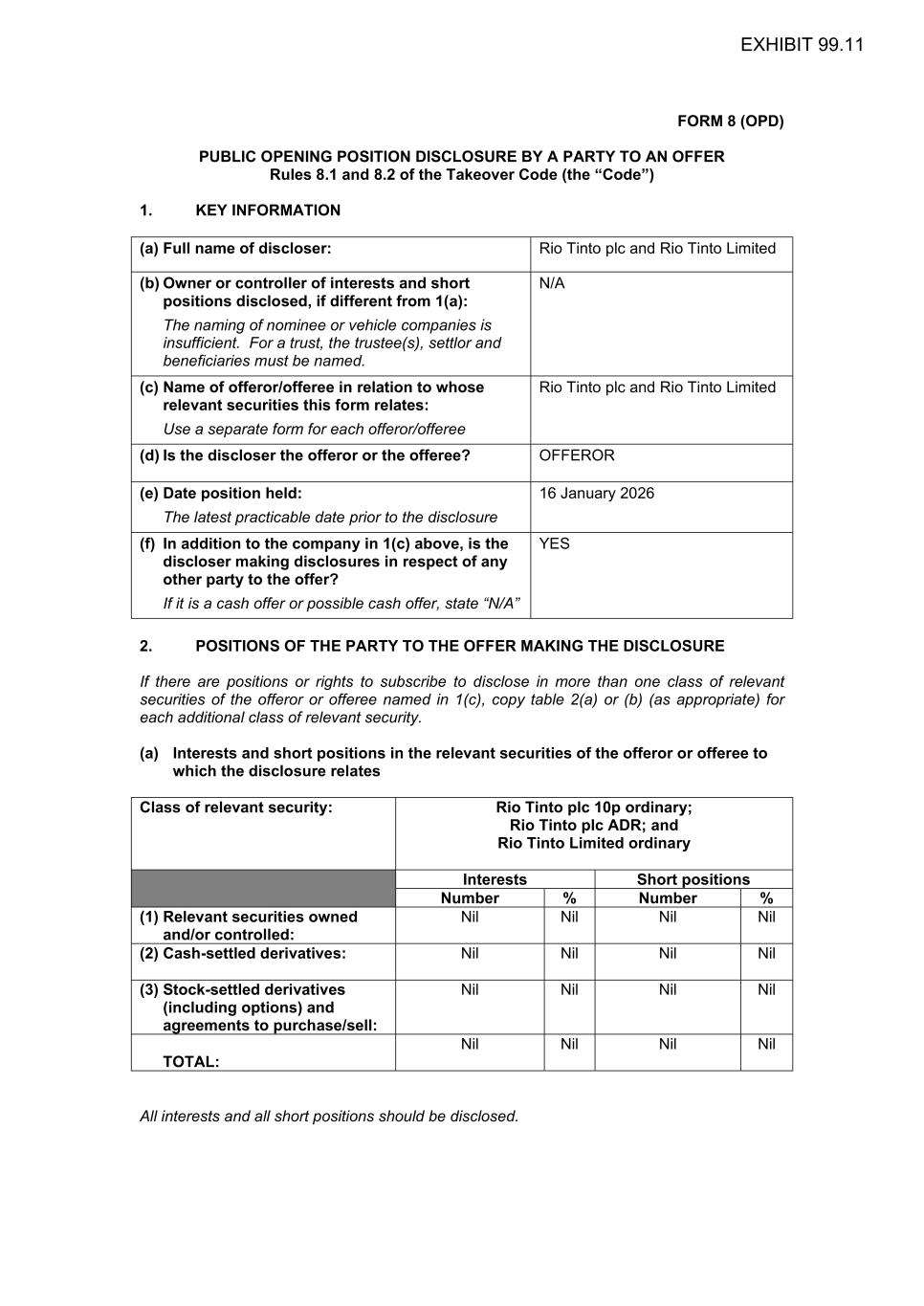

FORM 8 (OPD) PUBLIC OPENING POSITION DISCLOSURE BY A PARTY TO AN OFFER Rules 8.1 and 8.2 of the Takeover Code (the “Code”) 1. KEY INFORMATION (a) Full name of discloser: Rio Tinto plc and Rio Tinto Limited (b) Owner or controller of interests and short positions disclosed, if different from 1(a): The naming of nominee or vehicle companies is insufficient. For a trust, the trustee(s), settlor and beneficiaries must be named. N/A (c) Name of offeror/offeree in relation to whose relevant securities this form relates: Use a separate form for each offeror/offeree Rio Tinto plc and Rio Tinto Limited (d) Is the discloser the offeror or the offeree? OFFEROR (e) Date position held: The latest practicable date prior to the disclosure 16 January 2026 (f) In addition to the company in 1(c) above, is the discloser making disclosures in respect of any other party to the offer? If it is a cash offer or possible cash offer, state “N/A” YES 2. POSITIONS OF THE PARTY TO THE OFFER MAKING THE DISCLOSURE If there are positions or rights to subscribe to disclose in more than one class of relevant securities of the offeror or offeree named in 1(c), copy table 2(a) or (b) (as appropriate) for each additional class of relevant security. (a) Interests and short positions in