UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. XX)

Filed by the Registrant [x] | |

Filed by a Party other than the Registrant [ ] | |

Check the appropriate box: | |

[ ] | Preliminary Proxy Statement |

[ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

[x] | Definitive Proxy Statement |

[ ] | Definitive Additional Materials |

[ ] | Soliciting Material under §240.14a-12 |

. | |

(Name of Registrant as Specified In Its Charter) | |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | |

Payment of Filing Fee (Check the appropriate box): | |

[x] | No fee required. |

[ ] | Fee paid previously with preliminary materials |

[ ] | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

TO OUR SHAREHOLDERS:

April 1, 2025 It is my pleasure to invite you to participate in the 2025 Annual Meeting of Shareholders (including any adjournment of the meeting, the Annual Meeting) of Merit Medical Systems, Inc. (Merit or the Company), which will be held on May 14, 2025, at 2:00 p.m. (Mountain Time). The Annual Meeting will be held virtually, via live webcast, at www.virtualshareholdermeeting.com/MMSI2025. Shareholders will be able to attend the Annual Meeting, and submit questions and vote their shares during the Annual Meeting, from any location that has internet connectivity. There will be no physical in-person meeting; however, we hope you will attend the meeting virtually. For further information about how to attend the Annual Meeting via live webcast, and how to submit questions and vote your shares during the live webcast, please refer to the accompanying Proxy Statement or the Notice Regarding the Availability of Proxy Materials which was mailed to you (the Notice). We finished 2024 with strong momentum by delivering better-than-expected financial results in the fourth quarter, reflecting continued strong execution. We successfully completed the first year of our Continued Growth Initiatives Program (CGI Program). As a result, we continue to strengthen profitability, deliver top-line growth, and drive continuous innovation in the marketplace. We saw record-setting revenue and achieved operating margin and free cash flow levels that yielded shareholder returns at the upper end of our peer group. We hope you will participate in the Annual Meeting. The Company is providing access to the proxy materials for the Annual Meeting via the internet. Accordingly, you can access the proxy materials and vote prior to the Annual Meeting by visiting www.proxyvote.com. Instructions for accessing the proxy materials and voting are described in the Proxy Statement and in the Notice. Please review the proxy materials prior to voting. Your vote is important to all of us at Merit. I look forward to your virtual attendance at the Annual Meeting.

FRED P. LAMPROPOULOS |

|

|

“We successfully completed the first year of our CGI Program. As a result, we continue to strengthen profitability, deliver top-line growth, and drive continuous innovation in the marketplace.” |

GUIDE TO PROXY STATEMENT

1 | Purpose of these materials: On behalf of our Board of Directors, we are making these materials available to you in connection with our solicitation of proxies for our Annual Meeting. You are receiving this communication because you hold shares of Merit’s stock. What we need from you: Please read these materials and submit your vote and proxy by telephone, Internet or, if you received your materials by mail, by completing and returning your proxy card. We ask that you vote in advance as soon as practicable. More information: The Notice, this Proxy Statement and the accompanying form of proxy are first being mailed or made available to our shareholders on or about April 4, 2025. This Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 (Annual Report) are available online at: www.proxyvote.com. You may also request a paper copy of the Annual Report, including the related financial statements and schedules, free of charge, by writing to our Corporate Secretary at the address below (principal executive offices of the Company): Merit Medical Systems, Inc. Attn: Corporate Secretary | ||

2 | |||

5 | |||

6 | |||

7 | |||

9 | |||

12 | |||

22 | |||

26 | |||

27 | |||

29 | |||

29 | |||

34 | |||

55 | |||

56 | |||

56 | |||

58 | |||

59 | |||

60 | |||

60 | |||

61 | |||

67 | |||

70 | |||

72 | |||

72 | |||

73 | Proposal 3 – Ratification of Appointment of Independent Registered Public Accounting Firm | ||

74 | |||

74 | |||

75 | |||

75 | Securities Authorized for Issuance Under Equity Compensation Plans | ||

76 | |||

76 | |||

81 | |||

81 | |||

82 |

NOTICE OF 2025 ANNUAL MEETING OF SHAREHOLDERS

| |||

Date and Time | Access | Record Date | |

|

|

| |

May 14, 2025 2:00 p.m. Mountain Time | Webcast www.virtualshareholdermeeting.com | March 18, 2025 Only shareholders of record on the Record Date may vote | |

Items of Business

Proposals | Board’s | More | |

1 | Elect four directors, each to serve until 2028 | FOR | Page 6 |

2 | Non-binding, advisory vote to approve named executive officer compensation (“Say on Pay”) | FOR | Page 55 |

3 | Ratify appointment of Deloitte & Touche LLP as our independent registered public accounting firm | FOR | Page 73 |

Your vote is important to our future. We strongly encourage you to read the Proxy Statement and then promptly vote your shares as instructed herein.

Shareholders can vote via the Internet, by telephone or by mail. Specific instructions on how to vote are included in the Notice that we will mail to our shareholders on or about April 4, 2025. Shareholders will also be able to vote electronically during the webcast of the 2025 Annual Meeting.

Phone and Internet voting will close at 11:59 p.m. EDT on May 13, 2025, but voting by Internet will open again during the meeting. Voting instructions for shares held in the Company’s 401(k) Profit Sharing Plan must be received by 11:59 p.m. EDT on May 9, 2025 and such shares may not be voted during the meeting. Holders in “street name” must instruct their broker, bank or nominee how to vote their shares through the voting instructions provided by their broker, bank or nominee.

By Order of the Board of Directors, | |

| |

Brian G. Lloyd |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 14, 2025

The Company’s Notice, Proxy Statement and Annual Report are available at: www.proxyvote.com.

www.merit.com | 1

PROXY STATEMENT SUMMARY

PROXY STATEMENT SUMMARY

This Proxy Statement is provided in connection with the solicitation of proxies by the Board of Directors of Merit Medical Systems, Inc. (Board or Board of Directors) for the Annual Meeting of Shareholders to be held on May 14, 2025, at 2:00 p.m. Mountain Time (Annual Meeting or 2025 Annual Meeting). In this Proxy Statement, we may refer to Merit Medical Systems, Inc. as the Company, Merit, we, us, or our. The following summary highlights information contained elsewhere in this Proxy Statement and does not contain all of the information you should consider. Before voting, please review the entire Proxy Statement and the Annual Report.

Voting Roadmap Even if you attend the Annual Meeting, you can vote in advance using a method below. | |||||||

| Before the meeting go to: During the meeting go to: |

| Call 1-800-690-6903 |

| (cast your ballot, | ||

Phone and Internet voting will close at 11:59 P.M. Eastern Time on May 13, 2025 but voting by Internet will open again during the meeting (see below). Voting instructions for shares held in the Company’s 401(k) Profit Sharing Plan must be received by 11:59 P.M. Eastern Time on May 9, 2025 and such shares may not be voted during the meeting. Holders in “street name” must instruct their broker, bank or nominee how to vote their shares. | |||||||

PROPOSAL 1: Election of Four Nominees for Director (See page 6) | |||||||

The Board of Directors recommends that you vote FOR each director nominee. These individuals bring a range of relevant experiences and diversity of perspectives that is essential to good governance and leadership of our Company. | The Board recommends a |

| |||||

PROPOSAL 2: Advisory Vote on Executive Compensation (Say-On-Pay) (See page 55) | |||||||

The Board of Directors recommends that you vote FOR this “Say-on-Pay” advisory proposal because our compensation program attracts top executive talent commensurate with our peers and reinforces our “Pay for Performance” philosophy. | The Board recommends a |

| |||||

PROPOSAL 3: Ratify Appointment of Independent Registered Public Accounting Firm (See page 73) | |||||||

We have selected Deloitte & Touche LLP (Deloitte) to serve as our independent registered public accounting firm for the year ending December 31, 2025 because Deloitte is an independent firm with reasonable fees and has significant industry and financial reporting expertise. | The Board recommends a |

| |||||

2 | Understand. Innovate. Deliver.TM

PROXY STATEMENT SUMMARY

A Snapshot of Our Board of Directors

The following table provides summary information about each director nominee (first four), as well as each director whose term of office will continue after the Annual Meeting.

