| — Confidential — March 5, 2022 Presentation to the Special Committee Project RETURN |

| 1 — Confidential — Disclaimer This presentation has been prepared by Centerview Partners LLC (“Centerview”) for use solely by the management and Special Committee of RETURN, Inc.(“RETURN”) in connection with its evaluation of a proposed transaction involving RETURN and for no other purpose. The information contained herein is based upon information supplied by or on behalf of RETURN and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by RETURN. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of RETURN or any other entity, or concerning the solvency or fair value of RETURN or any other entity. With respect to financial forecasts, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the management of RETURN as to the future financial performance of RETURN, and at your direction Centerview has relied upon such forecasts, as provided by RETURN’s management, with respect to RETURN. Centerview assumes no responsibility for and expresses no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise and Centerview assumes no obligation to update or otherwise revise these materials. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performing this financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute a particular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerview’s analysis, without considering the analysis as a whole, would create an incomplete view of the processunderlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of theanalysis described above should not be taken to be Centerview’s view of the actual value of RETURN. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centervieware intended solely for the benefit and use of the management and Special Committee of RETURN (in its capacity as such) in its consideration of the proposed transaction, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of RETURN or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating the proposed transaction, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided byCenterview. |

| 2 — Confidential — Review of Key Dates for the Special Committee .. Oct. 13, 2021: Kick-off call to review process objectives and framework .. Oct. 25, 2021: Strategic review of RETURN’s current market positioning, Management standalone plan and strategic alternatives; discussion of preliminary financial analysis of Management standalone plan .. Nov. 2, 2021: Financial update call conducted by RETURN Management / Centerview with COPY .. Nov. 12, 2021:COPY communicated to Centerview that they are prepared to consider exploring a transaction at an indicative valuation of $22.00 per share (29% implied spot premium(1)) and reiterated that they are not a seller; COPY also requested to engage with a limited number of financing sources and complete focused due diligence – Special Committee subsequently authorized COPY to discuss financing with Goldman and RBC – Special Committee also authorized Centerview to communicate to COPY that a non-binding indication of interest would be needed to assess further engagement .. Nov. 22, 2021: COPY communicated to Centerview that they are prepared to consider a transaction at an indicative valuation of $23.00 per share; COPY confirmed their leverage assumptions with Goldman Sachs and RBC of 6x+ through HoldCo note – Special Committee subsequently authorized Centerview to communicate to COPY that the Special Committee would be unwilling to transact at $23.00 per share – Special Committee also instructed Management to create a single operating case to serve as the basis for analyses as the process progressed .. Dec. 2, 2021: COPY requested business unit calls with the following attendees: Art Steinhafel and Jim Keppler (U.S. Windows); John Buckley and Jim Keppler (U.S. Siding); Philip Langlois (Canada); Matt Ackley and Jim Keppler (Commercial) .. Dec. 3, 2021: RETURN’s CFO presented a Management Case to the Special Committee and subsequently shared the projections with Centerview (1) Based on RETURN’s closing share price of $17.04 as of November 12, 2021. |

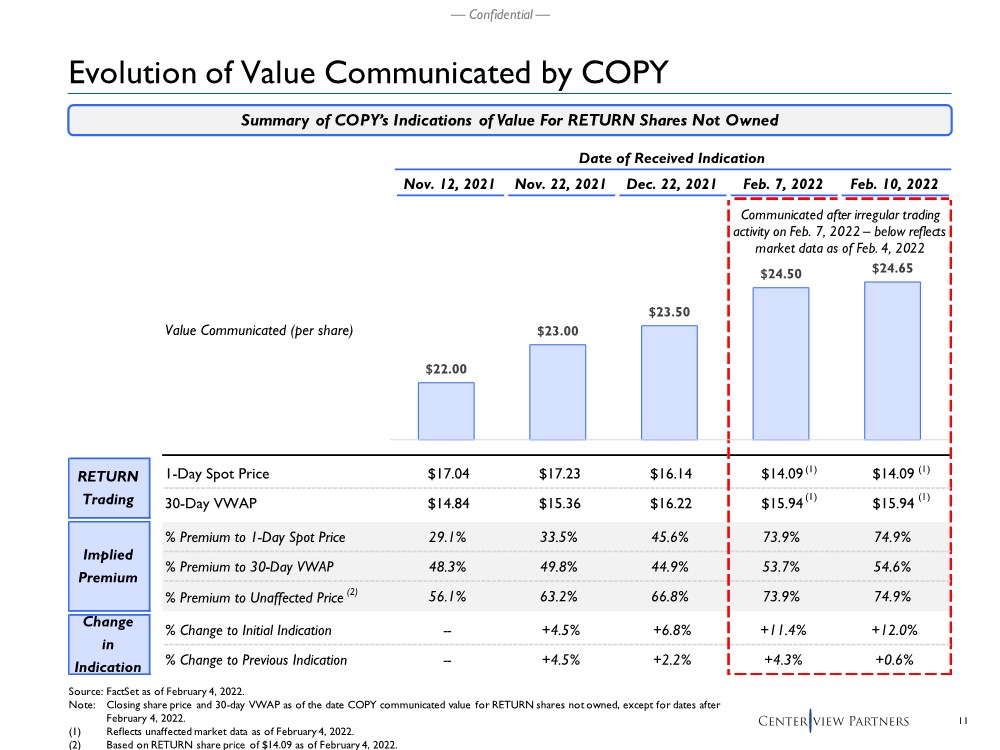

| 3 — Confidential — Review of Key Dates for the Special Committee (Cont.) .. Dec. 16, 2021: RETURN Management and COPY completed the requested business unit reviews; focus centered on the Management Plan, including underlying drivers, market context and operating synergies – COPY then requested follow-up materials as part of their ongoing review of value – Special Committee approved distribution of the requested follow-up materials on December 20, 2021 .. Dec. 22, 2021: COPY communicated to Centerview that they are prepared to consider a transaction at an indicative valuation of $23.50 per share – COPY expressed concerns around specific assumptions in the projections shared by Management • Volume for Windows segment and materials pricing-cost spread for Commercial segment .. Jan. 3, 2022: RETURN’s CFO provided the Special Committee with an update to the Management Plan .. Jan. 19, 2022: COPY and COPY’s advisors were provided access to a virtual data room – Management and Centerview have since completed multiple requests related to COPY’s business, financial and operational due diligence .. Feb. 3, 2022: RETURN’s CFO provided Centerview with an update to the Management Plan, which Centerview subsequently shared with COPY; update included the UCC acquisition and actual balance sheet figures as of December 31, 2021 .. Feb. 7, 2022: COPY communicated to Centerview that they are prepared to consider a transaction at an indicative valuation of $24.50 per share .. Feb. 7, 2022: Unusually high options trading reported in RETURN stock .. Feb. 10, 2022: Bloomberg reports potential COPY offer .. Feb. 10, 2022: Following communication with Centerview, COPY communicated to Centerview that they are prepared to consider a transaction at an indicative valuation of $24.65 per share |

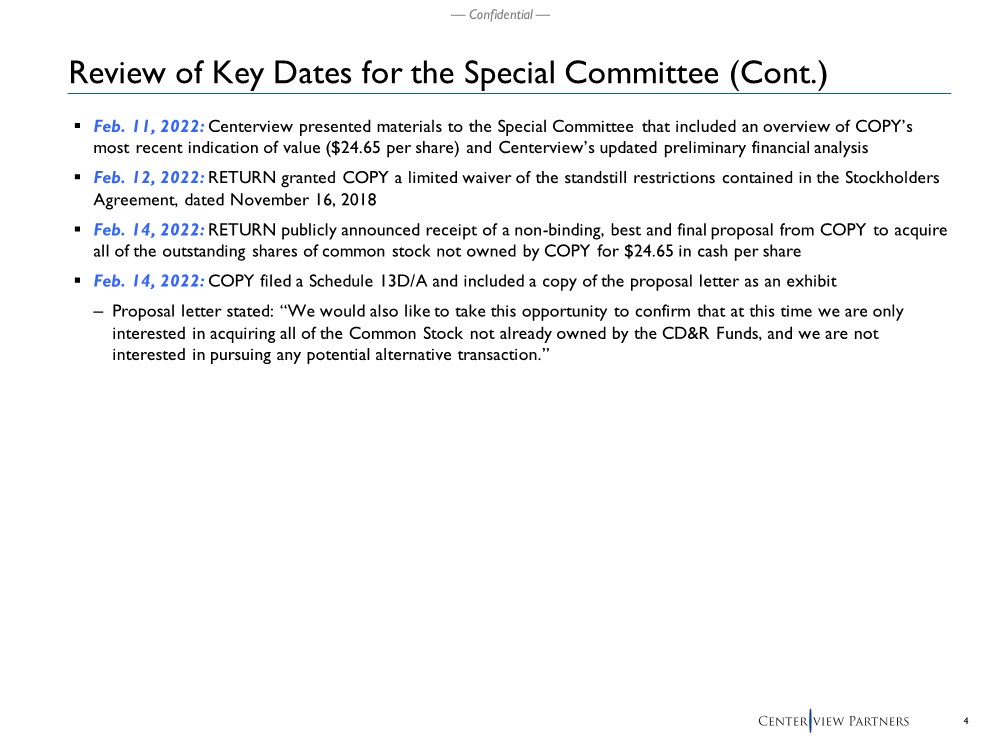

| 4 — Confidential — Review of Key Dates for the Special Committee (Cont.) .. Feb. 11, 2022: Centerview presented materials to the Special Committee that included an overview of COPY’s most recent indication of value ($24.65 per share) and Centerview’s updated preliminary financial analysis .. Feb. 12, 2022: RETURN granted COPY a limited waiver of the standstill restrictions contained in the Stockholders Agreement, dated November 16, 2018 .. Feb. 14, 2022: RETURN publicly announced receipt of a non-binding, best and final proposal from COPY to acquire all of the outstanding shares of common stock not owned by COPY for $24.65 in cash per share .. Feb. 14, 2022: COPY filed a Schedule 13D/A and included a copy of the proposal letter as an exhibit – Proposal letter stated: “We would also like to take this opportunity to confirm that at this time we are only interested in acquiring all of the Common Stock not already owned by the CD&R Funds, and we are not interested in pursuing any potential alternative transaction.” |

