3rd Quarter 2025 Earnings Presentation October 30, 2025

Disclaimer FORWARD-LOOKING STATEMENTS This communication may contain certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements about the benefits of the acquisition of Pacific Premier Bancorp, Inc. (“Pacific Premier”) by Columbia Banking System, Inc. (“Columbia”) the plans, objectives, expectations and intentions of Columbia and other statements that are not historical facts. Such statements are subject to numerous assumptions, risks, and uncertainties. All statements other than statements of historical fact, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as “expect,” “anticipate,” “believe,” “intend,” “estimate,” “plan,” “believe,” “target,” “goal,” or similar expressions, or future or conditional verbs such as “will,” “may,” “might,” “should,” “would,” “could,” or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. In this presentation we make forward-looking statements about strategic and growth initiatives and the result of such activity. Risks and uncertainties that could cause results to differ from forward-looking statements we make include, without limitation: current and future economic and market conditions, including the effects of declines in housing and commercial real estate prices, high unemployment rates, continued or renewed inflation and any recession or slowdown in economic growth particularly in the western United States; economic forecast variables that are either materially worse or better than end of quarter projections and deterioration in the economy that could result in increased loan and lease losses, especially those risks associated with concentrations in real estate related loans; risks related to our acquisition of Pacific Premier (the "Transaction"), including, among others, (i) diversion of management’s attention from ongoing business operations and opportunities, (ii) cost savings and any revenue or expense synergies from the Transaction may not be fully realized or may take longer than anticipated to be realized, (iii) deposit attrition, customer or employee loss, and/or revenue loss as a result of the Transaction, and (iv) shareholder litigation that could negatively impact our business and operations; the impact of proposed or imposed tariffs by the U.S. government and retaliatory tariffs proposed or imposed by U.S. trading partners that could have an adverse impact on customers; our ability to effectively manage problem credits; the impact of bank failures or adverse developments at other banks on general investor sentiment regarding the liquidity and stability of banks; changes in interest rates that could significantly reduce net interest income and negatively affect asset yields and valuations and funding sources; changes in the scope and cost of FDIC insurance and other coverage; our ability to successfully implement efficiency and operational excellence initiatives; our ability to successfully develop and market new products and technology; changes in laws or regulations; potential adverse reactions or changes to business or employee relationships; the effect of geopolitical instability, including wars, conflicts and terrorist attacks; and natural disasters and other similar unexpected events outside of our control. We also caution that the amount and timing of any future common stock dividends or repurchases will depend on the earnings, cash requirements and financial condition of Columbia, market conditions, capital requirements, applicable law and regulations (including federal securities laws and federal banking regulations), and other factors deemed relevant by Columbia's Board of Directors, and may be subject to regulatory approval or conditions. NON-GAAP FINANCIAL MEASURES In addition to results presented in accordance with GAAP, this presentation contains certain non-GAAP financial measures. A reconciliation of GAAP to non-GAAP measures is included in the Appendix. The Company believes presenting certain non-GAAP financial measures provides investors with information useful in understanding our financial performance, our performance trends, and our financial position. We utilize these measures for internal planning and forecasting purposes, and operating pre-provision net revenue and operating return on tangible common equity are also used as part of our incentive compensation program for our executive officers. We, as well as securities analysts, investors, and other interested parties, also use these measures to compare peer company operating performance. We believe that our presentation and discussion, together with the accompanying reconciliations, provides a complete understanding of factors and trends affecting our business and allows investors to view performance in a manner similar to management. These non-GAAP measures should not be considered a substitution for GAAP basis measures and results, and we strongly encourage investors to review our consolidated financial statements in their entirety and not to rely on any single financial measure. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures having the same or similar names. 2

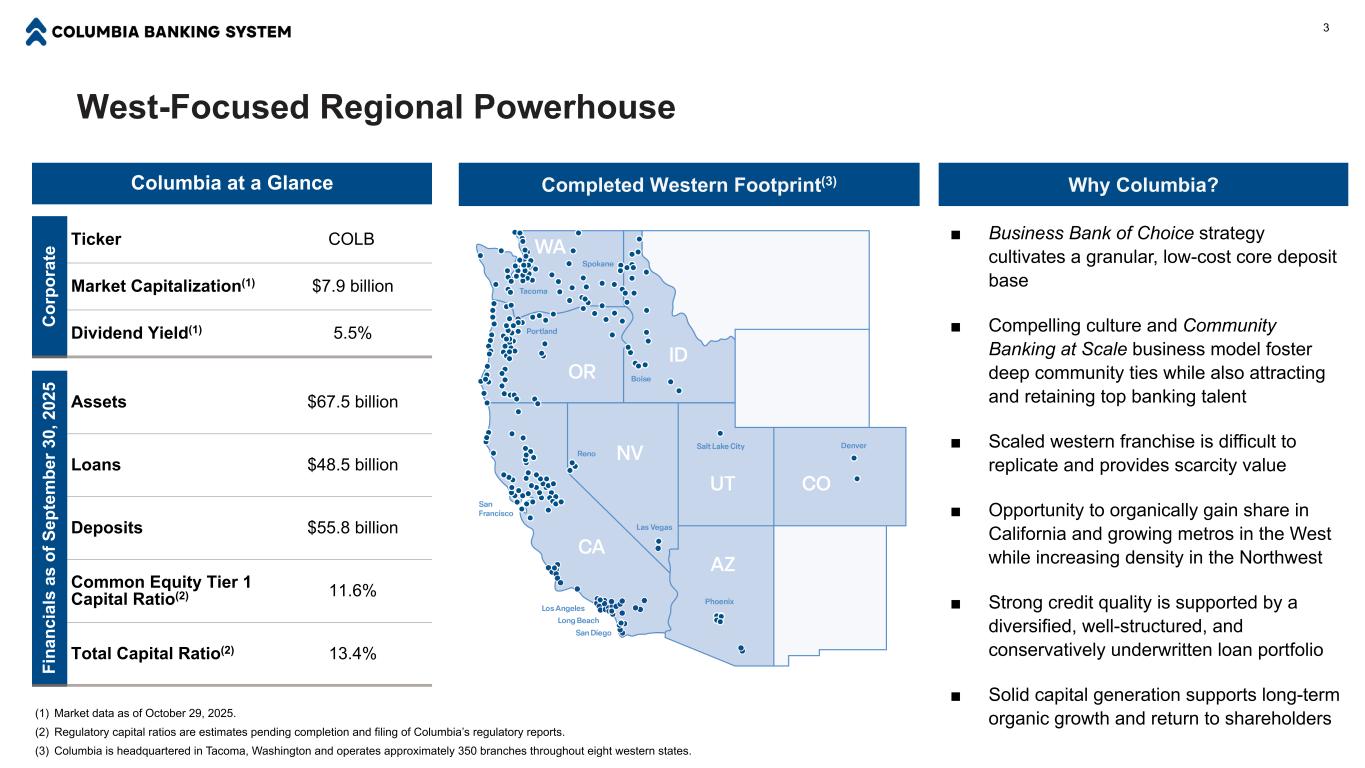

West-Focused Regional Powerhouse 3 Completed Western Footprint(3) Why Columbia? ■ Business Bank of Choice strategy cultivates a granular, low-cost core deposit base ■ Compelling culture and Community Banking at Scale business model foster deep community ties while also attracting and retaining top banking talent ■ Scaled western franchise is difficult to replicate and provides scarcity value ■ Opportunity to organically gain share in California and growing metros in the West while increasing density in the Northwest ■ Strong credit quality is supported by a diversified, well-structured, and conservatively underwritten loan portfolio ■ Solid capital generation supports long-term organic growth and return to shareholders Columbia at a Glance C or po ra te Ticker COLB Market Capitalization(1) $7.9 billion Dividend Yield(1) 5.5% Fi na nc ia ls a s of S ep te m be r 3 0, 2 02 5 Assets $67.5 billion Loans $48.5 billion Deposits $55.8 billion Common Equity Tier 1 Capital Ratio(2) 11.6% Total Capital Ratio(2) 13.4% (1) Market data as of October 29, 2025. (2) Regulatory capital ratios are estimates pending completion and filing of Columbia’s regulatory reports. (3) Columbia is headquartered in Tacoma, Washington and operates approximately 350 branches throughout eight western states.

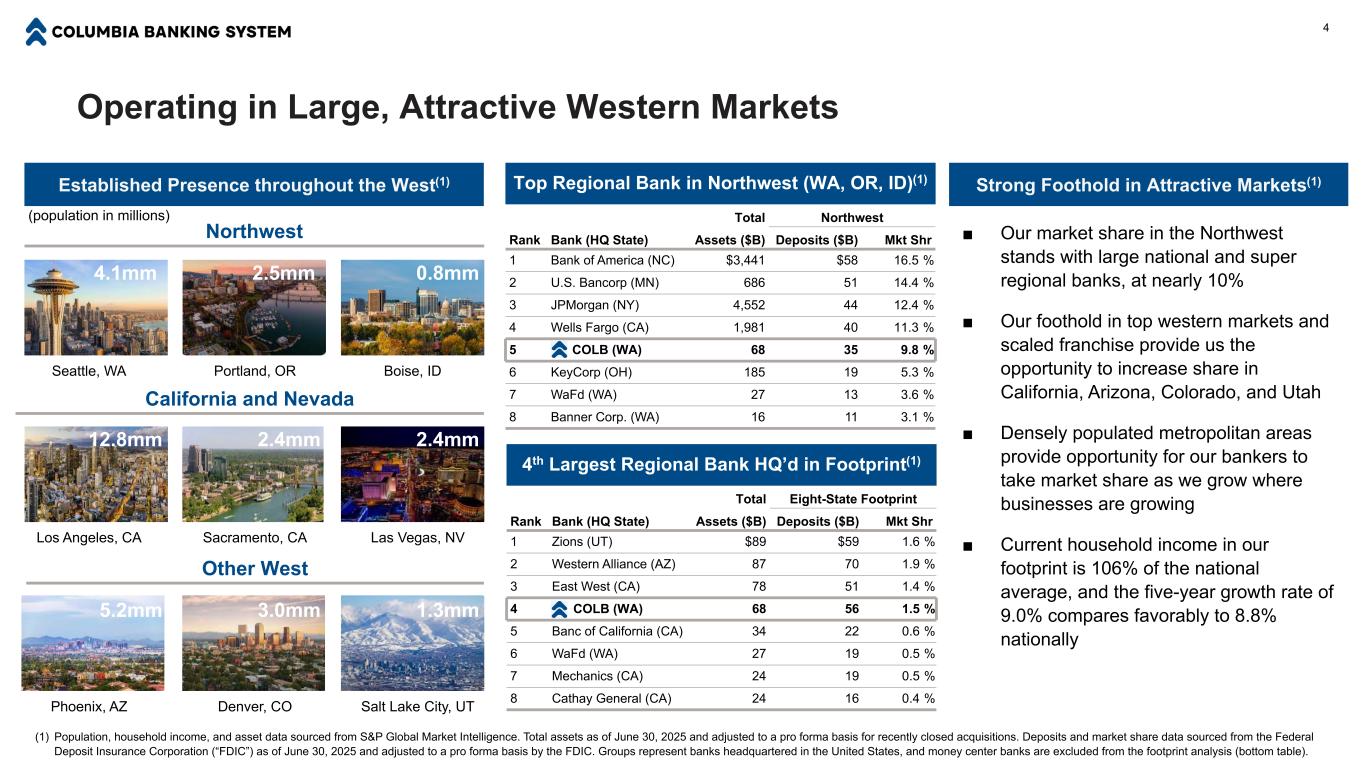

Operating in Large, Attractive Western Markets 4 Established Presence throughout the West(1) Northwest (population in millions) Seattle, WA Portland, OR California and Nevada Los Angeles, CA Sacramento, CA Other West Phoenix, AZ Denver, CO 4.1mm 2.5mm 12.8mm 2.4mm 5.2mm 3.0mm Top Regional Bank in Northwest (WA, OR, ID)(1) Total Northwest Rank Bank (HQ State) Assets ($B) Deposits ($B) Mkt Shr 1 Bank of America (NC) $3,441 $58 16.5 % 2 U.S. Bancorp (MN) 686 51 14.4 % 3 JPMorgan (NY) 4,552 44 12.4 % 4 Wells Fargo (CA) 1,981 40 11.3 % 5 COLB (WA) 68 35 9.8 % 6 KeyCorp (OH) 185 19 5.3 % 7 WaFd (WA) 27 13 3.6 % 8 Banner Corp. (WA) 16 11 3.1 % 4th Largest Regional Bank HQ’d in Footprint(1) Total Eight-State Footprint Rank Bank (HQ State) Assets ($B) Deposits ($B) Mkt Shr 1 Zions (UT) $89 $59 1.6 % 2 Western Alliance (AZ) 87 70 1.9 % 3 East West (CA) 78 51 1.4 % 4 COLB (WA) 68 56 1.5 % 5 Banc of California (CA) 34 22 0.6 % 6 WaFd (WA) 27 19 0.5 % 7 Mechanics (CA) 24 19 0.5 % 8 Cathay General (CA) 24 16 0.4 % Strong Foothold in Attractive Markets(1) ■ Our market share in the Northwest stands with large national and super regional banks, at nearly 10% ■ Our foothold in top western markets and scaled franchise provide us the opportunity to increase share in California, Arizona, Colorado, and Utah ■ Densely populated metropolitan areas provide opportunity for our bankers to take market share as we grow where businesses are growing ■ Current household income in our footprint is 106% of the national average, and the five-year growth rate of 9.0% compares favorably to 8.8% nationally Boise, ID Salt Lake City, UT Las Vegas, NV 0.8mm 2.4mm 1.3mm (1) Population, household income, and asset data sourced from S&P Global Market Intelligence. Total assets as of June 30, 2025 and adjusted to a pro forma basis for recently closed acquisitions. Deposits and market share data sourced from the Federal Deposit Insurance Corporation (“FDIC”) as of June 30, 2025 and adjusted to a pro forma basis by the FDIC. Groups represent banks headquartered in the United States, and money center banks are excluded from the footprint analysis (bottom table).

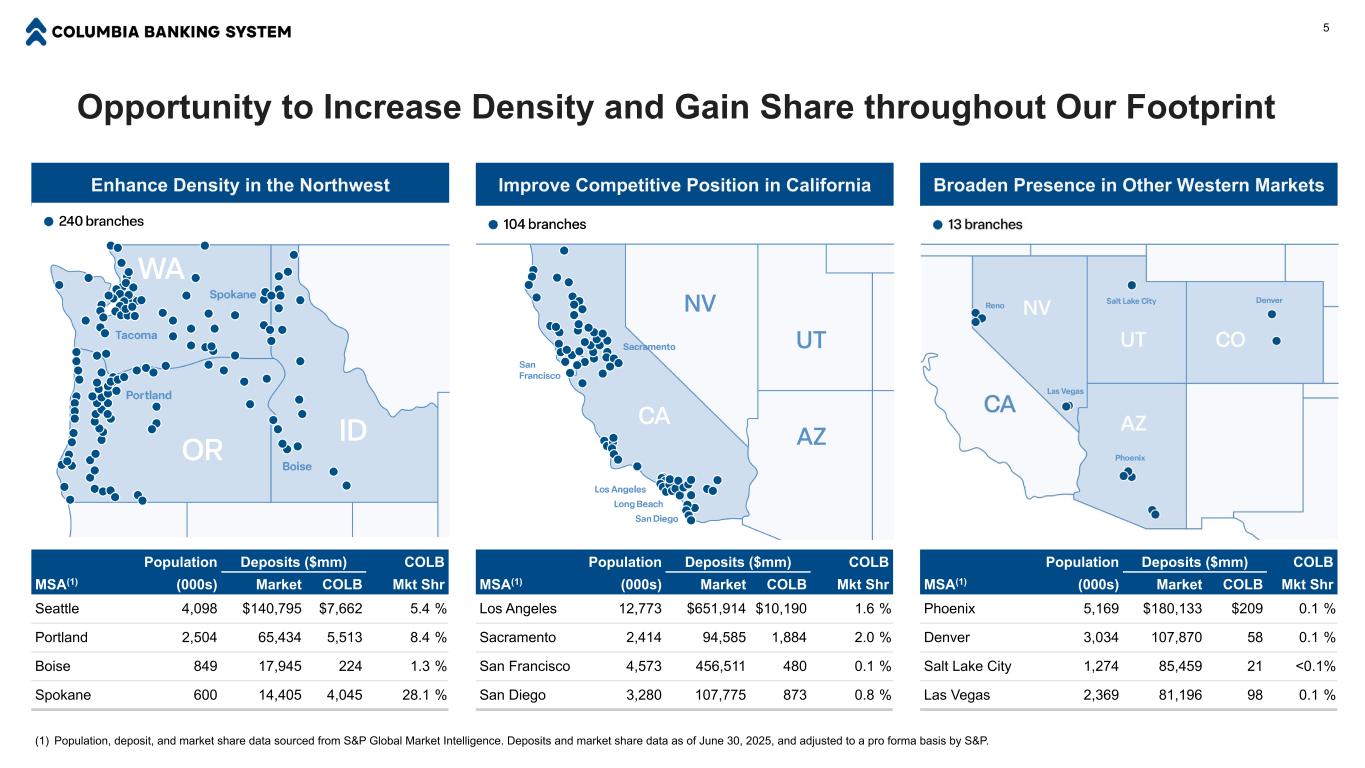

Population Deposits ($mm) COLB MSA(1) (000s) Market COLB Mkt Shr Seattle 4,098 $140,795 $7,662 5.4 % Portland 2,504 65,434 5,513 8.4 % Boise 849 17,945 224 1.3 % Spokane 600 14,405 4,045 28.1 % Opportunity to Increase Density and Gain Share throughout Our Footprint 5 Improve Competitive Position in California Broaden Presence in Other Western MarketsEnhance Density in the Northwest Population Deposits ($mm) COLB MSA(1) (000s) Market COLB Mkt Shr Phoenix 5,169 $180,133 $209 0.1 % Denver 3,034 107,870 58 0.1 % Salt Lake City 1,274 85,459 21 <0.1% Las Vegas 2,369 81,196 98 0.1 % Population Deposits ($mm) COLB MSA(1) (000s) Market COLB Mkt Shr Los Angeles 12,773 $651,914 $10,190 1.6 % Sacramento 2,414 94,585 1,884 2.0 % San Francisco 4,573 456,511 480 0.1 % San Diego 3,280 107,775 873 0.8 % (1) Population, deposit, and market share data sourced from S&P Global Market Intelligence. Deposits and market share data as of June 30, 2025, and adjusted to a pro forma basis by S&P.

