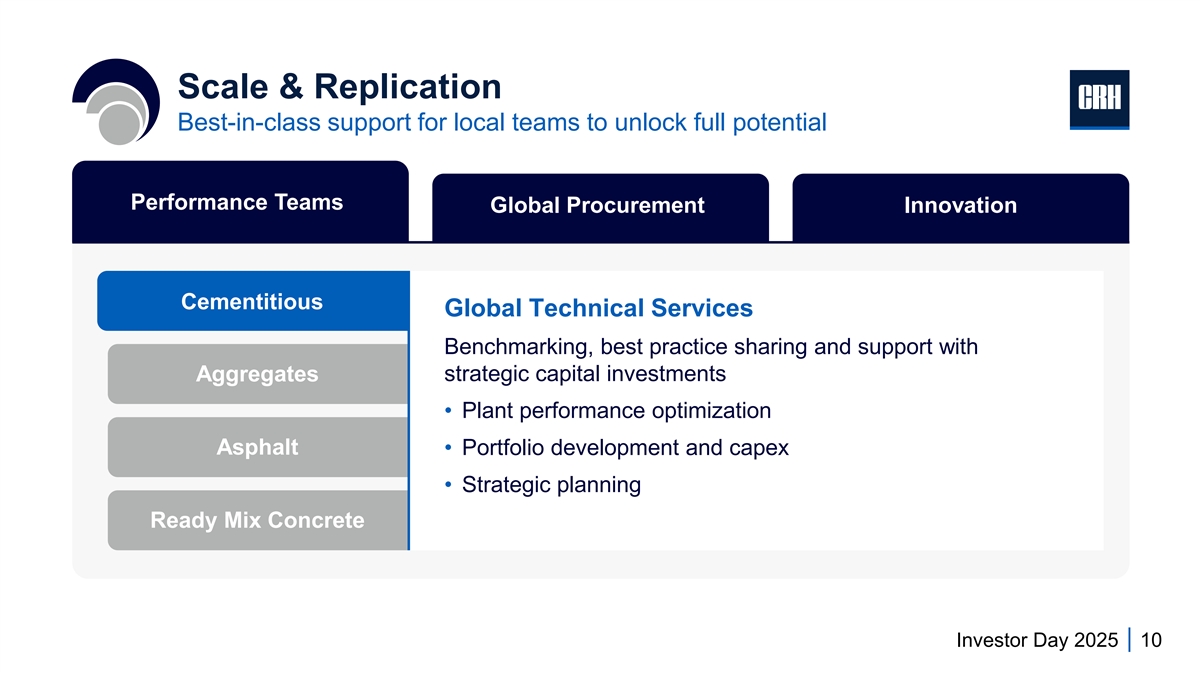

Scale & Replication Best-in-class support for local teams to unlock full potential Performance Teams Global Procurement Innovation Cementitious Global Technical Services Benchmarking, best practice sharing and support with Aggregates strategic capital investments • Plant performance optimization Asphalt • Portfolio development and capex • Strategic planning Ready Mix Concrete Investor Day 2025 10