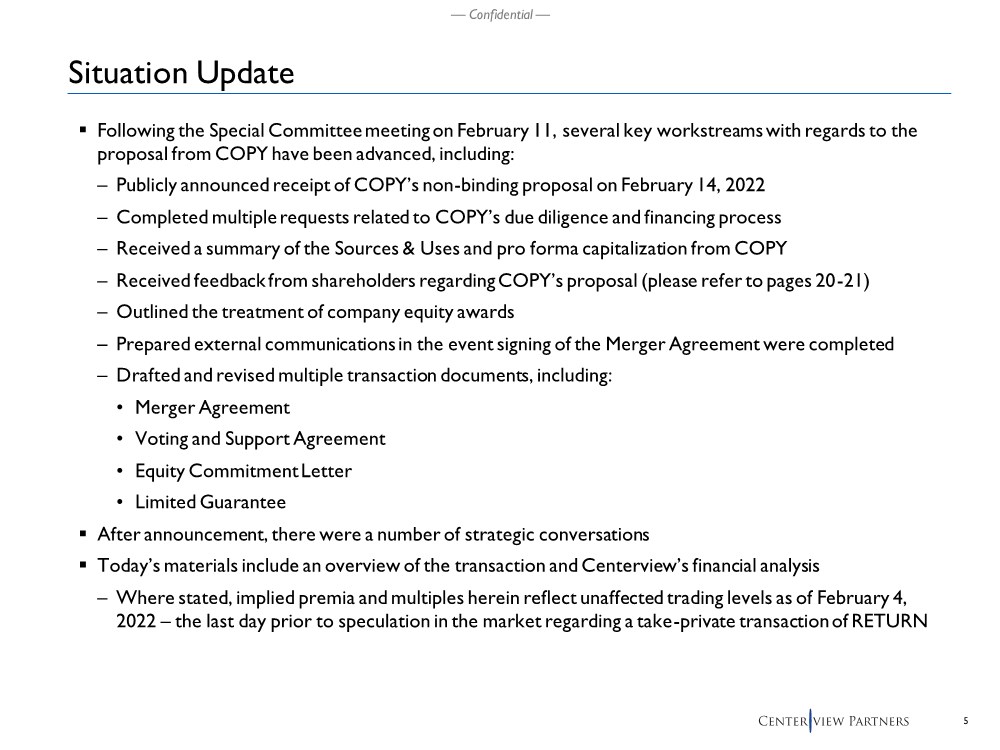

| 5 — Confidential — Situation Update .. Following the Special Committee meeting on February 11, several key workstreamswith regards to the proposal from COPY have been advanced, including: – Publicly announced receipt of COPY’s non-binding proposal on February 14, 2022 – Completed multiple requests related to COPY’s due diligence and financing process – Received a summary of the Sources & Uses and pro forma capitalization from COPY – Received feedback from shareholders regarding COPY’s proposal (please refer to pages 20-21) – Outlined the treatment of company equity awards – Prepared external communications in the event signing of the Merger Agreement were completed – Drafted and revised multiple transaction documents, including: • Merger Agreement • Voting and Support Agreement • Equity Commitment Letter • Limited Guarantee .. After announcement, there were a number of strategic conversations .. Today’s materials include an overview of the transaction and Centerview’s financial analysis – Where stated, implied premia and multiples herein reflect unaffected trading levels as of February 4, 2022 – the last day prior to speculation in the market regarding a take-private transaction of RETURN |

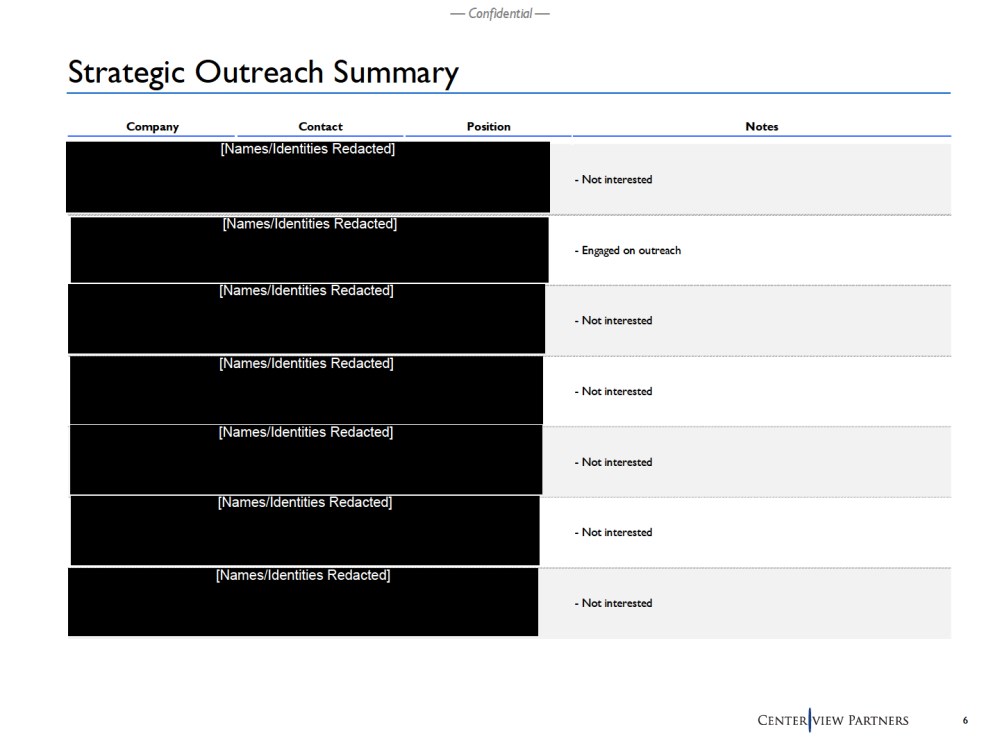

| 6 — Confidential — Strategic Outreach Summary Company Contact Position Notes Nucor Alex Hoffman General Manager, Business Development - Not interested Westlake Chemical Larry Schubert VP, Corporate Development & Sustainability - Engaged on outreach Mohawk Industries James Brunk CFO - Not interested LafargeHolcim Geraldine Picaud CFO - Not interested Carlisle Companies Kevin Zdimal CFO - Not interested Saint-Gobain Mark Rayfield CEO of North America & CertainTeed - Not interested CRH David Dillon EVP, Chief of Staff - Not interested |

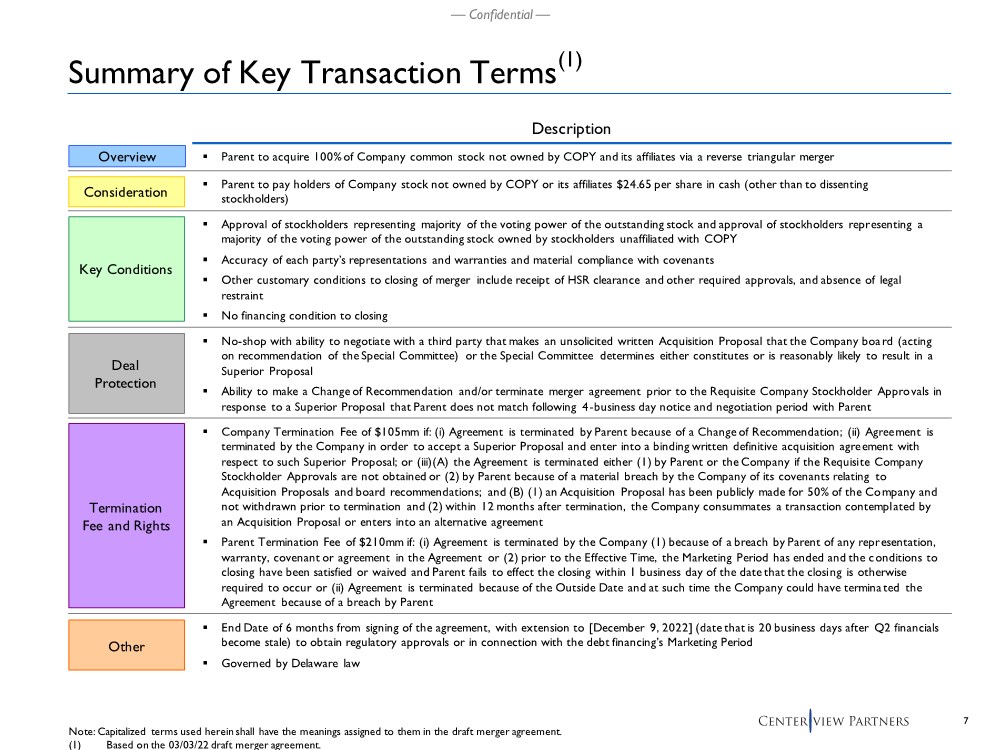

| 7 — Confidential — Description .. Parent to acquire 100% of Company common stock not owned by COPY and its affiliates via a reverse triangular merger .. Parent to pay holders of Company stock not owned by COPY or its affiliates $24.65 per share in cash (other than to dissenting stockholders) .. Approval of stockholders representing majority of the voting power of the outstanding stock and approval of stockholders representing a majority of the voting power of the outstanding stock owned by stockholders unaffiliated with COPY .. Accuracy of each party’s representations and warranties and material compliance with covenants .. Other customary conditions to closing of merger include receipt of HSR clearance and other required approvals, and absence of legal restraint .. No financing condition to closing .. No-shop with ability to negotiate with a third party that makes an unsolicited written Acquisition Proposal that the Company board (acting on recommendation of the Special Committee) or the Special Committee determines either constitutes or is reasonably likely to result in a Superior Proposal .. Ability to make a Change of Recommendation and/or terminate merger agreement prior to the Requisite Company Stockholder Approvals in response to a Superior Proposal that Parent does not match following 4-business day notice and negotiation period with Parent .. Company Termination Fee of $105mm if: (i) Agreement is terminated by Parent because of a Change of Recommendation; (ii) Agreement is terminated by the Company in order to accept a Superior Proposal and enter into a binding written definitive acquisition agreement with respect to such Superior Proposal; or (iii)(A) the Agreement is terminated either (1) by Parent or the Company if the Requisite Company Stockholder Approvals are not obtained or (2) by Parent because of a material breach by the Company of its covenants relating to Acquisition Proposals and board recommendations; and (B) (1) an Acquisition Proposal has been publicly made for 50% of the Company and not withdrawn prior to termination and (2) within 12 months after termination, the Company consummates a transaction contemplated by an Acquisition Proposal or enters into an alternative agreement .. Parent Termination Fee of $210mm if: (i) Agreement is terminated by the Company (1) because of a breach by Parent of any representation, warranty, covenant or agreement in the Agreement or (2) prior to the Effective Time, the Marketing Period has ended and the conditions to closing have been satisfied or waived and Parent fails to effect the closing within 1 business day of the date that the closing is otherwise required to occur or (ii) Agreement is terminated because of the Outside Date and at such time the Company could have terminated the Agreement because of a breach by Parent .. End Date of 6 months from signing of the agreement, with extension to [December 9, 2022] (date that is 20 business days after Q2 financials become stale) to obtain regulatory approvals or in connection with the debt financing’s Marketing Period .. Governed by Delaware law Overview Consideration Termination Fee and Rights Deal Protection Key Conditions Other Note: Capitalized terms used hereinshall have the meanings assigned to them in the draft merger agreement. (1) Based on the 03/03/22 draft merger agreement. Summary of Key Transaction Terms(1) |

