1 Lithium Deep Dive Argentina 8 December 2025 EXHIBIT 99.13

2 Cautionary statements This presentation has been prepared by Rio Tinto plc and Rio Tinto Limited (together with their subsidiaries, “Rio Tinto”). By accessing/attending this presentation you acknowledge that you have read and understood the following statements. Forward - looking statements This presentation includes “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts included in this presentation, including, without limitation, those regarding Rio Tinto’s financial position, business strategy, plans and objectives of management for future operations (including development plans and objectives relating to Rio Tinto’s products, production forecasts and reserve and resource positions), are forward - looking statements. The words “intend”, “aim”, “project”, “anticipate”, “estimate”, “plan”, “believes”, “expects”, “may”, “should”, “will”, “target”, “set to” or similar expressions, commonly identify such forward - looking statements. Such forward - looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Rio Tinto, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward - looking statements. Such forward - looking statements are based on numerous assumptions regarding Rio Tinto’s present and future business strategies and the environment in which Rio Tinto will operate in the future. Among the important factors that could cause Rio Tinto’s actual results, performance or achievements to differ materially from those in the forward - looking statements include, but are not limited to: an inability to live up to Rio Tinto’s values and any resultant damage to its reputation; the impacts of geopolitics on trade and investment; the impacts of climate change and the transition to a low - carbon future; an inability to successfully execute and/or realise value from acquisitions and divestments; the level of new ore resources, including the results of exploration programmes and/or acquisitions; disruption to strategic partnerships that play a material role in delivering growth, production, cash or market positioning; damage to Rio Tinto’s relationships with communities and governments; an inability to attract and retain requisite skilled people; declines in commodity prices and adverse exchange rate movements; an inability to raise sufficient funds for capital investment; inadequate estimates of ore resources and reserves; delays or overruns of large and complex projects; changes in tax regulation; safety incidents or major hazard events; cyber breaches; physical impacts from climate change; the impacts of water scarcity; natural disasters; an inability to successfully manage the closure, reclamation and rehabilitation of sites; the impacts of civil unrest; breaches of Rio Tinto’s policies, standard and procedures, laws or regulations; trade tensions between the world’s major economies; increasing societal and investor expectations, in particular with regard to environmental, social and governance considerations; the impacts of technological advancements; and such other risks and uncertainties identified in Rio Tinto’s most recent Annual Report and accounts in Australia and the United Kingdom and the most recent Annual Report on Form 20 - F filed with the United States Securities and Exchange Commission (the “SEC”) or Form 6 - Ks furnished to, or filed with, the SEC. Forward - looking statements should, therefore, be construed in light of such risk factors and undue reliance should not be placed on forward - looking statements. These forward - looking statements speak only as of the date of this presentation. Rio Tinto expressly disclaims any obligation or undertaking (except as required by applicable law, the UK Listing Rules, the Disclosure Guidance and Transparency Rules of the Financial Conduct Authority and the Listing Rules of the Australian Securities Exchange) to release publicly any updates or revisions to any forward - looking statement contained herein to reflect any change in Rio Tinto’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Nothing in this presentation should be interpreted to mean that future earnings per share of Rio Tinto plc or Rio Tinto Limited will necessarily match or exceed its historical published earnings per share. Past performance cannot be relied on as a guide to future performance. Disclaimer Neither this presentation, nor the question - and - answer session, nor any part thereof, may be recorded, transcribed, distributed, published or reproduced in any form, except as permitted by Rio Tinto. By accessing/ attending this presentation, you agree with the foregoing, and, upon request, you will promptly return any records or transcripts at the presentation without retaining any copies. This presentation contains a number of non - IFRS financial measures. Rio Tinto management considers these to be key financial performance indicators of the business and they are defined and/or reconciled in Rio Tinto’s annual results press release, Annual Report and accounts in Australia and the United Kingdom and/or the most recent Annual Report on Form 20 - F filed with the SEC or Form 6 - Ks furnished to, or filed with, the SEC. Reference to consensus figures are not based on Rio Tinto’s own opinions, estimates or forecasts and are compiled and published without comment from, or endorsement or verification by, Rio Tinto. The consensus figures do not necessarily reflect guidance provided from time to time by Rio Tinto were given in relation to equivalent metrics, which to the extent available can be found on the Rio Tinto website. By referencing consensus figures, Rio Tinto does not imply that it endorses, confirms or expresses a view on the consensus figures. The consensus figures are provided for informational purposes only and are not intended to, nor do they, constitute investment advice or any solicitation to buy, hold or sell securities or other financial instruments. No warranty or representation, either express or implied, is made by Rio Tinto or its affiliates, or their respective directors, officers and employees, in relation to the accuracy, completeness or achievability of the consensus figures and, to the fullest extent permitted by law, no responsibility or liability is accepted by any of those persons in respect of those matters. Rio Tinto assumes no obligation to update, revise or supplement the consensus figures to reflect circumstances existing after the date hereof. Rio Tinto plc No. 719885 6 St James’s Square, London SW1Y 4AD, United Kingdom Rio Tinto Limited ACN 004 458 404 Level 43, 120 Collins Street, Melbourne 3000 Australia This presentation is authorised for release to the market by Andy Hodges, Rio Tinto’s Group Company Secretary

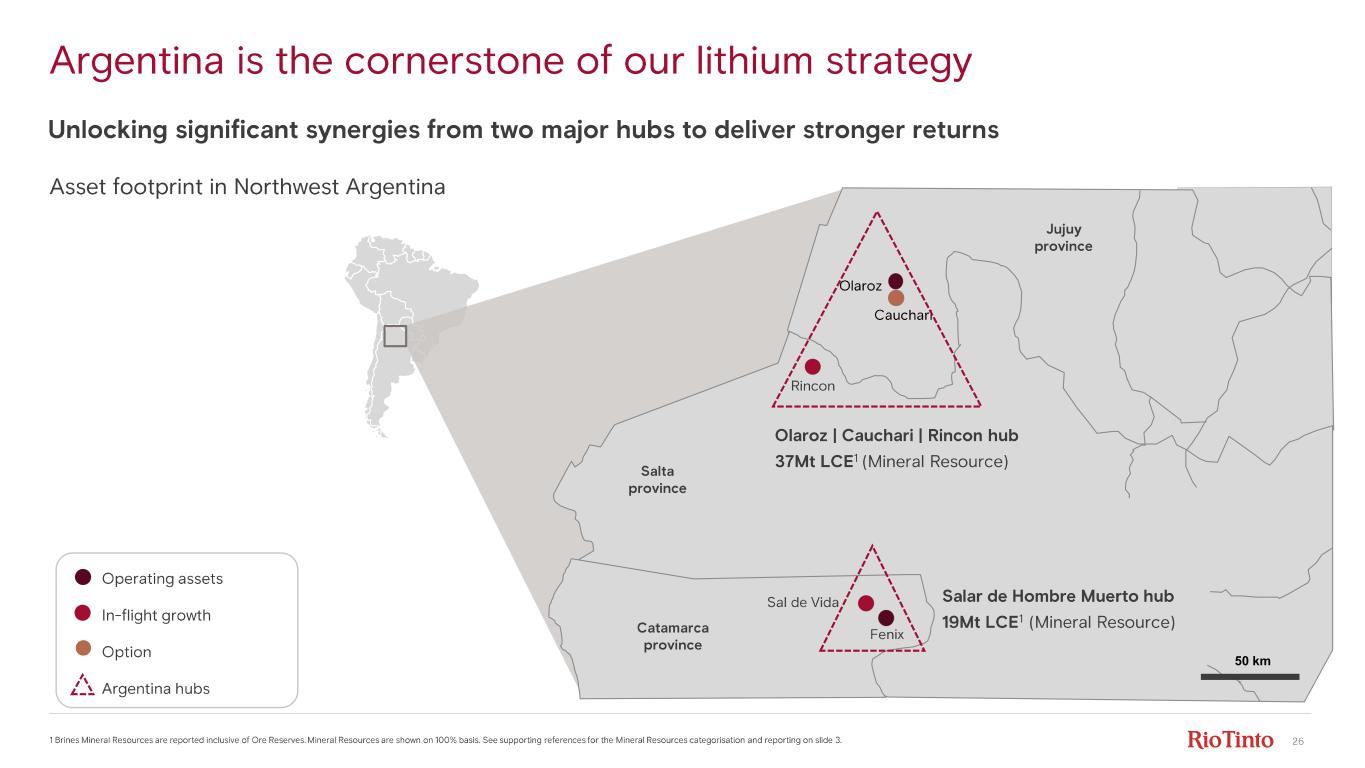

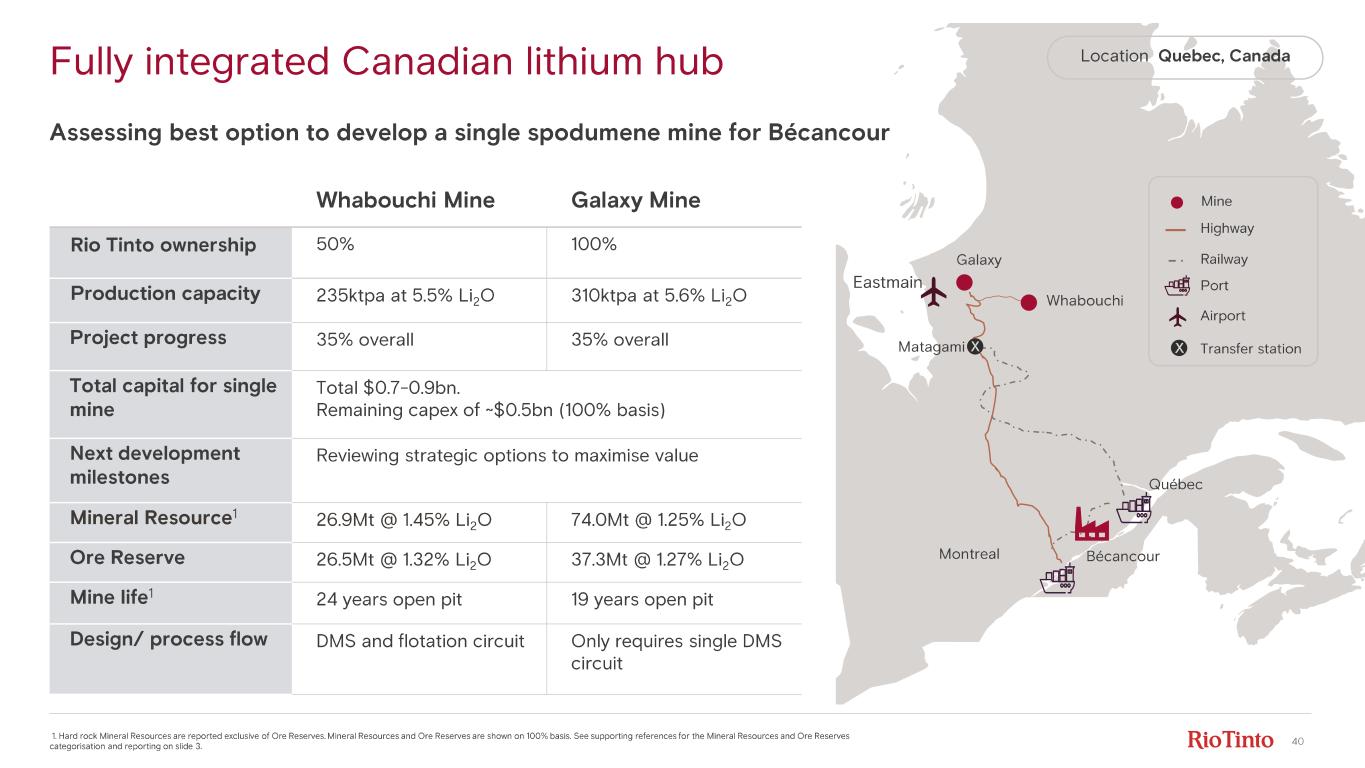

3 Supporting statements Mineral Resources - Olaroz , Cauchari, Rincon, Fenix and Sal de Vida The Olaroz , Cauchari and Rincon Mineral Resources, and the Fenix and Sal de Vida Mineral Resources referenced on slides 26, 29, 31, 36, 37 and 38 are based on the Mineral Resources reported in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, 2012 Edition ( JORC Code ) and the ASX Listing Rules, in the case of Rincon, in Rio Tinto’s 2024 Annual Report released to the ASX on 20 February 2025 and available at riotinto.com, and in relation to the other deposits in "Initial reporting of lithium Mineral Resources and Ore Reserves: supporting information and Table 1 checklists " released to the ASX on 4 December 2025 ( Table 1 Release ) and available at riotinto.com. Mineral Resources inclusive of Ore Reserves at Olaroz , Cauchari and Rincon total 37 Mt Lithium Carbonate Equivalent (LCE) , and comprise: • Olaroz Mineral Resources inclusive of Ore Reserves totalling 19.7 Mt LCE, consisting of 8.5 Mt LCE of Measured Mineral Resources, 8.4 Mt LCE of Indicated Mineral Resources and 2.8 Mt LCE of Inferred Mineral Resources. • Cauchari Mineral Resources inclusive of Ore Reserves totalling 6.0 Mt LCE, and consisting of 1.9 Mt LCE of Measured Mineral Resources, 2.6 Mt LCE of Indicated Mineral Resources and 1.5 Mt LCE of Inferred Mineral Resources; and • Rincon Mineral Resources inclusive of Ore Reserves totalling 11.7 Mt LCE, consisting of 1.5 Mt LCE of Measured Mineral Resources, 7.9 Mt LCE of Indicated Mineral Resources and 2.3 Mt LCE of Inferred Mineral Resources. Mineral Resources inclusive of Ore Reserves at Fenix and Sal de Vida total 19 Mt LCE, and comprise: • Fenix Mineral Resources inclusive of Ore Reserves totalling 11.7 Mt LCE, consisting of 2.7 Mt LCE of Measured Mineral Resources, 4.3 Mt LCE of Indicated Mineral Resources and 4.7 Mt LCE of Inferred Mineral Resources; and • Sal de Vida Mineral Resources inclusive of Ore Reserves totalling 7.2 Mt LCE, consisting of 3.5 Mt LCE of Measured Mineral Resources, 3.0 Mt LCE of Indicated Mineral Resources and 0.7 Mt LCE of Inferred Mineral Resources. The Competent Persons responsible for the information in the 2024 Annual Report that relates to Rincon Mineral Resources are Megan Zivic and Michael Rosko, each of whom is a Registered Member of the Society for Mining, Metallurgy & Exploration (SME - RM). The Competent Person responsible for the information in the Table 1 release that relates to Fenix, Olaroz , Sal de Vida and Cauchari Mineral Resources is Sean Kosinski, who is a Certified Professional Geologist and a member of the American Institute of Professional Geologists. Mineral Resources and Ore Reserves - Whabouchi and Galaxy The Whabouchi and Galaxy Mineral Resources and Ore Reserves referenced on slide 40 are based on the Mineral Resources and Ore Reserves as reported in accordance with the JORC Code and the ASX Listing Rules in the Table 1 Release available at riotinto.com. Galaxy Mineral Resources exclusive of Ore Reserves total 74.0 Mt at 1.25% Li 2O consisting of 18.1 Mt at 1.12% Li 2O of Indicated Mineral Resources and 55.9 Mt at 1.29% Li 2O of Inferred Mineral Resources. Galaxy Ore Reserves comprise 37.3 Mt at 1.27% Li 2O of Probable Ore Reserves. The Competent Person responsible for the information in the Table 1 release that relates to Galaxy Mineral Resources is Luke Evans, P.Eng., who is a Member of the l’Ordre des Ingénieurs du Québec. The Competent Persons responsible for the information in the Table 1 release that relates to Galaxy Ore Reserves is Normand Lecuyer, P.Eng., who is a Member of l’Ordre des Ingénieurs du Québec. Whabouchi Mineral Resources exclusive of Ore Reserves total 26.9 Mt at 1.45% Li 2O, consisting of 18.7 Mt at 1.51% Li 2O of Indicated Mineral Resources and 8.3 Mt at 1.31% Li 2O of Inferred Mineral Resources. Whabouchi Ore Reserves total 26.5 Mt at 1.32% Li 2O consisting of 10.5 Mt at 1.40% Li 2O of Proved Ore Reserves and 16.0 Mt at 1.27% Li 2O of Probable Ore Reserves. The Competent Person responsible for the information in the Table 1 release that relates to Whabouchi Mineral Resources is Christian Beaulieu, who is a Member of the l’Ordre des géologues du Québec. The Competent Persons responsible for the information in the Table 1 release that relates to Whabouchi Ore Reserves is Jeffrey Cassoff who is a Member of l’Ordre des Ingénieurs du Québec. Production Targets The production targets for the operations and projects including Fenix, Olaroz , Sal de Vida, Rincon, Galaxy, Nemaska and Cauchari. support the total portfolio revenue potential set out on slides 46 and 49 comprise 93 ktpa LCE for 2027 ( underpinned as to 97% by Proved Ore Reserves and as to 3% by Probable Ore Reserves); 114 ktpa LCE for 2028 ( underpinned as to 79% by Proved Ore Reserves and as to 21% by Probable Ore Reserves); 174 ktpa LCE for 2029 ( underpinned as to 56% by Proved Ore Reserves and as to 44% by Probable Ore Reserves); 212 ktpa LCE for 2030 ( underpinned as to 56% by Proved Ore Reserves and as to 44% by Probable Ore Reserves); an average of 331 ktpa LCE for the years 2031 - 35 ( underpinned as to 54% by Proved Ore Reserves and 46% by Probable Ore Reserves); and an average of 365 ktpa LCE for the years 2036 - 40 ( underpinned as to 14% by Proved Ore Reserves and 86% by Probable Ore Reserves). The estimated Ore Reserves underpinning these production targets are as reported in the 2024 Annual Report and the Table 1 Release, and have been prepared by Competent Persons in accordance with the requirements of the JORC code. Lithium Carbonate Equivalent LCE Ore Reserves are reported at the well head and thus assume 100% recovery at that point. To obtain the equivalent tonnage for LCE, the estimated mass of lithium is multiplied by a factor that is based on the atomic weights of each element in lithium carbonate to obtain the final compound weight. The factor used was 5.323 to obtain LCE mass from lithium mass. General Mineral Resources are reported inclusive of Ore Reserves for lithium brines deposits and exclusive of Ore Reserves for hard rock lithium deposits. Mineral Resources and Ore Reserves are reported on a 100% basis. Rio Tinto confirms that it is not aware of any new information or data that materially affects the information included in the 2024 Annual Report or the Table 1 Release, that all material assumptions and technical parameters underpinning the estimates in the 2024 Annual Report and the Table 1 Release continue to apply and have not materially changed, and that the form and context in which each Competent Person’s findings are presented have not been materially modified.