Director | Term | Board Committees | ||||||

Name, Primary Occupation | Age | Since | Expires | Independent | A | C | F(1) | G |

THOMAS J. GUNDERSON Former Medtech Analyst at Piper Jaffray | 74 | 2017 | 2025(2) | Yes | ● | □ | ||

Laura S. Kaiser President & CEO of SSM Health | 64 | 2022 | 2025(2) | Yes | ● | ● | ||

F. ANN MILLNER, ED.D. Regents Professor of Health Administrative Services at Weber State Univ. | 73 | 2015 | 2025(2) | Yes | ● | ● | ||

Michael R. McDonnell Former Chief Financial Officer of Biogen, Inc. | 61 | 2022 | 2025(2) | Yes | ● | ● | ||

LONNY J. CARPENTER Former Group President, Stryker Corporation | 63 | 2020 | 2026 | Yes | □ | ● | ||

DAVID K. FLOYD Former Group President, Stryker Corporation | 64 | 2020 | 2026 | Yes | ● | □ | ||

Lynne N. ward Former Executive Director of my529 (formerly Utah Educational Savings Plan) | 66 | 2019 | 2026 | Yes | □ | ● | ||

STEPHEN C. EVANS Founder, Chairman & CEO of Flag Bridge Global Solutions, LLC; Rear Admiral (Ret.) and Former Special Advisor to the Commander, U.S. Navy | 60 | 2021 | 2027 | Yes | ● | ● | ||

Fred P. Lampropoulos Chair, President & CEO of Merit | 75 | 1987 | 2027 | No | ||||

SILVIA M. PEREZ President, Commercial Branding and Transportation, 3M Company | 58 | 2024 | 2027 | Yes | ● | ● | ||

□: Committee Chair | A: Audit Committee | F: Finance and Operating Committee(1) |

●: Committee Member | C: Compensation and Talent Development Committee | G: Governance and Sustainability Committee |

| (1) | Effective May 15, 2024, the Board combined two of its committees into a single committee—the committee that was then known as the Finance Committee was combined with the committee that was then known as the Operating Committee (Operating Committee). The combined committee is now known as the Finance and Operating Committee and is referred to in this Proxy Statement as the Finance Committee. |

| (2) | If elected at the Annual Meeting, Dr. Millner, Ms. Kaiser and Messrs. Gunderson and McDonnell would serve terms expiring in 2028. |

www.merit.com | 3

PROXY STATEMENT SUMMARY

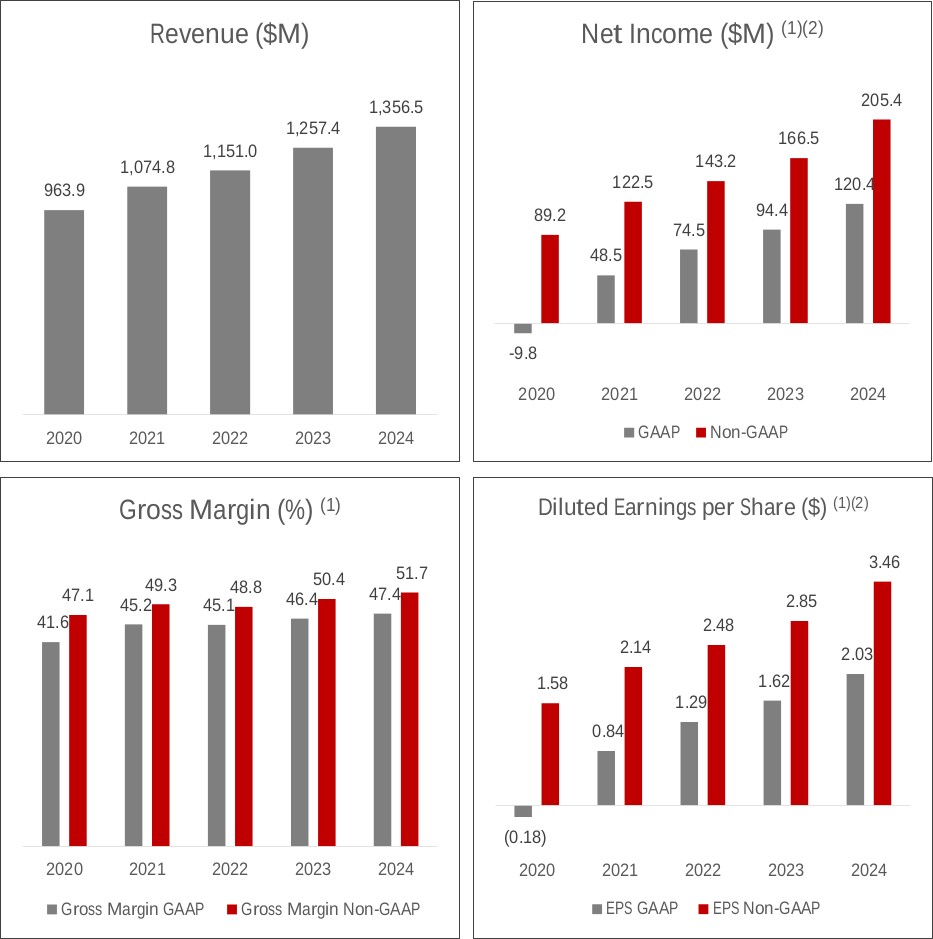

Selected 2024 Highlights

Revenue | Operating Cash Flow | 5-Year TSR (1) | ||||

$1.357 billion | $221 million | 210% |

| (1) | Reflects five-year cumulative total return of Merit common stock, no par value (Common Stock), as reported on the Nasdaq Global Select Market System (Nasdaq) for the period from December 31, 2019 to December 31, 2024. Past results are not necessarily an indicator of future performance. |

Environment | Continued Growth Initiatives | ||

Prioritized reduction of environmental footprint by continuing to implement programs to reduce waste, conserve resources and improve the areas where we do business | Completed the first year of our CGI Program, demonstrating significant progress towards each of the three financial targets outlined for the three-year period ending December 31, 2026 |

Compensation Highlights

Consistent with our strong interest in shareholder engagement and our pay-for-performance approach, the Compensation and Talent Development Committee of our Board (Compensation Committee) has continued to refine our executive compensation program to encourage alignment between the interests of our executives and shareholders. Shareholders have shown strong support for our executive compensation program, with 96% of shareholders represented at our 2024 Annual Meeting of Shareholders voting in favor of it. |

|

We pay for performance | |||

| 60% 60% of CEO’s target equity compensation package is performance-based |

| 60% 60% of other Named Executive Officers’ target equity compensation package is performance-based |

The Merit Medical Systems, Inc. 2018 Long-Term Incentive Plan, as amended (2018 Incentive Plan), provides for the issuance of up to 9,100,000 shares of our Common Stock. Awards granted under the 2018 Incentive Plan generally have minimum vesting periods of not less than one year.

During 2020, we began a program of awarding performance-based restricted stock units under the provisions of the 2018 Incentive Plan, which ties a significant portion of executive equity compensation to the achievement of operating cash flow metrics, adjusted for the performance of our stock relative to the Russell 2000 market index. These performance-based restricted stock units generally have a three-year performance period.

We ask that our shareholders approve, on an advisory basis, the compensation of our Named Executive Officers (NEOs). For additional information regarding our executive compensation practices, see “Compensation Discussion and Analysis” in this Proxy Statement.