| 8 — Confidential — Table of Contents Section I …………………………………………………………………....Transaction Overview Section 2 …………………………………………………………Centerview’s Financial Analysis Appendix ………………………………………………………………...Supplementary Materials |

| — Confidential — Transaction Overview 1 |

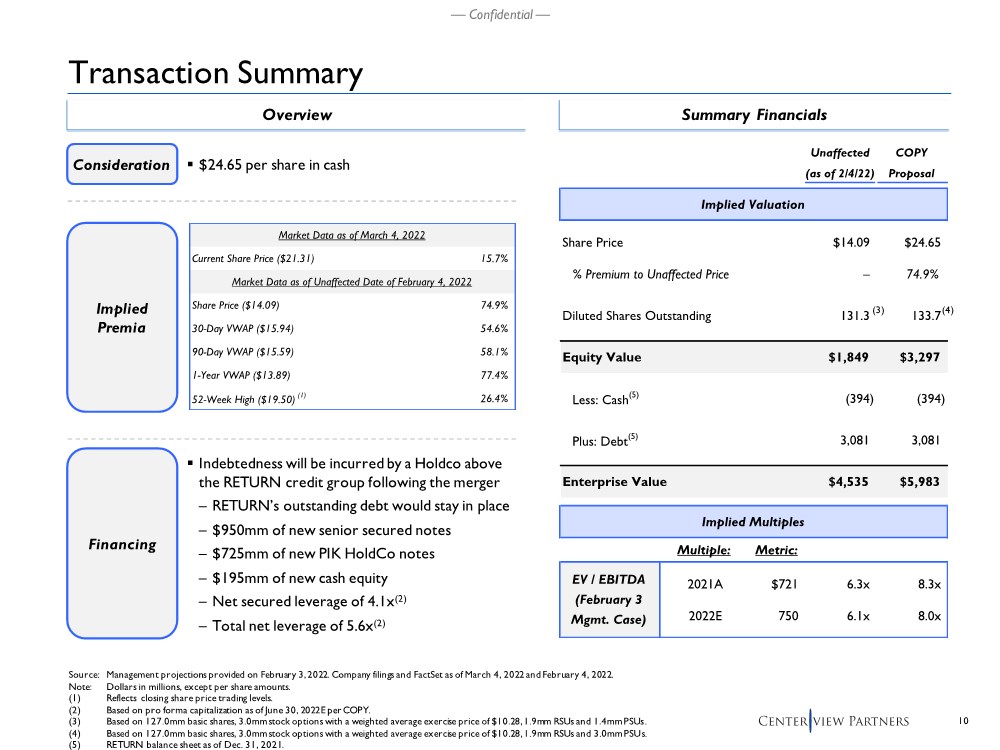

| 10 — Confidential — Transaction Summary Consideration . $24.65 per share in cash Source: Management projections provided on February 3, 2022. Company filings and FactSet as of March 4, 2022 and February 4, 2022. Note: Dollars in millions, except per share amounts. (1) Reflects closing share price trading levels. (2) Based on pro forma capitalization as of June 30, 2022E per COPY. (3) Based on 127.0mm basic shares, 3.0mm stock options with a weighted average exercise price of $10.28, 1.9mm RSUs and 1.4mm PSUs. (4) Based on 127.0mm basic shares, 3.0mm stock options with a weighted average exercise price of $10.28, 1.9mm RSUs and 3.0mm PSUs. (5) RETURN balance sheet as of Dec. 31, 2021. Overview Financing .. Indebtedness will be incurred by a Holdco above the RETURN credit group following the merger – RETURN’s outstanding debt would stay in place – $950mm of new senior secured notes – $725mm of new PIK HoldCo notes – $195mm of new cash equity – Net secured leverage of 4.1x(2) – Total net leverage of 5.6x(2) Summary Financials Unaffected COPY (as of 2/4/22) Proposal Implied Valuation Share Price $14.09 $24.65 % Premium to Unaffected Price – 74.9% Diluted Shares Outstanding 131.3 133.7 Equity Value $1,849 $3,297 Less: Cash(5) (394) (394) Plus: Debt(5) 3,081 3,081 Enterprise Value $4,535 $5,983 Implied Multiples Multiple: Metric: 2021A $721 6.3x 8.3x 2022E 750 6.1x 8.0x EV / EBITDA (February 3 Mgmt. Case) Implied Premia Market Data as of March 4, 2022 Current Share Price ($21.31) 15.7% Market Data as of Unaffected Date of February 4, 2022 Share Price ($14.09) 74.9% 30-Day VWAP ($15.94) 54.6% 90-Day VWAP ($15.59) 58.1% 1-Year VWAP ($13.89) 77.4% 52-Week High ($19.50) (1) 26.4% (3) (4) |

| 11 — Confidential — Source: FactSet as of February 4, 2022. Note: Closing share price and 30-day VWAP as of the date COPY communicated value for RETURN shares not owned, except for dates after February 4, 2022. (1) Reflects unaffected market data as of February 4, 2022. (2) Based on RETURN share price of $14.09 as of February 4, 2022. Summary of COPY’s Indications of Value For RETURN Shares Not Owned Evolution of Value Communicated by COPY Date of Received Indication Nov. 12, 2021 Nov. 22, 2021 Dec. 22, 2021 Feb. 7, 2022 Feb. 10, 2022 Value Communicated (per share) 1-Day Spot Price $17.04 $17.23 $16.14 $14.09 $14.09 30-Day VWAP $14.84 $15.36 $16.22 $15.94 $15.94 % Premium to 1-Day Spot Price 29.1% 33.5% 45.6% 73.9% 74.9% % Premium to 30-Day VWAP 48.3% 49.8% 44.9% 53.7% 54.6% % Premium to Unaffected Price (2) 56.1% 63.2% 66.8% 73.9% 74.9% % Change to Initial Indication -- +4.5% +6.8% +11.4% +12.0% % Change to Previous Indication -- +4.5% +2.2% +4.3% +0.6% RETURN Trading Implied Premium Change in Indication $22.00 $23.00 $23.50 $24.50 $24.65 Communicated after irregular trading activity on Feb. 7, 2022 – below reflects market data as of Feb. 4, 2022 (1) (1) (1) (1) |

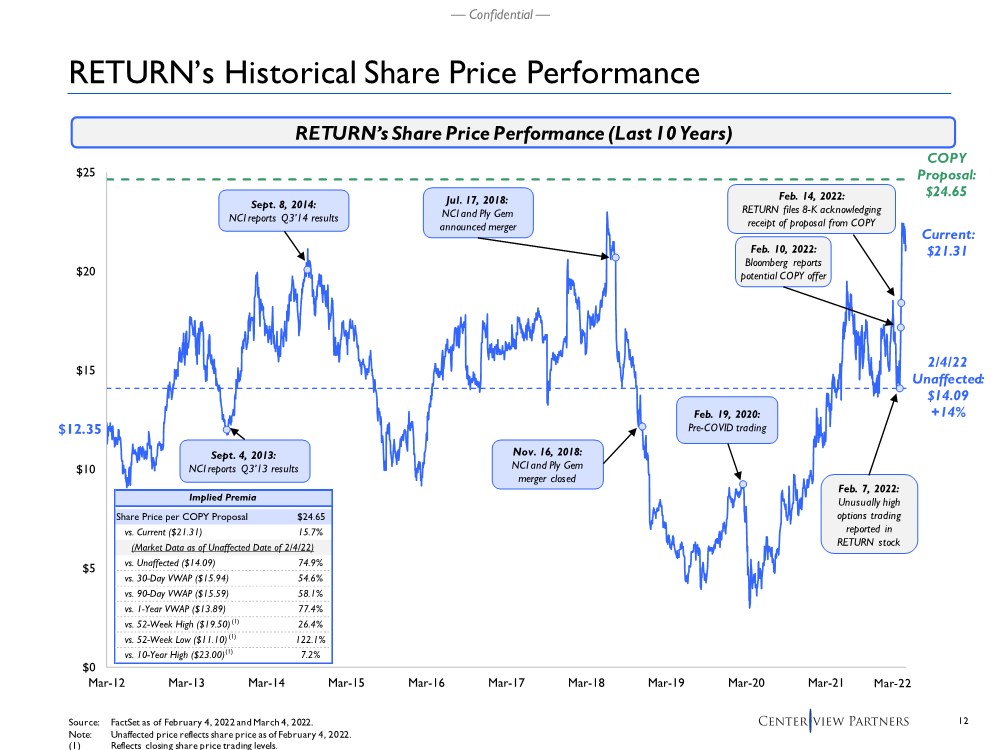

| 12 — Confidential — $0 $5 $10 $15 $20 $25 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 RETURN’s Historical Share Price Performance Source: FactSet as of February 4, 2022 and March 4, 2022. Note: Unaffected price reflects share price as of February 4, 2022. (1) Reflects closing share price trading levels. $12.35 Current: $21.31 Jul. 17, 2018: NCI and Ply Gem announced merger Nov. 16, 2018: NCI and Ply Gem merger closed RETURN’s Share Price Performance (Last 10 Years) Implied Premia Share Price per COPY Proposal $24.65 vs. Current ($21.31) 15.7% (Market Data as of Unaffected Date of 2/4/22) vs. Unaffected ($14.09) 74.9% vs. 30-Day VWAP ($15.94) 54.6% vs. 90-Day VWAP ($15.59) 58.1% vs. 1-Year VWAP ($13.89) 77.4% vs. 52-Week High ($19.50) 26.4% vs. 52-Week Low ($11.10) 122.1% vs. 10-Year High ($23.00) 7.2% (1) (1) COPY Proposal: $24.65 Feb. 19, 2020: Pre-COVID trading Feb. 10, 2022: Bloomberg reports potential COPY offer Feb. 7, 2022: Unusually high options trading reported in RETURN stock 2/4/22 Unaffected: $14.09 +14% (1) Feb. 14, 2022: RETURN files 8-K acknowledging receipt of proposal from COPY Sept. 8, 2014: NCI reports Q3’14 results Sept. 4, 2013: NCI reports Q3’13 results Mar-22 |

