We build and service the infrastructure that enables our economy to run, our people to move and our country to grow. Investor Presentation

2 DISCLOSURE: Forward-Looking Statements This presentation contains, and the officers and directors of the Company may from time to time make, statements that are considered forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which may include statements about: our business strategy; our financial strategy; our industry outlook; our guidance; our expected margin growth; and our plans, objectives, expectations, forecasts, outlook and intentions. All of these types of statements, other than statements of historical fact included in this presentation, are forward-looking statements. In some cases, forward- looking statements can be identified by terminology such as “may,” “will,” “could,” "would," “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” "guidance," “continue,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this presentation are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. In addition, management’s assumptions about future events may prove to be inaccurate. Management cautions all readers that the forward- looking statements contained in this presentation are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward- looking statements due to factors listed in the “Risk Factors” section in our filings with the U.S. Securities and Exchange Commission and elsewhere in those filings. Additional factors or risks that we currently deem immaterial, that are not presently known to us or that arise in the future could also cause our actual results to differ materially from our expected results. Given these uncertainties, investors are cautioned that many of the assumptions upon which our forward-looking statements are based are likely to change after the date the forward-looking statements are made. The forward-looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any forward-looking statements for any reason, whether as a result of new information, future events or developments, changed circumstances, or otherwise, notwithstanding any changes in our assumptions, changes in business plans, actual experience or other changes. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf. Sterling Infrastructure, Inc. | STRL: IR Presentation

3 DISCLOSURE: Non-GAAP Measures This presentation contains “Non-GAAP” financial measures as defined under Regulation G of the amended U.S. Securities Exchange Act of 1934. The Company reports financial results in accordance with U.S. generally accepted accounting principles (“GAAP”), but the Company believes that certain Non- GAAP financial measures provide useful supplemental information to investors regarding the underlying business trends and performance of the Company’s ongoing operations and are useful for period-over-period comparisons of those operations. Non-GAAP financial measures should be used in addition to, and not in lieu of, results prepared in conformity with GAAP. Reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measure are provided in the Appendix to this presentation. We have not provided the most directly comparable GAAP financial measures, or a quantitative reconciliation thereto, for the forward-looking full year guidance that includes CEC’s 2025 estimated adjusted net income, estimated adjusted diluted earnings per share, or estimated adjusted EBITDA included in this presentation in reliance on the “unreasonable efforts” exception provided under Rule 100(a)(2) of Regulation G. Providing the most directly comparable GAAP financial measures, or a quantitative reconciliation thereto, cannot be done without unreasonable effort due to the inherent uncertainty and difficulty in predicting the timing and amount of certain items, including but not limited to amortization of intangible assets and depreciation, which may be significant and difficult to project with a reasonable degree of accuracy, as the allocation of purchase price to intangible assets and property and equipment has not yet been performed. Because these adjustments are inherently variable and uncertain and depend on various factors that are beyond the Company’s control, we are also unable to predict their probable significance. The variability of these items could have an unpredictable, and potentially significant, impact on our future GAAP financial results. Sterling Infrastructure, Inc. | STRL: IR Presentation

KEY Sterling Infrastructure, Inc. | STRL: IR Presentation 4 TAKEAWAYS Sterling, A Leading Infrastructure Services Provider • Focused on high-margin growth, strategic market expansion and operational excellence Transformation Built the Foundation for Success • Disciplined approach to project selection and resource allocation, prioritizing high-margin, high-return opportunities Backlog, A Pipeline of High-Profitability Work • Future project phases offer clear visibility into growth Strong Platform Serving Diverse End Markets • We meet the infrastructure needs that shape America’s future Multi-year Investment Trends Driving Growth Across Our Segments • E-Infrastructure Solutions: Data center infrastructure, manufacturing onshoring, e-commerce • Transportation Solutions: 5-year highway bill, upgrade of infrastructure • Building Solutions: Focused on high-growth metropolitan areas Optimizing Margins and Returns to Drive Shareholder Value • Strong financial performance and operating cash flow generation Balance Sheet with Significant Firepower to Support Future Growth

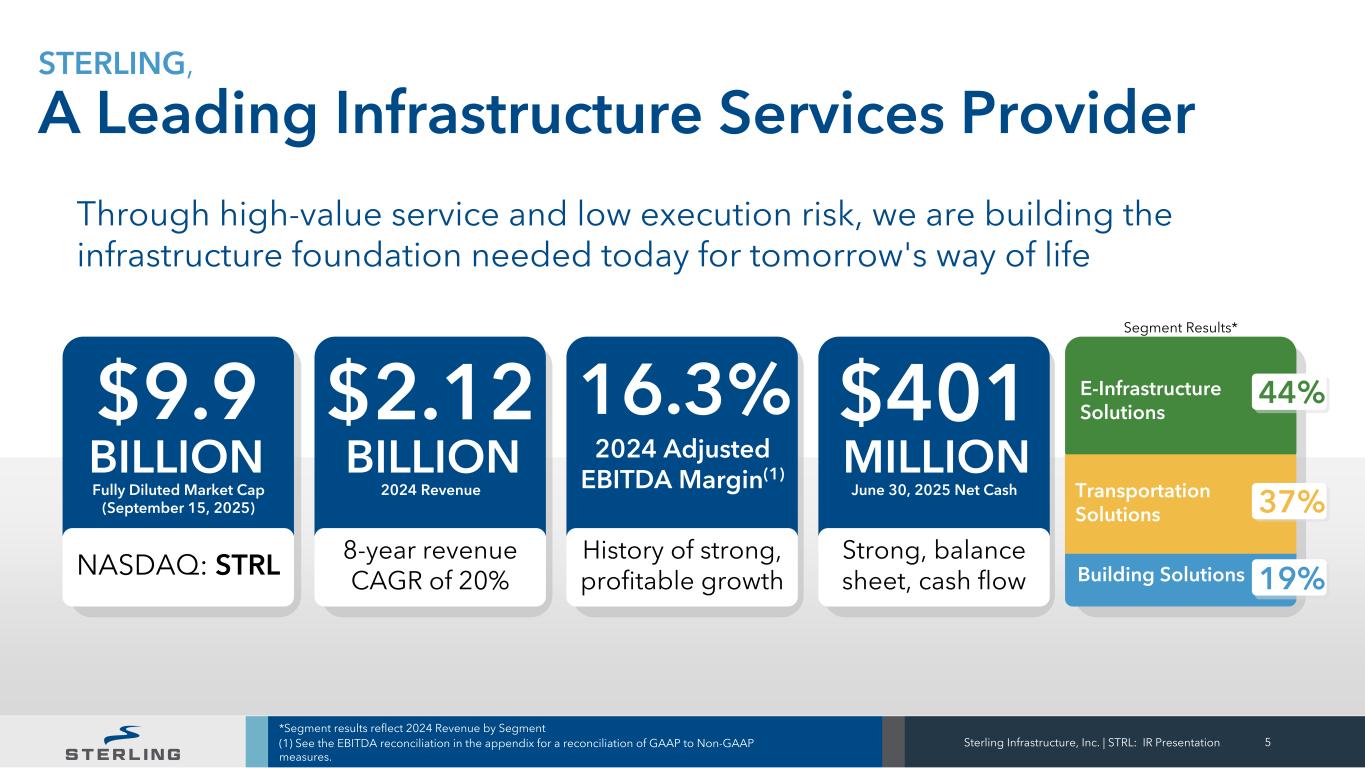

E-Infrastructure Solutions Building Solutions Transportation Solutions 44% 5Sterling Infrastructure, Inc. | STRL: IR Presentation *Segment results reflect 2024 Revenue by Segment (1) See the EBITDA reconciliation in the appendix for a reconciliation of GAAP to Non-GAAP measures. Through high-value service and low execution risk, we are building the infrastructure foundation needed today for tomorrow's way of life $9.9 16.3% 2024 Revenue $401 BILLION Fully Diluted Market Cap (September 15, 2025) $2.12 BILLION 2024 Adjusted EBITDA Margin(1) June 30, 2025 Net Cash STERLING, A Leading Infrastructure Services Provider MILLION NASDAQ: STRL 8-year revenue CAGR of 20% History of strong, profitable growth Strong, balance sheet, cash flow 37% 19% Segment Results*

