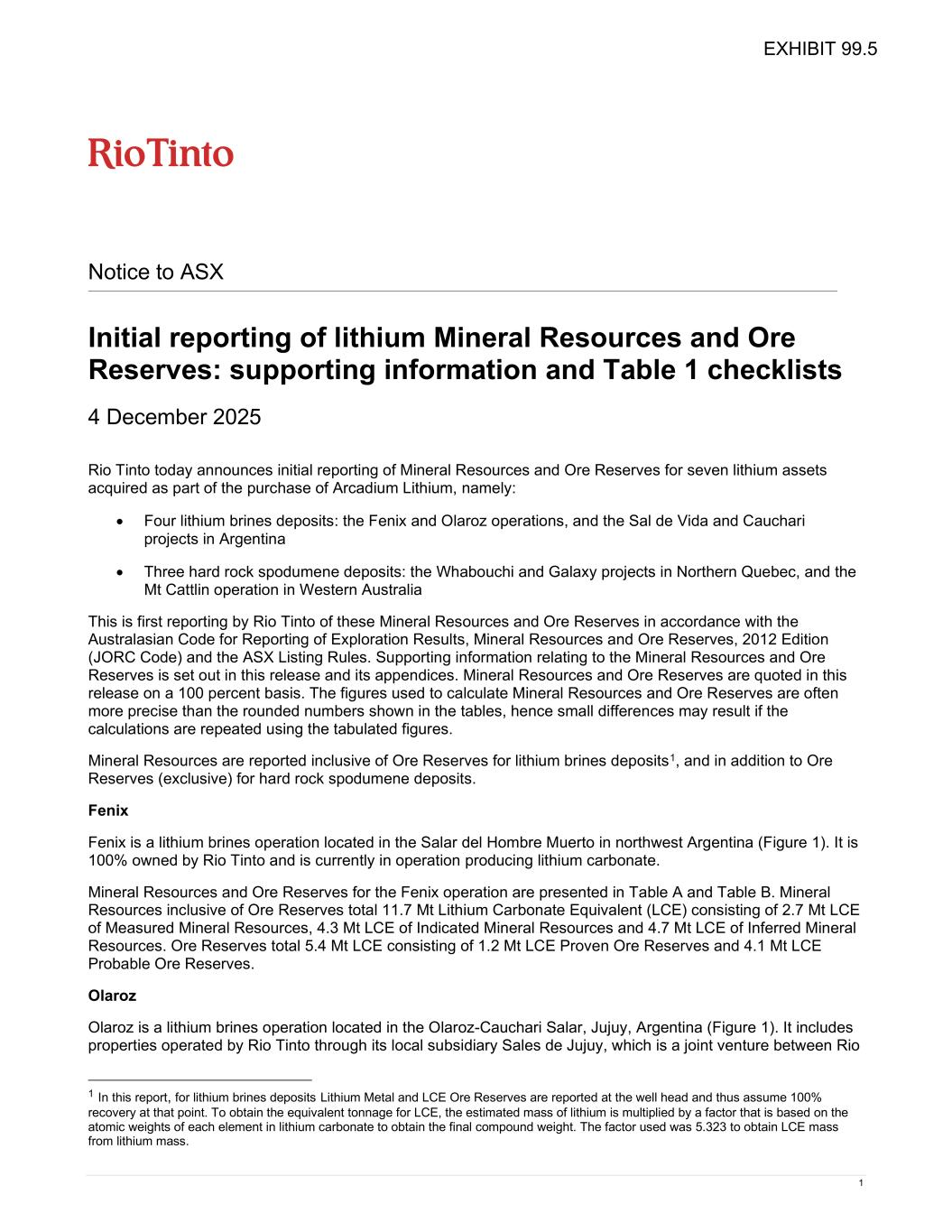

1 Notice to ASX Initial reporting of lithium Mineral Resources and Ore Reserves: supporting information and Table 1 checklists 4 December 2025 Rio Tinto today announces initial reporting of Mineral Resources and Ore Reserves for seven lithium assets acquired as part of the purchase of Arcadium Lithium, namely: • Four lithium brines deposits: the Fenix and Olaroz operations, and the Sal de Vida and Cauchari projects in Argentina • Three hard rock spodumene deposits: the Whabouchi and Galaxy projects in Northern Quebec, and the Mt Cattlin operation in Western Australia This is first reporting by Rio Tinto of these Mineral Resources and Ore Reserves in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, 2012 Edition (JORC Code) and the ASX Listing Rules. Supporting information relating to the Mineral Resources and Ore Reserves is set out in this release and its appendices. Mineral Resources and Ore Reserves are quoted in this release on a 100 percent basis. The figures used to calculate Mineral Resources and Ore Reserves are often more precise than the rounded numbers shown in the tables, hence small differences may result if the calculations are repeated using the tabulated figures. Mineral Resources are reported inclusive of Ore Reserves for lithium brines deposits1, and in addition to Ore Reserves (exclusive) for hard rock spodumene deposits. Fenix Fenix is a lithium brines operation located in the Salar del Hombre Muerto in northwest Argentina (Figure 1). It is 100% owned by Rio Tinto and is currently in operation producing lithium carbonate. Mineral Resources and Ore Reserves for the Fenix operation are presented in Table A and Table B. Mineral Resources inclusive of Ore Reserves total 11.7 Mt Lithium Carbonate Equivalent (LCE) consisting of 2.7 Mt LCE of Measured Mineral Resources, 4.3 Mt LCE of Indicated Mineral Resources and 4.7 Mt LCE of Inferred Mineral Resources. Ore Reserves total 5.4 Mt LCE consisting of 1.2 Mt LCE Proven Ore Reserves and 4.1 Mt LCE Probable Ore Reserves. Olaroz Olaroz is a lithium brines operation located in the Olaroz-Cauchari Salar, Jujuy, Argentina (Figure 1). It includes properties operated by Rio Tinto through its local subsidiary Sales de Jujuy, which is a joint venture between Rio 1 In this report, for lithium brines deposits Lithium Metal and LCE Ore Reserves are reported at the well head and thus assume 100% recovery at that point. To obtain the equivalent tonnage for LCE, the estimated mass of lithium is multiplied by a factor that is based on the atomic weights of each element in lithium carbonate to obtain the final compound weight. The factor used was 5.323 to obtain LCE mass from lithium mass. .5

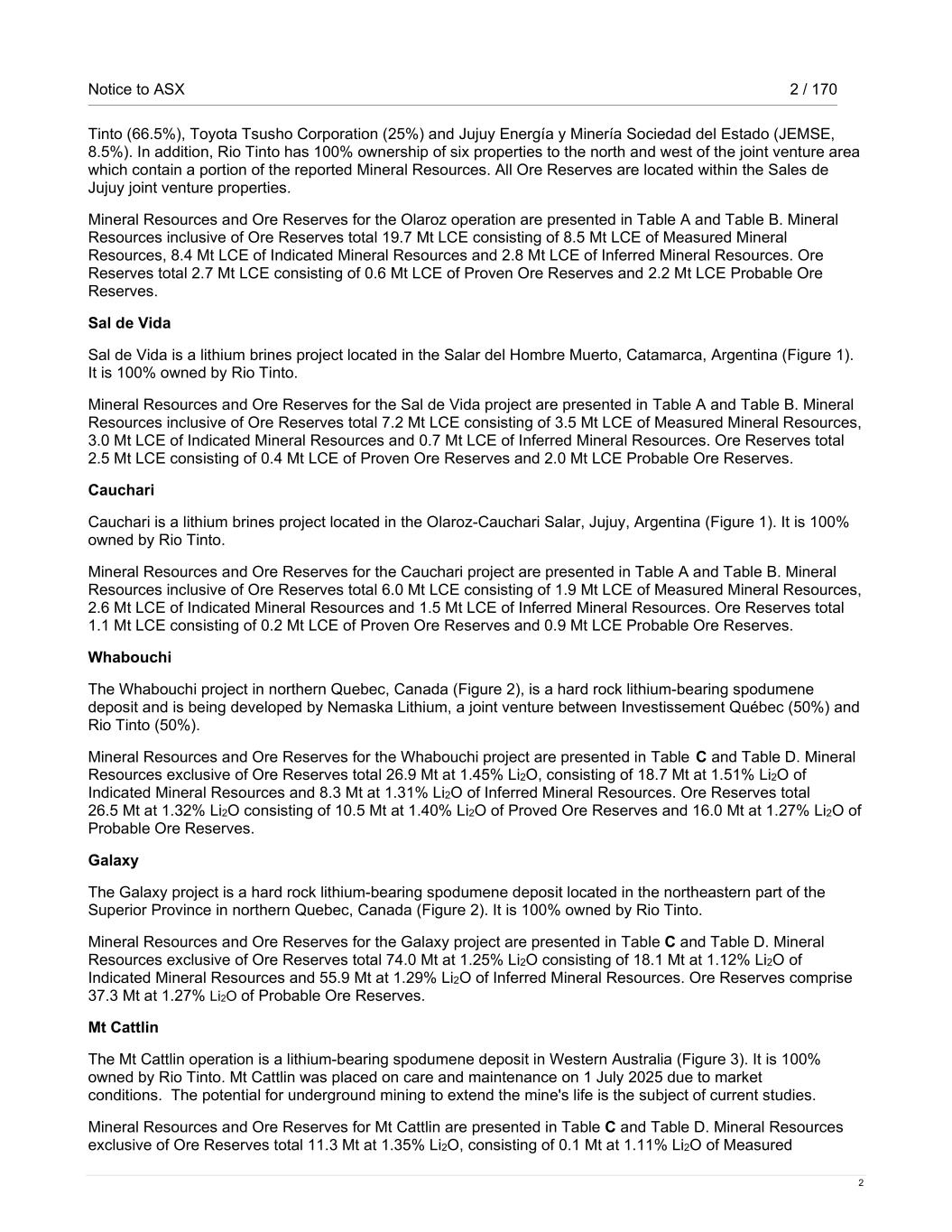

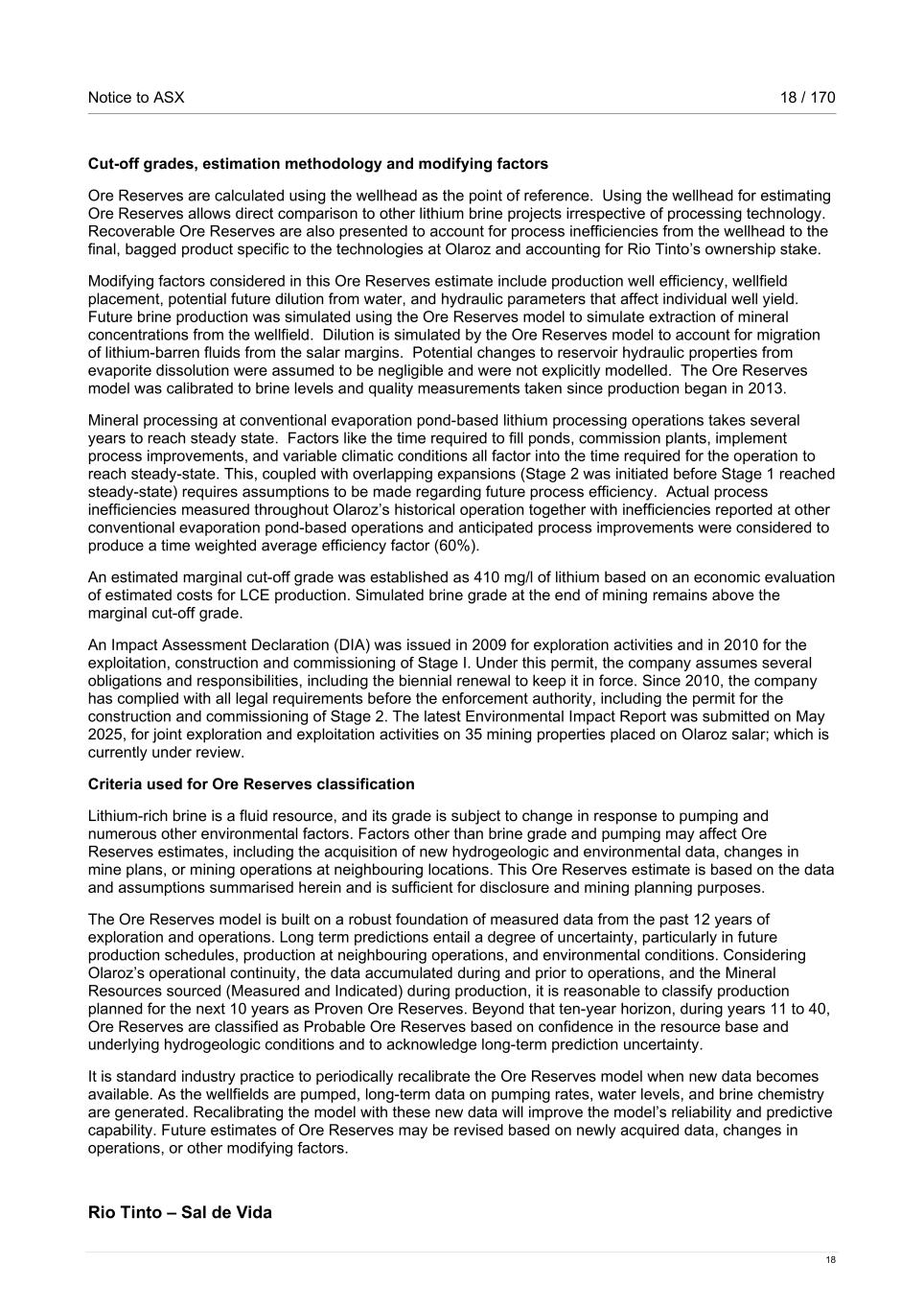

Notice to ASX 2 / 170 2 Tinto (66.5%), Toyota Tsusho Corporation (25%) and Jujuy Energía y Minería Sociedad del Estado (JEMSE, 8.5%). In addition, Rio Tinto has 100% ownership of six properties to the north and west of the joint venture area which contain a portion of the reported Mineral Resources. All Ore Reserves are located within the Sales de Jujuy joint venture properties. Mineral Resources and Ore Reserves for the Olaroz operation are presented in Table A and Table B. Mineral Resources inclusive of Ore Reserves total 19.7 Mt LCE consisting of 8.5 Mt LCE of Measured Mineral Resources, 8.4 Mt LCE of Indicated Mineral Resources and 2.8 Mt LCE of Inferred Mineral Resources. Ore Reserves total 2.7 Mt LCE consisting of 0.6 Mt LCE of Proven Ore Reserves and 2.2 Mt LCE Probable Ore Reserves. Sal de Vida Sal de Vida is a lithium brines project located in the Salar del Hombre Muerto, Catamarca, Argentina (Figure 1). It is 100% owned by Rio Tinto. Mineral Resources and Ore Reserves for the Sal de Vida project are presented in Table A and Table B. Mineral Resources inclusive of Ore Reserves total 7.2 Mt LCE consisting of 3.5 Mt LCE of Measured Mineral Resources, 3.0 Mt LCE of Indicated Mineral Resources and 0.7 Mt LCE of Inferred Mineral Resources. Ore Reserves total 2.5 Mt LCE consisting of 0.4 Mt LCE of Proven Ore Reserves and 2.0 Mt LCE Probable Ore Reserves. Cauchari Cauchari is a lithium brines project located in the Olaroz-Cauchari Salar, Jujuy, Argentina (Figure 1). It is 100% owned by Rio Tinto. Mineral Resources and Ore Reserves for the Cauchari project are presented in Table A and Table B. Mineral Resources inclusive of Ore Reserves total 6.0 Mt LCE consisting of 1.9 Mt LCE of Measured Mineral Resources, 2.6 Mt LCE of Indicated Mineral Resources and 1.5 Mt LCE of Inferred Mineral Resources. Ore Reserves total 1.1 Mt LCE consisting of 0.2 Mt LCE of Proven Ore Reserves and 0.9 Mt LCE Probable Ore Reserves. Whabouchi The Whabouchi project in northern Quebec, Canada (Figure 2), is a hard rock lithium-bearing spodumene deposit and is being developed by Nemaska Lithium, a joint venture between Investissement Québec (50%) and Rio Tinto (50%). Mineral Resources and Ore Reserves for the Whabouchi project are presented in Table C and Table D. Mineral Resources exclusive of Ore Reserves total 26.9 Mt at 1.45% Li2O, consisting of 18.7 Mt at 1.51% Li2O of Indicated Mineral Resources and 8.3 Mt at 1.31% Li2O of Inferred Mineral Resources. Ore Reserves total 26.5 Mt at 1.32% Li2O consisting of 10.5 Mt at 1.40% Li2O of Proved Ore Reserves and 16.0 Mt at 1.27% Li2O of Probable Ore Reserves. Galaxy The Galaxy project is a hard rock lithium-bearing spodumene deposit located in the northeastern part of the Superior Province in northern Quebec, Canada (Figure 2). It is 100% owned by Rio Tinto. Mineral Resources and Ore Reserves for the Galaxy project are presented in Table C and Table D. Mineral Resources exclusive of Ore Reserves total 74.0 Mt at 1.25% Li2O consisting of 18.1 Mt at 1.12% Li2O of Indicated Mineral Resources and 55.9 Mt at 1.29% Li2O of Inferred Mineral Resources. Ore Reserves comprise 37.3 Mt at 1.27% Li2O of Probable Ore Reserves. Mt Cattlin The Mt Cattlin operation is a lithium-bearing spodumene deposit in Western Australia (Figure 3). It is 100% owned by Rio Tinto. Mt Cattlin was placed on care and maintenance on 1 July 2025 due to market conditions. The potential for underground mining to extend the mine's life is the subject of current studies. Mineral Resources and Ore Reserves for Mt Cattlin are presented in Table C and Table D. Mineral Resources exclusive of Ore Reserves total 11.3 Mt at 1.35% Li2O, consisting of 0.1 Mt at 1.11% Li2O of Measured

