Date Landstar System, Inc. Earnings Conference Call 4Q 2025 .2

Forward-Looking Statements Disclaimer The following is a “safe harbor” statement under the Private Securities Litigation Reform Act of 1995. Statements made in this slide presentation that are not based on historical facts are “forward-looking statements.” This presentation may make certain statements containing forward-looking statements, such as statements which relate to Landstar’s business objectives, plans, strategies and expectations. Such statements are by nature subject to uncertainties and risks, including but not limited to: the operational, financial or legal risks or uncertainties detailed in Landstar’s Form 10-K for the 2024 fiscal year and Form 10-Q for the 2025 first quarter, described in the section Risk Factors, and other SEC filings from time to time. These risks and uncertainties could cause actual results or events to differ materially from historical results or those anticipated. Investors should not place undue reliance on such forward-looking statements, and the Company undertakes no obligation to publicly update or revise any forward-looking statements. 4Q 2025

Non-GAAP Financial Measures 4Q 2025 In this slide presentation, the Company provides the following information that may be deemed a non-GAAP financial measure: variable contribution, variable contribution margin and operating income as a percentage of variable contribution. Management believes variable contribution and variable contribution margin are useful measures of the variable costs that we incur at a shipment-by-shipment level attributable to our transportation network of third-party capacity providers and independent agents in order to provide services to our customers. Management believes that operating income as a percentage of variable contribution is a useful measure as: (i) variable costs of revenue for a significant portion of the Company’s business are highly influenced by short-term market-based trends in the freight transportation industry, whereas other costs, including other costs of revenue, are much less impacted by short-term freight market trends; and (ii) this measure is meaningful to investors’ evaluations of the Company’s management of costs attributable to operations other than the purely variable costs associated with purchased transportation and commissions to agents that the Company incurs to provide services to our customers. Management also believes that it is appropriate to present each of the financial measures that may be deemed a non-GAAP financial measure, as referred to above, for the following reasons: (1) disclosure of these matters will allow investors to better understand the underlying trends in the Company’s financial condition and results of operations; (2) this information will facilitate comparisons by investors of the Company’s results as compared to the results of peer companies; and (3) management considers this financial information in its decision making. A tabulation of the expenses identified as costs of revenue as well as a reconciliation of gross profit to variable contribution and gross profit margin to variable contribution margin for the 2025 and 2024 fourth quarters and fiscal year periods is included in this slide presentation within the Appendix.

