TELUS Corporation

Annual Information Form for the year ended

December 31, 2025

February 12, 2026

.3

Annual Information Form for the year ended December 31, 2025, dated February 12, 2026

[previously filed on SEDAR]

TELUS Corporation

Annual Information Form for the year ended

December 31, 2025

February 12, 2026

1. | CAUTION REGARDING FORWARD-LOOKING STATEMENTS |

The terms TELUS, the Company, we, us and our refer to TELUS Corporation and, where the context of the narrative permits or requires, its subsidiaries.

This document contains forward-looking statements about expected events and our financial and operating performance. Forward-looking statements include any statements that do not refer to historical facts. They include, but are not limited to, statements relating to our objectives and our strategies to achieve those objectives, our expectations regarding trends in the telecommunications industry (including demand for data and ongoing subscriber base growth), our expectations regarding growth in different areas of our business and regarding the nature, timing and benefits of our asset monetization and deleveraging plans, and our financing plans (including our targeted dividend payments). Forward-looking statements are typically identified by the words assumption, goal, guidance, objective, outlook, strategy, target and other similar expressions, or verbs such as aim, anticipate, believe, could, expect, intend, may, plan, predict, seek, should, strive and will. These statements are made pursuant to the “safe harbour” provisions of applicable securities laws in Canada and the United States Private Securities Litigation Reform Act of 1995.

By their nature, forward-looking statements are subject to inherent risks and uncertainties and are based on assumptions, including assumptions about future economic conditions and courses of action. These assumptions may ultimately prove to have been inaccurate and, as a result, our actual results or other events may differ materially from expectations expressed in, or implied by, the forward-looking statements.

These risks and the assumptions underlying our forward-looking statements are described in additional detail in Section 9 General trends, outlook and assumptions, and regulatory developments and proceedings and Section 10 Risks and risk management in our 2025 Management’s discussion and analysis (MD&A). Those descriptions are incorporated by reference in this cautionary statement but are not intended to be a complete list of the risks that could affect the Company, or of our assumptions.

Risks and uncertainties that could cause actual performance or other events to differ materially from the forward-looking statements made herein and in other TELUS filings include, but are not limited to, the following:

| ● | Regulatory matters. We operate in a number of highly regulated industries and conduct business in many jurisdictions and are therefore subject to a wide variety of laws and regulations domestically and internationally. Policies and approaches advanced by elected officials and regulatory decisions, reviews and other government activity may have strategic, operational and/or financial impacts (including on revenue and free cash flow). |

Risks and uncertainties include:

o | potential changes to our regulatory regime or the outcomes of proceedings, cases or inquiries relating to its application, including, but not limited to, those set out in Section 9.4 Communications industry regulatory developments and proceedings in the MD&A; |

o | our ability to comply with complex and changing regulation of the healthcare, virtual care and medical devices industries in the jurisdictions in which we operate, including as an operator of health clinics; and |

o | our ability to comply with, or facilitate our clients’ compliance with, numerous, complex and sometimes conflicting legal regimes, both domestically and internationally. |

| ● | Competitive environment. Competitor expansion, activity and intensity (pricing, including discounting, bundling), as well as non-traditional competition, disruptive technology and disintermediation, may alter the nature of the markets in which we compete and impact our market share and financial results (including revenue and free cash flow). The reduction in the number of new permanent and temporary residents in Canada may intensify competitive pressure. TELUS Health, TELUS Digital and TELUS Agriculture & Consumer Goods also face intense competition in their respective different markets. |

| ● | Technology. Consumer adoption of alternative technologies and changing customer expectations have the potential to impact our revenue streams and customer churn rates. |

Risks and uncertainties include:

o | disruptive technologies, including software-defined networks in the business market, that may displace or cause us to reprice our existing data services, and self-installed technology solutions; |

2 | 2025 Annual Information Form |

| |

o | any failure to innovate, maintain technological advantages or respond effectively and in a timely manner to changes in technology; |

o | the roll-out, anticipated benefits and efficiencies, and ongoing evolution of wireless broadband technologies and systems; |

o | our reliance on wireless network access agreements, which have facilitated our deployment of mobile technologies; |

o | our expected long-term need to acquire additional spectrum through future spectrum auctions and from third parties to meet growing demand for data, and our ability to utilize spectrum we acquire; |

o | deployment and operation of new fixed broadband network technologies at a reasonable cost and the availability and success of new products and services to be rolled out using such network technologies; and |

o | our deployment of self-learning tools and automation, which may change the way we interact with customers. |

| ● | Security and data protection. Our ability to prevent, detect and identify potential threats and vulnerabilities depends on the effectiveness of our security controls in protecting our infrastructure and operating environment, and our timeliness in responding to attacks and restoring business operations. A successful attack may impede the operations of our network or lead to the unauthorized access to, interception, destruction, use or dissemination of, customer, team member or business information and confidential data. The necessary use of sensitive personal information by our business may expose us to the risk of non-compliance with applicable law in a jurisdiction or compromise perceptions of our brand. |

| ● | Generative AI (GenAI). GenAI exposes us to numerous risks, including risks related to operational reliability, responsible AI usage, data privacy and cybersecurity, the possibility that our use of AI may generate inaccurate or inappropriate content or create negative perceptions among customers, the risk that we may not develop and adopt AI technologies effectively and could fail to achieve improved efficiency through our use of GenAI or that the use of AI could reduce demand for our services, and that regulation could affect future implementation of AI. |

| ● | Climate and the environment. Natural disasters, pandemics, disruptive events and the effects of climate change may impact our operations, customer satisfaction and team member experience. |

Our goals to achieve carbon neutrality and reduce our greenhouse gas (GHG) emissions in our operations are subject to our ability to identify, procure and implement solutions that reduce energy consumption and adopt cleaner sources of energy, our ability to identify and make suitable investments in renewable energy, including in the form of virtual power purchase agreements, and our ability to continue to realize significant absolute reductions in energy use and the resulting GHG emissions from our operations.

| ● | Operational performance, business combinations and divestitures, and TELUS Digital privitization. Investments and acquisitions present opportunities to expand our operational scope, but may expose us to new risks. We may be unsuccessful in gaining market traction/share or in integrating acquisitions into our operations within expected timelines or at all, we may not realize the expected benefits of acquisitions, and integration efforts may divert resources from other priorities. There is no assurance that we will realize any or all of the anticipated benefits of the privatization of TELUS International (Cda) Inc. in the timeframe anticipated or at expected cost levels, that we will be able to drive cross-selling opportunities, or that our estimates and expectations in relation to future economic and business conditions and the resulting impact on growth and various financial metrics will prove to be accurate. |

Risks relating to operational performance include:

o | our reliance on third-party cloud-based computing services to deliver our IT services; and |

o | economic, political and other risks associated with doing business globally (including war and other geopolitical developments). |

We may not be able to deliver the service excellence our customers expect or maintain our competitive advantage in this area.

| ● | Our systems and processes. Systems and technology innovation, maintenance and management may impact our IT systems and network reliability, as well as our operating costs. |