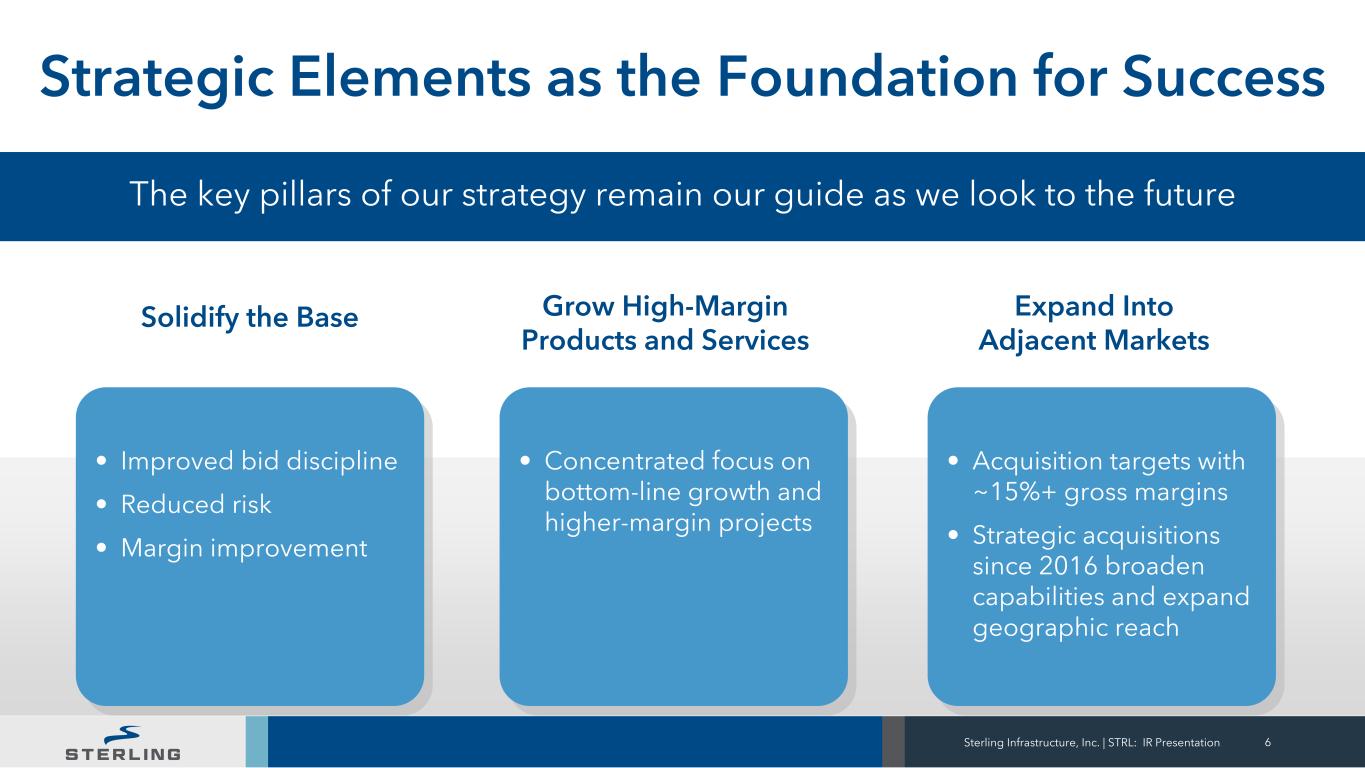

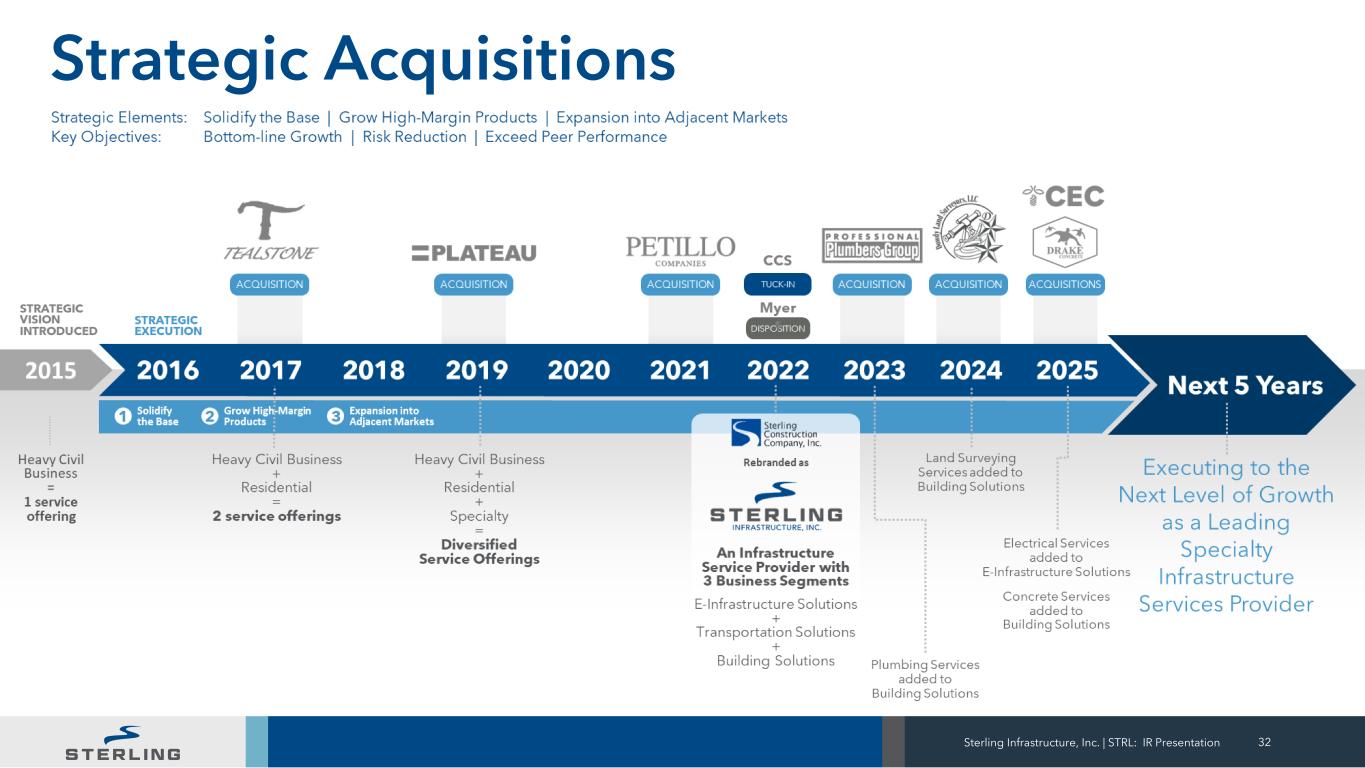

• Improved bid discipline • Reduced risk • Margin improvement • Concentrated focus on bottom-line growth and higher-margin projects • Acquisition targets with ~15%+ gross margins • Strategic acquisitions since 2016 broaden capabilities and expand geographic reach 6 Strategic Elements as the Foundation for Success Sterling Infrastructure, Inc. | STRL: IR Presentation Solidify the Base Grow High-Margin Products and Services Expand Into Adjacent Markets The key pillars of our strategy remain our guide as we look to the future

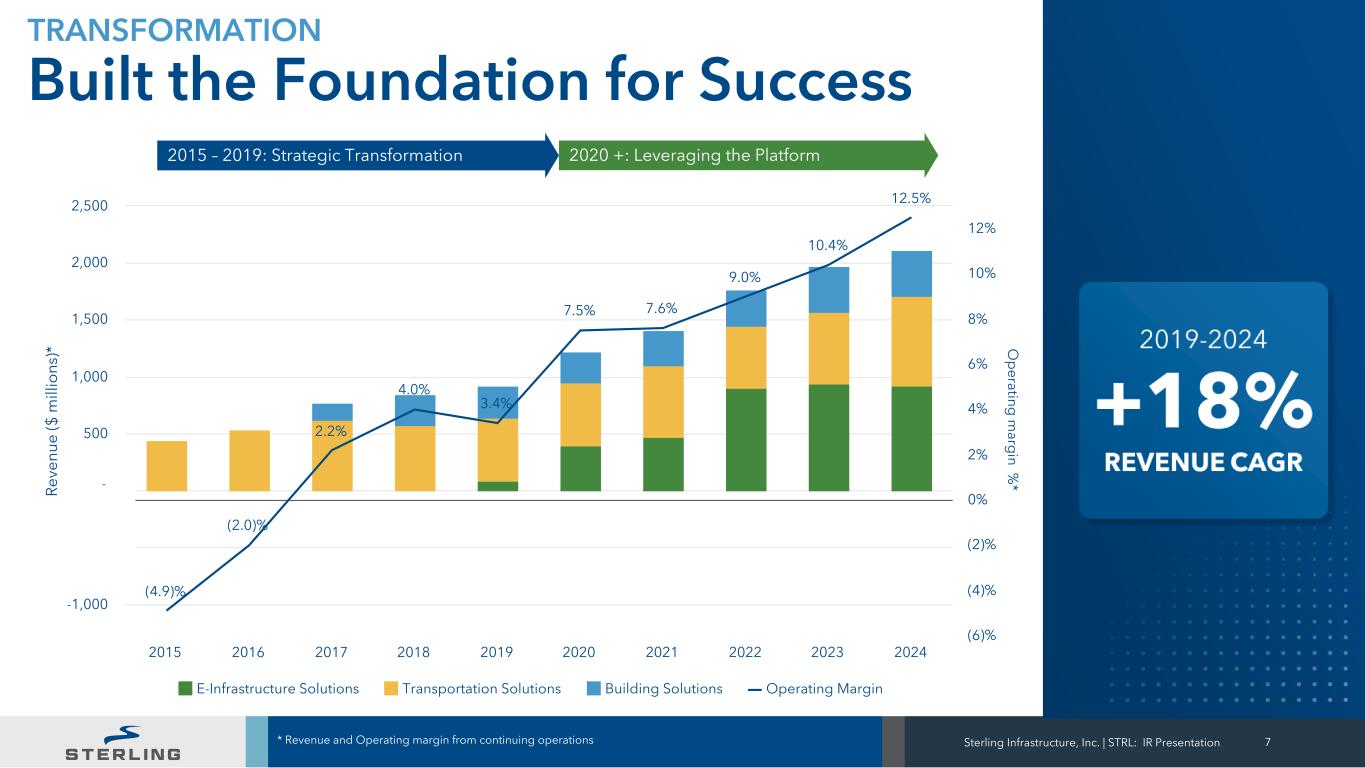

Sterling Infrastructure, Inc. | STRL: IR Presentation 7 R ev en ue ($ m ill io ns )* O p erating m arg in % * (4.9)% (2.0)% 2.2% 4.0% 3.4% 7.5% 7.6% 9.0% 10.4% 12.5% E-Infrastructure Solutions Transportation Solutions Building Solutions Operating Margin 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 -1,000 -500 0 500 1,000 1,500 2,000 2,500 (6)% (4)% (2)% 0% 2% 4% 6% 8% 10% 12% 2015 – 2019: Strategic Transformation 2020 +: Leveraging the Platform * Revenue and Operating margin from continuing operations +18% REVENUE CAGR 2019-2024 TRANSFORMATION Built the Foundation for Success

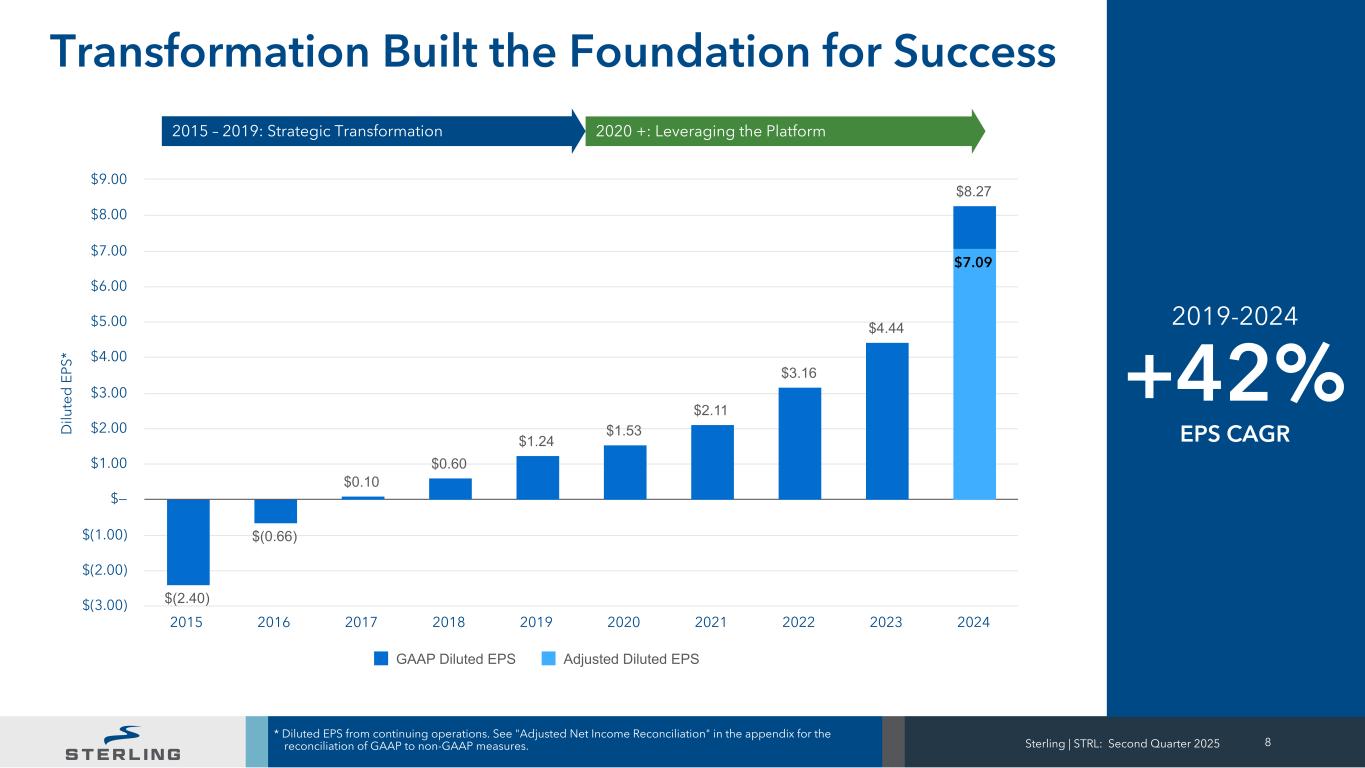

+42% EPS CAGR 2019-2024 8 2015 – 2019: Strategic Transformation 2020 +: Leveraging the Platform D ilu te d E PS * $0.10 $0.60 $1.24 $1.53 $2.11 $3.16 $4.44 $8.27 $(2.40) $(0.66) $7.09 GAAP Diluted EPS Adjusted Diluted EPS 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 $(3.00) $(2.00) $(1.00) $— $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 Transformation Built the Foundation for Success * Diluted EPS from continuing operations. See "Adjusted Net Income Reconciliation" in the appendix for the reconciliation of GAAP to non-GAAP measures. Sterling | STRL: Second Quarter 2025

