| J a n u a r y 1 2 , 2 0 2 6 J.P. Morgan Healthcare Conference This non-promotional presentation contains investigational data as well as forward-looking statements; actual results may vary materially. |

| 2 J.P. Morgan Healthcare Conference Dr. Leonard Schleifer, MD, PhD Board Co-Chair, Co-Founder, President, & Chief Executive Officer Dr. George Yancopoulos, MD, PhD Board Co-Chair, Co-Founder, President, & Chief Scientific Officer |

| 3 Note regarding forward-looking statements and non-GAAP financial measures This presentation includes forward-looking statements that involve risks and uncertainties relating to future events and the future performance of Regeneron Pharmaceuticals, Inc. ("Regeneron" or the "Company"), and actual events or results may differ materially from these forward-looking statements. Words such as "anticipate," "expect," "intend," "plan," "believe," "seek," "estimate," variations of such words, and similar expressions are intended to identify such forward-looking statements, although not all forward-looking statements contain these identifying words. These statements concern, and these risks and uncertainties include, among others, competing drugs and product candidates that may be superior to, or more cost effective than, products marketed or otherwise commercialized by Regeneron and/or its collaborators or licensees (collectively, "Regeneron's Products") and product candidates being developed by Regeneron and/or its collaborators or licensees (collectively, "Regeneron's Product Candidates") (including biosimilar versions of Regeneron's Products); uncertainty of the utilization, market acceptance, and commercial success of Regeneron's Products and Regeneron's Product Candidates and the impact of studies (whether conducted by Regeneron or others and whether mandated or voluntary) or recommendations and guidelines from governmental authorities and other third parties or other factors beyond Regeneron's control on the commercial success of Regeneron's Products and Regeneron's Product Candidates; the nature, timing, and possible success and therapeutic applications of Regeneron's Products and Regeneron's Product Candidates and research and clinical programs now underway or planned, including without limitation EYLEA HD® (aflibercept) Injection 8 mg, EYLEA® (aflibercept) Injection, Dupixent® (dupilumab), Libtayo® (cemiplimab), Praluent® (alirocumab), Kevzara® (sarilumab), Evkeeza® (evinacumab), Veopoz® (pozelimab), Ordspono (odronextamab), Lynozyfic (linvoseltamab), other clinical programs discussed in this presentation, Regeneron's and its collaborators' earlier-stage programs, and the use of human genetics in Regeneron's research programs; the likelihood and timing of achieving any of the anticipated milestones discussed or referenced in this presentation; safety issues resulting from the administration of Regeneron's Products and Regeneron's Product Candidates in patients, including serious complications or side effects in connection with the use of Regeneron's Products and Regeneron's Product Candidates in clinical trials; the likelihood, timing, and scope of possible regulatory approval and commercial launch of Regeneron's Product Candidates and new indications for Regeneron's Products, such as those listed above; the extent to which the results from the research and development programs conducted by Regeneron and/or its collaborators may be replicated in other studies and/or lead to advancement of product candidates to clinical trials, therapeutic applications, or regulatory approval; ongoing regulatory obligations and oversight impacting Regeneron's Products, research and clinical programs, and business, including those relating to patient privacy; determinations by regulatory and administrative governmental authorities which may delay or restrict Regeneron's ability to continue to develop or commercialize Regeneron's Products and Regeneron's Product Candidates; Regeneron's ability to manufacture and manage supply chains for multiple products and product candidates and risks associated with tariffs and other trade restrictions; the ability of Regeneron's collaborators, suppliers, or other third parties (as applicable) to perform manufacturing, filling, finishing, packaging, labeling, distribution, and other steps related to Regeneron's Products and Regeneron's Product Candidates; the availability and extent of reimbursement or copay assistance for Regeneron's Products from third-party payors and other third parties, including private payor healthcare and insurance programs, health maintenance organizations, pharmacy benefit management companies, and government programs such as Medicare and Medicaid; coverage and reimbursement determinations by such payors and other third parties and new policies and procedures adopted by such payors and other third parties; changes to drug pricing regulations and requirements and Regeneron's drug pricing strategy; other changes in laws, regulations, and policies affecting the healthcare industry; unanticipated expenses; the costs of developing, producing, and selling products; Regeneron's ability to meet any of its financial projections or guidance and changes to the assumptions underlying those projections or guidance; Regeneron's estimates of market opportunities for Regeneron's Products and Regeneron's Product Candidates; the potential for any license or collaboration agreement, including Regeneron's agreements with Sanofi and Bayer (or their respective affiliated companies, as applicable), to be cancelled or terminated; the impact of public health outbreaks, epidemics, or pandemics on Regeneron's business; and risks associated with litigation and other proceedings and government investigations relating to the Company and/or its operations (including the pending civil proceedings initiated or joined by the U.S. Department of Justice and the U.S. Attorney's Office for the District of Massachusetts), risks associated with intellectual property of other parties and pending or future litigation relating thereto (including without limitation the patent litigation and other related proceedings relating to EYLEA), the ultimate outcome of any such proceedings and investigations, and the impact any of the foregoing may have on Regeneron’s business, prospects, operating results, and financial condition. A more complete description of these and other material risks can be found in Regeneron's filings with the U.S. Securities and Exchange Commission. Any forward-looking statements are made based on management's current beliefs and judgment, and the reader is cautioned not to rely on any forward-looking statements made by Regeneron. Regeneron does not undertake any obligation to update (publicly or otherwise) any forward-looking statement, including without limitation any financial projection or guidance, whether as a result of new information, future events, or otherwise. This presentation includes projected 2026 non-GAAP R&D expense, which is a financial measure that is not calculated in accordance with U.S. Generally Accepted Accounting Principles ("GAAP"). This and other non-GAAP financial measures are computed by excluding certain non-cash and/or other items from the related GAAP financial measure. The Company also includes a non-GAAP adjustment for the estimated income tax effect of reconciling items. The Company makes such adjustments for items the Company does not view as useful in evaluating its operating performance. Management uses this and other non-GAAP measures for planning, budgeting, forecasting, assessing historical performance, and making financial and operational decisions, and also provides forecasts to investors on this basis. Additionally, such non-GAAP measures provide investors with an enhanced understanding of the financial performance of the Company's core business operations. However, there are limitations in the use of such non-GAAP financial measures as they exclude certain expenses that are recurring in nature. Furthermore, the Company's non-GAAP financial measures may not be comparable with non-GAAP information provided by other companies. Any non-GAAP financial measure presented by Regeneron should be considered supplemental to, and not a substitute for, measures of financial performance prepared in accordance with GAAP. A reconciliation of the non-GAAP financial measure used in this presentation is provided herein. |

| 4 Note: Definitions for all acronyms and abbreviations in this presentation can be found on slide 19. Leveraging the power of science to bring transformative medicines to patients... over and over again 14 internally-discovered therapies have been approved, poised to deliver many more… Delivering Breakthrough Medicines ~45 clinical programs across six core therapeutic areas provides a strong foundation for future growth Following the Science World’s largest DNA and proteomics-linked healthcare database, enabling advanced drug discovery, development, and healthcare analytics Integrating Genetics, Proteomics, and Big Data Powerful toolkit of proprietary, turnkey technology platforms provides enduring competitive advantages Accelerating Innovation and R&D Productivity Leaders in human antibodies Pioneers in bispecifics siRNA | gene editing | AAV gene therapy Genetics Medicines |