4 Introduction to our Lithium team and business Barbara Fochtman Managing Director, Rio Tinto Lithium Rincon, Argentina

5 Agenda Topic Presenter Safety Share Barbara Fochtman Managing Director, Rio Tinto Lithium Introduction Attractive markets Sarah Maryssael Head of Strategy, Rio Tinto Lithium Our business model Barbara Fochtman Managing Director, Rio Tinto Lithium Operational Excellence Disciplined Growth Djaber Belabdi Managing Director, Rio Tinto Projects Capital Efficiency Creating Value Ulric Adom CFO, Rio Tinto Aluminium & Lithium Q&A

6 Safety share

7 Shaping a high - quality Lithium business to meet strong demand • +13% demand CAGR to 2035 • Right team • World - class assets • Proven DLE technologies • Solid track record of delivering growth projects now backed by Rio Tinto expertise • Deep pipeline of options at competitive capital intensity Focus on delivering in - flight projects to reach ~200ktpa capacity by 2028 Commit additional capital when supported by markets and returns

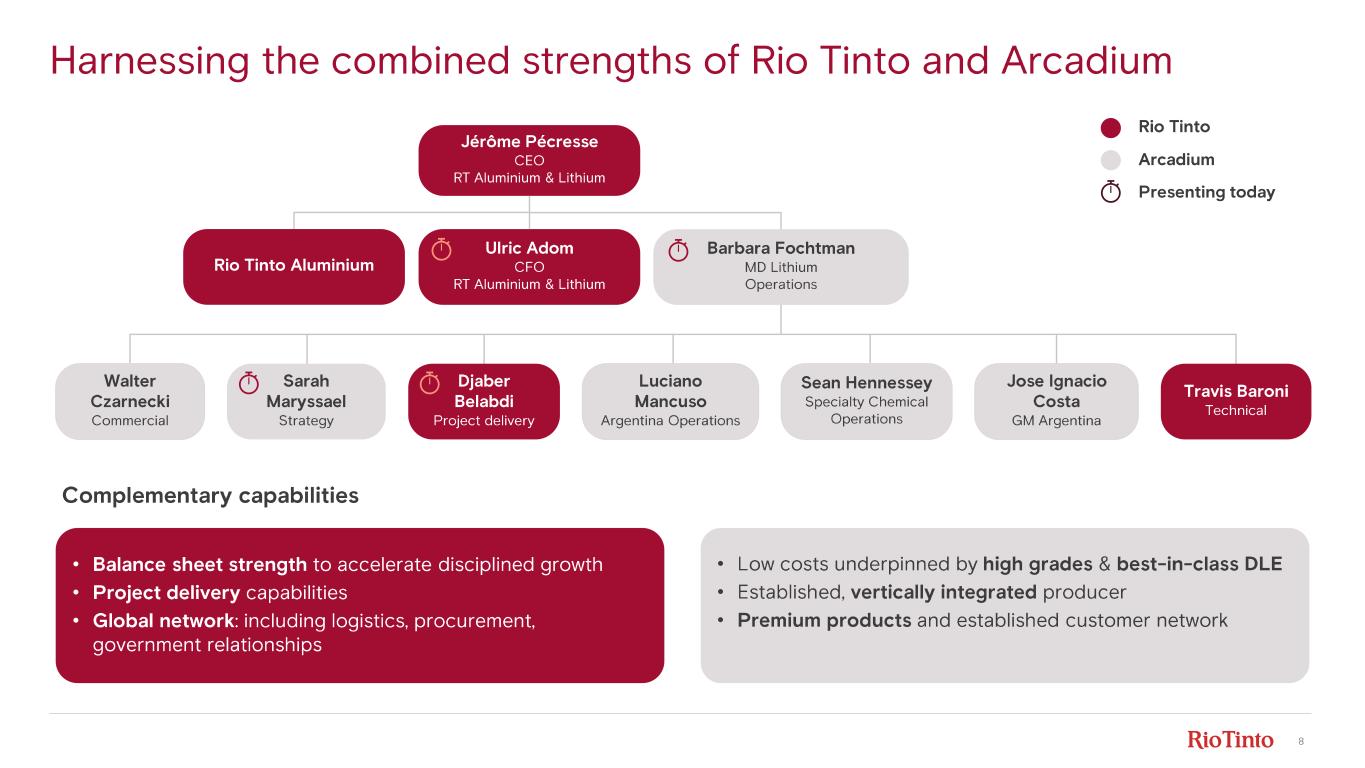

8 Harnessing the combined strengths of Rio Tinto and Arcadium Rio Tinto Jérôme Pécresse CEO RT Aluminium & Lithium Ulric Adom CFO RT Aluminium & Lithium Barbara Fochtman MD Lithium Operations Rio Tinto Aluminium Complementary capabilities • Balance sheet strength to accelerate disciplined growth • Project delivery capabilities • Global network : including logistics, procurement , government relationships Arcadium Presenting today • Low costs underpinned by high grades & best - in- class DLE • Established, vertically integrated producer • Premium products and established customer network Sarah Maryssael Strategy Djaber Belabdi Project delivery Luciano Mancuso Argentina Operations Sean Hennessey Specialty Chemical Operations Travis Baroni Technical Walter Czarnecki Commercial Jose Ignacio Costa GM Argentina

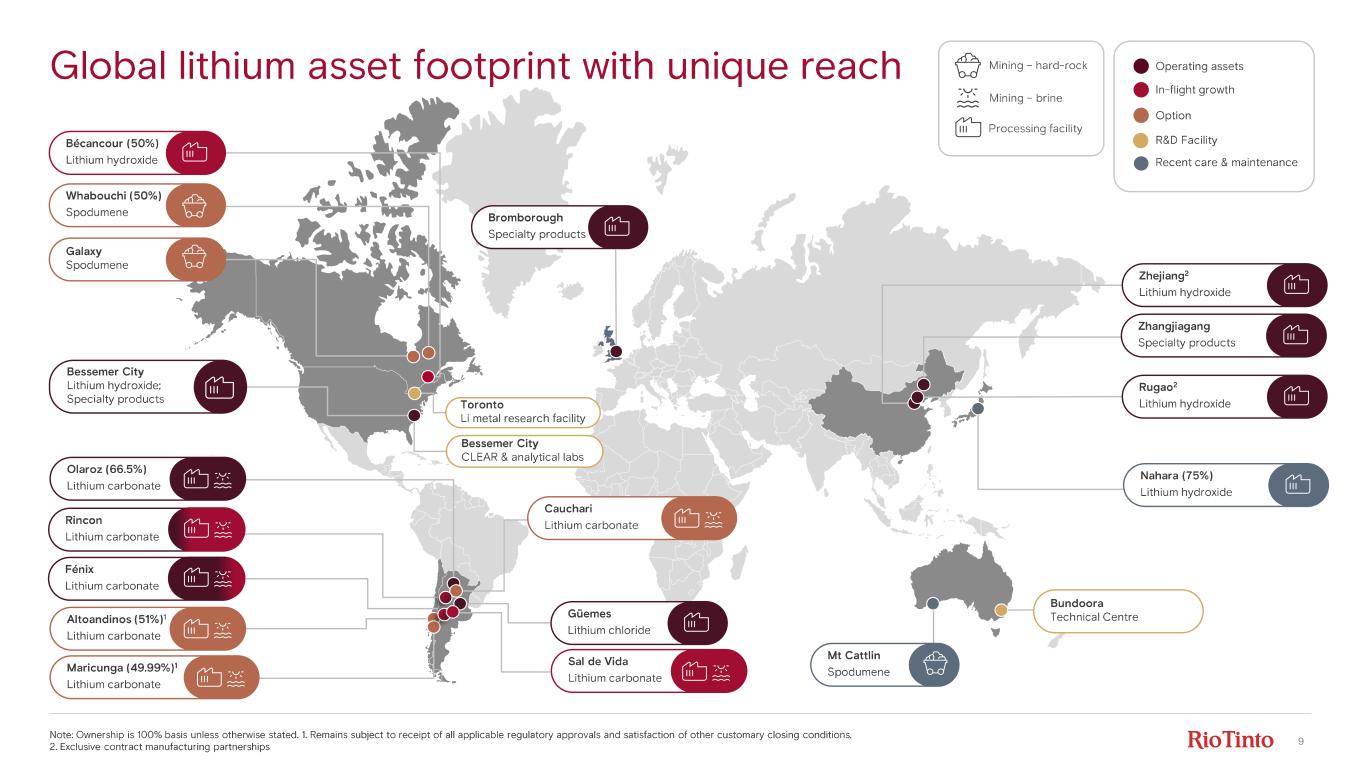

9 Sal de Vida Lithium carbonate Altoandinos (51%) 1 Lithium carbonate Global lithium asset footprint with unique reach Note: Ownership is 100% basis unless otherwise stated. 1. Remains subject to receipt of all applicable regulatory approvals and satisfaction of other customary closing conditions . 2. Exclusive contract manufacturing partnerships Mining – hard - rock Processing facility Mining – brine Toronto Li metal research facility Bessemer City CLEAR & analytical labs Operating assets In- flight growth Option Recent care & maintenance R&D Facility Bécancour (50%) Lithium hydroxide Whabouchi (50%) Spodumene Galaxy Spodumene Bessemer City Lithium hydroxide; Specialty products Olaroz (66.5%) Lithium carbonate Rincon Lithium carbonate Fénix Lithium carbonate Maricunga (49.99%) 1 Lithium carbonate Bromborough Specialty products Cauchari Lithium carbonate Güemes Lithium chloride Zhejiang 2 Lithium hydroxide Zhangjiagang Specialty products Rugao 2 Lithium hydroxide Nahara (75%) Lithium hydroxide Bundoora Technical Centre Mt Cattlin Spodumene

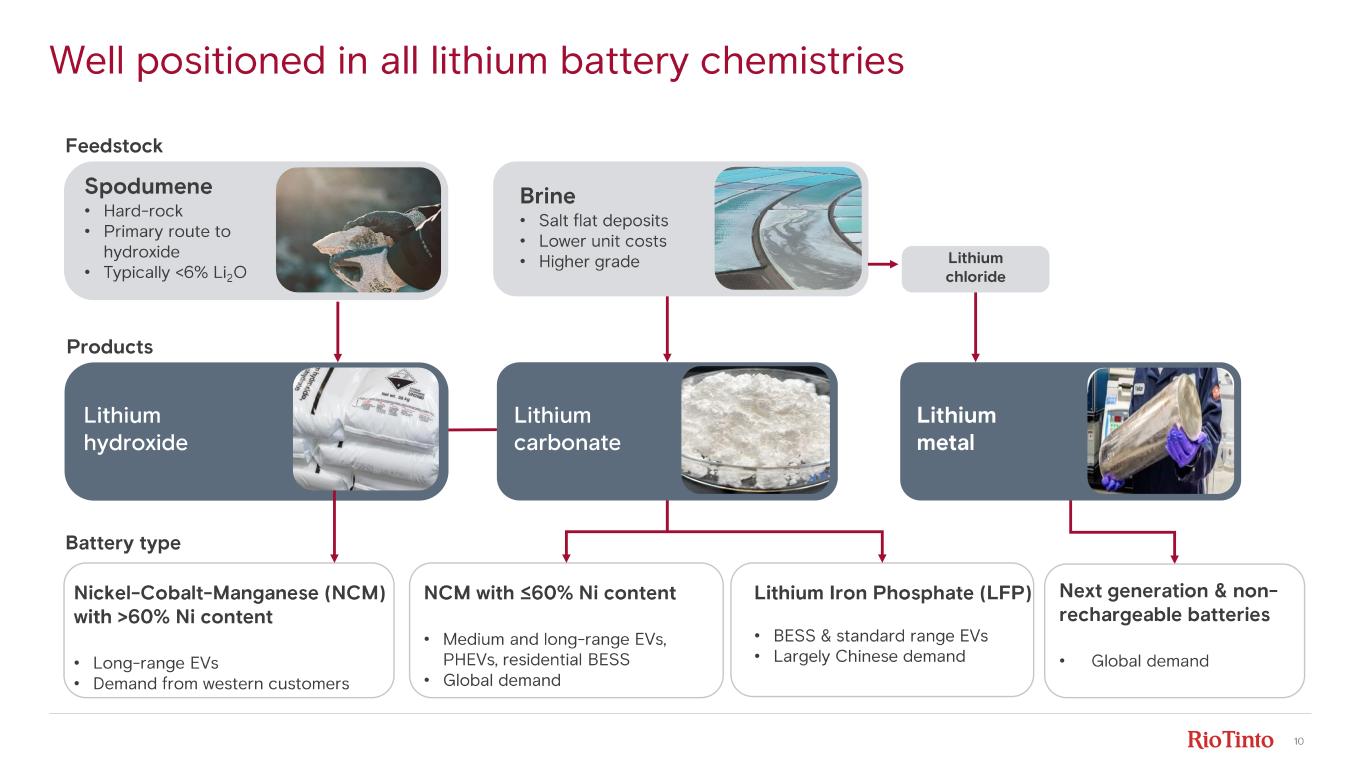

10 Well positioned in all lithium battery chemistries Feedstock Products Battery type Lithium chloride Lithium metal Nickel - Cobalt - Manganese (NCM) with >60% Ni content • Long - range EVs • Demand from western customers NCM with ≤60% Ni content • Medium and long - range EVs, PHEVs, residential BESS • Global demand Lithium hydroxide Spodumene • Hard - rock • Primary route to hydroxide • Typically <6% Li 2O Brine • Salt flat deposits • Lower unit costs • Higher grade Lithium Iron Phosphate (LFP) • BESS & standard range EVs • Largely Chinese demand Lithium carbonate Next generation & non - rechargeable batteries • Global demand

11 Attractive markets Sarah Maryssael Head of Strategy, Rio Tinto Lithium

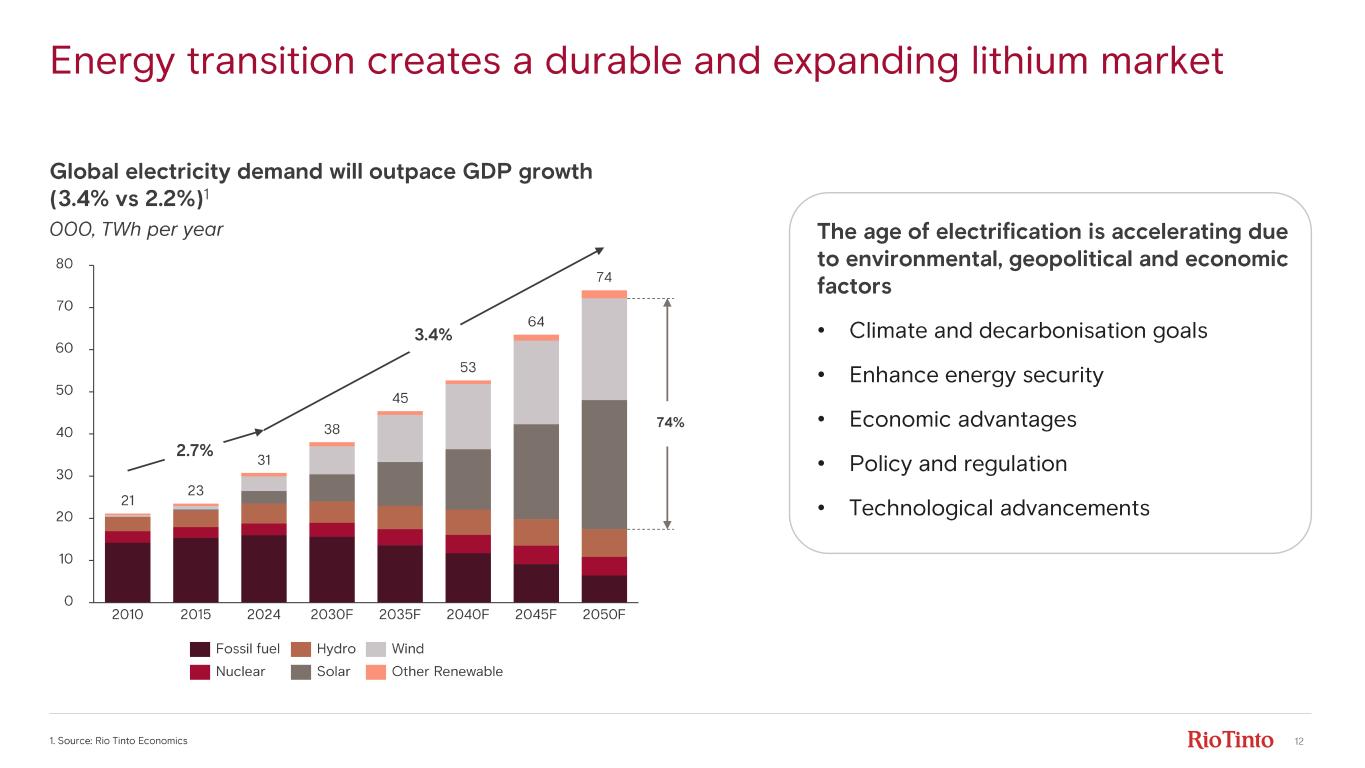

12 Energy transition creates a durable and expanding lithium market 1. Source: Rio Tinto Economics Global electricity demand will outpace GDP growth (3.4% vs 2.2%) 1 The age of electrification is accelerating due to environmental, geopolitical and economic factors • Climate and decarbonisation goals • Enhance energy security • Economic advantages • Policy and regulation • Technological advancements 10 20 30 40 50 60 70 80 0 2010 2015 2024 2030 F 2035 F 2040 F 2045 F 2050 F 21 23 31 38 45 53 64 74 74% 2.7% 3.4% Fossil fuel Nuclear Hydro Solar Wind Other Renewable 000, TWh per year

13 Lithium’s superior performance in mobility and storage applications Li - ion batteries; mature technology attracts significant, long - term investment from auto manufacturers • Lightest metal on the periodic table • Weigh less, ideal for portable electronics and mobility • Li ions move easily back and forth between the cathode and anode • Quickly recharged 1000s of times • Each atom can store and release a lot of energy relative to its size • Holds more power in a smaller space • Higher voltage per cell • Fewer cells to get the same power Lightweight High energy density High voltage Quick recharge

