Executive Chairman

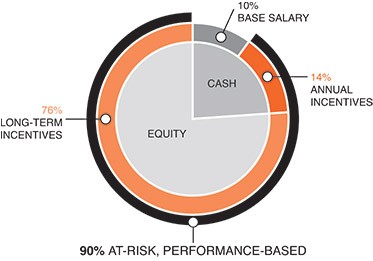

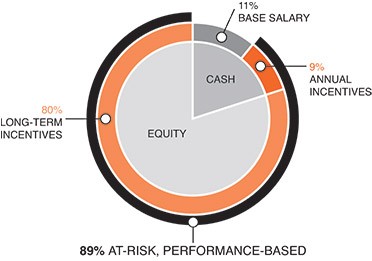

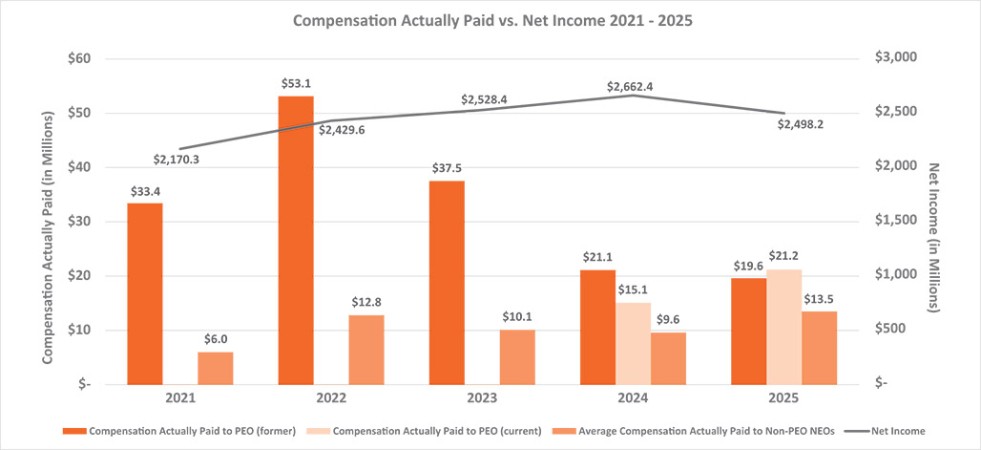

In determining compensation for Mr. Rhodes in his role as Executive Chairman, the Compensation Committee reviewed peer group data and found great variability in Executive Chairman pay, due to each Company’s unique facts and circumstances. The Committee sought to design a compensation structure that incentivized Mr. Rhodes to remain focused on the long-term performance and success of the Company while also acknowledging the significant change in his role. As such, Mr. Rhodes’ compensation is heavily weighted towards long-term, at-risk incentive compensation, with a modest base salary and no annual incentive award opportunity. In addition, the Committee used premium priced stock options for 50% of the award with five-year cliff vesting to further reinforce the importance of long-term growth and sustainability. In October 2024, in light of the successful leadership transition, the Committee reduced Mr. Rhodes’ compensation by 50%.

Other Executive Officers

The Compensation Committee annually reviews and approves base salaries for AutoZone’s remaining executive officers based on recommendations of the President and Chief Executive Officer and considerations of the various factors described above.

The Compensation Committee looked at various factors to determine pay for the most senior executives consisting of the Chief Financial Officer, Chief Operating Officer, Executive Vice President, Merchandising, Marketing and Supply Chain and Senior Vice President, Commercial: demonstrated performance, related experience in the market and with AutoZone, added expectations to play a more significant role in management and direction of their respective areas, and to attract a field of appropriately qualified and experienced leadership candidates for open roles. The Compensation Committee evaluated pay compared to market, considering the defined peer group as well as the S&P500 of related roles.