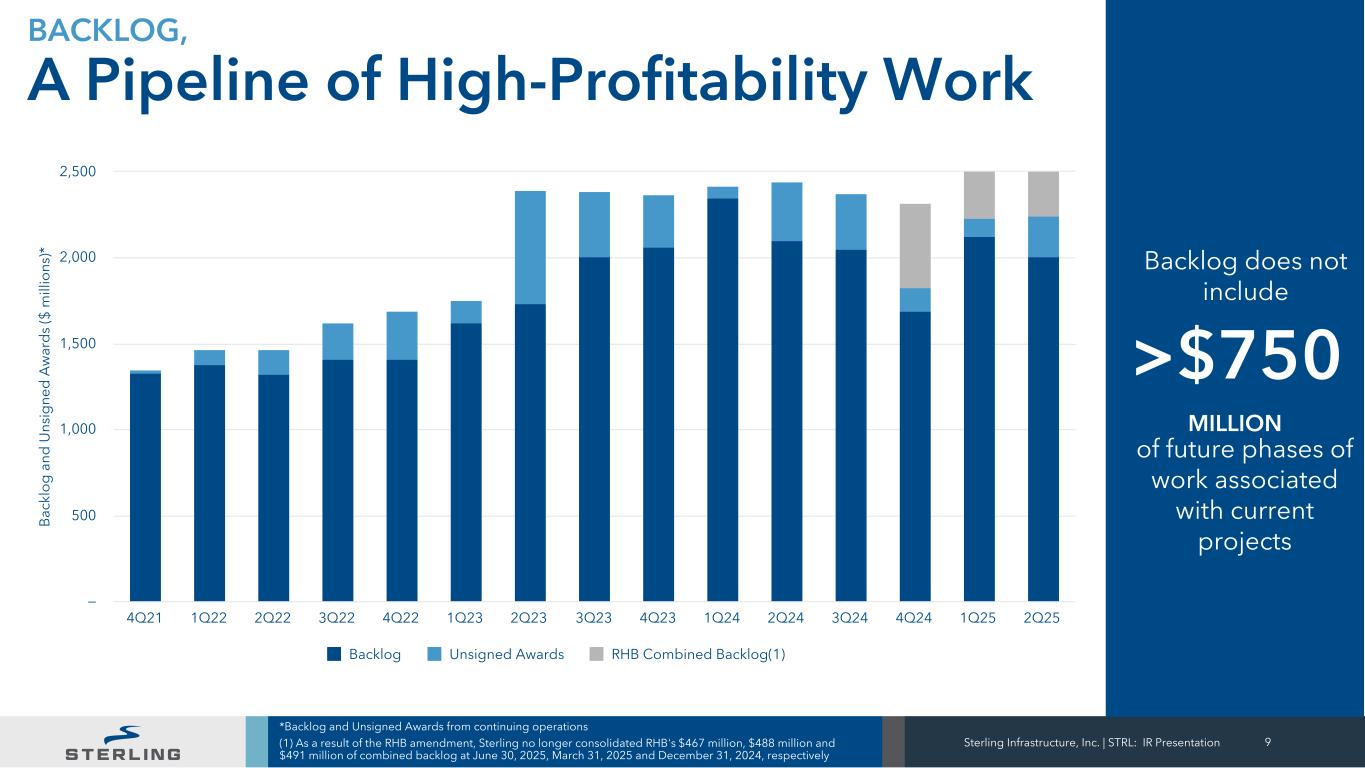

MILLION Sterling Infrastructure, Inc. | STRL: IR Presentation 9 *Backlog and Unsigned Awards from continuing operations (1) As a result of the RHB amendment, Sterling no longer consolidated RHB's $467 million, $488 million and $491 million of combined backlog at June 30, 2025, March 31, 2025 and December 31, 2024, respectively B ac kl o g a nd U ns ig ne d A w ar d s ($ m ill io ns )* Backlog Unsigned Awards RHB Combined Backlog(1) 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 — 500 1,000 1,500 2,000 2,500 >$750 Backlog does not include of future phases of work associated with current projects BACKLOG, A Pipeline of High-Profitability Work

10 Strong Platform Serving Diverse End Markets Sterling Infrastructure, Inc. | STRL: IR Presentation Sterling is playing a critical role in building the data infrastructure that enables today's way of life, the manufacturing production coming back to the US, the highways, the bridges, and the airports that connect us, and the homes we live in.

Sterling Infrastructure, Inc. | STRL: IR Presentation 11 *ENR (Engineering News-Record) The Top 600, The Top 20 Firms in Excavation, October 28, 2024 **Compound Annual Growth Rate (CAGR) E-Infrastructure Solutions Largest, highest-margin segment ranked #1 in ENR's 2023 Top 20 Firms in Excavation* E-Infrastructure Solutions data center project 2024 Financial Metrics $924M 22.0% REVENUE Op. Margin Four-Year CAGR** 23% REVENUE 28% Op. Income What We Do: Leading provider of large-scale specialty site infrastructure development services, including site selection and preparation, and mission-critical electrical services in the South, Southeastern, Northeastern and Mid-Atlantic U.S. Markets • Data Centers • Next Generation Manufacturing • Semiconductor Fabrication • E-Commerce Distribution Centers • Warehousing Drivers • Strong demand for data centers and mission-critical projects • Reshoring of manufacturing capacity • E-Commerce distribution center and small warehouses showing early signs of activity Key Customers

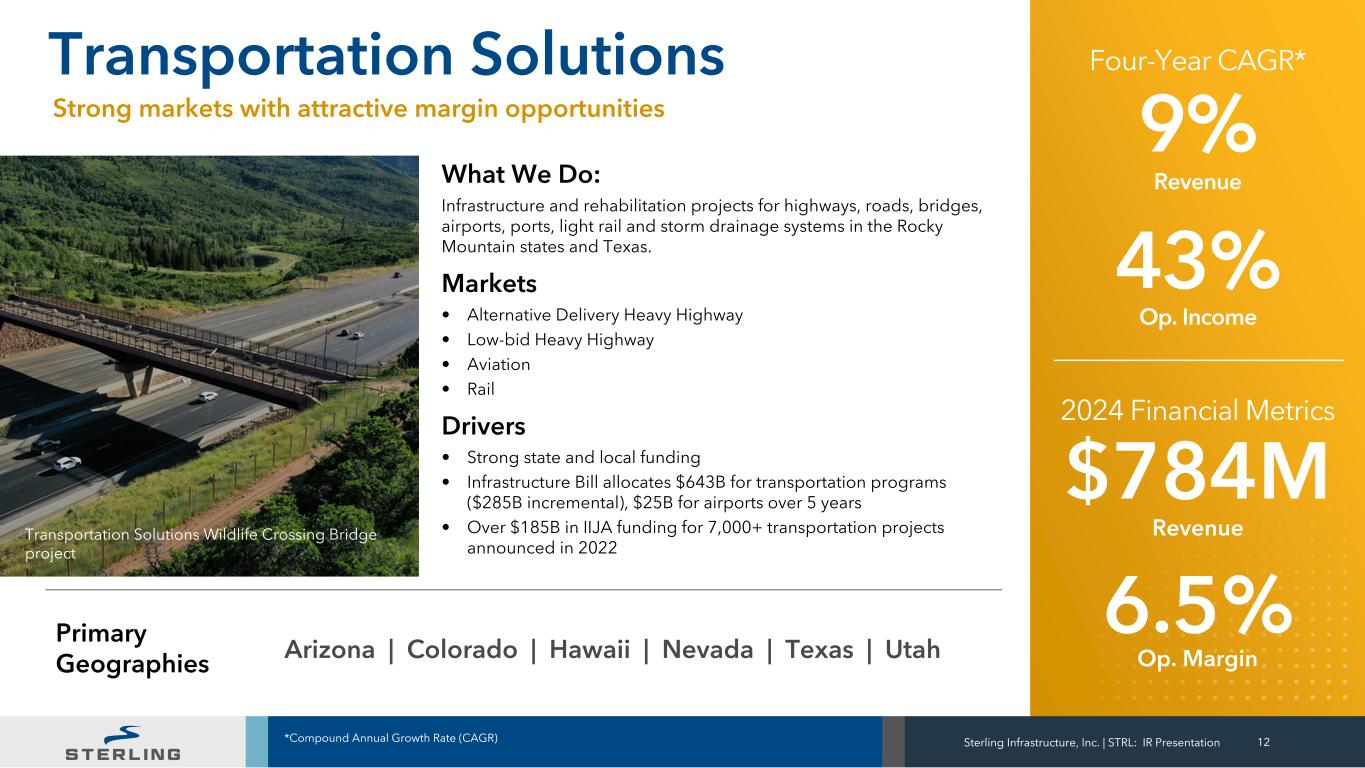

Sterling Infrastructure, Inc. | STRL: IR Presentation 12*Compound Annual Growth Rate (CAGR) Transportation Solutions Wildlife Crossing Bridge project Transportation Solutions Strong markets with attractive margin opportunities E-Infrastructure Solutions data cent r p ject Revenue Op. Margin Four-Year CAGR* 9% Revenue 43% Op. Income What We Do: Infrastructure and rehabilitation projects for highways, roads, bridges, airports, ports, light rail and storm drainage systems in the Rocky Mountain states and Texas. Markets • Alternative Delivery Heavy Highway • Low-bid Heavy Highway • Aviation • Rail Drivers • Strong state and local funding • Infrastructure Bill allocates $643B for transportation programs ($285B incremental), $25B for airports over 5 years • Over $185B in IIJA funding for 7,000+ transportation projects announced in 2022 Primary Geographies Arizona | Colorado | Hawaii | Nevada | Texas | Utah 2024 Financial Metrics $784M 6.5% Transportation Solutions Wildlife Crossing Bridge project

Sterling Infrastructure, Inc. | STRL: IR Presentation 13*Compound Annual Growth Rate (CAGR) Building Solutions Improved bid discipline and reduced risk What We Do: Residential and Commercial concrete slabs in the Dallas/Fort Worth (DFW), Houston, and Phoenix markets. Plumbing capabilities (rough in, top outs, fixtures in DFW) and surveying. Markets • Dallas/Fort Worth • Houston • Phoenix Drivers • Demand for single-family homes in Dallas, Houston, and Phoenix markets • Share gain in the Houston and Phoenix markets • Plumbing demand and cross-selling capabilities • Favorable mix shift Revenue Op. Margin Four-Year CAGR* 10% Revenue 13% Op. Income 2024 Financial Metrics $408M 13.2%Leading Home Builders not limited to: Building Solutions Dallas area large subdivision project for leading builder

Financial Overview Sterling Infrastructure, Inc. | STRL: IR Presentation 14 FINANCIAL OVERVIEW • Financial Results Highlights • Cash Flow • Balance Sheet • Capital Allocation Priorities • Full Year Guidance • Summary