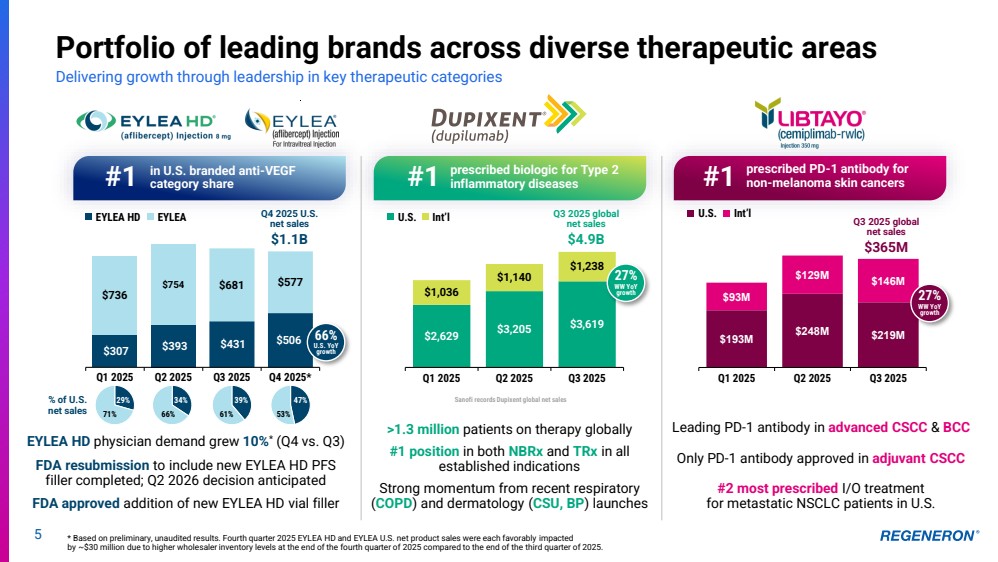

| prescribed biologic for Type 2 #1 inflammatory diseases $2,629 $3,205 $3,619 $1,036 $1,140 $1,238 Q1 2025 Q2 2025 Q3 2025 5 Portfolio of leading brands across diverse therapeutic areas Delivering growth through leadership in key therapeutic categories * Based on preliminary, unaudited results. Fourth quarter 2025 EYLEA HD and EYLEA U.S. net product sales were each favorably impacted by ~$30 million due to higher wholesaler inventory levels at the end of the fourth quarter of 2025 compared to the end of the third quarter of 2025. U.S. Int’l Sanofi records Dupixent global net sales $307 $393 $431 $506 $736 $754 $681 $577 Q1 2025 Q2 2025 Q3 2025 Q4 2025* EYLEA HD physician demand grew 10%* (Q4 vs. Q3) FDA resubmission to include new EYLEA HD PFS filler completed; Q2 2026 decision anticipated FDA approved addition of new EYLEA HD vial filler $193M $248M $219M $93M $129M $146M Q1 2025 Q2 2025 Q3 2025 Leading PD-1 antibody in advanced CSCC & BCC Only PD-1 antibody approved in adjuvant CSCC #2 most prescribed I/O treatment for metastatic NSCLC patients in U.S. U.S. Int’l EYLEA HD EYLEA Q3 2025 global net sales $4.9B in U.S. branded anti-VEGF category share prescribed PD-1 antibody for #1 #1 non-melanoma skin cancers >1.3 million patients on therapy globally #1 position in both NBRx and TRx in all established indications Strong momentum from recent respiratory (COPD) and dermatology (CSU, BP) launches patients on therapy % of U.S. 29% 34% 39% net sales 71% 66% 61% 47% 53% 66% U.S. YoY growth 27% WW YoY growth Q3 2025 global net sales $365M 27% WW YoY growth Q4 2025 U.S. net sales $1.1B |

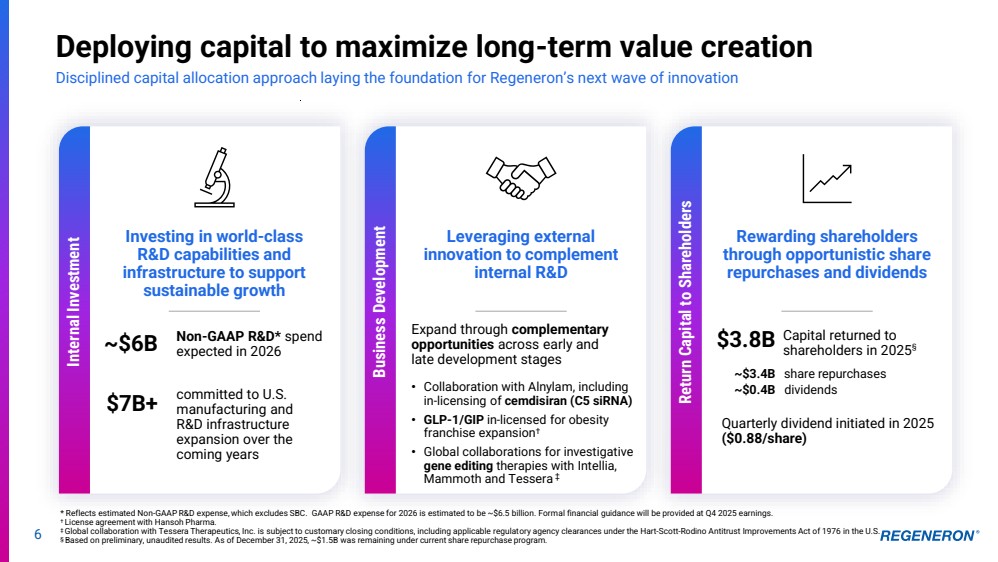

| 6 Deploying capital to maximize long-term value creation Disciplined capital allocation approach laying the foundation for Regeneron’s next wave of innovation * Reflects estimated Non-GAAP R&D expense, which excludes SBC. GAAP R&D expense for 2026 is estimated to be ~$6.5 billion. Formal financial guidance will be provided at Q4 2025 earnings. † License agreement with Hansoh Pharma. ‡ Global collaboration with Tessera Therapeutics, Inc. is subject to customary closing conditions, including applicable regulatory agency clearances under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 in the U.S. § Based on preliminary, unaudited results. As of December 31, 2025, ~$1.5B was remaining under current share repurchase program. Internal Investment Investing in world-class R&D capabilities and infrastructure to support sustainable growth Leveraging external innovation to complement internal R&D Expand through complementary opportunities across early and late development stages • Collaboration with Alnylam, including in-licensing of cemdisiran (C5 siRNA) • GLP-1/GIP in-licensed for obesity franchise expansion† • Global collaborations for investigative gene editing therapies with Intellia, Mammoth and Tessera ‡ Rewarding shareholders through opportunistic share repurchases and dividends ~$6B committed to U.S. manufacturing and R&D infrastructure expansion over the coming years Non-GAAP R&D* spend expected in 2026 $7B+ Capital returned to shareholders in 2025 $3.8B § ~$3.4B ~$0.4B share repurchases dividends Quarterly dividend initiated in 2025 ($0.88/share) Business Development Return Capital to Shareholders |

