|

Roche/Foundation Medicine collaboration: - Advancing patient care and science in oncology IR conference call, 12 January 2015 1 |

|

Roche/Foundation Medicine collaboration: - Advancing patient care and science in oncology IR conference call, 12 January 2015 1 |

|

CAUTIONARY STATEMENT REGARDING FORWARD -LOOKING STATEMENTS SOME OF THE STATEMENTS CONTAINED IN THESE MATERIALS ARE FORWARD -LOOKING STATEMENTS, INCLUDING STATEMENTS REGARDING THE EXPECTED CONSUMMATION OF THE TRANSACTION, WHICH INVOLVES A NUMBER OF RISKS AND UNCERTAINTIES, INCLUDING THE SATISFACTION OF CLOSING CONDITIONS FOR THE TRANSACTION, INCLUDING REGULATORY APPROVAL FOR THE TRANSACTION, THE POSSIBILITY THAT THE TRANSACTION WILL NOT BE COMPLETED AND OTHER RISKS AND UNCERTAINTIES DISCUSSED IN FOUNDATION MEDICINE'S PUBLIC FILINGS WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE "SEC"), INCLUDING THE "RISK FACTORS" SECTIONS OF FOUNDATION MEDICINE'S ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2013 AND SUBSEQUENT QUARTERLY REPORTS ON FORM 10-Q, AS WELL AS THE TENDER OFFER STATEMENT ON SCHEDULE TO AND RELATED TENDER OFFER MATERIALS TO BE FILED BY ROCHE AND THE SOLICITATION/RECOMMENDATION ON SCHEDULE 14D-9 TO BE FILED BY FOUNDATION MEDICINE. THESE STATEMENTS ARE BASED ON CURRENT EXPECTATIONS, ASSUMPTIONS, ESTIMATES AND PROJECTIONS, AND INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER FACTORS THAT MAY CAUSE RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS TO BE MATERIALLY DIFFERENT FROM ANY FUTURE STATEMENTS. THESE STATEMENTS ARE GENERALLY IDENTIFIED BY WORDS OR PHRASES SUCH AS "BELIEVE", "ANTICIPATE", "EXPECT", "INTEND", "PLAN", "WILL", "MAY", "SHOULD", "ESTIMATE", "PREDICT", "POTENTIAL", "CONTINUE" OR THE NEGATIVE OF SUCH TERMS OR OTHER SIMILAR EXPRESSIONS. IF UNDERLYING ASSUMPTIONS PROVE INACCURATE OR UNKNOWN RISKS OR UNCERTAINTIES MATERIALIZE, ACTUAL RESULTS AND THE TIMING OF EVENTS MAY DIFFER MATERIALLY FROM THE RESULTS AND/OR TIMING DISCUSSED IN THE FORWARD -LOOKING STATEMENTS, AND YOU SHOULD NOT PLACE UNDUE RELIANCE ON THESE STATEMENTS. ROCHE AND FOUNDATION MEDICINE DISCLAIM ANY INTENT OR ADDITIONAL OBLIGATION TOINFORMATION UPDATE ANY ANDFORWARD WHERE TO FIND IT -LOOKING STATEMENTS AS A RESULT OF DEVELOPMENTS OCCURRING AFTER THE THESE PERIOD MATERIALS COVERED BY THIS ARE FORREPORT INFORMATIONAL OR OTHERWISE. PURPOSES ONLY AND DO NOT CONSTITUTE AN OFFER TO PURCHASE OR A SOLICITATION OF AN OFFER TO SELL FOUNDATION MEDICINE COMMON STOCK. THE OFFER TO BUY FOUNDATION MEDICINE COMMON STOCK WILL ONLY BE MADE PURSUANT TO A TENDER OFFER STATEMENT ON SCHEDULE TO (INCLUDING THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL AND OTHER RELATED TENDER OFFER MATERIALS) . INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THESE MATERIALS (WHICH WILL BE FILED BY ROCHE WITH THE SEC AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WITH RESPECT TO THE TENDER OFFER (WHICH WILL BE FILED BY FOUNDATION MEDICINE WITH THE SEC) WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING THE TERMS AND CONDITIONS OF THE OFFER, THAT SHOULD BE READ CAREFULLY BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. INVESTORS AND SECURITY HOLDERS MAY OBTAIN A FREE COPY OF THESE MATERIALS (WHEN AVAILABLE) AND OTHER DOCUMENTS FILED BY ROCHE AND FOUNDATION MEDICINE WITH THE SEC AT THE WEBSITE MAINTAINED BY THE SEC AT WWW. SEC.GOV. THE TENDER OFFER STATEMENT AND RELATED MATERIALS, AND THE SOLICITATION/RECOMMENDATION STATEMENT, MAY ALSO BE OBTAINED (WHEN AVAILABLE) FOR FREE BY CONTACTING THE INFORMATION AGENT FOR THE TENDER OFFER. Any statements regarding earnings per share growth is not a profit forecast and should not be interpreted to mean that Roche's earnings or earnings per share for this year or any subsequent period will necessarily match or exceed the historical published earnings or earnings per share of Roche. For marketed products discussed in this presentation, please see full prescribing information on our website www.roche.com All mentioned trademarks are legally protected. 2 |