Risks and uncertainties include:

o | our ability to maintain customer service and operate our network in the event of human error or human-caused threats, such as cyberattacks and equipment failures that could cause network outages; |

o | technical disruptions and infrastructure breakdowns; |

o | delays and rising costs, including as a result of government restrictions or trade actions; and |

o | the completeness and effectiveness of business continuity and disaster recovery plans and responses. |

|

| December 31, 2025 | 3 |

| ● | Our team. The rapidly evolving and highly competitive nature of our markets and operating environment, along with the globalization and evolving demographic profile of our workforce, and the effectiveness of our internal training, development, succession and health and well-being programs, may impact our ability to attract, develop and retain team members with the skills required to meet the changing needs of our customers and our business. Team members may face greater mental health challenges associated with the significant change initiatives at the organization, which may result in the loss of key team members through short-term and long-term disability and churn. Integration of international business acquisitions and concurrent integration activities may impact operational efficiency, organizational culture and engagement. |

| ● | Suppliers. We may be impacted by supply chain disruptions and lack of resiliency in relation to global or local events. Dependence on a single supplier for products, components, service delivery or support may impact our ability to efficiently meet constantly changing and rising customer expectations while maintaining quality of service. Our suppliers’ ability to maintain and service their product lines could affect the success of upgrades to, and evolution of, technology that we offer. |

| ● | Real estate matters. Real estate investments are exposed to possible financing risks and uncertainty related to future demand, occupancy and rental rates, especially following the pandemic. Future real estate developments may not be completed on budget or on time and may not obtain lease commitments as planned. We may be exposed to the risk of loss in relation to our investments if the business plans of our real estate joint venture developments are not successfully executed. |

| ● | Financing, debt and dividends. Our ability to access funding at optimal pricing may be impacted by general market conditions and changing assessments in the fixed-income and equity capital markets regarding our ability to generate sufficient future cash flow to service our debt. Failure to complete planned deleveraging initiatives or to achieve the anticipated benefits of those initiatives could increase our cost of capital. Our current intention to pay dividends to shareholders could constrain our ability to invest in our operations to support future growth. |

Risks and uncertainties include:

| o | our ability to use equity as a form of consideration in business acquisitions is impacted by stock market valuations of TELUS Common Shares; |

| o | our capital expenditure levels and potential outlays for spectrum licences in auctions or purchases from third parties affect and are affected by: our broadband initiatives; our ongoing deployment of newer mobile technologies; investments in network technology required to comply with laws and regulations relating to the security of cyber systems, including bans on the products and services of certain vendors; investments in network resiliency and reliability; the allocation of resources to acquisitions and future spectrum auctions held by Innovation, Science and Economic Development Canada (ISED). Our capital expenditure levels could be impacted if we do not achieve our targeted operational and financial results or if there are changes to our regulatory environment; and |

| o | lower than planned free cash flow could constrain our ability to invest in operations, reduce leverage or return capital to shareholders. Quarterly dividend decisions are made by our Board of Directors based on our financial position and outlook. There can be no assurance that our dividend growth program will be maintained through 2028 or renewed. |

| ● | Tax matters. Complexity of domestic and foreign tax laws, regulations and reporting requirements that apply to TELUS and our international operating subsidiaries may impact financial results. International acquisitions and expansion of operations heighten our exposure to multiple forms of taxation. |

| ● | The economy. Changing global economic conditions, including a potential recession and varying expectations about inflation, as well as our effectiveness in monitoring and revising growth assumptions and contingency plans, may impact the achievement of our corporate objectives, our financial results (including free cash flow), and our defined benefit pension plans. Geopolitical uncertainties and changes in trade policies and agreements, including tariffs or trade restrictions, could increase our costs, disrupt our supply chains and adversely affect our operations and financial results. They present a risk of recession and may cause customers to reduce or delay discretionary spending, impacting new service purchases or volumes of use, and to consider substitution by lower-priced alternatives. |

| ● | Litigation and legal matters. Complexity of, and compliance with, laws, regulations, commitments and expectations may have a financial and reputational impact. |

Risks include:

o | our ability to defend against existing and potential claims or our ability to negotiate and exercise indemnity rights or other protections in respect of such claims; and |

o | the complexity of legal compliance in domestic and foreign jurisdictions, including compliance with competition, anti-bribery and foreign corrupt practices laws. |

4 | 2025 Annual Information Form |

| |

Additional risks and uncertainties that are not currently known to us or that we currently deem to be immaterial may also have a material adverse effect on our financial position, financial performance, cash flows, business or reputation. Except as otherwise indicated in this document, the forward-looking statements made herein do not reflect the potential impact of any non-recurring or special items or any mergers, acquisitions, dispositions or other business combinations or transactions that may be announced or that may occur after the date of this document.

Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements in this document describe our expectations, and are based on our assumptions, as at the date of this document and are subject to change after this date. We disclaim any intention or obligation to update or revise any forward-looking statements except as required by law.

This cautionary statement qualifies all of the forward-looking statements in this Annual Information Form.

|

| December 31, 2025 | 5 |

2. | TABLE OF CONTENTS |

| | Page reference | ||||

| | | | Incorporated by reference | ||

Item | | Annual | | Management’s | | Financial |

1 CAUTION REGARDING FORWARD-LOOKING STATEMENTS | 2 | 65,78,73 | | |||

2 TABLE OF CONTENTS | | 6 | | | | |

3 CORPORATE STRUCTURE | | | | | | |

3.1 Name, address and incorporation | | 7 | | | | |

3.2 Intercorporate relationships | | 7 | | | | Note 28(b) |

4 GENERAL DEVELOPMENT OF BUSINESS | | | | | | |

4.1 Three-year history | | 8 | | 6,15,16,31,116 | | |

5 DESCRIPTION OF BUSINESS | | | | | | |

5.1 Who we are | | 20 | | | | |

(a) Organization | | 21 | | 31 | | |

(b) Our strategy | | 21 | | 15 | | |

(c) Business overview | | 21 | | 6,20,24,33,39,44,46,65 | | |

(d) Competitive environment | | 21 | | 20,89 | | |

(e) Corporate social responsibility and environment | | 21 | | | | |

(f) Employee relations | | 23 | | 24 | | |

5.2 Risk factors | | 23 | | 78 | | |

5.3 Regulation | | 23 | | 73,84 | | |

6 DIVIDENDS AND DISTRIBUTIONS | | 23 | | 29,55 | | |

7 DESCRIPTION OF CAPITAL STRUCTURE | | | | | | |

7.1 General description of capital structure | | 23 | | 28,73,84 | | |

7.2 Constraints | | 25 | | | | |

7.3 Ratings | | 26 | | 55,58 | | |

8 MARKET FOR SECURITIES | | | | | | |

8.1 Trading price and volume | | 28 | | | | |

8.2 Prior sales | | 28 | | | | Notes 26(b) |

9 DIRECTORS AND OFFICERS | | | | | | |

9.1 Name, occupation and security holding | | 29 | | | | |

9.2 Cease trade orders, bankruptcies, penalties or sanctions | | 30 | | | | |

10 LEGAL PROCEEDINGS AND REGULATORY ACTIONS | | 31 | | 115 | | Note 29(a) |

11 INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | | 31 | | | | |

12 TRANSFER AGENT AND REGISTRAR | | 31 | | | | |

13 MATERIAL CONTRACTS | | 31 | | | | |

14 INTERESTS OF EXPERT | | 32 | | | | |

15 AUDIT COMMITTEE | | 32 | | | | |

16 ADDITIONAL INFORMATION | | 34 | | | | |

APPENDIX A: TERMS OF REFERENCE FOR THE AUDIT COMMITTEE | | 35 | | | | |

1 As filed on SEDAR+ on February 12, 2026

Each Section of the Management’s Discussion and Analysis for the fiscal year ended December 31, 2025 (2025 annual MD&A), referred to in this Annual Information Form (AIF) is incorporated by reference and filed on SEDAR+ at sedarplus.ca. For greater certainty, notwithstanding references to TELUS’ information circular, consolidated financial statements, sustainability and ESG report and the telus.com website, these documents and website are not incorporated into this AIF. In this AIF, except where otherwise indicated, all references to dollars or $ are to Canadian dollars.