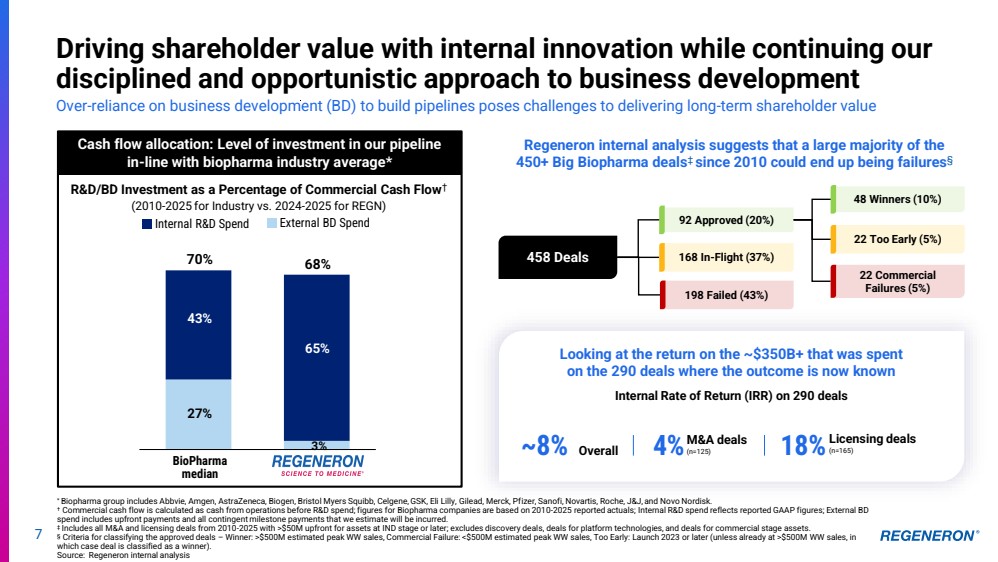

| 7 Driving shareholder value with internal innovation while continuing our disciplined and opportunistic approach to business development Over-reliance on business development (BD) to build pipelines poses challenges to delivering long-term shareholder value Cash flow allocation: Level of investment in our pipeline in-line with biopharma industry average* 43% 27% 65% 3% 70% 68% Internal R&D Spend External BD Spend R&D/BD Investment as a Percentage of Commercial Cash Flow† (2010-2025 for Industry vs. 2024-2025 for REGN) BioPharma median Regeneron internal analysis suggests that a large majority of the 450+ Big Biopharma deals‡ since 2010 could end up being failures§ Looking at the return on the ~$350B+ that was spent on the 290 deals where the outcome is now known ~8% Overall 18%Licensing deals 4% (n=165) M&A deals (n=125) Internal Rate of Return (IRR) on 290 deals 458 Deals 48 Winners (10%) 22 Too Early (5%) 22 Commercial Failures (5%) 92 Approved (20%) 168 In-Flight (37%) 198 Failed (43%) * Biopharma group includes Abbvie, Amgen, AstraZeneca, Biogen, Bristol Myers Squibb, Celgene, GSK, Eli Lilly, Gilead, Merck, Pfizer, Sanofi, Novartis, Roche, J&J, and Novo Nordisk. † Commercial cash flow is calculated as cash from operations before R&D spend; figures for Biopharma companies are based on 2010-2025 reported actuals; Internal R&D spend reflects reported GAAP figures; External BD spend includes upfront payments and all contingent milestone payments that we estimate will be incurred. ‡ Includes all M&A and licensing deals from 2010-2025 with >$50M upfront for assets at IND stage or later; excludes discovery deals, deals for platform technologies, and deals for commercial stage assets. § Criteria for classifying the approved deals – Winner: >$500M estimated peak WW sales, Commercial Failure: <$500M estimated peak WW sales, Too Early: Launch 2023 or later (unless already at >$500M WW sales, in which case deal is classified as a winner). Source: Regeneron internal analysis |

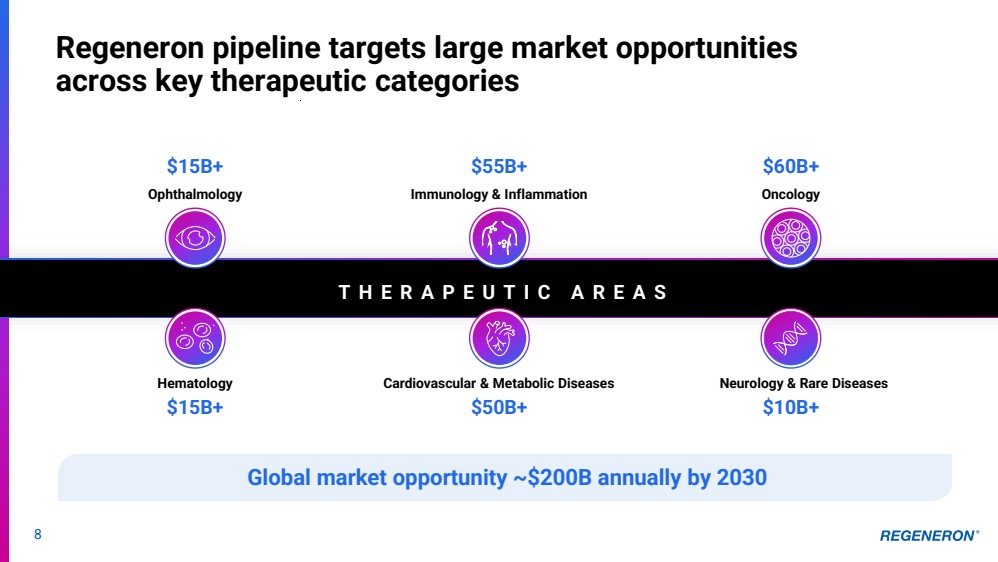

| Regeneron pipeline targets large market opportunities across key therapeutic categories Ophthalmology Oncology Hematology Cardiovascular & Metabolic Diseases Neurology & Rare Diseases $15B+ $55B+ $60B+ $15B+ $50B+ $10B+ T H E R A P E U T I C A R E A S Global market opportunity ~$200B annually by 2030 Immunology & Inflammation 8 |

