.2

Devon & Coterra Transformative Merger February 2, 2026

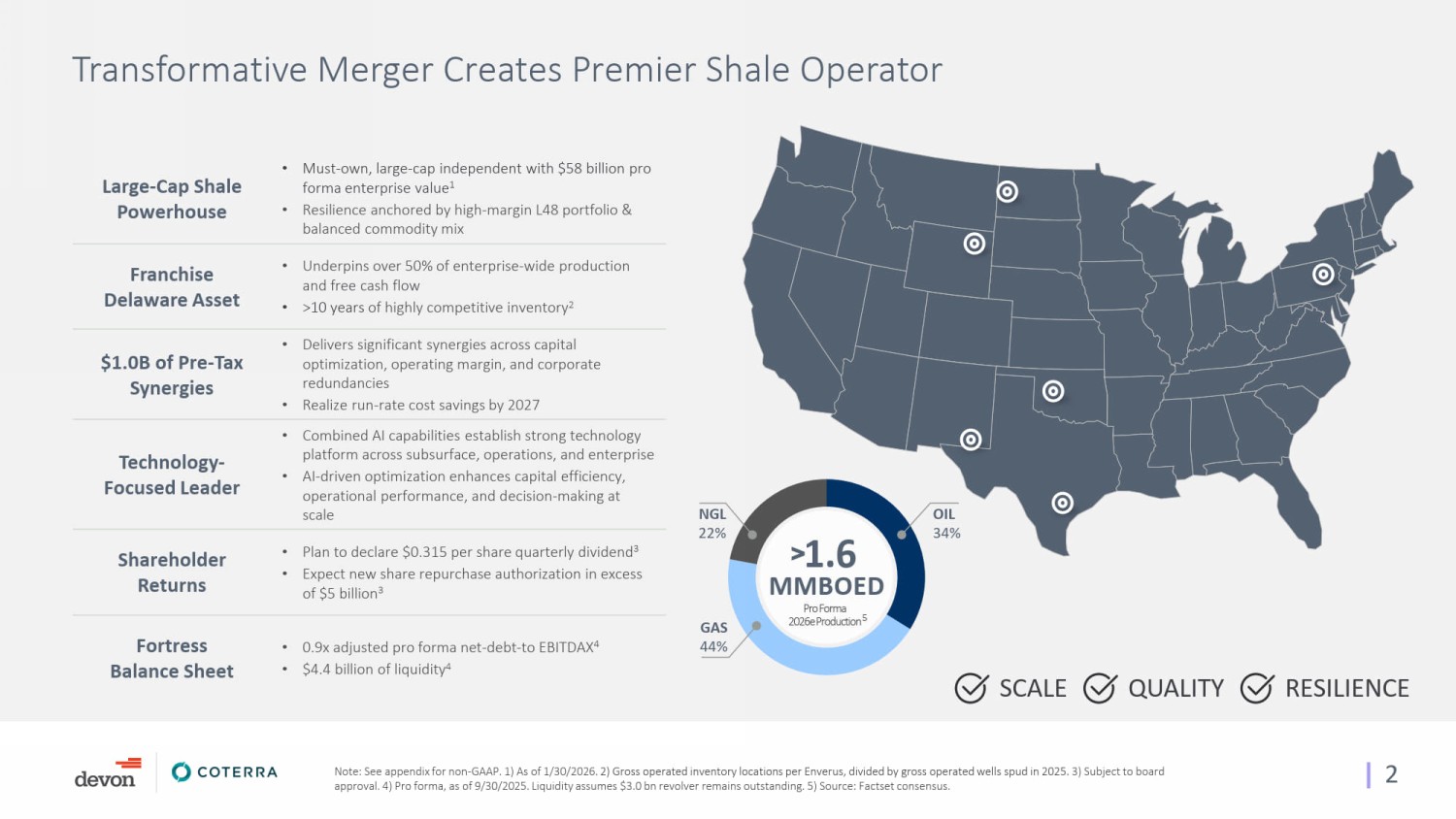

| 2 OIL 34% GAS 44% NGL 22% Pro Forma 2026e Production 1.6 > MMBOED Transformative Merger Creates Premier Shale Operator • Must - own, large - cap independent with $58 billion pro forma enterprise value 1 • Resilience anchored by high - margin L48 portfolio & balanced commodity mix Large - Cap Shale Powerhouse • Underpins over 50% of enterprise - wide production and free cash flow • >10 years of highly competitive inventory 2 Franchise Delaware Asset • Delivers significant synergies across capital optimization, operating margin, and corporate redundancies • Realize run - rate cost savings by 2027 $1.0B of Pre - Tax Synergies • Combined AI capabilities establish strong technology platform across subsurface, operations, and enterprise • AI - driven optimization enhances capital efficiency, operational performance, and decision - making at scale Technology - Focused Leader • Plan to declare $0.315 per share quarterly dividend 3 • Expect new share repurchase authorization in excess of $5 billion 3 Shareholder Returns • 0.9x adjusted pro forma net - debt - to EBITDAX 4 • $4.4 billion of liquidity 4 Fortress Balance Sheet SCALE QUALITY RESILIENCE Note: See appendix for non - GAAP. 1) As of 1/30/2026. 2) Gross operated inventory locations per Enverus, divided by gross operated wells spud in 2025. 3) Subject to board approval. 4 ) Pro forma, as of 9/30/2025. Liquidity assumes $3.0 bn revolver remains outstanding. 5) Source: Factset consensus. 5