Frank Lonegro Chief Executive Officer 4Q 2025 Executive Summary

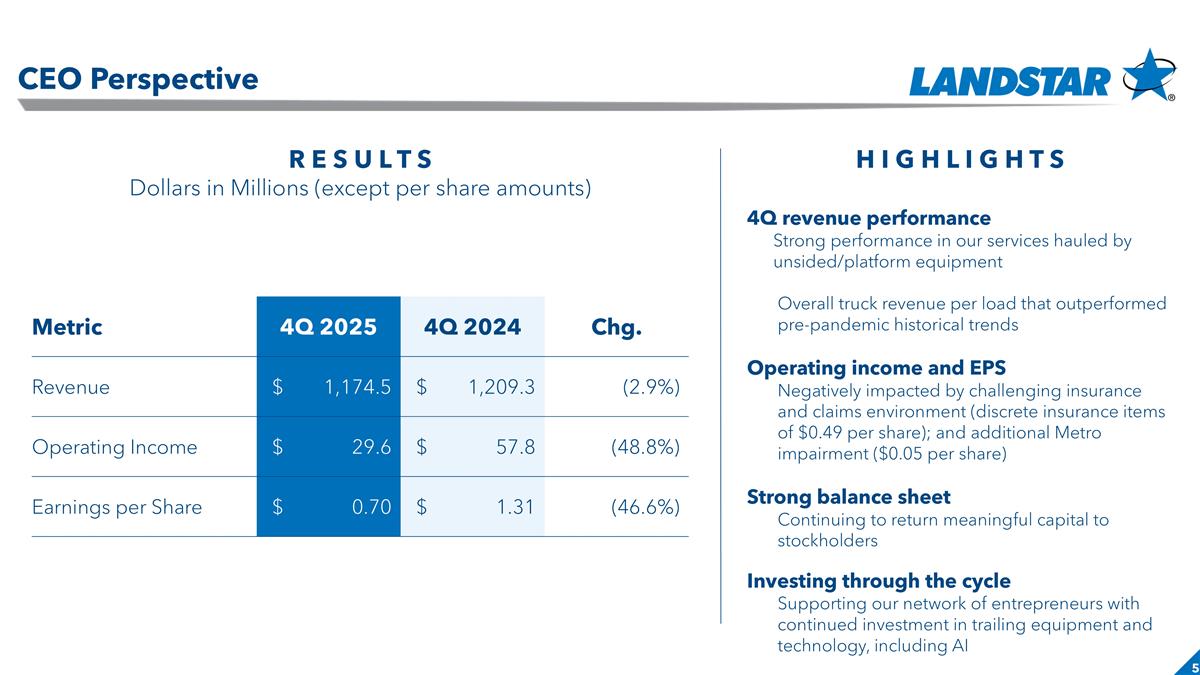

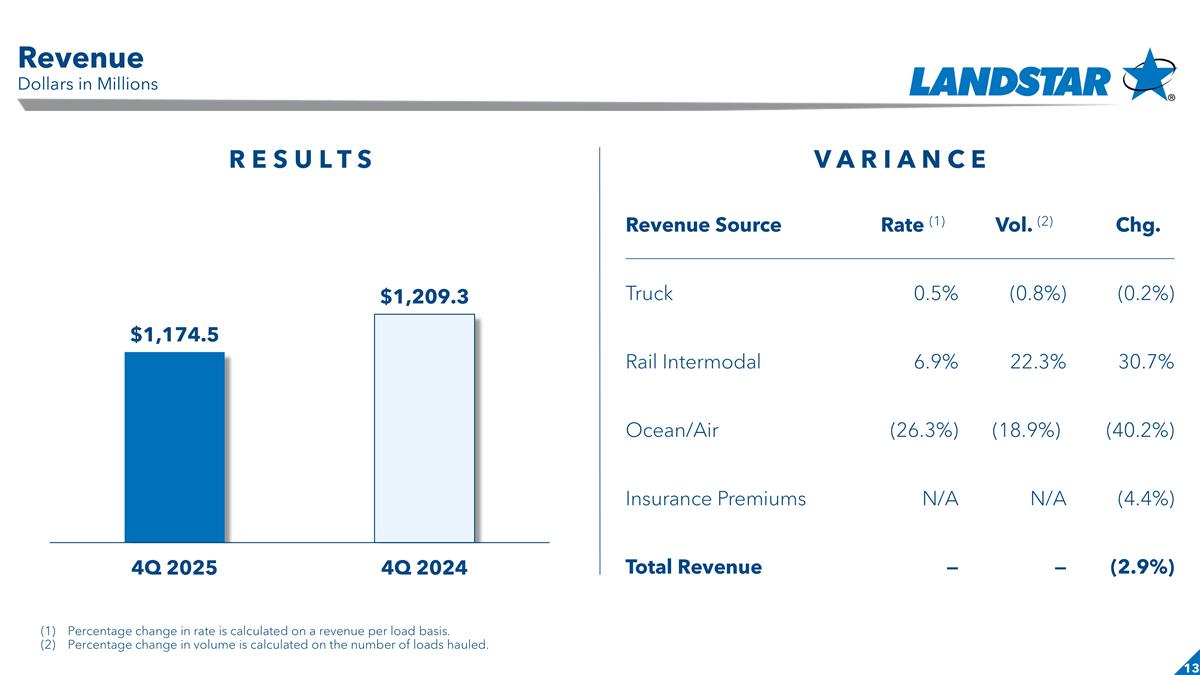

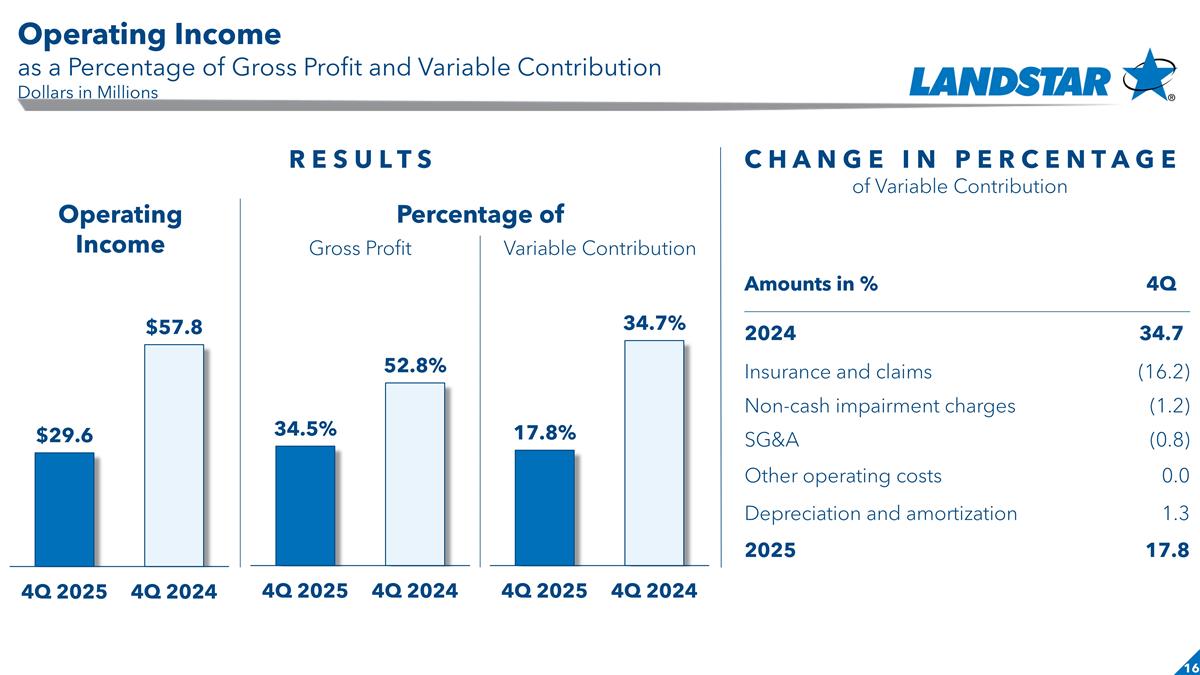

Slide header CEO Perspective R E S U L T S Dollars in Millions (except per share amounts) H I G H L I G H T S 4Q revenue performance Strong performance in our services hauled by unsided/platform equipment Overall truck revenue per load that outperformed pre-pandemic historical trends Operating income and EPS Negatively impacted by challenging insurance and claims environment (discrete insurance items of $0.49 per share); and additional Metro impairment ($0.05 per share) Strong balance sheet Continuing to return meaningful capital to stockholders Investing through the cycle Supporting our network of entrepreneurs with continued investment in trailing equipment and technology, including AI Metric 4Q 2025 4Q 2024 Chg. Revenue $ 1,174.5 $ 1,209.3 (2.9%) Operating Income $ 29.6 $ 57.8 (48.8%) Earnings per Share $ 0.70 $ 1.31 (46.6%)

Jim Applegate Chief Corporate Sales, Strategy and Specialized Freight Officer 4Q 2025 AI Strategy

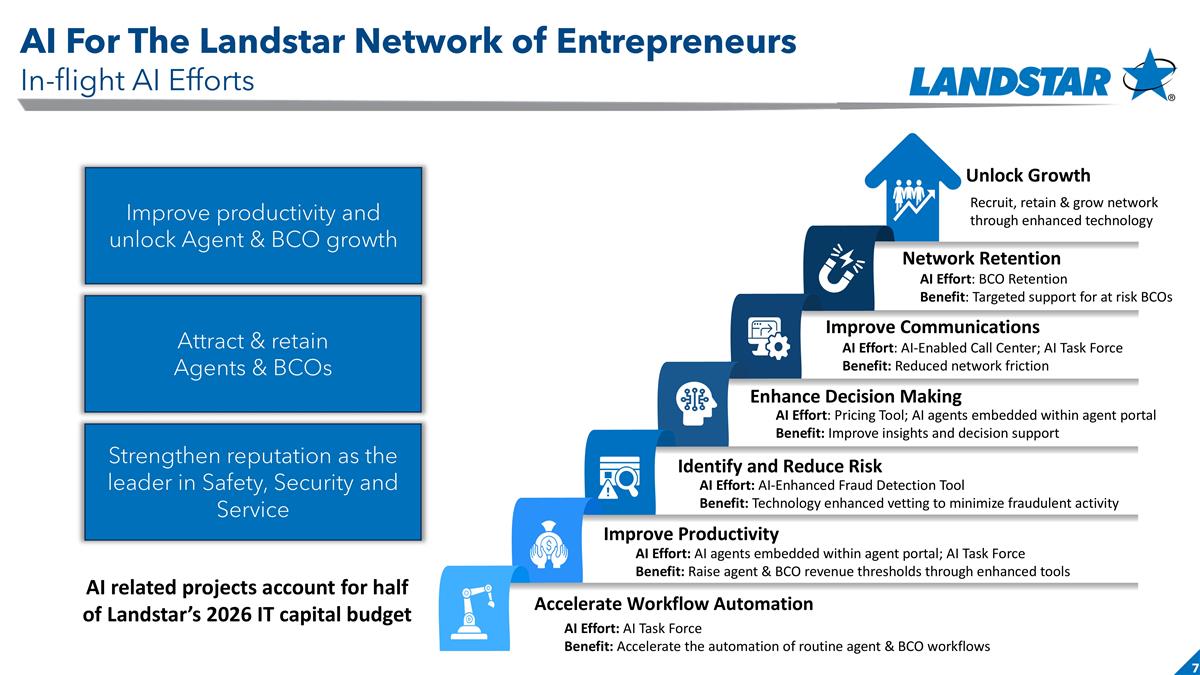

AI Effort: AI Task Force Benefit: Accelerate the automation of routine agent & BCO workflows Unlock Growth Network Retention Improve Communications Enhance Decision Making Identify and Reduce Risk Improve Productivity Accelerate Workflow Automation Recruit, retain & grow network through enhanced technology AI Effort: BCO Retention Benefit: Targeted support for at risk BCOs AI Effort: AI agents embedded within agent portal; AI Task Force Benefit: Raise agent & BCO revenue thresholds through enhanced tools AI Effort: AI-Enhanced Fraud Detection Tool Benefit: Technology enhanced vetting to minimize fraudulent activity AI Effort: Pricing Tool; AI agents embedded within agent portal Benefit: Improve insights and decision support AI Effort: AI-Enabled Call Center; AI Task Force Benefit: Reduced network friction Improve productivity and unlock Agent & BCO growth Attract & retain Agents & BCOs Strengthen reputation as the leader in Safety, Security and Service AI For The Landstar Network of Entrepreneurs In-flight AI Efforts AI related projects account for half of Landstar’s 2026 IT capital budget

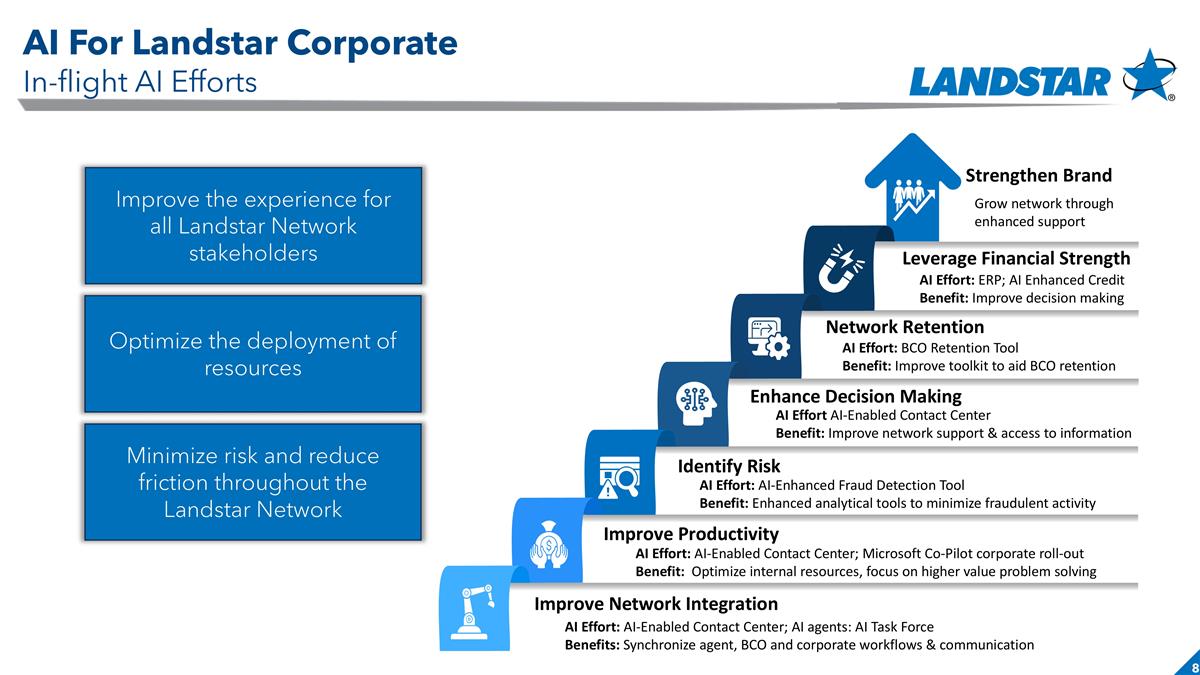

AI Effort: AI-Enabled Contact Center; AI agents: AI Task Force Benefits: Synchronize agent, BCO and corporate workflows & communication Strengthen Brand Leverage Financial Strength Network Retention Enhance Decision Making Identify Risk Improve Productivity Improve Network Integration Grow network through enhanced support AI Effort: ERP; AI Enhanced Credit Benefit: Improve decision making AI Effort: AI-Enabled Contact Center; Microsoft Co-Pilot corporate roll-out Benefit: Optimize internal resources, focus on higher value problem solving AI Effort: AI-Enhanced Fraud Detection Tool Benefit: Enhanced analytical tools to minimize fraudulent activity AI Effort AI-Enabled Contact Center Benefit: Improve network support & access to information AI Effort: BCO Retention Tool Benefit: Improve toolkit to aid BCO retention Improve the experience for all Landstar Network stakeholders Optimize the deployment of resources Minimize risk and reduce friction throughout the Landstar Network AI For Landstar Corporate In-flight AI Efforts