| — Confidential — Centerview’s Financial Analysis 2 |

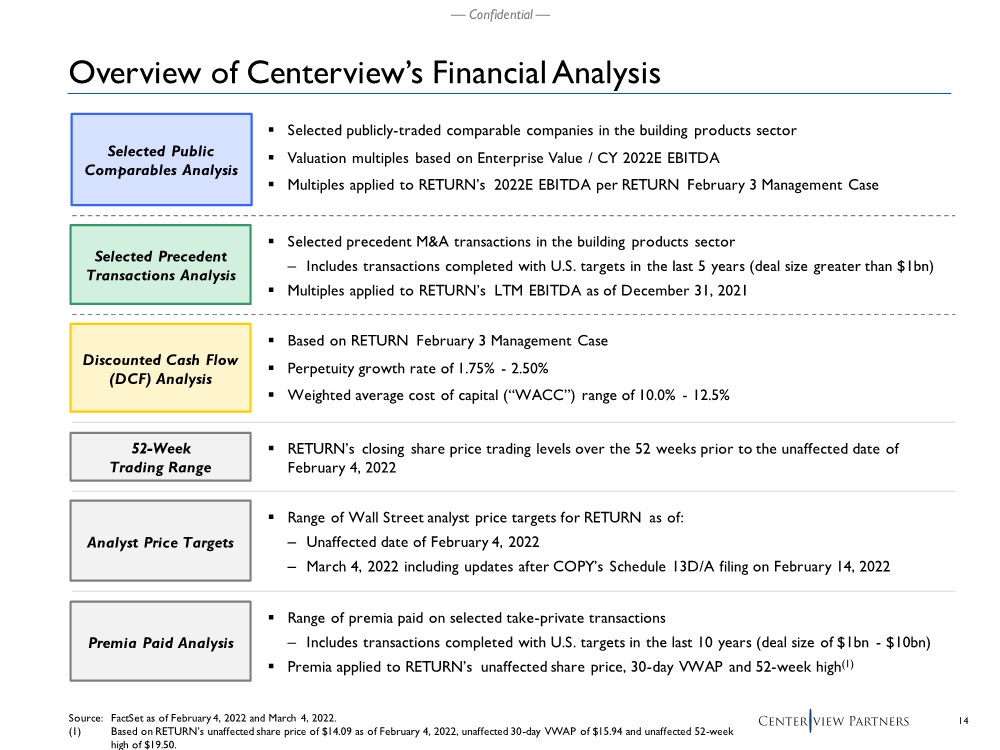

| 14 — Confidential — Source: FactSet as of February 4, 2022 and March 4, 2022. (1) Based on RETURN’s unaffected share price of $14.09 as of February 4, 2022, unaffected 30-day VWAP of $15.94 and unaffected 52-week high of $19.50. .. Selected publicly-traded comparable companies in the building products sector .. Valuation multiples based on Enterprise Value / CY 2022E EBITDA .. Multiples applied to RETURN’s 2022E EBITDA per RETURN February 3 Management Case .. Based on RETURN February 3 Management Case .. Perpetuity growth rate of 1.75% - 2.50% .. Weighted average cost of capital (“WACC”) range of 10.0% - 12.5% .. Selected precedent M&A transactions in the building products sector – Includes transactions completed with U.S. targets in the last 5 years (deal size greater than $1bn) .. Multiples applied to RETURN’s LTM EBITDA as of December 31, 2021 .. RETURN’s closing share price trading levels over the 52 weeks prior to the unaffected date of February 4, 2022 52-Week Trading Range Selected Precedent Transactions Analysis Discounted Cash Flow (DCF) Analysis .. Range of Wall Street analyst price targets for RETURN as of: – Unaffected date of February 4, 2022 – March 4, 2022 including updates after COPY’s Schedule 13D/A filing on February 14, 2022 Analyst Price Targets Selected Public Comparables Analysis Premia Paid Analysis .. Range of premia paid on selected take-private transactions – Includes transactions completed with U.S. targets in the last 10 years (deal size of $1bn - $10bn) .. Premia applied to RETURN’s unaffected share price, 30-day VWAP and 52-week high(1) Overview of Centerview’s Financial Analysis |

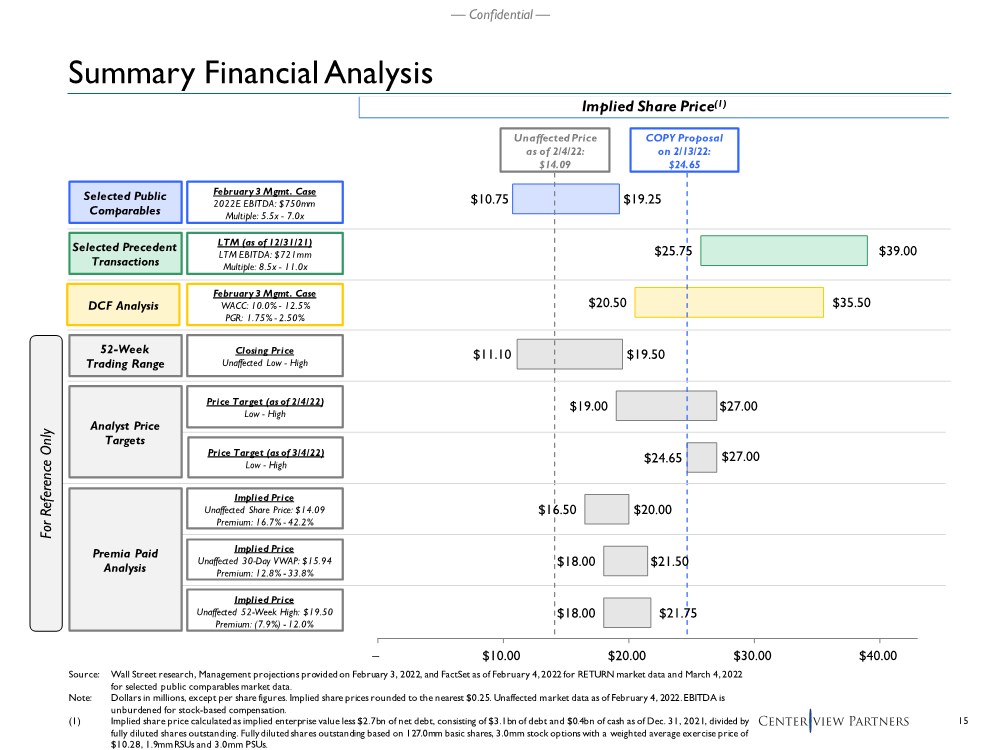

| 15 — Confidential — $10.75 $25.75 $20.50 $11.10 $19.00 $24.65 $16.50 $18.00 $18.00 $19.25 $39.00 $35.50 $19.50 $27.00 $27.00 $20.00 $21.50 $21.75 – $10.00 $20.00 $30.00 $40.00 Source: Wall Street research, Management projections provided on February 3, 2022, and FactSet as of February 4, 2022 for RETURN market data and March 4, 2022 for selected public comparables market data. Note: Dollars in millions, except per share figures. Implied share prices rounded to the nearest $0.25. Unaffected market data as of February 4, 2022. EBITDA is unburdened for stock-based compensation. (1) Implied share price calculated as implied enterprise value less $2.7bn of net debt, consisting of $3.1bn of debt and $0.4bn of cash as of Dec. 31, 2021, divided by fully diluted shares outstanding. Fully diluted shares outstanding based on 127.0mm basic shares, 3.0mm stock options with a weighted average exercise price of $10.28, 1.9mm RSUs and 3.0mm PSUs. 52-Week Trading Range Selected Public Comparables Selected Precedent Transactions Implied Share Price(1) LTM (as of 12/31/21) LTM EBITDA: $721mm Multiple: 8.5x - 11.0x February 3 Mgmt. Case WACC: 10.0% - 12.5% PGR: 1.75% - 2.50% Closing Price Unaffected Low - High February 3 Mgmt. Case 2022E EBITDA: $750mm Multiple: 5.5x - 7.0x Unaffected Price as of 2/4/22: $14.09 Analyst Price Targets Price Target (as of 2/4/22) Low - High DCF Analysis Premia Paid Analysis Implied Price Unaffected Share Price: $14.09 Premium: 16.7% - 42.2% COPY Proposal on 2/13/22: $24.65 Summary Financial Analysis Implied Price Unaffected 30-Day VWAP: $15.94 Premium: 12.8% - 33.8% Implied Price Unaffected 52-Week High: $19.50 Premium: (7.9%) - 12.0% For Reference Only Price Target (as of 3/4/22) Low - High |

