.5 Investor Day 2025 New York Why We Win in Roads Built for Growth Powered by Performance

Disclaimer Unless the context otherwise provides, “we,” “us,” “our,” “CRH”, the “Company” and like terms refer to CRH plc and its consolidated subsidiaries. Forward-Looking Statements In order to utilize the “Safe Harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, CRH is providing the following cautionary statement. This presentation contains statements that are, or may be deemed to be, forward-looking statements with respect to the financial condition, results of operations, business, viability and future performance of CRH and certain of the plans and objectives of CRH. These forward-looking statements may generally, but not always, be identified by the use of words such as “will”, “anticipates”, “should”, “could”, “would”, “targets”, “aims”, “may”, “continues”, “expects”, “is expected to”, “estimates”, “believes”, “intends” or similar expressions. These forward-looking statements include all matters that are not historical facts or matters of fact at the date of this presentation. In particular, the following, among other statements, are all forward-looking in nature: plans and expectations regarding megatrends and growth with respect to each, including infrastructure, transportation, water and reindustrialization; statements regarding margin, return, cash generation and growth prospects for CRH’s roads’ business; statements relating to CRH’s total addressable market; expectations regarding public funding; and statements regarding the opportunities for further expansion. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that may or may not occur in the future and reflect the Company’s current expectations and assumptions as to such future events and circumstances that may not prove accurate. You are cautioned not to place undue reliance on any forward-looking statements. These forward-looking statements are made as of the date of this presentation. The Company expressly disclaims any obligation or undertaking to publicly update or revise these forward-looking statements other than as required by applicable law. A number of material factors could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements, certain of which are beyond our control, and which include, among other factors, the risks and uncertainties described herein and under “Risk Factors” in our 2024 Form 10-K and in our other filings with the SEC. Non-GAAP Financial Information This presentation includes discussion of Return on Invested Capital and cash gross profit per ton for CRH’s roads businesses, each of which is financial information that is not calculated in accordance with U.S. generally accepted accounting principles (‘GAAP’). Non-GAAP financial information should not be considered a replacement for GAAP measures. Investor Day 2025 2

Today’s Speakers Nathan Creech Jake Parson President, President, CRH Americas CRH Americas Materials Northeast Investor Day 2025 3

Our Growth Algorithm Growing CRH Leading Megatrends Winning Way Compounder of Capital Infrastructure Transportation x = Water Proven long-term delivery 1 Double-digit earnings growth Reindustrialization Investor Day 2025 4 For footnoted information, refer to Appendix.