Transition to chairman

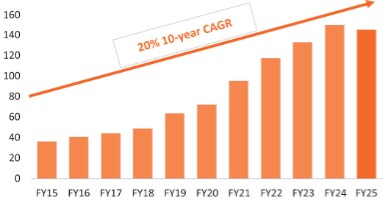

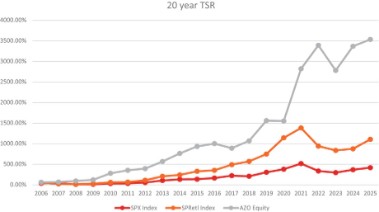

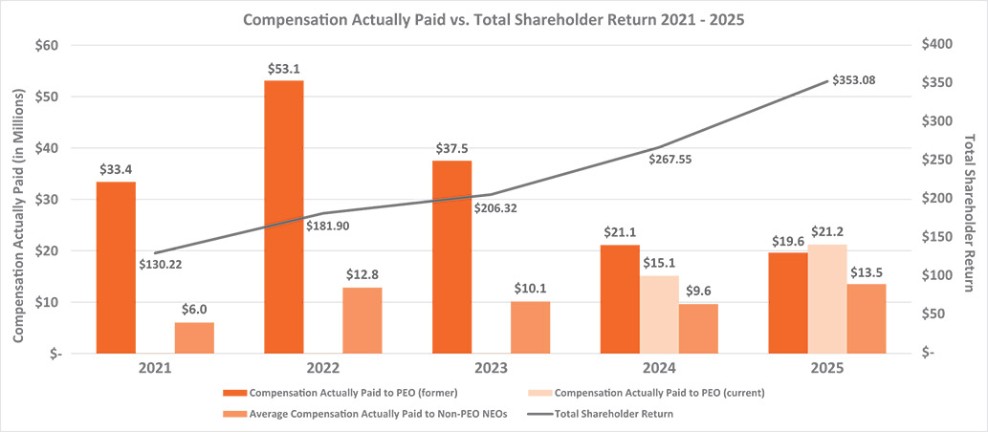

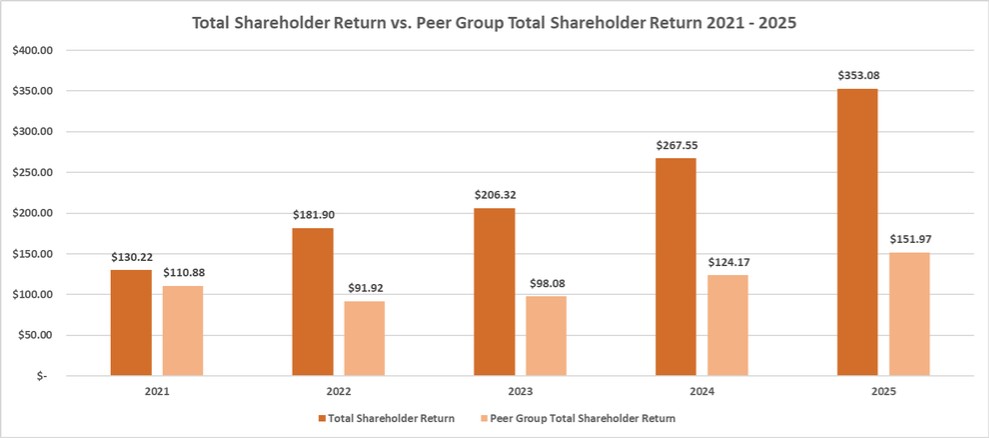

Over the past 20+ years, AutoZone’s success has been driven by a stable, experienced, and strategically aligned leadership team. AutoZone’s executive leadership, among the most tenured in the retail sector, has consistently executed a disciplined growth strategy, enabling the company to expand its footprint, enhance operational efficiency, and deliver long-term value to shareholders.

Mr. Rhodes, who joined AutoZone in 1994 and served as CEO from 2005 to 2024, played a pivotal role in shaping the company’s strategic direction. Under his leadership, AutoZone expanded its domestic and international footprint, strengthened its supply chain, and delivered consistent shareholder value. In 2024, Rhodes transitioned to the role of Executive Chairman, continuing to provide strategic oversight.

Mr. Daniele, who became CEO in 2024, has held numerous leadership roles across store operations, merchandising, supply chain, and commercial since joining the company in 1993. This deep institutional knowledge has been critical in navigating the complexities of a dynamic retail environment, including supply chain disruptions, evolving customer expectations, and technological advancements.

Each executive leader at AutoZone has brought focused expertise to their domain, whether in strategic direction, operational execution, or commercial growth. This structure has enabled AutoZone to remain resilient during periods of industry volatility and macroeconomic uncertainty. The company’s investment in leadership development and succession planning has further strengthened its ability to adapt and thrive.

The continuity of leadership has been a cornerstone of AutoZone’s success. The recent CEO transition reflects that enduring strength. Mr. Daniele has demonstrated exceptional leadership since assuming the role of CEO, building on decades of experience within the company and earning the trust of both the board and the broader AutoZone team. Supported by a seasoned and deeply knowledgeable executive team, Mr. Daniele has shown a clear vision for the future while honoring the company’s core values and operational excellence. With this strong foundation in place, now is the time for Mr. Rhodes to transition to the role of Chairman. His continued presence ensures strategic continuity and preserves the institutional knowledge that has guided AutoZone through the years of growth.

indicates Committee Chairperson

indicates Committee Chairperson