6 | 2025 Annual Information Form |

| |

3. | CORPORATE STRUCTURE |

3.1 | Name, address and incorporation |

TELUS was incorporated under the Company Act (British Columbia) (the B.C. Company Act) on October 26, 1998, under the name BCT.TELUS Communications Inc. (BCT). On January 31, 1999, pursuant to a court-approved plan of arrangement under the Canada Business Corporations Act among BCT, BC TELECOM Inc. (BC TELECOM) and the former Alberta-based TELUS Corporation (TC), BCT acquired all of the shares of BC TELECOM and TC in exchange for common shares, and non-voting shares of BCT and BC TELECOM were dissolved. On May 3, 2000, BCT changed its name to TELUS Corporation and in February 2005, the Company transitioned under the Business Corporations Act (British Columbia), successor to the B.C. Company Act. On February 4, 2013, in accordance with the terms of a court approved plan of arrangement under the Business Corporations Act (British Columbia), TELUS exchanged all of its issued and outstanding Non-Voting Shares into Common Shares on a one-for-one basis. On April 16, 2013, TELUS subdivided its Common Shares on a two-for-one basis. On March 17, 2020, TELUS subdivided its issued and outstanding Common Shares on a two-for-one basis. On January 1, 2024, as part of an internal reorganization TELUS Holdings 2023 Inc. amalgamated with TELUS Corporation. On January 1, 2026, as part of an internal reorganization TELUS International (Cda) Inc. transferred its business assets to TELUS Digital (Cda) Inc., and amalgamated with TELUS Corporation.

TELUS maintains its registered office at Floor 5, 510 West Georgia Street, Vancouver, British Columbia (B.C.) and its executive office at Floor 23, 510 West Georgia Street, Vancouver, B.C.

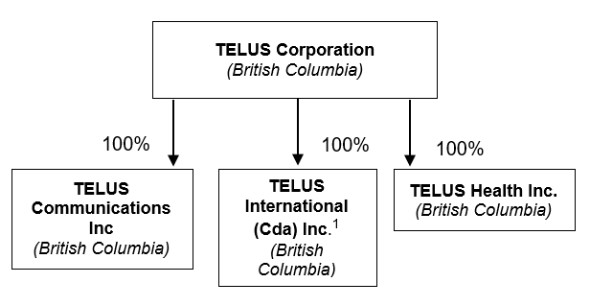

3.2 | Intercorporate relationships and TELUS subsidiaries |

TELUS’ telecommunications businesses are primarily operated through TELUS Communications Inc (TCI). TELUS Health (via TELUS Health Inc.) is enhancing more than 160 million lives across 200 countries and territories through innovative preventive medicine and well-being technologies. TELUS Digital (via TELUS International (Cda) Inc. as at December 31, 2025) is a digital customer experience innovator with a portfolio of integrated capabilities structured around four key service lines: digital solutions, artificial intelligence (AI) and data solutions, trust, safety and security, and customer experience management (CXM).

In February 2021, TELUS International (Cda) Inc. made an initial public offering (IPO) of subordinate voting shares (TI Subordinate Voting Shares); both TELUS Corporation and a TELUS International (Cda) Inc. non-controlling shareholder individually also offered TI Subordinate Voting Shares in conjunction with the IPO. On October 31, 2025, TELUS Corporation acquired all of the issued and outstanding shares in TELUS International (Cda) Inc. that it did not already own, thereby privatizing TELUS International (Cda) Inc.

In the year ended December 31, 2025, TCI, TELUS International (Cda) Inc. and TELUS Health Inc. were the only subsidiaries that owned assets constituting more than 10% of the consolidated assets of TELUS, with TCI and TELUS International (Cda) Inc. generating sales and operating revenues that exceeded 10% of the consolidated sales and operating revenues of TELUS. In addition, all of the assets, sales and operating revenues of TELUS’ other subsidiaries (other than TCI, TELUS International (Cda) Inc. and TELUS Health Inc.), together did not exceed 20% of TELUS’ total consolidated assets or 20% of TELUS’ total consolidated sales and operating revenues as at December 31, 2025.

1 Effective January 1, 2026, as part of an internal reorganization, TELUS International (Cda) Inc. transferred its business assets to wholly-owned subsidiary TELUS Digital (Cda) Inc. (d.b.a. TELUS Digital), and amalgamated with TELUS Corporation.

|

| December 31, 2025 | 7 |

4. | GENERAL DEVELOPMENT OF THE BUSINESS |

4.1 | Three-year history |

During the three-year period ended on December 31, 2025, we continued to advance our national growth strategy, guided by our strategic imperatives.

For a review of the events and conditions that influenced our general development during 2025, and how our business has continued to evolve, please see Section 1.2 - The environment in which we operate, Section 2.2 - Strategic imperatives, as well as progress on our corporate priorities in Section 3 - Corporate priorities and Section 5 – Discussion of operations of our 2025 annual MD&A which sections are hereby incorporated by reference. This AIF also incorporates by reference Section 11 - Definitions and reconciliations of our 2025 annual MD&A.

The following discussion relates to 2023 and 2024 events and conditions.

Strategic imperative: Building national capabilities across data, IP, voice and wireless

In January 2023, we announced a partnership with the University of Windsor to launch a 5G-connected campus and commercial lab to support advanced research with 5G technology and establish the university as a go-to centre for innovation. The collaboration will support multidisciplinary research in the agriculture, advanced manufacturing, and connected and autonomous vehicles sectors.

In February 2023, we announced a new collaboration with Amazon Web Services, Inc. (AWS) to create a new TELUS smart living solution that will use the latest advancements in cloud technologies, Internet of Things (IoT), machine learning and AI to create automation experiences using all of a customer’s connected devices. This smart living solution will reduce the complexity of installing and managing connected home devices and services from multiple vendors, device manufacturers and service providers.

In May 2023, we were named the first North American communications service provider (CSP) to be awarded the “Running on ODA” status by industry association TM Forum, recognizing the progress we are making in our open digital architecture (ODA) and delivery capabilities, using cloud-native, vendor agnostic solutions and TM Forum’s industry standard open application programming interfaces (APIs) to deliver value to customers. We were the fourth CSP globally to gain this recognition. TM Forum is an industry association of over 850 global companies that collaboratively solve complex industry-wide challenges, deploy new services and create technology breakthroughs to accelerate change.

In June 2023, our #StandWithOwners program returned for the fourth consecutive year, championing innovative, growing Canadian businesses. Five owners each received a grand prize valued at over $125,000 in funding, advertising and technology, as well as additional prizes to help their business grow and thrive.

In June 2023, we announced that we had signed an agreement with the École de Technologie Supérieure (ÉTS) and iBwave, a Montreal-based software developer, to stimulate innovation in the construction and telecom industries using 5G technology. The collaboration included the development of a 5G laboratory at ÉTS, serving as a multidisciplinary platform for researchers, students and companies to drive innovation in telecommunications, construction, engineering and architecture through 5G networks.

In June 2023, we announced a strategic partnership with JOLT, an Australian electric vehicle (EV) charging company, to install up to 5,000 public DC fast chargers across Canada, running on the TELUS network. This partnership accelerates the development of critical infrastructure to meet public demand, helping to drive the adoption of EVs and support the reduction of greenhouse gas emissions.

In August 2023, we announced the accelerated deployment of our Smart Building technologies across residential and commercial buildings throughout Canada to help organizations reduce energy consumption and adopt technology solutions that assist them in aligning with net-zero carbon emission mandates.

8 | 2025 Annual Information Form |

| |

During the third quarter of 2023, we became the first telecommunications company in Canada to sign the Voluntary Code of Conduct on the Responsible Development and Management of Advanced Generative AI Systems introduced by Innovation, Science and Economic Development Canada.

In 2023, we were the first company in the world to achieve ISO 31700-1 Privacy by Design certification for our Data for Good program, an award-winning insights platform that gives researchers access to high-quality, strongly de-identified data for projects that support social good.

In October 2023, we announced an agreement with FLO, a leading North American EV charging network operator and a smart charging solutions provider, to bring our connectivity to FLO chargers. FLO will leverage our dedicated IoT network solutions and connectivity platforms in FLO public and commercial Level 2 and DC fast chargers across North America. Our innovative technology is expected to enhance reliability and uptime and increase operational efficiency by providing real-time visibility on at least 60,000 of FLO’s chargers in Canada and the U.S., including the new FLO ultra-fast charger.