the relevant securities of the offeror or offeree to which the disclosure relates Class of relevant security: Rio Tinto plc 10p ordinary; Rio Tinto plc ADR; and Rio Tinto Limited ordinary Interests Short positions Number % Number % (1) Relevant securities owned and/or controlled: Nil Nil Nil Nil (2) Cash-settled derivatives: Nil Nil Nil Nil (3) Stock-settled derivatives (including options) and agreements to purchase/sell: Nil Nil Nil Nil TOTAL: Nil Nil Nil Nil All interests and all short positions should be disclosed. EXHIBIT 99.11

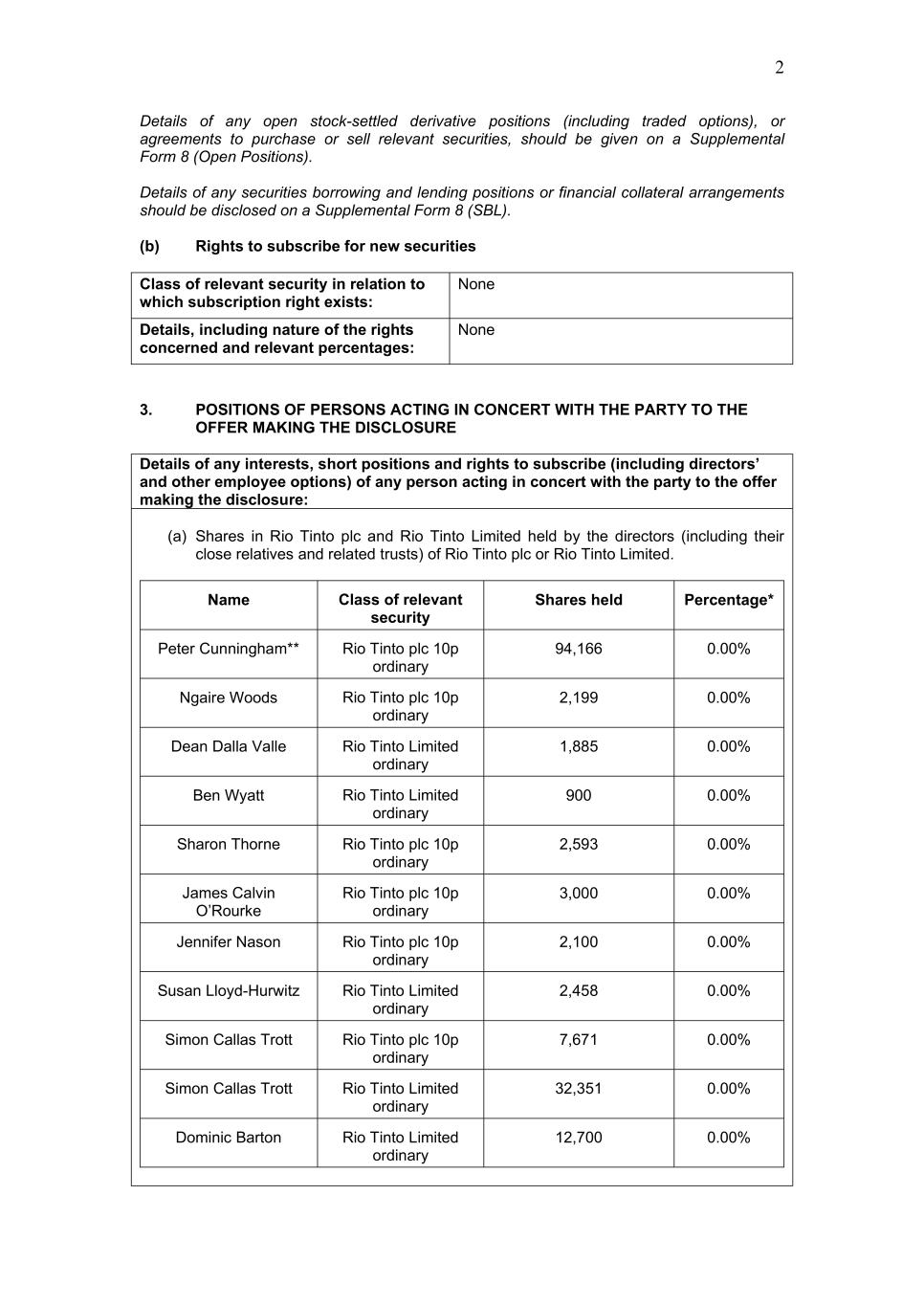

2 Details of any open stock-settled derivative positions (including traded options), or agreements to purchase or sell relevant securities, should be given on a Supplemental Form 8 (Open Positions). Details of any securities borrowing and lending positions or financial collateral arrangements should be disclosed on a Supplemental Form 8 (SBL). (b) Rights to subscribe for new securities Class of relevant security in relation to which subscription right exists: None Details, including nature of the rights concerned and relevant percentages: None 3. POSITIONS OF PERSONS ACTING IN CONCERT WITH THE PARTY TO THE OFFER MAKING THE DISCLOSURE Details of any interests, short positions and rights to subscribe (including directors’ and other employee options) of any person acting in concert with the party to the offer making the disclosure: (a) Shares in Rio Tinto plc and Rio Tinto Limited held by the directors (including their close relatives and related trusts) of Rio Tinto plc or Rio Tinto Limited. Name Class of relevant security Shares held Percentage* Peter Cunningham** Rio Tinto plc 10p ordinary 94,166 0.00% Ngaire Woods Rio Tinto plc 10p ordinary 2,199 0.00% Dean Dalla Valle Rio Tinto Limited ordinary 1,885 0.00% Ben Wyatt Rio Tinto Limited ordinary 900 0.00% Sharon Thorne Rio Tinto plc 10p ordinary 2,593 0.00% James Calvin O’Rourke Rio Tinto plc 10p ordinary 3,000 0.00% Jennifer Nason Rio Tinto plc 10p ordinary 2,100 0.00% Susan Lloyd-Hurwitz Rio Tinto Limited ordinary 2,458 0.00% Simon Callas Trott Rio Tinto plc 10p ordinary 7,671 0.00% Simon Callas Trott Rio Tinto Limited ordinary 32,351 0.00% Dominic Barton Rio Tinto Limited ordinary 12,700 0.00%

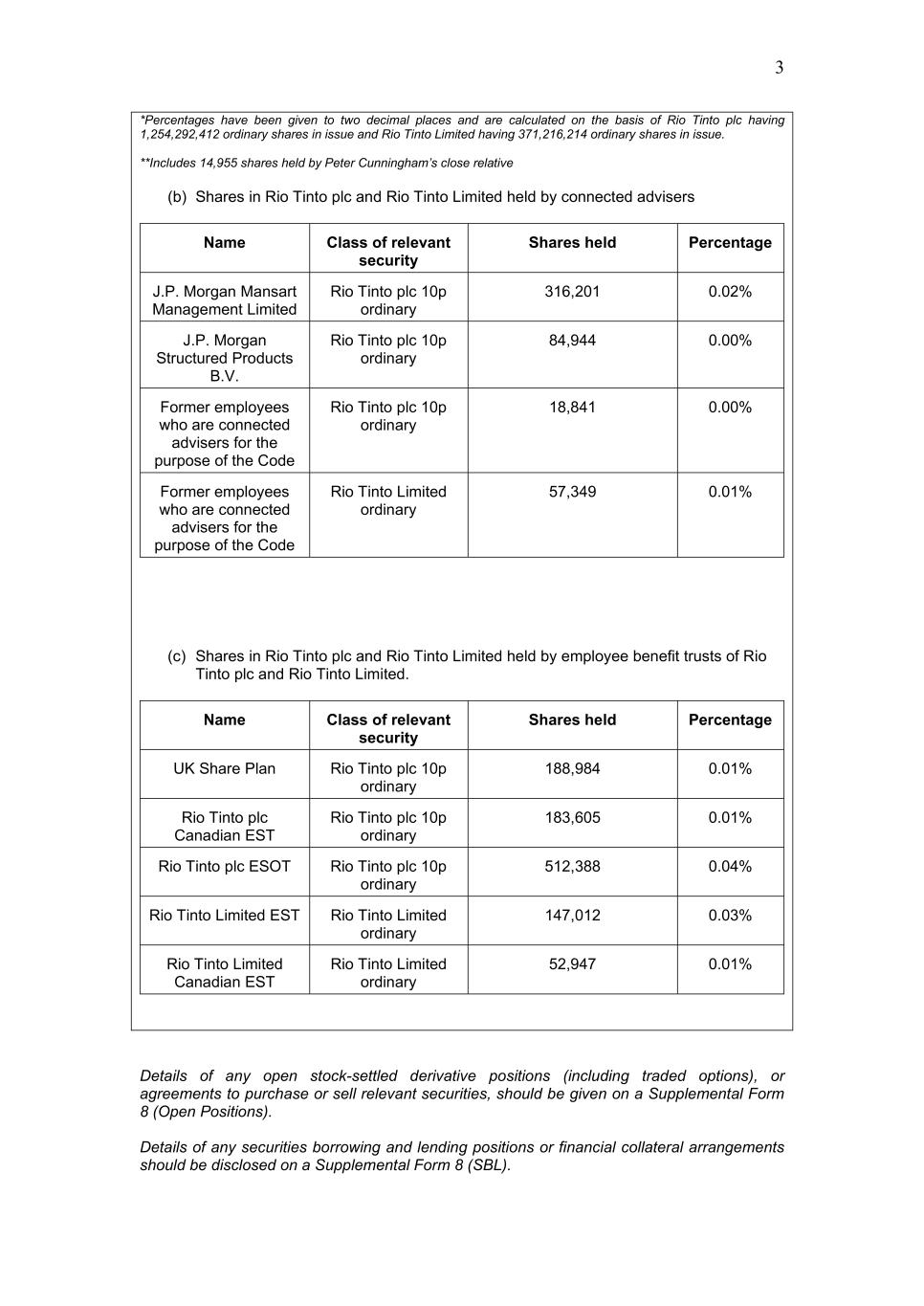

3 *Percentages have been given to two decimal places and are calculated on the basis of Rio Tinto plc having 1,254,292,412 ordinary shares in issue and Rio Tinto Limited having 371,216,214 ordinary shares in issue. **Includes 14,955 shares held by Peter Cunningham’s close relative (b) Shares in Rio Tinto plc and Rio Tinto