1

Item 2.02 Results of Operations and Financial Condition.

On January 7, 2026, the firm (The Goldman Sachs Group, Inc., together with its consolidated subsidiaries) reported

the following information: The firm has entered into an agreement to transition the Apple Card program and

associated accounts to a new issuer. The transition is expected to take place in approximately 24 months. The

transaction is expected to result in a $0.46 increase to the firm's fourth quarter 2025 diluted earnings per share. This

reflects a release of $2.48 billion of loan loss reserves reflected in provision for credit losses, partially offset by a

reduction in net revenues of $2.26 billion related to markdowns on the outstanding credit card loan portfolio and

contract termination obligations as well as $38 million of operating expenses.

The information in this Item 2.02 shall be deemed "filed" for purposes of Section 18 of the Securities Exchange Act

of 1934.

Item 8.01 Other Events.

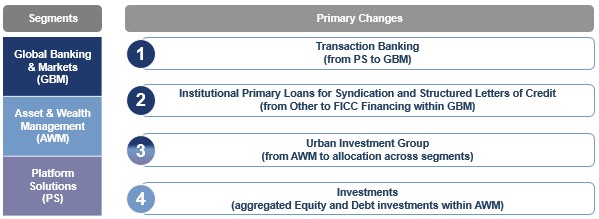

The firm has made certain changes to its business segments commencing with the fourth quarter of 2025.

The firm will continue to operate and report its results in the following three business segments: Global Banking &

Markets, Asset & Wealth Management and Platform Solutions. Certain organizational changes have been made

within these segments as the firm continues to narrow its strategic focus regarding consumer-related activities within

Platform Solutions. The business segments are presented below:

Prior results beginning with the firm’s 2021 fiscal year are presented on a comparable basis in the tables on pages 4 -

7.

The changes to the firm’s business segments have no effect on the firm’s historical total net revenues, total provision

for credit losses, total operating expenses and total pre-tax earnings in the consolidated statements of earnings. Prior

period segment results have been conformed to reflect this new presentation.