Please wait

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of

1934

Filed

by

the Registrant x

Filed

by

a Party other than the Registrant o

Check

the

appropriate box:

| o |

Preliminary

Proxy Statement

|

| o |

Confidential,

for Use of the Commission only (as permitted by Rule

14a-6(e)(2))

|

| x |

Definitive

Proxy Statement

|

| o |

Definitive

Additional Materials

|

| o |

Soliciting

Material Pursuant to § 240.14a-11(c) or §

240.14a-12

|

(Name

of

Registrant as Specified In Its Charter)

(Name

of

Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box)

| o |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and

0-11.

|

|

|

(1) |

Title

of each class of securities to which transaction

applies:

|

|

|

(2) |

Aggregate

number of securities to which transaction

applies:

|

|

|

(3) |

Per

unit price or other underlying value of transaction computed pursuant

to

Exchange Act Rule 0-11 (Set forth the amount on which the filing

fee is

calculated and state how it was

determined):

|

|

|

(4) |

Proposed

maximum aggregate value of

transaction:

|

| o |

Fee

paid previously with preliminary

materials.

|

| o |

Check

box if any part of the fee is offset as provided by Exchange

Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee

was paid

previously. Identify the previous filing by registration statement

number,

or the Form or Schedule and the date of its

filing.

|

|

|

(6) |

Amount

Previously Paid:

|

|

|

(7) |

Form,

Schedule or Registration Statement

No.:

|

E.DIGITAL

CORPORATION

13114

Evening Creek Drive South, San Diego, California 92128

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

To

be Held August 4, 2005

TO

THE STOCKHOLDERS OF

E.DIGITAL

CORPORATION

Notice

is

hereby given that the Annual Meeting of Stockholders (the “Annual Meeting”) of

e.Digital Corporation, a Delaware corporation (the “Company”), will be held at

the offices of the Company, located at 13114 Evening Creek Drive South, San

Diego, California 92128, on August 4, 2005, beginning at 2:00 p.m. local time.

The Annual Meeting will be held for the following purposes:

1. To

elect

directors of the Company to serve as directors until the annual meeting of

stockholders to be held in 2006, and until such directors’ successor has been

duly elected and qualified or until such directors have otherwise ceased to

serve as directors.

2. To

approve an amendment to the Company's Certificate of Incorporation to increase

the number of shares of common stock, $.001 par value, that the Company is

authorized to issue from 200,000,000 to 300,000,000.

3. To

approve the 2005 Equity-Based Compensation Plan.

4. To

ratify

the appointment of Singer Lewak Greenbaum & Goldstein, LLP as independent

accountants for the Company for the fiscal year ending March 31,

2006.

5. To

transact such other business as may properly come before the meeting or any

postponements or adjournments thereof.

The

Board

of Directors has fixed June 6, 2005 as the record date for the determination

of

stockholders entitled to notice of and to vote at the Annual Meeting and any

postponements or adjournments thereof, and only stockholders of record at the

close of business on that date are entitled to such notice and to vote at the

Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting

will be available at the offices of the Company for ten (10) days prior to

the

Annual Meeting.

We

hope

that you will use this opportunity to take an active part in the affairs of

the

Company by voting on the business to come before the Annual Meeting either

by

executing and returning the enclosed Proxy Card or by casting your vote in

person at the Annual Meeting.

STOCKHOLDERS

UNABLE TO ATTEND THE ANNUAL MEETING IN PERSON ARE REQUESTED TO DATE AND SIGN

THE

ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE. A STAMPED ENVELOPE IS ENCLOSED

FOR

YOUR CONVENIENCE. IF A STOCKHOLDER RECEIVES MORE THAN ONE PROXY CARD BECAUSE

HE

OR SHE OWNS SHARES REGISTERED IN DIFFERENT NAMES OR ADDRESSES, EACH PROXY CARD

SHOULD BE COMPLETED AND RETURNED.

| |

|

By Order of the Board of

Directors |

| |

|

|

| |

|

/s/ ATUL ANANDPURA |

| |

|

ATUL

ANANDPURA |

| |

|

President

and Chief Executive Officer

|

| |

|

|

| San Diego, California |

|

Telephone - (858)

679-1504 |

| July 12, 2005 |

|

Facsimile - (858)

486-3922 |

| |

|

|

e.Digital

Corporation

This

Proxy is solicited on behalf of the Board of Directors

2005

ANNUAL MEETING OF STOCKHOLDERS

To

Be Held August 4, 2005

The

undersigned stockholder of e.Digital Corporation, a Delaware corporation, hereby

acknowledges receipt of the Notice of Annual Meeting of Stockholders and Proxy

Statement, each dated July 12, 2005, and hereby appoints Atul Anandpura and

Robert Putnam, and each of them, proxies and attorneys-in-fact, with full power

to each of substitution, on behalf and in the name of the undersigned, to

represent the undersigned at the 2005 Annual Meeting of Stockholders of

e.Digital Corporation, to be held on Tuesday, August 4, 2005, at 2:00 p.m.,

local time, at the

offices of the Company, located at 13114 Evening Creek Drive South, San Diego,

California 92128,

and at

any adjournment thereof, and to vote all shares of Common Stock which the

undersigned would be entitled to vote if then and there personally present,

on

the matters set forth below:

| 1. |

ELECTION

OF DIRECTORS:

___ FOR

all nominees listed below ___ WITHHOLD

AUTHORITY

to

vote

|

(except as indicated)

for all nominees listed below

If

you

wish to withhold authority to vote for any individual nominee, strike a line

through that nominee’s name in the following list:

Atul

Anandpura, Robert Putnam, Allen Cocumelli, Renee Warden and Alex

Diaz.

| 2. |

PROPOSAL

TO APPROVE AN AMENDMENT TO THE COMPANY'S CERTIFICATE OF INCORPORATION

TO

INCREASE THE NUMBER OF SHARES OF COMMON STOCK, $.001 PAR VALUE, THAT

THE

COMPANY IS AUTHORIZED TO ISSUE FROM 200,000,000 TO

300,000,000:

|

|

___

FOR

|

__

AGAINST

|

__

ABSTAIN

|

and,

in

their discretion, upon such other matter or matters that may properly come

before the meeting or any adjournment thereof.

| 3. |

PROPOSAL

TO APPROVE THE 2005 EQUITY-BASED COMPENSATION

PLAN:

|

|

___

FOR

|

__

AGAINST

|

__

ABSTAIN

|

and,

in

their discretion, upon such other matter or matters that may properly come

before the meeting or any adjournment thereof.

| 4. |

PROPOSAL

TO RATIFY THE APPOINTMENT OF SINGER LEWAK GREENBAUM & GOLDSTEIN LLP,

AS THE INDEPENDENT AUDITORS OF THE COMPANY FOR THE FISCAL YEAR ENDING

MARCH 31, 2006:

|

|

___

FOR

|

__

AGAINST

|

__

ABSTAIN

|

and,

in

their discretion, upon such other matter or matters that may properly come

before the meeting or any adjournment thereof.