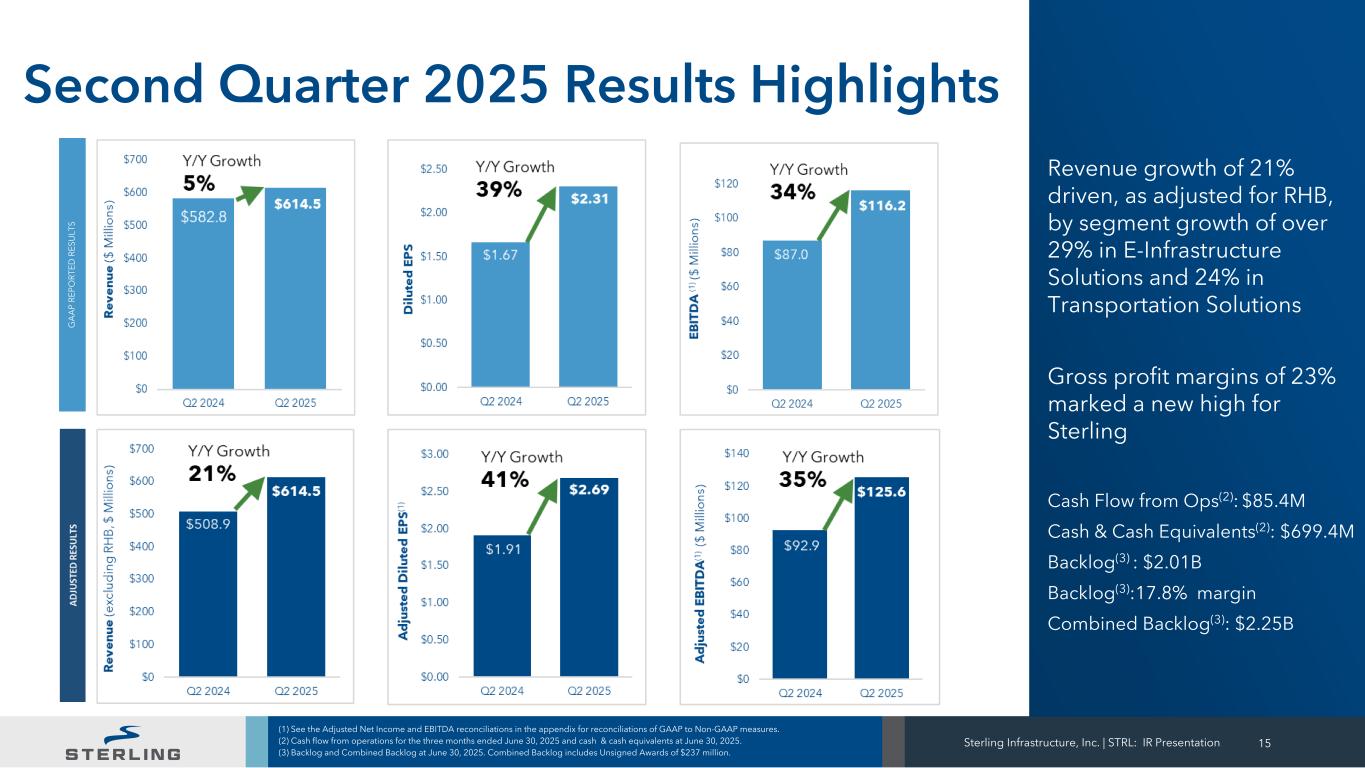

G A A P R EP O R TE D R ES U LT S 15 (1) See the Adjusted Net Income and EBITDA reconciliations in the appendix for reconciliations of GAAP to Non-GAAP measures. (2) Cash flow from operations for the three months ended June 30, 2025 and cash & cash equivalents at June 30, 2025. (3) Backlog and Combined Backlog at June 30, 2025. Combined Backlog includes Unsigned Awards of $237 million. Second Quarter 2025 Results Highlights Sterling Infrastructure, Inc. | STRL: IR Presentation Revenue growth of 21% driven, as adjusted for RHB, by segment growth of over 29% in E-Infrastructure Solutions and 24% in Transportation Solutions Gross profit margins of 23% marked a new high for Sterling Cash Flow from Ops(2): $85.4M Cash & Cash Equivalents(2): $699.4M Backlog(3) : $2.01B Backlog(3):17.8% margin Combined Backlog(3): $2.25B

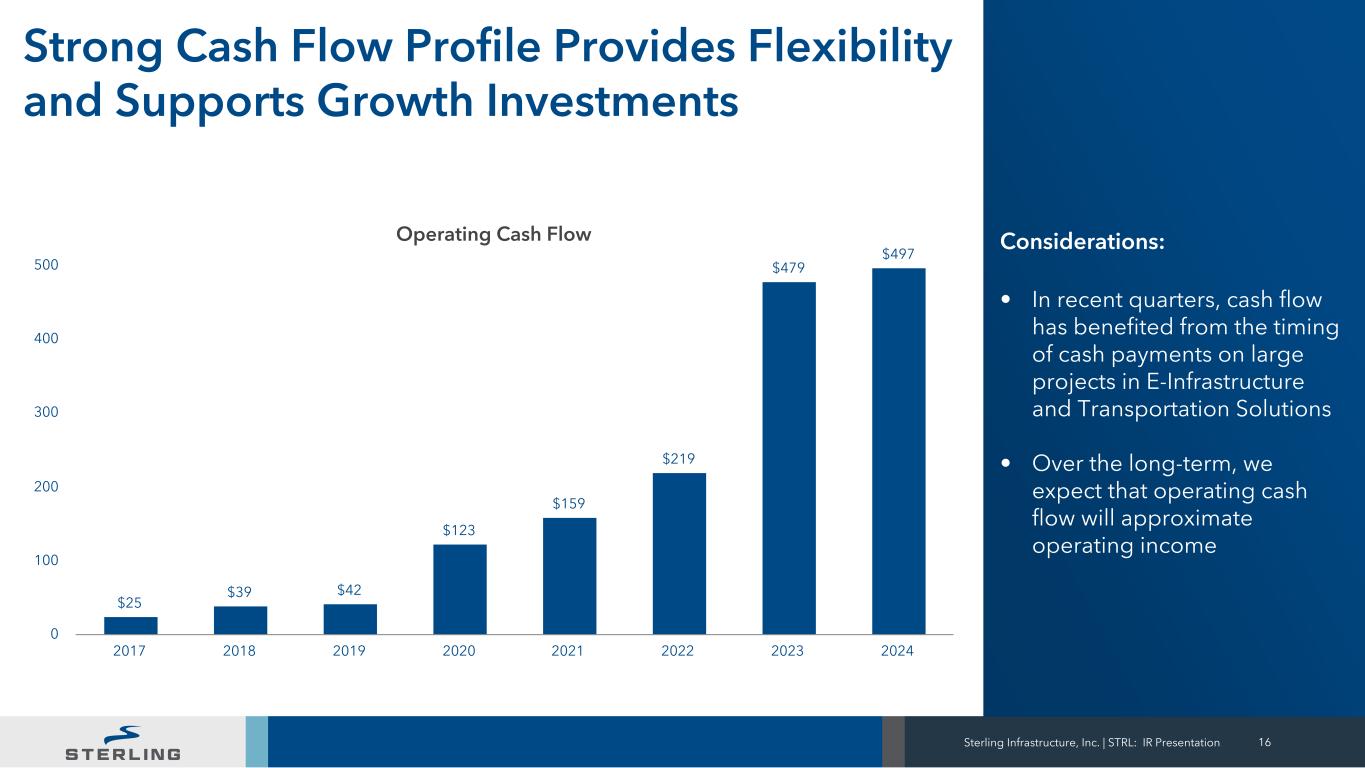

16 Strong Cash Flow Profile Provides Flexibility and Supports Growth Investments Sterling Infrastructure, Inc. | STRL: IR Presentation Considerations: • In recent quarters, cash flow has benefited from the timing of cash payments on large projects in E-Infrastructure and Transportation Solutions • Over the long-term, we expect that operating cash flow will approximate operating income Operating Cash Flow $25 $39 $42 $123 $159 $219 $479 $497 2017 2018 2019 2020 2021 2022 2023 2024 0 100 200 300 400 500

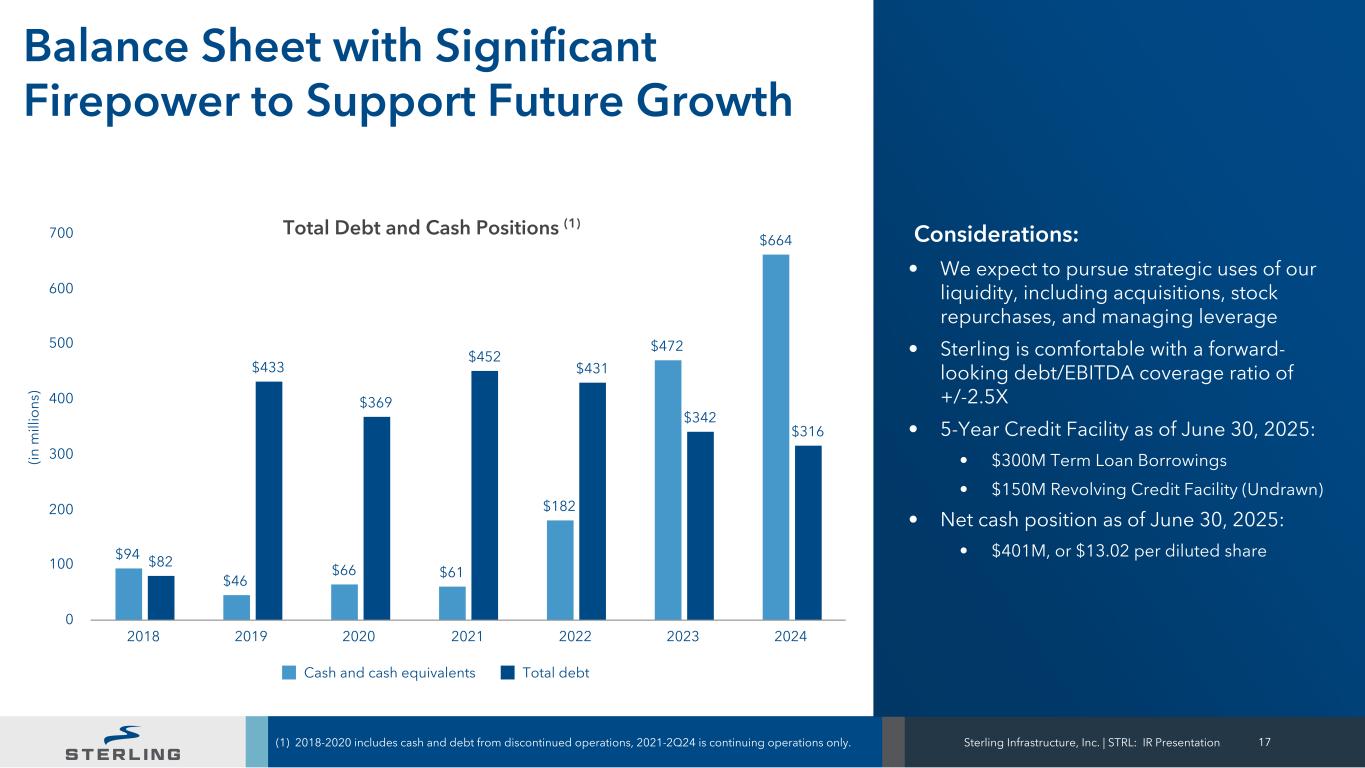

17 Balance Sheet with Significant Firepower to Support Future Growth (1) 2018-2020 includes cash and debt from discontinued operations, 2021-2Q24 is continuing operations only. Sterling Infrastructure, Inc. | STRL: IR Presentation (in m ill io ns ) $94 $46 $66 $61 $182 $472 $664 $82 $433 $369 $452 $431 $342 $316 Cash and cash equivalents Total debt 2018 2019 2020 2021 2022 2023 2024 0 100 200 300 400 500 600 700 Total Debt and Cash Positions (1) Considerations: • We expect to pursue strategic uses of our liquidity, including acquisitions, stock repurchases, and managing leverage • Sterling is comfortable with a forward- looking debt/EBITDA coverage ratio of +/-2.5X • 5-Year Credit Facility as of June 30, 2025: • $300M Term Loan Borrowings • $150M Revolving Credit Facility (Undrawn) • Net cash position as of June 30, 2025: • $401M, or $13.02 per diluted share

Capital Allocation Priorities Support Growth in Existing and New Markets Support organic growth in existing and new markets • Capital expenditures support multi-year growth, weighted toward E-Infrastructure Solutions Strategic M&A – “Bolt on” and/ or 4th Leg Opportunities • “Bolt-ons”: Continue to evaluate small-to-mid sized acquisition opportunities that complement our current service offerings and customer base • 4th Leg opportunities: Adjacent market opportunities with exposure to strong, multi-year infrastructure investment trends and/or a recurring revenue element • Seeking margin-accretive deals with attractive end market exposures at a reasonable price Share Repurchase Program • $200 million authorization • Taking an opportunistic approach to repurchase Sterling Infrastructure, Inc. | STRL: IR Presentation 18