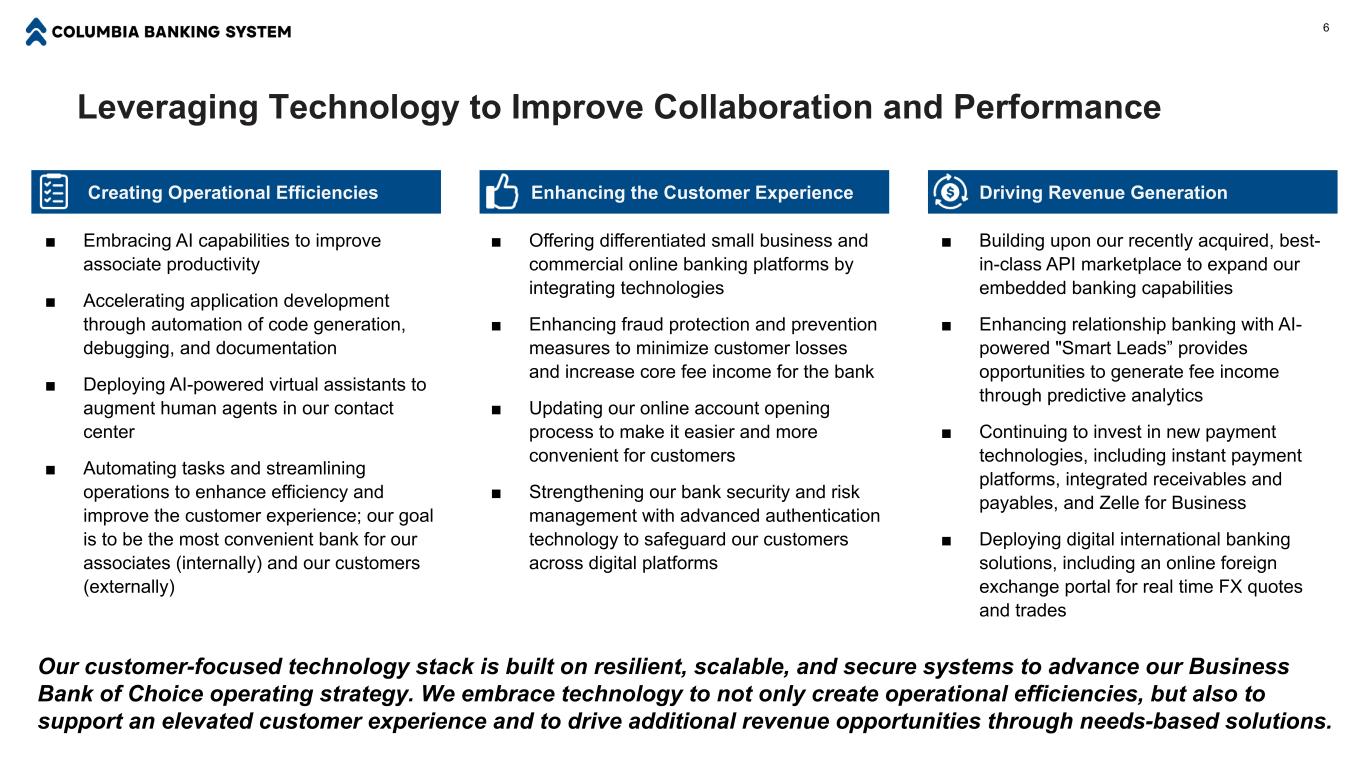

Leveraging Technology to Improve Collaboration and Performance 6 Enhancing the Customer Experience Driving Revenue Generation Creating Operational Efficiencies ■ Building upon our recently acquired, best- in-class API marketplace to expand our embedded banking capabilities ■ Enhancing relationship banking with AI- powered "Smart Leads” provides opportunities to generate fee income through predictive analytics ■ Continuing to invest in new payment technologies, including instant payment platforms, integrated receivables and payables, and Zelle for Business ■ Deploying digital international banking solutions, including an online foreign exchange portal for real time FX quotes and trades ■ Offering differentiated small business and commercial online banking platforms by integrating technologies ■ Enhancing fraud protection and prevention measures to minimize customer losses and increase core fee income for the bank ■ Updating our online account opening process to make it easier and more convenient for customers ■ Strengthening our bank security and risk management with advanced authentication technology to safeguard our customers across digital platforms ■ Embracing AI capabilities to improve associate productivity ■ Accelerating application development through automation of code generation, debugging, and documentation ■ Deploying AI-powered virtual assistants to augment human agents in our contact center ■ Automating tasks and streamlining operations to enhance efficiency and improve the customer experience; our goal is to be the most convenient bank for our associates (internally) and our customers (externally) Our customer-focused technology stack is built on resilient, scalable, and secure systems to advance our Business Bank of Choice operating strategy. We embrace technology to not only create operational efficiencies, but also to support an elevated customer experience and to drive additional revenue opportunities through needs-based solutions.

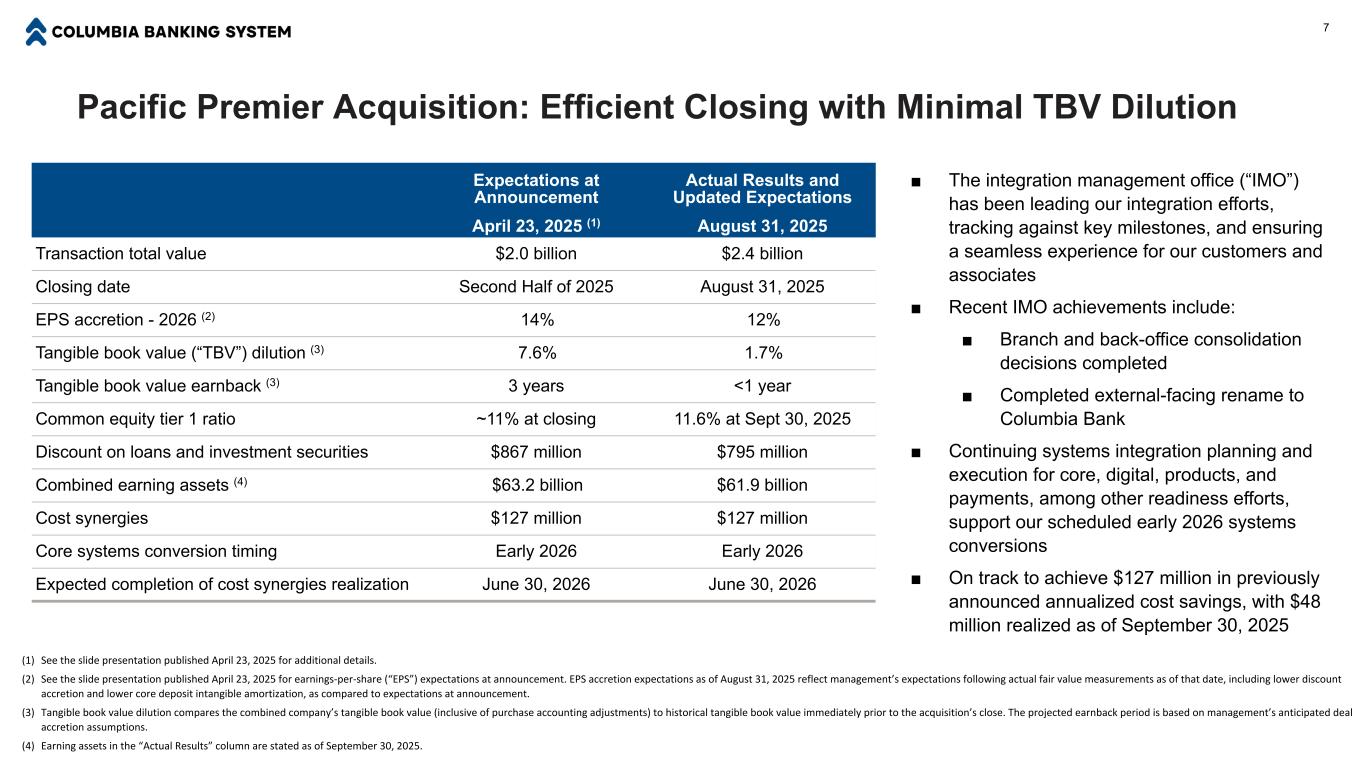

Pacific Premier Acquisition: Efficient Closing with Minimal TBV Dilution 7 Expectations at Announcement Actual Results and Updated Expectations April 23, 2025 (1) August 31, 2025 Transaction total value $2.0 billion $2.4 billion Closing date Second Half of 2025 August 31, 2025 EPS accretion - 2026 (2) 14% 12% Tangible book value (“TBV”) dilution (3) 7.6% 1.7% Tangible book value earnback (3) 3 years <1 year Common equity tier 1 ratio ~11% at closing 11.6% at Sept 30, 2025 Discount on loans and investment securities $867 million $795 million Combined earning assets (4) $63.2 billion $61.9 billion Cost synergies $127 million $127 million Core systems conversion timing Early 2026 Early 2026 Expected completion of cost synergies realization June 30, 2026 June 30, 2026 (1) See the slide presentation published April 23, 2025 for additional details. (2) See the slide presentation published April 23, 2025 for earnings-per-share (“EPS”) expectations at announcement. EPS accretion expectations as of August 31, 2025 reflect management’s expectations following actual fair value measurements as of that date, including lower discount accretion and lower core deposit intangible amortization, as compared to expectations at announcement. (3) Tangible book value dilution compares the combined company’s tangible book value (inclusive of purchase accounting adjustments) to historical tangible book value immediately prior to the acquisition’s close. The projected earnback period is based on management’s anticipated deal accretion assumptions. (4) Earning assets in the “Actual Results” column are stated as of September 30, 2025. ■ The integration management office (“IMO”) has been leading our integration efforts, tracking against key milestones, and ensuring a seamless experience for our customers and associates ■ Recent IMO achievements include: ■ Branch and back-office consolidation decisions completed ■ Completed external-facing rename to Columbia Bank ■ Continuing systems integration planning and execution for core, digital, products, and payments, among other readiness efforts, support our scheduled early 2026 systems conversions ■ On track to achieve $127 million in previously announced annualized cost savings, with $48 million realized as of September 30, 2025

Financial Highlights 8

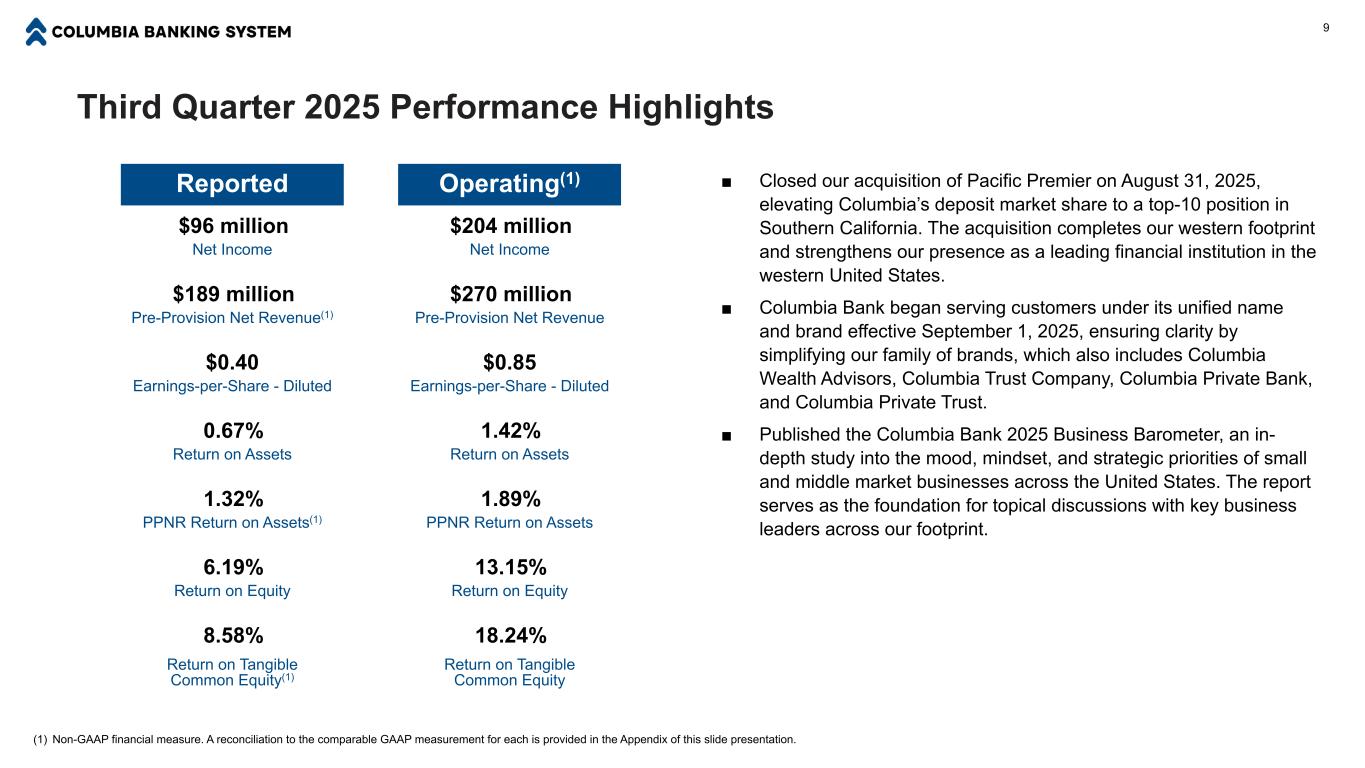

Third Quarter 2025 Performance Highlights 9 ■ Closed our acquisition of Pacific Premier on August 31, 2025, elevating Columbia’s deposit market share to a top-10 position in Southern California. The acquisition completes our western footprint and strengthens our presence as a leading financial institution in the western United States. ■ Columbia Bank began serving customers under its unified name and brand effective September 1, 2025, ensuring clarity by simplifying our family of brands, which also includes Columbia Wealth Advisors, Columbia Trust Company, Columbia Private Bank, and Columbia Private Trust. ■ Published the Columbia Bank 2025 Business Barometer, an in- depth study into the mood, mindset, and strategic priorities of small and middle market businesses across the United States. The report serves as the foundation for topical discussions with key business leaders across our footprint. Reported Operating(1) $96 million $204 million Net Income Net Income $189 million $270 million Pre-Provision Net Revenue(1) Pre-Provision Net Revenue $0.40 $0.85 Earnings-per-Share - Diluted Earnings-per-Share - Diluted 0.67% 1.42% Return on Assets Return on Assets 1.32% 1.89% PPNR Return on Assets(1) PPNR Return on Assets 6.19% 13.15% Return on Equity Return on Equity 8.58% 18.24% Return on Tangible Common Equity(1) Return on Tangible Common Equity (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement for each is provided in the Appendix of this slide presentation.

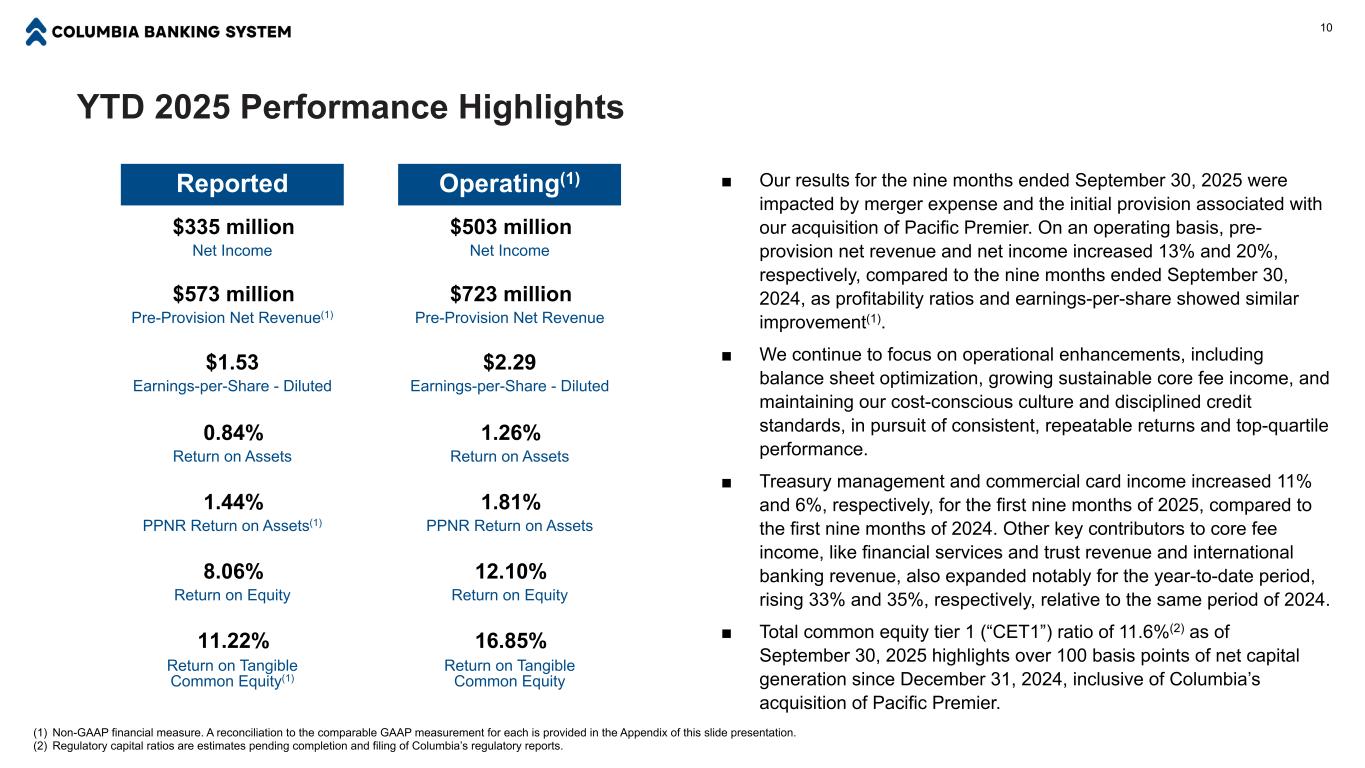

YTD 2025 Performance Highlights 10 ■ Our results for the nine months ended September 30, 2025 were impacted by merger expense and the initial provision associated with our acquisition of Pacific Premier. On an operating basis, pre- provision net revenue and net income increased 13% and 20%, respectively, compared to the nine months ended September 30, 2024, as profitability ratios and earnings-per-share showed similar improvement(1). ■ We continue to focus on operational enhancements, including balance sheet optimization, growing sustainable core fee income, and maintaining our cost-conscious culture and disciplined credit standards, in pursuit of consistent, repeatable returns and top-quartile performance. ■ Treasury management and commercial card income increased 11% and 6%, respectively, for the first nine months of 2025, compared to the first nine months of 2024. Other key contributors to core fee income, like financial services and trust revenue and international banking revenue, also expanded notably for the year-to-date period, rising 33% and 35%, respectively, relative to the same period of 2024. ■ Total common equity tier 1 (“CET1”) ratio of 11.6%(2) as of September 30, 2025 highlights over 100 basis points of net capital generation since December 31, 2024, inclusive of Columbia’s acquisition of Pacific Premier. Reported Operating(1) $335 million $503 million Net Income Net Income $573 million $723 million Pre-Provision Net Revenue(1) Pre-Provision Net Revenue $1.53 $2.29 Earnings-per-Share - Diluted Earnings-per-Share - Diluted 0.84% 1.26% Return on Assets Return on Assets 1.44% 1.81% PPNR Return on Assets(1) PPNR Return on Assets 8.06% 12.10% Return on Equity Return on Equity 11.22% 16.85% Return on Tangible Common Equity(1) Return on Tangible Common Equity (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement for each is provided in the Appendix of this slide presentation. (2) Regulatory capital ratios are estimates pending completion and filing of Columbia’s regulatory reports.