Frank Lonegro Chief Executive Officer 4Q 2025 Network and Capacity

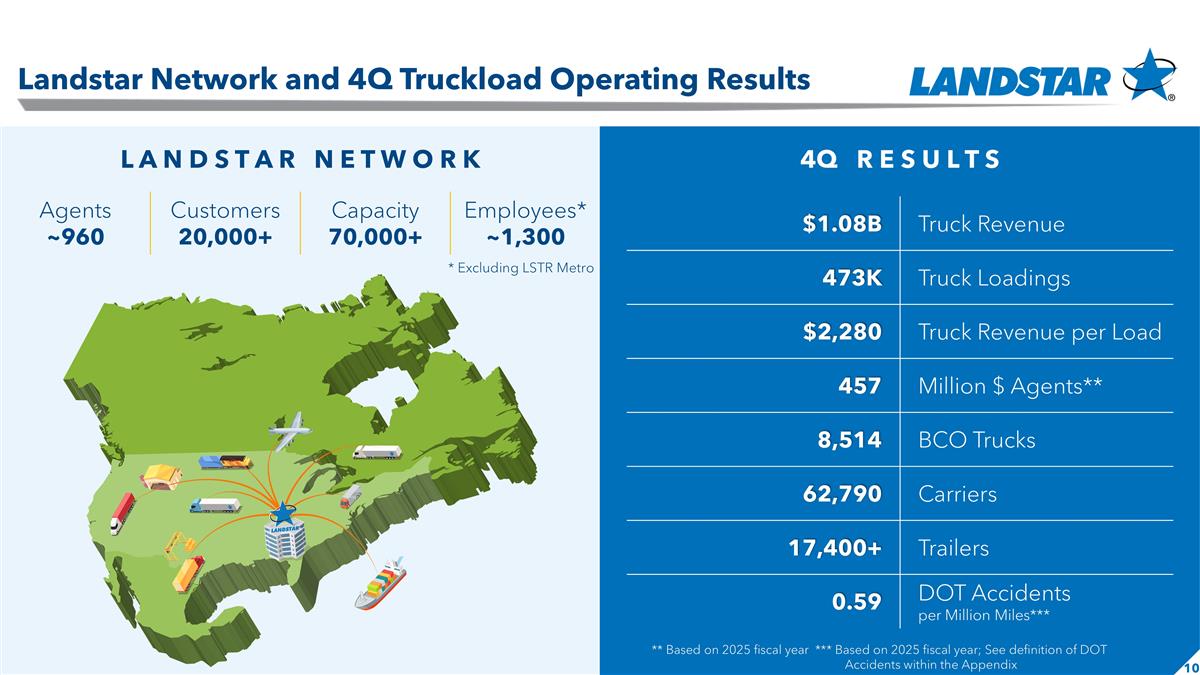

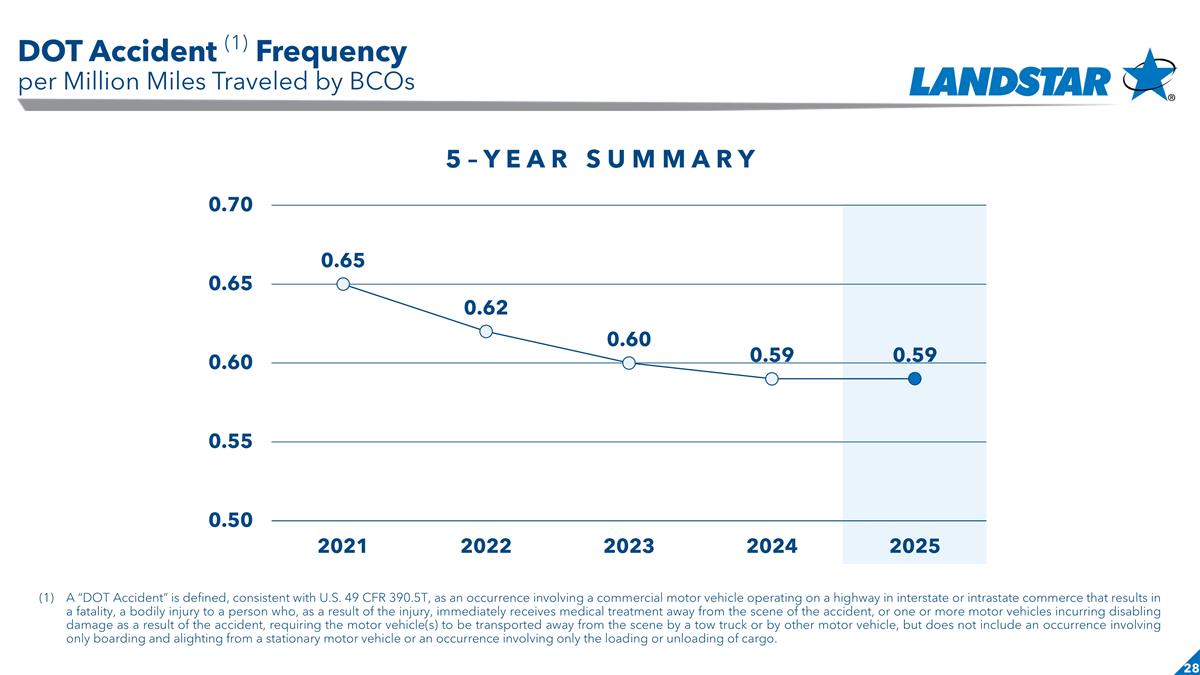

Slide header $1.08B Truck Revenue 473K Truck Loadings $2,280 Truck Revenue per Load 457 Million $ Agents** 8,514 BCO Trucks 62,790 Carriers 17,400+ Trailers 0.59 DOT Accidents per Million Miles*** ** Based on 2025 fiscal year *** Based on 2025 fiscal year; See definition of DOT Accidents within the Appendix 4Q R E S U L T S L A N D S T A R N E T W O R K Agents ~960 Customers 20,000+ Capacity 70,000+ Employees* ~1,300 Landstar Network and 4Q Truckload Operating Results * Excluding LSTR Metro