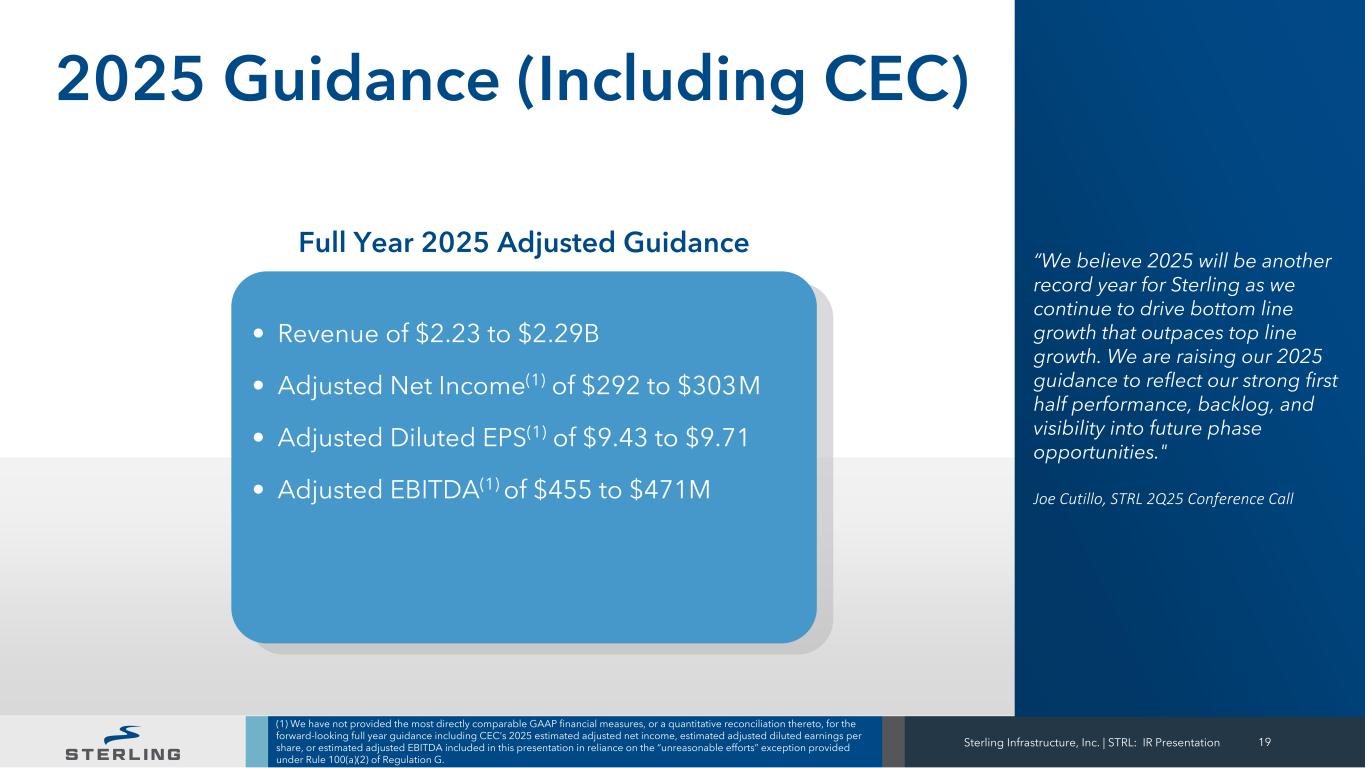

“We believe 2025 will be another record year for Sterling as we continue to drive bottom line growth that outpaces top line growth. We are raising our 2025 guidance to reflect our strong first half performance, backlog, and visibility into future phase opportunities." Joe Cutillo, STRL 2Q25 Conference Call • Revenue of $2.23 to $2.29B • Adjusted Net Income(1) of $292 to $303 M • Adjusted Diluted EPS(1) of $9.43 to $9.71 • Adjusted EBITDA(1) of $455 to $471M 19 2025 Guidance (Including CEC) Sterling Infrastructure, Inc. | STRL: IR Presentation Full Year 2025 Adjusted Guidance (1) We have not provided the most directly comparable GAAP financial measures, or a quantitative reconciliation thereto, for the forward-looking full year guidance including CEC’s 2025 estimated adjusted net income, estimated adjusted diluted earnings per share, or estimated adjusted EBITDA included in this presentation in reliance on the “unreasonable efforts” exception provided under Rule 100(a)(2) of Regulation G.

20Sterling Infrastructure, Inc. | STRL: IR Presentation Through high-value service and low execution risk, we are building the infrastructure foundation needed today for tomorrow's way of life Successful strategic foundation with strong, diversified platform STERLING, A Leading Infrastructure Services Provider Strong, multi-year, secular growth drivers Continued opportunity for margin expansion Robust balance sheet, free cash flow Strong historical stock performance

+ Appendix Sterling Infrastructure, Inc. | STRL: IR Presentation 21

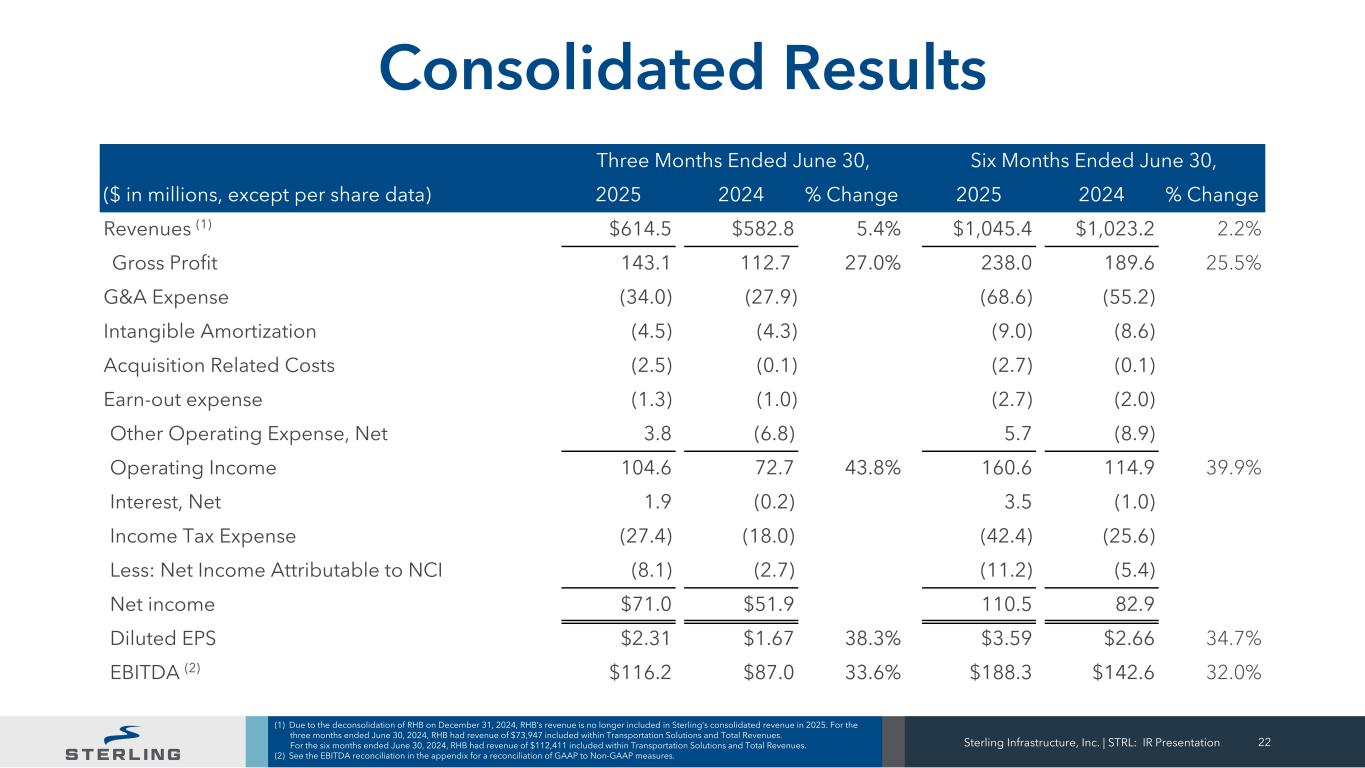

22 Consolidated Results (1) Due to the deconsolidation of RHB on December 31, 2024, RHB’s revenue is no longer included in Sterling’s consolidated revenue in 2025. For the three months ended June 30, 2024, RHB had revenue of $73,947 included within Transportation Solutions and Total Revenues. For the six months ended June 30, 2024, RHB had revenue of $112,411 included within Transportation Solutions and Total Revenues. (2) See the EBITDA reconciliation in the appendix for a reconciliation of GAAP to Non-GAAP measures. Sterling Infrastructure, Inc. | STRL: IR Presentation Three Months Ended June 30, Six Months Ended June 30, ($ in millions, except per share data) 2025 2024 % Change 2025 2024 % Change Revenues (1) $614.5 $582.8 5.4% $1,045.4 $1,023.2 2.2% Gross Profit 143.1 112.7 27.0% 238.0 189.6 25.5% G&A Expense (34.0) (27.9) (68.6) (55.2) Intangible Amortization (4.5) (4.3) (9.0) (8.6) Acquisition Related Costs (2.5) (0.1) (2.7) (0.1) Earn-out expense (1.3) (1.0) (2.7) (2.0) Other Operating Expense, Net 3.8 (6.8) 5.7 (8.9) Operating Income 104.6 72.7 43.8% 160.6 114.9 39.9% Interest, Net 1.9 (0.2) 3.5 (1.0) Income Tax Expense (27.4) (18.0) (42.4) (25.6) Less: Net Income Attributable to NCI (8.1) (2.7) (11.2) (5.4) Net income $71.0 $51.9 110.5 82.9 Diluted EPS $2.31 $1.67 38.3% $3.59 $2.66 34.7% EBITDA (2) $116.2 $87.0 33.6% $188.3 $142.6 32.0%

