Getting the right Customers and keeping them is the foundation of our business. It demands a single-minded commitment to Customer satisfaction. Meeting this commitment requires tough standards, good people, and constant attention to the importance of each individual Customer. Introduced during the summer of 1986, the precepts are displayed throughout the company, and each person has a copy. These words have been reviewed every year since they were written, and not one word has ever been changed. (In 2000, a new precept was added.) These precepts are simple and straightforward, and we mean every single one.

CONTENTS

2 |

2003 Financial Highlights | |

3 |

Letter to Stockholders | |

4 |

Who We Are | |

6 |

How We Market | |

8 |

How We Lend | |

9 |

How We Keep Customers | |

10 |

Funding | |

11 |

Financials | |

104 |

MBNA Corporation Board of Directors, | |

| MBNA Principal Officers, | ||

| MBNA Office Locations |

2 |

2003 FINANCIAL HIGHLIGHTS

| Year Ended December 31, | 2003 | 2002 | 2001 | 2000 | 1999 | |||||||||||||||

| (dollars in thousands, except per share amounts) | ||||||||||||||||||||

Per Common Share Data (a) |

||||||||||||||||||||

Earnings |

$ | 1.82 | $ | 1.37 | $ | 1.31 | $ | 1.05 | $ | .84 | ||||||||||

Earnings—assuming dilution |

1.79 | 1.34 | 1.28 | 1.02 | .80 | |||||||||||||||

Dividends (b) |

.36 | .27 | .24 | .21 | .19 | |||||||||||||||

Book value |

8.53 | 6.96 | 5.94 | 5.02 | 3.31 | |||||||||||||||

Ratios |

||||||||||||||||||||

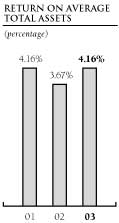

Return on average total assets |

4.16 | % | 3.67 | % | 4.16 | % | 3.94 | % | 3.62 | % | ||||||||||

Return on average stockholders’

equity |

22.98 | 21.29 | 24.07 | 25.79 | 27.18 | |||||||||||||||

Stockholders’ equity to total assets |

18.80 | 17.22 | 17.16 | 17.13 | 13.61 | |||||||||||||||

Sales and cash advance volume |

$ | 184,293,873 | $ | 160,046,164 | $ | 142,261,636 | $ | 125,683,731 | $ | 105,806,935 | ||||||||||

Financial Statement Data |

||||||||||||||||||||

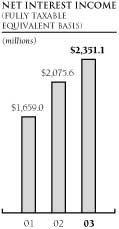

Net interest income (c) |

$ | 2,350,373 | $ | 2,074,575 | $ | 1,657,340 | $ | 1,395,015 | $ | 1,175,759 | ||||||||||

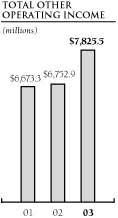

Other operating income (c) |

7,825,480 | 6,752,923 | 6,673,316 | 4,920,403 | 4,193,527 | |||||||||||||||

Net Income (a) |

2,338,104 | 1,765,954 | 1,694,291 | 1,312,532 | 1,024,423 | |||||||||||||||

Deposits |

31,836,081 | 30,616,216 | 27,094,745 | 24,343,595 | 18,714,753 | |||||||||||||||

Stockholders’ equity |

11,113,040 | 9,101,319 | 7,798,718 | 6,627,278 | 4,199,443 | |||||||||||||||

Managed Data |

||||||||||||||||||||

Total managed loans |

$ | 118,493,560 | $ | 107,257,842 | $ | 97,496,051 | $ | 88,790,721 | $ | 72,255,513 | ||||||||||

| (a) | For full year 2002, net income excluding the change in the estimated value of accrued interest and fees in September 2002 would have been $1.93 billion or $1.47 per common share—assuming dilution. |

| (b) | On January 22, 2004, the Board of Directors approved an increase of 20% in the quarterly dividend to $.12 per common share. |

| (c) | For purposes of comparability, certain prior period amounts have been reclassified. These reclassifications did not affect net income. |

This annual report includes managed data. A reconciliation of the managed data to the most directly comparable GAAP data is included in the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of the annual report.

3 |

DEAR STOCKHOLDERS

On behalf of all the people of MBNA, we are pleased to report another year of solid financial performance.

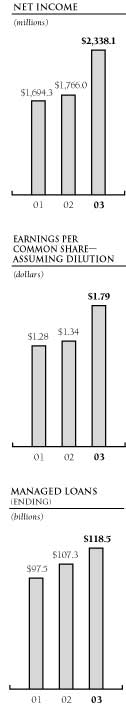

For the 13th consecutive year, we have recorded increases in both our earnings and our quarterly dividends. Net income for 2003 increased to $2.34 billion, or $1.79 per common share, and the quarterly dividend rate rose 20% to $.12 per common share.

Everything that happens at MBNA is the direct result of the commitment and dedication of the people who work here. We are very proud of the people of MBNA and what they have accomplished over a long period of time.

Several notable achievements helped drive our performance in 2003:

| • | Growing managed loans $11.2 billion to $118.5 billion. |

| • | The acquisition of 10.7 million new accounts with characteristics that are consistent with our existing cardholders. |

| • | The signing of 384 new endorsements and the renewal of more than 1,400 group contracts—remaining the leader in affinity marketing. |

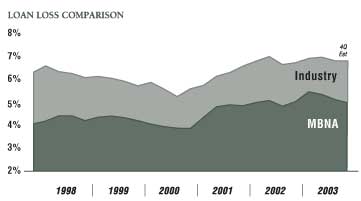

| • | Controlling loan losses at 5.22%—lower than published industry levels. |

MBNA is an international financial services company providing lending, insurance, and deposit account products and services. Our core business is to provide credit card services to affinity groups, financial institutions, and consumers. We provide a service that enables people to have the things they need today while paying for them sensibly out of future income. It is a good business and an enduring one. It is a business that if done right, can produce consistent profitability—something we have been able to do for 22 years through varying economic cycles.

We continue to strengthen the company through investments in new products and services. Our marketing franchise consists of more than 5,000 organizations that endorse our products throughout the United States, the United Kingdom, Ireland, Canada, and Spain—and these organizations will help ensure a continuing supply of new Customers.

On December 30, 2003, Charlie Cawley, MBNA’s CEO, retired after more than 31 years with MBNA and its former parent company. We thank him for his leadership, vision, and determination, and for his contributions to MBNA’s success and growth.

This year’s annual report discusses the factors that shaped 2003 results. It also explores MBNA’s approach to its business—the mix of beliefs, practices, and commitments that define us. We believe it is a solid formula for success.

Sincerely,

4 |

WHO WE ARE

MBNA Corporation is an international financial services company that provides lending, insurance, and deposit account products and services through MBNA America Bank, N.A., in the United States; MBNA Europe Bank Limited in the United Kingdom, Ireland, and Spain; and MBNA Canada Bank in Canada. Our core business is lending through credit cards to consumers.

The credit card business is a good business for a number of reasons. Credit cards free people from the need to carry cash and let them have the things they need today and pay for them out of future income. It is a business that has universal demand. Demand for our product cuts across industry, geography, and Customer type. Literally tens of millions of potential additional Customers already could qualify for our cards in the countries in which we operate, and economic growth and development bring millions more into the market every year. That leaves plenty of opportunities to add new accounts and grow our business.

It is a business with no industry, geographic, or Customer concentrations. Our loans are spread across the five countries where we do business with more than 30 million active borrowers whose average account balance is $3,800—so credit card lending produces relatively low-risk assets.

It is a business that is reliably profitable. Done right, the credit card business is a business that can be managed and priced to achieve consistent profitability—something MBNA has been able to do since 1982.

MBNA has been successful by carefully differentiating the company from its competitors through our excellence in marketing, lending, and providing service to our Customers. We predominately market our products through affinity marketing—selling to people with a common interest.

MBNA’s preeminence in the affinity credit card market can be traced to our ability to do many things. We understand the importance of partnering with organizations that people care about. We provide products that enable consumers to express their pride, passion, and interests and be rewarded for it. In addition, we provide our affinity partners with the ability to strengthen their relationship with their members.

Our approach to affinity marketing is based on a simple yet demanding formula: use our understanding of people who share common interests to craft the best products, marketing programs, and lending strategies, and then provide Customers

5 |

MBNA Europe

with truly superior service and attention. Our expertise has enabled us to develop successful partnerships with more than 5,000 endorsing organizations.

Our approach also has enabled us to successfully expand internationally. Just five years ago, our international operations represented just 8% of our managed loan portfolio. In 2003, the figure grew to 18%.