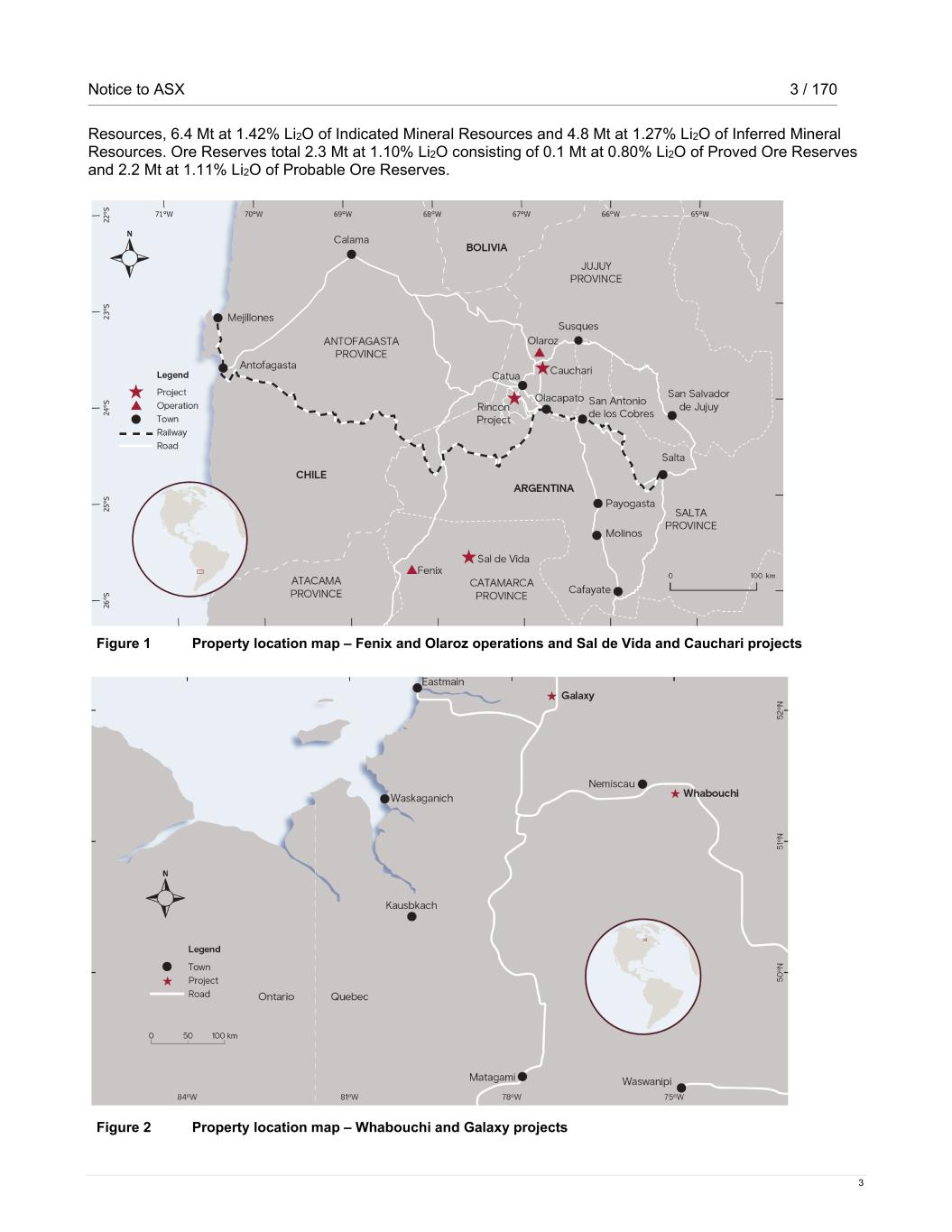

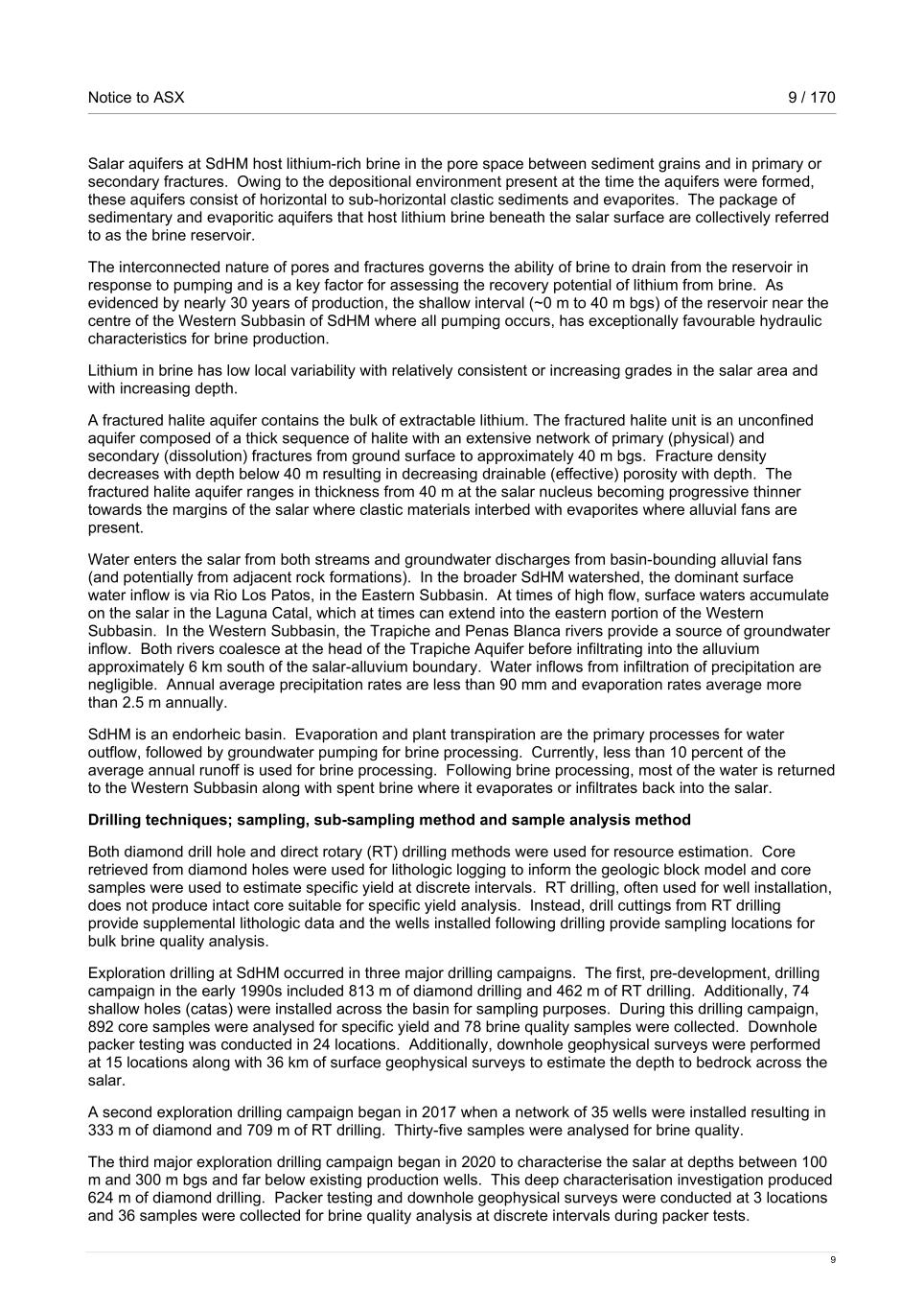

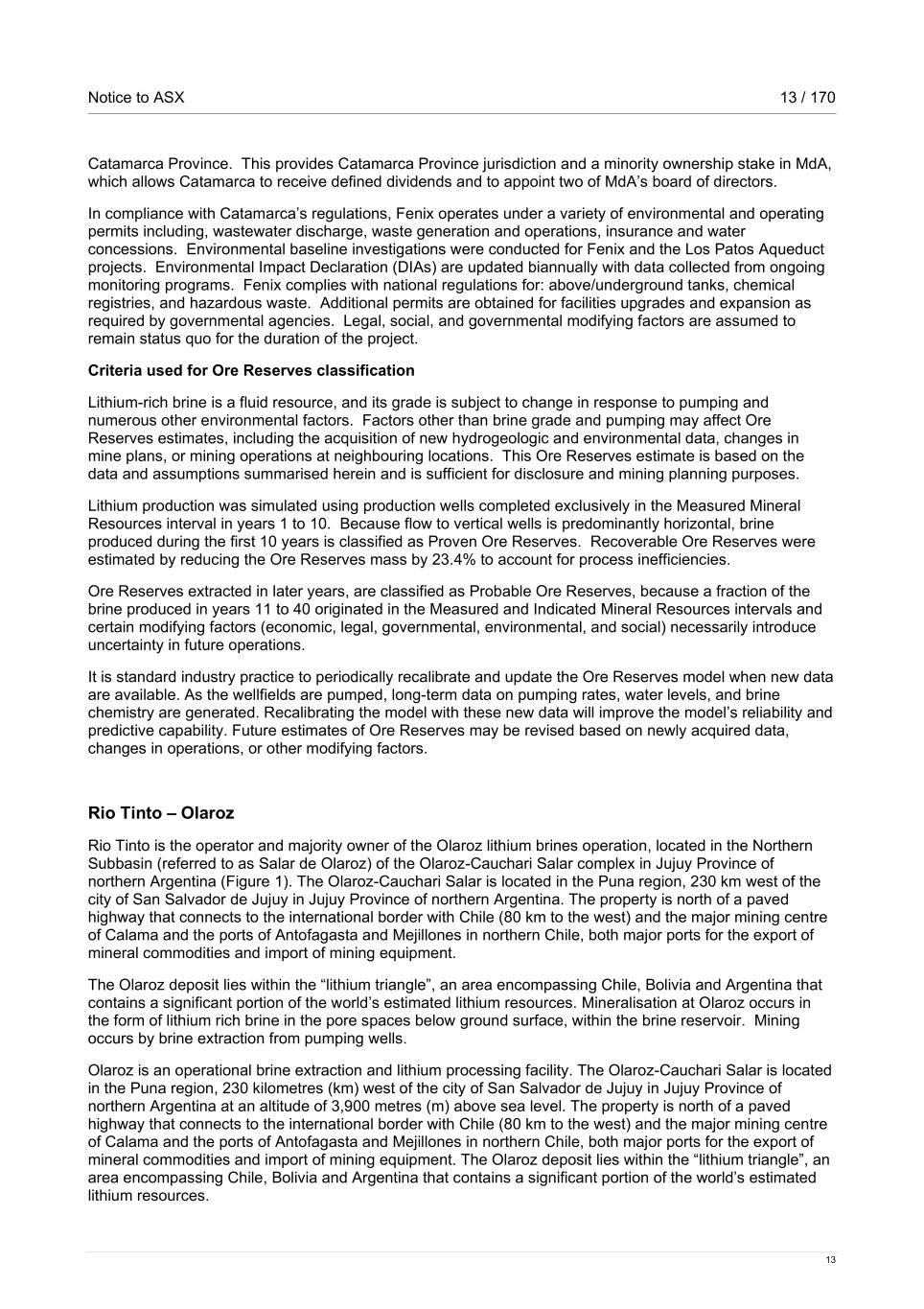

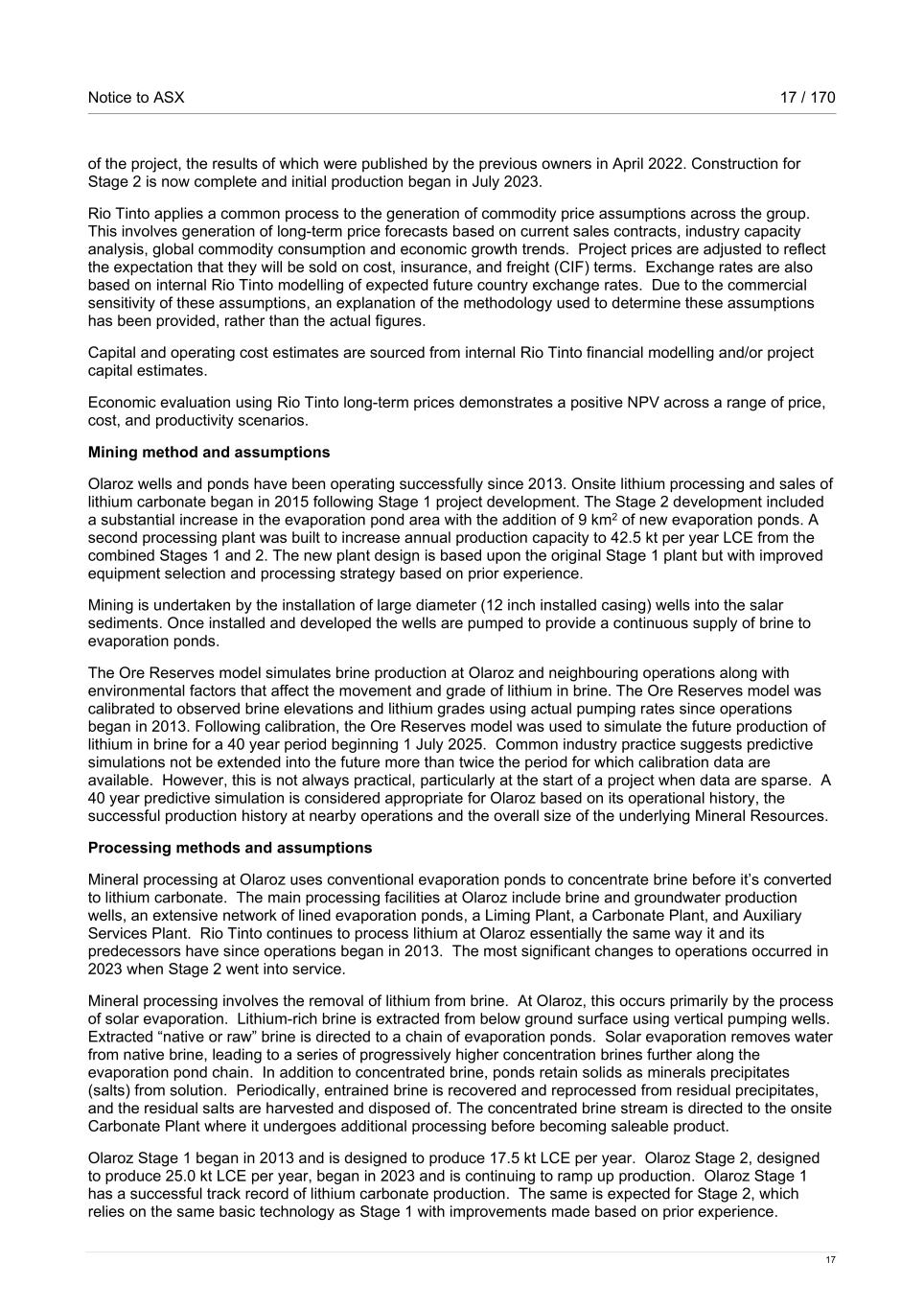

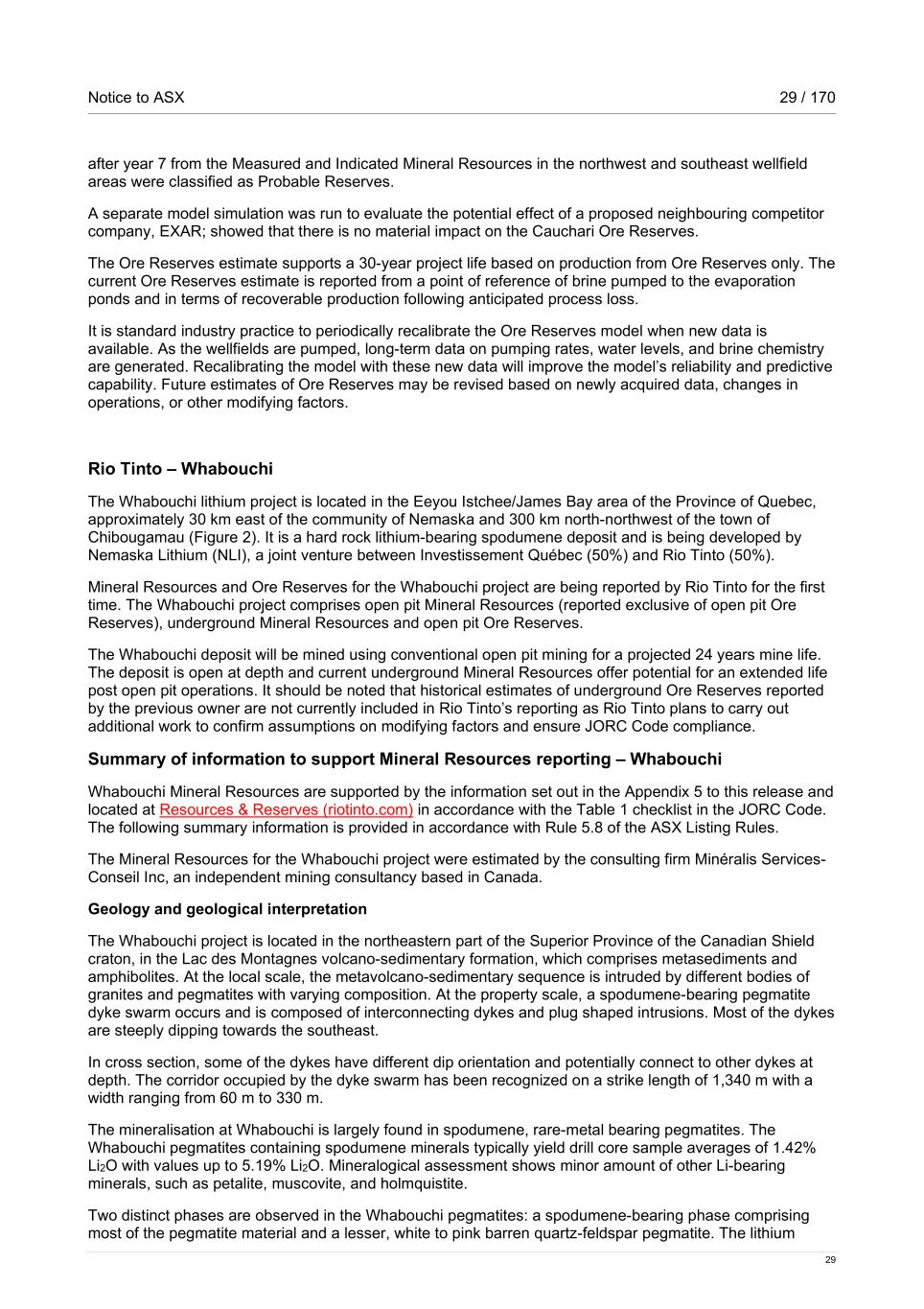

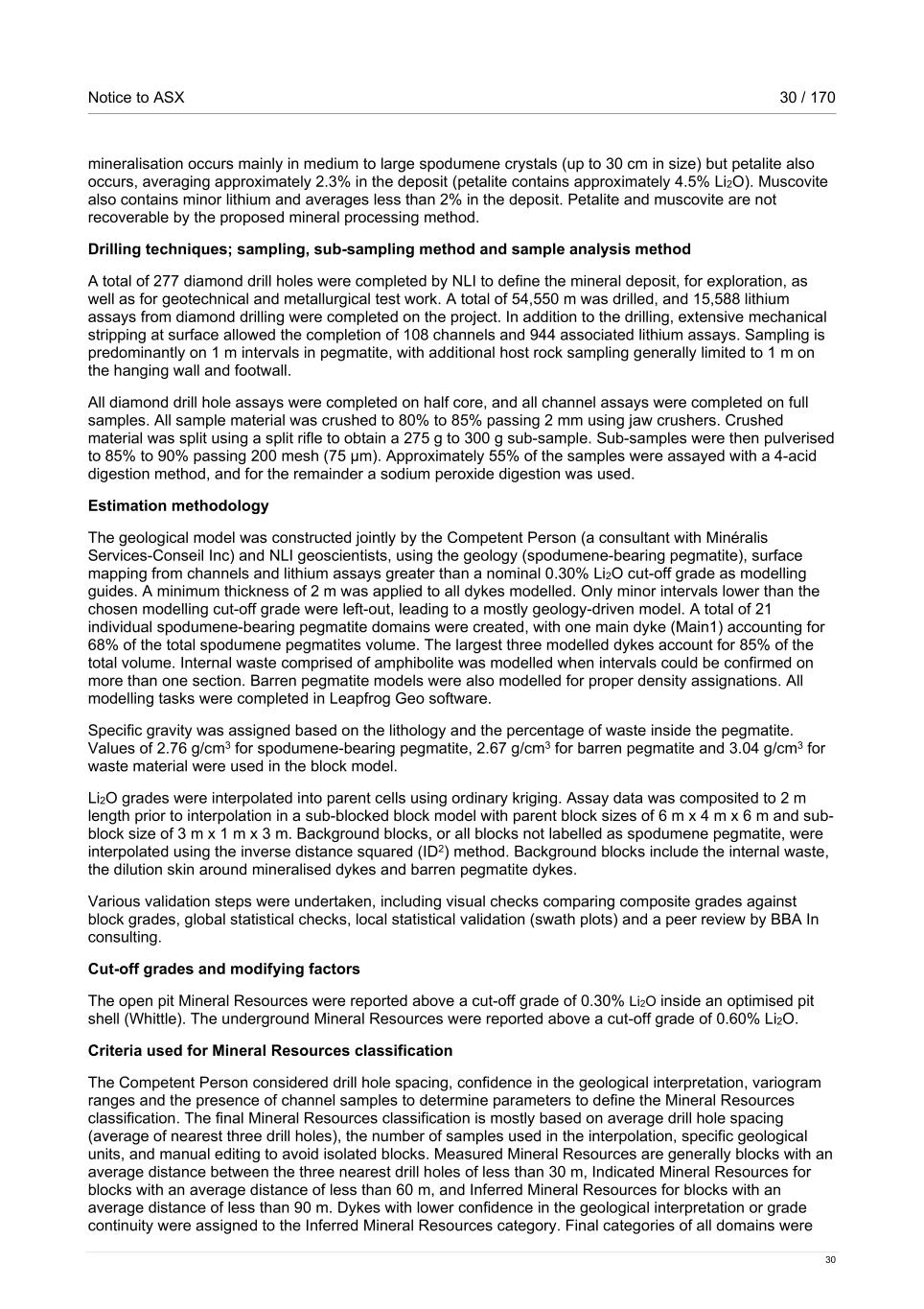

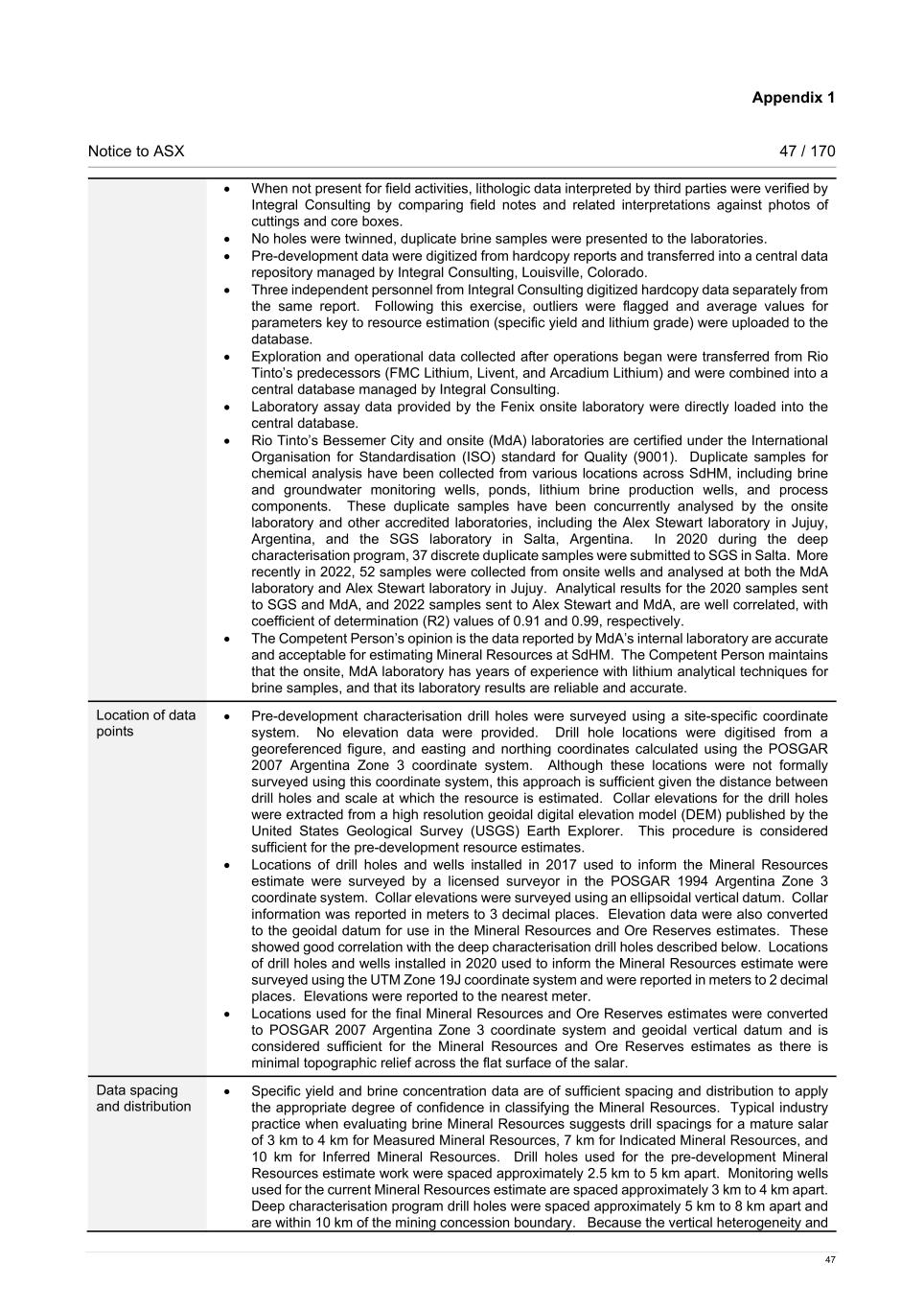

Notice to ASX 3 / 170 3 Resources, 6.4 Mt at 1.42% Li2O of Indicated Mineral Resources and 4.8 Mt at 1.27% Li2O of Inferred Mineral Resources. Ore Reserves total 2.3 Mt at 1.10% Li2O consisting of 0.1 Mt at 0.80% Li2O of Proved Ore Reserves and 2.2 Mt at 1.11% Li2O of Probable Ore Reserves. Figure 1 Property location map – Fenix and Olaroz operations and Sal de Vida and Cauchari projects Figure 2 Property location map – Whabouchi and Galaxy projects

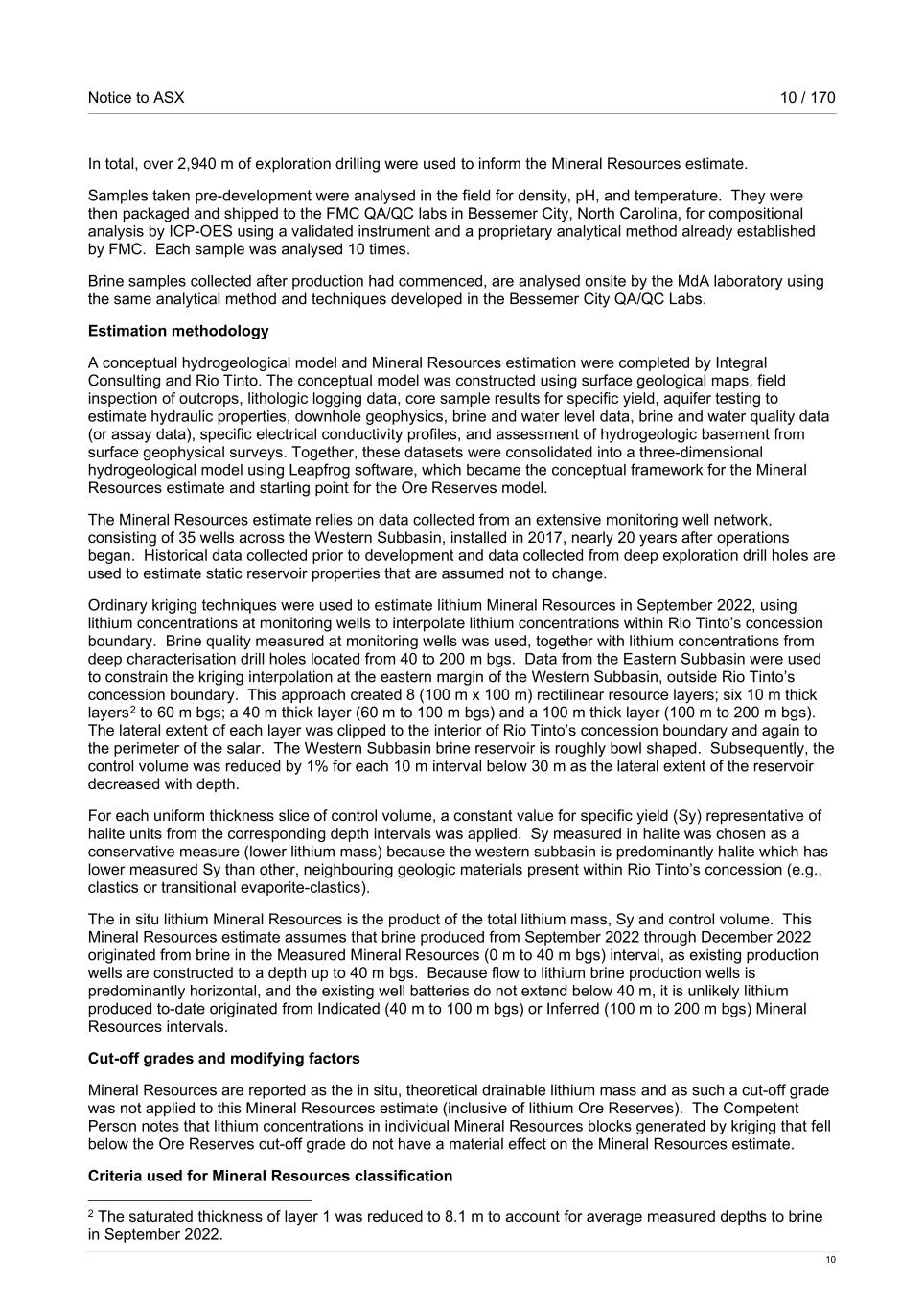

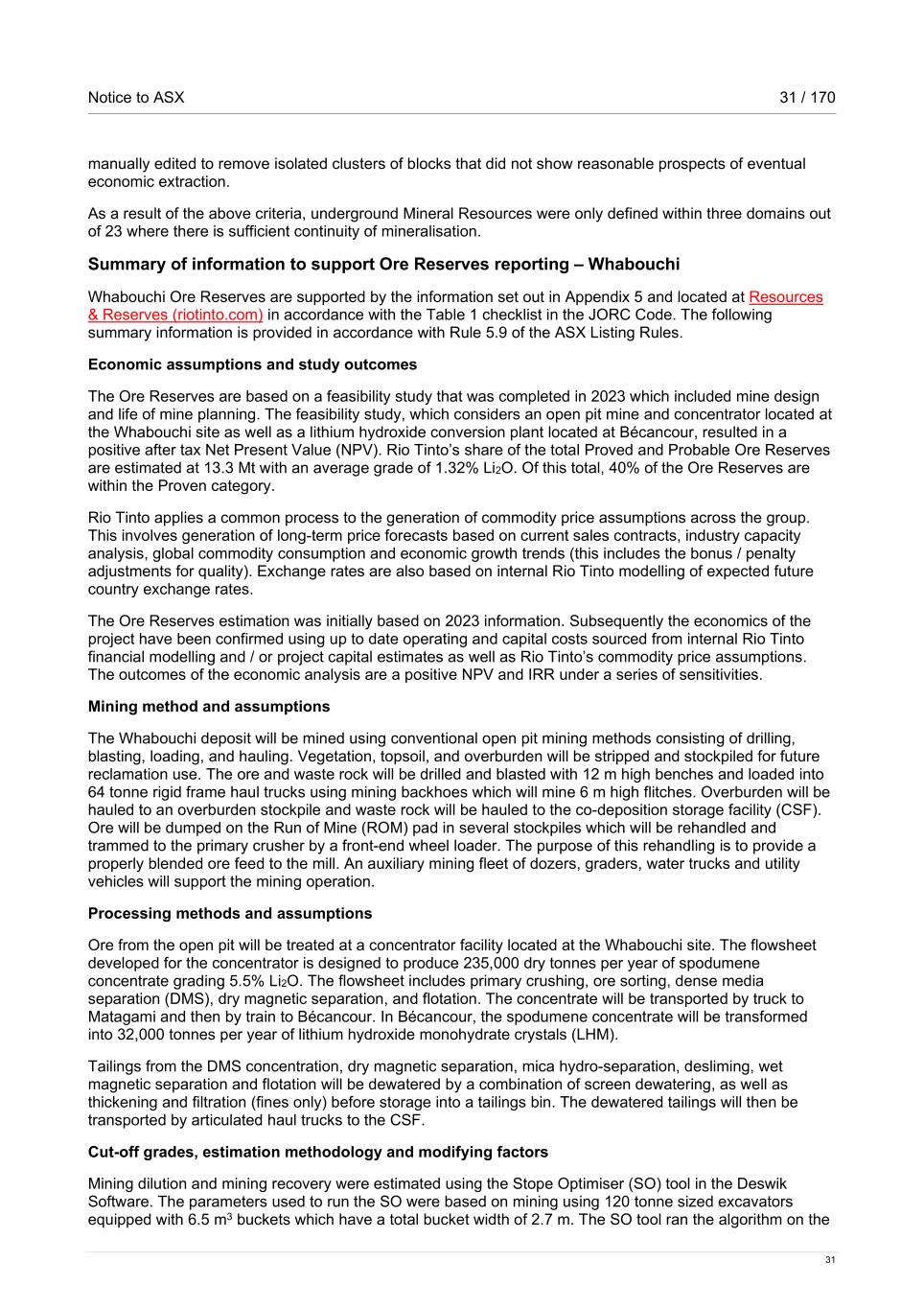

Notice to ASX 4 / 170 4 Figure 3 Property location map – Mt Cattlin operation

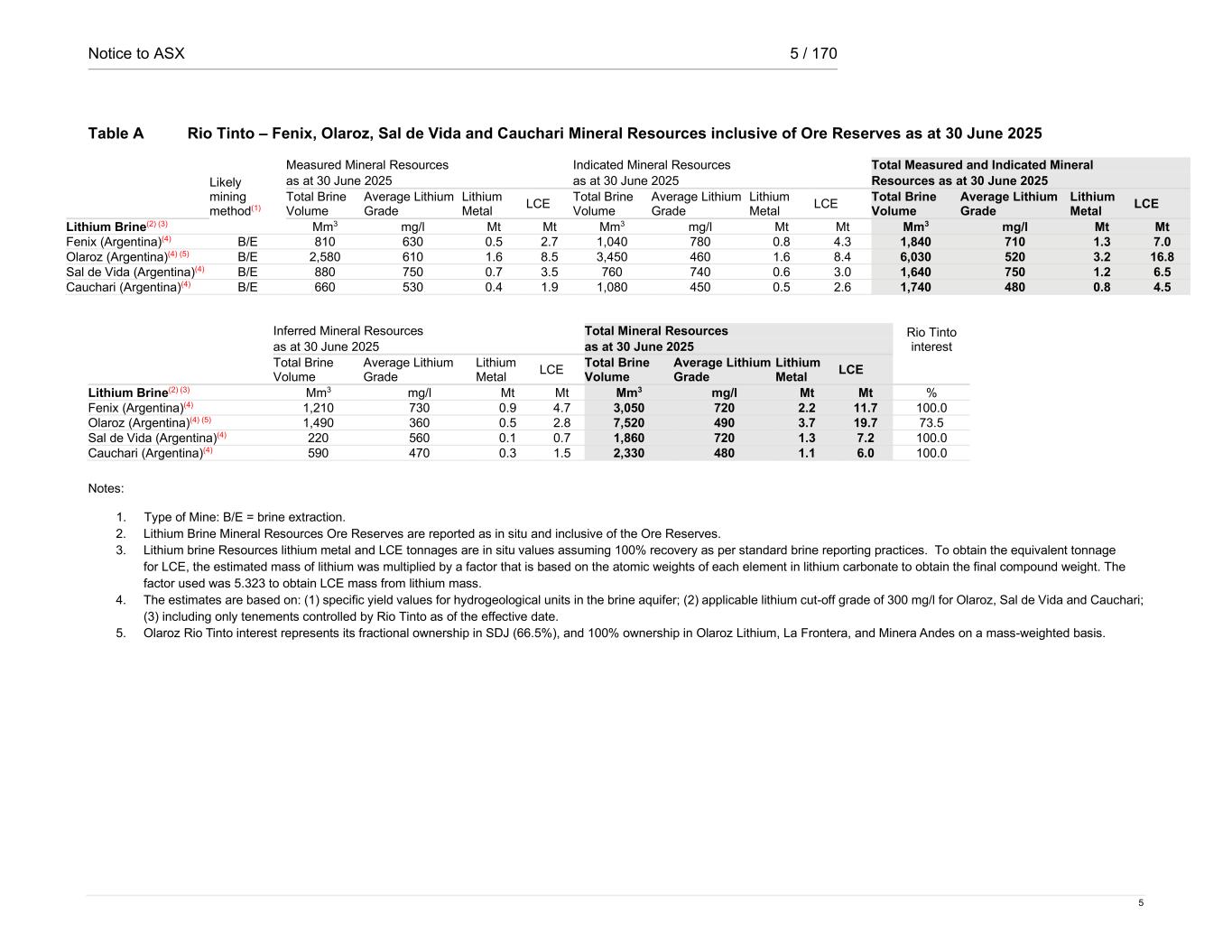

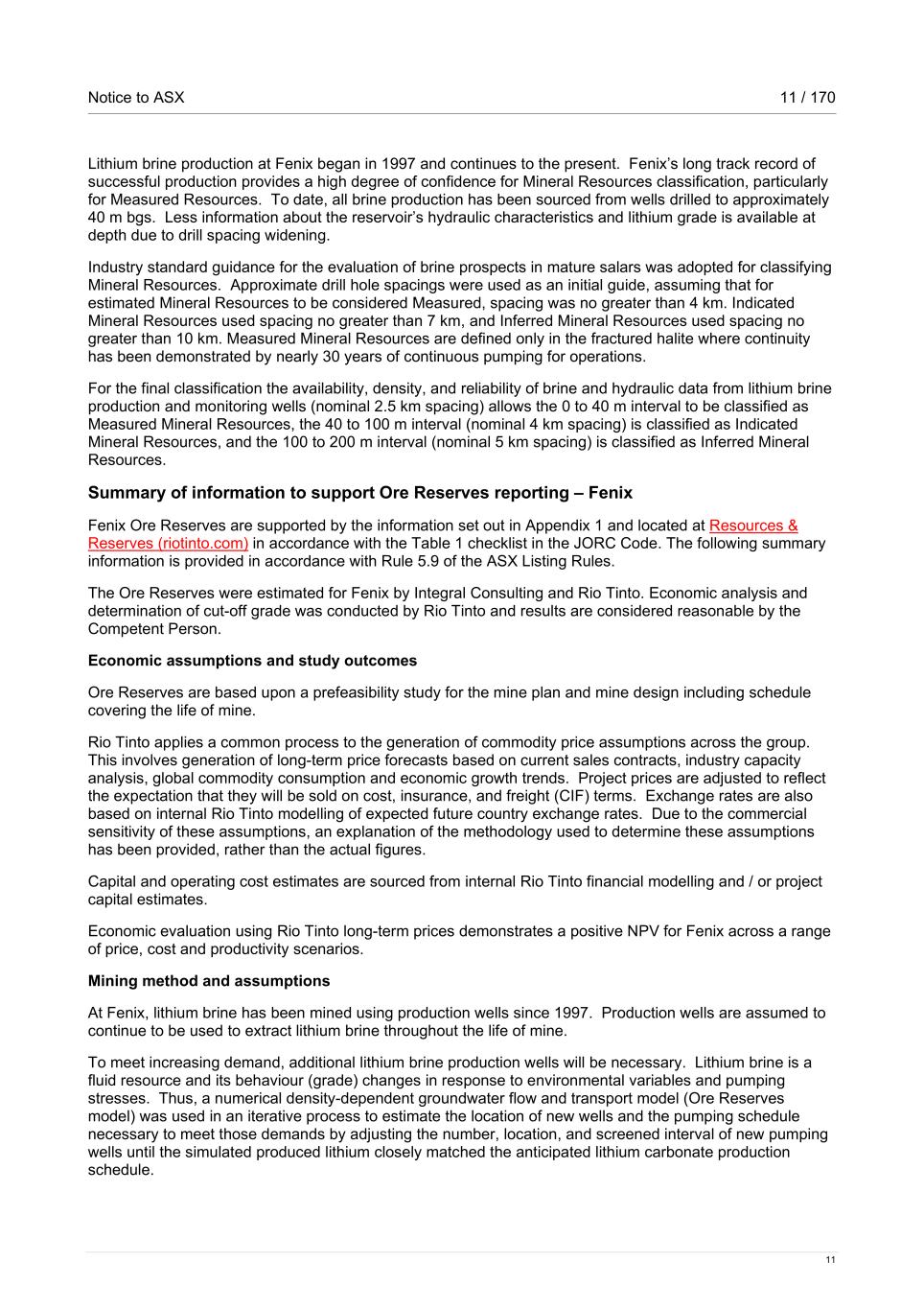

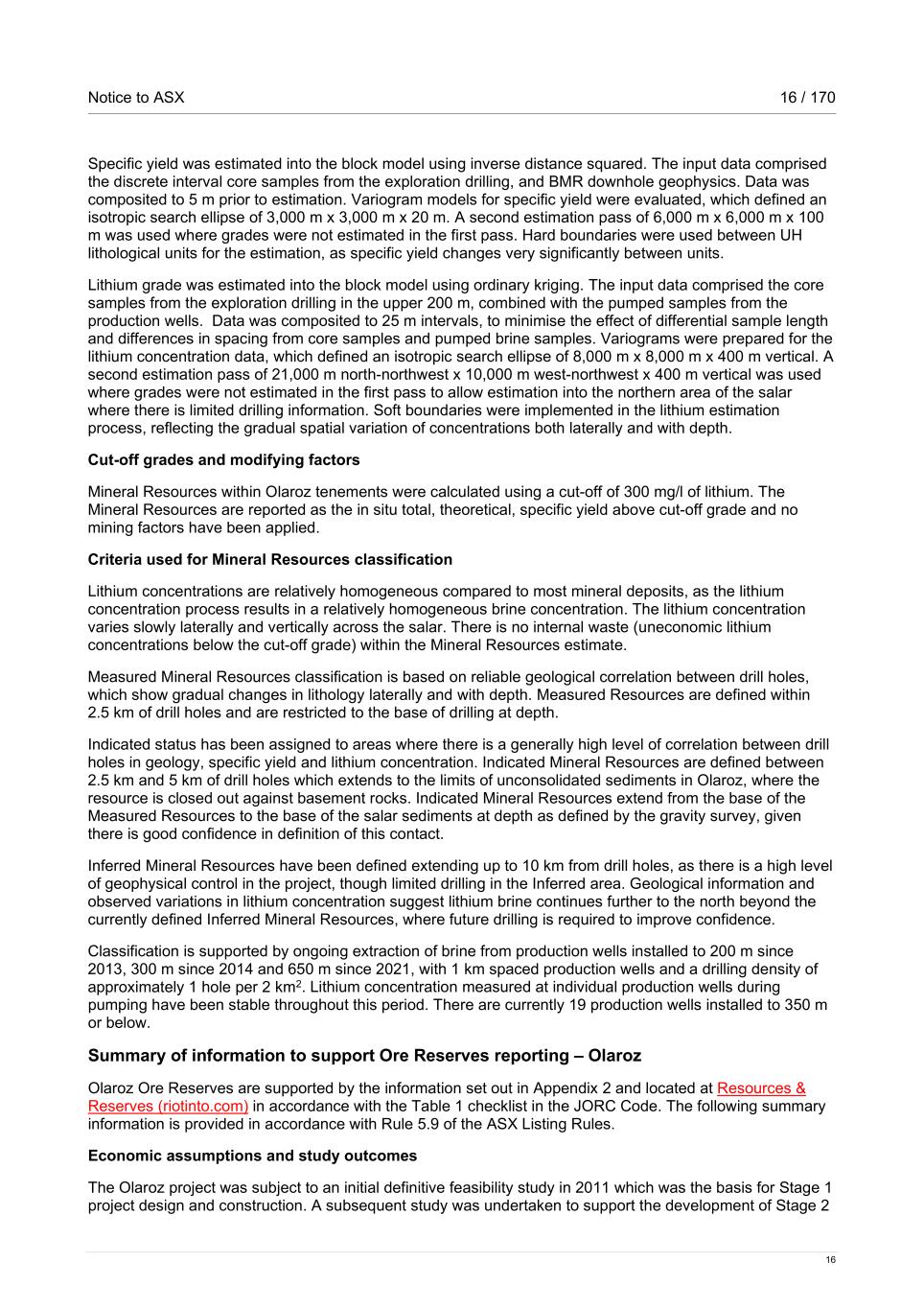

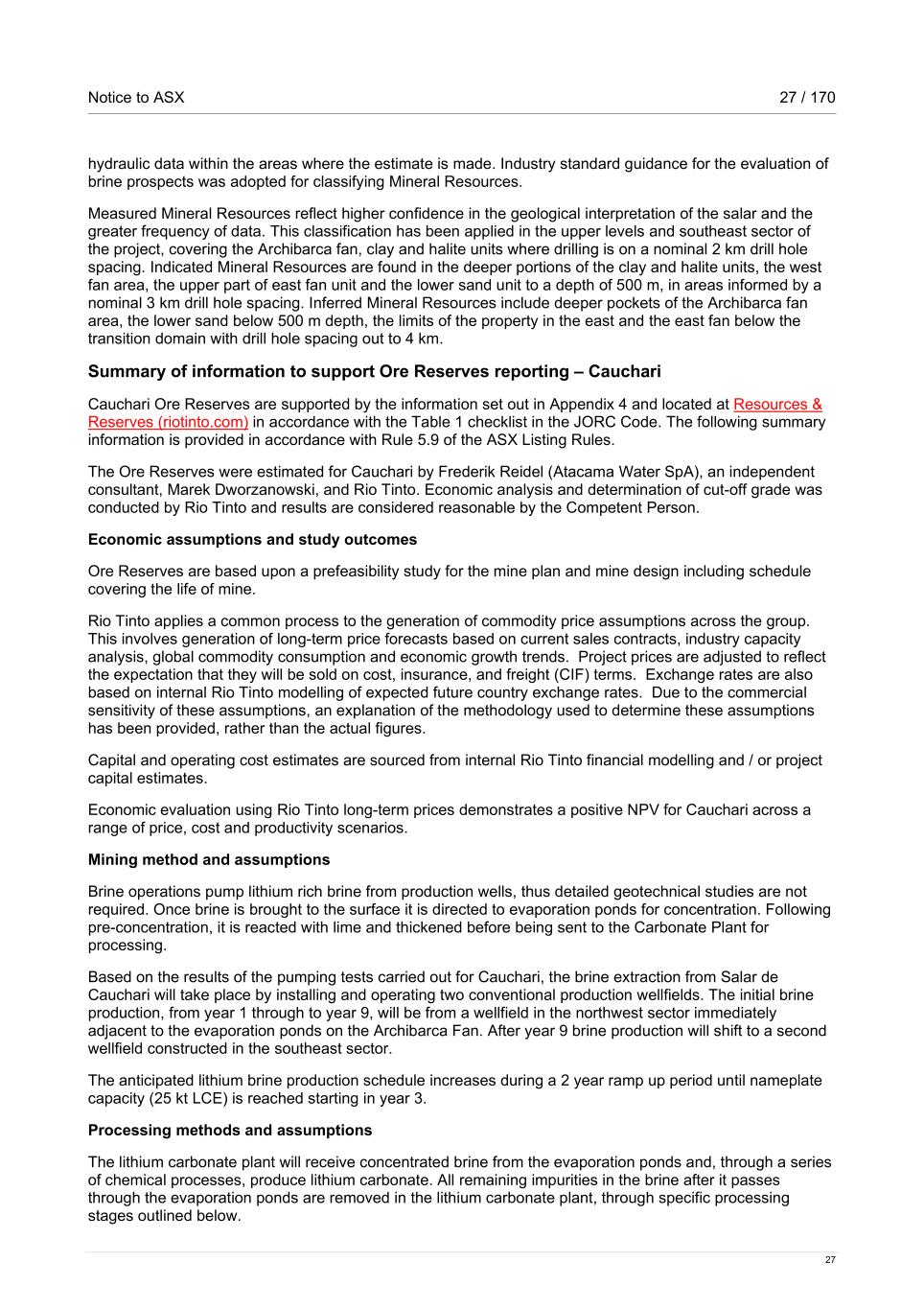

Notice to ASX 5 / 170 5 Table A Rio Tinto – Fenix, Olaroz, Sal de Vida and Cauchari Mineral Resources inclusive of Ore Reserves as at 30 June 2025 Likely mining method(1) Measured Mineral Resources Indicated Mineral Resources Total Measured and Indicated Mineral as at 30 June 2025 as at 30 June 2025 Resources as at 30 June 2025 Total Brine Volume Average Lithium Grade Lithium Metal LCE Total Brine Volume Average Lithium Grade Lithium Metal LCE Total Brine Volume Average Lithium Grade Lithium Metal LCE Lithium Brine(2) (3) Mm3 mg/l Mt Mt Mm3 mg/l Mt Mt Mm3 mg/l Mt Mt Fenix (Argentina)(4) B/E 810 630 0.5 2.7 1,040 780 0.8 4.3 1,840 710 1.3 7.0 Olaroz (Argentina)(4) (5) B/E 2,580 610 1.6 8.5 3,450 460 1.6 8.4 6,030 520 3.2 16.8 Sal de Vida (Argentina)(4) B/E 880 750 0.7 3.5 760 740 0.6 3.0 1,640 750 1.2 6.5 Cauchari (Argentina)(4) B/E 660 530 0.4 1.9 1,080 450 0.5 2.6 1,740 480 0.8 4.5 Inferred Mineral Resources Total Mineral Resources Rio Tinto interest as at 30 June 2025 as at 30 June 2025 Total Brine Volume Average Lithium Grade Lithium Metal LCE Total Brine Volume Average Lithium Grade Lithium Metal LCE Lithium Brine(2) (3) Mm3 mg/l Mt Mt Mm3 mg/l Mt Mt % Fenix (Argentina)(4) 1,210 730 0.9 4.7 3,050 720 2.2 11.7 100.0 Olaroz (Argentina)(4) (5) 1,490 360 0.5 2.8 7,520 490 3.7 19.7 73.5 Sal de Vida (Argentina)(4) 220 560 0.1 0.7 1,860 720 1.3 7.2 100.0 Cauchari (Argentina)(4) 590 470 0.3 1.5 2,330 480 1.1 6.0 100.0 Notes: 1. Type of Mine: B/E = brine extraction. 2. Lithium Brine Mineral Resources Ore Reserves are reported as in situ and inclusive of the Ore Reserves. 3. Lithium brine Resources lithium metal and LCE tonnages are in situ values assuming 100% recovery as per standard brine reporting practices. To obtain the equivalent tonnage for LCE, the estimated mass of lithium was multiplied by a factor that is based on the atomic weights of each element in lithium carbonate to obtain the final compound weight. The factor used was 5.323 to obtain LCE mass from lithium mass. 4. The estimates are based on: (1) specific yield values for hydrogeological units in the brine aquifer; (2) applicable lithium cut-off grade of 300 mg/l for Olaroz, Sal de Vida and Cauchari; (3) including only tenements controlled by Rio Tinto as of the effective date. 5. Olaroz Rio Tinto interest represents its fractional ownership in SDJ (66.5%), and 100% ownership in Olaroz Lithium, La Frontera, and Minera Andes on a mass-weighted basis.

