Fiscal 2026 First Quarter Earnings Presentation February 5, 2026

About This Presentation This presentation contains statements, estimates and projections that are forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended). Such statements use forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” or other similar words and terms of similar meaning, although not all forward- looking statements contain such words. These statements discuss plans, strategies, events or developments that we expect or anticipate will or may occur in the future. Management believes that these are reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control; accordingly, there is no assurance that results will be realized. You should read UGI’s Annual Report on Form 10-K for a more extensive list of factors that could affect results. We undertake no obligation (and expressly disclaim any obligation) to update publicly any forward-looking statement, whether as a result of new information or future events, except as required by the federal securities laws. Management uses “adjusted net income attributable to UGI Corporation” and “adjusted diluted earnings per share (“EPS”)”, each of which are non-GAAP financial measures, when evaluating UGI's overall performance. Management believes that these non-GAAP measures provide meaningful information to investors about UGI’s performance because they eliminate the impacts of (1) gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions and (2) other significant discrete items that can affect the comparison of period-over-period results. Volatility in net income attributable to UGI can occur as a result of gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions but included in earnings in accordance with U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures. The tables in the Appendix reconcile adjusted diluted earnings per share (EPS) and adjusted net income attributable to UGI Corporation to their nearest GAAP measures. 2

Bob Flexon President & Chief Executive Officer Sean O’Brien Chief Financial Officer

