Acquisition of Clyde Industries October 9, 2025

Forward-Looking Statements The following constitutes a “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements that involve a number of risks and uncertainties, including forward-looking statements about the financial and operating performance of Clyde Industries, the benefits of the acquisition of Clyde Industries (the "Acquisition"), and the expected future business and financial performance of Clyde Industries and Kadant. These forward-looking statements represent our expectations as of the date of this presentation. We undertake no obligation to publicly update any forward- looking statement, whether as a result of new information, future events, or otherwise. These forward-looking statements are subject to known and unknown risks and uncertainties that may cause our actual results to differ materially from these forward-looking statements as a result of various important factors, including those set forth under the heading "Risk Factors" in Kadant’s Annual Report on Form 10-K for the fiscal year ended December 28, 2024 and subsequent filings with the Securities and Exchange Commission. These include risks and uncertainties relating to Kadant’s ability to successfully integrate Clyde Industries and its operations and employees and realize anticipated benefits from the Acquisition; unanticipated disruptions to the business, general and regional economic conditions, and the future performance of Clyde Industries; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement of the Acquisition; competitive, investor or customer responses to the Acquisition; the ability to realize anticipated synergies and cost savings; unexpected costs, charges or expenses resulting from the Acquisition; adverse changes in global and local economic conditions; the variability and difficulty in accurately predicting revenues from large capital equipment and systems projects; our acquisition strategy; levels of residential construction activity; reductions by our wood processing customers of their capital spending or production of oriented strand board; changes to the global timber supply; development and use of digital media; cyclical economic conditions affecting the global mining industry; demand for coal, including economic and environmental risks associated with coal; failure of our information systems or breaches of data security and cybersecurity incidents; implementation of our internal growth strategy; competition; our ability to successfully manage our manufacturing operations; supply chain constraints, inflationary pressure, price increases and shortages in raw materials; loss of key personnel and effective succession planning; future restructurings; protection of intellectual property; changes to tax laws and regulations; climate change; adequacy of our insurance coverage; global operations; policies of the Chinese government; the variability and uncertainties in sales of capital equipment in China; currency fluctuations; changes to government regulations and policies around the world; compliance with government regulations and policies and compliance with laws; environmental laws and regulations; environmental, health and safety laws and regulations impacting the mining industry; our debt obligations; restrictions in our credit agreement and note purchase agreement; soundness of financial institutions; fluctuations in our share price; and anti-takeover provisions. KADANT ACQUISITION UPDATE – OCTOBER 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 2

3KADANT ACQUISITION UPDATE – OCTOBER 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. Acquisition of Clyde Industries Clyde Industries is the leading manufacturer of highly engineered boiler efficiency and cleaning system technologies

Clyde Industries Acquisition Overview • Manufacturer of highly engineered boiler efficiency solutions and cleaning system technologies • Founded in 1924 • Headquartered in Atlanta (USA) with 400+ employees worldwide • Regional sites in Brazil, China, Indonesia, Finland, India, Colombia and Canada • Market leading position for recovery boilers in the Pulp & Paper industry • Revenue for the fiscal year ended February 28, 2025 was $92 million • Purchase price was $175 million* 4 * Subject to customary adjustments KADANT ACQUISITION UPDATE – OCTOBER 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED.