(Continued

on reverse side)

THIS

PROXY WILL BE VOTED AS DIRECTED OR, IF NO CONTRARY DIRECTION AND NO ABSTENTION

IS INDICATED, WILL BE VOTED FOR THE ELECTION OF DIRECTORS, FOR THE AMENDMENT

TO THE COMPANY'S CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF SHARES

OF COMMON STOCK THAT THE COMPANY IS AUTHORIZED TO ISSUE FROM 200,000,000 TO

300,000,000, FOR THE 2005 EQUITY-BASED COMPENSATION PLAN

AND FOR

THE RATIFICATION OF THE APPOINTMENT OF SINGER LEWAK GREENBAUM & GOLDSTEIN

LLP, AS INDEPENDENT AUDITORS, AND AS SAID PROXIES DEEM ADVISABLE ON SUCH OTHER

MATTERS AS MAY PROPERLY COME BEFORE THE MEETING. THE TELEPHONE NUMBER OF THE

COMPANY IS (858) 679-1504 AND ITS FACSIMILE NUMBER IS (858)

486-3922.

| |

|

DATED:___________________,

2005 |

| |

|

|

| |

|

|

| |

|

Signature

|

| |

|

|

| |

|

|

| |

|

Signature

|

| |

|

|

| |

|

(This

Proxy should be marked, dated and signed by the stockholder(s) exactly

as

his or her name appears hereon, and returned promptly in the enclosed

envelope. Persons signing in a fiduciary capacity should so indicate.

If

shares are held by joint tenants or as community property, both should

sign).

|

| |

|

|

| |

|

o

I

PLAN TO ATTEND THE MEETING |

Even

if

you plan to join us at the meeting,

Please.

.

.

Sign,

date, and return your proxy in the enclosed,

postage paid

envelope.

Thank

You

e.Digital

Corporation

13114

Evening Creek Drive South

San

Diego, California 92128

ANNUAL

MEETING OF STOCKHOLDERS

To

Be Held August 4, 2005

PROXY

STATEMENT

This

Proxy Statement is furnished in connection with the solicitation of proxies

by

the Board of Directors of e.Digital Corporation, a Delaware corporation (the

“Company”), for use at the Annual Meeting of Stockholders (the “Annual Meeting”)

to be held at 2:00 p.m., local time, on August 4, 2005, and any postponements

or

adjournments thereof for the purposes set forth in the accompanying Notice

of

Annual Meeting. The telephone number of the Company is (858) 679-1504 and its

facsimile number is (858) 486-3922. This Proxy Statement and the accompanying

form of proxy were first mailed to stockholders on or about July 12,

2005.

RECORD

DATE AND VOTING

June

6,

2005 has been fixed as the record date (the “Record Date”) for the determination

of stockholders entitled to notice of and to vote at the Annual Meeting, and

any

postponements or adjournments thereof. As of June 6, 2005, there were

175,260,876 shares of the Company’s common stock, $.001 par value per share (the

“Common Stock”), 110,000 shares of Series D preferred stock (the “Series D

Preferred Stock”) and 4,330 shares of Series EE preferred stock (the “Series EE

Preferred Stock”) issued and outstanding. A majority of the shares entitled to

vote, present in person or represented by proxy, will constitute a quorum at

the

meeting.

Except

as

provided below, on all matters to be voted upon at the Annual Meeting, each

holder of record of Common Stock on the Record Date will be entitled to one

vote

for each share held, and each holder of Series D Preferred Stock on the Record

Date will be entitle to fifty votes for each share held, or an aggregate of

5,500,000 votes for the Series D Preferred Stock. The shares of Series EE

Preferred Stock issued and outstanding have no voting rights. With respect

to

all matters other then the election of directors and the proposed amendment

to

the Company’s Certificate of Incorporation, the affirmative vote of a majority

of the shares present in person or represented by proxy at the meeting and

entitled to vote on the subject matter will be the act of the stockholders.

Directors will be elected by a plurality of the votes of the shares present

in

person or represented by proxy and entitled to vote on the election of

directors. The matter of the proposed amendment to the Company’s Certificate of

Incorporation, requires the affirmative vote of a majority of the outstanding

shares of Common Stock on the record date. Abstentions will be treated as the

equivalent of a negative vote for the purpose of determining whether a proposal

has been adopted and will have no effect for the purpose of determining whether

a director has been elected. Unless otherwise instructed, proxies solicited

by

the Company will be voted “FOR” the nominees named herein for election as

directors, “FOR” the approval of an amendment to the Company’s Certificate of

Incorporation to increase the number of shares of Common Stock, $.001 par value,

that the Company is authorized to issue from 200,000,000 to 300,000,000, “FOR”

the approval of the 2005 Equity-Based Compensation Plan and “FOR” the

ratification of the selection of Singer Lewak Greenbaum & Goldstein LLP to

provide audit services to the Company for the fiscal year ending March 31,

2006.

New

York

Stock Exchange Rules (“NYSE Rules”) generally require that when shares are

registered in street or nominee name, its member brokers must receive specific

instructions from the beneficial owners in order to vote on certain proposals.

However, the NYSE Rules do not require specific instructions in order for a

broker to vote on the election of directors. If a member broker indicates on

the

proxy that such broker does not have discretionary authority as to certain

shares to vote on any proposal that does require specific instructions, those

shares will not be considered as present and entitled to vote with respect

to

that matter. Pursuant to Delaware law, a broker non-vote will not be treated

as

present or voting in person or by proxy on the proposal. A broker non-vote

will

have no effect for the purpose of determining whether a director has been

elected.

A

stockholder giving a proxy has the power to revoke it at any time before it

is

exercised by giving written notice of revocation to the Secretary of the

Company, by executing a subsequent proxy, or by attending the Annual Meeting

and

voting in person. Subject to any such revocation, all shares represented by

properly executed proxies will be voted in accordance with the specifications

on

the enclosed proxy card.

ELECTION

OF DIRECTORS

(Proposal

One)

The

Company’s bylaws state that the Board of Directors shall consist of not less

than four nor more than seven members. The specific number of Board members

within this range is established by the Board of Directors and is currently

set

at five. A Board of five directors, will be elected at the Annual Meeting.

Unless otherwise instructed, proxy holders will vote the proxies received by

them for the Company’s five nominees named below. In the event that any nominee

of the Company is unable or declines to serve as a director at the time of

the

Annual Meeting, the proxies will be voted for any nominee who shall be

designated by the present Board of Directors to fill the vacancy. In the event

that additional persons are nominated for election as directors, the proxy

holders intend to vote all proxies received by them in such a manner as will

assure the election of as many of the nominees listed below as possible, and,

in

such event, the specific nominees to be voted for will be determined by the

proxy holders. It is not expected that any nominee will be unable or will

decline to serve as a director. The term of office of each person elected as

a

director will continue until the next annual meeting of stockholders and such

time as his or her successor is fully elected and qualified or until his or

her

earlier resignation, removal or death. The nominees have supplied the following

background information to the Company:

|

Name

|

|

Age

|

|

Principal

Occupation

|

|

Director

Since

|

| |

|

|

|

|

|

|

|

Atul

Anandpura

|

|

41

|

|

President

and Chief Executive Officer of the Company

|

|

2004

|

| |

|

|

|

|

|

|

|

Robert

Putnam

|

|

46

|

|

Senior

Vice President since 1993, Interim Chief Accounting Officer and Secretary

since 2005

|

|

1995

|

| |

|

|

|

|

|

|

|

Allen

Cocumelli

|

|

52

|

|

Chief

Operating Officer of Simple Network Communications

Inc. since 1997

|

|

1999

|

| |

|

|

|

|

|

|

|

Alex

Diaz

|

|

40

|

|

Chairman

of the Board of Directors of the Company

since 2002; Executive Vice President of Califormula Radio Group since

1996

|

|

2002

|

| |

|

|

|

|

|

|

|

Renee

Warden

|

|

41

|

|

Corporate

Controller of Kintera, Inc. since 2005;