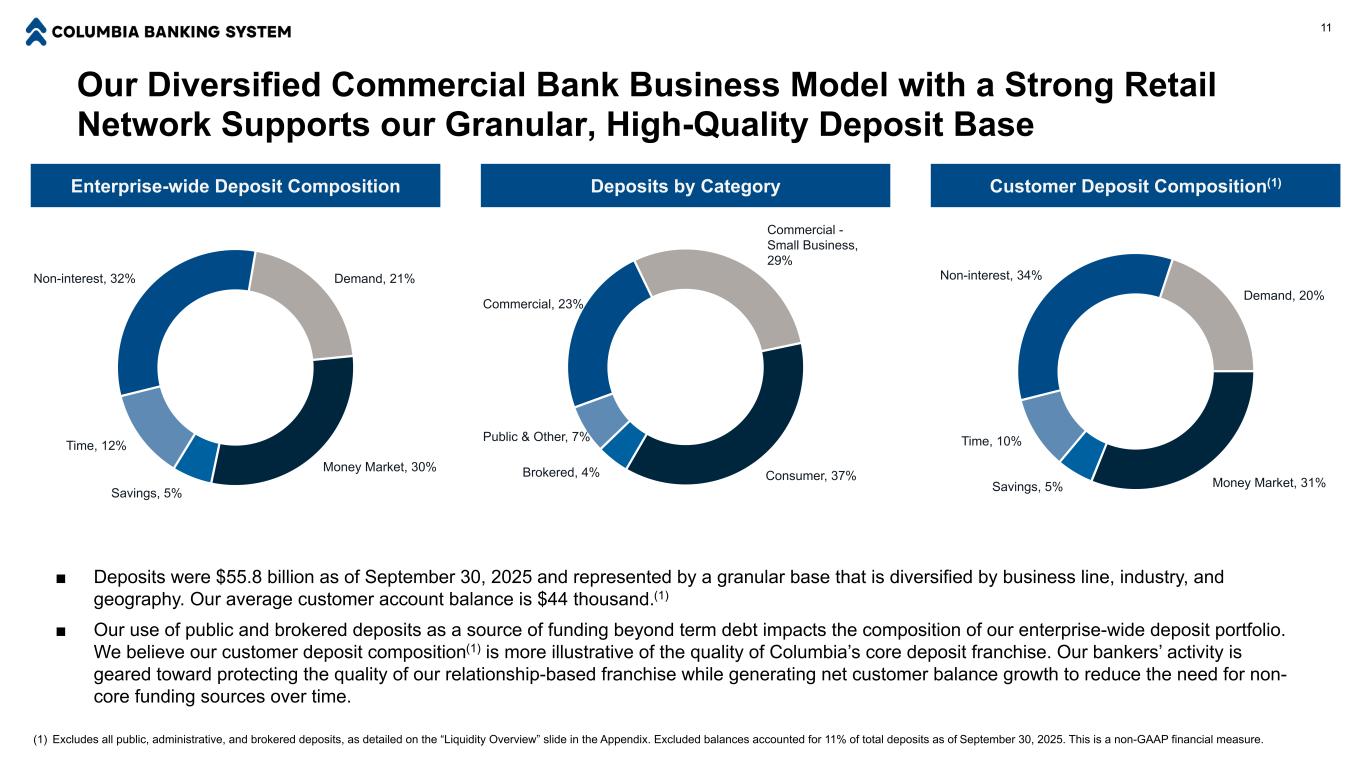

Our Diversified Commercial Bank Business Model with a Strong Retail Network Supports our Granular, High-Quality Deposit Base Non-interest, 32% Demand, 21% Money Market, 30% Savings, 5% Time, 12% Enterprise-wide Deposit Composition 11 ■ Deposits were $55.8 billion as of September 30, 2025 and represented by a granular base that is diversified by business line, industry, and geography. Our average customer account balance is $44 thousand.(1) ■ Our use of public and brokered deposits as a source of funding beyond term debt impacts the composition of our enterprise-wide deposit portfolio. We believe our customer deposit composition(1) is more illustrative of the quality of Columbia’s core deposit franchise. Our bankers’ activity is geared toward protecting the quality of our relationship-based franchise while generating net customer balance growth to reduce the need for non- core funding sources over time. Commercial, 23% Commercial - Small Business, 29% Consumer, 37%Brokered, 4% Public & Other, 7% Deposits by Category Customer Deposit Composition(1) Non-interest, 34% Demand, 20% Money Market, 31%Savings, 5% Time, 10% (1) Excludes all public, administrative, and brokered deposits, as detailed on the “Liquidity Overview” slide in the Appendix. Excluded balances accounted for 11% of total deposits as of September 30, 2025. This is a non-GAAP financial measure.

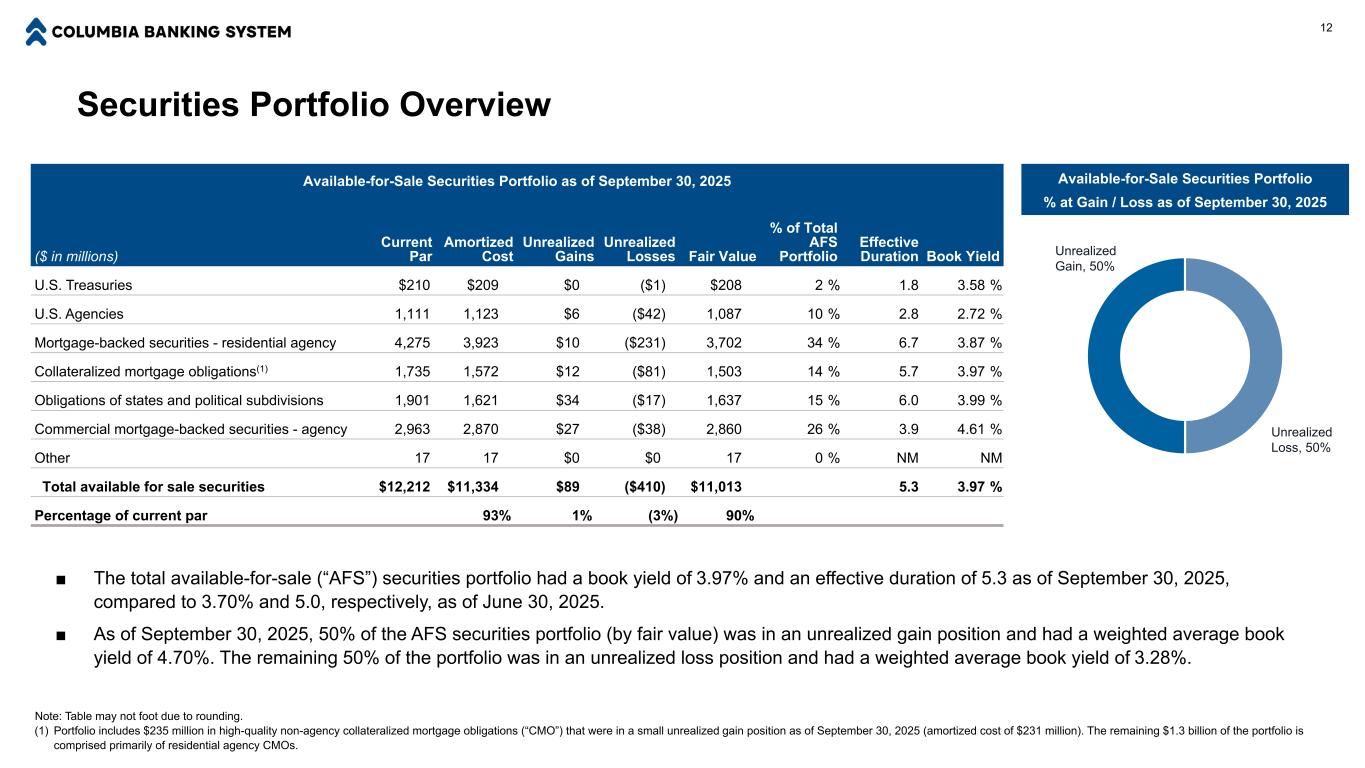

Available-for-Sale Securities Portfolio as of September 30, 2025 ($ in millions) Current Par Amortized Cost Unrealized Gains Unrealized Losses Fair Value % of Total AFS Portfolio Effective Duration Book Yield U.S. Treasuries $210 $209 $0 ($1) $208 2 % 1.8 3.58 % U.S. Agencies 1,111 1,123 $6 ($42) 1,087 10 % 2.8 2.72 % Mortgage-backed securities - residential agency 4,275 3,923 $10 ($231) 3,702 34 % 6.7 3.87 % Collateralized mortgage obligations(1) 1,735 1,572 $12 ($81) 1,503 14 % 5.7 3.97 % Obligations of states and political subdivisions 1,901 1,621 $34 ($17) 1,637 15 % 6.0 3.99 % Commercial mortgage-backed securities - agency 2,963 2,870 $27 ($38) 2,860 26 % 3.9 4.61 % Other 17 17 $0 $0 17 0 % NM NM Total available for sale securities $12,212 $11,334 $89 ($410) $11,013 5.3 3.97 % Percentage of current par 93% 1% (3%) 90% 12 Securities Portfolio Overview Note: Table may not foot due to rounding. (1) Portfolio includes $235 million in high-quality non-agency collateralized mortgage obligations (“CMO”) that were in a small unrealized gain position as of September 30, 2025 (amortized cost of $231 million). The remaining $1.3 billion of the portfolio is comprised primarily of residential agency CMOs. ■ The total available-for-sale (“AFS”) securities portfolio had a book yield of 3.97% and an effective duration of 5.3 as of September 30, 2025, compared to 3.70% and 5.0, respectively, as of June 30, 2025. ■ As of September 30, 2025, 50% of the AFS securities portfolio (by fair value) was in an unrealized gain position and had a weighted average book yield of 4.70%. The remaining 50% of the portfolio was in an unrealized loss position and had a weighted average book yield of 3.28%. Unrealized Gain, 50% Unrealized Loss, 50% Available-for-Sale Securities Portfolio % at Gain / Loss as of September 30, 2025

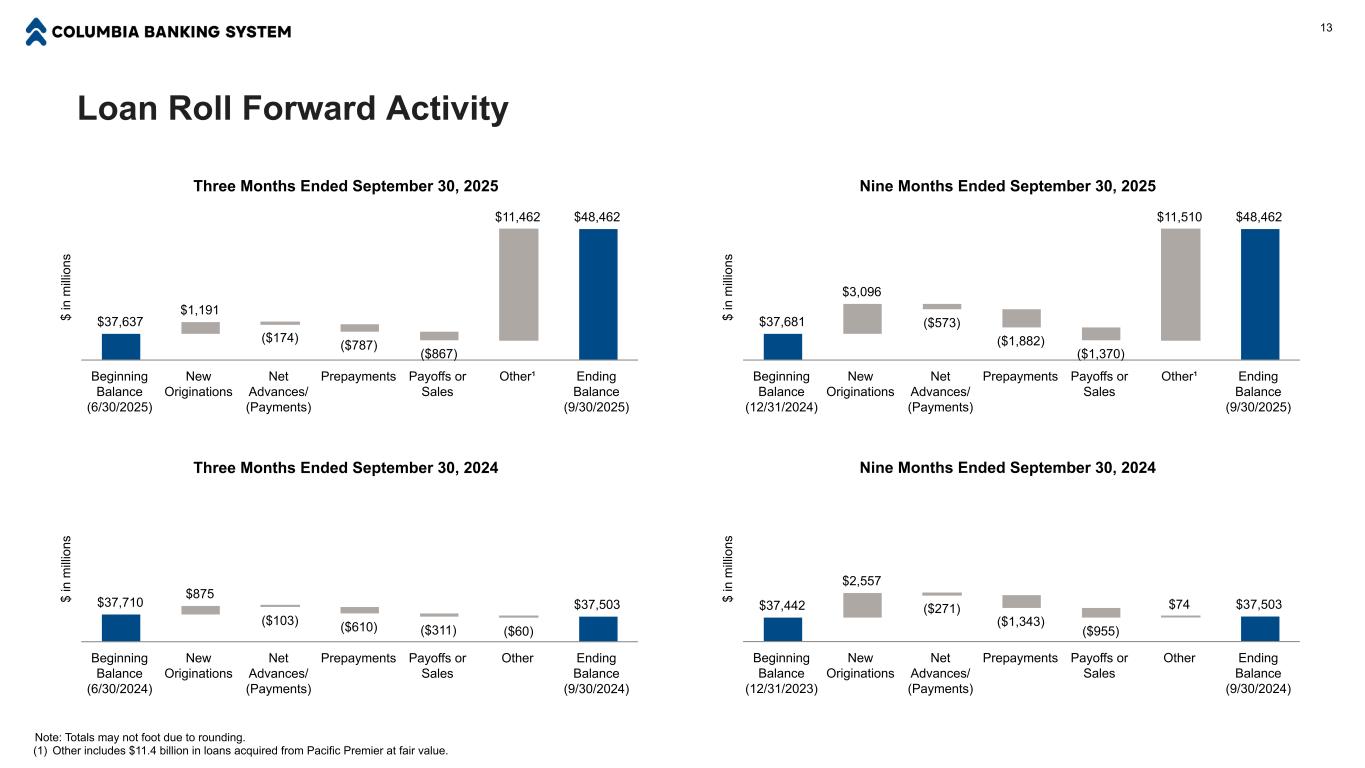

Loan Roll Forward Activity $ in m illi on s Three Months Ended September 30, 2025 $37,637 $1,191 ($174) ($787) ($867) $11,462 $48,462 Beginning Balance (6/30/2025) New Originations Net Advances/ (Payments) Prepayments Payoffs or Sales Other¹ Ending Balance (9/30/2025) 13 $ in m illi on s Three Months Ended September 30, 2024 $37,710 $875 ($103) ($610) ($311) ($60) $37,503 Beginning Balance (6/30/2024) New Originations Net Advances/ (Payments) Prepayments Payoffs or Sales Other Ending Balance (9/30/2024) $ in m illi on s Nine Months Ended September 30, 2025 $37,681 $3,096 ($573) ($1,882) ($1,370) $11,510 $48,462 Beginning Balance (12/31/2024) New Originations Net Advances/ (Payments) Prepayments Payoffs or Sales Other¹ Ending Balance (9/30/2025) $ in m illi on s Nine Months Ended September 30, 2024 $37,442 $2,557 ($271) ($1,343) ($955) $74 $37,503 Beginning Balance (12/31/2023) New Originations Net Advances/ (Payments) Prepayments Payoffs or Sales Other Ending Balance (9/30/2024) Note: Totals may not foot due to rounding. (1) Other includes $11.4 billion in loans acquired from Pacific Premier at fair value.

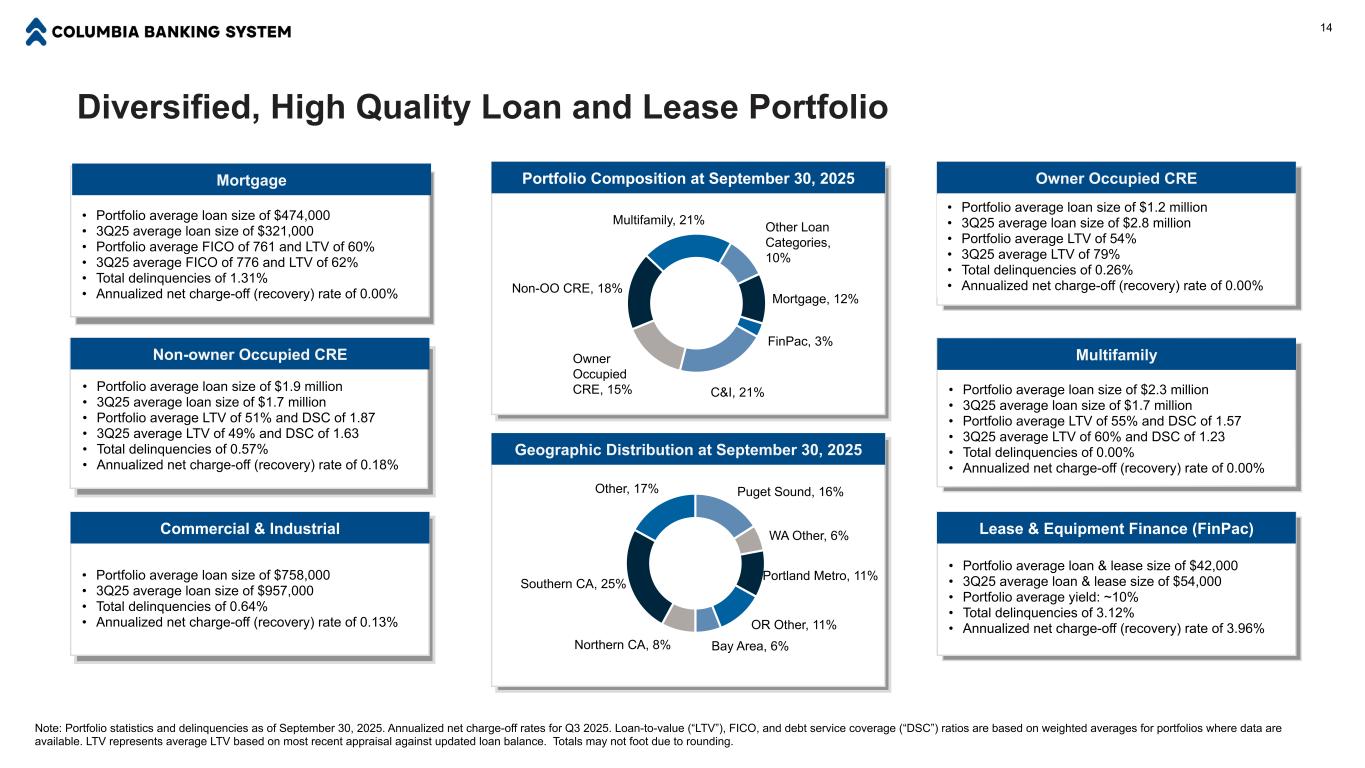

Diversified, High Quality Loan and Lease Portfolio Note: Portfolio statistics and delinquencies as of September 30, 2025. Annualized net charge-off rates for Q3 2025. Loan-to-value (“LTV”), FICO, and debt service coverage (“DSC”) ratios are based on weighted averages for portfolios where data are available. LTV represents average LTV based on most recent appraisal against updated loan balance. Totals may not foot due to rounding. • Portfolio average loan size of $474,000 • 3Q25 average loan size of $321,000 • Portfolio average FICO of 761 and LTV of 60% • 3Q25 average FICO of 776 and LTV of 62% • Total delinquencies of 1.31% • Annualized net charge-off (recovery) rate of 0.00% Non-owner Occupied CRE • Portfolio average loan size of $1.9 million • 3Q25 average loan size of $1.7 million • Portfolio average LTV of 51% and DSC of 1.87 • 3Q25 average LTV of 49% and DSC of 1.63 • Total delinquencies of 0.57% • Annualized net charge-off (recovery) rate of 0.18% Commercial & Industrial • Portfolio average loan size of $758,000 • 3Q25 average loan size of $957,000 • Total delinquencies of 0.64% • Annualized net charge-off (recovery) rate of 0.13% Multifamily • Portfolio average loan size of $2.3 million • 3Q25 average loan size of $1.7 million • Portfolio average LTV of 55% and DSC of 1.57 • 3Q25 average LTV of 60% and DSC of 1.23 • Total delinquencies of 0.00% • Annualized net charge-off (recovery) rate of 0.00% Owner Occupied CRE • Portfolio average loan size of $1.2 million • 3Q25 average loan size of $2.8 million • Portfolio average LTV of 54% • 3Q25 average LTV of 79% • Total delinquencies of 0.26% • Annualized net charge-off (recovery) rate of 0.00% Lease & Equipment Finance (FinPac) • Portfolio average loan & lease size of $42,000 • 3Q25 average loan & lease size of $54,000 • Portfolio average yield: ~10% • Total delinquencies of 3.12% • Annualized net charge-off (recovery) rate of 3.96% Puget Sound, 16% WA Other, 6% Portland Metro, 11% OR Other, 11% Bay Area, 6%Northern CA, 8% Southern CA, 25% Other, 17% Mortgage, 12% FinPac, 3% C&I, 21% Owner Occupied CRE, 15% Non-OO CRE, 18% Multifamily, 21% Other Loan Categories, 10% Portfolio Composition at September 30, 2025 Geographic Distribution at September 30, 2025 Mortgage 14

