Clear Course for Profitable Growth 2Q 2025 Earnings Call August 5, 2025

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, relating to our business and financial outlook, which are based on our current beliefs, assumptions, intentions, plans, expectations, estimates, forecasts and projections. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “intends,” “predicts,” “potential,” “positioned,” “deliver,” or “continue” or other comparable terminology. Forward-looking statements in this presentation include the Company's expectations regarding net sales, adjusted EBITDA, and free cash flow for the year ended December 31, 2025. Forward-looking statements are not guarantees of our future performance, are based on our current expectations and assumptions regarding our business, the economy and other future conditions, and are subject to risks, uncertainties and changes in circumstances that are difficult to predict, including the risks described in Part I, Item 1A under the heading Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2024, and in Part II, Item 1A under the heading Risk Factors in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2025. Factors that could cause future results to differ from those expressed by forward-looking statements include, but are not limited to, (i) our ability to maintain operations to support our customers and patients in the near-term and to capitalize on future growth opportunities, (ii) risks associated with acceptance of surgical products and procedures by surgeons and hospitals, (iii) development and acceptance of new products or product enhancements, (iv) clinical and statistical verification of the benefits achieved via the use of our products, (v) our ability to adequately manage inventory, (vi) our ability to successfully optimize our commercial channels, (vii) our success in defending legal proceedings brought against us, and (viii) the other risks and uncertainties more fully described in our periodic filings with the Securities and Exchange Commission (the “SEC”). As a result of these various risks, our actual outcomes and results may differ materially from those expressed in these forward-looking statements. Further, any forward-looking statement speaks only as of the date hereof, unless it is specifically otherwise stated to be made as of a different date. The Company undertakes no obligation to update, and expressly disclaim any duty to update, its forward-looking statements, whether as a result of circumstances or events that arise after the date hereof, new information, or otherwise, except as required by law. The Company is unable to provide expectations of GAAP net income (loss), the closest comparable GAAP measures to adjusted EBITDA (which is a non-GAAP measure), on a forward-looking basis because the Company is unable to predict, without unreasonable efforts, the ultimate outcome of matters (including acquisition-related expenses, accounting fair value adjustments, and other such items) that will determine the quantitative amount of the items excluded in calculating adjusted EBITDA, which items are further described in the reconciliation tables and related descriptions below. These items are uncertain, depend on various factors, and could be material to the Company’s results computed in accordance with GAAP.

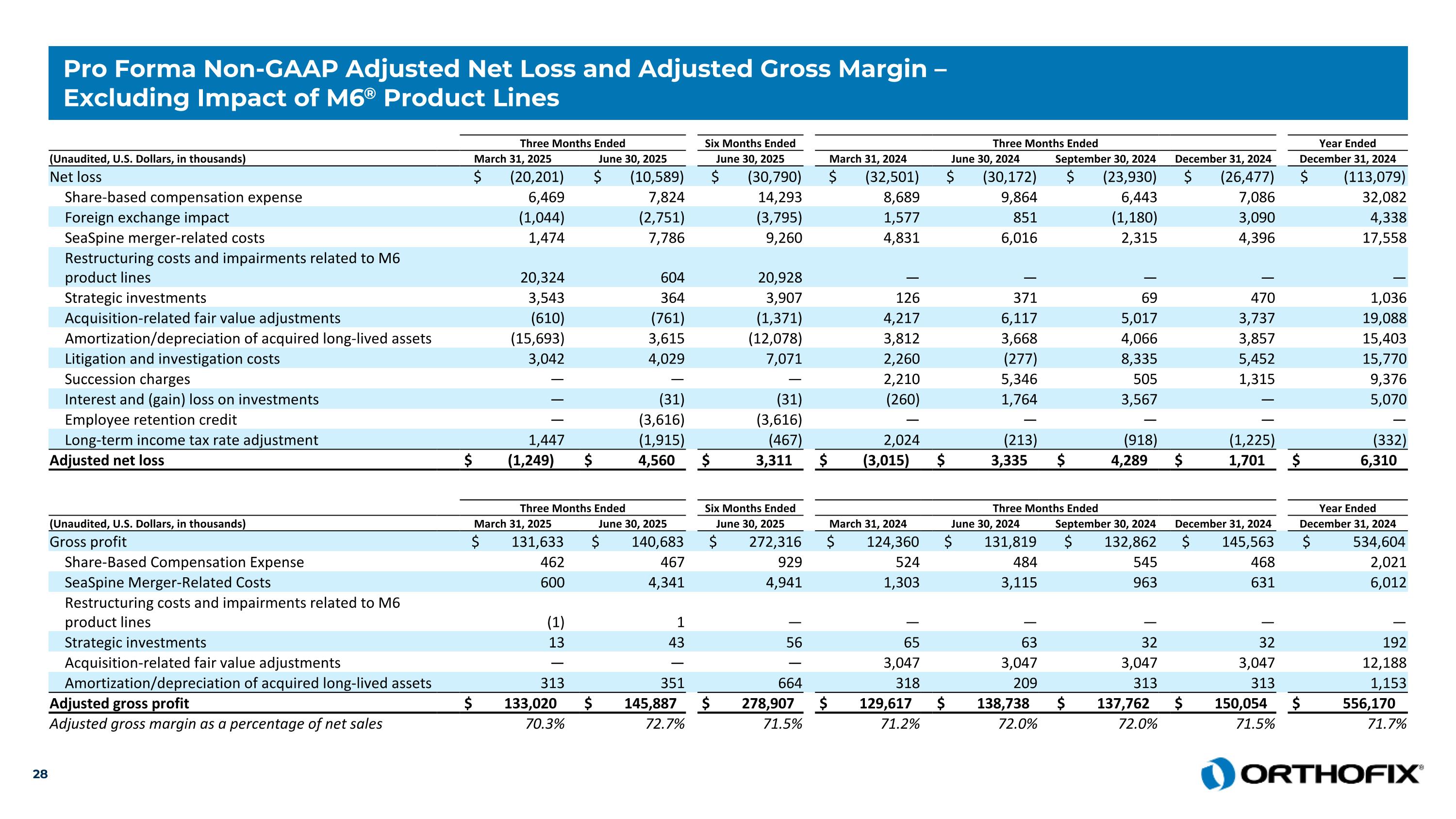

Non-GAAP Financial Measures Management uses certain non-GAAP financial measures in this presentation, most specifically Adjusted EBITDA, Adjusted Gross Margin, Adjusted Net Income and Free Cash Flow, as a supplement to GAAP financial measures to further evaluate the Company’s operating performance period over period, analyze the underlying business trends, assess performance relative to competitors and establish operational objectives. Management believes it is important to provide investors with the same non-GAAP metrics it uses to evaluate the performance and underlying trends of the Company’s business operations to facilitate comparisons to its historical operating results and evaluate the effectiveness of its operating strategies. Disclosure of these non-GAAP financial measures also facilitates comparisons of the Company’s underlying operating performance with other companies in the industry that also supplement their GAAP results with non-GAAP financial measures. Unless noted otherwise, full-year guidance is based on the current foreign currency exchange rates and does not take into account any additional potential exchange rate changes that may occur this year. These non-GAAP financial measures should not be considered in isolation from, or as replacements for, the most directly comparable GAAP financial measures, as these measures are not prepared in accordance with U.S. GAAP. Reconciliations between GAAP and non‐GAAP results are included at the end of this presentation and represent the most comparable GAAP measure(s) to the applicable non-GAAP measure(s) shown in the table. For further information regarding the nature of these exclusions, why the Company believes that these non-GAAP financial measures provide useful information to investors, the specific manner in which management uses these measures, and some of the limitations associated with the use of these measures, please refer to the Company's Current Report on Form 8-K regarding its second quarter 2025 press release filed on August 5, 2025 with the SEC and available on the SEC's website at www.sec.gov and on the “Investors” page of the Company’s website at www.orthofix.com. The Company’s non-GAAP financial measures for the three and six months ended June 30, 2025, and 2024, have been adjusted to eliminate the financial effects of the Company’s decision to discontinue its M6® product lines. Accordingly, previously reported figures for 2024 have been recast to reflect the financial impact of this decision. Amounts may not add due to rounding.

TAKE OWNERSHIP INNOVATE BOLDLY WIN TOGETHER The unrivaled partner in Med Tech, delivering exceptional experiences and life-changing solutions. 4

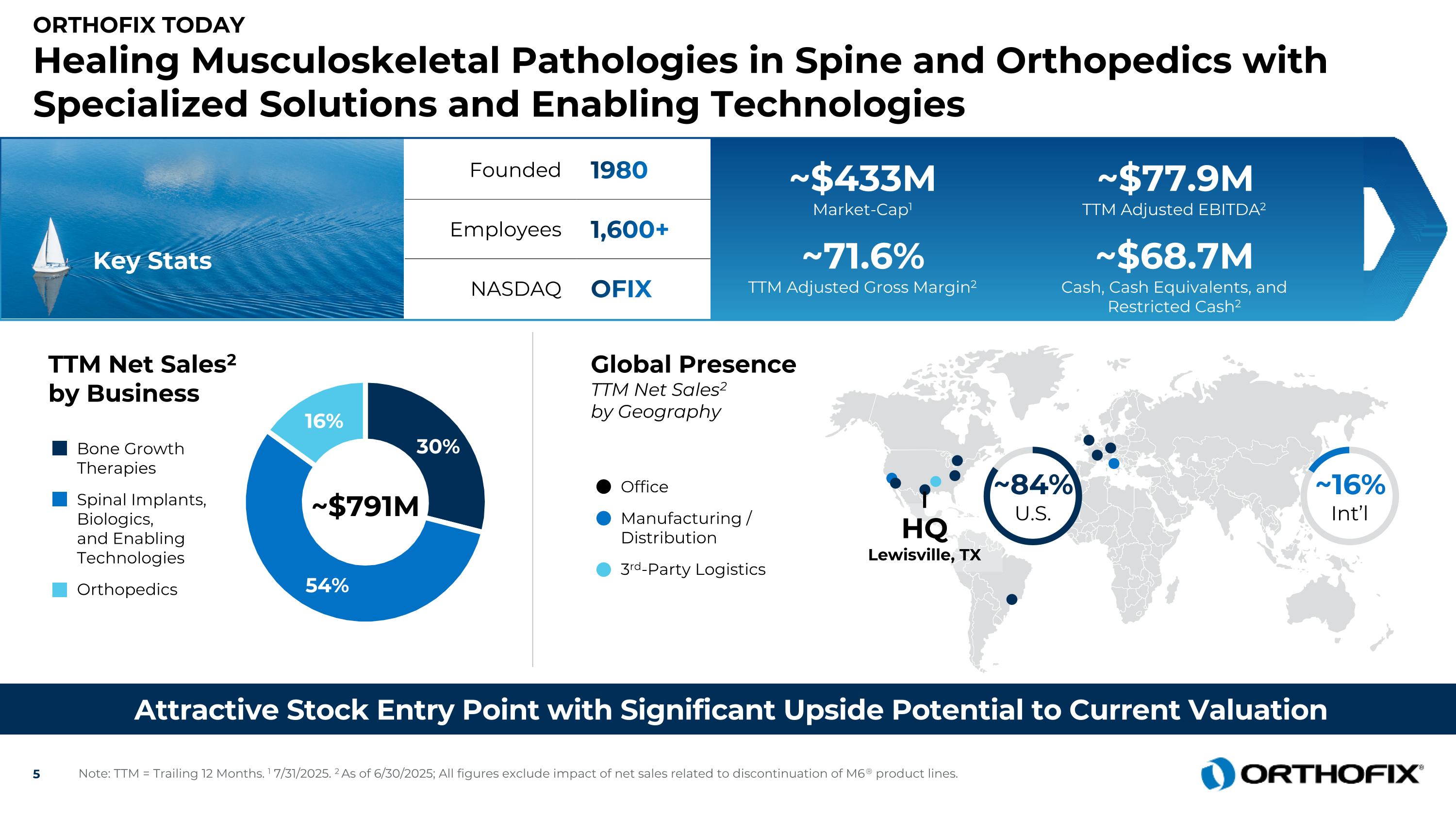

Orthofix Today Healing Musculoskeletal Pathologies in Spine and Orthopedics with Specialized Solutions and Enabling Technologies Attractive Stock Entry Point with Significant Upside Potential to Current Valuation Key Stats TTM Net Sales2 by Business ~$791M Bone Growth Therapies Spinal Implants, Biologics, and Enabling Technologies Orthopedics ~16% Int’l HQ Lewisville, TX ~84% U.S. Founded 1980 Employees 1,600+ NASDAQ OFIX Office Manufacturing / Distribution 3rd-Party Logistics Global Presence TTM Net Sales2 by Geography ~$433M Market-Cap1 ~$77.9M TTM Adjusted EBITDA2 ~71.6% TTM Adjusted Gross Margin2 ~$68.7M Cash, Cash Equivalents, and Restricted Cash2 Note: TTM = Trailing 12 Months. 1 7/31/2025. 2 As of 6/30/2025; All figures exclude impact of net sales related to discontinuation of M6® product lines.