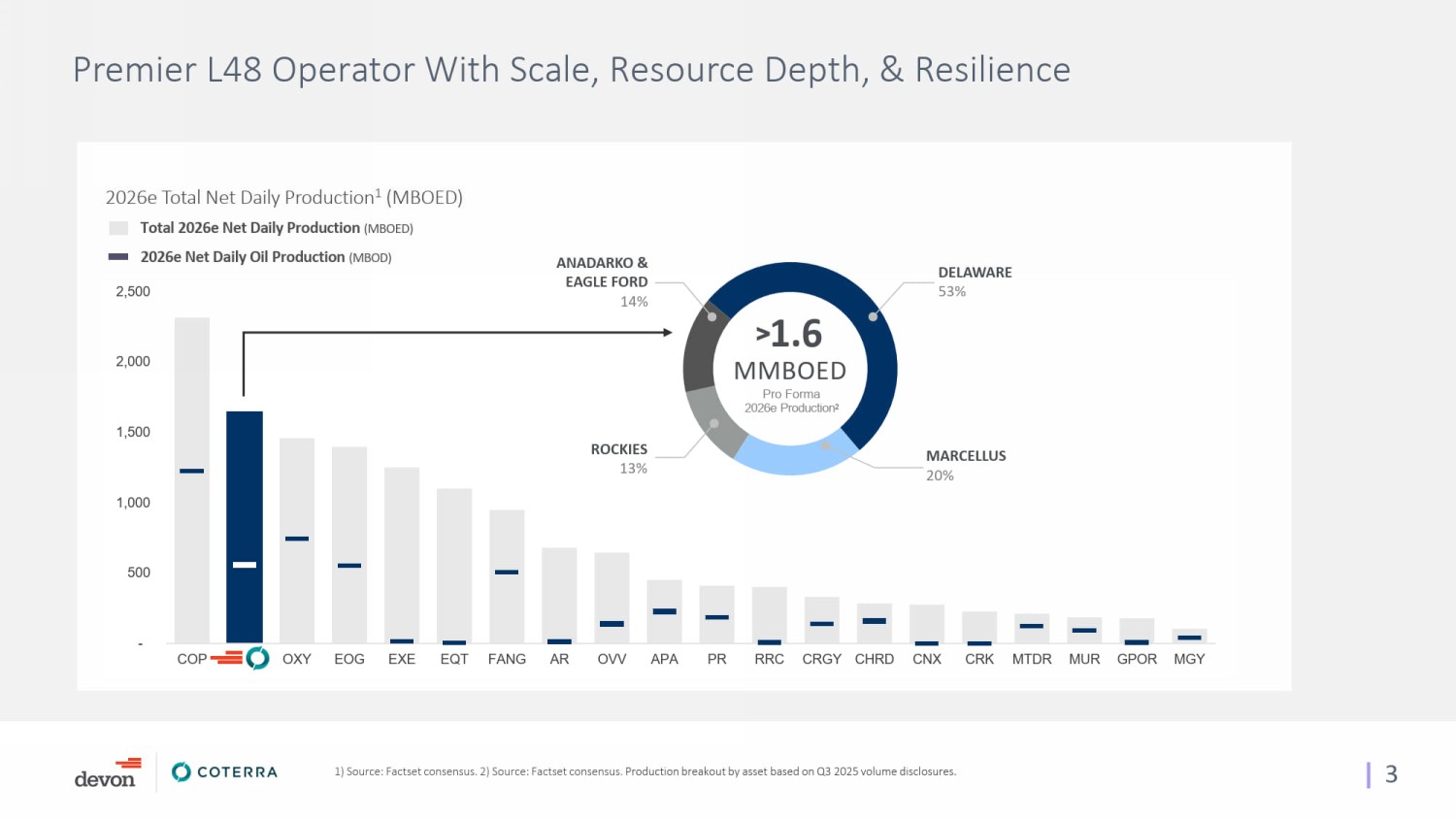

| 3 - 500 1,000 1,500 2,000 2,500 COP OXY EOG EXE EQT FANG AR OVV APA PR RRC CRGY CHRD CNX CRK MTDR MUR GPOR MGY Premier L48 Operator With Scale, Resource Depth, & Resilience 2026e Total Net Daily Production 1 (MBOED) 2026e Net Daily Oil Production (MBOD) Total 2026e Net Daily Production (MBOED) Pro Forma 2026e Production 2 DELAWARE 53% ROCKIES 13% ANADARKO & EAGLE FORD 14% 1.6 > MMBOED MARCELLUS 20% 1) Source: Factset consensus. 2) Source: Factset consensus. Production breakout by asset based on Q3 2025 volume disclosures.

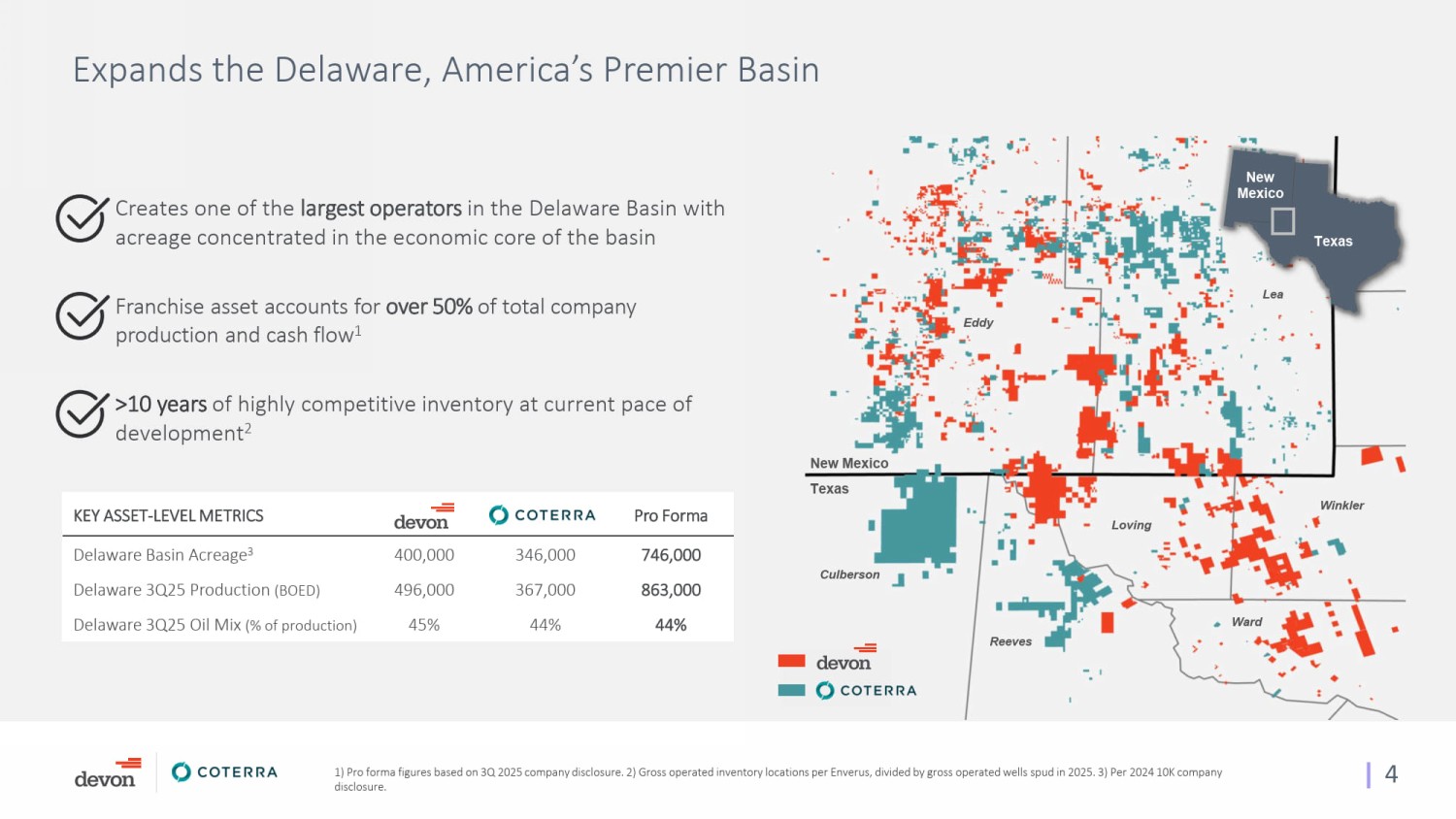

| 4 Expands the Delaware, America’s Premier Basin Creates one of the largest operators in the Delaware Basin with acreage concentrated in the economic core of the basin Franchise asset accounts for over 50% of total company production and cash flow 1 >10 years of highly competitive inventory at current pace of development 2 Pro Forma KEY ASSET - LEVEL METRICS 746,000 346,000 400,000 Delaware Basin Acreage 3 863,000 367,000 496,000 Delaware 3Q25 Production (BOED) 44% 44% 45% Delaware 3Q25 Oil Mix (% of production) Culberson Texas New Mexico Eddy Loving Reeves Lea Winkler Ward New Mexico Texas 1) Pro forma figures based on 3Q 2025 company disclosure. 2) Gross operated inventory locations per Enverus, divided by gross op erated wells spud in 2025. 3) Per 2024 10K company disclosure.