In November 2023, we were the successful auction participant for 1,430 spectrum licences in the 3800 MHz spectrum auction. Combined with the spectrum we secured in the 3500 MHz band in 2021, we had secured approximately 100 MHz of prime 5G mid-band spectrum nationally, with contiguity in 96% of the country, including all major markets, at an average price of $0.82 per MHz-pop. This contiguous spectrum provides wider channels and enables a superior network experience for customers.

In November 2023, TELUS and TerreStar Solutions announced the successful use of satellite connectivity to conduct voice calls, and in partnership with Skylo, a global non-terrestrial-network service provider, send text messages between smartphones and connect to IoT devices. This successful trial paves the way to eliminating no-coverage zones and providing ubiquitous connectivity.

In January 2024, we announced a partnership with Ericsson in the deployment of our 5G stand - alone network from coast to coast. Leveraging Ericsson’s 5G core technologies, our 5G stand - alone network enables us to bring customers the most advanced 5G services with functionalities like ultra - low latency and faster speeds that will support the next generation of 5G edge computing and IoT technologies for entire industries and organizations, from autonomous vehicles to enhanced public safety and healthcare technologies.

In February 2024, we partnered with Cisco Systems to launch new 5G capabilities in North America that support IoT use - cases for industry verticals, with a focus on connected cars. This technology will open up pathways to enhancing the driving experience, enabling connected car manufacturers to leverage our wireless network to introduce 5G - enabled telematics, infotainment applications and advanced network services, along with subscription - based Wi - Fi services.

Together with Samsung Electronics Co., Ltd., in February 2024, we announced that we will build Canada’s first commercial virtualized and open radio access network (RAN) - an intelligent, next - generation technology with enhanced performance, flexibility, energy efficiency and automation. With an Open RAN, we are able to use components from different manufacturers that best meet our needs, while a Virtualized RAN allows us to use software instead of hardware. This provides us with faster access to the latest technologies as they become available, helping enhance the customer experience and drive network innovation, while increasing opportunities for equipment vendors.

In February 2024, we announced a collaboration with AWS and Samsung Electronics Co., Ltd. to become the first telecommunications provider in North America to evolve the roaming architecture, in our quest to enable greater reliability and faster speeds for customers travelling abroad. Roaming traffic is generally routed through the service provider’s home country, resulting in slower speeds for customers. With this evolved roaming architecture, traffic no longer needs to go through Canada but will be routed directly to the closest AWS Region worldwide that houses our network through Samsung virtualized roaming gateways, significantly enhancing the speed and responsiveness of mobile services.

In May 2024, we announced the acquisition of Vumetric Cybersecurity, a leading cybersecurity provider specializing in advanced penetration testing that can identify cyber vulnerabilities and threats to companies across Canada and North America. This acquisition bolsters our suite of privacy, security and compliance offerings, complementing our comprehensive portfolio of cybersecurity services and capabilities and decades of experience, reinforcing the security posture of organizations, helping them be resilient in the face of current and emerging cyber threats.

|

| December 31, 2025 | 9 |

In May 2024, we announced a new customer support tool for telus.com, powered by generative AI (GenAI). The new tool offers fast, easy and intuitive responses to customer queries, for a more convenient and seamless digital experience, in addition to reducing our cost structure. This GenAI customer support tool is the first in the world to be internationally certified in Privacy by Design (ISO 31700 - 1). This international certification underscores our commitment to ensuring the highest standards of privacy and data protection, while continuously innovating to deliver a best - in - class customer experience.

In June 2024, we announced the return of our #StandWithOwners program for the fifth consecutive year with over $1 million in prizing, the largest prize pool to date. The #StandWithOwners program champions innovative, growing Canadian businesses, and this year’s contest saw record engagement with thousands of applications received from across the country - a 61% increase compared to last year. #StandWithOwners winners were announced in October 2024, with 20 outstanding businesses being recognized, including six recipients of a grand prize valued at more than $200,000 in funding, technology and national recognition.

In July 2024, we announced the first step in a multi - year strategic partnership with WestJet that will transform the inflight experience for WestJet guests by providing fast and free internet onboard WestJet aircraft, sponsored by TELUS.

In August 2024, we announced our membership in the National Institute of Standards and Technology’s U.S. AI Safety Institute Consortium to support the development and deployment of trustworthy and safe AI, making us the first Canadian telecom company to join. Our participation highlights our commitment to responsible AI, ensuring that AI is developed and deployed in a trustworthy, ethical manner that is safe and benefits everyone.

In September 2024, we launched SmartEnergy, which can help Canadians to manage and control their home energy usage. With the SmartHome+ app, subscribers can optimize their connected smart devices to save money on their energy bills, support their community power grids by joining energy - saving events, and reduce their environmental footprint through various initiatives, including the planting of a tree each quarter on their behalf.

In October 2024, Mobile Klinik announced a collaboration with Apkudo to use its circular industry platform, which will transform our device repair and refurbishment processes. Apkudo’s automation technology will help us streamline device testing and grading, reduce operational risks, scale operations, and ensure that every refurbished certified pre - owned device meets our rigorous standards, offering our customers more transparency around the life cycle of their device.

In October 2024, we announced the successful completion of our multi - year data modernization journey in collaboration with Google Cloud and Onix. We were able to move enterprise data from fragmented, on - premises data sources to a unified cloud - based self - serve analysis platform. This program significantly improves data access, reliability and usability, opening a path for advanced AI capabilities across our operations, reductions in energy consumption, and faster delivery of more personalized customer solutions.

In October 2024, we announced a collaboration with Photonic Inc. to accelerate the development of next - generation quantum communications in Canada. Photonic will have dedicated access to our fibre - optic network, configured to test increasingly complex quantum networking that leverages quantum encryption for ultra - secure, tamper - evident transfer of information over long distances. This will enable the testing of quantum technologies and emerging solutions that can reshape the Canadian digital landscape, improve productivity and drive economic growth.

In November 2024, we announced that we are now offering TELUS PureFibre internet to residents in Ontario and parts of Quebec. This gives more Canadians access to exclusive bundling options with TELUS Mobility, SmartHome security and Stream+ services.

Strategic imperative: Providing integrated solutions that differentiate TELUS from our competitors

In 2023, we completed copper retirement initiatives in multiple targeted central offices and sites, which are aligned with unlocking the significant value in real estate monetization and optimization.

In 2023, we continued to invest in our leading-edge broadband technology.

| ● | At December 31, 2023, our 4G LTE technology covered 99% of Canada’s population and our LTE advanced technology covered approximately 95% of Canada’s population. Our 5G network connected more than 31.6 million Canadians, representing approximately 86% of Canada’s population at December 31, 2023. |

10 | 2025 Annual Information Form |

| |

| ● | As at December 31, 2023, we had connected approximately 3.2 million households and businesses in B.C., Alberta and Eastern Quebec with fibre-optic cable, which provides immediate access to our fibre-optic infrastructure. |

In November 2023, we released our fifth annual Indigenous Reconciliation and Connectivity Report, detailing our progress on the reconciliation commitments in our 2021 Indigenous Reconciliation Action Plan (IRAP) and announcing a new commitment to incorporate Indigenous perspectives into our data ethics and AI strategy.

For our leadership in economic reconciliation, in November 2023, we were honoured to be a recipient of the Indigenomics 10 to Watch award, presented by the Indigenomics Institute.

We were recognized by Mediacorp Canada Inc. during 2023 as one of Canada’s Top Employers for Young People (2023) in January, Canada’s Best Diversity Employers (2023) in March 2023 and Canada’s Greenest Employers (2023) in April 2023.

Throughout 2024, we completed copper retirement initiatives in multiple central offices. These initiatives are aligned with our real estate development plans. We expect to continue these initiatives as we develop a mix of real estate assets, and further monetizing copper through our active decommissioning program, while also realizing the operational benefits of fibre.