In 1993, MBNA entered its first international market in the United Kingdom, and since then has become the second largest credit card lender in the United Kingdom with $17.2 billion in loans and a 15% market share. MBNA Europe has earned the endorsement of more than 900 membership organizations and financial institutions, including Thomas Cook, Abbey, Law Society of Ireland, Royal College of Physicians of England, Oxford University, the WWF, Alliance & Leicester, and Manchester United. In 2003, we added new endorsements including the British Heart Foundation, National Geographic, and Banco Cooperativo in Spain, among many others.

MBNA Canada

Our experience in the United Kingdom helped us expand our international business by opening a bank in Canada in 1997. Since then, MBNA Canada has generated $3.6 billion in loans and 2.5 million accounts and gained a market share of 9%. In 2003, we added 79 new endorsements in Canada including Sheridan College, the Toronto Blue Jays, and the Edmonton Oilers.

MBNA’s international operations are an important part of the company’s future. We have been successful in other countries because we follow the same principles that made us an industry leader in the United States.

Our $12 billion Consumer Finance business includes installment and revolving unsecured loan products. Customers use these non-credit card products to consolidate loans or for large expenses such as home improvements or college tuition.

6 |

HOW WE MARKET

MBNA’s business is the business of affinity.

Affinity marketing seeks to understand and identify people sharing a special bond or relationship—people united by some shared experience, common pursuit, belief, or other unifying consideration—and to market products that help satisfy and promote that sense of affinity and belonging.

MBNA is the recognized leader in credit card affinity marketing. Since we first entered the business in 1982, we have marketed our products and services through more than 5,000 endorsing organizations, serving the needs of more than 50 million Customers.

Our business sectors encompass an exceptionally broad range of affinity groups. Today, we enjoy endorsements internationally from organizations representing such groups as:

Professionals including physicians, dentists, attorneys, educators, military, and law enforcement.

Our Professional sector has more than 1,400 professional organization endorsements, including the Association of Trial Lawyers of America, the American Medical Student Association, and the American Institute of Architects. The sector added more than 1 million new accounts in 2003.

Special interest groups. MBNA provides credit cards for members of a variety of clubs, associations, and other organizations devoted to supporting special causes. Endorsing environmental groups, for example, include the Nature Conservancy, Sierra Club, and National Audubon Society.

Enthusiasts for virtually all major sports, including baseball, football, basketball, hockey, golf, tennis, and motorsports. More than 700 sports-related organizations, including the National Football League, Major League Baseball, NASCAR, and the PGA, endorse MBNA products, and more than 7.8 million people now carry MBNA cards featuring their favorite team or race car driver.

College and university alumni and loyalists. MBNA is the official credit card of more than 800 colleges and universities. Familiar names on our cards include Penn State University, the University of California at Los Angeles, the University of North Carolina, and Stanford University.

7 |

More than 350 financial institutions. MBNA products are sold to Customers of such well-known names as Wachovia Bank, SunTrust Bank, and PNC Bank. These financial institution partnerships helped generate 750,000 new accounts in 2003 through a network of more than 15,000 bank branches.

Alliances with nearly 100 prominent businesses. Our alliances with other companies allow us to reach out to Customers of L.L. Bean, Cendant, Barnes & Noble, Carlson Wagonlit Travel, and Amtrak among others.

In 2003, MBNA earned 384 new endorsements from such high-quality organizations as Merrill Lynch, eBay, Gander Mountain, the American Institute of Chemical Engineers, the California Teachers Association, and Arizona State University. Affinity marketing enabled us to acquire 10.7 million new accounts in 2003. The marketing programs we used included a spectrum of techniques and channels:

Direct Mail is one of our most important marketing tools. MBNA’s in-house, full-service advertising agency develops thousands of customized mail campaigns for our affinity groups. Keeping design and production of these campaigns inside lets marketing managers and advertising professionals work together closely on a continuing basis, helping generate the creative and cost-effective programs that have made direct mail the source of the majority of our new accounts.

Telesales complements our customized direct mail campaigns. We operate one of the largest financial services telesales systems in the United States and Europe, which allows us to customize each call to appeal to the personal interest or group affiliation of the individual Customer.

Event Marketing extends our personal approach to marketing to large events. Each year, we attend more than 1,000 events, ranging from football games to professional conventions, to offer our products directly to members or fans of our endorsing organizations.

The Internet allows us to use the Web sites of our endorsing organizations and the e-mail addresses of their members to market our products. Advertising in the publications and newsletters of many of our groups also provides a targeted and effective means of bringing our product offering to more potential Customers.

In addition to these familiar marketing methods, our commitment to innovation has led to the development of our newest acquisition channel—Point-of-Sale Marketing. This technique allows a Customer to apply for a credit card in a bank or retail store and receive an instant loan decision for immediate activation. Point-of-sale programs with firms such as Bass Pro Shops, Gander Mountain, and RadioShack have been particularly successful.

8 |

HOW WE LEND

MBNA’s unique marketing strategy and diverse acquisition methods get the right people to apply for our products. Effective lending ensures that MBNA chooses the right Customers. The right Customer is someone who borrows from us and pays us back responsibly. Our success at approving the right Customer is the result of a personal approach to lending. Experienced credit analysts, using sophisticated technology, highly predictive scoring models, and good common sense, approve most of the loans we make at MBNA.

Credit analysts look at many factors before making a lending decision. They analyze the applicant’s capacity to repay—making sure their income is sufficient to handle their household debt. They also look at the overall stability of the individual, such as homeownership and length of time on the job. And most important, the credit analyst makes sure the applicant has good repayment habits with a history of paying bills on time.

More than a third of all teachers in the U.S. carry an MBNA credit card.

A credit analyst may decide yes, no, or maybe when making a lending decision. When a credit analyst says maybe, he or she calls the applicant to develop additional information needed to change the answer to yes or no. This additional information is fundamental in making the right lending decision and also ensures that the Customer receives the proper credit line.

Marketing to people with strong common interests and judgmental lending result in getting Customers who perform well and are very loyal. MBNA Customers have a 53% higher balance per active account and are 25% less likely to default than industry averages.

9 |

HOW WE KEEP CUSTOMERS

Getting the right Customers is just part of producing consistent results. Keeping these Customers is equally important to our success now and in the future. We do this by treating our Customers as we expect to be treated. Every time a Customer communicates with us presents another opportunity to strengthen our relationship. Each person who works at MBNA is responsible for influencing how our Customers feel about the company. Maintaining high levels of Customer satisfaction enables us to continue to retain our most profitable Customers and endorsing organizations every year.

We make substantial investments in the latest and best technology to enhance the quality and efficiency of our Customer satisfaction. Our Customer Satisfaction and Loss Prevention Super Stations, for example, provide MBNA representatives with the tools and information they need to meet Customer needs. We match that investment with unremitting attention to how we do things.

Customer Satisfaction representatives communicate directly with our Customers every day. We receive nearly 100 million Customer inquiries each year, and every contact is an opportunity for MBNA to exceed our Customers’ expectations and let them know how important they are to us. MBNA representatives are empowered to make decisions

and exercise individual judgment to satisfy our Customers—one at a time. We continually monitor service standards important to our Customers, such as average speed of answer and initial call resolution, to ensure that we maintain the highest levels of Customer satisfaction.

The single most important factor in our success has always been the people of MBNA. Today, MBNA is a company of 28,000 people driven to satisfy the Customer.

10 |

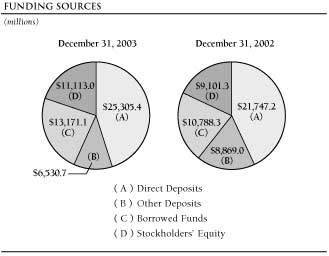

FUNDING

MBNA continues to expand and diversify its funding sources and investor base to support asset growth globally. Our funding sources include asset-backed securitizations, retail deposits, brokered CDs, and senior and subordinated debt.

MBNA continues to securitize loan receivables as a major source of funding. MBNA has been a leader in this market since pioneering the practice of securitizing credit card receivables in 1986. Asset securitization removes loan receivables from the balance sheet through a sale to a trust that is independent of MBNA. The securities issued by these trusts are primarily AAA-rated securities sold to investors on a global basis. Subordinated asset-backed securities are also sold to investors and typically not retained by MBNA. Proceeds are used by MBNA to fund its lending activities.

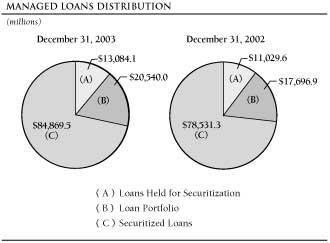

The global credit card asset securitization market continues to be a vibrant, cost-effective source of funding. The innovative design of these securitizations, MBNA’s reputation, and the consistent performance of the receivables have allowed the company to price these transactions at favorable rates compared to other issuers. MBNA issues in multiple currencies and markets, drawing investors from North America, Europe, and Asia to participate in transactions. MBNA maintained its status as a top-tier issuer by completing 31 securitizations totaling $13.6 billion in 2003. Securitizations now total $84.9 billion. These transactions continue to be well received by investors.

