Social Responsibility.

Corporate Values

Fostering and maintaining a strong, healthy culture is a key strategic focus. Our corporate values are authenticity, accountability, excellence, integrity and respect, and we are committed to building a corporate culture that supports these values. These values reflect who we are and the way our employees interact with one another, our partners and our stockholders, and are the essential tenets that guide our decisions, govern our relationships, both internally and externally, and articulate what we stand for and who we are. These values dictate the ways in which we interact, work and communicate, how we resolve conflicts and ultimately, how we strive to make Geron successful. We are Authentic, having well-intentioned interactions that are genuine and real. We are Accountable, taking responsibility for our actions, including decisions, and the effect they have on Geron. We are Excellent, having relentlessly high standards. We have Integrity, requiring our employees to behave ethically in all situations and demanding the same from others. We encourage our employees to live out our core values and to discuss our core values with potential candidates looking to join our team. We believe that this is an important step in helping our culture stay strong and unique.

Our team of talented professionals is the foundation of our company and fuels our historical and prospective achievements for patients. We consider the intellectual capital of our employees to be an essential driver of our business and key to our future opportunities. As of December 31, 2023, we had 141 fulltime employees. Twenty of our employees hold Ph.D. degrees and 63 hold other advanced degrees. Of this current total workforce, 67 employees were engaged in, or directly supported, our research and development activities, and 74 employees were engaged in commercial, medical affairs, business development, legal, finance, human resources, information technology and administration. Every employee plays a vital role in furthering our goals and impacting our progress towards fully realizing our goal to develop and seek to commercialize imetelstat.

In addition to our employee base, we have established, and expect to continue to establish, consulting agreements with drug development professionals, clinicians, regulatory experts and other professionals with experience in numerous fields, including clinical science, biostatistics, clinical operations, pharmacovigilance, quality, manufacturing and regulatory affairs. As of December 31, 2023, we had approximately 122 consultants.

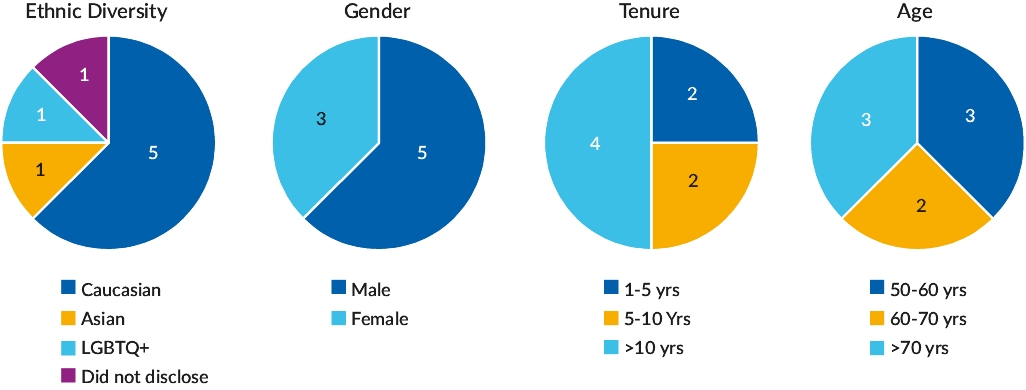

To succeed in our mission, we must attract, recruit, retain, develop and motivate qualified clinical, nonclinical, scientific, manufacturing, regulatory, management and other personnel needed to support our business and operations. As a biotechnology company with locations in the San Francisco Bay Area and northern New Jersey, we operate in a highly competitive industry and geographies for employee talent. In 2023, we engaged in extensive recruiting efforts to source and interview a talented and diverse pipeline of candidates, and enhanced our capabilities by significantly expanding our employee base. We grew our workforce by 46 employees, 23 of whom are part of our commercial team, and expected to play a critical role in implementing our plans to commercialize imetelstat, if approved. We maintain a comprehensive dashboard of measurements, including recruitment productivity, diversity, equity and inclusion metrics, employee engagement scores, total rewards benchmarking, participation rates and satisfaction scores for internal training, turnover rates and exit interview results, to guide our human capital management efforts.

We believe that our ability to attract highly skilled and talented employees in a competitive labor market is enhanced by nurturing our workplace culture, providing competitive compensation and benefits programs and supporting employee career development and related management training. To that end, we continue to invest resources and energy into being an employer of choice – attracting and engaging individuals who are innovative, curious, driven, diligent, collaborative and of the highest integrity and ethics. Some of our key efforts in this area and management of our human capital assets generally are described here.

Compensation and Benefits

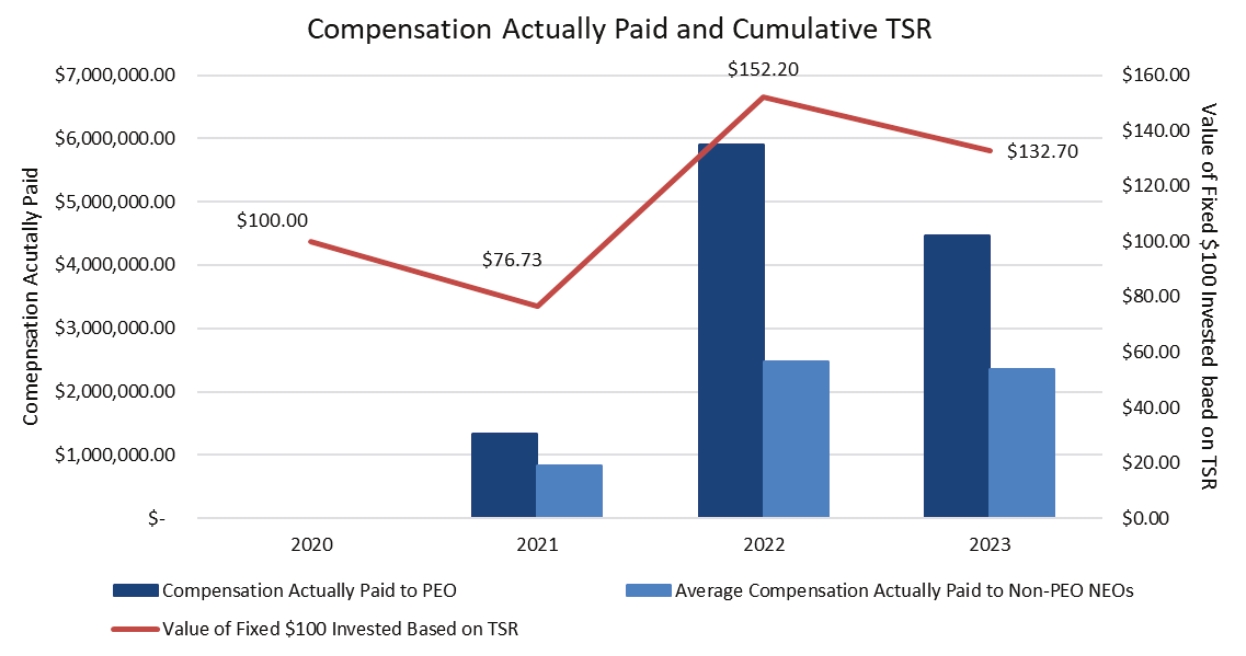

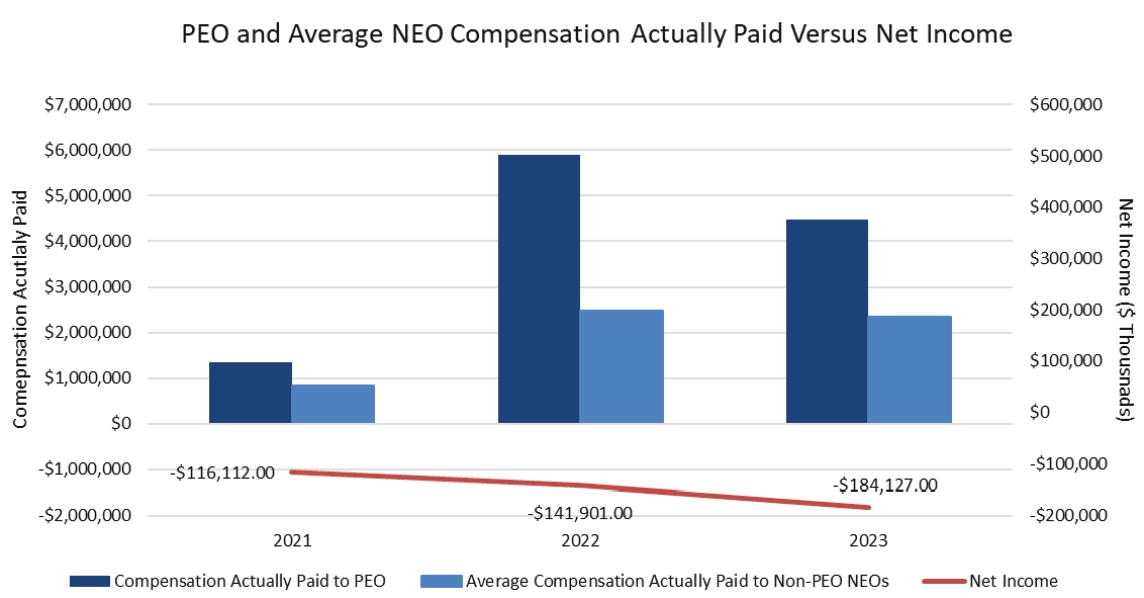

Our compensation philosophy is to provide pay and benefits that are competitive in the biotechnology and pharmaceutical industry where we compete for talent. We monitor our compensation programs closely and review them annually to provide what we