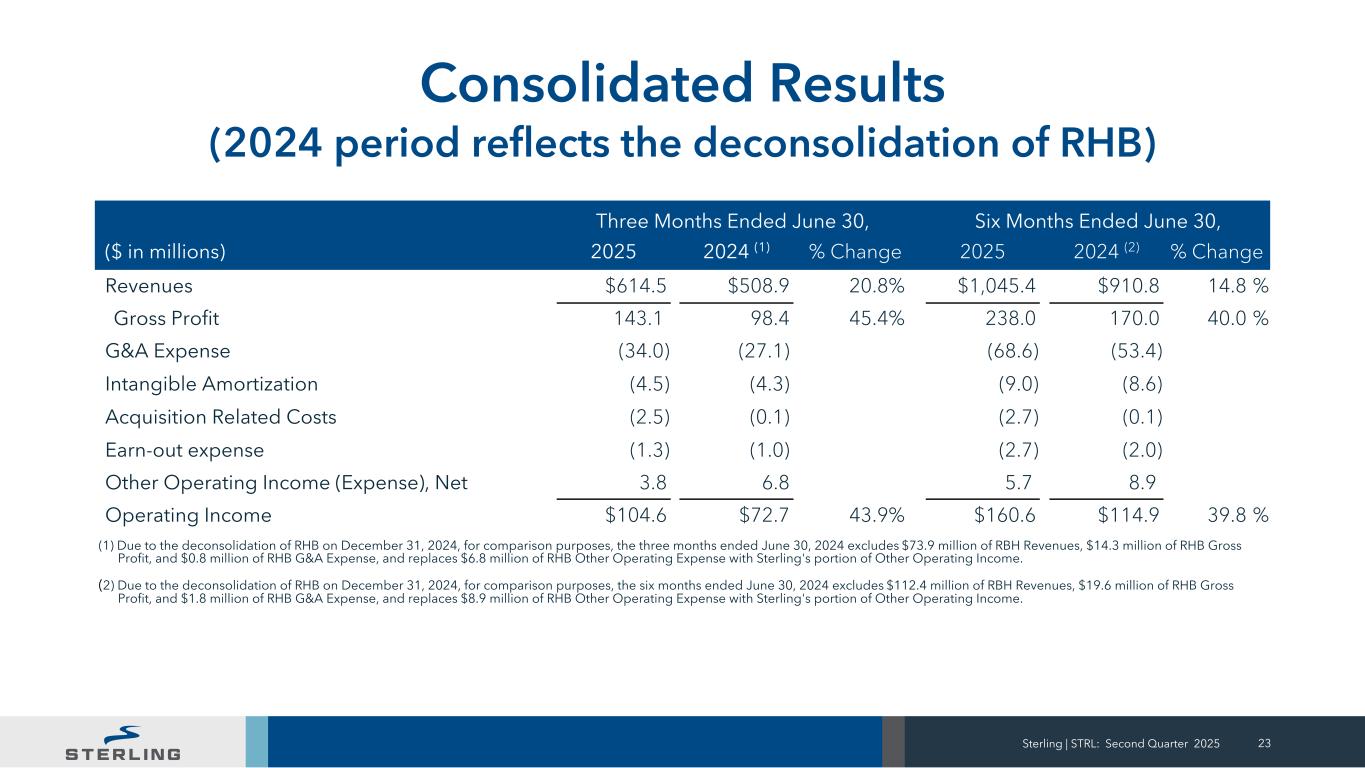

Sterling | STRL: Second Quarter 2025 23 Consolidated Results (2024 period reflects the deconsolidation of RHB) Three Months Ended June 30, Six Months Ended June 30, ($ in millions) 2025 2024 (1) % Change 2025 2024 (2) % Change Revenues $614.5 $508.9 20.8% $1,045.4 $910.8 14.8 % Gross Profit 143.1 98.4 45.4% 238.0 170.0 40.0 % G&A Expense (34.0) (27.1) (68.6) (53.4) Intangible Amortization (4.5) (4.3) (9.0) (8.6) Acquisition Related Costs (2.5) (0.1) (2.7) (0.1) Earn-out expense (1.3) (1.0) (2.7) (2.0) Other Operating Income (Expense), Net 3.8 6.8 5.7 8.9 Operating Income $104.6 $72.7 43.9% $160.6 $114.9 39.8 % (1) Due to the deconsolidation of RHB on December 31, 2024, for comparison purposes, the three months ended June 30, 2024 excludes $73.9 million of RBH Revenues, $14.3 million of RHB Gross Profit, and $0.8 million of RHB G&A Expense, and replaces $6.8 million of RHB Other Operating Expense with Sterling's portion of Other Operating Income. (2) Due to the deconsolidation of RHB on December 31, 2024, for comparison purposes, the six months ended June 30, 2024 excludes $112.4 million of RBH Revenues, $19.6 million of RHB Gross Profit, and $1.8 million of RHB G&A Expense, and replaces $8.9 million of RHB Other Operating Expense with Sterling's portion of Other Operating Income.

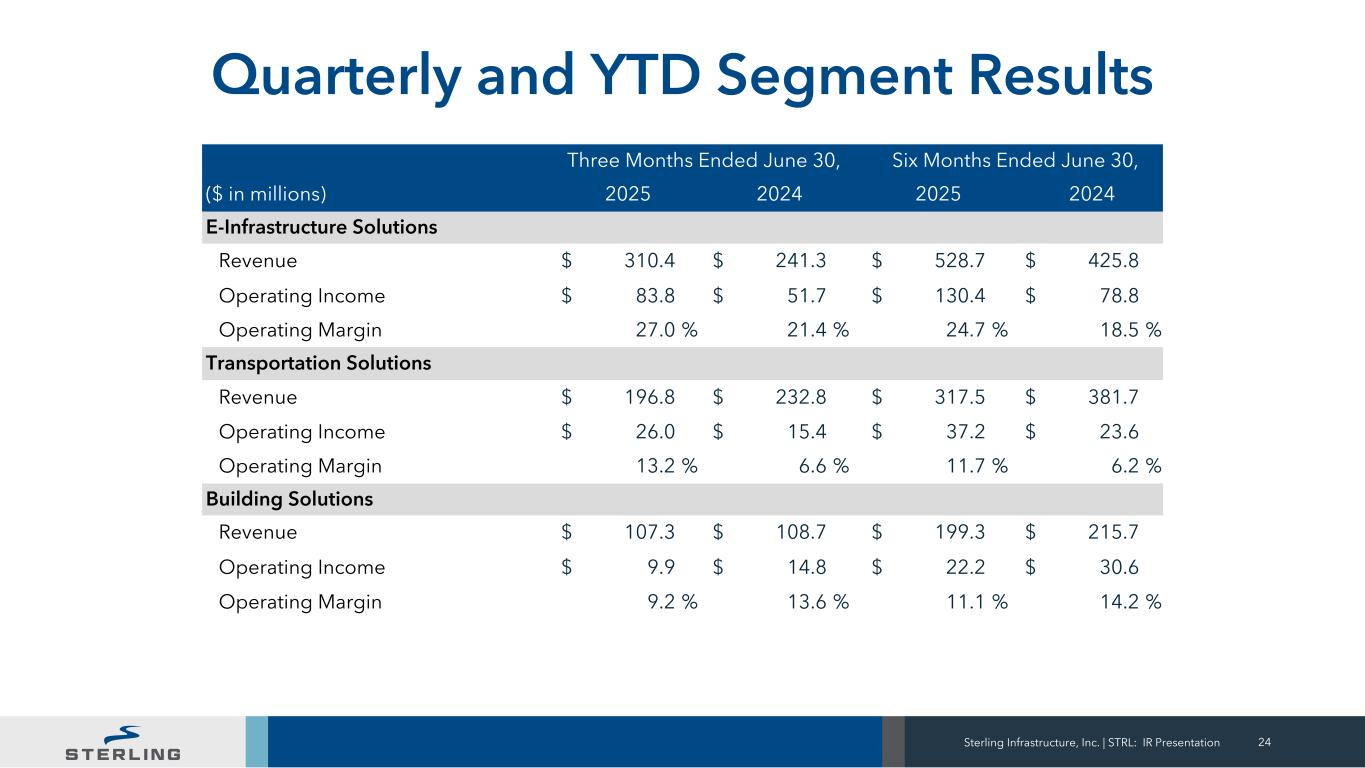

24 Quarterly and YTD Segment Results Sterling Infrastructure, Inc. | STRL: IR Presentation Three Months Ended June 30, Six Months Ended June 30, ($ in millions) 2025 2024 2025 2024 E-Infrastructure Solutions Revenue $ 310.4 $ 241.3 $ 528.7 $ 425.8 Operating Income $ 83.8 $ 51.7 $ 130.4 $ 78.8 Operating Margin 27.0 % 21.4 % 24.7 % 18.5 % Transportation Solutions Revenue $ 196.8 $ 232.8 $ 317.5 $ 381.7 Operating Income $ 26.0 $ 15.4 $ 37.2 $ 23.6 Operating Margin 13.2 % 6.6 % 11.7 % 6.2 % Building Solutions Revenue $ 107.3 $ 108.7 $ 199.3 $ 215.7 Operating Income $ 9.9 $ 14.8 $ 22.2 $ 30.6 Operating Margin 9.2 % 13.6 % 11.1 % 14.2 %

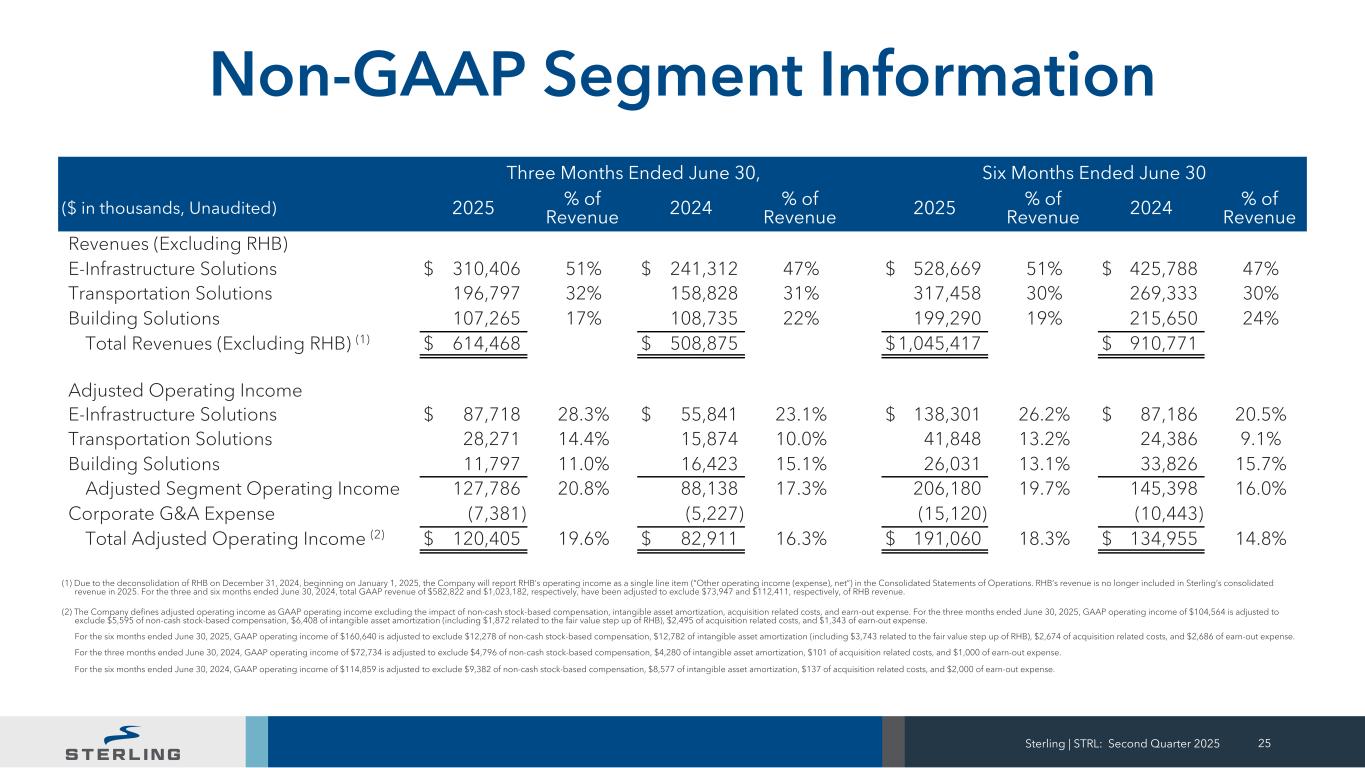

Sterling | STRL: Second Quarter 2025 25 Three Months Ended June 30, Six Months Ended June 30 ($ in thousands, Unaudited) 2025 % of Revenue 2024 % of Revenue 2025 % of Revenue 2024 % of Revenue Revenues (Excluding RHB) E-Infrastructure Solutions $ 310,406 51% $ 241,312 47% $ 528,669 51% $ 425,788 47% Transportation Solutions 196,797 32% 158,828 31% 317,458 30% 269,333 30% Building Solutions 107,265 17% 108,735 22% 199,290 19% 215,650 24% Total Revenues (Excluding RHB) (1) $ 614,468 $ 508,875 $ 1,045,417 $ 910,771 Adjusted Operating Income E-Infrastructure Solutions $ 87,718 28.3% $ 55,841 23.1% $ 138,301 26.2% $ 87,186 20.5% Transportation Solutions 28,271 14.4% 15,874 10.0% 41,848 13.2% 24,386 9.1% Building Solutions 11,797 11.0% 16,423 15.1% 26,031 13.1% 33,826 15.7% Adjusted Segment Operating Income 127,786 20.8% 88,138 17.3% 206,180 19.7% 145,398 16.0% Corporate G&A Expense (7,381) (5,227) (15,120) (10,443) Total Adjusted Operating Income (2) $ 120,405 19.6% $ 82,911 16.3% $ 191,060 18.3% $ 134,955 14.8% (1) Due to the deconsolidation of RHB on December 31, 2024, beginning on January 1, 2025, the Company will report RHB’s operating income as a single line item (“Other operating income (expense), net”) in the Consolidated Statements of Operations. RHB’s revenue is no longer included in Sterling’s consolidated revenue in 2025. For the three and six months ended June 30, 2024, total GAAP revenue of $582,822 and $1,023,182, respectively, have been adjusted to exclude $73,947 and $112,411, respectively, of RHB revenue. (2) The Company defines adjusted operating income as GAAP operating income excluding the impact of non-cash stock-based compensation, intangible asset amortization, acquisition related costs, and earn-out expense. For the three months ended June 30, 2025, GAAP operating income of $104,564 is adjusted to exclude $5,595 of non-cash stock-based compensation, $6,408 of intangible asset amortization (including $1,872 related to the fair value step up of RHB), $2,495 of acquisition related costs, and $1,343 of earn-out expense. For the six months ended June 30, 2025, GAAP operating income of $160,640 is adjusted to exclude $12,278 of non-cash stock-based compensation, $12,782 of intangible asset amortization (including $3,743 related to the fair value step up of RHB), $2,674 of acquisition related costs, and $2,686 of earn-out expense. For the three months ended June 30, 2024, GAAP operating income of $72,734 is adjusted to exclude $4,796 of non-cash stock-based compensation, $4,280 of intangible asset amortization, $101 of acquisition related costs, and $1,000 of earn-out expense. For the six months ended June 30, 2024, GAAP operating income of $114,859 is adjusted to exclude $9,382 of non-cash stock-based compensation, $8,577 of intangible asset amortization, $137 of acquisition related costs, and $2,000 of earn-out expense. Non-GAAP Segment Information