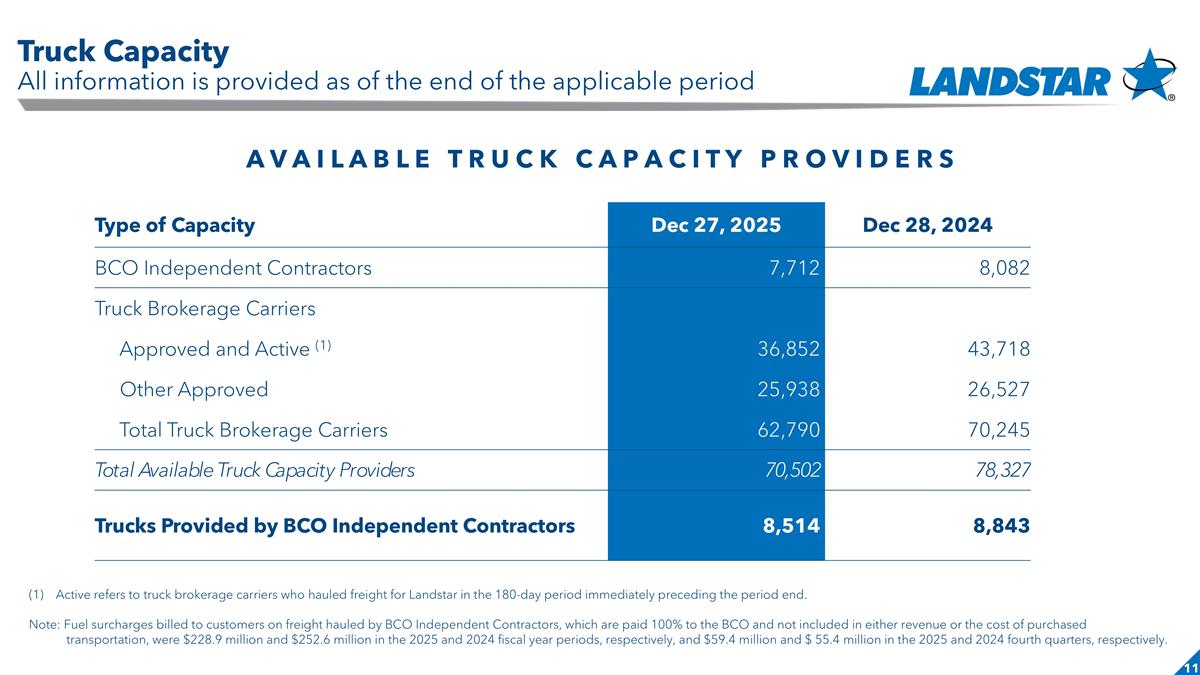

Slide header Active refers to truck brokerage carriers who hauled freight for Landstar in the 180-day period immediately preceding the period end. Note: Fuel surcharges billed to customers on freight hauled by BCO Independent Contractors, which are paid 100% to the BCO and not included in either revenue or the cost of purchased transportation, were $228.9 million and $252.6 million in the 2025 and 2024 fiscal year periods, respectively, and $59.4 million and $ 55.4 million in the 2025 and 2024 fourth quarters, respectively. A V A I L A B L E T R U C K C A P A C I T Y P R O V I D E R S Type of Capacity Dec 27, 2025 Dec 28, 2024 BCO Independent Contractors 7,712 8,082 Truck Brokerage Carriers Approved and Active (1) 36,852 43,718 Other Approved 25,938 26,527 Total Truck Brokerage Carriers 62,790 70,245 Total Available Truck Capacity Providers 70,502 78,327 Trucks Provided by BCO Independent Contractors 8,514 8,843 Truck Capacity All information is provided as of the end of the applicable period

Jim Todd Chief Financial Officer 4Q 2025 Financial Results

Slide header Revenue Source Rate (1) Vol. (2) Chg. Truck 0.5% (0.8%) (0.2%) Rail Intermodal 6.9% 22.3% 30.7% Ocean/Air (26.3%) (18.9%)) (40.2%) Insurance Premiums N/A N/A (4.4%) Total Revenue — — (2.9%) R E S U L T S V A R I A N C E Percentage change in rate is calculated on a revenue per load basis. Percentage change in volume is calculated on the number of loads hauled. Revenue Dollars in Millions

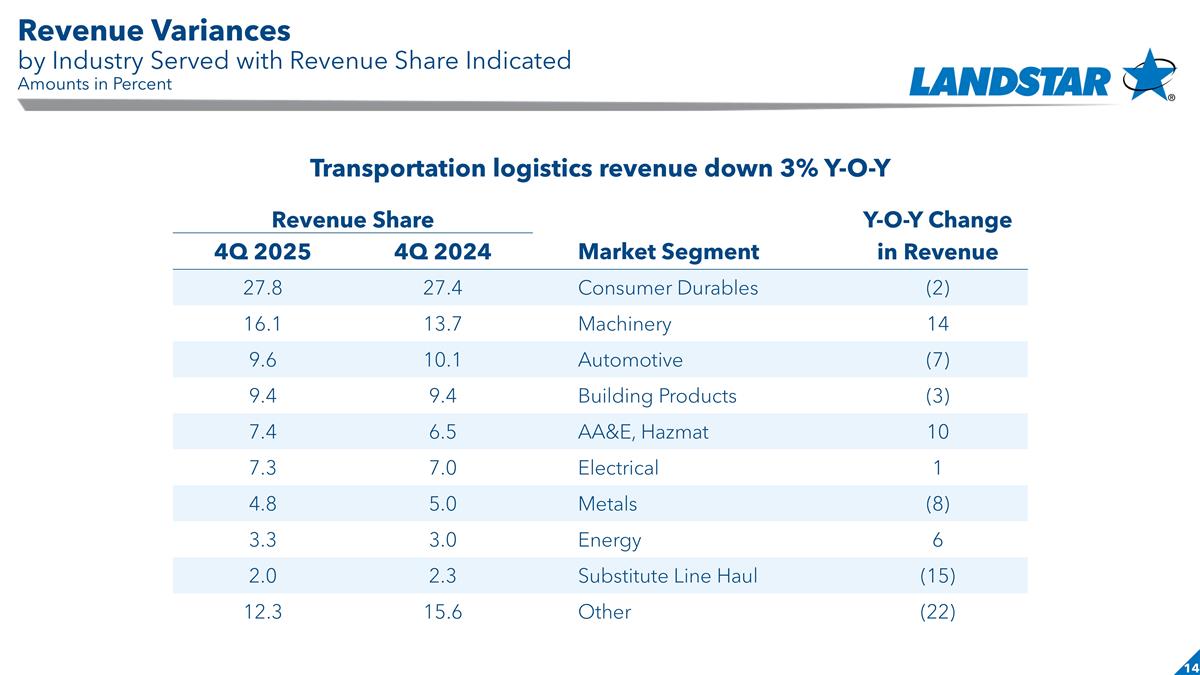

Slide header Revenue Share Y-O-Y Change 4Q 2025 4Q 2024 Market Segment in Revenue 27.8 27.4 Consumer Durables (2) 16.1 13.7 Machinery 14 9.6 10.1 Automotive (7) 9.4 9.4 Building Products (3) 7.4 6.5 AA&E, Hazmat 10 7.3 7.0 Electrical 1 4.8 5.0 Metals (8) 3.3 3.0 Energy 6 2.0 2.3 Substitute Line Haul (15) 12.3 15.6 Other (22) Transportation logistics revenue down 3% Y-O-Y Revenue Variances by Industry Served with Revenue Share Indicated Amounts in Percent

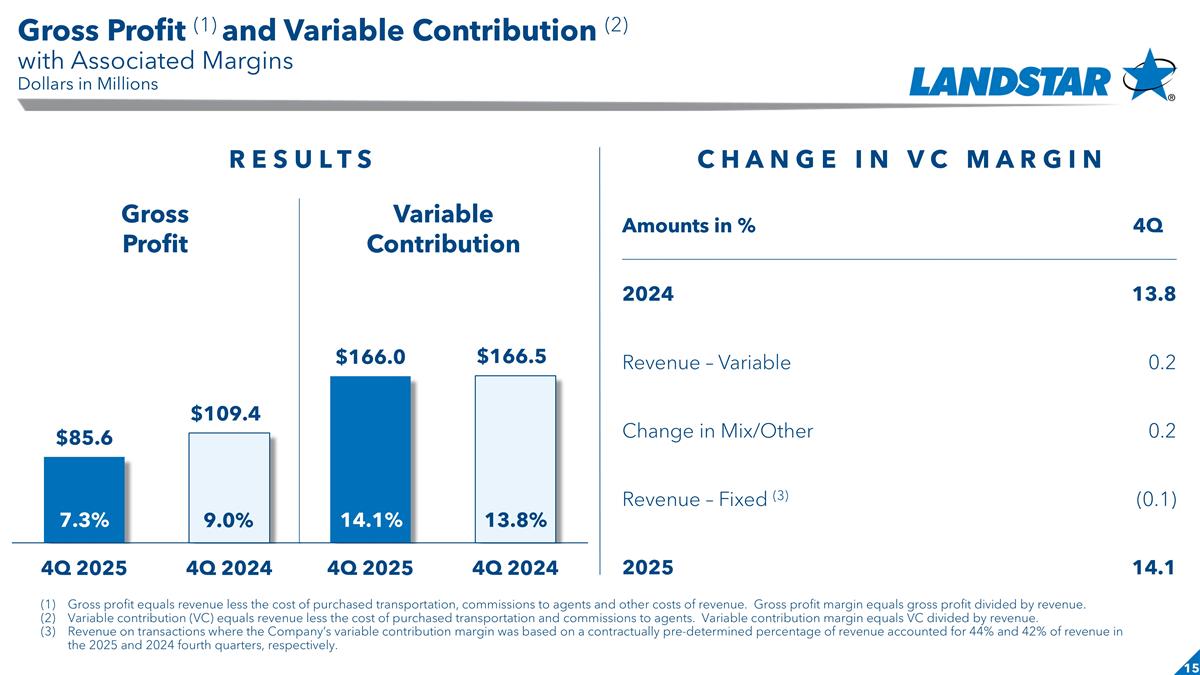

Slide header Gross Profit Variable Contribution Amounts in % 4Q 2024 13.8 Revenue – Variable 0.2 Change in Mix/Other 0.2 Revenue – Fixed (3) (0.1) 2025 14.1 C H A N G E I N V C M A R G I N Gross profit equals revenue less the cost of purchased transportation, commissions to agents and other costs of revenue. Gross profit margin equals gross profit divided by revenue. Variable contribution (VC) equals revenue less the cost of purchased transportation and commissions to agents. Variable contribution margin equals VC divided by revenue. Revenue on transactions where the Company’s variable contribution margin was based on a contractually pre-determined percentage of revenue accounted for 44% and 42% of revenue in the 2025 and 2024 fourth quarters, respectively. R E S U L T S 7.3% 9.0% 14.1% 13.8% Gross Profit (1) and Variable Contribution (2) with Associated Margins Dollars in Millions