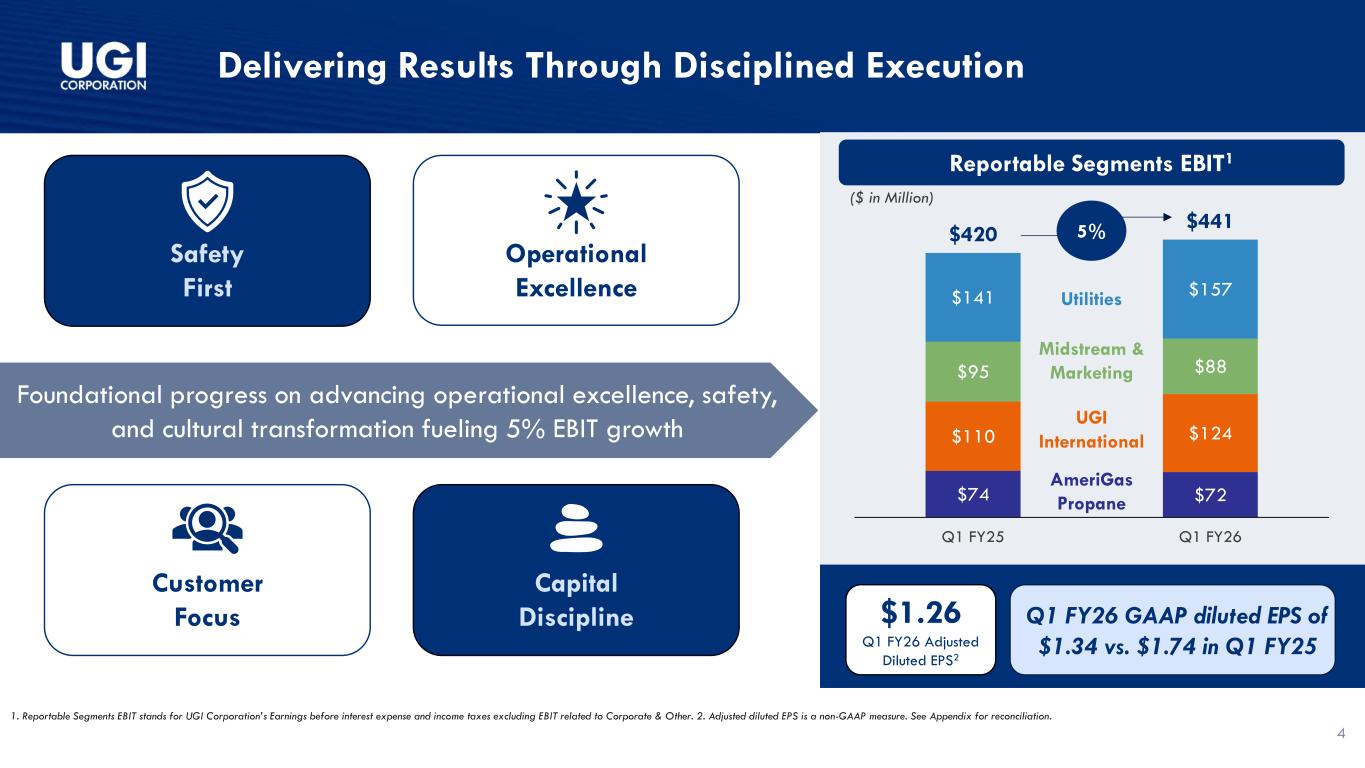

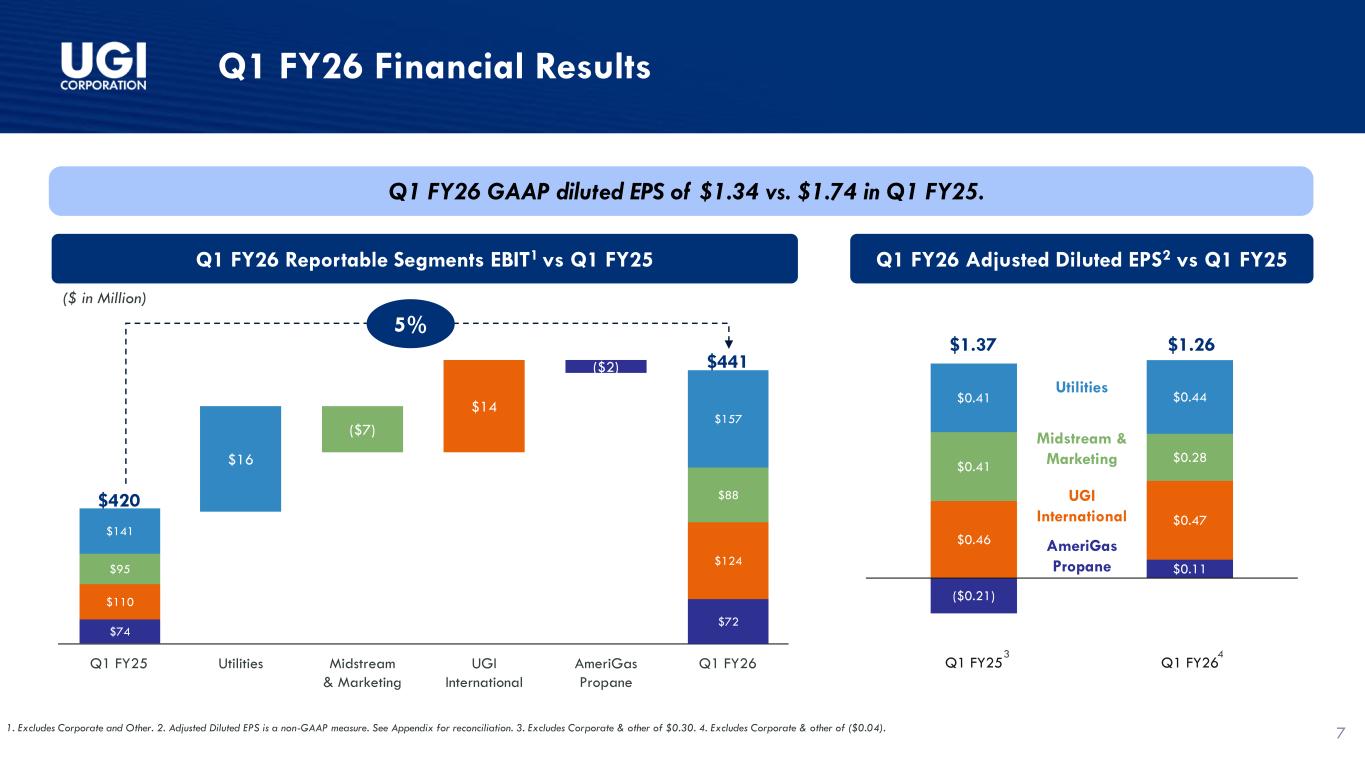

$74 $72 $110 $124 $95 $88 $141 $157 $420 $441 Q1 FY25 Q1 FY26 Delivering Results Through Disciplined Execution 1. Reportable Segments EBIT stands for UGI Corporation’s Earnings before interest expense and income taxes excluding EBIT related to Corporate & Other. 2. Adjusted diluted EPS is a non-GAAP measure. See Appendix for reconciliation. 4 Reportable Segments EBIT1 Utilities Midstream & Marketing UGI International AmeriGas Propane 5% Operational Excellence Capital Discipline Safety First Customer Focus Foundational progress on advancing operational excellence, safety, and cultural transformation fueling 5% EBIT growth Q1 FY26 GAAP diluted EPS of $1.34 vs. $1.74 in Q1 FY25 $1.26 Q1 FY26 Adjusted Diluted EPS2 ($ in Million)

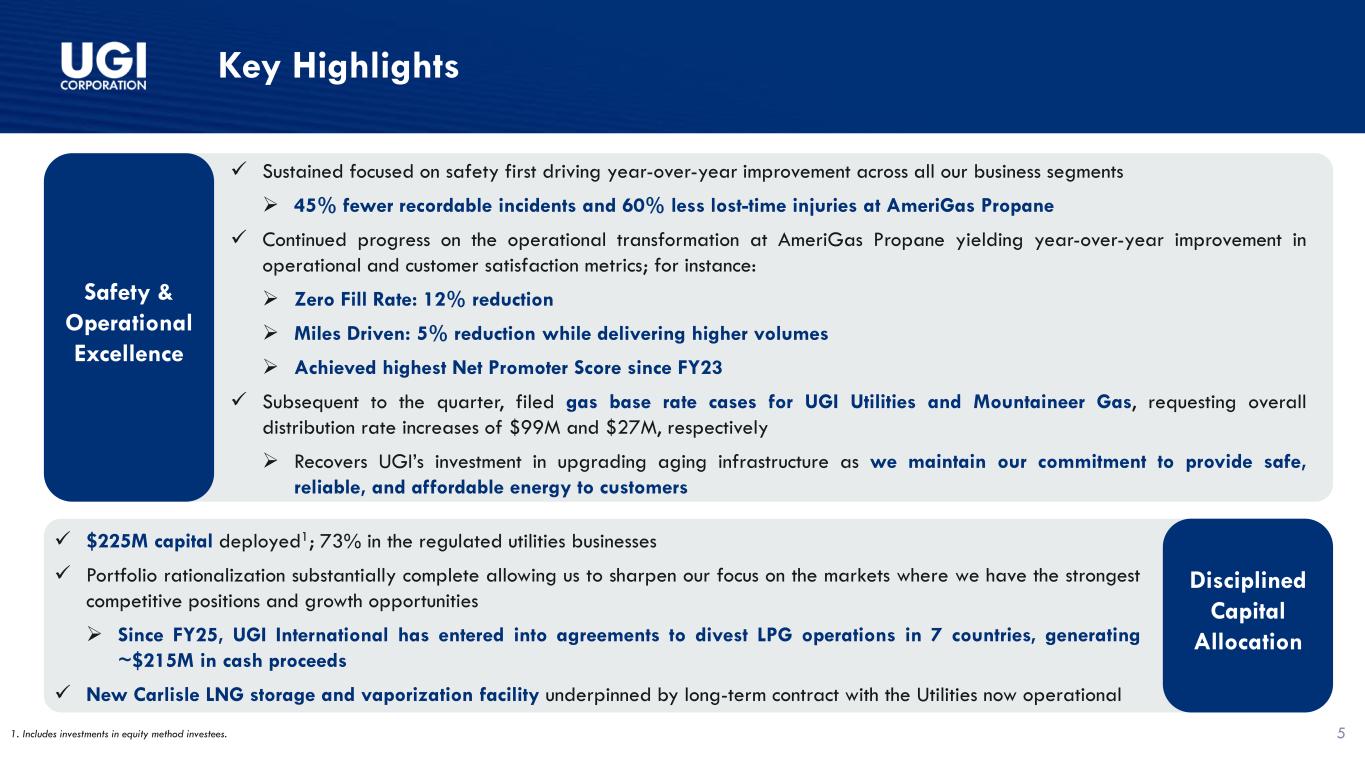

Key Highlights 1. Includes investments in equity method investees. 5 ✓ Sustained focused on safety first driving year-over-year improvement across all our business segments ➢ 45% fewer recordable incidents and 60% less lost-time injuries at AmeriGas Propane ✓ Continued progress on the operational transformation at AmeriGas Propane yielding year-over-year improvement in operational and customer satisfaction metrics; for instance: ➢ Zero Fill Rate: 12% reduction ➢ Miles Driven: 5% reduction while delivering higher volumes ➢ Achieved highest Net Promoter Score since FY23 ✓ Subsequent to the quarter, filed gas base rate cases for UGI Utilities and Mountaineer Gas, requesting overall distribution rate increases of $99M and $27M, respectively ➢ Recovers UGI’s investment in upgrading aging infrastructure as we maintain our commitment to provide safe, reliable, and affordable energy to customers Safety & Operational Excellence Disciplined Capital Allocation ✓ $225M capital deployed1; 73% in the regulated utilities businesses ✓ Portfolio rationalization substantially complete allowing us to sharpen our focus on the markets where we have the strongest competitive positions and growth opportunities ➢ Since FY25, UGI International has entered into agreements to divest LPG operations in 7 countries, generating ~$215M in cash proceeds ✓ New Carlisle LNG storage and vaporization facility underpinned by long-term contract with the Utilities now operational

Q1 FY26 Financial Update

Q1 FY26 Financial Results Q1 FY26 GAAP diluted EPS of $1.34 vs. $1.74 in Q1 FY25. 1. Excludes Corporate and Other. 2. Adjusted Diluted EPS is a non-GAAP measure. See Appendix for reconciliation. 3. Excludes Corporate & other of $0.30. 4. Excludes Corporate & other of ($0.04). Q1 FY26 Reportable Segments EBIT1 vs Q1 FY25 $420 $16 ($7) $14 ($2) $441 Q1 FY25 Utilities Midstream & Marketing UGI International AmeriGas Propane Q1 FY26 $74 $110 $95 $141 $72 $124 $88 $157 Q1 FY26 Adjusted Diluted EPS2 vs Q1 FY25 ($ in Million) ($0.21) $0.11 $0.46 $0.47 $0.41 $0.28 $0.41 $0.44 Q1 FY25 Q1 FY26 Utilities Midstream & Marketing UGI International AmeriGas Propane $1.37 $1.26 7 5% 3 4

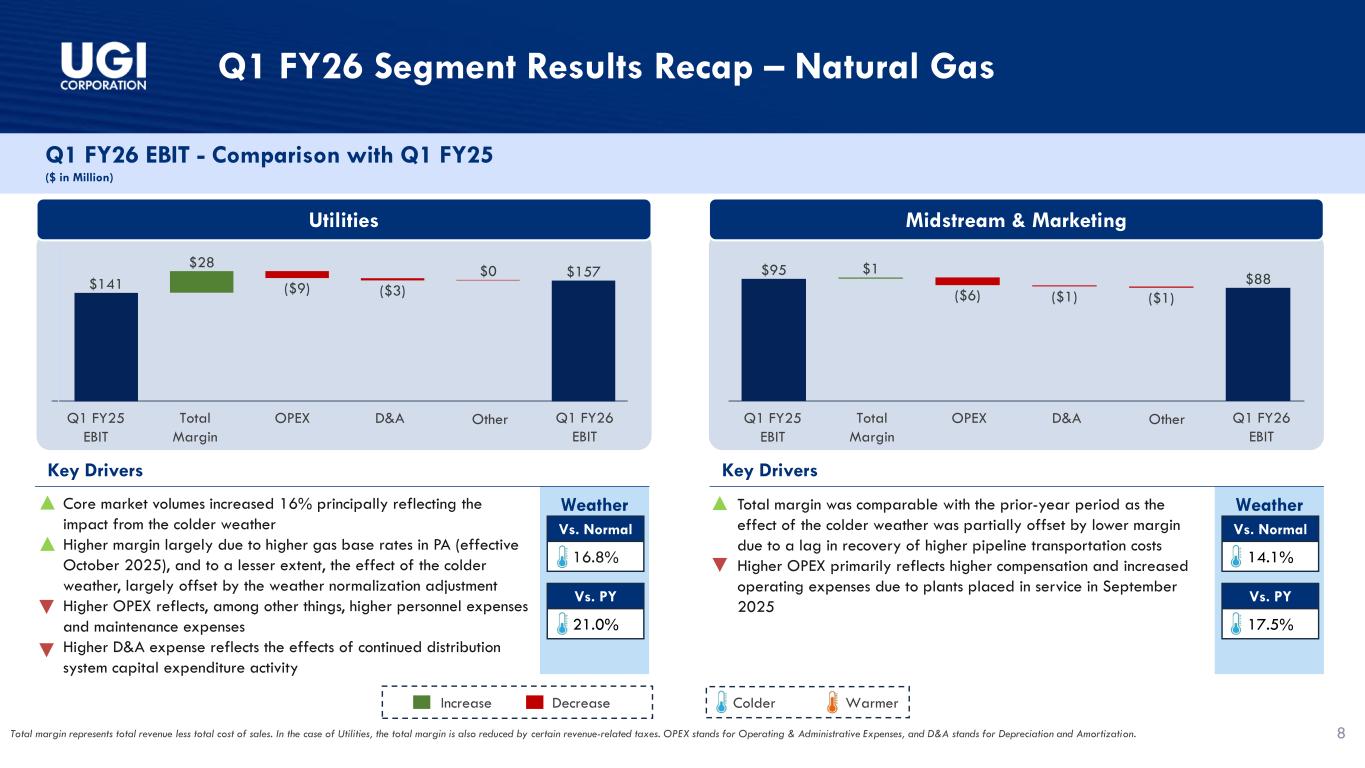

Q1 FY26 Segment Results Recap – Natural Gas Q1 FY26 EBIT - Comparison with Q1 FY25 ($ in Million) Utilities Midstream & Marketing Weather Total margin represents total revenue less total cost of sales. In the case of Utilities, the total margin is also reduced by certain revenue-related taxes. OPEX stands for Operating & Administrative Expenses, and D&A stands for Depreciation and Amortization. Key Drivers • Core market volumes increased 16% principally reflecting the impact from the colder weather • Higher margin largely due to higher gas base rates in PA (effective October 2025), and to a lesser extent, the effect of the colder weather, largely offset by the weather normalization adjustment Higher OPEX reflects, among other things, higher personnel expenses and maintenance expenses • Higher D&A expense reflects the effects of continued distribution system capital expenditure activity 16.8% 21.0% Vs. Normal Vs. PY Increase Decrease WarmerColder Weather Key Drivers • Total margin was comparable with the prior-year period as the effect of the colder weather was partially offset by lower margin due to a lag in recovery of higher pipeline transportation costs • Higher OPEX primarily reflects higher compensation and increased operating expenses due to plants placed in service in September 2025 14.1% 17.5% Vs. Normal Vs. PY Q1 FY25 EBIT Q1 FY26 EBIT Total Margin OPEX D&A Other Q1 FY25 EBIT Q1 FY26 EBIT Total Margin OPEX D&A Other $141 $28 ($9) ($3) $0 $157 $95 $1 ($6) ($1) ($1) $88 8

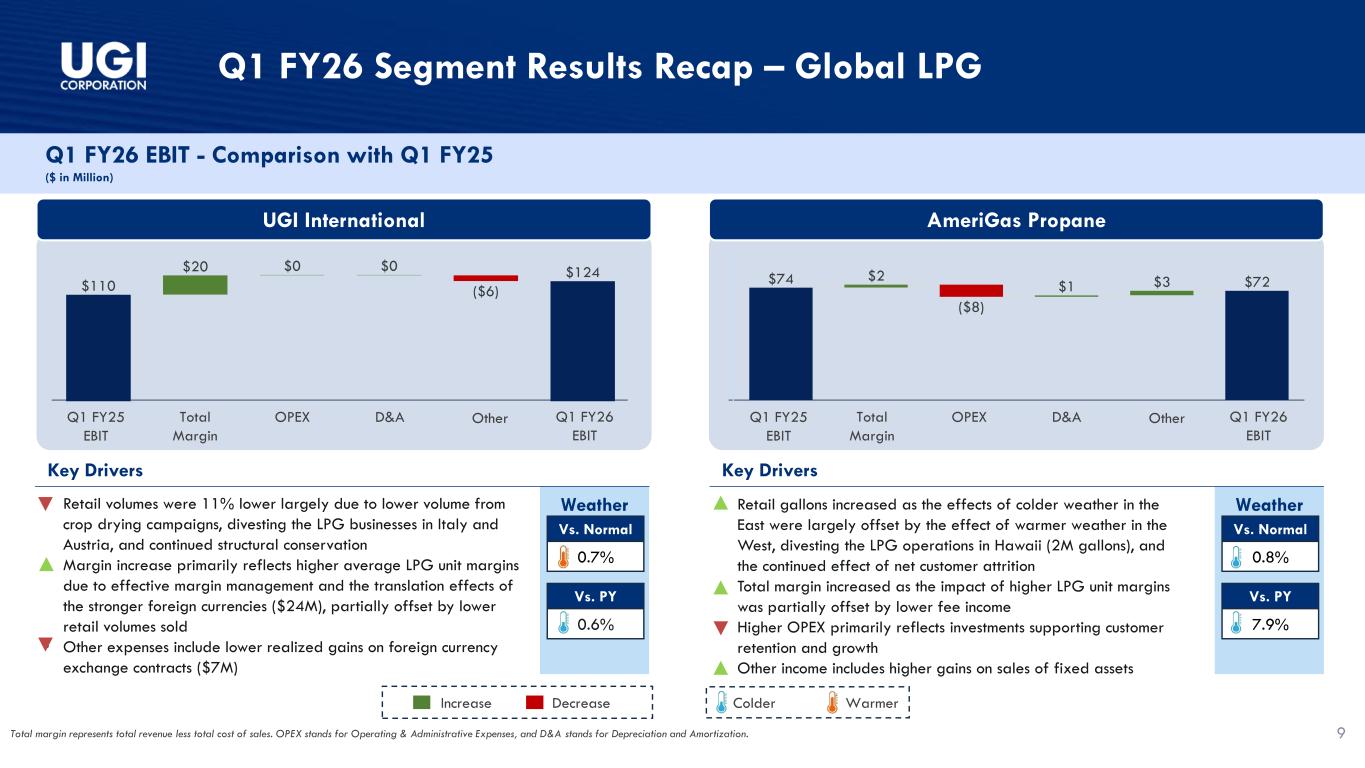

Q1 FY26 Segment Results Recap – Global LPG Q1 FY26 EBIT - Comparison with Q1 FY25 ($ in Million) UGI International AmeriGas Propane Weather Key Drivers • Retail volumes were 11% lower largely due to lower volume from crop drying campaigns, divesting the LPG businesses in Italy and Austria, and continued structural conservation • Margin increase primarily reflects higher average LPG unit margins due to effective margin management and the translation effects of the stronger foreign currencies ($24M), partially offset by lower retail volumes sold • Other expenses include lower realized gains on foreign currency exchange contracts ($7M) Increase Decrease WarmerColder Weather Key Drivers • Retail gallons increased as the effects of colder weather in the East were largely offset by the effect of warmer weather in the West, divesting the LPG operations in Hawaii (2M gallons), and the continued effect of net customer attrition • Total margin increased as the impact of higher LPG unit margins was partially offset by lower fee income • Higher OPEX primarily reflects investments supporting customer retention and growth • Other income includes higher gains on sales of fixed assets 0.7% 0.6% Vs. Normal Vs. PY 0.8% 7.9% Vs. Normal Vs. PY Q1 FY25 EBIT Q1 FY26 EBIT Total Margin OPEX D&A Other Q1 FY25 EBIT Q1 FY26 EBIT Total Margin OPEX D&A Other Total margin represents total revenue less total cost of sales. OPEX stands for Operating & Administrative Expenses, and D&A stands for Depreciation and Amortization. $110 $20 $0 $0 ($6) $124 $74 $2 ($8) $1 $3 $72 9

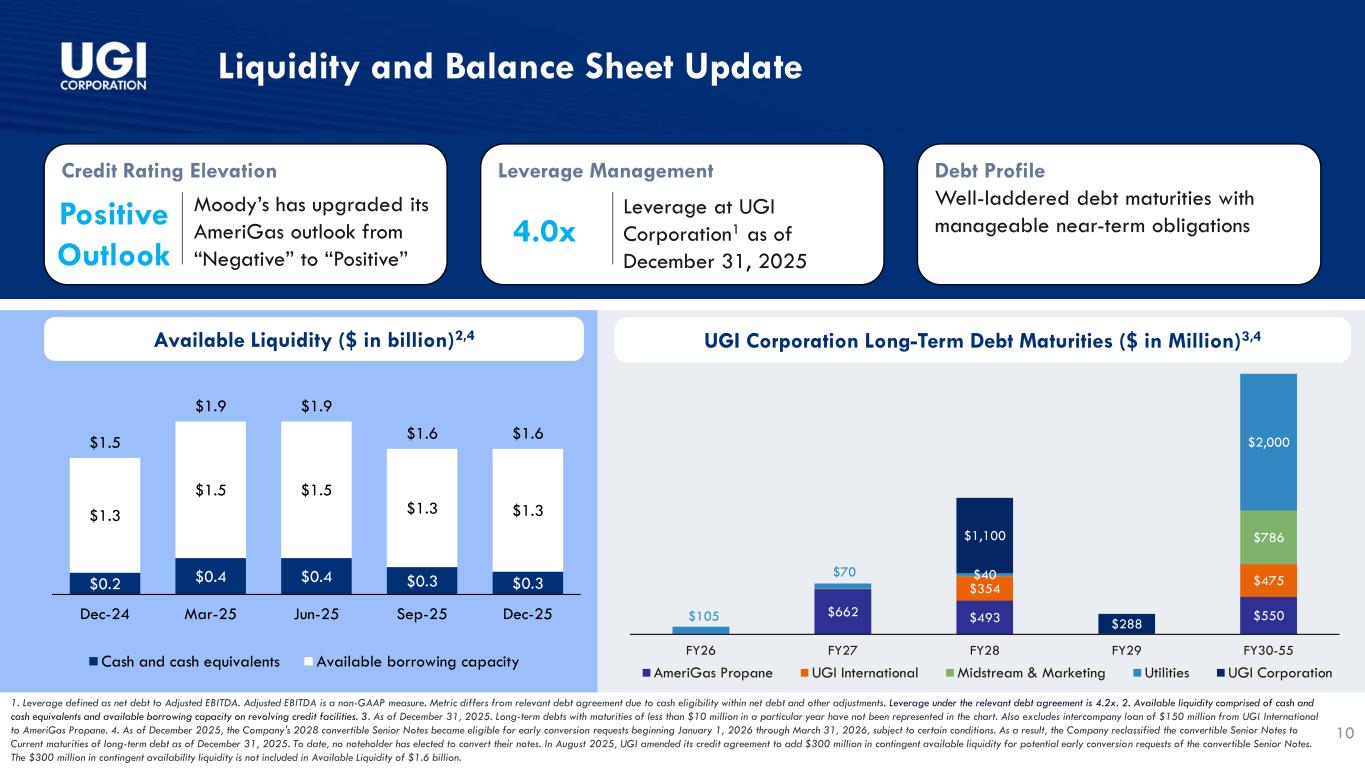

Liquidity and Balance Sheet Update 1. Leverage defined as net debt to Adjusted EBITDA. Adjusted EBITDA is a non-GAAP measure. Metric differs from relevant debt agreement due to cash eligibility within net debt and other adjustments. Leverage under the relevant debt agreement is 4.2x. 2. Available liquidity comprised of cash and cash equivalents and available borrowing capacity on revolving credit facilities. 3. As of December 31, 2025. Long-term debts with maturities of less than $10 million in a particular year have not been represented in the chart. Also excludes intercompany loan of $150 million from UGI International to AmeriGas Propane. 4. As of December 2025, the Company's 2028 convertible Senior Notes became eligible for early conversion requests beginning January 1, 2026 through March 31, 2026, subject to certain conditions. As a result, the Company reclassified the convertible Senior Notes to Current maturities of long-term debt as of December 31, 2025. To date, no noteholder has elected to convert their notes. In August 2025, UGI amended its credit agreement to add $300 million in contingent available liquidity for potential early conversion requests of the convertible Senior Notes. The $300 million in contingent availability liquidity is not included in Available Liquidity of $1.6 billion. UGI Corporation Long-Term Debt Maturities ($ in Million)3,4Available Liquidity ($ in billion)2,4 Credit Rating Elevation Leverage Management Debt Profile Well-laddered debt maturities with manageable near-term obligations Moody’s has upgraded its AmeriGas outlook from “Negative” to “Positive” Leverage at UGI Corporation1 as of December 31, 2025 Positive Outlook 4.0x 10 $0.2 $0.4 $0.4 $0.3 $0.3 $1.3 $1.5 $1.5 $1.3 $1.3 $1.5 $1.9 $1.9 $1.6 $1.6 Dec-24 Mar-25 Jun-25 Sep-25 Dec-25 Cash and cash equivalents Available borrowing capacity $662 $493 $550 $354 $475 $786 $105 $70 $40 $2,000 $1,100 $288 FY26 FY27 FY28 FY29 FY30-55 AmeriGas Propane UGI International Midstream & Marketing Utilities UGI Corporation

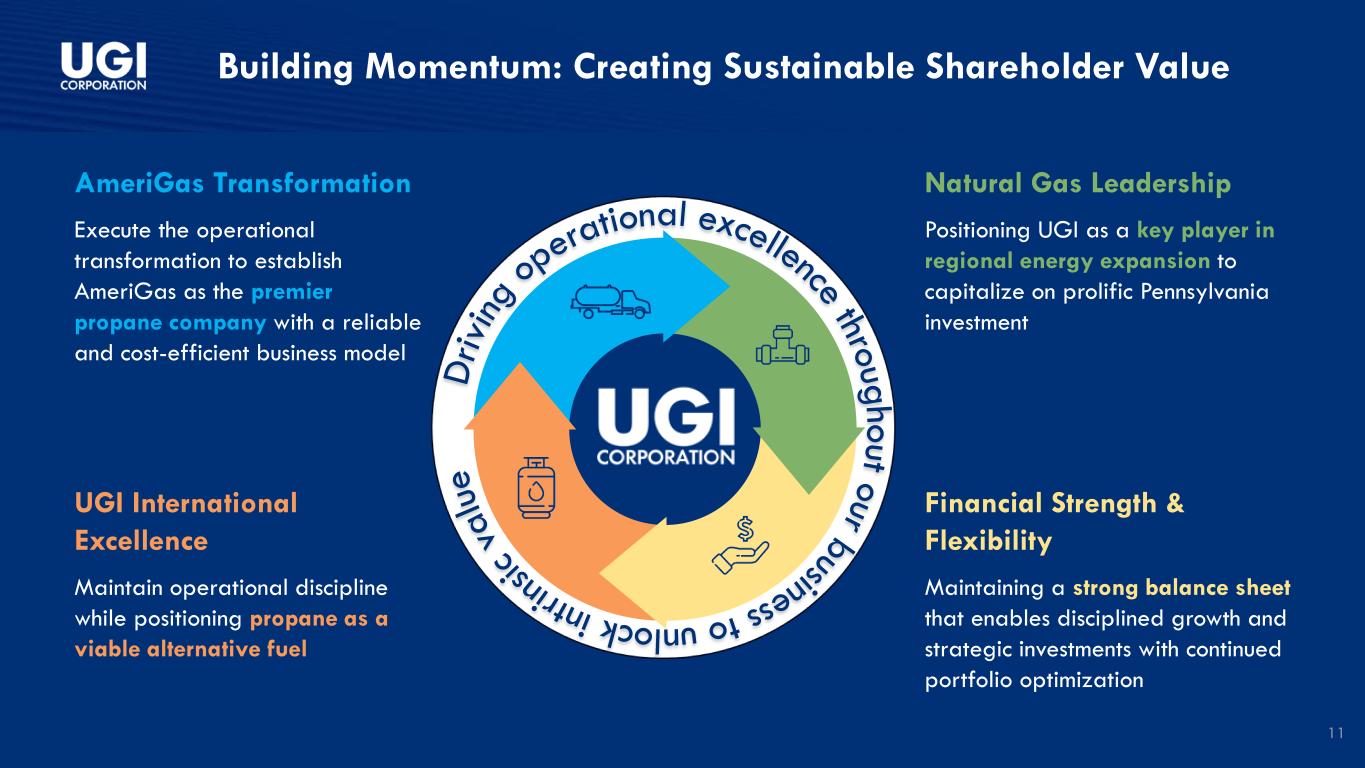

11 Building Momentum: Creating Sustainable Shareholder Value AmeriGas Transformation Execute the operational transformation to establish AmeriGas as the premier propane company with a reliable and cost-efficient business model Natural Gas Leadership Positioning UGI as a key player in regional energy expansion to capitalize on prolific Pennsylvania investment Financial Strength & Flexibility Maintaining a strong balance sheet that enables disciplined growth and strategic investments with continued portfolio optimization UGI International Excellence Maintain operational discipline while positioning propane as a viable alternative fuel D ri vi ng op erational excellence thro ug ho ut o ur businesstounlockintr ins ic va lu e

Q & Q A

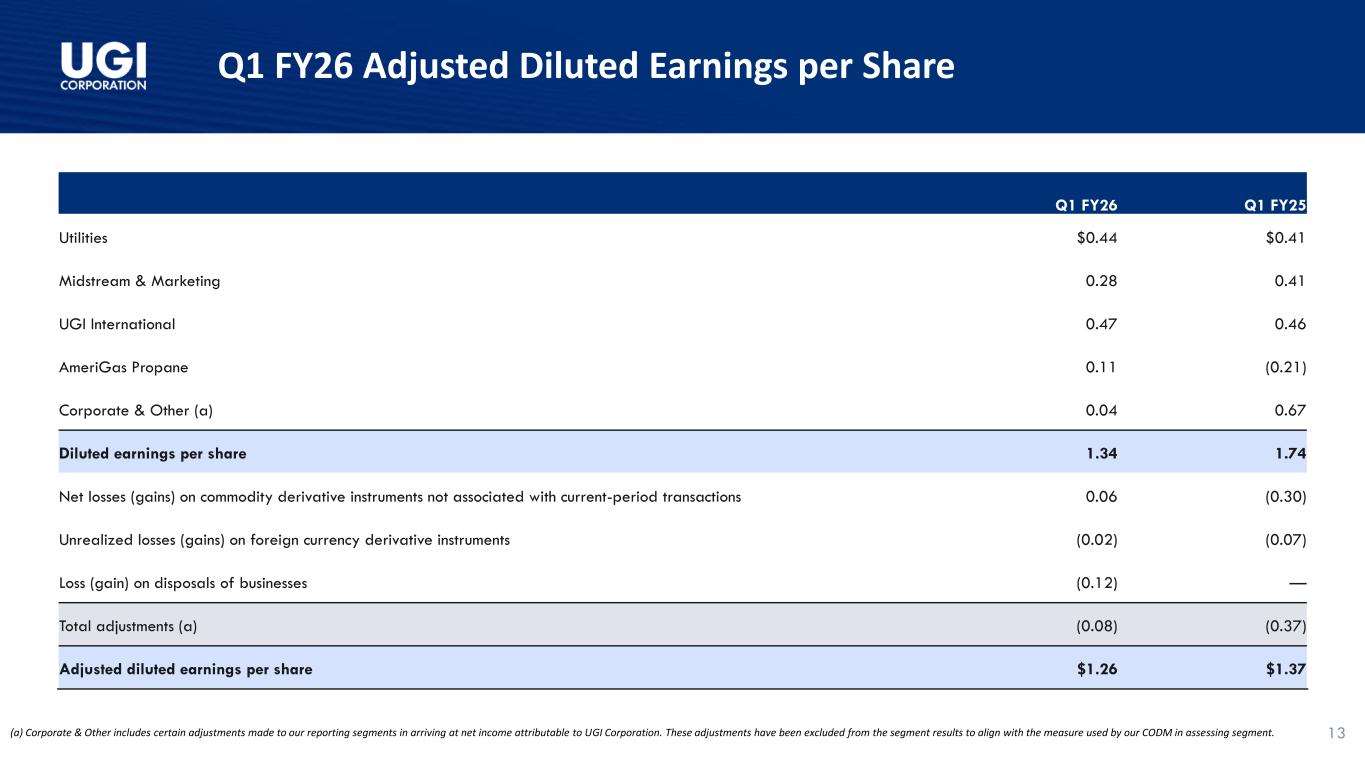

Q1 FY26 Adjusted Diluted Earnings per Share (a) Corporate & Other includes certain adjustments made to our reporting segments in arriving at net income attributable to UGI Corporation. These adjustments have been excluded from the segment results to align with the measure used by our CODM in assessing segment. Q1 FY26 Q1 FY25 Utilities $0.44 $0.41 Midstream & Marketing 0.28 0.41 UGI International 0.47 0.46 AmeriGas Propane 0.11 (0.21) Corporate & Other (a) 0.04 0.67 Diluted earnings per share 1.34 1.74 Net losses (gains) on commodity derivative instruments not associated with current-period transactions 0.06 (0.30) Unrealized losses (gains) on foreign currency derivative instruments (0.02) (0.07) Loss (gain) on disposals of businesses (0.12) — Total adjustments (a) (0.08) (0.37) Adjusted diluted earnings per share $1.26 $1.37 13

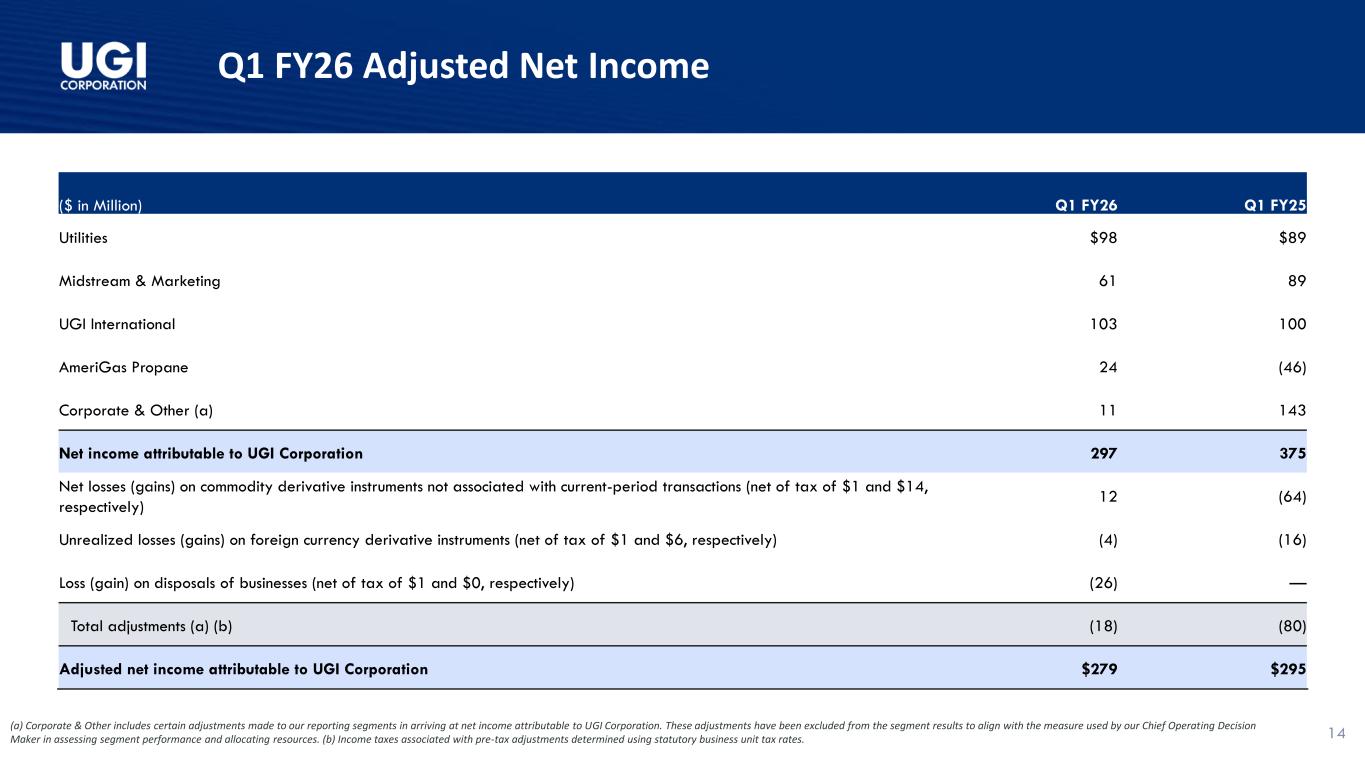

Q1 FY26 Adjusted Net Income (a) Corporate & Other includes certain adjustments made to our reporting segments in arriving at net income attributable to UGI Corporation. These adjustments have been excluded from the segment results to align with the measure used by our Chief Operating Decision Maker in assessing segment performance and allocating resources. (b) Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates. ($ in Million) Q1 FY26 Q1 FY25 Utilities $98 $89 Midstream & Marketing 61 89 UGI International 103 100 AmeriGas Propane 24 (46) Corporate & Other (a) 11 143 Net income attributable to UGI Corporation 297 375 Net losses (gains) on commodity derivative instruments not associated with current-period transactions (net of tax of $1 and $14, respectively) 12 (64) Unrealized losses (gains) on foreign currency derivative instruments (net of tax of $1 and $6, respectively) (4) (16) Loss (gain) on disposals of businesses (net of tax of $1 and $0, respectively) (26) — Total adjustments (a) (b) (18) (80) Adjusted net income attributable to UGI Corporation $279 $295 14

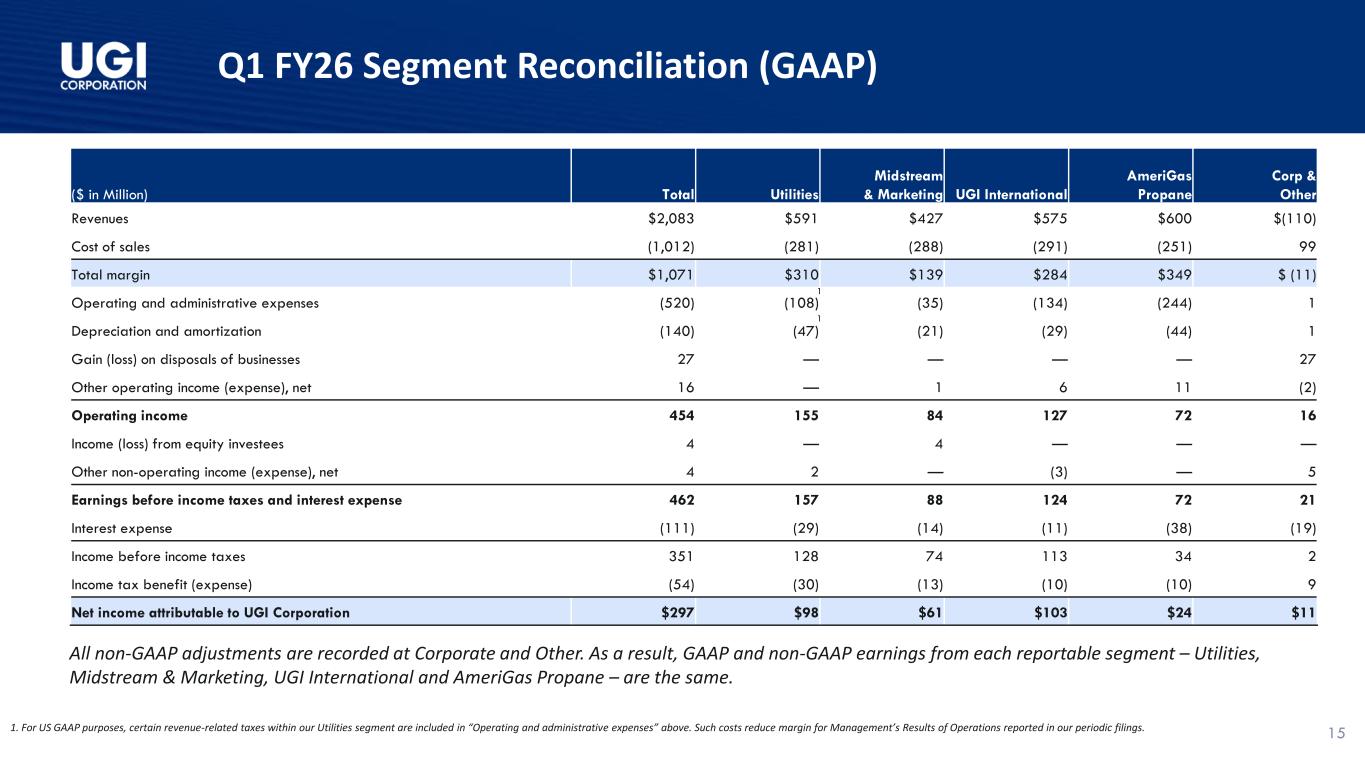

($ in Million) Total Utilities Midstream & Marketing UGI International AmeriGas Propane Corp & Other Revenues $2,083 $591 $427 $575 $600 $(110) Cost of sales (1,012) (281) (288) (291) (251) 99 Total margin $1,071 $310 $139 $284 $349 $ (11) Operating and administrative expenses (520) (108) (35) (134) (244) 1 Depreciation and amortization (140) (47) (21) (29) (44) 1 Gain (loss) on disposals of businesses 27 — — — — 27 Other operating income (expense), net 16 — 1 6 11 (2) Operating income 454 155 84 127 72 16 Income (loss) from equity investees 4 — 4 — — — Other non-operating income (expense), net 4 2 — (3) — 5 Earnings before income taxes and interest expense 462 157 88 124 72 21 Interest expense (111) (29) (14) (11) (38) (19) Income before income taxes 351 128 74 113 34 2 Income tax benefit (expense) (54) (30) (13) (10) (10) 9 Net income attributable to UGI Corporation $297 $98 $61 $103 $24 $11 Q1 FY26 Segment Reconciliation (GAAP) 1. For US GAAP purposes, certain revenue-related taxes within our Utilities segment are included in “Operating and administrative expenses” above. Such costs reduce margin for Management’s Results of Operations reported in our periodic filings. 1 1 All non-GAAP adjustments are recorded at Corporate and Other. As a result, GAAP and non-GAAP earnings from each reportable segment – Utilities, Midstream & Marketing, UGI International and AmeriGas Propane – are the same. 15

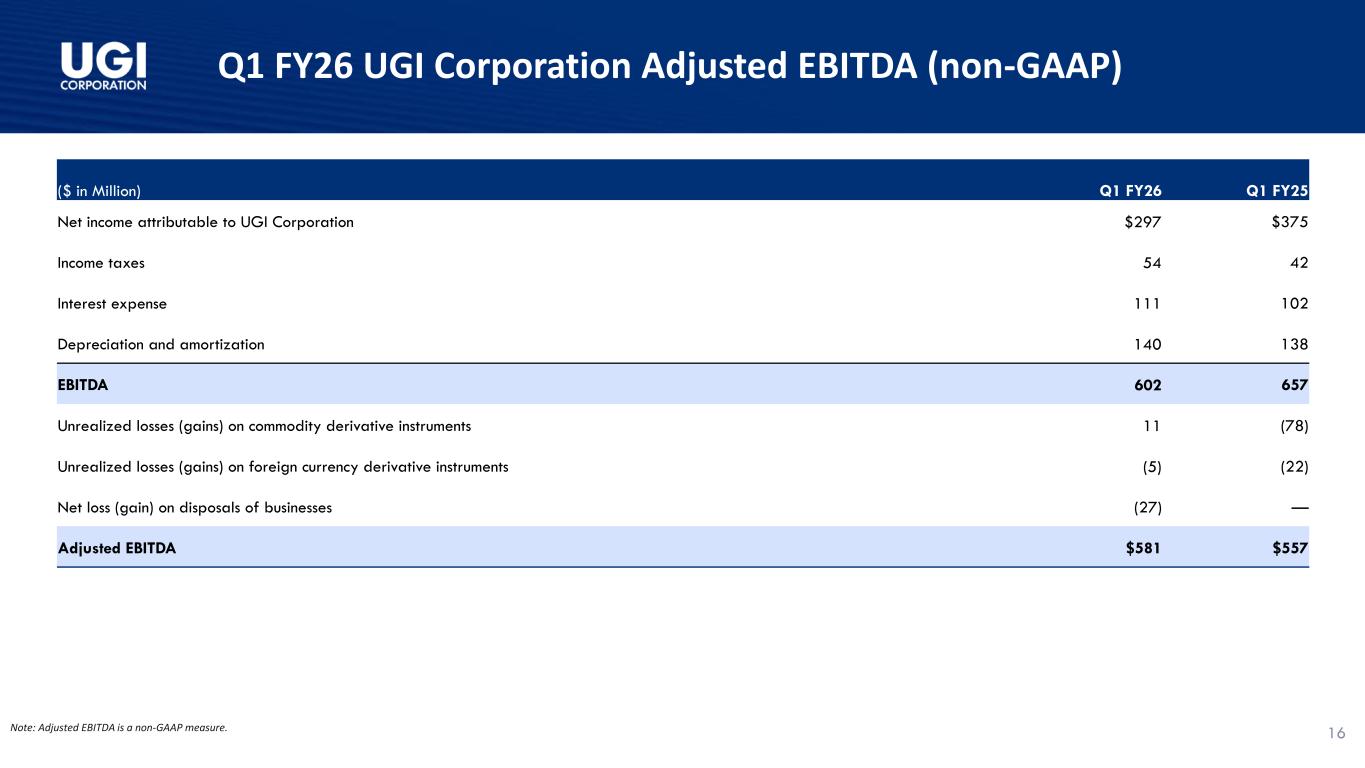

Q1 FY26 UGI Corporation Adjusted EBITDA (non-GAAP) ($ in Million) Q1 FY26 Q1 FY25 Net income attributable to UGI Corporation $297 $375 Income taxes 54 42 Interest expense 111 102 Depreciation and amortization 140 138 EBITDA 602 657 Unrealized losses (gains) on commodity derivative instruments 11 (78) Unrealized losses (gains) on foreign currency derivative instruments (5) (22) Net loss (gain) on disposals of businesses (27) — Adjusted EBITDA $581 $557 16Note: Adjusted EBITDA is a non-GAAP measure.

Investor Relations: Tameka Morris morrista@ugicorp.com Arnab Mukherjee mukherjeea@ugicorp.com