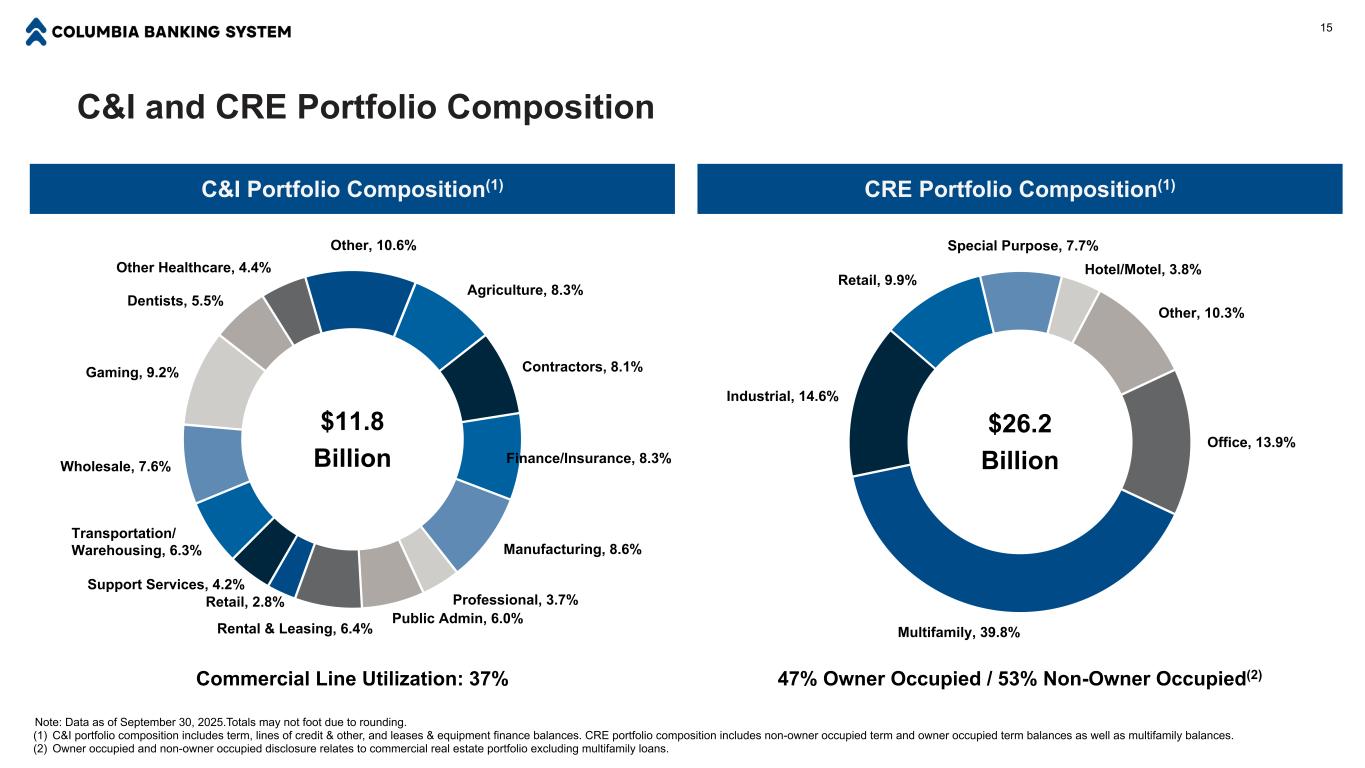

C&I and CRE Portfolio Composition Agriculture, 8.3% Contractors, 8.1% Finance/Insurance, 8.3% Manufacturing, 8.6% Professional, 3.7% Public Admin, 6.0% Rental & Leasing, 6.4% Retail, 2.8% Support Services, 4.2% Transportation/ Warehousing, 6.3% Wholesale, 7.6% Gaming, 9.2% Dentists, 5.5% Other Healthcare, 4.4% Other, 10.6% Office, 13.9% Multifamily, 39.8% Industrial, 14.6% Retail, 9.9% Special Purpose, 7.7% Hotel/Motel, 3.8% Other, 10.3% CRE Portfolio Composition(1)C&I Portfolio Composition(1) Note: Data as of September 30, 2025.Totals may not foot due to rounding. (1) C&I portfolio composition includes term, lines of credit & other, and leases & equipment finance balances. CRE portfolio composition includes non-owner occupied term and owner occupied term balances as well as multifamily balances. (2) Owner occupied and non-owner occupied disclosure relates to commercial real estate portfolio excluding multifamily loans. 47% Owner Occupied / 53% Non-Owner Occupied(2)Commercial Line Utilization: 37% 15 $11.8 Billion $26.2 Billion

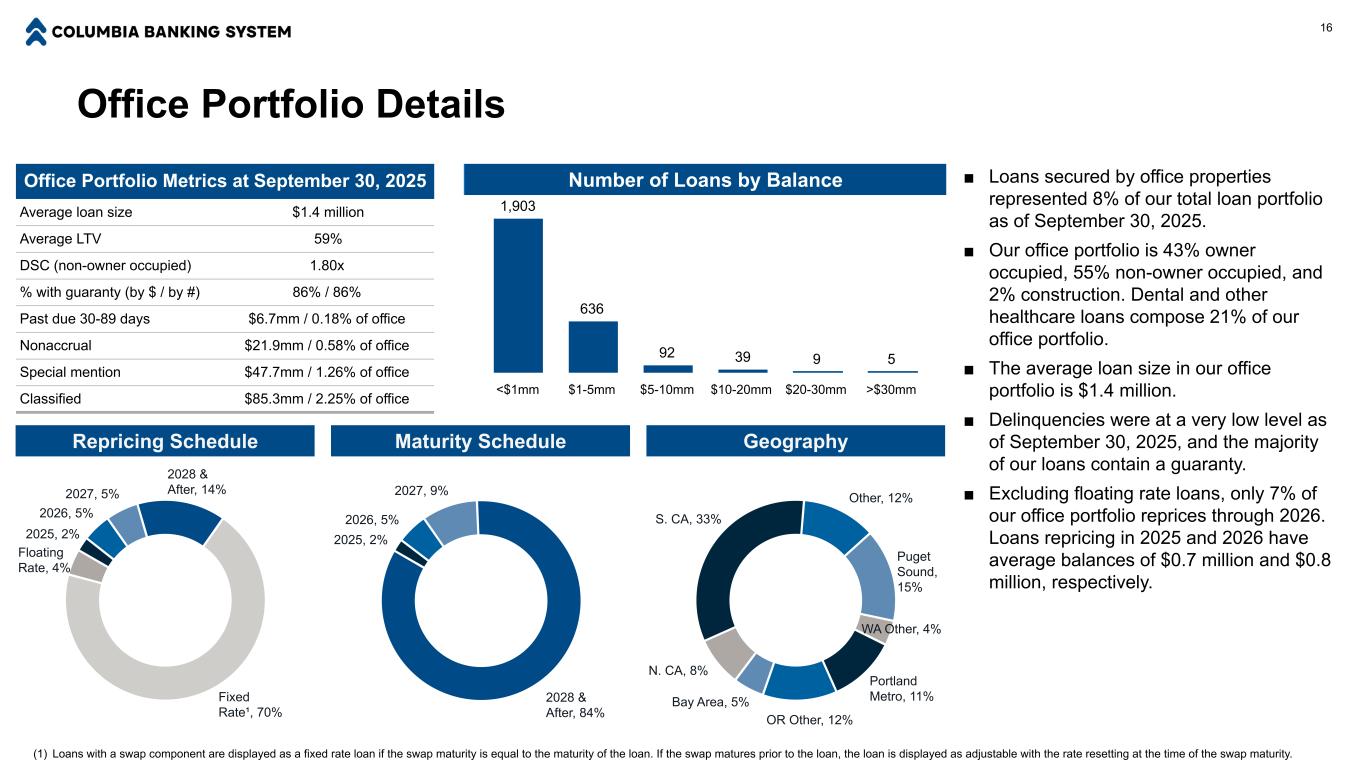

Office Portfolio Details Puget Sound, 15% WA Other, 4% Portland Metro, 11% OR Other, 12% Bay Area, 5% N. CA, 8% S. CA, 33% Other, 12% Office Portfolio Metrics at September 30, 2025 Average loan size $1.4 million Average LTV 59% DSC (non-owner occupied) 1.80x % with guaranty (by $ / by #) 86% / 86% Past due 30-89 days $6.7mm / 0.18% of office Nonaccrual $21.9mm / 0.58% of office Special mention $47.7mm / 1.26% of office Classified $85.3mm / 2.25% of office Number of Loans by Balance Geography 16 ■ Loans secured by office properties represented 8% of our total loan portfolio as of September 30, 2025. ■ Our office portfolio is 43% owner occupied, 55% non-owner occupied, and 2% construction. Dental and other healthcare loans compose 21% of our office portfolio. ■ The average loan size in our office portfolio is $1.4 million. ■ Delinquencies were at a very low level as of September 30, 2025, and the majority of our loans contain a guaranty. ■ Excluding floating rate loans, only 7% of our office portfolio reprices through 2026. Loans repricing in 2025 and 2026 have average balances of $0.7 million and $0.8 million, respectively. 1,746 441 71 38 7 6 <$1mm $1-5mm $5-10mm $10-20mm $20-30mm >$30mm 2025, 2% 2026, 5% 2027, 5% 2028 & After, 14% Fixed Rate¹, 70% Floating Rate, 4% Repricing Schedule (1) Loans with a swap component are displayed as a fixed rate loan if the swap maturity is equal to the maturity of the loan. If the swap matures prior to the loan, the loan is displayed as adjustable with the rate resetting at the time of the swap maturity. 2025, 2% 2026, 5% 2027, 9% 2028 & After, 84% Maturity Schedule , 19 8 9 6 7 1,903 636 92 9 5

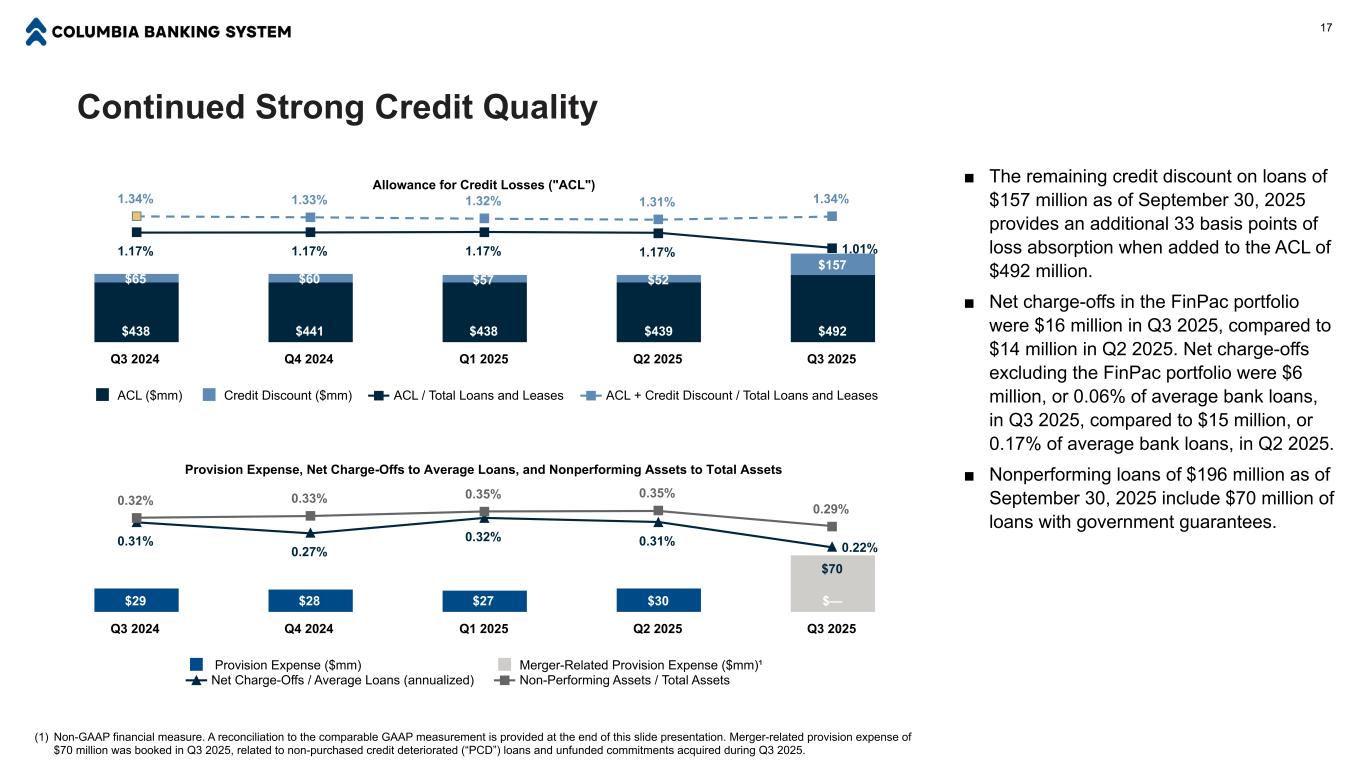

Continued Strong Credit Quality Provision Expense, Net Charge-Offs to Average Loans, and Nonperforming Assets to Total Assets $29 $28 $27 $30 $— $70 0.31% 0.27% 0.32% 0.31% 0.22% 0.32% 0.33% 0.35% 0.35% 0.29% Provision Expense ($mm) Merger-Related Provision Expense ($mm)¹ Net Charge-Offs / Average Loans (annualized) Non-Performing Assets / Total Assets Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 17 Allowance for Credit Losses ("ACL") $438 $441 $438 $439 $492 $65 $60 $57 $52 $157 1.17% 1.17% 1.17% 1.17% 1.01% 1.34% 1.33% 1.32% 1.31% 1.34% ACL ($mm) Credit Discount ($mm) ACL / Total Loans and Leases ACL + Credit Discount / Total Loans and Leases Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 ■ The remaining credit discount on loans of $157 million as of September 30, 2025 provides an additional 33 basis points of loss absorption when added to the ACL of $492 million. ■ Net charge-offs in the FinPac portfolio were $16 million in Q3 2025, compared to $14 million in Q2 2025. Net charge-offs excluding the FinPac portfolio were $6 million, or 0.06% of average bank loans, in Q3 2025, compared to $15 million, or 0.17% of average bank loans, in Q2 2025. ■ Nonperforming loans of $196 million as of September 30, 2025 include $70 million of loans with government guarantees. (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided at the end of this slide presentation. Merger-related provision expense of $70 million was booked in Q3 2025, related to non-purchased credit deteriorated (“PCD”) loans and unfunded commitments acquired during Q3 2025.

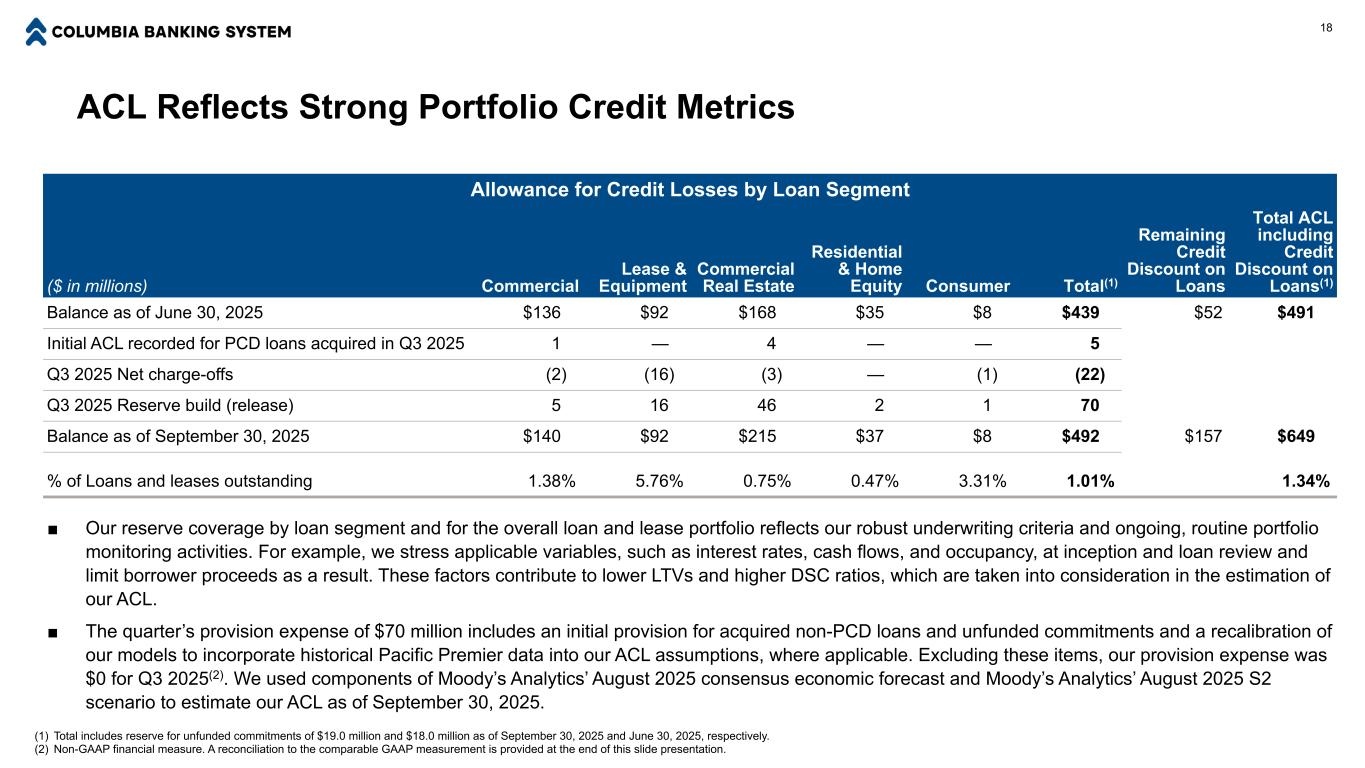

ACL Reflects Strong Portfolio Credit Metrics (1) Total includes reserve for unfunded commitments of $19.0 million and $18.0 million as of September 30, 2025 and June 30, 2025, respectively. (2) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided at the end of this slide presentation. 18 ■ Our reserve coverage by loan segment and for the overall loan and lease portfolio reflects our robust underwriting criteria and ongoing, routine portfolio monitoring activities. For example, we stress applicable variables, such as interest rates, cash flows, and occupancy, at inception and loan review and limit borrower proceeds as a result. These factors contribute to lower LTVs and higher DSC ratios, which are taken into consideration in the estimation of our ACL. ■ The quarter’s provision expense of $70 million includes an initial provision for acquired non-PCD loans and unfunded commitments and a recalibration of our models to incorporate historical Pacific Premier data into our ACL assumptions, where applicable. Excluding these items, our provision expense was $0 for Q3 2025(2). We used components of Moody’s Analytics’ August 2025 consensus economic forecast and Moody’s Analytics’ August 2025 S2 scenario to estimate our ACL as of September 30, 2025. Allowance for Credit Losses by Loan Segment ($ in millions) Commercial Lease & Equipment Commercial Real Estate Residential & Home Equity Consumer Total(1) Remaining Credit Discount on Loans Total ACL including Credit Discount on Loans(1) Balance as of June 30, 2025 $136 $92 $168 $35 $8 $439 $52 $491 Initial ACL recorded for PCD loans acquired in Q3 2025 1 — 4 — — 5 Q3 2025 Net charge-offs (2) (16) (3) — (1) (22) Q3 2025 Reserve build (release) 5 16 46 2 1 70 Balance as of September 30, 2025 $140 $92 $215 $37 $8 $492 $157 $649 % of Loans and leases outstanding 1.38% 5.76% 0.75% 0.47% 3.31% 1.01% 1.34%