In 2024, we continued to invest in our leading - edge broadband technology.

| ● | At December 31, 2024, our 4G LTE technology covered 99% of Canada’s population and our LTE advanced technology covered approximately 95% of Canada’s population. Our 5G network connected approximately 32.3 million Canadians, representing more than 87% of Canada’s population at December 31, 2024. |

| ● | As at December 31, 2024, we had connected more than 3.4 million households and businesses in B.C., Alberta and Eastern Quebec with fibre - optic cable. |

In October 2024, Forbes named us one of its 2024 World’s Best Employers, the only Canadian telecommunications company included in this ranking.

In November 2024, we released our sixth annual Indigenous Reconciliation and Connectivity Report, with concrete examples of the ways our acts of reconciliation, in close partnership with Indigenous communities, are helping deliver sustained, positive social, cultural and economic outcomes that reach far beyond connectivity.

We were recognized by Mediacorp Canada Inc. during 2024 as one of Canada’s Top Employers for Young People (2024) in January 2024, one of Canada’s Best Diversity Employers (2024) in March 2024 and one of Canada’s Greenest Employers (2024) in April 2024.

Strategic imperative: Partnering, acquiring and divesting to accelerate the implementation of our strategy and focus our resources on core business

TELUS Digital closed its acquisition of WillowTree in January 2023, now rebranded as WillowTree, a TELUS Digital Experience Company. WillowTree, a full-service digital product provider that is focused on end-user experiences, brings key tech talent and capabilities to TELUS Digital’s portfolio of next generation solutions, and further augments its digital consulting and innovative client-centric software development capabilities.

During the second quarter of 2023, TELUS Digital expanded its global operations to South Africa and Morocco, fulfilling near-term client demand for greater diversification in offshore and nearshore delivery capabilities, with additional growth expected in the region over the longer term. In the fourth quarter of 2023, TELUS Digital announced the official opening of its site in Casablanca, Morocco, designed with numerous sustainable features and constructed to multiple green certification standards.

In October 2023, TELUS Digital announced the launch of Fuel iX to deliver end-to-end customer experience (CX) innovation. Fuel iX brings together the full spectrum of intelligent experiences across customer, digital, voice, user, employee and human experience.

In November 2023, TELUS Digital announced it had partnered with Five9 to launch the next evolution of the Five9 Intelligent CS Platform, an end-to-end contact-centre-as-a service (CCaaS) solution.

|

| December 31, 2025 | 11 |

In January 2023, the Canadian Centre for Agricultural Wellbeing welcomed us as its exclusive provider for mental health services. These services help break down barriers to mental health support for farmers who may not have considered reaching out for help before, such as when experiencing catastrophic events, as well as for farmers who do not have access to provincial and federal programming.

In March 2023, we announced a collaboration with Beneva to expand its group insurance offering, namely its employee assistance program. This collaboration enables Beneva to enhance the customer experience of its plan sponsors and members across the country by expanding the type of care and assistance they can access to improve their mental, physical and financial health.

In April 2023, we brought virtual veterinary care to dogs and cats in Ontario with TELUS Health MyPet. This follows the initial launch of TELUS Health MyPet in B.C. in August 2022.

In May 2023, we launched Total Mental Health for organizations across Canada and the United States. This digital-first solution provides employees with access to a team of care professionals who curate personal care journeys with unlimited mental health counselling, therapist-led internet-based cognitive behavioural therapy (iCBT) programs, digital tools, assessments, and ongoing tracking and feedback that is accessible by employees through their company’s health benefits.

In July 2023, we launched TELUS Health Wellbeing in the U.K. to provide working individuals with personalized and flexible workplace health benefits plans.

On August 31, 2023, we completed the rebrand of LifeWorks to TELUS Health. This transformation marked one of the largest rebrands in TELUS’ history as we embark on our journey as a unified global brand.

In October 2023, we announced our collaboration with Mindyra Health to increase mental health accessibility and affordability for students, athletes, employees and their dependents across the United States. Through this collaboration, individuals receive the support they need via tele-counselling services with experienced healthcare professionals.

In October 2023, Healix announced the delivery of mental health services to support clients’ employees whenever they travel for business via experienced counsellors from TELUS Health. The service provides confidential mental health support 24/7 in times of crisis to support their mental well-being wherever they are in the world.

In November 2023, we launched our next-generation medical alert system to support aging in place across Canada. Our new TELUS Health Medical Alert Pendant comes with a connected Caregiver app that offers advanced GPS enabled location tracking and 24/7 access to live emergency support.

In the third quarter of 2023, we harmonized 11 acquired legacy TELUS Agriculture & Consumer Goods brands for a consolidated go-to-market strategy under the TELUS umbrella. This digital-first approach will enable an optimized, efficient path to capitalize on market opportunities.

In October 2023, Decisive Farming by TELUS Agriculture announced a new partnership with GrainFox to bring more digital grain trade and sell options to Canadian farmers, providing technology-based solutions to support the ongoing transformation of agriculture in Canada. GrainFox, a provider of digital agricultural and financial tools, delivers personalized, data-driven insights to farmers through a mobile or desktop interface.

In the third and fourth quarters of 2023, we celebrated notable customer wins and renewals that resulted in the highest annual sales in the consumer goods business since inception of TELUS Agriculture & Consumer Goods.

In April 2024, TELUS Digital announced the Fuel iXTM beta launch of two solution layers: Fuel iX Core and Fuel iX Apps, as part of the ongoing growth and refinement of TELUS Digital’s enterprise - grade AI engine. Fuel iX helps clients advance their GenAI pilots into production at scale, securely and safely, with access to more than 100 large language models and the ability to change models after launch.

In July 2024, TELUS Digital launched Fuel iX EX, an enterprise - safe GenAI employee assistant that supports productivity, creativity and research. Fuel iX EX offers companies a single point of entry where their employees can access an intuitive GenAI

12 | 2025 Annual Information Form |

| |

interface and select from more than 20 large language models from multiple vendors to help them with everyday tasks, including knowledge searches, summarization, copywriting, image generation and code writing.

In August 2024, TELUS Digital unveiled TELUS Expert Messaging, a GenAI asynchronous messaging solution for the My TELUS app that eliminates wait times associated with conventional phone and live chat queues. This lets TELUS customers access human support whenever it is convenient for them, 24/7, by sending a message from their mobile device and receiving a notification when an expert has responded, often resolving their inquiry in a single message.

In September 2024, the global rebrand from TELUS International to TELUS Digital was completed. The new name reflects TELUS Digital’s commitment to providing a digital - first experience across every service it delivers to clients, ensuring a seamless integration of digital, AI - powered and human interactions that optimize

In February 2024, we extended our TELUS Health Wellbeing solution to organizations in Australia. TELUS Health Wellbeing allows meaningful engagement with employees to educate and inspire them to make positive behavioural changes for improved health. This includes health assessments and personalized challenges, as well as recommendations to enhance decision making for better overall health.

In March 2024, we announced that we had been selected by Ontario Health to provide a remote care management (RCM) solution for Ontario. This RCM solution will equip healthcare practitioners with resources and tools for actively monitoring patients from a distance over time, resulting in early detection and quick intervention, fewer hospital admissions and improved outcomes.

In May 2024, we announced a collaboration with Anxiety Canada, a registered charity dedicated to destigmatizing anxiety and its related disorders. This is enabling people across Canada to access virtual counselling sessions through the TELUS Health MyCare app, managing anxiety to help them live the lives they want.

In June 2024, we announced a collaboration with Kits Eyecare Ltd. (KITS) to offer direct billing for 38 insurance companies covering over 70% of Canadians. At that time, KITS offered the widest direct billing coverage in Canada for the optical category.

In the second quarter of 2024, we acquired a leading provider of employee and family assistance programs (EFAP) and well - being services in Latin America. This added significantly to our client base and our capacity to deliver Spanish language services in Latin American markets.

In July 2024, we announced a collaboration with Nova Scotia Health to enable residents of Nova Scotia with access to their primary care information through the YourHealthNS app. This data interoperability initiative is the first large - scale effort in Canada to standardize and connect primary care data and empowers people in Nova Scotia to better manage their health and improve health outcomes.