|

Roche to acquire a majority equity interest in FMI and enter into a strategic

collaboration

[] Roche and Foundation Medicine ("FMI") announced today that they will enter

into a broad and strategic collaboration that has been approved by the Boards

of both companies

[] This strategic collaboration aims to further advance FMI's leading position

in molecular information and analysis while providing Roche a unique

opportunity to identify and develop novel treatment options for patients -- The

collaboration agreements provide funding and milestones of more than USD

150m. Such funding will be used for molecular insights to support development

of combination therapies, novel targets, clinical populations, and next

generation companion diagnostics

[] Under the terms of the majority equity investment, Roche will invest USD

250m in FMI at a per share issuance price of USD 50 to fund FMI's operations

and development

[] In addition, Roche will commence a tender offer which, together with Roche's

direct investment in FMI, will result in Roche owning a minimum of 52.4% and a

maximum of 56.3% of FMI on a fully diluted basis. The offered share price

constitutes a 109% premium over the closing price of last Friday (January

9(th))

[] All elements of this transaction are subject to FMI shareholder approval,

are cross- conditional, and will come into force simultaneously

3

|

|

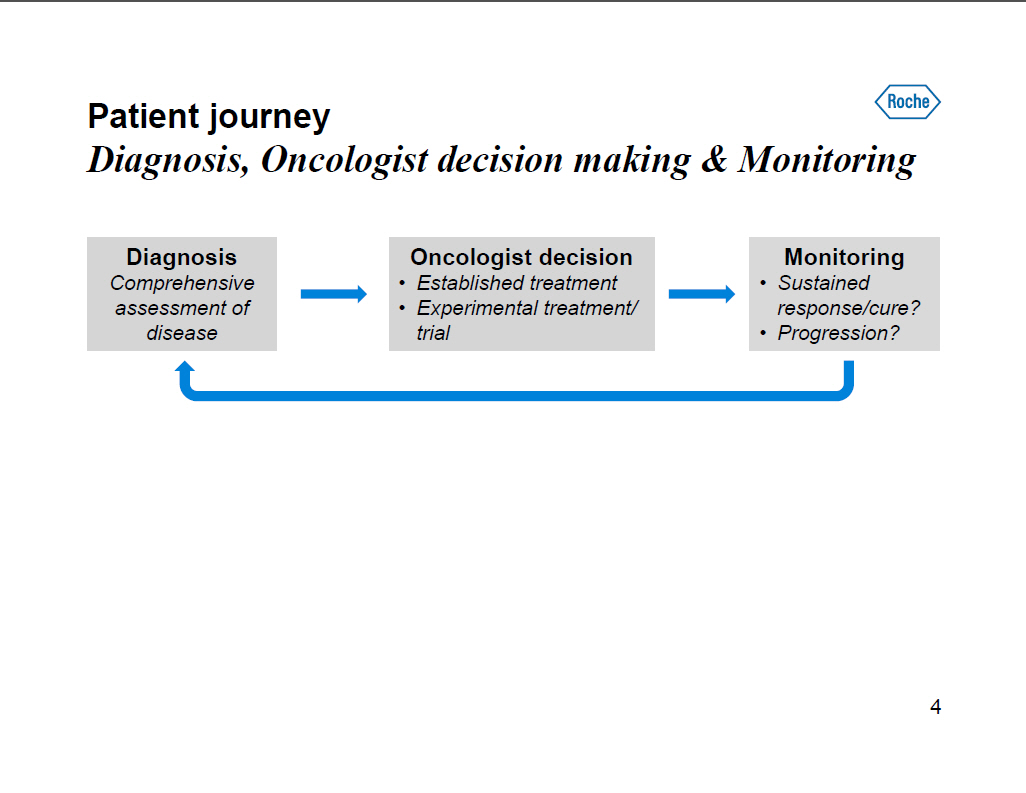

Patient journey Diagnosis, Oncologist decision making and Monitoring Diagnosis Comprehensive assessment of disease Oncologist decision [] Established treatment [] Experimental treatment/ trial Monitoring [] Sustained response/cure? [] Progression? 4 |

|

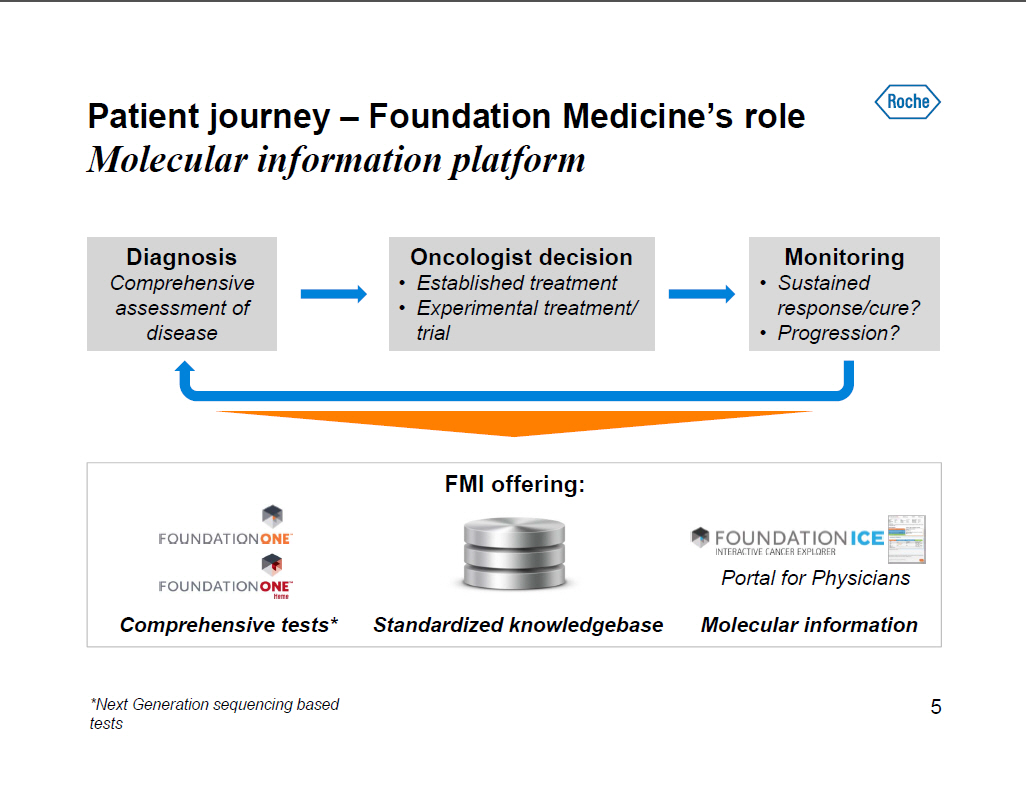

Patient journey -- Foundation Medicine's role Molecular information platform Diagnosis Comprehensive assessment of disease Oncologist decision [] Established treatment [] Experimental treatment/ trial Monitoring [] Sustained response/cure? [] Progression? FMI offering: Comprehensive tests* Standardized knowledgebase Molecular information [GRAPHIC OMITTED] *Next Generation sequencing based tests 5 |