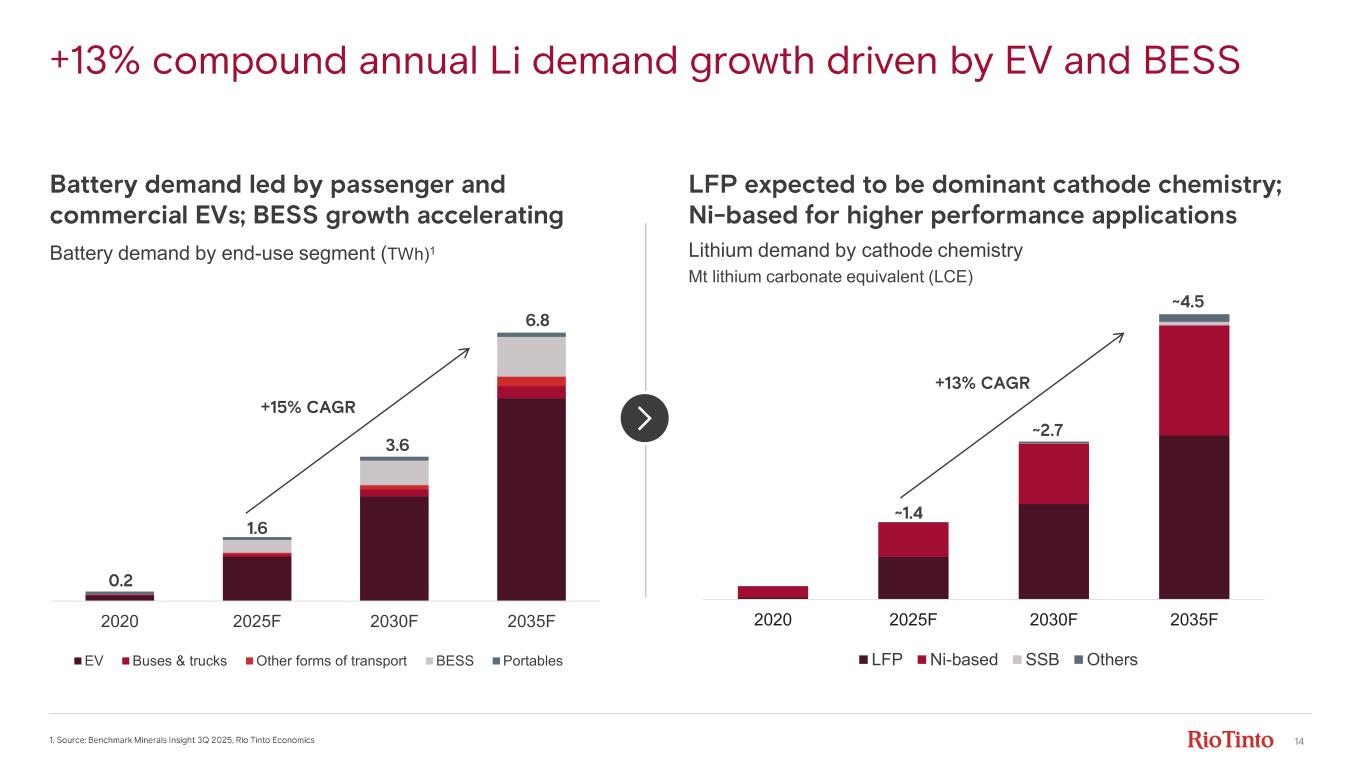

14 2020 2025F 2030F 2035F LFP Ni-based SSB Others 2020 2025F 2030F 2035F EV Buses & trucks Other forms of transport BESS Portables +13% compound annual Li demand growth driven by EV and BESS 1. Source: Benchmark Minerals Insight 3Q 2025, Rio Tinto Economics Battery demand by end-use segment (TWh)1 Battery demand led by passenger and commercial EVs; BESS growth accelerating 0.2 1.6 6.8 Lithium demand by cathode chemistry Mt lithium carbonate equivalent (LCE) LFP expected to be dominant cathode chemistry; Ni- based for higher performance applications 3.6 +15% CAGR ~2.7 ~4.5 ~1.4 +13% CAGR

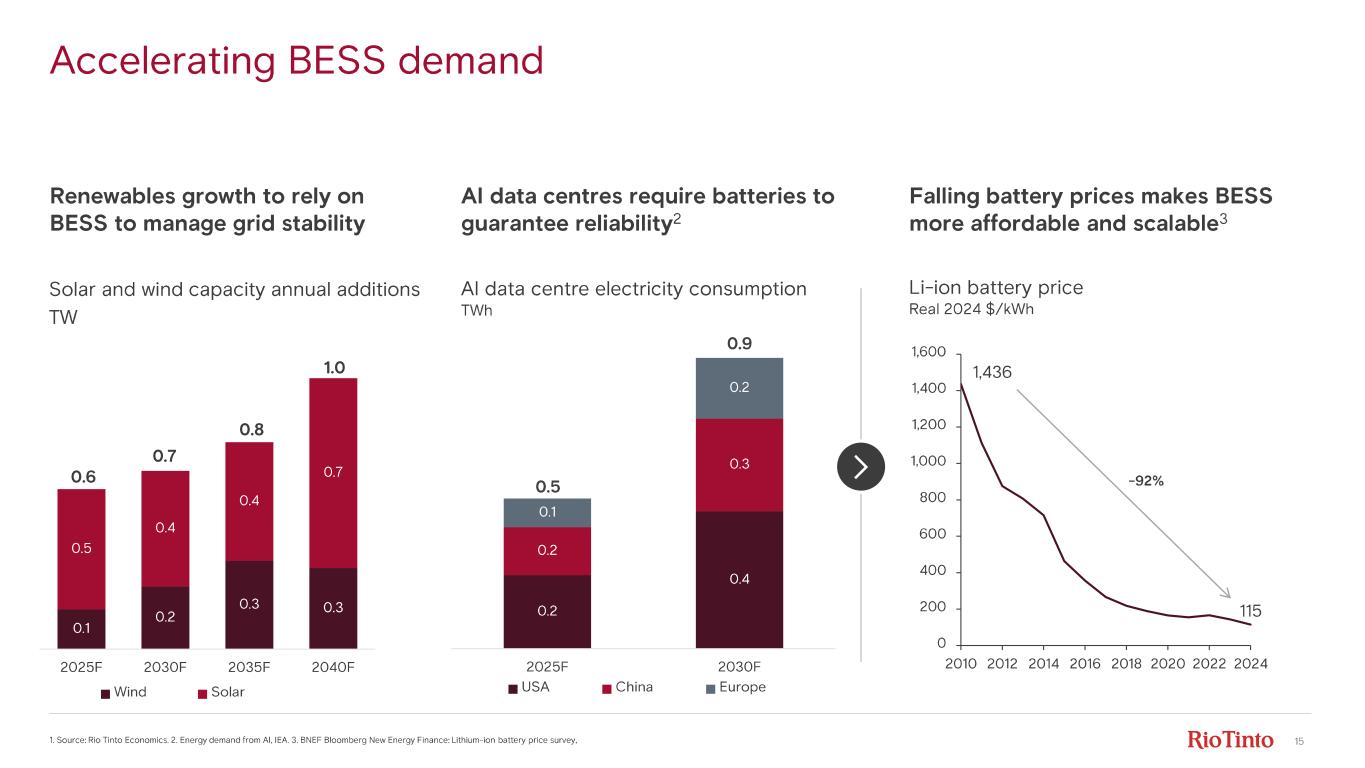

15 Accelerating BESS demand 1. Source: Rio Tinto Economics. 2. Energy demand from AI, IEA. 3. BNEF Bloomberg New Energy Finance: Lithium - ion battery price s urvey, Falling battery prices makes BESS more affordable and scalable 3 Renewables growth to rely on BESS to manage grid stability 1,436 115 0 200 400 600 800 1,000 1,200 1,400 1,600 2010 2012 2014 2016 2018 2020 2022 2024 Li - ion battery price Real 2024 $/kWh 0.1 0.2 0.3 0.3 0.5 0.4 0.4 0.7 2025F 2030F 2035F 2040F Wind Solar 0.7 0.6 0.8 1.0 AI data centres require batteries to guarantee reliability 2 0.2 0.4 0.2 0.3 0.1 0.2 2025F 2030F USA China Europe Solar and wind capacity annual additions TW AI data centre electricity consumption TWh 0.5 0.9 - 92 %

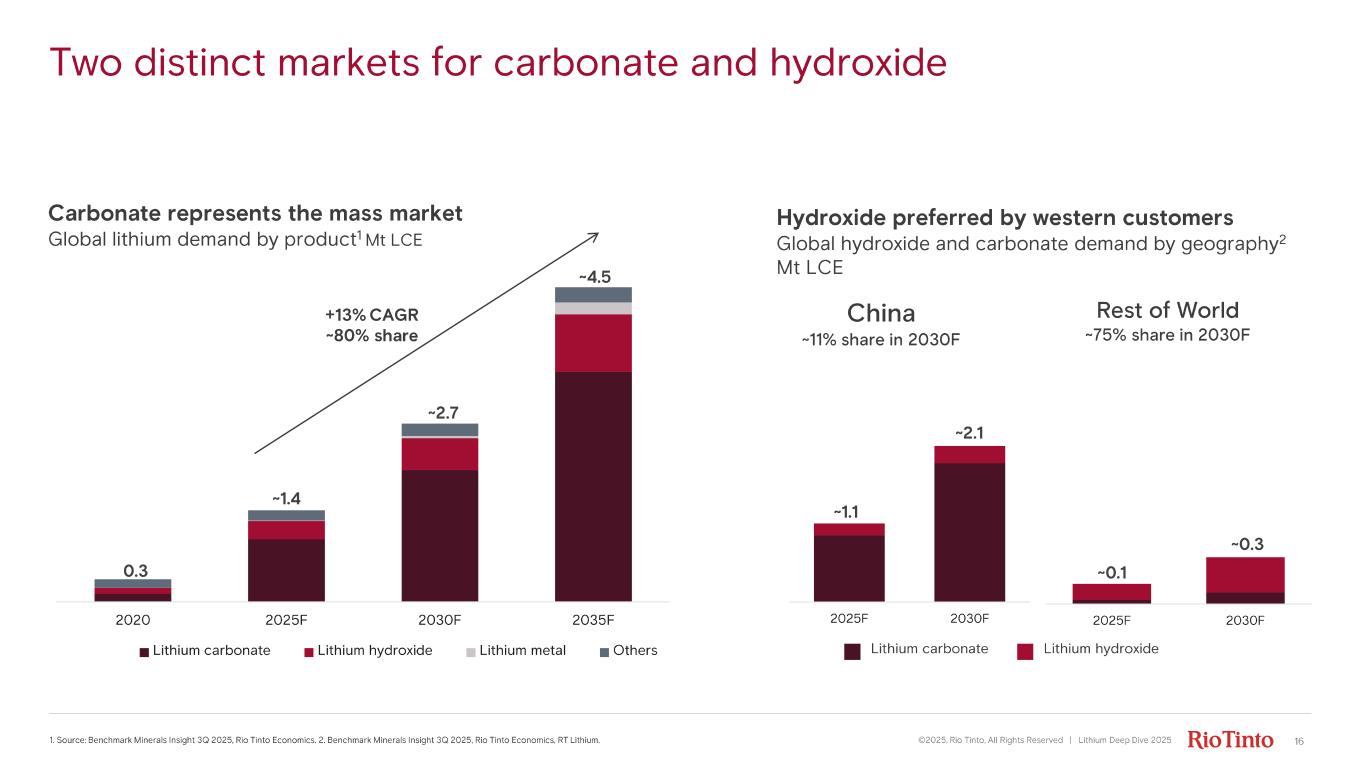

16 2025F 2030F Two distinct markets for carbonate and hydroxide ©2025, Rio Tinto, All Rights Reserved | Lithium Deep Dive 20251. Source: Benchmark Minerals Insight 3Q 2025, Rio Tinto Economics. 2. Benchmark Minerals Insight 3Q 2025, Rio Tinto Economics, RT Lithi um. Carbonate represents the mass market Global lithium demand by product 1 Mt LCE Hydroxide preferred by western customers Global hydroxide and carbonate demand by geography 2 Mt LCE 2020 2025F 2030F 2035F Lithium carbonate Lithium hydroxide Lithium metal Others ~2.7 ~4.5 0.3 ~1.4 +13% CAGR ~80% share Lithium carbonate Lithium hydroxide Rest of World ~75% share in 2030F China ~11% share in 2030F 2025F 2030F ~0.1 ~0.3 ~2.1 ~1.1

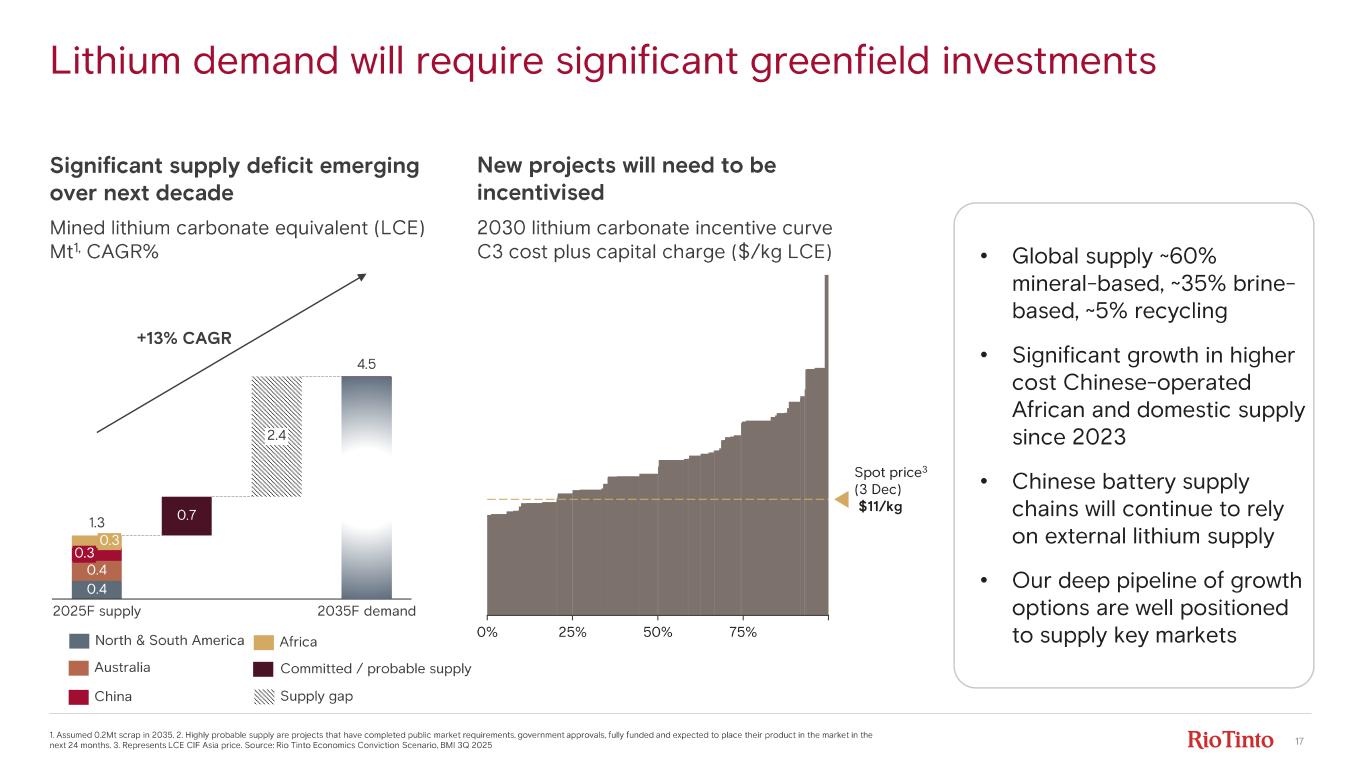

17 Lithium demand will require significant greenfield investments 1. Assumed 0.2Mt scrap in 2035. 2. Highly probable supply are projects that have completed public market requirements, govern men t approvals, fully funded and expected to place their product in the market in the next 24 months. 3. Represents LCE CIF Asia price. Source: Rio Tinto Economics Conviction Scenario, BMI 3Q 2025 Significant supply deficit emerging over next decade 2030 lithium carbonate incentive curve C3 cost plus capital charge ($/kg LCE) Mined lithium carbonate equivalent (LCE) Mt1, CAGR% New projects will need to be incentivised 0% 25% 75%50% Spot price 3 (3 Dec) $11/kg 0.4 4.5 0.4 0.7 0.3 0.3 2025F supply 2.4 2035F demand 1.3 +13% CAGR Africa China Australia North & South America Committed / probable supply Supply gap • Global supply ~60% mineral - based, ~35% brine - based, ~5% recycling • Significant growth in higher cost Chinese - operated African and domestic supply since 2023 • Chinese battery supply chains will continue to rely on external lithium supply • Our deep pipeline of growth options are well positioned to supply key markets

18 Highly attractive long - term fundamentals • Compelling lithium demand outlook: +13% CAGR to 2035 underpinned by EV and BESS applications • Lithium - ion battery technology is mature, highly scalable: lightweight, energy - dense and fast recharge • Global portfolio well positioned to supply into key markets: – Mass market of lithium carbonate sales in China – Specialised market of lithium hydroxide in the West – Future potential of lithium metal for next - gen batteries • Commercial strategy aligned with leading auto and battery customers

19 Our business model Barbara Fochtman Managing Director, Rio Tinto Lithium Rincon, Argentina

20 Diverse product mix into global end markets Battery grade lithium hydroxide Battery grade lithium carbonate Non - battery lithium hydroxide Technical grade lithium carbonate High purity lithium metal Butyllithium & other specialties G lo b al e n d m ar ke ts • Mobility/ EVs • Grid - scale energy storage • AI infrastructure • Defence • High performance greases • Glass • Ceramics • Construction • Other industrials • Next generation batteries • Aerospace • Non - rechargeable batteries • Defence • Pharmaceuticals • Agrochemicals • Polymers • Semiconductors P ro d u ct m ix

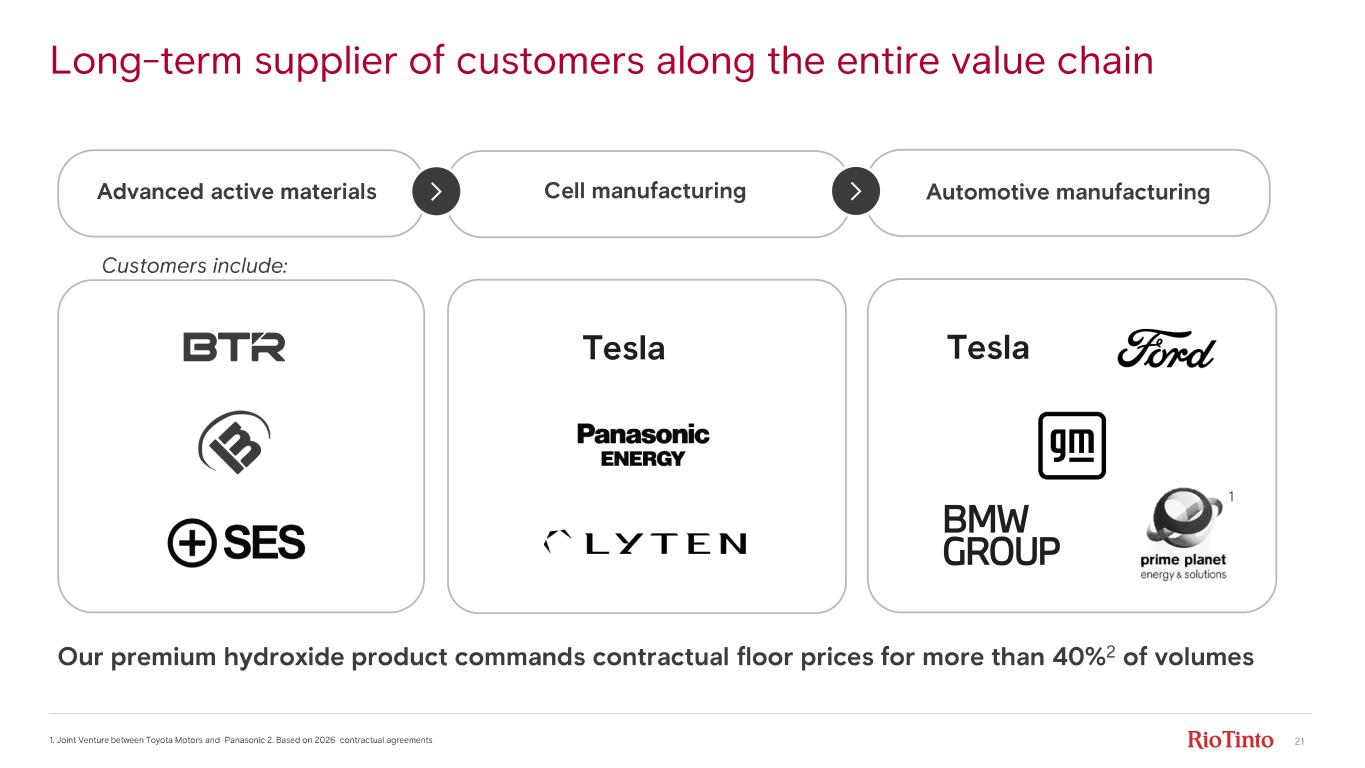

21 Long - term supplier of customers along the entire value chain Advanced active materials Cell manufacturing Automotive manufacturing Our premium hydroxide product commands contractual floor prices for more than 40% 2 of volumes 1. Joint Venture between Toyota Motors and Panasonic 2. Based on 2026 contractual agreements Customers include: Tesla Tesla 1