Leading Performance in Action: Mulzer Crushed Stone Investor Day 11

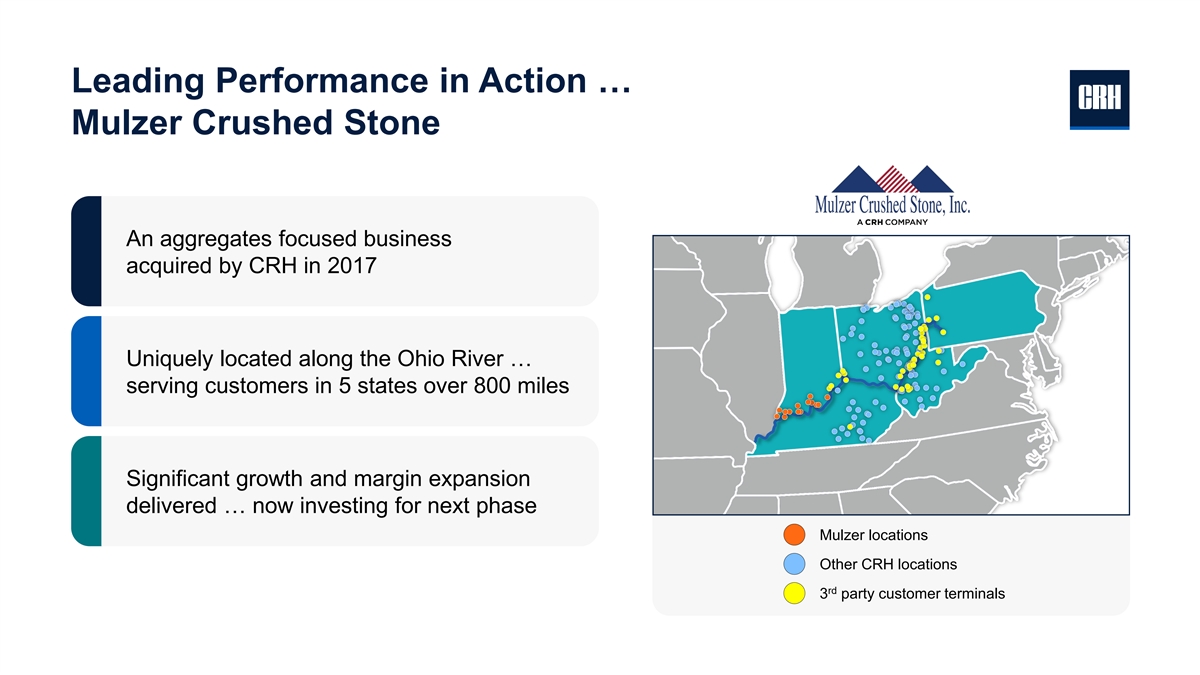

Leading Performance in Action … Mulzer Crushed Stone An aggregates focused business acquired by CRH in 2017 Uniquely located along the Ohio River … serving customers in 5 states over 800 miles Significant growth and margin expansion delivered … now investing for next phase Mulzer locations Other CRH locations rd 3 party customer terminals Investor Day 2025 12

Leading Performance in Action: Ash Grove Investor Day 2025 13

Unmatched Performance Excellence Capabilities Dedicated resources enable local teams to accelerate best-in-class performance … Global capabilities Embedded performance Value Successful integration & to capitalize on growth excellence initiatives & Creation synergy delivery opportunities local accountability Delivering continued margin expansion & ensuring a clear runway for growth Investor Day 2025 14