We also have established a $32 billion deposit base, mainly through the issuance of retail certificate of

deposit and money market accounts. More than 2,000 affinity groups endorse our deposit products for their members, including the American Automobile Association, Military Officers Association of America, and National Education Association. MBNA’s retail deposit products are marketed much like our other products: through the mail and over the telephone. MBNA does not maintain a large retail branch network; as a result, we can offer investors very competitive rates on deposit products.

MBNA’s unsecured debt programs are also important components of our funding mix and are attractive investments for pension funds, investment advisors, foreign and domestic banks, insurance companies, and retail investors. They allow MBNA to tap investors in domestic and international markets. Current outstandings under these programs are $11.8 billion.

12 |

FIVE-YEAR STATISTICAL SUMMARY (dollars in thousands, except per share amounts)

| Year Ended December 31, | 2003 | 2002 | 2001 | 2000 | 1999 | |||||||||||||||

Income Statement Data for the Year (a) |

||||||||||||||||||||

Net interest income (b) |

$ | 2,350,373 | $ | 2,074,575 | $ | 1,657,340 | $ | 1,395,015 | $ | 1,175,759 | ||||||||||

Provision for possible credit losses |

1,392,701 | 1,340,157 | 1,140,615 | 547,309 | 636,614 | |||||||||||||||

Other operating income (b) |

7,825,480 | 6,752,923 | 6,673,316 | 4,920,403 | 4,193,527 | |||||||||||||||

Other operating expense |

5,124,147 | 4,701,925 | 4,474,831 | 3,647,702 | 3,077,708 | |||||||||||||||

Net income |

2,338,104 | 1,765,954 | 1,694,291 | 1,312,532 | 1,024,423 | |||||||||||||||

Per Common Share Data for the Year (a) (c) |

||||||||||||||||||||

Earnings |

$ | 1.82 | $ | 1.37 | $ | 1.31 | $ | 1.05 | $ | .84 | ||||||||||

Earnings—assuming dilution |

1.79 | 1.34 | 1.28 | 1.02 | .80 | |||||||||||||||

Dividends |

.36 | .27 | .24 | .21 | .19 | |||||||||||||||

Book value |

8.53 | 6.96 | 5.94 | 5.02 | 3.31 | |||||||||||||||

Ratios (a) |

||||||||||||||||||||

Net interest margin (d) (e) |

5.37 | % | 5.54 | % | 5.51 | % | 5.50 | % | 5.30 | % | ||||||||||

Return on average total assets |

4.16 | 3.67 | 4.16 | 3.94 | 3.62 | |||||||||||||||

Return on average stockholders’ equity |

22.98 | 21.29 | 24.07 | 25.79 | 27.18 | |||||||||||||||

Stockholders’ equity to total assets |

18.80 | 17.22 | 17.16 | 17.13 | 13.61 | |||||||||||||||

Loan receivables (e) (f): |

||||||||||||||||||||

Delinquency (g) |

3.84 | 4.36 | 4.67 | 4.03 | 4.01 | |||||||||||||||

Net credit losses (h) |

4.84 | 4.57 | 4.20 | 3.38 | 3.65 | |||||||||||||||

Sales and cash advance volume |

$ | 184,293,873 | $ | 160,046,164 | $ | 142,261,636 | $ | 125,683,731 | $ | 105,806,935 | ||||||||||

Managed Data (a) (i) |

||||||||||||||||||||

At year end: |

||||||||||||||||||||

Loans held for securitization |

$ | 13,084,105 | $ | 11,029,627 | $ | 9,929,948 | $ | 8,271,933 | $ | 9,692,616 | ||||||||||

Loan portfolio |

20,539,972 | 17,696,881 | 14,703,616 | 11,682,904 | 7,971,093 | |||||||||||||||

Securitized loans |

84,869,483 | 78,531,334 | 72,862,487 | 68,835,884 | 54,591,804 | |||||||||||||||

Total managed loans |

$ | 118,493,560 | $ | 107,257,842 | $ | 97,496,051 | $ | 88,790,721 | $ | 72,255,513 | ||||||||||

Average for the year: |

||||||||||||||||||||

Loans held for securitization |

$ | 9,198,810 | $ | 8,130,207 | $ | 6,909,840 | $ | 8,129,333 | $ | 4,071,394 | ||||||||||

Loan portfolio |

18,985,008 | 17,184,993 | 13,429,548 | 9,588,815 | 10,351,101 | |||||||||||||||

Securitized loans |

81,691,156 | 74,718,731 | 70,560,600 | 59,726,838 | 49,706,760 | |||||||||||||||

Total managed loans |

$ | 109,874,974 | $ | 100,033,931 | $ | 90,899,988 | $ | 77,444,986 | $ | 64,129,255 | ||||||||||

For the year: |

||||||||||||||||||||

Delinquency (e) (g) |

4.39 | % | 4.88 | % | 5.09 | % | 4.49 | % | 4.45 | % | ||||||||||

Net credit losses (e) (h) |

5.22 | 4.99 | 4.74 | 4.39 | 4.33 | |||||||||||||||

Net interest margin (d) (e) |

8.39 | 8.42 | 8.42 | 7.08 | 7.42 | |||||||||||||||

Net interest income |

$ | 10,204,638 | $ | 9,118,677 | $ | 8,204,142 | $ | 5,837,109 | $ | 5,187,801 | ||||||||||

Provision for possible credit losses |

5,768,170 | 5,175,540 | 4,592,629 | 3,348,289 | 2,885,149 | |||||||||||||||

Other operating income |

4,346,684 | 3,544,204 | 3,578,528 | 3,279,289 | 2,430,020 | |||||||||||||||

| (a) | In September 2002, MBNA Corporation implemented the one-time industry wide Federal Financial Institutions Examination Council’s (“FFIEC”) accounting guidance, and changed the estimated value of accrued interest and fees, resulting in a decrease to income before income taxes of $263.7 million ($167.2 million after taxes) for the year ended December 31, 2002. Net income for the year ended December 31, 2002 was $1.8 billion or $1.34 per common share—assuming dilution. Excluding this change in September 2002, earnings per common share—assuming dilution for the year ended December 31, 2002 would have been $1.47, an increase of 15% compared with the year ended December 31, 2001. Earnings per common share—assuming dilution for the year ended December 31, 2003 increased 34%, compared with the year ended December 31, 2002. Excluding this change in September 2002, earnings per common share—assuming dilution for the year ended December 31, 2003 would have increased 22%, compared with the year ended December 31, 2002. | |||

| (b) | For purposes of comparability, certain prior period amounts have been reclassified. These reclassifications did not affect net income. | |||

| (c) | Per common share data and weighted average common shares outstanding and common stock equivalents have been adjusted to reflect the three-for-two stock split of MBNA Corporation’s Common Stock effected in the form of a dividend, issued on July 15, 2002, to stockholders of record as of the close of business on July 1, 2002. Earnings per common share is computed using net income applicable to common stock and weighted average common shares outstanding, whereas earnings per common share—assuming dilution includes the potential dilutive effect of common stock equivalents in accordance with Statement of Financial Accounting Standards No. 128, “Earnings per Share.” | |||

| (d) | Net interest margin ratios are presented on a fully taxable equivalent basis. | |||

| (e) | In December 2000, MBNA Corporation implemented the FFIEC revised policy on the classification of consumer loans. Excluding the one-time FFIEC adjustment, loan delinquency and managed loan delinquency would have been 4.32% and 4.94%, respectively, at December 31, 2000, and loan receivable net credit losses, managed net credit losses, managed net interest margin, and net interest margin would have been 3.03%, 3.94%, 7.14%, and 5.54%, respectively, for the year ended December 31, 2000. | |||

FIVE-YEAR STATISTICAL SUMMARY — Continued (dollars in thousands)

| Year Ended December 31, | 2003 | 2002 | 2001 | 2000 | 1999 | |||||||||||||||

Balance Sheet Data at Year End (a) |

||||||||||||||||||||

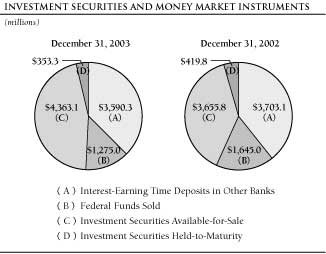

Investment securities and money market instruments (b) |

$ | 9,581,715 | $ | 9,423,620 | $ | 6,517,052 | $ | 5,205,395 | $ | 4,546,132 | ||||||||||