Driving Value at Scale in our US Roads platform Investor Day 2025 5

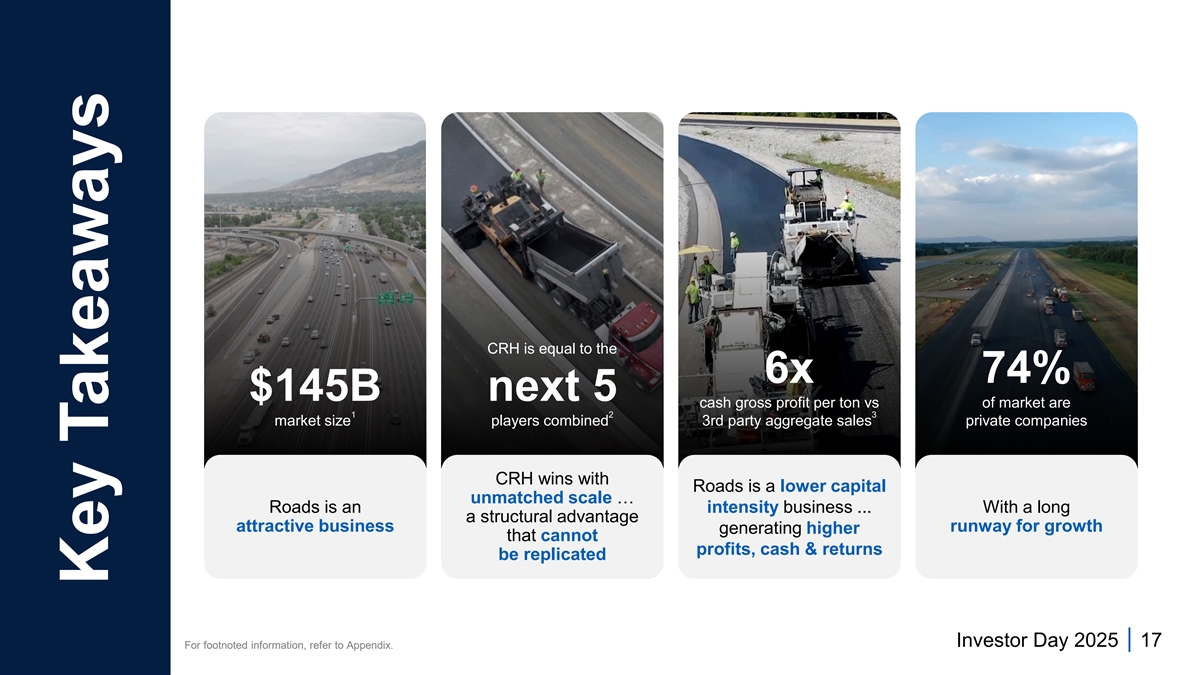

Driving Value at Scale in our US Roads Platform CRH wins with Roads is a lower capital unmatched scale … Roads is an intensity business ... With a long a structural advantage attractive business runway for growth generating higher that cannot profits, cash & returns be replicated Investor Day 2025 6

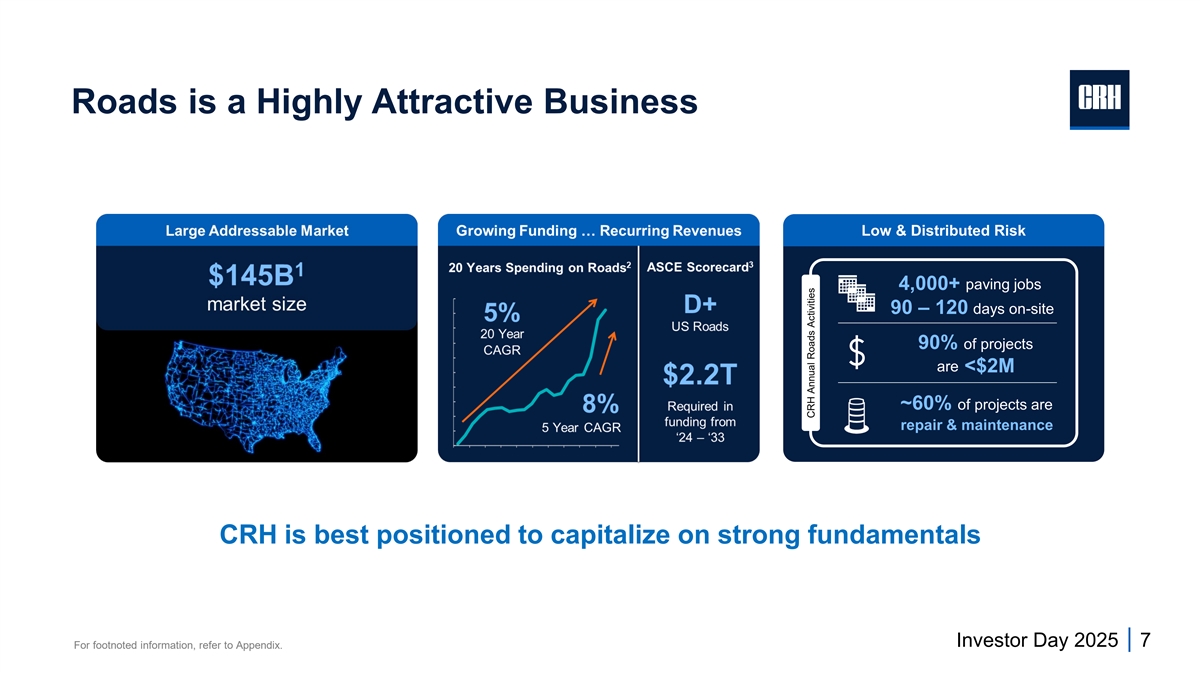

Roads is a Highly Attractive Business Low & Distributed Risk 4,000+ paving jobs 90 – 120 days on-site 90% of projects are <$2M ~60% of projects are repair & maintenance CRH is best positioned to capitalize on strong fundamentals Investor Day 2025 7 For footnoted information, refer to Appendix. CRH Annual Roads Activities

CRH is the Undisputed Leader in Roads 1 $6.4B revenues Leading positions across 43 states 2/3rds of US population live within 50 miles of a CRH asphalt plant Investor Day 2025 8 For footnoted information, refer to Appendix.