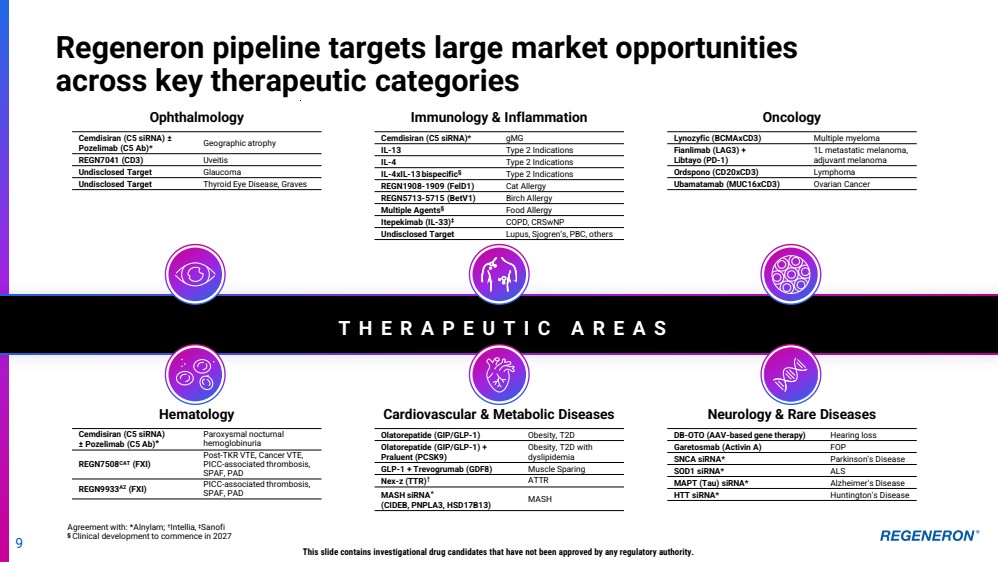

| 9 Cemdisiran (C5 siRNA) ± Pozelimab (C5 Ab)* Paroxysmal nocturnal hemoglobinuria REGN7508CAT (FXI) Post-TKR VTE, Cancer VTE, PICC-associated thrombosis, SPAF, PAD REGN9933A2 (FXI) PICC-associated thrombosis, SPAF, PAD This slide contains investigational drug candidates that have not been approved by any regulatory authority. Ophthalmology Immunology & Inflammation Oncology Hematology Cardiovascular & Metabolic Diseases Neurology & Rare Diseases T H E R A P E U T I C A R E A S Olatorepatide (GIP/GLP-1) Obesity, T2D Olatorepatide (GIP/GLP-1) + Praluent (PCSK9) Obesity, T2D with dyslipidemia GLP-1 + Trevogrumab (GDF8) Muscle Sparing Nex-z (TTR)† ATTR MASH siRNA* (CIDEB, PNPLA3, HSD17B13) MASH DB-OTO (AAV-based gene therapy) Hearing loss Garetosmab (Activin A) FOP SNCA siRNA* Parkinson’s Disease SOD1 siRNA* ALS MAPT (Tau) siRNA* Alzheimer’s Disease HTT siRNA* Huntington’s Disease Cemdisiran (C5 siRNA)* gMG IL-13 Type 2 Indications IL-4 Type 2 Indications IL-4xIL-13 bispecific§ Type 2 Indications REGN1908-1909 (FelD1) Cat Allergy REGN5713-5715 (BetV1) Birch Allergy Multiple Agents§ Food Allergy Itepekimab (IL-33)‡ COPD, CRSwNP Undisclosed Target Lupus, Sjogren’s, PBC, others Lynozyfic (BCMAxCD3) Multiple myeloma Fianlimab (LAG3) + Libtayo (PD-1) 1L metastatic melanoma, adjuvant melanoma Ordspono (CD20xCD3) Lymphoma Ubamatamab (MUC16xCD3) Ovarian Cancer Cemdisiran (C5 siRNA) ± Pozelimab (C5 Ab)* Geographic atrophy REGN7041 (CD3) Uveitis Undisclosed Target Glaucoma Undisclosed Target Thyroid Eye Disease, Graves Regeneron pipeline targets large market opportunities across key therapeutic categories Agreement with: *Alnylam; † Intellia, ‡Sanofi § Clinical development to commence in 2027 |

| 10 Sustaining I&I leadership and unlocking new growth opportunities Leveraging learnings from Dupixent and disease biology to advance next-gen approaches to treat inflammatory diseases ‘Lifecycle’ opportunities • Longer Dupixent* dosing intervals • Novel long-acting IL-4Rα † antibody • Long-acting, fully-human IL-13 & IL-4 antibodies with optimized binding properties – Expedited AD development plan for IL-13; FIH expected in 1H 2026 • Long-acting IL-4xIL-13 bispecific Pursuing multi-pronged approach to sustain I&I leadership into the next decade Advancing broader allergy pipeline into large commercial opportunities Allergen-specific antibody approaches • Cat (FelD1) and birch (BetV1) allergy programs each demonstrated positive Phase 3 results in 2025 • Registration-enabling studies initiating in 2026 for both programs; data anticipated in 2027 Severe IgE-mediated food allergy • Lynozyfic (BCMAxCD3) + Dupixent* achieved proof-of-principle; demonstrated sustained >90% reductions in IgE in 4 of 4 evaluable patients • Advancing novel therapeutic candidates to develop more-targeted and/or specific approaches to potentially eliminate IgE-mediated allergies; FIH expected by 2027 This slide contains investigational drug candidates that have not been approved by any regulatory authority. * In collaboration with Sanofi † Covered by the Sanofi collaboration Immunology & Inflammation Type 2 Diseases Novel I&I Targets IgE-Mediated Allergy Allergen-Specific Allergy Investigating novel I&I targets • Itepekimab* (IL-33): Advancing in respiratory indications with strong genetic associations – Phase 3 CRSwNP data anticipated in 2027 • Additional genetic-defined targets discovered by RGC, each with pipeline-in-a-product potential, expected to enter clinic in 2026-2027 |

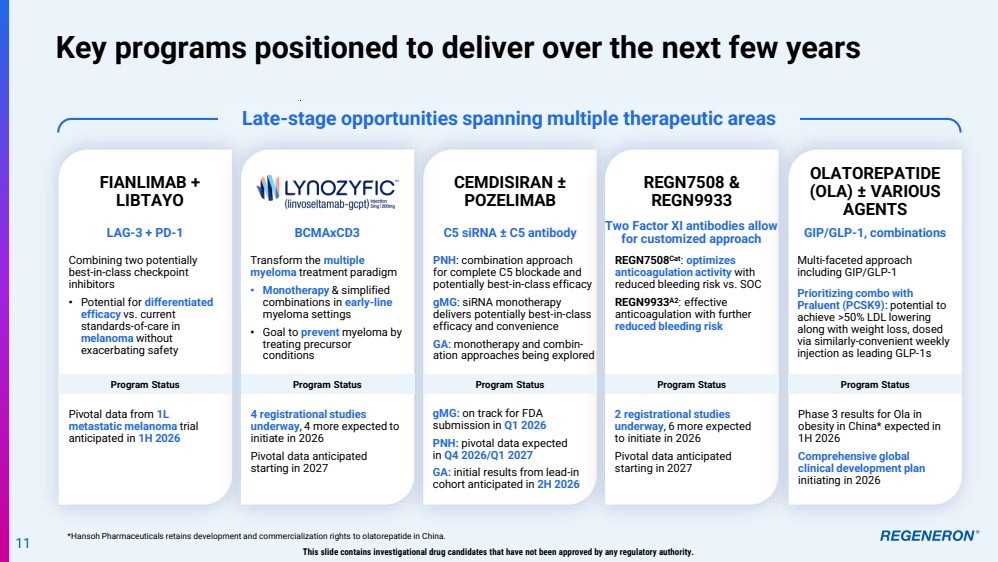

| Late-stage opportunities spanning multiple therapeutic areas Key programs positioned to deliver over the next few years *Hansoh Pharmaceuticals retains development and commercialization rights to olatorepatide in China. 11 This slide contains investigational drug candidates that have not been approved by any regulatory authority. REGN7508 & REGN9933 Combining two potentially best-in-class checkpoint inhibitors • Potential for differentiated efficacy vs. current standards-of-care in melanoma without exacerbating safety FIANLIMAB + LIBTAYO CEMDISIRAN ± POZELIMAB Program Status Pivotal data from 1L metastatic melanoma trial anticipated in 1H 2026 Transform the multiple myeloma treatment paradigm • Monotherapy & simplified combinations in early-line myeloma settings • Goal to prevent myeloma by treating precursor conditions Multi-faceted approach including GIP/GLP-1 Prioritizing combo with Praluent (PCSK9): potential to achieve >50% LDL lowering along with weight loss, dosed via similarly-convenient weekly injection as leading GLP-1s REGN7508Cat: optimizes anticoagulation activity with reduced bleeding risk vs. SOC REGN9933A2: effective anticoagulation with further reduced bleeding risk PNH: combination approach for complete C5 blockade and potentially best-in-class efficacy gMG: siRNA monotherapy delivers potentially best-in-class efficacy and convenience GA: monotherapy and combin-ation approaches being explored Phase 3 results for Ola in obesity in China* expected in 1H 2026 Comprehensive global clinical development plan initiating in 2026 2 registrational studies underway, 6 more expected to initiate in 2026 Pivotal data anticipated starting in 2027 LAG-3 + PD-1 BCMAxCD3 GIP/GLP-1, combinations Two Factor XI antibodies allow for customized approach C5 siRNA ± C5 antibody gMG: on track for FDA submission in Q1 2026 PNH: pivotal data expected in Q4 2026/Q1 2027 GA: initial results from lead-in cohort anticipated in 2H 2026 OLATOREPATIDE (OLA) ± VARIOUS AGENTS Program Status Program Status Program Status Program Status 4 registrational studies underway, 4 more expected to initiate in 2026 Pivotal data anticipated starting in 2027 |