Slide header Operating Income Percentage of Gross Profit Variable Contribution C H A N G E I N P E R C E N T A G E of Variable Contribution R E S U L T S Operating Income as a Percentage of Gross Profit and Variable Contribution Dollars in Millions Amounts in % 4Q 2024 34.7) Insurance and claims (16.2) Non-cash impairment charges (1.2) SG&A (0.8) Other operating costs 0.0 Depreciation and amortization 1.3 2025 17.8

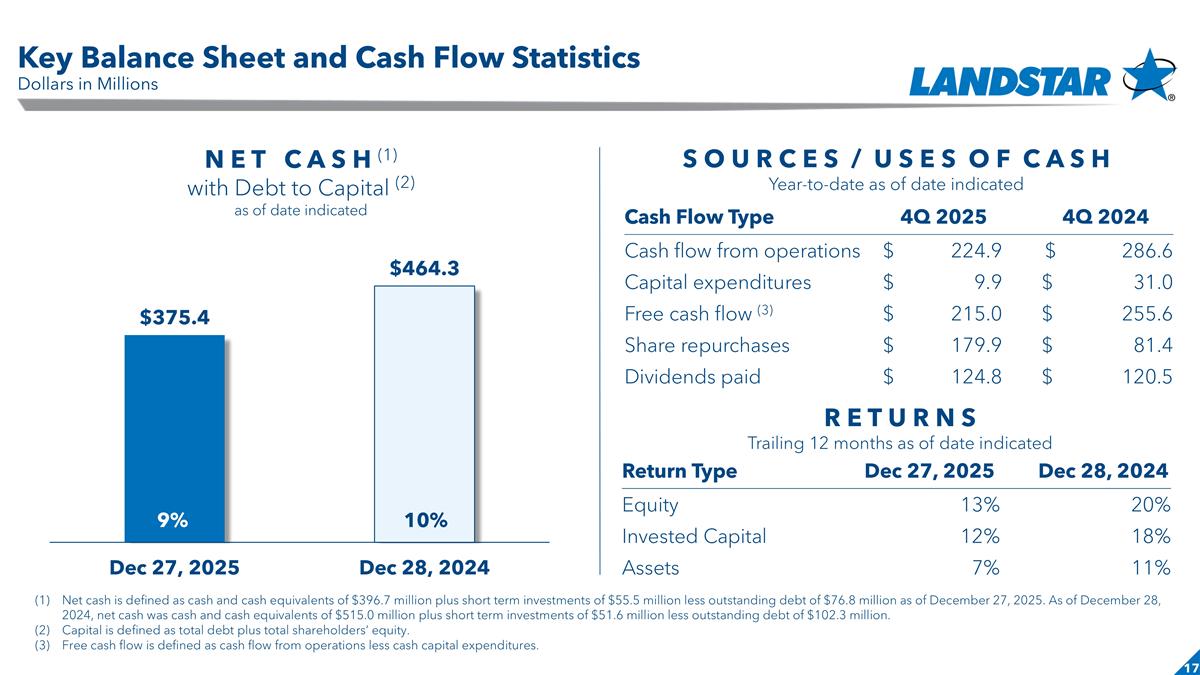

Slide header Return Type Dec 27, 2025 Dec 28, 2024 Equity 13% 20% Invested Capital 12% 18% Assets 7% 11% N E T C A S H (1) with Debt to Capital (2) as of date indicated S O U R C E S / U S E S O F C A S H Year-to-date as of date indicated Cash Flow Type 4Q 2025 4Q 2024 Cash flow from operations $ 224.9 $ 286.6 Capital expenditures $ 9.9 $ 31.0 Free cash flow (3) $ 215.0 $ 255.6 Share repurchases $ 179.9 $ 81.4 Dividends paid $ 124.8 $ 120.5 R E T U R N S Trailing 12 months as of date indicated Net cash is defined as cash and cash equivalents of $396.7 million plus short term investments of $55.5 million less outstanding debt of $76.8 million as of December 27, 2025. As of December 28, 2024, net cash was cash and cash equivalents of $515.0 million plus short term investments of $51.6 million less outstanding debt of $102.3 million. Capital is defined as total debt plus total shareholders’ equity. Free cash flow is defined as cash flow from operations less cash capital expenditures. 9% 10% Key Balance Sheet and Cash Flow Statistics Dollars in Millions

Frank Lonegro Chief Executive Officer 4Q 2025 Closing Remarks

Slide header Current Market Update and Historical Trends Ü Current Market Update - January 2026 business activity: – Truck Loads: January approximately 1% below January 2025 – Essentially in line with typical December to January month-to-month historical trends – Truck Revenue per Load: January approximately 4% above January 2025 – Modestly above typical December to January month-to-month historical trends Historical Trends - Pre-pandemic historical seasonality patterns would normally yield: – Truck Revenue: Mid-single digit to high-single digit decrease from 4Q to 1Q – Truck Loads: 4% decline 4Q to 1Q – Truck Revenue per Load: 4% decline 4Q to 1Q

4Q 2025 Appendix

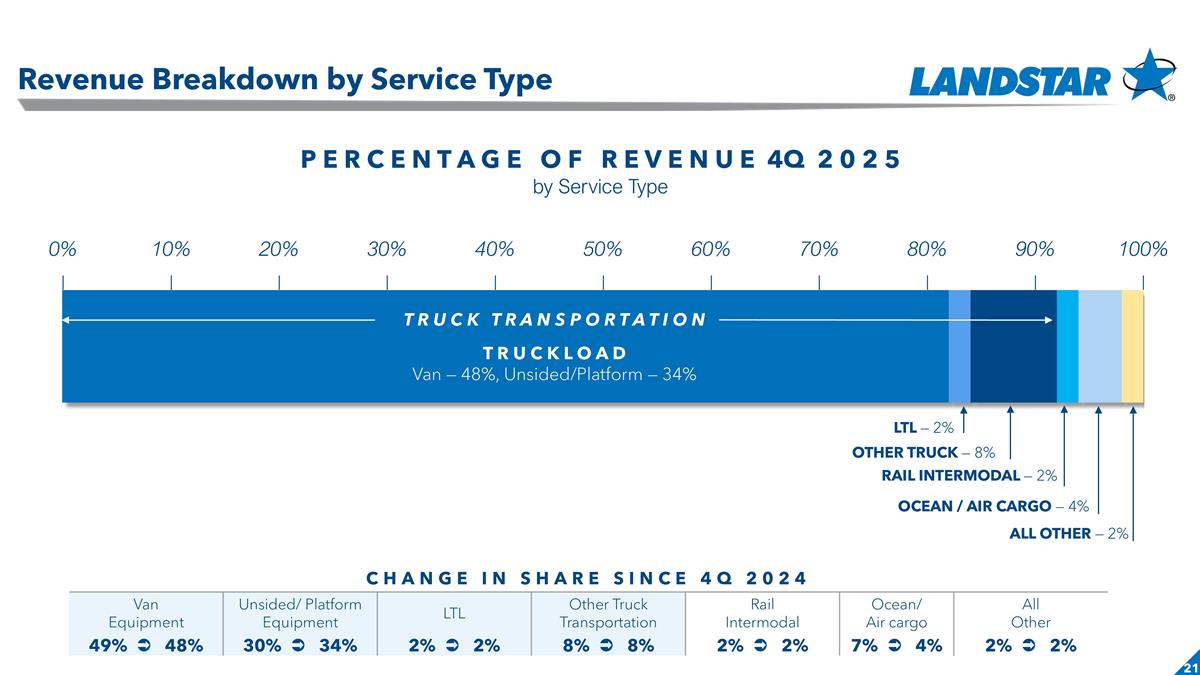

Slide header Revenue Breakdown by Service Type P E R C E N T A G E O F R E V E N U E 4Q 2 0 2 5 by Service Type LTL — 2% T R U C K L O A D Van — 48%, Unsided/Platform — 34% OTHER TRUCK — 8% T R U C K T R A N S P O R T A T I O N RAIL INTERMODAL — 2% OCEAN / AIR CARGO — 4% CHANGE IN SHARE SINCE 4Q 2024 Van Equipment Unsided/ Platform Equipment LTL Other Truck Transportation Rail Intermodal Ocean/ Air cargo All Other 49% Ü 48% 30% Ü 34% 2% Ü 2% 8% Ü 8% 2% Ü 2% 7% Ü 4% 2% Ü 2% ALL OTHER — 2%