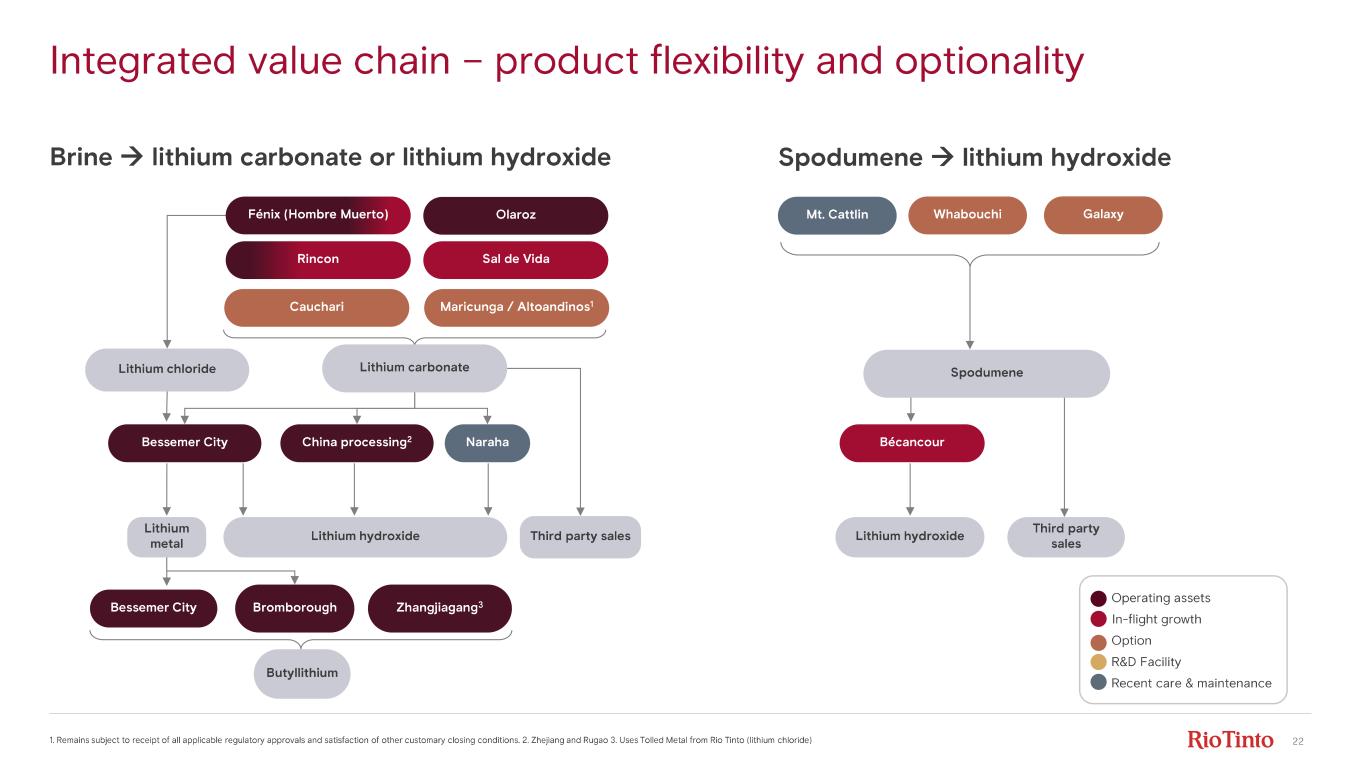

22 Fénix (Hombre Muerto) Olaroz Cauchari Sal de Vida Galaxy Mt. Cattlin Brine → lithium carbonate or lithium hydroxide Spodumene → lithium hydroxide Maricunga / Altoandinos 1 Integrated value chain – product flexibility and optionality 1. Remains subject to receipt of all applicable regulatory approvals and satisfaction of other customary closing conditions. 2. Zhejiang and Rugao 3. Uses Tolled Metal from Rio Tinto (lithium chloride) Lithium carbonate Third party salesLithium hydroxide Lithium hydroxide Spodumene Bessemer City China processing 2 Bécancour Third party sales Lithium metal Lithium chloride Bromborough Zhangjiagang 3 Whabouchi Rincon Naraha Operating assets In- flight growth Option Recent care & maintenance R&D Facility Butyllithium Bessemer City

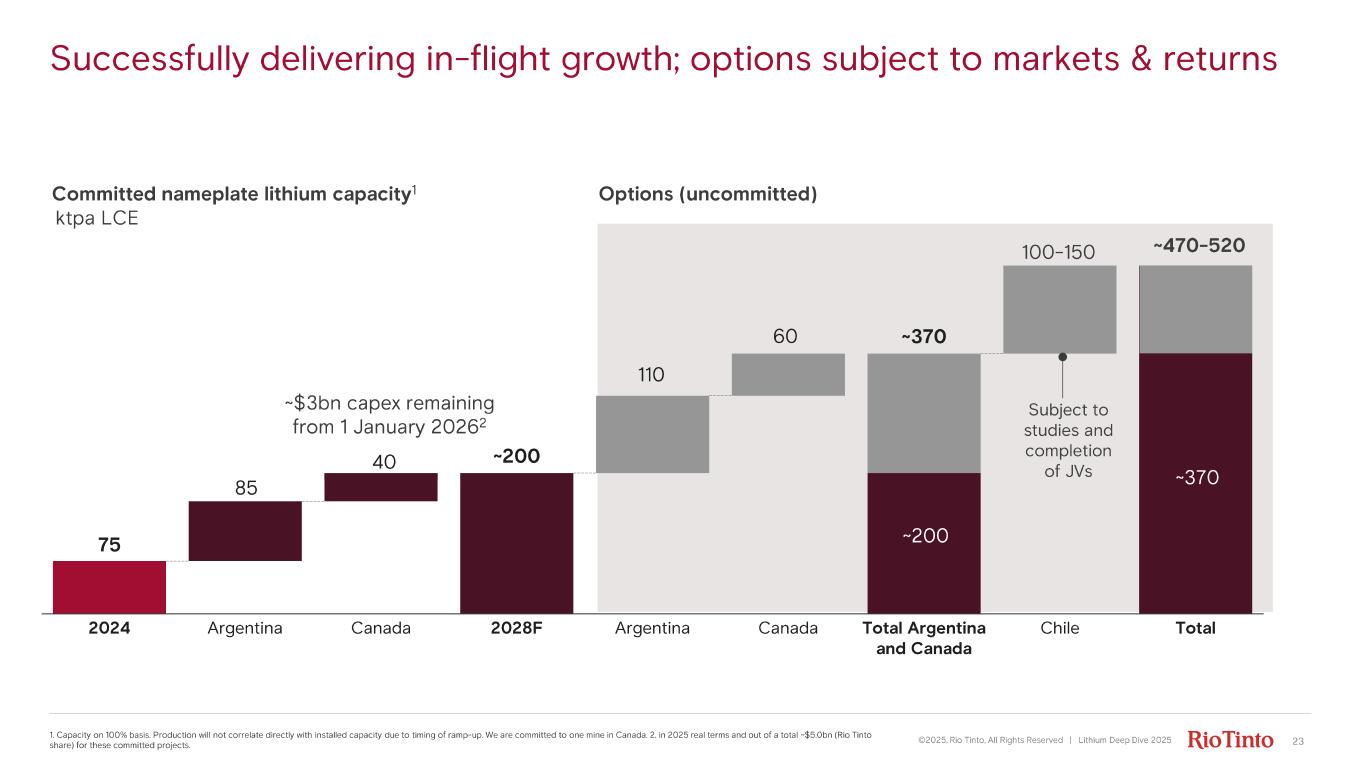

23 Successfully delivering in - flight growth; options subject to markets & returns ©2025, Rio Tinto, All Rights Reserved | Lithium Deep Dive 2025 1. Capacity on 100% basis. Production will not correlate directly with installed capacity due to timing of ramp - up. We are committed to one mine in Canada. 2. in 2025 real terms and out of a total ~$5.0bn (Rio Tinto share) for these committed projects. ktpa LCE Committed nameplate lithium capacity 1 Options (uncommitted) Subject to studies and completion of JVs 100 - 150 ~470 - 520 75 2024 Argentina Canada 2028F Argentina Canada Total Argentina and Canada Chile Total ~200 ~370 100 - 150 ~$3bn capex remaining from 1 January 2026 2 ~200 110 60 ~470 - 520 ~370 85 40

24 Our long history and growing presence in Argentina 1997 Fenix commences operations - Argentina’s first modern DLE brine operation 1968 Rio Tinto acquires U.S Borax & Borax Argentina 2014 Olaroz Stage 1 achieves first production 2021 Sal de Vida battery - grade carbonate pilot 2022 Rio Tinto acquires Rincon 2024 - 2025 Fenix and Olaroz expansions Rincon first production Underpinned by in - country expertise and provincial relationships 1944 Lithium Corporation of America founded 1985 FMC buys Lithium Corporation of America 1991 Sony partnership to supply lithium - ion batteries 2008 Battery laboratory established 2010 Joint venture launched with Toyota Tsusho 2015 Olaroz begins lithium carbonate production 2018 FMC spins off its lithium business to create Livent 2021 Allkem formed from Orocobre and Galaxy Resources 2024 Arcadium Lithium formed from Allkem and Livent 2025 Rio Tinto acquire s Arcadium Lithium

25 Uniquely positioned through strong and collaborative engagement Federal • Established national mining code • Set financial frameworks (RIGI) Provincial ownership • Control and grant mining rights • Align with national law and have primary environmental authority Working effectively with local stakeholders • Largest mining employer: – 2,000+ full - time employees – 70% local workforce from host provinces • $600m+ 1 local procurement, supporting 100+ local suppliers • $7m 1 invested in community programs, participation agreements & infrastructure • Alignment with IFC 2 Performance Standards and UN SDGs 3 25+ years continuous presence in Jujuy, Salta and Catamarca provinces 1. In 2024. 2. International Finance Corporation. 3. United Nations Sustainable Development Goals

26 Argentina is the cornerstone of our lithium strategy 1 Brines Mineral Resources are reported inclusive of Ore Reserves. Mineral Resources are shown on 100% basis. See supporting references for the Mineral Resources categorisation and reporting on slide 3. Asset footprint in Northwest Argentina Operating assets In- flight growth Option Argentina hubs Rincon Catamarca province Salta province Fenix Sal de Vida Jujuy province Cauchari Olaroz Salar de Hombre Muerto hub 19Mt LCE 1 (Mineral Resource) Olaroz | Cauchari | Rincon hub 37Mt LCE 1 (Mineral Resource) 50 km Unlocking significant synergies from two major hubs to deliver stronger returns

27 Operational excellence at our world - class assets Barbara Fochtman Managing Director, Rio Tinto Lithium

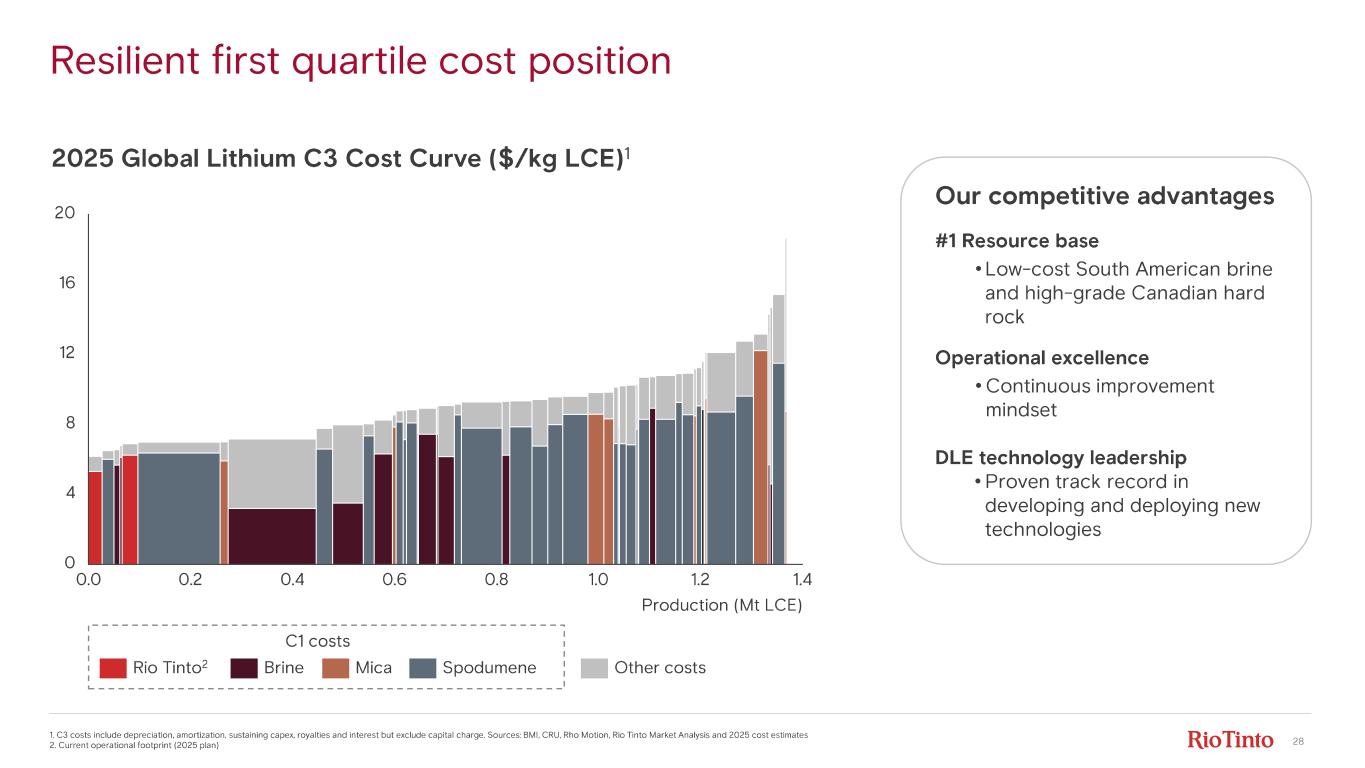

28 Resilient first quartile cost position 1. C3 costs include depreciation, amortization, sustaining capex, royalties and interest but exclude capital charge. Sources: BMI, CRU, Rho Motion, Rio Tinto Market Analysis and 2025 cost estimates 2. Current operational footprint (2025 plan) 4 0 1.41.21.00.80.60.40.20.0 20 16 12 8 Production (Mt LCE) 2025 Global Lithium C3 Cost Curve ($/kg LCE) 1 Rio Tinto 2 Brine Mica Spodumene Other costs C1 costs Our competitive advantages #1 Resource base • Low - cost South American brine and high - grade Canadian hard rock Operational excellence • Continuous improvement mindset DLE technology leadership • Proven track record in developing and deploying new technologies

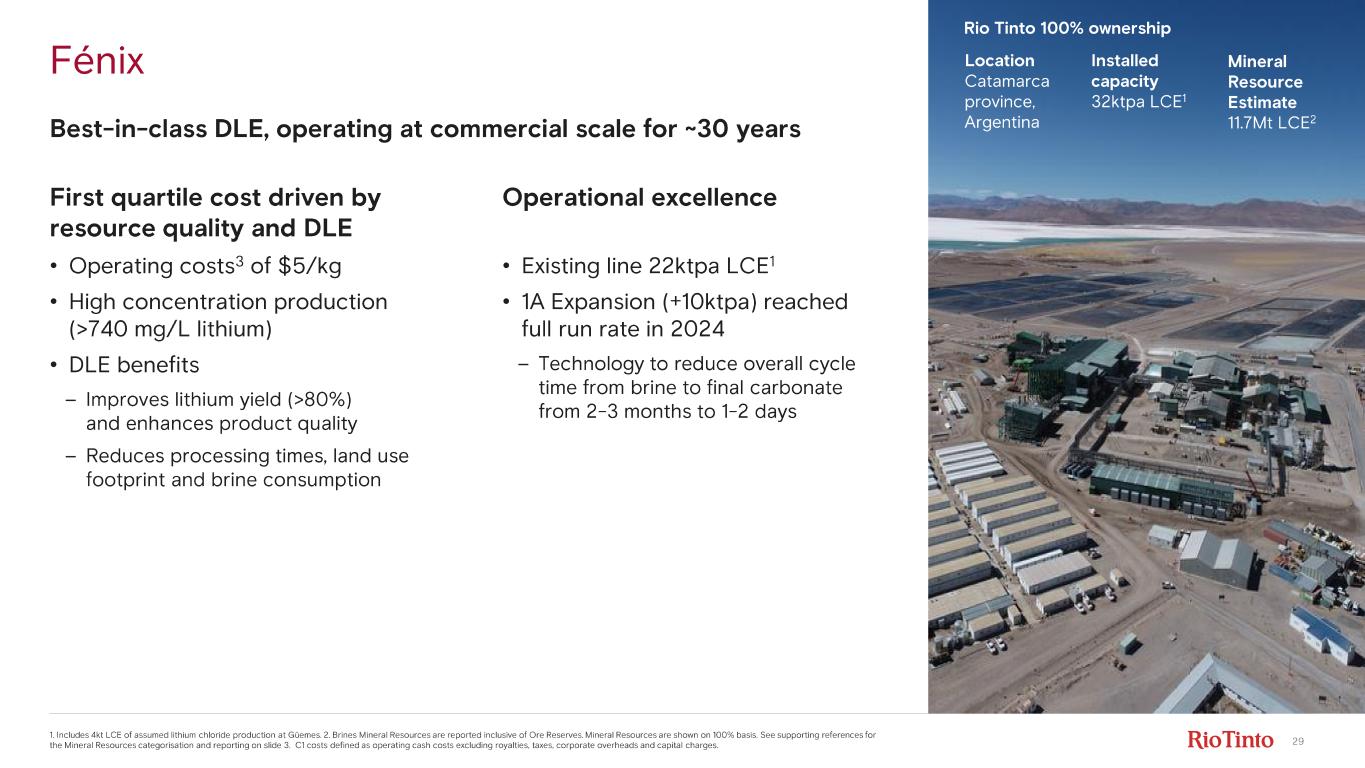

29 Fénix 1. Includes 4kt LCE of assumed lithium chloride production at Güemes. 2. Brines Mineral Resources are reported inclusive of Ore Reserves. Mineral Resources are shown on 100% basis. See supporting re ferences for the Mineral Resources categorisation and reporting on slide 3. C1 costs defined as operating cash costs excluding royalties, taxes, corporate overheads and capital charges. First quartile cost driven by resource quality and DLE • Operating costs 3 of $5/kg • High concentration production (>740 mg/L lithium) • DLE benefits – Improves lithium yield (>80%) and enhances product quality – Reduces processing times, land use footprint and brine consumption Operational excellence • Existing line 22ktpa LCE 1 • 1A Expansion (+10ktpa) reached full run rate in 2024 – Technology to reduce overall cycle time from brine to final carbonate from 2 - 3 months to 1 - 2 days Best - in- class DLE, operating at commercial scale for ~30 years Mineral Resource Estimate 11.7Mt LCE 2 Location Catamarca province, Argentina Installed capacity 32ktpa LCE 1 Rio Tinto 100% ownership