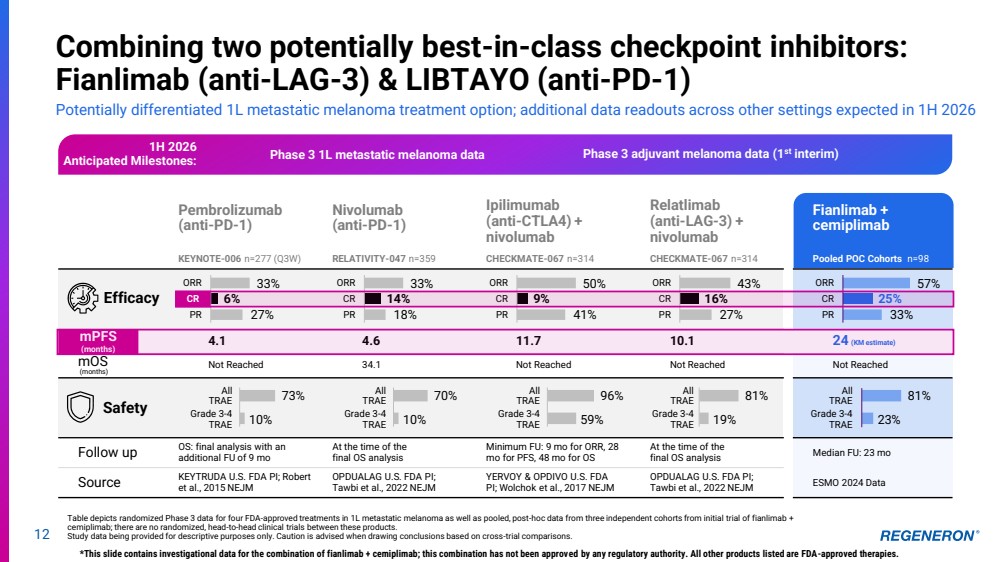

| Pembrolizumab (anti-PD-1) KEYNOTE-006 n=277 (Q3W) Nivolumab (anti-PD-1) RELATIVITY-047 n=359 Ipilimumab (anti-CTLA4) + nivolumab CHECKMATE-067 n=314 Relatlimab (anti-LAG-3) + nivolumab CHECKMATE-067 n=314 Fianlimab + cemiplimab Pooled POC Cohorts n=98 mPFS 4.1 4.6 11.7 10.1 24 (KM estimate) mOS (months) Not Reached 34.1 Not Reached Not Reached Not Reached All TRAE Grade 3-4 TRAE All TRAE Grade 3-4 TRAE All TRAE Grade 3-4 TRAE All TRAE Grade 3-4 TRAE All TRAE Grade 3-4 TRAE Follow up OS: final analysis with an additional FU of 9 mo At the time of the final OS analysis Minimum FU: 9 mo for ORR, 28 mo for PFS, 48 mo for OS At the time of the final OS analysis Median FU: 23 mo Source KEYTRUDA U.S. FDA PI; Robert et al., 2015 NEJM OPDUALAG U.S. FDA PI; Tawbi et al., 2022 NEJM YERVOY & OPDIVO U.S. FDA PI; Wolchok et al., 2017 NEJM OPDUALAG U.S. FDA PI; Tawbi et al., 2022 NEJM ESMO 2024 Data 12 Combining two potentially best-in-class checkpoint inhibitors: Fianlimab (anti-LAG-3) & LIBTAYO (anti-PD-1) Potentially differentiated 1L metastatic melanoma treatment option; additional data readouts across other settings expected in 1H 2026 Table depicts randomized Phase 3 data for four FDA-approved treatments in 1L metastatic melanoma as well as pooled, post-hoc data from three independent cohorts from initial trial of fianlimab + cemiplimab; there are no randomized, head-to-head clinical trials between these products. Study data being provided for descriptive purposes only. Caution is advised when drawing conclusions based on cross-trial comparisons. *This slide contains investigational data for the combination of fianlimab + cemiplimab; this combination has not been approved by any regulatory authority. All other products listed are FDA-approved therapies. Safety Efficacy 33% 6% 27% ORR CR PR 33% 14% 18% ORR CR PR 50% 9% 41% ORR CR PR 43% 16% 27% ORR CR PR 57% 25% 33% ORR CR PR 73% 10% 70% 10% 96% 59% 81% 19% 81% 23% CR mPFS (months) 1H 2026 Anticipated Milestones: Phase 3 adjuvant melanoma data (1st Phase 3 1L metastatic melanoma data interim) |