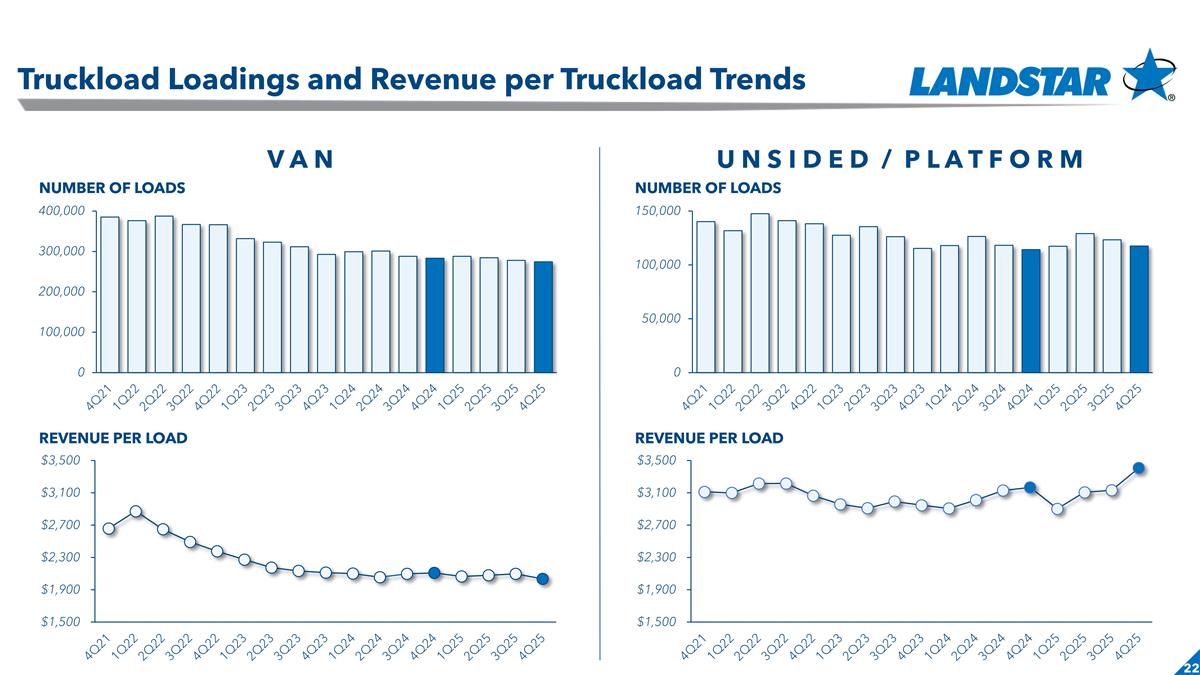

Slide header Truckload Loadings and Revenue per Truckload Trends U N S I D E D / P L A T F O R M V A N NUMBER OF LOADS REVENUE PER LOAD NUMBER OF LOADS REVENUE PER LOAD

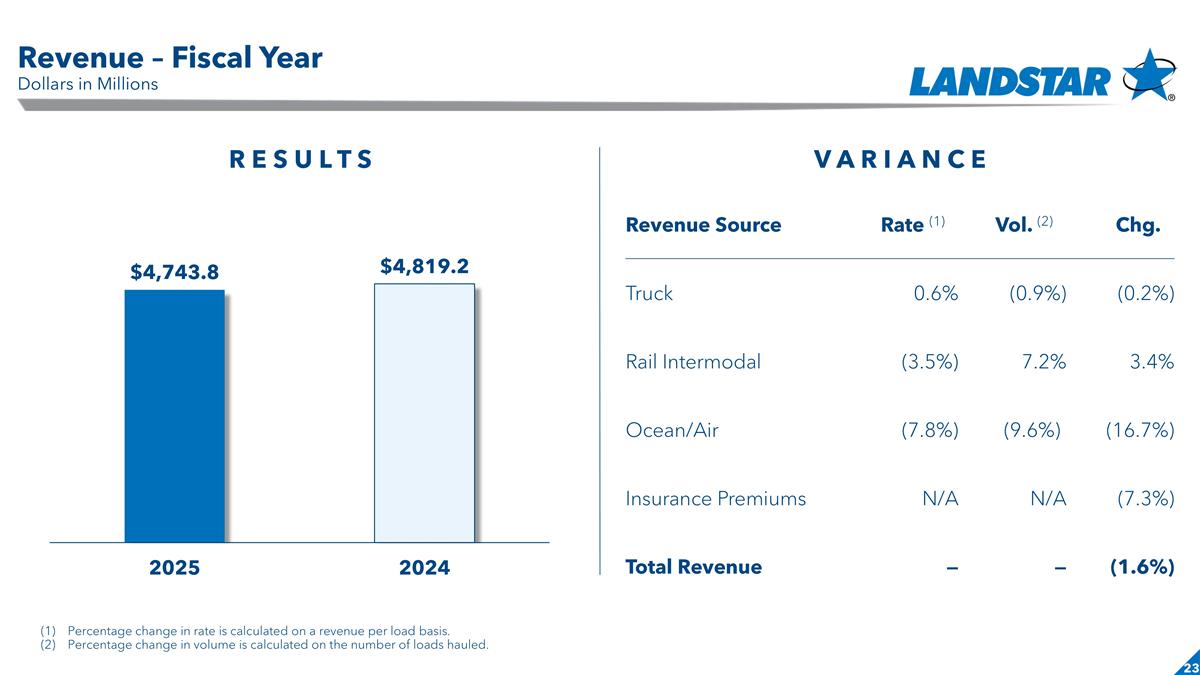

Slide header Revenue – Fiscal Year Dollars in Millions Revenue Source Rate (1) Vol. (2) Chg. Truck 0.6% (0.9%) (0.2%) Rail Intermodal (3.5%) 7.2% 3.4% Ocean/Air (7.8%) (9.6%)) (16.7%) Insurance Premiums N/A N/A (7.3%) Total Revenue — — (1.6%) R E S U L T S V A R I A N C E Percentage change in rate is calculated on a revenue per load basis. Percentage change in volume is calculated on the number of loads hauled.

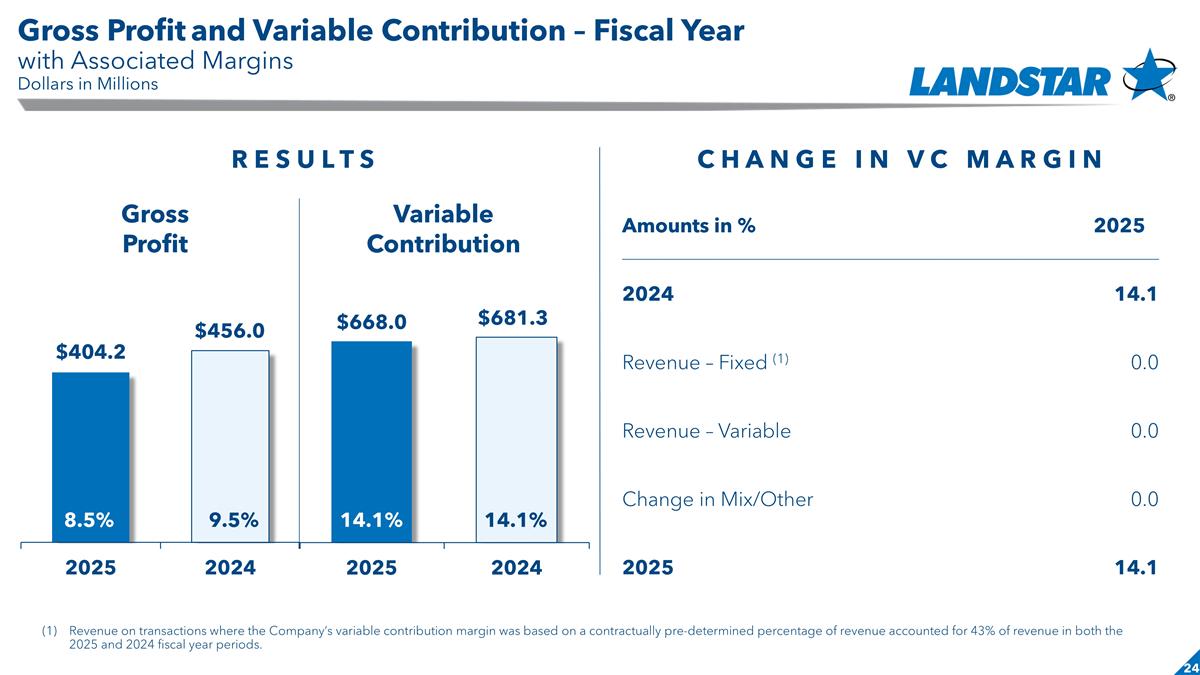

Slide header Gross Profit and Variable Contribution – Fiscal Year with Associated Margins Dollars in Millions Gross Profit Variable Contribution Amounts in % 2025 2024 14.1 Revenue – Fixed (1) 0.0 Revenue – Variable 0.0 Change in Mix/Other 0.0 2025 14.1 C H A N G E I N V C M A R G I N Revenue on transactions where the Company’s variable contribution margin was based on a contractually pre-determined percentage of revenue accounted for 43% of revenue in both the 2025 and 2024 fiscal year periods. R E S U L T S 8.5% 9.5% 14.1% 14.1%