Loans held for securitization |

13,084,105 | 11,029,627 | 9,929,948 | 8,271,933 | 9,692,616 | |||||||||||||||

Credit card loans |

11,910,507 | 9,484,115 | 8,261,575 | 7,798,772 | 6,060,564 | |||||||||||||||

Other consumer loans |

8,629,465 | 8,212,766 | 6,442,041 | 3,884,132 | 1,910,529 | |||||||||||||||

Total loan portfolio |

20,539,972 | 17,696,881 | 14,703,616 | 11,682,904 | 7,971,093 | |||||||||||||||

Reserve for possible credit losses |

(1,216,316 | ) | (1,111,299 | ) | (833,423 | ) | (527,573 | ) | (516,261 | ) | ||||||||||

Net loan portfolio |

19,323,656 | 16,585,582 | 13,870,193 | 11,155,331 | 7,454,832 | |||||||||||||||

Total assets |

59,113,355 | 52,856,746 | 45,447,945 | 38,678,096 | 30,859,132 | |||||||||||||||

Total deposits |

31,836,081 | 30,616,216 | 27,094,745 | 24,343,595 | 18,714,753 | |||||||||||||||

Long-term debt and bank notes |

12,145,628 | 9,538,173 | 6,867,033 | 5,735,635 | 5,708,880 | |||||||||||||||

Stockholders’ equity |

11,113,040 | 9,101,319 | 7,798,718 | 6,627,278 | 4,199,443 | |||||||||||||||

Average Balance Sheet Data for the Year (a) |

||||||||||||||||||||

Investment securities and money market instruments (b) |

$ | 11,693,550 | $ | 8,257,838 | $ | 6,500,608 | $ | 5,051,619 | $ | 5,771,007 | ||||||||||

Loans held for securitization |

9,198,810 | 8,130,207 | 6,909,840 | 8,129,333 | 4,071,394 | |||||||||||||||

Credit card loans |

10,657,649 | 9,672,043 | 7,887,115 | 6,784,742 | 8,184,713 | |||||||||||||||

Other consumer loans |

8,327,359 | 7,512,950 | 5,542,433 | 2,804,073 | 2,166,388 | |||||||||||||||

Total loan portfolio |

18,985,008 | 17,184,993 | 13,429,548 | 9,588,815 | 10,351,101 | |||||||||||||||

Reserve for possible credit losses |

(1,158,510 | ) | (941,780 | ) | (656,654 | ) | (549,033 | ) | (416,627 | ) | ||||||||||

Net loan portfolio |

17,826,498 | 16,243,213 | 12,772,894 | 9,039,782 | 9,934,474 | |||||||||||||||

Total assets |

56,232,903 | 48,154,027 | 40,764,316 | 33,299,176 | 28,310,222 | |||||||||||||||

Total deposits |

31,880,540 | 28,481,487 | 25,147,782 | 20,654,087 | 16,901,334 | |||||||||||||||

Long-term debt and bank notes |

10,557,593 | 8,040,419 | 6,309,446 | 5,699,638 | 5,974,276 | |||||||||||||||

Stockholders’ equity |

10,172,778 | 8,293,823 | 7,039,986 | 5,088,882 | 3,769,539 | |||||||||||||||

Weighted average common shares outstanding (000) (c) |

1,278,166 | 1,277,787 | 1,277,745 | 1,230,827 | 1,201,530 | |||||||||||||||

Weighted average common shares outstanding and common

stock equivalents (000) (c) |

1,295,142 | 1,302,712 | 1,314,230 | 1,269,803 | 1,255,625 | |||||||||||||||

| (f) | Loan receivables include loans held for securitization and the loan portfolio. | |||

| (g) | Delinquency represents accruing loans that are 30 days or more past due. | |||

| (h) | MBNA Corporation’s net credit loss ratio is calculated by dividing annualized net credit losses, which exclude uncollectible accrued interest and fees and fraud losses, for the period by average loans, which include estimated collectible billed interest and fees for the corresponding period. | |||

| (i) | MBNA Corporation allocates resources on a managed basis, and financial data provided to management reflects MBNA Corporation’s results on a managed basis. Managed data assumes MBNA Corporation’s securitized loan principal receivables have not been sold and presents the earnings on securitized loan principal receivables in the same fashion as MBNA Corporation’s owned loans. Management, equity and debt analysts, rating agencies and others evaluate MBNA Corporation’s operations on a managed basis because the loans that are securitized are subject to underwriting standards comparable to MBNA Corporation’s owned loans, and MBNA Corporation services the securitized and owned loans, and the related accounts, together and in the same manner without regard to ownership of the loans. In a securitization, the loan principal receivables are sold to the trust, but the account relationships are not sold. MBNA Corporation continues to own and service the accounts that generate the securitized loan principal receivables. The credit performance of the entire managed loan portfolio is important to understand the quality of originations and the related credit risks inherent in the owned portfolio and retained interests in its securitization transactions. | |||

| Table 34 reconciles income statement data for the period to managed net interest income, managed provision for possible credit losses, and managed other operating income, and the loan receivables net credit loss ratio to the managed net credit loss ratio, the loan receivables delinquency ratio to the managed delinquency ratio, and the net interest margin ratio to the managed net interest margin ratio. Managed other operating income includes the impact of the net gain (loss) recognized on securitization activity in accordance with Statement of Financial Accounting Standards No. 140, “Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities—a Replacement of FASB Statement No. 125” (“Statement No. 140”). | ||||

14 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This discussion is intended to further the reader’s understanding of the consolidated financial statements, financial condition, and results of operations of MBNA Corporation. It should be read in conjunction with the audited consolidated financial statements, notes, and tables included in this report. For purposes of comparability, certain prior period amounts have been reclassified.

| Page | ||

15 |

Introduction and Overview | |

16 |

Critical Accounting Policies | |

19 |

Change in Accounting Estimate for Interest | |

| and Fees Recognized In 2002 | ||

19 |

Earnings Summary | |

21 |

Net Interest Income | |

25 |

Investment Securities and Money Market Instruments | |

26 |

Other Interest-Earning Assets | |

26 |

Loan Receivables | |

29 |

Premises and Equipment | |

30 |

Accounts Receivable from Securitization | |

30 |

Prepaid Expenses and Deferred Charges | |

30 |

Other Assets | |

30 |

Interest-Bearing Deposits | |

31 |

Borrowed Funds | |

31 |

Noninterest-Bearing Deposits | |

31 |

Accrued Expenses and Other Liabilities | |

32 |

Accumulated Other Comprehensive Income | |

32 |

Total Other Operating Income | |

36 |

Total Other Operating Expense | |

37 |

Income Taxes | |

37 |

Loan Quality | |

45 |

Dividend Limitations | |

46 |

Capital Adequacy | |

46 |

Off-Balance Sheet Arrangements | |

52 |

Liquidity and Rate Sensitivity | |

59 |

Cross-Border Outstandings | |

59 |

Regulatory Matters | |

60 |

Managed Reconciliation of the Five-Year Statistical Summary |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

INTRODUCTION AND OVERVIEW

MBNA Corporation (“the Corporation”), a bank holding company located in Wilmington, Delaware, is the parent company of MBNA America Bank, N.A. (“the Bank”), a national bank and the Corporation’s principal subsidiary. The Bank has two wholly owned foreign bank subsidiaries, MBNA Europe Bank Limited (“MBNA Europe”) located in the United Kingdom (U.K.) and MBNA Canada Bank (“MBNA Canada”) located in Canada. The Corporation’s primary business is giving its Customers the ability to have what they need today and pay for it out of future income by lending money through credit card and other consumer loans. Through the Bank, the Corporation is the largest independent credit card lender in the world and is the leading issuer of credit cards through endorsed marketing. In addition to its credit card lending, the Corporation also makes other consumer loans, which include installment and revolving unsecured loan products, and offers insurance and deposit products. The Corporation is also the parent of MBNA America (Delaware), N.A. (“MBNA Delaware”), a national bank, which offers business card products, mortgage loans, aircraft loans, and other specialty lending products. Mortgage loans, aircraft loans, and other specialty lending products are included in other consumer loan receivables, and business card products are included in credit card loan receivables in the Corporation’s audited consolidated statements of financial condition.

The Corporation seeks to manage its business to achieve its net income and other objectives. It does this primarily by attempting to grow loans to generate related interest and other operating income through adding new accounts and stimulating usage of existing accounts while controlling loan losses and expense growth. The Corporation generates income through finance charges assessed on outstanding loan receivables, securitization income, interchange income, credit card and other consumer loan fees, insurance income, interest earned on investment securities and money market instruments and other interest-earning assets. The Corporation’s primary costs are the costs of funding and growing its loan receivables, investment securities, and other assets, which include interest paid on deposits, short-term borrowings and long-term debt and bank notes, credit losses, business development and operating expenses, royalties to endorsing organizations, and income taxes.