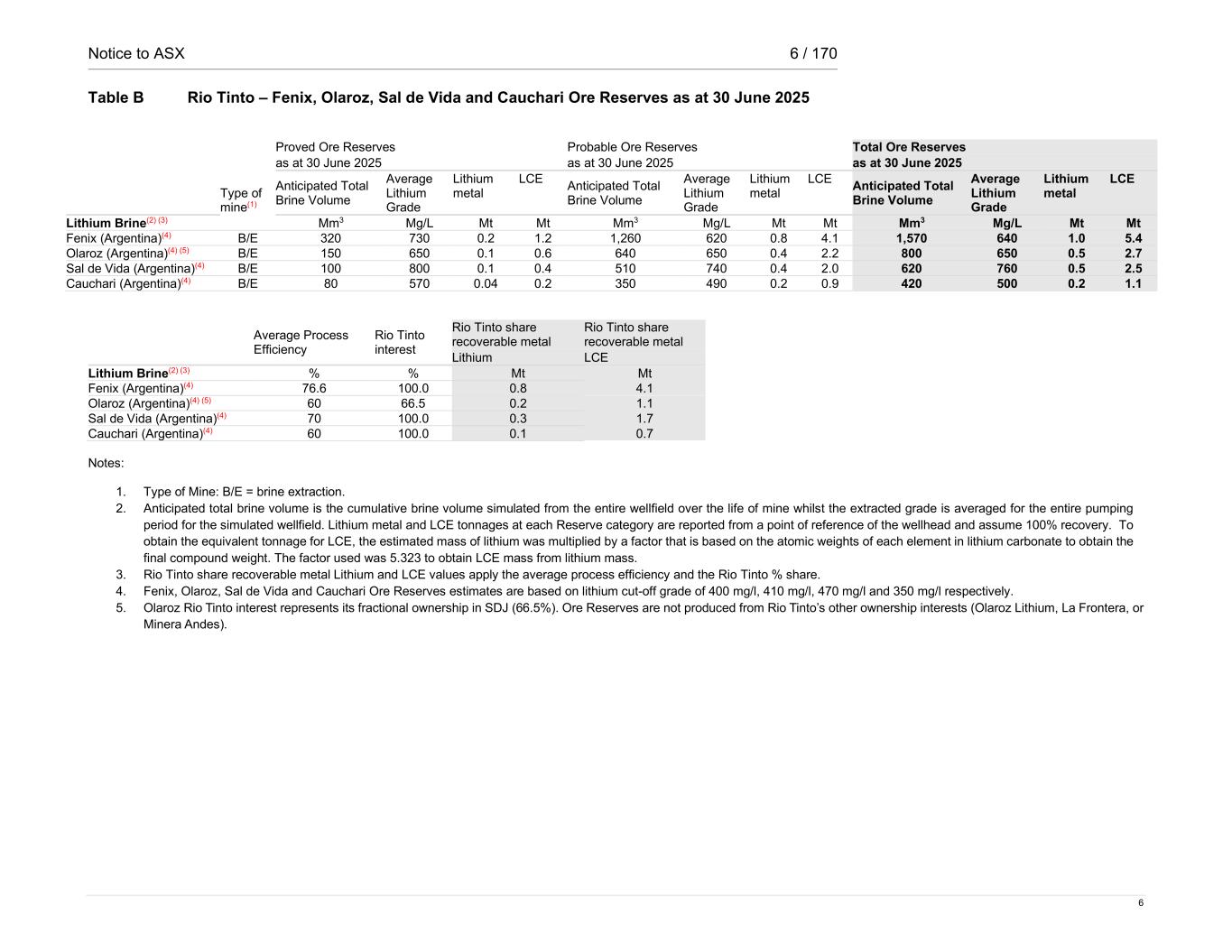

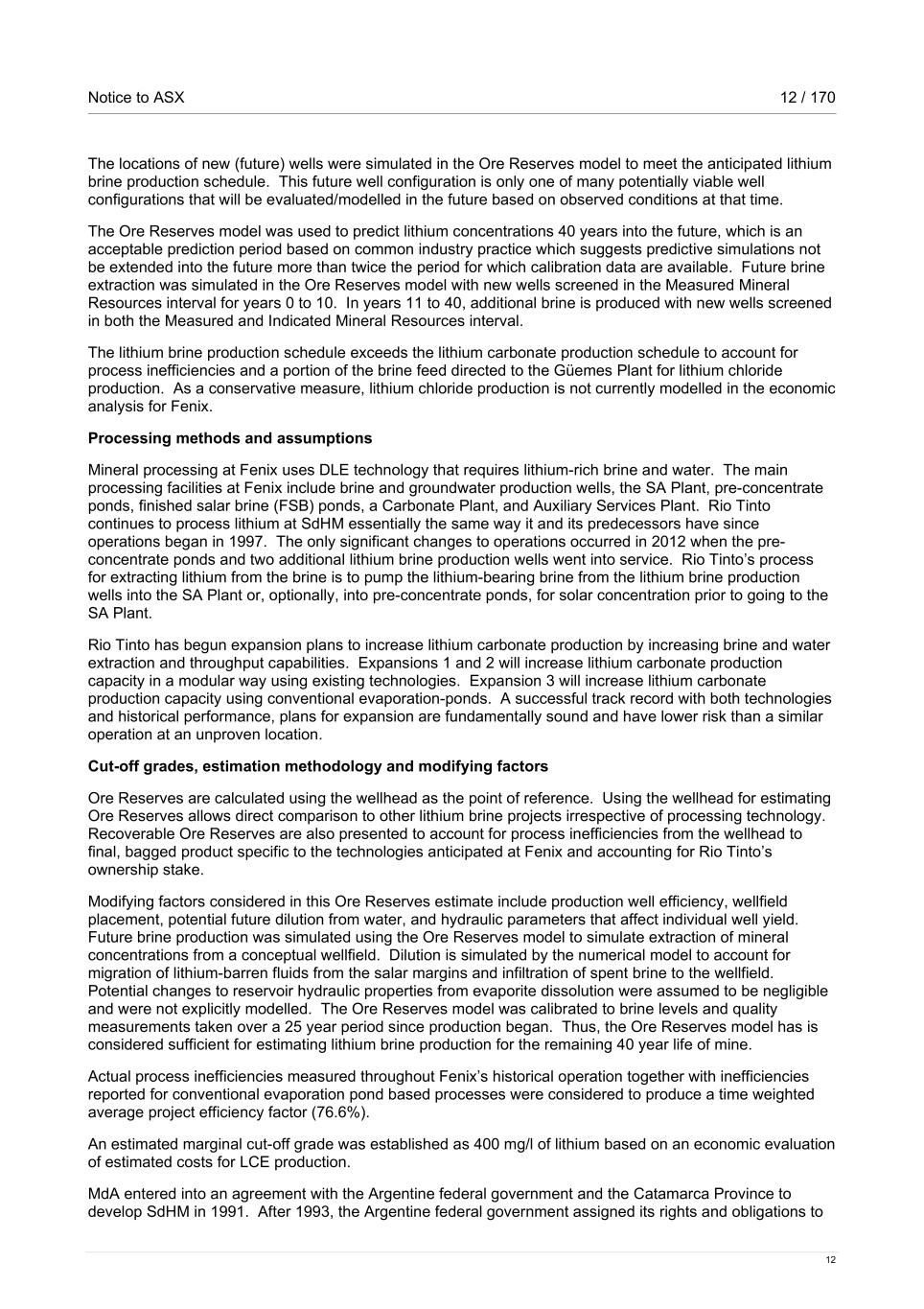

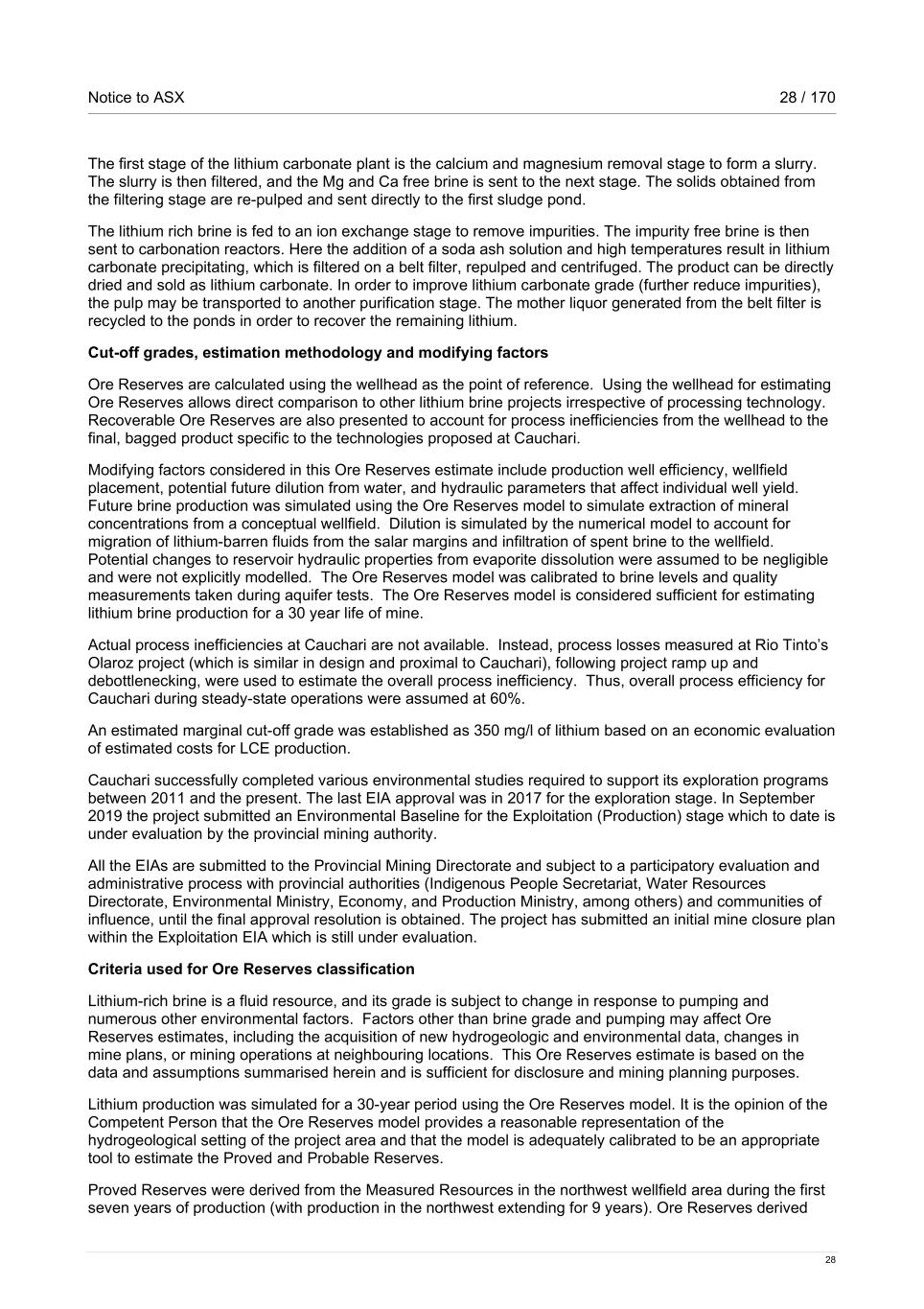

Notice to ASX 6 / 170 6 Table B Rio Tinto – Fenix, Olaroz, Sal de Vida and Cauchari Ore Reserves as at 30 June 2025 Type of mine(1) Proved Ore Reserves Probable Ore Reserves Total Ore Reserves as at 30 June 2025 as at 30 June 2025 as at 30 June 2025 Anticipated Total Brine Volume Average Lithium Grade Lithium metal LCE Anticipated Total Brine Volume Average Lithium Grade Lithium metal LCE Anticipated Total Brine Volume Average Lithium Grade Lithium metal LCE Lithium Brine(2) (3) Mm3 Mg/L Mt Mt Mm3 Mg/L Mt Mt Mm3 Mg/L Mt Mt Fenix (Argentina)(4) B/E 320 730 0.2 1.2 1,260 620 0.8 4.1 1,570 640 1.0 5.4 Olaroz (Argentina)(4) (5) B/E 150 650 0.1 0.6 640 650 0.4 2.2 800 650 0.5 2.7 Sal de Vida (Argentina)(4) B/E 100 800 0.1 0.4 510 740 0.4 2.0 620 760 0.5 2.5 Cauchari (Argentina)(4) B/E 80 570 0.04 0.2 350 490 0.2 0.9 420 500 0.2 1.1 Average Process Efficiency Rio Tinto interest Rio Tinto share recoverable metal Rio Tinto share recoverable metal Lithium LCE Lithium Brine(2) (3) % % Mt Mt Fenix (Argentina)(4) 76.6 100.0 0.8 4.1 Olaroz (Argentina)(4) (5) 60 66.5 0.2 1.1 Sal de Vida (Argentina)(4) 70 100.0 0.3 1.7 Cauchari (Argentina)(4) 60 100.0 0.1 0.7 Notes: 1. Type of Mine: B/E = brine extraction. 2. Anticipated total brine volume is the cumulative brine volume simulated from the entire wellfield over the life of mine whilst the extracted grade is averaged for the entire pumping period for the simulated wellfield. Lithium metal and LCE tonnages at each Reserve category are reported from a point of reference of the wellhead and assume 100% recovery. To obtain the equivalent tonnage for LCE, the estimated mass of lithium was multiplied by a factor that is based on the atomic weights of each element in lithium carbonate to obtain the final compound weight. The factor used was 5.323 to obtain LCE mass from lithium mass. 3. Rio Tinto share recoverable metal Lithium and LCE values apply the average process efficiency and the Rio Tinto % share. 4. Fenix, Olaroz, Sal de Vida and Cauchari Ore Reserves estimates are based on lithium cut-off grade of 400 mg/l, 410 mg/l, 470 mg/l and 350 mg/l respectively. 5. Olaroz Rio Tinto interest represents its fractional ownership in SDJ (66.5%). Ore Reserves are not produced from Rio Tinto’s other ownership interests (Olaroz Lithium, La Frontera, or Minera Andes).

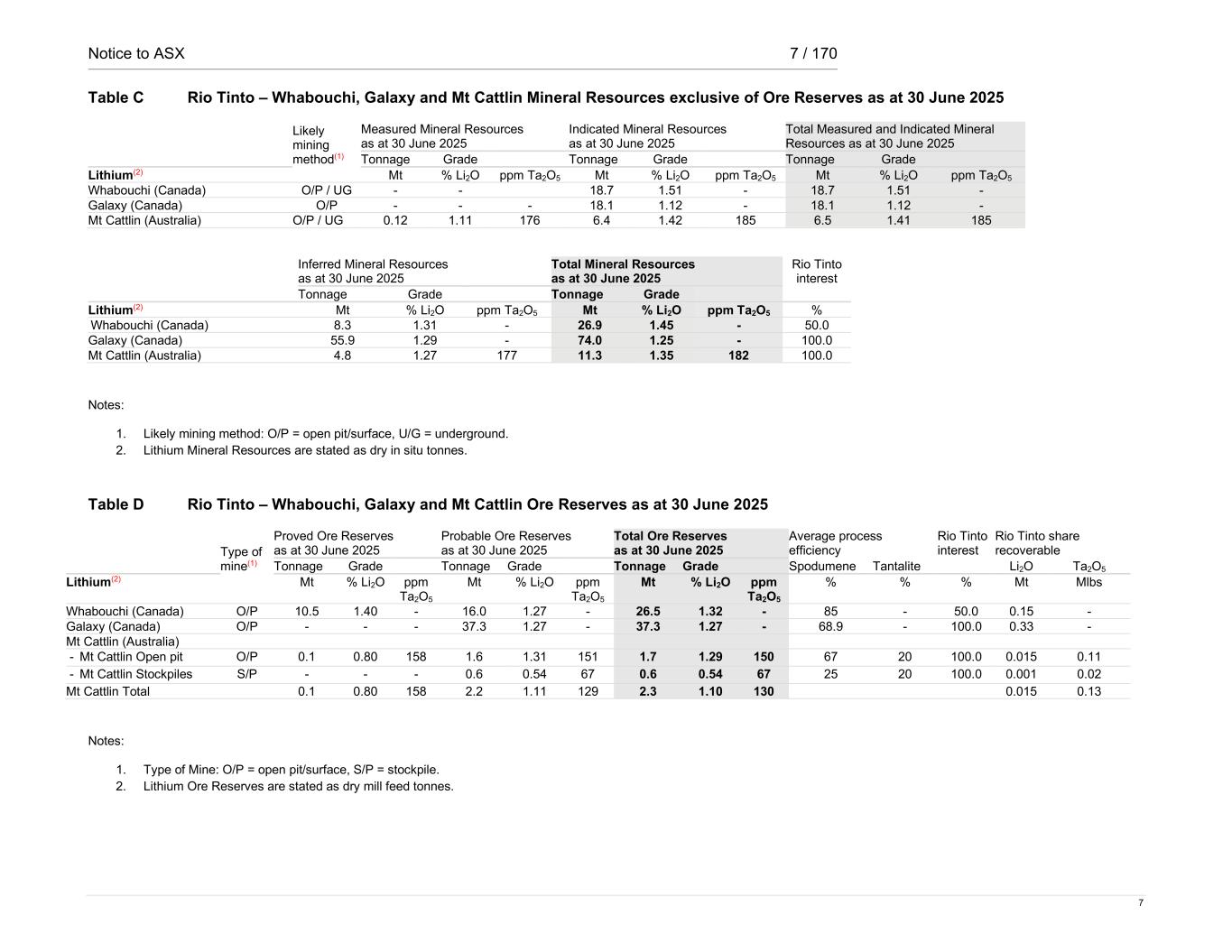

Notice to ASX 7 / 170 7 Table C Rio Tinto – Whabouchi, Galaxy and Mt Cattlin Mineral Resources exclusive of Ore Reserves as at 30 June 2025 Likely mining method(1) Measured Mineral Resources as at 30 June 2025 Indicated Mineral Resources as at 30 June 2025 Total Measured and Indicated Mineral Resources as at 30 June 2025 Tonnage Grade Tonnage Grade Tonnage Grade Lithium(2) Mt % Li2O ppm Ta2O5 Mt % Li2O ppm Ta2O5 Mt % Li2O ppm Ta2O5 Whabouchi (Canada) O/P / UG - - 18.7 1.51 - 18.7 1.51 - Galaxy (Canada) O/P - - - 18.1 1.12 - 18.1 1.12 - Mt Cattlin (Australia) O/P / UG 0.12 1.11 176 6.4 1.42 185 6.5 1.41 185 Inferred Mineral Resources as at 30 June 2025 Total Mineral Resources as at 30 June 2025 Rio Tinto interest Tonnage Grade Tonnage Grade Lithium(2) Mt % Li2O ppm Ta2O5 Mt % Li2O ppm Ta2O5 % Whabouchi (Canada) 8.3 1.31 - 26.9 1.45 - 50.0 Galaxy (Canada) 55.9 1.29 - 74.0 1.25 - 100.0 Mt Cattlin (Australia) 4.8 1.27 177 11.3 1.35 182 100.0 Notes: 1. Likely mining method: O/P = open pit/surface, U/G = underground. 2. Lithium Mineral Resources are stated as dry in situ tonnes. Table D Rio Tinto – Whabouchi, Galaxy and Mt Cattlin Ore Reserves as at 30 June 2025 Type of mine(1) Proved Ore Reserves as at 30 June 2025 Probable Ore Reserves as at 30 June 2025 Total Ore Reserves as at 30 June 2025 Average process efficiency Rio Tinto interest Rio Tinto share recoverable Tonnage Grade Tonnage Grade Tonnage Grade Spodumene Tantalite Li2O Ta2O5 Lithium(2) Mt % Li2O ppm Ta2O5 Mt % Li2O ppm Ta2O5 Mt % Li2O ppm Ta2O5 % % % Mt Mlbs Whabouchi (Canada) O/P 10.5 1.40 - 16.0 1.27 - 26.5 1.32 - 85 - 50.0 0.15 - Galaxy (Canada) O/P - - - 37.3 1.27 - 37.3 1.27 - 68.9 - 100.0 0.33 - Mt Cattlin (Australia) - Mt Cattlin Open pit O/P 0.1 0.80 158 1.6 1.31 151 1.7 1.29 150 67 20 100.0 0.015 0.11 - Mt Cattlin Stockpiles S/P - - - 0.6 0.54 67 0.6 0.54 67 25 20 100.0 0.001 0.02 Mt Cattlin Total 0.1 0.80 158 2.2 1.11 129 2.3 1.10 130 0.015 0.13 Notes: 1. Type of Mine: O/P = open pit/surface, S/P = stockpile. 2. Lithium Ore Reserves are stated as dry mill feed tonnes.

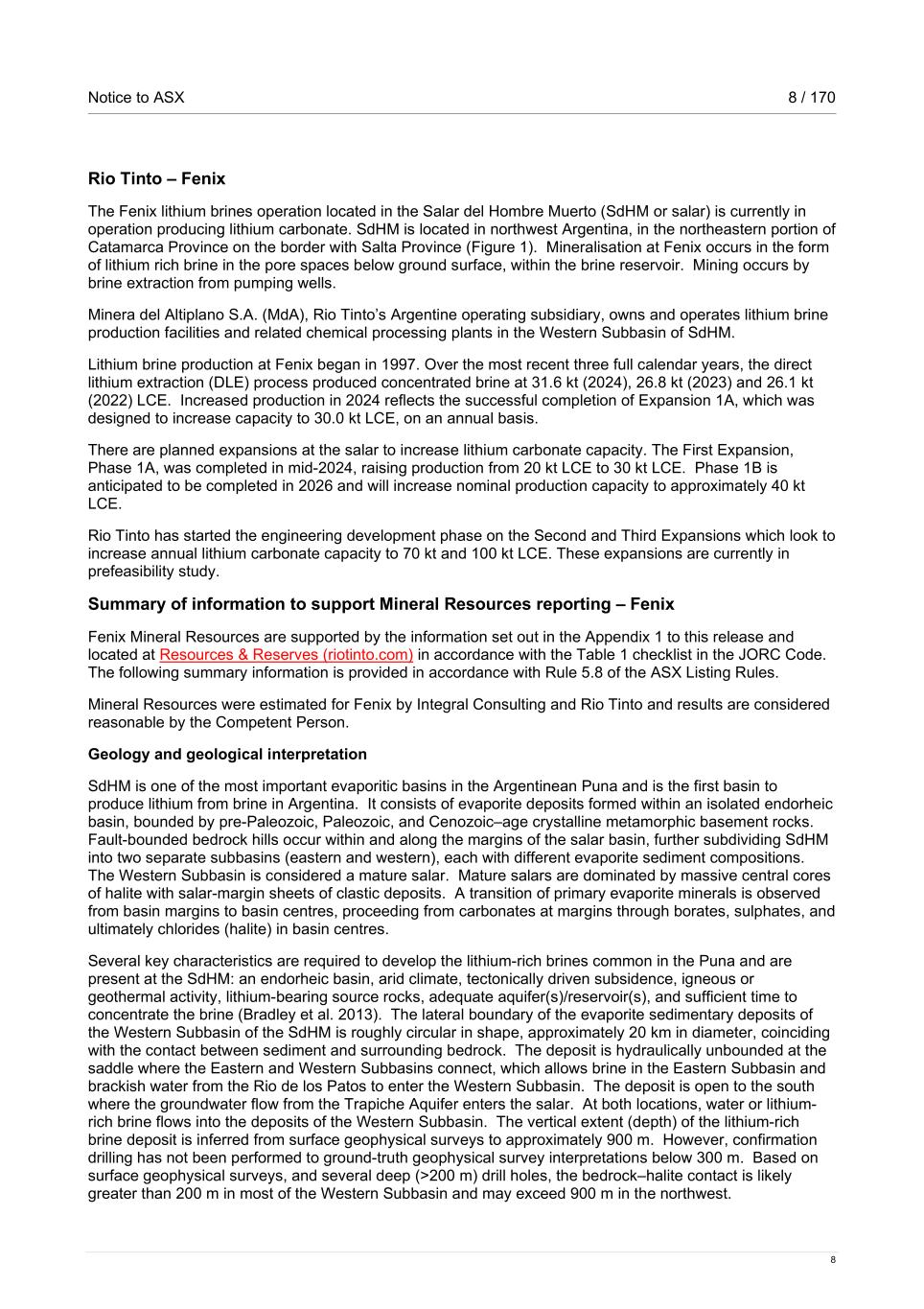

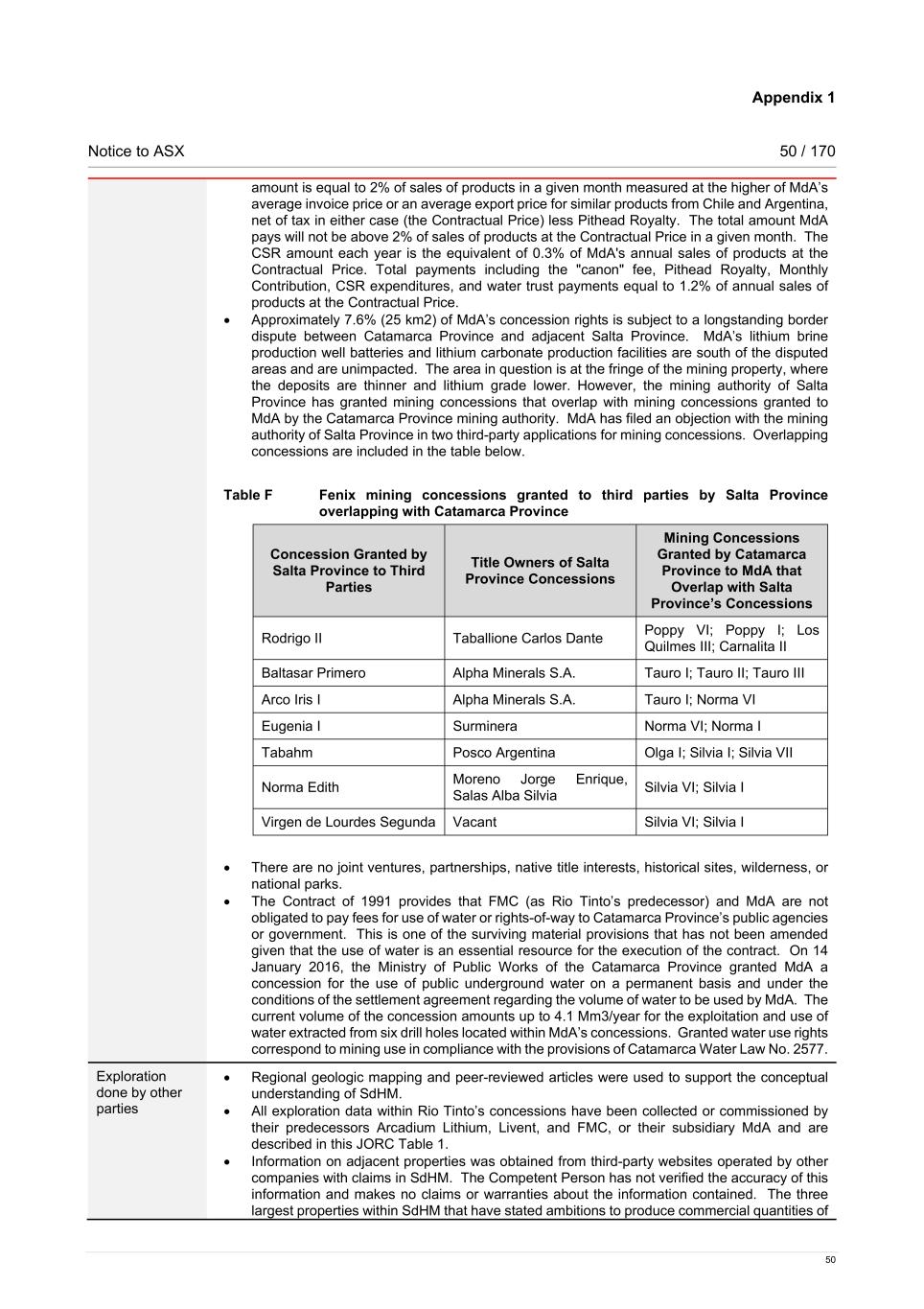

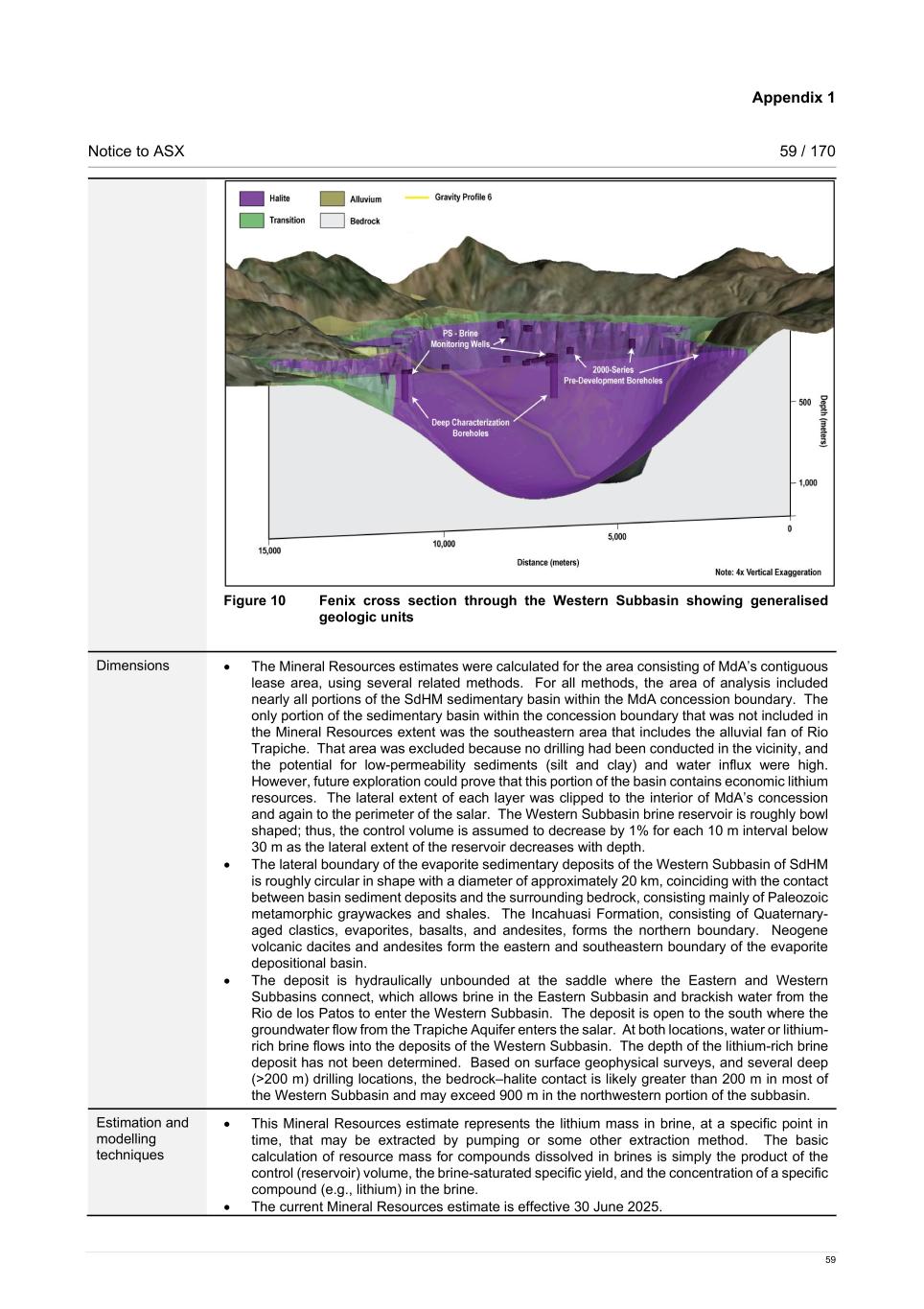

Notice to ASX 8 / 170 8 Rio Tinto – Fenix The Fenix lithium brines operation located in the Salar del Hombre Muerto (SdHM or salar) is currently in operation producing lithium carbonate. SdHM is located in northwest Argentina, in the northeastern portion of Catamarca Province on the border with Salta Province (Figure 1). Mineralisation at Fenix occurs in the form of lithium rich brine in the pore spaces below ground surface, within the brine reservoir. Mining occurs by brine extraction from pumping wells. Minera del Altiplano S.A. (MdA), Rio Tinto’s Argentine operating subsidiary, owns and operates lithium brine production facilities and related chemical processing plants in the Western Subbasin of SdHM. Lithium brine production at Fenix began in 1997. Over the most recent three full calendar years, the direct lithium extraction (DLE) process produced concentrated brine at 31.6 kt (2024), 26.8 kt (2023) and 26.1 kt (2022) LCE. Increased production in 2024 reflects the successful completion of Expansion 1A, which was designed to increase capacity to 30.0 kt LCE, on an annual basis. There are planned expansions at the salar to increase lithium carbonate capacity. The First Expansion, Phase 1A, was completed in mid-2024, raising production from 20 kt LCE to 30 kt LCE. Phase 1B is anticipated to be completed in 2026 and will increase nominal production capacity to approximately 40 kt LCE. Rio Tinto has started the engineering development phase on the Second and Third Expansions which look to increase annual lithium carbonate capacity to 70 kt and 100 kt LCE. These expansions are currently in prefeasibility study. Summary of information to support Mineral Resources reporting – Fenix Fenix Mineral Resources are supported by the information set out in the Appendix 1 to this release and located at Resources & Reserves (riotinto.com) in accordance with the Table 1 checklist in the JORC Code. The following summary information is provided in accordance with Rule 5.8 of the ASX Listing Rules. Mineral Resources were estimated for Fenix by Integral Consulting and Rio Tinto and results are considered reasonable by the Competent Person. Geology and geological interpretation SdHM is one of the most important evaporitic basins in the Argentinean Puna and is the first basin to produce lithium from brine in Argentina. It consists of evaporite deposits formed within an isolated endorheic basin, bounded by pre-Paleozoic, Paleozoic, and Cenozoic–age crystalline metamorphic basement rocks. Fault-bounded bedrock hills occur within and along the margins of the salar basin, further subdividing SdHM into two separate subbasins (eastern and western), each with different evaporite sediment compositions. The Western Subbasin is considered a mature salar. Mature salars are dominated by massive central cores of halite with salar-margin sheets of clastic deposits. A transition of primary evaporite minerals is observed from basin margins to basin centres, proceeding from carbonates at margins through borates, sulphates, and ultimately chlorides (halite) in basin centres. Several key characteristics are required to develop the lithium-rich brines common in the Puna and are present at the SdHM: an endorheic basin, arid climate, tectonically driven subsidence, igneous or geothermal activity, lithium-bearing source rocks, adequate aquifer(s)/reservoir(s), and sufficient time to concentrate the brine (Bradley et al. 2013). The lateral boundary of the evaporite sedimentary deposits of the Western Subbasin of the SdHM is roughly circular in shape, approximately 20 km in diameter, coinciding with the contact between sediment and surrounding bedrock. The deposit is hydraulically unbounded at the saddle where the Eastern and Western Subbasins connect, which allows brine in the Eastern Subbasin and brackish water from the Rio de los Patos to enter the Western Subbasin. The deposit is open to the south where the groundwater flow from the Trapiche Aquifer enters the salar. At both locations, water or lithium- rich brine flows into the deposits of the Western Subbasin. The vertical extent (depth) of the lithium-rich brine deposit is inferred from surface geophysical surveys to approximately 900 m. However, confirmation drilling has not been performed to ground-truth geophysical survey interpretations below 300 m. Based on surface geophysical surveys, and several deep (>200 m) drill holes, the bedrock–halite contact is likely greater than 200 m in most of the Western Subbasin and may exceed 900 m in the northwest.