Former

Chief Accounting Officer and Secretary of the

Company

|

|

N/A

|

| |

|

|

|

|

|

|

Required

Vote and Recommendation

The

election of directors requires the affirmative vote of a plurality of the shares

of Common Stock present or represented by proxy and entitled to vote at the

Annual Meeting. Accordingly, under Delaware law and the Company’s Certificate of

Incorporation and Bylaws, abstentions and broker non-votes will not have any

effect on the election of a particular director. Unless otherwise instructed

or

unless authority to vote is withheld, the enclosed Proxy will be voted for

the

election of the above Nominees.

The

Board of Directors recommends that the stockholders vote “FOR” the election of

the above Nominees.

MANAGEMENT

Set

forth

below is certain information with respect to each of the nominees for the office

of director, each director whose term of office will continue after the Annual

Meeting and each executive officer and key employee of the Company:

|

Name

|

|

Age

|

|

Position

|

| |

|

|

|

|

|

Alex

Diaz

|

|

40

|

|

Chairman

of the Board and Director

|

|

Atul

Anandpura

|

|

41

|

|

President,

Chief Executive Officer and Director

|

|

Robert

Putnam

|

|

46

|

|

Senior

Vice President, Interim Chief Accounting Officer, Secretary and

Director

|

|

Allen

Cocumelli

|

|

52

|

|

Director

|

|

Renee

Warden

|

|

41

|

|

Nominee

|

| |

|

|

|

|

Biographical

Information

Alex

Diaz - Mr.

Diaz

joined the Board in July 2002 and was appointed Chairman in November 2002.

Mr.

Diaz is Executive Vice President of Califormula Radio Group in San Diego, where

he oversees the wide area network (WAN) linking audio, production studios,

and

transmitter sites, all of which he designed. He also established a Web presence

for several of Califormula’s San Diego radio stations, including Jammin’ Z90,

Radio Latina, and classical music station XLNC1. Before joining Califormula,

Mr.

Diaz worked at Radio Computing Services in New York. Mr. Diaz holds bachelor’s

degrees in mathematics and computer science from the University of California

in

San Diego.

Atul

Anandpura

- Mr.

Anandpura joined the company in 1999 as the Vice President of Research and

Development. In July 2004 was appointed President and Chief Executive Officer.

Mr. Anandpura was also appointed a Director of the Company in 2004. From 1996

to

1999 Mr. Anandpura held the position of Managing Director for Maycom Europe

Ltd.

in Surrey U.K. At Maycom, Mr. Anandpura marketed and developed MP3 player,

advanced digital voice recorder with PC Link and various low power wireless

communication devices. Prior to joining Maycom. From 1986 to 1996 Mr. Anandpura

held the positions of Project Manager, Senior Design Engineer for Maxon Systems

Inc., in Surrey U.K. At Maxon Systems, Mr. Anandpura managed and designed the

analog, digital hardware, DSP based products and embedded software for telephone

related products for British Telecom, Matra Communication and other companies.

Mr. Anandpura obtained his Bachelor of Engineering Electronics degree from

M.S.

University in Baroda, India.

Robert

Putnam

- Mr.

Putnam was appointed Senior Vice President in April 1993. He was appointed

a

Director of the Company in 1995. In May 2005, Mr. Putnam assumed the additional

responsibilities of Interim Chief Accounting Officer and Corporate Secretary.

Mr. Putnam served as Secretary of the Company from March 1998 until December

2001. He served as a Director of American Technology Corporation (“ATC”) from

1984 to September 1997 and served as Secretary/Treasurer until February 1994,

President and Chief Executive Officer from February 1994 to September 1997

and

currently serves as Vice President, Investor Relations of ATC. He has also

served, as Secretary/Treasurer of Patriot Scientific (“Patriot”) since 1989 and

from 1989 to March 1998 was a Director of Patriot. Mr. Putnam obtained a B.A.

degree in mass communications/advertising from Brigham Young University in

1983.

Mr. Putnam devotes only part-time services to the company, approximately twenty

hours per week.

Allen

Cocumelli

- Mr.

Cocumelli was appointed to the Board of Directors on August 25, 1999 and served

as Chairman of the Board from April 2000 until November 2002. Mr. Cocumelli

has

been General Counsel of Simple Network Communications Inc. (“Simplenet”) since

1996 and Chief Operating Officer of Simplenet since November 1997. Prior to

joining Simplenet, Mr. Cocumelli was in the private practice of law. From 1978

to 1986 Mr. Cocumelli served as a manager in the Components Manufacturing Group

and as Director of Corporate Training and Development at Intel. Mr. Cocumelli

obtained a B.S. degree in Industrial Psychology from the University of

California, Los Angeles in 1972 and a J.D. from Thomas Jefferson University

in

1991. Mr. Cocumelli is a member of the California Bar Association.

Renee

Warden

- Ms.

Warden has been Corporate Controller for Kintera, Inc. since May 2005. Prior

to

joining Kintera, Inc., Ms. Warden was an executive officer of the Company.

Ms.

Warden joined the Company in 1991 as Accounting Manager. In 1997 Ms. Warden

was

appointed Controller and Corporate Secretary for the Company and in 2003 was

promoted to Chief Accounting Officer and Secretary until May 2005. From 1993

to

2003 Ms. Warden also held the positions of Chief Accounting Officer, Secretary

and Director of Human Resources for ATC. Ms. Warden obtained a B.S. degree

in

business accounting from the University of Phoenix in 1999.

The

terms

of all directors will expire at the next annual meeting of the Company’s

stockholders, or when their successors are elected and qualified. Directors

are

elected each year, and all directors serve one-year terms. Officers serve at

the

pleasure of the Board of Directors. There are no arrangements or understandings

between the Company and any other person pursuant to which he was or is to

be

selected as a director, executive officer or nominee. There are no other persons

whose activities are material or are expected to be material to the Company’s

affairs. For

information concerning beneficial ownership of Common Stock by directors,

nominees and executive officers, see “Security Ownership of Certain Beneficial

Owners and Management” below.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

Common

Stock

The

following security ownership information is set forth, as of June 6, 2005,

with

respect to certain persons or groups known to the Company to be beneficial

owners of more than 5% of the Company’s outstanding Common Stock and with

respect to each director of the Company, each of the executive officers named

in

the Summary Compensation Table currently employed by the Company, and all

current directors, nominees and executive officers as a group (five persons).