The Corporation obtains funds to make loans to its Customers primarily through the process of asset securitization, raising deposits, and the issuance of short-term and long-term debt. Asset securitization removes loan principal receivables from the audited consolidated statements of financial condition through the sale of loan principal receivables to a trust. The trust sells securities backed by those loan principal receivables to investors. The trusts

are independent of the Corporation, and the Corporation has no control over the trusts. The trusts are not subsidiaries of the Corporation and are excluded from the Corporation’s audited consolidated financial statements in accordance with accounting principles generally accepted in the United States (“GAAP”).

The Corporation allocates resources on a managed basis, and financial data provided to management reflects the Corporation’s results on a managed basis. Managed data assumes the Corporation’s securitized loan principal receivables have not been sold and presents the earnings on securitized loan principal receivables in the same fashion as the Corporation’s owned loans. Management, equity and debt analysts, rating agencies and others evaluate the Corporation’s operations on a managed basis because the loans that are securitized are subject to underwriting standards comparable to the Corporation’s owned loans, and the Corporation services the securitized and owned loans, and the related accounts, together and in the same manner without regard to ownership of the loans. In a securitization, the loan principal receivables are sold to the trust, but the account relationships are not sold. The Corporation continues to own and service the accounts that generate the securitized loan principal receivables. The credit performance of the entire managed loan portfolio is important to understand the quality of originations and the related credit risks inherent in the owned portfolio and retained interests in securitization transactions. Asset securitization has a significant effect on the Corporation’s audited consolidated financial statements. The impact is discussed under “Off-Balance Sheet Arrangements—Impact of Off-Balance Sheet Securitization Transactions on the Corporation’s Results.” Securitization income is the most significant revenue item and is discussed under “Total Other Operating Income.” Whenever managed data is included in this report, a reconciliation of the managed data to the most directly comparable financial measure presented in accordance with GAAP is provided.

DURING 2003, THE CORPORATION:

| • | Grew loan receivables by $4.9 billion to $33.6 billion, and grew managed loans by $11.2 billion to $118.5 billion, through marketing and portfolio acquisitions. The Corporation’s international loan growth in the U.K., Canada, Ireland, and Spain benefited in part from the strengthening of foreign currencies against the U.S. dollar, which increased foreign loan receivables by $960.9 million in 2003. |

| • | Added 10.7 million new loan, deposit, and insurance accounts, 384 new endorsements from organizations, and renewed more than 1,400 group contracts. The Corporation is now endorsed by more than 5,000 affinity groups and financial institutions. |

16 |

| • | Maintained a relatively stable net interest margin by balancing the interest rates it charges on its loan accounts against the Corporation’s funding costs. The net interest margin was 5.37% and 5.54% for the years ended December 31, 2003 and 2002, respectively. The managed net interest margin was 8.39% and 8.42% for the years ended December 31, 2003 and 2002, respectively. |

| • | Controlled loan losses at 4.84% and losses on managed loans at 5.22%. Loan quality was affected by general economic conditions, such as levels of unemployment, bankruptcy filings, and the continued seasoning of the Corporation’s loan receivables and managed loans. |

| • | Increased interchange income, credit card fee income, and insurance income. |

| • | Continued to securitize loan principal receivables as a source of funding, increasing securitization income. |

| • | Controlled other operating expenses, which increased at a slower rate than growth in managed loans. |

These items, as well as other factors, contributed to the increase in net income for 2003 to $2.3 billion, or $1.79 per common share—assuming dilution and are discussed in further detail throughout “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

2004

In 2004, the Corporation will continue to focus on loan and account growth and managing its net interest margin, while attempting to control expenses and credit losses and manage its business to achieve its net income and other objectives.

Should interest rates increase in 2004, the Corporation’s funding costs are likely to increase, impacting the Corporation’s managed net interest margin. The Corporation could then determine to increase the interest rates it charges on its loan accounts or change its promotional or other interest rates on new loans in marketing activation programs to attempt to achieve a certain net interest margin. Any increases in the rates it charges on accounts could have an effect on the Corporation’s efforts to attract new Customers and grow managed loans, particularly with the continuing competition in the credit card and consumer lending industry. The Corporation’s interest rate risk is further discussed under “Liquidity and Rate Sensitivity.”

In 2004, the Corporation’s results will continue to be affected by the amount of credit losses. Credit losses are influenced by a number of factors, including the credit quality of the Corporation’s loans, general economic conditions, the level of consumer bankruptcies and regulatory policies. The pace of the U.S. economic recovery in 2004, and the levels of consumer spending and consumer confidence will be important factors that affect the Corporation’s success controlling credit losses and growing loans.

In 2004, the Corporation will continue to utilize strategies to control other operating expenses. These expenses are important for the Corporation to continue to attract new accounts and grow

loans. However, the Corporation will continue to strive to be more efficient and focus on controlling the growth of these expenses so that they grow more slowly than the growth in managed loans.

For 2004, management will be focused on the above challenges and opportunities and other factors affecting the business similar to the factors driving 2003 results as discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The risks to achieving the Corporation’s financial objectives for 2004 are discussed in the “Important Factors Regarding Forward-Looking Statements” section of the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2003.

The Corporation has filed as exhibits to its Form 10-K the certification of the Chief Executive Officer and the certification of the Chief Financial Officer under section 302 of the Sarbanes-Oxley Act of 2002.

CRITICAL ACCOUNTING POLICIES

Management makes certain judgments and uses certain estimates and assumptions when applying accounting principles in the preparation of the Corporation’s audited consolidated financial statements. The nature of the estimates and assumptions are material due to the levels of subjectivity and judgment necessary to account for highly uncertain factors or the susceptibility of such factors to change. Management has identified the policies related to the accounting for asset securitization, the reserve for possible credit losses, intangible assets, and revenue recognition as critical accounting policies, which require management to make significant judgments, estimates and assumptions.

Management believes the current assumptions and other considerations used to estimate amounts reflected in the Corporation’s audited consolidated financial statements are appropriate. However, if actual experience differs from the assumptions and other considerations used in estimating amounts reflected in the Corporation’s audited consolidated financial statements, the resulting changes could have a material adverse effect on the Corporation’s consolidated results of operations, and in certain situations, could have a material adverse effect on the Corporation’s financial condition.

The development and selection of the critical accounting policies, and the related disclosures have been reviewed with the Audit Committee of the Corporation’s Board of Directors.

ASSET SECURITIZATION

The Corporation uses securitization of its loan principal receivables as one source to meet its funding needs. The Corporation accounts for its securitization transactions in accordance with Statement of Financial Accounting Standards No. 140, “Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities—a Replacement of FASB Statement No. 125” (“Statement No. 140”), issued by the Financial Accounting Standards Board (“FASB”). When the Corporation securitizes loan

principal receivables, the Corporation recognizes a gain on sale and retained beneficial interests, including an interest-only strip receivable. The interest-only strip receivable represents the contractual right to receive interest and other revenue less certain costs from the trust over the estimated life of the securitized loan principal receivables. The Corporation’s securitization trusts are qualified special-purpose entities as defined by Statement No. 140 that are specifically exempted from the requirements of FASB Interpretation No. 46, “Consolidation of Variable Interest Entities” (“Interpretation No. 46”).

The Corporation estimates the fair value of the interest-only strip receivable based on the present value of expected future net revenue flows. Since quoted market prices for the interest-only strip receivable are not available, management uses certain assumptions and estimates in determining the fair value of the interest-only strip receivable. These assumptions and estimates include projections concerning interest income, certain fees, recoveries on charged-off securitized loans, gross credit losses on securitized loans, contractual servicing fees, and the interest rate paid to investors in a securitization transaction (“excess spread”). These projections are used to estimate the excess spread to be earned by the Corporation over the estimated life of the securitized loan principal receivables. The other assumptions and estimates used by the Corporation in estimating the fair value of the interest-only strip receivable include projected loan payment rates, which are used to determine the estimated life of the securitized loan principal receivables, and an appropriate discount rate.

The assumptions and estimates used to estimate the fair value of the interest-only strip receivable at December 31, 2003, reflect management’s judgment as to the expected excess spread to be earned and projected loan payment rates to be experienced on the securitized loans. These estimates are likely to change in the future, as the individual components of the excess spread and projected loan payment rates are sensitive to market and economic conditions. For example, the rates paid to investors in the Corporation’s securitization transactions are primarily variable rates subject to change based on changes in market interest rates. Changes in market interest rates and competitive pressures can also affect the projected interest income on securitized loans, as the Corporation could reprice the managed loan portfolio. Credit loss projections could change in the future based on changes in the credit quality of the securitized loans, the Corporation’s account management and collection practices, and general economic conditions. Projected loan payment rates could fluctuate based on general economic conditions and competition. Actual and expected changes in these assumptions may result in future estimates of the excess spread and projected loan payment rates being materially different from the estimates used in the periods covered by this report.