|

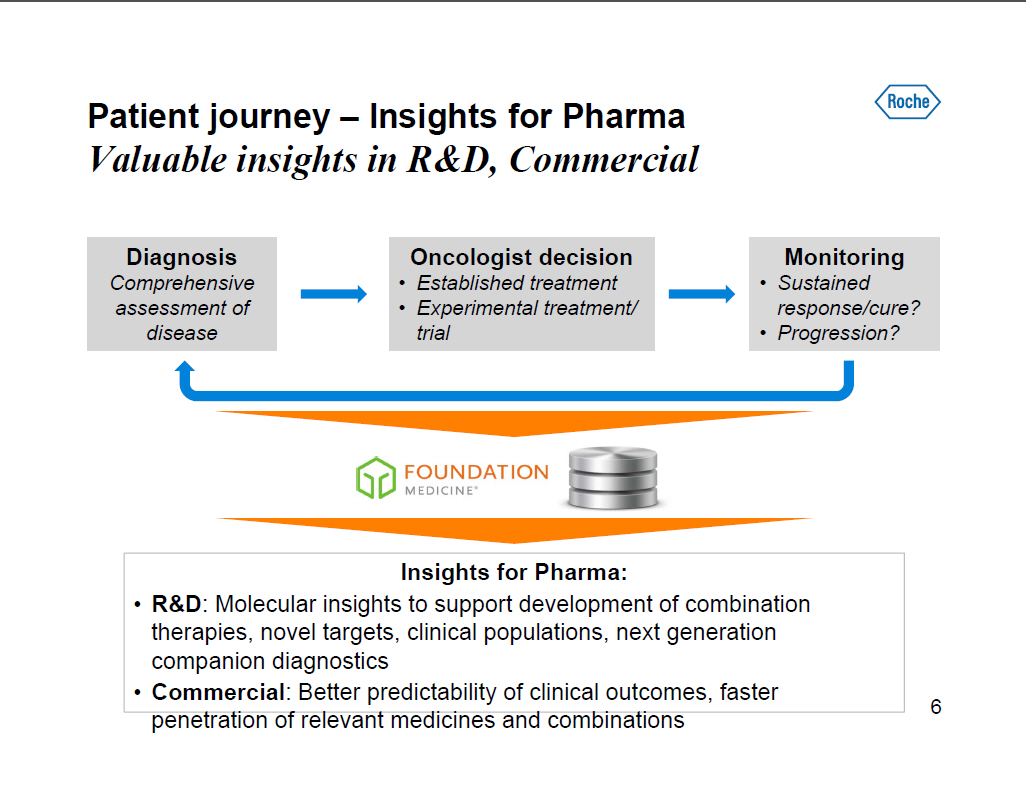

Patient journey -- Insights for Pharma Valuable insights in RandD, Commercial Diagnosis Comprehensive assessment of disease Oncologist decision [] Established treatment [] Experimental treatment/ trial Monitoring [] Sustained response/cure? [] Progression? Insights for Pharma: [] RandD: Molecular insights to support development of combination therapies, novel targets, clinical populations, next generation companion diagnostics [] Commercial: Better predictability of clinical outcomes, faster penetration of relevant medicines and combinations [GRAPHIC OMITTED] 6 |