Limited held by connected advisers Name Class of relevant security Shares held Percentage J.P. Morgan Mansart Management Limited Rio Tinto plc 10p ordinary 316,201 0.02% J.P. Morgan Structured Products B.V. Rio Tinto plc 10p ordinary 84,944 0.00% Former employees who are connected advisers for the purpose of the Code Rio Tinto plc 10p ordinary 18,841 0.00% Former employees who are connected advisers for the purpose of the Code Rio Tinto Limited ordinary 57,349 0.01% (c) Shares in Rio Tinto plc and Rio Tinto Limited held by employee benefit trusts of Rio Tinto plc and Rio Tinto Limited. Name Class of relevant security Shares held Percentage UK Share Plan Rio Tinto plc 10p ordinary 188,984 0.01% Rio Tinto plc Canadian EST Rio Tinto plc 10p ordinary 183,605 0.01% Rio Tinto plc ESOT Rio Tinto plc 10p ordinary 512,388 0.04% Rio Tinto Limited EST Rio Tinto Limited ordinary 147,012 0.03% Rio Tinto Limited Canadian EST Rio Tinto Limited ordinary 52,947 0.01% Details of any open stock-settled derivative positions (including traded options), or agreements to purchase or sell relevant securities, should be given on a Supplemental Form 8 (Open Positions). Details of any securities borrowing and lending positions or financial collateral arrangements should be disclosed on a Supplemental Form 8 (SBL).