On a quarterly basis, the Corporation reviews prior assumptions and estimates compared to actual trust performance and other factors based on the prior period that approximates the average life of the securitized loan receivables. The actual trust performance

results and other factors are compared to the estimates and assumptions used in the determination of the fair value of the interest-only strip receivable. Based on this review and the Corporation’s current assumptions and estimates for future periods, the Corporation adjusts as appropriate, the assumptions and estimates used in determining the fair value of the interest-only strip receivable. If the assumptions change, or actual results differ from projected results, the interest-only strip receivable and securitization income would be affected. If management had made different assumptions for the periods covered by this report that raised or lowered the excess spread or projected loan payment rates, the Corporation’s financial condition and results of operations could have differed materially. For example, a 20% change in the excess spread assumption for all securitized loan principal receivables could have resulted in a change of approximately $268 million in the value of the total interest-only strip receivable at December 31, 2003, and a related change in securitization income.

Based on quarterly 2003 reviews of the interest-only strip receivable, the actual performance of the securitized receivables did not materially differ from the assumptions and estimates used to value the interest-only strip receivable.

Note 8: Asset Securitization to the audited consolidated financial statements provides further detail regarding the Corporation’s assumptions and estimates used in determining the fair value of the interest-only strip receivable and their sensitivities to adverse changes.

RESERVE FOR POSSIBLE CREDIT LOSSES

The Corporation maintains the reserve for possible credit losses at an amount sufficient to absorb losses inherent in the Corporation’s loan principal receivables at the reporting date based on a projection of probable net credit losses. To project probable net credit losses, the Corporation regularly performs a migration analysis of delinquent and current accounts. A migration analysis is a technique used to estimate the likelihood that a loan receivable will progress through the various delinquency stages and ultimately charge off. On a quarterly basis, the Corporation reviews and adjusts, as appropriate, these estimates. The Corporation’s projection of probable net credit losses considers the impact of economic conditions on the borrowers’ ability to repay, past collection experience, the risk characteristics and composition of the portfolio, and other factors. The Corporation then reserves for the projected probable net credit losses based on its projection of these amounts. The Corporation establishes appropriate levels of the reserve for possible credit losses for its products, including domestic credit card, domestic other consumer and foreign loans, based on their risk characteristics. A provision is charged against earnings to maintain the reserve for possible credit losses at an appropriate level. The Corporation records acquired reserves for current period loan acquisitions.

The Corporation’s projections of probable net credit losses are inherently uncertain, and as a result the Corporation cannot predict with certainty the amount of such losses. Changes in

18 |

economic conditions, the risk characteristics and composition of the portfolio, bankruptcy laws or regulatory policies, and other factors could impact the Corporation’s actual and projected net credit losses and the related reserve for possible credit losses. If management had made different assumptions about probable net credit losses, the Corporation’s financial condition and results of operations could have differed materially. For example, a 10% change in management’s projection of probable net credit losses could have resulted in a change of approximately $122 million in the reserve for possible credit losses and a related change in the provision for possible credit losses at December 31, 2003.

Based on the 2003 review of the reserve for possible credit losses, the actual net credit losses did not materially differ from the projections of net credit losses used to establish the reserve for possible credit losses.

Note 10: Reserve for Possible Credit Losses to the audited consolidated financial statements provides further detail regarding the Corporation’s reserve for possible credit losses.

INTANGIBLE ASSETS

The Corporation’s intangible assets include purchased credit card relationships (“PCCRs”), which are carried at net book value. The Corporation records these intangible assets as part of the acquisition of credit card loans and the corresponding Customer relationships. The Corporation’s intangible assets are amortized over the period the assets are expected to contribute to the cash flows of the Corporation, which reflect the expected pattern of benefit. PCCRs are amortized using an accelerated method based upon the projected cash flows the Corporation will receive from the Customer relationships during the estimated useful lives of the PCCRs.

The Corporation’s PCCRs are subject to impairment tests in accordance with Statement of Financial Accounting Standards No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets” (“Statement No. 144”). The Corporation reviews the carrying value of its PCCRs for impairment on a quarterly basis, or sooner, whenever events or changes in circumstances indicate that their carrying amount may not be fully recoverable, by comparing their carrying value to the sum of the undiscounted expected future cash flows from the loans and corresponding credit card relationships. In accordance with Statement No. 144, an impairment exists if the sum of the undiscounted expected future cash flows is less than the carrying amount of the asset. An impairment would result in a write-down of the PCCRs to estimated fair value based on the discounted future cash flows expected from the PCCRs. The Corporation performs the impairment test on a specific portfolio basis, since it represents the lowest level for which identifiable cash flows are independent of the cash flows of other assets and liabilities.

The Corporation makes certain estimates and assumptions that affect the determination of the expected future cash flows from the loans and corresponding credit card relationships. These estimates and assumptions include levels of account usage and activation,

active account attrition, funding costs, credit loss experience, servicing costs, growth in average account balances, interest and fees assessed on loans, and other factors. Significant changes in these estimates and assumptions could result in an impairment of the PCCRs. The estimated undiscounted cash flows of acquired Customer credit card relationships exceeds the $3.1 billion net book value of the Corporation’s PCCRs at December 31, 2003 by approximately $3.8 billion. If the active account attrition rates for all acquired portfolios in the twelve month period following December 31, 2003, were to be 10 percentage points higher than the rates assumed by management when it valued the PCCRs (for example, the assumed attrition rates were 10% but the actual rates were 20%) and all other estimates and assumptions were held constant, the estimated undiscounted cash flows of acquired Customer accounts in the aggregate would still exceed the net book value of acquired Customer accounts by approximately $2.6 billion, and no impairment would result on any individual PCCR.

There were no impairment write-downs of intangible assets during the year ended December 31, 2003.

REVENUE RECOGNITION

Interest income is recognized based upon the amount of loans outstanding and their contractual annual percentage rates. Interest income is included in loan receivables when billed to the Customer. The Corporation accrues unbilled interest income on a monthly basis from the Customer’s statement billing cycle date to the end of the month. The Corporation uses certain estimates and assumptions (for example, estimated yield) in the determination of the accrued unbilled portion of interest income that is included in accrued income receivable in the Corporation’s audited consolidated statements of financial condition. The Corporation also uses certain assumptions and estimates in the valuation of the accrued interest on securitized loans which is included in accounts receivable from securitization in the Corporation’s audited consolidated statements of financial condition. If management had made different assumptions about the determination of the accrued unbilled portion of interest income and the valuation of accrued interest on securitized loans, the Corporation’s financial condition and results of operations could have differed materially. For example, a 10% change in management’s projection of the estimated yield on its loan receivables and the valuation of the accrued interest receivable on securitized loans could have resulted in a change totaling approximately $70 million in interest income and other operating income at December 31, 2003.

For 2003, the Corporation’s estimated yield on its loan receivables and the valuation of the accrued interest receivable on securitized loans did not materially differ from the actual yield.

The Corporation also recognizes fees (except annual fees) on loan receivables in earnings as the fees are assessed according to agreements with the Corporation’s Customers. Credit card and other consumer loan fees include annual, late, overlimit, returned check, cash advance, express payment, and other miscellaneous

fees. These fees are included in the Corporation’s loan receivables when billed. Annual fees on loan receivables and incremental direct loan origination costs are deferred and amortized on a straight-line basis over the one-year period to which they pertain.

The Corporation adjusts the amount of interest and fee income on loan receivables recognized in the current period for its estimate of interest and fee income that it does not expect to collect in subsequent periods through adjustments to the respective income statement captions, loan receivables, and accrued income receivable. The estimate of uncollectible interest and fees is based on a migration analysis of delinquent and current loan receivables that will progress through the various delinquency stages and will ultimately charge off. The Corporation also adjusts the estimated value of accrued interest and fees on securitized loans for the amount of uncollectible interest and fees that are not expected to be collected through an adjustment to accounts receivable from securitization and securitization income. This estimate is also based on a migration analysis of delinquent and current securitized loans that will progress through the various delinquency stages and ultimately charge off. On a quarterly basis, the Corporation reviews and adjusts, as appropriate, these estimates.

If management had made different assumptions about uncollectible interest and fees on its loan receivables and its securitized loans, the Corporation’s financial condition and results of operations could have differed. For example, a 10% change in management’s estimate of uncollectible interest and fees could have resulted in a change totaling approximately $41 million in interest income and other operating income at December 31, 2003.