|

Foundation Medicine overview Strategic rationale Transaction summary 7 |

|

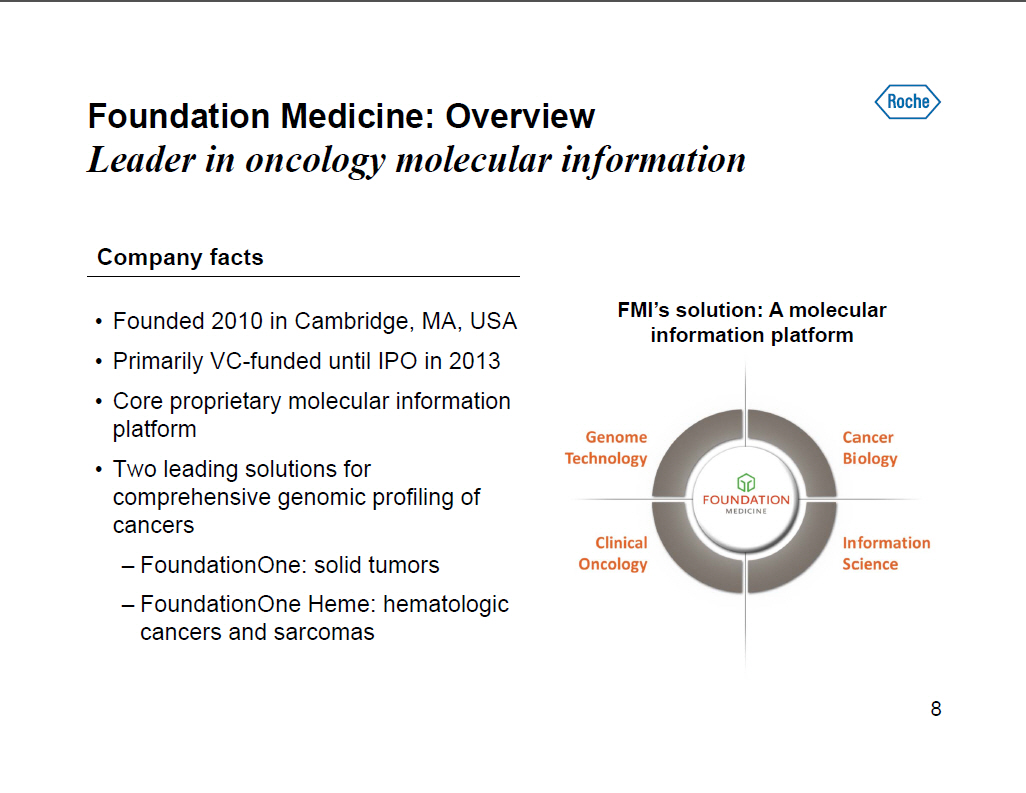

Foundation Medicine: Overview Leader in oncology molecular information Company facts [] Founded 2010 in Cambridge, MA, USA [] Primarily VC-funded until IPO in 2013 [] Core proprietary molecular information platform [] Two leading solutions for comprehensive genomic profiling of cancers -- FoundationOne: solid tumors -- FoundationOne Heme: hematologic cancers and sarcomas FMI's solution: A molecular information platform [GRAPHIC OMITTED] [GRAPHIC OMITTED] [GRAPHIC OMITTED] [GRAPHIC OMITTED] 8 |