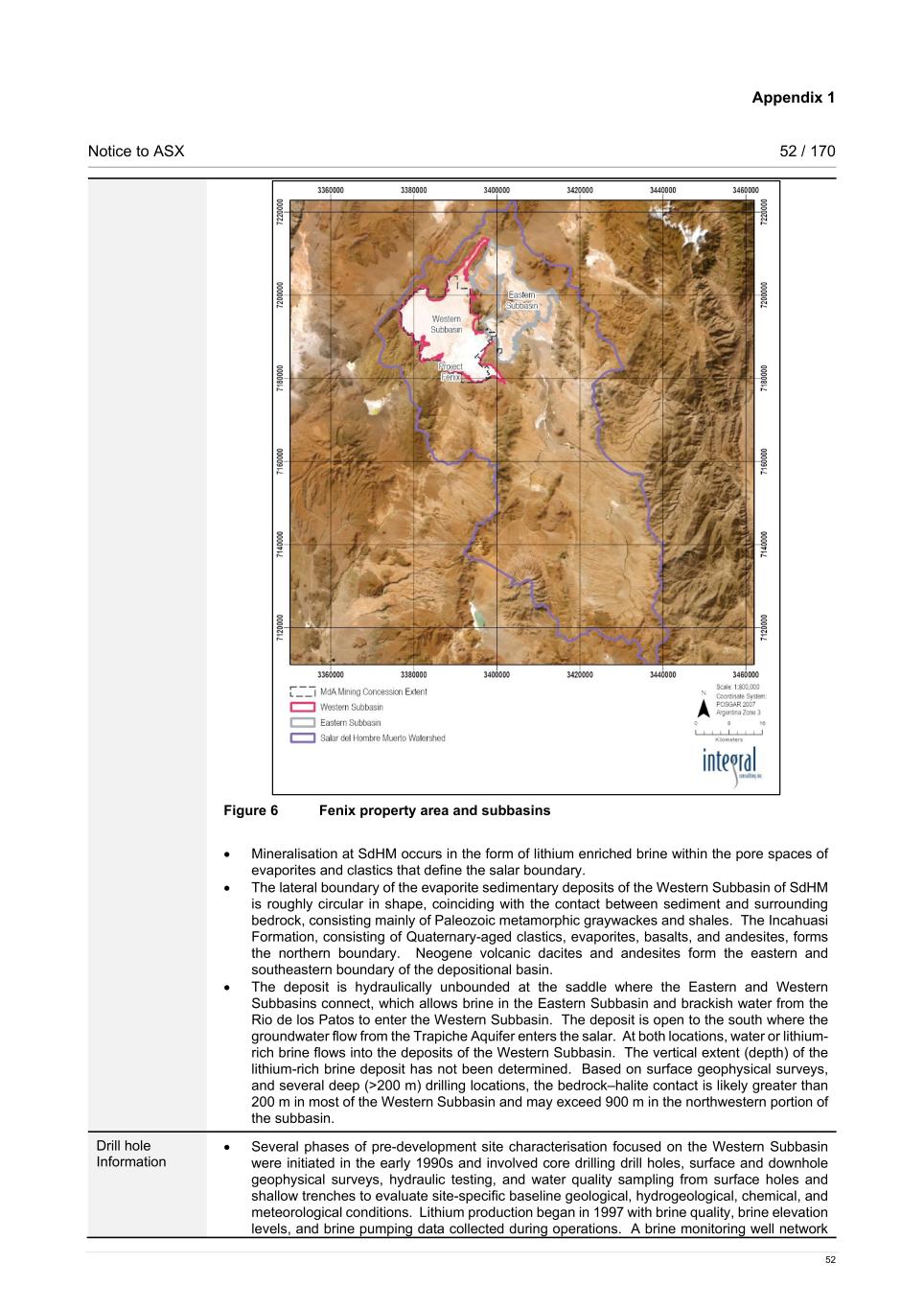

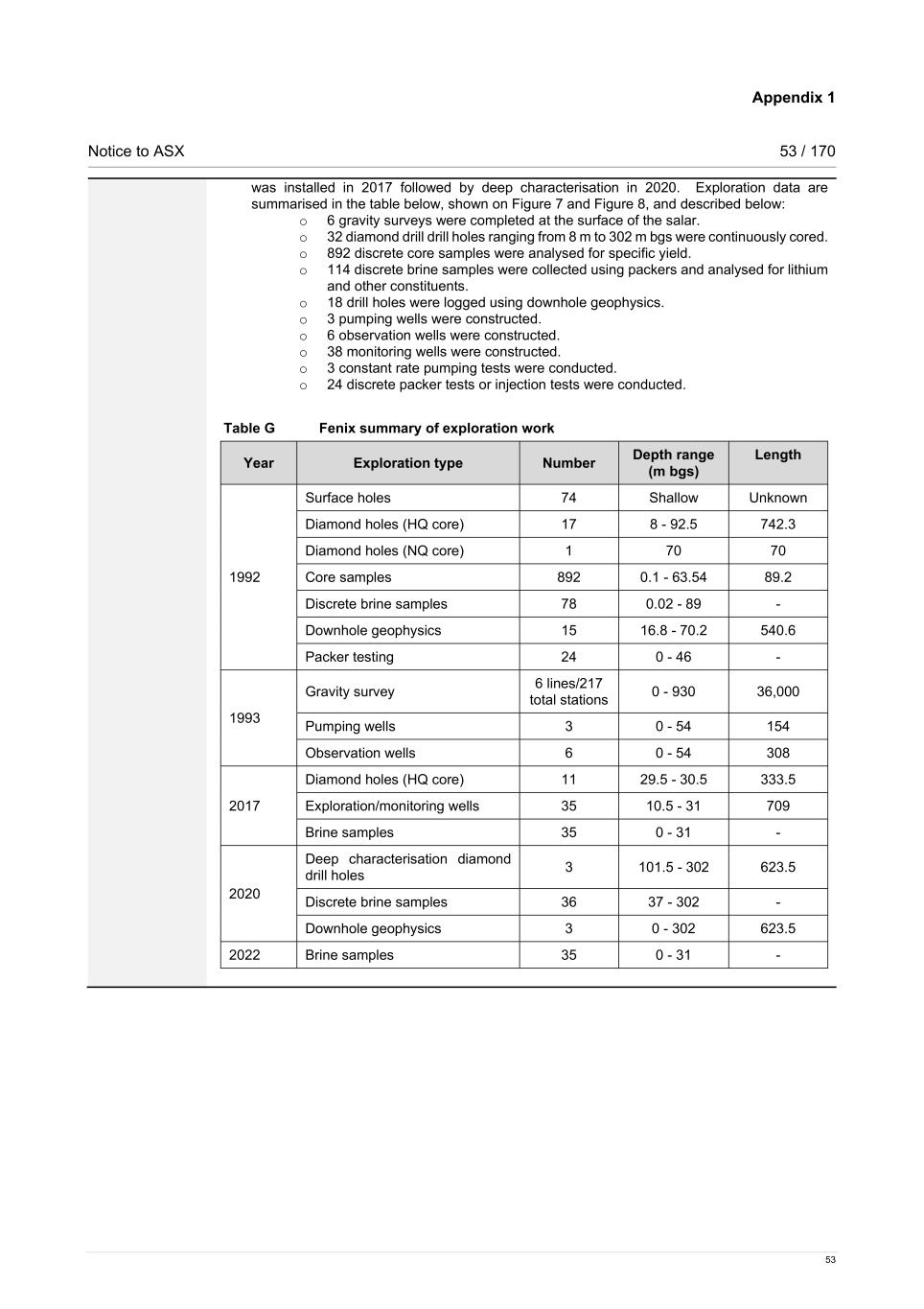

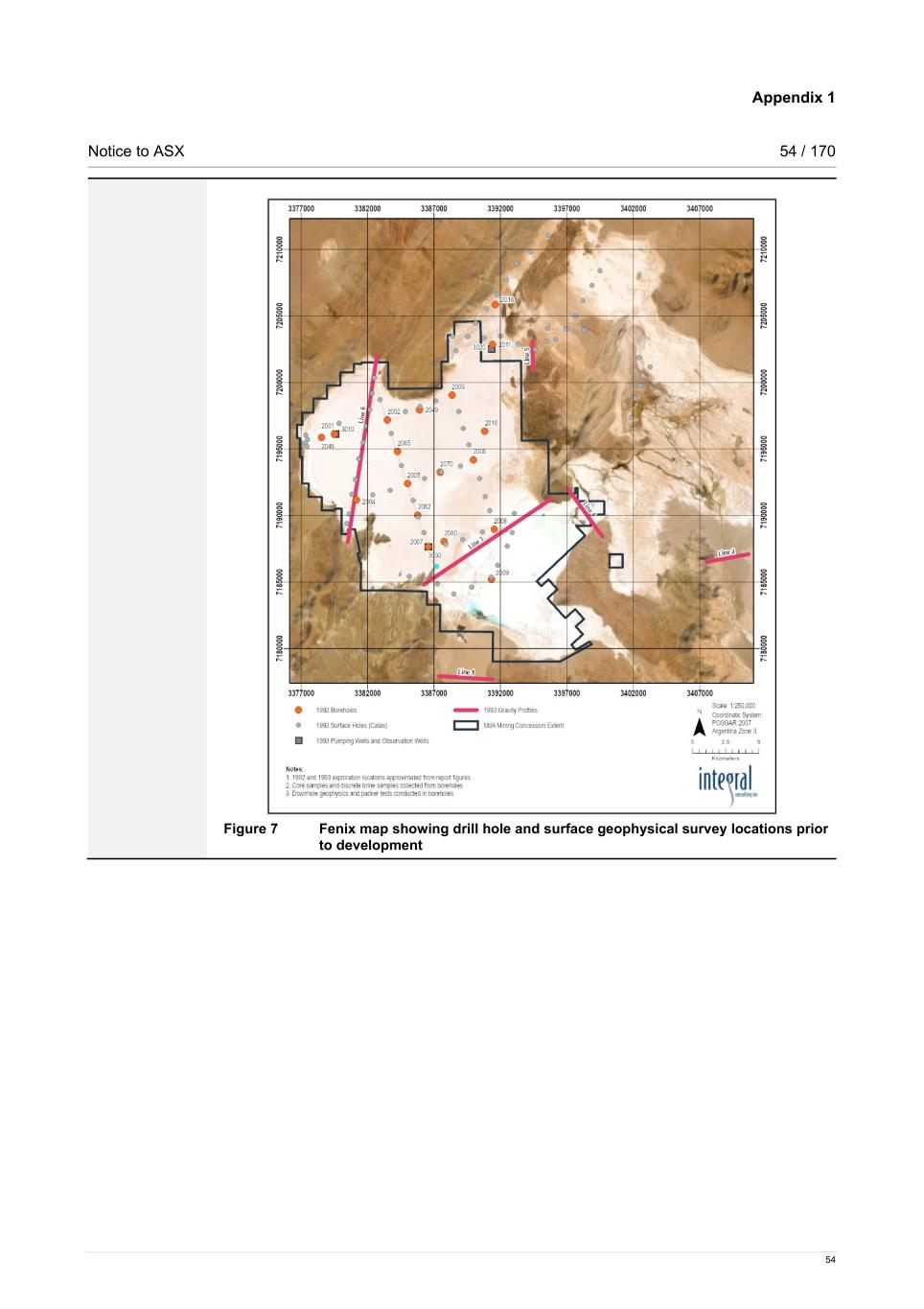

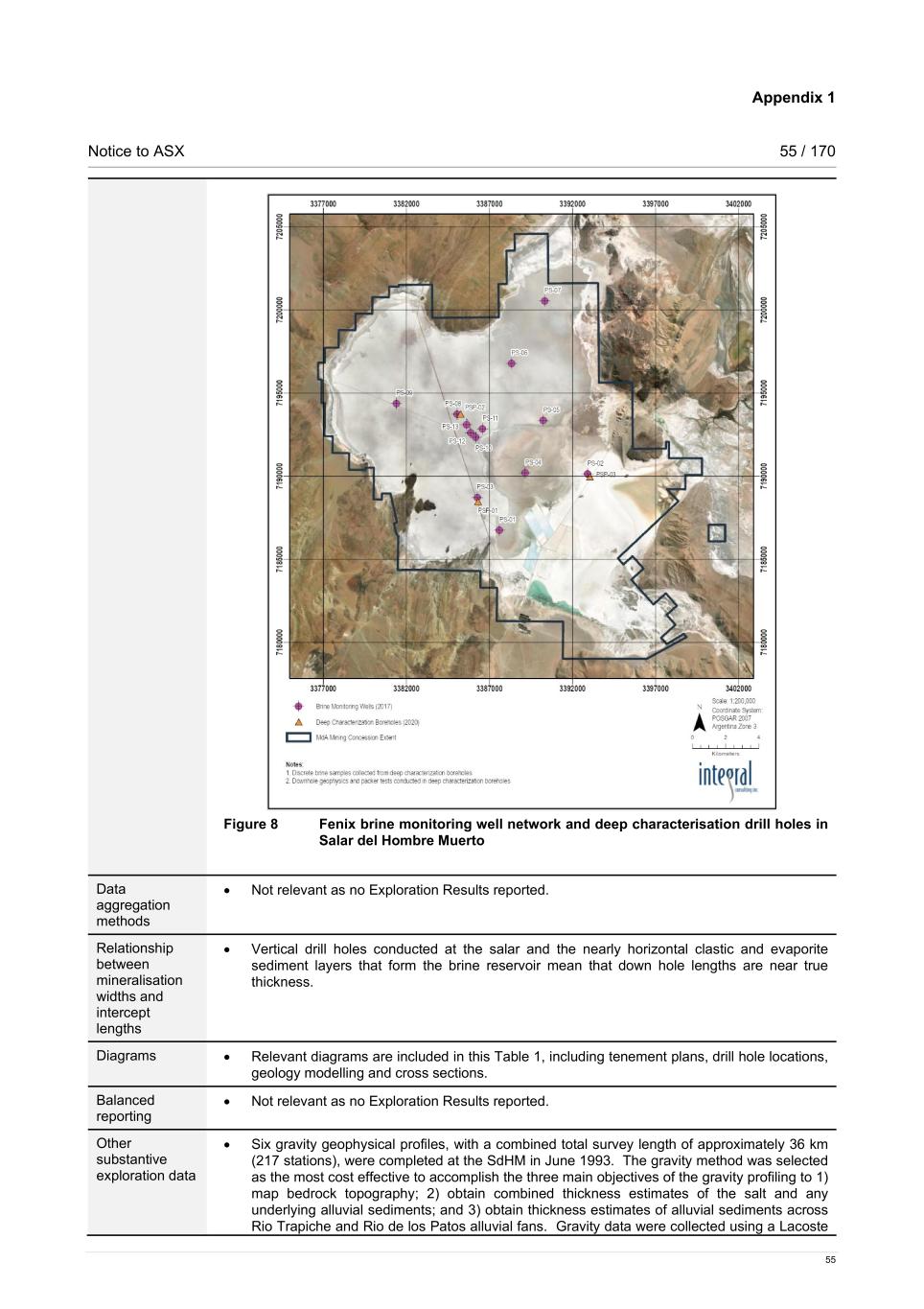

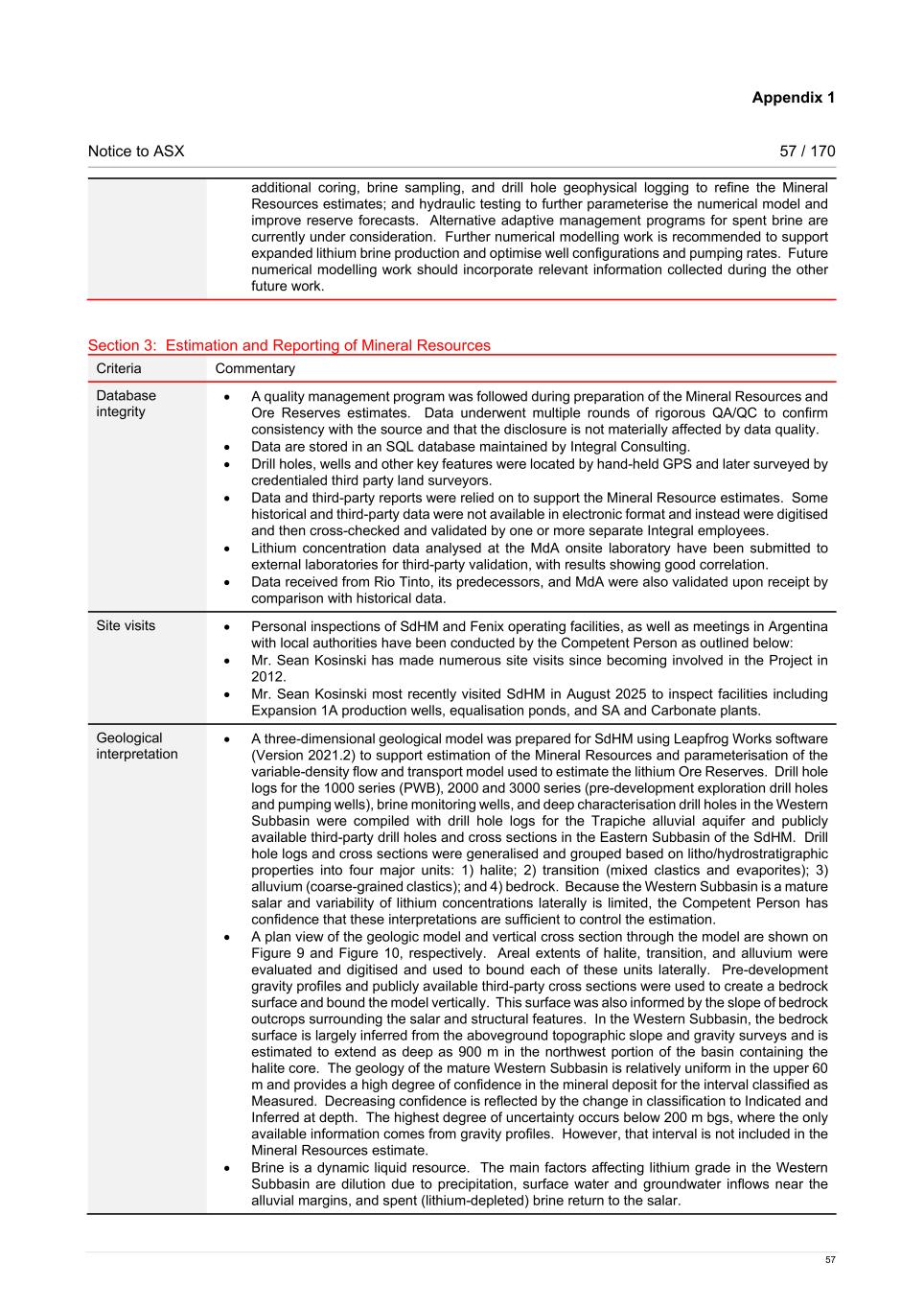

Notice to ASX 9 / 170 9 Salar aquifers at SdHM host lithium-rich brine in the pore space between sediment grains and in primary or secondary fractures. Owing to the depositional environment present at the time the aquifers were formed, these aquifers consist of horizontal to sub-horizontal clastic sediments and evaporites. The package of sedimentary and evaporitic aquifers that host lithium brine beneath the salar surface are collectively referred to as the brine reservoir. The interconnected nature of pores and fractures governs the ability of brine to drain from the reservoir in response to pumping and is a key factor for assessing the recovery potential of lithium from brine. As evidenced by nearly 30 years of production, the shallow interval (~0 m to 40 m bgs) of the reservoir near the centre of the Western Subbasin of SdHM where all pumping occurs, has exceptionally favourable hydraulic characteristics for brine production. Lithium in brine has low local variability with relatively consistent or increasing grades in the salar area and with increasing depth. A fractured halite aquifer contains the bulk of extractable lithium. The fractured halite unit is an unconfined aquifer composed of a thick sequence of halite with an extensive network of primary (physical) and secondary (dissolution) fractures from ground surface to approximately 40 m bgs. Fracture density decreases with depth below 40 m resulting in decreasing drainable (effective) porosity with depth. The fractured halite aquifer ranges in thickness from 40 m at the salar nucleus becoming progressive thinner towards the margins of the salar where clastic materials interbed with evaporites where alluvial fans are present. Water enters the salar from both streams and groundwater discharges from basin-bounding alluvial fans (and potentially from adjacent rock formations). In the broader SdHM watershed, the dominant surface water inflow is via Rio Los Patos, in the Eastern Subbasin. At times of high flow, surface waters accumulate on the salar in the Laguna Catal, which at times can extend into the eastern portion of the Western Subbasin. In the Western Subbasin, the Trapiche and Penas Blanca rivers provide a source of groundwater inflow. Both rivers coalesce at the head of the Trapiche Aquifer before infiltrating into the alluvium approximately 6 km south of the salar-alluvium boundary. Water inflows from infiltration of precipitation are negligible. Annual average precipitation rates are less than 90 mm and evaporation rates average more than 2.5 m annually. SdHM is an endorheic basin. Evaporation and plant transpiration are the primary processes for water outflow, followed by groundwater pumping for brine processing. Currently, less than 10 percent of the average annual runoff is used for brine processing. Following brine processing, most of the water is returned to the Western Subbasin along with spent brine where it evaporates or infiltrates back into the salar. Drilling techniques; sampling, sub-sampling method and sample analysis method Both diamond drill hole and direct rotary (RT) drilling methods were used for resource estimation. Core retrieved from diamond holes were used for lithologic logging to inform the geologic block model and core samples were used to estimate specific yield at discrete intervals. RT drilling, often used for well installation, does not produce intact core suitable for specific yield analysis. Instead, drill cuttings from RT drilling provide supplemental lithologic data and the wells installed following drilling provide sampling locations for bulk brine quality analysis. Exploration drilling at SdHM occurred in three major drilling campaigns. The first, pre-development, drilling campaign in the early 1990s included 813 m of diamond drilling and 462 m of RT drilling. Additionally, 74 shallow holes (catas) were installed across the basin for sampling purposes. During this drilling campaign, 892 core samples were analysed for specific yield and 78 brine quality samples were collected. Downhole packer testing was conducted in 24 locations. Additionally, downhole geophysical surveys were performed at 15 locations along with 36 km of surface geophysical surveys to estimate the depth to bedrock across the salar. A second exploration drilling campaign began in 2017 when a network of 35 wells were installed resulting in 333 m of diamond and 709 m of RT drilling. Thirty-five samples were analysed for brine quality. The third major exploration drilling campaign began in 2020 to characterise the salar at depths between 100 m and 300 m bgs and far below existing production wells. This deep characterisation investigation produced 624 m of diamond drilling. Packer testing and downhole geophysical surveys were conducted at 3 locations and 36 samples were collected for brine quality analysis at discrete intervals during packer tests.

Notice to ASX 10 / 170 10 In total, over 2,940 m of exploration drilling were used to inform the Mineral Resources estimate. Samples taken pre-development were analysed in the field for density, pH, and temperature. They were then packaged and shipped to the FMC QA/QC labs in Bessemer City, North Carolina, for compositional analysis by ICP-OES using a validated instrument and a proprietary analytical method already established by FMC. Each sample was analysed 10 times. Brine samples collected after production had commenced, are analysed onsite by the MdA laboratory using the same analytical method and techniques developed in the Bessemer City QA/QC Labs. Estimation methodology A conceptual hydrogeological model and Mineral Resources estimation were completed by Integral Consulting and Rio Tinto. The conceptual model was constructed using surface geological maps, field inspection of outcrops, lithologic logging data, core sample results for specific yield, aquifer testing to estimate hydraulic properties, downhole geophysics, brine and water level data, brine and water quality data (or assay data), specific electrical conductivity profiles, and assessment of hydrogeologic basement from surface geophysical surveys. Together, these datasets were consolidated into a three-dimensional hydrogeological model using Leapfrog software, which became the conceptual framework for the Mineral Resources estimate and starting point for the Ore Reserves model. The Mineral Resources estimate relies on data collected from an extensive monitoring well network, consisting of 35 wells across the Western Subbasin, installed in 2017, nearly 20 years after operations began. Historical data collected prior to development and data collected from deep exploration drill holes are used to estimate static reservoir properties that are assumed not to change. Ordinary kriging techniques were used to estimate lithium Mineral Resources in September 2022, using lithium concentrations at monitoring wells to interpolate lithium concentrations within Rio Tinto’s concession boundary. Brine quality measured at monitoring wells was used, together with lithium concentrations from deep characterisation drill holes located from 40 to 200 m bgs. Data from the Eastern Subbasin were used to constrain the kriging interpolation at the eastern margin of the Western Subbasin, outside Rio Tinto’s concession boundary. This approach created 8 (100 m x 100 m) rectilinear resource layers; six 10 m thick layers2 to 60 m bgs; a 40 m thick layer (60 m to 100 m bgs) and a 100 m thick layer (100 m to 200 m bgs). The lateral extent of each layer was clipped to the interior of Rio Tinto’s concession boundary and again to the perimeter of the salar. The Western Subbasin brine reservoir is roughly bowl shaped. Subsequently, the control volume was reduced by 1% for each 10 m interval below 30 m as the lateral extent of the reservoir decreased with depth. For each uniform thickness slice of control volume, a constant value for specific yield (Sy) representative of halite units from the corresponding depth intervals was applied. Sy measured in halite was chosen as a conservative measure (lower lithium mass) because the western subbasin is predominantly halite which has lower measured Sy than other, neighbouring geologic materials present within Rio Tinto’s concession (e.g., clastics or transitional evaporite-clastics). The in situ lithium Mineral Resources is the product of the total lithium mass, Sy and control volume. This Mineral Resources estimate assumes that brine produced from September 2022 through December 2022 originated from brine in the Measured Mineral Resources (0 m to 40 m bgs) interval, as existing production wells are constructed to a depth up to 40 m bgs. Because flow to lithium brine production wells is predominantly horizontal, and the existing well batteries do not extend below 40 m, it is unlikely lithium produced to-date originated from Indicated (40 m to 100 m bgs) or Inferred (100 m to 200 m bgs) Mineral Resources intervals. Cut-off grades and modifying factors Mineral Resources are reported as the in situ, theoretical drainable lithium mass and as such a cut-off grade was not applied to this Mineral Resources estimate (inclusive of lithium Ore Reserves). The Competent Person notes that lithium concentrations in individual Mineral Resources blocks generated by kriging that fell below the Ore Reserves cut-off grade do not have a material effect on the Mineral Resources estimate. Criteria used for Mineral Resources classification 2 The saturated thickness of layer 1 was reduced to 8.1 m to account for average measured depths to brine in September 2022.

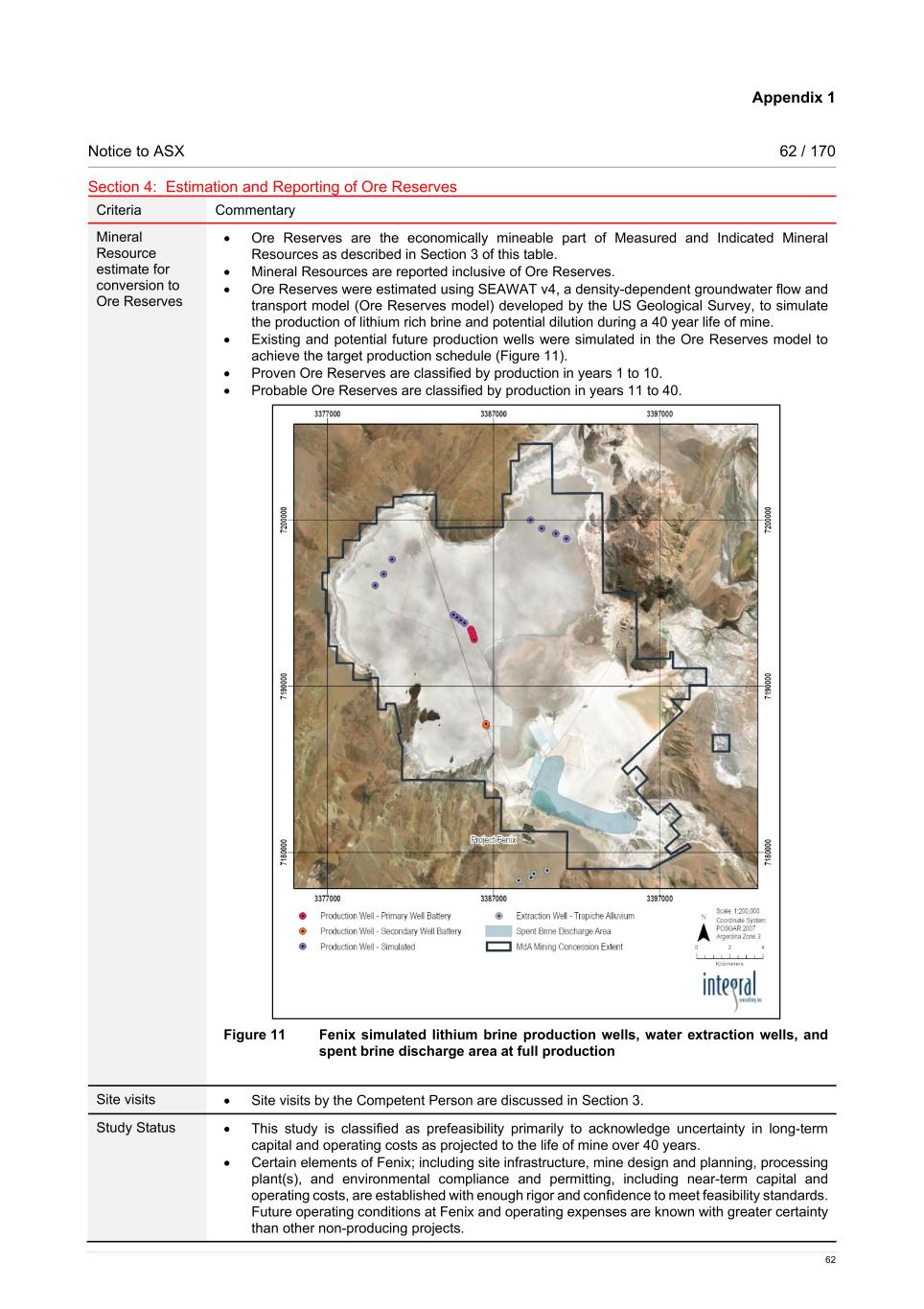

Notice to ASX 11 / 170 11 Lithium brine production at Fenix began in 1997 and continues to the present. Fenix’s long track record of successful production provides a high degree of confidence for Mineral Resources classification, particularly for Measured Resources. To date, all brine production has been sourced from wells drilled to approximately 40 m bgs. Less information about the reservoir’s hydraulic characteristics and lithium grade is available at depth due to drill spacing widening. Industry standard guidance for the evaluation of brine prospects in mature salars was adopted for classifying Mineral Resources. Approximate drill hole spacings were used as an initial guide, assuming that for estimated Mineral Resources to be considered Measured, spacing was no greater than 4 km. Indicated Mineral Resources used spacing no greater than 7 km, and Inferred Mineral Resources used spacing no greater than 10 km. Measured Mineral Resources are defined only in the fractured halite where continuity has been demonstrated by nearly 30 years of continuous pumping for operations. For the final classification the availability, density, and reliability of brine and hydraulic data from lithium brine production and monitoring wells (nominal 2.5 km spacing) allows the 0 to 40 m interval to be classified as Measured Mineral Resources, the 40 to 100 m interval (nominal 4 km spacing) is classified as Indicated Mineral Resources, and the 100 to 200 m interval (nominal 5 km spacing) is classified as Inferred Mineral Resources. Summary of information to support Ore Reserves reporting – Fenix Fenix Ore Reserves are supported by the information set out in Appendix 1 and located at Resources & Reserves (riotinto.com) in accordance with the Table 1 checklist in the JORC Code. The following summary information is provided in accordance with Rule 5.9 of the ASX Listing Rules. The Ore Reserves were estimated for Fenix by Integral Consulting and Rio Tinto. Economic analysis and determination of cut-off grade was conducted by Rio Tinto and results are considered reasonable by the Competent Person. Economic assumptions and study outcomes Ore Reserves are based upon a prefeasibility study for the mine plan and mine design including schedule covering the life of mine. Rio Tinto applies a common process to the generation of commodity price assumptions across the group. This involves generation of long-term price forecasts based on current sales contracts, industry capacity analysis, global commodity consumption and economic growth trends. Project prices are adjusted to reflect the expectation that they will be sold on cost, insurance, and freight (CIF) terms. Exchange rates are also based on internal Rio Tinto modelling of expected future country exchange rates. Due to the commercial sensitivity of these assumptions, an explanation of the methodology used to determine these assumptions has been provided, rather than the actual figures. Capital and operating cost estimates are sourced from internal Rio Tinto financial modelling and / or project capital estimates. Economic evaluation using Rio Tinto long-term prices demonstrates a positive NPV for Fenix across a range of price, cost and productivity scenarios. Mining method and assumptions At Fenix, lithium brine has been mined using production wells since 1997. Production wells are assumed to continue to be used to extract lithium brine throughout the life of mine. To meet increasing demand, additional lithium brine production wells will be necessary. Lithium brine is a fluid resource and its behaviour (grade) changes in response to environmental variables and pumping stresses. Thus, a numerical density-dependent groundwater flow and transport model (Ore Reserves model) was used in an iterative process to estimate the location of new wells and the pumping schedule necessary to meet those demands by adjusting the number, location, and screened interval of new pumping wells until the simulated produced lithium closely matched the anticipated lithium carbonate production schedule.

Notice to ASX 12 / 170 12 The locations of new (future) wells were simulated in the Ore Reserves model to meet the anticipated lithium brine production schedule. This future well configuration is only one of many potentially viable well configurations that will be evaluated/modelled in the future based on observed conditions at that time. The Ore Reserves model was used to predict lithium concentrations 40 years into the future, which is an acceptable prediction period based on common industry practice which suggests predictive simulations not be extended into the future more than twice the period for which calibration data are available. Future brine extraction was simulated in the Ore Reserves model with new wells screened in the Measured Mineral Resources interval for years 0 to 10. In years 11 to 40, additional brine is produced with new wells screened in both the Measured and Indicated Mineral Resources interval. The lithium brine production schedule exceeds the lithium carbonate production schedule to account for process inefficiencies and a portion of the brine feed directed to the Güemes Plant for lithium chloride production. As a conservative measure, lithium chloride production is not currently modelled in the economic analysis for Fenix. Processing methods and assumptions Mineral processing at Fenix uses DLE technology that requires lithium-rich brine and water. The main processing facilities at Fenix include brine and groundwater production wells, the SA Plant, pre-concentrate ponds, finished salar brine (FSB) ponds, a Carbonate Plant, and Auxiliary Services Plant. Rio Tinto continues to process lithium at SdHM essentially the same way it and its predecessors have since operations began in 1997. The only significant changes to operations occurred in 2012 when the pre- concentrate ponds and two additional lithium brine production wells went into service. Rio Tinto’s process for extracting lithium from the brine is to pump the lithium-bearing brine from the lithium brine production wells into the SA Plant or, optionally, into pre-concentrate ponds, for solar concentration prior to going to the SA Plant. Rio Tinto has begun expansion plans to increase lithium carbonate production by increasing brine and water extraction and throughput capabilities. Expansions 1 and 2 will increase lithium carbonate production capacity in a modular way using existing technologies. Expansion 3 will increase lithium carbonate production capacity using conventional evaporation-ponds. A successful track record with both technologies and historical performance, plans for expansion are fundamentally sound and have lower risk than a similar operation at an unproven location. Cut-off grades, estimation methodology and modifying factors Ore Reserves are calculated using the wellhead as the point of reference. Using the wellhead for estimating Ore Reserves allows direct comparison to other lithium brine projects irrespective of processing technology. Recoverable Ore Reserves are also presented to account for process inefficiencies from the wellhead to final, bagged product specific to the technologies anticipated at Fenix and accounting for Rio Tinto’s ownership stake. Modifying factors considered in this Ore Reserves estimate include production well efficiency, wellfield placement, potential future dilution from water, and hydraulic parameters that affect individual well yield. Future brine production was simulated using the Ore Reserves model to simulate extraction of mineral concentrations from a conceptual wellfield. Dilution is simulated by the numerical model to account for migration of lithium-barren fluids from the salar margins and infiltration of spent brine to the wellfield. Potential changes to reservoir hydraulic properties from evaporite dissolution were assumed to be negligible and were not explicitly modelled. The Ore Reserves model was calibrated to brine levels and quality measurements taken over a 25 year period since production began. Thus, the Ore Reserves model has is considered sufficient for estimating lithium brine production for the remaining 40 year life of mine. Actual process inefficiencies measured throughout Fenix’s historical operation together with inefficiencies reported for conventional evaporation pond based processes were considered to produce a time weighted average project efficiency factor (76.6%). An estimated marginal cut-off grade was established as 400 mg/l of lithium based on an economic evaluation of estimated costs for LCE production. MdA entered into an agreement with the Argentine federal government and the Catamarca Province to develop SdHM in 1991. After 1993, the Argentine federal government assigned its rights and obligations to

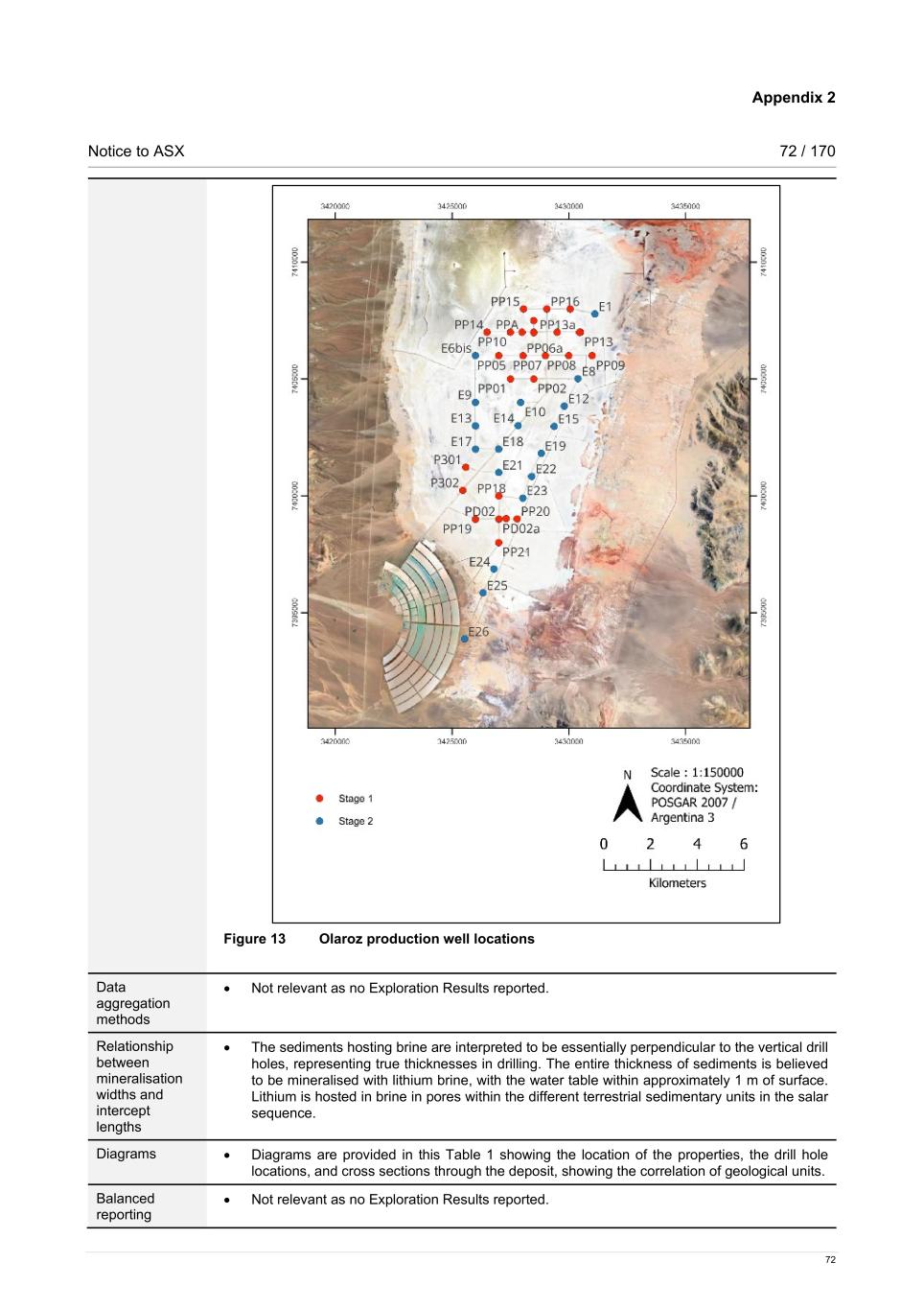

Notice to ASX 13 / 170 13 Catamarca Province. This provides Catamarca Province jurisdiction and a minority ownership stake in MdA, which allows Catamarca to receive defined dividends and to appoint two of MdA’s board of directors. In compliance with Catamarca’s regulations, Fenix operates under a variety of environmental and operating permits including, wastewater discharge, waste generation and operations, insurance and water concessions. Environmental baseline investigations were conducted for Fenix and the Los Patos Aqueduct projects. Environmental Impact Declaration (DIAs) are updated biannually with data collected from ongoing monitoring programs. Fenix complies with national regulations for: above/underground tanks, chemical registries, and hazardous waste. Additional permits are obtained for facilities upgrades and expansion as required by governmental agencies. Legal, social, and governmental modifying factors are assumed to remain status quo for the duration of the project. Criteria used for Ore Reserves classification Lithium-rich brine is a fluid resource, and its grade is subject to change in response to pumping and numerous other environmental factors. Factors other than brine grade and pumping may affect Ore Reserves estimates, including the acquisition of new hydrogeologic and environmental data, changes in mine plans, or mining operations at neighbouring locations. This Ore Reserves estimate is based on the data and assumptions summarised herein and is sufficient for disclosure and mining planning purposes. Lithium production was simulated using production wells completed exclusively in the Measured Mineral Resources interval in years 1 to 10. Because flow to vertical wells is predominantly horizontal, brine produced during the first 10 years is classified as Proven Ore Reserves. Recoverable Ore Reserves were estimated by reducing the Ore Reserves mass by 23.4% to account for process inefficiencies. Ore Reserves extracted in later years, are classified as Probable Ore Reserves, because a fraction of the brine produced in years 11 to 40 originated in the Measured and Indicated Mineral Resources intervals and certain modifying factors (economic, legal, governmental, environmental, and social) necessarily introduce uncertainty in future operations. It is standard industry practice to periodically recalibrate and update the Ore Reserves model when new data are available. As the wellfields are pumped, long-term data on pumping rates, water levels, and brine chemistry are generated. Recalibrating the model with these new data will improve the model’s reliability and predictive capability. Future estimates of Ore Reserves may be revised based on newly acquired data, changes in operations, or other modifying factors. Rio Tinto – Olaroz Rio Tinto is the operator and majority owner of the Olaroz lithium brines operation, located in the Northern Subbasin (referred to as Salar de Olaroz) of the Olaroz-Cauchari Salar complex in Jujuy Province of northern Argentina (Figure 1). The Olaroz-Cauchari Salar is located in the Puna region, 230 km west of the city of San Salvador de Jujuy in Jujuy Province of northern Argentina. The property is north of a paved highway that connects to the international border with Chile (80 km to the west) and the major mining centre of Calama and the ports of Antofagasta and Mejillones in northern Chile, both major ports for the export of mineral commodities and import of mining equipment. The Olaroz deposit lies within the “lithium triangle”, an area encompassing Chile, Bolivia and Argentina that contains a significant portion of the world’s estimated lithium resources. Mineralisation at Olaroz occurs in the form of lithium rich brine in the pore spaces below ground surface, within the brine reservoir. Mining occurs by brine extraction from pumping wells. Olaroz is an operational brine extraction and lithium processing facility. The Olaroz-Cauchari Salar is located in the Puna region, 230 kilometres (km) west of the city of San Salvador de Jujuy in Jujuy Province of northern Argentina at an altitude of 3,900 metres (m) above sea level. The property is north of a paved highway that connects to the international border with Chile (80 km to the west) and the major mining centre of Calama and the ports of Antofagasta and Mejillones in northern Chile, both major ports for the export of mineral commodities and import of mining equipment. The Olaroz deposit lies within the “lithium triangle”, an area encompassing Chile, Bolivia and Argentina that contains a significant portion of the world’s estimated lithium resources.