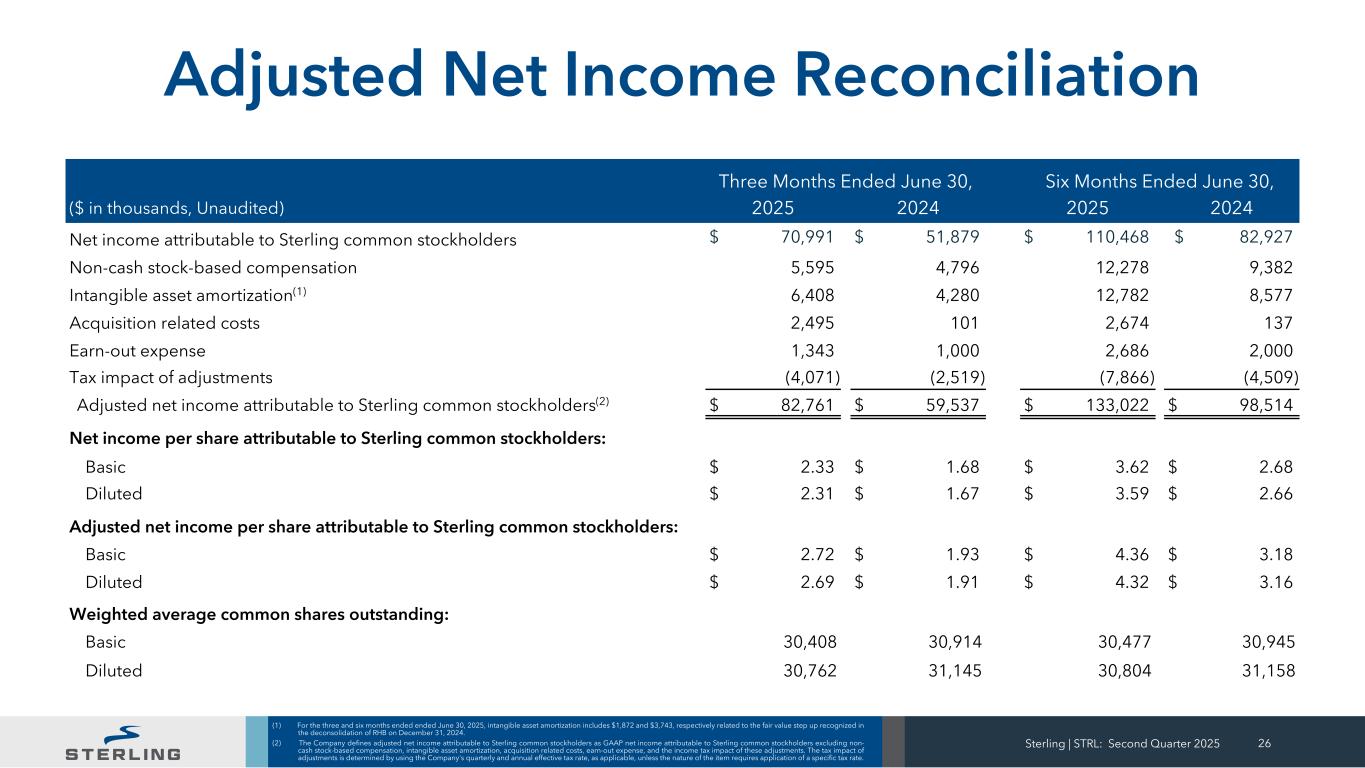

Sterling | STRL: Second Quarter 2025 26 Three Months Ended June 30, Six Months Ended June 30, ($ in thousands, Unaudited) 2025 2024 2025 2024 Net income attributable to Sterling common stockholders $ 70,991 $ 51,879 $ 110,468 $ 82,927 Non-cash stock-based compensation 5,595 4,796 12,278 9,382 Intangible asset amortization(1) 6,408 4,280 12,782 8,577 Acquisition related costs 2,495 101 2,674 137 Earn-out expense 1,343 1,000 2,686 2,000 Tax impact of adjustments (4,071) (2,519) (7,866) (4,509) Adjusted net income attributable to Sterling common stockholders(2) $ 82,761 $ 59,537 $ 133,022 $ 98,514 Net income per share attributable to Sterling common stockholders: Basic $ 2.33 $ 1.68 $ 3.62 $ 2.68 Diluted $ 2.31 $ 1.67 $ 3.59 $ 2.66 Adjusted net income per share attributable to Sterling common stockholders: Basic $ 2.72 $ 1.93 $ 4.36 $ 3.18 Diluted $ 2.69 $ 1.91 $ 4.32 $ 3.16 Weighted average common shares outstanding: Basic 30,408 30,914 30,477 30,945 Diluted 30,762 31,145 30,804 31,158 Adjusted Net Income Reconciliation (1) For the three and six months ended ended June 30, 2025, intangible asset amortization includes $1,872 and $3,743, respectively related to the fair value step up recognized in the deconsolidation of RHB on December 31, 2024. (2) The Company defines adjusted net income attributable to Sterling common stockholders as GAAP net income attributable to Sterling common stockholders excluding non- cash stock-based compensation, intangible asset amortization, acquisition related costs, earn-out expense, and the income tax impact of these adjustments. The tax impact of adjustments is determined by using the Company's quarterly and annual effective tax rate, as applicable, unless the nature of the item requires application of a specific tax rate.

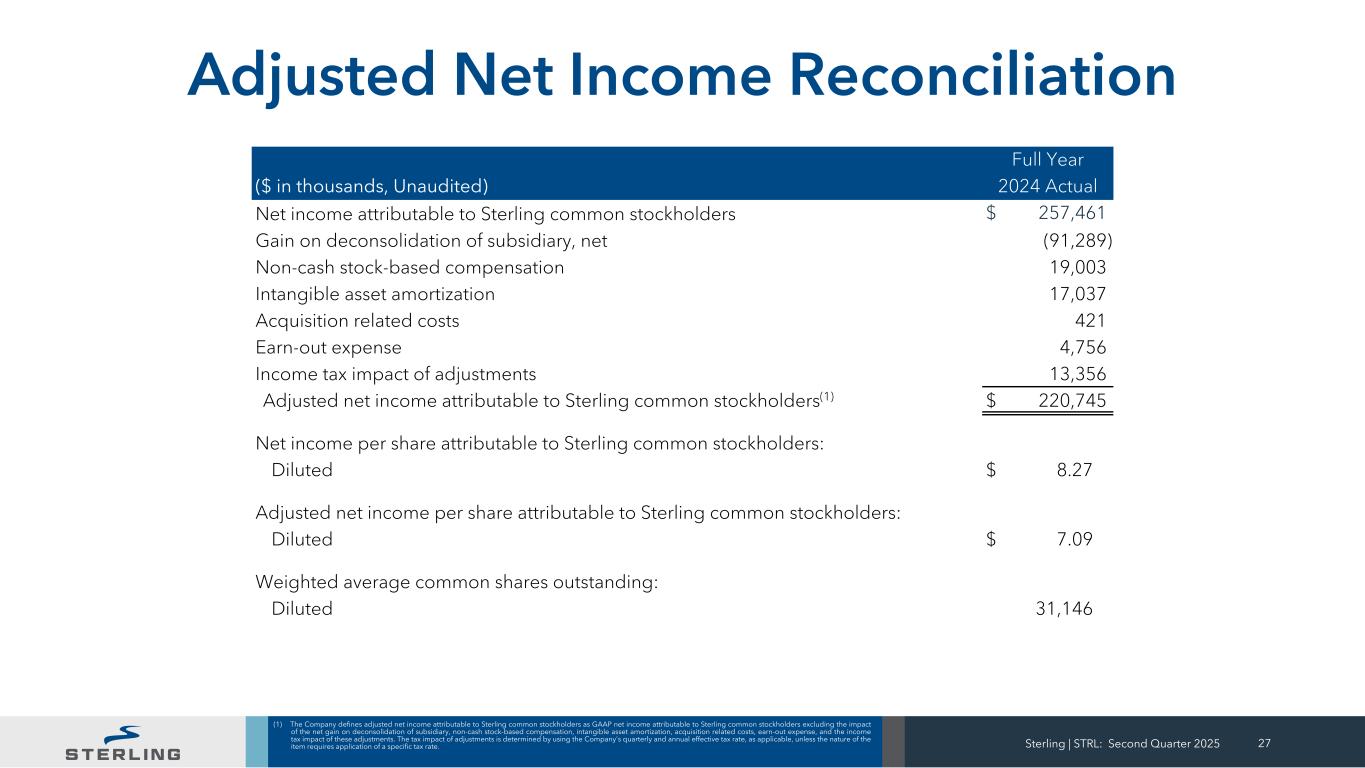

Sterling | STRL: Second Quarter 2025 27 (1) The Company defines adjusted net income attributable to Sterling common stockholders as GAAP net income attributable to Sterling common stockholders excluding the impact of the net gain on deconsolidation of subsidiary, non-cash stock-based compensation, intangible asset amortization, acquisition related costs, earn-out expense, and the income tax impact of these adjustments. The tax impact of adjustments is determined by using the Company's quarterly and annual effective tax rate, as applicable, unless the nature of the item requires application of a specific tax rate. Full Year ($ in thousands, Unaudited) 2024 Actual Net income attributable to Sterling common stockholders $ 257,461 Gain on deconsolidation of subsidiary, net (91,289) Non-cash stock-based compensation 19,003 Intangible asset amortization 17,037 Acquisition related costs 421 Earn-out expense 4,756 Income tax impact of adjustments 13,356 Adjusted net income attributable to Sterling common stockholders(1) $ 220,745 Net income per share attributable to Sterling common stockholders: Diluted $ 8.27 Adjusted net income per share attributable to Sterling common stockholders: Diluted $ 7.09 Weighted average common shares outstanding: Diluted 31,146 Adjusted Net Income Reconciliation