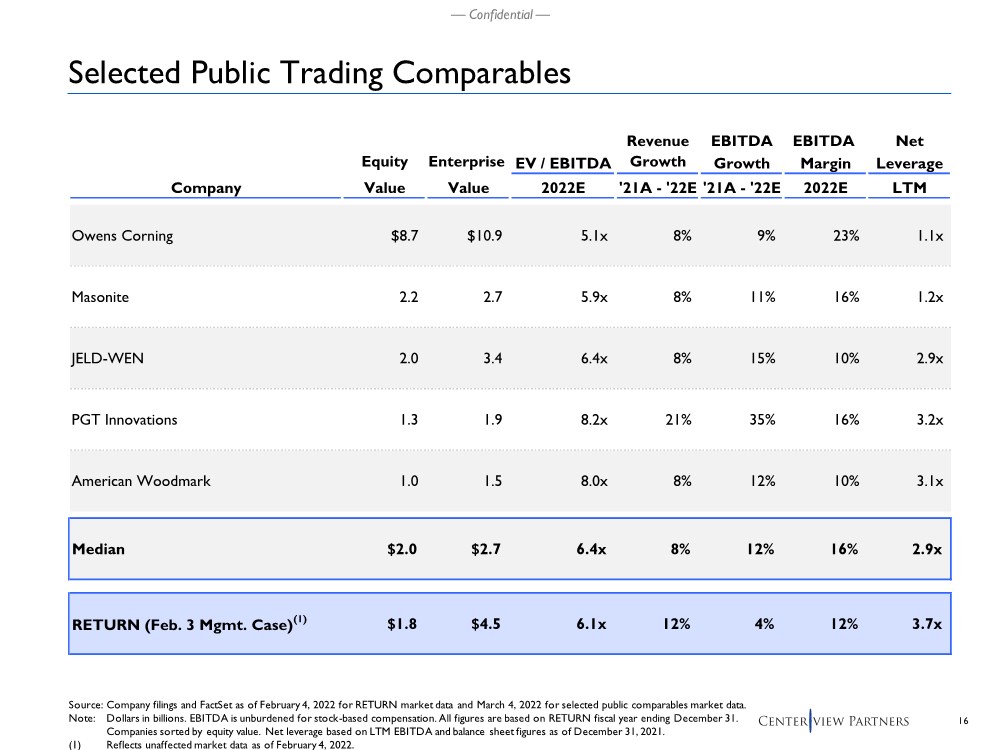

| 16 — Confidential — Selected Public Trading Comparables Source: Company filings and FactSet as of February 4, 2022 for RETURN market data and March 4, 2022 for selected public comparables market data. Note: Dollars in billions. EBITDA is unburdened for stock-based compensation. All figures are based on RETURN fiscal year ending December 31. Companies sorted by equity value. Net leverage based on LTM EBITDA and balance sheet figures as of December 31, 2021. (1) Reflects unaffected market data as of February 4, 2022. Revenue EBITDA EBITDA Net Equity Enterprise EV / EBITDA Growth Growth Margin Leverage Company Value Value 2022E '21A - '22E '21A - '22E 2022E LTM Owens Corning $8.7 $10.9 5.1x 8% 9% 23% 1.1x Masonite 2.2 2.7 5.9x 8% 11% 16% 1.2x JELD-WEN 2.0 3.4 6.4x 8% 15% 10% 2.9x PGT Innovations 1.3 1.9 8.2x 21% 35% 16% 3.2x American Woodmark 1.0 1.5 8.0x 8% 12% 10% 3.1x Median $2.0 $2.7 6.4x 8% 12% 16% 2.9x RETURN (Feb. 3 Mgmt. Case)(1) $1.8 $4.5 6.1x 12% 4% 12% 3.7x |

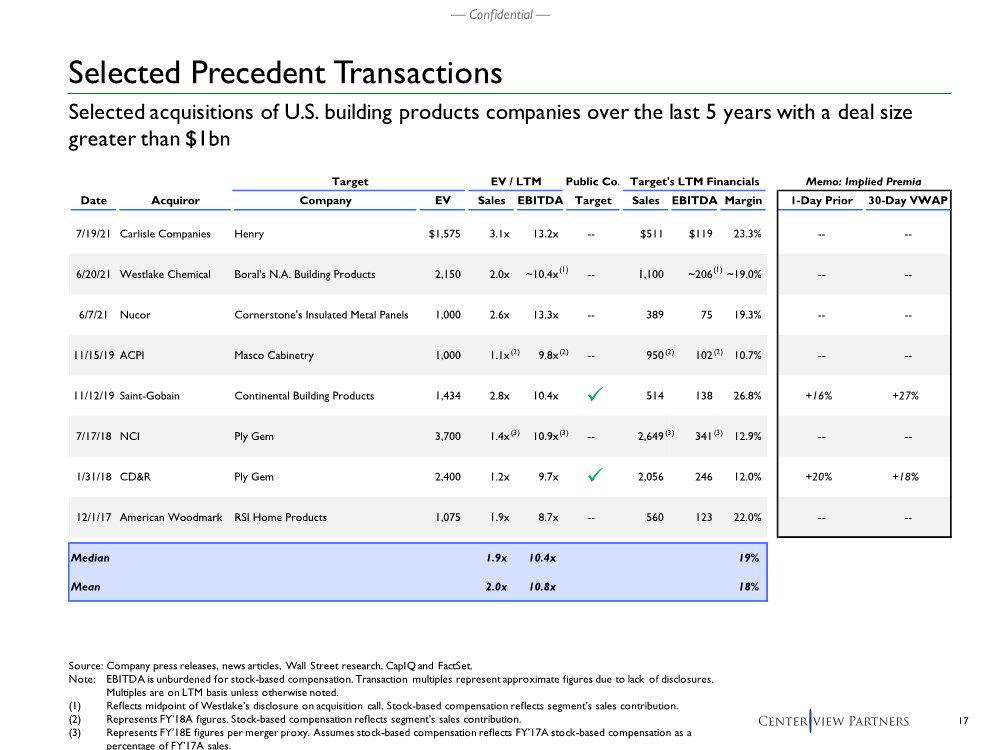

| 17 — Confidential — Target EV / LTM Public Co. Target's LTM Financials Memo: Implied Premia Date Acquiror Company EV Sales EBITDA Target Sales EBITDA Margin 1-Day Prior 30-Day VWAP 7/19/21 Carlisle Companies Henry $1,575 3.1x 13.2x -- $511 $119 23.3% -- -- 6/20/21 Westlake Chemical Boral's N.A. Building Products 2,150 2.0x ~10.4x -- 1,100 ~206 ~19.0% -- -- 6/7/21 Nucor Cornerstone's Insulated Metal Panels 1,000 2.6x 13.3x -- 389 75 19.3% -- -- 11/15/19 ACPI Masco Cabinetry 1,000 1.1x 9.8x -- 950 102 10.7% -- -- 11/12/19 Saint-Gobain Continental Building Products 1,434 2.8x 10.4x x 514 138 26.8% +16% +27% 7/17/18 NCI Ply Gem 3,700 1.4x 10.9x -- 2,649 341 12.9% -- -- 1/31/18 CD&R Ply Gem 2,400 1.2x 9.7x x 2,056 246 12.0% +20% +18% 12/1/17 American Woodmark RSI Home Products 1,075 1.9x 8.7x -- 560 123 22.0% -- -- Median 1.9x 10.4x 19% Mean 2.0x 10.8x 18% Source: Company press releases, news articles, Wall Street research, CapIQ and FactSet. Note: EBITDA is unburdened for stock-based compensation. Transaction multiples represent approximate figures due to lack of disclosures. Multiples are on LTM basis unless otherwise noted. (1) Reflects midpoint of Westlake’s disclosure on acquisition call. Stock-based compensation reflects segment’s sales contribution. (2) Represents FY’18A figures. Stock-based compensation reflects segment’s sales contribution. (3) Represents FY’18E figures per merger proxy. Assumes stock-based compensation reflects FY’17A stock-based compensation as a percentage of FY’17A sales. Selected acquisitions of U.S. building products companies over the last 5 years with a deal size greater than $1bn (2) (1) (2) (2) (2) Selected Precedent Transactions (1) (3) (3) (3) (3) |

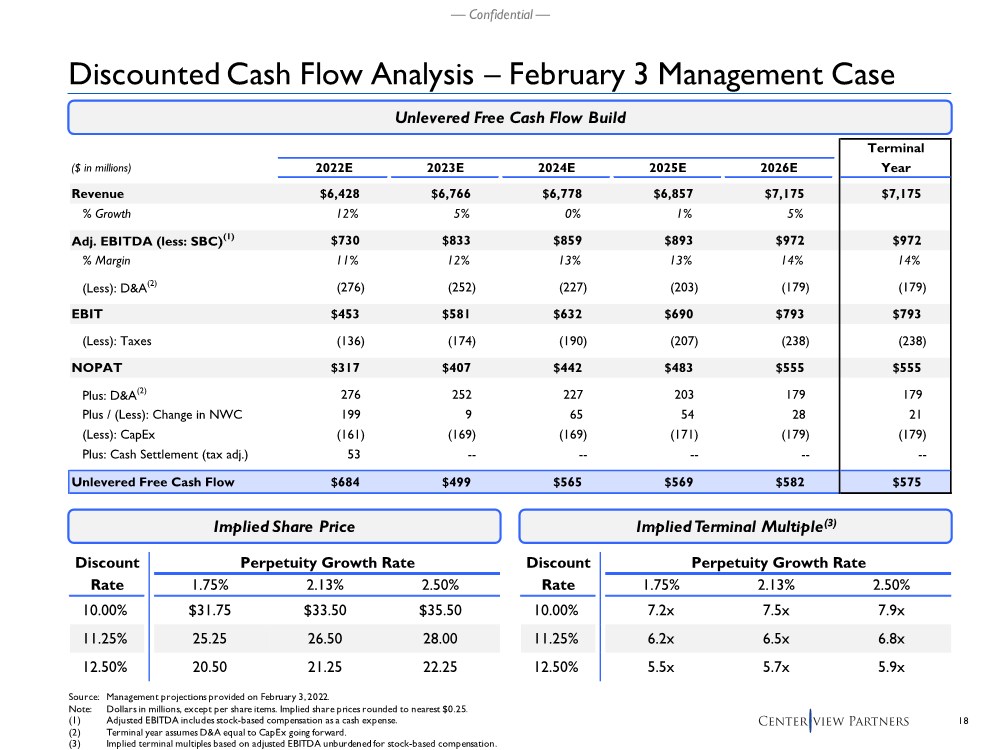

| 18 — Confidential — Discounted Cash Flow Analysis – February 3 Management Case Source: Management projections provided on February 3, 2022. Note: Dollars in millions, except per share items. Implied share prices rounded to nearest $0.25. (1) Adjusted EBITDA includes stock-based compensation as a cash expense. (2) Terminal year assumes D&A equal to CapEx going forward. (3) Implied terminal multiples based on adjusted EBITDA unburdened for stock-based compensation. Unlevered Free Cash Flow Build Terminal ($ in millions) 2022E 2023E 2024E 2025E 2026E Year Revenue $6,428 $6,766 $6,778 $6,857 $7,175 $7,175 % Growth 12% 5% 0% 1% 5% Adj. EBITDA (less: SBC)(1) $730 $833 $859 $893 $972 $972 % Margin 11% 12% 13% 13% 14% 14% (Less): D&A(2) (276) (252) (227) (203) (179) (179) EBIT $453 $581 $632 $690 $793 $793 (Less): Taxes (136) (174) (190) (207) (238) (238) NOPAT $317 $407 $442 $483 $555 $555 Plus: D&A(2) 276 252 227 203 179 179 Plus / (Less): Change in NWC 199 9 65 54 28 21 (Less): CapEx (161) (169) (169) (171) (179) (179) Plus: Cash Settlement (tax adj.) 53 -- -- -- -- -- Unlevered Free Cash Flow $684 $499 $565 $569 $582 $575 Implied Share Price Implied Terminal Multiple(3) Discount Perpetuity Growth Rate Rate 1.75% 2.13% 2.50% 10.00% $31.75 $33.50 $35.50 11.25% 25.25 26.50 28.00 12.50% 20.50 21.25 22.25 Discount Perpetuity Growth Rate Rate 1.75% 2.13% 2.50% 10.00% 7.2x 7.5x 7.9x 11.25% 6.2x 6.5x 6.8x 12.50% 5.5x 5.7x 5.9x |