In November 2024, we announced the opening of a new public health primary care clinic in the heart of Toronto accepting up to 6,000 new patients and planning to expand in the future. The TELUS Health MyCare Union clinic combines virtual healthcare technology with traditional in - person care, which improves access to care and demonstrates that the adoption of technology supports both the patient and the physician.

In the second half of 2024, we acquired international digital health and well - being providers, and EFAP providers. These business acquisitions expanded our global footprint in the Americas, Europe and Asia - Pacific.

In the first quarter of 2024, we completed the acquisition of Proagrica, a global provider of agronomic and business data solutions across the agricultural supply chain. The acquisition adds diversity and strength to our talent and expertise, supporting our delivery of customer - centric solutions across the agricultural ecosystem, enhancing the customer digitization journey, improving data connectivity and generating data - based insights.

During the first quarter of 2024, our animal agriculture business rolled out the new TELUS Feedlot record management solution in Canada. This helps our clients by collecting data that supports more informed recommendations for cost - effective animal health strategies.

|

| December 31, 2025 | 13 |

In the second quarter of 2024, we acquired a cattle health and production consulting company, solidifying our position as a world - leading provider of feedlot data analytics and insights, and onboarding more feedlot clients to leverage our investments in digital solutions.

Strategic imperative: Focusing relentlessly on the growth markets of data, IP and wireless

TELUS technology solutions (including TELUS Health for the years 2023 and 2024) (TTech) service revenues increased by $1,330 million or 10.0% in 2023. Our main drivers of growth included: (i) growth in health services revenues driven by business acquisitions, including our acquisition of LifeWorks on September 1, 2022, as well as organic growth; (ii) higher mobile network revenues, including growth in our mobile phone subscriber bases, in addition to increased mobile phone ARPU; and (iii) an increase in fixed data service revenues resulting from subscriber growth and higher, albeit moderating, revenue per internet customer. These were partly offset by technological substitution driving declines in TV and legacy voice margins, as well as lower agriculture and consumer goods margins as a result of transient headwinds and macroeconomic challenges.

TTech fixed data services revenues increased by $232 million or 5.3% in 2023. The increase was driven primarily by growth in our internet, security, and TV subscribers, reflecting respective increases of 8.8%, 8.0%, and 5.2% during the year, and higher revenue per internet customer as a result of internet speed updates and rate changes. This growth was partially offset by lower TV revenues, reflecting an increased mix of customers selecting smaller TV combination packages and technological substitution, and the ongoing decline in legacy data service revenues.

TTech mobile network revenue increased by $336 million or 5.1% in 2023, generated from increases in our mobile subscriber base, including growth of IoT connections, supported by roaming improvements resulting from increased international travel volumes. These impacts were partly offset by (i) lower overage revenues as customers continued to adopt larger or unlimited data and voice allotments in their rate plans; (ii) the impact of the competitive environment that put pressure on base rate plan prices; and (iii) a greater uptake of family discounts and bundling credits.

TTech health service revenues increased by $792 million or 86.7% in 2023, driven by: (i) our acquisition of LifeWorks on September 1, 2022; (ii) higher revenues as a result of the continued adoption of our virtual solutions, inclusive of organic growth in demand for our integrated health, productivity, retirement and benefit solutions; (ii) the continued adoption of our virtual care solutions; and (iii) increased pharmacy management software revenue.

Our digital and customer experience (TELUS Digital) operating revenues increased by $222 million or 8.3% in 2023. This was attributable to growth in our tech and games clients, eCommerce, fintech and other industry vertical clients, arising from additional services provided to existing accounts and the onboarding of new clients, including those gained from the acquisition of WillowTree on January 3, 2023. The strengthening of the U.S. dollar against the Canadian dollar resulted in a favourable foreign currency impact on TELUS Digital operating results, partially offset by the weakening European euro and related unfavourable foreign currency impact on our European euro - denominated operating results.

TELUS consolidated service revenues increased by $1,552 million or 9.7% in 2023, which exemplified our commitment to a highly differentiated and potent asset mix geared towards high - growth, technology - oriented verticals. The acquisition of WillowTree on January 3, 2023, enabled our further expansion as a full - service digital product provider. This brought key talent and capabilities to TELUS Digital’s portfolio of next - generation solutions, while also enhancing our digital consulting and revenue - generating capabilities. In addition, the acquisition of LifeWorks in 2022 has allowed for continued innovation and market share growth through our solid financial backing, along with significant cross - selling synergies. Lastly, our continued advanced capital investments in our fibre build and 5G coverage, as well as other capital investments which enable us to support continuing subscriber growth, deliver on our digitization strategy and drive product enhancements, will bolster top - line revenue growth and enhance our strong competitive positioning.

TTech service revenues increased by $240 million in 2024. Our main drivers included: (i) an increase in fixed data service revenues resulting from internet, security and TV subscriber growth. These factors were partially offset by lower revenue per TV customer; (ii) largely due to growth in our mobile phone subscriber base and an increase in IoT connections, partially offset by lower mobile phone ARPU; (iii) growth in health services revenues driven by business acquisitions, as well as organic growth; and (iv) higher agriculture and consumer goods margins primarily attributable to business acquisitions and improved organic growth in consumer goods services. These were partly offset by technological substitution and price plan changes driving declines in legacy voice margins.

14 | 2025 Annual Information Form |

| |

TTech fixed data services revenues increased by $105 million or 2.3% in 2024. The increase in fixed data service revenues resulting from internet and security subscriber growth, reflecting respective increases of 5.1% and 6.1% during the year. These factors were partially offset by lower TV revenue per customer, reflecting an increase in the mix of customers selecting smaller TV combination packages and technological substitution, and lower security revenue per customer, reflecting an increase in the demand for inherently lower - ARPU home automation services.

TTech mobile network revenue increased by $77 million or 1.1% in 2024, largely due to growth in our mobile phone subscriber base and an increase in IoT connections, partially offset by lower mobile phone ARPU due to the impact of the competitive environment putting pressure on base rate plan prices.

TELUS Health service revenues increased by $74 million or 4.3% in 2024, driven by business acquisitions related to employee and family assistance programs and organic growth, pharmacy upgrades, virtual pharmacy sales, and an increase in the demand for health benefits management services and retirement benefits solutions.

TELUS Digital operating revenues decreased by $167 million or 5.8% in 2024. This was attributable to (i) lower revenues from a leading social media client and other technology clients; and (ii) a reduction in revenue in other industry verticals, notably among communications (excluding the TTech segment) and eCommerce clients. These decreases were partially offset by: (i) growth in services provided to certain existing clients; (ii) new clients added since the prior year; and (iii) the strengthening of both the U.S. dollar and the European euro against the Canadian dollar, which resulted in a favourable foreign currency impact on our TELUS Digital operating results.

TELUS consolidated service revenues increased by $73 million or 0.4% in 2024, which exemplified our commitment to a highly differentiated and potent asset mix geared towards high - growth, technology - oriented verticals, despite a challenging mobile competitive environment.