CHANGE IN ACCOUNTING ESTIMATE FOR INTEREST AND FEES RECOGNIZED IN 2002

In September 2002, the Corporation implemented the Federal Financial Institutions Examination Council (“FFIEC”) guidance for uncollectible accrued interest and fees for its managed loan portfolio. As a result, the Corporation changed its estimate of the value of accrued interest and fees in September 2002. The change in the estimated value of accrued interest and fees resulted in a decrease to income before income taxes of $263.7 million ($167.2 million after taxes) or $.13 per common share—assuming dilution for the year ended December 31, 2002, through a reduction of $66.3 million of interest income and $197.4 million of other operating income. This change in the estimated value of accrued interest and fees in 2002 also reduced ending total loan receivables by $86.5 million, accrued income receivable by $5.2 million, and accounts receivable from securitization by $172.0 million. The Corporation’s earnings per common share, excluding the change in the estimated value of accrued interest and fees in 2002, would have been $1.50 for the year ended December 31, 2002, and earnings per common share—assuming dilution would have been $1.47 for the year ended December 31, 2002. The change in the estimated value of accrued interest and fees has not had a material effect on earnings in subsequent periods.

Throughout this report, various items in the

consolidated financial statements are discussed

excluding the change in the estimated value of  accrued interest and fees in 2002. Management

believes this presentation is useful to

investors because the change in accounting

estimate had a material impact on the results

of operations in 2002, but not in 2003. As a

result, the business factors and trends

affecting the Corporation’s results from 2002

to 2003 and from 2001 to 2002 in certain cases

are better discussed and analyzed without the

impact of the change in estimate.

accrued interest and fees in 2002. Management

believes this presentation is useful to

investors because the change in accounting

estimate had a material impact on the results

of operations in 2002, but not in 2003. As a

result, the business factors and trends

affecting the Corporation’s results from 2002

to 2003 and from 2001 to 2002 in certain cases

are better discussed and analyzed without the

impact of the change in estimate.

EARNINGS SUMMARY

Net income for 2003 increased $572.2 million or 32.4% to $2.3 billion or $1.79 per common share from $1.8 billion or $1.34 per common share in 2002. Excluding the change in the estimated value of accrued interest and fees in 2002, net income would have increased $405.0 million or 20.9% for 2003. Net income for 2002 increased $71.7 million or 4.2% from $1.7 billion or $1.28 per common share in 2001. Excluding the change in the estimated value of accrued interest and fees in 2002, net income would have increased $238.8 million or 14.1% to $1.9 billion or $1.47 per common share for 2002. All earnings per common share amounts are presented assuming dilution.

The overall growth in earnings for 2003 was primarily attributable to the growth in the Corporation’s loan receivables, higher levels of securitized loans, an increase in other operating income, interest income, and a decrease in interest expense, partially offset by higher credit losses and an increase in other operating expense. The overall growth in earnings for 2002 was primarily attributable to the growth in the Corporation’s loan receivables and higher levels of securitized loans, partially offset by the change in the estimated value of accrued interest and fees in 2002 and higher credit losses.

20 |

TABLE 1: SUMMARIZED CONSOLIDATED STATEMENTS OF INCOME (dollars in thousands, except per share amounts)

| Year Ended December 31, | 2003 | 2002 | 2001 | |||||||||

Total interest income |

$ | 3,858,884 | $ | 3,678,070 | $ | 3,471,405 | ||||||

Total interest expense |

1,508,511 | 1,603,495 | 1,814,065 | |||||||||

Net interest income |

2,350,373 | 2,074,575 | 1,657,340 | |||||||||

Provision for possible credit losses |

1,392,701 | 1,340,157 | 1,140,615 | |||||||||

Net interest income after provision for possible credit losses |

957,672 | 734,418 | 516,725 | |||||||||

Total other operating income |

7,825,480 | 6,752,923 | 6,673,316 | |||||||||

Total other operating expense |

5,124,147 | 4,701,925 | 4,474,831 | |||||||||

Income before income taxes |

3,659,005 | 2,785,416 | 2,715,210 | |||||||||

Applicable income taxes |

1,320,901 | 1,019,462 | 1,020,919 | |||||||||

Net income |

$ | 2,338,104 | $ | 1,765,954 | $ | 1,694,291 | ||||||

Earnings per common share |

$ | 1.82 | $ | 1.37 | $ | 1.31 | ||||||

Earnings per

common share—assuming dilution |

1.79 | 1.34 | 1.28 | |||||||||

Dividends per common share |

.36 | .27 | .24 | |||||||||

Table 1 summarizes the Corporation’s consolidated statements of income, which has been derived from the audited consolidated financial statements, for the years ended December 31, 2003, 2002, and 2001.

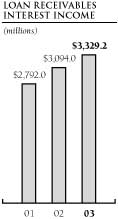

Ending loan receivables increased $4.9 billion or 17.0% to $33.6 billion for 2003 and increased $4.1 billion or 16.6% to $28.7 billion for 2002 from $24.6 billion for 2001. Total managed loans increased $11.2 billion or 10.5% to $118.5 billion for 2003 and increased $9.8 billion or 10.0% to $107.3 billion for 2002, as compared to $97.5 billion for 2001. Average loan receivables increased $2.9 billion or 11.3% to $28.2 billion for 2003 and increased $5.0 billion or 24.5% to $25.3 billion for 2002 from $20.3 billion for 2001. Total average managed loans increased $9.8 billion or 9.8% to $109.9 billion for 2003 and increased $9.1 billion or 10.0% to $100.0 billion for 2002 from $90.9 billion for 2001.

Table 2 reconciles the Corporation’s loan receivables to its managed loans and average loan receivables to its average managed loans.

Other operating income increased $1.1 billion or 15.9% to $7.8 billion for 2003 and increased $79.6 million or 1.2% to $6.8 billion for 2002 from $6.7 billion for 2001. Excluding the change in the estimated value of accrued interest and fees in 2002, other operating income would have increased $875.2 million or

12.6% for 2003 and $277.0 million or 4.2% for 2002. Interest income increased $180.8 million or 4.9% to $3.9 billion for 2003 and increased $206.7 million or 6.0% to $3.7 billion for 2002 from $3.5 billion for 2001. Excluding the change in the estimated value of accrued interest and fees in 2002, interest income would have increased $114.5 million or 3.1% for 2003 and $272.9 million or 7.9% for 2002. Interest expense decreased $95.0 million or 5.9% to $1.5 billion for 2003 and decreased $210.6 million or 11.6% to $1.6 billion for 2002 from $1.8 billion for 2001. Other operating expense increased $422.2 million or 9.0% to $5.1 billion for 2003, and increased $227.1 million or 5.1% to $4.7 billion for 2002 from $4.5 billion for 2001.

The net credit loss ratio on loan receivables for 2003 was 4.84%, as compared to 4.57% in 2002, and 4.20% in 2001. The net credit loss ratio on managed loans for 2003 was 5.22%, as compared to 4.99% in 2002 and 4.74% in 2001. Delinquency on loan receivables at December 31, 2003 was 3.84%, as compared to 4.36% at December 31, 2002 and 4.67% at December 31, 2001. Delinquency on managed loans was 4.39% at December 31, 2003, as compared to 4.88% at December 31, 2002, and 5.09% at December 31, 2001.

Refer to Table 13 for a reconciliation of the loan receivables delinquency ratio to the managed delinquency ratio. Refer to Table 18 for a reconciliation of the loan receivables net credit loss ratio to the managed net credit loss ratio.

TABLE 2: RECONCILIATION OF LOAN RECEIVABLES TO MANAGED LOANS (dollars in thousands)

| Year Ended December 31, | 2003 | 2002 | 2001 | |||||||||

At Year End: |

||||||||||||

Loans held for securitization |

$ | 13,084,105 | $ | 11,029,627 | $ | 9,929,948 | ||||||

Loan portfolio |

20,539,972 | 17,696,881 | 14,703,616 | |||||||||

Loan receivables |

33,624,077 | 28,726,508 | 24,633,564 | |||||||||

Securitized loans |

84,869,483 | 78,531,334 | 72,862,487 | |||||||||

Total managed loans |

$ | 118,493,560 | $ | 107,257,842 | $ | 97,496,051 | ||||||

Average for the Year: |

||||||||||||

Loans held for securitization |

$ | 9,198,810 | $ | 8,130,207 | $ | 6,909,840 | ||||||

Loan portfolio |

18,985,008 | 17,184,993 | 13,429,548 | |||||||||

Loan receivables |

28,183,818 | 25,315,200 | 20,339,388 | |||||||||

Securitized loans |

81,691,156 | 74,718,731 | 70,560,600 | |||||||||

Total managed loans |

$ | 109,874,974 | $ | 100,033,931 | $ | 90,899,988 | ||||||

The Corporation’s return on average total assets for 2003 increased to 4.16% from 3.67% for 2002. Excluding the change in the estimated value of accrued interest and fees in 2002, the Corporation’s return on average total assets for 2003 would have increased 15 basis points from 2002 as a result of the Corporation’s net income growing faster than its average total assets. The Corporation’s return on average total assets for 2002 decreased to 3.67% from 4.16% for 2001. Excluding the change in the estimated value of accrued interest and fees in 2002, the Corporation’s return on average total assets for 2002 would have decreased 15 basis points from 2001 as a result of the Corporation’s net income growing slower than its average total assets.