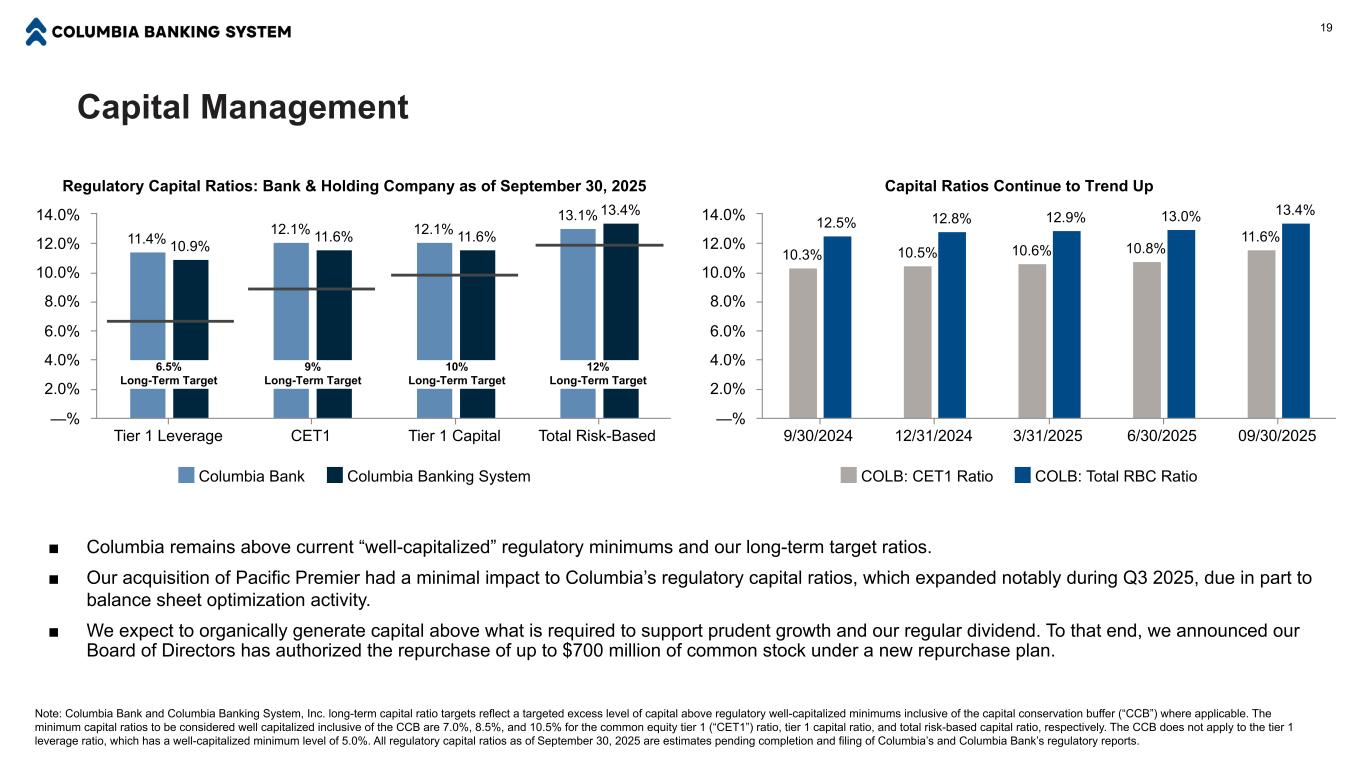

Capital Management 19 Regulatory Capital Ratios: Bank & Holding Company as of September 30, 2025 11.4% 12.1% 12.1% 13.1% 10.9% 11.6% 11.6% 13.4% Columbia Bank Columbia Banking System Tier 1 Leverage CET1 Tier 1 Capital Total Risk-Based —% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% ■ Columbia remains above current “well-capitalized” regulatory minimums and our long-term target ratios. ■ Our acquisition of Pacific Premier had a minimal impact to Columbia’s regulatory capital ratios, which expanded notably during Q3 2025, due in part to balance sheet optimization activity. ■ We expect to organically generate capital above what is required to support prudent growth and our regular dividend. To that end, we announced our Board of Directors has authorized the repurchase of up to $700 million of common stock under a new repurchase plan. Note: Columbia Bank and Columbia Banking System, Inc. long-term capital ratio targets reflect a targeted excess level of capital above regulatory well-capitalized minimums inclusive of the capital conservation buffer (“CCB”) where applicable. The minimum capital ratios to be considered well capitalized inclusive of the CCB are 7.0%, 8.5%, and 10.5% for the common equity tier 1 (“CET1”) ratio, tier 1 capital ratio, and total risk-based capital ratio, respectively. The CCB does not apply to the tier 1 leverage ratio, which has a well-capitalized minimum level of 5.0%. All regulatory capital ratios as of September 30, 2025 are estimates pending completion and filing of Columbia’s and Columbia Bank’s regulatory reports. Capital Ratios Continue to Trend Up 10.3% 10.5% 10.6% 10.8% 11.6% 12.5% 12.8% 12.9% 13.0% 13.4% COLB: CET1 Ratio COLB: Total RBC Ratio 9/30/2024 12/31/2024 3/31/2025 6/30/2025 09/30/2025 —% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 12% Long-Term Target 10% Long-Term Target 9% Long-Term Target 6.5% Long-Term Target

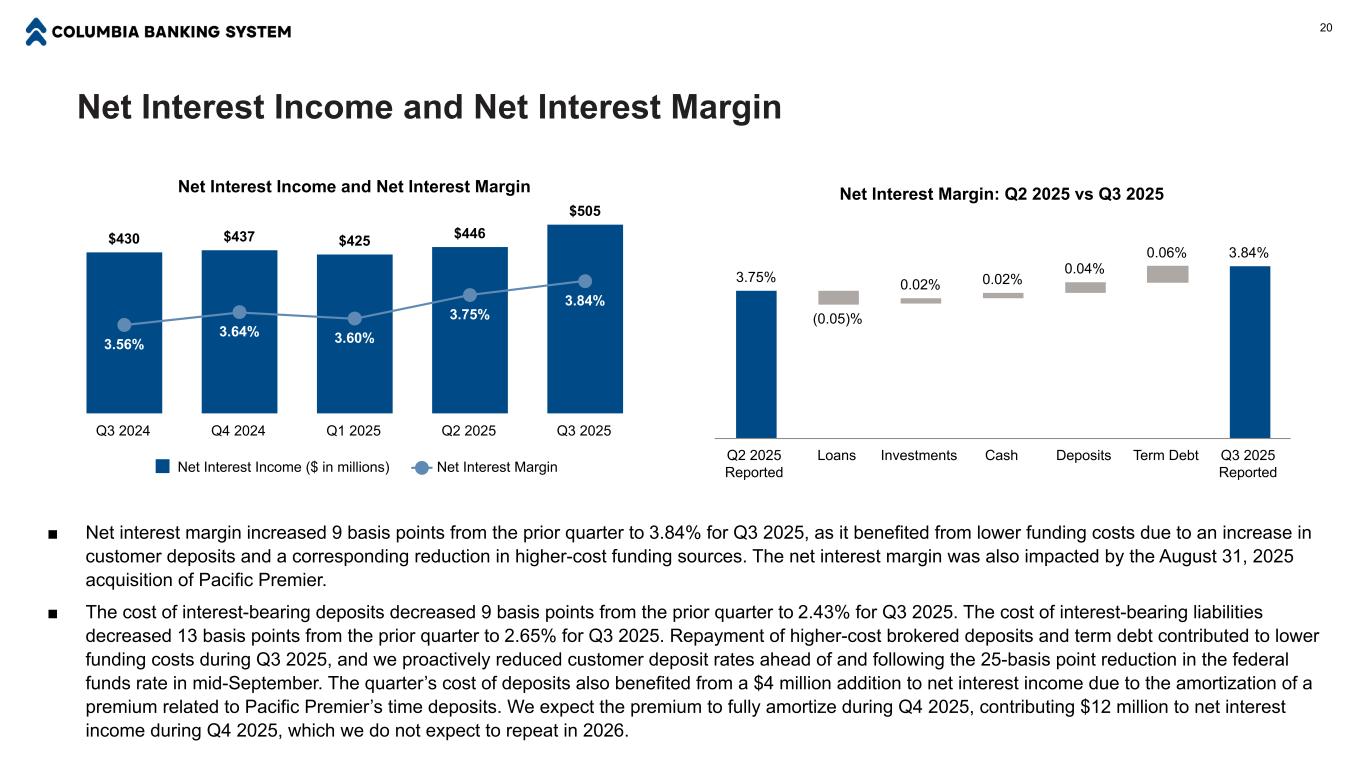

Net Interest Income and Net Interest Margin Net Interest Income and Net Interest Margin $430 $437 $425 $446 $505 3.56% 3.64% 3.60% 3.75% 3.84% Net Interest Income ($ in millions) Net Interest Margin Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Net Interest Margin: Q2 2025 vs Q3 2025 3.75% (0.05)% 0.02% 0.02% 0.04% 0.06% 3.84% Q2 2025 Reported Loans Investments Cash Deposits Term Debt Q3 2025 Reported 20 ■ Net interest margin increased 9 basis points from the prior quarter to 3.84% for Q3 2025, as it benefited from lower funding costs due to an increase in customer deposits and a corresponding reduction in higher-cost funding sources. The net interest margin was also impacted by the August 31, 2025 acquisition of Pacific Premier. ■ The cost of interest-bearing deposits decreased 9 basis points from the prior quarter to 2.43% for Q3 2025. The cost of interest-bearing liabilities decreased 13 basis points from the prior quarter to 2.65% for Q3 2025. Repayment of higher-cost brokered deposits and term debt contributed to lower funding costs during Q3 2025, and we proactively reduced customer deposit rates ahead of and following the 25-basis point reduction in the federal funds rate in mid-September. The quarter’s cost of deposits also benefited from a $4 million addition to net interest income due to the amortization of a premium related to Pacific Premier’s time deposits. We expect the premium to fully amortize during Q4 2025, contributing $12 million to net interest income during Q4 2025, which we do not expect to repeat in 2026.

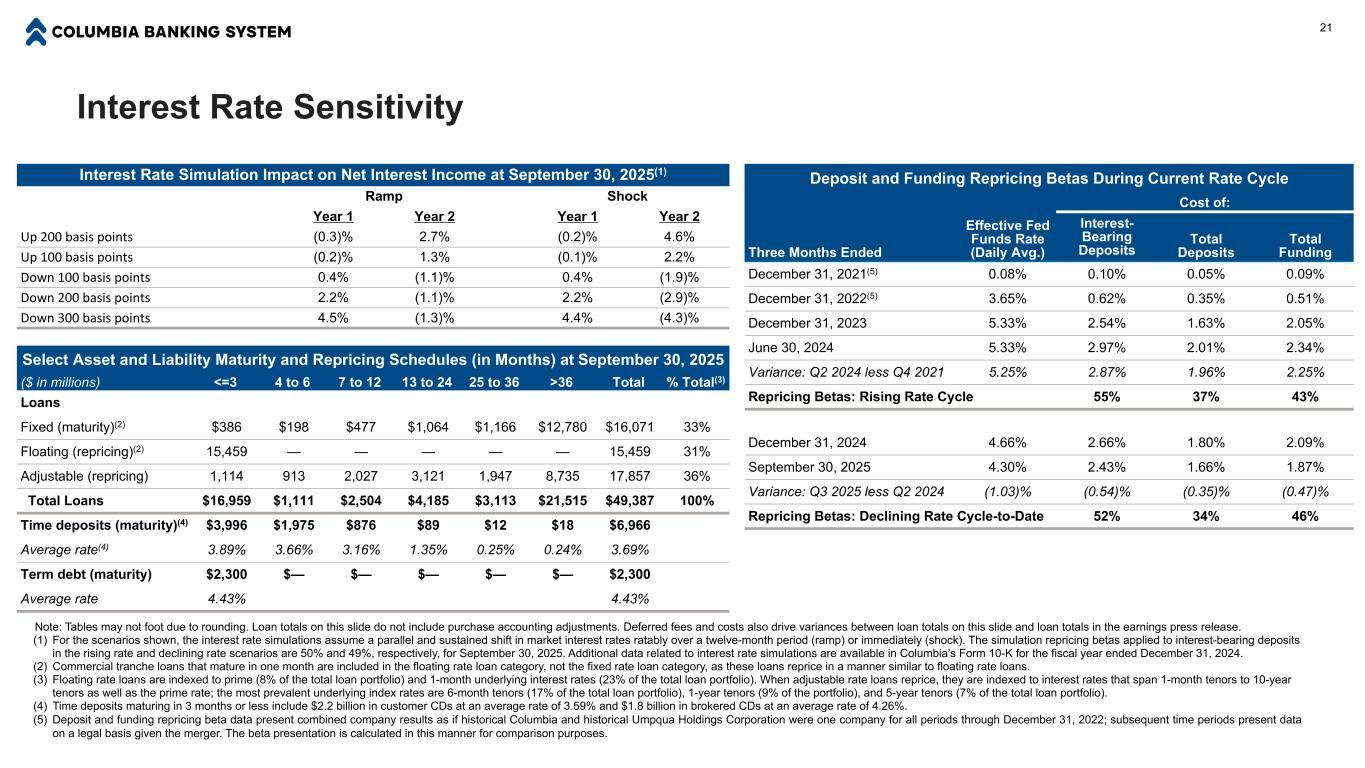

Select Asset and Liability Maturity and Repricing Schedules (in Months) at September 30, 2025 ($ in millions) <=3 4 to 6 7 to 12 13 to 24 25 to 36 >36 Total % Total(3) Loans Fixed (maturity)(2) $386 $198 $477 $1,064 $1,166 $12,780 $16,071 33% Floating (repricing)(2) 15,459 — — — — — 15,459 31% Adjustable (repricing) 1,114 913 2,027 3,121 1,947 8,735 17,857 36% Total Loans $16,959 $1,111 $2,504 $4,185 $3,113 $21,515 $49,387 100% Time deposits (maturity)(4) $3,996 $1,975 $876 $89 $12 $18 $6,966 Average rate(4) 3.89% 3.66% 3.16% 1.35% 0.25% 0.24% 3.69% Term debt (maturity) $2,300 $— $— $— $— $— $2,300 Average rate 4.43% 4.43% Interest Rate Sensitivity 21 Note: Tables may not foot due to rounding. Loan totals on this slide do not include purchase accounting adjustments. Deferred fees and costs also drive variances between loan totals on this slide and loan totals in the earnings press release. (1) For the scenarios shown, the interest rate simulations assume a parallel and sustained shift in market interest rates ratably over a twelve-month period (ramp) or immediately (shock). The simulation repricing betas applied to interest-bearing deposits in the rising rate and declining rate scenarios are 50% and 49%, respectively, for September 30, 2025. Additional data related to interest rate simulations are available in Columbia’s Form 10-K for the fiscal year ended December 31, 2024. (2) Commercial tranche loans that mature in one month are included in the floating rate loan category, not the fixed rate loan category, as these loans reprice in a manner similar to floating rate loans. (3) Floating rate loans are indexed to prime (8% of the total loan portfolio) and 1-month underlying interest rates (23% of the total loan portfolio). When adjustable rate loans reprice, they are indexed to interest rates that span 1-month tenors to 10-year tenors as well as the prime rate; the most prevalent underlying index rates are 6-month tenors (17% of the total loan portfolio), 1-year tenors (9% of the portfolio), and 5-year tenors (7% of the total loan portfolio). (4) Time deposits maturing in 3 months or less include $2.2 billion in customer CDs at an average rate of 3.59% and $1.8 billion in brokered CDs at an average rate of 4.26%. (5) Deposit and funding repricing beta data present combined company results as if historical Columbia and historical Umpqua Holdings Corporation were one company for all periods through December 31, 2022; subsequent time periods present data on a legal basis given the merger. The beta presentation is calculated in this manner for comparison purposes. Interest Rate Simulation Impact on Net Interest Income at September 30, 2025(1) Ramp Shock Year 1 Year 2 Year 1 Year 2 Up 200 basis points (0.3)% 2.7% (0.2)% 4.6% Up 100 basis points (0.2)% 1.3% (0.1)% 2.2% Down 100 basis points 0.4% (1.1)% 0.4% (1.9)% Down 200 basis points 2.2% (1.1)% 2.2% (2.9)% Down 300 basis points 4.5% (1.3)% 4.4% (4.3)% Deposit and Funding Repricing Betas During Current Rate Cycle Effective Fed Funds Rate (Daily Avg.) Cost of: Three Months Ended Interest- Bearing Deposits Total Deposits Total Funding December 31, 2021(5) 0.08% 0.10% 0.05% 0.09% December 31, 2022(5) 3.65% 0.62% 0.35% 0.51% December 31, 2023 5.33% 2.54% 1.63% 2.05% June 30, 2024 5.33% 2.97% 2.01% 2.34% Variance: Q2 2024 less Q4 2021 5.25% 2.87% 1.96% 2.25% Repricing Betas: Rising Rate Cycle 55% 37% 43% December 31, 2024 4.66% 2.66% 1.80% 2.09% September 30, 2025 4.30% 2.43% 1.66% 1.87% Variance: Q3 2025 less Q2 2024 (1.03)% (0.54)% (0.35)% (0.47)% Repricing Betas: Declining Rate Cycle-to-Date 52% 34% 46%

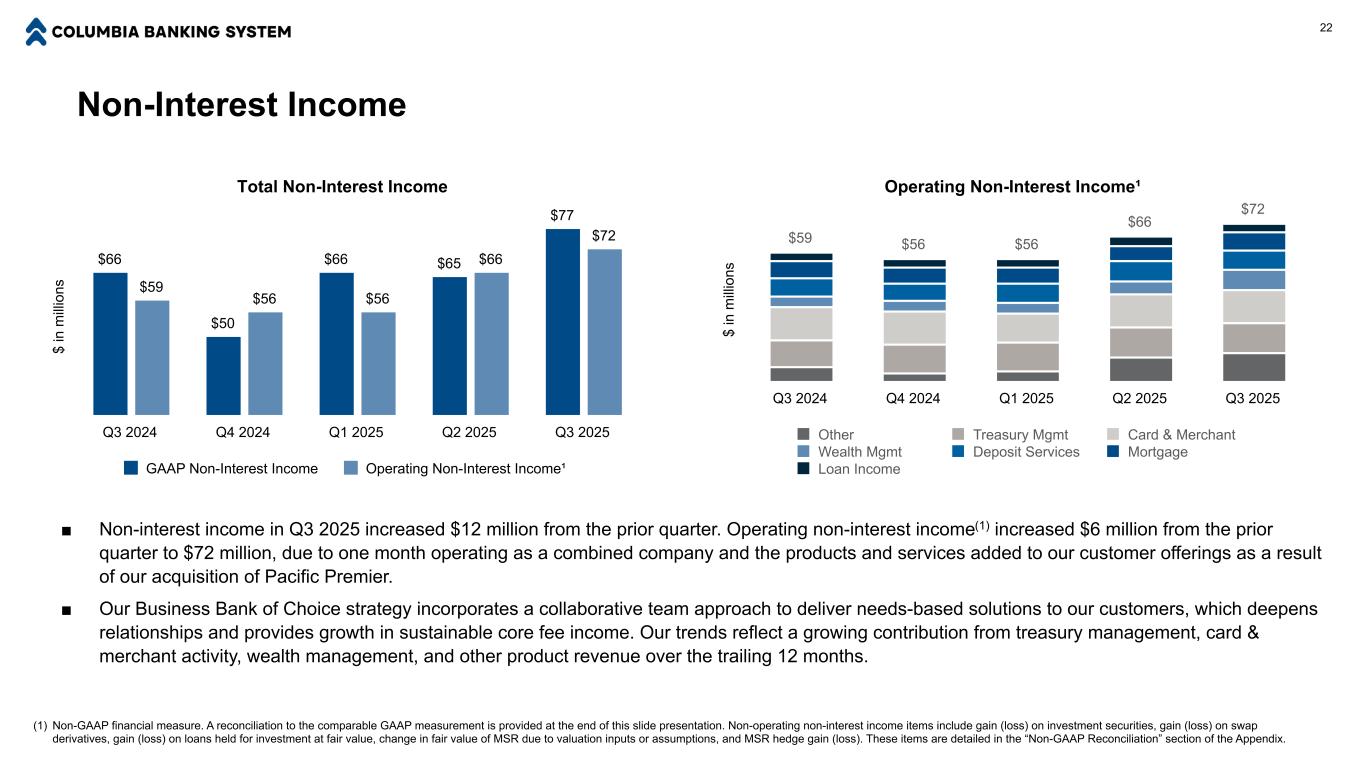

Non-Interest Income 22 $ in m ill io ns Total Non-Interest Income $66 $50 $66 $65 $77 $59 $56 $56 $66 $72 GAAP Non-Interest Income Operating Non-Interest Income¹ Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 ■ Non-interest income in Q3 2025 increased $12 million from the prior quarter. Operating non-interest income(1) increased $6 million from the prior quarter to $72 million, due to one month operating as a combined company and the products and services added to our customer offerings as a result of our acquisition of Pacific Premier. ■ Our Business Bank of Choice strategy incorporates a collaborative team approach to deliver needs-based solutions to our customers, which deepens relationships and provides growth in sustainable core fee income. Our trends reflect a growing contribution from treasury management, card & merchant activity, wealth management, and other product revenue over the trailing 12 months. $ in m ill io ns Operating Non-Interest Income¹ $59 $56 $56 $66 $72 Other Treasury Mgmt Card & Merchant Wealth Mgmt Deposit Services Mortgage Loan Income Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided at the end of this slide presentation. Non-operating non-interest income items include gain (loss) on investment securities, gain (loss) on swap derivatives, gain (loss) on loans held for investment at fair value, change in fair value of MSR due to valuation inputs or assumptions, and MSR hedge gain (loss). These items are detailed in the “Non-GAAP Reconciliation” section of the Appendix.

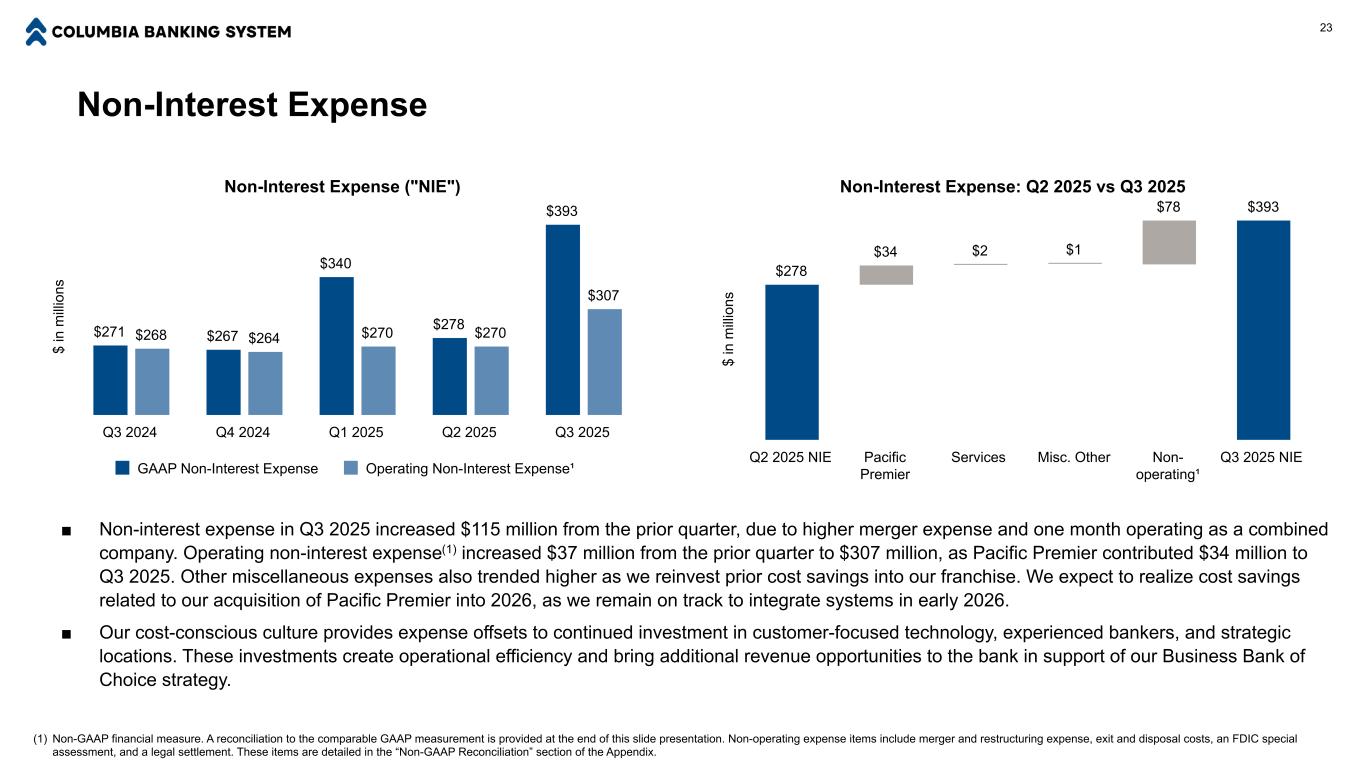

Non-Interest Expense 23 $ in m ill io ns Non-Interest Expense ("NIE") $271 $267 $340 $278 $393 $268 $264 $270 $270 $307 GAAP Non-Interest Expense Operating Non-Interest Expense¹ Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 ■ Non-interest expense in Q3 2025 increased $115 million from the prior quarter, due to higher merger expense and one month operating as a combined company. Operating non-interest expense(1) increased $37 million from the prior quarter to $307 million, as Pacific Premier contributed $34 million to Q3 2025. Other miscellaneous expenses also trended higher as we reinvest prior cost savings into our franchise. We expect to realize cost savings related to our acquisition of Pacific Premier into 2026, as we remain on track to integrate systems in early 2026. ■ Our cost-conscious culture provides expense offsets to continued investment in customer-focused technology, experienced bankers, and strategic locations. These investments create operational efficiency and bring additional revenue opportunities to the bank in support of our Business Bank of Choice strategy. $ in m ill io ns Non-Interest Expense: Q2 2025 vs Q3 2025 $278 $34 $2 $1 $78 $393 Q2 2025 NIE Pacific Premier Services Misc. Other Non- operating¹ Q3 2025 NIE (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided at the end of this slide presentation. Non-operating expense items include merger and restructuring expense, exit and disposal costs, an FDIC special assessment, and a legal settlement. These items are detailed in the “Non-GAAP Reconciliation” section of the Appendix.

24 Appendix

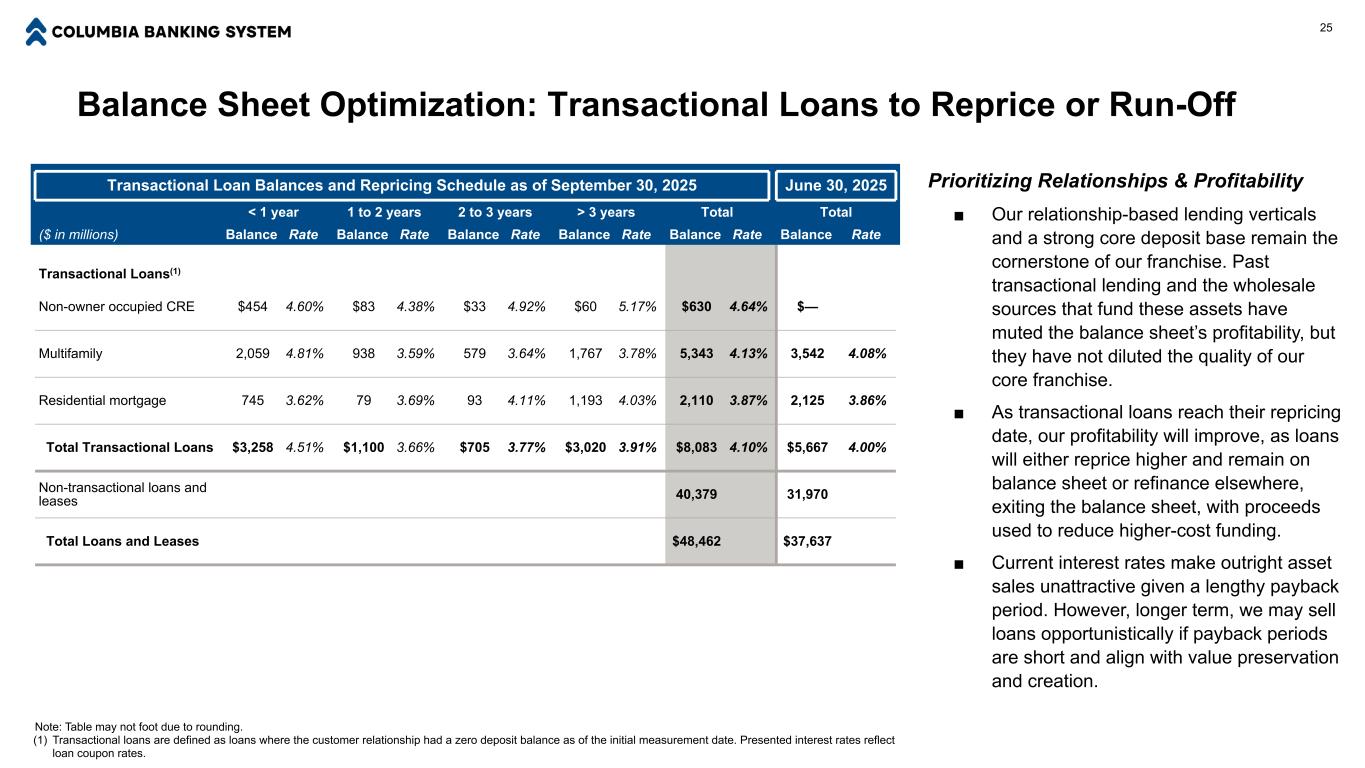

Balance Sheet Optimization: Transactional Loans to Reprice or Run-Off 25 Transactional Loan Balances and Repricing Schedule as of September 30, 2025 June 30, 2025 < 1 year 1 to 2 years 2 to 3 years > 3 years Total Total ($ in millions) Balance Rate Balance Rate Balance Rate Balance Rate Balance Rate Balance Rate Transactional Loans(1) Non-owner occupied CRE $454 4.60% $83 4.38% $33 4.92% $60 5.17% $630 4.64% $— Multifamily 2,059 4.81% 938 3.59% 579 3.64% 1,767 3.78% 5,343 4.13% 3,542 4.08% Residential mortgage 745 3.62% 79 3.69% 93 4.11% 1,193 4.03% 2,110 3.87% 2,125 3.86% Total Transactional Loans $3,258 4.51% $1,100 3.66% $705 3.77% $3,020 3.91% $8,083 4.10% $5,667 4.00% Non-transactional loans and leases 40,379 31,970 Total Loans and Leases $48,462 $37,637 Prioritizing Relationships & Profitability ■ Our relationship-based lending verticals and a strong core deposit base remain the cornerstone of our franchise. Past transactional lending and the wholesale sources that fund these assets have muted the balance sheet’s profitability, but they have not diluted the quality of our core franchise. ■ As transactional loans reach their repricing date, our profitability will improve, as loans will either reprice higher and remain on balance sheet or refinance elsewhere, exiting the balance sheet, with proceeds used to reduce higher-cost funding. ■ Current interest rates make outright asset sales unattractive given a lengthy payback period. However, longer term, we may sell loans opportunistically if payback periods are short and align with value preservation and creation. Note: Table may not foot due to rounding. (1) Transactional loans are defined as loans where the customer relationship had a zero deposit balance as of the initial measurement date. Presented interest rates reflect loan coupon rates.

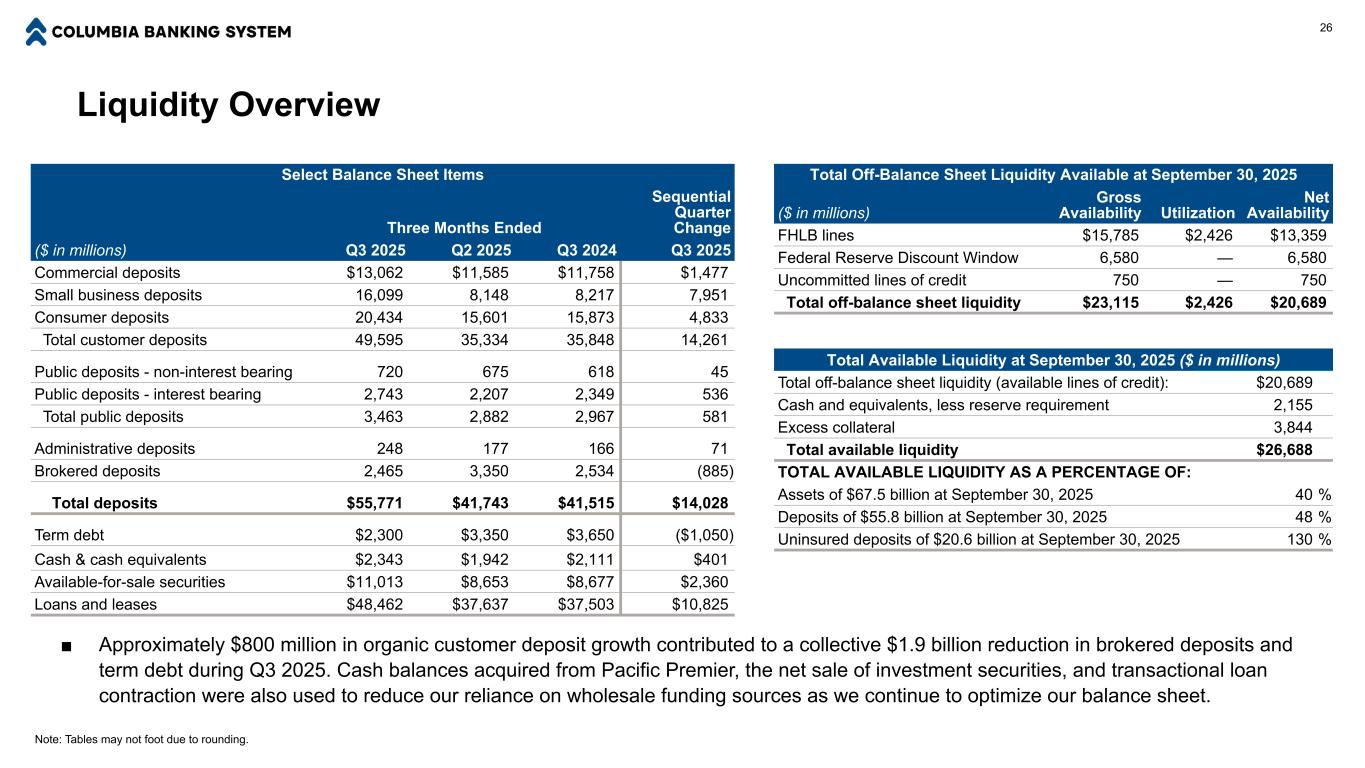

Liquidity Overview Total Available Liquidity at September 30, 2025 ($ in millions) Total off-balance sheet liquidity (available lines of credit): $20,689 Cash and equivalents, less reserve requirement 2,155 Excess collateral 3,844 Total available liquidity $26,688 TOTAL AVAILABLE LIQUIDITY AS A PERCENTAGE OF: Assets of $67.5 billion at September 30, 2025 40 % Deposits of $55.8 billion at September 30, 2025 48 % Uninsured deposits of $20.6 billion at September 30, 2025 130 % Total Off-Balance Sheet Liquidity Available at September 30, 2025 ($ in millions) Gross Availability Utilization Net Availability FHLB lines $15,785 $2,426 $13,359 Federal Reserve Discount Window 6,580 — 6,580 Uncommitted lines of credit 750 — 750 Total off-balance sheet liquidity $23,115 $2,426 $20,689 26 ■ Approximately $800 million in organic customer deposit growth contributed to a collective $1.9 billion reduction in brokered deposits and term debt during Q3 2025. Cash balances acquired from Pacific Premier, the net sale of investment securities, and transactional loan contraction were also used to reduce our reliance on wholesale funding sources as we continue to optimize our balance sheet. Select Balance Sheet Items Three Months Ended Sequential Quarter Change ($ in millions) Q3 2025 Q2 2025 Q3 2024 Q3 2025 Commercial deposits $13,062 $11,585 $11,758 $1,477 Small business deposits 16,099 8,148 8,217 7,951 Consumer deposits 20,434 15,601 15,873 4,833 Total customer deposits 49,595 35,334 35,848 14,261 Public deposits - non-interest bearing 720 675 618 45 Public deposits - interest bearing 2,743 2,207 2,349 536 Total public deposits 3,463 2,882 2,967 581 Administrative deposits 248 177 166 71 Brokered deposits 2,465 3,350 2,534 (885) Total deposits $55,771 $41,743 $41,515 $14,028 Term debt $2,300 $3,350 $3,650 ($1,050) Cash & cash equivalents $2,343 $1,942 $2,111 $401 Available-for-sale securities $11,013 $8,653 $8,677 $2,360 Loans and leases $48,462 $37,637 $37,503 $10,825 Note: Tables may not foot due to rounding.

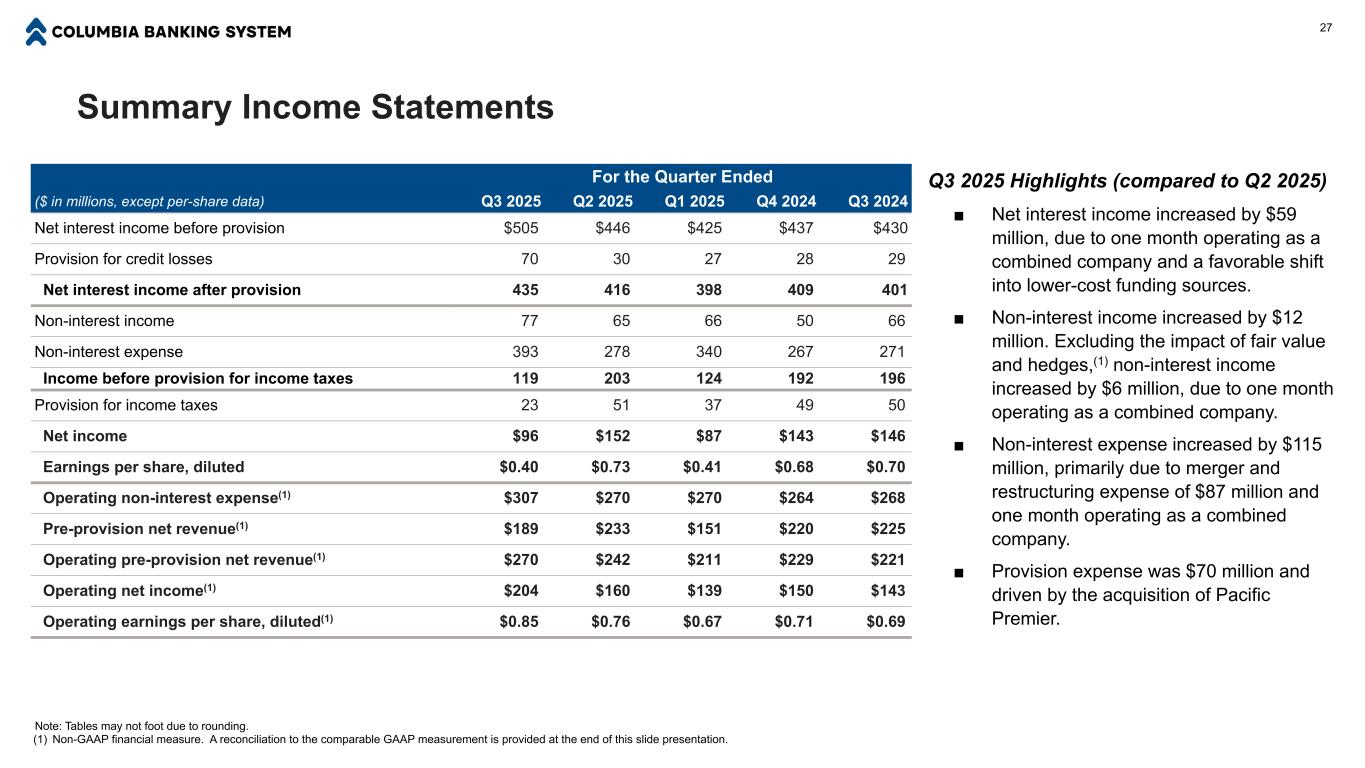

Summary Income Statements Note: Tables may not foot due to rounding. (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided at the end of this slide presentation. For the Quarter Ended ($ in millions, except per-share data) Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 Net interest income before provision $505 $446 $425 $437 $430 Provision for credit losses 70 30 27 28 29 Net interest income after provision 435 416 398 409 401 Non-interest income 77 65 66 50 66 Non-interest expense 393 278 340 267 271 Income before provision for income taxes 119 203 124 192 196 Provision for income taxes 23 51 37 49 50 Net income $96 $152 $87 $143 $146 Earnings per share, diluted $0.40 $0.73 $0.41 $0.68 $0.70 Operating non-interest expense(1) $307 $270 $270 $264 $268 Pre-provision net revenue(1) $189 $233 $151 $220 $225 Operating pre-provision net revenue(1) $270 $242 $211 $229 $221 Operating net income(1) $204 $160 $139 $150 $143 Operating earnings per share, diluted(1) $0.85 $0.76 $0.67 $0.71 $0.69 27 Q3 2025 Highlights (compared to Q2 2025) ■ Net interest income increased by $59 million, due to one month operating as a combined company and a favorable shift into lower-cost funding sources. ■ Non-interest income increased by $12 million. Excluding the impact of fair value and hedges,(1) non-interest income increased by $6 million, due to one month operating as a combined company. ■ Non-interest expense increased by $115 million, primarily due to merger and restructuring expense of $87 million and one month operating as a combined company. ■ Provision expense was $70 million and driven by the acquisition of Pacific Premier.

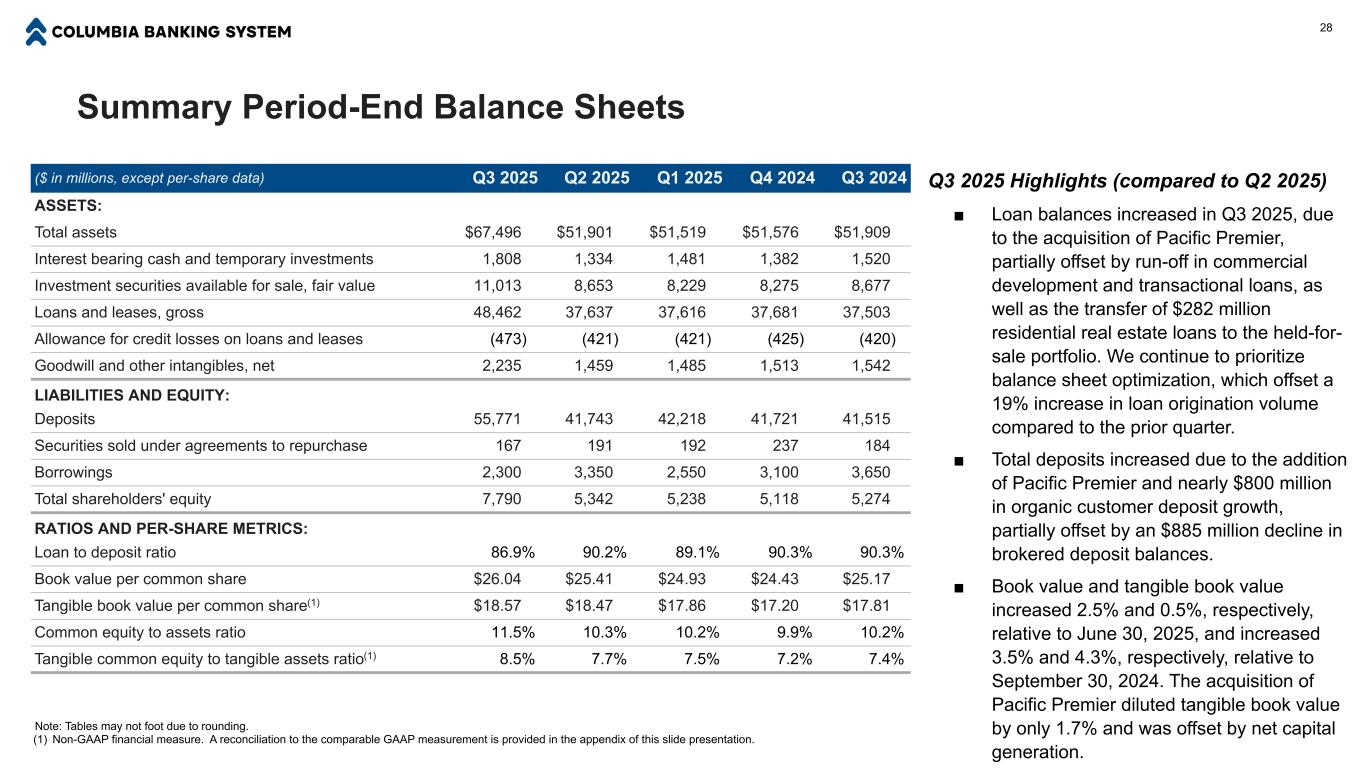

Summary Period-End Balance Sheets Note: Tables may not foot due to rounding. (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided in the appendix of this slide presentation. ($ in millions, except per-share data) Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 ASSETS: Total assets $67,496 $51,901 $51,519 $51,576 $51,909 Interest bearing cash and temporary investments 1,808 1,334 1,481 1,382 1,520 Investment securities available for sale, fair value 11,013 8,653 8,229 8,275 8,677 Loans and leases, gross 48,462 37,637 37,616 37,681 37,503 Allowance for credit losses on loans and leases (473) (421) (421) (425) (420) Goodwill and other intangibles, net 2,235 1,459 1,485 1,513 1,542 LIABILITIES AND EQUITY: Deposits 55,771 41,743 42,218 41,721 41,515 Securities sold under agreements to repurchase 167 191 192 237 184 Borrowings 2,300 3,350 2,550 3,100 3,650 Total shareholders' equity 7,790 5,342 5,238 5,118 5,274 RATIOS AND PER-SHARE METRICS: Loan to deposit ratio 86.9% 90.2% 89.1% 90.3% 90.3% Book value per common share $26.04 $25.41 $24.93 $24.43 $25.17 Tangible book value per common share(1) $18.57 $18.47 $17.86 $17.20 $17.81 Common equity to assets ratio 11.5% 10.3% 10.2% 9.9% 10.2% Tangible common equity to tangible assets ratio(1) 8.5% 7.7% 7.5% 7.2% 7.4% 28 Q3 2025 Highlights (compared to Q2 2025) ■ Loan balances increased in Q3 2025, due to the acquisition of Pacific Premier, partially offset by run-off in commercial development and transactional loans, as well as the transfer of $282 million residential real estate loans to the held-for- sale portfolio. We continue to prioritize balance sheet optimization, which offset a 19% increase in loan origination volume compared to the prior quarter. ■ Total deposits increased due to the addition of Pacific Premier and nearly $800 million in organic customer deposit growth, partially offset by an $885 million decline in brokered deposit balances. ■ Book value and tangible book value increased 2.5% and 0.5%, respectively, relative to June 30, 2025, and increased 3.5% and 4.3%, respectively, relative to September 30, 2024. The acquisition of Pacific Premier diluted tangible book value by only 1.7% and was offset by net capital generation.

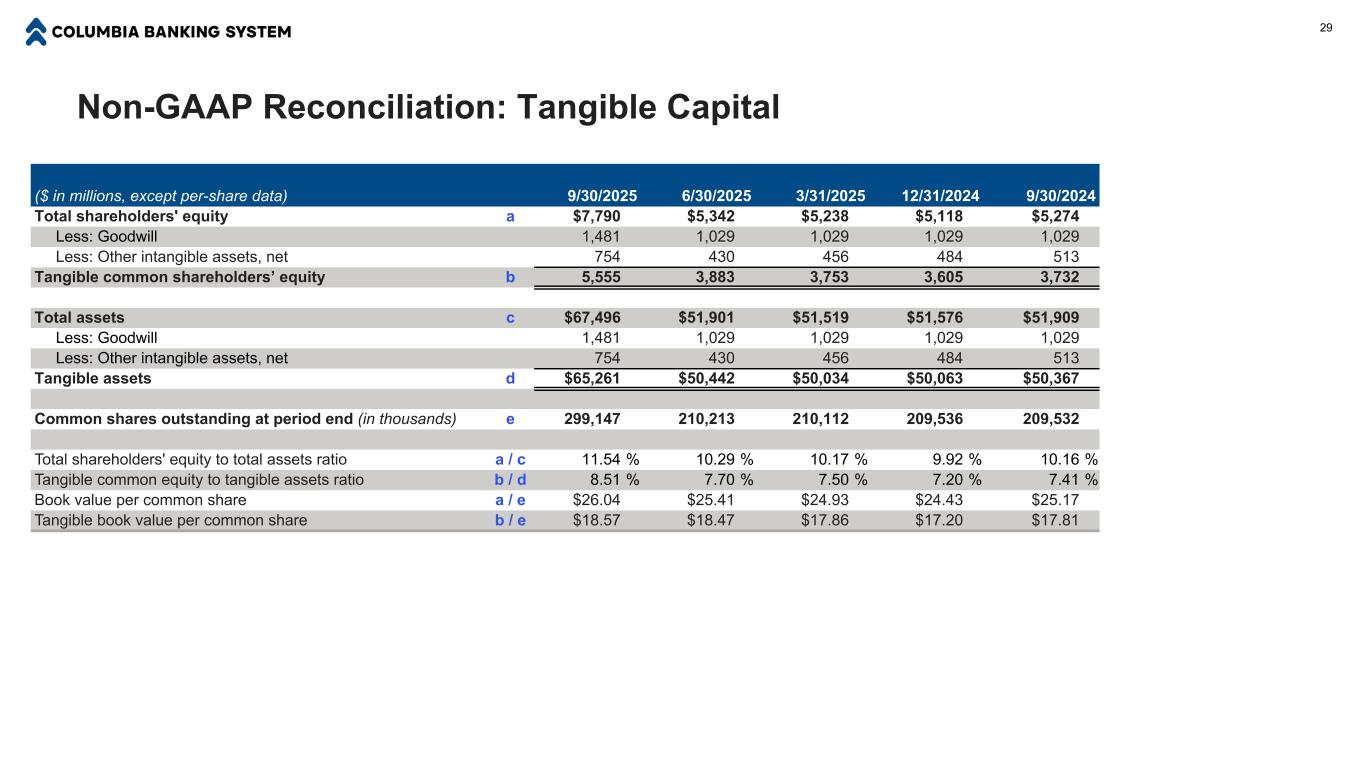

Non-GAAP Reconciliation: Tangible Capital ($ in millions, except per-share data) 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Total shareholders' equity a $7,790 $5,342 $5,238 $5,118 $5,274 Less: Goodwill 1,481 1,029 1,029 1,029 1,029 Less: Other intangible assets, net 754 430 456 484 513 Tangible common shareholders’ equity b 5,555 3,883 3,753 3,605 3,732 Total assets c $67,496 $51,901 $51,519 $51,576 $51,909 Less: Goodwill 1,481 1,029 1,029 1,029 1,029 Less: Other intangible assets, net 754 430 456 484 513 Tangible assets d $65,261 $50,442 $50,034 $50,063 $50,367 Common shares outstanding at period end (in thousands) e 299,147 210,213 210,112 209,536 209,532 Total shareholders' equity to total assets ratio a / c 11.54 % 10.29 % 10.17 % 9.92 % 10.16 % Tangible common equity to tangible assets ratio b / d 8.51 % 7.70 % 7.50 % 7.20 % 7.41 % Book value per common share a / e $26.04 $25.41 $24.93 $24.43 $25.17 Tangible book value per common share b / e $18.57 $18.47 $17.86 $17.20 $17.81 29

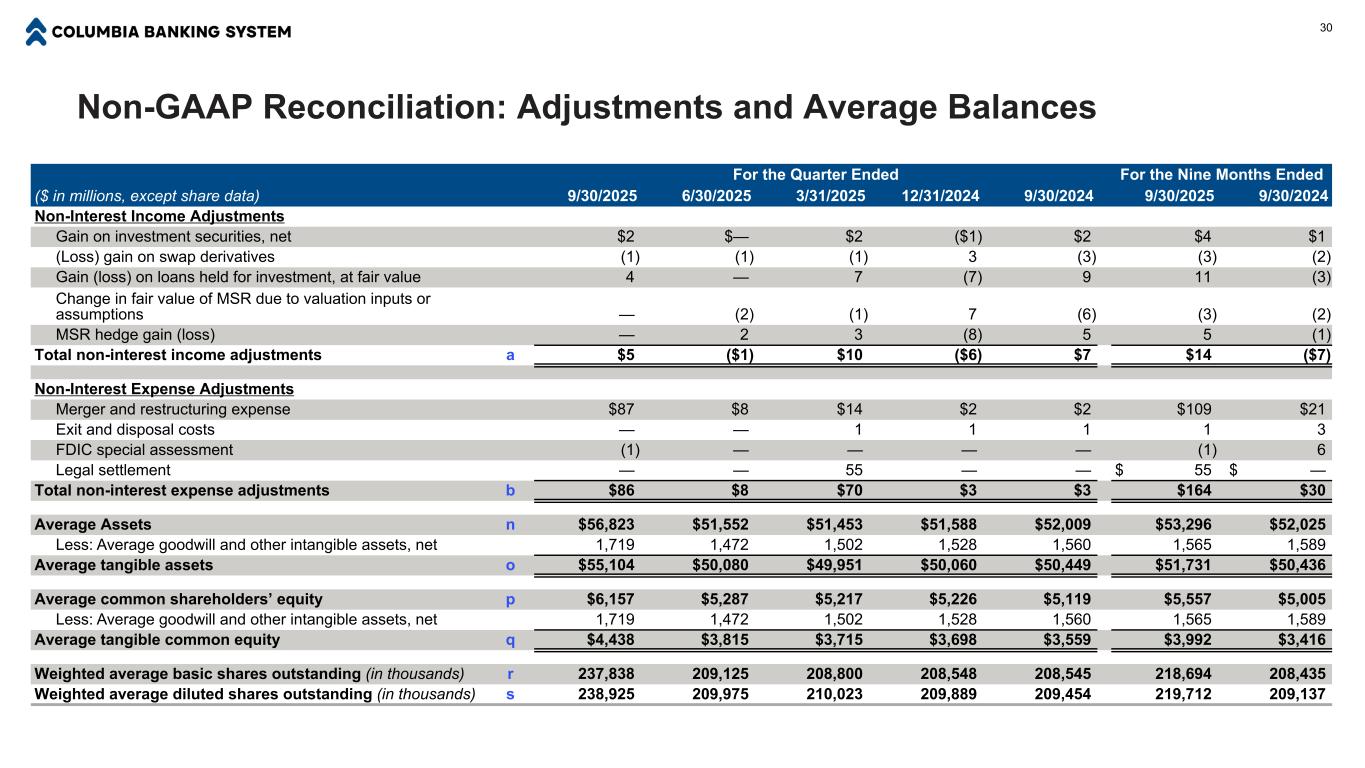

Non-GAAP Reconciliation: Adjustments and Average Balances For the Quarter Ended For the Nine Months Ended ($ in millions, except share data) 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 9/30/2025 9/30/2024 Non-Interest Income Adjustments Gain on investment securities, net $2 $— $2 ($1) $2 $4 $1 (Loss) gain on swap derivatives (1) (1) (1) 3 (3) (3) (2) Gain (loss) on loans held for investment, at fair value 4 — 7 (7) 9 11 (3) Change in fair value of MSR due to valuation inputs or assumptions — (2) (1) 7 (6) (3) (2) MSR hedge gain (loss) — 2 3 (8) 5 5 (1) Total non-interest income adjustments a $5 ($1) $10 ($6) $7 $14 ($7) Non-Interest Expense Adjustments Merger and restructuring expense $87 $8 $14 $2 $2 $109 $21 Exit and disposal costs — — 1 1 1 1 3 FDIC special assessment (1) — — — — (1) 6 Legal settlement — — 55 — — $ 55 $ — Total non-interest expense adjustments b $86 $8 $70 $3 $3 $164 $30 Average Assets n $56,823 $51,552 $51,453 $51,588 $52,009 $53,296 $52,025 Less: Average goodwill and other intangible assets, net 1,719 1,472 1,502 1,528 1,560 1,565 1,589 Average tangible assets o $55,104 $50,080 $49,951 $50,060 $50,449 $51,731 $50,436 Average common shareholders’ equity p $6,157 $5,287 $5,217 $5,226 $5,119 $5,557 $5,005 Less: Average goodwill and other intangible assets, net 1,719 1,472 1,502 1,528 1,560 1,565 1,589 Average tangible common equity q $4,438 $3,815 $3,715 $3,698 $3,559 $3,992 $3,416 Weighted average basic shares outstanding (in thousands) r 237,838 209,125 208,800 208,548 208,545 218,694 208,435 Weighted average diluted shares outstanding (in thousands) s 238,925 209,975 210,023 209,889 209,454 219,712 209,137 30

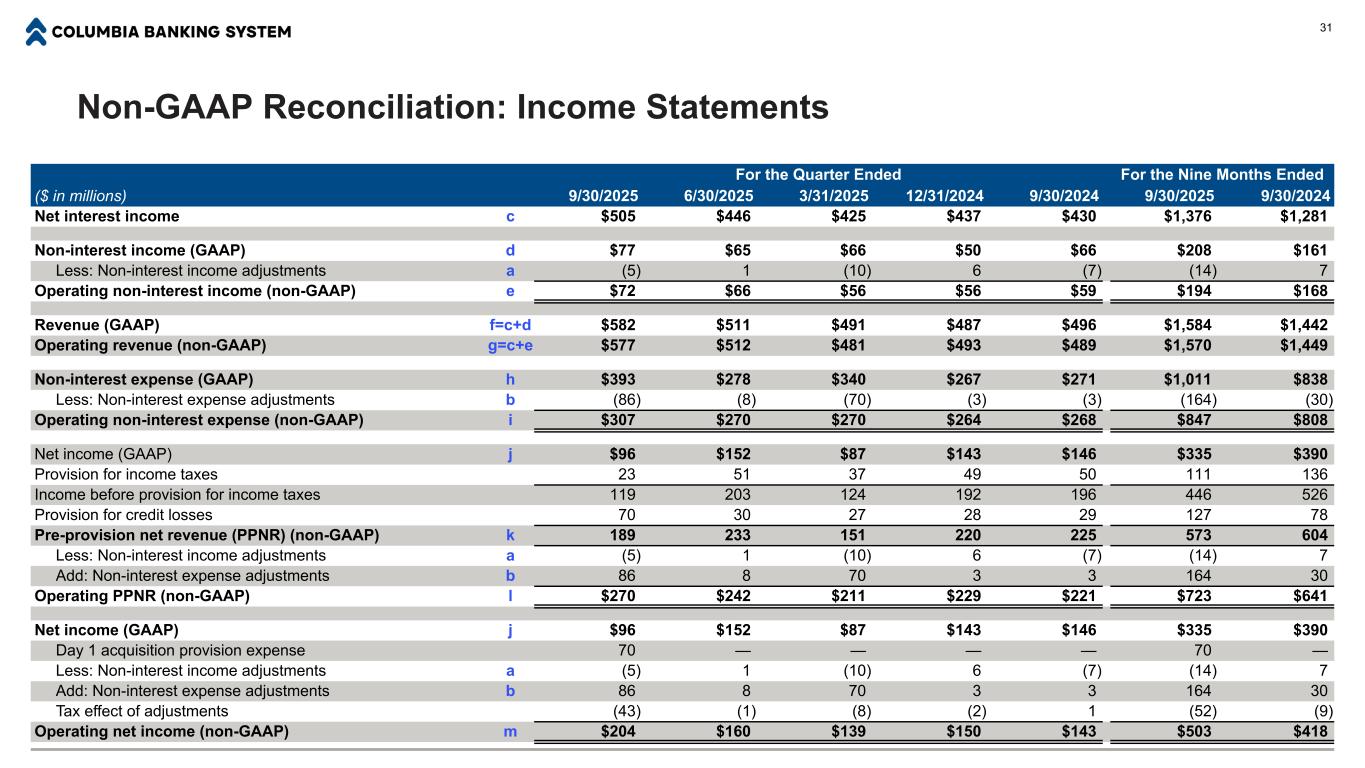

Non-GAAP Reconciliation: Income Statements For the Quarter Ended For the Nine Months Ended ($ in millions) 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 9/30/2025 9/30/2024 Net interest income c $505 $446 $425 $437 $430 $1,376 $1,281 Non-interest income (GAAP) d $77 $65 $66 $50 $66 $208 $161 Less: Non-interest income adjustments a (5) 1 (10) 6 (7) (14) 7 Operating non-interest income (non-GAAP) e $72 $66 $56 $56 $59 $194 $168 Revenue (GAAP) f=c+d $582 $511 $491 $487 $496 $1,584 $1,442 Operating revenue (non-GAAP) g=c+e $577 $512 $481 $493 $489 $1,570 $1,449 Non-interest expense (GAAP) h $393 $278 $340 $267 $271 $1,011 $838 Less: Non-interest expense adjustments b (86) (8) (70) (3) (3) (164) (30) Operating non-interest expense (non-GAAP) i $307 $270 $270 $264 $268 $847 $808 Net income (GAAP) j $96 $152 $87 $143 $146 $335 $390 Provision for income taxes 23 51 37 49 50 111 136 Income before provision for income taxes 119 203 124 192 196 446 526 Provision for credit losses 70 30 27 28 29 127 78 Pre-provision net revenue (PPNR) (non-GAAP) k 189 233 151 220 225 573 604 Less: Non-interest income adjustments a (5) 1 (10) 6 (7) (14) 7 Add: Non-interest expense adjustments b 86 8 70 3 3 164 30 Operating PPNR (non-GAAP) l $270 $242 $211 $229 $221 $723 $641 Net income (GAAP) j $96 $152 $87 $143 $146 $335 $390 Day 1 acquisition provision expense 70 — — — — 70 — Less: Non-interest income adjustments a (5) 1 (10) 6 (7) (14) 7 Add: Non-interest expense adjustments b 86 8 70 3 3 164 30 Tax effect of adjustments (43) (1) (8) (2) 1 (52) (9) Operating net income (non-GAAP) m $204 $160 $139 $150 $143 $503 $418 31

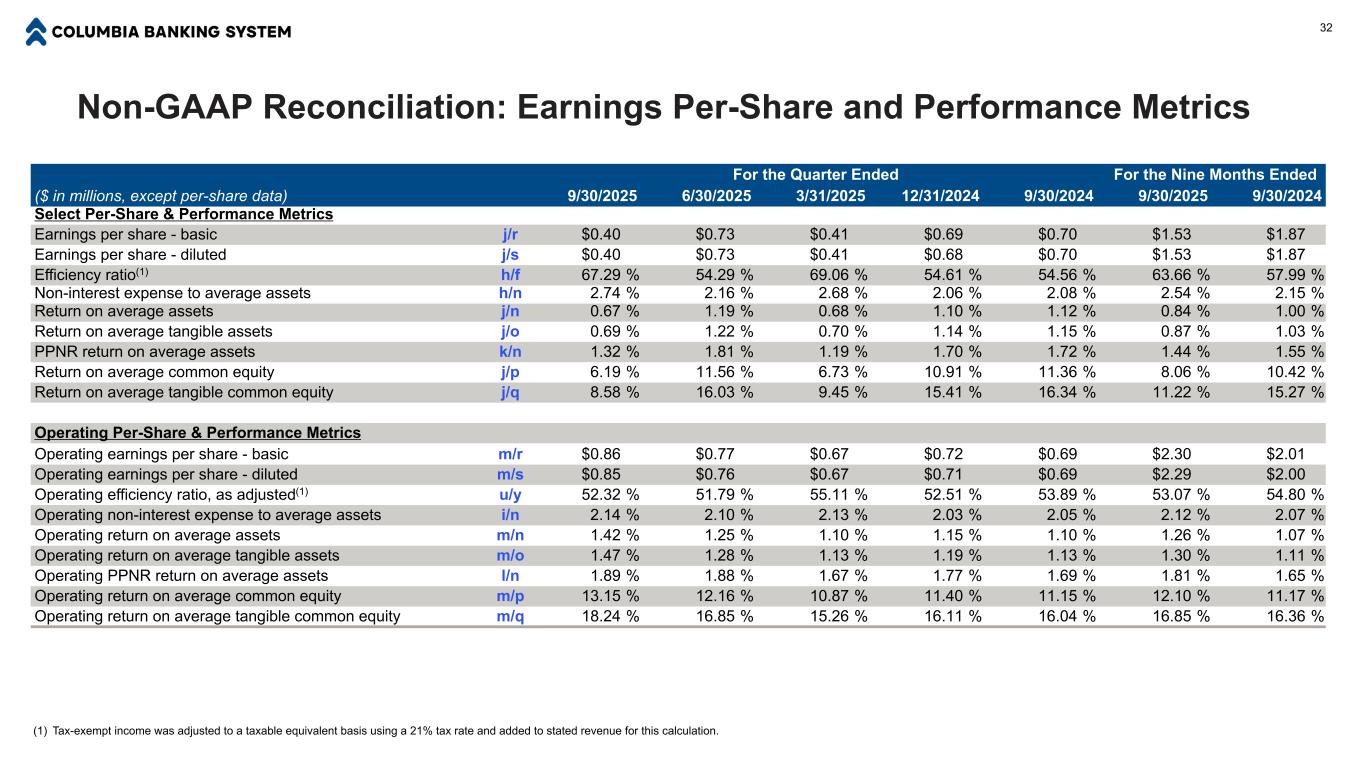

Non-GAAP Reconciliation: Earnings Per-Share and Performance Metrics For the Quarter Ended For the Nine Months Ended ($ in millions, except per-share data) 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 9/30/2025 9/30/2024 Select Per-Share & Performance Metrics Earnings per share - basic j/r $0.40 $0.73 $0.41 $0.69 $0.70 $1.53 $1.87 Earnings per share - diluted j/s $0.40 $0.73 $0.41 $0.68 $0.70 $1.53 $1.87 Efficiency ratio(1) h/f 67.29 % 54.29 % 69.06 % 54.61 % 54.56 % 63.66 % 57.99 % Non-interest expense to average assets h/n 2.74 % 2.16 % 2.68 % 2.06 % 2.08 % 2.54 % 2.15 % Return on average assets j/n 0.67 % 1.19 % 0.68 % 1.10 % 1.12 % 0.84 % 1.00 % Return on average tangible assets j/o 0.69 % 1.22 % 0.70 % 1.14 % 1.15 % 0.87 % 1.03 % PPNR return on average assets k/n 1.32 % 1.81 % 1.19 % 1.70 % 1.72 % 1.44 % 1.55 % Return on average common equity j/p 6.19 % 11.56 % 6.73 % 10.91 % 11.36 % 8.06 % 10.42 % Return on average tangible common equity j/q 8.58 % 16.03 % 9.45 % 15.41 % 16.34 % 11.22 % 15.27 % Operating Per-Share & Performance Metrics Operating earnings per share - basic m/r $0.86 $0.77 $0.67 $0.72 $0.69 $2.30 $2.01 Operating earnings per share - diluted m/s $0.85 $0.76 $0.67 $0.71 $0.69 $2.29 $2.00 Operating efficiency ratio, as adjusted(1) u/y 52.32 % 51.79 % 55.11 % 52.51 % 53.89 % 53.07 % 54.80 % Operating non-interest expense to average assets i/n 2.14 % 2.10 % 2.13 % 2.03 % 2.05 % 2.12 % 2.07 % Operating return on average assets m/n 1.42 % 1.25 % 1.10 % 1.15 % 1.10 % 1.26 % 1.07 % Operating return on average tangible assets m/o 1.47 % 1.28 % 1.13 % 1.19 % 1.13 % 1.30 % 1.11 % Operating PPNR return on average assets l/n 1.89 % 1.88 % 1.67 % 1.77 % 1.69 % 1.81 % 1.65 % Operating return on average common equity m/p 13.15 % 12.16 % 10.87 % 11.40 % 11.15 % 12.10 % 11.17 % Operating return on average tangible common equity m/q 18.24 % 16.85 % 15.26 % 16.11 % 16.04 % 16.85 % 16.36 % (1) Tax-exempt income was adjusted to a taxable equivalent basis using a 21% tax rate and added to stated revenue for this calculation. 32

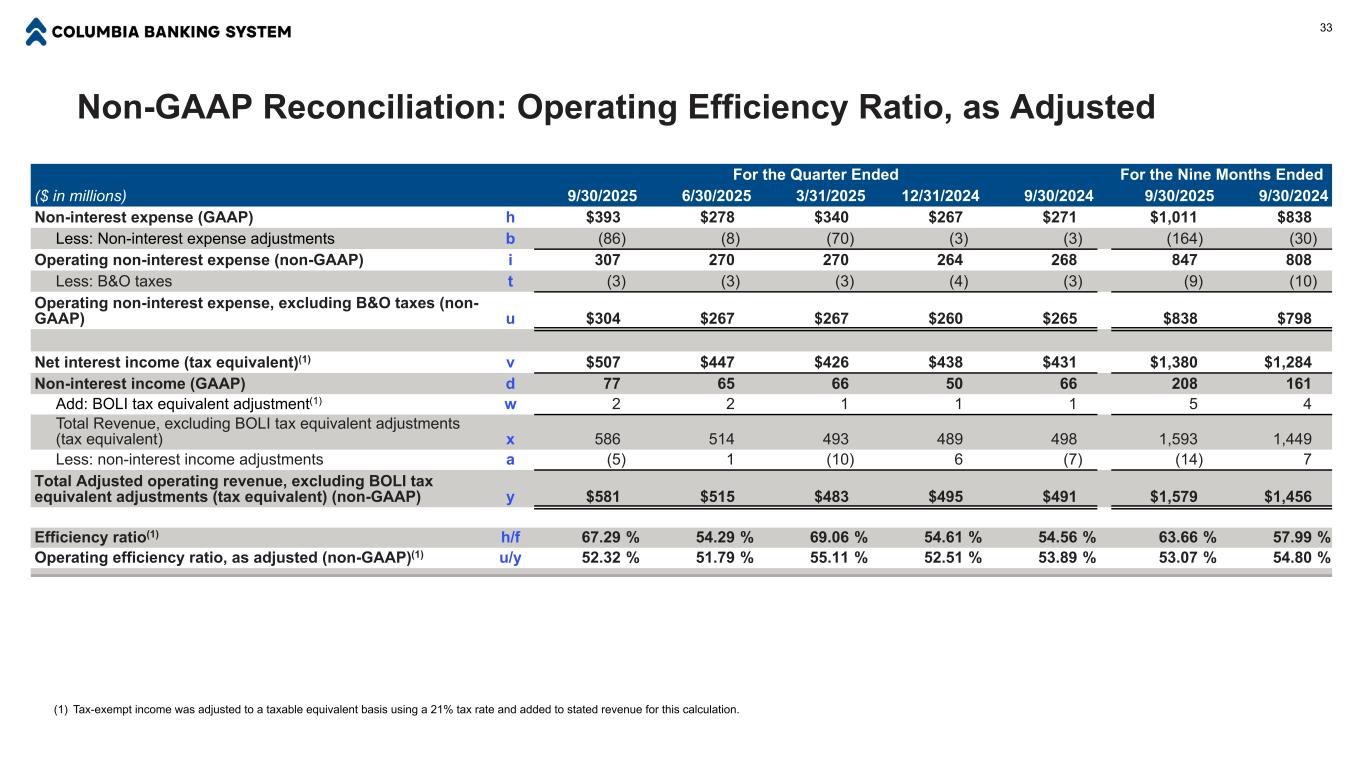

Non-GAAP Reconciliation: Operating Efficiency Ratio, as Adjusted 33 For the Quarter Ended For the Nine Months Ended ($ in millions) 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 9/30/2025 9/30/2024 Non-interest expense (GAAP) h $393 $278 $340 $267 $271 $1,011 $838 Less: Non-interest expense adjustments b (86) (8) (70) (3) (3) (164) (30) Operating non-interest expense (non-GAAP) i 307 270 270 264 268 847 808 Less: B&O taxes t (3) (3) (3) (4) (3) (9) (10) Operating non-interest expense, excluding B&O taxes (non- GAAP) u $304 $267 $267 $260 $265 $838 $798 Net interest income (tax equivalent)(1) v $507 $447 $426 $438 $431 $1,380 $1,284 Non-interest income (GAAP) d 77 65 66 50 66 208 161 Add: BOLI tax equivalent adjustment(1) w 2 2 1 1 1 5 4 Total Revenue, excluding BOLI tax equivalent adjustments (tax equivalent) x 586 514 493 489 498 1,593 1,449 Less: non-interest income adjustments a (5) 1 (10) 6 (7) (14) 7 Total Adjusted operating revenue, excluding BOLI tax equivalent adjustments (tax equivalent) (non-GAAP) y $581 $515 $483 $495 $491 $1,579 $1,456 Efficiency ratio(1) h/f 67.29 % 54.29 % 69.06 % 54.61 % 54.56 % 63.66 % 57.99 % Operating efficiency ratio, as adjusted (non-GAAP)(1) u/y 52.32 % 51.79 % 55.11 % 52.51 % 53.89 % 53.07 % 54.80 % (1) Tax-exempt income was adjusted to a taxable equivalent basis using a 21% tax rate and added to stated revenue for this calculation.