4 | Understand. Innovate. Deliver.TM

CORPORATE GOVERNANCE AND RELATED MATTERS

CORPORATE GOVERNANCE AND RELATED MATTERS

| Governance Highlights | ||

The Board believes good governance is integral to achieving long-term value and is committed to governance policies and practices that benefit the Company and our shareholders. This belief is manifest in: | |||

● Highly independent Board – Nine of our ten Directors are independent ● Under the direction of the Board’s Governance and Sustainability Committee (Governance Committee), continued Board refreshment practices ● Six new directors since 2020, increasing gender and racial diversity ● Added critical medical industry and operational oversight expertise ● Continued to provide direction and oversight of a multifaceted succession plan in preparation for the anticipated transition in CEO responsibilities ● Continued enhanced focus on oversight of enterprise risk management, led by the Board’s Finance Committee ● Enhanced Board oversight of cybersecurity risk management and sustainable business practices ● Provided oversight and guidance to the Company’s management in the development and pursuit of the objectives set forth in the CGI Program, resulting in achievement of the financial targets for the first year of the three-year program | ● Strengthened our governance practices through the consolidation of the Finance and Operating Committees ● Strong and active lead independent director ● Average Board tenure of independent directors is approximately five years ● Robust sequence of three-year Board assessment cycles focused on assessing and enhancing the effectiveness of the Board and its committees and members ● Regular executive sessions of independent directors ● Annual independent director evaluation of CEO ● Comprehensive code of ethics and corporate governance guidelines ● Majority voting for all directors ● Robust stock ownership guidelines for directors and CEO ● No shareholder rights plan (“poison pill”) or dual class capitalization structure ● Annual “say-on-pay” advisory votes | ||

www.merit.com | 5

CORPORATE GOVERNANCE AND RELATED MATTERS

PROPOSAL 1: Election of Four Nominees for Director | ||

The Board of Directors recommends that you vote FOR all four director nominees. These individuals bring a range of relevant experience and overall diversity of perspectives that is essential to good governance and leadership of our Company. | The Board recommends a |

|

At the Annual Meeting, shareholders will be asked to consider the nominations of four directors to serve until our 2028 Annual Meeting of Shareholders and until their successors are duly elected and qualified. If any of the below nominees becomes unavailable to serve, proxies solicited by this Proxy Statement will be voted for other persons designated by the Board in their stead.

Classification of Board of Directors

Our Second Amended and Restated Articles of Incorporation (Articles of Incorporation) provide for a classified, or “staggered,” board of directors. Our Board is divided into three classes, with directors in each class serving a three-year term. Our Fourth Amended and Restated Bylaws (Bylaws) provide that the number of directors serving in each class shall be as nearly equal in size as possible. Accordingly, approximately one-third of our directors’ terms expire at each annual meeting of shareholders. Based upon the existing classification of the Board, the terms of Thomas J. Gunderson, Laura S. Kaiser, Michael R. McDonnell and F. Ann Millner, Ed.D. are scheduled to expire in connection with our Annual Meeting. The Board has nominated each of Thomas J. Gunderson, Laura S. Kaiser, Michael R. McDonnell and F. Ann Millner, Ed.D. for election at the Annual Meeting to serve a new three-year term.

Size of the Board of Directors

Our Bylaws permit the Board to set the number of directors to a number not less than three and not more than eleven. In 2023, the Board adopted a resolution setting the number of directors at ten, which is the current number of directors.

6 | Understand. Innovate. Deliver.TM

CORPORATE GOVERNANCE AND RELATED MATTERS

Nominees for Election as Directors

Each of the following nominees currently serves as a director of the Company. Our Board and its Governance Committee believe that the nominees possess the experience and qualifications that directors of the Company should possess, and that the experience and qualifications of each nominee complement the experience and qualifications of the other directors. The experience and qualifications of each nominee, including information regarding the experience and qualifications that led the Board to conclude that she or he should be nominated to serve as a director of the Company, are set forth below:

THOMAS J. GUNDERSON Independent Director Age: 74 Director Since: May 2017 Committees: Finance (Chair), Audit Other Public Boards: TransMedics Group, Inc. Education: B.A. (biology focus), Carleton College; M.S. (cell biology), University of Minnesota; M.B.A., University of St. Thomas Term Expires: 2025 |

| LAURA S. KAISER Independent Director Age: 64 Director Since: May 2022 Committees: Governance, Compensation Other Public Boards: None Education: B.S. (health sciences management), University of Missouri; M.B.A., Saint Louis University; Masters of Health Administration, Saint Louis University Term Expires: 2025 |

| |

Career Highlights ● Member of the Board of Directors of TransMedics Group, Inc., a medical technology company focused on developing organ transplant therapy for end-stage organ failure patients, 2019 to present ● Chair of the Minneapolis Heart Institute Foundation, (Director from 2011 to present, Chair from 2015 to 2020 and 2024 to present) ● Executive in Residence at the University of Minnesota’s Medical Industry Leadership Institute, 2016 to present ● Member of American Heart Association Science and Technology Accelerator Committee, 2015 to 2017 ● Managing Director and senior research analyst at Piper Jaffray (focus on medical technology companies), 1992 to 2016 ● Project Director at American Medical Systems (private medical device company acquired by Pfizer in 1983), 1979 to 1992 ● Recognized by several industry publications, including the Wall Street Journal, Institutional Investor, First Call, Thomson Reuters, and Medical Device and Diagnostic Industry (e.g., in 1996 and 2000, he was named an All-Star Analyst for medical stocks by the Wall Street Journal and in 2014, Thomson-Reuters named him “Top Stock Picker” in the medical technology sector) Qualifications of Particular Relevance to Merit Mr. Gunderson provides the Board with more than 30 years of substantive experience in the medical device industry, with a seasoned perspective on the challenges, trends and opportunities of publicly-traded medical device manufacturers, as well as a keen understanding of the Company’s competitive position within its industry. Mr. Gunderson also contributes a strong background in financial and economic analysis and valuable insights regarding business development and acquisition opportunities. Mr. Gunderson’s financial background and industry experience have been beneficial in his service as the Chair of the Finance Committee. | Career Highlights ● President and Chief Executive Officer of SSM Health, an integrated multi-state health system with more than 40,000 employees and 35 hospitals, medical group, health plan and pharmacy benefit management company, 2017 to present ● Former Chairperson of Catholic Health Association of the United States, representing more than 600 hospitals and 1,600 long-term care and other health facilities in all 50 states, 2018 to 2024 ● Board Director, American Hospital Association, 2024 to present ● Served on the Board of Directors for Nuance Communications, a multinational computer technology company acquired by Microsoft Corp., 2017-2022 ● Previously served as the Chief Operating Officer of Intermountain Health, an integrated multi-state health system with 24 hospitals, 2012 to 2017 ● Named one of the “100 Most Influential People in Healthcare” by Modern Healthcare for the past seven years Qualifications of Particular Relevance to Merit Ms. Kaiser is a seasoned executive with more than 35 years of experience in the healthcare industry. The Board believes her senior leadership experience in healthcare and her consistent delivery of operational results, strategic expertise, market growth and innovative partnerships with organizations such as Costco, Medica, Civica and Siemens, enable her to provide valuable industry and organizational perspective to the Board and the Company’s management team. The Board also believes Ms. Kaiser’s deep industry experience allows her to provide insight regarding merger and acquisition opportunities and transactions, regulatory initiatives and compliance, and governmental policies. | |||

www.merit.com | 7

CORPORATE GOVERNANCE AND RELATED MATTERS

MICHAEL R. MCDONNELL Independent Director Age: 61 Director Since: May 2022 Committees: Audit, Finance Other Public Boards: None Education: B.S. (accounting), Georgetown University Term Expires: 2025 |

| F. ANN MILLNER, Ed.D. Lead Independent Director Age: 73 Director Since: July 2015 Committees: Governance, Compensation Other Public Boards: None Education: B.S. (education), University of Tennessee; M.S. (allied health education and management), Southwest Texas State University; Ed.D (education administration), Brigham Young University; Completed medical technology program, Vanderbilt University Term Expires: 2025 |