The Corporation’s net income grew at a faster rate than its average total assets during 2003, excluding the change in the estimated value of accrued interest and fees in 2002, primarily as a result of an increase of 11.7% in securitization income for 2003 from 2002. Net income grew at a slower rate than average total assets during 2002, excluding the change in the estimated value of accrued interest and fees in 2002, primarily as a result of an increase of only 2.0% in securitization income for 2002 from 2001. See “Total Other Operating Income” for further discussion of the changes in securitization income for 2003 and 2002.

The Corporation’s return on average stockholders’ equity was 22.98% for 2003, as compared to 21.29% for 2002 and 24.07% for 2001. Excluding the change in the estimated value of accrued interest and fees in 2002, the Corporation’s return on average stockholders’ equity would have decreased 21 basis points and 88 basis points for 2003 and 2002, respectively, as a result of the

Corporation’s net income growing at a slower rate than its average stockholders’ equity. The Corporation’s net income typically grows at a slower rate than its average stockholders’ equity as the Corporation reinvests a significant portion of its net income back into the business. Also, the strengthening of foreign currencies against the U.S. dollar increased stockholders’ equity, partially offset by an increase in the Corporation’s dividend rate per common share and other factors.

Table 3 reconciles the Corporation’s return on average total assets and return on average stockholders’ equity for 2002, to the Corporation’s return on average total assets and return on average stockholders’ equity for 2002 excluding the change in the estimated value of accrued interest and fees in 2002.

NET INTEREST INCOME

Net interest income represents interest income on total interest-earning assets, on a fully taxable equivalent basis where appropriate, less interest expense on total interest-bearing liabilities. Fully taxable equivalent basis represents the income on total interest-earning assets that is either tax-exempt or taxed at a reduced rate, adjusted to give effect to the prevailing incremental federal income tax rate, and adjusted for nondeductible carrying costs and state income taxes, where applicable. Yield calculations, where appropriate, include these adjustments.

Tables 4 and 5 provide further detail regarding the Corporation’s average balances, yields and rates, interest income and expense, and the impact that rate and volume changes had on the Corporation’s net interest income for the years ended December 31, 2003, 2002, and 2001.

TABLE 3: RECONCILIATION OF THE AS REPORTED RETURN ON AVERAGE TOTAL ASSETS AND STOCKHOLDERS’ EQUITY TO THE RETURN ON AVERAGE TOTAL ASSETS AND STOCKHOLDERS’ EQUITY EXCLUDING THE CHANGE IN THE ESTIMATED VALUE OF ACCRUED INTEREST AND FEES IN 2002 (dollars in thousands)

| Year Ended December 31, 2002 |

||||||||||||

| Average Balance | Ratio | Net Income | ||||||||||

Return on Average Total Assets |

||||||||||||

As reported |

$ | 48,154,027 | 3.67 | % | $ | 1,765,954 | ||||||

Impact of the change in the estimated value of accrued interest and fees in 2002 |

67,182 | 167,167 | ||||||||||

Excluding the change in the estimated value of accrued interest and fees in 2002 |

$ | 48,221,209 | 4.01 | $ | 1,933,121 | |||||||

Return on Average Stockholders’ Equity |

||||||||||||

As reported |

$ | 8,293,823 | 21.29 | $ | 1,765,954 | |||||||

Impact of the change in the estimated value of accrued interest and fees in 2002 |

42,593 | 167,167 | ||||||||||

Excluding the change in the estimated value of accrued interest and fees in 2002 |

$ | 8,336,416 | 23.19 | $ | 1,933,121 | |||||||

22 |

TABLE 4: STATEMENTS OF AVERAGE BALANCES, YIELDS AND RATES, INCOME OR EXPENSE

(dollars in thousands, yields and rates on a fully taxable equivalent basis)

| Year Ended December 31, | 2003 | | | 2002 | | | 2001 | |||||||||||||||||||||||||||||||

| Average | Yield/ | Income | Average | Yield/ | Income | Average | Yield/ | Income | ||||||||||||||||||||||||||||

| Balance | Rate | or Expense | Balance | Rate | or Expense | Balance | Rate | or Expense | ||||||||||||||||||||||||||||

Assets |

||||||||||||||||||||||||||||||||||||

Interest-earning assets: |

||||||||||||||||||||||||||||||||||||

Money market instruments: |

||||||||||||||||||||||||||||||||||||

Interest-earning time deposits in other banks: |

||||||||||||||||||||||||||||||||||||

Domestic |

$ | 8,181 | 1.91 | % | $ | 156 | $ | 1,244 | .96 | % | $ | 12 | $ | 1,199 | 3.59 | % | $ | 43 | ||||||||||||||||||

Foreign |

4,629,799 | 1.71 | 79,103 | 2,149,065 | 2.47 | 53,121 | 1,690,774 | 4.22 | 71,298 | |||||||||||||||||||||||||||

Total interest-earning time deposits

in other banks |

4,637,980 | 1.71 | 79,259 | 2,150,309 | 2.47 | 53,133 | 1,691,973 | 4.22 | 71,341 | |||||||||||||||||||||||||||

Federal funds sold |

2,957,819 | 1.12 | 33,137 | 2,127,914 | 1.67 | 35,460 | 1,526,879 | 3.71 | 56,651 | |||||||||||||||||||||||||||

Total money market instruments |

7,595,799 | 1.48 | 112,396 | 4,278,223 | 2.07 | 88,593 | 3,218,852 | 3.98 | 127,992 | |||||||||||||||||||||||||||

Investment securities (a): |

||||||||||||||||||||||||||||||||||||

Domestic: |

||||||||||||||||||||||||||||||||||||

Taxable (b) |

3,722,062 | 2.67 | 99,223 | 3,688,047 | 3.42 | 126,062 | 3,001,592 | 5.04 | 151,173 | |||||||||||||||||||||||||||

Tax-exempt (c) |

109,403 | 1.99 | 2,176 | 110,054 | 2.69 | 2,965 | 102,710 | 4.68 | 4,807 | |||||||||||||||||||||||||||

Total domestic investment securities |

3,831,465 | 2.65 | 101,399 | 3,798,101 | 3.40 | 129,027 | 3,104,302 | 5.02 | 155,980 | |||||||||||||||||||||||||||

Foreign |

266,286 | 4.19 | 11,147 | 181,514 | 4.60 | 8,349 | 177,454 | 5.55 | 9,840 | |||||||||||||||||||||||||||

Total investment securities |

4,097,751 | 2.75 | 112,546 | 3,979,615 | 3.45 | 137,376 | 3,281,756 | 5.05 | 165,820 | |||||||||||||||||||||||||||

Other interest-earning assets (a) (b) (d) |

3,904,013 | 7.82 | 305,468 | 3,869,893 | 9.28 | 359,159 | 3,256,773 | 11.89 | 387,250 | |||||||||||||||||||||||||||

Loan receivables: |

||||||||||||||||||||||||||||||||||||

Loans held for securitization: |

||||||||||||||||||||||||||||||||||||

Domestic: |

||||||||||||||||||||||||||||||||||||

Credit card |

7,143,690 | 12.33 | 881,161 | 6,311,804 | 12.89 | 813,536 | 5,178,099 | 14.61 | 756,463 | |||||||||||||||||||||||||||

Other consumer |

52,883 | 5.35 | 2,827 | 438,187 | 15.30 | 67,062 | 605,683 | 15.86 | 96,088 | |||||||||||||||||||||||||||

Total domestic loans held for

securitization |

7,196,573 | 12.28 | 883,988 | 6,749,991 | 13.05 | 880,598 | 5,783,782 | 14.74 | 852,551 | |||||||||||||||||||||||||||

Foreign |

2,002,237 | 11.44 | 228,989 | 1,380,216 | 12.75 | 175,960 | 1,126,058 | 12.99 | 146,330 | |||||||||||||||||||||||||||

Total loans held for securitization |

9,198,810 | 12.10 | 1,112,977 | 8,130,207 | 13.00 | 1,056,558 | 6,909,840 | 14.46 | 998,881 | |||||||||||||||||||||||||||

Loan portfolio (d): |

||||||||||||||||||||||||||||||||||||

Domestic: |

||||||||||||||||||||||||||||||||||||

Credit card |