| — Confidential — Appendix Supplementary Materials |

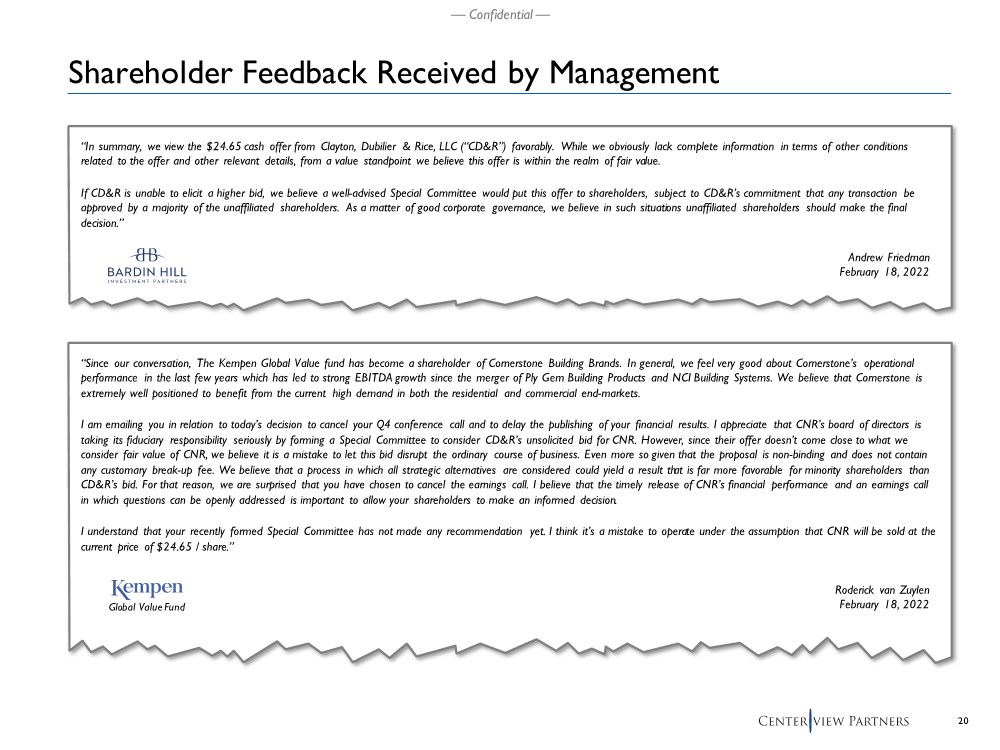

| 20 — Confidential — Shareholder Feedback Received by Management “In summary, we view the $24.65 cash offer from Clayton, Dubilier & Rice, LLC (“CD&R”) favorably. While we obviously lack complete information in terms of other conditions related to the offer and other relevant details, from a value standpoint we believe this offer is within the realm of fair value. If CD&R is unable to elicit a higher bid, we believe a well-advised Special Committee would put this offer to shareholders, subject to CD&R’s commitment that any transaction be approved by a majority of the unaffiliated shareholders. As a matter of good corporate governance, we believe in such situations unaffiliated shareholders should make the final decision.” Andrew Friedman February 18, 2022 “Since our conversation, The Kempen Global Value fund has become a shareholder of Cornerstone Building Brands. In general, we feel very good about Cornerstone’s operational performance in the last few years which has led to strong EBITDA growth since the merger of Ply Gem Building Products and NCI Building Systems. We believe that Cornerstone is extremely well positioned to benefit from the current high demand in both the residential and commercial end-markets. I am emailing you in relation to today’s decision to cancel your Q4 conference call and to delay the publishing of your financial results. I appreciate that CNR’s board of directors is taking its fiduciary responsibility seriously by forming a Special Committee to consider CD&R’s unsolicited bid for CNR. However, since their offer doesn’t come close to what we consider fair value of CNR, we believe it is a mistake to let this bid disrupt the ordinary course of business. Even more so given that the proposal is non-binding and does not contain any customary break-up fee. We believe that a process in which all strategic alternatives are considered could yield a result th at is far more favorable for minority shareholders than CD&R’s bid. For that reason, we are surprised that you have chosen to cancel the earnings call. I believe that the timely release of CNR’s financial performance and an earnings call in which questions can be openly addressed is important to allow your shareholders to make an informed decision. I understand that your recently formed Special Committee has not made any recommendation yet. I think it’s a mistake to operate under the assumption that CNR will be sold at the current price of $24.65 / share.” Roderick van Zuylen February 18, 2022 Global Value Fund |

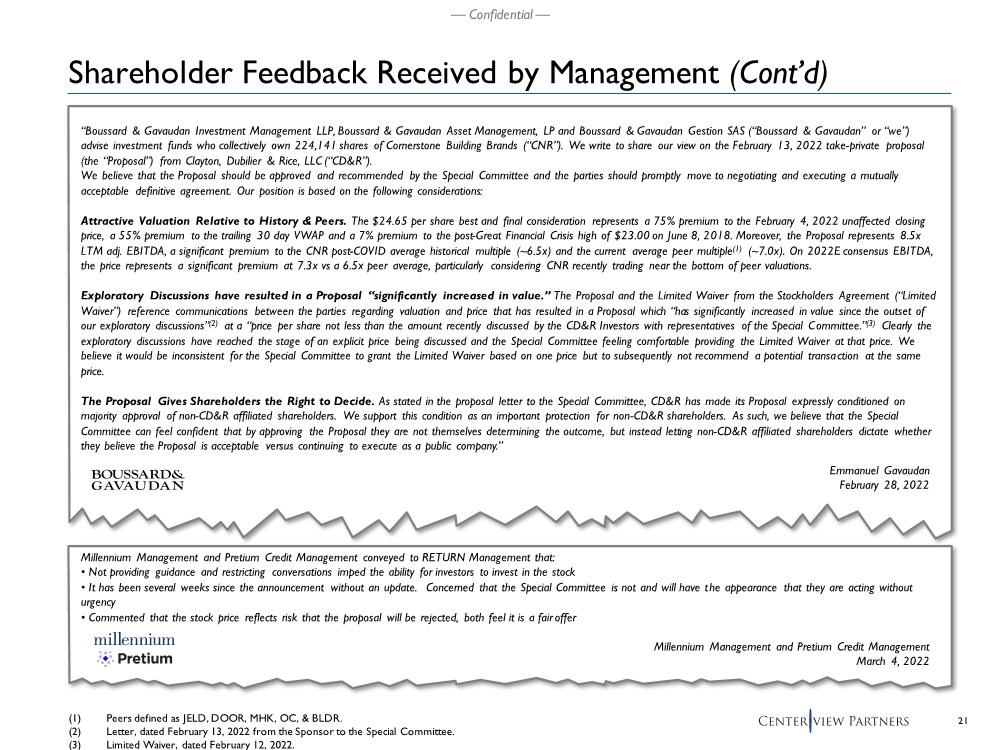

| 21 — Confidential — Shareholder Feedback Received by Management (Cont’d) (1) Peers defined as JELD, DOOR, MHK, OC, & BLDR. (2) Letter, dated February 13, 2022 from the Sponsor to the Special Committee. (3) Limited Waiver, dated February 12, 2022. “Boussard & Gavaudan Investment Management LLP, Boussard & Gavaudan Asset Management, LP and Boussard & Gavaudan Gestion SAS (“Boussard & Gavaudan” or “we”) advise investment funds who collectively own 224,141 shares of Cornerstone Building Brands (“CNR”). We write to share our view on the February 13, 2022 take-private proposal (the “Proposal”) from Clayton, Dubilier & Rice, LLC (“CD&R”). We believe that the Proposal should be approved and recommended by the Special Committee and the parties should promptly move to negotiating and executing a mutually acceptable definitive agreement. Our position is based on the following considerations: Attractive Valuation Relative to History & Peers. The $24.65 per share best and final consideration represents a 75% premium to the February 4, 2022 unaffected closing price, a 55% premium to the trailing 30 day VWAP and a 7% premium to the post-Great Financial Crisis high of $23.00 on June 8, 2018. Moreover, the Proposal represents 8.5x LTM adj. EBITDA, a significant premium to the CNR post-COVID average historical multiple (~6.5x) and the current average peer multiple(1) (~7.0x). On 2022E consensus EBITDA, the price represents a significant premium at 7.3x vs a 6.5x peer average, particularly considering CNR recently trading near the bottom of peer valuations. Exploratory Discussions have resulted in a Proposal “significantly increased in value.” The Proposal and the Limited Waiver from the Stockholders Agreement (“Limited Waiver”) reference communications between the parties regarding valuation and price that has resulted in a Proposal which “has significantly increased in value since the outset of our exploratory discussions”(2) at a “price per share not less than the amount recently discussed by the CD&R Investors with representatives of the Special Committee.”(3) Clearly the exploratory discussions have reached the stage of an explicit price being discussed and the Special Committee feeling comfortable providing the Limited Waiver at that price. We believe it would be inconsistent for the Special Committee to grant the Limited Waiver based on one price but to subsequently not recommend a potential transaction at the same price. The Proposal Gives Shareholders the Right to Decide. As stated in the proposal letter to the Special Committee, CD&R has made its Proposal expressly conditioned on majority approval of non-CD&R affiliated shareholders. We support this condition as an important protection for non-CD&R shareholders. As such, we believe that the Special Committee can feel confident that by approving the Proposal they are not themselves determining the outcome, but instead letting non-CD&R affiliated shareholders dictate whether they believe the Proposal is acceptable versus continuing to execute as a public company.” Emmanuel Gavaudan February 28, 2022 Millennium Management and Pretium Credit Management conveyed to RETURN Management that: • Not providing guidance and restricting conversations imped the ability for investors to invest in the stock • It has been several weeks since the announcement without an update. Concerned that the Special Committee is not and will have the appearance that they are acting without urgency • Commented that the stock price reflects risk that the proposal will be rejected, both feel it is a fair offer Millennium Management and Pretium Credit Management March 4, 2022 |