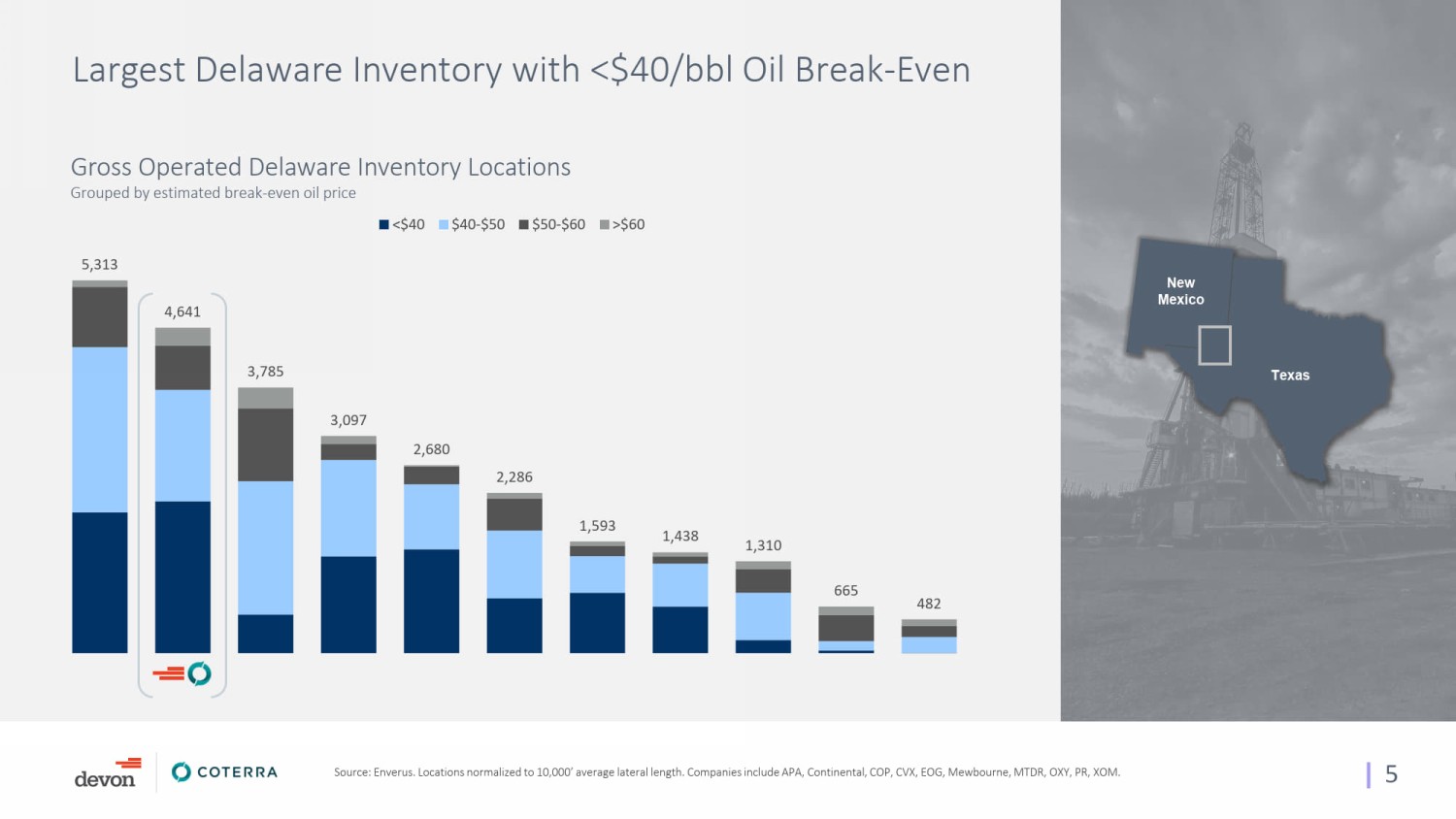

| 5 5,313 4,641 3,785 3,097 2,680 2,286 1,593 1,438 1,310 665 482 <$40 $40-$50 $50-$60 >$60 Largest Delaware Inventory with <$40/ bbl Oil Break - Even Gross Operated Delaware Inventory Locations Grouped by estimated break - even oil price Texas New Mexico Source: Enverus. Locations normalized to 10,000’ average lateral length. Companies include APA, Continental, COP, CVX, EOG, M ewb ourne, MTDR, OXY, PR, XOM.