| |

Career Highlights ● Chief Financial Officer of Biogen Inc, a multinational Nasdaq-listed company engaged in discovering, developing, and delivering therapies for people living with serious and complex diseases, 2020 to February 28, 2025. ● Executive Vice President and Chief Financial Officer of IQVIA Holdings Inc., a global provider of advanced analytics, technology solutions and contract research services to the life sciences industry, 2015 to 2020 ● Executive Vice President and Chief Financial Officer of Intelsat, a global provider of satellite services, 2008-2015 ● Chief Operating Officer (2006-2008) and Chief Financial Officer (2004-2008) of MCG Capital Corporation, a publicly-held commercial finance company, 2004 to 2008 ● Chief Financial Officer of EchoStar Communications Corporation (dba Dish Network), a satellite television provider, 2000 to 2004 ● Partner of PricewaterhouseCoopers, LLP, 1996 to 2000, other positions, PricewaterhouseCoopers, LLP, 1986-1996 ● Director of Catalyst Health Solutions, Inc., a publicly-held pharmacy benefits management company, 2005 to 2012 ● Certified public accountant Qualifications of Particular Relevance to Merit Mr. McDonnell is a financial executive with more than 35 years of experience providing financial and accounting advice and oversight to life science and technology companies and over 24 years serving as a public company CFO. The Board believes Mr. McDonnell’s depth of understanding of financial management, accounting principles and practices, capital markets and financing transactions strengthen the Board’s oversight of the Company’s finance and accounting policies, procedures and practices. The Board also believes Mr. McDonnell’s industry experience enables him to contribute to the Board’s evaluation and oversight of merger and acquisition and capital funding transactions, as well as the Company’s investor relations and shareholder outreach efforts. | Career Highlights ● Regents Professor and Professor of Health Administrative Services at Weber State University, 2013 to present ● Member of the Utah State Senate (member of multiple committees and subcommittees), 2015 to present ● Executive Committee of National Conference of State Legislatures, 2023 to present ● Member of Board of Trustees of Intermountain Health (integrated multi-state health system), 2005 to present ● President of Weber State University, 2002 to 2012 (first female president of a Utah state university) ● Vice President of University Relations at Weber State University, 1993 to 2002 ● Associate Dean of Continuing Education and Assistant Vice President of Community Partnerships at Weber State University, 1985 to 1993 Qualifications of Particular Relevance to Merit The Board believes Dr. Millner's qualifications to serve as a director of the Company include her executive leadership skills and her experience in the areas of organizational administration, operations and financial management, and business strategy. Those skills and experience have been particularly valuable to the Company in the course of Dr. Millner’s service as Lead Independent Director. During her service, Dr. Millner has played a significant role in the development of our corporate governance practices and engagement with our shareholders. | |||

8 | Understand. Innovate. Deliver.TM

CORPORATE GOVERNANCE AND RELATED MATTERS

Directors Whose Terms of Office Continue

In its regular discussions regarding Board composition, our Governance Committee works with the Board to determine the appropriate mix of professional experience, areas of expertise, educational background and other qualifications that are particularly desirable for our directors to possess in light of our current and future business strategies.

The Board believes that its current members have the right combination of experience and qualifications to continue to lead the Company to success. Information regarding the specific experience, qualifications, attributes and skills that led the Board and the Governance Committee to conclude that each continuing director should serve on the Board are set forth below:

LONNY J. CARPENTER Independent Director Age: 63 Director Since: June 2020 Committees: Compensation (Chair), Finance Other Public Boards: Novanta Inc. Education: B.S., United States Military Academy at West Point Term Expires: 2026 |

| DAVID K. FLOYD Independent Director Age: 64 Director Since: June 2020 Committees: Governance (Chair), Finance Other Public Boards: None Education: B.S., Grace College Term Expires: 2026 |

| |

Career Highlights ● Member of the Board of Directors of Orchid Orthopedics Solutions (a privately-owned orthopedic medical device outsourcing company), 2019 to present ● Member of the Board of Directors of The Boler Company, (a privately-owned auto part manufacturing company), 2019 to present ● Member of the Board of Directors (Lead Independent Director) of Novanta Inc., a manufacturer of precision photonic and motion control components and subsystems, 2018 to 2024 ● Group President, Global Quality and Business Operations, Stryker Corporation, 2016 to 2019 ● Group President, Global Quality and Operations, Stryker Corporation, 2011 to 2016 ● President, Instruments and Medical Division, Stryker Corporation, 2006 to 2008 ● Captain in the U.S. Army and helicopter pilot having served in leadership roles for the 101st Airborne Division Qualifications of Particular Relevance to Merit The Board believes Mr. Carpenter’s broad business background and experience in setting enterprise-wide direction, experience in quality, manufacturing, procurement and logistics strategies from his tenure at Stryker provide the Board with practical, real-world knowledge and guidance and have strengthened the Company’s efficiency and cost-reduction initiatives. Mr. Carpenter’s business background and experience have been particularly beneficial to the Company in the course of his current leadership of the Compensation Committee, his leadership of the Operating Committee prior to its consolidation into the Finance Committee and the development of our CGI Program. | Career Highlights ● Board Chair, Corin Group LTD, a privately-held global orthopedic enabling technology company, 2020 to present ● Board member and Operations Committee Chair of Health Outcomes Performance Company (HoPCo), a privately-owned musculoskeletal and value-based care company focused on transforming the patient care experience and improving the practice of medicine, 2020 to present ● Senior Advisor, Permira, a leading global private equity investment firm ● Group President, Orthopaedics, Stryker Corporation, 2012 to 2019 ● U.S. President and Worldwide President of Johnson & Johnson’s DePuy Orthopaedics, 2007 to 2011 Qualifications of Particular Relevance to Merit Mr. Floyd possesses more than 35 years of experience as a leader in the life sciences industry, including serving as president and CEO within several leading medical technology companies. Additionally, the Board believes Mr. Floyd’s over 20 years of general management experience provide the Board with expertise on a broad range of matters, including mergers and acquisitions, strategic planning, global business and operations, corporate governance and product commercialization. The Board believes Mr. Floyd’s industry and management experience have been particularly beneficial through his service on the Governance, Finance and Operating Committees and his guidance in the Company’s development of our CGI Program. | |||

www.merit.com | 9

CORPORATE GOVERNANCE AND RELATED MATTERS

LYNNE N. WARD Independent Director Age: 66 Director Since: August 2019 Committees: Audit (Chair), Finance Other Public Boards: None Education: B.S. University of Utah (Accounting) Term Expires: 2026 |

| REAR ADMIRAL (RET.) STEPHEN C. EVANS Independent Director Age: 60 Director Since: June 2021 Committees: Audit, Compensation Other Public Boards: Alarm.com Holdings, Inc. Education: M.A., U.S. Naval War College (National Security Affairs), B.A., The Citadel Term Expires: 2027 |

| |

Career Highlights ● Executive Director of my529 (formerly known as the Utah Educational Savings Plan), offering municipal fund securities, 2004 to 2019. Underlying investments were with Vanguard, Dimensional, PIMCO, Sallie Mae Bank and U.S. Bank. ● Member of the University of Utah’s Investment Advisory Committee, 2018 to 2024 ● Member of the Board of Directors of the Blue Healthcare Bank, 2007 to 2009 ● Member of the Board of Directors of Stampin’ Up!, 2010 to 2016 ● Member of the National Association of Corporate Directors (Utah Chapter), 2017 to present ● Walker Institute at Weber State University board of directors, 2012 to 2021 ● Senior leader and advisor to Utah governors Olene S. Walker and Michael O. Leavitt ● Senior leader for Utah state government’s central accounting office and Utah State Auditor’s Office ● Certified public accountant Qualifications of Particular Relevance to Merit Ms. Ward demonstrated her diverse skills by leading my529’s rapid growth of $950 million to $14 billion assets under management. The Board believes her high standards, strategic foresight and business development fueled that growth. Her cost management, and investment and marketing innovations of a highly regulated product led to year-over-year Gold ratings from Morningstar. The Board believes Ms. Ward has strong career experience, including financial oversight capabilities and leadership of a rapidly growing organization. The Board believes her contributions strengthen the Company’s strategic direction while encouraging operational excellence. The Board also recognizes the valuable perspective and significant service Ms. Ward provides to the Company as Chair of the Audit Committee of the Board (Audit Committee). | Career Highlights ● Served in the United States Navy, most recently as Special Advisor to the Commander, Naval Operations, before retiring in 2020. During more than 20 years of service in the United States Navy, Admiral Evans held a variety of leadership positions, including Senior Advisor, Deputy U.S. Military, NATO Military Committee; Commander, George H. W. Bush Carrier Strike Group; and Commander, Naval Service Training Command ● Served on diplomatic missions in over 64 countries, delivering results in international diplomacy and military relations to establish enduring, productive global partnerships ● Commanded U.S. naval forces in six operational theaters ● Served in a senior strategic advisory role to the 75th Secretary of the Navy ● Represented the U.S. in deliberations and actions of NATO, providing counsel to Heads of State in Europe and around the world Qualifications of Particular Relevance to Merit Admiral Evans possesses extensive experience in handling complex, international relationships. His prior leadership experiences, particularly within the last two decades, involved extensive cybersecurity oversight, and he has broad experience in anticipating and identifying cyber risks and digital vulnerabilities. Admiral Evans’ cybersecurity experience is of particular importance to the Company as we seek to secure our information technology and build secure and effective information systems and to assess and mitigate potential cybersecurity risk. Admiral Evans has extensive insight on geo-political matters, and the Board believes that, together with his experience in handling global partnerships, he provides valuable counsel to the Company as it seeks to expand its operations and sales efforts across the globe. | |||