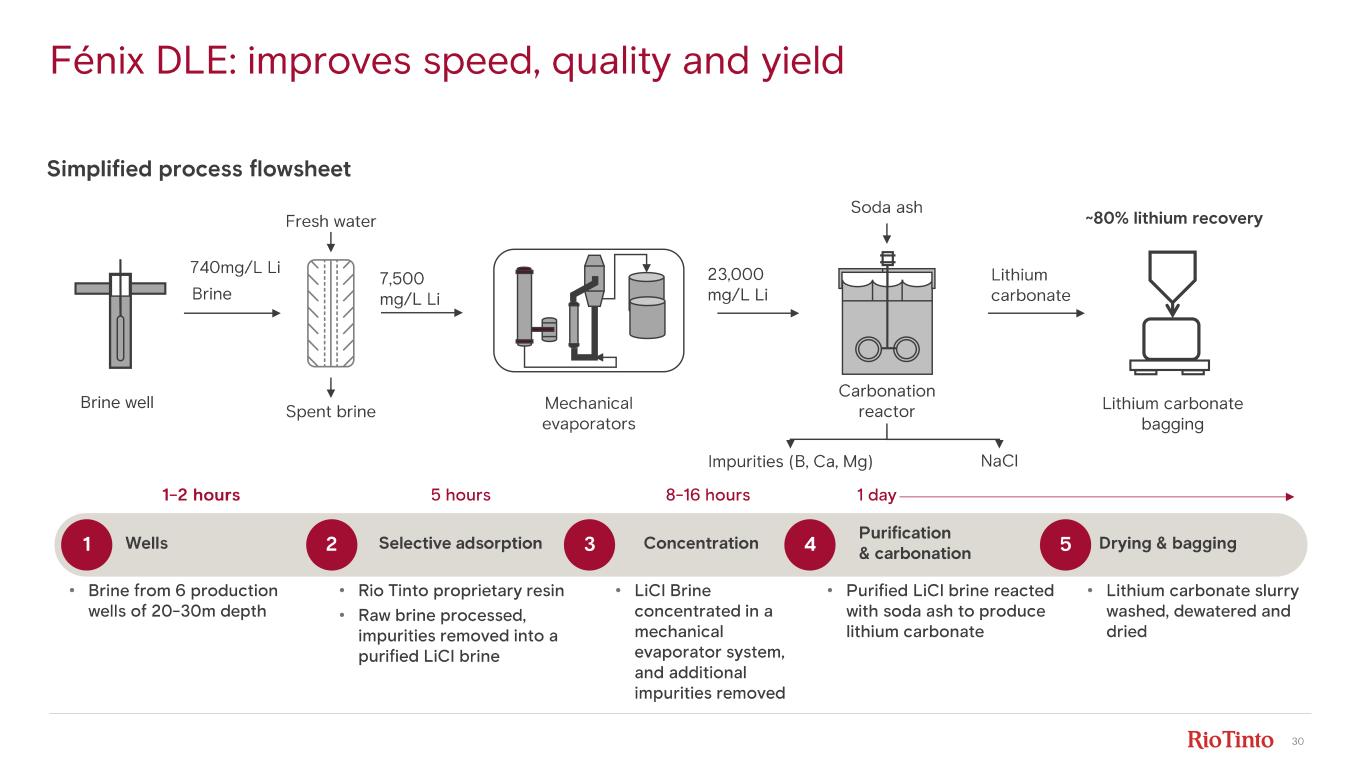

30 Wells1 • Brine from 6 production wells of 20 - 30m depth Selective adsorption 2 Concentration3 Purification & carbonation4 Drying & bagging5 • Rio Tinto proprietary resin • Raw brine processed, impurities removed into a purified LiCl brine • Purified LiCl brine reacted with soda ash to produce lithium carbonate • Lithium carbonate slurry washed, dewatered and dried Brine well Fresh water Brine 23,000 mg/L Li Lithium carbonate Carbonation reactor Lithium carbonate bagging Soda ash ~80% lithium recovery Spent brine 7,500 mg/L Li NaClImpurities (B, Ca, Mg) Simplified process flowsheet • LiCl Brine concentrated in a mechanical evaporator system, and additional impurities removed Mechanical evaporators 1- 2 hours 5 hours 1 day8- 16 hours Fénix DLE: improves speed, quality and yield 740mg/L Li

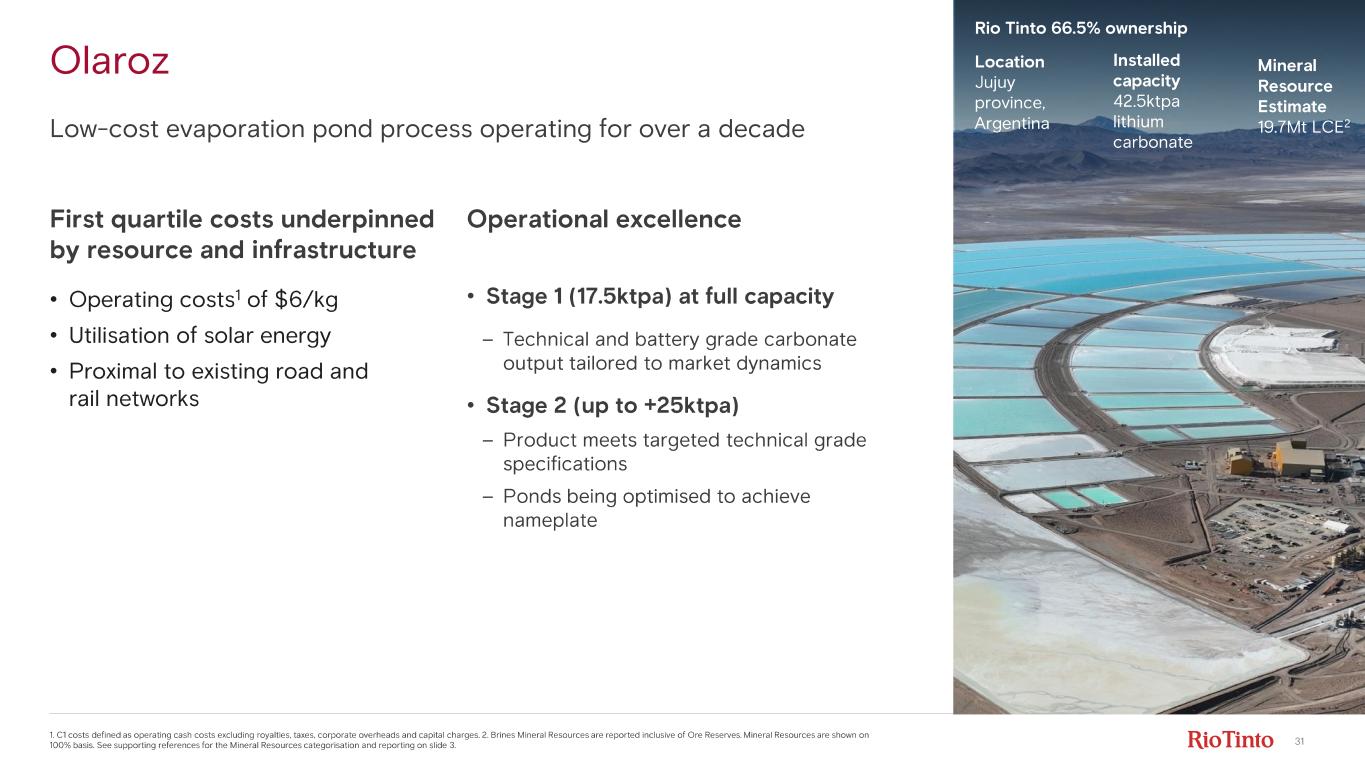

31 Olaroz 1. C1 costs defined as operating cash costs excluding royalties, taxes, corporate overheads and capital charges. 2. Brines Mineral Resources are reported inclusive of Ore Reserves. Mineral Resources are shown on 100% basis. See supporting references for the Mineral Resources categorisation and reporting on slide 3. First quartile costs underpinned by resource and infrastructure • Operating costs 1 of $6/kg • Utilisation of solar energy • Proximal to existing road and rail networks Operational excellence • Stage 1 (17.5ktpa) at full capacity – Technical and battery grade carbonate output tailored to market dynamics • Stage 2 (up to +25ktpa) – Product meets targeted technical grade specifications – Ponds being optimised to achieve nameplate Low - cost evaporation pond process operating for over a decade Mineral Resource Estimate 19.7Mt LCE 2 Location Jujuy province, Argentina Installed capacity 42.5ktpa lithium carbonate Rio Tinto 66.5% ownership

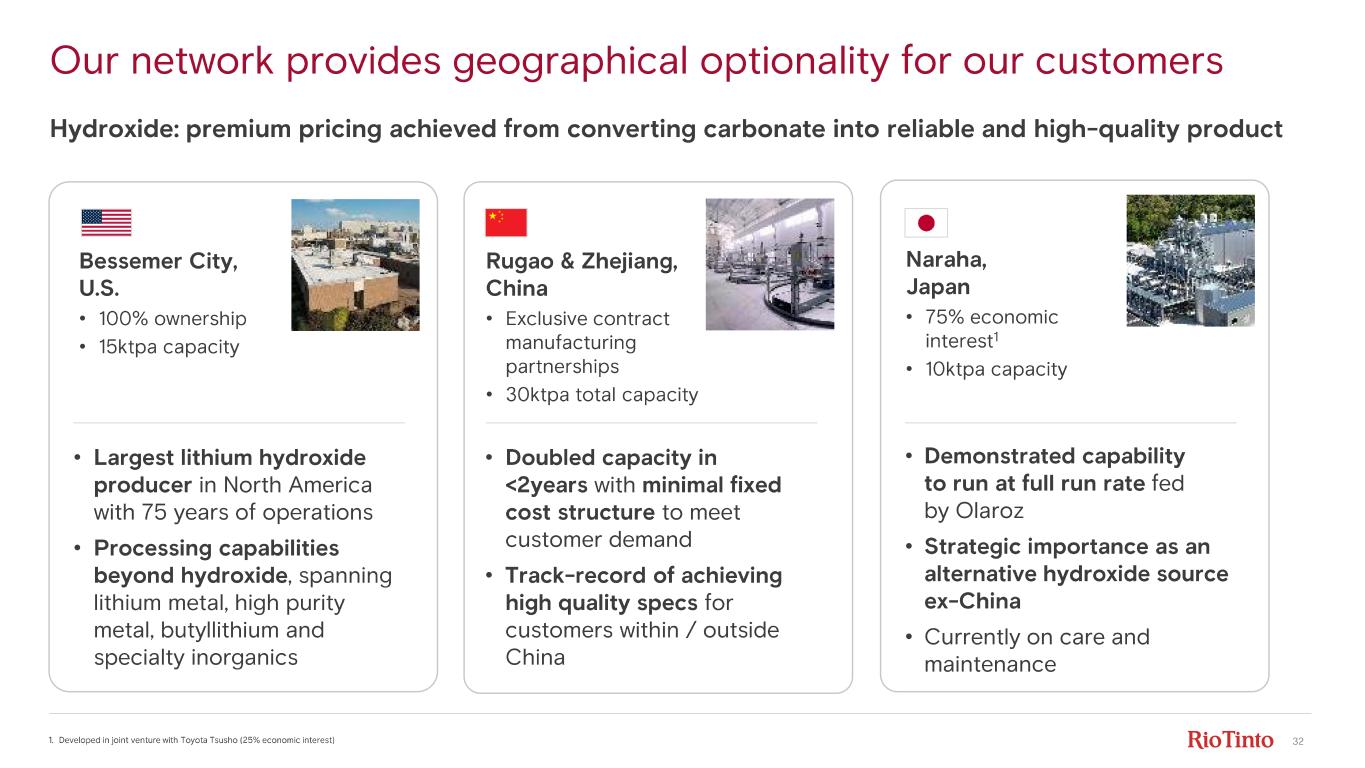

32 Our network provides geographical optionality for our customers 1. Developed in joint venture with Toyota Tsusho (25% economic interest) Bessemer City, U.S. • 100% ownership • 15ktpa capacity • Largest lithium hydroxide producer in North America with 75 years of operations • Processing capabilities beyond hydroxide , spanning lithium metal, high purity metal, butyllithium and specialty inorganics Hydroxide: premium pricing achieved from converting carbonate into reliable and high - quality product • Doubled capacity in <2years with minimal fixed cost structure to meet customer demand • Track - record of achieving high quality specs for customers within / outside China Rugao & Zhejiang, China • Exclusive contract manufacturing partnerships • 30ktpa total capacity • Demonstrated capability to run at full run rate fed by Olaroz • Strategic importance as an alternative hydroxide source ex- China • Currently on care and maintenance Naraha, Japan • 75% economic interest 1 • 10ktpa capacity

33 End - to- end leader in technology development Combining Arcadium and Rio Tinto’s expertise and strategic partnerships to accelerate breakthroughs • Developing sustainable, low - cost production pathway using carbonate feedstock • Advancing printable lithium – a key enabler for commercial production of lithium metal anodes and next generation batteries • Creating an enhanced and standardised DLE flowsheet for future projects Extraction / DLE Lithium metal Product R&D Underpinned by strong analytical capabilities

34 Disciplined growth in execution Djaber Belabdi Managing Director, Rio Tinto Projects Sal de Vida , Argentina

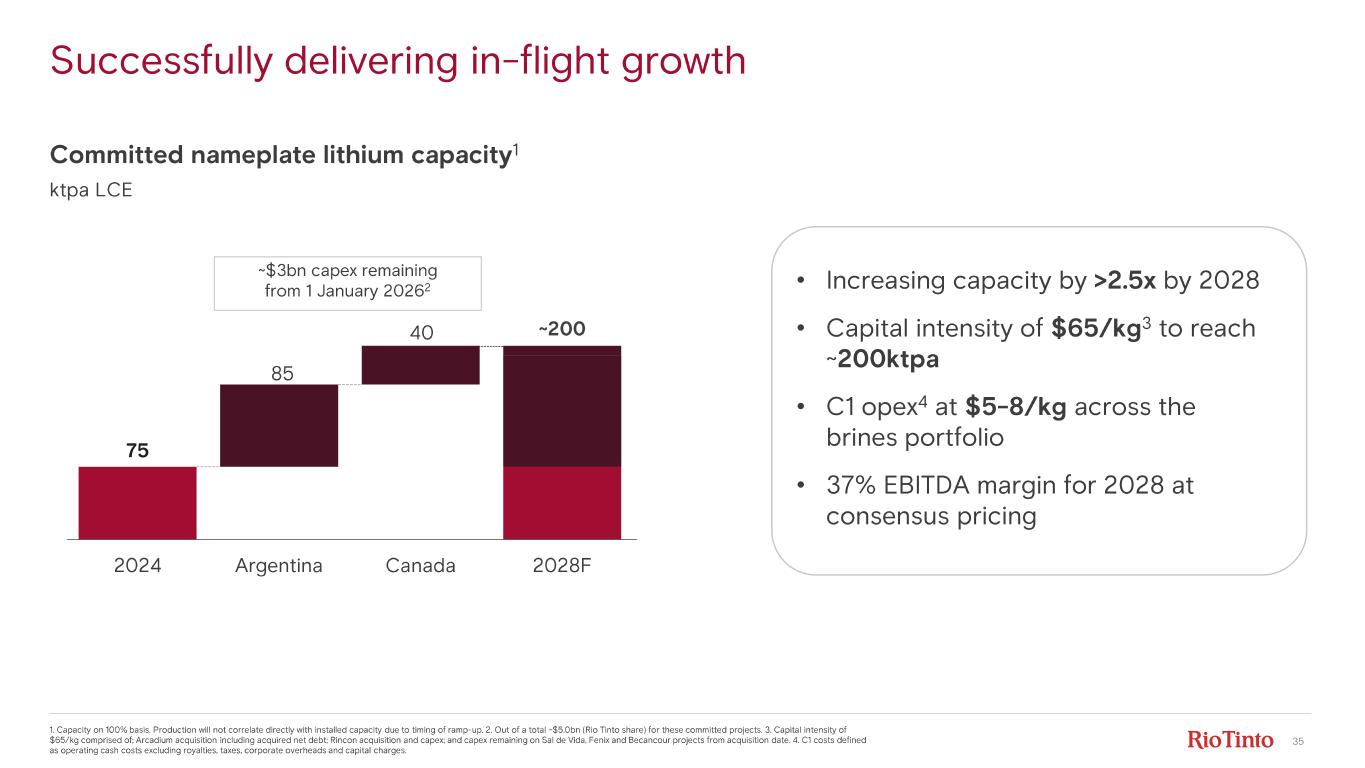

35 1. Capacity on 100% basis. Production will not correlate directly with installed capacity due to timing of ramp - up. 2 . Out of a total ~$5.0bn (Rio Tinto share) for these committed projects. 3. Capital intensity of $65/kg comprised of; Arcadium acquisition including acquired net debt; Rincon acquisition and capex; and capex remaining on S al de Vida, Fenix and Becancour projects from acquisition date. 4 . C1 costs defined as operating cash costs excluding royalties, taxes, corporate overheads and capital charges. 75 370 2024 Argentina Canada 2028F 10 Argentina Canada 170 190-200 Total Argentina and Canada 125 Chile 125 Total ~200 100 60-70 370 ~$3bn capex remaining from 1 January 2026 2 ktpa LCE Committed nameplate lithium capacity 1 • Increasing capacity by >2.5x by 2028 • Capital intensity of $65/kg 3 to reach ~20 ktpa • C1 opex 4 at $5 - 8/kg across the brines portfolio • 37% EBITDA margin for 2028 at consensus pricing Successfully delivering in - flight growth 85 40

36 Rio Tinto ownership 100% Production capacity 10ktpa lithium carbonate Operation Proprietary DLE technology Progress Mechanically complete, commissioning 60% Planned first production H2 2026 Total capital $633m ($65m 1 remaining from 1 Jan 2026) Projected C1 cost 2 ~$5/kg LCE Mineral Resource Estimate 3 11.7Mt LCE Mine Life ~40 years F énix 1B Learnings from successful 1A expansion to accelerate ramp - up 1. Excludes ~$30m capex for Olacapato Compressor Plant also to be completed in 2026 (total cost $80m). 2. C1 costs defined as operating cash costs excluding royalties, taxes, corporate overheads and capital charges. 3. Brines Mineral Resources are reported inclusive of Ore Reserves. Mineral Resources are shown on 100% basis. See supporting re ferences for the Mineral Resources categorisation and reporting on slide 3.. Location Catamarca province, Argentina