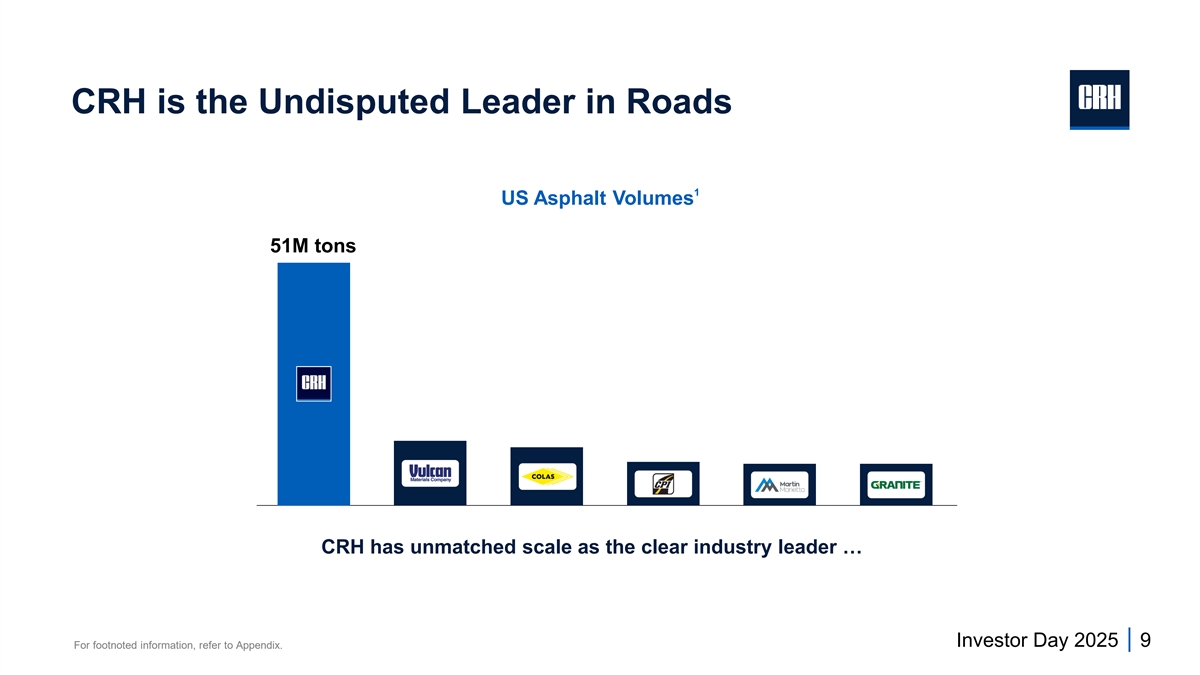

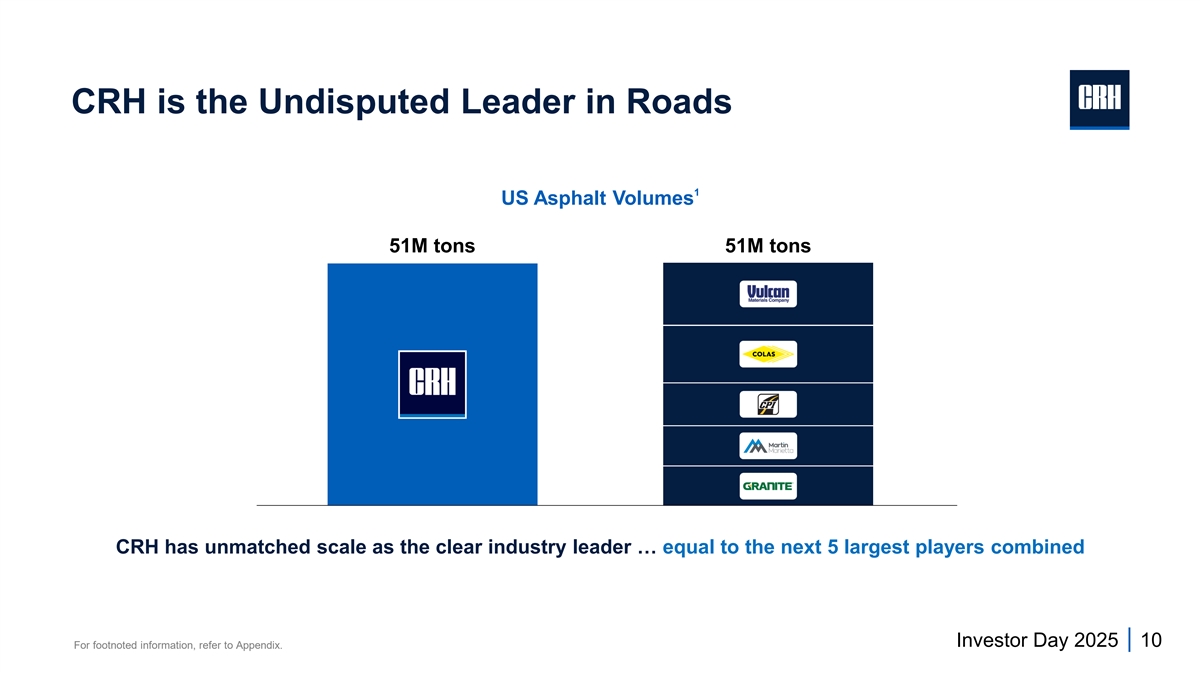

CRH is the Undisputed Leader in Roads 1 US Asphalt Volumes 51M tons CRH has unmatched scale as the clear industry leader … Investor Day 2025 9 For footnoted information, refer to Appendix.

