report of management on internal control over financial reporting

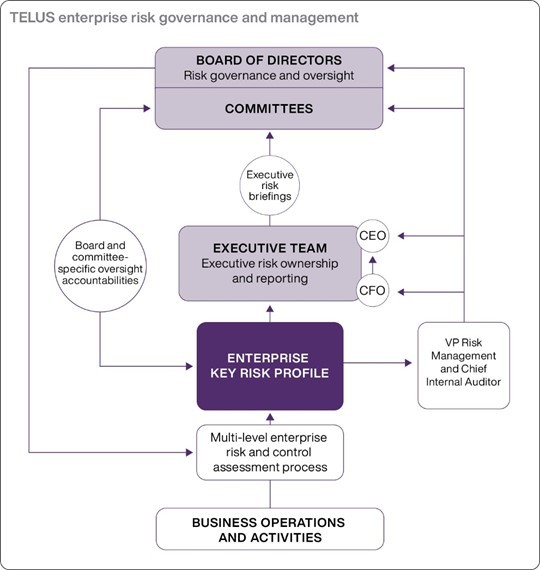

Management of TELUS Corporation (TELUS, or the Company) is responsible for establishing and maintaining adequate internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting.

TELUS’ President and Chief Executive Officer and Executive Vice-president and Chief Financial Officer have assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2025, in accordance with the criteria established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. Internal control over financial reporting is a process designed by, or under the supervision of, the President and Chief Executive Officer and the Executive Vice-president and Chief Financial Officer and effected by the Board of Directors, management and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

Due to its inherent limitations, internal control over financial reporting may not prevent or detect misstatements on a timely basis. Also, projections of any evaluation of the effectiveness of internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Based on the assessment referenced in the preceding paragraph, management has determined that the Company’s internal control over financial reporting is effective as of December 31, 2025. In connection with this assessment, no material weaknesses in the Company’s internal control over financial reporting were identified by management as of December 31, 2025.

The Company acquired Workplace Options on May 1, 2025, as set out in Note 18(b) of the Consolidated financial statements, and management has excluded from its assessment of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2025, Workplace Options internal control over financial reporting associated with less than 1%, less than 1%, 2% and 1% of the Company’s consolidated current assets, consolidated current liabilities, consolidated non-current assets and consolidated non-current liabilities, respectively, and total revenue of $132 million and net loss of $40 million included in the Consolidated financial statements of the Company as of and for the year ended December 31, 2025.

Deloitte LLP, an Independent Registered Public Accounting Firm, audited the Company’s Consolidated financial statements for the year ended December 31, 2025, and as stated in the Report of Independent Registered Public Accounting Firm, they have expressed an unqualified opinion on the effectiveness of the Company’s internal control over financial reporting as of December 31, 2025.

/s/ “Doug French” | | /s/ “Darren Entwistle” |

Doug French | Darren Entwistle | |

Executive Vice-president | President | |

and Chief Financial Officer | and Chief Executive Officer | |

February 12, 2026 | February 12, 2026 |