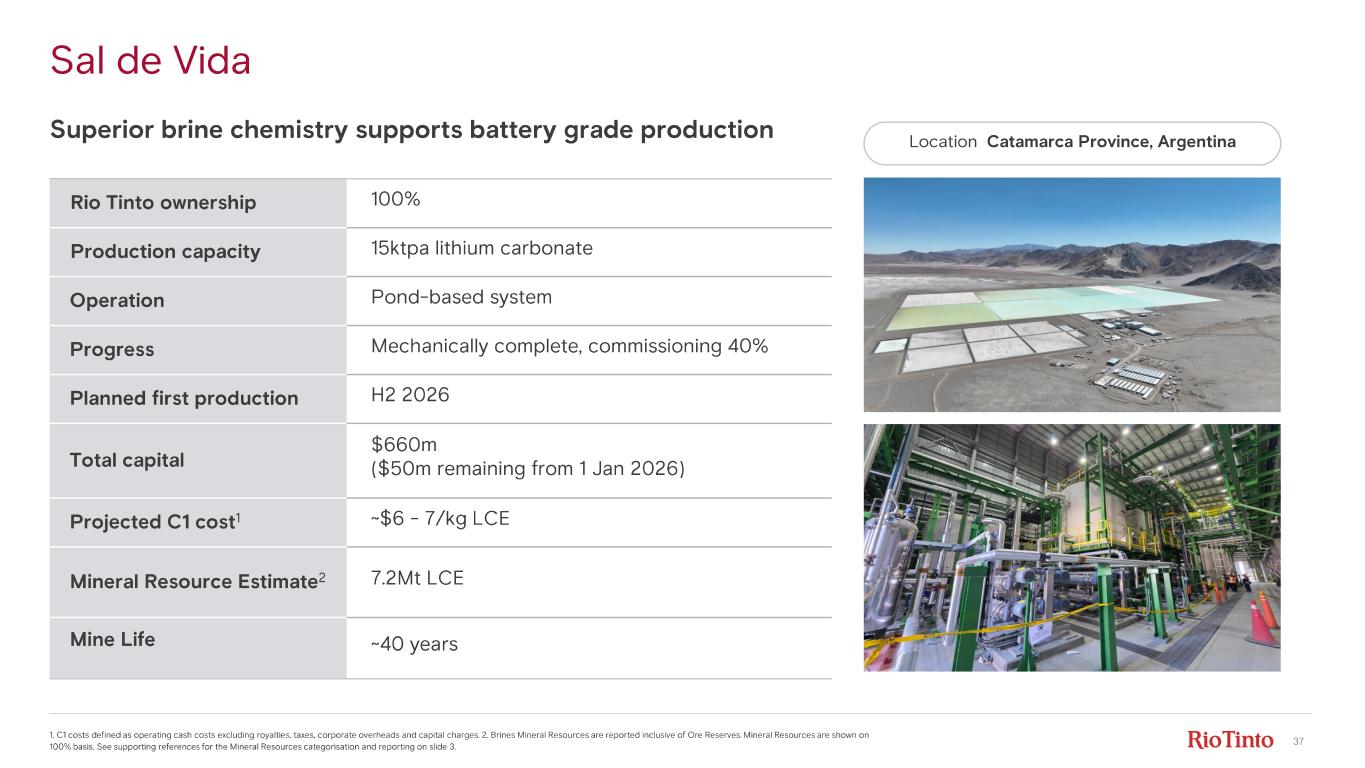

37 Sal de Vida Superior brine chemistry supports battery grade production 1. C1 costs defined as operating cash costs excluding royalties, taxes, corporate overheads and capital charges. 2. Brines Mineral Resources are reported inclusive of Ore Reserves. Mineral Resources are shown on 100% basis. See supporting references for the Mineral Resources categorisation and reporting on slide 3. Rio Tinto ownership 100% Production capacity 15ktpa lithium carbonate Operation Pond - based system Progress Mechanically complete, commissioning 40% Planned first production H2 2026 Total capital $660m ($50m remaining from 1 Jan 2026) Projected C1 cost 1 ~$6 - 7/kg LCE Mineral Resource Estimate 2 7.2Mt LCE Mine Life ~40 years Location Catamarca Province, Argentina

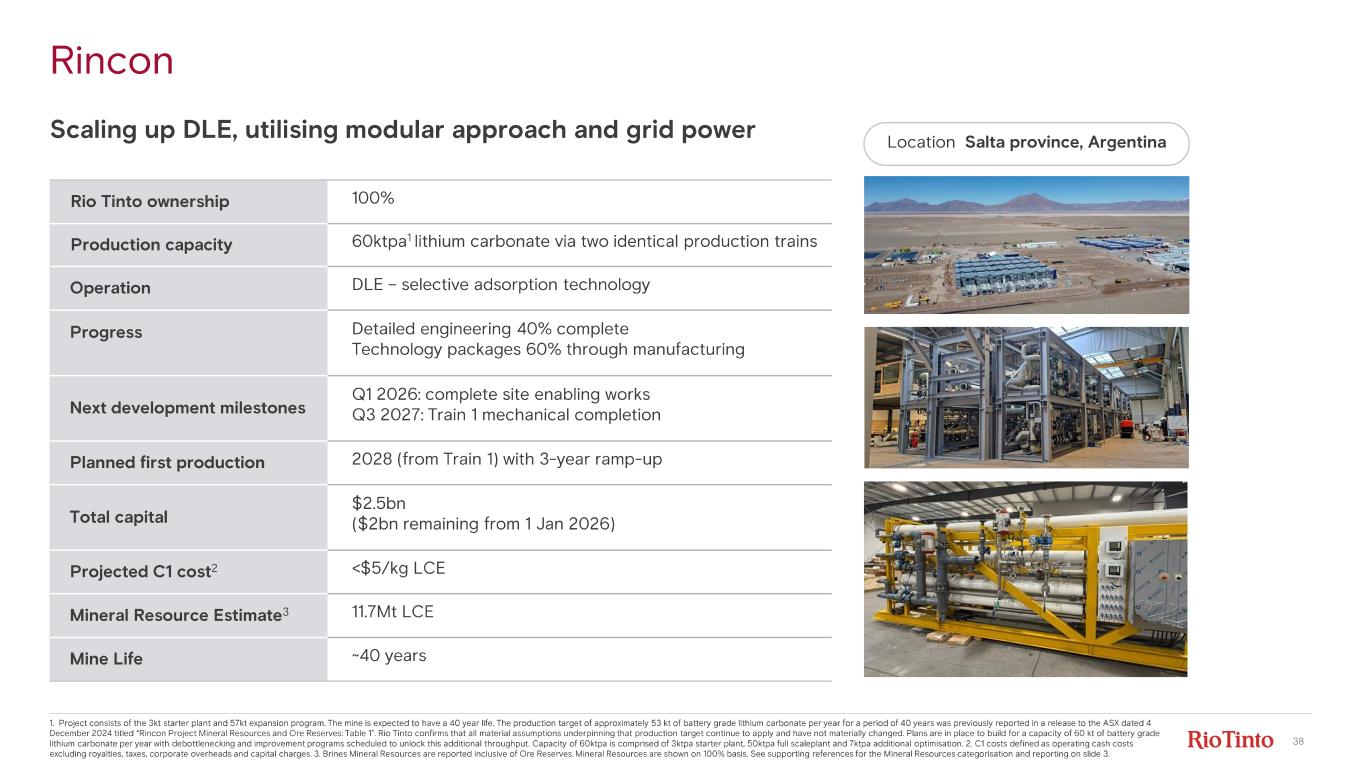

38 Rincon 1. Project consists of the 3kt starter plant and 57kt expansion program. The mine is expected to have a 40 year life. The production target of approximately 53 kt of battery grade lithium carbonate per year for a period of 40 years was previou sly reported in a release to the ASX dated 4 December 2024 titled “Rincon Project Mineral Resources and Ore Reserves: Table 1”. Rio Tinto confirms that all material assum ptions underpinning that production target continue to apply and have not materially changed. Plans are in place to build for a cap acity of 60 kt of battery grade lithium carbonate per year with debottlenecking and improvement programs scheduled to unlock this additional throughput. Capa city of 60ktpa is comprised of 3ktpa starter plant, 50ktpa full scaleplant and 7ktpa additional optimisation. 2. C1 costs defined as operating cash costs excluding royalties, taxes, corporate overheads and capital charges. 3. Brines Mineral Resources are reported inclusive of Ore Reserves. Mineral Resources are shown on 100% basis. See supporting re ferences for the Mineral Resources categorisation and reporting on slide 3. Site enabling works Membrane package Scaling up DLE, utilising modular approach and grid power Rio Tinto ownership 100% Production capacity 60ktpa 1 lithium carbonate via two identical production trains Operation DLE – selective adsorption technology Progress Detailed engineering 40% complete Technology packages 60% through manufacturing Next development milestones Q1 2026: complete site enabling works Q3 2027: Train 1 mechanical completion Planned first production 2028 (from Train 1) with 3 - year ramp - up Total capital $2.5bn ($2bn remaining from 1 Jan 2026) Projected C1 cost 2 <$5/kg LCE Mineral Resource Estimate 3 11.7Mt LCE Mine Life ~40 years Location Salta province, Argentina

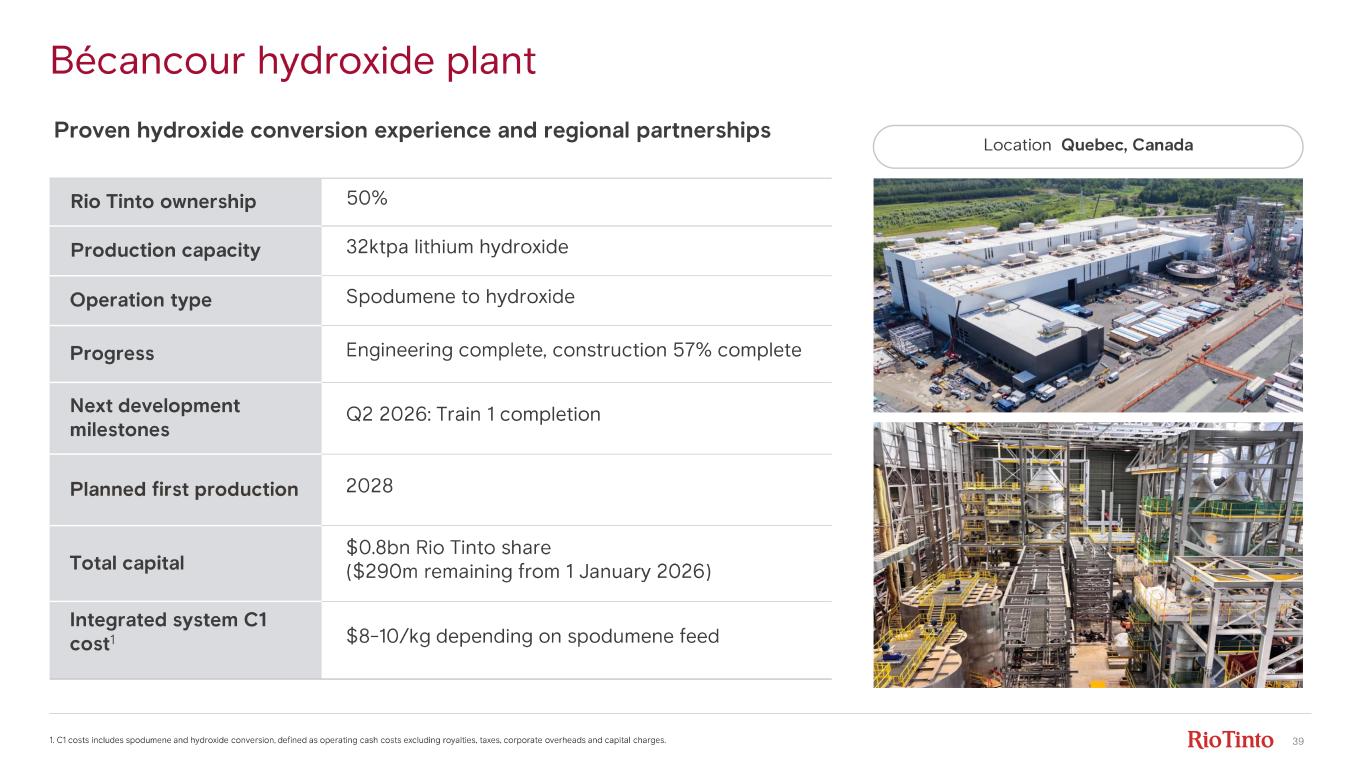

39 Bécancour hydroxide plant Proven hydroxide conversion experience and regional partnerships Site enabling works Membrane package 1. C1 costs includes spodumene and hydroxide conversion, defined as operating cash costs excluding royalties, taxes, corporat e o verheads and capital charges. Rio Tinto ownership 50% Production capacity 32ktpa lithium hydroxide Operation type Spodumene to hydroxide Progress Engineering complete, construction 57% complete Next development milestones Q2 2026: Train 1 completion Planned first production 2028 Total capital $0.8bn Rio Tinto share ($290m remaining from 1 January 2026) Integrated system C1 cost 1 $8 - 10/kg depending on spodumene feed Location Quebec, Canada

40 Fully integrated Canadian lithium hub 1. Hard rock Mineral Resources are reported exclusive of Ore Reserves. Mineral Resources and Ore Reserves are shown on 100% basis. See sup por ting references for the Mineral Resources and Ore Reserves categorisation and reporting on slide 3. Whabouchi Mine Galaxy Mine Rio Tinto ownership 50% 100% Production capacity 235ktpa at 5.5% Li 2O 310ktpa at 5.6% Li 2O Project progress 35% overall 35% overall Total capital for single mine Total $0.7 - 0.9bn. Remaining capex of ~$0.5bn (100% basis) Next development milestones Reviewing strategic options to maximise value Mineral Resource 1 26.9Mt @ 1.45% Li 2O 74.0Mt @ 1.25% Li 2O Ore Reserve 26.5Mt @ 1.32% Li 2O 37.3Mt @ 1.27% Li 2O Mine life 1 24 years open pit 19 years open pit Design/ process flow DMS and flotation circuit Only requires single DMS circuit Assessing best option to develop a single spodumene mine for Bécancour Whabouchi Galaxy Eastmain Montreal Bécancour Québec Highway Railway Port Mine Airport Location Quebec, Canada Matagami x x Transfer station

Djaber Belabdi Managing Director, Rio Tinto Projects Capital efficiency Pipeline of growth options

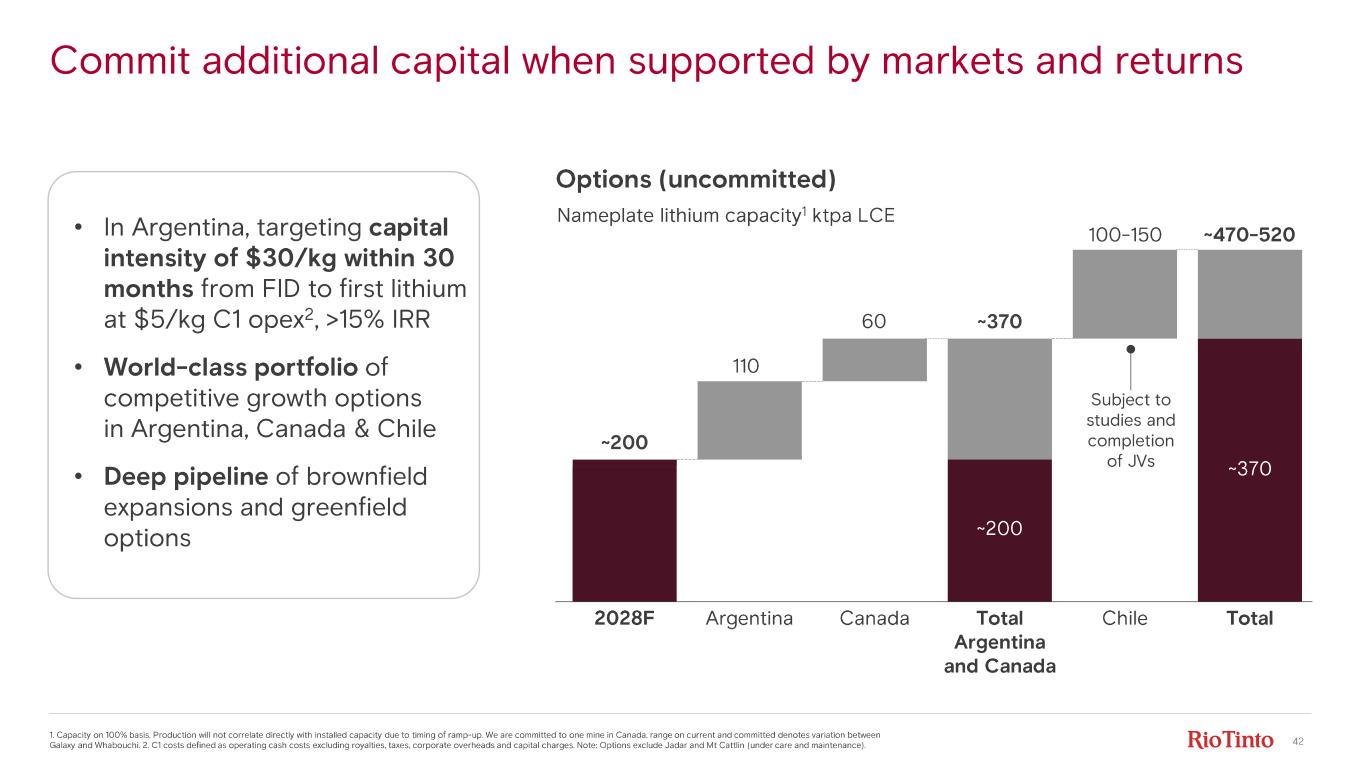

42 1. Capacity on 100% basis. Production will not correlate directly with installed capacity due to timing of ramp - up. We are committed to one mine in Canada, range on current and committed denotes variation between Galaxy and Whabouchi . 2. C1 costs defined as operating cash costs excluding royalties, taxes, corporate overheads and capital charges. Note: Options exclude Jadar and Mt Cattlin (under care and maintenance). Lithium 75 ~37085 Arcadium 2024 nameplate capacity Argentina 30 - 40 Canada 2028F Argentina Canada ~200 Total Argentina and Canada Chile Total ~200 ~370 • In Argentina, targeting capital intensity of $30/kg within 30 months from FID to first lithium at $5/kg C1 opex 2, >15% IRR • World - class portfolio of competitive growth options in Argentina, Canada & Chile • Deep pipeline of brownfield expansions and greenfield options Subject to studies and completion of JVs Nameplate lithium capacity 1 ktpa LCE Options (uncommitted) 100 - 150 ~470 - 520 Commit additional capital when supported by markets and returns 60 110