Orthofix’s second quarter results demonstrate clear progress on our three-year plan to transform the business. Our disciplined approach led to strong adjusted EBITDA margin growth and positive free cash flow generation, underscoring our ability to grow the business responsibly. Strategic initiatives, like accelerating spine distributor transitions in certain underpenetrated U.S. territories, are gaining traction and creating a powerful foundation for a stronger, more scalable commercial organization to drive our next phase of growth. Looking ahead, we expect to benefit from recent product launches and deliver meaningful product innovation to improve outcomes and efficiencies for our surgeons and their patients. I am confident the Company is well positioned to deliver sustainable, long-term shareholder value throughout the second half of 2025 and beyond. “ Massimo Calafiore President & Chief Executive Officer ” 6 1 The Company’s non-GAAP financial measures have been adjusted to eliminate the financial effects of the Company’s decision to discontinue its M6® product lines. 2 Constant currency is calculated by applying foreign currency rates applicable to the comparable, prior-year period to present the current period net sales at comparable rates. 3 The reasons for and nature of non-GAAP disclosures by the Company, descriptions of the adjustments used to calculate those non-GAAP financial measures, and reconciliations of those non-GAAP financial measures to the most comparable GAAP financial measure, are provided in the Company’s press release issued and Quarterly Report on Form 10-Q filed on August 5, 2025.4 Spine Fixation is comprised of the Company's Spinal Implants product category, excluding motion preservation product offerings. Q2 2025 Financial Highlights $20.6M Non-GAAP Pro Forma Adjusted EBITDA1,3 $4.0M YoY increase and ~190 bps margin expansion $4.5M Free Cash Flow3 Continued positive YoY progress 5% U.S. Spine Fixation4 YoY Net Sales Growth U.S. procedure volume growth of 7% 6% Bone Growth Therapies YoY Net Sales Growth 7% Growth in BGT Fracture 72.7% Non-GAAP Pro Forma Adjusted Gross Margin1,3 Compared to 71.3% reported for Q2 2024 $200.7M Pro Forma Net Sales1 4% growth YoY on constant currency basis1,2 28% U.S. Orthopedics YoY Net Sales Growth 4th consecutive quarter of double-digit growth

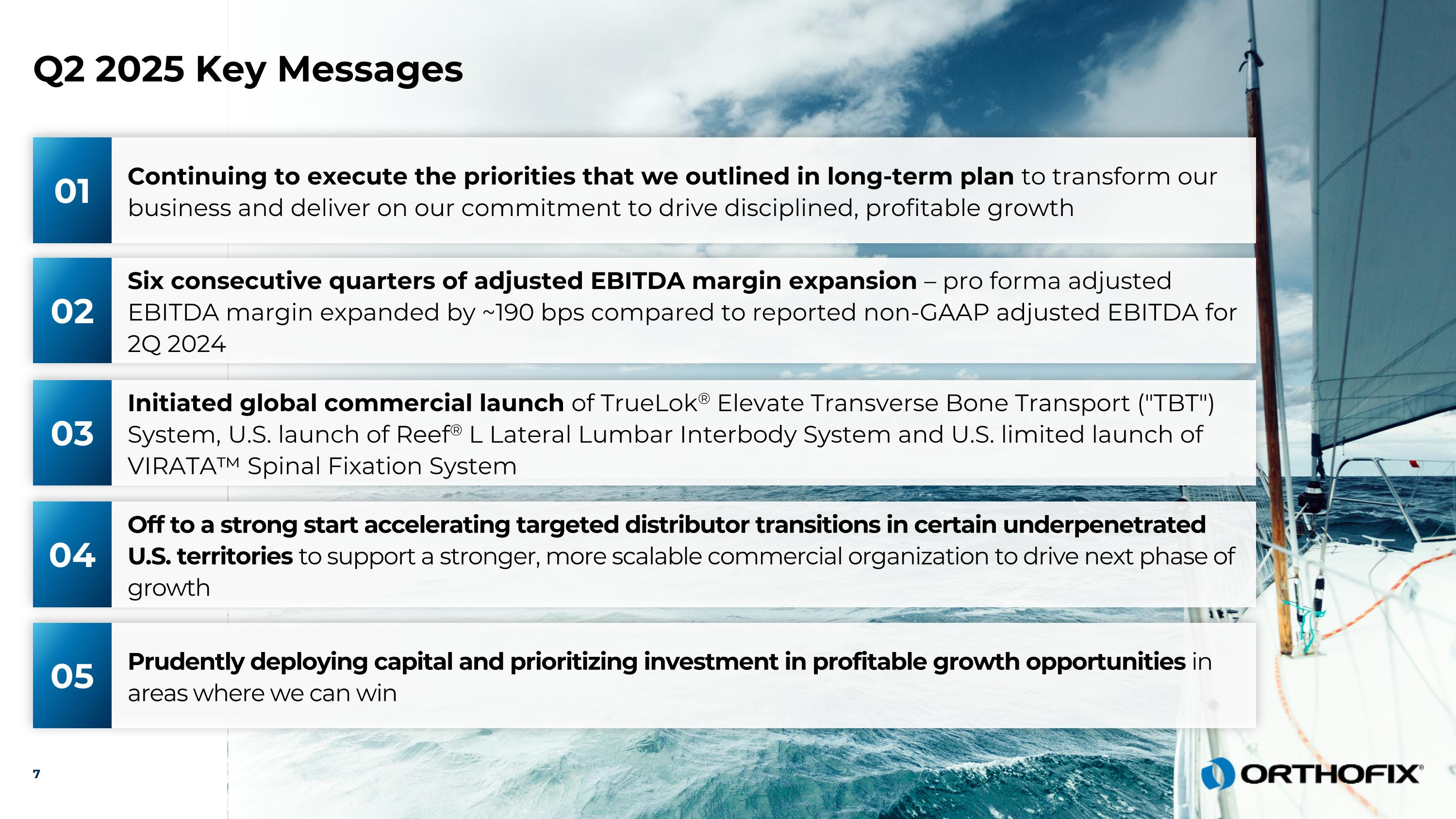

7 Continuing to execute the priorities that we outlined in long-term plan to transform our business and deliver on our commitment to drive disciplined, profitable growth 01 Six consecutive quarters of adjusted EBITDA margin expansion – pro forma adjusted EBITDA margin expanded by ~190 bps compared to reported non-GAAP adjusted EBITDA for 2Q 2024 02 Initiated global commercial launch of TrueLok® Elevate Transverse Bone Transport ("TBT") System, U.S. launch of Reef® L Lateral Lumbar Interbody System and U.S. limited launch of VIRATA™ Spinal Fixation System 03 Off to a strong start accelerating targeted distributor transitions in certain underpenetrated U.S. territories to support a stronger, more scalable commercial organization to drive next phase of growth 04 Prudently deploying capital and prioritizing investment in profitable growth opportunities in areas where we can win 05 Q2 2025 Key Messages

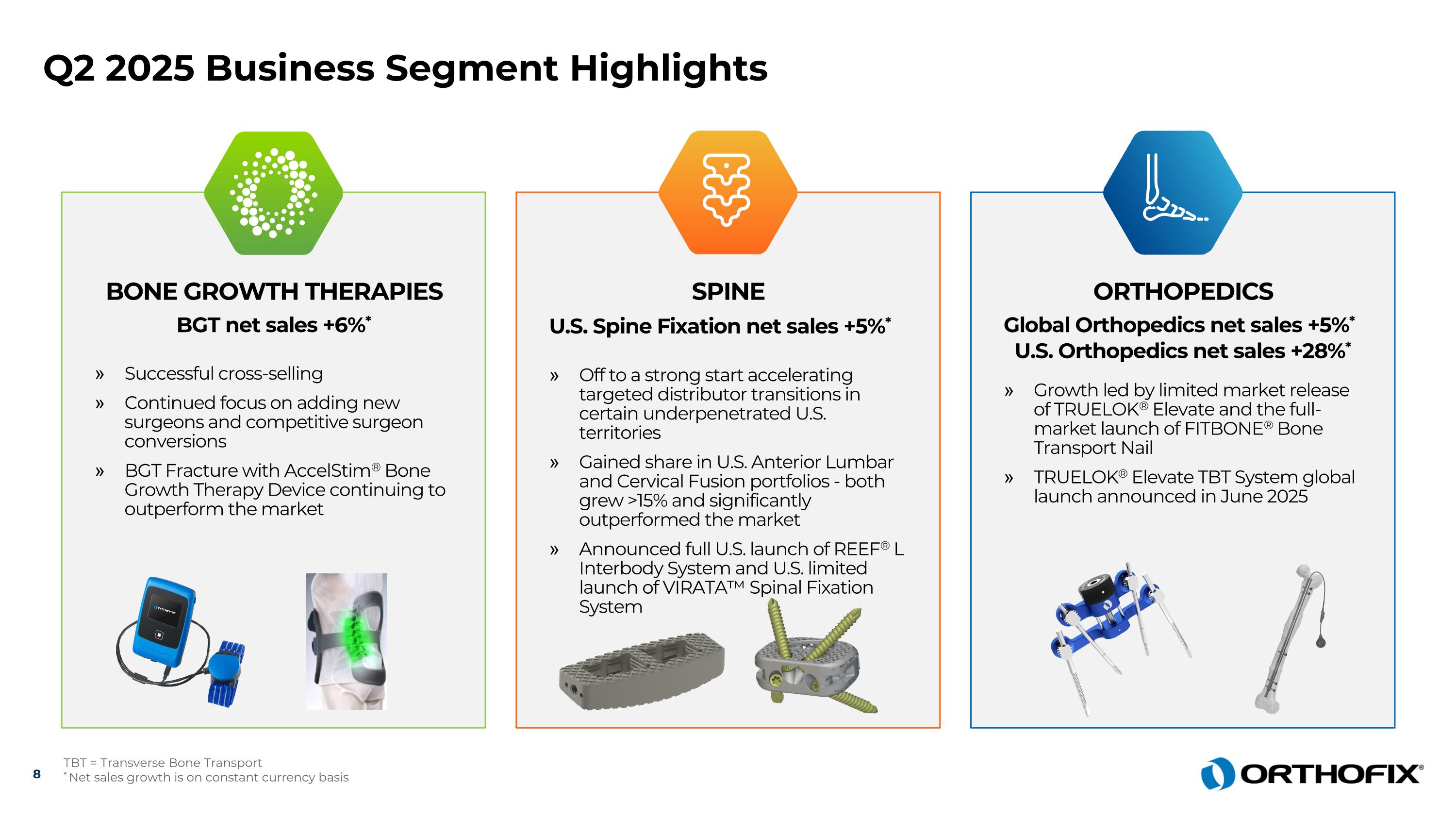

Q2 2025 Business Segment Highlights 8 TBT = Transverse Bone Transport * Net sales growth is on constant currency basis BONE GROWTH THERAPIES BGT net sales +6%* Successful cross-selling Continued focus on adding new surgeons and competitive surgeon conversions BGT Fracture with AccelStim® Bone Growth Therapy Device continuing to outperform the market ORTHOPEDICS Global Orthopedics net sales +5%* U.S. Orthopedics net sales +28%* Growth led by limited market release of TRUELOK® Elevate and the full-market launch of FITBONE® Bone Transport Nail TRUELOK® Elevate TBT System global launch announced in June 2025 SPINE U.S. Spine Fixation net sales +5%* Off to a strong start accelerating targeted distributor transitions in certain underpenetrated U.S. territories Gained share in U.S. Anterior Lumbar and Cervical Fusion portfolios - both grew >15% and significantly outperformed the market Announced full U.S. launch of REEF® L Interbody System and U.S. limited launch of VIRATA™ Spinal Fixation System

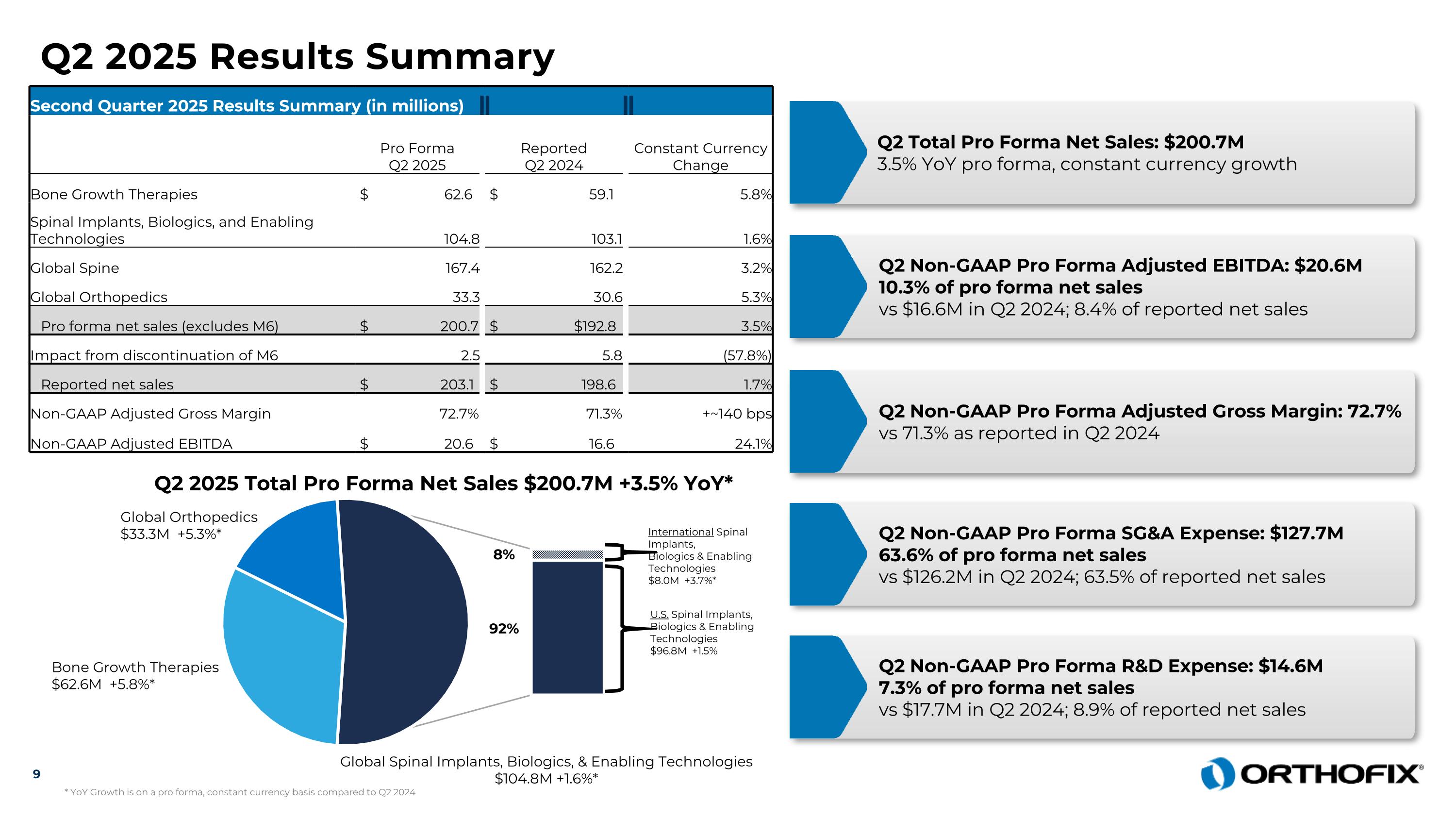

Q2 2025 Results Summary Second Quarter 2025 Results Summary (in millions) Pro Forma Q2 2025 Reported Q2 2024 Constant Currency Change Bone Growth Therapies $ 62.6 $ 59.1 5.8% Spinal Implants, Biologics, and Enabling Technologies 104.8 103.1 1.6% Global Spine 167.4 162.2 3.2% Global Orthopedics 33.3 30.6 5.3% Pro forma net sales (excludes M6) $ 200.7 $ $192.8 3.5% Impact from discontinuation of M6 2.5 5.8 (57.8%) Reported net sales $ 203.1 $ 198.6 1.7% Non-GAAP Adjusted Gross Margin 72.7% 71.3% +~140 bps Non-GAAP Adjusted EBITDA $ 20.6 $ 16.6 24.1% Q2 Total Pro Forma Net Sales: $200.7M 3.5% YoY pro forma, constant currency growth Q2 Non-GAAP Pro Forma Adjusted EBITDA: $20.6M 10.3% of pro forma net sales vs $16.6M in Q2 2024; 8.4% of reported net sales Q2 Non-GAAP Pro Forma Adjusted Gross Margin: 72.7% vs 71.3% as reported in Q2 2024 Q2 Non-GAAP Pro Forma SG&A Expense: $127.7M 63.6% of pro forma net sales vs $126.2M in Q2 2024; 63.5% of reported net sales Q2 Non-GAAP Pro Forma R&D Expense: $14.6M 7.3% of pro forma net sales vs $17.7M in Q2 2024; 8.9% of reported net sales 9 Q2 2025 Total Pro Forma Net Sales $200.7M +3.5% YoY* Bone Growth Therapies $62.6M +5.8%* Global Orthopedics $33.3M +5.3%* Global Spinal Implants, Biologics, & Enabling Technologies $104.8M +1.6%* International Spinal Implants, Biologics & Enabling Technologies $8.0M +3.7%* U.S. Spinal Implants, Biologics & Enabling Technologies $96.8M +1.5% 92% 8% * YoY Growth is on a pro forma, constant currency basis compared to Q2 2024

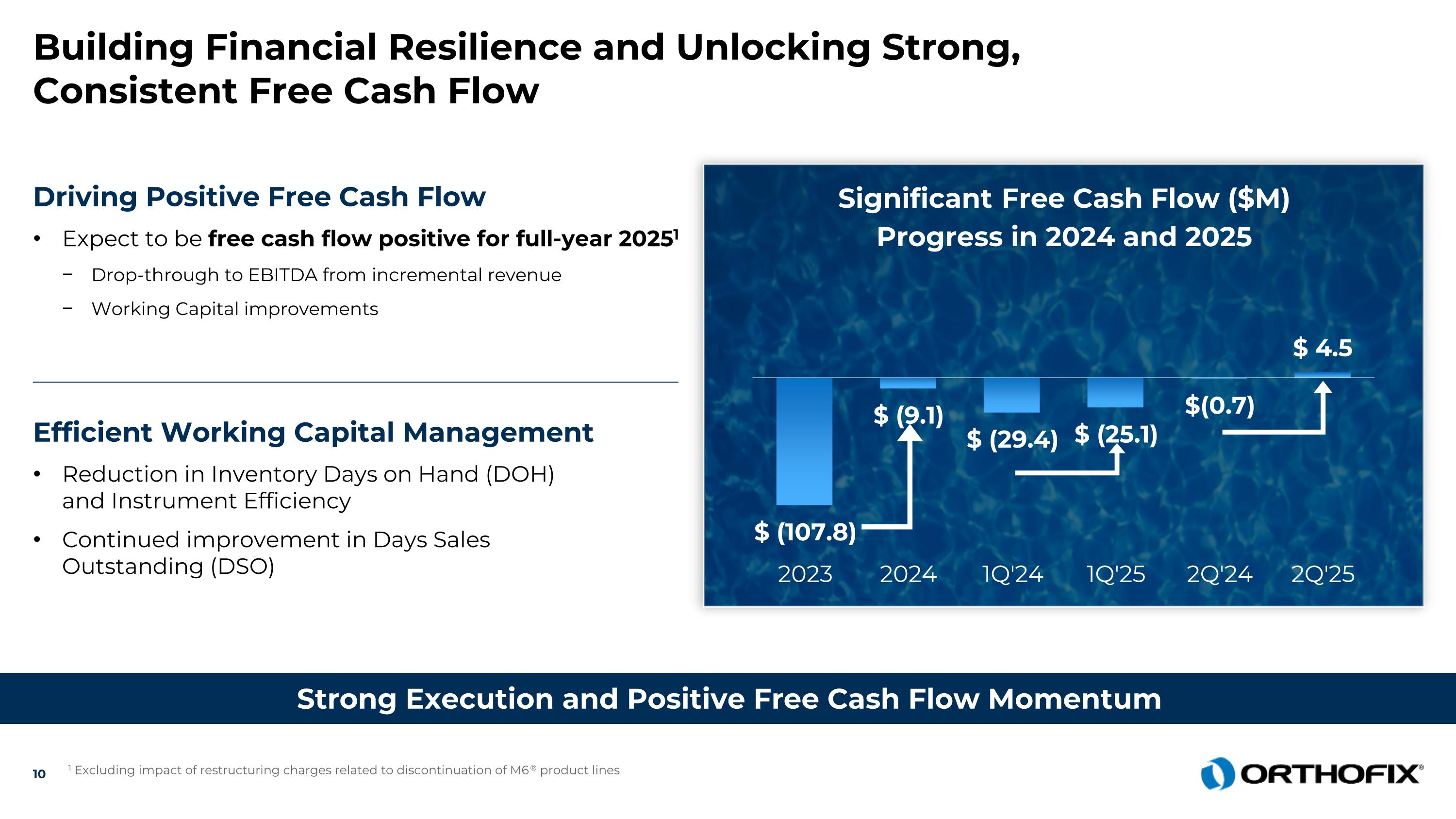

Building Financial Resilience and Unlocking Strong, Consistent Free Cash Flow Strong Execution and Positive Free Cash Flow Momentum Driving Positive Free Cash Flow Expect to be free cash flow positive for full-year 20251 Drop-through to EBITDA from incremental revenue Working Capital improvements Efficient Working Capital Management Reduction in Inventory Days on Hand (DOH) and Instrument Efficiency Continued improvement in Days Sales Outstanding (DSO) 1 Excluding impact of restructuring charges related to discontinuation of M6® product lines

Looking Forward – Accelerating Our Profitable Growth Engine Advancing Toward Our Goals for Consistent Above-Market Growth, Improved Profitability, and Positive Free Cash Flow Invest in Differentiated Technologies in Areas Where We Can Win and Lead Innovation Capitalize on Multiple Access Points to Grow Business at Sustained, Above-Market Rates Operate with Discipline for Margin Expansion Building Financial Resilience and Unlocking Strong, Consistent Free Cash Flow

Full-Year 2025 Guidance1 $808M – $816M Pro Forma Net Sales $82M – $86M Pro Forma Adj. EBITDA Positive Free Cash Flow for 2025² 1 As of the Company’s Q2 2025 Earnings Call hosted on 8/5/2025. Inclusion of this information in this presentation is not a confirmation or an update of, and should not be construed or otherwise assumed to reflect any confirmation or update of, that guidance by Orthofix leadership as of any date other than 8/5/2025. Pro forma net sales range of $808 million to $816 million excludes sales from the discontinued M6® product lines and assumes a $5 million negative impact from U.S. funded non-governmental organization (NGO) business as compared to the full-year 2024. This guidance range is based on current foreign currency exchange rates and does not take into account any additional potential exchange rate changes that may occur this year. 2 Excluding impact of restructuring charges related to the discontinuation of the M6® product lines

Investment Summary – Why Invest in Orthofix? 01 Strong fundamentals with profitable growth opportunity and compelling value proposition across diverse portfolio 02 More focused commercial strategy with robust innovation pipeline complemented by successful cross-selling 03 Established leadership team well-positioned to implement strategic vision and achieve sustainable, profitable growth across portfolio 04 Improved operational execution to drive toward profitability objectives and positive free cash flow 05 Long-term financial targets reflect confidence in sustainable growth trends and commercial strategy and execution

For additional information, please contact: Julie Dewey, IRC Chief IR & Communications Officer juliedewey@orthofix.com 209-613-6945 www.Orthofix.com NASDAQ: OFIX

Financial and Non-GAAP Reconciliation Tables Appendix

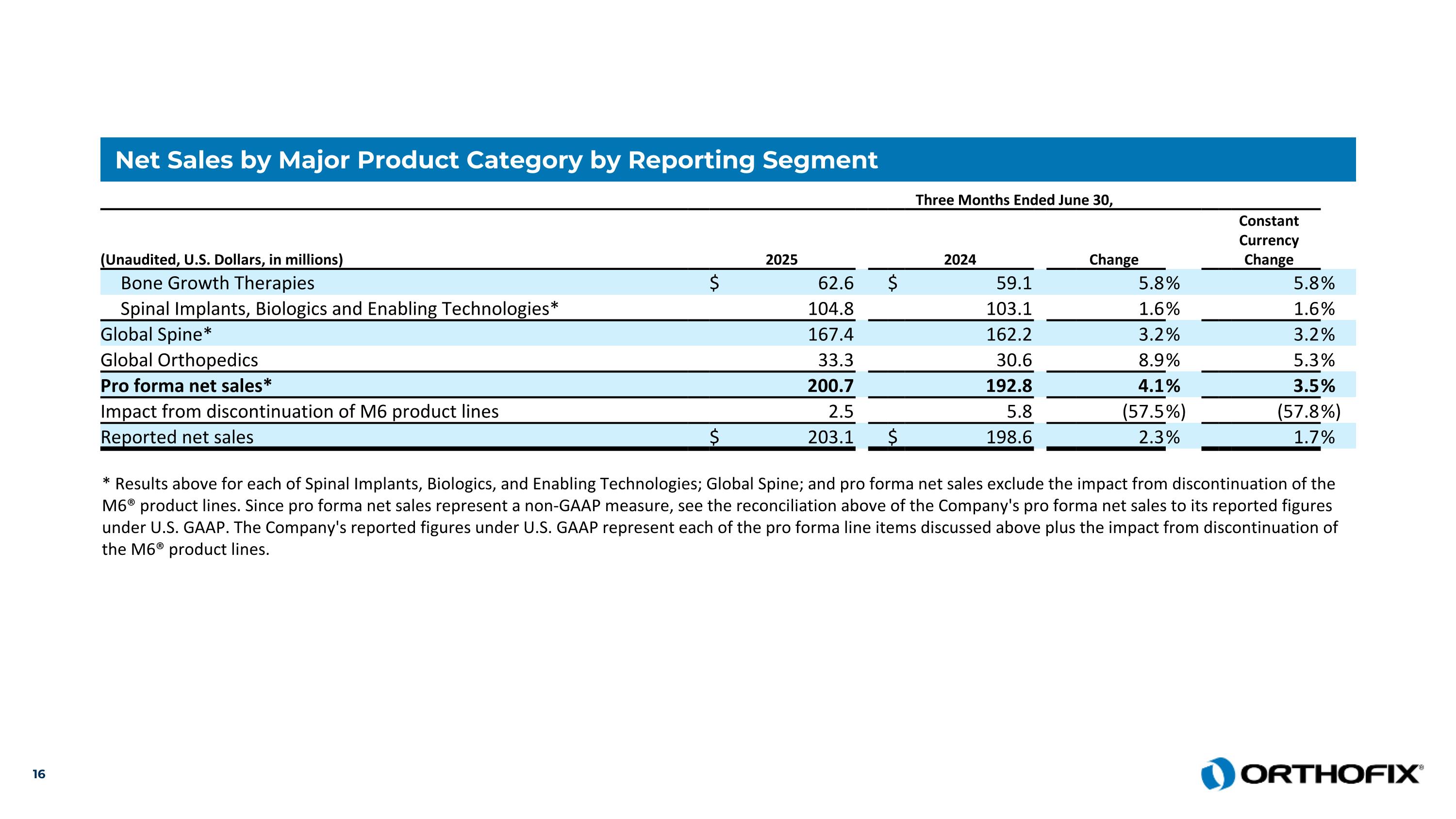

Net Sales by Major Product Category by Reporting Segment Three Months Ended June 30, (Unaudited, U.S. Dollars, in millions) 2025 2024 Change Constant Currency Change Bone Growth Therapies $ 62.6 $ 59.1 5.8 % 5.8 % Spinal Implants, Biologics and Enabling Technologies* 104.8 103.1 1.6 % 1.6 % Global Spine* 167.4 162.2 3.2 % 3.2 % Global Orthopedics 33.3 30.6 8.9 % 5.3 % Pro forma net sales* 200.7 192.8 4.1 % 3.5 % Impact from discontinuation of M6 product lines 2.5 5.8 (57.5 %) (57.8 %) Reported net sales $ 203.1 $ 198.6 2.3 % 1.7 % * Results above for each of Spinal Implants, Biologics, and Enabling Technologies; Global Spine; and pro forma net sales exclude the impact from discontinuation of the M6® product lines. Since pro forma net sales represent a non-GAAP measure, see the reconciliation above of the Company's pro forma net sales to its reported figures under U.S. GAAP. The Company's reported figures under U.S. GAAP represent each of the pro forma line items discussed above plus the impact from discontinuation of the M6® product lines.

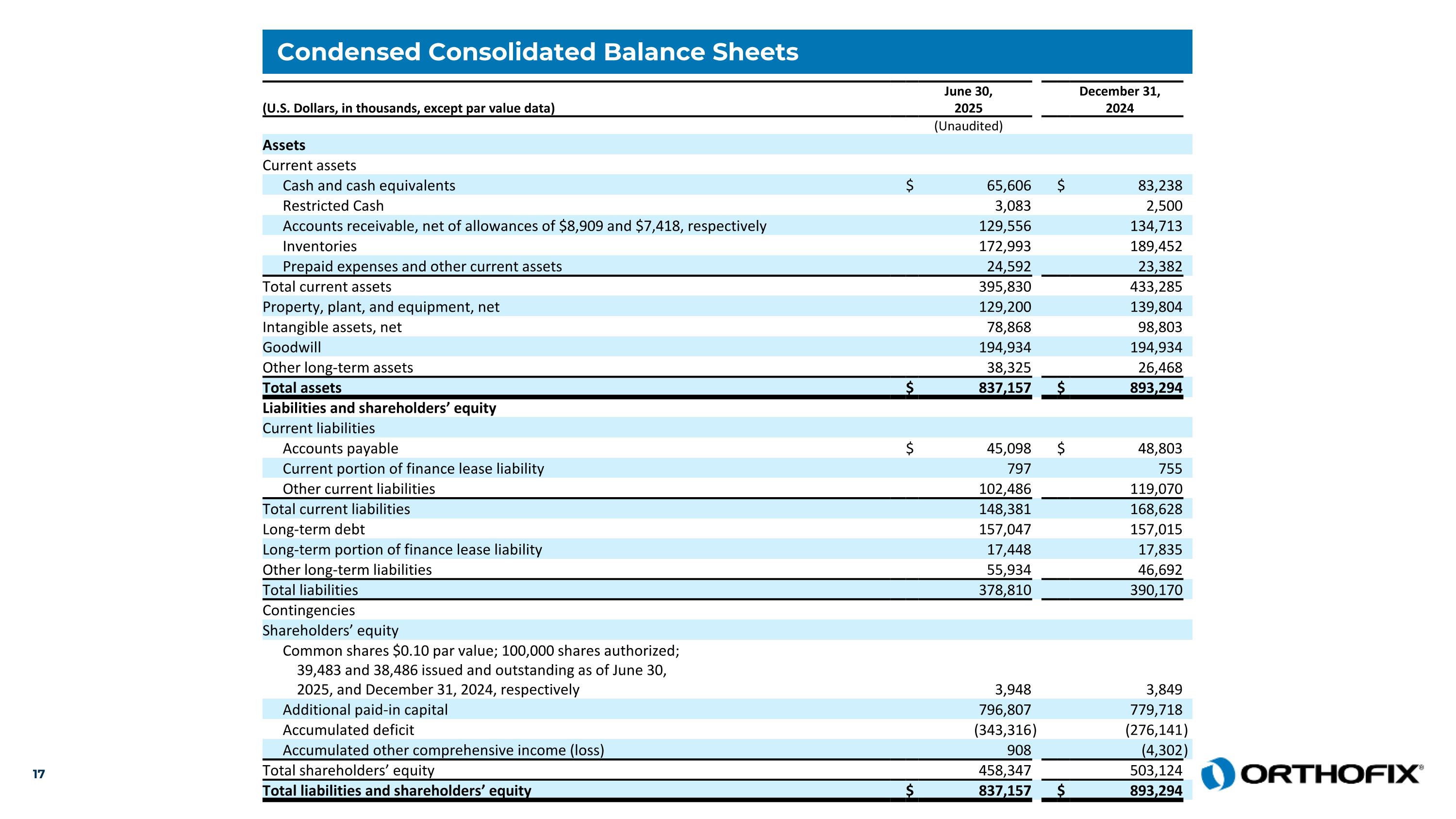

Condensed Consolidated Balance Sheets (U.S. Dollars, in thousands, except par value data) June 30, 2025 December 31, 2024 (Unaudited) Assets Current assets Cash and cash equivalents $ 65,606 $ 83,238 Restricted Cash 3,083 2,500 Accounts receivable, net of allowances of $8,909 and $7,418, respectively 129,556 134,713 Inventories 172,993 189,452 Prepaid expenses and other current assets 24,592 23,382 Total current assets 395,830 433,285 Property, plant, and equipment, net 129,200 139,804 Intangible assets, net 78,868 98,803 Goodwill 194,934 194,934 Other long-term assets 38,325 26,468 Total assets $ 837,157 $ 893,294 Liabilities and shareholders’ equity Current liabilities Accounts payable $ 45,098 $ 48,803 Current portion of finance lease liability 797 755 Other current liabilities 102,486 119,070 Total current liabilities 148,381 168,628 Long-term debt 157,047 157,015 Long-term portion of finance lease liability 17,448 17,835 Other long-term liabilities 55,934 46,692 Total liabilities 378,810 390,170 Contingencies Shareholders’ equity Common shares $0.10 par value; 100,000 shares authorized; 39,483 and 38,486 issued and outstanding as of June 30, 2025, and December 31, 2024, respectively 3,948 3,849 Additional paid-in capital 796,807 779,718 Accumulated deficit (343,316 ) (276,141 ) Accumulated other comprehensive income (loss) 908 (4,302 ) Total shareholders’ equity 458,347 503,124 Total liabilities and shareholders’ equity $ 837,157 $ 893,294

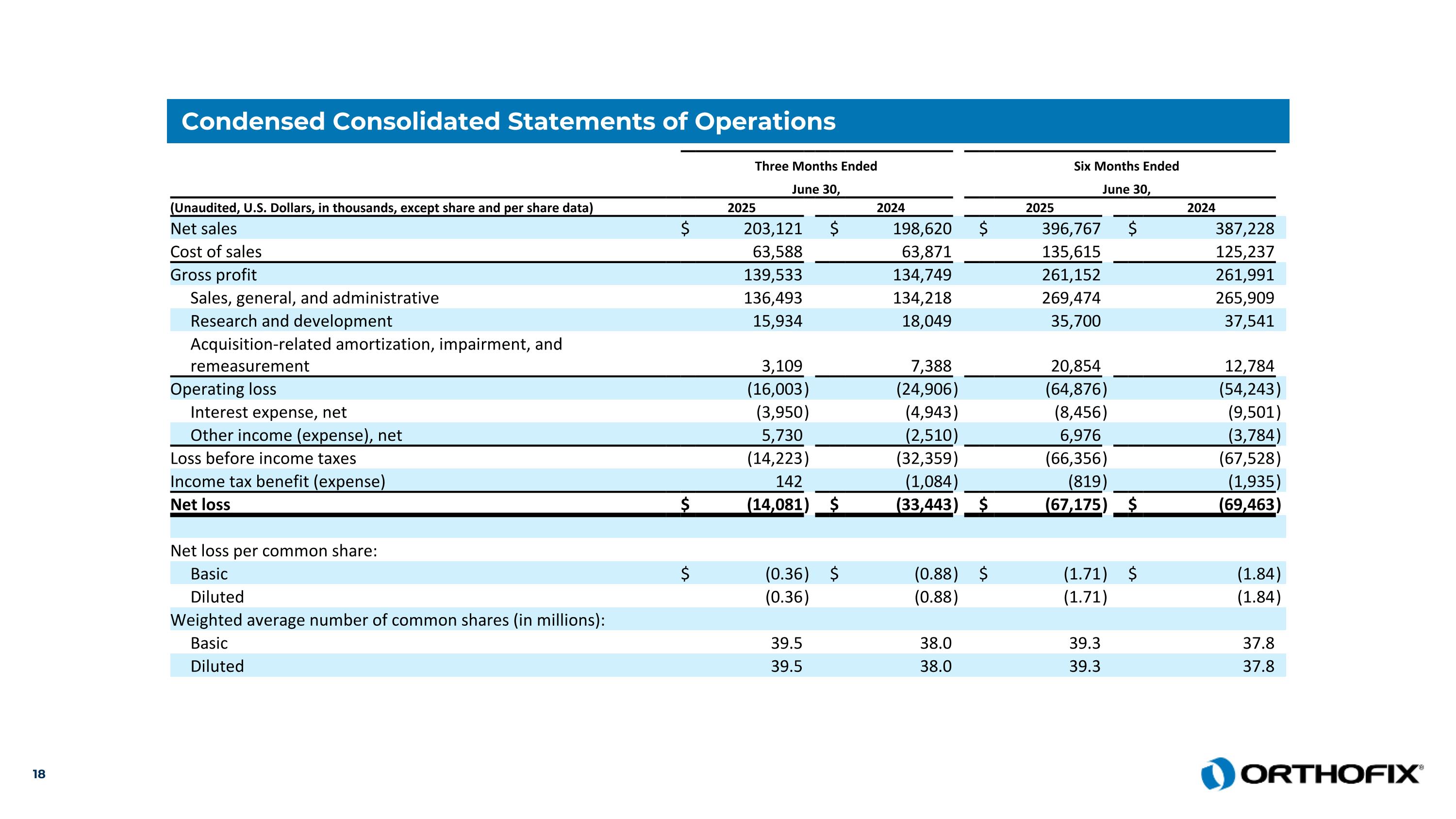

Condensed Consolidated Statements of Operations Three Months Ended Six Months Ended June 30, June 30, (Unaudited, U.S. Dollars, in thousands, except share and per share data) 2025 2024 2025 2024 Net sales $ 203,121 $ 198,620 $ 396,767 $ 387,228 Cost of sales 63,588 63,871 135,615 125,237 Gross profit 139,533 134,749 261,152 261,991 Sales, general, and administrative 136,493 134,218 269,474 265,909 Research and development 15,934 18,049 35,700 37,541 Acquisition-related amortization, impairment, and remeasurement 3,109 7,388 20,854 12,784 Operating loss (16,003 ) (24,906 ) (64,876 ) (54,243 ) Interest expense, net (3,950 ) (4,943 ) (8,456 ) (9,501 ) Other income (expense), net 5,730 (2,510 ) 6,976 (3,784 ) Loss before income taxes (14,223 ) (32,359 ) (66,356 ) (67,528 ) Income tax benefit (expense) 142 (1,084 ) (819 ) (1,935 ) Net loss $ (14,081 ) $ (33,443 ) $ (67,175 ) $ (69,463 ) Net loss per common share: Basic $ (0.36 ) $ (0.88 ) $ (1.71 ) $ (1.84 ) Diluted (0.36 ) (0.88 ) (1.71 ) (1.84 ) Weighted average number of common shares (in millions): Basic 39.5 38.0 39.3 37.8 Diluted 39.5 38.0 39.3 37.8

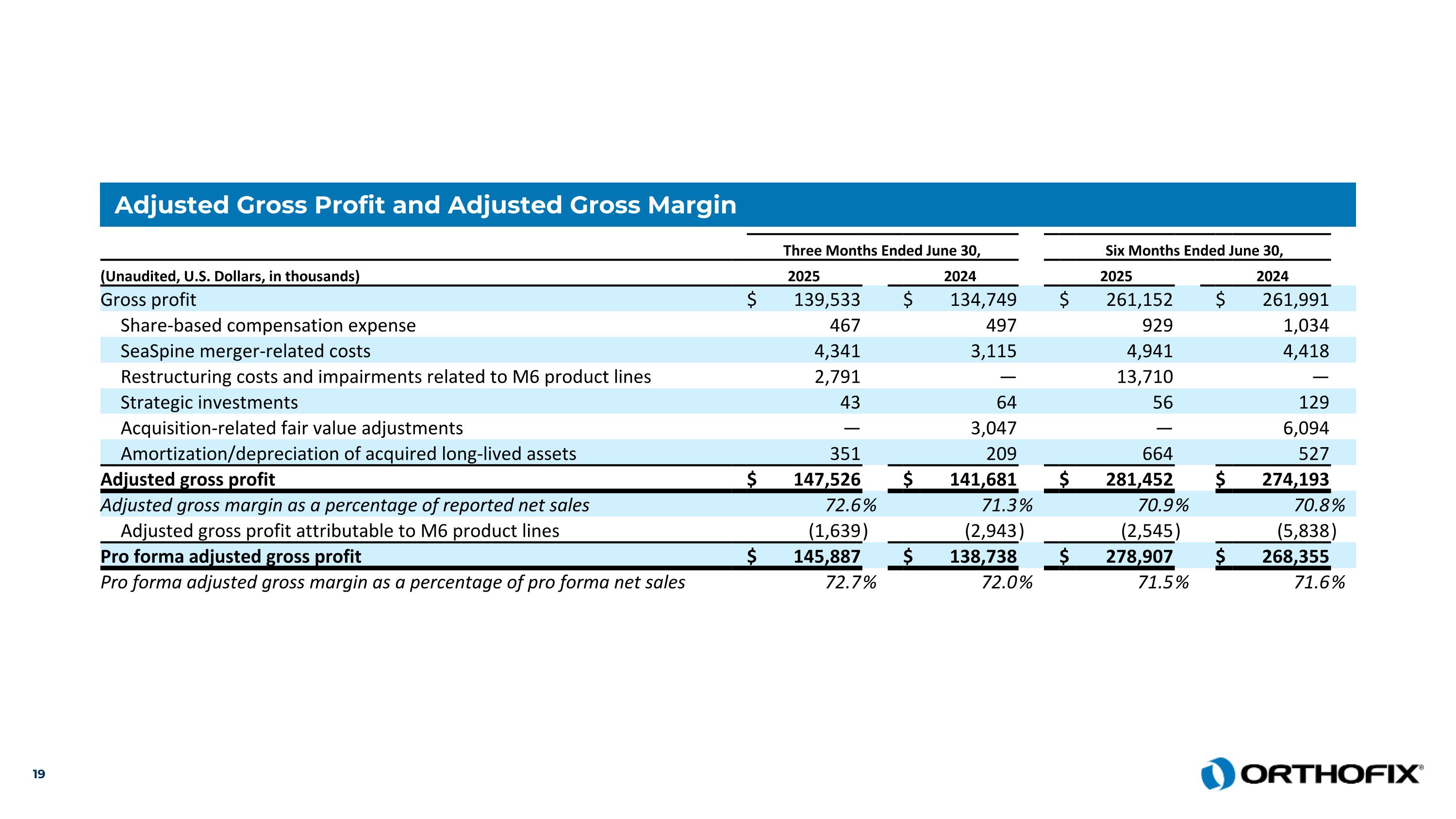

Adjusted Gross Profit and Adjusted Gross Margin Three Months Ended June 30, Six Months Ended June 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 2025 2024 Gross profit $ 139,533 $ 134,749 $ 261,152 $ 261,991 Share-based compensation expense 467 497 929 1,034 SeaSpine merger-related costs 4,341 3,115 4,941 4,418 Restructuring costs and impairments related to M6 product lines 2,791 — 13,710 — Strategic investments 43 64 56 129 Acquisition-related fair value adjustments — 3,047 — 6,094 Amortization/depreciation of acquired long-lived assets 351 209 664 527 Adjusted gross profit $ 147,526 $ 141,681 $ 281,452 $ 274,193 Adjusted gross margin as a percentage of reported net sales 72.6 % 71.3 % 70.9 % 70.8 % Adjusted gross profit attributable to M6 product lines (1,639 ) (2,943 ) (2,545 ) (5,838 ) Pro forma adjusted gross profit $ 145,887 $ 138,738 $ 278,907 $ 268,355 Pro forma adjusted gross margin as a percentage of pro forma net sales 72.7 % 72.0 % 71.5 % 71.6 %

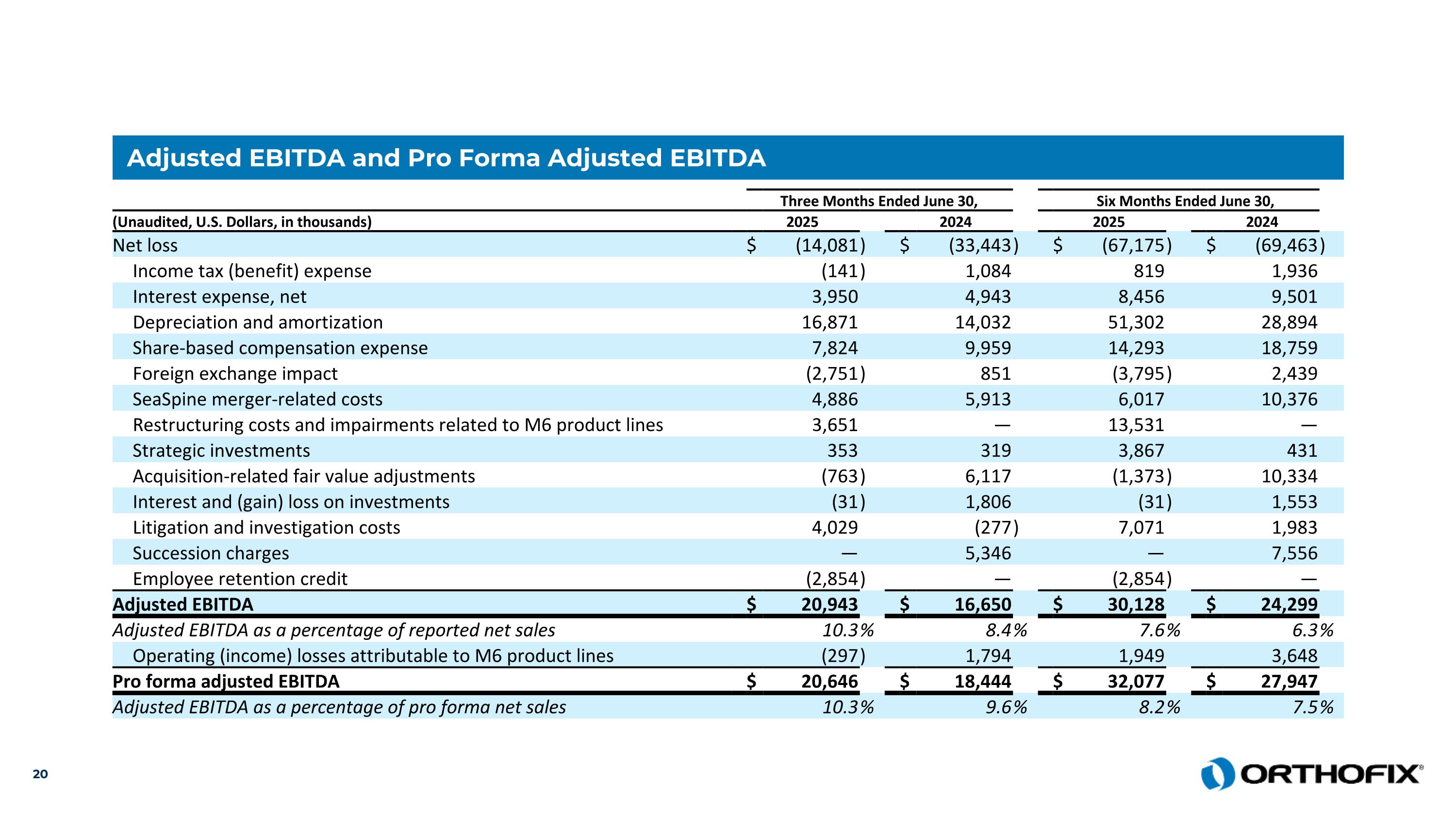

Adjusted EBITDA and Pro Forma Adjusted EBITDA Three Months Ended June 30, Six Months Ended June 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 2025 2024 Net loss $ (14,081 ) $ (33,443 ) $ (67,175 ) $ (69,463 ) Income tax (benefit) expense (141 ) 1,084 819 1,936 Interest expense, net 3,950 4,943 8,456 9,501 Depreciation and amortization 16,871 14,032 51,302 28,894 Share-based compensation expense 7,824 9,959 14,293 18,759 Foreign exchange impact (2,751 ) 851 (3,795 ) 2,439 SeaSpine merger-related costs 4,886 5,913 6,017 10,376 Restructuring costs and impairments related to M6 product lines 3,651 — 13,531 — Strategic investments 353 319 3,867 431 Acquisition-related fair value adjustments (763 ) 6,117 (1,373 ) 10,334 Interest and (gain) loss on investments (31 ) 1,806 (31 ) 1,553 Litigation and investigation costs 4,029 (277 ) 7,071 1,983 Succession charges — 5,346 — 7,556 Employee retention credit (2,854 ) — (2,854 ) — Adjusted EBITDA $ 20,943 $ 16,650 $ 30,128 $ 24,299 Adjusted EBITDA as a percentage of reported net sales 10.3 % 8.4 % 7.6 % 6.3 % Operating (income) losses attributable to M6 product lines (297 ) 1,794 1,949 3,648 Pro forma adjusted EBITDA $ 20,646 $ 18,444 $ 32,077 $ 27,947 Adjusted EBITDA as a percentage of pro forma net sales 10.3 % 9.6 % 8.2 % 7.5 %

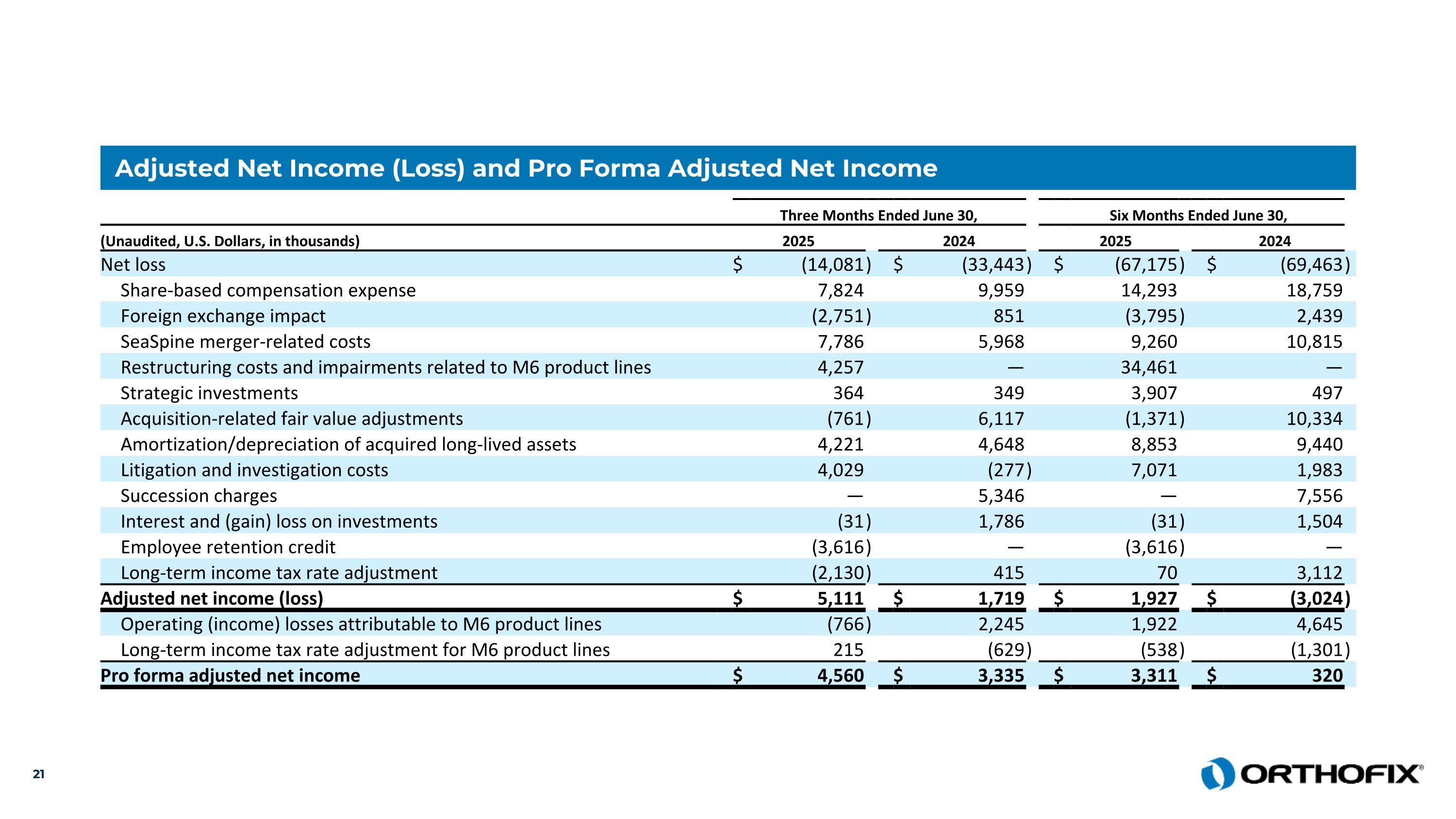

Adjusted Net Income (Loss) and Pro Forma Adjusted Net Income Three Months Ended June 30, Six Months Ended June 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 2025 2024 Net loss $ (14,081 ) $ (33,443 ) $ (67,175 ) $ (69,463 ) Share-based compensation expense 7,824 9,959 14,293 18,759 Foreign exchange impact (2,751 ) 851 (3,795 ) 2,439 SeaSpine merger-related costs 7,786 5,968 9,260 10,815 Restructuring costs and impairments related to M6 product lines 4,257 — 34,461 — Strategic investments 364 349 3,907 497 Acquisition-related fair value adjustments (761 ) 6,117 (1,371 ) 10,334 Amortization/depreciation of acquired long-lived assets 4,221 4,648 8,853 9,440 Litigation and investigation costs 4,029 (277 ) 7,071 1,983 Succession charges — 5,346 — 7,556 Interest and (gain) loss on investments (31 ) 1,786 (31 ) 1,504 Employee retention credit (3,616 ) — (3,616 ) — Long-term income tax rate adjustment (2,130 ) 415 70 3,112 Adjusted net income (loss) $ 5,111 $ 1,719 $ 1,927 $ (3,024 ) Operating (income) losses attributable to M6 product lines (766 ) 2,245 1,922 4,645 Long-term income tax rate adjustment for M6 product lines 215 (629 ) (538 ) (1,301 ) Pro forma adjusted net income $ 4,560 $ 3,335 $ 3,311 $ 320

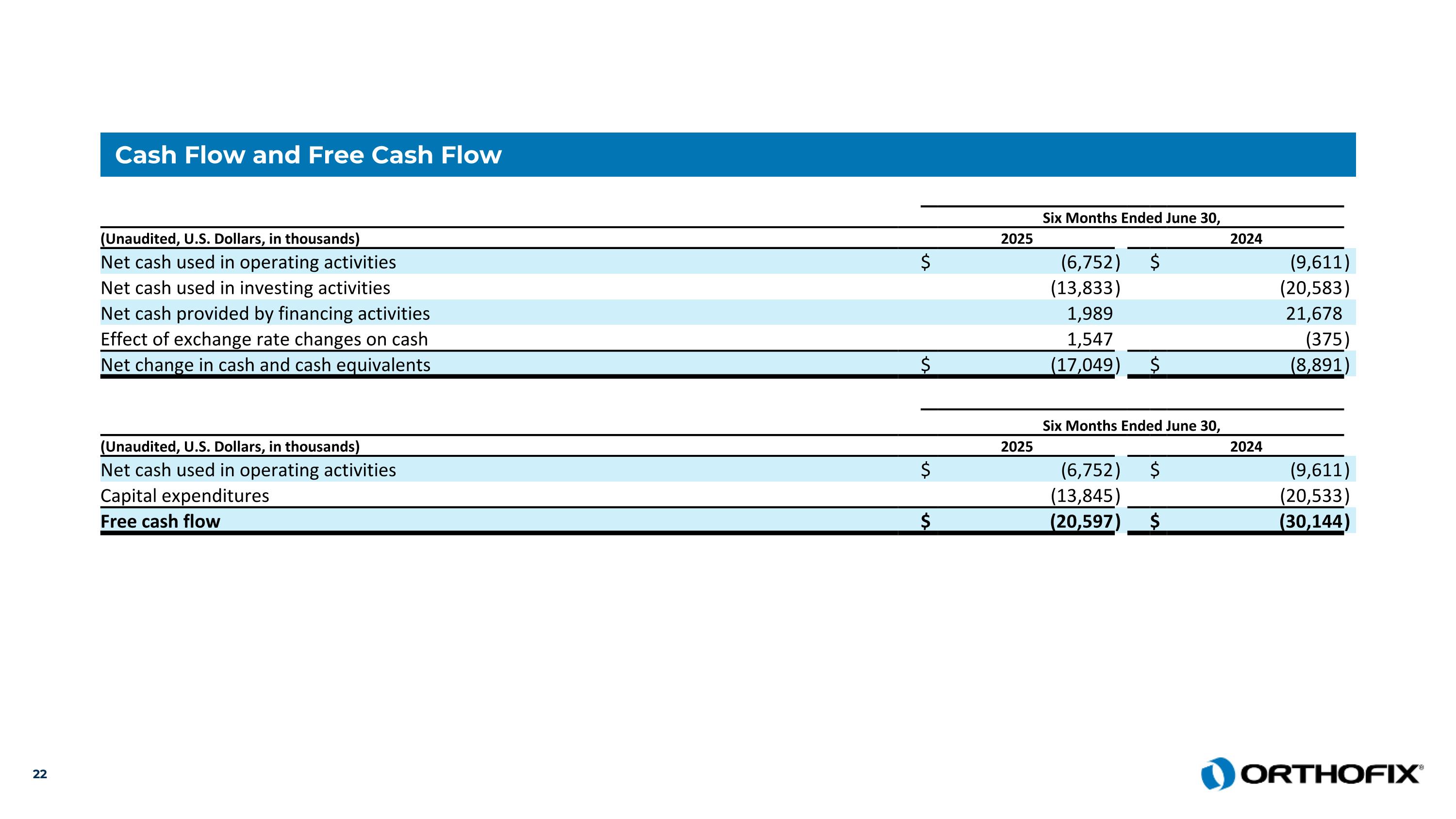

Cash Flow and Free Cash Flow Six Months Ended June 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 Net cash used in operating activities $ (6,752 ) $ (9,611 ) Net cash used in investing activities (13,833 ) (20,583 ) Net cash provided by financing activities 1,989 21,678 Effect of exchange rate changes on cash 1,547 (375 ) Net change in cash and cash equivalents $ (17,049 ) $ (8,891 ) Six Months Ended June 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 Net cash used in operating activities $ (6,752 ) $ (9,611 ) Capital expenditures (13,845 ) (20,533 ) Free cash flow $ (20,597 ) $ (30,144 )

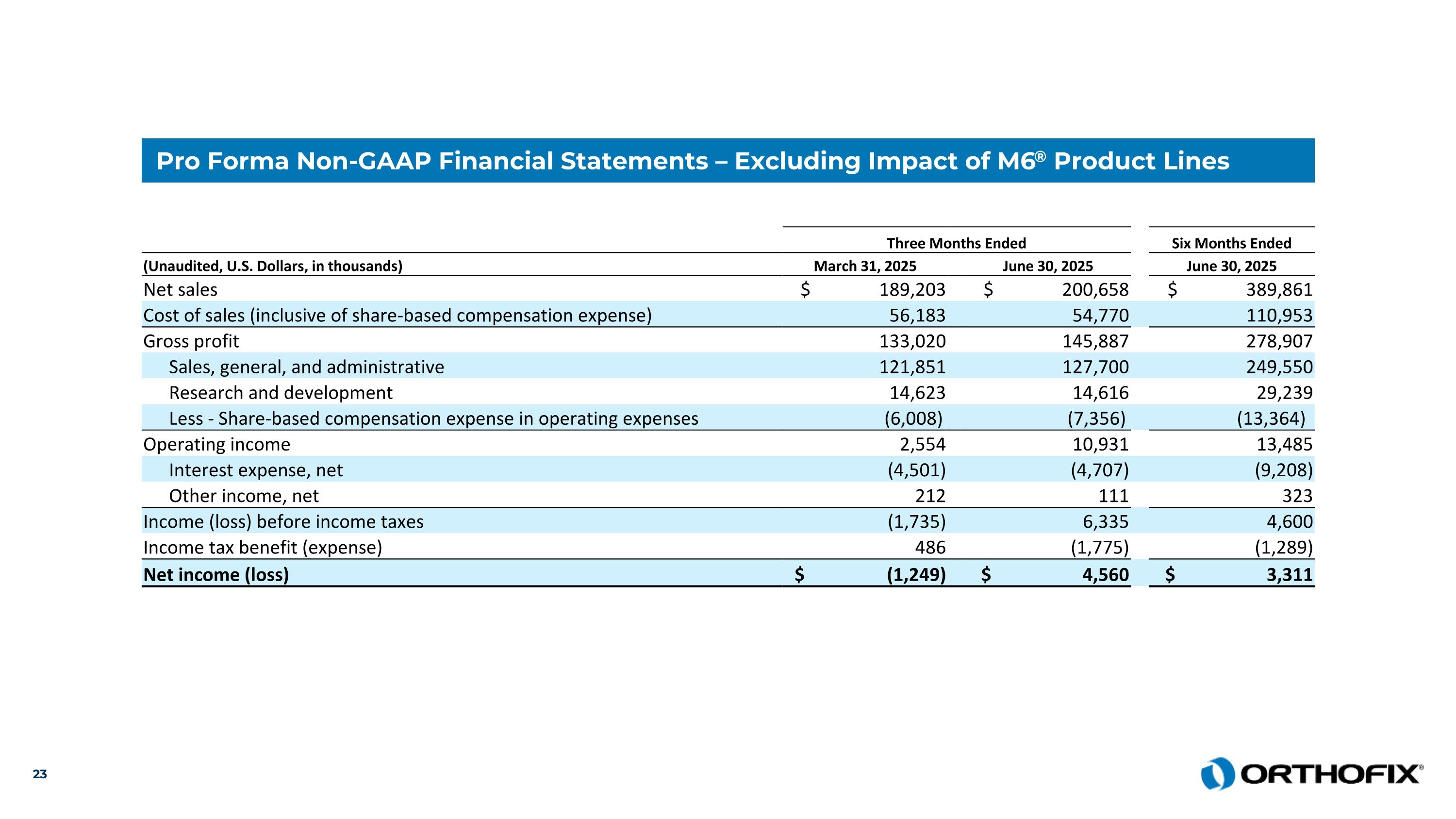

Pro Forma Non-GAAP Financial Statements – Excluding Impact of M6® Product Lines Three Months Ended Six Months Ended (Unaudited, U.S. Dollars, in thousands) March 31, 2025 June 30, 2025 June 30, 2025 Net sales $ 189,203 $ 200,658 $ 389,861 Cost of sales (inclusive of share-based compensation expense) 56,183 54,770 110,953 Gross profit 133,020 145,887 278,907 Sales, general, and administrative 121,851 127,700 249,550 Research and development 14,623 14,616 29,239 Less - Share-based compensation expense in operating expenses (6,008) (7,356) (13,364) Operating income 2,554 10,931 13,485 Interest expense, net (4,501) (4,707) (9,208) Other income, net 212 111 323 Income (loss) before income taxes (1,735) 6,335 4,600 Income tax benefit (expense) 486 (1,775) (1,289) Net income (loss) $ (1,249) $ 4,560 $ 3,311

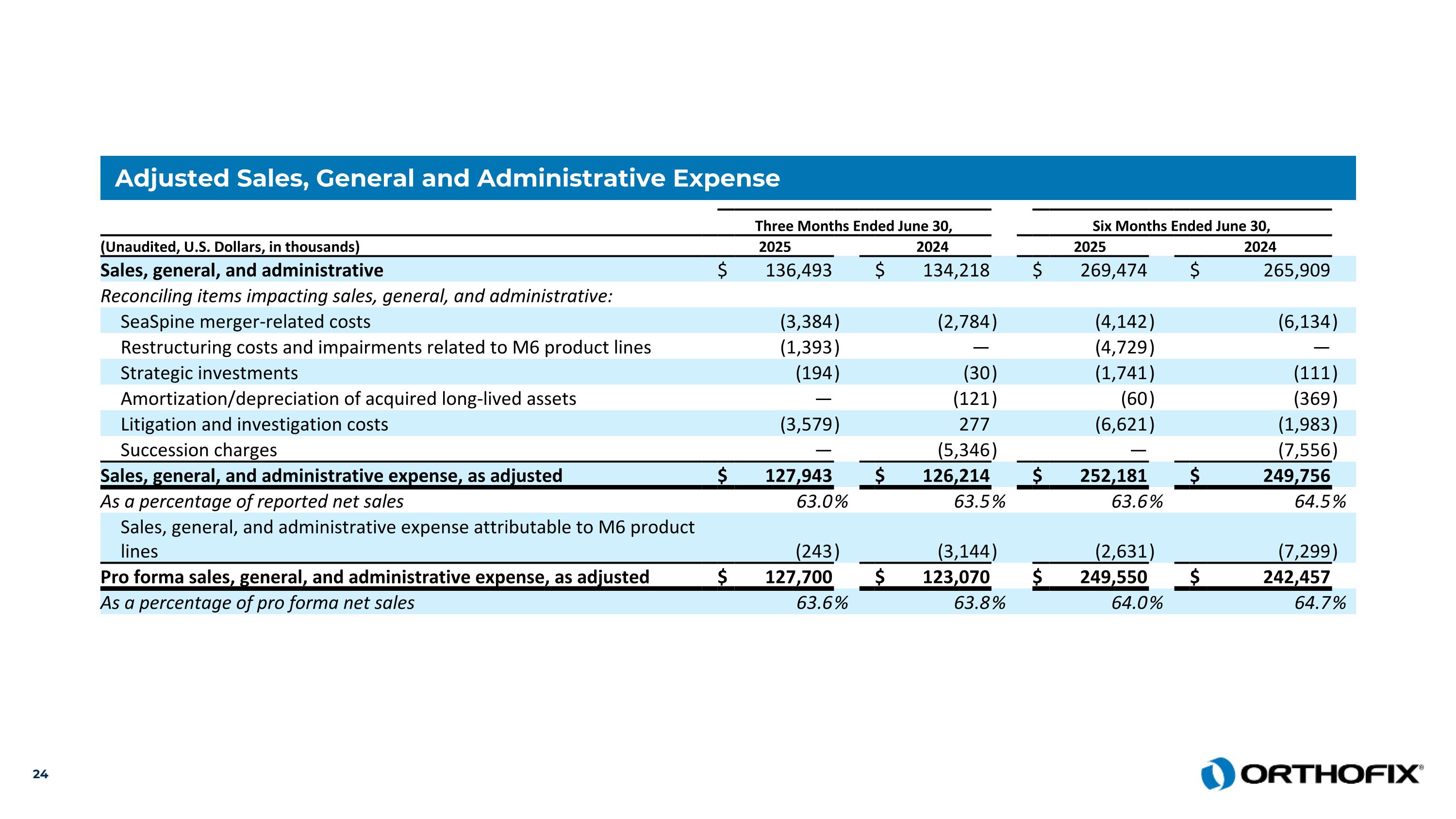

Adjusted Sales, General and Administrative Expense Three Months Ended June 30, Six Months Ended June 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 2025 2024 Sales, general, and administrative $ 136,493 $ 134,218 $ 269,474 $ 265,909 Reconciling items impacting sales, general, and administrative: SeaSpine merger-related costs (3,384 ) (2,784 ) (4,142 ) (6,134 ) Restructuring costs and impairments related to M6 product lines (1,393 ) — (4,729 ) — Strategic investments (194 ) (30 ) (1,741 ) (111 ) Amortization/depreciation of acquired long-lived assets — (121 ) (60 ) (369 ) Litigation and investigation costs (3,579 ) 277 (6,621 ) (1,983 ) Succession charges — (5,346 ) — (7,556 ) Sales, general, and administrative expense, as adjusted $ 127,943 $ 126,214 $ 252,181 $ 249,756 As a percentage of reported net sales 63.0 % 63.5 % 63.6 % 64.5 % Sales, general, and administrative expense attributable to M6 product lines (243 ) (3,144 ) (2,631 ) (7,299 ) Pro forma sales, general, and administrative expense, as adjusted $ 127,700 $ 123,070 $ 249,550 $ 242,457 As a percentage of pro forma net sales 63.6 % 63.8 % 64.0 % 64.7 %

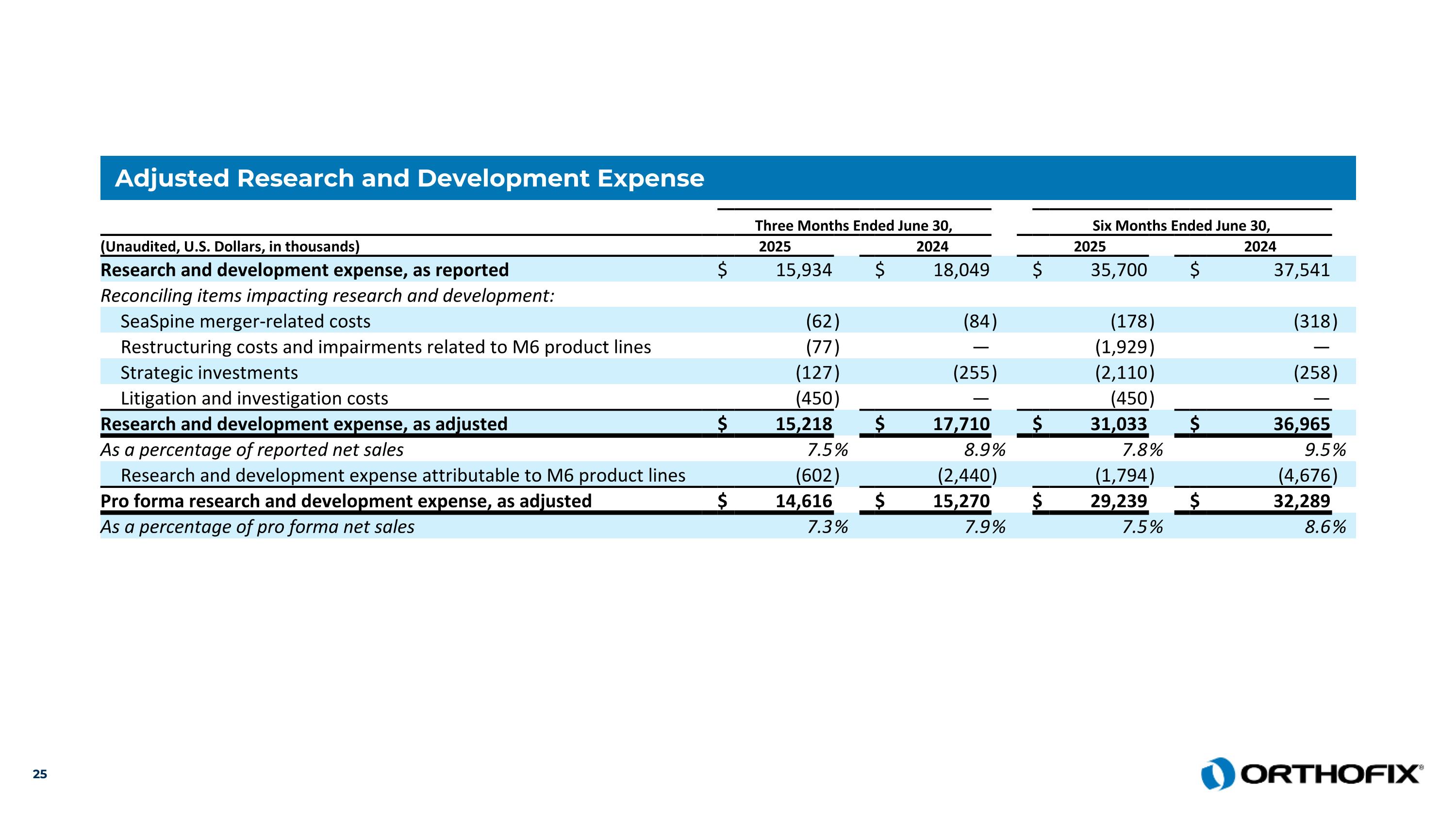

Adjusted Research and Development Expense Three Months Ended June 30, Six Months Ended June 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 2025 2024 Research and development expense, as reported $ 15,934 $ 18,049 $ 35,700 $ 37,541 Reconciling items impacting research and development: SeaSpine merger-related costs (62 ) (84 ) (178 ) (318 ) Restructuring costs and impairments related to M6 product lines (77 ) — (1,929 ) — Strategic investments (127 ) (255 ) (2,110 ) (258 ) Litigation and investigation costs (450 ) — (450 ) — Research and development expense, as adjusted $ 15,218 $ 17,710 $ 31,033 $ 36,965 As a percentage of reported net sales 7.5 % 8.9 % 7.8 % 9.5 % Research and development expense attributable to M6 product lines (602 ) (2,440 ) (1,794 ) (4,676 ) Pro forma research and development expense, as adjusted $ 14,616 $ 15,270 $ 29,239 $ 32,289 As a percentage of pro forma net sales 7.3 % 7.9 % 7.5 % 8.6 %

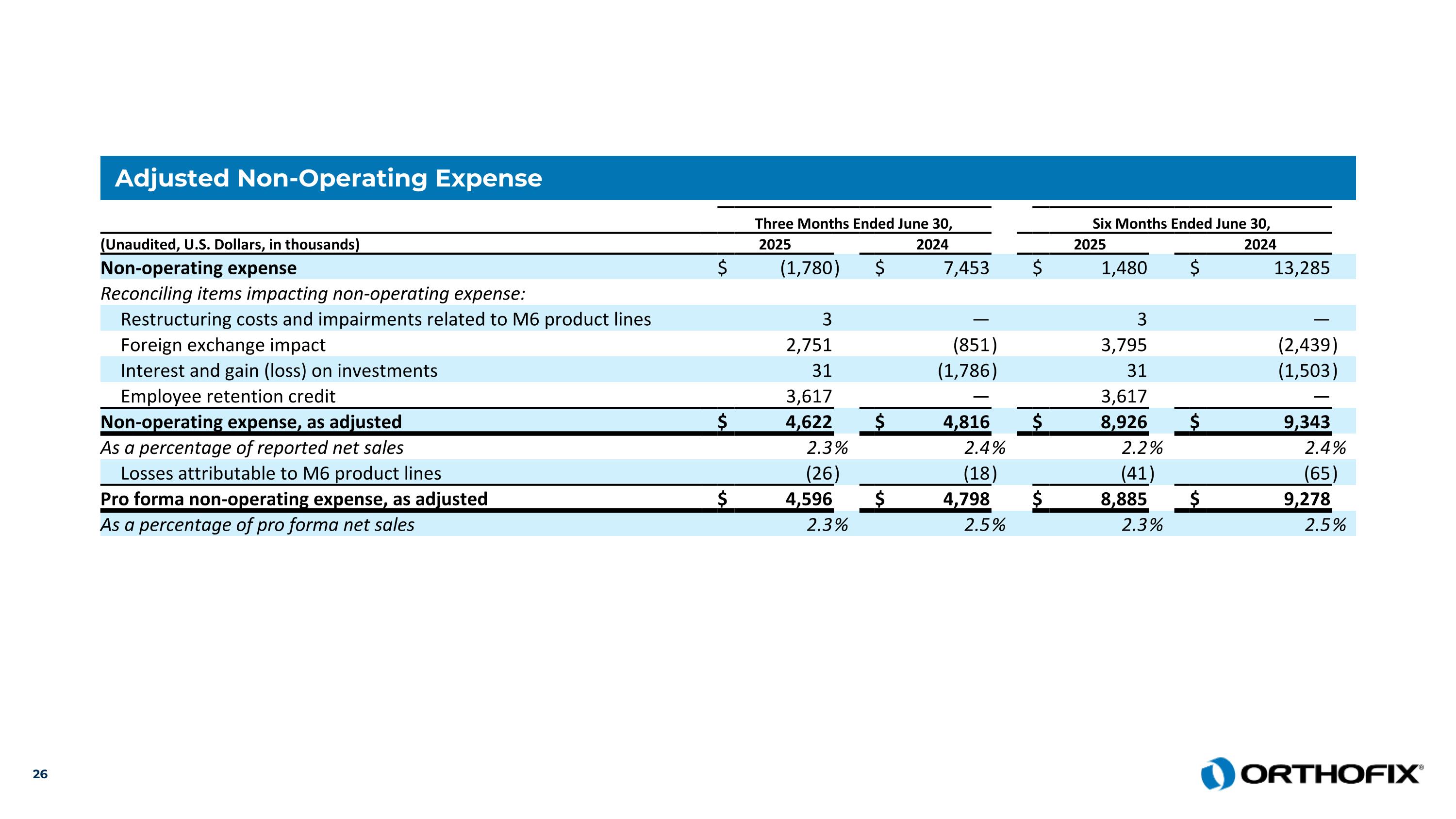

Adjusted Non-Operating Expense Three Months Ended June 30, Six Months Ended June 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 2025 2024 Non-operating expense $ (1,780 ) $ 7,453 $ 1,480 $ 13,285 Reconciling items impacting non-operating expense: Restructuring costs and impairments related to M6 product lines 3 — 3 — Foreign exchange impact 2,751 (851 ) 3,795 (2,439 ) Interest and gain (loss) on investments 31 (1,786 ) 31 (1,503 ) Employee retention credit 3,617 — 3,617 — Non-operating expense, as adjusted $ 4,622 $ 4,816 $ 8,926 $ 9,343 As a percentage of reported net sales 2.3 % 2.4 % 2.2 % 2.4 % Losses attributable to M6 product lines (26 ) (18 ) (41 ) (65 ) Pro forma non-operating expense, as adjusted $ 4,596 $ 4,798 $ 8,885 $ 9,278 As a percentage of pro forma net sales 2.3 % 2.5 % 2.3 % 2.5 %

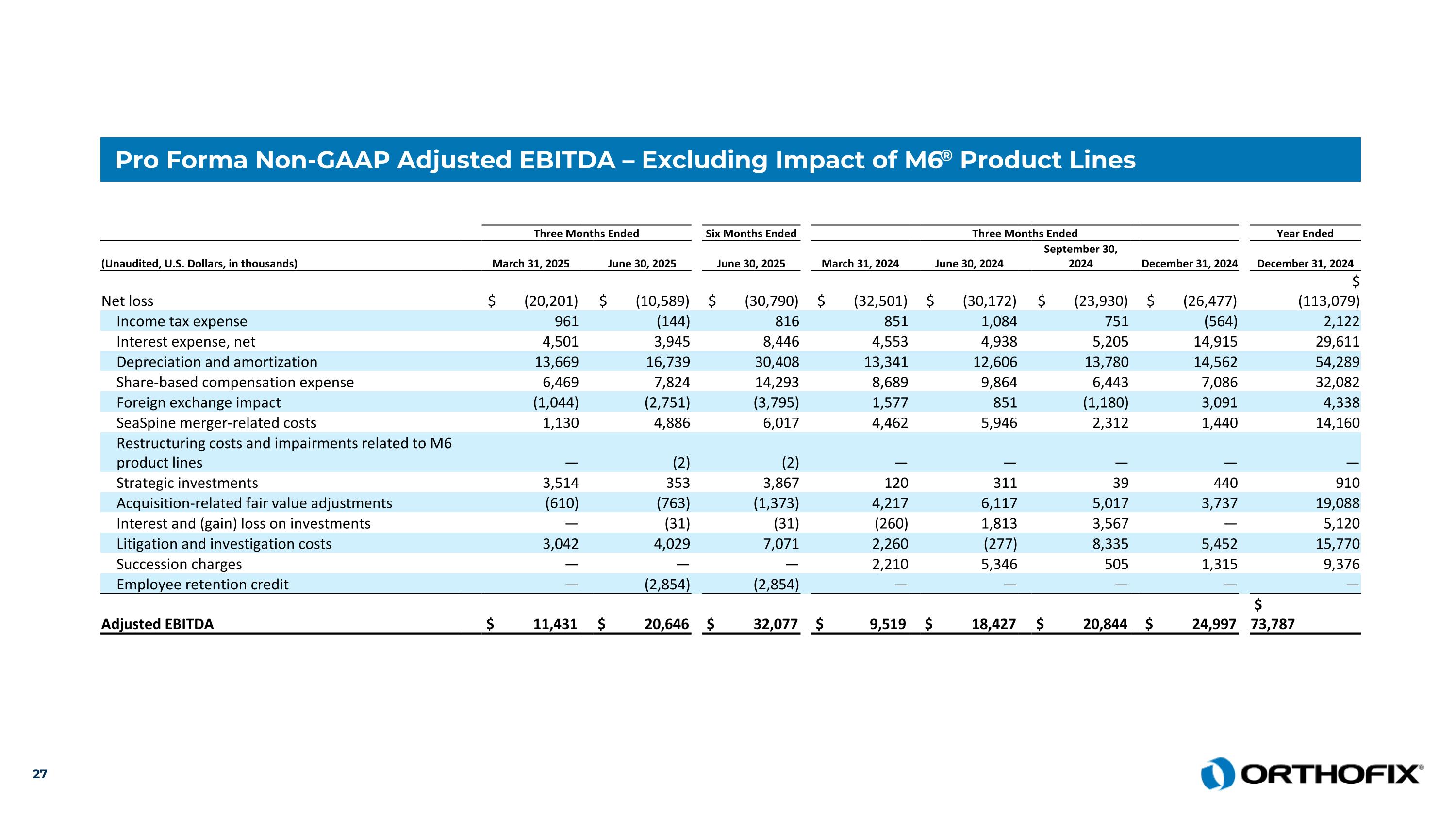

Pro Forma Non-GAAP Adjusted EBITDA – Excluding Impact of M6® Product Lines Three Months Ended Six Months Ended Three Months Ended Year Ended (Unaudited, U.S. Dollars, in thousands) March 31, 2025 June 30, 2025 June 30, 2025 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 December 31, 2024 Net loss $ (20,201) $ (10,589) $ (30,790) $ (32,501) $ (30,172) $ (23,930) $ (26,477) $ (113,079) Income tax expense 961 (144) 816 851 1,084 751 (564) 2,122 Interest expense, net 4,501 3,945 8,446 4,553 4,938 5,205 14,915 29,611 Depreciation and amortization 13,669 16,739 30,408 13,341 12,606 13,780 14,562 54,289 Share-based compensation expense 6,469 7,824 14,293 8,689 9,864 6,443 7,086 32,082 Foreign exchange impact (1,044) (2,751) (3,795) 1,577 851 (1,180) 3,091 4,338 SeaSpine merger-related costs 1,130 4,886 6,017 4,462 5,946 2,312 1,440 14,160 Restructuring costs and impairments related to M6 product lines — (2) (2) — — — — — Strategic investments 3,514 353 3,867 120 311 39 440 910 Acquisition-related fair value adjustments (610) (763) (1,373) 4,217 6,117 5,017 3,737 19,088 Interest and (gain) loss on investments — (31) (31) (260) 1,813 3,567 — 5,120 Litigation and investigation costs 3,042 4,029 7,071 2,260 (277) 8,335 5,452 15,770 Succession charges — — — 2,210 5,346 505 1,315 9,376 Employee retention credit — (2,854) (2,854) — — — — — Adjusted EBITDA $ 11,431 $ 20,646 $ 32,077 $ 9,519 $ 18,427 $ 20,844 $ 24,997 $ 73,787

Pro Forma Non-GAAP Adjusted Net Loss and Adjusted Gross Margin – Excluding Impact of M6® Product Lines Three Months Ended Six Months Ended Three Months Ended Year Ended (Unaudited, U.S. Dollars, in thousands) March 31, 2025 June 30, 2025 June 30, 2025 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 December 31, 2024 Net loss $ (20,201) $ (10,589) $ (30,790) $ (32,501) $ (30,172) $ (23,930) $ (26,477) $ (113,079) Share-based compensation expense 6,469 7,824 14,293 8,689 9,864 6,443 7,086 32,082 Foreign exchange impact (1,044) (2,751) (3,795) 1,577 851 (1,180) 3,090 4,338 SeaSpine merger-related costs 1,474 7,786 9,260 4,831 6,016 2,315 4,396 17,558 Restructuring costs and impairments related to M6 product lines 20,324 604 20,928 — — — — — Strategic investments 3,543 364 3,907 126 371 69 470 1,036 Acquisition-related fair value adjustments (610) (761) (1,371) 4,217 6,117 5,017 3,737 19,088 Amortization/depreciation of acquired long-lived assets (15,693) 3,615 (12,078) 3,812 3,668 4,066 3,857 15,403 Litigation and investigation costs 3,042 4,029 7,071 2,260 (277) 8,335 5,452 15,770 Succession charges — — — 2,210 5,346 505 1,315 9,376 Interest and (gain) loss on investments — (31) (31) (260) 1,764 3,567 — 5,070 Employee retention credit — (3,616) (3,616) — — — — — Long-term income tax rate adjustment 1,447 (1,915) (467) 2,024 (213) (918) (1,225) (332) Adjusted net loss $ (1,249) $ 4,560 $ 3,311 $ (3,015) $ 3,335 $ 4,289 $ 1,701 $ 6,310 Three Months Ended Six Months Ended Three Months Ended Year Ended (Unaudited, U.S. Dollars, in thousands) March 31, 2025 June 30, 2025 June 30, 2025 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 December 31, 2024 Gross profit $ 131,633 $ 140,683 $ 272,316 $ 124,360 $ 131,819 $ 132,862 $ 145,563 $ 534,604 Share-Based Compensation Expense 462 467 929 524 484 545 468 2,021 SeaSpine Merger-Related Costs 600 4,341 4,941 1,303 3,115 963 631 6,012 Restructuring costs and impairments related to M6 product lines (1) 1 — — — — — — Strategic investments 13 43 56 65 63 32 32 192 Acquisition-related fair value adjustments — — — 3,047 3,047 3,047 3,047 12,188 Amortization/depreciation of acquired long-lived assets 313 351 664 318 209 313 313 1,153 Adjusted gross profit $ 133,020 $ 145,887 $ 278,907 $ 129,617 $ 138,738 $ 137,762 $ 150,054 $ 556,170 Adjusted gross margin as a percentage of net sales 70.3% 72.7% 71.5% 71.2% 72.0% 72.0% 71.5% 71.7%