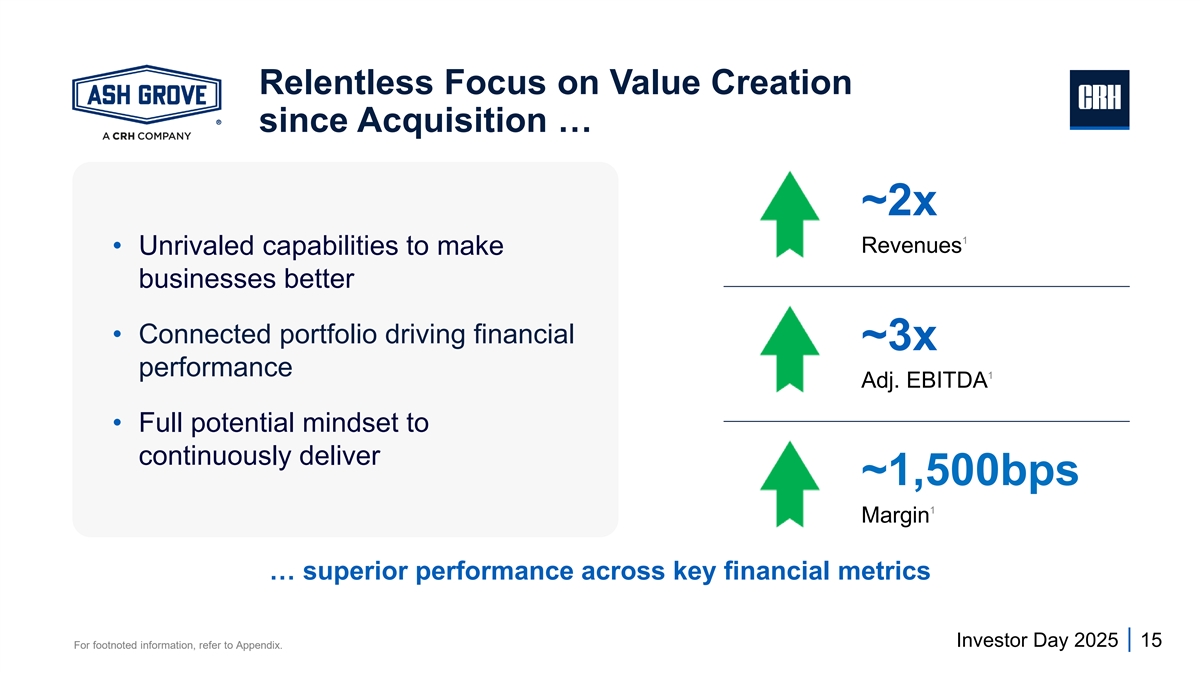

Relentless Focus on Value Creation since Acquisition … ~2x 1 Revenues • Unrivaled capabilities to make businesses better • Connected portfolio driving financial ~3x performance 1 Adj. EBITDA • Full potential mindset to continuously deliver ~1,500bps 1 Margin … superior performance across key financial metrics Investor Day 2025 15 For footnoted information, refer to Appendix.

Investing to Unlock the Next Phase of Growth … Hunter cement Eco Material Durkee, Oregon acquisition (2024) growth capex (2025) acquisition (2025) 2mt cement plant & Increasing cement capacity Market leader in SCMs in network of terminals to meet demand North America … increasing our cementitious supply to deliver continued value creation Investor Day 2025 16

Leading Performance Our Leading Performance system is locally owned & globally enabled Deployed at unmatched scale across ~4,000 locations, leveraging the power of our ~300 local brands Allows us to relentlessly drive and compound organic & inorganic growth 1 A key enabler to achieving 11 years of margin expansion & to executing on our Financial Targets Investor Day 2025 17 For footnoted information, refer to Appendix. Key Takeaways

Appendix: Endnotes Slide 3 1. ‘Double-digit earnings growth’ refers to CRH’s compound annualized growth rate of Adjusted EBITDA for the period from December 31, 2014 to December 31, 2024. Metrics from the financial year ended December 31, 2014 are based on IFRS. 2014 EBITDA (as defined) has been modified to exclude contributions from subsequently divested businesses. The adjustments required to reflect these metrics under U.S. GAAP have not been quantified. No material differences have been identified that would impact trends calculated in accordance with U.S. GAAP in comparison to IFRS. For source data of this 2014 metric, please refer to the Appendix of the main September 2025 Investor Day presentation. Metrics from the financial year ended December 31, 2024 are based on U.S. GAAP as reported in our 2024 Form 10-K. Slide 15 1. Management estimates derived from operating company-level financial information comparing results from our U.S. cement operations for the twelve months ended December 31, 2024, which was based on U.S. GAAP financial reporting, with the pre-acquisition results prepared in accordance with the acquiree’s accounting policies for the twelve months ended December 31, 2017. This comparison is intended to illustrate directional performance improvement and should not be interpreted as an audited historical financial comparison. Slide 17 1. Based on IFRS financial reporting to 2022 and U.S. GAAP for 2023 and 2024. Investor Day 2025 18