Filed Pursuant to Rule 424(b)(3)

Registration Nos. 333-290139 and 333-290141

PROSPECTUS SUPPLEMENT

(to Prospectus dated September 25, 2025)

Dear Holder,

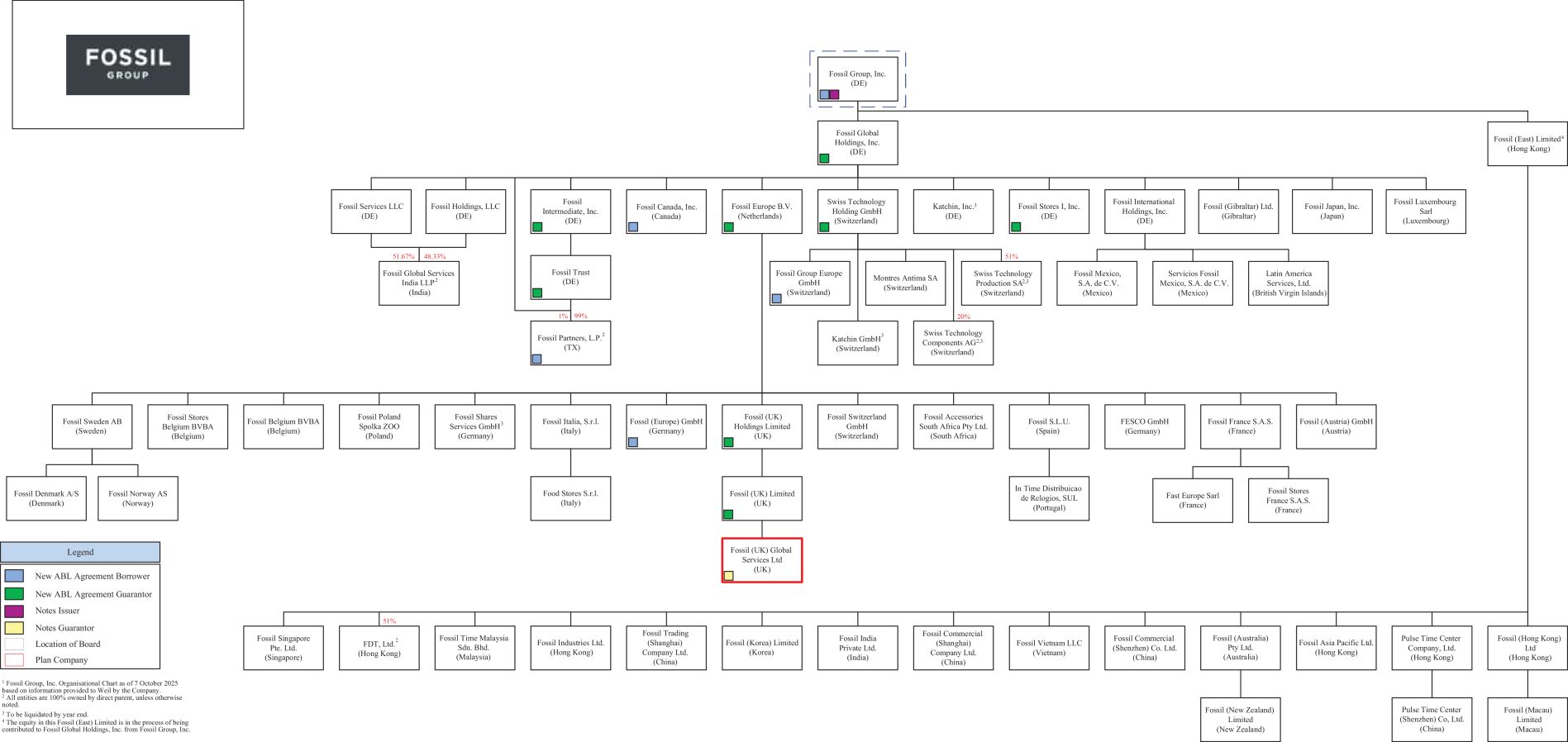

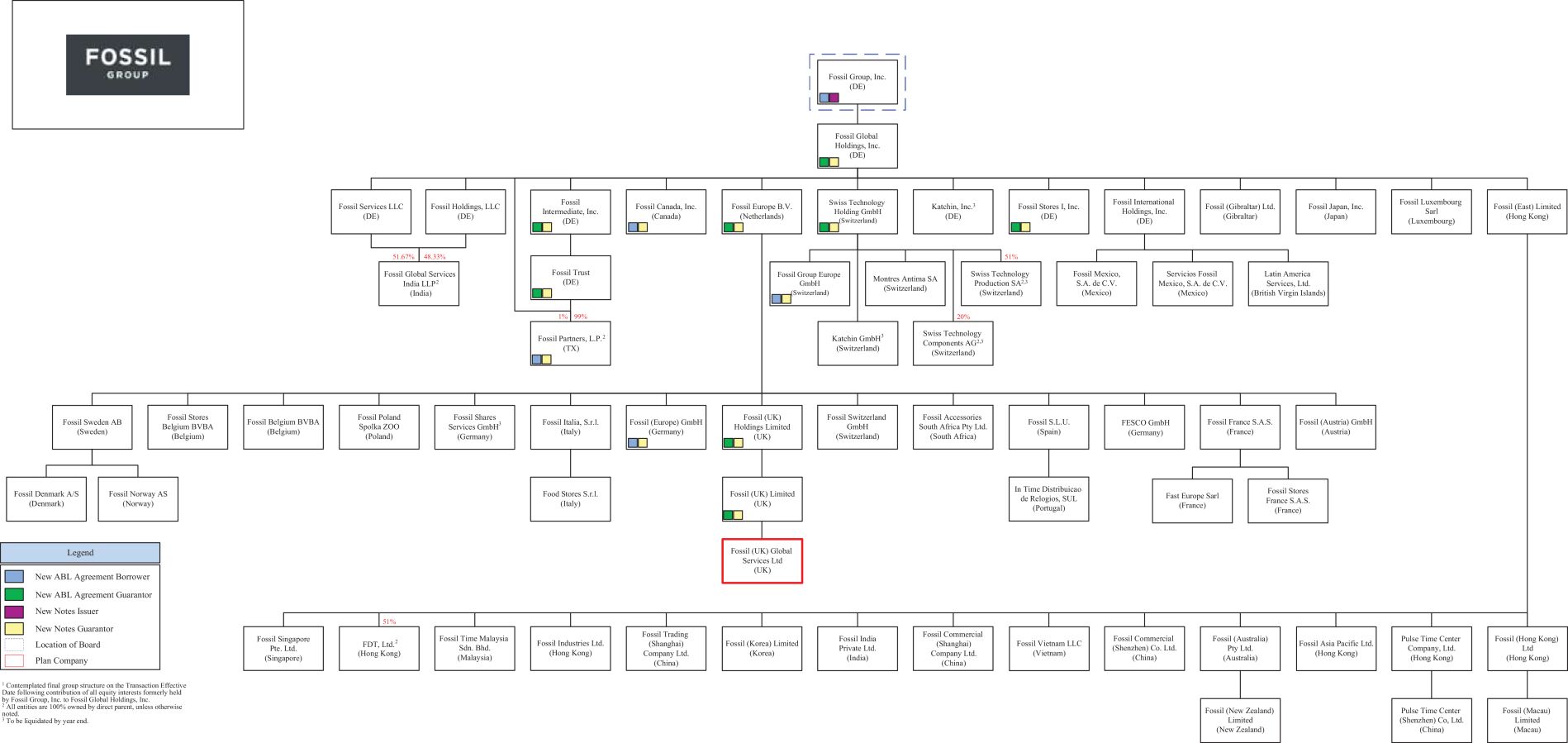

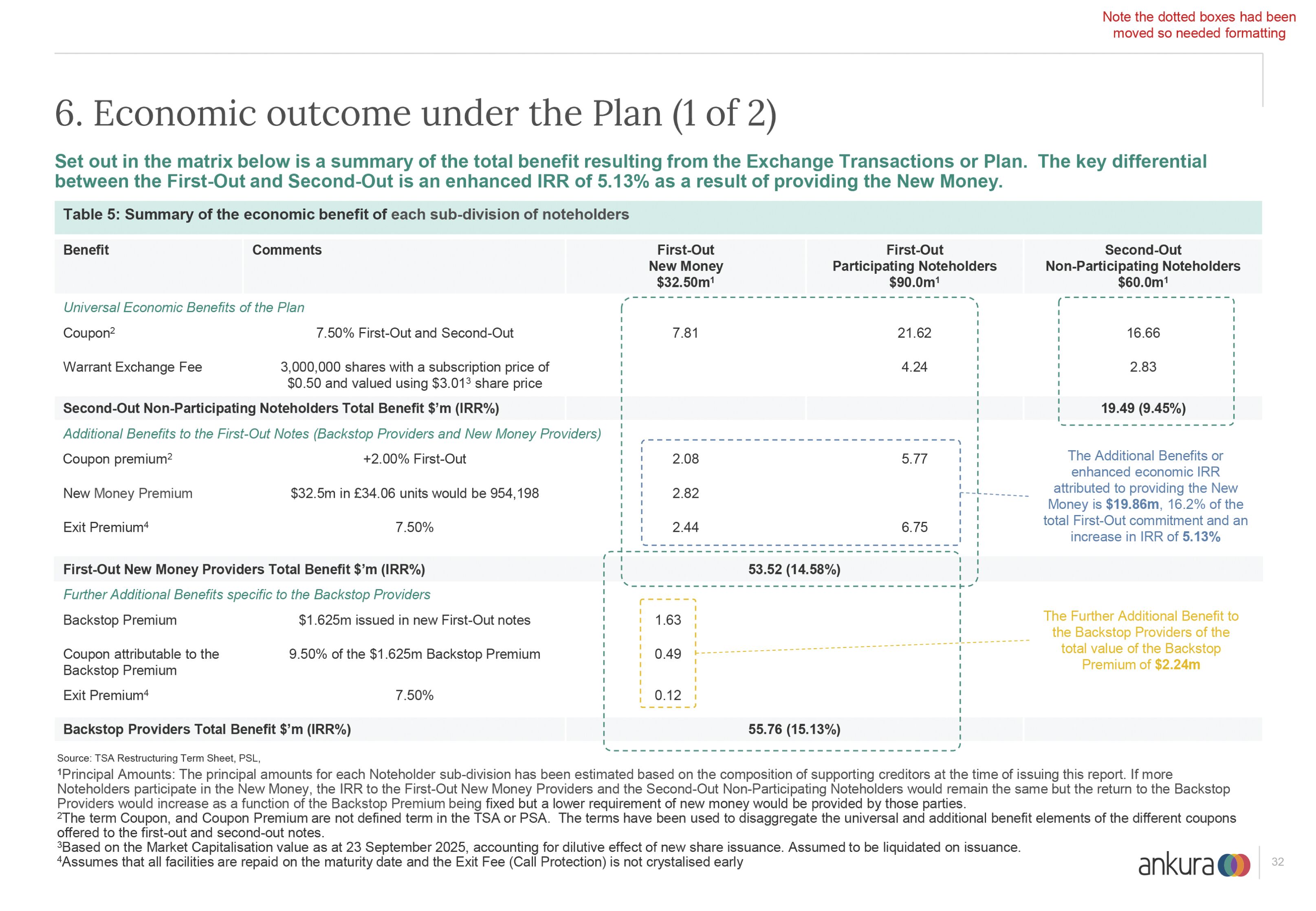

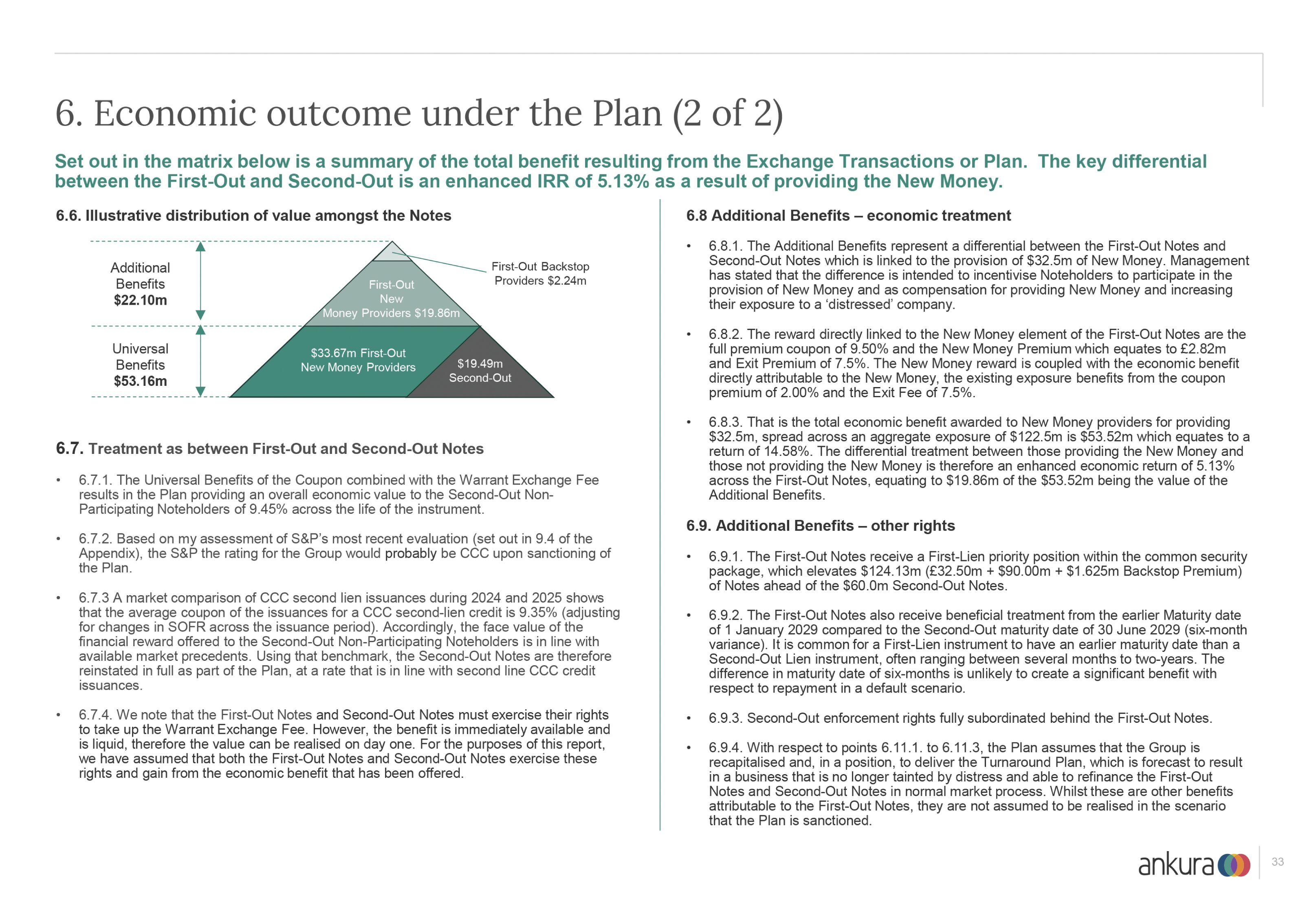

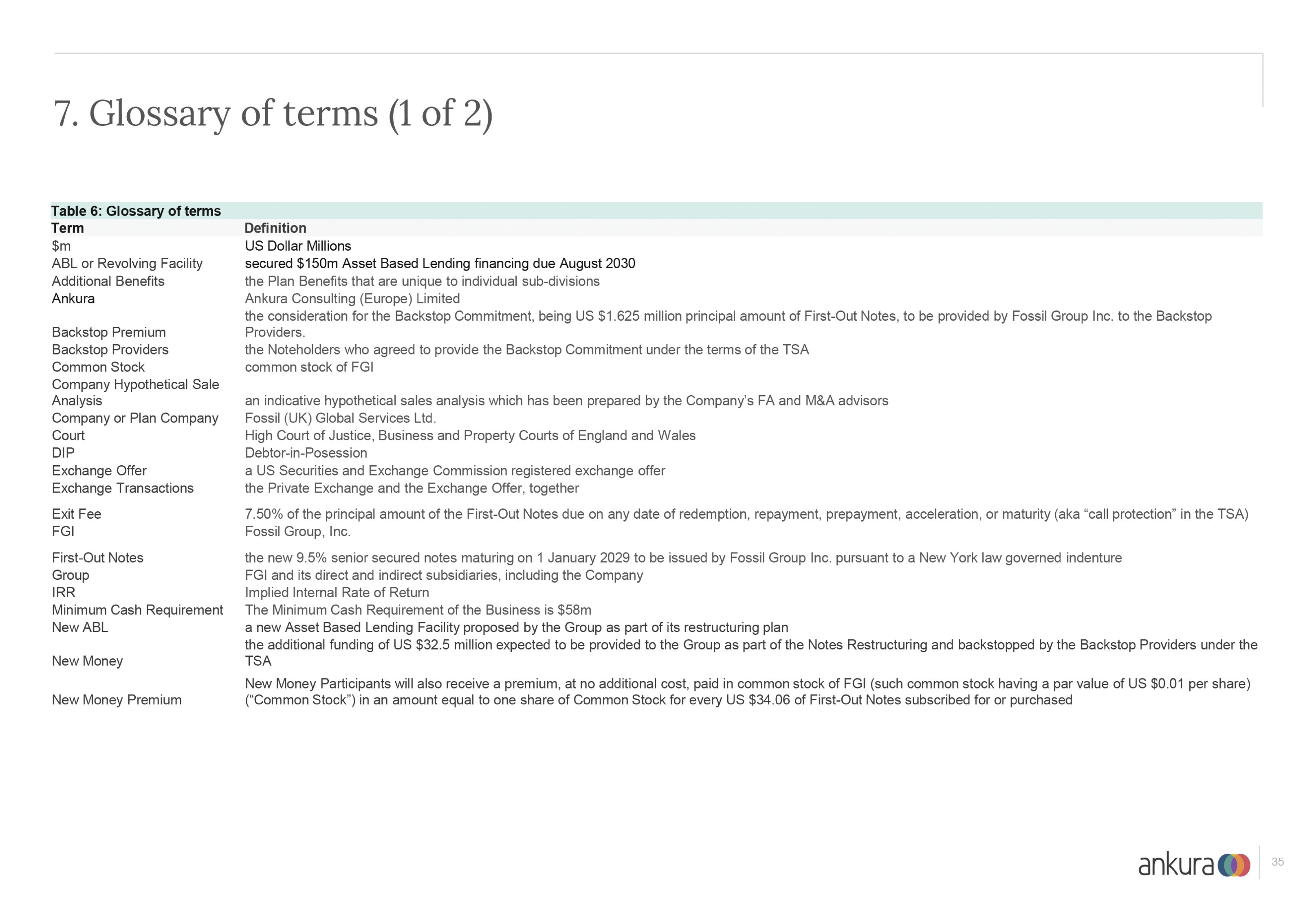

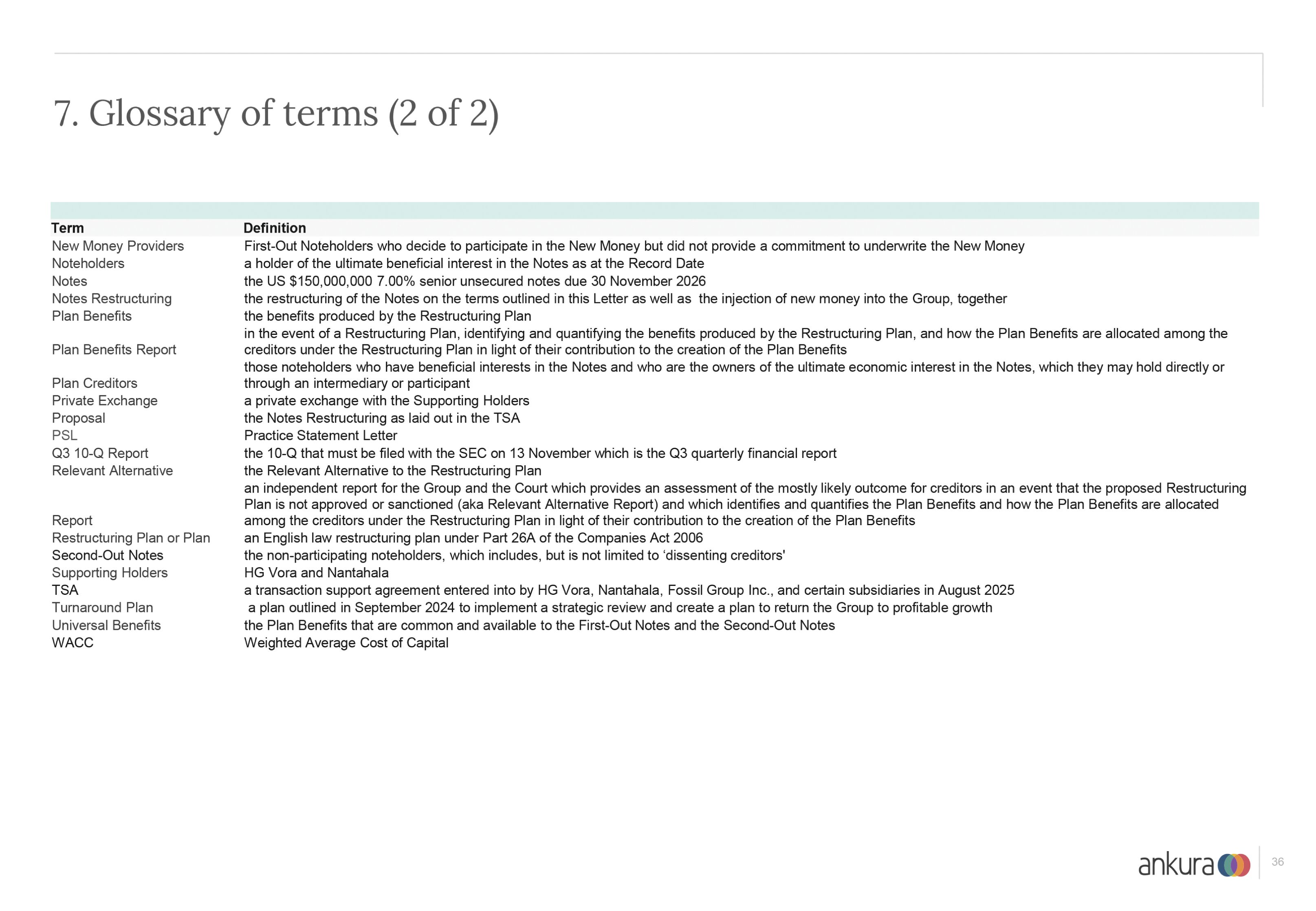

As previously announced, Fossil Group, Inc. (“FGI”) has extended its public offer to exchange (the “Exchange Offer”) any and all of its 7.00% Senior Notes due 2026 (the “Notes”) until 5:00 p.m. (New York City time) / 10: 00 p.m. (London