Other than as set forth below, the Company is not aware of any other person

who

may be deemed to be a beneficial owner of more than 5% of the Company’s Common

Stock.

|

|

|

Amount

and Nature of

|

|

Percent

|

|

Title

|

|

Name

and Address of Beneficial Owner

|

|

Beneficial

Ownership

|

|

of

Class

|

|

of

Class

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Atul

Anandpura

|

|

|

366,667

|

(1)

|

|

*

|

|

|

Common

|

|

|

13114

Evening Creek Dr. S.

|

|

|

|

|

|

|

|

|

|

|

|

San

Diego, CA 92128

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Robert

Putnam

|

|

|

1,175,000

|

(2)

|

|

*

|

|

|

Common

|

|

|

13114

Evening Creek Dr. S.

|

|

|

|

|

|

|

|

|

|

|

|

San

Diego, CA 92128

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Allen

Cocumelli

|

|

|

351,000

|

(3)

|

|

*

|

|

|

Common

|

|

|

13114

Evening Creek Dr. S.

|

|

|

|

|

|

|

|

|

|

|

|

San

Diego, CA 92128

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Alex

Diaz

|

|

|

585,000

|

(4)

|

|

*

|

|

|

Common

|

|

|

13114

Evening Creek Dr. S.

|

|

|

|

|

|

|

|

|

|

|

|

San

Diego, CA 92128

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Renee

Warden

|

|

|

100,000

|

(5)

|

|

*

|

|

|

Common

|

|

|

13114

Evening Creek Dr. S.

|

|

|

|

|

|

|

|

|

|

|

|

San

Diego, CA 92128

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

All

officers, directors and nominees as

a group (5 persons)

|

|

|

2,577,667

|

(6)

|

|

1.5

|

%

|

|

Common

|

|

| |

|

|

|

|

|

|

|

|

|

|

| (1) |

Includes

options exercisable within 60 days to purchase

366,667 shares.

|

| (2) |

Includes

options exercisable within 60 days to purchase 50,000 shares.

|

| (3) |

Includes

options exercisable within 60 days to purchase 350,000

shares.

|

| (4) |

Includes

options exercisable within 60 days to purchase 225,000 shares.

|

| (5) |

Includes

options exercisable within 60 days to purchase 100,000

shares.

|

| (6) |

Includes

options exercisable within 60 days to purchase 1,091,667 shares.

Excludes

unvested options to purchase 1,166,666

shares.

|

Series

D Preferred Stock

The

following security ownership information is set forth as of June 6, 2005, with

respect to certain persons or groups known to the Company to be beneficial

owners of more than 5% of Series D Preferred Stock.

|

|

|

Amount

and Nature of

|

|

Percent

|

|

|

|

|

Name

and Address of

Beneficial Owner

|

|

Beneficial

Ownership(1)

|

|

of

Class

|

|

of

Class

|

|

| |

|

|

|

|

|

|

|

|

Jerry

E. Polis Family Trust

|

|

|

95,000

|

(2)

|

|

86

|

%

|

|

Series

D

|

|

|

980

American Pacific Dr. Ste. 111

|

|

|

|

|

|

|

|

|

Preferred

Stock

|

|

|

Henderson,

NV 89014

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Palermo

Trust

|

|

|

10,000

|

(3)

|

|

9

|

%

|

|

Series

D

|

|

|

8617

Canyon View Dr.

|

|

|

|

|

|

|

|

|

Preferred

Stock

|

|

|

Las

Vegas, NV 89117

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Represents

number of shares of Series D Preferred Stock, held as of June 6,

2005. At

such date an aggregate of 110,000 shares of Series D Preferred Stock

were

issued and outstanding convertible into an aggregate of 7,505,088

hares of

Common Stock.

|

|

(2)

|

|

Jerry

E. Polis is Trustee and believed by the Company to have sole voting

and

investment power with respect to the Series D Preferred Stock held.

|

|

(3)

|

|

James

A. Barnes is Trustee and believed by the Company to have sole voting

and

investment power with respect to the Series D Preferred Stock

held.

|

| |

|

|

Series

EE Preferred Stock

The

following security ownership information is set forth as of June 6, 2005, with

respect to certain persons or groups known to the Company to be beneficial

owners of more than 5% of Series EE Preferred Stock.

|

|

|

Amount

and Nature of

|

|

Percent

|

|

Title

|

|

Name

and Address of Beneficial Owner

|

|

Beneficial

Ownership(1)

|

|

of

Class

|

|

of

Class

|

|

| |

|

|

|

|

|

|

|

|

Basso

Multi-Strategy Holding

Fund Ltd.

|

|

|

1,950

|

(2)

|

|

45

|

%

|

|

Series

EE

|

|

|

c/o

DKR Capital Partners, LP

|

|

|

|

|

|

|

|

|

Preferred

Stock

|

|

|

1281

East Main St.

|

|

|

|

|

|

|

|

|

|

|

|

Stamford,

CT 06902

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Bristol

Investment

|

|

|

1,830

|

(3)

|

|

42

|

%

|

|

Series

EE

|

|

|

10990

Wilshire Blvd., Ste. 1410

|

|

|

|

|

|

|

|

|

Preferred

Stock

|

|

|

Los

Angeles, California 90024

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Basso

Private Opportunity Holding

Fund Ltd.

|

|

|

550

|

(4)

|

|

13

|

%

|

|

Series

EE

|

|

|

c/o

DKR Capital Partners, LP

|

|

|

|

|

|

|

|

|

Preferred

Stock

|

|

|

1281

East Main St.

|

|

|

|

|

|

|

|

|

|

|

|

Stamford,

CT 06902

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Represents

number of shares of Series EE Preferred Stock, held as of June 6,

2005. At

such date an aggregate of 4,330 shares of Series EE Preferred Stock

were

issued and outstanding convertible into an aggregate of 2,380,232

shares

of Common Stock.

|

|

(2)

|

|

DKR

LP is registered investment advisor with the Securities and Exchange

Commission and as such, is the investment manager to Basso Multi-Strategy

Holding Fund, Ltd. DKR LP has retained Basso to act as the portfolio

manager to the fund. As such DKR LP and Basso have shares dispositive

and

voting power over the securities. Howard Fischer is president of

Basso and

is named as authorized signatory.

|

|

(3)

|

|

Paul

Kessler, as Direct and Manager of Bristol Capital Advisors, LLC the

investment manager to Bristol Investment, Fund, Ltd., and has sole

voting

and investment power with respect to the securities

held.

|

|

(4)

|

|

DKR

LP is registered investment advisor with the Securities and Exchange

Commission and as such, is the investment manager to Basso Multi-Strategy

Holding Fund, Ltd. DKR LP has retained Basso to act as the portfolio

manager to the fund. As such DKR LP and Basso have shares dispositive

and

voting power over the securities. Howard Fischer is president of

Basso and

is named as authorized signatory.

|

Compliance

with Section 16(a) of the Securities Exchange Act of 1934

Section

16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires the

Company’s directors, executive officers and persons who own more than 10% of the

Common Stock to file initial reports of ownership (Forms 3) and reports of

changes in ownership of Common Stock (Forms 4 and Forms 5) with the Securities

and Exchange Commission.