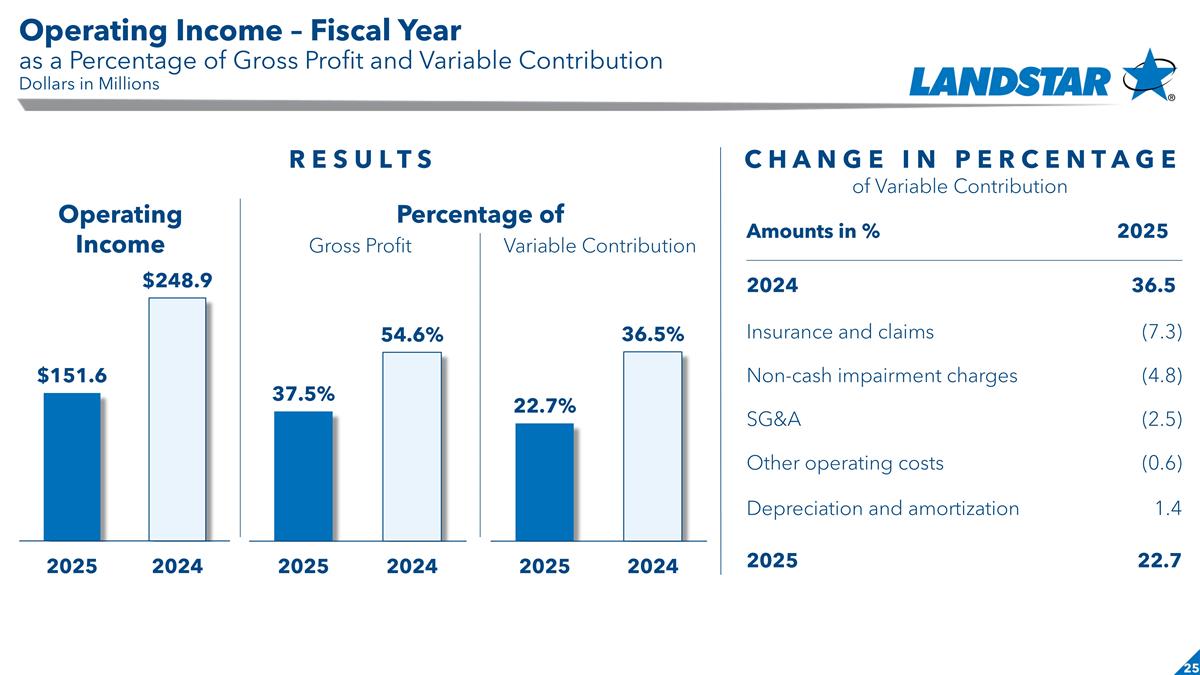

Slide header Operating Income – Fiscal Year as a Percentage of Gross Profit and Variable Contribution Dollars in Millions Operating Income Percentage of Gross Profit Variable Contribution C H A N G E I N P E R C E N T A G E of Variable Contribution R E S U L T S Amounts in % 2025 2024 36.5) Insurance and claims (7.3) Non-cash impairment charges (4.8) SG&A (2.5) Other operating costs (0.6) Depreciation and amortization 1.4 2025 22.7