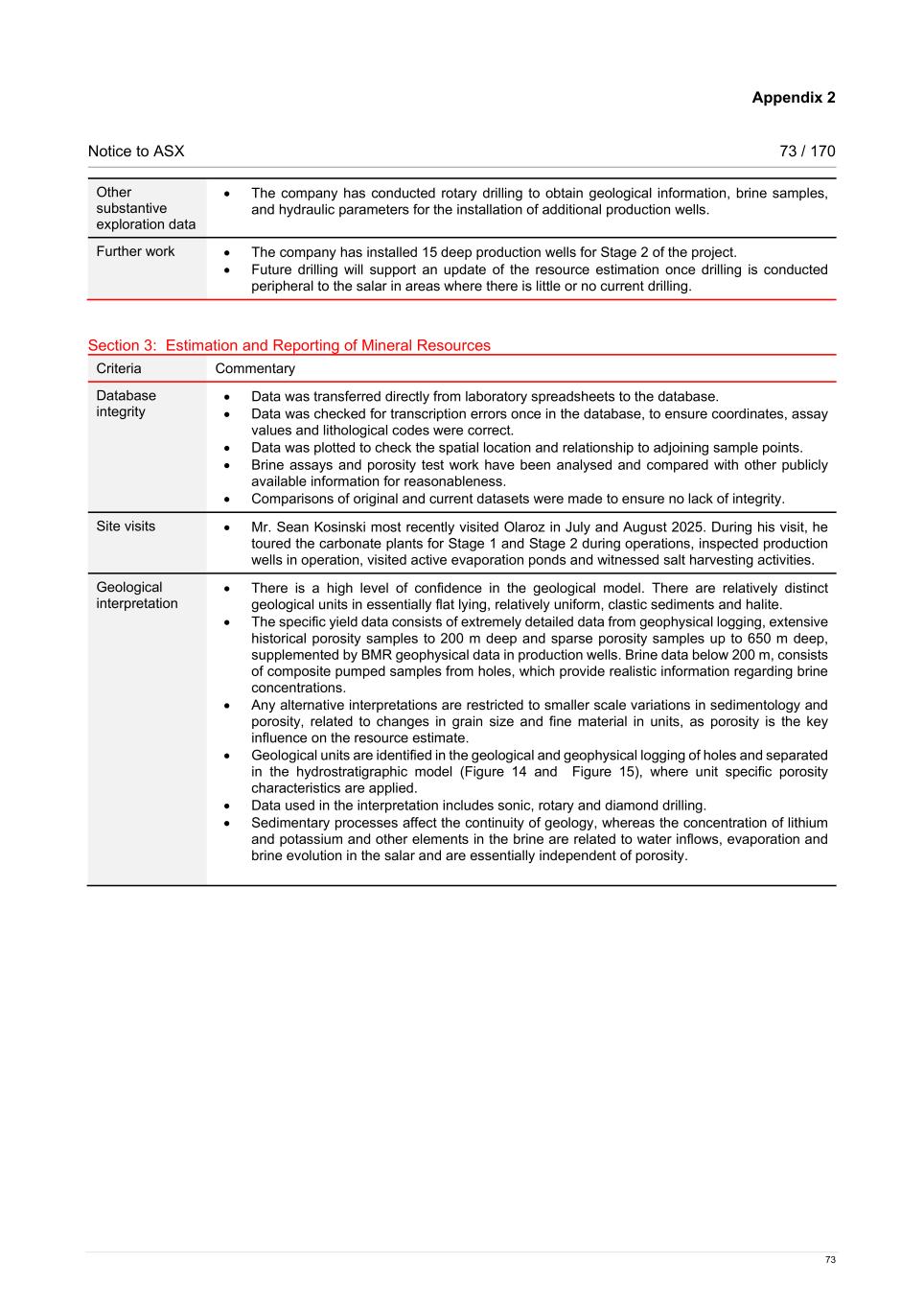

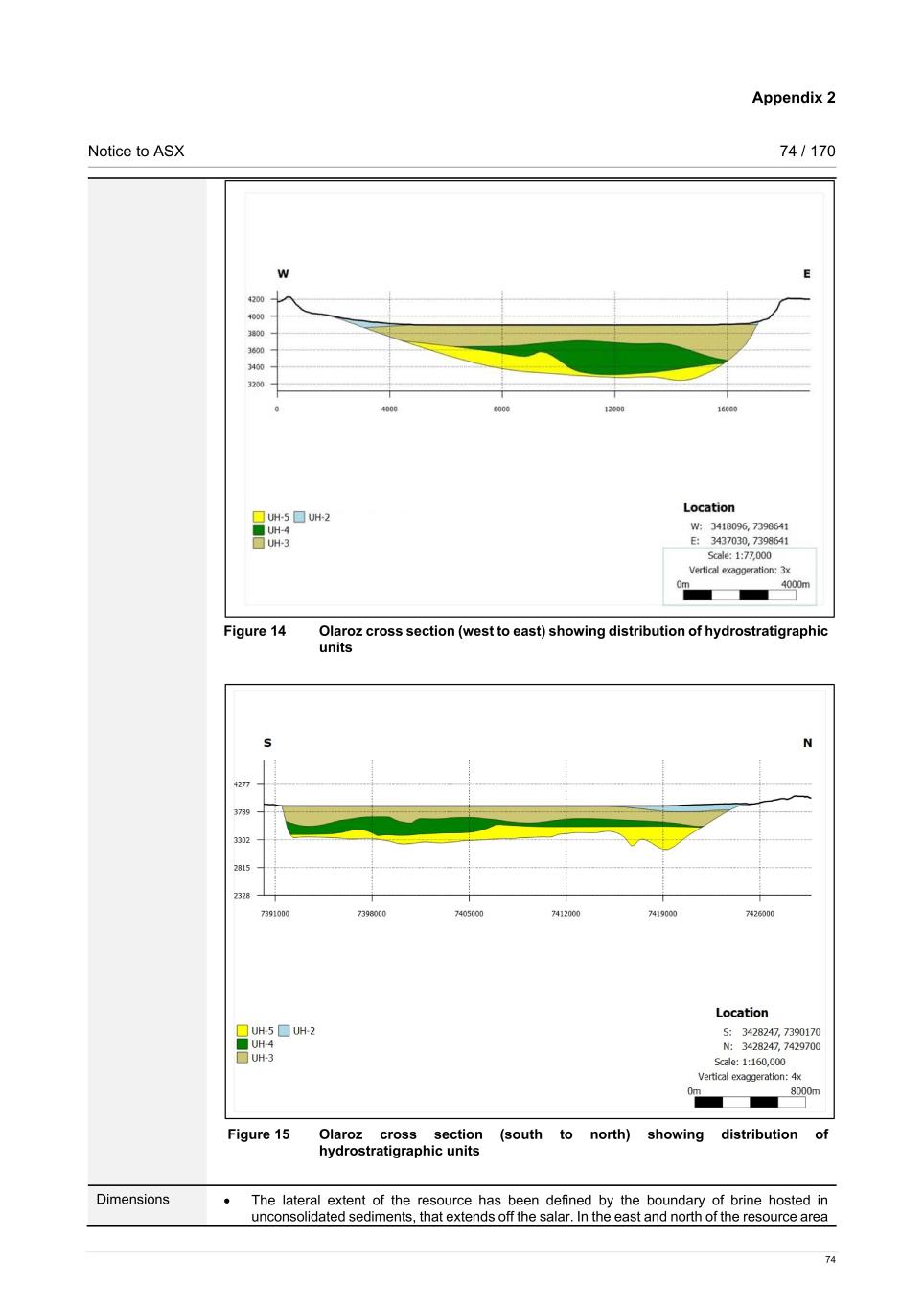

Notice to ASX 14 / 170 14 Rio Tinto holds a 66.5% ownership interest in Sales de Jujuy S.A. (SDJ), its local subsidiary that operates Olaroz. The remaining ownership is held by Toyota Tsusho (25%) and the Jujuy Energía y Minería Sociedad del Estado (JEMSE) (8.5%). This Joint Venture controls mineral properties covering the majority of the Salar de Olaroz, compromising 33 mining concessions and 2 exploration properties (cateos). In addition to its participation in SDJ, Rio Tinto holds a 100% interest in several properties located to the north and west of the joint venture area as detailed in Appendix 2. Lithium brine production at Olaroz began in 2015 and continues to the present. The current annual capacity for Olaroz (Stage 1) is 17.5 kt LCE. Over the most recent three full calendar years, Olaroz produced 15.6 kt (2024), 11.8 kt (2023) and 9.3 kt (2022) LCE. An expansion (Stage 2) currently underway aims to increase nominal production capacity by 25.0 kt LCE, raising total capacity at Olaroz to 42.5 ktpa LCE in 2030. Olaroz is fully permitted by the provincial mining authorities and has provincial and federal permits, to allow operations for an initial 40 year mine life with renewable options to extend beyond 2053. Olaroz is not known to be subject to any environmental liabilities. Summary of information to support Mineral Resources reporting – Olaroz Olaroz Mineral Resources are supported by the information set out in the Appendix 2 to this release and located at Resources & Reserves (riotinto.com) in accordance with the Table 1 checklist in the JORC Code. The following summary information is provided in accordance with Rule 5.8 of the ASX Listing Rules. Geology and geological interpretation Salar de Olaroz (the salar) is located in the elevated Altiplano-Puna plateau of the Central Andes. The Puna plateau of northwestern Argentina comprises a series of dominantly north-northwest to north-northeast trending, reverse fault-bounded, ranges up to 5,000 m to 6,000 m high, with intervening internally drained basins at an average elevation of 3,700 m. These mountain ranges are composed of Ordovician metasediments to Tertiary continental sediments, that include historical evaporite units formed in an arid environment. High evaporation rates, together with reduced precipitation, have led to the deposition of evaporites in many of the Puna basins since 15 Ma, with borate deposition occurring for the past 8 million years. Precipitation of salts and evaporites has occurred in the centre of basins, where evaporation is the only natural means of water outflow from the hydrological system. Geophysical programs have been used to define the lateral extents of the brine beneath alluvial sediments, around the margins of the salar, which are important constraints for the geological and hydrogeological models and to assess distal areas for brine prospectivity. The northern SDJ and 100% Rio Tinto properties have been subject to minimal exploration to date. However, electrical geophysics indicates potential for future brine extraction beneath alluvial and deltaic sediments north of the salar. Geophysics also provided information on the basin depth, indicating that the basin fill is deeper in the east than in the west. Drilling led to development of a mixed salar basin model, with four separate geological and hydrogeological (hydrostratigraphic) units (UH2, UH3, UH4, and UH5) above the Tertiary basement, defined by geological and geophysical logging of holes. Unit UH2 consists of alluvial fans on the western and eastern margins of the salar, which contain brine beneath brackish water off the salar. Unit UH3 are mixed sediments with clay and sand intervals, Unit UH4 includes evaporite deposits, principally halite, with clay, silt and sand interbeds. Unit UH5 is primarily sand, interbedded with clay and silt. Sandy material is sourced from the historical western margin of the basin, and most likely also in the north, becoming progressively deeper in the east of the basin. Mineralisation in the Olaroz salar consists of lithium dissolved in a hyper-saline brine, which is about eight times more concentrated than seawater. The natural lithium concentration is the product of solar evaporation of brackish water which flows into the salar as groundwater and occasional surface water flows. The concentrated brine with lithium is distributed throughout the salar in pore spaces between grains of sediment. The brine also extends a considerable distance away from the salar, beneath alluvial gravel fans around the edges of the salar. These areas are largely unexplored by the company to date. In addition to lithium, there are other elements, such as sodium, magnesium, and boron, which constitute impurities that are removed in the ponds and processing plant.

Notice to ASX 15 / 170 15 Drilling techniques; sampling, sub-sampling method and sample analysis method Drilling was undertaken over several drilling campaigns spanning several years, from the initial exploration in 2008 through to the installation of production wells for Stage 1 and Stage 2 production. Throughout exploration, 28 diamond holes (2,700 m), 20 sonic holes (894 m), 5 brine exploration holes (2,492 m), 35 production wells (14,437 m), and 5 water supply wells (282 m) were drilled. Exploration drilling was conducted with a combination of sonic, rotary, and diamond drilling for shallow holes, with diamond drilling below depths of 200 m. Diamond drilling was predominantly using HQ diameter equipment. Two types of samples are collected during exploration diamond drilling: core porosity samples and brine samples. Core samples were collected in triple tube liners, with lexan tubes substituted for triple tube split liners to collect core samples for laboratory analysis. This was typically every 3 m for sonic drill holes and 6 m for diamond holes. These cores were sent to several experienced porosity testing laboratories, to measure the specific yield, and to assess lateral and vertical variations in porosity through the resource area. Brine samples from exploration wells were collected predominantly with a bailer device. Multiple brine samples were collected down each hole, with this information available for specific depths in exploration holes. Drilling to install production wells used rotary mud drilling with a tricone bit, reaching depths typically between 450 and 650 m. Drill cuttings were collected to evaluate the lithology type. Stage 2 production wells were profiled with a drill hole magnetic resonance (BMR) tool, which measures the specific yield porosity in situ, providing information on the downhole variability. BMR and other geophysical downhole logging was used to optimize the location of the well screens in intervals of higher porosity and permeability. Production wells were sampled from production pumping or, for wells not used for production, from pumping tests previously completed. Brine samples collected from production drill holes likely represent the anticipated long-term average lithium grade, over the life of well operation. Sample results provide a single homogenised analysis for each hole, which was applied to the Mineral Resources model over the interval of the well screens. Brine samples from exploration holes were collected and sent for analysis to external laboratories – mainly Alex Stuart laboratories in Mendoza and Juyuy. The brine samples were analysed at Olaroz’s onsite laboratory, with split samples periodically sent to Alex Stuart for QA/QC purposes. Anions and cations were analysed using different analytical techniques. Lithium is analysed by Atomic Absorption equipment at the Olaroz laboratory. Other cations at this and other laboratories were analysed by ICP-OES equipment, with some earlier analyses from 2008 to 2011 utilising ICP-AES equipment. Anions are analysed by a variety of analytical techniques, with differences noted in the methods used between laboratories. Estimation methodology Estimation of brine Mineral Resources requires definition of the extents of the reservoir and property boundaries and the distribution of specific yield and lithium grade within the reservoir. The Mineral Resources estimate is the product of reservoir volume, the specific yield and the concentration of lithium in the brine. The estimate is limited laterally by the mining tenement boundaries and at depth by the salar sediment- Tertiary basement contact. The upper limit is the phreatic surface, which has been created from static depth- to-brine level measurements. Under gravels around the edges of the salar material below the cut-off grade are excluded from the Mineral Resources estimate. The three-dimensional distribution of the different hydrostratigraphic (UH) units described above was defined using Leapfrog software, with these units based on geological and geophysical logging observations. A block model was generated containing these domains, with 200 x 200 m blocks, with a 100 m vertical extent, with sub-blocks of 20 x 20 x 5 m around the external boundary of the model and between classification domains. Estimation of specific yield and lithium grades was carried out using Leapfrog software.

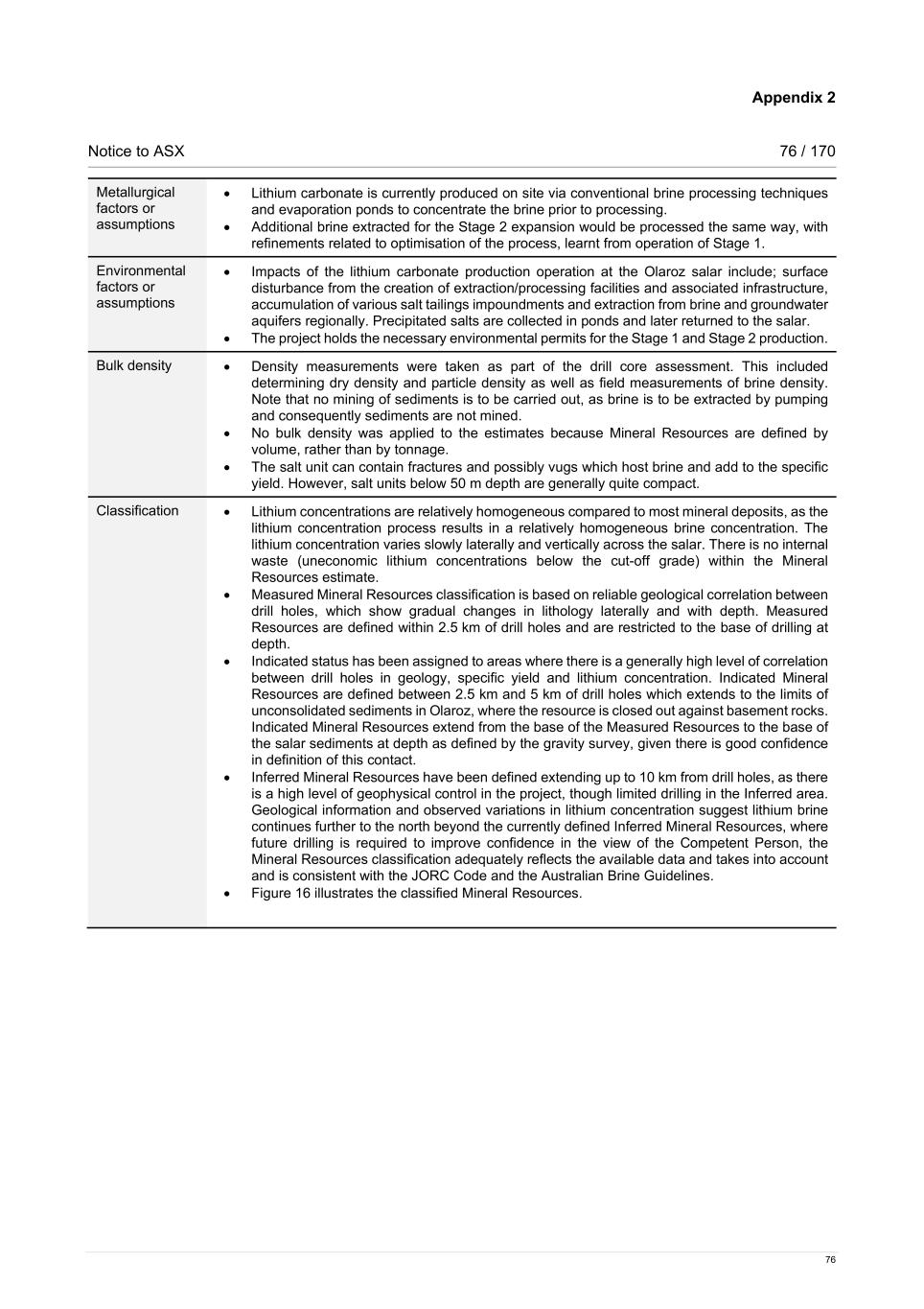

Notice to ASX 16 / 170 16 Specific yield was estimated into the block model using inverse distance squared. The input data comprised the discrete interval core samples from the exploration drilling, and BMR downhole geophysics. Data was composited to 5 m prior to estimation. Variogram models for specific yield were evaluated, which defined an isotropic search ellipse of 3,000 m x 3,000 m x 20 m. A second estimation pass of 6,000 m x 6,000 m x 100 m was used where grades were not estimated in the first pass. Hard boundaries were used between UH lithological units for the estimation, as specific yield changes very significantly between units. Lithium grade was estimated into the block model using ordinary kriging. The input data comprised the core samples from the exploration drilling in the upper 200 m, combined with the pumped samples from the production wells. Data was composited to 25 m intervals, to minimise the effect of differential sample length and differences in spacing from core samples and pumped brine samples. Variograms were prepared for the lithium concentration data, which defined an isotropic search ellipse of 8,000 m x 8,000 m x 400 m vertical. A second estimation pass of 21,000 m north-northwest x 10,000 m west-northwest x 400 m vertical was used where grades were not estimated in the first pass to allow estimation into the northern area of the salar where there is limited drilling information. Soft boundaries were implemented in the lithium estimation process, reflecting the gradual spatial variation of concentrations both laterally and with depth. Cut-off grades and modifying factors Mineral Resources within Olaroz tenements were calculated using a cut-off of 300 mg/l of lithium. The Mineral Resources are reported as the in situ total, theoretical, specific yield above cut-off grade and no mining factors have been applied. Criteria used for Mineral Resources classification Lithium concentrations are relatively homogeneous compared to most mineral deposits, as the lithium concentration process results in a relatively homogeneous brine concentration. The lithium concentration varies slowly laterally and vertically across the salar. There is no internal waste (uneconomic lithium concentrations below the cut-off grade) within the Mineral Resources estimate. Measured Mineral Resources classification is based on reliable geological correlation between drill holes, which show gradual changes in lithology laterally and with depth. Measured Resources are defined within 2.5 km of drill holes and are restricted to the base of drilling at depth. Indicated status has been assigned to areas where there is a generally high level of correlation between drill holes in geology, specific yield and lithium concentration. Indicated Mineral Resources are defined between 2.5 km and 5 km of drill holes which extends to the limits of unconsolidated sediments in Olaroz, where the resource is closed out against basement rocks. Indicated Mineral Resources extend from the base of the Measured Resources to the base of the salar sediments at depth as defined by the gravity survey, given there is good confidence in definition of this contact. Inferred Mineral Resources have been defined extending up to 10 km from drill holes, as there is a high level of geophysical control in the project, though limited drilling in the Inferred area. Geological information and observed variations in lithium concentration suggest lithium brine continues further to the north beyond the currently defined Inferred Mineral Resources, where future drilling is required to improve confidence. Classification is supported by ongoing extraction of brine from production wells installed to 200 m since 2013, 300 m since 2014 and 650 m since 2021, with 1 km spaced production wells and a drilling density of approximately 1 hole per 2 km2. Lithium concentration measured at individual production wells during pumping have been stable throughout this period. There are currently 19 production wells installed to 350 m or below. Summary of information to support Ore Reserves reporting – Olaroz Olaroz Ore Reserves are supported by the information set out in Appendix 2 and located at Resources & Reserves (riotinto.com) in accordance with the Table 1 checklist in the JORC Code. The following summary information is provided in accordance with Rule 5.9 of the ASX Listing Rules. Economic assumptions and study outcomes The Olaroz project was subject to an initial definitive feasibility study in 2011 which was the basis for Stage 1 project design and construction. A subsequent study was undertaken to support the development of Stage 2

Notice to ASX 17 / 170 17 of the project, the results of which were published by the previous owners in April 2022. Construction for Stage 2 is now complete and initial production began in July 2023. Rio Tinto applies a common process to the generation of commodity price assumptions across the group. This involves generation of long-term price forecasts based on current sales contracts, industry capacity analysis, global commodity consumption and economic growth trends. Project prices are adjusted to reflect the expectation that they will be sold on cost, insurance, and freight (CIF) terms. Exchange rates are also based on internal Rio Tinto modelling of expected future country exchange rates. Due to the commercial sensitivity of these assumptions, an explanation of the methodology used to determine these assumptions has been provided, rather than the actual figures. Capital and operating cost estimates are sourced from internal Rio Tinto financial modelling and/or project capital estimates. Economic evaluation using Rio Tinto long-term prices demonstrates a positive NPV across a range of price, cost, and productivity scenarios. Mining method and assumptions Olaroz wells and ponds have been operating successfully since 2013. Onsite lithium processing and sales of lithium carbonate began in 2015 following Stage 1 project development. The Stage 2 development included a substantial increase in the evaporation pond area with the addition of 9 km2 of new evaporation ponds. A second processing plant was built to increase annual production capacity to 42.5 kt per year LCE from the combined Stages 1 and 2. The new plant design is based upon the original Stage 1 plant but with improved equipment selection and processing strategy based on prior experience. Mining is undertaken by the installation of large diameter (12 inch installed casing) wells into the salar sediments. Once installed and developed the wells are pumped to provide a continuous supply of brine to evaporation ponds. The Ore Reserves model simulates brine production at Olaroz and neighbouring operations along with environmental factors that affect the movement and grade of lithium in brine. The Ore Reserves model was calibrated to observed brine elevations and lithium grades using actual pumping rates since operations began in 2013. Following calibration, the Ore Reserves model was used to simulate the future production of lithium in brine for a 40 year period beginning 1 July 2025. Common industry practice suggests predictive simulations not be extended into the future more than twice the period for which calibration data are available. However, this is not always practical, particularly at the start of a project when data are sparse. A 40 year predictive simulation is considered appropriate for Olaroz based on its operational history, the successful production history at nearby operations and the overall size of the underlying Mineral Resources. Processing methods and assumptions Mineral processing at Olaroz uses conventional evaporation ponds to concentrate brine before it’s converted to lithium carbonate. The main processing facilities at Olaroz include brine and groundwater production wells, an extensive network of lined evaporation ponds, a Liming Plant, a Carbonate Plant, and Auxiliary Services Plant. Rio Tinto continues to process lithium at Olaroz essentially the same way it and its predecessors have since operations began in 2013. The most significant changes to operations occurred in 2023 when Stage 2 went into service. Mineral processing involves the removal of lithium from brine. At Olaroz, this occurs primarily by the process of solar evaporation. Lithium-rich brine is extracted from below ground surface using vertical pumping wells. Extracted “native or raw” brine is directed to a chain of evaporation ponds. Solar evaporation removes water from native brine, leading to a series of progressively higher concentration brines further along the evaporation pond chain. In addition to concentrated brine, ponds retain solids as minerals precipitates (salts) from solution. Periodically, entrained brine is recovered and reprocessed from residual precipitates, and the residual salts are harvested and disposed of. The concentrated brine stream is directed to the onsite Carbonate Plant where it undergoes additional processing before becoming saleable product. Olaroz Stage 1 began in 2013 and is designed to produce 17.5 kt LCE per year. Olaroz Stage 2, designed to produce 25.0 kt LCE per year, began in 2023 and is continuing to ramp up production. Olaroz Stage 1 has a successful track record of lithium carbonate production. The same is expected for Stage 2, which relies on the same basic technology as Stage 1 with improvements made based on prior experience.

Notice to ASX 18 / 170 18 Cut-off grades, estimation methodology and modifying factors Ore Reserves are calculated using the wellhead as the point of reference. Using the wellhead for estimating Ore Reserves allows direct comparison to other lithium brine projects irrespective of processing technology. Recoverable Ore Reserves are also presented to account for process inefficiencies from the wellhead to the final, bagged product specific to the technologies at Olaroz and accounting for Rio Tinto’s ownership stake. Modifying factors considered in this Ore Reserves estimate include production well efficiency, wellfield placement, potential future dilution from water, and hydraulic parameters that affect individual well yield. Future brine production was simulated using the Ore Reserves model to simulate extraction of mineral concentrations from the wellfield. Dilution is simulated by the Ore Reserves model to account for migration of lithium-barren fluids from the salar margins. Potential changes to reservoir hydraulic properties from evaporite dissolution were assumed to be negligible and were not explicitly modelled. The Ore Reserves model was calibrated to brine levels and quality measurements taken since production began in 2013. Mineral processing at conventional evaporation pond-based lithium processing operations takes several years to reach steady state. Factors like the time required to fill ponds, commission plants, implement process improvements, and variable climatic conditions all factor into the time required for the operation to reach steady-state. This, coupled with overlapping expansions (Stage 2 was initiated before Stage 1 reached steady-state) requires assumptions to be made regarding future process efficiency. Actual process inefficiencies measured throughout Olaroz’s historical operation together with inefficiencies reported at other conventional evaporation pond-based operations and anticipated process improvements were considered to produce a time weighted average efficiency factor (60%). An estimated marginal cut-off grade was established as 410 mg/l of lithium based on an economic evaluation of estimated costs for LCE production. Simulated brine grade at the end of mining remains above the marginal cut-off grade. An Impact Assessment Declaration (DIA) was issued in 2009 for exploration activities and in 2010 for the exploitation, construction and commissioning of Stage I. Under this permit, the company assumes several obligations and responsibilities, including the biennial renewal to keep it in force. Since 2010, the company has complied with all legal requirements before the enforcement authority, including the permit for the construction and commissioning of Stage 2. The latest Environmental Impact Report was submitted on May 2025, for joint exploration and exploitation activities on 35 mining properties placed on Olaroz salar; which is currently under review. Criteria used for Ore Reserves classification Lithium-rich brine is a fluid resource, and its grade is subject to change in response to pumping and numerous other environmental factors. Factors other than brine grade and pumping may affect Ore Reserves estimates, including the acquisition of new hydrogeologic and environmental data, changes in mine plans, or mining operations at neighbouring locations. This Ore Reserves estimate is based on the data and assumptions summarised herein and is sufficient for disclosure and mining planning purposes. The Ore Reserves model is built on a robust foundation of measured data from the past 12 years of exploration and operations. Long term predictions entail a degree of uncertainty, particularly in future production schedules, production at neighbouring operations, and environmental conditions. Considering Olaroz’s operational continuity, the data accumulated during and prior to operations, and the Mineral Resources sourced (Measured and Indicated) during production, it is reasonable to classify production planned for the next 10 years as Proven Ore Reserves. Beyond that ten-year horizon, during years 11 to 40, Ore Reserves are classified as Probable Ore Reserves based on confidence in the resource base and underlying hydrogeologic conditions and to acknowledge long-term prediction uncertainty. It is standard industry practice to periodically recalibrate the Ore Reserves model when new data becomes available. As the wellfields are pumped, long-term data on pumping rates, water levels, and brine chemistry are generated. Recalibrating the model with these new data will improve the model’s reliability and predictive capability. Future estimates of Ore Reserves may be revised based on newly acquired data, changes in operations, or other modifying factors. Rio Tinto – Sal de Vida

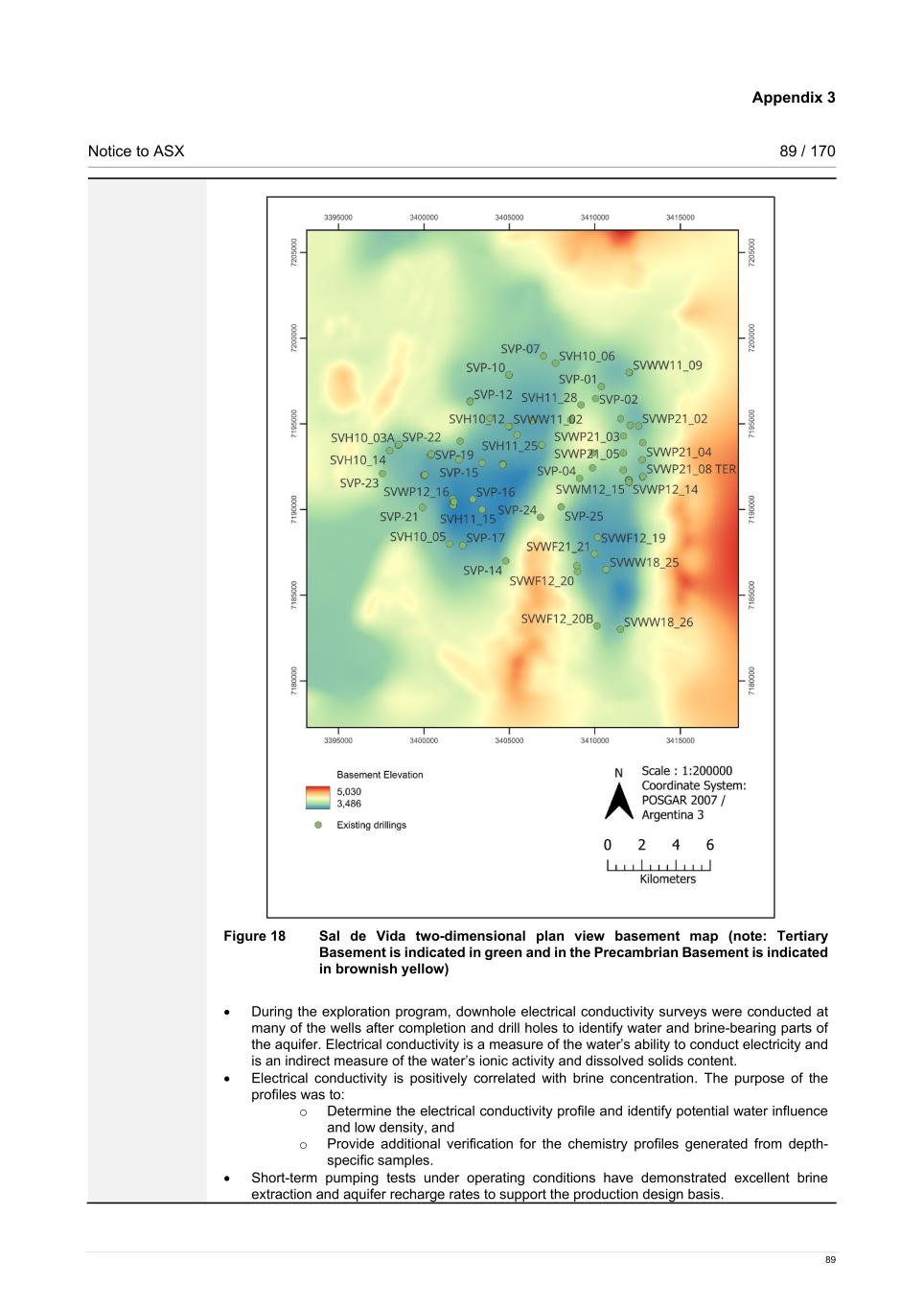

Notice to ASX 19 / 170 19 The Sal de Vida (SdV) lithium brines project located in the Eastern Subbasin of Salar del Hombre Muerto (SdHM or salar) is currently in advanced development stage, with production scheduled to commence in half 2, 2026 (Figure 1). Mineralisation at Sal de Vida occurs in the form of lithium rich brine in the pore spaces below ground surface, within the brine reservoir. Mining will occur by brine extraction from pumping wells. Sal de Vida S.A. (SdV S.A.), Rio Tinto’s Argentine operating subsidiary, owns and operates lithium brine production facilities and related chemical processing plants in the Eastern Subbasin of SdHM. Nominal annual LCE capacity at Sal de Vida is designed to reach 45 kt LCE in two stages. Stage 1 is expected to provide a capacity of 15 kt LCE from brine extracted from the East Wellfield. Sal de Vida Stage 1 pond construction commenced in January 2022. The project has been divided into several work packages, namely: well field and brine distribution, evaporation ponds, process plant and utilities, and energy. Currently, construction of the first three pond complexes is complete, and brine pumping for concentration has begun. Completion of plant construction, pre-commissioning and commissioning activities are expected by H1 2026 with first production expected in H2 2026 and ramp up expected to take 1 year. The prefeasibility study update for Sal de Vida Stage 2 confirms the expansion will be completed on the same design basis as Stage 1 with a twofold modular replication of the Stage 1 design. Stage 2 construction is anticipated to commence upon receipt of applicable permits and plant completion of Stage 1 with Stage 2 first production approximately 2.5 to 3 years thereafter. Summary of information to support Mineral Resources reporting – Sal de Vida Sal de Vida Mineral Resources are supported by the information set out in the Appendix 3 to this release and located at Resources & Reserves (riotinto.com) in accordance with the Table 1 checklist in the JORC Code. The following summary information is provided in accordance with Rule 5.8 of the ASX Listing Rules. Geology and geological interpretation SdHM is one of the most important evaporitic basins in the Argentinean Puna and is the first basin to produce lithium from brine in Argentina. It consists of evaporite deposits formed within an isolated endorheic basin, bounded by pre-Paleozoic, Paleozoic, and Cenozoic–age crystalline metamorphic basement rocks. Fault-bounded bedrock hills occur within and along the margins of the salar basin, further subdividing SdHM into two separate subbasins (eastern and western), each with different evaporite sediment compositions. The Western Subbasin is considered a mature salar, whereas the Eastern Subbasin is considered immature. Sal de Vida is located in the Eastern Subbasin of SdHM. Immature salars are dominated by clastic deposits with interbedded evaporites. In the Eastern Subbasin, a transition of evaporite facies is observed from basin margins to basin centres, proceeding from sulphates at margins through borates in basin centres. The lateral boundary of the evaporite sedimentary deposits of the Eastern Subbasin of the SdHM is irregular in shape. From north to south, the Eastern Subbasin is approximately 12 km, where an apron of erosional volcaniclastic sediments surrounding Cerro Ratones, and a large alluvial fan formed by the Rio Los Patos bound the Eastern Subbasin to the north and south, respectively. Roughly 14 km separate the eastern and western margins of the Eastern Subbasin. The eastern margin is characterised by a sequence of pre- Cambrian rocks that form the north-south trending Sierra de Cienaga Redonda. The western margin opens to the Western Subbasin at a shallow bedrock saddle that separates both subbasins where the distance at surface between Farallon Catal and Peninsula Hombre Muerto narrows. The eastern and western subbasins are hydraulically connected at the buried bedrock saddle, where brine and water flow from east to west. The vertical extent (depth) of the lithium-rich brine deposit, inferred from surface geophysical surveys and drilling, is nominally 350 m. Based on geophysical surveys, lithologic logging, and surface geologic mapping, the bedrock contact is likely greater than 300 m in most of the Eastern Subbasin and may exceed 500 m in the southwest quadrant of the subbasin. Brackish water overlies brine across most of the Eastern Subbasin with a thicker transition zone in the south where groundwater inflows from the Rio Los Patos. The lithium-rich brine targeted for extraction tends to occur from 60 to 80 m bgs, downward to the bedrock contact. Salar aquifers host lithium-rich brine in the pore space between sediment grains and in primary or secondary fractures. Owing to the depositional environment present at the time the aquifers were formed, these aquifers consist of horizontal to sub-horizontal clastic sediments and evaporites. The package of

Notice to ASX 20 / 170 20 sedimentary and evaporitic aquifers that host lithium brine beneath the salar surface are collectively referred to as the brine reservoir. The interconnected nature of pores and fractures governs the ability of brine to drain from the reservoir in response to pumping and is a key factor for assessing the recovery potential of lithium from brine. Results from a long-term aquifer test campaign and from short-term tests suggest the brine reservoir has favourable hydraulic characteristics for brine production. The reservoir at SdV consists of 5 major hydrolithologic units: (1) clay, (2) evaporites, (3) silts and sands, (4) sands and silts, and (5) volcaniclastics (travertines, tuffs, and dacitic gravels). Brine production will target units 2, 3, and 4, where hydraulic properties are most favourable, and drainable porosities averaged 4.1, 4.9, and 13.1 percent, respectively. Water enters the salar from both streams and groundwater discharges from basin-bounding alluvial fans (and potentially from adjacent rock formations). In the broader SdHM watershed, the dominant surface water inflow is via Rio Los Patos, in the Eastern Subbasin. At times of high flow, surface waters accumulate on the salar in the Laguna Catal, which at times can extend into the eastern portion of the Western Subbasin. Water inflows from infiltration of precipitation on the salar surface are negligible. Annual average precipitation rates are less than 90 mm. SdHM is an endorheic (or closed) basin. Evaporation and plant transpiration are the primary processes for water outflow, followed by groundwater pumping. Average evapotranspiration estimates made within the Eastern Subbasin were assumed equal to average recharge (approximately 1,500 l/s). Outflows by groundwater pumping occur in the headwaters of the Los Patos watershed where Rio Tinto extracts raw water for brine processing. That system is designed to withdraw up to 180 l/s, however recent (2024) withdrawals averaged less than 100 l/s. Currently, there are no other known withdrawals of groundwater in the Eastern Subbasin. Sal de Vida’s brine chemistry has a high lithium grade, low levels of magnesium, calcium and boron impurities and readily upgrades to battery grade lithium carbonate. Long-term hydrological pump testing under operating conditions has demonstrated excellent brine extraction rates to support the production design basis. Drilling techniques; sampling, sub-sampling method and sample analysis method The Sal de Vida Project was drilled and logged with vertical exploration drill holes and wells. Diamond drill hole, air rotary (AR), mud rotary (MR), and reverse circulation (RC) drilling methods were used for Mineral Resources estimation. Core retrieved from diamond holes were used for lithologic logging to inform the geologic block model and core samples were used to estimate specific yield at discrete intervals. AR and RC drilling does not produce intact core suitable for specific yield analysis. Instead, drill cuttings provide supplemental lithologic data. Wells installed following drilling provide sampling locations for bulk brine quality analysis. Exploration drilling at Sal de Vida occurred in six major phases, with Phase 1 commencing in 2009, and Phase 6 in late 2020 as part of development for the East Wellfield. During the exploration drilling program, approximately 7,083 m were drilled, with 1,165 m using diamond coring methods and 5,918 m of AR, MR and RC drilling. Diamond cores were obtained in the field for both drainable and total porosity. Porosity samples were sealed in plastic tubes and shipped to Core Laboratories, an independent ISO 9000:2008 accredited laboratory in Houston, Texas, for analysis of specific yield. Depth specific brine samples were collected from the in situ formation, ahead of the core bit. Four additional methods were used to obtain brine samples. Brine samples used to support the reliability of the depth specific samples included analyses of brine centrifuged from core samples, brine obtained from low flow sampling of the exploration core holes, brine samples obtained near the end of the pumping tests in the exploration wells, and brine samples obtained during RC drilling. After the samples were sealed on site, they were stored in a cool location, then shipped in sealed containers to the laboratories for analysis. Drill hole and well spacing is in general about 4 km in most areas, consistent with guidelines set forth in Houston et al., 2011 for evaluation of brine-based lithium resources in salar-type systems. The drill spacing is sufficient to demonstrate a high degree of confidence in reservoir extent and its properties, and brine grade both horizontally and vertically.