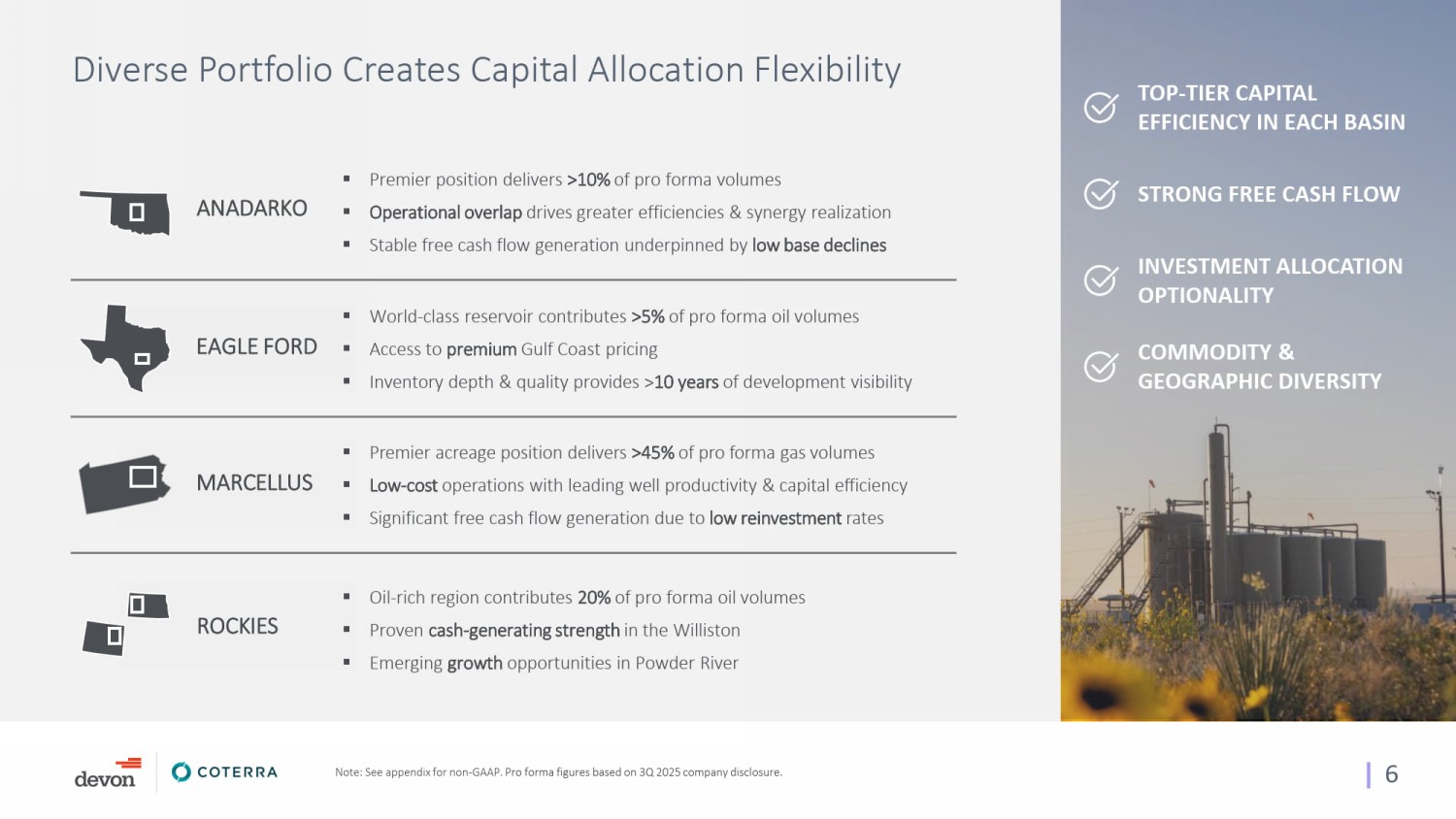

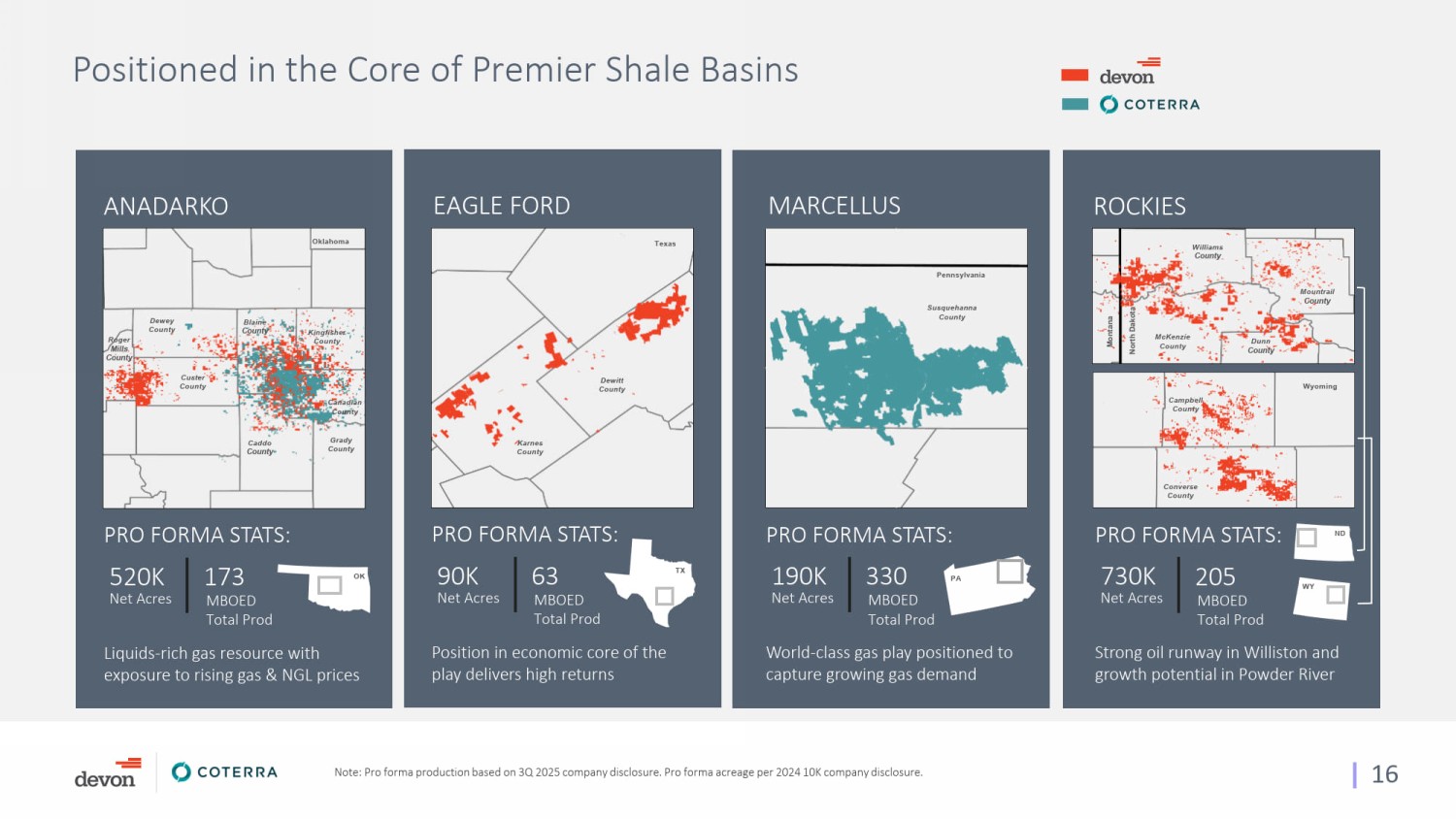

| 6 Diverse Portfolio Creates Capital Allocation Flexibility ▪ Premier position delivers > 10% of pro forma volumes ▪ Operational overlap drives greater efficiencies & synergy realization ▪ Stable free cash flow generation underpinned by low base declines ANADARKO EAGLE FORD ▪ World - class reservoir contributes >5 % of pro forma oil volumes ▪ Access to premium Gulf Coast pricing ▪ Inventory depth & quality provides > 10 years of development visibility MARCELLUS ▪ Premier acreage position delivers >45% of pro forma gas volumes ▪ Low - cost operations with leading well productivity & capital efficiency ▪ Significant free cash flow generation due to low reinvestment rates ROCKIES ▪ Oil - rich region contributes 20% of pro forma oil volumes ▪ Proven cash - generating strength in the Williston ▪ E merging growth opportunities in Powder River Note: See appendix for non - GAAP. P ro forma figures based on 3Q 2025 company disclosure. TOP - TIER CAPITAL EFFICIENCY IN EACH BASIN STRONG FREE CASH FLOW INVESTMENT ALLOCATION OPTIONALITY COMMODITY & GEOGRAPHIC DIVERSITY

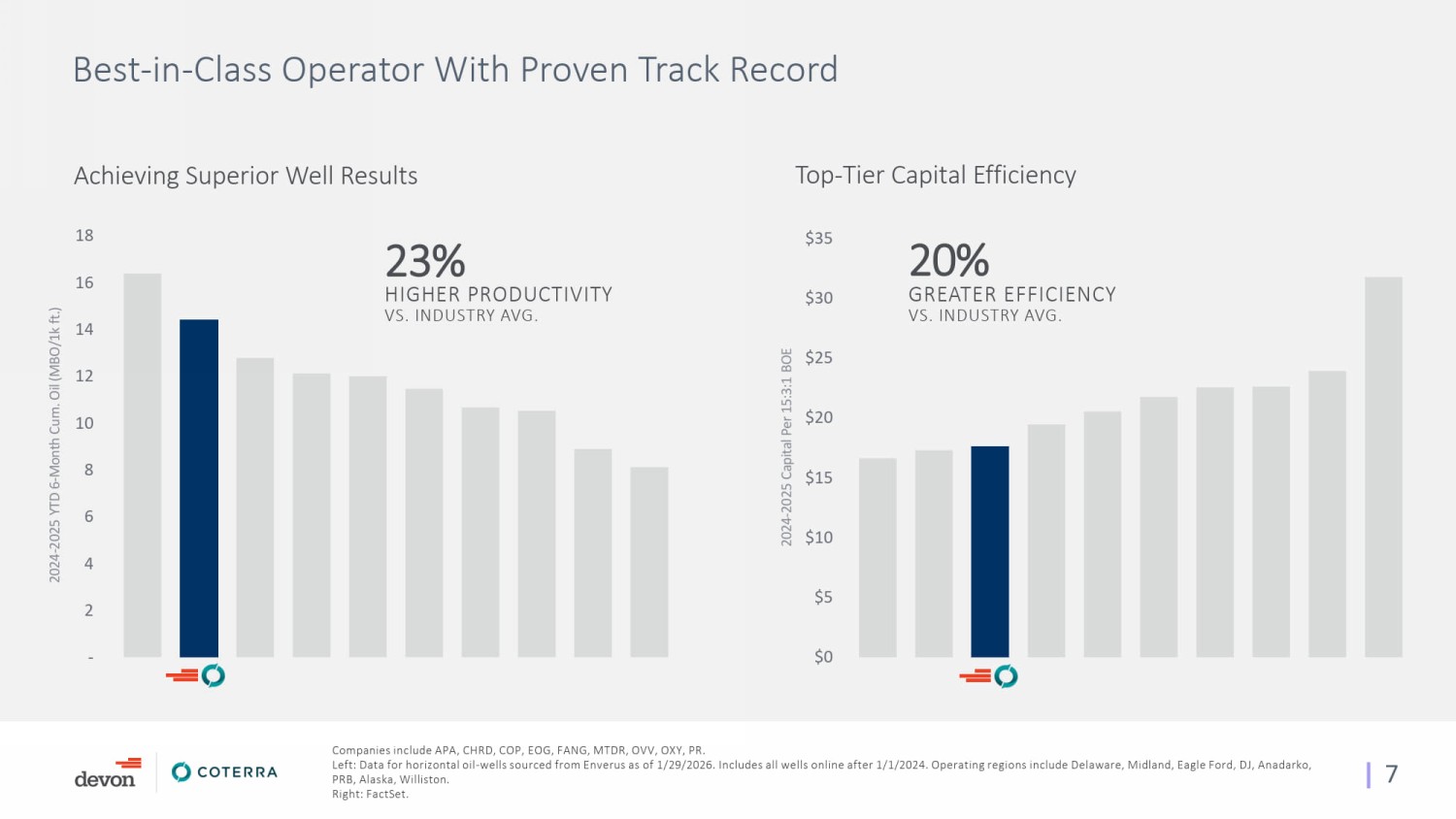

| 7 $0 $5 $10 $15 $20 $25 $30 $35 Top - Tier Capital Efficiency - 2 4 6 8 10 12 14 16 18 Best - in - Class Operator With Proven Track Record Achieving Superior Well Results Companies include APA, CHRD , COP, EOG , FANG, MTDR , OVV , OXY, PR. Left: Data for horizontal oil - wells sourced from Enverus as of 1/29/2026. Includes all wells online after 1/1/2024. Operating regions include Delaware, Midland, Eagle Ford, DJ, Anadarko, PRB , Alaska, Williston. Right: FactSet. HIGHER PRODUCTIVITY VS. INDUSTRY AVG. 23 % 2024 - 2025 YTD 6 - Month Cum. Oil (MBO/1k ft.) 2024 - 2025 Capital P er 15 :3:1 BOE GREATER EFFICIENCY VS. INDUSTRY AVG. 20 %

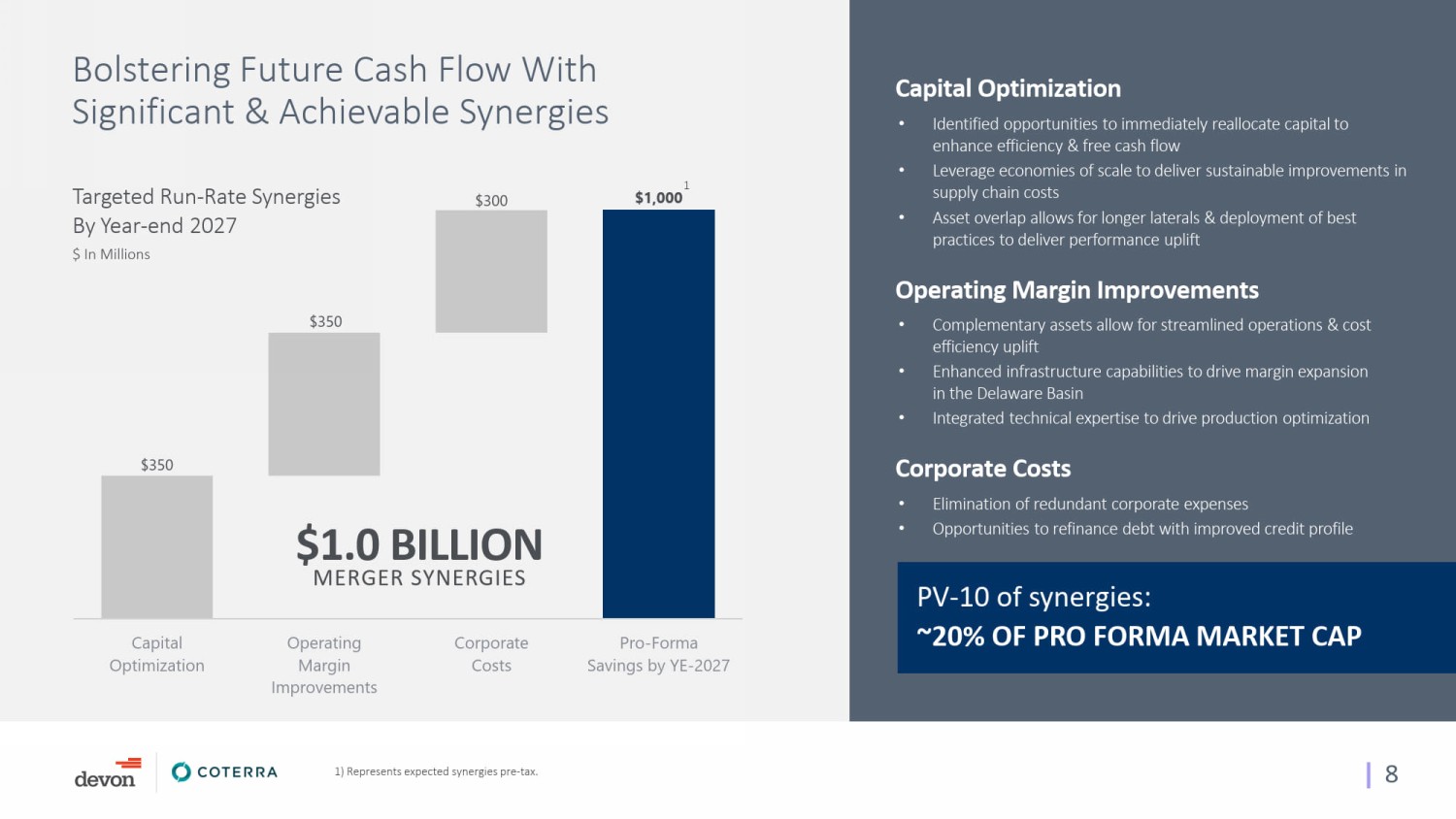

| 8 $1,000 $350 $350 $300 Capital Optimization Operating Margin Improvements Corporate Costs Pro-Forma Savings by YE-2027 Bolstering Future Cash Flow With Significant & Achievable Synergies Targeted Run - Rate Synergies By Year - end 2027 $ In Millions MERGER SYNERGIES $1.0 BILLION • Complementary asset s allow for streamlined operations & cost efficiency uplift • Enhanced infrastructure capabilities to drive margin expansion in the Delaware Basin • I ntegrated technical expertise to drive production optimization Operating Margin Improvements Corporate Costs • Elimination of redundant corporate expenses • Opportunities to refinance debt with improved credit profile Capital Optimization • Identified opportunities to immediately reallocate capital to enhance efficiency & free cash flow • Leverage economies of scale to deliver sustainable improvements in supply chain costs • Asset overlap allows for l onger laterals & deployment of best practices to deliver performance uplift 1) Represents expected synergies pre - tax. 1 PV - 10 of synergies: ~ 20% OF PRO FORMA MARKET CAP

| 9 Complementary Capabilities Establish Strong Technology Platform Building on a legacy of AI innovation | Together, a technology - driven powerhouse SUBSURFACE • AI systems integrate basin - wide data to predict well performance pre - drill • Quantifies geology, frac design, spacing, and other factors impacting well results • Optimized well spacing and frac design decisions Improve capital efficiency & economic returns PRODUCTION OPERATIONS • AI - enabled artificial lift optimizes production via automated well adjustments • Advanced analytics reduces downtime DRILLING & COMPLETIONS • Machine learning on real - time data drives improved drilling speeds and completions efficiency • AI agents targeting well designs, cycle time reductions, and vendor management Improving operational speed, costs, & consistency Maximize base production performance ENTERPRISE • Early adopters of internal AI platforms, resulting in productivity boost and improved decisions • Generative AI accesses data, automates workflows, and develops new solutions Drives better, faster decision - making

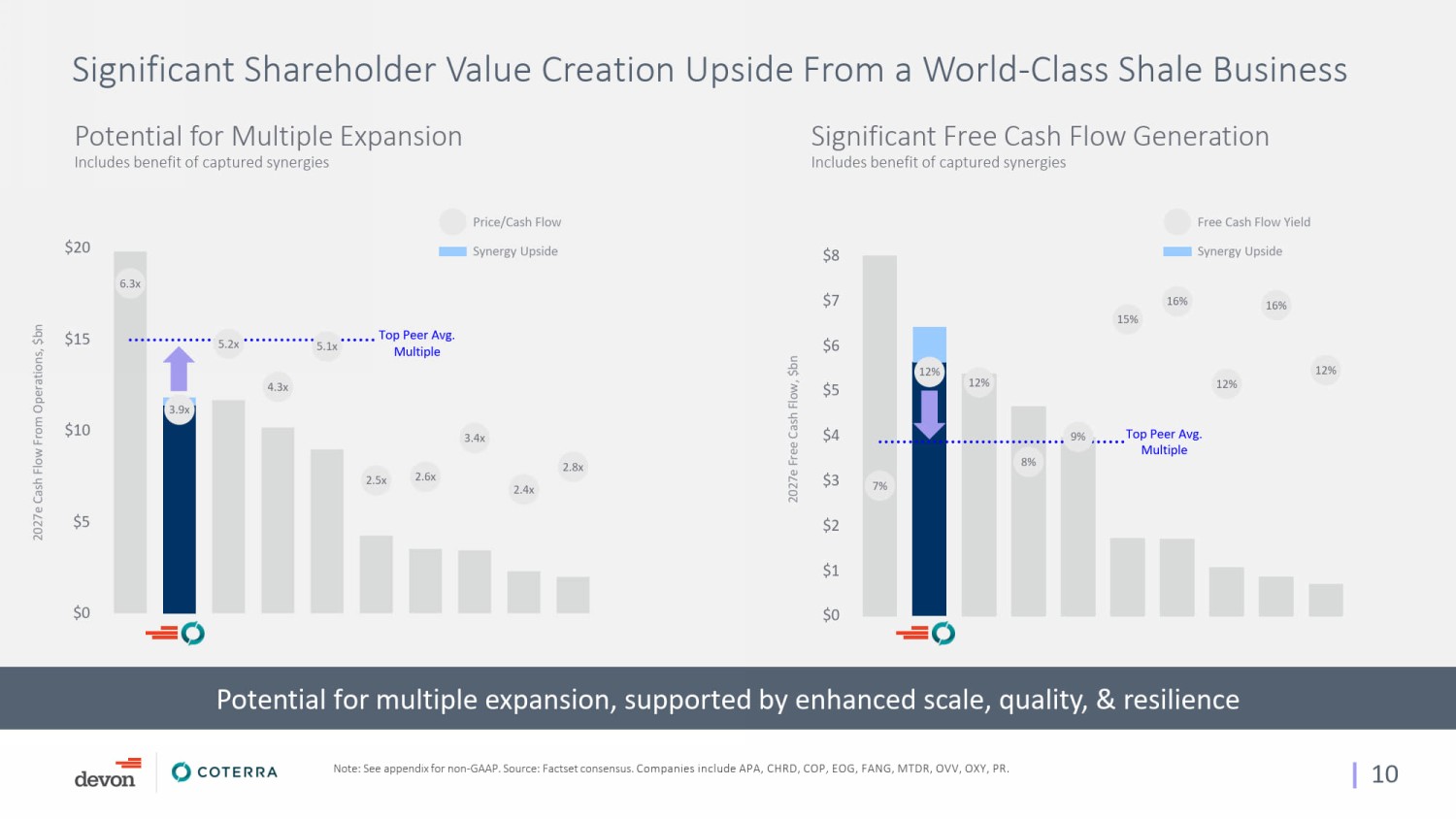

| 10 7% 12% 12% 8% 9% 15% 16% 12% 16% 12% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% $0 $1 $2 $3 $4 $5 $6 $7 $8 6.3x 3.9x 5.2x 4.3x 5.1x 2.5x 2.6x 3.4x 2.4x 2.8x 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x 7.0x $0 $5 $10 $15 $20 Significant Shareholder Value Creation Upside From a World - Class Shale Business Note: See appendix for non - GAAP. Source: Factset consensus. Companies include APA, CHRD, COP, EOG, FANG, MTDR, OVV, OXY, PR. Potential for Multiple Expansion Includes benefit of captured synergies Significant Free Cash Flow Generation Includes benefit of captured synergies Potential for multiple expansion, supported by enhanced scale, quality, & resilience 2027e Cash Flow From Operations, $bn 2027e Free Cash Flow, $bn Top Peer Avg. Multiple Price/Cash Flow Synergy Upside Free Cash Flow Yield Synergy Upside Top Peer Avg. Multiple

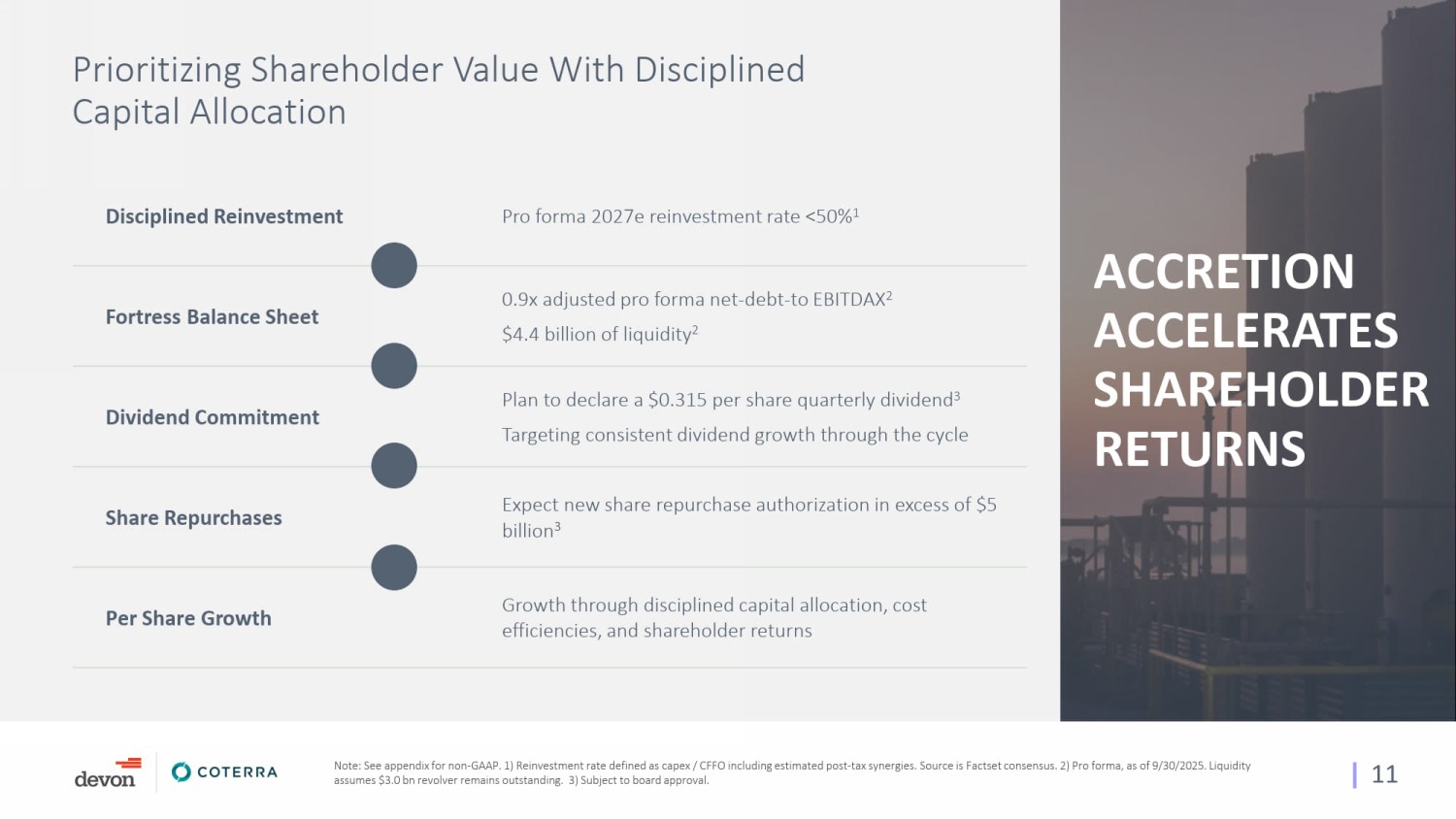

| 11 Prioritizing Shareholder Value With Disciplined Capital Allocation Note: See appendix for non - GAAP. 1) Reinvestment rate defined as capex / CFFO including estimated post - tax synergies. Source is Factset consensus. 2) Pro forma, as of 9/30/2025. Liquidity assumes $3.0 bn revolver remains outstanding. 3) Subject to board approval. ACCRETION ACCELERATES SHAREHOLDER RETURNS Pro forma 2027e reinvestment rate <50% 1 Disciplined Reinvestment 0.9x adjusted pro forma net - debt - to EBITDAX 2 $4.4 billion of liquidity 2 Fortress Balance Sheet Plan to declare a $0.315 per share quarterly dividend 3 Targeting consistent dividend growth through the cycle Dividend Commitment Expect new share repurchase authorization in excess of $5 billion 3 Share Repurchases Growth through disciplined capital allocation, cost efficiencies, and shareholder returns Per Share Growth

| 12 Scale, Quality, & Resilience Merger creates a must - own large - cap shale powerhouse | 12 Large - Cap Leader Asset Quality & Inventory Depth Technology - Focused Operator Disciplined Capital Allocation