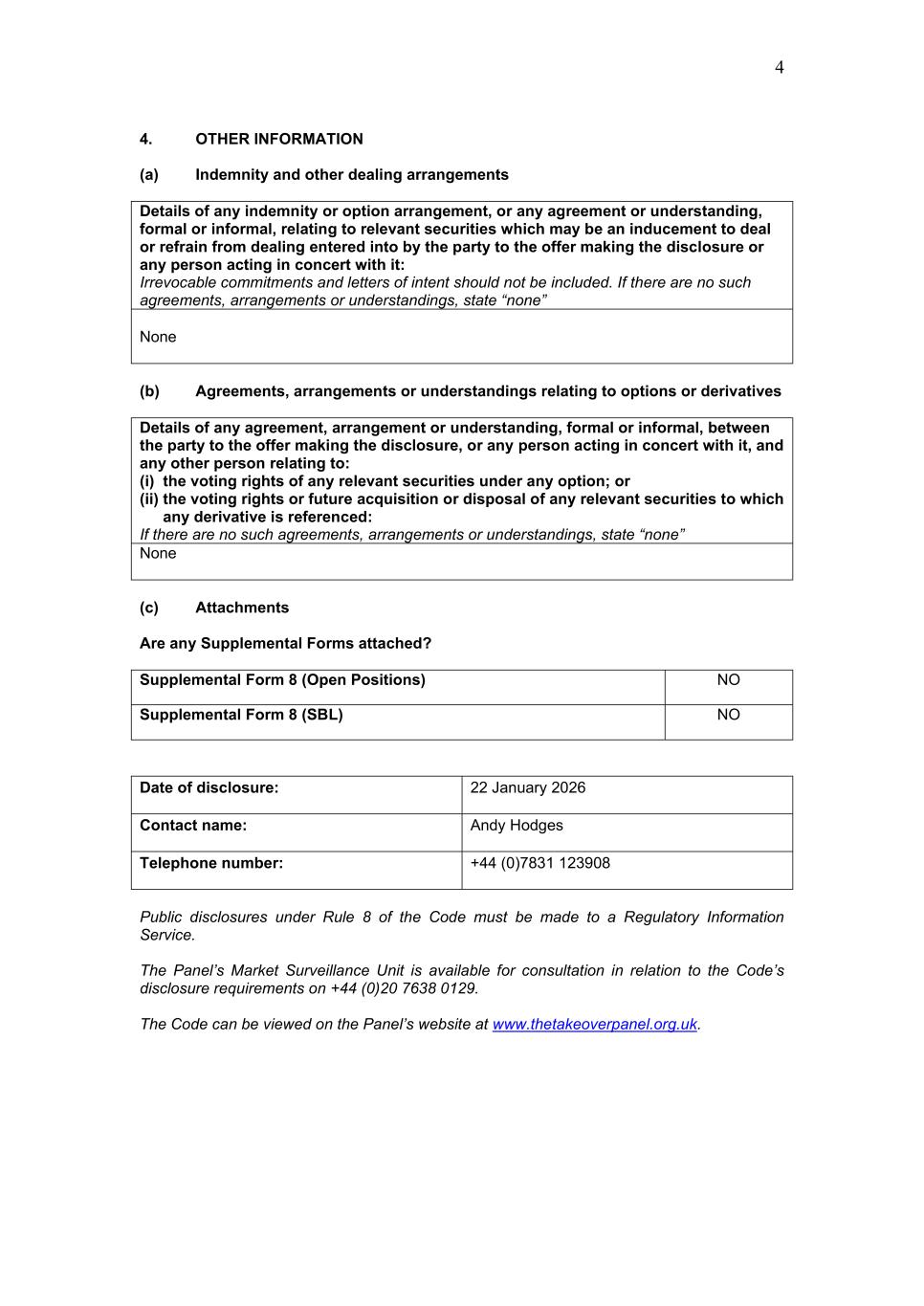

4 4. OTHER INFORMATION (a) Indemnity and other dealing arrangements Details of any indemnity or option arrangement, or any agreement or understanding, formal or informal, relating to relevant securities which may be an inducement to deal or refrain from dealing entered into by the party to the offer making the disclosure or any person acting in concert with it: Irrevocable commitments and letters of intent should not be included. If there are no such agreements, arrangements or understandings, state “none” None (b) Agreements, arrangements or understandings relating to options or derivatives Details of any agreement, arrangement or understanding, formal or informal, between the party to the offer making the disclosure, or any person acting in concert with it, and any other person relating to: (i) the voting rights of any relevant securities under any option; or (ii) the voting rights or future acquisition or disposal of any relevant securities to which any derivative is referenced: If there are no such agreements, arrangements or understandings, state “none” None (c) Attachments Are any Supplemental Forms attached? Supplemental Form 8 (Open Positions) NO Supplemental Form 8 (SBL) NO Date of disclosure: 22 January 2026 Contact name: Andy Hodges Telephone number: +44 (0)7831 123908 Public disclosures under Rule 8 of the Code must be made to a Regulatory Information Service. The Panel’s Market Surveillance Unit is available for consultation in relation to the Code’s disclosure requirements on +44 (0)20 7638 0129. The Code can be viewed on the Panel’s website at www.thetakeoverpanel.org.uk.