Strategic imperative: Going to market as one team under a common brand, executing a single strategy

Throughout 2023, we continued to leverage our Connecting for Good programs to support marginalized individuals by enhancing their access to both technology and healthcare, as well as our TELUS Wise program to improve digital literacy and online safety knowledge. Since the launch of these programs, they have provided support for over 1.1 million individuals to the end of 2023.

| ● | During 2023, we welcomed 8,500 new households to our Internet for Good program. Since we launched the program in 2016, we have connected over 55,000 households and 175,000 low-income family members and seniors, persons in need who are living with disabilities, government-assisted refugees and youth leaving foster care with low-cost internet service to the end of 2023. |

| ● | Our Mobility for Good program offers free or low-cost smartphones and mobile phone rate plans to all youth aging out of foster care and to qualifying low-income seniors across Canada. During 2023, we added 8,600 youth and seniors, as well as Indigenous women at risk of or surviving violence, government-assisted refugees and other marginalized individuals to the program. |

| o | In June 2023, we expanded the reach of our Internet for Good and Mobility for Good programs to help government-assisted refugees arriving in Canada get connected. Partnering with 15 resettlement assistance program service provider organizations across the country and growing, Mobility for Good for government-assisted refugees offers a free smartphone and low-cost data plan while Internet for Good for government-assisted refugees offers low-cost high-speed internet service. We have provided support to over 6,200 government assisted refugees and their family members through these programs to the end of 2023. |

| o | Since launching our Mobility for Good for Indigenous Women at Risk program in 2021, we have supported 2,700 women to the end of 2023. |

| ● | Our Health for Good mobile health clinics facilitated more than 56,000 patient visits during 2023. Since the program’s inception, we have accommodated 200,000 cumulative patient visits in 25 communities across Canada to the end of 2023, bringing primary and mental healthcare to individuals experiencing homelessness. |

| o | In March 2023, we expanded our Health for Good program to support women and caregivers in need of mental health services by providing free access to TELUS Health MyCare counselling services. Partnering with three charitable organizations, in 2023 we provided 900 free counselling sessions to women and caregivers in need in British Columbia, Alberta, Saskatchewan and Ontario. |

|

| December 31, 2025 | 15 |

| o | In April 2023, we partnered with Old Brewery Mission to launch a new mobile health clinic in Montreal. The Old Brewery Mission Mobile Health Clinic, powered by TELUS Health, is helping marginalized Montreal residents and communities with access to free healthcare services, as well as social and housing-related support. |

| o | In July 2023, we launched a second mobile health clinic in Victoria in partnership with Victoria Cool Aid Society to address the growing need for primary healthcare and provide support for people experiencing homelessness. |

| ● | During 2023, our Tech for Good program provided access to personalized one-on-one training, support and customized recommendations on mobile devices and related assistive technology and/or access to discounted mobile plans for over 2,300 Canadians living with disabilities, helping them improve their independence and quality of life. Since the program’s inception in 2017, we have supported 8,800 individuals in Canada who are living with disabilities through the program and/or the TELUS Wireless Accessibility Discount to the end of 2023. |

| ● | In 2023, 116,500 individuals in Canada and around the world participated in virtual TELUS Wise workshops and events to improve digital literacy and online safety, bringing total cumulative participation to 680,000 individuals to the end of 2023 since the program launched in 2013. |

| o | In October 2023, we celebrated 10 years of TELUS Wise with the launch of a new TELUS Wise responsible AI online workshop for youth. |

In 2023, the TELUS Friendly Future Foundation (the Foundation) and Canadian TELUS Community Boards continued to direct all of their funding to charitable initiatives, including the TELUS Student Bursary for post-secondary students facing financial barriers. In 2023, the Foundation supported two million youth by granting $11 million, including $2 million in bursaries, to 550 charitable and community organizations. Since its inception in 2018, the Foundation has provided $47 million in cash donations to our communities, helping 15 million youth reach their full potential to the end of 2023.

| ● | In February 2023, the Foundation launched its Livable Communities for our Youth Challenge, providing funding to improve the lives of youth by connecting innovative entrepreneurs to Canadian charities. |

| ● | In October 2023, the Foundation launched the TELUS Student Bursary, Canada’s largest bursary fund, supporting students. With bursaries valued at up to $5,000, this new $50 million fund, established through an endowment gift of $25 million from TELUS and a commitment of $25 million in fundraising from the Foundation, will help hundreds of students each year access post-secondary education leading to a brighter future. Each bursary recipient will also have access to free mobility and low-cost internet service plans through our Mobility for Good and Internet for Good programs. At the start of the 2023 - 2024 school year in September, the Foundation awarded its first round of bursaries to more than 400 students across the country. |

Our Canadian and global TELUS Community Boards entrust local leaders to make recommendations on the allocation of grants in their communities. These grants support registered charities that offer health, education or technology programs to help youth thrive. Since 2005, our 19 TELUS Community Boards have directed $107 million in cash donations to more than 9,600 initiatives, providing resources and support for underserved citizens, especially young people, around the world to the end of 2023.

| ● | During the third quarter of 2023, we announced the expansion of five TELUS Community Boards in Alberta and Ontario, which are now providing support for millions of citizens in Alberta and Ontario. |

In May 2023, our 18th annual TELUS Days of Giving inspired more than 80,000 TELUS team members, retirees, family and friends in 260 communities, across 32 countries to volunteer, contributing to 1.5 million hours of service globally in 2023.

In November 2023, we added two new clubs in North Carolina to the TELUS Community Ambassadors program, bringing together over 5,000 current and retired team members across 25 clubs to volunteer in their local communities.

During 2023, TELUS, our team members, customers and the Foundation have provided $12.6 million, in cash donations and in-kind contributions to support 22 humanitarian and disaster relief efforts in Canada and around the world. Our efforts in 2023 included supporting those impacted by unprecedented wildfires and hurricanes in Canada and earthquakes in Türkiye, Syria and Morocco.

TELUS Indigenous Communities Fund offers grants for Indigenous-led social, health and community programs. In July 2023, we announced a doubling of our commitment to the Fund, over the next five years. Since its inception in November 2021, the Fund has distributed $575,000 in cash donations to 29 community programs supporting food security, education, cultural and linguistic revitalization, wildfire relief efforts, and the health, mental health and well-being of Indigenous Peoples across Canada to the end of 2023.

16 | 2025 Annual Information Form |

| |

TELUS Pollinator Fund for Good made multiple equity investments during 2023. These included: Flash Forest, a Canadian reforestation company with a mission to plant one billion trees; three new clean technology startups - Climate Robotics, erthos and Plentify - to strengthen climate resilience with agricultural technologies sequestering carbon, plant-powered alternatives to plastic and cleaner energy solutions; and Dryad, a German startup that provides ultra-early wildfire detection through large-scale IoT networks and sensors to reduce the risk of fires spreading out of control. Since its inception in 2020, the Fund has invested in 30 socially innovative companies, with 40% led by women and 50% led by Indigenous or racialized founders to the end of 2023.

| ● | During the first quarter of 2023, the Fund was named Funder of the Year at the 2023 B.C. Cleantech Awards for supporting cleantech ventures as they grow and scale. |

During 2023, we received recognition for our global leadership in sustainability, corporate citizenship, social purpose, and environmental and social reporting, including:

| ● | In January 2023, we were included in the Corporate Knights 2023 Global 100 Most Sustainable Corporations in the World as the top North American telecommunications company, ranking 37th overall; this was the 11th time we have been included since inception of the recognition in 2005. Additionally, in June 2023, we were named to the Corporate Knights Best 50 Corporate Citizens in Canada for the 17th time, ranking in the top 10 and as the highest among the telecom industry in Canada. |

| ● | In May 2023, we received the Mercure award for Sustainable Development Strategy in the Large Corporation category as part of the 2023 Mercuriades Awards, which celebrate the innovation, ambition, entrepreneurship and performance of Quebec businesses. |

| ● | In May 2023, at the Loyalty360 Awards, we won the platinum award for corporate social responsibility, gold award for brand-to-brand partnerships and bronze award for 360 degree (brand). |

| ● | In December 2023, we were named to the Dow Jones Sustainability North America Index for the 23rd consecutive year. |

In April 2023, we were recognized for the second consecutive year as one of Canada’s top 10 most valuable brands by Brand Finance. In its Canada 100 2023 report, it valued our 2023 brand at $10.3 billion, a $200 million year-over-year increase.

In January 2024, we were recognized as the highest-valued telecom brand in Canada. In Brand Finance’s Global 500 2024 most valuable brands report, it valued our 2024 brand at US$8.6 billion (C$11.5 billion), moving up 37 spots in its ranking, representing our highest third-party brand valuation ever.