Appendix

| 14 Transaction Overview • Transaction value: $58 billion (pro forma enterprise value 1 ) • All - stock combination • Exchange ratio: 0.70 share of Devon for each share of Coterra • Pro forma equity ownership: 54% Devon and 46% Coterra Transaction Structure • Clay Gaspar to serve as President and CEO • Tom Jorden to serve as Non - Executive Chairman of the Board • Executive leadership comprised of talent from both Devon and Coterra • Devon to appoint independent lead director • Board of Directors: 6 Devon and 5 Coterra • Headquarters in Houston with continued significant presence in Oklahoma City Leadership & Governance • Unanimously approved by Devon and Coterra Boards of Directors • Transaction subject to the approval of Devon and Coterra shareholders • Subject to regulatory approvals & other customary closing conditions • Expected closing in Q2 2026 Approvals & Timing 1) As of 1/30/2026.

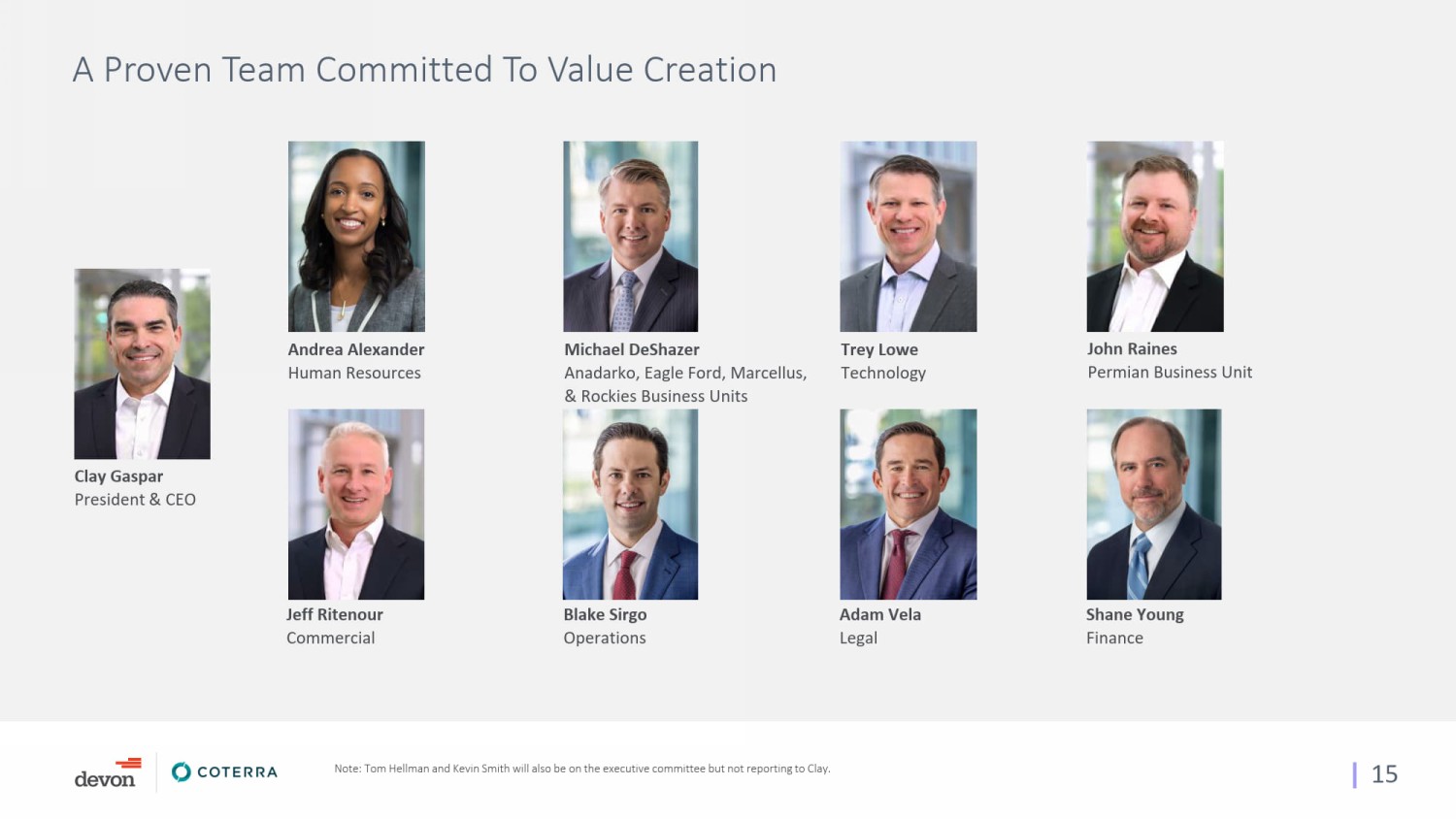

| 15 A Proven Team Committed To Value Creation Note: Tom Hellman and Kevin Smith will also be on the executive committee but not reporting to Clay. Andrea Alexander Human Resources Michael DeShazer Anadarko, Eagle Ford, Marcellus, & Rockies Business Units Trey Lowe Technology Jeff Ritenour Commercial Blake Sirgo Operations Adam Vela Legal John Raines Permian Business Unit Shane Young Finance Clay Gaspar President & CEO

| 16 MARCELLUS 190K Net Acres 330 MBOED Total Prod World - class gas play positioned to capture growing gas demand PRO FORMA STATS: Susquehanna County Pennsylvania ANADARKO 520K Net Acres 173 MBOED Total Prod Liquids - rich gas resource with exposure to rising gas & NGL prices PRO FORMA STATS: Caddo County Blaine County Kingfisher County Canadian County Custer County Roger Mills County Dewey County Grady County EAGLE FORD 90K Net Acres 63 MBOED Total Prod Position in economic core of the play delivers high returns PRO FORMA STATS: Karnes County Dewitt County Texas ROCKIES 730K Net Acres 205 MBOED Total Prod Strong oil runway in Williston and growth potential in Powder River PRO FORMA STATS: North Dakota Montana McKenzie County Williams County Dunn County Mountrail County Campbell County Converse County Positioned in the Core of Premier Shale Basins Note: Pro forma production based on 3Q 2025 company disclosure. Pro forma acreage per 2024 10K company disclosure. Oklahoma Wyoming TX OK PA ND WY