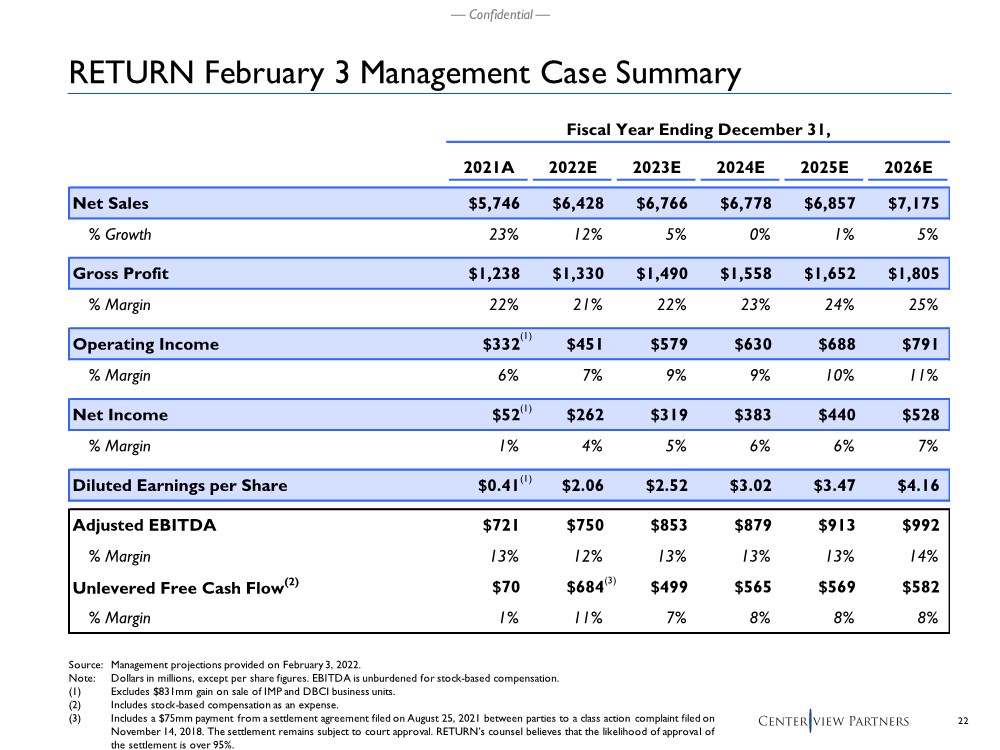

| 22 — Confidential — Fiscal Year Ending December 31, 2021A 2022E 2023E 2024E 2025E 2026E Net Sales $5,746 $6,428 $6,766 $6,778 $6,857 $7,175 % Growth 23% 12% 5% 0% 1% 5% Gross Profit $1,238 $1,330 $1,490 $1,558 $1,652 $1,805 % Margin 22% 21% 22% 23% 24% 25% Operating Income $332 $451 $579 $630 $688 $791 % Margin 6% 7% 9% 9% 10% 11% Net Income $52 $262 $319 $383 $440 $528 % Margin 1% 4% 5% 6% 6% 7% Diluted Earnings per Share $0.41 $2.06 $2.52 $3.02 $3.47 $4.16 Adjusted EBITDA $721 $750 $853 $879 $913 $992 % Margin 13% 12% 13% 13% 13% 14% Unlevered Free Cash Flow(2) $70 $684 $499 $565 $569 $582 % Margin 1% 11% 7% 8% 8% 8% Source: Management projections provided on February 3, 2022. Note: Dollars in millions, except per share figures. EBITDA is unburdened for stock-based compensation. (1) Excludes $831mm gain on sale of IMP and DBCI business units. (2) Includes stock-based compensation as an expense. (3) Includes a $75mm payment from a settlement agreement filed on August 25, 2021 between parties to a class action complaint filed on November 14, 2018. The settlement remains subject to court approval. RETURN’s counsel believes that the likelihood of approval of the settlement is over 95%. (3) RETURN February 3 Management Case Summary (1) (1) (1) |

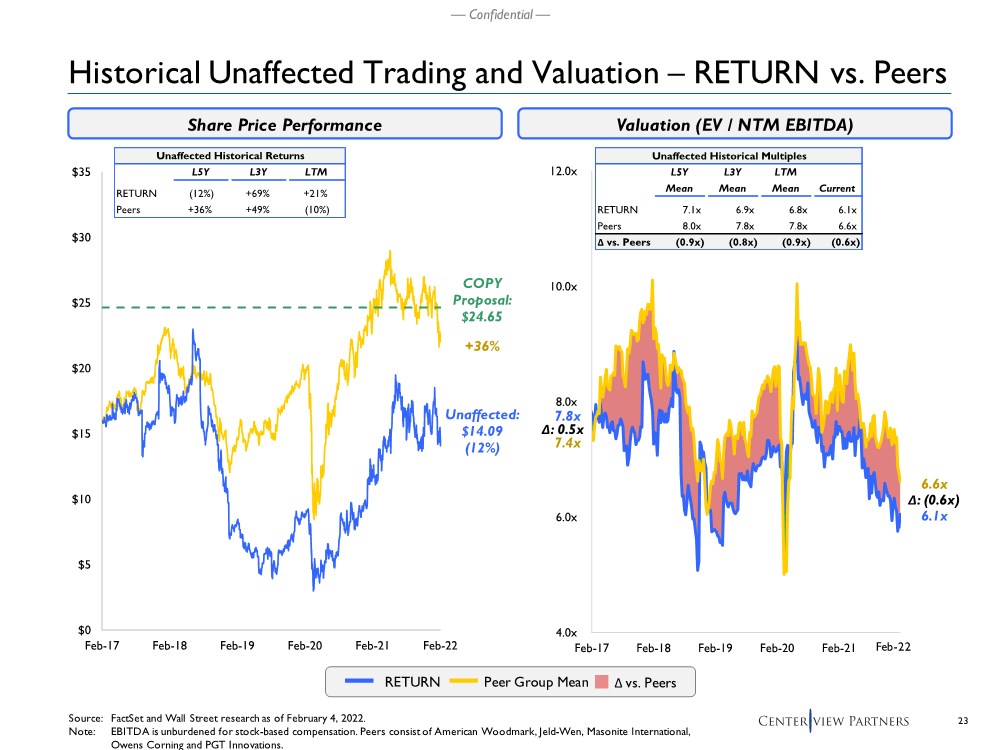

| 23 — Confidential — Unaffected Historical Multiples L5Y L3Y LTM Mean Mean Mean Current RETURN 7.1x 6.9x 6.8x 6.1x Peers 8.0x 7.8x 7.8x 6.6x Δ vs. Peers (0.9x) (0.8x) (0.9x) (0.6x) 4.0x 6.0x 8.0x 10.0x 12.0x Feb-17 Feb-18 Feb-19 Feb-20 Feb-21 $0 $5 $10 $15 $20 $25 $30 $35 Feb-17 Feb-18 Feb-19 Feb-20 Feb-21 Feb-22 Historical Unaffected Trading and Valuation – RETURN vs. Peers Source: FactSet and Wall Street research as of February 4, 2022. Note: EBITDA is unburdened for stock-based compensation. Peers consist of American Woodmark, Jeld-Wen, Masonite International, Owens Corning and PGT Innovations. Valuation (EV / NTM EBITDA) 6.1x 6.6x 7.8x 7.4x Unaffected: $14.09 (12%) COPY Proposal: $24.65 +36% Share Price Performance Peer Group Mean RETURN Δ vs. Peers Δ: 0.5x Δ: (0.6x) Unaffected Historical Returns L5Y L3Y LTM RETURN (12%) +69% +21% Peers +36% +49% (10%) Feb-22 |

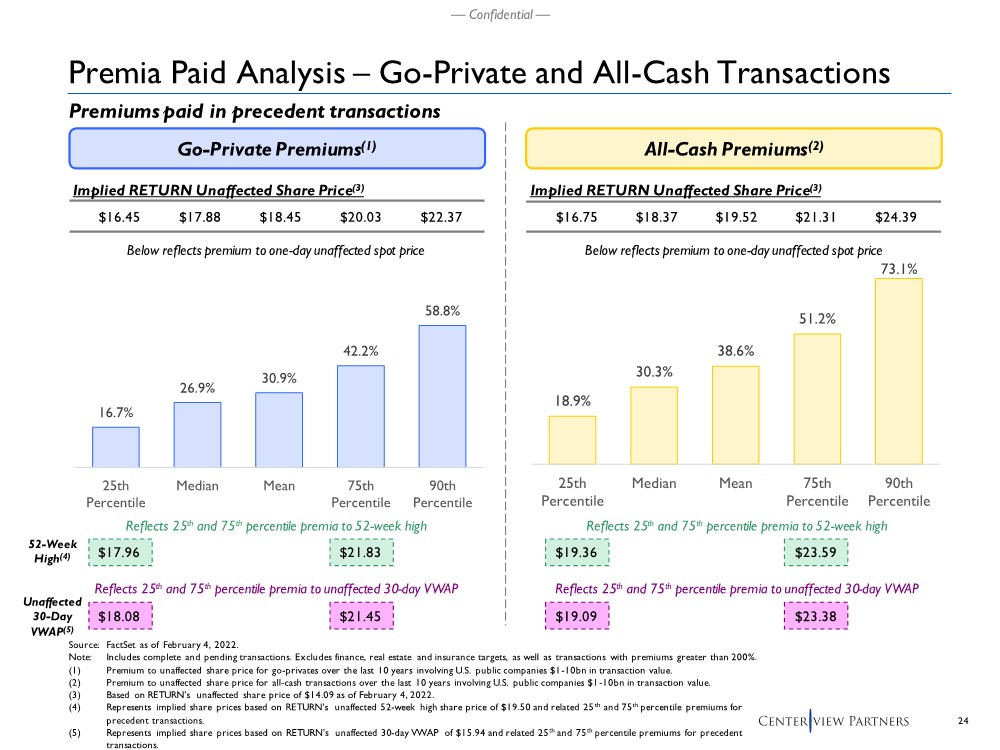

| 24 — Confidential — Premia Paid Analysis – Go-Private and All-Cash Transactions Premiums paid in precedent transactions Source: FactSet as of February 4, 2022. Note: Includes complete and pending transactions. Excludes finance, real estate and insurance targets, as well as transactions with premiums greater than 200%. (1) Premium to unaffected share price for go-privates over the last 10 years involving U.S. public companies $1-10bn in transaction value. (2) Premium to unaffected share price for all-cash transactions over the last 10 years involving U.S. public companies $1-10bn in transaction value. (3) Based on RETURN’s unaffected share price of $14.09 as of February 4, 2022. (4) Represents implied share prices based on RETURN’s unaffected 52-week high share price of $19.50 and related 25 th and 75th percentile premiums for precedent transactions. (5) Represents implied share prices based on RETURN’s unaffected 30-day VWAP of $15.94 and related 25th and 75th percentile premiums for precedent transactions. Go-Private Premiums(1) All-Cash Premiums(2) Implied RETURN Unaffected Share Price(3) $16.45 $17.88 $18.45 $20.03 $22.37 Implied RETURN Unaffected Share Price(3) $16.75 $18.37 $19.52 $21.31 $24.39 16.7% 26.9% 30.9% 42.2% 58.8% 25th Percentile Median Mean 75th Percentile 90th Percentile 18.9% 30.3% 38.6% 51.2% 73.1% 25th Percentile Median Mean 75th Percentile 90th Percentile $17.96 $21.83 $18.08 $21.45 $23.59 $23.38 $19.36 $19.09 52-Week High(4) Unaffected 30-Day VWAP(5) Below reflects premium to one-day unaffected spot price Below reflects premium to one-day unaffected spot price Reflects 25th and 75th percentile premia to 52-week high Reflects 25th and 75th percentile premia to 52-week high Reflects 25th and 75th percentile premia to unaffected 30-day VWAP Reflects 25th and 75th percentile premia to unaffected 30-day VWAP |