10 | Understand. Innovate. Deliver.TM

CORPORATE GOVERNANCE AND RELATED MATTERS

FRED P. LAMPROPOULOS Chair, President, Chief Executive Officer Age: 75 Director Since: July 1987 Other Public Boards: None Term Expires: 2027 |

| SILVIA M. PEREZ Independent Director Age: 58 Director Since: May 2024 Other Public Boards: None Committees: Audit, Governance Education: Pharmaceutical Chemist, University of the Republic (Uruguay); Industrial Pharmacist, Federal University of Parana (Brazil) Term Expires: 2027 |

| |

Career Highlights ● Chair of the Board, Chief Executive Officer (CEO) and President of the Company since its formation in 1987 ● Chair of the Board and President of Utah Medical Products, Inc. (medical device manufacturer), 1983 to 1987 ● Filed more than 300 domestic and international patents and applications on medical devices ● Serves on multiple community and advisory boards ● Recipient of numerous community and industry awards, including the 2019 Salt Lake Chamber of Commerce “Giant in our City” and 2003 and 2018 Utah Governor’s Medal for Science and Technology Qualifications of Particular Relevance to Merit The Board believes the Company benefits immensely from Mr. Lampropoulos’ experience as founder, President and CEO. He plays an essential role in communicating the expectations, advice, concerns and encouragement of the Board to our employees. Mr. Lampropoulos has a deep knowledge and understanding of the Company, as well as the industry and markets in which our products compete. Mr. Lampropoulos also performs an essential function as the Chair of the Board, providing decisive leadership and direction to the activities and deliberations of the Board. The Board also believes Mr. Lampropoulos’ leadership, drive and determination are significant factors in our growth and development and continue to be tremendous assets to the Company and its shareholders. | Career Highlights ● President of Commercial Branding and Transportation, a $2.6 billion revenue division of 3M Company, a multinational NYSE-listed company operating in the fields of industry, consumer goods and worker safety, 2023 to present ● President and General Manager of Commercial Solutions Division of 3M Company, an approximate $1.8 billion division, 2020 to 2023 ● Interim President of Acelity acquisition, overseeing the integration of Acelity into 3M Company, which was the largest acquisition in the history of 3M Company, 2019 to 2020 ● Various leadership roles within the healthcare business of 3M Company, both domestic and international, 1994 to 2019 ● Obtained Six Sigma Black Belt and Master Black Belt Certifications Qualifications of Particular Relevance to Merit Ms. Perez brings a 25-plus year career in the healthcare industry with a broad background spanning clinical, regulatory, operations, marketing, and business leadership. The Board believes her broad experience and proven track record of leadership success enable her to provide valuable industry and organizational perspective to the Board and the Company’s management team. The Board also believes Ms. Perez’s first-hand experience with post-acquisition business integration aids the Company in its strategic merger and acquisition endeavors. | |||

www.merit.com | 11

CORPORATE GOVERNANCE AND RELATED MATTERS

Our Board of Directors

Our business affairs are managed subject to the oversight of the Board, which represents and is accountable to the shareholders of the Company. The Board advises and oversees management, which is responsible for the day-to-day operations of the Company. The primary mission of the Board is to represent and protect the interests of our shareholders. As a result, the basic responsibility of our directors is to act in good faith and with due care so as to exercise their business judgment on an informed basis in what they reasonably and honestly believe to be in the best interests of the Company and its shareholders. The Board reviews and assesses our strategic, competitive and financial performance.

Board Structure

Chair of the Board

The Chair of the Board provides leadership to the Board and works with it to define its structure, agenda and activities in order to fulfill its responsibilities. The Chair works with senior management to help ensure that matters for which management is responsible are appropriately reported to the Board.

Fred P. Lampropoulos currently serves as the Chair of the Board, CEO and President of the Company. The Board and Governance Committee believe that the traditional practice of combining the roles of chair of the board and chief executive officer currently provides the preferred form of leadership for the Company. Given Mr. Lampropoulos’ vast experience since founding the Company in 1987, his role as an inventor and his involvement in filing of more than 300 patents and pending applications, the respect which he has earned from our employees, business partners, government and educational leaders and shareholders, and his proven leadership skills, the Board believes Mr. Lampropoulos’ continued service in both capacities serves the best interests of our Company and its shareholders. Further, the Board believes Mr. Lampropoulos’ fulfillment of both responsibilities encourages accountability and effective decision-making and provides strong leadership for employees and other stakeholders.

Independent Directors

Under our Corporate Governance Guidelines (Governance Guidelines), a majority of our directors should be independent directors who meet the director independence guidelines set forth in the Nasdaq Marketplace Rules. Among other things, each independent director should be free of significant business connections with competitors, suppliers, or customers of the Company.

In 2024, the Governance Committee undertook its annual review of director independence and recommended that the Board determine that Mr. Carpenter, Admiral Evans, Mr. Floyd, Mr. Gunderson, Ms. Kaiser, Mr. McDonnell, Dr. Millner, Ms. Perez and Ms. Ward each be designated as an independent director. Mr. Lampropoulos is not considered independent because of his employment as President and CEO of the Company.

12 | Understand. Innovate. Deliver.TM

CORPORATE GOVERNANCE AND RELATED MATTERS

Lead Independent Director

Since July 2021, Dr. Millner has served as the Lead Independent Director. The position of Lead Independent Director comes with clearly delineated and comprehensive duties, as set out in our Governance Guidelines. These duties include:

Board meetings and executive sessions | ● Authority to call meetings of the independent directors ● Presides at all meetings of the Board at which the Chair is not present, including executive sessions of the independent directors | |

Chair Liaison | ● Serves as principal liaison between the Chair and the independent directors | |

Agendas | ● Contributes to the development of and approves meeting agendas for the Board and information sent to the Board by the Chair, including supporting materials | |

Meeting Schedules | ● Approves meeting schedules for the Board and its committees to facilitate sufficient time for discussion of all agenda items | |

Communicating with Shareholders | ● Ensures availability for consultation and direct communication with major shareholders of the Company upon reasonable request |

Our independent directors regularly meet in executive session without the Chair present, at least once each quarter. During these sessions, the independent directors discuss topics such as executive (including the CEO) succession planning, corporate governance, business strategy and Board responsibilities.

Composition and Selection of Board Members

The Governance Committee is responsible for reviewing annually with the Board the desired skills and characteristics of directors, as well as the composition of the Board as a whole. Directors should be individuals who have succeeded in their particular field and who demonstrate integrity, reliability, knowledge of corporate affairs, and an ability to work well together. Directors should have:

| ● | demonstrated management ability at senior levels in successful organizations; |

| ● | current or recent employment in positions of significant responsibility and decision-making; |

| ● | expertise in leading rapidly growing multi-national organizations; or |

| ● | current and prior experience related to anticipated Board and committee responsibilities in other areas of importance to the Company. |

The Governance Committee reviews the skills and characteristics required of directors in the context of the current composition of the Board. There is currently no set of specific minimum qualifications that must be met by a nominee recommended by the Governance Committee, as different factors may assume greater or lesser significance at particular times and the needs of the Board may vary in light of its composition and the Governance Committee’s perceptions about future issues and needs. Additionally, in considering the composition of the Board and identifying nominees, the Governance Committee does not have a formal policy regarding the consideration of gender, race, sexual preference, religion and other traits typically associated with the term “diversity.”