time) / on 10 November 2025. Because the Minimum Tender Condition (as defined herein) (or any other condition to completing the Exchange Offer without a Restructuring Plan (as defined herein)) has not been satisfied or waived, FGI is required to proceed with a restructuring of the Company’s Notes on substantially the same terms as the Exchange Offer (with the exception of the Exchange Offer Amendments (as defined herein)) through a proceeding under the UK Companies Act 2006 of England and Wales (a “UK Proceeding”) pursuant to the terms of the transaction support agreement, dated as of 13 August 2025, by and among, FGI, Fossil (UK) Global Services Ltd (the “Company”), certain direct and indirect subsidiaries of FGI and certain existing holders of Notes.

This prospectus supplement, which supplements the Company’s prospectus dated 25 September 2025 (the “Prospectus”), provides a detailed explanation of the Restructuring Plan and voting process (the “Explanatory Statement”) in connection with the UK Proceeding. In addition to the Explanatory Statement, you are encouraged to read the Prospectus and its annexes carefully and in their entirety, including the section of the Prospectus entitled “Risk Factors,” for a discussion of risks relating to the transactions described herein. You may also obtain more information about the Company from documents we file with the U.S. Securities and Exchange Commission (the “SEC”) from time to time.

If you have any questions about the Restructuring Plan, please contact the Information Agent and/or the Retail Advocate (each as defined herein), using the contact details below:

Epiq Corporate Restructuring, LLC, as information agent of the Company

Telephone: + 1 (646) 362-6336

Email: registration@epiqglobal.com (with the subject line to include “Fossil”)

Plan Website: https://dm.epiq11.com/fossil

Jon Yorke, as Retail Advocate

Email: jy@fgadvocate.com

Attention: Jon Yorke

Sincerely,

FOSSIL GROUP, INC.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

None of FGI, the Company, the applicable New Notes Trustee (as defined herein), the Dealer Manager (as defined herein), the Information Agent, the Notes Trustee (as defined herein) or any director, officer, employee, agent or affiliate of any such person has expressed any opinion as to whether the terms of the Restructuring Plan and related transactions are fair. In addition, none of the clearing systems has expressed any opinion as to whether the terms of the Restructuring Plan and related transactions are fair. None of the Company, the applicable New Notes Trustee, the Dealer Manager, the Information Agent, the Notes Trustee or any director, officer, employee, agent or affiliate of any such person makes any recommendation that Noteholders (as defined herein) vote in favour of the Restructuring Plan, and no one has been authorized by FGI, the Company, the applicable New Notes Trustee, the Dealer Manager, the Information Agent, the Notes Trustee or any director, officer, employee, agent or affiliate of any such person to make any such recommendation. Holders must make their own decision as to whether to vote in favour of the Restructuring Plan.

The date of this prospectus supplement is October 8, 2025.