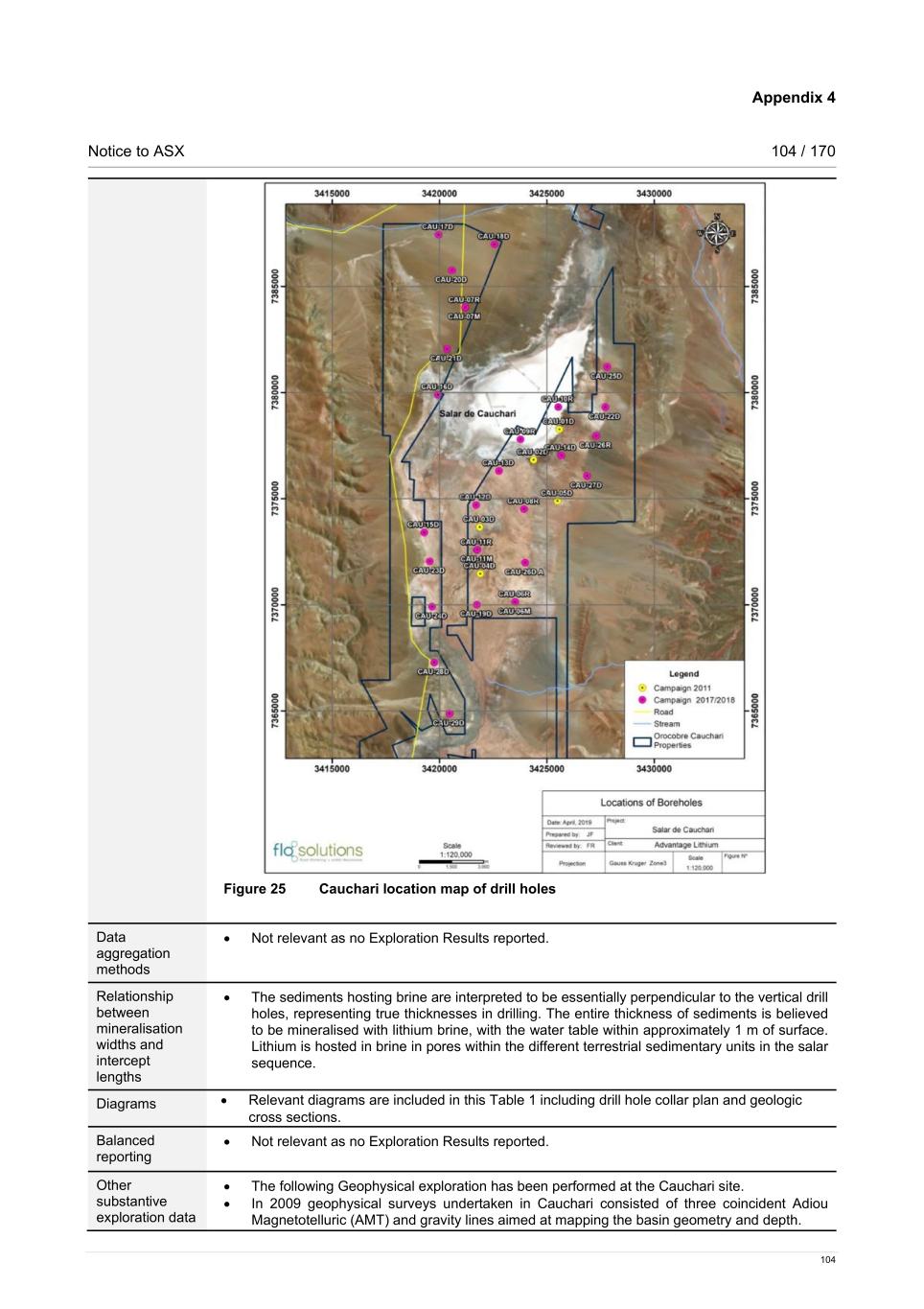

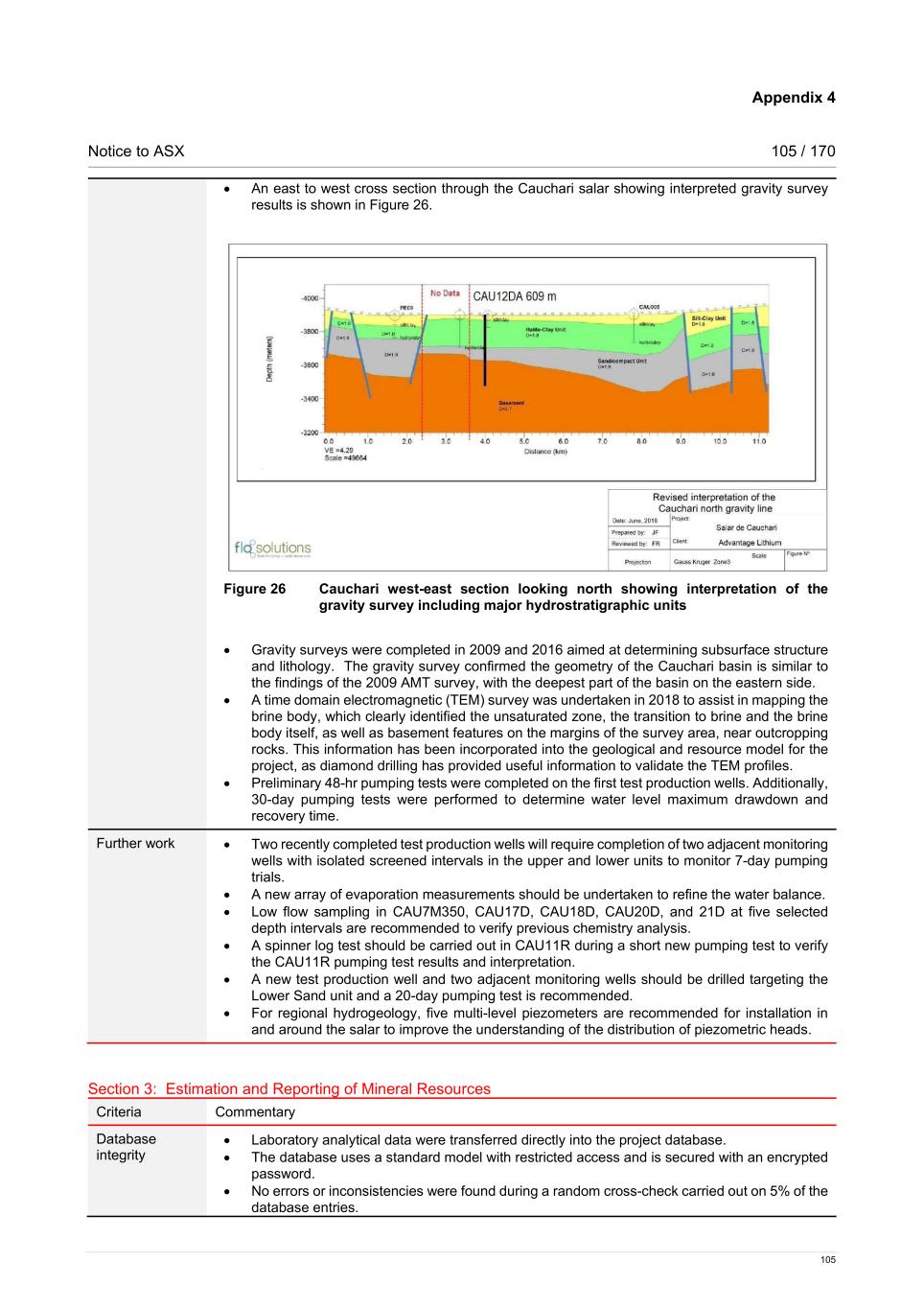

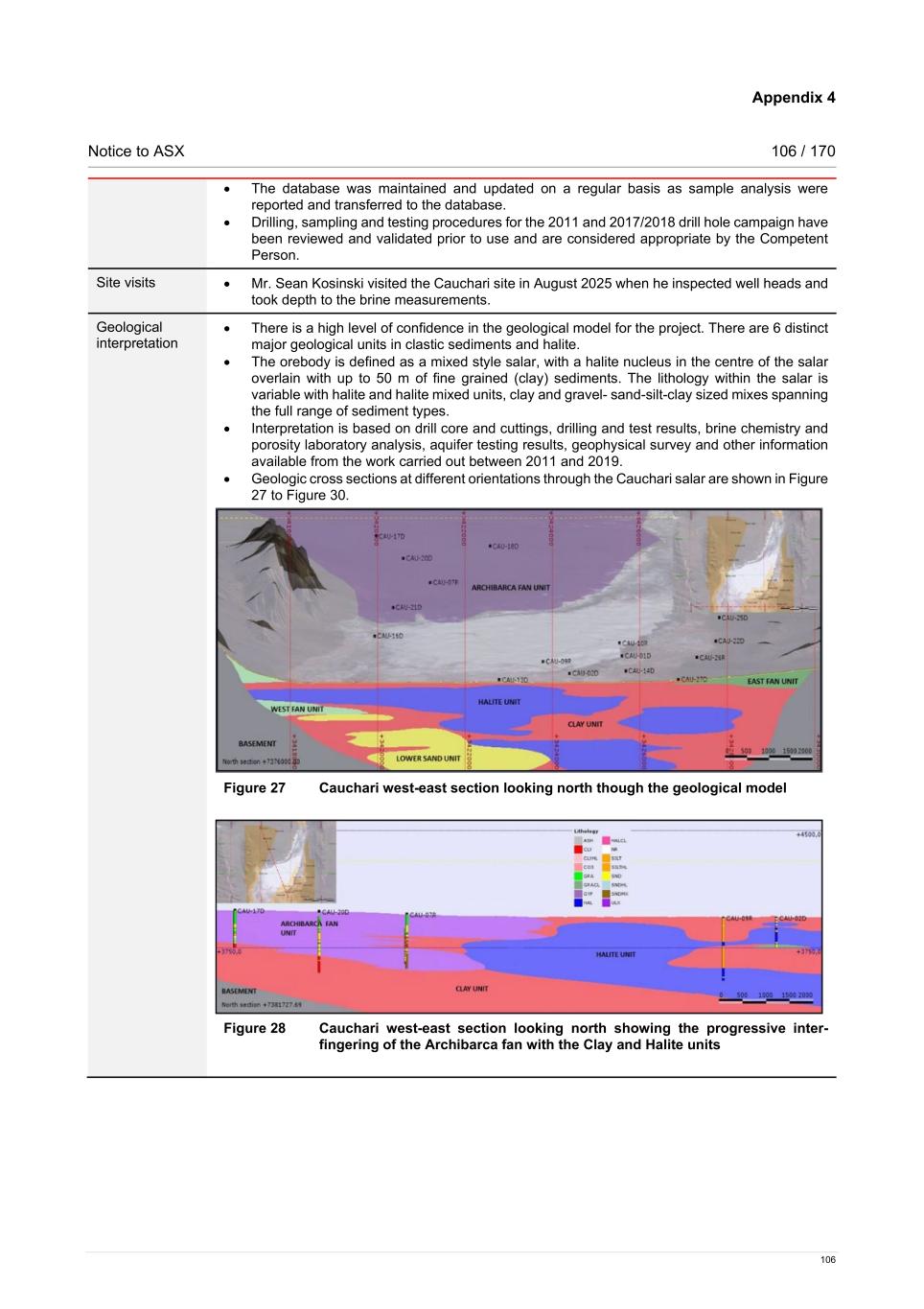

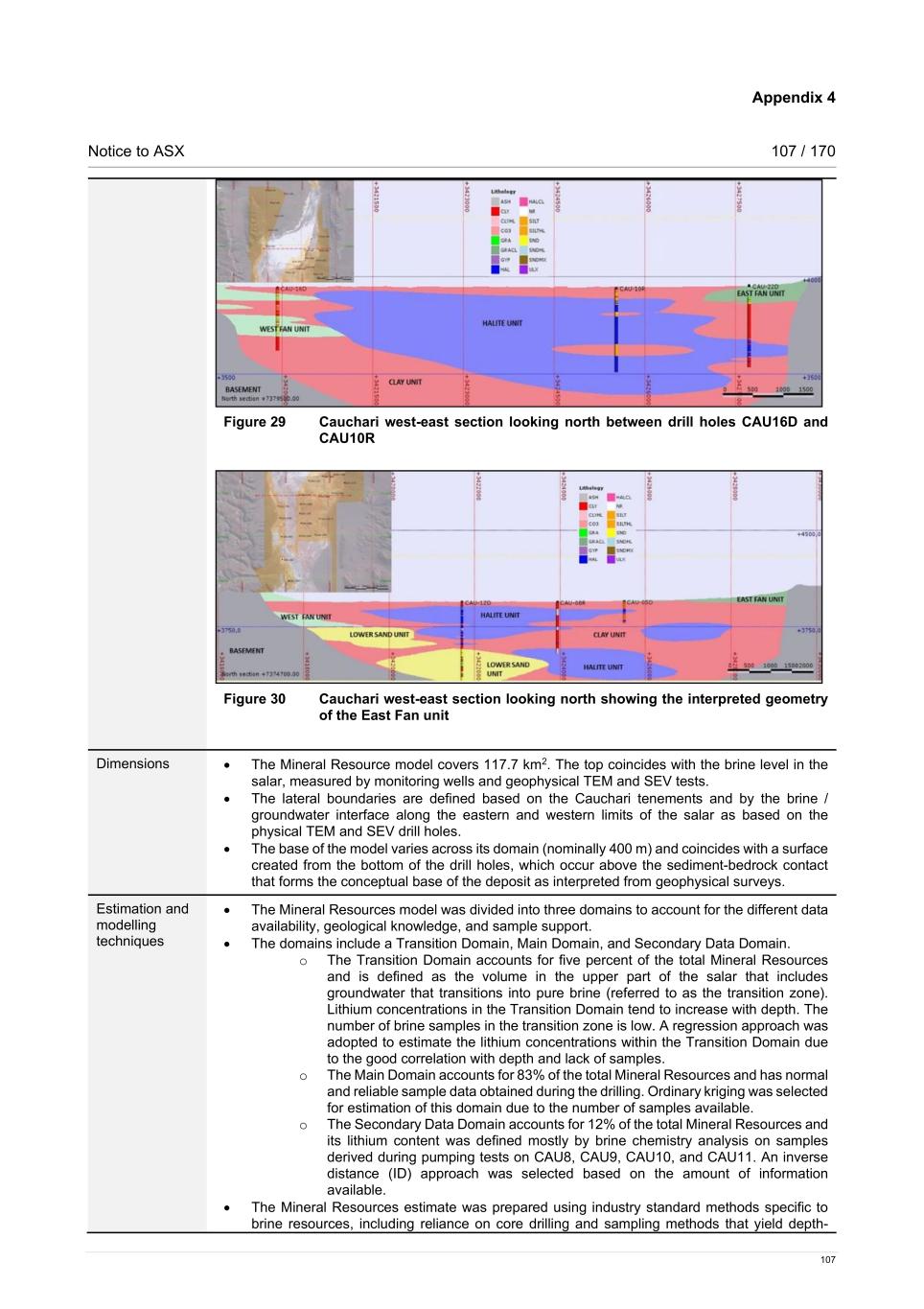

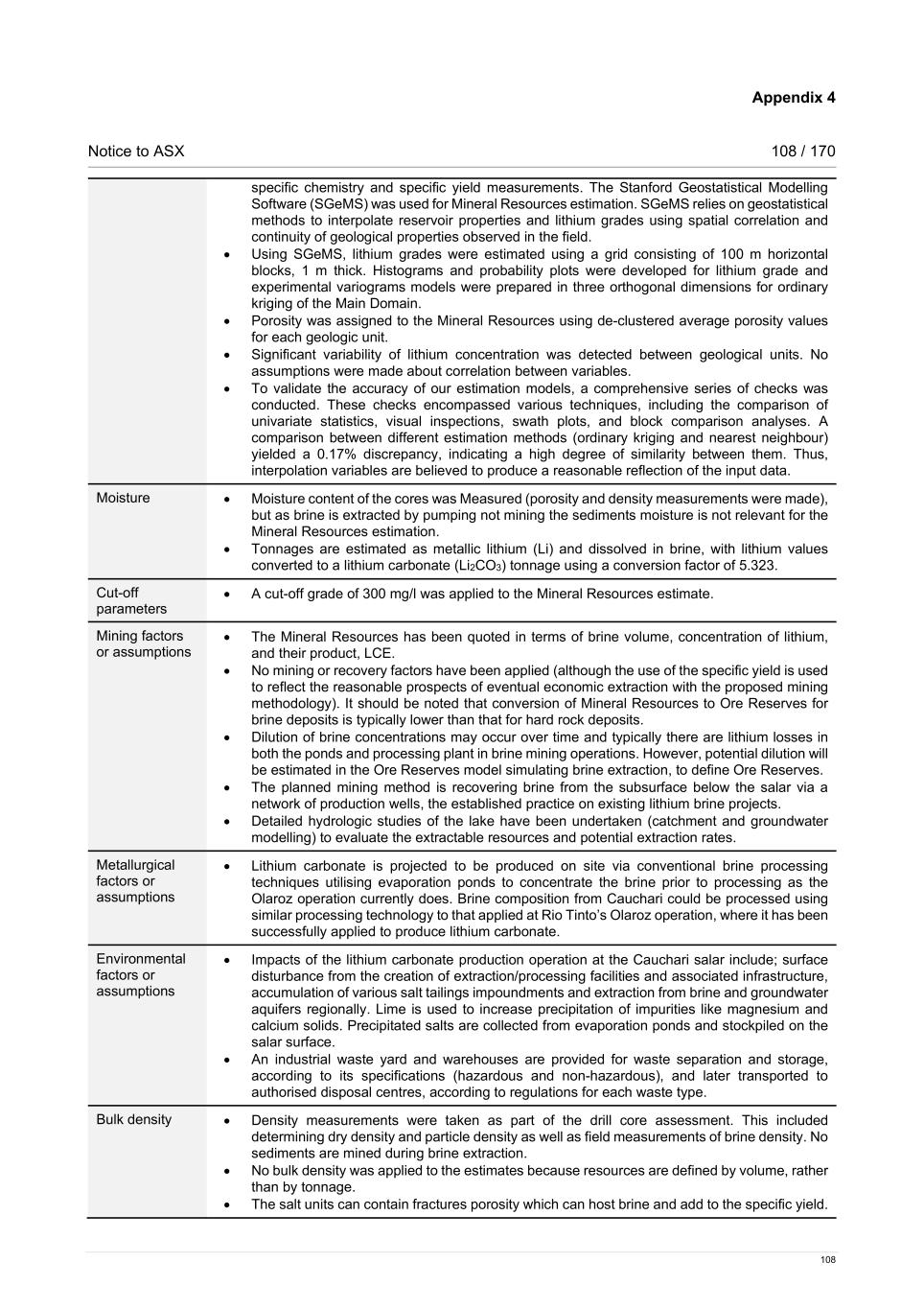

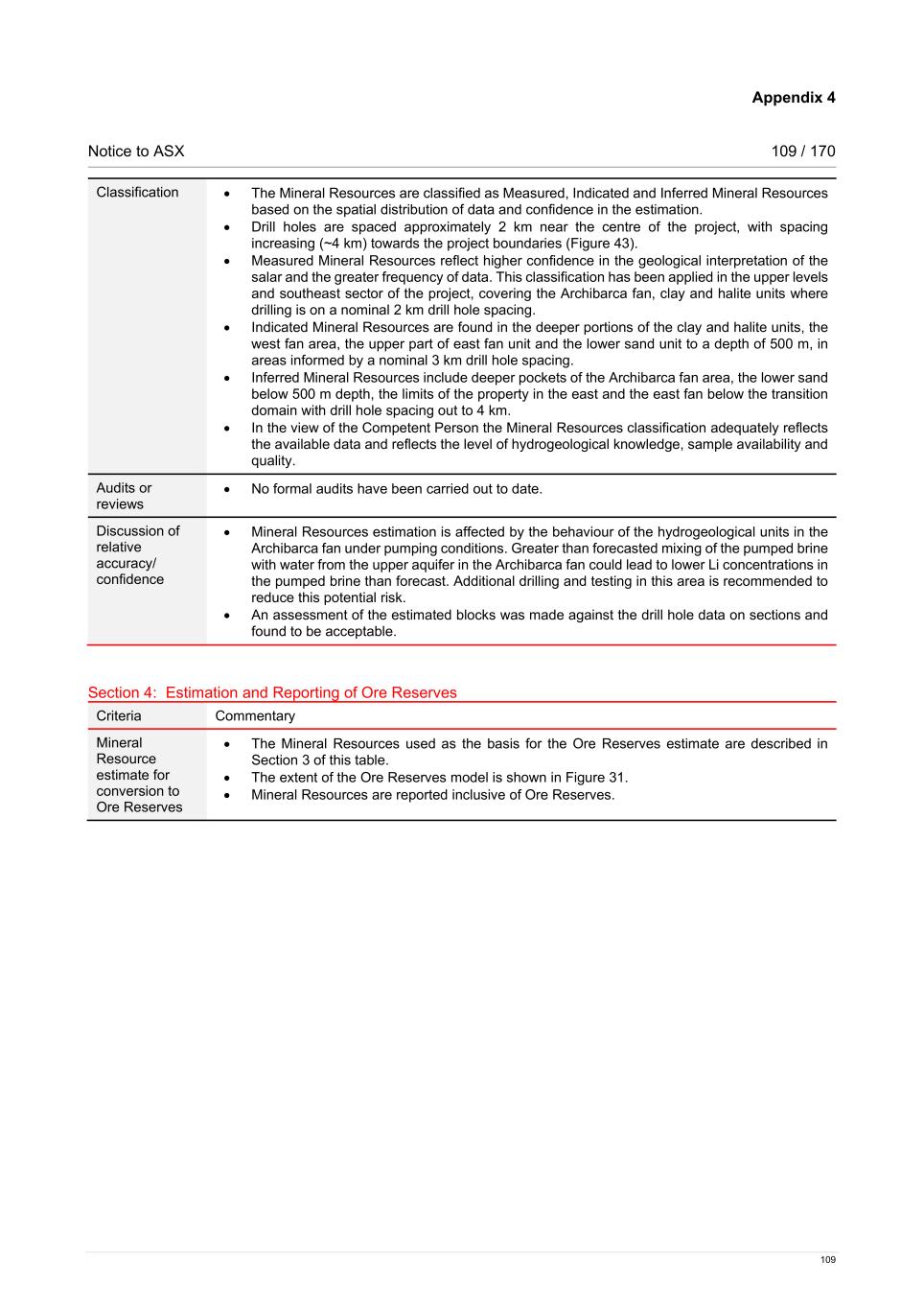

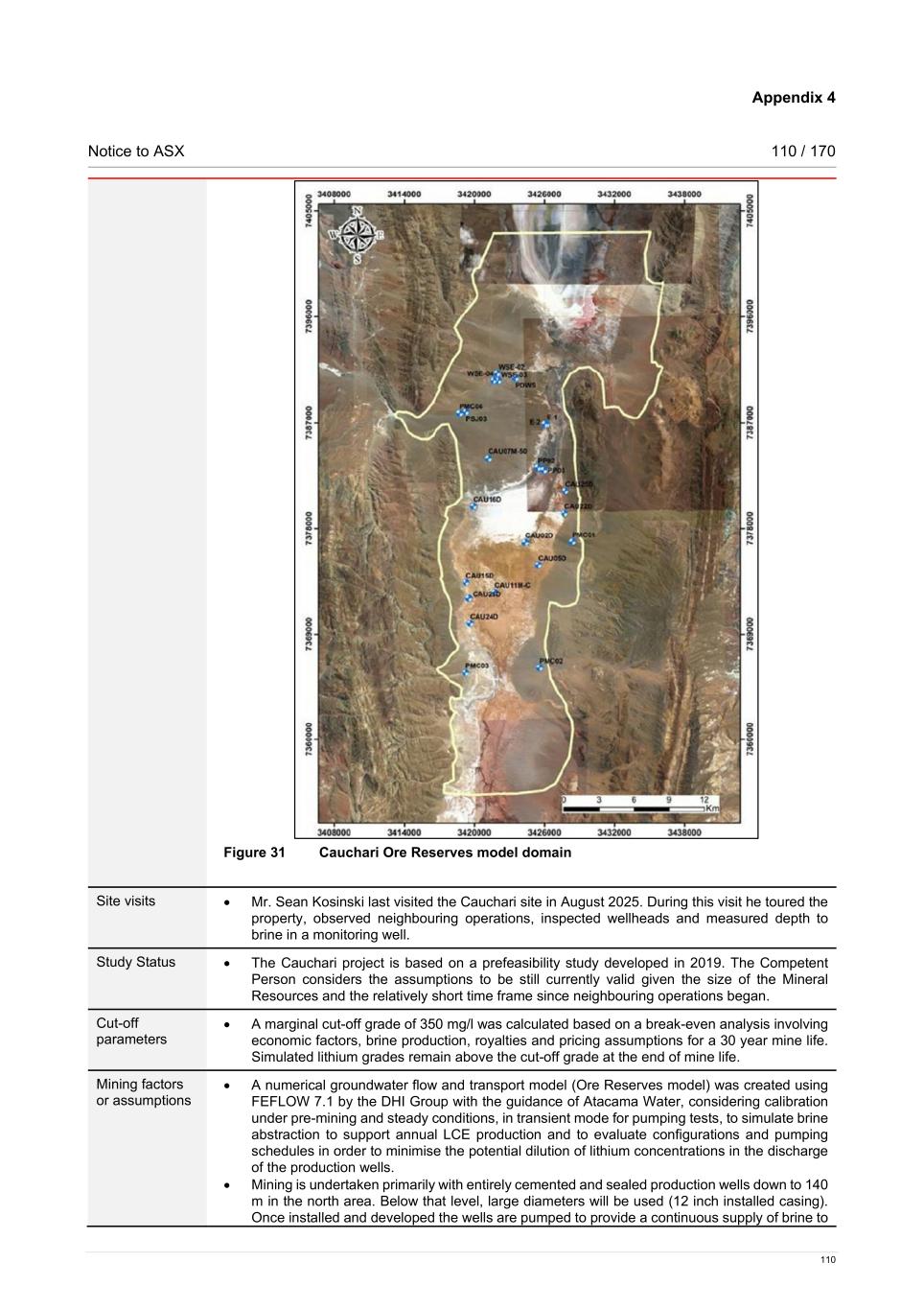

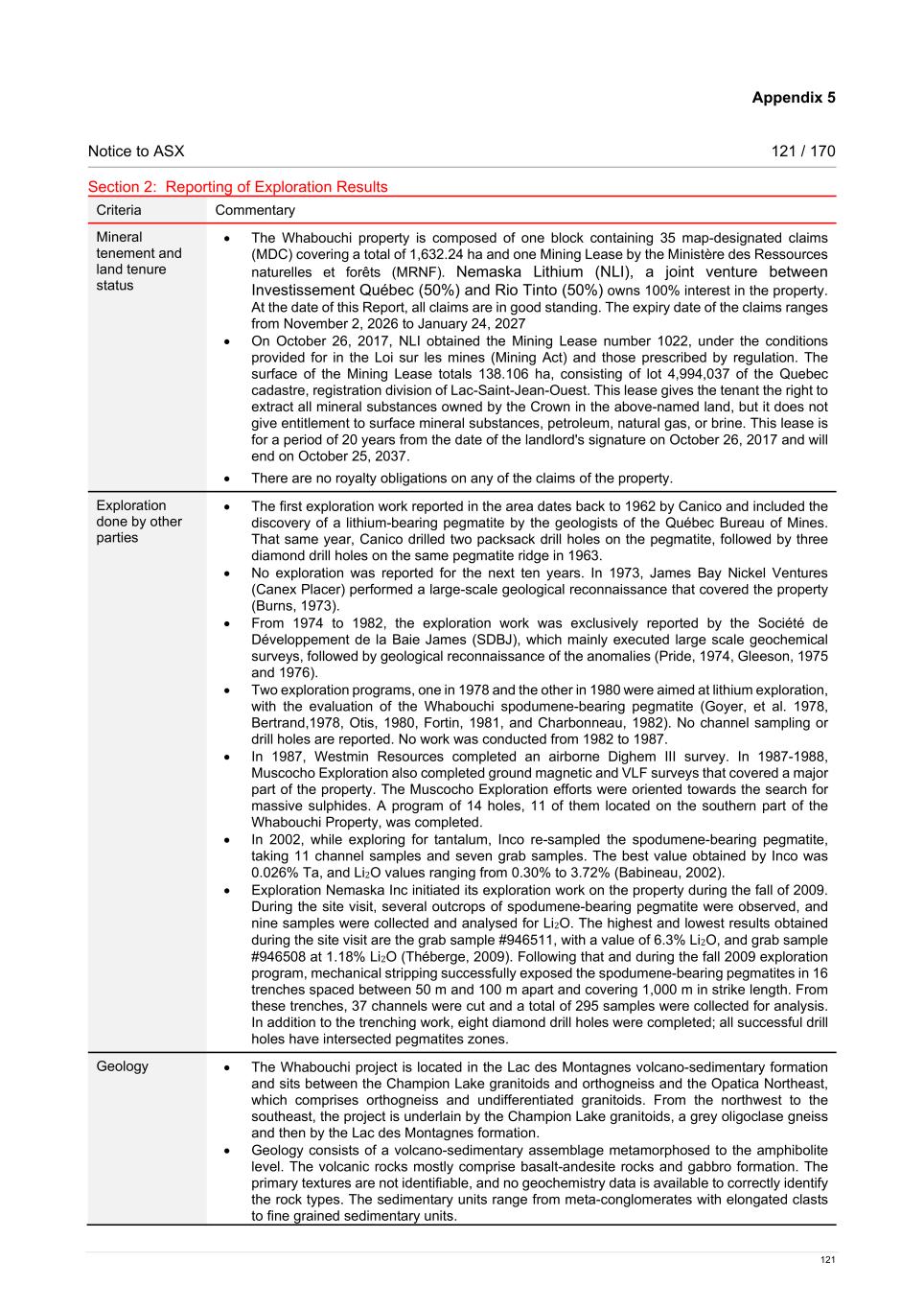

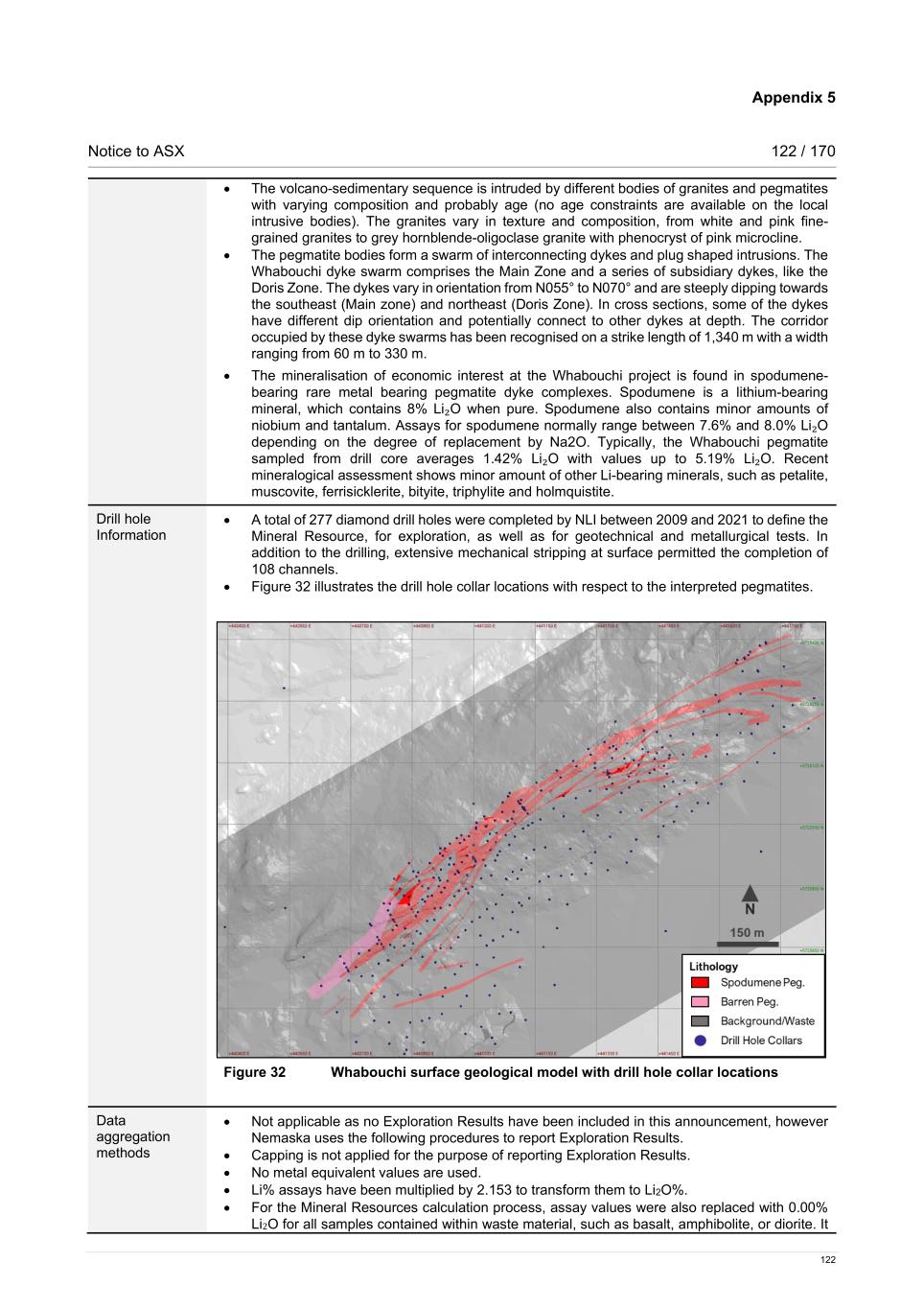

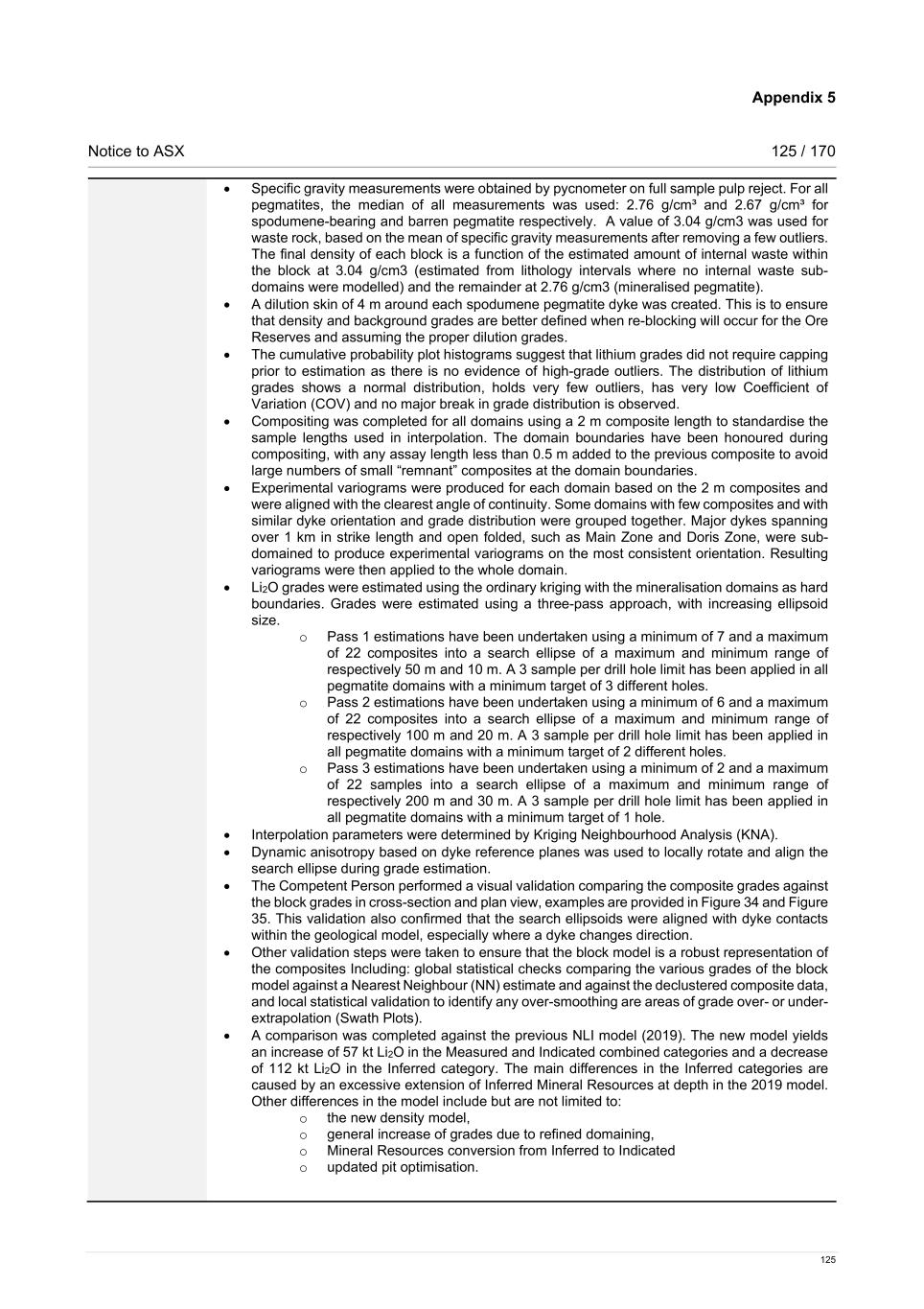

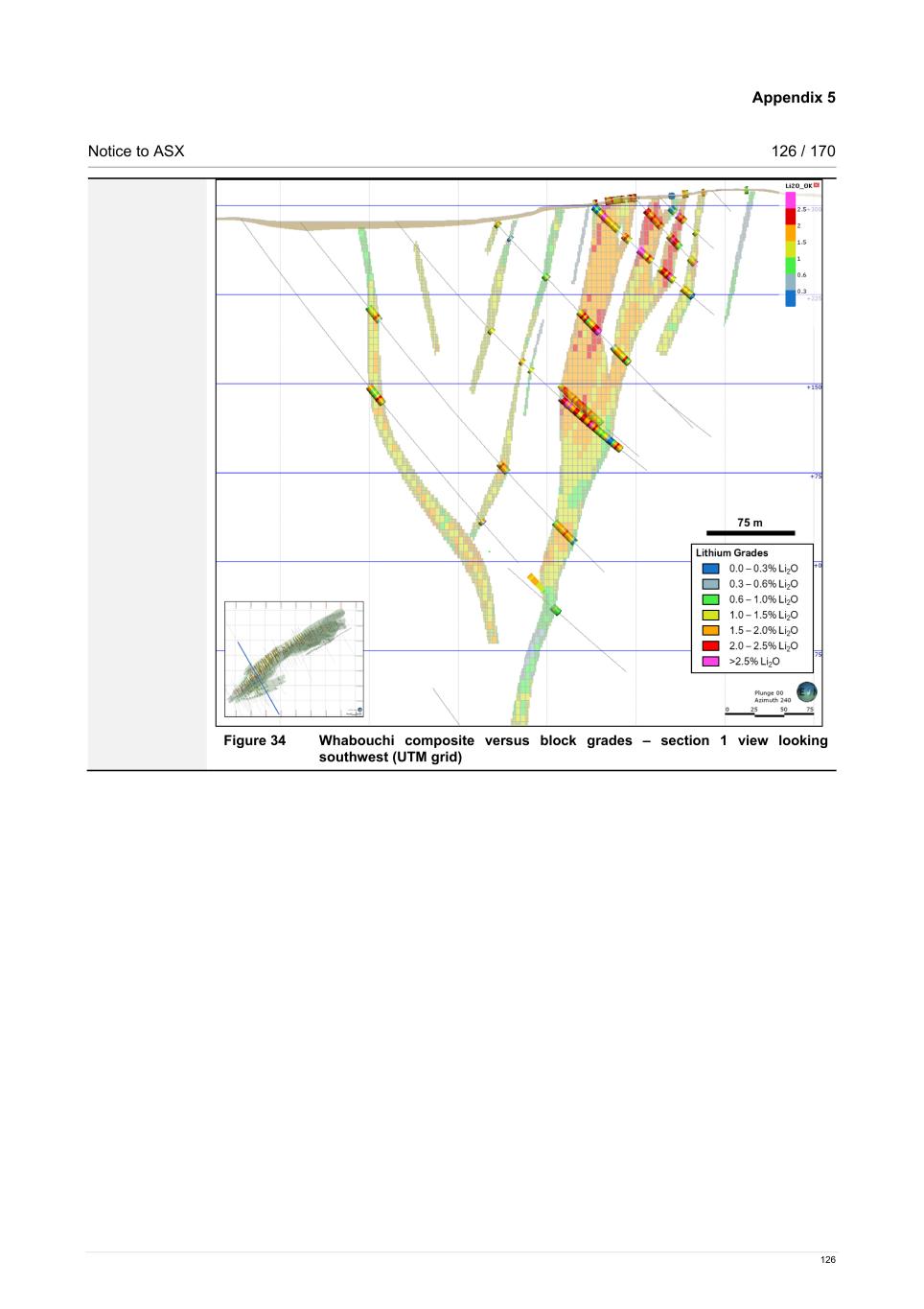

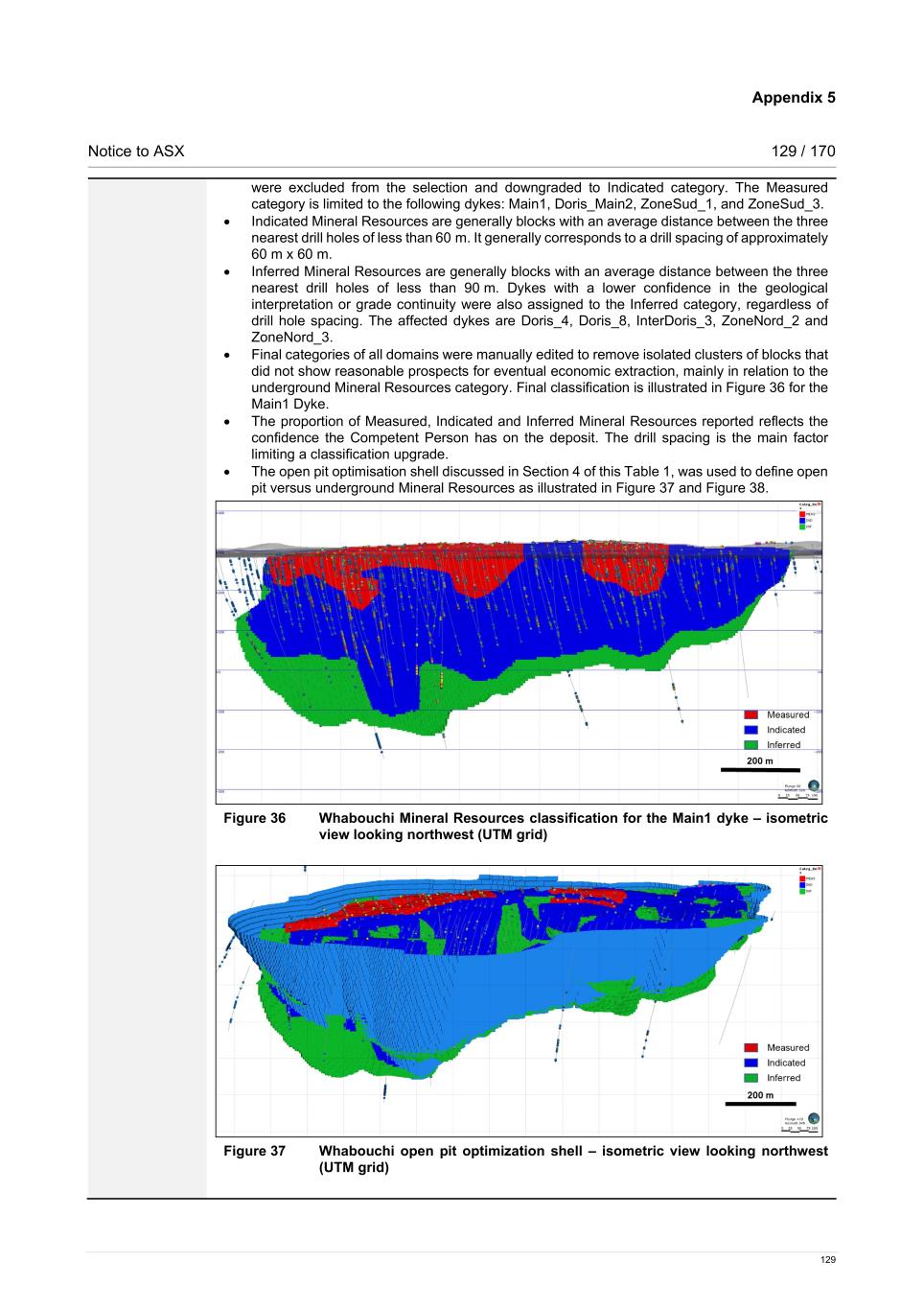

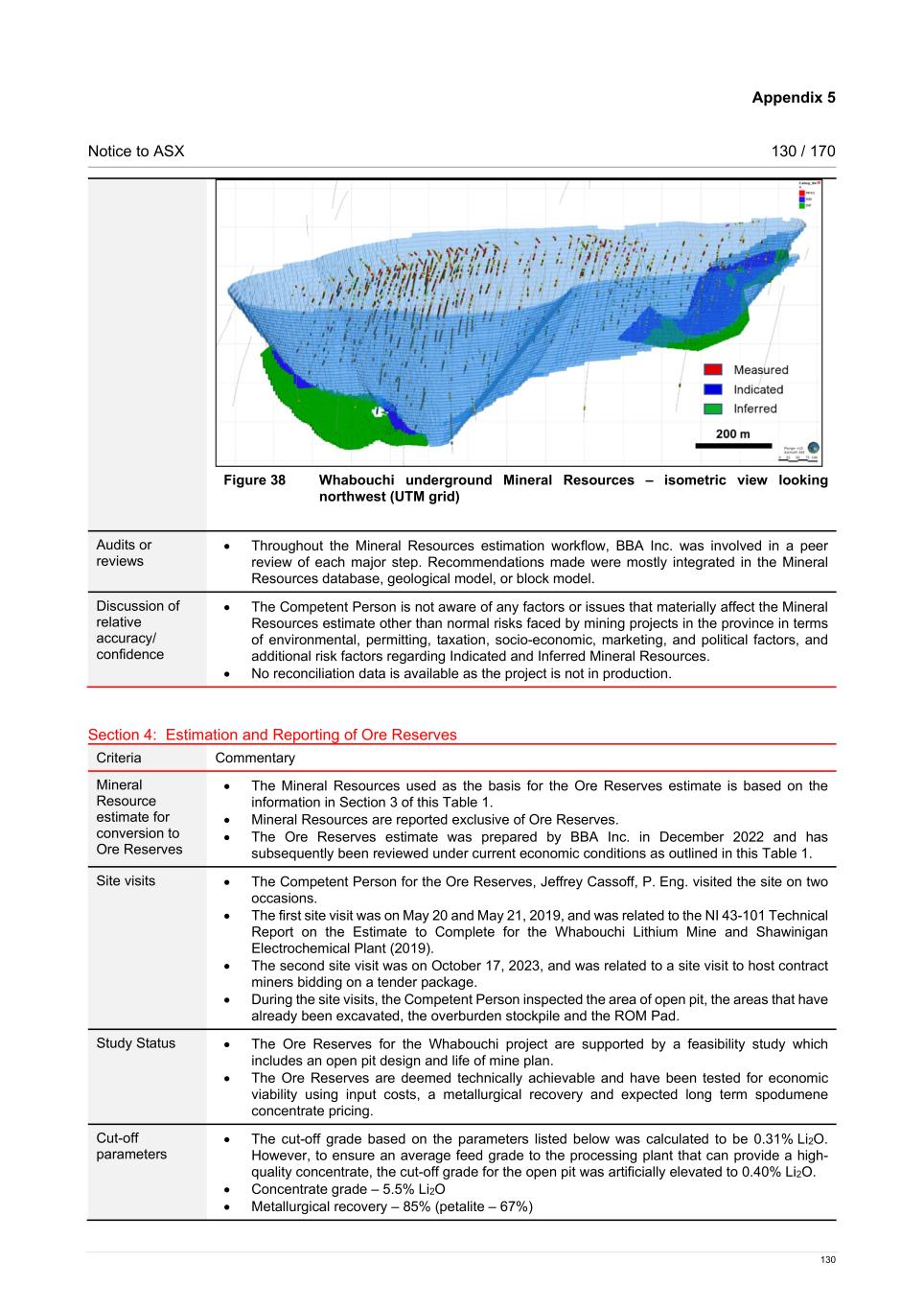

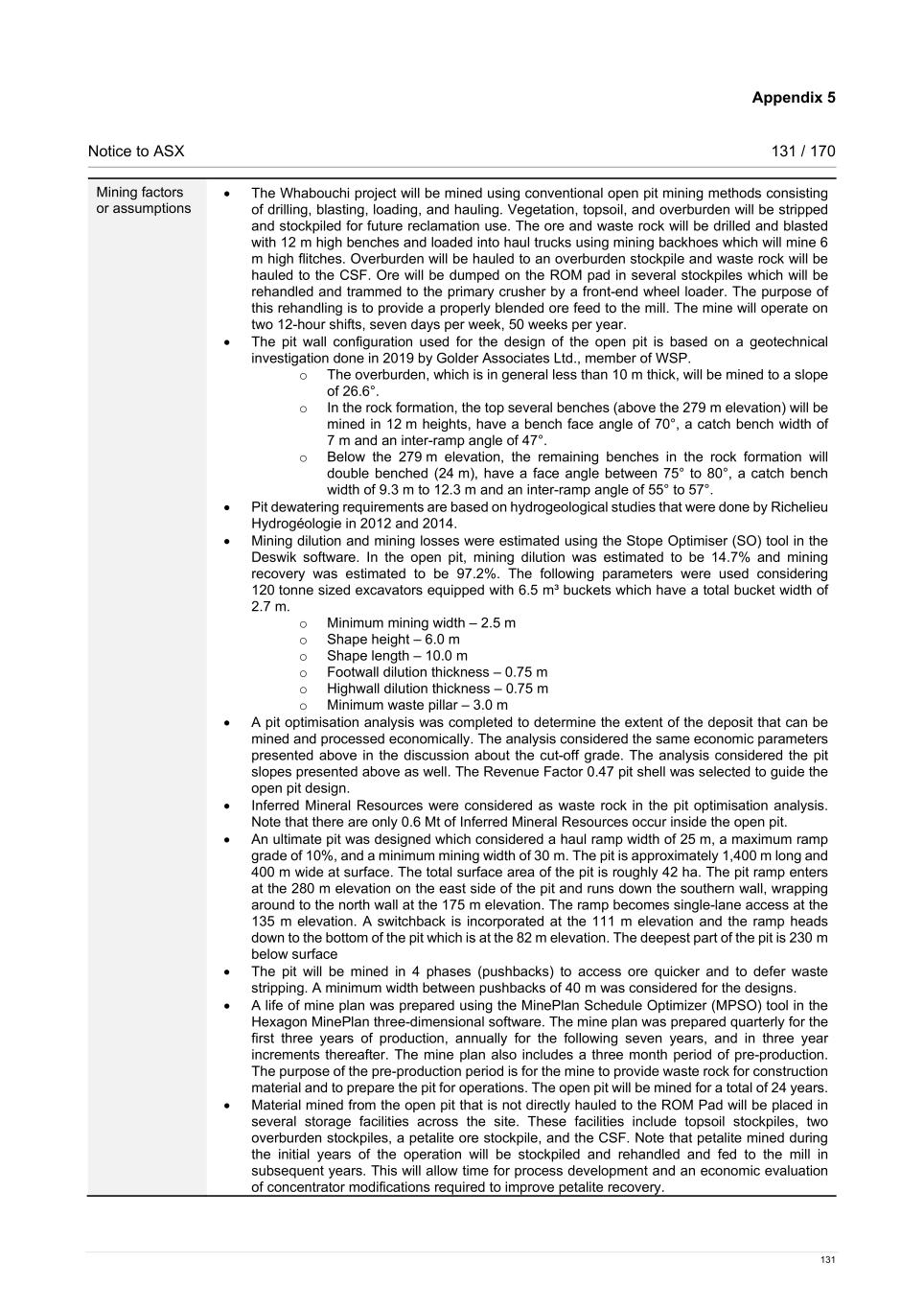

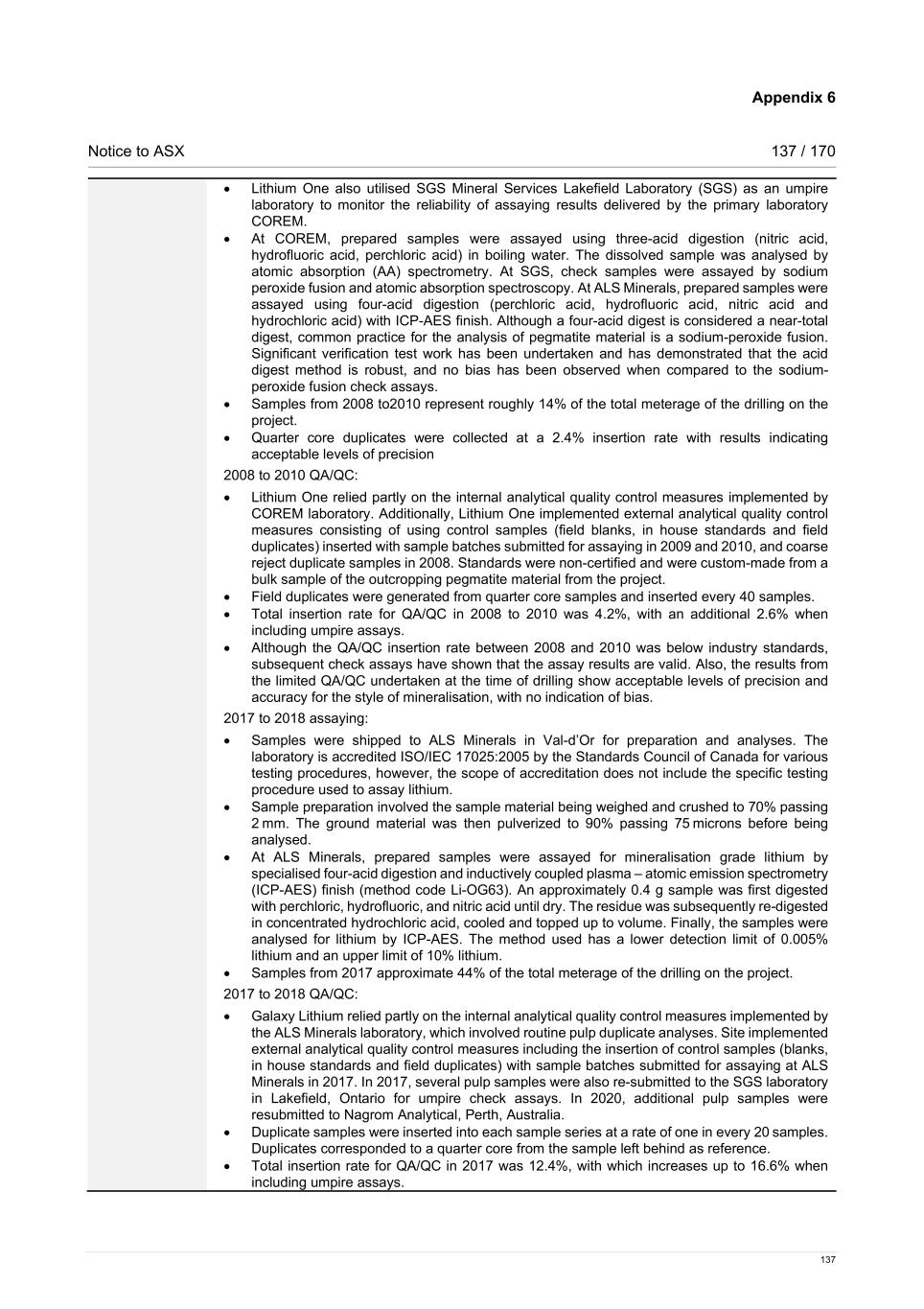

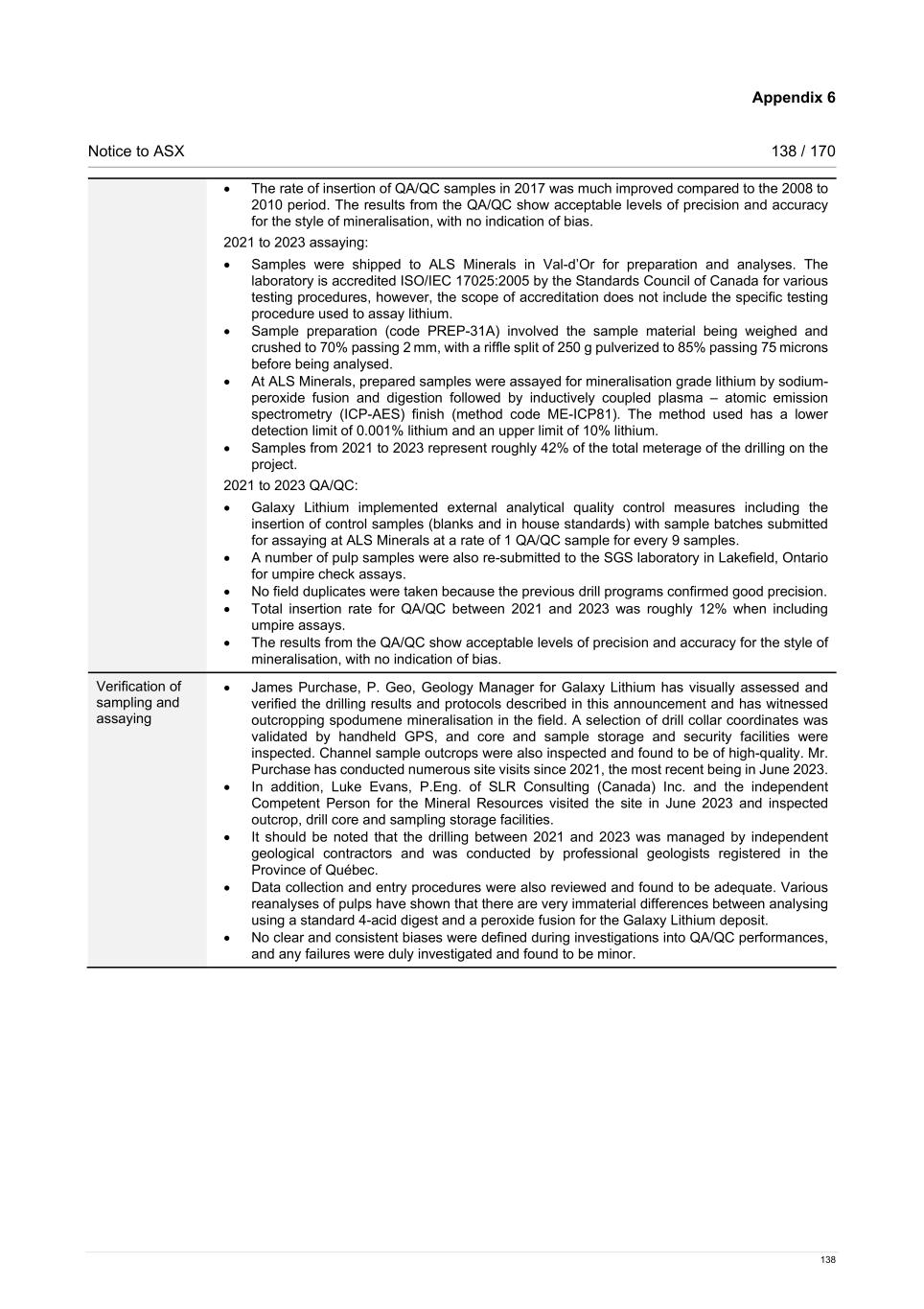

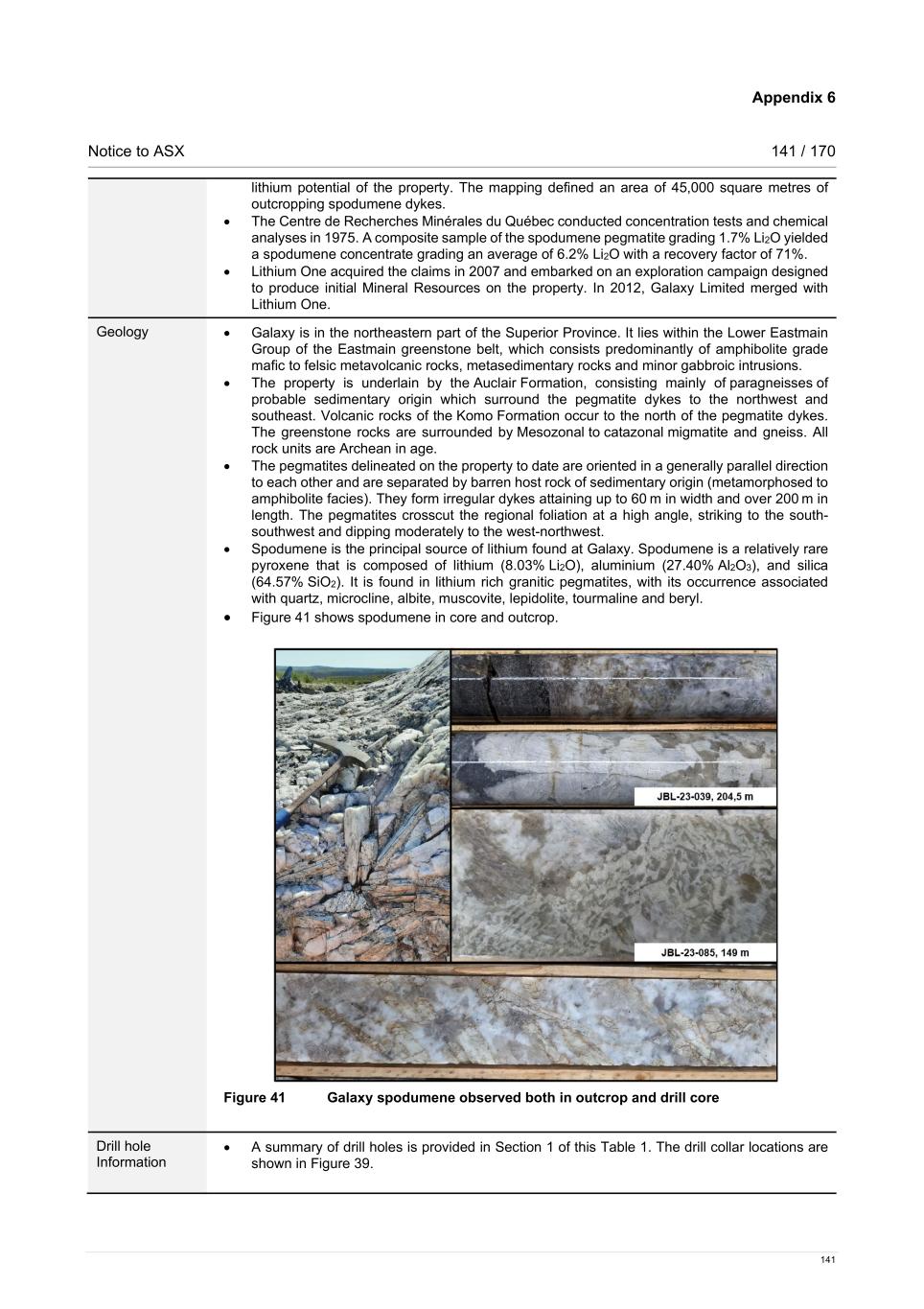

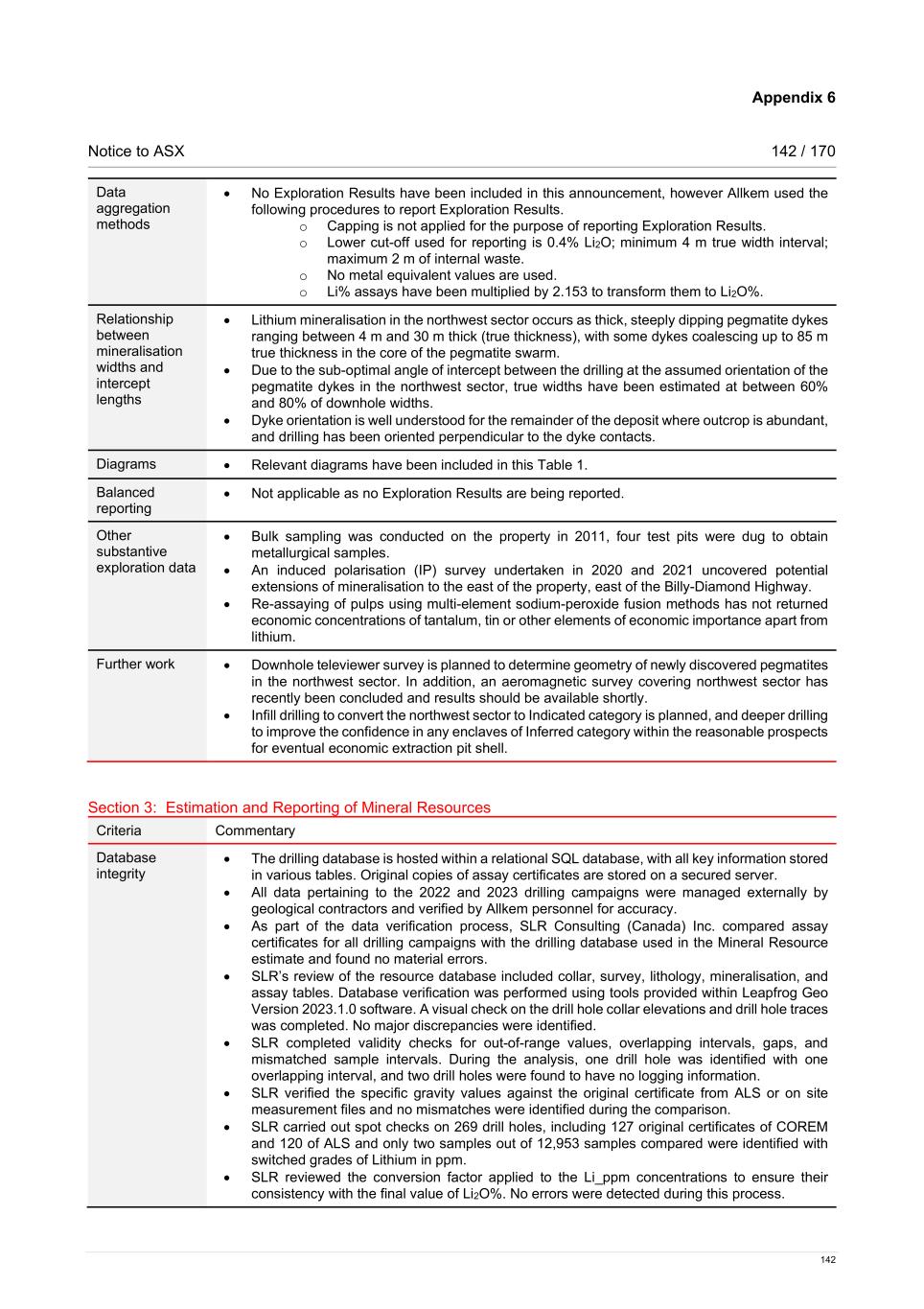

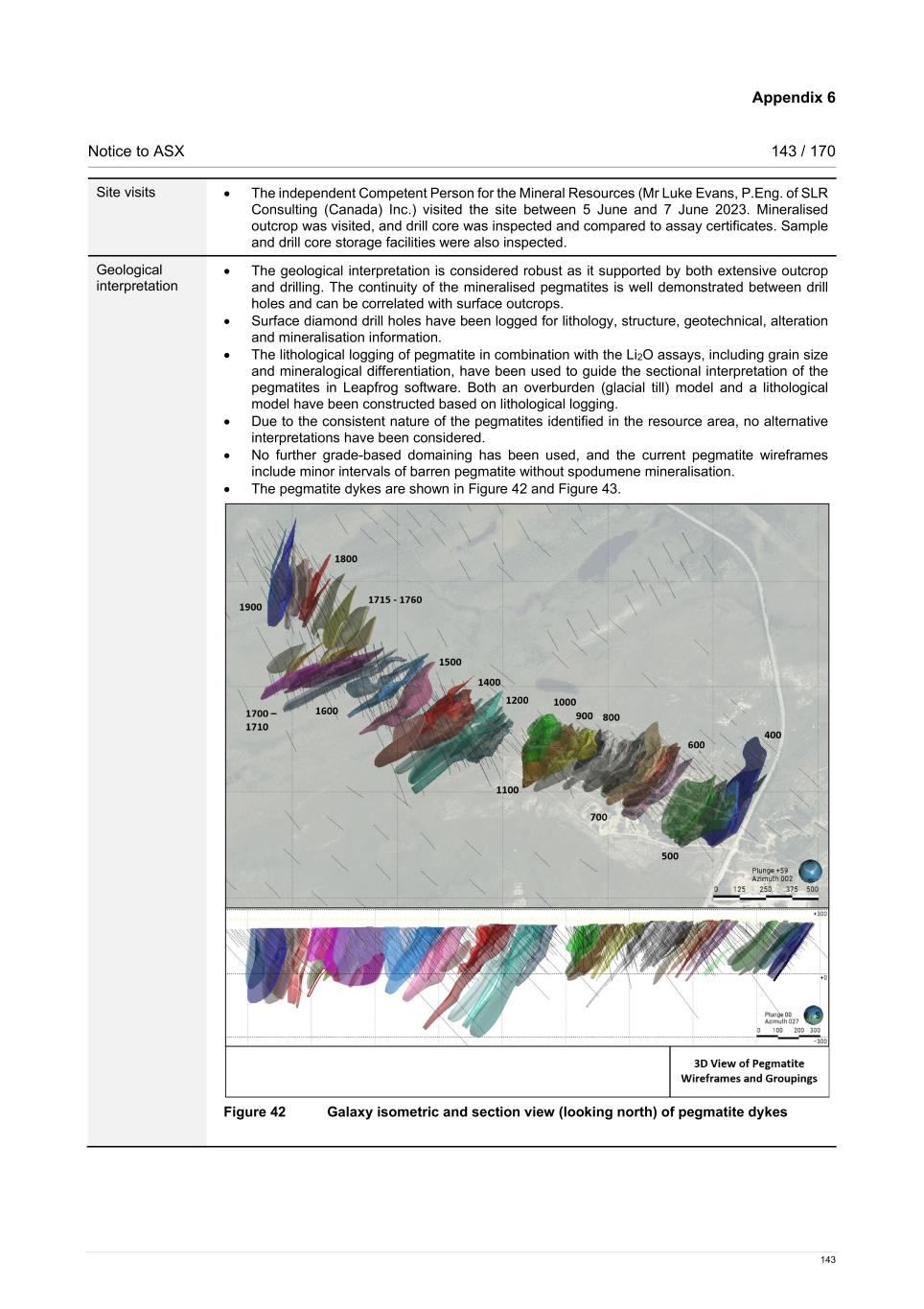

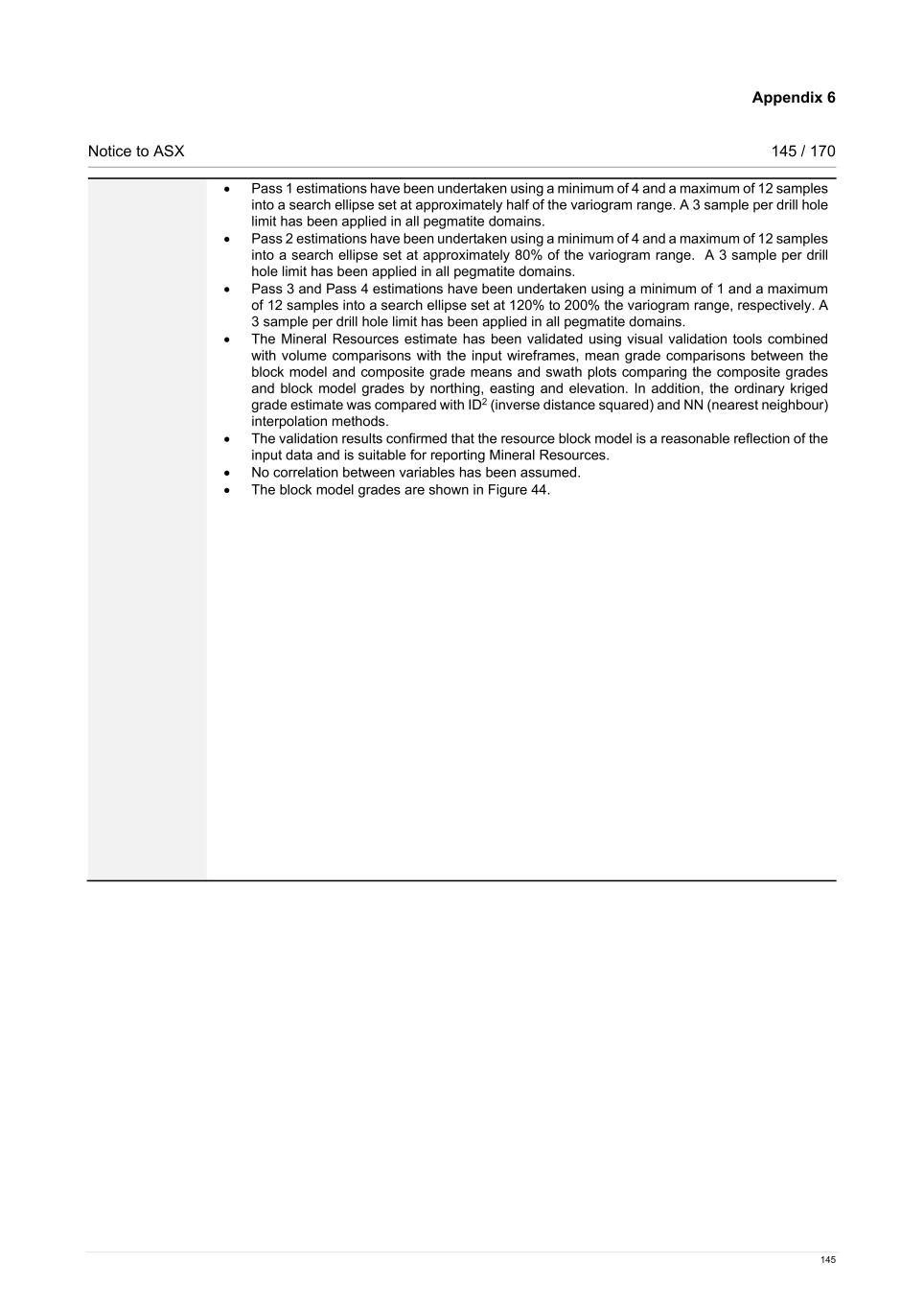

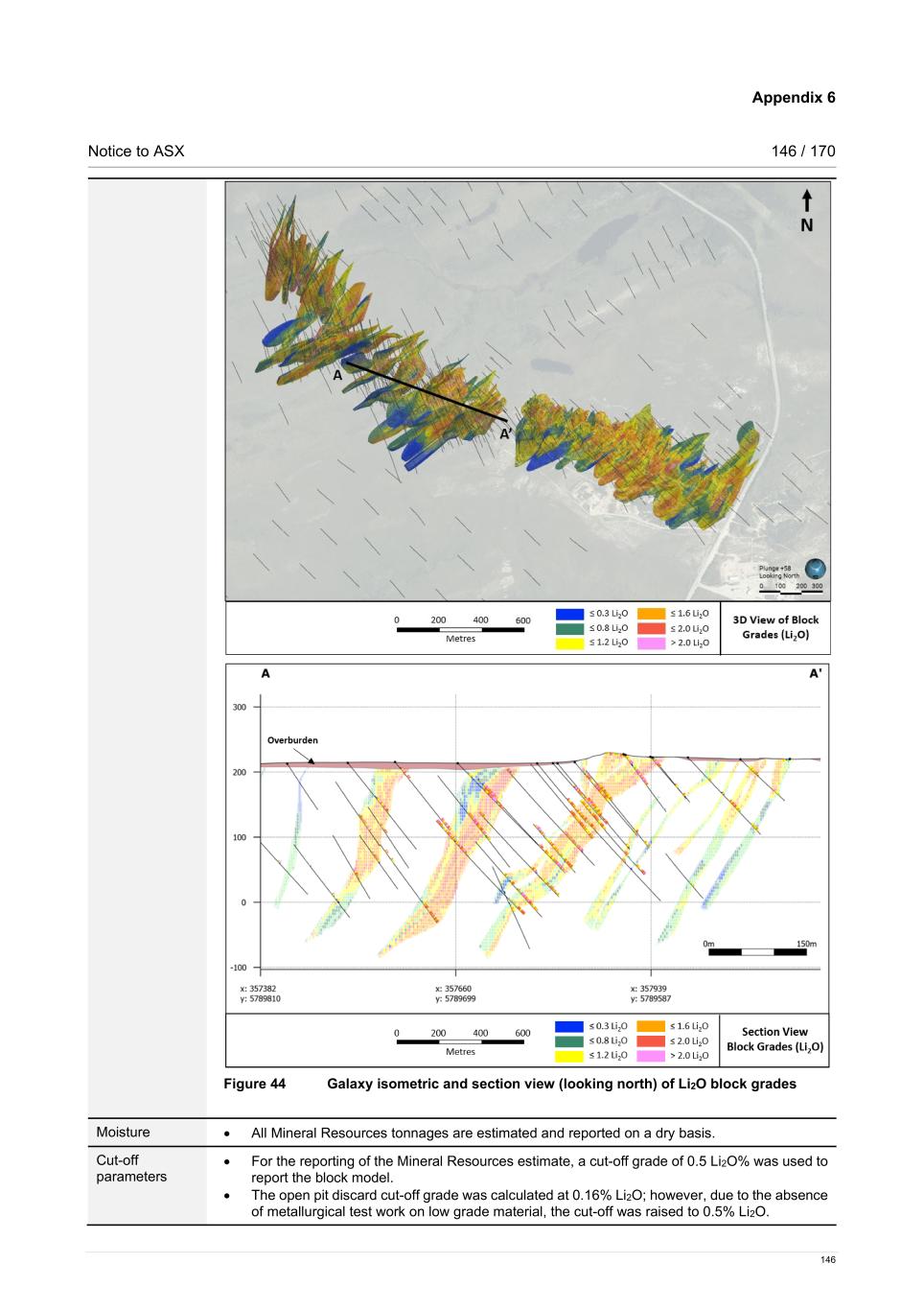

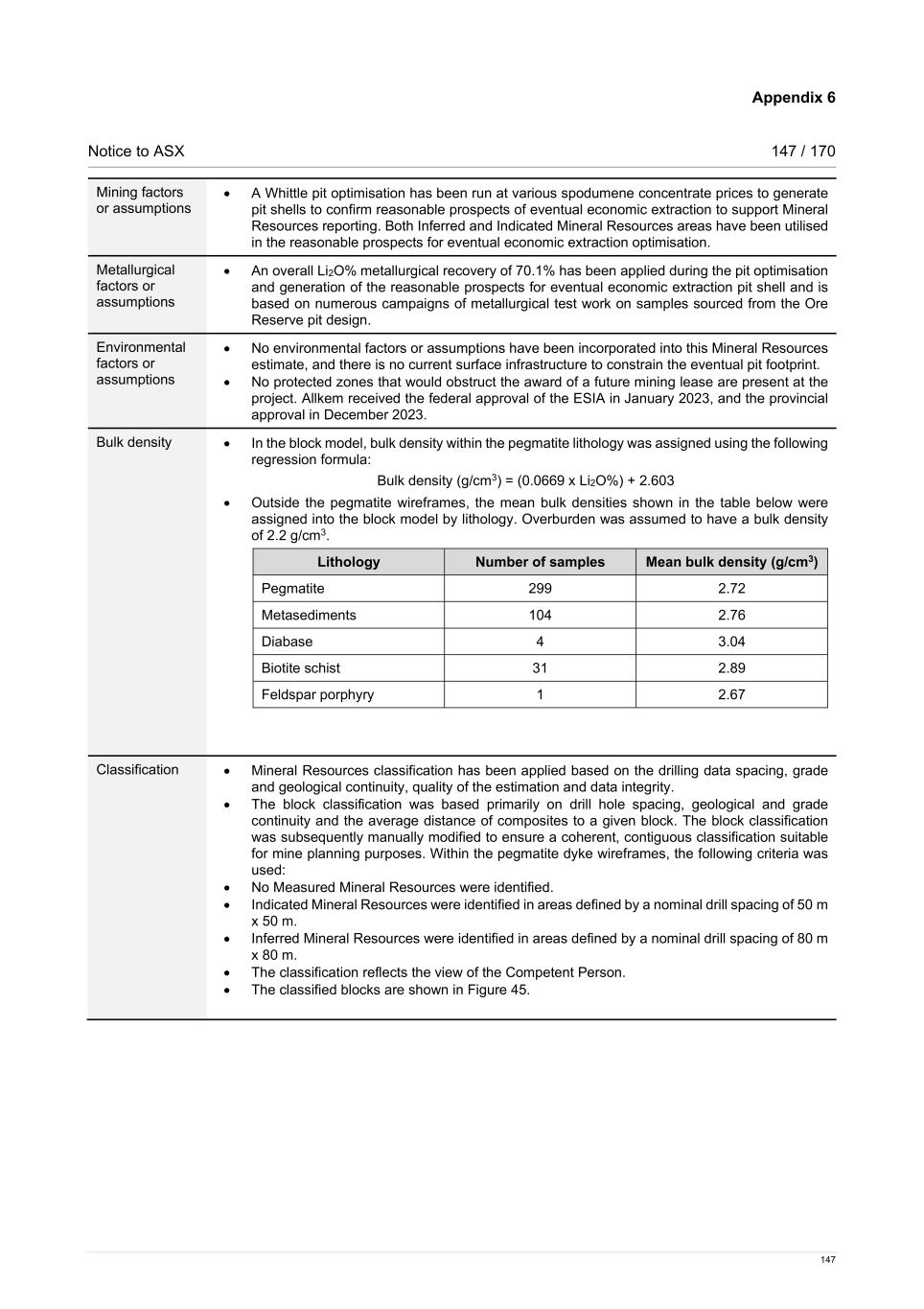

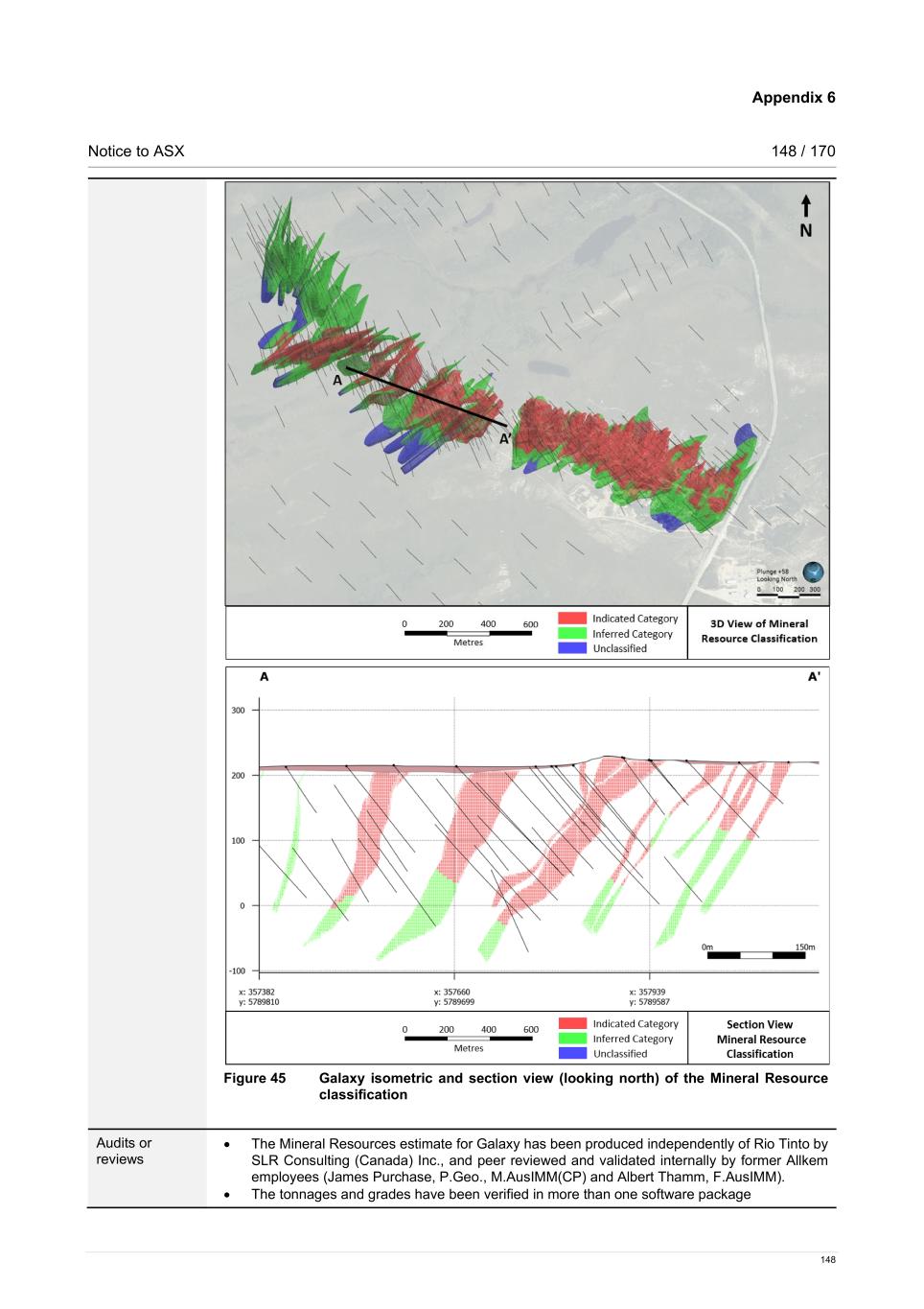

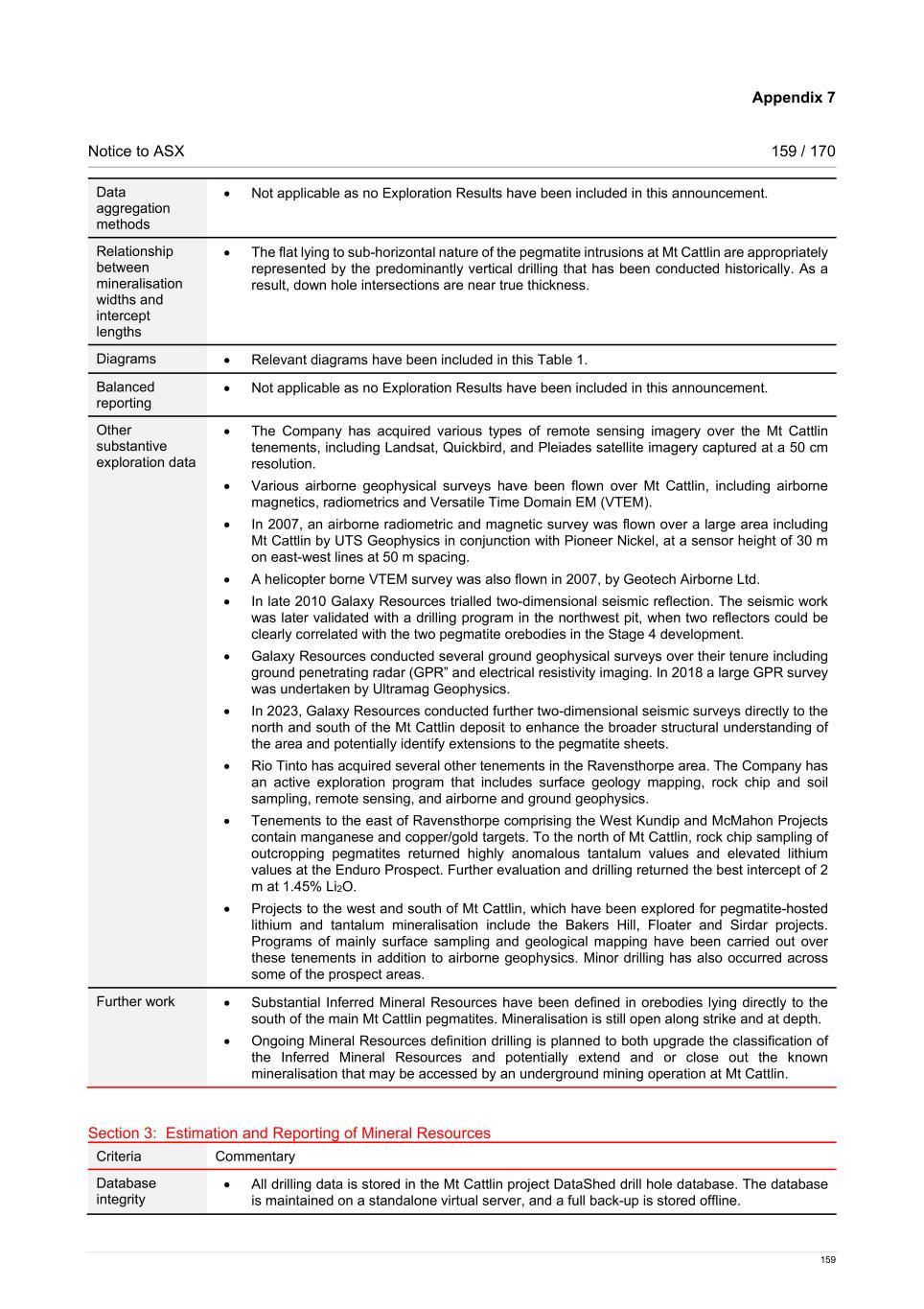

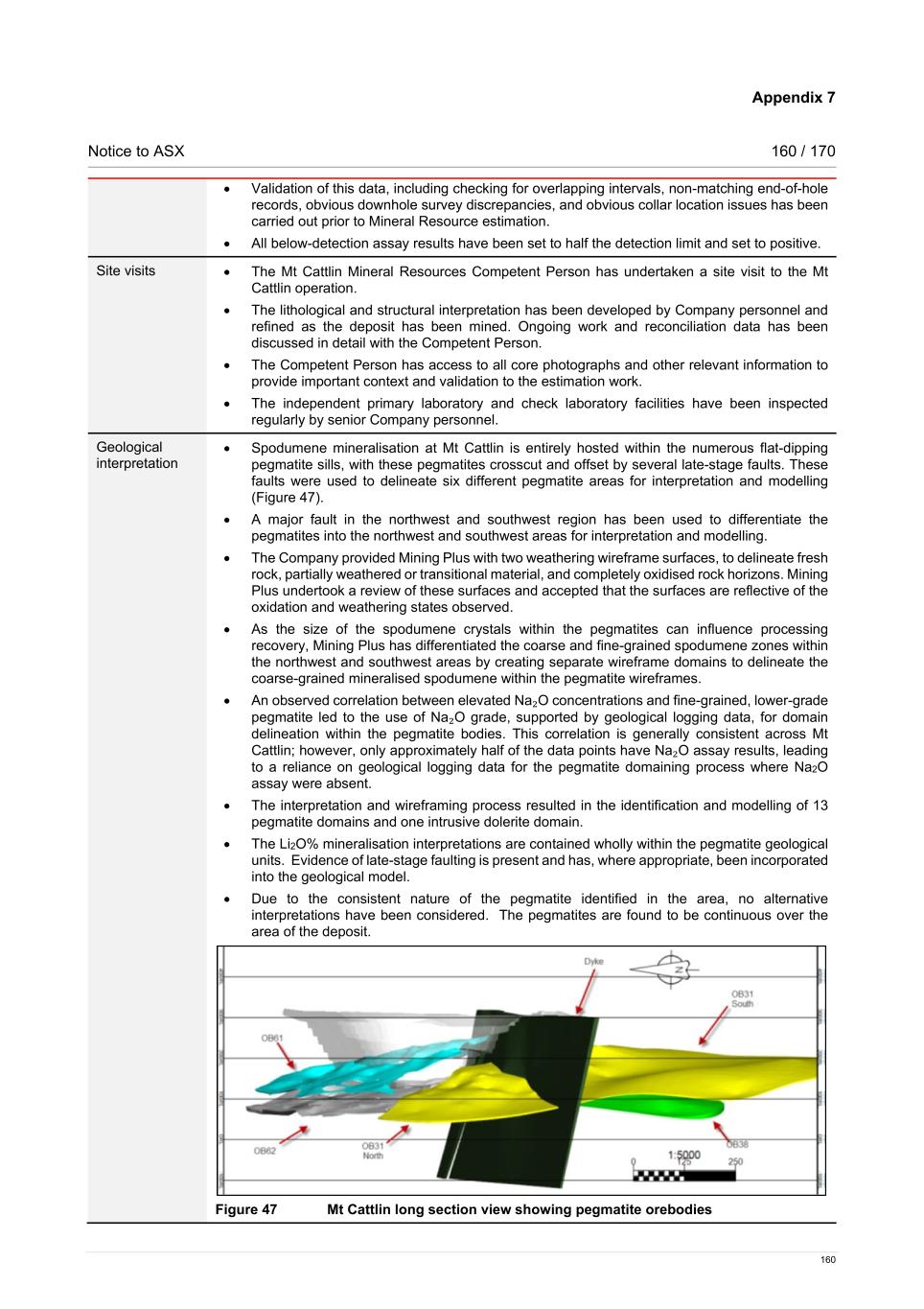

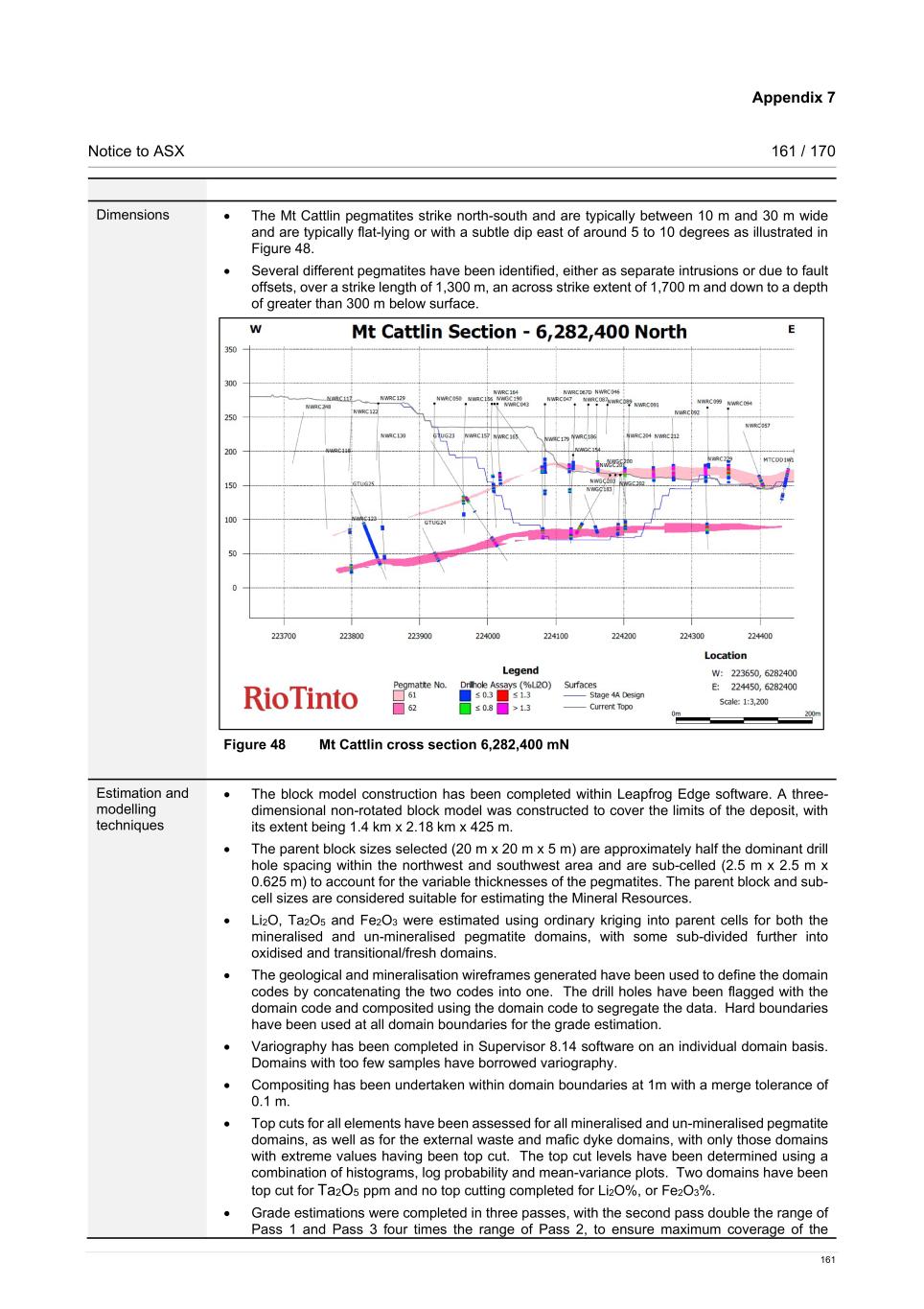

Notice to ASX 21 / 170 21 Exploration program results demonstrate this hydrogeological system contains relatively uniform lithium and potassium grades throughout the entire salar. The majority of the salar contains high-density brine with an average lithium grade over 700 mg/l. The reservoir is extensive and aquifer test results provide demonstrated ability to extract economic volumes of brine. Estimation methodology Mineral Resources estimation methods to characterise in situ brine deposits must include two key components: characterisation of mineral grade dissolved in the brines, and characterisation of the host aquifer specific yield that contains the mineral to be estimated. To estimate the total amount of lithium in the brine, the basin was first sectioned into polygons based on the location of exploration drilling, a commonly applied method for lithium brine Mineral Resources estimates. Each polygon block contained one core drill exploration hole that was analysed for both depth-specific brine chemistry and specific yield. Boundaries between polygon blocks were generally equidistant from the core drill holes and the total well depth was used as the base of the polygons. The total area of polygon blocks used for Mineral Resources estimates is about 160.9 km2. Within each polygon shown on the surface, the subsurface lithological column was separated into lithologic units. Each interval was assigned a specific thickness and was given a value for specific yield and average lithium content based on laboratory analyses of samples collected during exploration drilling. The estimated Mineral Resources for each polygon was the sum of the products of saturated lithologic unit thickness, polygon area, specific yield, and lithium content. The Mineral Resources estimated for each polygon was independent of adjacent polygons. Cut-off grades and modifying factors Mineral Resources are reported as the in situ, theoretical drainable lithium mass. A cut-off grade of 300 mg/l was applied to the Mineral Resources estimate. Within each polygon shown at the surface, the subsurface column was separated into discrete lithologic units and was assigned a specific yield value representative of the unit and average lithium concentration for the interval. Intervals of each vertical unit within a polygon with lithium content less than cut-off grade were not included in the Mineral Resources estimate, as they do not demonstrate a reasonable basis for the reasonable prospects for eventual economic extraction of Mineral Resources. Criteria used for Mineral Resources classification Industry standard guidance for the evaluation brine prospects was adopted for classifying Mineral Resources. Confidence in hydrogeological and grade continuity were taken into account for classification of Mineral Resources. Classification is based on level of confidence in understanding of the conceptual model, drill hole spacing, distribution and range of continuity of lithium samples, and hydraulic parameter characterisation. Based on the current understanding of the hydrogeological system of the Salar de Hombre Muerto, the additional data on brine occurrence and chemistry, the relative consistency of the hydrogeological and chemical data, confidence in the drilling and sampling results achieved to date, and historical production information (east side), there were sufficient grounds to classify certain polygons as Measured Mineral Resources. Approximate drill hole spacings were initially used as a guide, assuming that for estimated Mineral Resources to be considered Measured, spacing was no greater than 4 km. Indicated Mineral Resources used spacing no greater than 7 km, and Inferred Mineral Resources used spacing no greater than 10 km. Measured Mineral Resources are defined only in the fractured halite where continuity has been demonstrated by pumping tests Some areas with drill spacings closer than 4 km, were classified either Indicated or Inferred Mineral Resources when progressively lower levels of understanding or reliability on basin stratigraphy, reservoir properties, or hydrogeologic conditions exist. Summary of information to support Ore Reserves reporting – Sal de Vida Sal de Vida Ore Reserves are supported by the information set out in Appendix 3 and located at Resources & Reserves (riotinto.com) in accordance with the Table 1 checklist in the JORC Code. The following summary information is provided in accordance with Rule 5.9 of the ASX Listing Rules.