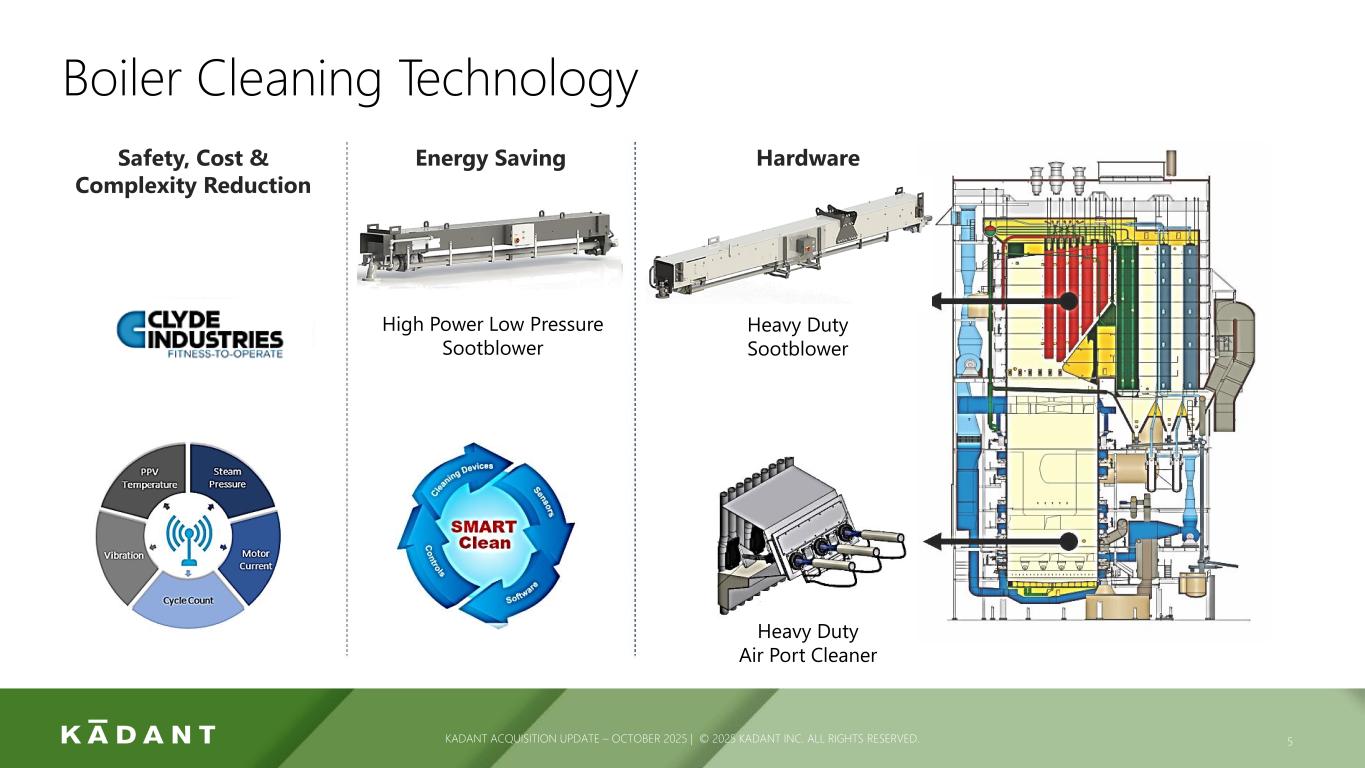

KADANT ACQUISITION UPDATE – OCTOBER 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. Boiler Cleaning Technology 5 Safety, Cost & Complexity Reduction Energy Saving Hardware Heavy Duty Sootblower High Power Low Pressure Sootblower Heavy Duty Air Port Cleaner

KADANT ACQUISITION UPDATE – OCTOBER 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. Other Boiler-Related Technologies 6 H-fin Economizer Energy RecoveryElectrostatic Precipitator

KADANT ACQUISITION UPDATE – OCTOBER 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 7 World’s Largest Recovery Boilers Utilize Clyde Industries’ Sootblowers

KADANT ACQUISITION UPDATE – OCTOBER 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 8 Large modern recovery boilers have up to 200 sootblowers on a single installation

Primary Industries Served 9 POWER GENERATION GENERAL INDUSTRY PULP & PAPER KADANT ACQUISITION UPDATE – OCTOBER 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED.

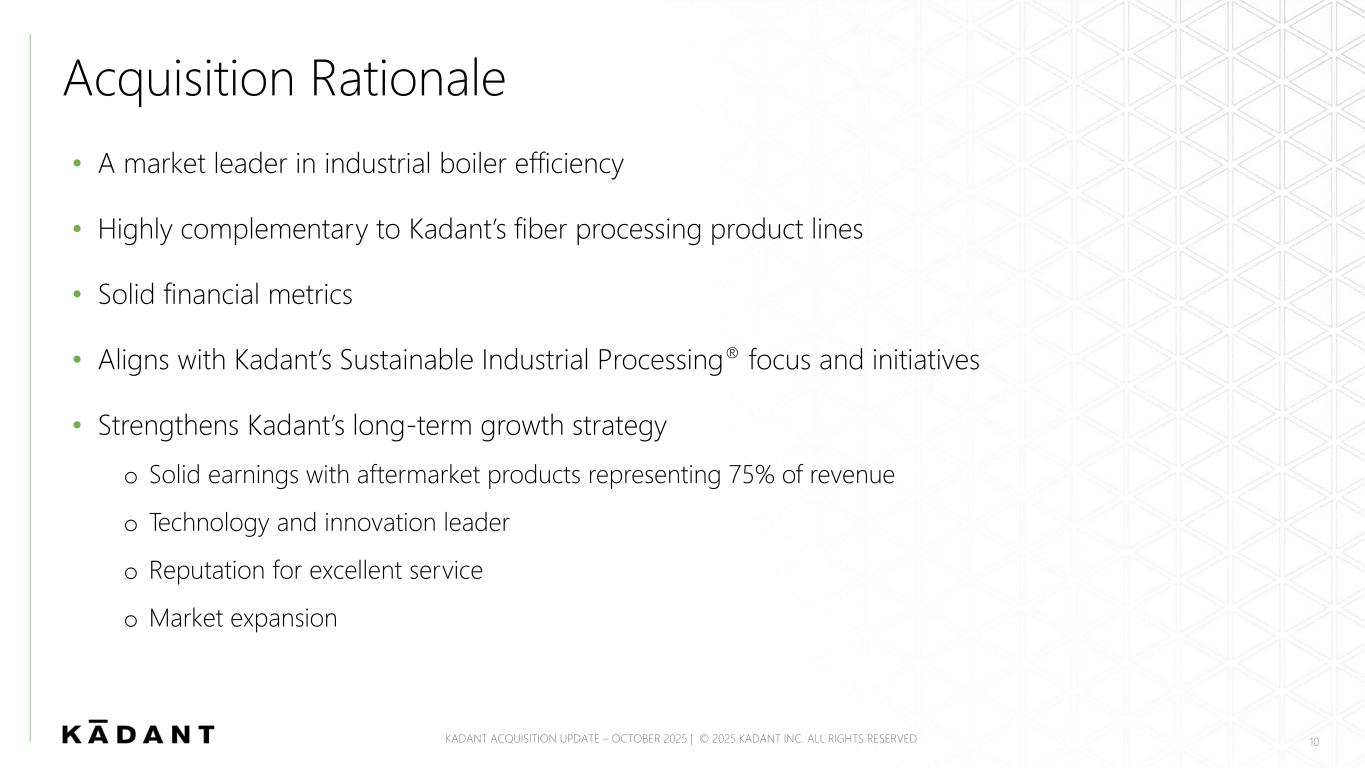

• A market leader in industrial boiler efficiency • Highly complementary to Kadant’s fiber processing product lines • Solid financial metrics • Aligns with Kadant’s Sustainable Industrial Processing® focus and initiatives • Strengthens Kadant’s long-term growth strategy o Solid earnings with aftermarket products representing 75% of revenue o Technology and innovation leader o Reputation for excellent service o Market expansion Acquisition Rationale KADANT ACQUISITION UPDATE – OCTOBER 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 10

Integration • Clyde Industries will be included in our Industrial Processing reporting segment • Clyde Industries’ operations will continue in their current locations as part of our decentralized operating structure • Continue to build on the strength of the Clyde Industries’ brand • Opportunities for collaboration and sharing best practices KADANT ACQUISITION UPDATE – OCTOBER 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 11

Financial Metrics • $175 million purchase price, subject to customary adjustments • Borrowed $170 million • Borrowing rate is approximately 5.4% • Revenue was $92 million* * For the fiscal year ended February 28, 2025 KADANT ACQUISITION UPDATE – OCTOBER 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 12

To participate in the live Q&A session, please go to investor.kadant.com and click on the Q&A session link to receive a dial-in number and unique PIN. Please mute the audio on your computer. Questions & Answers 13

INVESTOR RELATIONS CONTACT Michael McKenney IR@kadant.com MEDIA RELATIONS CONTACT Wes Martz media@kadant.com 14