However, the Governance Committee considers it important that the Board be composed of directors with a broad range of experience, areas of expertise and skills and considers several factors, including a candidate’s: diversity; gender; age; skills; integrity and moral responsibility; policy-making experience; ability to work constructively with our management and other directors; capacity to evaluate strategy and reach sound conclusions; availability of time to devote to the Board; and awareness of relevant social, political, and economic trends affecting the Company.

www.merit.com | 13

CORPORATE GOVERNANCE AND RELATED MATTERS

The Governance Committee uses a variety of methods for identifying and evaluating director nominees. The Governance Committee assesses the appropriate size of the Board, and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Governance Committee considers various potential candidates for director. Candidates may come to the attention of the Governance Committee through various means, including recommendations from current directors, third-party advisory firms, shareholders or other individuals.

Experience and Skills

The table below summarizes some of the relevant experience, qualifications and demographic information of each existing director. Although the Board believes each director provides the Company with extensive experience and skills which complement the experience and skills of other directors and are of great benefit to the Company and its shareholders, the following table identifies the core competencies of each director. The biographies above describe each director’s background in more detail.

Experience and Skills Matrix

Lonny J. | Stephen C. | David K. | Thomas J. | Laura S. | Fred P. | Michael R. | F. Ann | Silvia M. | Lynne N. | |

|---|---|---|---|---|---|---|---|---|---|---|

Board Tenure | 5 | 4 | 5 | 8 | 3 | 38 | 3 | 10 | 1 | 6 |

Age | 63 | 60 | 64 | 74 | 64 | 75 | 61 | 73 | 58 | 66 |

Leadership experience | ● | ● | ● | ● | ● | ● | ● | ● | ||

Financial transactions | ● | ● | ● | |||||||

Financial management | ● | ● | ● | ● | ● | |||||

Global strategic planning | ● | ● | ● | ● | ||||||

Medical device industry knowledge | ● | ● | ● | ● | ● | |||||

R&D innovation | ● | |||||||||

Marketing & sales | ● | ● | ||||||||

Operations | ● | ● | ● | |||||||

Governance & regulatory | ● | ● | ||||||||

Investor & stakeholder relations | ● | ● | ● | |||||||

Digital, data & analytics | ● | ● | ||||||||

IT systems & cybersecurity | ● | ● | ||||||||

Talent management & compensation | ● | ● |

14 | Understand. Innovate. Deliver.TM

CORPORATE GOVERNANCE AND RELATED MATTERS

Board Diversity

The Company is committed to diversity and inclusion, and believes it is important that the Board is composed of individuals representing the diversity of our communities. The Governance Committee seeks director nominees with a broad diversity of experience, professions, skills and backgrounds.

Shareholder Recommendations The Governance Committee considers properly submitted director-nominee recommendations from shareholders prior to the issuance of the proxy statement for the next annual meeting of shareholders. Materials provided by a shareholder in connection with such a recommendation are forwarded to the Governance Committee. In evaluating those recommendations, the Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board and to address the membership criteria described above. Any shareholder wishing to recommend a candidate for consideration by the Governance Committee should submit a recommendation in writing indicating the candidate’s qualifications and other relevant biographical information and provide confirmation of the candidate’s consent to serve as a director. |

| We want to hear from you | ||

Interested shareholders should send recommendations to: Merit Medical Systems, Inc. Attn: Brian G. Lloyd, 1600 West Merit Parkway South Jordan, Utah 84095 | ||||

Board and Committee Meetings and Responsibilities

In 2024, the Board met 10 times. Directors are expected to attend regular Board meetings, Board committee meetings and annual shareholder meetings. The independent directors met in executive session five times during 2024. As further described below, the Board has a standing Audit Committee, Compensation Committee, Governance Committee and Finance Committee. The Company believes each of the directors serving on the Audit, Compensation, Finance and Governance Committees is an “independent director” for purposes of the Nasdaq Marketplace Rules and that each of the directors serving on the Compensation Committee is a “non-employee director” for purposes of Rule 16b-3 of the Securities Exchange Act of 1934, as amended (Exchange Act). | ≥75% All directors attended at least 75% of the total number of meetings of the Board and of any committee on which he or she served. |

www.merit.com | 15

CORPORATE GOVERNANCE AND RELATED MATTERS

Audit Committee | ||

Members | Primary Responsibilities | # of |

Lynne N. Ward (Chair) Stephen C. Evans Thomas J. Gunderson Michael R. McDonnell Silvia M. Perez The Board has determined that Ms. Ward and Messrs. Gunderson and McDonnell are audit committee financial experts, as defined in Item 407(d) of Regulation S-K under the Exchange Act. | The Audit Committee meets to review and discuss our accounting practices and procedures and quarterly and annual financial statements with our management and independent public accountants. The Audit Committee assists the Board in fulfilling its responsibility for oversight of the quality and integrity of our accounting, auditing and reporting practices. The Audit Committee’s primary duties include oversight of: ● the Company's financial accounting, reporting and control processes; ● the performance, qualifications and independence of the Company’s independent registered auditor; ● the Company’s internal audit function; ● the Company’s compliance with legal and regulatory requirements; ● the risk management policies and practices of the Company in relation to the Committee’s responsibilities and duties, including cybersecurity risk management; and ● the preparation of disclosures required by the rules of the Securities and Exchange Commission (the SEC) to be included in the Company’s filings with the SEC. | 10 |

Compensation and Talent Development Committee | ||

Members | Primary Responsibilities | # of |

Lonny J. Carpenter (Chair) Stephen C. Evans Laura S. Kaiser F. Ann Millner, Ed. D. | The Compensation Committee is responsible for overseeing, reviewing and approving executive compensation and benefit programs of the Company, as well as the Company’s talent development and executive succession planning activities. Additional information regarding the functions, procedures and authority of the Compensation Committee is provided in the Compensation Discussion and Analysis beginning on page 34 below. The Compensation Committee Report appears on page 54 below. | 5 |

Governance and Sustainability Committee | ||

Members | Primary Responsibilities | # of |

David K. Floyd (Chair) Laura S. Kaiser F. Ann Millner, Ed. D. Silvia M. Perez | The Governance Committee is responsible for oversight of (i) the Company’s corporate governance practices, including the practices set forth in our Governance Guidelines and the Company’s director nomination process and procedures, (ii) the Company’s practices with respect to environmental sustainability and (iii) matters impacting the Company’s image and reputation and its standing as a responsible corporate citizen. The Governance Committee selects, evaluates and recommends to the full Board qualified candidates for election to the Board. | 7 |

16 | Understand. Innovate. Deliver.TM

CORPORATE GOVERNANCE AND RELATED MATTERS

Finance and Operating Committee | ||

Members | Primary Responsibilities | # of |

Thomas J. Gunderson (Chair) Lonny J. Carpenter David K. Floyd Michael R. McDonnell Lynne N. Ward | The Finance Committee assists the Board with oversight of the Company’s financial and operational management, including oversight of the Company’s financing and capital structure objectives and operating targets. The Finance Committee played a significant role in the development of our CGI Program and oversees progress towards the goals of such program. Additionally, the Finance Committee provides oversight regarding the following: ● the Company’s merger and acquisition strategy; ● the Company’s investment programs and practices, including international cash management; ● the Company’s strategic planning and activities; and ● the Company’s risk management activities, including our enterprise risk management program. | 8(1) |

| (1) | The eight meetings of the Finance Committee during 2024 are the sum of the following: (i) three meetings held separately by the Operating Committee prior to combination with the Finance Committee, (ii) two meetings held separately by the Finance Committee prior to combination with the Operating Committee, and (iii) three meetings of the Finance and Operating Committee following the combination of the Finance Committee and Operating Committee into a single committee. |

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is composed solely of the four independent directors listed above. No member of the Compensation Committee is a current or former officer or employee of the Company or any of its subsidiaries. During 2024, no member of the Compensation Committee had a relationship that must be described under the SEC rules relating to disclosure of related person transactions. In 2024, none of our executive officers served on the board of directors or compensation committee of any entity that had one or more of its executive officers serving on the Board or the Compensation Committee.

Board Evaluation

In 2022, the Governance Committee engaged an experienced independent governance advisor to develop and conduct a comprehensive Board evaluation process to assess the effectiveness of our Board, committees and members. The evaluation process aims to identify strengths and development opportunities with respect to our Board and its committees in the areas of Board oversight and duties, Board functioning and meetings and Board composition and culture.