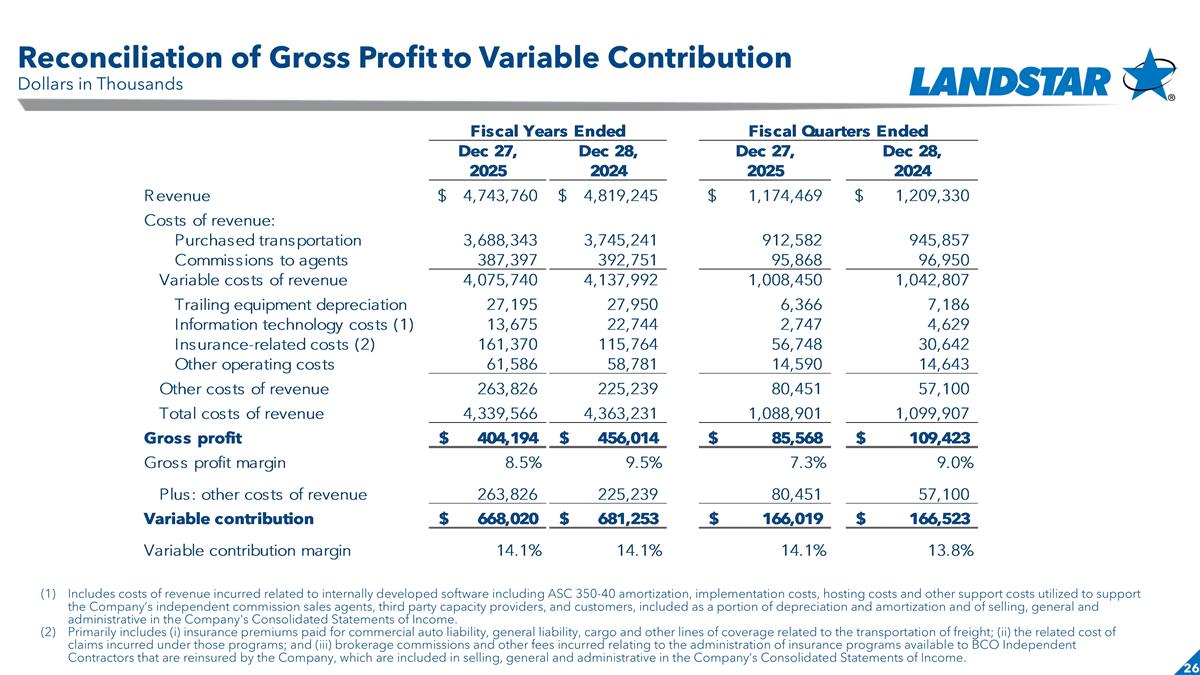

Slide header Reconciliation of Gross Profit to Variable Contribution Dollars in Thousands Includes costs of revenue incurred related to internally developed software including ASC 350-40 amortization, implementation costs, hosting costs and other support costs utilized to support the Company’s independent commission sales agents, third party capacity providers, and customers, included as a portion of depreciation and amortization and of selling, general and administrative in the Company's Consolidated Statements of Income. Primarily includes (i) insurance premiums paid for commercial auto liability, general liability, cargo and other lines of coverage related to the transportation of freight; (ii) the related cost of claims incurred under those programs; and (iii) brokerage commissions and other fees incurred relating to the administration of insurance programs available to BCO Independent Contractors that are reinsured by the Company, which are included in selling, general and administrative in the Company’s Consolidated Statements of Income. 2010 2011 2009 % Proj % Plan % External Revenue #REF! #REF! #REF! Purchased Transportation 0 #REF! 0 #REF! #REF! #REF! Commissions to Agents 0 #REF! 0 #REF! #REF! #REF! Net Revenue #REF! #REF! #REF! #REF! #REF! #REF! Investment Income 0 #REF! #VALUE! #VALUE! #REF! 1.1% Other Operating Costs #REF! #REF! #REF! #REF! #REF! #REF! Insurance Expense #REF! #REF! #REF! #REF! #REF! #REF! SG&A #REF! #REF! #REF! #REF! #REF! #REF! Depreciation and Amortization #REF! #REF! #REF! #REF! #REF! #REF! Operating Income #REF! #REF! #REF! #REF! #REF! #REF! Interest and Debt Expense #REF! #REF! #REF! Income Before Income Taxes #REF! #REF! #REF! Income Taxes #REF! #REF! #REF! Net Income #REF! #REF! #REF! Diluted Earnings per Share Shares Diluted Earnings per Share % of 2013 % of 2013 % of Fiscal Years Ended Fiscal Quarters Ended Dec 27, Dec 28, Dec 27, Dec 28, 2025 2024 2025 2024 2012 Rev/GP Plan Rev/GP Proj Rev/GP Revenue $4,743,760 $4,819,245 $1,174,469 $1,209,330 External Revenue #REF! #REF! #REF! Costs of revenue: Purchased Transportation #REF! #REF! #REF! #REF! #REF! #REF! Purchased transportation 3,688,343 3,745,241 ,912,582 ,945,857 Commissions to agents ,387,397 ,392,751 95,868 96,950 Variable costs of revenue 4,075,740 4,137,992 1,008,450 1,042,807 Interest and Debt Expense #REF! #REF! #REF! Income Before Income Taxes #REF! #REF! #REF! Trailing equipment depreciation 27,195 27,950 6,366 7,186 Information technology costs (1) 13,675 22,744 2,747 4,629 Insurance-related costs (2) ,161,370 ,115,764 56,748 30,642 Income Taxes #REF! #REF! #REF! Other operating costs 61,586 58,781 14,590 14,643 Other costs of revenue ,263,826 ,225,239 80,451 57,100 Total costs of revenue 4,339,566 4,363,231 1,088,901 1,099,907 Gross profit $,404,194 $,456,014 $85,568 $,109,423 Gross profit margin 8.5% 9.5% 7.3% 0.09 Plus: other costs of revenue ,263,826 ,225,239 80,451 57,100 Variable contribution $,668,020 $,681,253 $,166,019 $,166,523 Variable contribution margin 0.14082078351349983 0.14099999999999999 0.14135664713159735 0.13800000000000001 (1) Includes costs of revenue incurred related to internally developed software including ASC 350-40 amortization, implementation costs, hosting costs and other support costs utilized to support the Company’s independent commission sales agents, third party capacity providers, and customers, included as a portion of depreciation and amortization and of selling, general and administrative in the Company's Consolidated Statements of Income. (2) Primarily includes (i) insurance premiums paid for commercial auto liability, general liability, cargo and other lines of coverage related to the transportation of freight; (ii) the related cost of claims incurred under those programs; and (iii) brokerage commissions and other fees incurred relating to the administration of insurance programs available to BCO Independent Contractors that are reinsured by the Company, which are included in selling, general and administrative in the Company’s Consolidated Statements of Income. 2010 2011 2009 % Proj % Plan % External Revenue #REF! #REF! #REF! Purchased Transportation 0 #REF! 0 #REF! #REF! #REF! Commissions to Agents 0 #REF! 0 #REF! #REF! #REF! Net Revenue #REF! #REF! #REF! #REF! #REF! #REF! Investment Income 0 #REF! #VALUE! #VALUE! #REF! 1.1% Other Operating Costs #REF! #REF! #REF! #REF! #REF! #REF! Insurance Expense #REF! #REF! #REF! #REF! #REF! #REF! SG&A #REF! #REF! #REF! #REF! #REF! #REF! Depreciation and Amortization #REF! #REF! #REF! #REF! #REF! #REF! Operating Income #REF! #REF! #REF! #REF! #REF! #REF! Interest and Debt Expense #REF! #REF! #REF! Income Before Income Taxes #REF! #REF! #REF! Income Taxes #REF! #REF! #REF! Net Income #REF! #REF! #REF! Diluted Earnings per Share Shares Diluted Earnings per Share % of 2013 % of 2013 % of Fiscal Years Ended Fiscal Quarters Ended Dec 27, Dec 28, Dec 27, Dec 28, 2025 2024 2025 2024 2012 Rev/GP Plan Rev/GP Proj Rev/GP Revenue $4,743,760 $4,819,245 $1,174,469 $1,209,330 External Revenue #REF! #REF! #REF! Costs of revenue: Purchased Transportation #REF! #REF! #REF! #REF! #REF! #REF! Purchased transportation 3,688,343 3,745,241 ,912,582 ,945,857 Commissions to agents ,387,397 ,392,751 95,868 96,950 Variable costs of revenue 4,075,740 4,137,992 1,008,450 1,042,807 Interest and Debt Expense #REF! #REF! #REF! Income Before Income Taxes #REF! #REF! #REF! Trailing equipment depreciation 27,195 27,950 6,366 7,186 Information technology costs (1) 13,675 22,744 2,747 4,629 Insurance-related costs (2) ,161,370 ,115,764 56,748 30,642 Income Taxes #REF! #REF! #REF! Other operating costs 61,586 58,781 14,590 14,643 Other costs of revenue ,263,826 ,225,239 80,451 57,100 Total costs of revenue 4,339,566 4,363,231 1,088,901 1,099,907 Gross profit $,404,194 $,456,014 $85,568 $,109,423 Gross profit margin 8.5% 9.5% 7.3% 0.09 Plus: other costs of revenue ,263,826 ,225,239 80,451 57,100 Variable contribution $,668,020 $,681,253 $,166,019 $,166,523 Variable contribution margin 0.14082078351349983 0.14099999999999999 0.14135664713159735 0.13800000000000001 (1) Includes costs of revenue incurred related to internally developed software including ASC 350-40 amortization, implementation costs, hosting costs and other support costs utilized to support the Company’s independent commission sales agents, third party capacity providers, and customers, included as a portion of depreciation and amortization and of selling, general and administrative in the Company's Consolidated Statements of Income. (2) Primarily includes (i) insurance premiums paid for commercial auto liability, general liability, cargo and other lines of coverage related to the transportation of freight; (ii) the related cost of claims incurred under those programs; and (iii) brokerage commissions and other fees incurred relating to the administration of insurance programs available to BCO Independent Contractors that are reinsured by the Company, which are included in selling, general and administrative in the Company’s Consolidated Statements of Income.

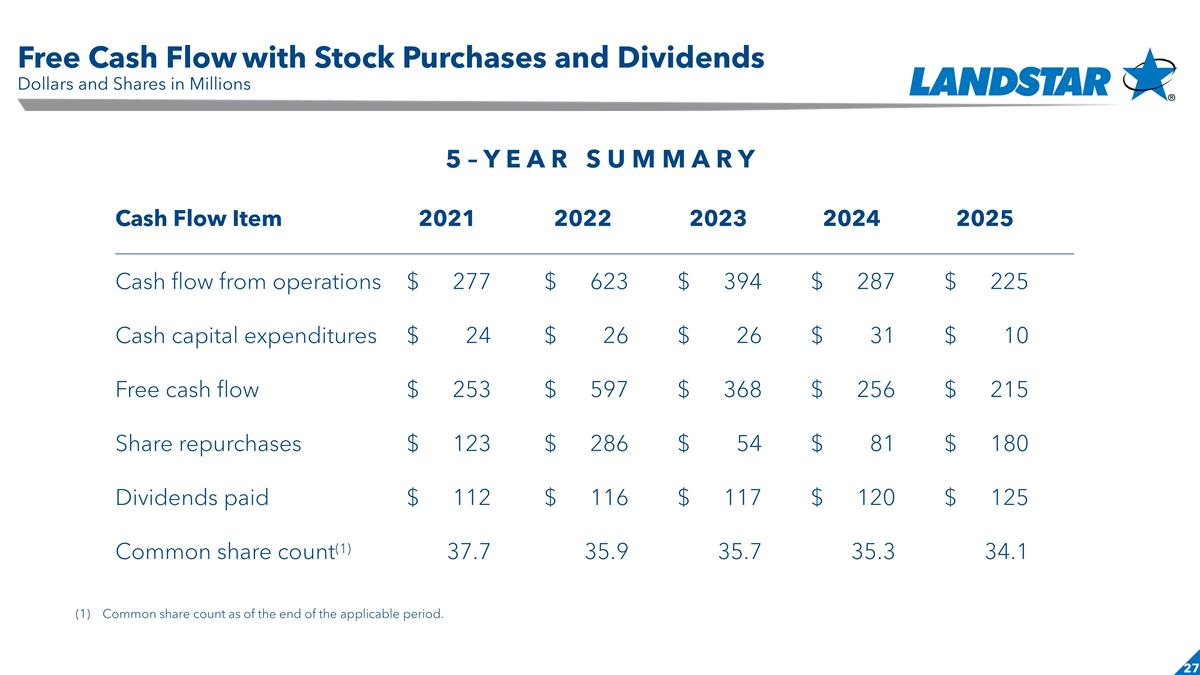

Slide header Free Cash Flow with Stock Purchases and Dividends Dollars and Shares in Millions 5 – Y E A R S U M M A R Y Cash Flow Item 2021 2022 2023 2024 2025 Cash flow from operations $ 277 $ 623 $ 394 $ 287 $ 225 Cash capital expenditures $ 24 $ 26 $ 26 $ 31 $ 10 Free cash flow $ 253 $ 597 $ 368 $ 256 $ 215 Share repurchases $ 123 $ 286 $ 54 $ 81 $ 180 Dividends paid $ 112 $ 116 $ 117 $ 120 $ 125 Common share count(1) 37.7 35.9 35.7 35.3 34.1 Common share count as of the end of the applicable period.

Slide header DOT Accident (1) Frequency per Million Miles Traveled by BCOs 5 – Y E A R S U M M A R Y A “DOT Accident” is defined, consistent with U.S. 49 CFR 390.5T, as an occurrence involving a commercial motor vehicle operating on a highway in interstate or intrastate commerce that results in a fatality, a bodily injury to a person who, as a result of the injury, immediately receives medical treatment away from the scene of the accident, or one or more motor vehicles incurring disabling damage as a result of the accident, requiring the motor vehicle(s) to be transported away from the scene by a tow truck or by other motor vehicle, but does not include an occurrence involving only boarding and alighting from a stationary motor vehicle or an occurrence involving only the loading or unloading of cargo.

Date Landstar System, Inc. Earnings Conference Call 4Q 2025