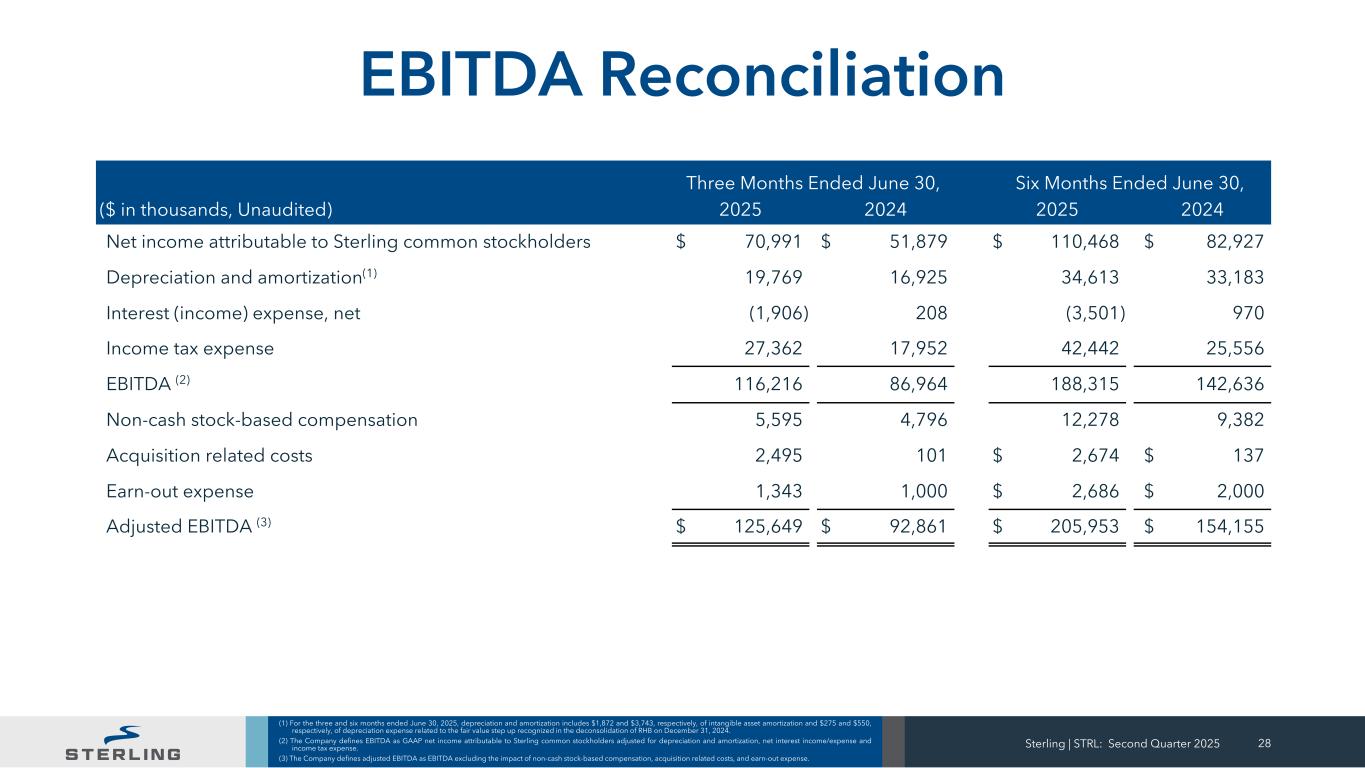

Sterling | STRL: Second Quarter 2025 28 Three Months Ended June 30, Six Months Ended June 30, ($ in thousands, Unaudited) 2025 2024 2025 2024 Net income attributable to Sterling common stockholders $ 70,991 $ 51,879 $ 110,468 $ 82,927 Depreciation and amortization(1) 19,769 16,925 34,613 33,183 Interest (income) expense, net (1,906) 208 (3,501) 970 Income tax expense 27,362 17,952 42,442 25,556 EBITDA (2) 116,216 86,964 188,315 142,636 Non-cash stock-based compensation 5,595 4,796 12,278 9,382 Acquisition related costs 2,495 101 $ 2,674 $ 137 Earn-out expense 1,343 1,000 $ 2,686 $ 2,000 Adjusted EBITDA (3) $ 125,649 $ 92,861 $ 205,953 $ 154,155 EBITDA Reconciliation (1) For the three and six months ended June 30, 2025, depreciation and amortization includes $1,872 and $3,743, respectively, of intangible asset amortization and $275 and $550, respectively, of depreciation expense related to the fair value step up recognized in the deconsolidation of RHB on December 31, 2024. (2) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders adjusted for depreciation and amortization, net interest income/expense and income tax expense. (3) The Company defines adjusted EBITDA as EBITDA excluding the impact of non-cash stock-based compensation, acquisition related costs, and earn-out expense.

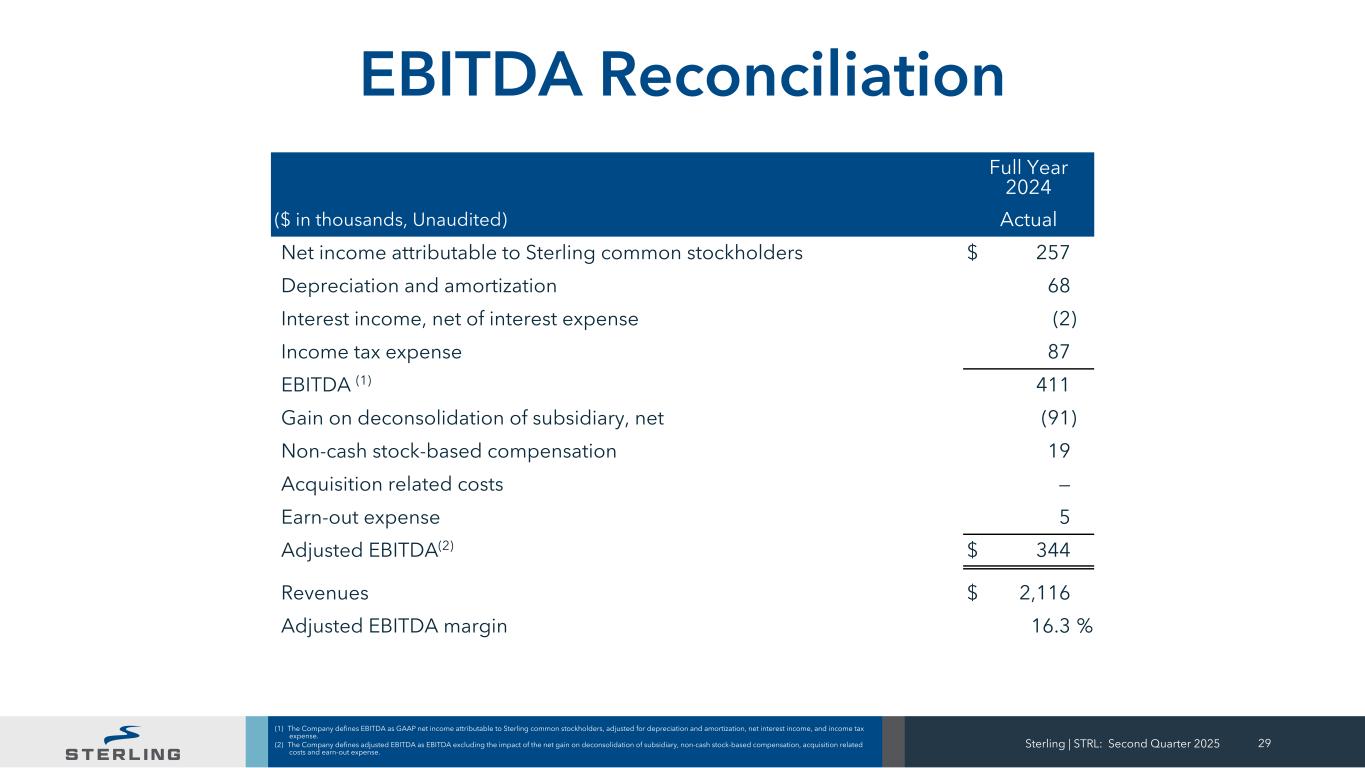

Sterling | STRL: Second Quarter 2025 29 (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders, adjusted for depreciation and amortization, net interest income, and income tax expense. (2) The Company defines adjusted EBITDA as EBITDA excluding the impact of the net gain on deconsolidation of subsidiary, non-cash stock-based compensation, acquisition related costs and earn-out expense. Full Year 2024 ($ in thousands, Unaudited) Actual Net income attributable to Sterling common stockholders $ 257 Depreciation and amortization 68 Interest income, net of interest expense (2) Income tax expense 87 EBITDA (1) 411 Gain on deconsolidation of subsidiary, net (91) Non-cash stock-based compensation 19 Acquisition related costs — Earn-out expense 5 Adjusted EBITDA(2) $ 344 Revenues $ 2,116 Adjusted EBITDA margin 16.3 % EBITDA Reconciliation

STRL 3-Year Stock Price Performance Source: FactSet Sterling Infrastructure, Inc. | STRL: IR Presentation 30

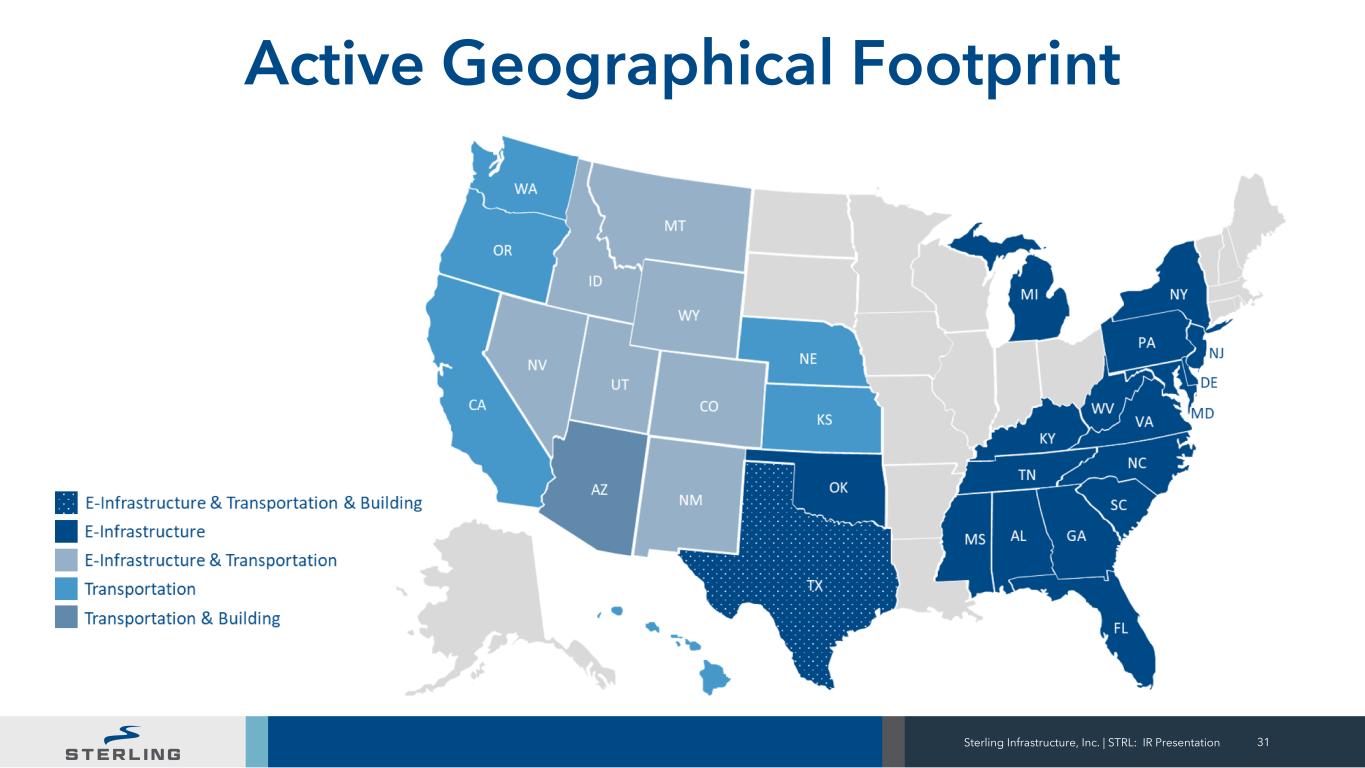

Active Geographical Footprint Sterling Infrastructure, Inc. | STRL: IR Presentation 31

32 Strategic Acquisitions Sterling Infrastructure, Inc. | STRL: IR Presentation

Protecting Our Environment • Sound governance • Environmentally responsible construction services and solutions for today and tomorrow Taking Care of Our People • Sterling’s safety rating consistently ranks 10X better than the industry average • Employee wellness programs through extensive benefit offerings • Training & Development programs, including the new focused training through Sterling Academy • Caring for our communities and supporting organizations across our footprint and beyond Governance • Committed to conducting business ethically and with integrity and full transparency • Committed to strong and effective governance practices that promote and protect the interests of our shareholders Sustainability From strategy to operations, we are committed to sustainability by operating responsibly to safeguard and improve society’s quality of life. Sterling's sustainability reports can be accessed via the Sterling Way (ESG) section of our website https://www.strlco.com/sustainability/ Sterling Infrastructure, Inc. | STRL: IR Presentation 33

We build and service the infrastructure that enables our economy to run, our people to move, and our country to grow. 34 Contact Us Sterling Infrastructure, Inc. Noelle Dilts, VP IR and Corporate Strategy Tel: (281) 214-0795 Cell (720) 270-6361 noelle.dilts@strlco.com Sterling Infrastructure, Inc. | STRL: IR Presentation