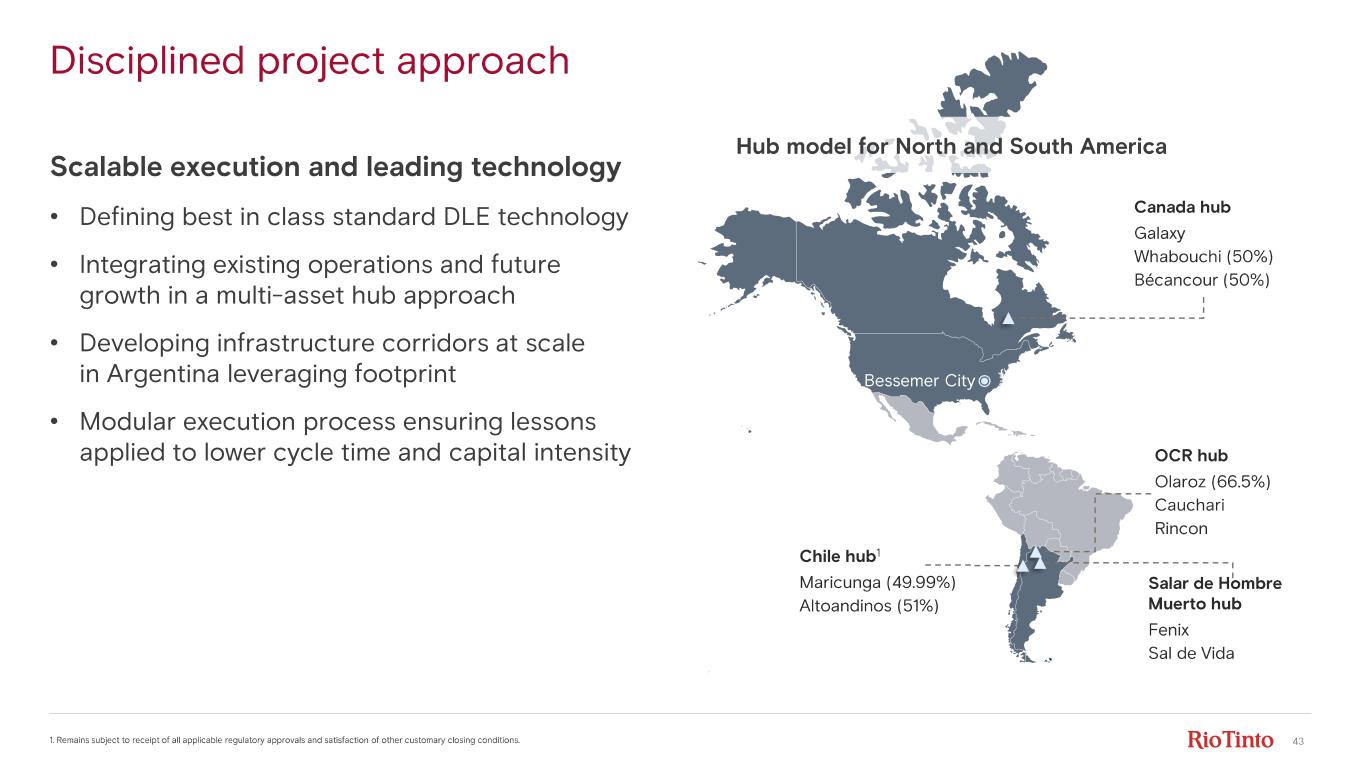

43 Disciplined project approach 1. Remains subject to receipt of all applicable regulatory approvals and satisfaction of other customary closing conditions. Canada hub Galaxy Whabouchi (50%) Bécancour (50%) Bessemer City Chile hub 1 Maricunga (49.99%) Altoandinos (51%) OCR hub Olaroz (66.5%) Cauchari Rincon Salar de Hombre Muerto hub Fenix Sal de Vida Hub model for North and South America Scalable execution and leading technology • Defining best in class standard DLE technology • Integrating existing operations and future growth in a multi - asset hub approach • Developing infrastructure corridors at scale in Argentina leveraging footprint • Modular execution process ensuring lessons applied to lower cycle time and capital intensity

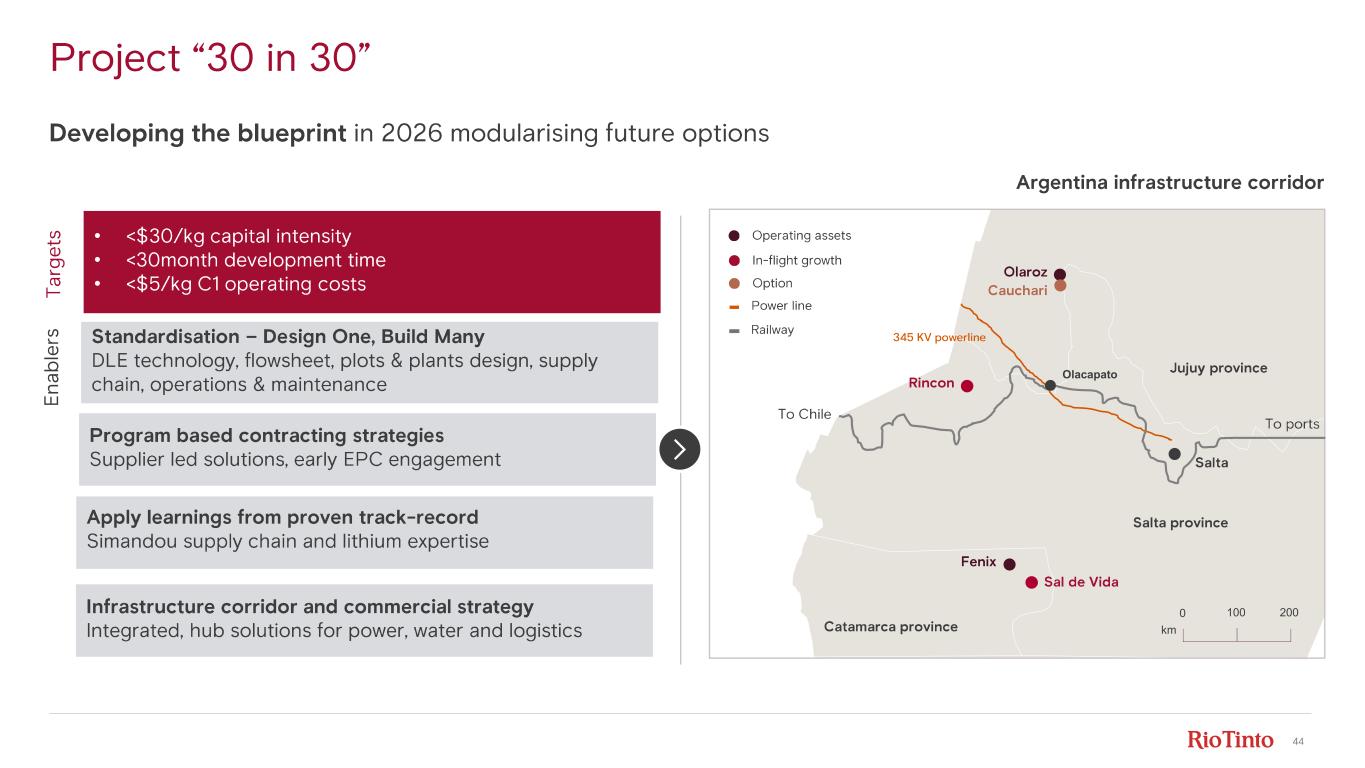

44 Project “30 in 30” Rincon Olaroz Catamarca province Salta province Sal de Vida Fenix Jujuy province Salta 0 100 200 km Rio Tinto Lithium 345 KV powerline Olacapato 33 KV 33 KV Power Lines (Current and Planned) Railway Rincon Olaroz Catamarca province Salta province Sal de Vida Fenix Jujuy province Salta 0 100 200 km 345 KV powerline Olacapato Ta rg et s En ab le rs Argentina infrastructure corridor Developing the blueprint in 2026 modularising future options Operating assets Power line Railway In- flight growth Standardisation – Design One, Build Many DLE technology, flowsheet , plots & plants design, supply chain, operations & maintenance Program based contracting strategies Supplier led solutions, early EPC engagement Infrastructure corridor and commercial strategy Integrated, hub solutions for power, water and logistics Apply learnings from proven track - record Simandou supply chain and lithium expertise • <$30/kg capital intensity • <30month development time • <$5/kg C1 operating costs Cauchari Option To Chile To ports

45 Rincon, Argentina Creating value through market cycles Ulric Adom CFO, Rio Tinto Aluminium & Lithium

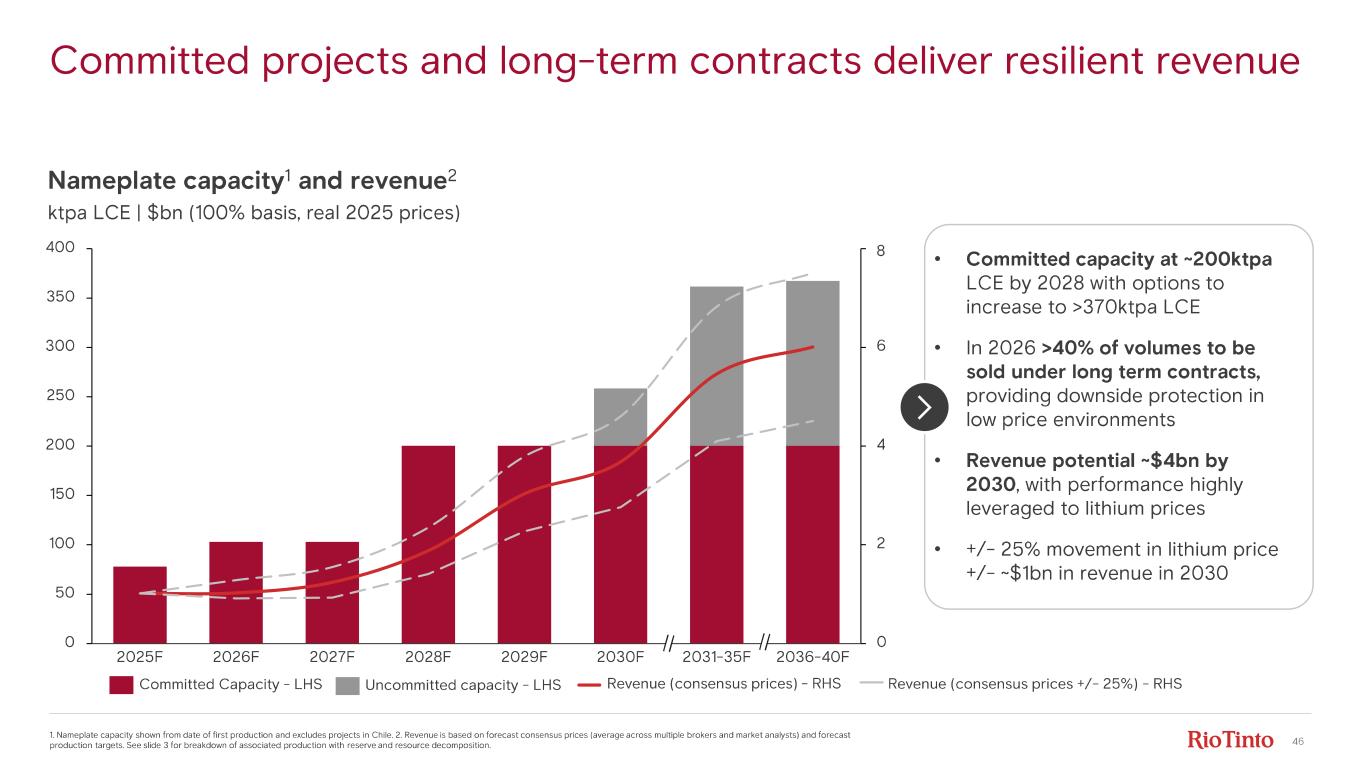

46 Committed projects and long - term contracts deliver resilient revenue 1. Nameplate capacity shown from date of first production and excludes projects in Chile. 2. Revenue is based on forecast con sen sus prices (average across multiple brokers and market analysts) and forecast production targets. See slide 3 for breakdown of associated production with reserve and resource decomposition. Nameplate capacity 1 and revenue 2 ktpa LCE | $bn (100% basis, real 2025 prices) 0 50 100 150 200 250 300 350 400 0 2 4 6 8 2025 F 2026 F 2027 F 2028 F 2029 F 2030 F 2031 - 35 F 2036 - 40 F Uncommitted capacity - LHSCommitted Capacity - LHS Revenue (consensus prices) - RHS Revenue (consensus prices +/ - 25%) - RHS • Committed capacity at ~200ktpa LCE by 2028 with options to increase to > 370ktpa LCE • In 2026 >40% of volumes to be sold under long term contracts, providing downside protection in low price environments • Revenue potential ~$4bn by 2030 , with performance highly leveraged to lithium prices • +/ - 25% movement in lithium price +/ - ~$1bn in revenue in 2030

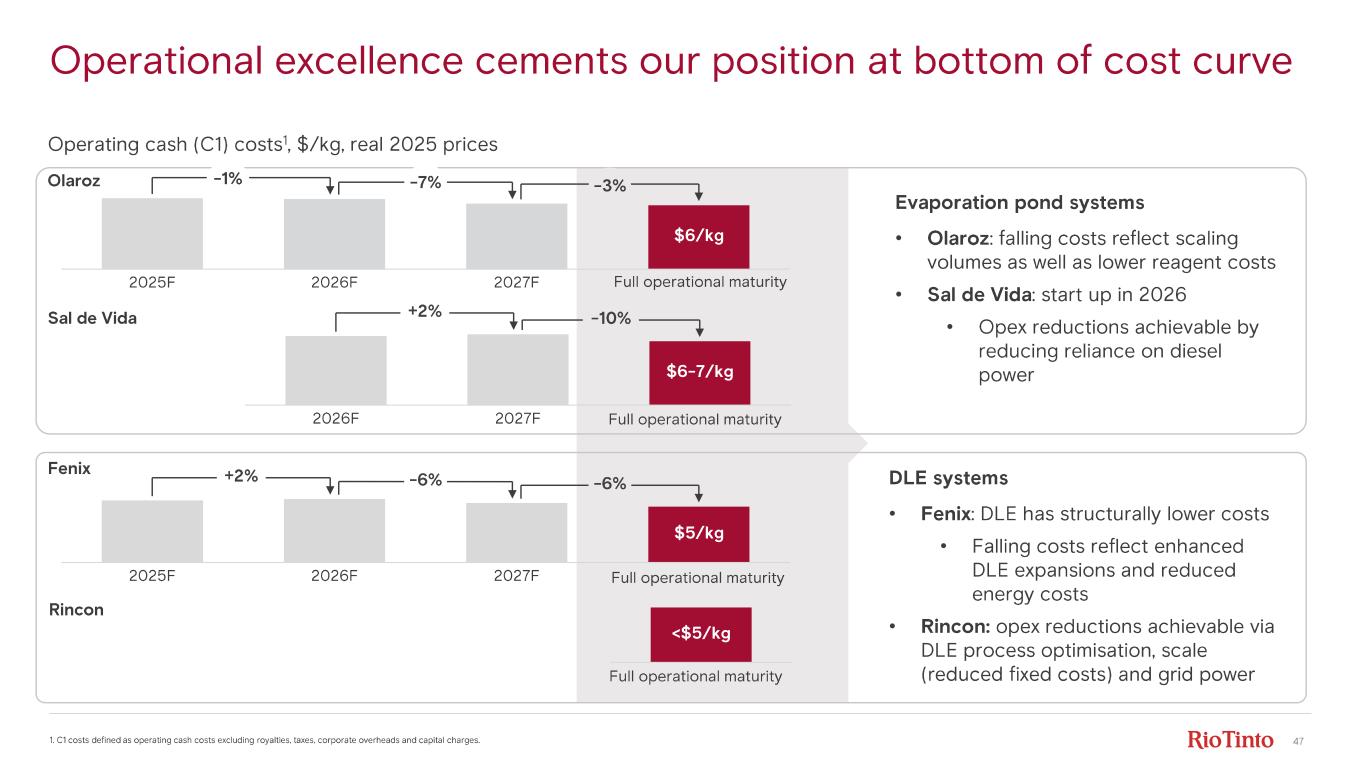

47 Evaporation pond systems • Olaroz : falling costs reflect scaling volumes as well as lower reagent costs • Sal de Vida : start up in 2026 • Opex reductions achievable by reducing reliance on diesel power Operational excellence cements our position at bottom of cost curve 1. C1 costs defined as operating cash costs excluding royalties, taxes, corporate overheads and capital charges. Fenix <$5/kg Rincon 2025 F 2026 F 2027 F $ 5/kg Full operational maturity +2% - 6% - 6% Olaroz Sal de Vida 2025 F 2026 F 2027 F $ 6/kg Full operational maturity - 1% - 7% - 3% 2026 F 2027 F $ 6- 7/kg Full operational maturity +2% - 10% Operating cash (C1) costs 1, $/kg, real 2025 prices Full operational maturity DLE systems • Fenix : DLE has structurally lower costs • Falling costs reflect enhanced DLE expansions and reduced energy costs • Rincon: opex reductions achievable via DLE process optimisation , scale (reduced fixed costs) and grid power

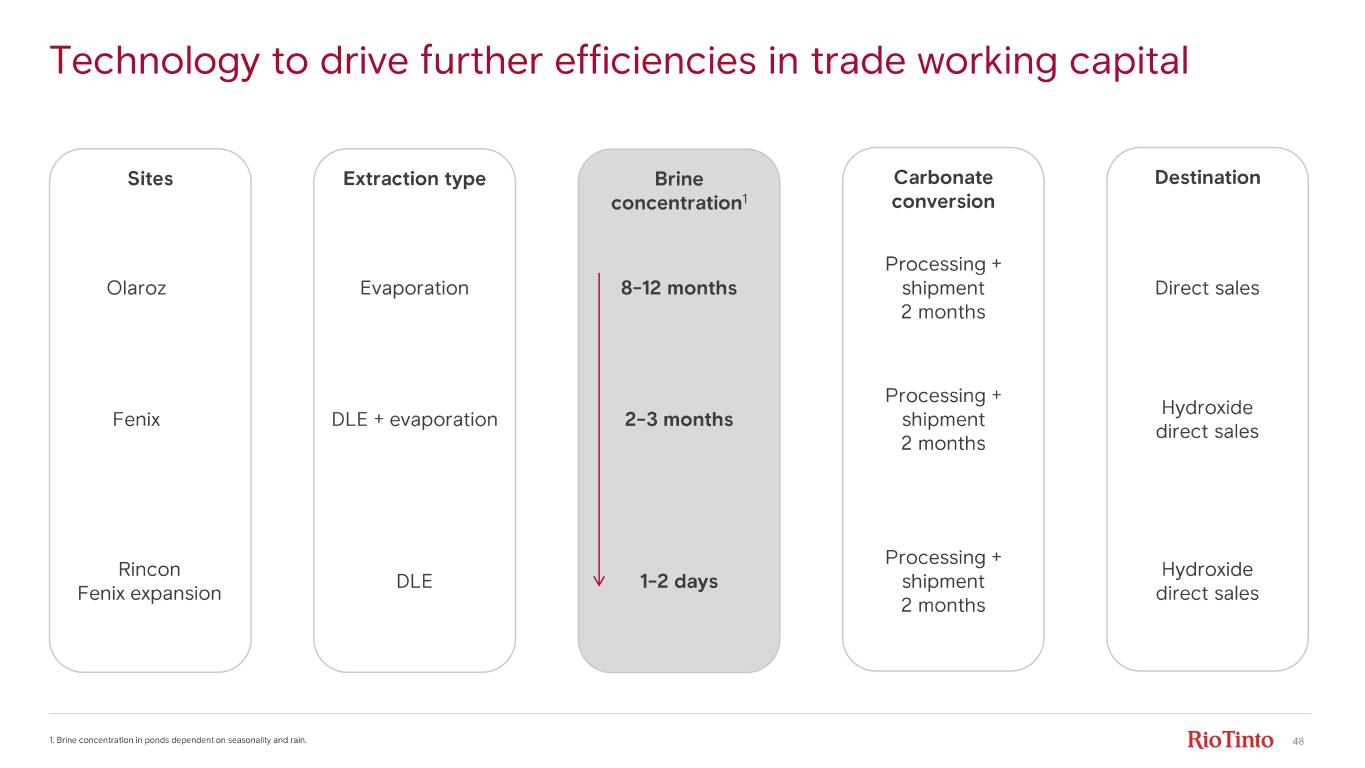

48 Technology to drive further efficiencies in trade working capital 1. Brine concentration in ponds dependent on seasonality and rain. Sites Brine concentration 1 Hydroxide direct sales Direct sales Fenix 8- 12 months 2- 3 months Processing + shipment 2 months Processing + shipment 2 months Hydroxide direct sales Rincon Fenix expansion 1- 2 days Processing + shipment 2 months Olaroz Carbonate conversion DestinationExtraction type Evaporation DLE + evaporation DLE