|

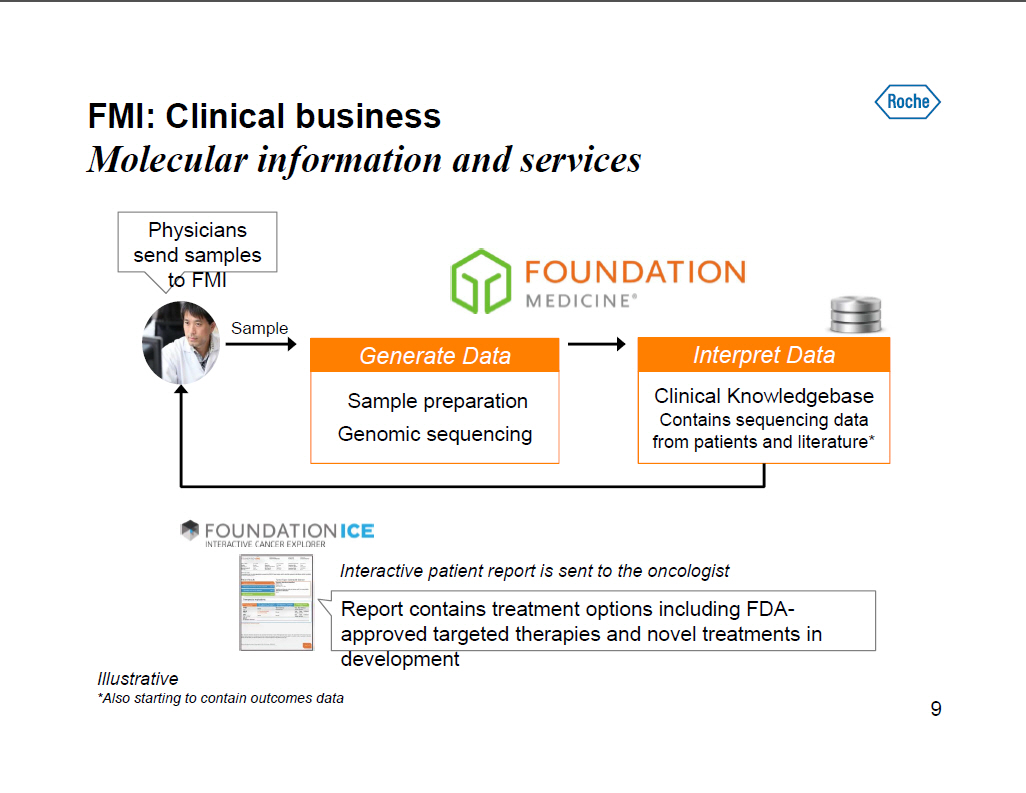

FMI: Clinical business Molecular information and services Physicians send samples to FMI [GRAPHIC OMITTED] Generate Data Sample preparation Genomic sequencing Interpret Data Clinical Knowledgebase Contains sequencing data from patients and literature* Interactive patient report is sent to the oncologist Report contains treatment options including FDA-approved targeted therapies and novel treatments in development Illustrative *Also starting to contain outcomes data 9 |