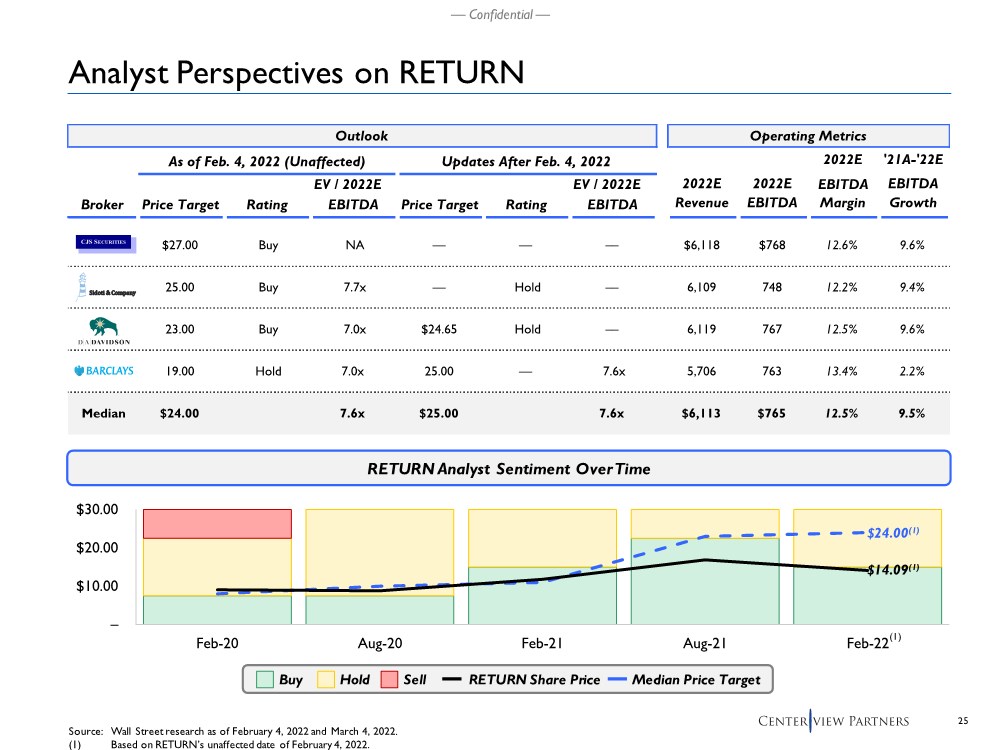

| 25 — Confidential — Outlook Operating Metrics As of Feb. 4, 2022 (Unaffected) Updates After Feb. 4, 2022 2022E '21A-'22E EV / 2022E EV / 2022E 2022E 2022E EBITDA EBITDA Broker Price Target Rating EBITDA Price Target Rating EBITDA Revenue EBITDA Margin Growth $27.00 Buy NA –– –– –– $6,118 $768 12.6% 9.6% 25.00 Buy 7.7x –– Hold –– 6,109 748 12.2% 9.4% 23.00 Buy 7.0x $24.65 Hold –– 6,119 767 12.5% 9.6% 19.00 Hold 7.0x 25.00 –– 7.6x 5,706 763 13.4% 2.2% Median $24.00 7.6x $25.00 7.6x $6,113 $765 12.5% 9.5% – $10.00 $20.00 $30.00 Feb-20 Aug-20 Feb-21 Aug-21 Feb-22 Analyst Perspectives on RETURN RETURN Analyst Sentiment Over Time Buy Hold Sell RETURN Share Price Median Price Target $24.00(1) $14.09(1) Source: Wall Street research as of February 4, 2022 and March 4, 2022. (1) Based on RETURN’s unaffected date of February 4, 2022. (1) |

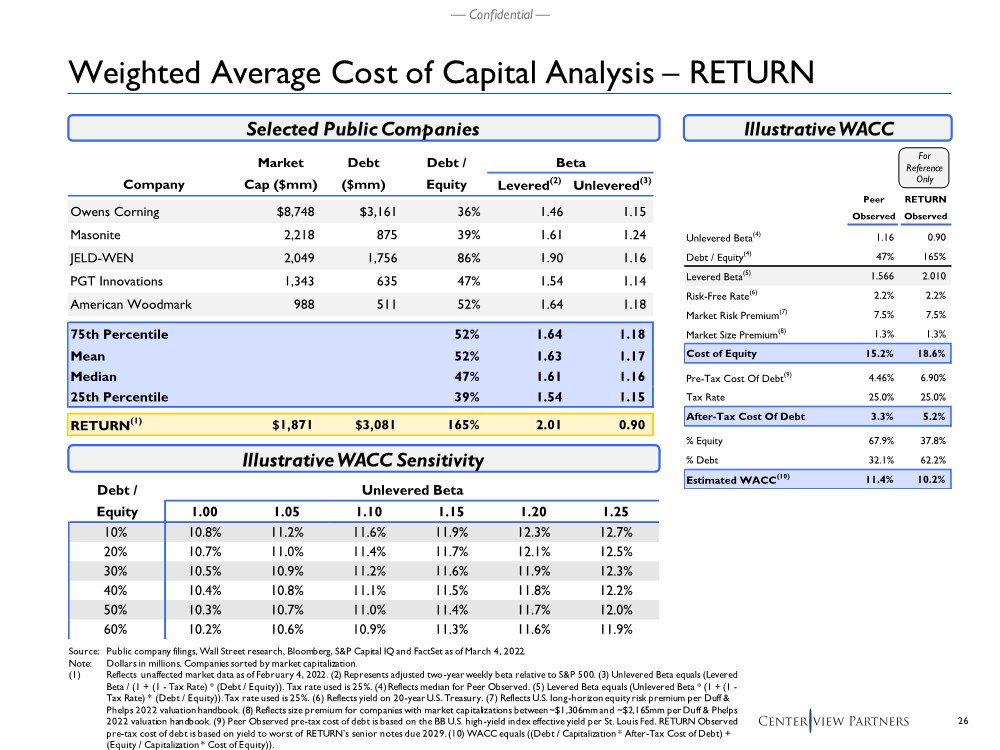

| 26 — Confidential — Debt / Unlevered Beta Equity 1.00 1.05 1.10 1.15 1.20 1.25 10% 10.8% 11.2% 11.6% 11.9% 12.3% 12.7% 20% 10.7% 11.0% 11.4% 11.7% 12.1% 12.5% 30% 10.5% 10.9% 11.2% 11.6% 11.9% 12.3% 40% 10.4% 10.8% 11.1% 11.5% 11.8% 12.2% 50% 10.3% 10.7% 11.0% 11.4% 11.7% 12.0% 60% 10.2% 10.6% 10.9% 11.3% 11.6% 11.9% Weighted Average Cost of Capital Analysis – RETURN Selected Public Companies Illustrative WACC IllustrativeWACC Sensitivity Source: Public company filings, Wall Street research, Bloomberg, S&P Capital IQ and FactSet as of March 4, 2022. Note: Dollars in millions. Companies sorted by market capitalization. (1) Reflects unaffected market data as of February 4, 2022. (2) Represents adjusted two-year weekly beta relative to S&P 500. (3) Unlevered Beta equals (Levered Beta / (1 + (1 - Tax Rate) * (Debt / Equity)). Tax rate used is 25%. (4) Reflects median for Peer Observed. (5) Levered Beta equals (Unlevered Beta * (1 + (1 - Tax Rate) * (Debt / Equity)). Tax rate used is 25%. (6) Reflects yield on 20-year U.S. Treasury. (7) Reflects U.S. long-horizon equity risk premium per Duff & Phelps 2022 valuation handbook. (8) Reflects size premium for companies with market capitalizations between ~$1,306mm and ~$2,165mm per Duff & Phelps 2022 valuation handbook. (9) Peer Observed pre-tax cost of debt is based on the BB U.S. high-yield index effective yield per St. Louis Fed. RETURN Observed pre-tax cost of debt is based on yield to worst of RETURN’s senior notes due 2029. (10) WACC equals ((Debt / Capitalization * After-Tax Cost of Debt) + (Equity / Capitalization * Cost of Equity)). Market Debt Debt / Beta Company Cap ($mm) ($mm) Equity Levered(2) Unlevered(3) Owens Corning $8,748 $3,161 36% 1.46 1.15 Masonite 2,218 875 39% 1.61 1.24 JELD-WEN 2,049 1,756 86% 1.90 1.16 PGT Innovations 1,343 635 47% 1.54 1.14 American Woodmark 988 511 52% 1.64 1.18 75th Percentile 52% 1.64 1.18 Mean 52% 1.63 1.17 Median 47% 1.61 1.16 25th Percentile 39% 1.54 1.15 RETURN(1) $1,871 $3,081 165% 2.01 0.90 Peer RETURN Observed Observed Unlevered Beta(4) 1.16 0.90 Debt / Equity(4) 47% 165% Levered Beta(5) 1.566 2.010 Risk-Free Rate(6) 2.2% 2.2% Market Risk Premium(7) 7.5% 7.5% Market Size Premium(8) 1.3% 1.3% Cost of Equity 15.2% 18.6% Pre-Tax Cost Of Debt(9) 4.46% 6.90% Tax Rate 25.0% 25.0% After-Tax Cost Of Debt 3.3% 5.2% % Equity 67.9% 37.8% % Debt 32.1% 62.2% Estimated WACC(10) 11.4% 10.2% For Reference Only |