| 17 Investor Notices, Contacts, & Non - GAAP Investor Relations Contacts Additional Information and Where To Find It In connection with the proposed merger (the “Proposed Transaction”) of Devon Energy Corporation (“Devon”) and Coterra Energy Inc. (“ Coterra ”), Devon will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S - 4 to register the shares of Devon’s common stock to be is sued in connection with the Proposed Transaction. The registration statement will include a document that serves as a prospectus of Devon and a joint proxy statement of each o f D evon and Coterra (the “joint proxy statement/prospectus”), and each party will file other documents regarding the Proposed Transaction with the SEC. INVESTO RS AND SECURITY HOLDERS OF DEVON AND COTERRA ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS, INCLUDING ANY AMENDMENTS OR SUPPL EME NTS TO THOSE DOCUMENTS, AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVA ILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT DEVON, COTERRA, THE PROPOSED TRANSACTION AND RELATED MATTERS. A definitive joint proxy st ate ment/prospectus will be sent to stockholders of each of Devon and Coterra when it becomes available. Investors and security holders will be able to obtain copies of the registration statement and th e joint proxy statement/prospectus and other documents containing important information about Devon and Coterra free of charge from the SEC’s website when it becomes available. The documents filed by Devon with the SEC may be obtained free of charge at Devon’s website at investors.devonenergy.com or at th e S EC’s website at www.sec.gov. These documents may also be obtained free of charge from Devon by requesting them by mail at Devon, Attn. Investor Relations, 333 West Sheridan Ave, Oklahoma City, OK 73102. The documents filed by Coterra with the SEC may be obtained free of charge at Coterra’s website at investors.coterra.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Coterra by requesting them by mail at Coterra , Attn: Investor Relations, Three Memorial City Plaza, 840 Gessner Road, Suite 1400, Houston, Texas 77024. Participants in the Solicitation Devon, Coterra and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Devon’s and Coterra’s stockholders with respect to the Proposed Transaction. Information about Devon’s directors and executive officers is availab le in Devon’s Annual Report on Form 10 - K for the 2024 fiscal year filed with the SEC on February 19, 2025 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0001090012/000095017025022844/dvn - 20241231.htm), and its definitive proxy statem ent for the 2025 annual meeting of shareholders filed with the SEC on April 23, 2025 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/000 1090012/000110465925037545/tm252204 - 6_def14a.htm). Information about Coterra’s directors and executive officers is available in Coterra’s Annual Report on Form 10 - K for the 2024 fiscal year filed with the SEC on February 25, 2025 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000858470/000085847025000075/cog - 2 0241231.htm), and its definitive proxy statement for the 2025 annual meeting of shareholders filed with the SEC on March 20, 2025 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000858470/000110465925026126/tm2429648 - 2_def14a.htm). Other information regard ing the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained i n t he registration statement, the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Proposed Transaction when they becom e a vailable. Stockholders, potential investors and other readers should read the joint proxy statement/prospectus carefully when it becomes available before making any voting o r i nvestment decisions. No Offer or Solicitation This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or th e s olicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale wo uld be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the r equ irements of Section 10 of the Securities Act of 1933, as amended. Use of Non - GAAP Information This presentation includes non - GAAP (generally accepted accounting principles) financial measures. Such non - GAAP measures are not alternatives to GAAP measures, and you should not consider these non - GAAP measures in isolation or as a substitute for analysis of Devon's or Coterra's results as reported under GAAP. For additional disclosure regarding such non - GAAP measures, including reconciliations to their most directly comparable GAAP measure, please refer to Devon's and Coterra's public filings with the SEC. Although this presentation contains certain forward looking non - GAAP measures, it is not practicable to reconcile, without unreasonable efforts, these forward - looking measures to the most comparable GAAP measures. Chris Carr Investor Relations Director 405 - 228 - 2496 Wade Browne Investor Relations 405 - 228 - 7240 investor.relations@dvn.com Daniel Guffey Vice President – Finance, IR, and Treasurer 281 - 589 - 4875 Hannah Stuckey Investor Relations Director 281 - 589 - 4983 ir@coterra.com

| 18 Forward - Looking Statements This communication includes “forward - looking statements” as defined by the SEC. Such statements include those concerning strate gic plans, Devon’s and Coterra’s expectations and objectives for future operations, as well as other future events or conditions, and are often identified by use of the words and phrases such as “expects,” “believes,” “will,” “would,” “could,” “continue,” “may,” “ai ms,” “likely to be,” “intends,” “forecasts,” “projections,” “estimates,” “plans,” “expectations,” “targets,” “opportunities,” “p otential,” “anticipates,” “outlook” and other similar terminology. All statements, other than statements of historical facts, included in this communication that address activities, events or developments that Devon or Coterra expects, believes or anticipates will or may occur in the future are forward - looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, man y of which are beyond Devon’s and Coterra’s control. Consequently, actual future results could differ materially and adversely from Devon’s and Coterra’s expectations due to a number of factors, including, but not limited to, those, identified below. With respect to the Proposed Transaction between Devon and Coterra , these factors could include, but are not limited to: the risk that Devon or Coterra may be unable to obtain governmental and regulatory approvals required for the Proposed Transaction, or that required governmental and regulatory approvals may delay the Proposed Transaction or result in the imposition of conditions t hat could reduce the anticipated benefits from the Proposed Transaction or cause the parties to abandon the Proposed Transaction; t he risk that a condition to closing of the Proposed Transaction may not be satisfied; the length of time necessary to consummate the Pro posed Transaction, which may be longer than anticipated for various reasons; the risk that the businesses will not be integra ted successfully; the risk that the cost savings, synergies and growth from the Proposed Transaction may not be fully realized or ma y take longer to realize than expected; the diversion of management time on transaction - related issues; the effect of future reg ulatory or legislative actions on the companies or the industries in which they operate; the risk that the credit ratings of the combine d c ompany or its subsidiaries may be different from what the companies expect; potential liability resulting from pending or fut ure litigation; changes in the general economic environment, or social or political conditions, that could affect the businesses; the potenti al impact of the announcement or consummation of the Proposed Transaction on relationships with customers, suppliers, competitor s, business partners, management and other employees; the ability to hire and retain key personnel; reliance on and integration of inform ati on technology systems; the risks associated with assumptions the parties make in connection with the parties’ critical accoun tin g estimates and legal proceedings; the volatility of oil, gas and natural gas liquids (NGL) prices, including from changes in trade relat ion s and policies, such as the imposition of tariffs by the U.S., China or other countries; uncertainties inherent in estimating oi l, gas and NGL reserves; the uncertainties, costs and risks involved in Devon’s and Coterra’s operations; natural disasters and epidemics; counterparty credit risks; risks relating to Devon’s and Coterra’s indebtedness; risks related to Devon’s and Coterra’s hedging activities; risks related to Devon’s and Coterra’s environmental, social and governance initiatives; claims, audits and other proceedings impacting the business of Devon or Coterra , including with respect to historic and legacy operations; governmental interventions in energy markets; competition for assets, materials, people and capital, which can be exacerbated by supply chain disruptions, including as a r esu lt of tariffs or other changes in trade policy; regulatory restrictions, compliance costs and other risks relating to governm ent al regulation, including with respect to federal lands, environmental matters and water disposal; cybersecurity risks; risks associated with ar tificial intelligence and other emerging technologies; Devon’s and Coterra’s limited control over third parties who operate some of their respective oil and gas properties and investments; midstream capacity constraints and potential interruptions in production, inc luding from limits to the build out of midstream infrastructure; the extent to which insurance covers any losses Devon or Coterra may experience; risks related to shareholder activism; general domestic and international economic and political conditions; the imp act of a prolonged federal, state or local government shutdown and threats not to increase the federal government’s debt limi t; as well as changes in tax, environmental and other laws, including court rulings, applicable to Devon’s and Coterra’s respective businesses. Additional information concerning other risk factors is also contained in Devon’s and Coterra’s most recently filed Annual Reports on Form 10 - K, subsequent Quarterly Reports on Form 10 - Q, Current Reports on Form 8 - K and oth er SEC filings. Many of these risks, uncertainties and assumptions are beyond Devon’s or Coterra’s ability to control or predict. Because of these risks, uncertainties and assumptions, you should not place undue reliance on t hese forward - looking statements. Nothing in this communication is intended, or is to be construed, as a profit forecast or to be interpreted to mean that earnings per share o f D evon or Coterra for the current or any future financial years or those of the combined company, will necessarily match or exceed the historic al published earnings per share of Devon or Coterra , as applicable. Neither Devon nor Coterra gives any assurance (1) that either Devon or Coterra will achieve their expectations, or (2) concerning any result or the timing thereof, in each case, with respect to the Propos ed Transaction or any regulatory action, administrative proceedings, government investigations, litigation, warning letters, con sen t decree, cost reductions, business strategies, earnings or revenue trends or future financial results. All subsequent written and oral forward - looking statements concerning Devon, Coterra , the Proposed Transaction, the combined company or other matters and attributable to Devon or Coterra or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Devon and Coterra do not undertake, and expressly disclaim, any duty to update or revise their respective forward - looking statements based on new information, future events or otherwise.