CRH is the Undisputed Leader in Roads 1 US Asphalt Volumes 51M tons 51M tons c D CRH has unmatched scale as the clear industry leader … equal to the next 5 largest players combined Investor Day 2025 10 For footnoted information, refer to Appendix.

CRH is the Undisputed Leader in Roads 800+ 23 ~450 800+ 1 Aggregate Sites (230M tons) Liquid Asphalt Terminals Hot Mix Asphalt Plants Paving & Related Services Crews … a fully connected roads offering with unmatched scale … Investor Day 2025 11 For footnoted information, refer to Appendix.

Video not running on version he sent us? 1 CRH is the Undisputed Leader in Roads ~20% of US cementitious v 1olume 1 is used in Road right-of-way ~85% of water, energy & communications infrastructure products are installed in Road right-of-way Investor Day 2025 12 For footnoted information, refer to Appendix.

CRH is the Undisputed Leader in Roads Best-in-class Performance Leveraging Scale to drive: Best practices Technical expertise Quality Investor Day 2025 13

CRH is the Undisputed Leader in Roads Driving Value Through Circularity & Innovation ~90 State-of-the-art laboratories ~25% of asphalt produced is recycled content Investor Day 2025 14

Customer Centric & Connected Portfolio ~6x 1 more profitable ~300bps 2 Adj. ROIC accretive Aggregates Liquid Asphalt Asphalt Paving Finished Road ~$10 CGP/t ~$60 CGP/t ... a multiplier for profits, cash & returns Investor Day 2025 15 Illustrative example For footnoted information, refer to Appendix.

High Growth Runway Fragmented Market of HMA industry is 74% still privately held Other public companies Privately Held Significant opportunity for further expansion Significant opportunity to drive further inorganic growth Investor Day 2025 16

CRH is equal to the 6x 74% $145B next 5 cash gross profit per ton vs of market are 1 2 3 market size players combined 3rd party aggregate sales private companies CRH wins with Roads is a lower capital unmatched scale … Roads is an intensity business ... With a long a structural advantage attractive business runway for growth generating higher that cannot profits, cash & returns be replicated Investor Day 2025 17 For footnoted information, refer to Appendix. Key Takeaways

Appendix: Endnotes Slide 4 1. ‘Double-digit earnings growth’ refers to CRH’s compound annualized growth rate of Adjusted EBITDA for the period from December 31, 2014 to December 31, 2024. Metrics from the financial year ended December 31, 2014 are based on IFRS. 2014 EBITDA (as defined) has been modified to exclude contributions from subsequently divested businesses. The adjustments required to reflect these metrics under U.S. GAAP have not been quantified. No material differences have been identified that would impact trends calculated in accordance with U.S. GAAP in comparison to IFRS. For source data of this 2014 metric, please refer to the Appendix of the main September 2025 Investor Day presentation. Metrics from the financial year ended December 31, 2024 are based on U.S. GAAP as reported in our 2024 Form 10-K. Slide 7 1. Management estimate. 2. U.S. Census Bureau, Total Construction Spending: Highway and Street in the United States, 2005-2024. 3. American Society of Civil Engineers, 2025 Infrastructure Report Card for America, March 2025. Slide 8 1. Refers to revenues derived from paving and contracting services in the Americas Materials Solutions segment for the financial year ended December 31, 2024 which is disclosed as Revenue in Road Solutions recognized over time in our 2024 Form 10-K. Slide 9 & 10 1. 2024 asphalt volumes. Sourced from each company’s 2024 filings and management estimates, respectively. Slide 11 1. 2024 annualized sales volumes reflecting the full-year impact of acquisitions and divestitures during the year and may vary from actual volumes sold. This includes volumes which are used internally (e.g., aggregates supplied internally for cement production). Slide 12 1. Management estimate. Slide 15 1. Compared to 3rd party aggregate sales. 2. Illustrative example comparing the anticipated Return on Invested Capital (ROIC) for an integrated Roads business with the ROIC of an aggregates business with third party sales only. ROIC for an integrated Roads business is calculated with reference to profits derived from average invested capital used for paving services and related internal supply of aggregates and asphalt. Slide 17 1. Management estimate. 2. 2024 annual asphalt volumes. Sourced from 2024 company’s public filings. 3. Illustrative example, compared to 3rd party aggregate sales. Investor Day 2025 18