Earnings Call Presentation – 4Q 2025 Fourth Quarter 2025 Earnings February 4, 2026

Earnings Call Presentation – 4Q 2025 Preliminary Matters 2 Cautionary Statements Regarding Forward-Looking Information This presentation may contain or incorporate by reference information that includes or is based on forward-looking statements within the meaning of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. We caution investors that these forward-looking statements are not guarantees of future performance, and actual results may differ materially. Such statements involve known and unknown risks, uncertainties, and other factors, including but not limited to: • changes in the frequency and severity of insurance claims; • claim development and the process of estimating claim reserves; • the impacts of inflation; • changes in interest rate environment; • supply chain disruption; • product demand and pricing; • effects of governmental and regulatory actions; • heightened competition; • litigation outcomes and trends; • investment risks; • cybersecurity risks or incidents; • impact of catastrophes; and • other risks and uncertainties detailed in Kemper’s Annual Report on Form 10-K and subsequent filings with the Securities and Exchange Commission (“SEC”). Kemper assumes no obligation to publicly correct or update any forward-looking statements as a result of events or developments subsequent to the date of this presentation. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures that the company believes are meaningful to investors. Non-GAAP financial measures have been reconciled to the most comparable GAAP financial measure.

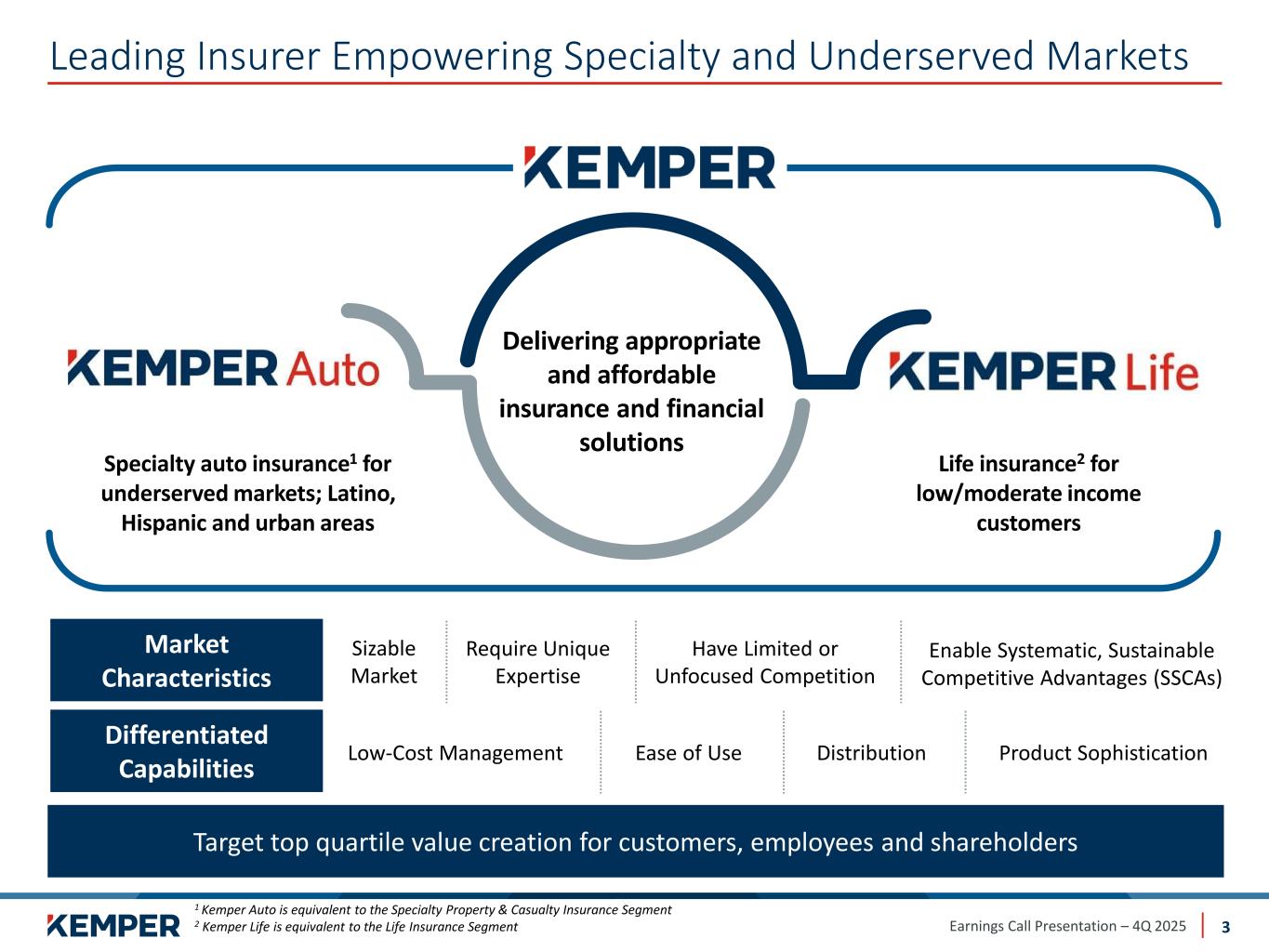

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 Target top quartile value creation for customers, employees and shareholders Leading Insurer Empowering Specialty and Underserved Markets 3 Distribution Have Limited or Unfocused Competition Require Unique Expertise Sizable Market Delivering appropriate and affordable insurance and financial solutions Specialty auto insurance1 for underserved markets; Latino, Hispanic and urban areas Life insurance2 for low/moderate income customers Market Characteristics Differentiated Capabilities Product SophisticationEase of UseLow-Cost Management Enable Systematic, Sustainable Competitive Advantages (SSCAs) 1 Kemper Auto is equivalent to the Specialty Property & Casualty Insurance Segment 2 Kemper Life is equivalent to the Life Insurance Segment

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 Quarter At a Glance 4 1 Results underperformed expectations driven by continued bodily injury severity and several infrequent items 2 Filed for rate and implemented non-rate actions to restore profitability 3 Implementing efficiency initiatives to reduce costs, optimizing organizational structure, and enhancing claims management processes 4 Piloted new auto products to drive growth 5 Maintaining balance sheet flexibility to support organic growth

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 5 ✓ Launched CEO search led by the Board and assisted by an executive search firm ✓ Implemented leadership changes in claims and technology to strengthen execution and accountability Leadership Changes Taking Actions to Improve Profitability and Drive Value Focused on disciplined execution, operational excellence, and efficiency across the business Growth Initiatives ✓ Piloted new personal auto product in AZ and OR; filed product in FL and TX ✓ Made disciplined rate adjustments in FL, TX and AZ to improve competitiveness and drive new business ✓ Life business launched an updated product portfolio and expanded distribution of its liability offering Pricing and Underwriting Actions ✓ Filed for rate and took non-rate actions to address liability costs related to impacts of CA minimum limit increases ✓ Accelerated third-party claims evaluation and settlement process, improving end-to-end handling ✓ Enhanced customer and agent experience with launch of new digital acquisition and service capabilities Cost Actions ✓ Implemented restructuring program – cumulative run-rate savings increased to $33 million ✓ Outlined efficiencies to support expansion plan in FL, TX and other regions with strong growth potential Capital Return ✓ Repurchased $50 million shares of common stock during the quarter, bringing 2025 total to ~$300 million ✓ Retired $450 million of debt in 2025

