\

|

Market Linked Securities — Autocallable with Contingent Coupon and Contingent Downside Principal at Risk Securities Linked to the Lowest Performing of the S&P 500® Index, the Russell 2000® Index and the State Street® Technology Select Sector SPDR® ETF due March 2, 2029 |

Summary of Terms |

|

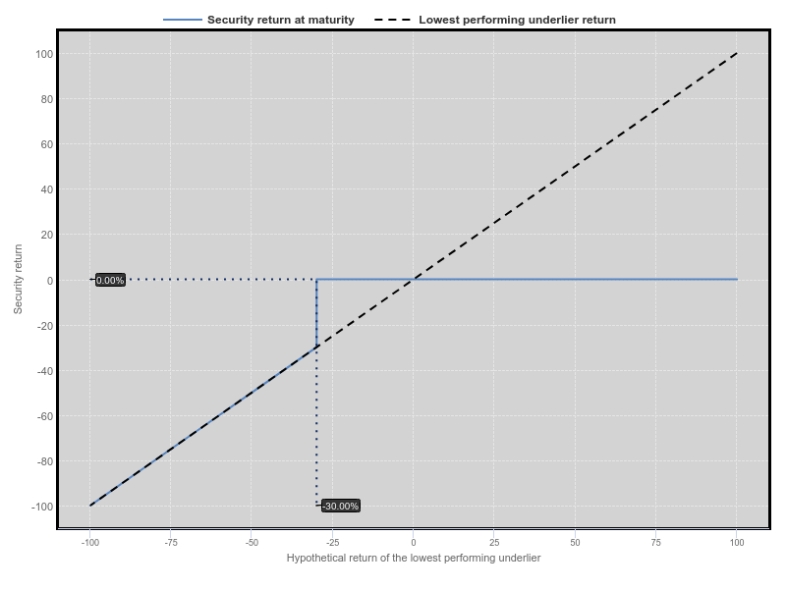

Hypothetical Payout Profile (Maturity Payment Amount) |

|

Company (Issuer) and Guarantor: |

GS Finance Corp. (issuer) and The Goldman Sachs Group, Inc. (guarantor) |

|

If the securities are not automatically called prior to stated maturity and the ending value of the lowest performing underlier on the final calculation day is less than its downside threshold value, you will lose more than 30%, and possibly all, of the face amount of your securities at stated maturity. Any return on the securities will be limited to the sum of your contingent coupon payments, if any. You will not participate in any appreciation of any underlier, but you will have full downside exposure to the lowest performing underlier on the final calculation day if the ending value of that underlier is less than its downside threshold value. You should read the accompanying preliminary pricing supplement dated February 9, 2026, which we refer to herein as the accompanying preliminary pricing supplement, to better understand the terms and risks of your investment, including the credit risk of GS Finance Corp. and The Goldman Sachs Group, Inc. The securities are part of the Medium-Term Notes, Series F program of GS Finance Corp. and are fully and unconditionally guaranteed by The Goldman Sachs Group, Inc. This document should be read in conjunction with the following:

|

Market Measures (each referred to as an “underlier,” and collectively as the “underliers”): |

the S&P 500® Index, the Russell 2000® Index and the State Street® Technology Select Sector SPDR® ETF |

|

|

Fund underlying index: |

with respect to the State Street® Technology Select Sector SPDR® ETF, the index tracked by such fund |

|

|

Pricing date: |

expected to be February 27, 2026 |

|

|

Issue date: |

expected to be March 4, 2026 |

|

|

Final calculation day: |

expected to be February 27, 2029 |

|

|

Stated maturity date: |

expected to be March 2, 2029 |

|

|

Starting value: |

with respect to an underlier, the closing value of such underlier on the pricing date |

|

|

Ending value: |

with respect to an underlier, the closing value of such underlier on the final calculation day |

|

|

Performance factor: |

with respect to an underlier on any calculation day, the quotient of (i) its closing value on such calculation day divided by its starting value (expressed as a percentage) |

|

|

Lowest performing underlier: |

for any calculation day, the underlier with the lowest performance factor on that calculation day |

|

|

Automatic call: |

If the closing value of the lowest performing underlier on any call date is greater than or equal to its starting value, the securities will be automatically called, and on the related call settlement date you will be entitled to receive a cash payment per security in U.S. dollars equal to the face amount plus a final contingent coupon payment. The securities will not be subject to automatic call until the August 2026 calculation day. |

|

|

Downside threshold value: |

with respect to an underlier, 70% of its starting value |

|

|

Contingent coupon payment: |

Subject to the automatic call, on each contingent coupon payment date, for each $1,000 of the outstanding face amount, you will receive a contingent coupon payment equal to at least $26.50 (equivalent to a contingent coupon rate of at least 10.60% per annum) (set on the pricing date) if, and only if, the closing value of the lowest performing underlier on the related calculation day is greater than or equal to its coupon threshold value. |

|

|

Coupon threshold value: |

with respect to an underlier, 70% of its starting value |

|

|

Call Dates: |

quarterly, the calculation days commencing in August 2026 and ending in November 2028, inclusive |

|

|

Call settlement date: |

the contingent coupon payment date immediately following the applicable call date |

|

|

Calculation days: |

quarterly, on the 27th day of each February, May, August and November, commencing May 2026 and ending November 2028, and the final calculation day |

|

|

Contingent coupon payment dates: |

quarterly, on the third business day following each calculation day; provided that the contingent coupon payment date with respect to the final calculation day will be the stated maturity date |

|

|

Maturity payment amount (for each $1,000 face amount of your securities): |

• if the ending value of the lowest performing underlier on the final calculation day is greater than or equal to its downside threshold value: $1,000; or • if the ending value of the lowest performing underlier on the final calculation day is less than its downside threshold value: $1,000 × performance factor of the lowest performing underlier on the final calculation day |

|

|

Underwriting discount: |

up to 2.325% of the face amount*; Wells Fargo Securities, LLC (“WFS”) is the agent for the distribution of the securities. WFS will receive the underwriting discount of up to 2.325% of the aggregate face amount of the securities sold. The agent may resell the securities to Wells Fargo Advisors (“WFA”) at the original issue price of the securities less a concession of 1.75% of the aggregate face amount of the securities. In addition to the selling concession received by WFA, WFS advises that WFA may also receive out of the underwriting discount a distribution expense fee of 0.075% for each $1,000 face amount of a security WFA sells. |

|

|

|

The estimated value of your securities at the time the terms of your securities are set on the pricing date is expected to be between $925 and $955 per $1,000 face amount. See the accompanying preliminary pricing supplement for a further discussion of the estimated value of your securities |

||

CUSIP: |

40058XHY3 |

|

|

Tax consequences: |

See “Supplemental Discussion of U.S. Federal Income Tax Considerations” in the accompanying preliminary pricing supplement |

|

|

* In addition, in respect of certain securities sold in this offering, GS&Co. may pay a fee of up to 0.30% of the aggregate face amount of the securities sold to selected securities dealers in consideration for marketing and other services in connection with the distribution of the securities to other securities dealers. |

|

|

|

The securities have more complex features than conventional debt securities and involve risks not associated with conventional debt securities. See “Risk Factors” in this term sheet and in the accompanying preliminary pricing supplement. This document does not provide all of the information that an investor should consider prior to making an investment decision. You should not invest in the securities without reading the accompanying preliminary pricing supplement and related documents for a more detailed description of the underliers, the terms of the securities and certain risks.