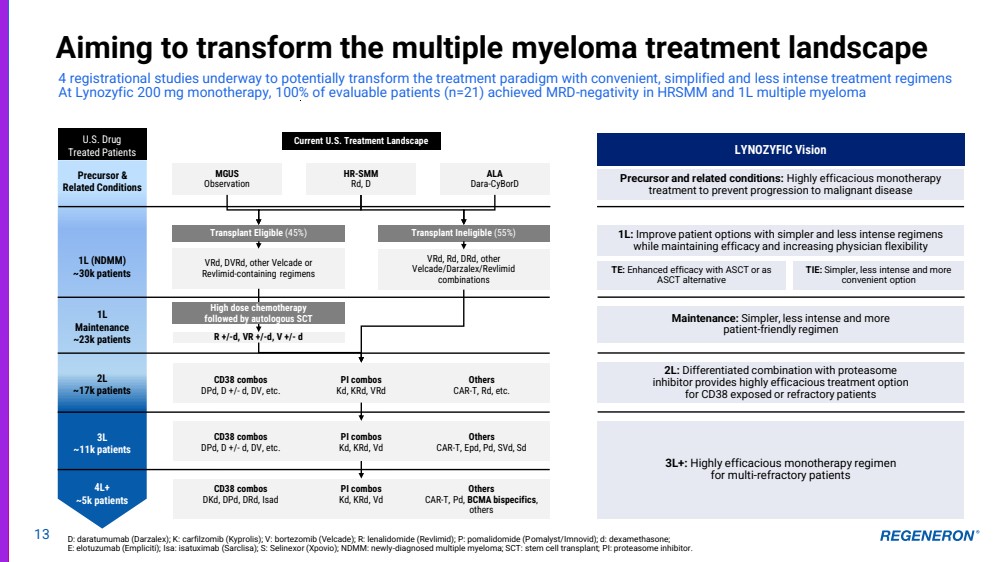

| LYNOZYFIC Vision 1L: Improve patient options with simpler and less intense regimens while maintaining efficacy and increasing physician flexibility TE: Enhanced efficacy with ASCT or as ASCT alternative TIE: Simpler, less intense and more convenient option Maintenance: Simpler, less intense and more patient-friendly regimen 2L: Differentiated combination with proteasome inhibitor provides highly efficacious treatment option for CD38 exposed or refractory patients 3L+: Highly efficacious monotherapy regimen for multi-refractory patients VRd, Rd, DRd, other Velcade/Darzalex/Revlimid combinations VRd, DVRd, other Velcade or Revlimid-containing regimens Current U.S. Treatment Landscape Transplant Eligible (45%) Transplant Ineligible (55%) R +/-d, VR +/-d, V +/- d 1L (NDMM) ~30k patients 1L Maintenance ~23k patients U.S. Drug Treated Patients 2L ~17k patients 3L ~11k patients 4L+ ~5k patients CD38 combos DKd, DPd, DRd, Isad PI combos Kd, KRd, Vd Others CAR-T, Pd, BCMA bispecifics, others CD38 combos DPd, D +/- d, DV, etc. PI combos Kd, KRd, Vd Others CAR-T, Epd, Pd, SVd, Sd CD38 combos DPd, D +/- d, DV, etc. PI combos Kd, KRd, VRd Others CAR-T, Rd, etc. High dose chemotherapy followed by autologous SCT MGUS Observation HR-SMM Rd, D ALA Dara-CyBorD Precursor and related conditions: Highly efficacious monotherapy treatment to prevent progression to malignant disease 13 Aiming to transform the multiple myeloma treatment landscape 4 registrational studies underway to potentially transform the treatment paradigm with convenient, simplified and less intense treatment regimens At Lynozyfic 200 mg monotherapy, 100% of evaluable patients (n=21) achieved MRD-negativity in HRSMM and 1L multiple myeloma Precursor & Related Conditions D: daratumumab (Darzalex); K: carfilzomib (Kyprolis); V: bortezomib (Velcade); R: lenalidomide (Revlimid); P: pomalidomide (Pomalyst/Imnovid); d: dexamethasone; E: elotuzumab (Empliciti); Isa: isatuximab (Sarclisa); S: Selinexor (Xpovio); NDMM: newly-diagnosed multiple myeloma; SCT: stem cell transplant; PI: proteasome inhibitor. |

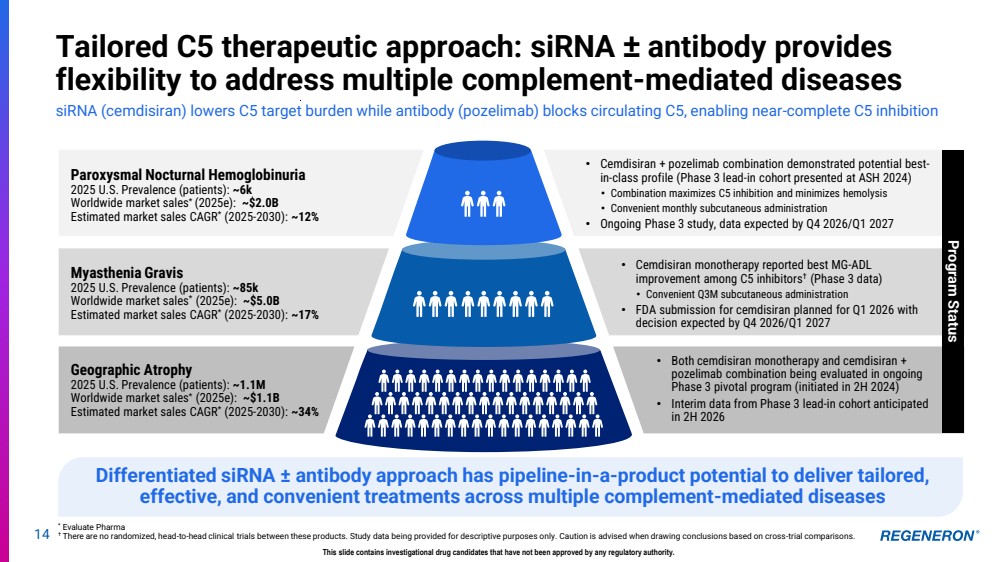

| 14 Tailored C5 therapeutic approach: siRNA ± antibody provides flexibility to address multiple complement-mediated diseases siRNA (cemdisiran) lowers C5 target burden while antibody (pozelimab) blocks circulating C5, enabling near-complete C5 inhibition * Evaluate Pharma † There are no randomized, head-to-head clinical trials between these products. Study data being provided for descriptive purposes only. Caution is advised when drawing conclusions based on cross-trial comparisons. This slide contains investigational drug candidates that have not been approved by any regulatory authority. • Both cemdisiran monotherapy and cemdisiran + pozelimab combination being evaluated in ongoing Phase 3 pivotal program (initiated in 2H 2024) • Interim data from Phase 3 lead-in cohort anticipated in 2H 2026 • Cemdisiran monotherapy reported best MG-ADL improvement among C5 inhibitors† (Phase 3 data) • Convenient Q3M subcutaneous administration • FDA submission for cemdisiran planned for Q1 2026 with decision expected by Q4 2026/Q1 2027 • Cemdisiran + pozelimab combination demonstrated potential best-in-class profile (Phase 3 lead-in cohort presented at ASH 2024) • Combination maximizes C5 inhibition and minimizes hemolysis • Convenient monthly subcutaneous administration • Ongoing Phase 3 study, data expected by Q4 2026/Q1 2027 Geographic Atrophy 2025 U.S. Prevalence (patients): ~1.1M Worldwide market sales* (2025e): ~$1.1B Estimated market sales CAGR* (2025-2030): ~34% Paroxysmal Nocturnal Hemoglobinuria 2025 U.S. Prevalence (patients): ~6k Worldwide market sales* (2025e): ~$2.0B Estimated market sales CAGR* (2025-2030): ~12% Myasthenia Gravis 2025 U.S. Prevalence (patients): ~85k Worldwide market sales* (2025e): ~$5.0B Estimated market sales CAGR* (2025-2030): ~17% Differentiated siRNA ± antibody approach has pipeline-in-a-product potential to deliver tailored, effective, and convenient treatments across multiple complement-mediated diseases Program Status |