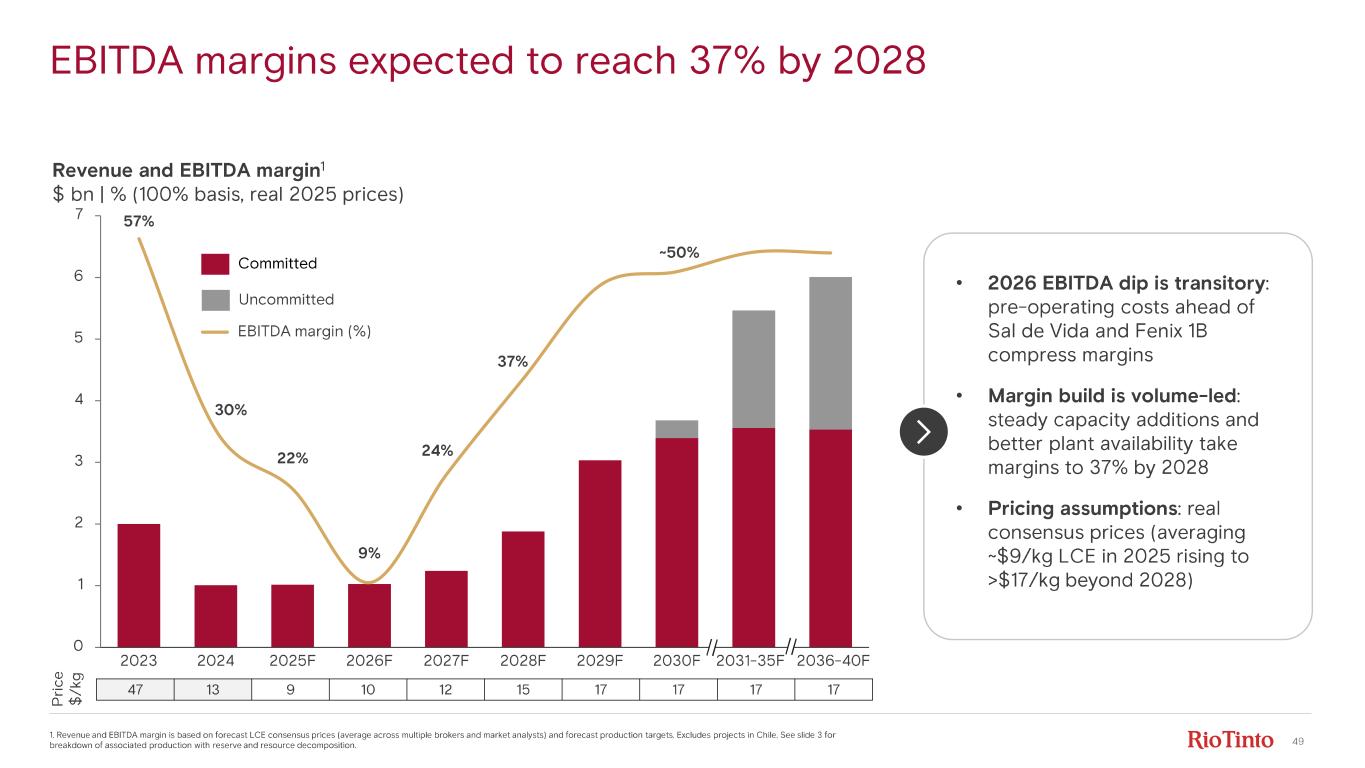

49 EBITDA margins expected to reach 37% by 2028 1. Revenue and EBITDA margin is based on forecast LCE consensus prices (average across multiple brokers and market analysts) and forecast production targets. Excludes projects in Chile. See slide 3 for breakdown of associated production with reserve and resource decomposition. Revenue and EBITDA margin 1 $ bn | % (100% basis, real 2025 prices) P ri ce $ /k g 47 13 9 10 12 15 17 17 17 17 0 1 2 3 4 5 6 7 57% 2023 30% 2024 22% 2025 F 9% 2026 F 24% 2027 F 37% 2028 F 2029 F 2030 F 2031 - 35 F 2036 - 40 F Uncommitted Committed EBITDA margin (%) • 2026 EBITDA dip is transitory : pre - operating costs ahead of Sal de Vida and Fenix 1B compress margins • Margin build is volume - led : steady capacity additions and better plant availability take margins to 37% by 2028 • Pricing assumptions : real consensus prices (averaging ~$9/kg LCE in 2025 rising to >$17/kg beyond 2028) ~50%

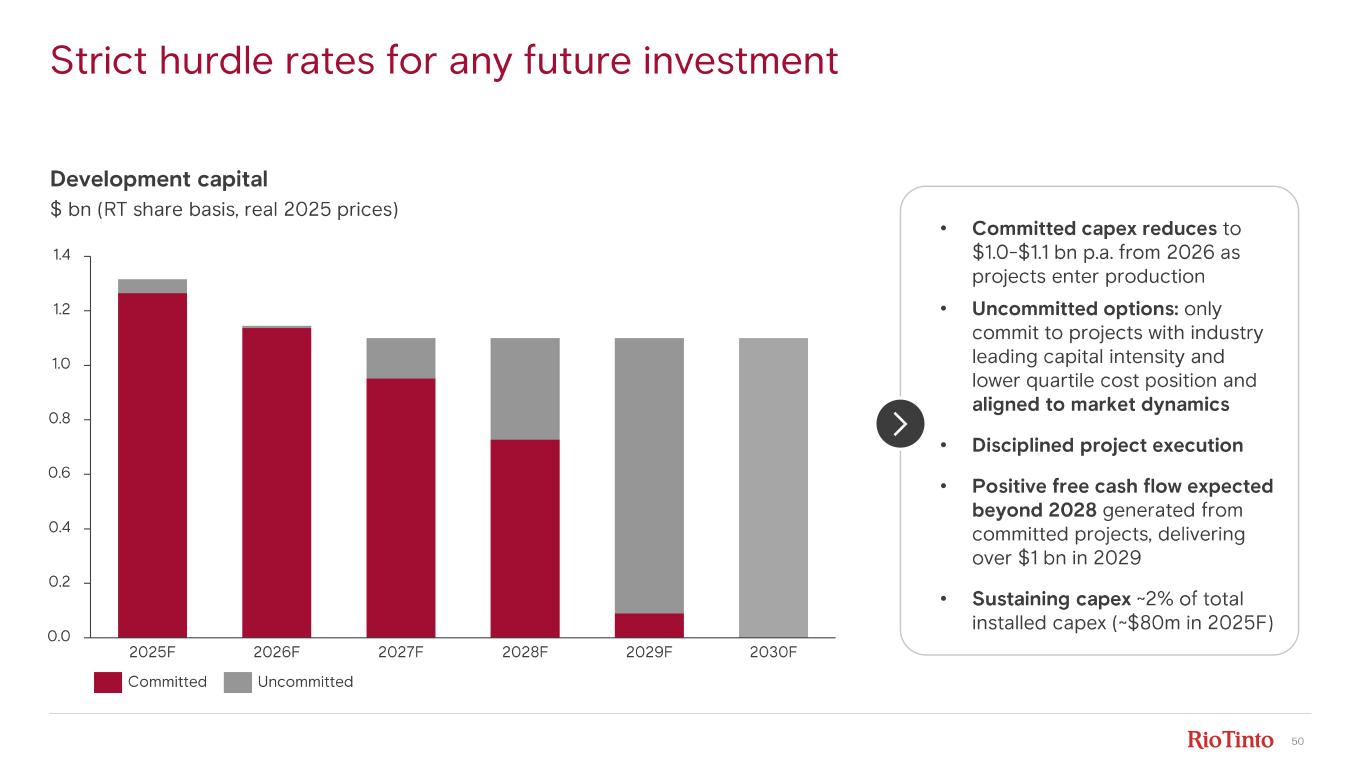

50 Strict hurdle rates for any future investment Development capital $ bn (RT share basis, real 2025 prices) 0.0 1.0 0.2 0.4 0.6 0.8 1.2 1.4 2025 F 2026 F 2027 F 2028 F 2029 F 2030 F UncommittedCommitted • Committed capex reduces to $1.0- $1.1 bn p.a. from 2026 as projects enter production • Uncommitted options: only commit to projects with industry leading capital intensity and lower quartile cost position and aligned to market dynamics • Disciplined project execution • Positive free cash flow expected beyond 2028 generated from committed projects, delivering over $1 bn in 2029 • Sustaining capex ~2% of total installed capex (~$80m in 2025F)

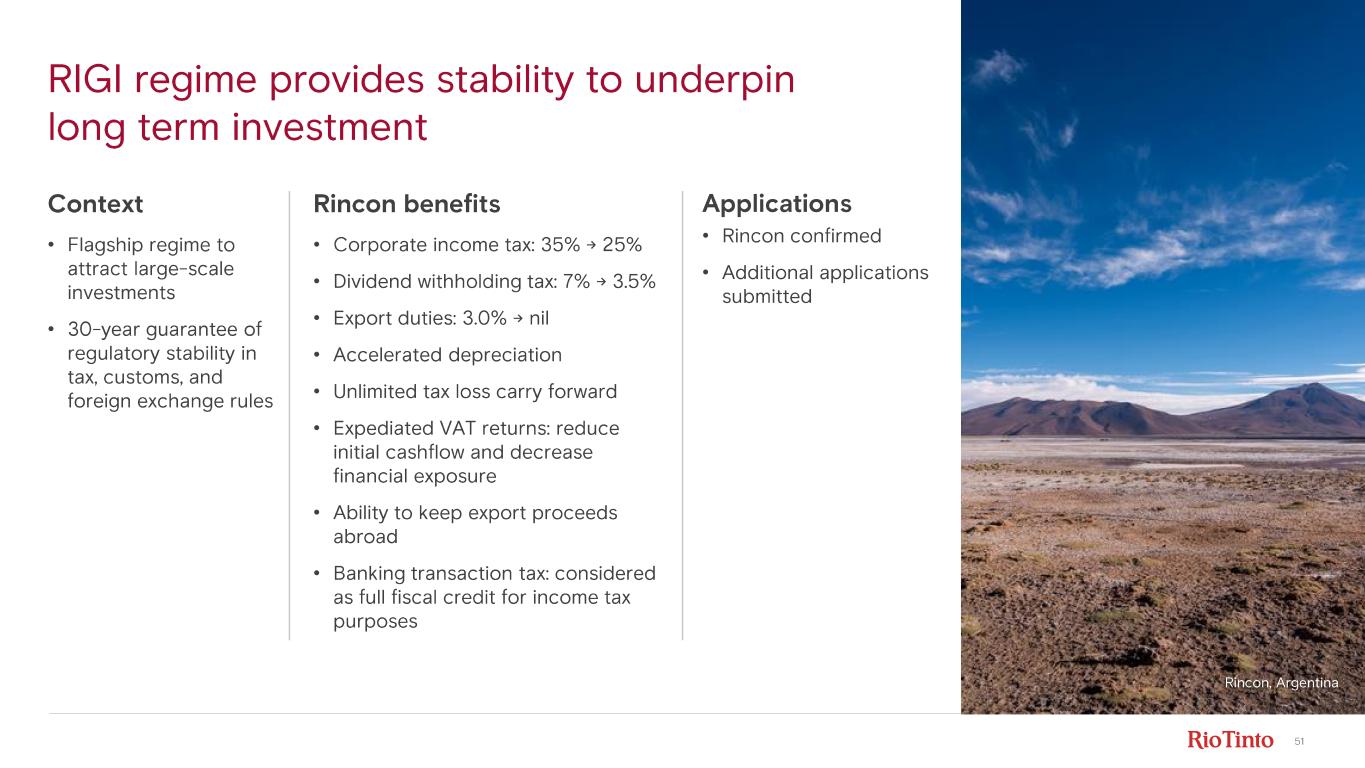

51 RIGI regime provides stability to underpin long term investment Applications • Rincon confirmed • Additional applications submitted Context • Flagship regime to attract large - scale investments • 30 - year guarantee of regulatory stability in tax, customs, and foreign exchange rules Rincon benefits • Corporate income tax: 35% → 25% • Dividend withholding tax: 7% → 3.5% • Export duties: 3.0% → nil • Accelerated depreciation • Unlimited tax loss carry forward • Expediated VAT returns: reduce initial cashflow and decrease financial exposure • Ability to keep export proceeds abroad • Banking transaction tax: considered as full fiscal credit for income tax purposes Rincon , Argentina

52 4 Creating value1 Operational excellence 2 Disciplined growth 3 Capital efficiency World - class integrated Lithium business and growth pipeline • +13% demand CAGR to 2035 • Proven DLE technology • Deep pipeline of growth options • Focus on capital intensity • Commit additional capital when supported by markets and returns 2026 production guidance Lithium: 61 - 64kt LCE (Rio Tinto share) Rincon, Argentina

53 Q&A Rincon, Argentina

54 Appendix

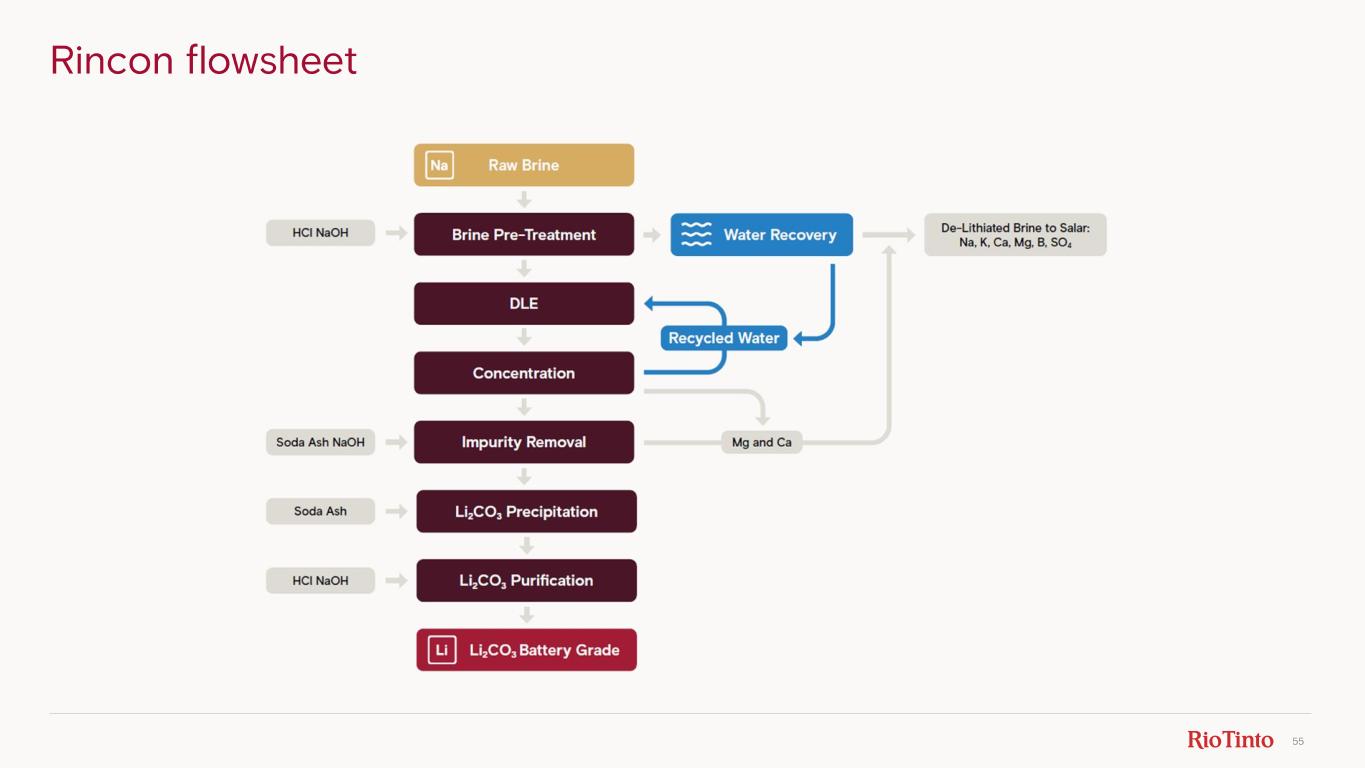

55 Rincon flowsheet

56 Acronym Definition LCE Lithium Carbonate Equivalent Li Lithium Li-ion Lithium-ion Li2O Lithium Oxide LiCl Lithium Chloride LFP Lithium Iron Phosphate LIOVIX® Proprietary technology for scalable production of lithium metal anodes and next-gen batteries LT Long Term MAusIMM Member of the Australasian Institute of Mining and Metallurgy Mg Magnesium Mg/L Milligrams per liter Mt Million tonnes Mtpa Million tonnes per annum MVR Mechanical Vapor Recompression NaCl Sodium Chloride Ni-based Nickel-based NCM Nickel-Cobalt-Manganese OEM Original Equipment Manufacturer Opex Operating Expenditure OTFS20 Oyu Tolgoi Feasibility Study 2020 p.a. per annum PHEV Plug-in Hybrid Electric Vehicle Q&A Questions and Answers Q2, Q3, Q4 Quarter 2, Quarter 3, Quarter 4 R&D Research and Development RIGI Regimen de Incentivo para Grandes Inversiones (Argentina investment regime) RT Rio Tinto RTL Rio Tinto Lithium SA Selective Adsorption SDGs Sustainable Development Goals SEC United States Securities and Exchange Commission SSB Solid State Battery TWh Terawatt hour UN SDGs United Nations Sustainable Development Goals VAT Value Added Tax Acronym Definition AI Artificial Intelligence ASX Australian Securities Exchange Au Gold B, Ca, Mg Boron, Calcium, Magnesium BESS Battery Energy Storage Systems BNEF Bloomberg New Energy Finance BuLi Butyllithium CAGR Compound Annual Growth Rate Capex Capital Expenditure C1 costs Operating cash costs excluding royalties, taxes, corporate overheads and capital charges C3 costs Includes operating cash costs, sustaining capex, royalties and interest (excludes depreciation and capital charge) Co-Dev Co-Development CRU Commodity Research Unit Cu Copper DLE Direct Lithium Extraction DMS Dense Media Separation EBITDA Earnings Before Interest, Taxes, Depreciation, and Amortization EPC Engineering, Procurement, and Construction ESIA Environmental and Social Impact Assessment EV Electric Vehicle FID Final Investment Decision g/t grams per tonne IFC International Finance Corporation IEA International Energy Agency IFRS International Financial Reporting Standards IRR Internal Rate of Return JORC code Australasian Code for Reporting of Exploration Results, Minerals Resources and Ore Reserves JV Joint Venture kt kilotonnes kpta Thousand tonnes per annum kozpa Thousand ounces per annum Acronyms