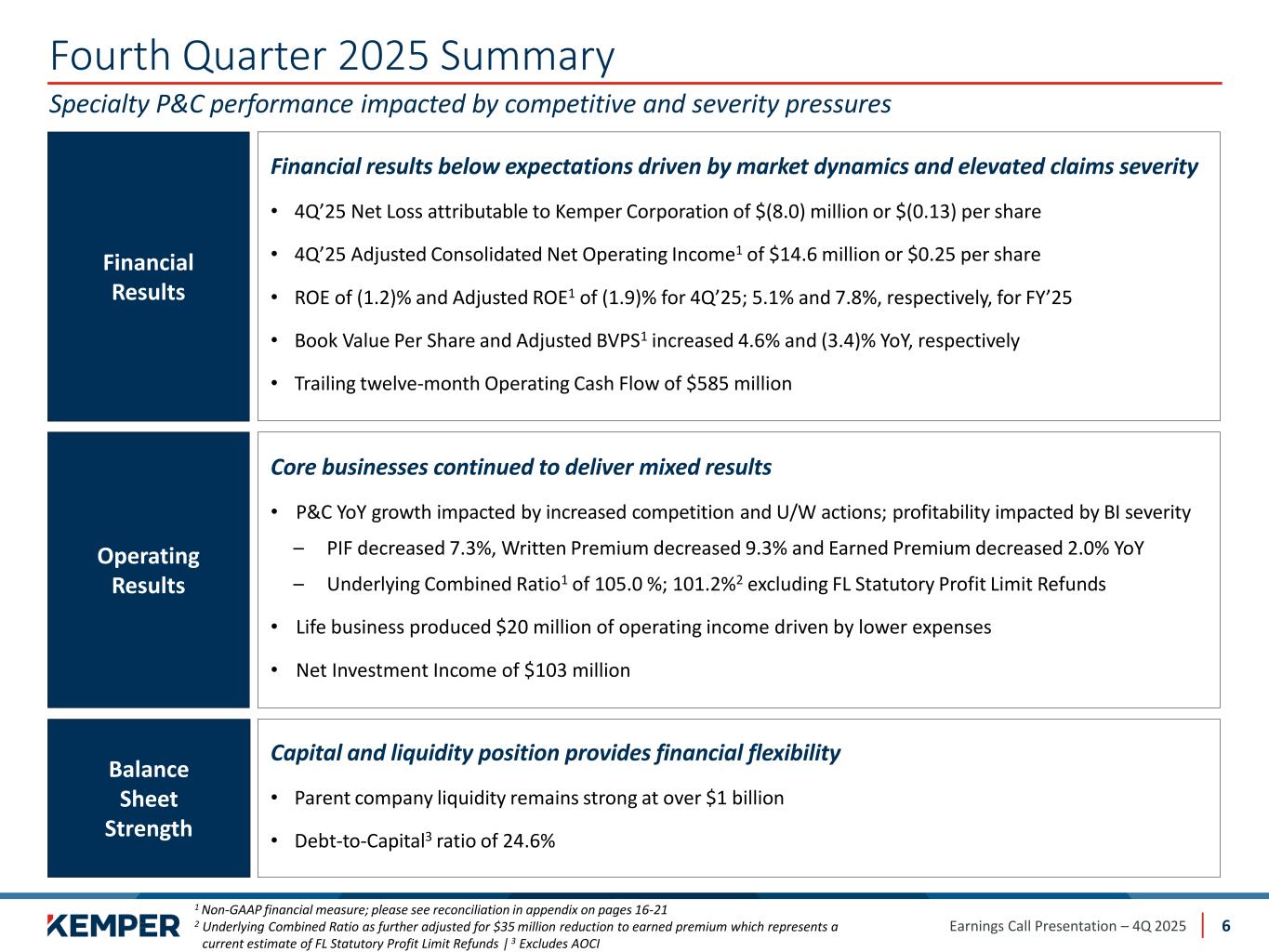

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 6 Core businesses continued to deliver mixed results • P&C YoY growth impacted by increased competition and U/W actions; profitability impacted by BI severity – PIF decreased 7.3%, Written Premium decreased 9.3% and Earned Premium decreased 2.0% YoY – Underlying Combined Ratio1 of 105.0 %; 101.2%2 excluding FL Statutory Profit Limit Refunds • Life business produced $20 million of operating income driven by lower expenses • Net Investment Income of $103 million Operating Results Financial results below expectations driven by market dynamics and elevated claims severity • 4Q’25 Net Loss attributable to Kemper Corporation of $(8.0) million or $(0.13) per share • 4Q’25 Adjusted Consolidated Net Operating Income1 of $14.6 million or $0.25 per share • ROE of (1.2)% and Adjusted ROE1 of (1.9)% for 4Q’25; 5.1% and 7.8%, respectively, for FY’25 • Book Value Per Share and Adjusted BVPS1 increased 4.6% and (3.4)% YoY, respectively • Trailing twelve-month Operating Cash Flow of $585 million Financial Results Capital and liquidity position provides financial flexibility • Parent company liquidity remains strong at over $1 billion • Debt-to-Capital3 ratio of 24.6% Balance Sheet Strength Fourth Quarter 2025 Summary Specialty P&C performance impacted by competitive and severity pressures 1 Non-GAAP financial measure; please see reconciliation in appendix on pages 16-21 2 Underlying Combined Ratio as further adjusted for $35 million reduction to earned premium which represents a current estimate of FL Statutory Profit Limit Refunds | 3 Excludes AOCI

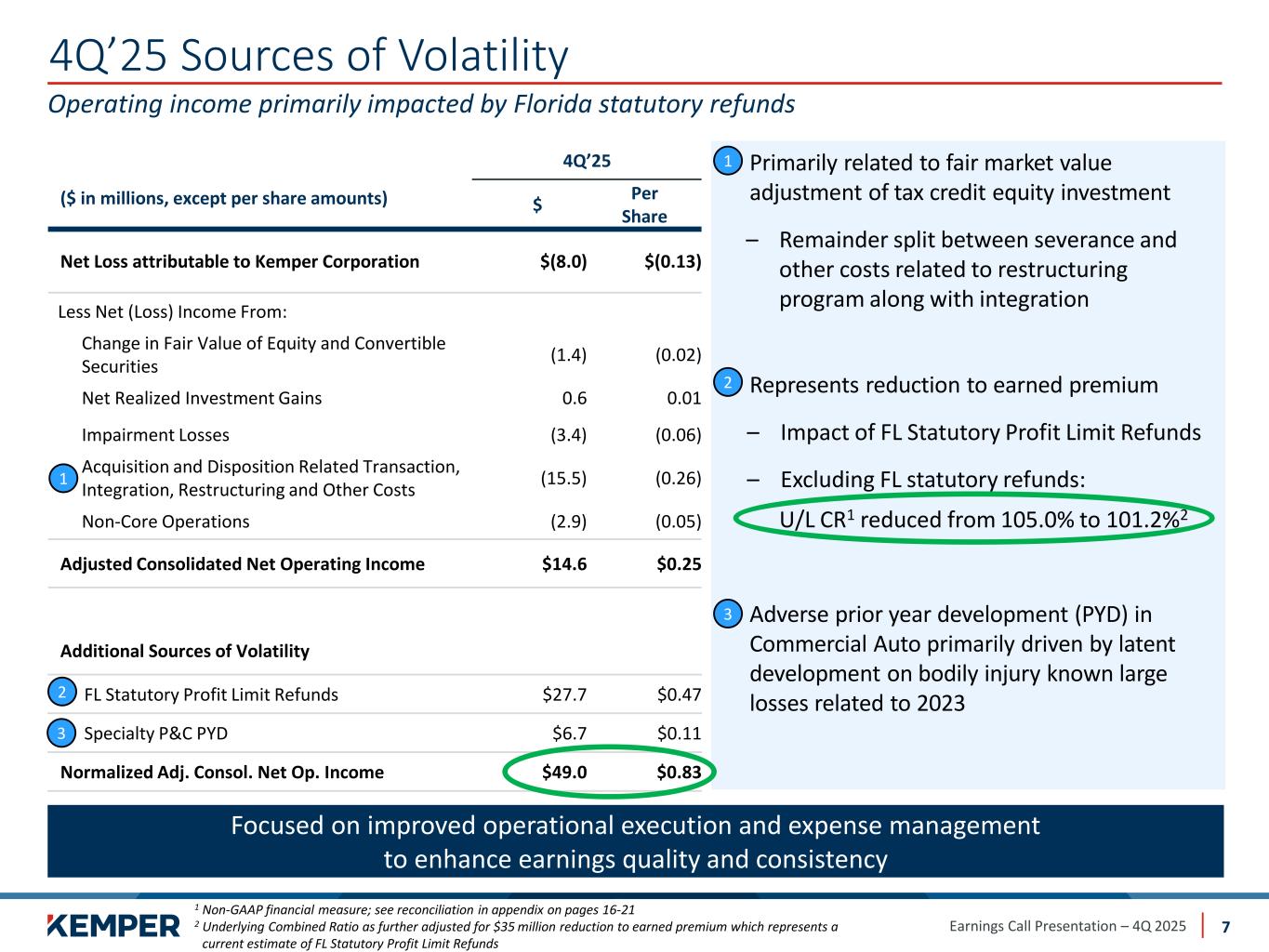

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 4Q’25 Sources of Volatility 7 • Primarily related to fair market value adjustment of tax credit equity investment – Remainder split between severance and other costs related to restructuring program along with integration • Represents reduction to earned premium – Impact of FL Statutory Profit Limit Refunds – Excluding FL statutory refunds: U/L CR1 reduced from 105.0% to 101.2%2 • Adverse prior year development (PYD) in Commercial Auto primarily driven by latent development on bodily injury known large losses related to 2023 Focused on improved operational execution and expense management to enhance earnings quality and consistency Operating income primarily impacted by Florida statutory refunds 4Q’25 ($ in millions, except per share amounts) $ Per Share Net Loss attributable to Kemper Corporation $(8.0) $(0.13) Less Net (Loss) Income From: Change in Fair Value of Equity and Convertible Securities (1.4) (0.02) Net Realized Investment Gains 0.6 0.01 Impairment Losses (3.4) (0.06) Acquisition and Disposition Related Transaction, Integration, Restructuring and Other Costs (15.5) (0.26) Non-Core Operations (2.9) (0.05) Adjusted Consolidated Net Operating Income $14.6 $0.25 Additional Sources of Volatility FL Statutory Profit Limit Refunds $27.7 $0.47 Specialty P&C PYD $6.7 $0.11 Normalized Adj. Consol. Net Op. Income $49.0 $0.83 1 2 3 1 2 3 1 Non-GAAP financial measure; see reconciliation in appendix on pages 16-21 2 Underlying Combined Ratio as further adjusted for $35 million reduction to earned premium which represents a current estimate of FL Statutory Profit Limit Refunds

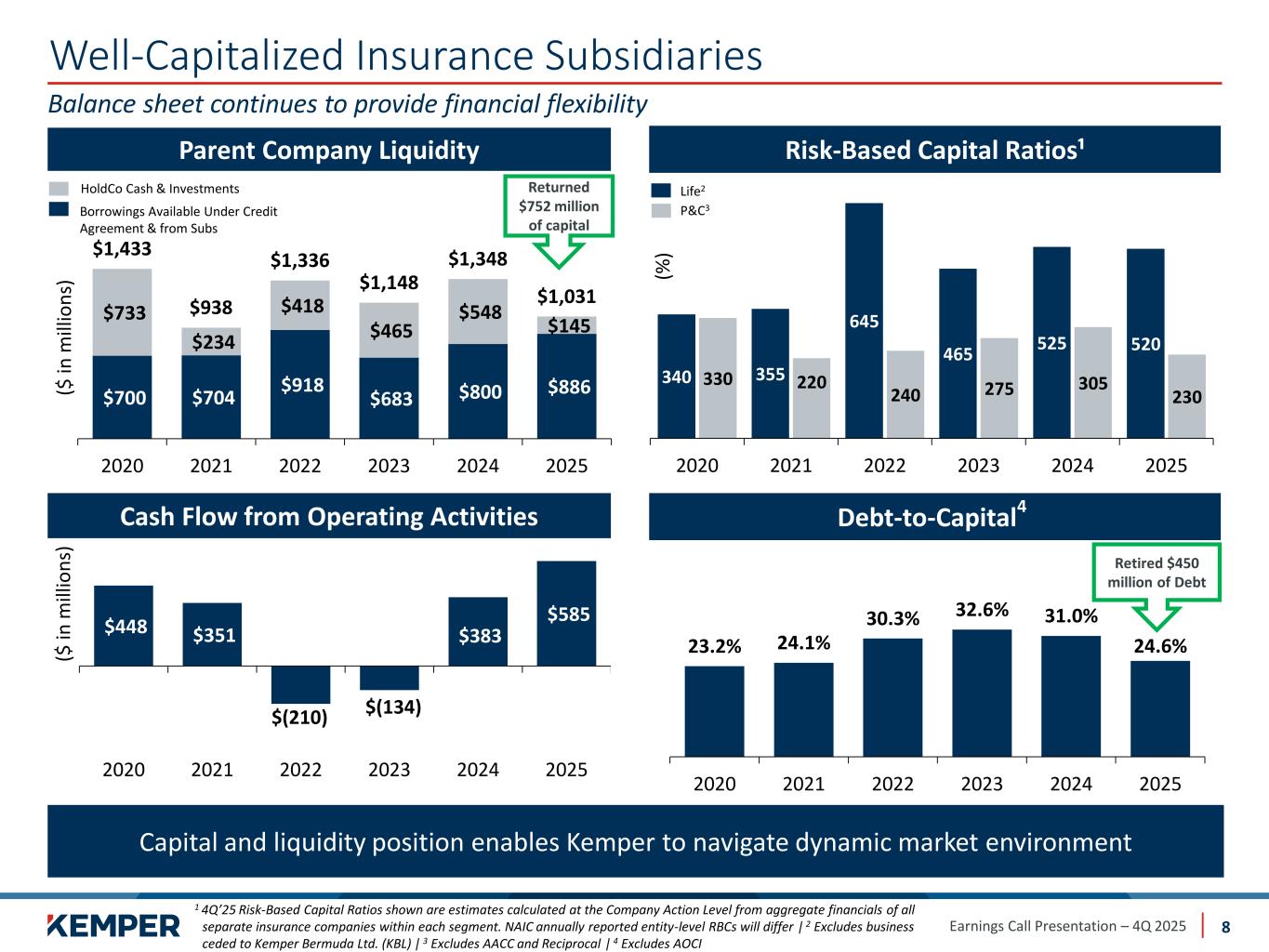

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 Well-Capitalized Insurance Subsidiaries 8 Balance sheet continues to provide financial flexibility Capital and liquidity position enables Kemper to navigate dynamic market environment 23.2% 24.1% 30.3% 32.6% 31.0% 24.6% 2020 2021 2022 2023 2024 2025 Debt-to-Capital 4 Parent Company Liquidity Risk-Based Capital Ratios¹ $700 $704 $918 $683 $800 $886 $733 $234 $418 $465 $548 $145 $1,433 $938 $1,336 $1,148 $1,348 $1,031 2020 2021 2022 2023 2024 2025 (% ) Debt Cash Flow from Operating Activities ($ in m ill io n s) $448 $351 $(210) $(134) $383 $585 2020 2021 2022 2023 2024 2025 HoldCo Cash & Investments Borrowings Available Under Credit Agreement & from Subs P&C3 Life2 ($ in m ill io n s) 340 355 645 465 525 520 330 220 240 275 305 230 2020 2021 2022 2023 2024 2025 1 4Q’25 Risk-Based Capital Ratios shown are estimates calculated at the Company Action Level from aggregate financials of all separate insurance companies within each segment. NAIC annually reported entity-level RBCs will differ | 2 Excludes business ceded to Kemper Bermuda Ltd. (KBL) | 3 Excludes AACC and Reciprocal | 4 Excludes AOCI Returned $752 million of capital Retired $450 million of Debt

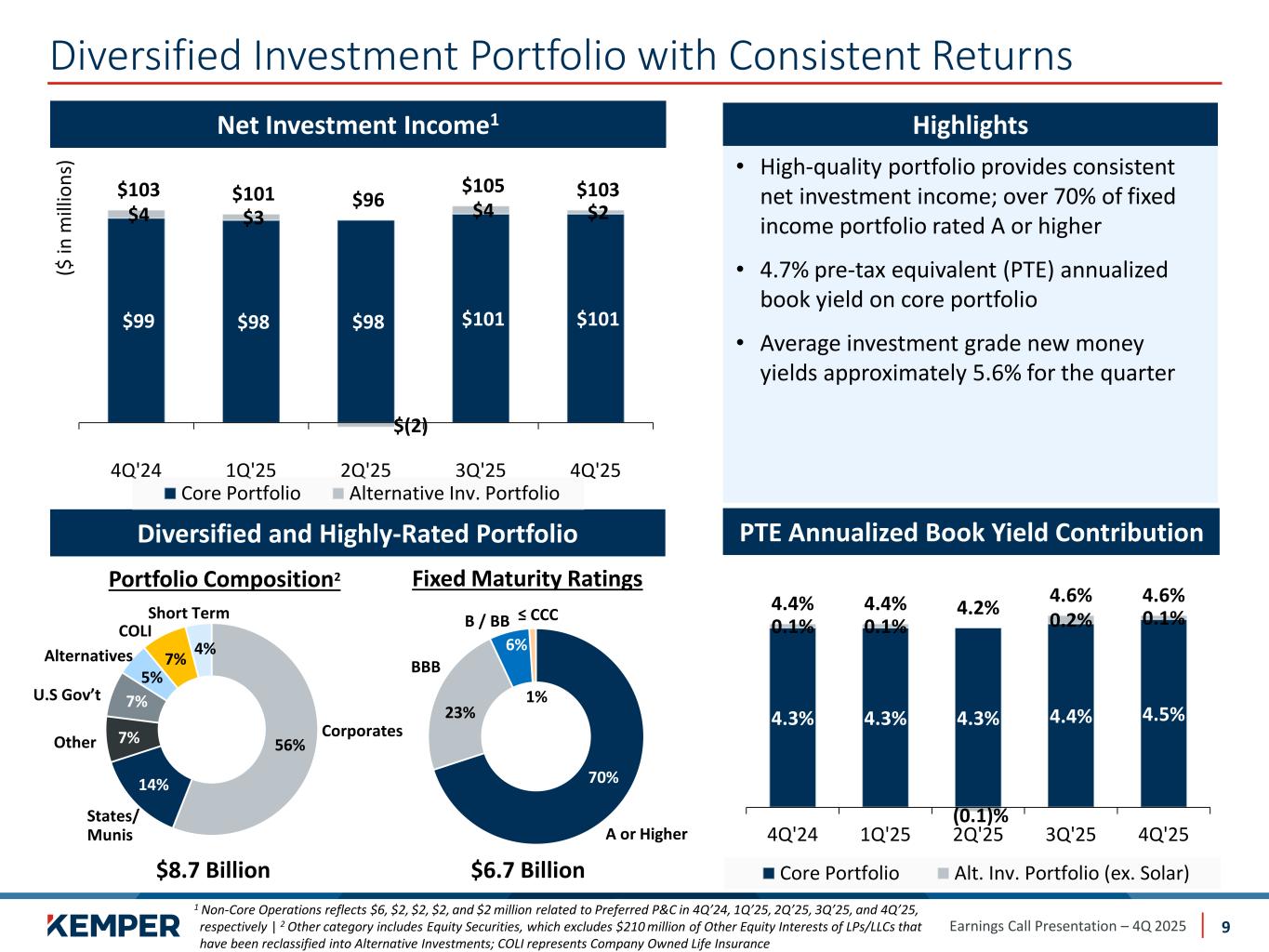

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 4.3% 4.3% 4.3% 4.4% 4.5% 0.1% 0.1% (0.1)% 0.2% 0.1% 4.4% 4.4% 4.2% 4.6% 4.6% 4Q'24 1Q'25 2Q'25 3Q'25 4Q'25 Core Portfolio Alt. Inv. Portfolio (ex. Solar) Diversified Investment Portfolio with Consistent Returns 9 56% 14% 7% 7% 5% 7% 4% Other States/ Munis COLI 70% 23% 6% 1% Diversified and Highly-Rated Portfolio Fixed Maturity Ratings $6.7 Billion A or Higher ≤ CCCB / BB BBB • High-quality portfolio provides consistent net investment income; over 70% of fixed income portfolio rated A or higher • 4.7% pre-tax equivalent (PTE) annualized book yield on core portfolio • Average investment grade new money yields approximately 5.6% for the quarter $99 $98 $98 $101 $101 $4 $3 $(2) $4 $2 $103 $101 $96 $105 $103 4Q'24 1Q'25 2Q'25 3Q'25 4Q'25 Core Portfolio Alternative Inv. Portfolio Net Investment Income1 Highlights Corporates Alternatives U.S Gov’t Portfolio Composition2 PTE Annualized Book Yield Contribution $8.7 Billion Short Term ($ in m ill io n s) 1 Non-Core Operations reflects $6, $2, $2, $2, and $2 million related to Preferred P&C in 4Q’24, 1Q’25, 2Q’25, 3Q’25, and 4Q’25, respectively | 2 Other category includes Equity Securities, which excludes $210 million of Other Equity Interests of LPs/LLCs that have been reclassified into Alternative Investments; COLI represents Company Owned Life Insurance

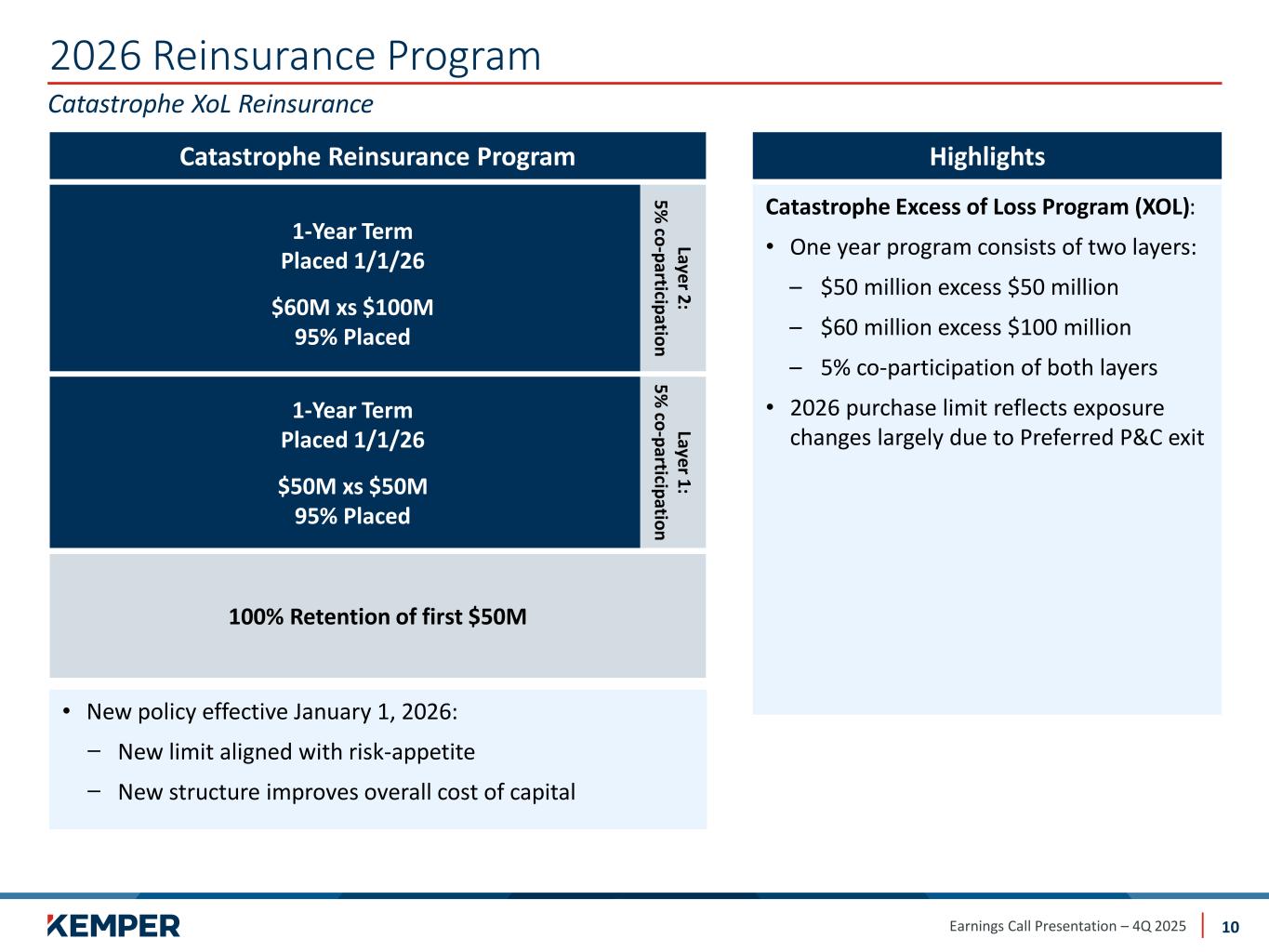

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 2026 Reinsurance Program 10 Catastrophe XoL Reinsurance • New policy effective January 1, 2026: ̶ New limit aligned with risk-appetite ̶ New structure improves overall cost of capital Catastrophe Excess of Loss Program (XOL): • One year program consists of two layers: – $50 million excess $50 million – $60 million excess $100 million – 5% co-participation of both layers • 2026 purchase limit reflects exposure changes largely due to Preferred P&C exit HighlightsCatastrophe Reinsurance Program 100% Retention of first $50M 1-Year Term Placed 1/1/26 $50M xs $50M 95% Placed 1-Year Term Placed 1/1/26 $60M xs $100M 95% Placed Laye r 1 : 5 % co -p articip atio n Laye r 2 : 5 % co -p articip atio n

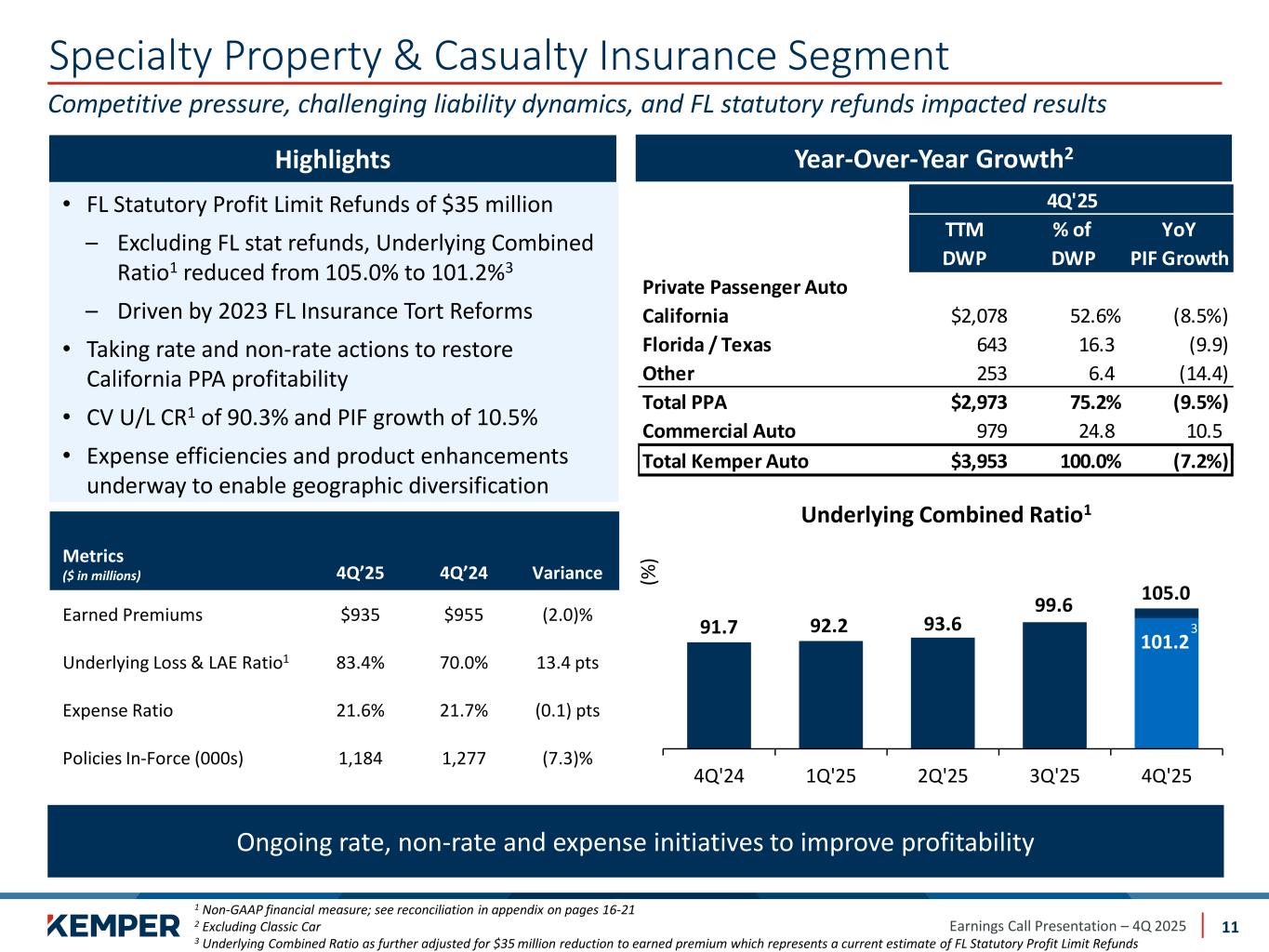

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 Specialty Property & Casualty Insurance Segment 11 Competitive pressure, challenging liability dynamics, and FL statutory refunds impacted results (% ) Highlights • FL Statutory Profit Limit Refunds of $35 million – Excluding FL stat refunds, Underlying Combined Ratio1 reduced from 105.0% to 101.2%3 – Driven by 2023 FL Insurance Tort Reforms • Taking rate and non-rate actions to restore California PPA profitability • CV U/L CR1 of 90.3% and PIF growth of 10.5% • Expense efficiencies and product enhancements underway to enable geographic diversification Metrics ($ in millions) 4Q’25 4Q’24 Variance Earned Premiums $935 $955 (2.0)% Underlying Loss & LAE Ratio1 83.4% 70.0% 13.4 pts Expense Ratio 21.6% 21.7% (0.1) pts Policies In-Force (000s) 1,184 1,277 (7.3)% Year-Over-Year Growth2 Ongoing rate, non-rate and expense initiatives to improve profitability 1 Non-GAAP financial measure; see reconciliation in appendix on pages 16-21 2 Excluding Classic Car 3 Underlying Combined Ratio as further adjusted for $35 million reduction to earned premium which represents a current estimate of FL Statutory Profit Limit Refunds 4Q'25 TTM % of YoY DWP DWP PIF Growth Private Passenger Auto California $2,078 52.6% (8.5%) Florida / Texas 643 16.3 (9.9) Other 253 6.4 (14.4) Total PPA $2,973 75.2% (9.5%) Commercial Auto 979 24.8 10.5 Total Kemper Auto $3,953 100.0% (7.2%) 91.7 92.2 93.6 99.6 105.0 101.2 4Q'24 1Q'25 2Q'25 3Q'25 4Q'25 Underlying Combined Ratio1 3

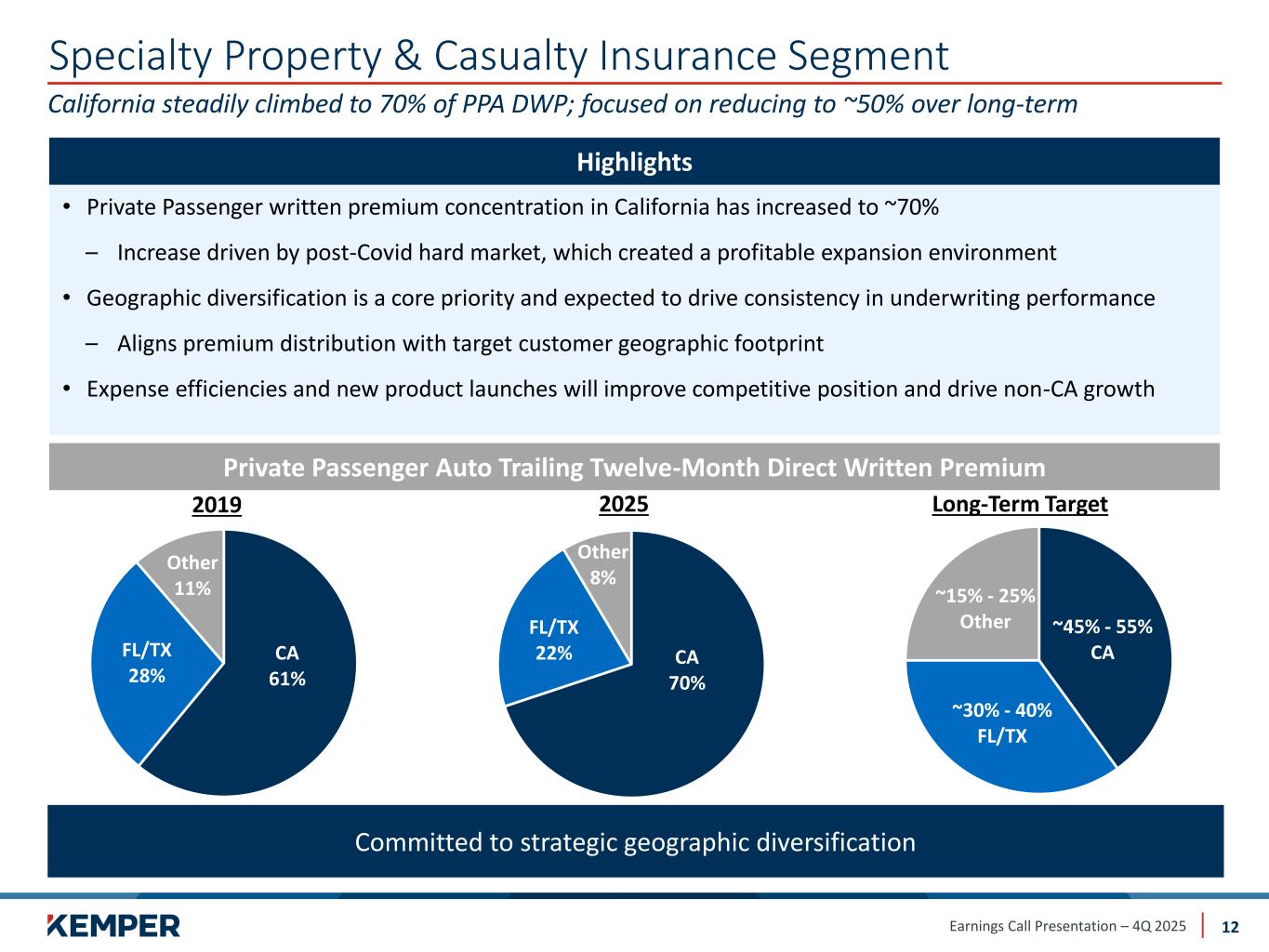

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 Specialty Property & Casualty Insurance Segment 12 California steadily climbed to 70% of PPA DWP; focused on reducing to ~50% over long-term Highlights • Private Passenger written premium concentration in California has increased to ~70% – Increase driven by post-Covid hard market, which created a profitable expansion environment • Geographic diversification is a core priority and expected to drive consistency in underwriting performance – Aligns premium distribution with target customer geographic footprint • Expense efficiencies and new product launches will improve competitive position and drive non-CA growth Committed to strategic geographic diversification 2 CA 61% FL/TX 28% Other 11% 2019 CA 70% FL/TX 22% Other 8% 2025 ~45% - 55% CA ~30% - 40% FL/TX ~15% - 25% Other Long-Term Target Private Passenger Auto Trailing Twelve-Month Direct Written Premium

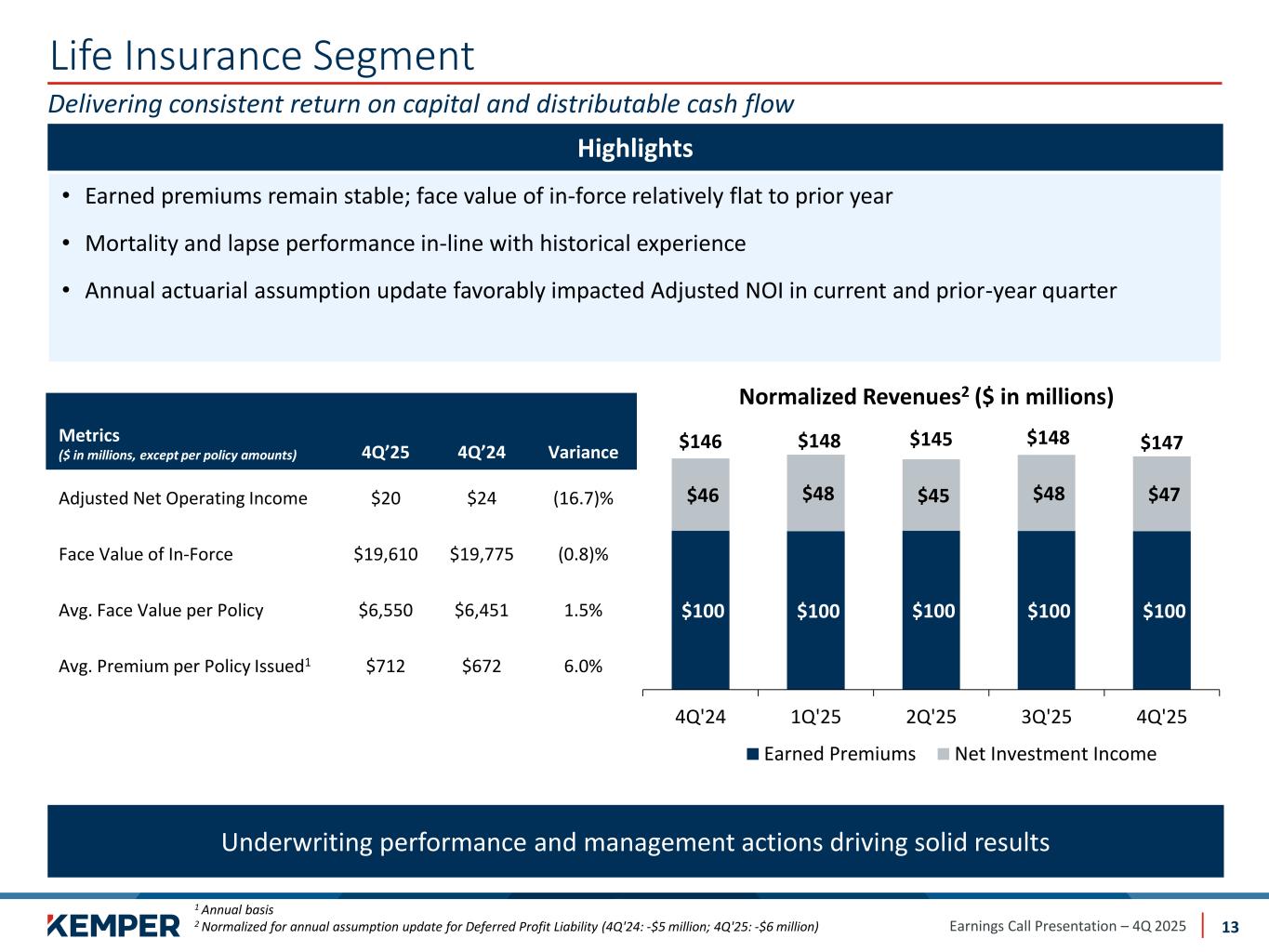

Earnings Call Presentation – 4Q 2025 Life Insurance Segment 13 Delivering consistent return on capital and distributable cash flow Underwriting performance and management actions driving solid results $100 $100 $100 $100 $100 $46 $48 $45 $48 $47 $146 $148 $145 $148 $147 4Q'24 1Q'25 2Q'25 3Q'25 4Q'25 Normalized Revenues2 ($ in millions) Earned Premiums Net Investment Income • Earned premiums remain stable; face value of in-force relatively flat to prior year • Mortality and lapse performance in-line with historical experience • Annual actuarial assumption update favorably impacted Adjusted NOI in current and prior-year quarter Highlights Metrics ($ in millions, except per policy amounts) 4Q’25 4Q’24 Variance Adjusted Net Operating Income $20 $24 (16.7)% Face Value of In-Force $19,610 $19,775 (0.8)% Avg. Face Value per Policy $6,550 $6,451 1.5% Avg. Premium per Policy Issued1 $712 $672 6.0% 1 Annual basis 2 Normalized for annual assumption update for Deferred Profit Liability (4Q'24: -$5 million; 4Q'25: -$6 million)

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 Quarter At a Glance 14 1 Results underperformed expectations driven by continued bodily injury severity and several infrequent items 2 Filed for rate and implemented non-rate actions to restore profitability 3 Implementing efficiency initiatives to reduce costs, optimizing organizational structure, and enhancing claims management processes 4 Piloted new auto products to drive growth 5 Maintaining balance sheet flexibility to support organic growth

Earnings Call Presentation – 4Q 2025 Appendix 15

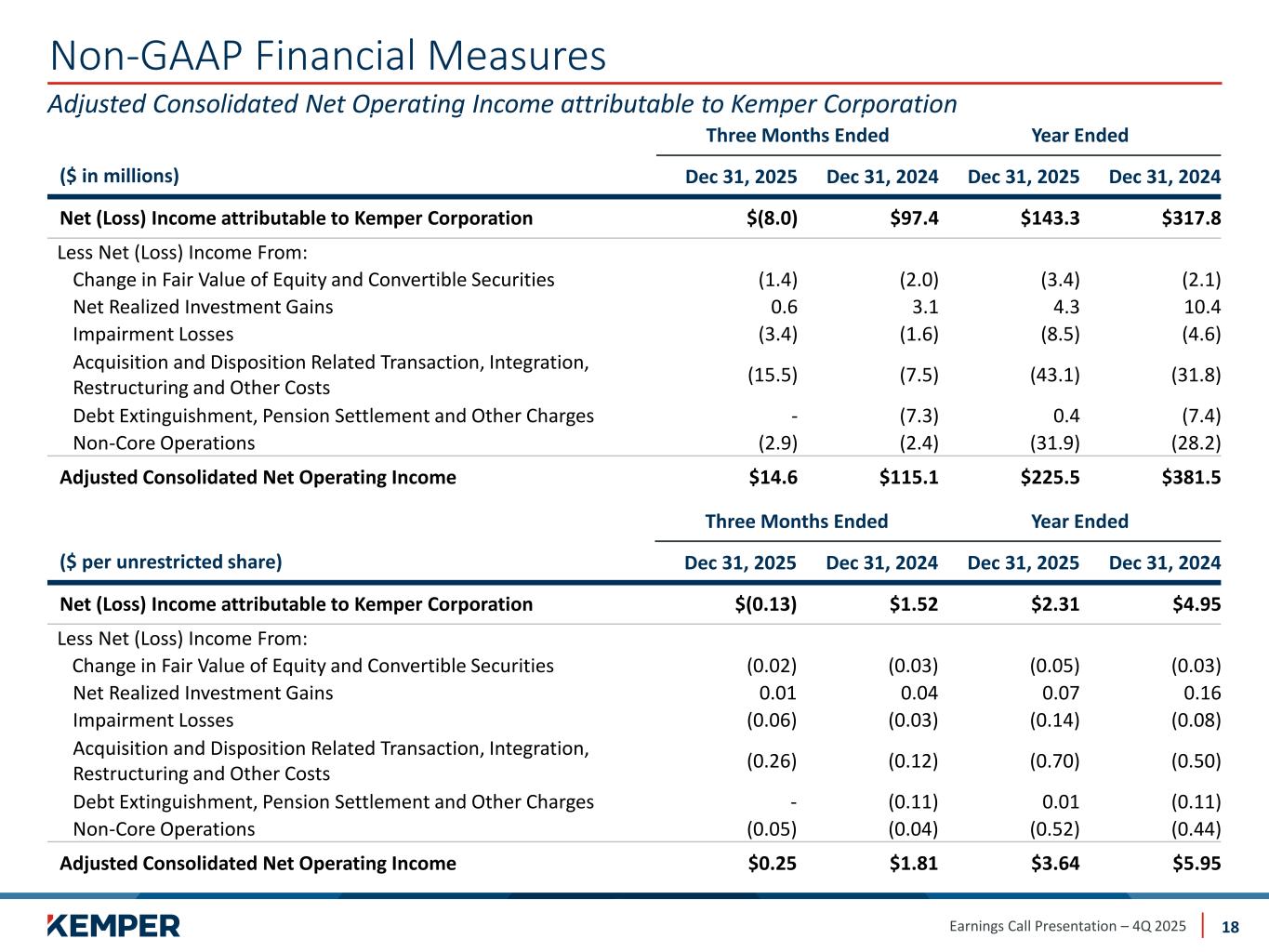

Earnings Call Presentation – 4Q 2025 Non-GAAP Financial Measures 16 Adjusted Consolidated Net Operating Income is an after-tax, non-GAAP financial measure and is computed by excluding from Net (Loss) Income attributable to Kemper Corporation the after-tax impact of: (i) Change in Fair Value of Equity and Convertible Securities; (ii) Net Realized Investment Gains (Losses); (iii) Impairment Losses; (iv) Acquisition and Disposition Related Transaction, Integration, Restructuring and Other Costs; (v) Debt Extinguishment, Pension Settlement and Other Charges; (vi) Goodwill Impairment Charges; (vii) Non-Core Operations; and (viii) Significant non-recurring or infrequent items that may not be indicative of ongoing operations. Significant non-recurring items are excluded when (a) the nature of the charge or gain is such that it is reasonably unlikely to recur within two years, and (b) there has been no similar charge or gain within the prior two years. The most directly comparable GAAP financial measure is Net (Loss) Income attributable to Kemper Corporation. There were no applicable significant non-recurring items that the Company excluded from the calculation of Adjusted Consolidated Net Operating Income for the three months and year ended December 31, 2025 or 2024. The Company believes that Adjusted Consolidated Net Operating Income provides investors with a valuable measure of its ongoing performance because it reveals underlying operational performance trends that otherwise might be less apparent if the items were not excluded. Change in Fair Value of Equity and Convertible Securities, Net Realized Investment Gains (Losses) and Impairment Losses related to investments included in the Company’s results may vary significantly between periods and are generally driven by business decisions and external economic developments such as capital market conditions that impact the values of the Company’s investments, the timing of which is unrelated to the insurance underwriting process. Acquisition and Disposition Related Transaction, Integration, Restructuring and Other Costs may vary significantly between periods and are generally driven by the timing of acquisitions and business decisions which are unrelated to the insurance underwriting process. In the third quarter of 2025, a restructuring program was launched to achieve operational and organizational efficiencies. The Company will continue to evaluate additional efficiency opportunities through 2027. Debt Extinguishment, Pension Settlement and Other Charges relate to (i) loss from early extinguishment of debt, which is driven by the Company’s financing and refinancing decisions and capital needs, as well as external economic developments such as debt market conditions, the timing of which is unrelated to the insurance underwriting process; (ii) settlement of pension plan obligations which are business decisions made by the Company, the timing of which is unrelated to the underwriting process; and (iii) other charges that are non-standard, not part of the ordinary course of business, and unrelated to the insurance underwriting process. Goodwill Impairment Charges are excluded because they are infrequent and non-recurring charges. Non-Core Operations includes the results of our Preferred Insurance business which we expect to fully exit. These results are excluded because they are irrelevant to our ongoing operations and do not qualify for Discontinued Operations under Generally Accepted Accounting Principles ("GAAP"). Significant non-recurring items are excluded because, by their nature, they are not indicative of the Company’s business or economic trends. The preceding non-GAAP financial measures should not be considered a substitute for the comparable GAAP financial measures, as they do not fully recognize the profitability of the Company’s businesses. Adjusted Consolidated Net Operating Income Per Unrestricted Share is a non-GAAP financial measure. It is computed by dividing Adjusted Consolidated Net Operating Income by the weighted average unrestricted shares outstanding. The most directly comparable GAAP financial measure is Net (Loss) Income attributable to Kemper Corporation per Unrestricted Share - basic. The Company believes that Adjusted Consolidated Net Operating Income Per Unrestricted Share provides investors with a valuable measure of its ongoing performance because it reveals underlying operational performance trends that otherwise might be less apparent if the items were not excluded. Income from Change in Fair Value of Equity and Convertible Securities, Net Realized Investment Gains (Losses), Impairment Losses related to investments, Acquisition and Disposition Related Transaction, Integration, Restructuring and Other Costs, Debt Extinguishment, Pension Settlement and Goodwill Impairment Charges included in the Company’s results may vary significantly between periods and are generally driven by business decisions and external economic developments such as capital market conditions that impact the values of the company’s investments, the timing of which is unrelated to the insurance underwriting process.

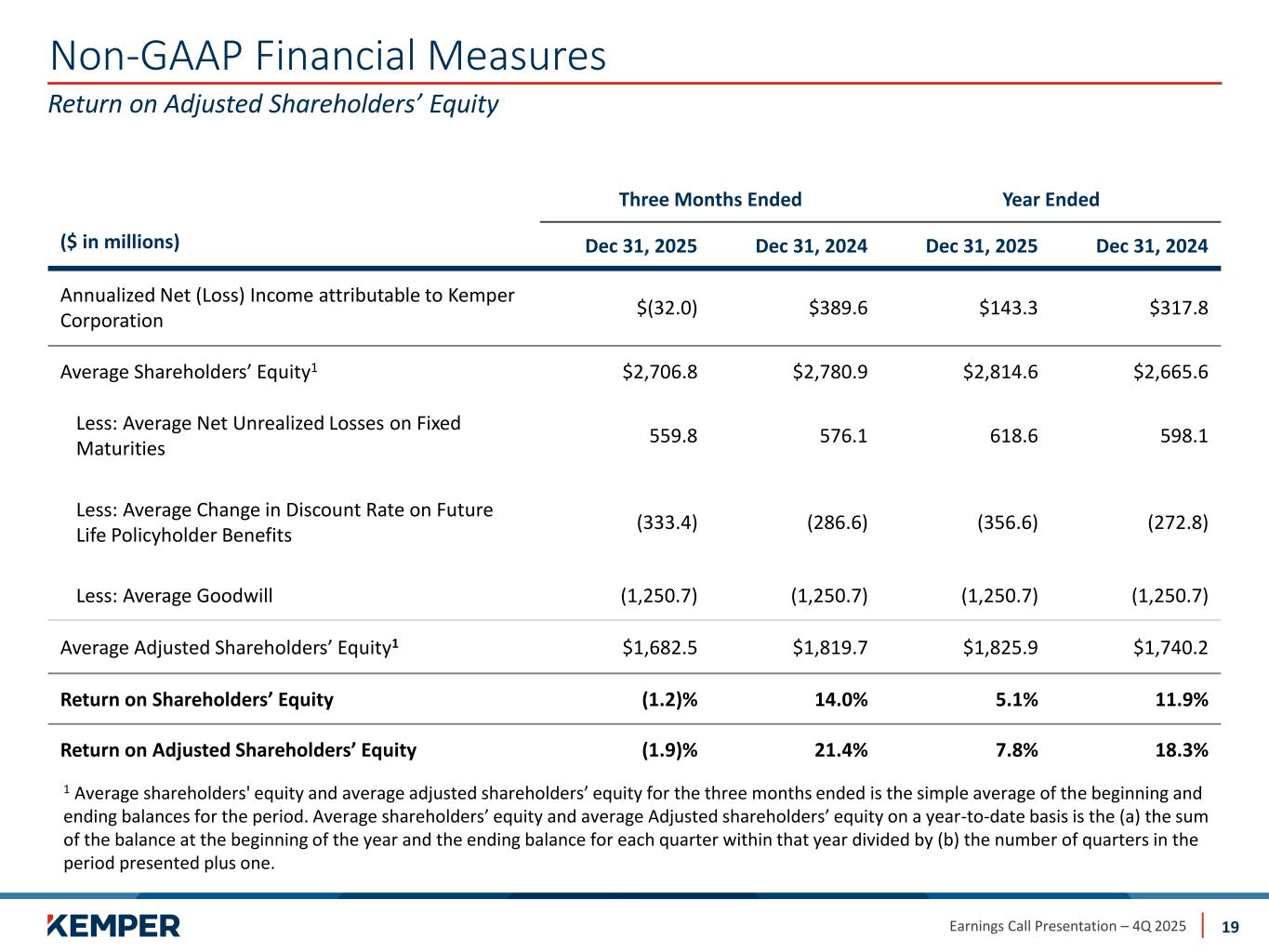

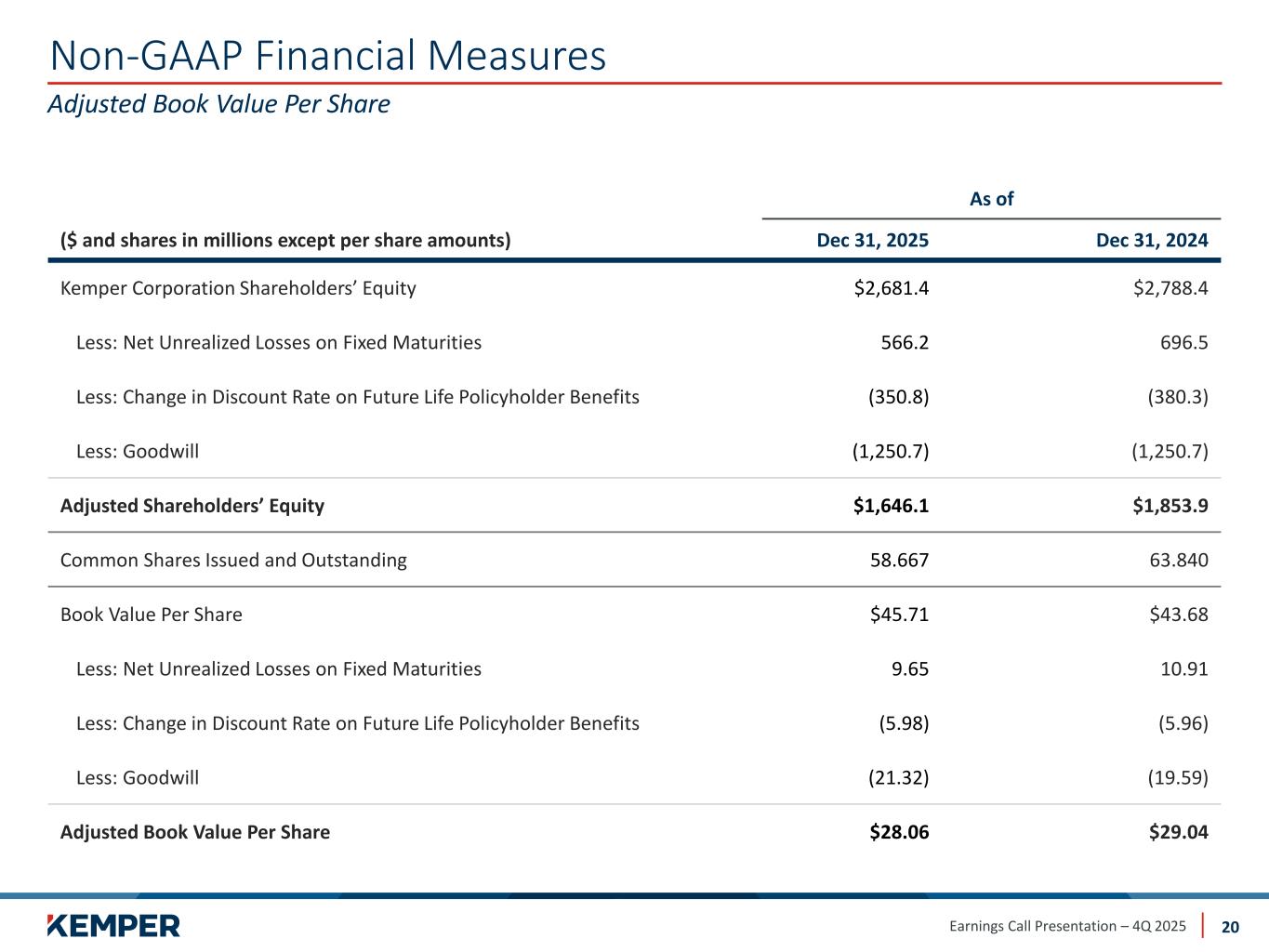

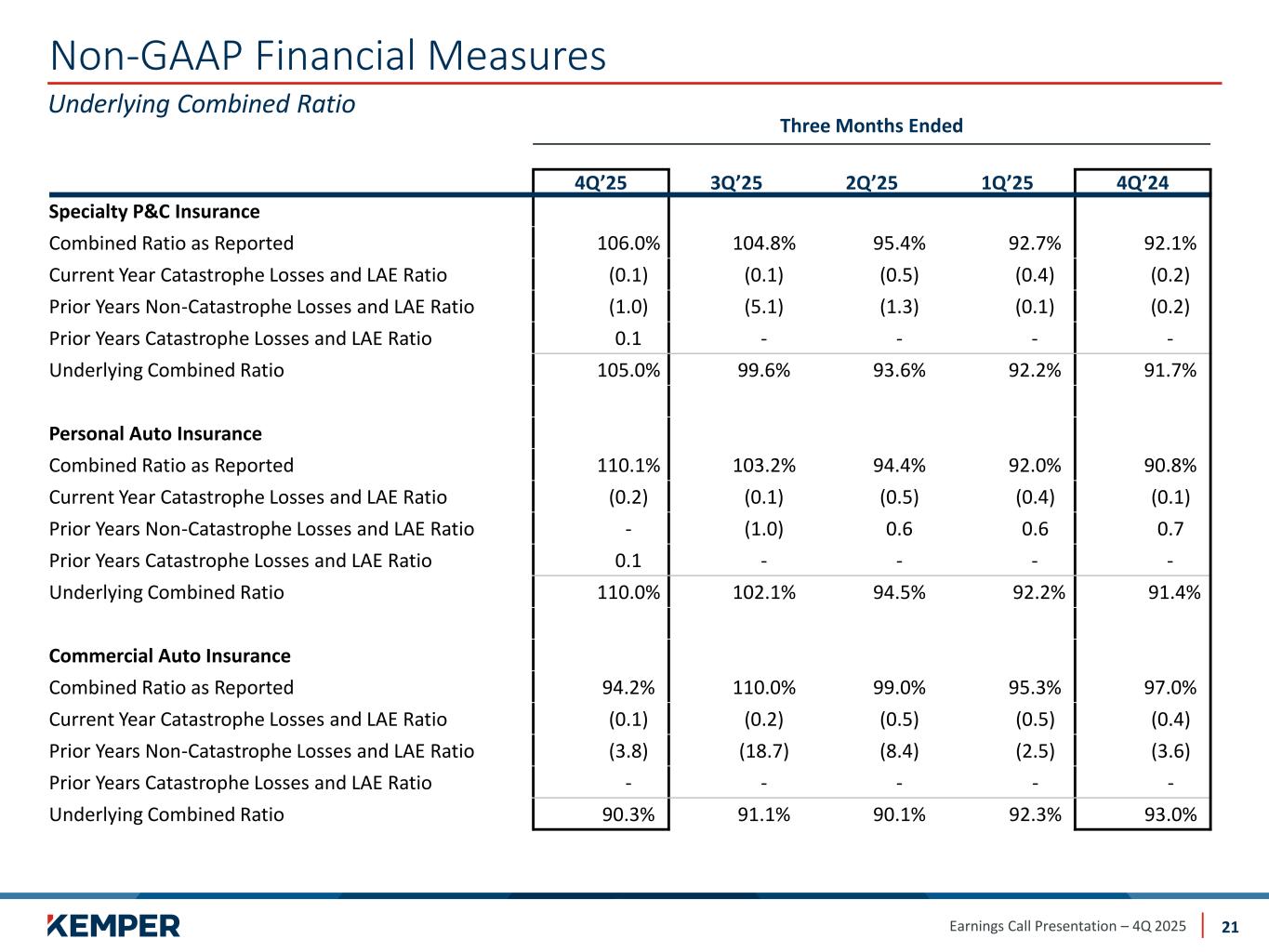

Earnings Call Presentation – 4Q 2025 Non-GAAP Financial Measures 17 Return on Adjusted Shareholders’ Equity is a calculation that uses a non-GAAP financial measure. It is calculated by dividing the period’s annualized Net (Loss) Income attributable to Kemper Corporation by the average shareholders’ equity excluding net unrealized gains and losses on fixed maturities, the change in discount rate on future life policyholder benefits and goodwill. Return on Shareholders’ Equity is the most directly comparable GAAP measure. We use this non-GAAP measure to identify and analyze the change in performance attributable to management efforts between periods. The Company believes this non-GAAP financial measure is useful to investors because it eliminates the effect of items that can fluctuate significantly from period to period and are generally driven by economic developments, primarily capital market conditions, the magnitude and timing of which are not influenced by management. The Company believes it enhances understanding and comparability of performance by highlighting underlying business activity and profitability drivers. Adjusted Book Value Per Share is a calculation that uses a non-GAAP financial measure. It is calculated by dividing shareholders’ equity after excluding the after-tax impact of net unrealized gains and losses on fixed income securities, the change in discount rate on future life policyholder benefits and goodwill by total Common Shares Issued and Outstanding. Book value per share is the most directly comparable GAAP financial measure. The Company uses the trends in book value per share excluding the after-tax impact of net unrealized gains and losses on fixed income securities, the change in discount rate on future life policyholder benefits and goodwill in conjunction with book value per share to identify and analyze the change in net worth excluding goodwill attributable to management efforts between periods. The Company believes the non-GAAP financial measure is useful to investors because it eliminates the effect of items that can fluctuate significantly from period to period and are generally driven by economic developments, primarily capital market conditions, the magnitude and timing of which are not influenced by management. The Company believes it enhances understanding and comparability of performance by highlighting underlying business activity and profitability drivers. Underlying Combined Ratio is a non-GAAP financial measure. It is computed by adding the Current Year Non-catastrophe Losses and LAE Ratio with the Insurance Expense Ratio. The most directly comparable GAAP financial measure is the Combined Ratio, which is computed by adding Total Incurred Losses and LAE Ratio, including the impact of catastrophe losses and loss and LAE reserve development from prior years, with the Insurance Expense Ratio. The Company believes Underlying Losses and LAE and the Underlying Combined Ratio are useful to investors and uses these financial measures to reveal the trends in the Company’s Property & Casualty Insurance segment that may be obscured by catastrophe losses and prior-year reserve development. These catastrophe losses may cause the Company’s loss trends to vary significantly between periods as a result of their incidence of occurrence and magnitude and can have a significant impact on incurred losses and LAE and the Combined Ratio. Prior-year reserve developments are caused by unexpected loss development on historical reserves. Because reserve development relates to the re-estimation of losses from earlier periods, it has no bearing on the performance of the Company’s insurance products in the current period. The Company believes it is useful for investors to evaluate these components separately and in the aggregate when reviewing the Company’s underwriting performance.

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 Non-GAAP Financial Measures 18 Adjusted Consolidated Net Operating Income attributable to Kemper Corporation Three Months Ended Year Ended ($ per unrestricted share) Dec 31, 2025 Dec 31, 2024 Dec 31, 2025 Dec 31, 2024 Net (Loss) Income attributable to Kemper Corporation $(0.13) $1.52 $2.31 $4.95 Less Net (Loss) Income From: Change in Fair Value of Equity and Convertible Securities (0.02) (0.03) (0.05) (0.03) Net Realized Investment Gains 0.01 0.04 0.07 0.16 Impairment Losses (0.06) (0.03) (0.14) (0.08) Acquisition and Disposition Related Transaction, Integration, Restructuring and Other Costs (0.26) (0.12) (0.70) (0.50) Debt Extinguishment, Pension Settlement and Other Charges - (0.11) 0.01 (0.11) Non-Core Operations (0.05) (0.04) (0.52) (0.44) Adjusted Consolidated Net Operating Income $0.25 $1.81 $3.64 $5.95 Three Months Ended Year Ended ($ in millions) Dec 31, 2025 Dec 31, 2024 Dec 31, 2025 Dec 31, 2024 Net (Loss) Income attributable to Kemper Corporation $(8.0) $97.4 $143.3 $317.8 Less Net (Loss) Income From: Change in Fair Value of Equity and Convertible Securities (1.4) (2.0) (3.4) (2.1) Net Realized Investment Gains 0.6 3.1 4.3 10.4 Impairment Losses (3.4) (1.6) (8.5) (4.6) Acquisition and Disposition Related Transaction, Integration, Restructuring and Other Costs (15.5) (7.5) (43.1) (31.8) Debt Extinguishment, Pension Settlement and Other Charges - (7.3) 0.4 (7.4) Non-Core Operations (2.9) (2.4) (31.9) (28.2) Adjusted Consolidated Net Operating Income $14.6 $115.1 $225.5 $381.5

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 Non-GAAP Financial Measures 19 Return on Adjusted Shareholders’ Equity 1 Average shareholders' equity and average adjusted shareholders’ equity for the three months ended is the simple average of the beginning and ending balances for the period. Average shareholders’ equity and average Adjusted shareholders’ equity on a year-to-date basis is the (a) the sum of the balance at the beginning of the year and the ending balance for each quarter within that year divided by (b) the number of quarters in the period presented plus one. Three Months Ended Year Ended ($ in millions) Dec 31, 2025 Dec 31, 2024 Dec 31, 2025 Dec 31, 2024 Annualized Net (Loss) Income attributable to Kemper Corporation $(32.0) $389.6 $143.3 $317.8 Average Shareholders’ Equity1 $2,706.8 $2,780.9 $2,814.6 $2,665.6 Less: Average Net Unrealized Losses on Fixed Maturities 559.8 576.1 618.6 598.1 Less: Average Change in Discount Rate on Future Life Policyholder Benefits (333.4) (286.6) (356.6) (272.8) Less: Average Goodwill (1,250.7) (1,250.7) (1,250.7) (1,250.7) Average Adjusted Shareholders’ Equity1 $1,682.5 $1,819.7 $1,825.9 $1,740.2 Return on Shareholders’ Equity (1.2)% 14.0% 5.1% 11.9% Return on Adjusted Shareholders’ Equity (1.9)% 21.4% 7.8% 18.3%

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 Non-GAAP Financial Measures 20 Adjusted Book Value Per Share As of ($ and shares in millions except per share amounts) Dec 31, 2025 Dec 31, 2024 Kemper Corporation Shareholders’ Equity $2,681.4 $2,788.4 Less: Net Unrealized Losses on Fixed Maturities 566.2 696.5 Less: Change in Discount Rate on Future Life Policyholder Benefits (350.8) (380.3) Less: Goodwill (1,250.7) (1,250.7) Adjusted Shareholders’ Equity $1,646.1 $1,853.9 Common Shares Issued and Outstanding 58.667 63.840 Book Value Per Share $45.71 $43.68 Less: Net Unrealized Losses on Fixed Maturities 9.65 10.91 Less: Change in Discount Rate on Future Life Policyholder Benefits (5.98) (5.96) Less: Goodwill (21.32) (19.59) Adjusted Book Value Per Share $28.06 $29.04

54 63 65 218 40 28 0 48 87 141 155 163 218 225 231 239 243 246 Earnings Call Presentation – 4Q 2025 Three Months Ended 4Q’25 3Q’25 2Q’25 1Q’25 4Q’24 Specialty P&C Insurance Combined Ratio as Reported 106.0% 104.8% 95.4% 92.7% 92.1% Current Year Catastrophe Losses and LAE Ratio (0.1) (0.1) (0.5) (0.4) (0.2) Prior Years Non-Catastrophe Losses and LAE Ratio (1.0) (5.1) (1.3) (0.1) (0.2) Prior Years Catastrophe Losses and LAE Ratio 0.1 - - - - Underlying Combined Ratio 105.0% 99.6% 93.6% 92.2% 91.7% Personal Auto Insurance Combined Ratio as Reported 110.1% 103.2% 94.4% 92.0% 90.8% Current Year Catastrophe Losses and LAE Ratio (0.2) (0.1) (0.5) (0.4) (0.1) Prior Years Non-Catastrophe Losses and LAE Ratio - (1.0) 0.6 0.6 0.7 Prior Years Catastrophe Losses and LAE Ratio 0.1 - - - - Underlying Combined Ratio 110.0% 102.1% 94.5% 92.2% 91.4% Commercial Auto Insurance Combined Ratio as Reported 94.2% 110.0% 99.0% 95.3% 97.0% Current Year Catastrophe Losses and LAE Ratio (0.1) (0.2) (0.5) (0.5) (0.4) Prior Years Non-Catastrophe Losses and LAE Ratio (3.8) (18.7) (8.4) (2.5) (3.6) Prior Years Catastrophe Losses and LAE Ratio - - - - - Underlying Combined Ratio 90.3% 91.1% 90.1% 92.3% 93.0% Non-GAAP Financial Measures 21 Underlying Combined Ratio