The evaluation conducted in the first phase of the process was led by the Governance Committee and facilitated by the independent advisor to preserve the integrity of the process and anonymity of the feedback of the Company’s directors and senior executive officers who participated in the process. The evaluation facilitator met individually with each director and some of the Company’s senior executive officers to obtain and compile responses to the evaluation, which included feedback from directors on other directors, for review by the Governance Committee and the Board.

The Governance Committee reviewed the first-phase evaluation results with the evaluation process facilitator and coordinated an opportunity for the facilitator to present the general conclusions developed in the course of the evaluation to the Board. The Board reviewed and discussed the conclusions presented by the facilitator and reviewed potential actions to be taken as a result of the evaluation. Subsequent to the completion of the evaluation, the Board has used the evaluation results to inform Board and committee composition and refreshment, including expansion and refinement of the attributes and experience criteria for Board membership and to address the evolving needs of the Company.

www.merit.com | 17

CORPORATE GOVERNANCE AND RELATED MATTERS

In the second phase of the evaluation process, the Governance Committee and the Board, in coordination with an external independent advisor, conducted a detailed review of the action items identified during the evaluation conducted in the first phase and a full-day Board effectiveness session facilitated by an independent external advisor in May 2023. In preparation for the session, the independent advisor conducted interviews with each of the directors, focused on Board effectiveness and executive succession planning. During the session, the advisor reviewed the interview findings, noting strengths and opportunities for further development, the directors (as an entire group and in sessions of the independent directors) discussed in detail the feedback provided by the advisor and the directors developed an action plan to address the objectives identified during the session, both with respect to the duties and responsibilities of the Board in general, as well as in preparation for the anticipated CEO succession transition.

At the end of 2023, the Governance Committee completed the third phase of the evaluation process by conducting a confidential internal assessment facilitated by the Company’s Corporate Secretary. Each director responded to a series of questions addressing the director’s assessment of the effectiveness of our Board, committees and members. The assessment questions were developed with the assistance of the independent advisor who conducted the evaluation in the first phase of the evaluation process and were designed to evaluate the actions taken by the Board, committees and members during the three-phase process. The Governance Committee reviewed the responses to the internal assessment and the Chair of the Governance Committee summarized the responses in a meeting of the Board. The Board and Governance Committee intend to use the assessment results in their continued efforts to identify opportunities for enhanced Board and committee effectiveness.

During 2024, the Governance Committee reviewed the results of the three-year evaluation process which the Board had commenced in 2022 and concluded that the process had been effective in enhancing the Board’s performance and effectiveness. Based on that conclusion, the Governance Committee entered into a new three-year Board evaluation process which is designed to be substantially similar to the process conducted during 2022-2024. In late 2024, the Governance Committee led the commencement of that process, which was facilitated by the independent governance advisor who had advised the Board during the initial three-year process. The independent advisor met individually with each director and some of the Company’s senior executive officers to obtain and compile responses to the evaluation, which included feedback from directors on other directors, for review by the Governance Committee and the Board. The Governance Committee reviewed the first-phase evaluation results with the independent advisor and coordinated an opportunity for the advisor to present those results and associated recommendations to all of the directors. The directors reviewed and discussed the results and recommendations presented by the facilitator and reviewed potential actions to be taken as a result of the evaluation. Under the direction of the Governance Committee, the Board intends to use the evaluation results to continue to identify opportunities where the Board and its committees can improve their performance and effectiveness, enhance the composition and expertise of the Board and encourage the Board and its committees to operate in accordance with our Governance Guidelines and committee charters.

Risk Management

The Board is involved in assessing and managing risks that could affect the Company. One of the roles of the Board is to periodically assess the processes used by management with respect to risk assessment and risk management, including identification by management of the principal risks of our business, and the implementation by management of appropriate systems to deal with such risks. The Board fulfills these responsibilities either directly, through delegation to committees of the Board, or, as appropriate, through delegation to individual directors.

The Board has delegated risk management oversight responsibilities to the Finance Committee. However, oversight of particular risks has been further delegated to the applicable standing committee(s) of the Board. The Audit Committee is generally responsible for oversight of risks relating to the quality and integrity of our financial reports, the independence and qualifications of our independent registered public accounting firm, our compliance with disclosure and financial reporting requirements, evaluation and oversight of cybersecurity policies, practices and operating effectiveness and compliance with legal and regulatory requirements. At least annually, the Board and/or the Audit Committee is briefed by the Company’s Chief Information Officer and other members of the

18 | Understand. Innovate. Deliver.TM

CORPORATE GOVERNANCE AND RELATED MATTERS

Company’s management on information technology and cybersecurity risks and the Company’s efforts to mitigate those risks. The Audit Committee also meets regularly with the Company’s Chief Legal Officer, Chief Compliance Officer and other Company officers to review the Company’s compliance with legal and regulatory requirements. The Compensation Committee is generally responsible for oversight of risks such as those relating to executive employment policies, our compensation and benefits systems, including our executive compensation program, and human capital development. The Governance Committee is generally responsible for oversight of risks associated with the Company’s sustainability efforts, director and management succession and development and implementation of corporate governance principles, as well as risks addressed through the identification and recommendation of individuals qualified to become directors of the Company. The Finance Committee is generally responsible for oversight of risks relating to mergers and acquisitions, as well as capital raising activities and transactions. These committees exercise their oversight responsibilities through reports from and meetings with officers of the Company responsible for each of these risk areas, including our Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Chief Legal Officer, Chief of Accounting, Chief Compliance Officer, Chief Information Officer, Director of Internal Audit, Vice President of Enterprise Risk Management and Vice President, Environmental, Social and Governance. In such meetings, committee members discuss and analyze such risks, and, when necessary, consult with outside advisors.

Director Orientation and Continuing Education

New directors participate in an orientation program developed and overseen by our Governance Committee, which is conducted prior to or shortly after the director’s election or appointment. This orientation program includes presentations by other directors and members of the Company’s senior management and other employees with respect to finance, operations, governance, legal and compliance matters, regulatory issues, cybersecurity, industry developments and strategic planning. In recent years, our Governance Committee has led an enhancement of our director orientation program, including scheduled orientation sessions with members of the Company’s senior management and delivery of detailed orientation materials. In addition to the initial onboarding process, members of the Company’s senior management regularly provide ongoing orientation and training sessions at Board meetings, including presentations regarding business strategy, legal and regulatory compliance, information technology and cybersecurity, business development and governance. The information technology and cybersecurity training provided to the Board is an extension of the Company’s cybersecurity awareness program provided by the Company’s information technology department to Company employees worldwide. The Company’s employee cybersecurity awareness program includes regular training courses which are available throughout the Company and periodic updates targeted to individual departments, sites or regions as appropriate. The Company also encourages directors to obtain third-party continuing education on topics of relevance to the Company and its operations and provides to directors reimbursement of up to $5,000 of annual educational expenses.

Shareholder Engagement

We regularly communicate with many of our largest shareholders regarding our operations and financial results. Our shareholder engagement efforts have historically been directed by our Lead Independent Director, with support from the Chairs of our Governance and Compensation Committees, as well as members of our executive management team.

In recent years the scope of engagement between our directors and many of our shareholders has shifted from in-person meetings to video and electronic discussions, although we have maintained contact with several of our large shareholders, through financial conferences and investor presentations. Most of the input we received during 2024 with respect to the interests of our shareholders was provided by external advisors and focused on the development of corporate governance and executive compensation practices which are generally deemed favorable by sophisticated shareholders and their advisors. After considering that input, during 2024 our Board

www.merit.com | 19

CORPORATE GOVERNANCE AND RELATED MATTERS

and its Governance and Compensation Committees took a number of actions which we believe have strengthened our corporate governance and executive compensation practices. Those actions include:

| ● | Identified experience and skills which would enhance the Board’s ability to fulfill its duties and responsibilities and recruited and nominated an individual whom the Board believes has contributed that experience and the benefit of those skills; |

| ● | Reviewed and amended the Governance Guidelines to strengthen our corporate governance practices, particularly in facilitation of the consolidation of the Operating and Finance Committees into a single committee; Reviewed and considered enhancements to the Company’s Corporate Policy on Insider Trading (Insider Trading Policy); |

| ● | Continued to encourage and provide oversight of expanded sustainable business practices; |

| ● | Continued and refined the Company’s long-term equity programs designed to increase the alignment of our executive and senior management compensation with Company performance; and |

| ● | Enhanced oversight of the Company’s enterprise risk management practices, under the direction of the Finance Committee |

Our Board is committed to implementing governance, executive compensation and sustainability practices which will contribute to the long-term success of the Company. To fulfill that commitment, our Board, primarily through its Governance and Compensation Committees, will continue to seek opportunities to consult with major shareholders in appropriate situations. We anticipate Dr. Millner and other Board committee chairs will lead those efforts, with the support of members of our executive management and investor relations teams.