In June 2023, we were recognized by Gustavson Brand Trust Index as the most trusted telecom brand in Canada, for the fifth consecutive year.

In June 2023, we won Best Eco-Loyalty Initiative and Best Corporate Social Responsibility (CSR) Initiative for our TELUS Rewards program at the International Loyalty Awards held in London, England.

In October 2023, we ranked fifth in Kantar BrandZ 2023 Most Valuable Canadian Brands.

In November 2023, we released our fifth annual Indigenous Reconciliation and Connectivity Report, detailing our progress on the reconciliation commitments in our 2021 IRAP and announcing a new commitment to incorporate Indigenous perspectives into our data ethics and AI strategy.

For our leadership in economic reconciliation, in November 2023, we were honoured to be a recipient of the Indigenomics 10 to Watch award, presented by the Indigenomics Institute.

Throughout 2024, we continued to leverage our TELUS Connecting for Good programs to support marginalized individuals by enhancing their access to both technology and healthcare, as well as our TELUS Wise program to improve digital literacy and the awareness of online safety knowledge. Since the launch of these programs to the end of 2024, they have provided support for over 1.3 million Canadians.

|

| December 31, 2025 | 17 |

| ● | During 2024, we welcomed over 8,400 new households to our Internet for Good program. Since we launched the program in 2016 through to 2024, we have connected 63,500 households, making low-cost high-speed internet available to 200,000 low-income seniors and members of low-income families, persons with disabilities, government-assisted refugees and youth leaving foster care. |

| ● | Our Mobility for Good program offers free or low-cost smartphones and mobility plans to youth aging out of foster care, low-income seniors and families, across Canada, as well as government-assisted refugees and Indigenous women at risk of, or experiencing violence. During 2024, we added more than 9,500 marginalized individuals to the program. |

| ● | In May 2024, we expanded Mobility for Good to 800,000 eligible low income families that are receiving the maximum Canada Child Benefit. |

| ● | During the second quarter of 2024, we expanded the Mobility for Good for Indigenous Women at Risk program to include the province of Quebec in partnership with Quebec Native Women and Quebec First Nations Women’s Space. Since we launched Mobility for Good for Indigenous Women at Risk in 2021 through to 2024, we have provided support for over 4,200 individuals nationally. |

Our Health for Good mobile health clinics facilitated 60,000 patient visits during 2024. Since the program’s inception in 2014 through to 2024, we have enabled 260,000 cumulative patient visits in 27 communities across Canada, bringing primary and mental healthcare to individuals experiencing homelessness.

| ● | In September 2024, we raised our overall commitment to the TELUS Health for Good program to $16 million through 2027 and launched a new mobile health clinic, bringing primary care and harm reduction services directly to people experiencing homelessness across the B.C. Interior. |

During 2024, our Tech for Good program provided access to personalized assessments, recommendations and training on mobile devices, computers, laptops and related assistive technology and/or access to discounted mobile plans for more than 3,800 Canadians living with disabilities, enabling them to make improvements in their quality of life and independence. Since its inception in 2017, we have provided support for over 12,600 individuals in Canada who are living with disabilities, through the program and/or the TELUS Wireless Accessibility Discount.

During 2024, 120,300 individuals in Canada and around the world participated in virtual TELUS Wise workshops and events to improve their digital literacy and awareness of online safety, bringing the total cumulative number of participants to over 800,000 since the program launched in 2013 to the end of 2024.

As at December 31, 2024, we had 19 TELUS Community Boards, 13 operating in Canada and six internationally. Our Community Boards entrust local leaders to make recommendations on the allocation of grants in their communities. These grants support registered charities that offer health, education or technology programs to help youth. Since 2005, our 19 TELUS Community Boards and the Foundation have supported 34.5 million youth in need across Canada and around the world, by granting more than $135 million in cash donations to 10,600 charitable initiatives.

During the third quarter of 2024, we announced a major milestone in charitable giving in Canada, as the TELUS Community Board program reached a total of $100 million in cash donations to local charities across the country since inception in 2005.

Working in close partnership with the 13 TELUS Community Boards in Canada, the Foundation distributes grants to charities that promote education, health and well-being for youth across the country. In addition, through the TELUS Student Bursary program, the Foundation provides bursaries for post-secondary students who face financial barriers and are committed to making a difference in their communities. During 2024, the Foundation provided support to 1.3 million youth by granting $10.8 million in cash donations and bursaries to more than 550 Canadian registered charities, community partners and projects. Since its inception in 2018 through to 2024, the Foundation has directed $57.6 million in cash donations to our communities and in bursary grants, helping 16.5 million youth reach their full potential.

| ● | In June 2024, the Foundation hosted its inaugural fundraising gala. More than 700 guests attended the event, which raised over $2.5 million to provide support to youth from underserved communities. |

| ● | During the fourth quarter of 2024, the Foundation awarded $2.2 million in bursaries to more than 500 post-secondary students. This is an investment in the future, empowering the next generation of changemakers on their educational path. Since the program’s inception in 2023 through to 2024, the Foundation has awarded bursaries totalling over $4 million to |

18 | 2025 Annual Information Form |

| |

| more than 1,000 students across Canada. For more information about the TELUS Student Bursary program, please visit friendlyfuture.com/bursary. |

The TELUS Indigenous Communities Fund offers grants for Indigenous-led social, health and community programs. In 2024, the Fund allocated $350,000 in cash donations to Indigenous-led organizations across Canada. Since its inception in 2021 through to 2024, the Fund has distributed $935,000 in cash donations to 42 community programs supporting food security, education, cultural and linguistic revitalization, wildfire relief efforts, and the health, mental health and well-being of Indigenous Peoples across Canada.

In 2024, our global TELUS family volunteered 1.5 million hours for the second consecutive year, with more than one million hours volunteered in each of the past eight years.

| ● | In May 2024, our 19th annual TELUS Days of Giving inspired 83,000 TELUS team members, retirees, family and friends to volunteer across 33 countries in support of our local communities, overtaking the record set in the previous year and making this year our most giving year to date. |

In August 2024, in support of the many people impacted by the wildfires in Jasper, Alberta, TELUS, our team members, customers and the Foundation have enabled more than $200,000 in cash donations and in-kind contributions. Our assistance included:

| ● | Distributing adult and youth disaster kits at evacuation centres containing essential items such as emergency blankets, reusable water bottles, charging cables and activities for kids. |

| ● | Rapidly deploying three cell towers on wheels (COWs) to provide wireless connectivity and support emergency communications along a no-coverage section of Trans-Canada Highway 16, to an RCMP checkpoint and one within the town of Jasper. |

| ● | Implementing our first deployment of a low earth orbit satellite temporary connectivity solution for a cell tower after its fibre connection was destroyed by the fire, restoring access to 9-1-1. |

| ● | Continually refuelling back-up generators to keep communication lines safely up and running after a loss of commercial power. |

| ● | Working closely with the incident command centre and its members to protect critical network infrastructure. |

| ● | Offering data top-ups and waiving long-distance mobile, home phone, texting and roaming fees for evacuees and others affected by the fires. |

| ● | Offering a free community crisis support line for emotional support, provided by TELUS Health and available 24/7 to all Canadians. |

| ● | Providing free counselling sessions through TELUS Health MyCare. |

| ● | Offering no-cost veterinary technician appointments through TELUS Health MyPet. |

| ● | Partnering with the Red Cross to establish a recovery centre, providing tents, site-wide Wi-Fi connectivity and essential care items for returning evacuees. In addition, our technicians conducted re-entry checks and prioritized a strategic restoration of service. |

In October 2024, we received a Response and Recovery Award from the Disaster Recovery Institute Canada (DRI) for crisis management during the 2024 Jasper wildfires. This was our third consecutive award, recognizing outstanding business continuity and disaster recovery, and our delivery of customer support and community service in a challenging situation.

Throughout 2024, we maintained our global leadership in sustainability, in line with our commitment to support a nature-positive future. Key milestones over the past year included: