U.S. Securities and Exchange Commission

Washington, DC 20549

Notice of Exempt Solicitation

Submitted Pursuant to Rule 14a-6(g)

1. Name of the Registrant: The Goldman Sachs Group, Inc.

2. Name of person relying on exemption: The Comptroller of the City of New York, on behalf of the New York City Employees’ Retirement System, the New York City Teachers’ Retirement Systems, and the New York City Police Pension Fund,

3. Address of person relying on exemption: 1 Centre Street, 8th Floor, New York, New York 10007

4. Written materials required to be submitted pursuant to Rule 14a-6(g)(1):

| · | Attachment 1: Letter and PowerPoint Presentation to shareholders in support of NYCRS' Clean Energy Financing Ratio Shareholder Proposal |

April 11, 2025

Dear Fellow Goldman Sachs Shareholders,

Re: Vote FOR Item 7 on Energy Supply Ratio (ESR) disclosure

I urge you to vote FOR Item 7 on Energy Supply Ratio (ESR) disclosure at Goldman Sachs’s annual meeting on April 23, 2025. As Comptroller of the City of New York, I serve as custodian, investment advisor, and a trustee for the five New York City Retirement Systems. The two Systems that submitted Item 7 are long-term institutional investors of Goldman Sachs.

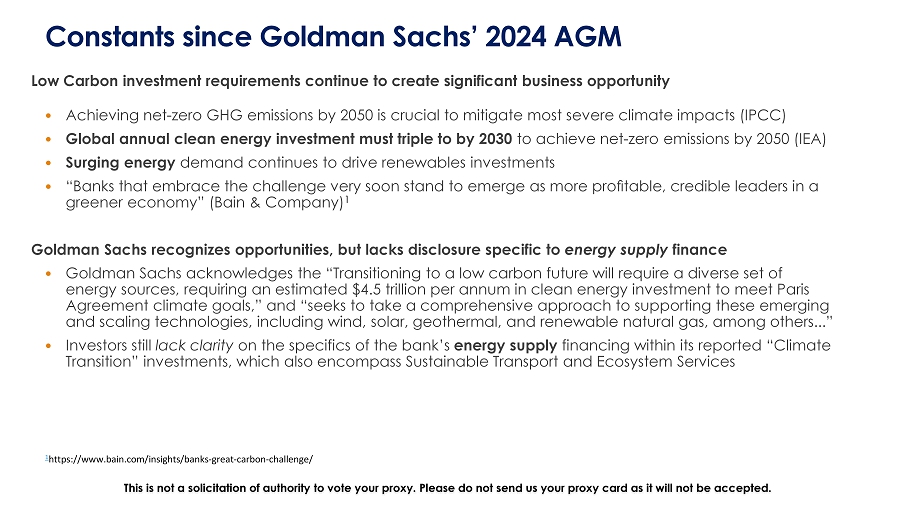

The bank is one of the largest energy underwriters and lenders, ranking among the top financiers of fossil fuel. The International Energy Agency (IEA) has emphasized that global investment in low-carbon energy supply must triple by 2030 to meet Paris Agreement’s climate targets. While the bank’s goal of net-zero financed GHG emissions by 2050 is crucial, its financing decisions now and in the future will actually drive the company’s decarbonization strategy.

Goldman Sachs recognizes both the material risks and opportunities associated with climate change. In its 2024 10-K, the bank acknowledges that “Climate change could disrupt our businesses and adversely affect client activity levels and the creditworthiness of our clients and counterparties.” At the same time, its 2023 Sustainability Report, Goldman Sachs highlights that “[t]ransitioning to a low carbon future will require a diverse set of energy sources, requiring an estimated $4.5 trillion per annum in clean energy investment to meet Paris Agreement climate goals,” and that it “seeks to take a comprehensive approach to supporting these emerging and scaling technologies, including wind, solar, geothermal, and renewable natural gas, among others.”

ESR, a dollar-based metric, complements GHG disclosures by showing how financing is allocated between low-carbon and fossil fuel activities. This data will provide investors with insight into the bank's energy transition priorities, risk management, and impact on energy supply— essential for assessing the bank’s progress on its climate commitments and its role in reducing global emissions.

Recent Company, Industry and Policy Developments Strengthen the Investor Case for ESR

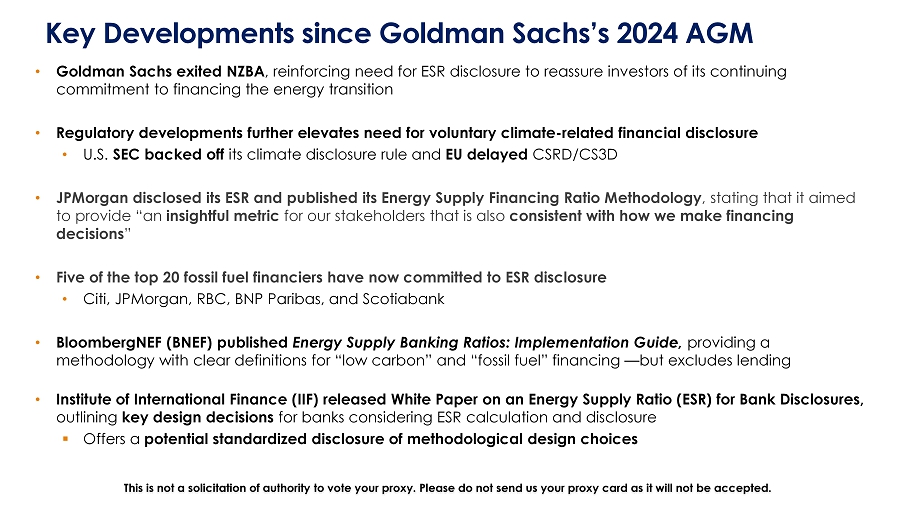

Since receiving 29% support at Goldman Sachs’s 2024 annual meeting, key industry developments have reinforced the feasibility, growing adoption, and investor relevance of ESR disclosure, and provided expert guidance for banks considering ESR disclosure:

| · | Goldman Sachs exited NZBA, reinforcing need for ESR disclosure to reassure investors of its continuing commitment to financing the energy transition |

| · | JPMorgan has now disclosed its ESR, confirming its feasibility and that it provides "an insightful metric for our stakeholders that is also consistent with how we make financing decisions."1 |

| · | Five of the top 20 fossil fuel financiers—including Citi, JPMorgan, RBC, BNP Paribas, and Scotiabank—have committed to ESR disclosure. |

| · | BloombergNEF (BNEF) published an ESR Implementation Guide, providing a methodology and clear definitions for “low carbon” and “fossil fuel” financing. |

This is not a solicitation of authority to vote your proxy.

Please DO NOT send us your proxy card as it will not be accepted.

| · | The Institute of International Finance (IIF) released a White Paper outlining key considerations for banks evaluating ESR disclosure and offering a potential standardized disclosure of methodological design choices. |

| · | The U.S. SEC's retreated from mandatory climate disclosure, the E.U. delayed CSRD/CS3D, and Goldman Sachs’ exited the Net-Zero Banking Alliance, further underscoring the urgent need for voluntary and timely climate-related financial disclosures on the bank’s energy transition risks and opportunities. |

Investor Benefits of ESR Disclosure

| · | Complements Existing GHG Disclosure: While reducing its financed emissions remains a Goldman Sachs objective, financing is a key strategy to achieving it. Unlike GHG emissions reporting, which models emissions outcomes, and may face data availability and reliability challenges, the ESR relies on dollar-based information and reflects the bank's financial flows — important to scaling up low-carbon energy and phasing down fossil fuels, essential to mitigating systemic climate risks. The ESR is less susceptible to exogenous factors than financed emissions and uses internal bank data rather than only relying on voluntary client disclosures or estimates. Together, ESR and financed emissions reporting provide a more comprehensive and reliable view of the bank’s role and priorities in the energy transition. |

| · | Not Prescriptive: The proposal leaves the ESR’s methodology entirely at Goldman Sachs’s discretion while ensuring critical transparency for investors. The proposal does not request targets or constrain any of the bank’s financing activities. |

| · | More Reliable Than Third-Party Estimates: A bank-calculated ESR using internal data rather than third-party estimates like BNEF—which rely solely on public information and may be costly or inaccessible to many investors—enhances reliability, transparency and accountability. Also, BNEF estimates do not include lending. |

| · | Management of Climate Risks and Opportunities: A bank-calculated ESR will enable investors to better assess the extent to which the bank is addressing risks associated with continued fossil fuel financing and capitalizing on the opportunities created by surging clean energy demand. As the bank has acknowledged, the energy transition is estimated to require $4.5 trillion per annum in clean energy investment to meet Paris Agreement climate goals. |

| · | Addresses Ambiguity in Bank’s Sustainable Finance Disclosures: Since setting its commendable $750 billion sustainable finance goal, Goldman Sachs reported achieving approximately $555 billion in commercial activity, including $302 billion in “Climate Transition” through 2023 However, investors still lack clarity on how its financing—particularly of energy supply—aligns with its climate commitments. In particular, investors lack clarity and would benefit from further disclosure on the specifics of the bank’s energy supply financing within its reported “Climate Transition” investments, which is more general and encompass Sustainable Transport and Ecosystem Services. |

| · | Bank’s Real-World Impact: ESR offers a clearer reflection of a bank’s role in shaping energy supply in the real economy, unlike financed GHG disclosures, which report client emissions. |

| · | Early Adoption Benefits Investors: ESR disclosure by Goldman Sachs would enable year-over-year trend analysis at Goldman and inform future industry-led standardization (e.g. PCAF); delaying such disclosures until standardization is achieved deprives investors of urgently needed insights into capital allocation decisions. |

This is not a solicitation of authority to vote your proxy.

Please DO NOT send us your proxy card as it will not be accepted.

Conclusion

I strongly encourage you to vote FOR Item 7 to ensure investors have the transparency needed to assess the bank’s progress towards its climate goals and its commitment to the energy transition.

For a more detailed analysis of why investors should support Proposal 8, please refer to the presentation available at https://comptroller.nyc.gov/wp-content/uploads/2025/04/Goldman-Sachs-ESR-Proposal-2025.pdf or see the attached copy included with this letter.

Please contact CorporateGovernanceTeam@comptroller.nyc.gov for any questions or to discuss the proposal.

Sincerely,

Brad Lander

Comptroller, City of New York

1 https://www.jpmorgan.com/content/dam/jpm/cib/complex/content/investment-banking/carbon-compass/JPMC_ESFR_Methodology.pdf

This is not a solicitation of authority to vote your proxy.

Please DO NOT send us your proxy card as it will not be accepted.

NYCRS Energy Supply Ratio (ESR) Shareholder Proposal Support Item 7 at Goldman Sachs’ April 23, 2025 Annual Meeting This is not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted. Corporate Governance & Responsible Investment

| 1 |

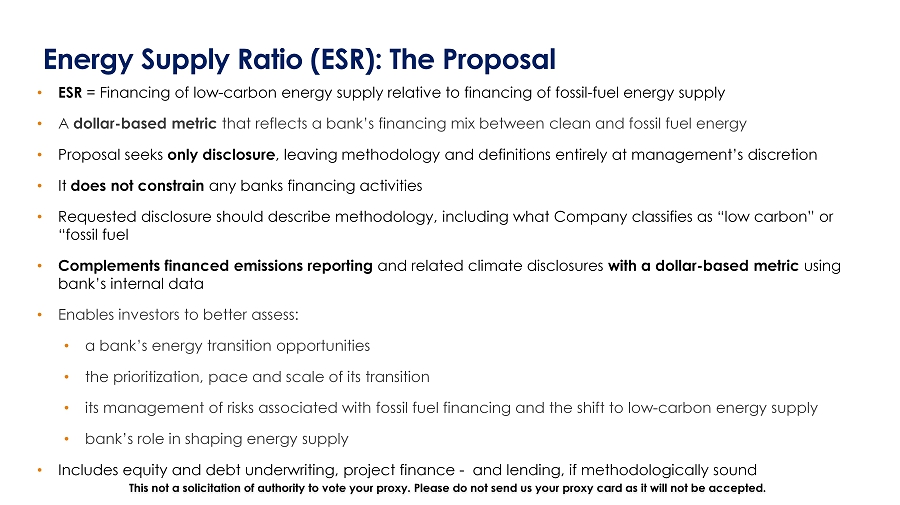

• ESR = Financing of low - carbon energy supply relative to financing of fossil - fuel energy supply • A dollar - based metric that reflects a bank’s financing mix between clean and fossil fuel energy • Proposal seeks only disclosure , leaving methodology and definitions entirely at management’s discretion • It does not constrain any banks financing activities • Requested disclosure should describe methodology, including what Company classifies as “low carbon” or “fossil fuel • Complements financed emissions reporting and related climate disclosures with a dollar - based metric using bank’s internal data • Enables investors to better assess: • a bank’s energy transition opportunities • the prioritization, pace and scale of its transition • its management of risks associated with fossil fuel financing and the shift to low - carbon energy supply • bank’s role in shaping energy supply • Includes equity and debt underwriting, project finance - and lending, if methodologically sound Energy Supply Ratio (ESR): The Proposal This not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted.

| 2 |

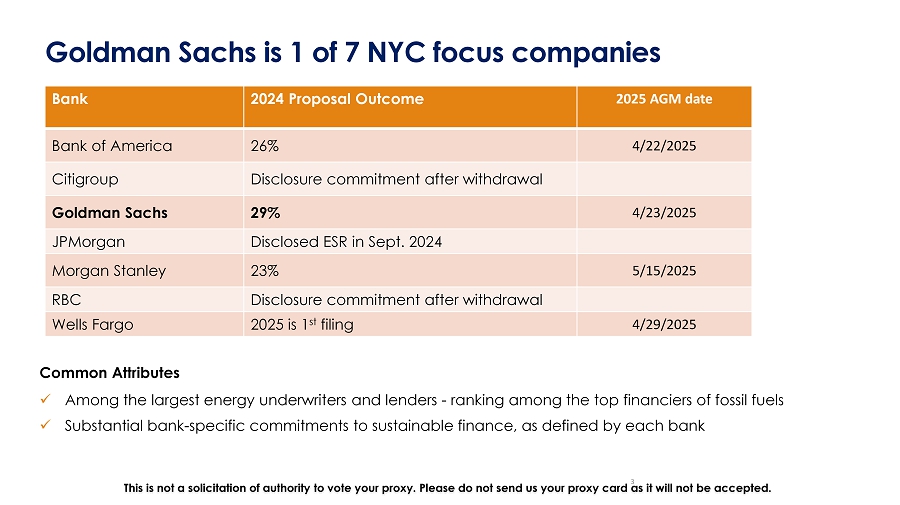

Goldman Sachs is 1 of 7 NYC focus companies Common Attributes x Among the largest energy underwriters and lenders - ranking among the top financiers of fossil fuels x Substantial bank - specific commitments to sustainable finance, as defined by each bank 3 This is not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted. 2025 AGM date 2024 Proposal Outcome Bank 4/22/2025 26% Bank of America Disclosure commitment after withdrawal Citigroup 4/23/2025 29% Goldman Sachs Disclosed ESR in Sept. 2024 JPMorgan 5/15/2025 23% Morgan Stanley Disclosure commitment after withdrawal RBC 4/29/2025 2025 is 1 st filing Wells Fargo

| 3 |

Key Developments since Goldman Sachs’s 2024 AGM • Goldman Sachs exited NZBA , reinforcing need for ESR disclosure to reassure investors of its continuing commitment to financing the energy transition • Regulatory developments further elevates need for voluntary climate - related financial disclosure • U.S. SEC backed off its climate disclosure rule and EU delayed CSRD/CS3D • JPMorgan disclosed its ESR and published its Energy Supply Financing Ratio Methodology , stating that it aimed to provide “an insightful metric for our stakeholders that is also consistent with how we make financing decisions ” • Five of the top 20 fossil fuel financiers have now committed to ESR disclosure • Citi, JPMorgan, RBC, BNP Paribas, and Scotiabank • BloombergNEF (BNEF) published Energy Supply Banking Ratios: Implementation Guide, providing a methodology with clear definitions for “low carbon” and “fossil fuel” financing — but excludes lending • Institute of International Finance (IIF) released White Paper on an Energy Supply Ratio (ESR) for Bank Disclosures, outlining key design decisions for banks considering ESR calculation and disclosure ▪ Offers a potential standardized disclosure of methodological design choices This is not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted.