Shareholder Communication with the Board of Directors

The Board will receive communications from Company shareholders. All communications, except those related to shareholder proposals that are discussed below under the heading “Shareholder Proposals for Annual Meeting 2026,” must be sent to our Corporate Secretary (Brian G. Lloyd) at our principal executive offices at 1600 West Merit Parkway, South Jordan, UT 84095. Communications submitted to the Board (other than communications received through our ethics hotline, which are reviewed and addressed by the Audit Committee) are generally reported to our directors at the next regular meeting of the Board.

All directors of the Company are strongly encouraged to attend our Annual Meeting. All ten of the directors, then serving on the Board or nominated to serve on the Board, were present in person or through video conference at our 2024 annual meeting of shareholders.

Governance Guidelines and Code of Ethics

Corporate Governance Guidelines

Our Governance Guidelines set forth the responsibilities of our directors.

The Governance Guidelines include guidelines that, among other things, contemplate that directors will maintain minimum stock ownership with a value of at least five times the annual retainer received. The Governance Guidelines also require the CEO to maintain minimum stock ownership with a value of at least five times his or her annual base salary. Directors have five years from appointment to the Board to comply with the minimum stock ownership requirement. The Governance Committee provides oversight of the stock ownership guidelines and may allow waivers with respect to the stock ownership guidelines for directors and the CEO on a case-by-case basis. Based on its review of the stock ownership of the directors and CEO, in December 2024 the Governance

20 | Understand. Innovate. Deliver.TM

CORPORATE GOVERNANCE AND RELATED MATTERS

Committee determined that all current directors and the CEO are in compliance with the stock ownership guidelines set forth in the Governance Guidelines or are within their five-year transition periods.

Governance Materials The following materials relating to corporate governance are available via our website at: www.merit.com/investors/corporate-governance-leadership/ | |

● Code of Business Conduct and Ethics | ● Code of Ethics for CEO and Senior Financial Officers |

● Corporate Governance Guidelines | ● Compensation Committee Charter |

● Audit Committee Charter | ● Governance Committee Charter |

● Finance Committee Charter | |

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics (Code of Conduct) applies to our directors and employees, including our NEOs, and is supplemented by additional provisions applicable to our CEO and senior financial and accounting officers. All Company directors, officers and employees are required to act ethically at all times and in accordance with the principles and policies set forth in the Code of Conduct.

Among other principles and policies, the Code of Conduct finds a conflict of interest exists when a person’s private interest interferes with the interests of the Company. The Code of Conduct recognizes that a conflict of interest occurs when the Company enters into a transaction in which an employee, officer, or director, or someone related to or affiliated with an employee, officer, or director, has a significant personal interest. The Code of Conduct also recognizes that a conflict of interest arises when an employee, officer or director of the Company receives an improper benefit as a result of the person’s position with the Company. Our Governance Guidelines prohibit the Company from making or arranging personal loans to directors or executive officers of the Company.

The Code of Conduct obligates employees, officers and directors to promptly disclose conflicts of interest to a supervisor, management, or the Board. Any director who has a conflicting interest in a potential conflicting interest transaction may not participate in the review of that transaction by the Board. Any waiver of the Code of Conduct may be made only by the Board and is required to be promptly disclosed as required by law or the regulations of any exchange on which our securities are traded, including Nasdaq.

Merit Ethics Hotline

As contemplated by the Code of Conduct, we maintain an ethics hotline that enables our employees, vendors, customers, and shareholders, as well as other interested parties, to submit confidential and anonymous reports of suspected or actual violations of the Code of Conduct or other issues of concern to those parties. The Audit Committee regularly reviews all complaints we receive through the ethics hotline. |

| Merit Ethics Hotline | ||

Our ethics hotline may be accessed: ● by telephone at (844) 637-6753 ● online at merit.ethicspoint.com | ||||

Director Retirement Policy

In October 2017, we amended our Governance Guidelines to require that, upon reaching 75 years of age, each director of the Company must submit to the Board a letter of resignation to be effective at the next annual meeting of shareholders. The Board will generally accept such resignations unless the Governance Committee or

www.merit.com | 21

CORPORATE GOVERNANCE AND RELATED MATTERS

the Board determines to extend the director’s service through the expiration of his or her then-current term or nominate the director for another term.

In accordance with the provisions of the Governance Guidelines, upon reaching the age of 75 years, Fred P. Lampropoulos tendered to the Board his letter of resignation. Our Governance Committee and the Board considered Mr. Lampropoulos’s resignation and his contributions to the Company. Following such consideration, the Governance Committee recommended that the Board decline to accept Mr. Lampropoulos’s resignation and, acting on that recommendation, the Board declined to accept his resignation. The Board determined that, despite being beyond the retirement age set forth in our Governance Guidelines, Mr. Lampropoulos continued to provide significant contributions to our Board and the Company, and his unique perspective and extensive skills and experience continued to make him a valuable asset to the Board and the Company. Mr. Lampropoulos’s current term as a director is scheduled to expire in 2027.

Sustainability

Under the oversight of our Board and management team, we continue to make sustainability a key focus of our business. We have a cross-functional Corporate Sustainability Council that promotes achievement of long-term sustainability goals across our enterprise. These efforts have included proactive actions to address both risks and opportunities related to our sustainability program, as we strive for continued growth and profitability.

Most of our products are disposable medical devices and are generally discarded after a single use due primarily to the risks of exposing patients to bloodborne pathogens capable of transmitting disease or other potentially infectious materials. Additionally, repeated sterilization to address such risks is not possible because it may adversely affect the quality of the materials used in many of our products and result in the failure of our products to function properly if used in multiple medical procedures. Consequently, many of our used products will likely end up in a medical waste disposal facility at the end of their usefulness. We continually look for opportunities to deliver sustainable, long-term growth of our business. Our sustainability practices are an integral component of our business strategy.

We have identified our sustainability opportunities and have developed areas of focus where we believe we are positioned to make a positive impact. These include programs designed to reduce waste, improve efficiencies, reduce greenhouse gas emissions, and protect the environment.

22 | Understand. Innovate. Deliver.TM

CORPORATE GOVERNANCE AND RELATED MATTERS

Sustainability Governance Structure

Our formal sustainability governance structure is depicted below, and its elements guide the implementation of our sustainability program. The Governance Committee oversees our sustainability program, including regular reviews of our stated targets and commitments.

Governing Body: | Board of Directors | Corporate Sustainability Council | Enterprise Risk and Resilience | Sustainability Management |

Lead by: | Chair of the Board and Chair of Governance Committee | President and CEO | Vice President, Enterprise Risk Management | Vice President, Environmental, Social & Governance |

Organization Participants: | Directors, facilitated by the Governance Committee | Chief Operating Officer Chief Financial Officer Senior Vice Presidents of business functions Vice Presidents of business segments | Vice Presidents of business segments | Directors and Senior Managers responsible for functions related to specific sustainability management and goals |

Functions & Oversight: | Monitors the Company’s adherence to corporate governance policies, including the Governance Guidelines, oversight of the Company’s practices with respect to environmental sustainability, oversight of matters impacting the Company’s image and reputation and its standing as a responsible corporate citizen and other responsibilities required by applicable laws and regulations. | Oversees the sustainability program and enables business segment and functions to pursue and implement opportunities and practices that support the sustainability policy | Oversees enterprise risk management and opportunities to inform executive leadership and the Board of Directors on risk management efforts and provides a forum to review and guide enterprise sustainability initiatives and provide input on sustainability program execution. | Reviews progress to targets and opportunities for program enhancement and shares internal and external insights and best practices. |

Sustainability Reporting