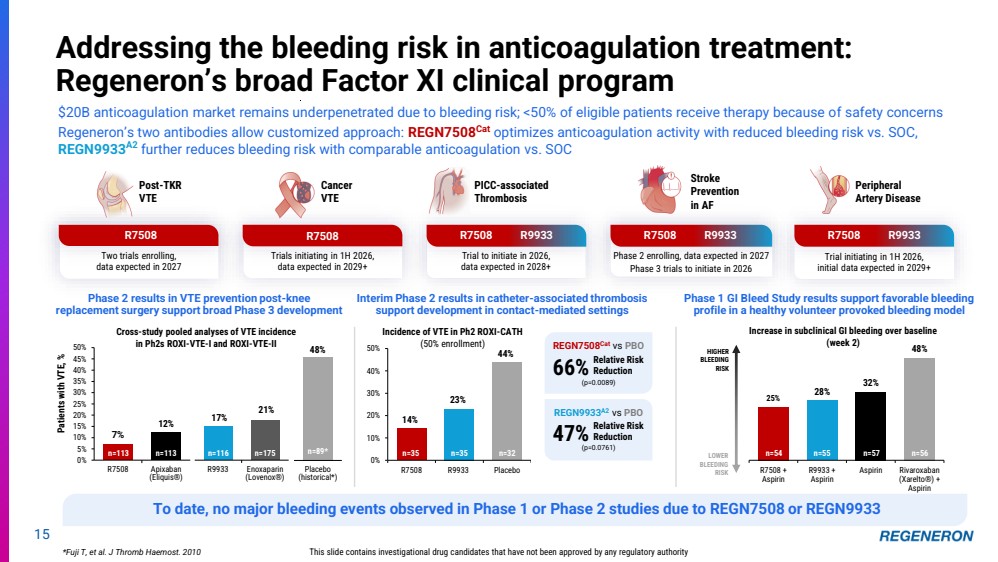

| 25% 28% 32% 48% R7508 + Aspirin R9933 + Aspirin Aspirin Rivaroxaban (Xarelto®) + Aspirin Trial initiating in 1H 2026, initial data expected in 2029+ Phase 2 enrolling, data expected in 2027 Phase 3 trials to initiate in 2026 Trial to initiate in 2026, data expected in 2028+ Two trials enrolling, data expected in 2027 Peripheral Artery Disease 15 Addressing the bleeding risk in anticoagulation treatment: Regeneron’s broad Factor XI clinical program This slide contains investigational drug candidates that have not been approved by any regulatory authority Stroke Prevention in AF Cancer VTE Post-TKR VTE PICC-associated Thrombosis R7508 R9933 *Fuji T, et al. J Thromb Haemost. 2010 14% 23% 44% 0% 10% 20% 30% 40% 50% R7508 R9933 Placebo n=35 n=35 n=32 REGN9933A2 vs PBO 47% Relative Risk Reduction (p=0.0761) REGN7508Cat vs PBO 66% Relative Risk Reduction (p=0.0089) R7508 R7508 R9933 R7508 R9933 Phase 2 results in VTE prevention post-knee replacement surgery support broad Phase 3 development Interim Phase 2 results in catheter-associated thrombosis support development in contact-mediated settings n=54 n=55 n=57 n=56 LOWER BLEEDING RISK HIGHER BLEEDING RISK Increase in subclinical GI bleeding over baseline (week 2) Phase 1 GI Bleed Study results support favorable bleeding profile in a healthy volunteer provoked bleeding model Incidence of VTE in Ph2 ROXI-CATH (50% enrollment) Trials initiating in 1H 2026, data expected in 2029+ R7508 $20B anticoagulation market remains underpenetrated due to bleeding risk; <50% of eligible patients receive therapy because of safety concerns Regeneron’s two antibodies allow customized approach: REGN7508Cat optimizes anticoagulation activity with reduced bleeding risk vs. SOC, REGN9933A2 further reduces bleeding risk with comparable anticoagulation vs. SOC Cross-study pooled analyses of VTE incidence in Ph2s ROXI-VTE-I and ROXI-VTE-II 7% 12% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% R7508 Apixaban (Eliquis®) Patients with VTE, % n=113 n=113 17% 21% R9933 Enoxaparin (Lovenox®) n=116 n=175 48% Placebo (historical*) n=89* To date, no major bleeding events observed in Phase 1 or Phase 2 studies due to REGN7508 or REGN9933 |

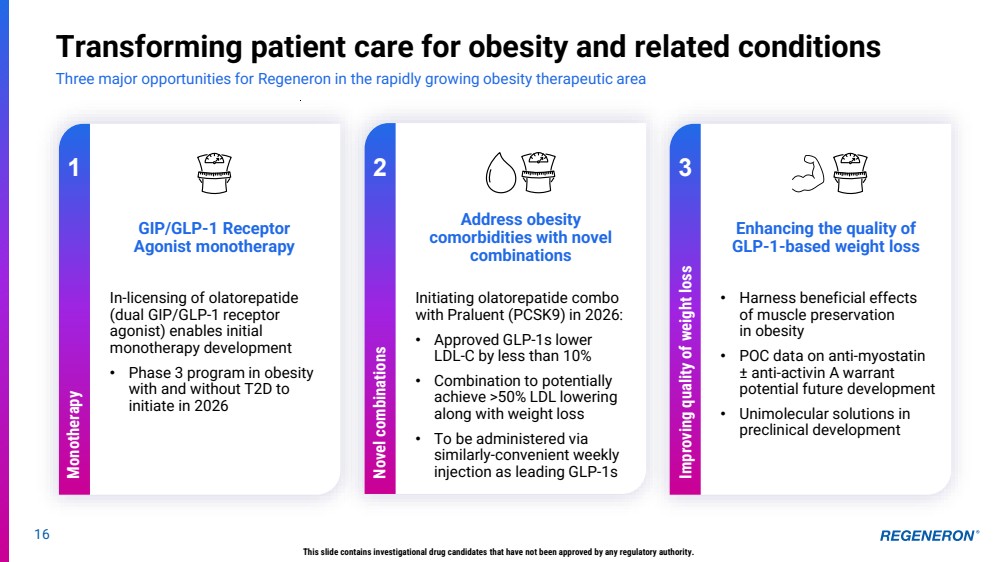

| 16 Transforming patient care for obesity and related conditions Three major opportunities for Regeneron in the rapidly growing obesity therapeutic area This slide contains investigational drug candidates that have not been approved by any regulatory authority. 1 GIP/GLP-1 Receptor Agonist monotherapy Enhancing the quality of GLP-1-based weight loss Address obesity comorbidities with novel combinations 2 3 • Harness beneficial effects of muscle preservation in obesity • POC data on anti-myostatin ± anti-activin A warrant potential future development • Unimolecular solutions in preclinical development Initiating olatorepatide combo with Praluent (PCSK9) in 2026: • Approved GLP-1s lower LDL-C by less than 10% • Combination to potentially achieve >50% LDL lowering along with weight loss • To be administered via similarly-convenient weekly injection as leading GLP-1s In-licensing of olatorepatide (dual GIP/GLP-1 receptor agonist) enables initial monotherapy development • Phase 3 program in obesity with and without T2D to initiate in 2026 Monotherapy Novel combinations Improving quality of weight loss |

| Q&A This non-promotional presentation contains investigational data as well as forward-looking statements; actual results may vary materially. Dr. George Yancopoulos, MD, PhD Board Co-Chair, Co-Founder, President, and Chief Scientific Officer Dr. Leonard Schleifer, MD, PhD Board Co-Chair, Co-Founder, President, and Chief Executive Officer 17 |