| 4 |

Constants since Goldman Sachs’ 2024 AGM Low Carbon investment requirements continue to create significant business opportunity • Achieving net - zero GHG emissions by 2050 is crucial to mitigate most severe climate impacts (IPCC) • Global annual clean energy investment must triple to by 2030 to achieve net - zero emissions by 2050 (IEA) • Surging energy demand continues to drive renewables investments • “Banks that embrace the challenge very soon stand to emerge as more profitable, credible leaders in a greener economy” (Bain & Company) 1 Goldman Sachs recognizes opportunities, but lacks disclosure specific to energy supply finance • Goldman Sachs acknowledges the “Transitioning to a low carbon future will require a diverse set of energy sources, requiring an estimated $4.5 trillion per annum in clean energy investment to meet Paris Agreement climate goals,” and “seeks to take a comprehensive approach to supporting these emerging and scaling technologies, including wind, solar, geothermal, and renewable natural gas, among others...” • Investors still lack clarity on the specifics of the bank’s energy supply financing within its reported “Climate Transition” investments, which also encompass Sustainable Transport and Ecosystem Services This is not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted. 1 https://www.bain.com/insights/banks - great - carbon - challenge/

| 5 |

Lessons from JPMorgan’s ESR Disclosure • Demonstrates feasibility and investor value: JPMorgan called it "An excellent example of what ongoing engagements and pragmatic requests can accomplish“ • JPMorgan weighed “the relevance of the subject matter of the [2024 NYC shareholder] proposal in the context of our business and its value to long - term shareholders” in making its disclosure decision • Improves upon BNEF approach by incorporating lending and other internal data , offering a more comprehensive and forward - looking picture • Transparent methodology can inform future standardization efforts This is not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted.

| 6 |

Reasons to vote FOR “ESR” Proposal 8 Dollar - Based Metric Complements Financed Emissions Disclosure • Reducing its financed emissions is the objective; financing is the key strategy to achieve it • While financed emissions reporting remains essential, it often depends on voluntary client disclosure and/or emissions estimates with data availability and reliability challenges • ESR is less susceptible to exogenous factors than financed emissions • A dollar - based ESR and financed emissions disclosure together provide a clearer, more comprehensive view of the bank’s role in the energy transition Captures Pace and Scale of Bank’s Energy Transition • ESR provides an integrated financial metric that uniquely captures both the scaling up of low - carbon energy and the phasing down of fossil fuels — essential for mitigating systemic financial and physical climate risks • Pace at which low - carbon energy supply is scaled up will dictate rate at which fossil fuels phase down (IEA) • A bank - calculated ESR using internal data rather than third - party estimates like BNEF — which rely solely on public information and may be costly or inaccessible to many investors — enhances reliability, transparency, and accountability Feasible with expert guidance available This is not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted.

| 7 |

Reasons to vote FOR the “ESR” Proposal 8 Not Prescriptive • Proposal seeks only disclosure, leaving methodology and definitions entirely at management’s discretion • It does not request targets nor constrain any of the banks’ financing activities More Reliable Than Third - Party Estimates: • A bank - calculated ESR using internal data rather than third - party estimates like BNEF is more reliable • Notably, BNEF estimates do not include lending Clarifies Real Economy Impact • Unlike financed emissions disclosures, an ESR reflects the bank’s financial flows — enabling investors to better assess the bank’s role in financing the energy transition Early Adoption Benefits Investors • Demonstrate bank’s continuing commitment to financing the energy transition – critical given NZBA exit and regulatory developments • Voluntary disclosure offers year - over - year insights at each bank and can inform industry - driven standardization (e.g., PCAF) • Delaying bank - specific disclosures until standardization is achieved deprives investors of urgently needed insights into capital allocation decisions This is not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted.

8