Based

solely on a review of copies of such reports furnished to the Company and

written representation that no other reports were required during the fiscal

year ended March 31, 2005, the Company believes that all persons subject to

the

reporting requirements pursuant to Section 16(a) filed the required reports

on a

timely basis with the Securities and Exchange Commission.

Code

of Business Conduct and Ethics

The

Company has adopted a Code of Conduct that includes a code of ethics that

applies to all of the Company’s employees and directors (including its principal

executive officer and its principal finance and accounting officer). This Code

of Conduct is posted on the Company’s website and is available for review at

www.edigital.com.

We

intend

to disclose any amendments to, or waivers from, our code of business conduct

and

ethics on our website.

Audit

Committee Financial Expert

The

Company has a standing Audit Committee that includes the following two members

of the Board of Directors: Alex Diaz and Robert Putnam. With the recent

resignation of Victor T.

Ramsauer

from the

Board of Directors, the Audit Committee does not currently have an audit

committee financial expert, as defined by Regulation S-K, or an “independent”

director, as defined under the NASDAQ National Stock Market rules and Rule

10A-3

of the Securities Exchange Act of 1934. The Company anticipates that Renee

Warden, upon her election to the Board, will be appointed to the Audit Committee

and be designated as the Audit Committee Financial Expert.

INFORMATION

ABOUT THE BOARD OF DIRECTORS AND

COMMITTEES

OF THE BOARD OF DIRECTORS

The

Board

of Directors met four times during fiscal 2005 and acted by unanimous written

consent four times. During such fiscal year, each Board member attended at

least

100% of the aggregate of the meetings of the Board held during the period for

which he was a director.

The

Company has an Audit Committee and a Compensation Committee.

Audit

Committee. The

Audit

Committee, currently consisting of Messrs. Diaz and Putnam, reviews the audit

and control functions of the Company, the Company’s accounting principles,

policies and practices and financial reporting, the scope of the audit conducted

by the Company’s auditors, the fees and all non-audit services of the

independent auditors and the independent auditors’ opinion and letter of comment

to management and management’s response thereto. The Audit Committee was

designated on June 7, 2000 and held four meetings during the fiscal year ended

March 31, 2005.

Compensation

Committee.

The

Compensation Committee

is

currently comprised of two non-employee Board members, Allen Cocumelli and

Alex

Diaz.

The

Compensation Committee

reviews

and recommends to the Board the salaries, bonuses and prerequisites of the

Company’s executive officers. The Compensation Committee also reviews and

recommends to the Board any new compensation or retirement plans and administers

such plans. The Compensation Committee held one meeting during the fiscal year

ended March 31, 2005.

REPORT

OF THE AUDIT COMMITTEE

Introductory

Note:

The

following report is not deemed to be incorporated by reference by any general

statement incorporating by reference this Proxy Statement into any filing under

the Securities Act of 1933, as amended, or under the Securities Exchange Act

of

1934, as amended, except to the extent that the Company specifically

incorporates this information by reference, and shall not otherwise be deemed

soliciting material or filed under such Acts.

The

Audit

Committee is comprised solely of independent directors, as defined in the

Marketplace Rules of The NASDAQ Stock Market, and operates under a written

charter adopted by the Board of Directors on June 7, 2000. The Audit Committee

oversees the Company’s financial reporting process on behalf of the Board of

Directors. The Company’s management has primary responsibility for the financial

statements and the reporting process including the systems of internal controls.

In fulfilling its oversight responsibilities, the Audit Committee reviewed

the

audited financial statements in the Annual Report with management including

a

discussion of the quality, not just the acceptability, of the accounting

principles, the reasonableness of significant judgments, and the clarity of

the

disclosures in the financial statements. The Audit Committee currently consists

of two members and holds one position vacant.

The

Audit

Committee reviewed with Singer Lewak Greenbaum & Goldstein LLP, the

Company’s independent auditors for the fiscal year ended March 31, 2005, who are

responsible for expressing an opinion on the conformity of those audited

financial statements with generally accepted accounting principles, their

judgments as to the quality, not just the acceptability, of the Company’s

accounting principles and such other matters as are required to be discussed

with the Audit Committee under Statement on Auditing Standards No. 61,

“Communications with Audit Committees.” In addition, the Audit Committee has

discussed with the independent auditors the auditors’ independence from

management and the Company including the matters in the written disclosures

which were required by the Independence Standards Board. The Audit Committee

also reviewed the independence letter from Singer Lewak Greenbaum &

Goldstein LLP required by Independence Standard Board Standard No. 1,

“Independence Discussions with Audit Committees.”

The

Audit

Committee discussed with the Company’s independent auditors the overall scope

and plans for their respective audits. The Audit Committee meets with the

internal and independent auditors, with and without management present, to

discuss the results of their examinations, their evaluations of the Company’s

internal controls, and the overall quality of the Company’s financial reporting.

In

reliance on the reviews and discussions referred to above, the Audit Committee

recommended to the Board of Directors (and the Board has approved) that the

audited financial statements be included in the Annual Report on Form 10-K

for

the fiscal year ended March 31, 2005 for filing with the Securities and Exchange

Commission. The Audit Committee and the Board have also recommended, subject

to

shareholder approval, the selection of Singer Lewak Greenbaum & Goldstein

LLP as the Company’s independent auditors for the fiscal year ended March 31,

2006.

By:

The

Audit Committee of the Board of Directors:

Date:

July 12, 2005

Alex

Diaz

Robert

Putnam

REPORT

OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

Introductory

Note:

The

following report is not deemed to be incorporated by reference by any general

statement incorporating by reference this Proxy Statement into any filing under

the Securities Act of 1933, as amended, or under the Securities Exchange Act

of

1934, as amended, except to the extent that the Company specifically

incorporates this information by reference, and shall not otherwise be deemed

soliciting material or filed under such Acts.

The

primary philosophy of the Compensation Committee regarding compensation is

to

offer packages which reward each of the members of senior management

proportionately to each person’s individual performances and to the Company’s

overall financial performance and growth during the previous year.

The

Board

measured individual and team performance on the basis of both quantitative

and

qualitative factors. The Board believes that the components of executive

compensation should include base salary, annual and long-term incentive

compensation, stock option grants and other benefits summarized

below.

Executive

Compensation

Base

Salary. Base

salaries are intended to be competitive with market rates and are based on

an

internal evaluation of the responsibilities of each position. Salaries for

executive officers are reviewed on an annual basis.

The

Committee’s compensation policies are particularly designed to align executive

officer and senior management salaries and bonus compensation to the

individual’s performance in the short-term and to emphasize compensation from

equity, primarily employee stock options, for long-term incentives.

Long-term

incentives.

The

Company’s long-term incentive program consists of a stock option program

pursuant to which the Chief Executive Officer and other executive officers

(as

well as other key employees) are periodically granted stock options at the

then

fair market value (or higher prices) of the Company’s Common Stock. These option

programs are designed to provide such persons with significant compensation

based on overall Company performance as reflected in the stock price, to create

a valuable retention device through standard three to five year vesting

schedules and to help align employees’ and shareholders’ interests. Stock

options are typically granted at the time of hire to key new employees, at

the

time of promotion to certain employees and periodically to a broad group of

existing key employees and executive officers.

CEO

Compensation. During

fiscal 2005, the Committee approved for Mr. Anandpura an annual base salary

of

$162,612,

a level

the Committee feels is at the lower range of base salaries for Chief Executive

Officers at similarly situated companies. Although the Committee attempts to

align the Chief Executive Officer’s salary with performance, it chose to limit

salary increases during fiscal 2005 as part of a general company-wide effort

to

reduce overhead. Mr. Anandpura did not receive a bonus for fiscal 2005 for

similar reasons. Mr. Anandpura is currently an employee at will.

Compliance

with Internal Revenue Code Section 162(m). Section

162(m) of the Internal Revenue Code disallows a tax deduction to publicly-held

companies for compensation paid to certain executive officers, to the extent

that compensation exceeds $1 million per officer in any year. The limitation

applies only to compensation which is not considered to be performance-based,

either because it is not tied to the attainment of performance milestones or

because it is not paid pursuant to a stockholder-approved plan. The

non-performance based compensation paid to the Company’s executive officers for

the 2005 fiscal year did not exceed the $1 million limit per officer. It is

not

expected that the compensation to be paid to the Company’s executive officers

for the 2006 fiscal year will exceed that limit. The Company’s 1994 Stock Option

Plan is structured so that any compensation deemed paid to an executive officer

in connection with the exercise of his or her outstanding options under the

1994

Plan with an exercise price per share equal to the fair market value per share

of the Common Stock on the grant date will qualify as performance-based

compensation which will not be subject to the $1 million limitation. Because

it

is unlikely that the cash compensation payable to any of the Company’s executive

officers in the foreseeable future will approach the $1 million limit. The

Committee’s present intention is to comply with the requirements of Section

162(m) unless and until the Committee determines that compliance would not

be in

the best interest of the Company and its shareowners.

By:

The

Compensation Committee of the Board of Directors:

Date:

July 12, 2005

Allen

Cocumelli

Alex

Diaz

COMPENSATION

COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The

Compensation Committee of the Company’s Board of Directors was formed in June

2000 and is currently comprised of Directors, Allen Cocumelli and Alex

Diaz.

None of

these individuals was at any time during the fiscal year 2005, or at any time,

an employee or officer of the Company. No executive officer of the Company

serves as a member of the board of directors or compensation committee of any

other entity that has one or more executive officers serving as a member of

the

Company’s Board of Directors or Compensation Committee.

Director

Compensation

Stock

Options

-

Directors have received in the past and may receive in the future stock options

pursuant to the Company’s stock option plans.

Standard

Compensation

- The

Company has no other arrangements to pay any direct or indirect remuneration

to

any directors of the Company in their capacity as directors other than in the

form of reimbursement of expenses for attending directors’ or committee

meetings.

COMPENSATION

OF EXECUTIVE OFFICERS

The

following table sets forth for the years ended March 31, 2005, 2004 and 2003,

the cash compensation of Mr. Atul Anandpura,, current President and Chief

Executive Officer and Mr. Alfred H. Falk, former President and Chief Executive

Officer (collectively, the “Named Executive Officers”). No other persons served

as Executive Officer of the Company during the fiscal year ended March 31,

2005

and received total compensation in excess of $100,000.

Summary

Compensation Table

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Annual

|

|

Compensation

|

|

Long

Term Compensation

Options

|

|

All

Other

|

|

|

Name

and Principal Position

|

|

Fiscal

Year

|

|

Salary

|

|

Bonus

|

|

Other(1)

|

|

(#

of Shares)

|

|

Compensation

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Atul

Anandpura, President and

Chief

Executive Officer

|

|

|

2005

2004

2003

|

|

$

$

$

|

162,612

141,750

141,750

|

|

$

$

$

|

-0-

-0-

-0-

|

|

$

$

$

|

-0-

-0-

-0-

|

|

|

1,000,000

350,000

135,000

|

|

|

-0-

-0-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alfred

H. Falk, President and

Chief

Executive Officer(2)

|

|

|

2005

2004

2003

|

|

$

$

$

|

155,000

155,000

154,974

|

|

$

$

$

|

-0-

-0-

35,000

|

|

$

$

$

|

2,215

9,600

9,600

|

|

|

400,000

400,000

-0-

|

|

|

-0-

-0-

-0-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (2) |

Mr.

Falk resigned as President and Chief Executive Officer and as a director

effective July 1, 2004. Mr. Falk continues to be employed by the

Company

as Vice President of Business

Development.

|

Option

Grants

Shown

below is further information on grants of stock options to the Named Executive

Officers reflected in the Summary Compensation Table shown above.

Option

Grants for Fiscal Year Ended March 31, 2005

| |

|

Number

of Securities

Underlying

Options

|

|

Percent

of

Total

Options Granted to

Employees

in

Fiscal

|

|

|

|

Expiration

|

|

Potential

Realizable Value at Assumed Annual Rates of Stock

Appreciation

|

|

| Name |

|

Granted

|

|

Year

|

|

Exercise

Price

|

|

Date

|

|

5%/$

|

|

10%/$

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alfred

H. Falk(1)

|

|

|

400,000

|

(2)

|

|

11.8

|

%

|

$

|

0.23

|

|

|

7/1/2009

|

|

|

25,418

|

|

|

56,167

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Atul

Anandpura

(2)

|

|

|

1,000,000

|

(3)

|

|

29.6

|

%

|

$

|

0.23

|

|

|

7/1/2009

|

|

|

63,545

|

|

|

140,417

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Mr.

Falk resigned as President and Chief Executive Officer and as a director

effective July 1, 2004. Mr. Falk continues to be employed by the

Company

as Vice President of Business

Development.

|

| (2) |

These

options vested at time of grant.

|

| (3) |

These

options vest 25% annually commencing on July 1,

2005.

|

Aggregated

Option Exercises and Fiscal Year-end Values

The

following table provides information on exercised and unexercised options of

the

Named Executive Officers at March 31, 2005:

Fiscal

Year-End Option Values

| |

|

Number

of Shares Acquired

on

|

|

|

|

Number

of Unexercised

Options

At

March

31, 2005

|

|

Value

of Unexercised

In-the-Money

Options At

March

31, 2005(1)

|

|

|

Name

|

|

Exercise

|

|

Value

Realized

|

|

Exercisable

|

|

Unexercisable

|

|

Exercisable

|

|

Unexercisable

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alfred

H. Falk

|

|

|

400,000

|

|

$

|

-0-

|

|

|

400,000

|

|

|

-0-

|

|

|

-0-

|

|

|

-0-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Atul

Anandpura

|

|

|

1,000,000

|

|

$

|

-0-

|

|

|

-0-

|

|

|

1,000,000

|

|

|

-0-

|

|

|

-0-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Based

on the last sale price at the close of business on March 31,

2005 of

$0.19.

|

The

Company has not awarded stock appreciation rights to any employee of the Company

and has no long-term incentive plans, as that term is defined in Securities

and

Exchange Commission regulations. The Company has no defined benefit or actuarial

plans covering any person.

Securities

Authorized for Issuance under Equity Compensation Plans

The

following table sets forth information as of March 31, 2005, with respect to

compensation plans (including individual compensation arrangements) under which

equity securities of the Company are authorized for issuance, aggregated as

follows:

Equity

Compensation Plan Information

|

Plan

Category

|

|

Number of securities to be

issued

upon exercise of

outstanding

options,

warrants

and rights

(a)

|

|

Weighted-average exercise

price

of outstanding options,

warrants and rights

(b)

|

|

Number of securities

remaining available for

future

issuance under

equity compensation plans

(excluding

securities reflected

in column (a))

(c)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Equity

compensation plans approved by security holders

|

|

|

14,000,000

|

|

$

|

0.7933

|

|

|

-0-

|

|

|

Equity

compensation plans not approved by security holders

|

|

|

N/A

|

|

|

N/A

|

|

|

N/A

|

|

|

Total

|

|

|

14,000,000

|

|

|

|

|

|

-0-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employment

Agreements

All

employees of the Company, including executive officers, are employees

at-will.

CERTAIN

TRANSACTIONS

Conflicts

of Interest.

Certain

conflicts of interest now exist and will continue to exist between the Company

and its officers and directors due to the fact that they have other employment

or business interests to which they devote some attention and they are expected

to continue to do so. The Company has not established policies or procedures

for

the resolution of current or potential conflicts of interest between the Company

and its management or management-affiliated entities. There can be no assurance

that members of management will resolve all conflicts of interest in the

Company’s favor. The officers and directors are accountable to the Company as

fiduciaries, which means that they are legally obligated to exercise good faith

and integrity in handling the Company’s affairs. Failure by them to conduct the

Company’s business in its best interests may result in liability to

them.

Officer

and director Robert Putnam also acts as Vice President, Investor Relations

of

ATC. The possibility exists that these other relationships could affect Mr.

Putnam’s independence as a director and/or officer of the Company. Mr. Putnam is

obligated to perform his duties in good faith and to act in the best interest

of

the Company and its stockholders, and any failure on his part to do so may

constitute a breach of his fiduciary duties and expose such person to damages

and other liability under applicable law. While the directors and officers

are

excluded from liability for certain actions, there is no assurance that Mr.

Putnam would be excluded from liability or indemnified if he breached his

loyalty to the Company.

Transactions

with Management.

None.

APPROVAL

OF AMENDMENT TO THE COMPANY’S

CERTIFICATE

OF INCORPORATION TO INCREASE

THE

TOTAL AUTHORIZED SHARES OF COMMON STOCK

(Proposal

Two)

General

On

February 4, 2005, the Board of Directors of the Company adopted, subject

to

stockholder approval, an amendment to the Company’s Certificate of Incorporation

(the “Certificate”) to increase the total authorized shares of Common Stock of

the Company from 200 million to 300 million. Such increase in the number of

authorized shares of Common Stock of the Company would be effected by restating

the first paragraph of current Article Fourth of the Certificate to

read as

follows:

“FOURTH:

The aggregate number of shares which the Corporation shall have authority to

issue is Three Hundred Five Million (305,000,000), divided into Three Hundred

Million (300,000,000) shares of Common Stock of the par value of $.001 per

share, and Five Million (5,000,000) shares of preferred stock of the par value

of $.001 per share.”

The

additional shares of Common Stock for which authorization is sought herein

would

be part of the existing class of Common Stock and, if and when issued, would

have the same rights and privileges as the shares of Common Stock presently

outstanding. Holders of Common Stock have no preemptive or other subscription

rights.

As

of

June 6, 2005, 175,260,876 shares of Common Stock were issued and outstanding,

6,406,665 shares were reserved for issuance pursuant to outstanding options

under the Company’s 1994 Stock Option Plan, 9,885,320 were reserved for issuance

upon conversion of the Series D and Series EE Preferred Stock and 7,084,855

shares were reserved for issuance upon exercise of outstanding warrants.

Therefore, of the 200,000,000 shares of Common Stock currently authorized by

the

Certificate, only 1,362,284 shares are presently available for general corporate

purposes. Assuming Proposal Two is approved by the stockholders, a total of

198,637,716 shares of Common Stock will be outstanding or reserved for issuance

upon exercise or conversion of outstanding preferred stock, options and

warrants, and 101,362,284 shares will be available for general corporate

purposes.

Purposes

and Effects of the Authorized Shares Amendment

The

increase in authorized shares of Common Stock is recommended by the Board of

Directors in order to provide a sufficient reserve of such shares for the

present and future needs and growth of the Company. Prior increases in the

authorized shares have primarily been used for equity financing transactions

and

for stock options and warrants. The Board of Directors believes that the number

of authorized shares currently available for issuance will not be sufficient

to

enable us to respond to potential business opportunities and to pursue important

objectives that may be anticipated. Accordingly, the Board believes that it

is

in the best interests of the Company and its stockholders to increase the number

of authorized shares of Common Stock, and the total authorized shares of capital

stock, as described above.

Other

than as described in the other proposals in this Proxy Statement, the Board

has

no current plans to issue Common Stock. However, the Board believes that the

availability of such shares will provide the Company with the flexibility to

issue Common Stock for proper corporate purposes that may be identified by

the

Board from time to time, such as financings, acquisitions or strategic business

relationships. Further, the Board believes the availability of additional shares

of Common Stock will enable the Company to attract and retain talented employees

through the grant of stock options and other stock-based incentives. The

issuance of additional shares of Common Stock may have a dilutive effect on

earnings per share and, for a person who does not purchase additional shares

to

maintain his or her pro rata interest, on a stockholder’s percentage voting

power.

Proposal

At

the

Annual Meeting, stockholders will be asked to approve the amendment of the

Certificate of Incorporation to increase the total authorized shares of Common

Stock of the Company from 200 million shares to 300 million shares. Such

approval will require the affirmative

vote of a majority of the outstanding shares of Common Stock on the record

date.

As a

result, abstentions and broker non-votes will have the same effect as negative

votes.

The

Board of Directors recommends a vote “FOR” the Proposal.

APPROVAL

OF 2005 EQUITY-BASED-COMPENSATION PLAN

(Proposal

Three)

The

Company’s stockholders are being asked to approve the. 2005 Equity-Based

Compensation Plan (the “Plan”). The

purpose of the Plan is to provide a means through which the Company may attract

and retain able persons as employees, directors and consultants of the Company

and to provide a means whereby those persons upon whom the responsibilities

of

the successful administration and management of the Company rest, and whose

present and potential contributions to the welfare of the Company are of

importance, can acquire and maintain stock ownership, or awards the value of

which is tied to the performance of the Company’s stock, thereby strengthening

their concern for the welfare of the Company and their desire to remain in

its

employ. A further purpose of this Plan is to provide such employees and

directors with additional incentive and reward opportunities designed to enhance

the profitable growth of the Company. Accordingly, this Plan primarily provides

for granting Incentive Stock Options, options which do not constitute Incentive

Stock Options, Restricted Stock Awards, Stock Appreciation Rights or any

combination of the foregoing

The

Compensation Committee of the Board of Directors and the full Board of Directors

unanimously adopted the Plan, subject to stockholder approval at the Annual

Meeting.

A

summary

of the principal features of the Plan is attached hereto as Exhibit A. The

complete Plan is attached hereto as Exhibit B.

Proposal

At

the

Annual Meeting, stockholders will be asked to approve the 2005 Equity-Based

Compensation Plan. Such approval will require

the

affirmative

vote of a majority of the shares present in person or represented by proxy

at

the meeting and entitled to vote thereon.

The

Board of Directors recommends a vote “FOR” the Proposal.

INDEPENDENT

AUDITORS

(Proposal

Four)

The

Audit

Committee has recommended, and the Board has approved, the selection of Singer

Lewak Greenbaum & Goldstein LLP to provide audit services to the Company for

the fiscal year ending March 31, 2006, and is asking the stockholders to ratify

this appointment. The affirmative vote of a majority of the shares represented

and voting at the Annual Meeting is being sought to ratify the selection of

Singer Lewak Greenbaum & Goldstein LLP. Representatives of Singer Lewak

Greenbaum & Goldstein LLP, expected to be present at the Annual Meeting,

will have an opportunity to make a statement if they desire to do so and will

be

available to respond to appropriate questions.

FEES

PAID TO INDEPENDENT AUDITORS

The

following table describes fees for professional audit services rendered by

Singer Lewak Greenbaum & Goldstein LLP, our principal accountant, for the

audit of our annual financial statements for the years ended March 31, 2004

and

March 31, 2003 and fees billed for other services rendered by Singer Lewak

Greenbaum & Goldstein LLP during those periods. These amounts include fees

paid to Singer Lewak Greenbaum & Goldstein LLP.

|

Type

of Fee

|

|

2005

|

|

2004

|

|

|

Audit

Fees (1)

|

|

$

|

90,507

|

|

$

|

74,417

|

|

|

Audit

Related Fees (2)

|

|

|

17,695

|

|

|

10,564

|

|

|

Tax

Fees (3)

|

|

|

--

|

|

|

--

|

|

|

All

Other Fees (4)

|

|

|

--

|

|

|

--

|

|

|

Total

|

|

$

|

108,202

|

|

$

|

84,918

|

|

| 1. |

Audit

Fees include the aggregate fees paid by us during the fiscal

year

indicated for professional services rendered by Singer Lewak

Greenbaum

& Goldstein LLP for the audit of our annual financial statements

and

review of financial statements included in our Forms 10-Q.

|

| 2. |

Audit

Related Fees include the aggregate fees paid by us during the fiscal

year

indicated for assurance and related services by Singer Lewak Greenbaum

& Goldstein LLP that are reasonably related to the performance of

the

audit or review of our financial statements and not included in

Audit

Fees. Also included in Audit Related Fees are fees for accounting

advice.

|

| 3. |

Tax

Fees include the aggregate fees paid by us during the fiscal year

for

services provided by Singer Lewak Greenbaum & Goldstein LLP with

respect to tax compliance, tax advice and tax

planning.

|

| 4. |

All

Other Fees include the aggregate fees paid by us during the fiscal

year

indicated for products and services provided by Singer Lewak Greenbaum

& Goldstein LLP, other than the services reported above.

|

Audit

Committee Pre-Approval Policies and Procedures

The

Audit

Committee on an annual basis reviews audit and non-audit services performed

by

the independent auditor. All audit and non-audit services are pre-approved

by

the Audit Committee, which considers, among other things, the possible effect

of

the performance of such services on the auditors' independence. The Audit

Committee has considered the role of Singer Lewak Greenbaum & Goldstein LLP

in providing services to us for the fiscal year ended March 31, 2005 and has

concluded that such services are compatible with their independence as our

company's auditors. The Audit Committee has established its pre-approval

policies and procedures, pursuant to which the Audit Committee approved the

foregoing audit services provided by Singer Lewak Greenbaum & Goldstein LLP

in fiscal year 2005.

DATE

FOR SUBMISSION OF STOCKHOLDER PROPOSALS FOR

2006

ANNUAL MEETING

Any

proposal relating to a proper subject which an eligible stockholder may intend

to present for action at the Company’s 2005 Annual Meeting of Stockholders and

which such stockholder may wish to have included in the proxy material for

such

meeting in accordance with the provisions of Rule 14a-8 promulgated under the

Exchange Act must be received as far in advance of the meeting as possible

in

proper form by the Secretary of the Company at 13114 Evening Creek Drive South,

San Diego, California 92128 and in any event not later than March 14, 2006.

It

is suggested that any such proposal be submitted by certified mail, return

receipt requested.

COMPANY

STOCK PRICE PERFORMANCE

Introductory

Note:

The

stock price performance graph below is required by the SEC and will not deemed

to be incorporated by reference by any general statement incorporating by

reference this Proxy Statement into any filing under the Securities Act of

1933,

as amended, or under the Securities Exchange Act of 1934, as amended, except

to

the extent that the Company specifically incorporates this information by

reference, and shall not otherwise be deemed soliciting material or filed under

such Acts.

The

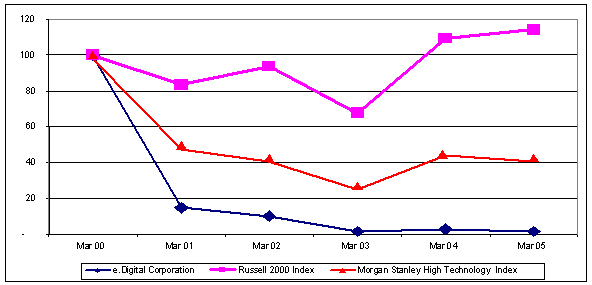

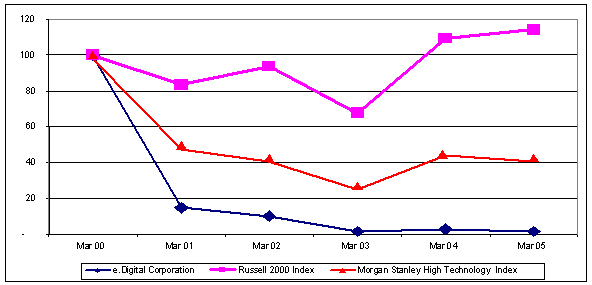

following graph compares the five-year cumulative total return on the Company’s

Common Stock to the total returns of 1)Russell 2000 Index and 2)Morgan Stanley

High Technology Index. This comparison assumes in each case that $100 was

invested on March 31, 1999 and all dividends were reinvested. The company’s

fiscal year ends on March 31. The past performance of the company’s common stock

is no indication of future performance.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Mar

00

|

|

Mar

01

|

|

Mar

02

|

|

Mar

03

|

|

Mar

04

|

|

Mar

05

|

|

|

e.Digital

Corporation

|

|

|

100

|

|

|

15

|

|

|

10

|

|

|

2

|

|

|

3

|

|

|

2

|

|

|

Russell

2000 Index

|

|

|

100

|

|

|

84

|

|

|

94

|

|

|

68

|

|

|