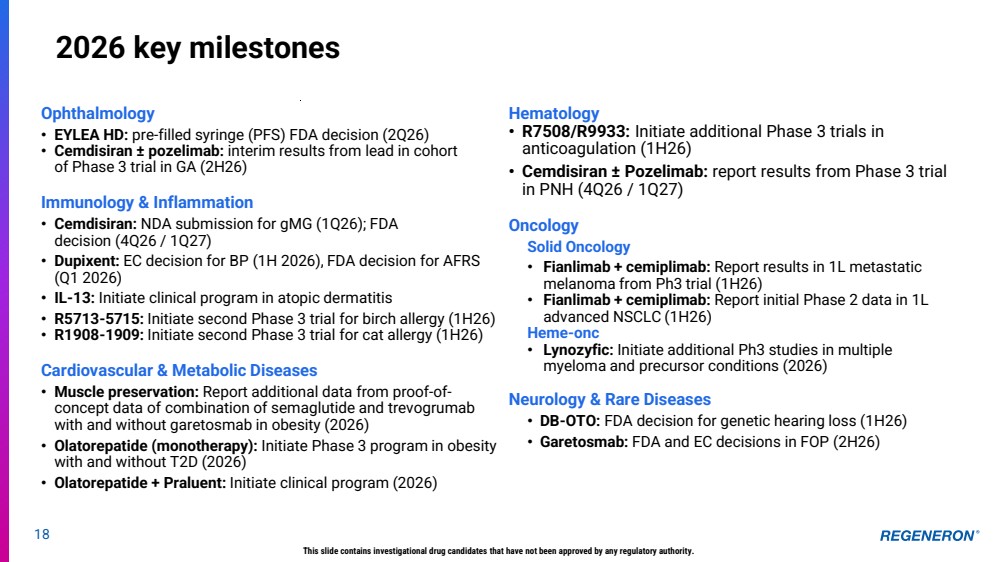

| 18 2026 Key Milestones Hematology • R7508/R9933: Initiate additional Phase 3 trials in anticoagulation (1H26) • Cemdisiran ± Pozelimab: report results from Phase 3 trial in PNH (4Q26 / 1Q27) Oncology Solid Oncology • Fianlimab + cemiplimab: Report results in 1L metastatic melanoma from Ph3 trial (1H26) • Fianlimab + cemiplimab: Report initial Phase 2 data in 1L advanced NSCLC (1H26) Heme-onc • Lynozyfic: Initiate additional Ph3 studies in multiple myeloma and precursor conditions (2026) Neurology & Rare Diseases • DB-OTO: FDA decision for genetic hearing loss (1H26) • Garetosmab: FDA and EC decisions in FOP (2H26) This slide contains investigational drug candidates that have not been approved by any regulatory authority. 2026 key milestones Ophthalmology • EYLEA HD: pre-filled syringe (PFS) FDA decision (2Q26) • Cemdisiran ± pozelimab: interim results from lead in cohort of Phase 3 trial in GA (2H26) Immunology & Inflammation • Cemdisiran: NDA submission for gMG (1Q26); FDA decision (4Q26 / 1Q27) • Dupixent: EC decision for BP (1H 2026), FDA decision for AFRS (Q1 2026) • IL-13: Initiate clinical program in atopic dermatitis • R5713-5715: Initiate second Phase 3 trial for birch allergy (1H26) • R1908-1909: Initiate second Phase 3 trial for cat allergy (1H26) Cardiovascular & Metabolic Diseases • Muscle preservation: Report additional data from proof-of-concept data of combination of semaglutide and trevogrumab with and without garetosmab in obesity (2026) • Olatorepatide (monotherapy): Initiate Phase 3 program in obesity with and without T2D (2026) • Olatorepatide + Praluent: Initiate clinical program (2026) |

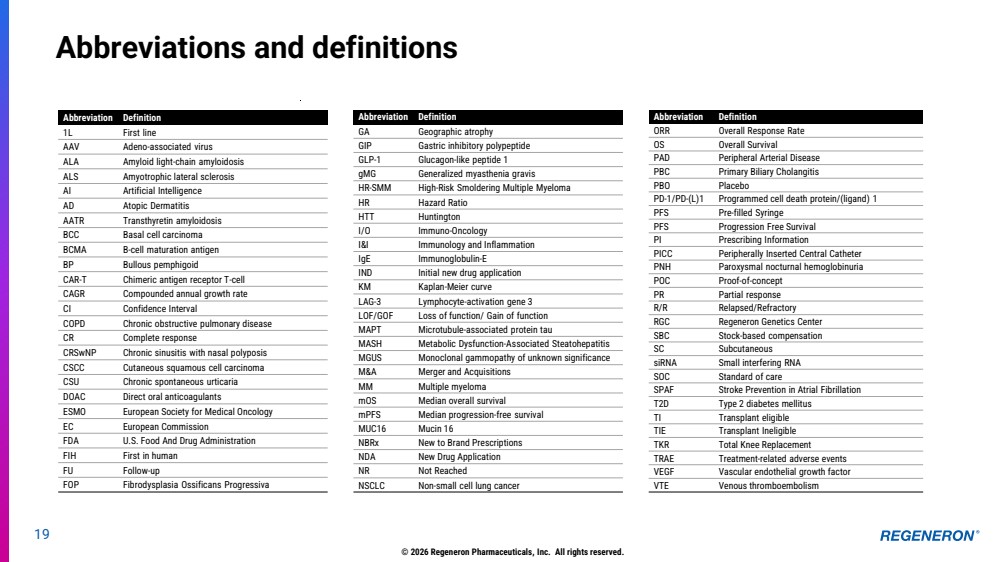

| 19 Abbreviations and definitions Abbreviation Definition 1L First line AAV Adeno-associated virus ALA Amyloid light-chain amyloidosis ALS Amyotrophic lateral sclerosis AI Artificial Intelligence AD Atopic Dermatitis AATR Transthyretin amyloidosis BCC Basal cell carcinoma BCMA B-cell maturation antigen BP Bullous pemphigoid CAR-T Chimeric antigen receptor T-cell CAGR Compounded annual growth rate CI Confidence Interval COPD Chronic obstructive pulmonary disease CR Complete response CRSwNP Chronic sinusitis with nasal polyposis CSCC Cutaneous squamous cell carcinoma CSU Chronic spontaneous urticaria DOAC Direct oral anticoagulants ESMO European Society for Medical Oncology EC European Commission FDA U.S. Food And Drug Administration FIH First in human FU Follow-up FOP Fibrodysplasia Ossificans Progressiva Abbreviation Definition GA Geographic atrophy GIP Gastric inhibitory polypeptide GLP-1 Glucagon-like peptide 1 gMG Generalized myasthenia gravis HR-SMM High-Risk Smoldering Multiple Myeloma HR Hazard Ratio HTT Huntington I/O Immuno-Oncology I&I Immunology and Inflammation IgE Immunoglobulin-E IND Initial new drug application KM Kaplan-Meier curve LAG-3 Lymphocyte-activation gene 3 LOF/GOF Loss of function/ Gain of function MAPT Microtubule-associated protein tau MASH Metabolic Dysfunction-Associated Steatohepatitis MGUS Monoclonal gammopathy of unknown significance M&A Merger and Acquisitions MM Multiple myeloma mOS Median overall survival mPFS Median progression-free survival MUC16 Mucin 16 NBRx New to Brand Prescriptions NDA New Drug Application NR Not Reached NSCLC Non-small cell lung cancer Abbreviation Definition ORR Overall Response Rate OS Overall Survival PAD Peripheral Arterial Disease PBC Primary Biliary Cholangitis PBO Placebo PD-1/PD-(L)1 Programmed cell death protein/(ligand) 1 PFS Pre-filled Syringe PFS Progression Free Survival PI Prescribing Information PICC Peripherally Inserted Central Catheter PNH Paroxysmal nocturnal hemoglobinuria POC Proof-of-concept PR Partial response R/R Relapsed/Refractory RGC Regeneron Genetics Center SBC Stock-based compensation SC Subcutaneous siRNA Small interfering RNA SOC Standard of care SPAF Stroke Prevention in Atrial Fibrillation T2D Type 2 diabetes mellitus TI Transplant eligible TIE Transplant Ineligible TKR Total Knee Replacement TRAE Treatment-related adverse events VEGF Vascular endothelial growth factor VTE Venous thromboembolism © 2026 Regeneron Pharmaceuticals, Inc. All rights reserved. |