|

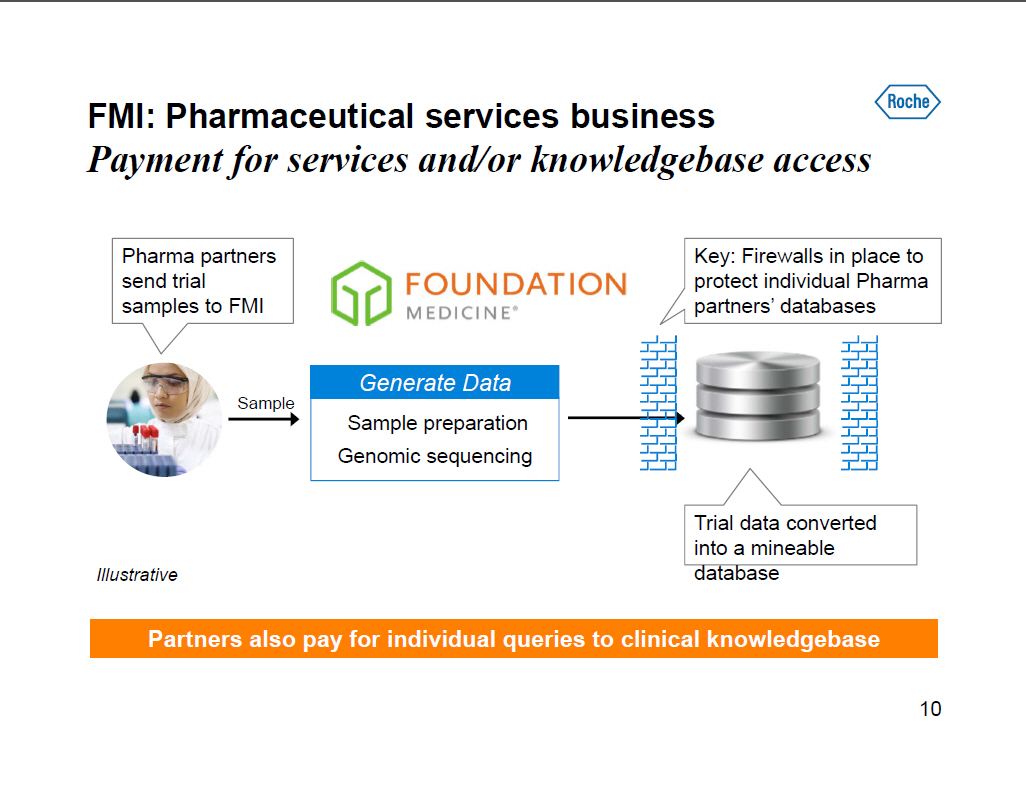

FMI: Pharmaceutical services business Payment for services and/or knowledgebase access Pharma partners send trial samples to FMI Generate Data Sample preparation Genomic sequencing Key: Firewalls in place to protect individual Pharma partners' databases Trial data converted into a mineable database [GRAPHIC OMITTED] Illustrative Partners also pay for individual queries to clinical knowledgebase 10 |

|

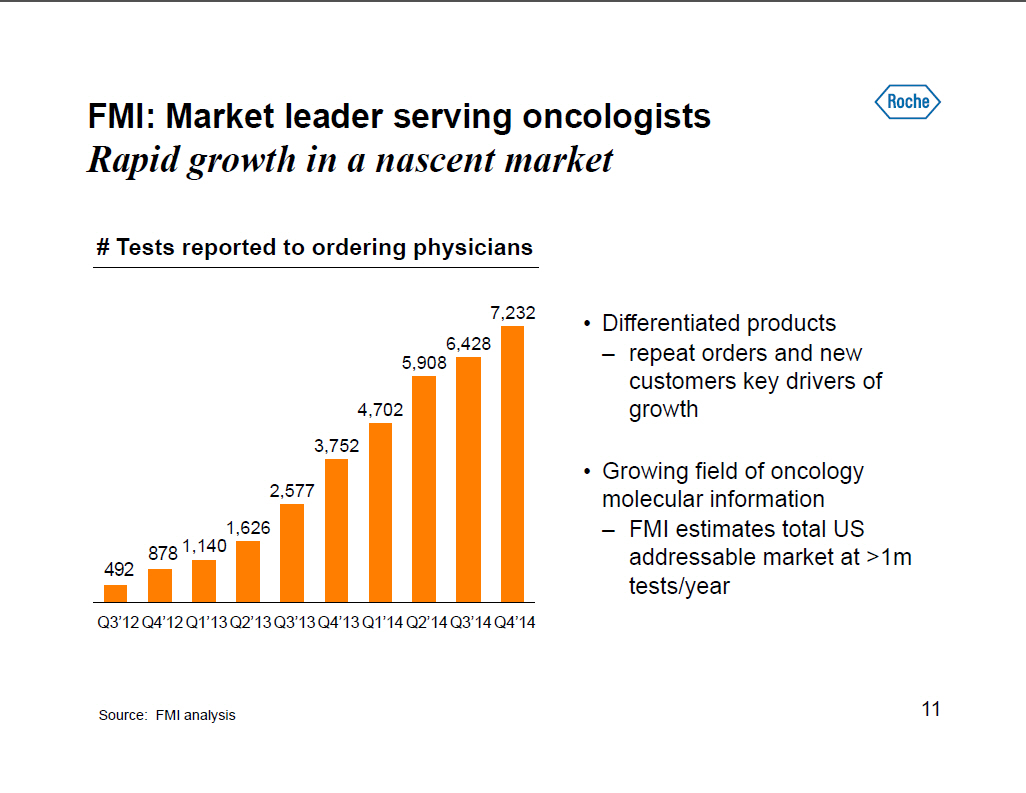

FMI: Market leader serving oncologists Rapid growth in a nascent market # Tests reported to ordering physicians [] Differentiated products -- repeat orders and new customers key drivers of growth [] Growing field of oncology molecular information -- FMI estimates total US addressable market at >1m tests/year 7,232 6,428 5,908 4,702 3,752 2,577 1,626 878 1,140 492 Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 Source: FMI analysis 11 |

|

Foundation Medicine overview Strategic rationale FMI fit with Roche What FMI and Roche can achieve together Transaction summary 12 |

|

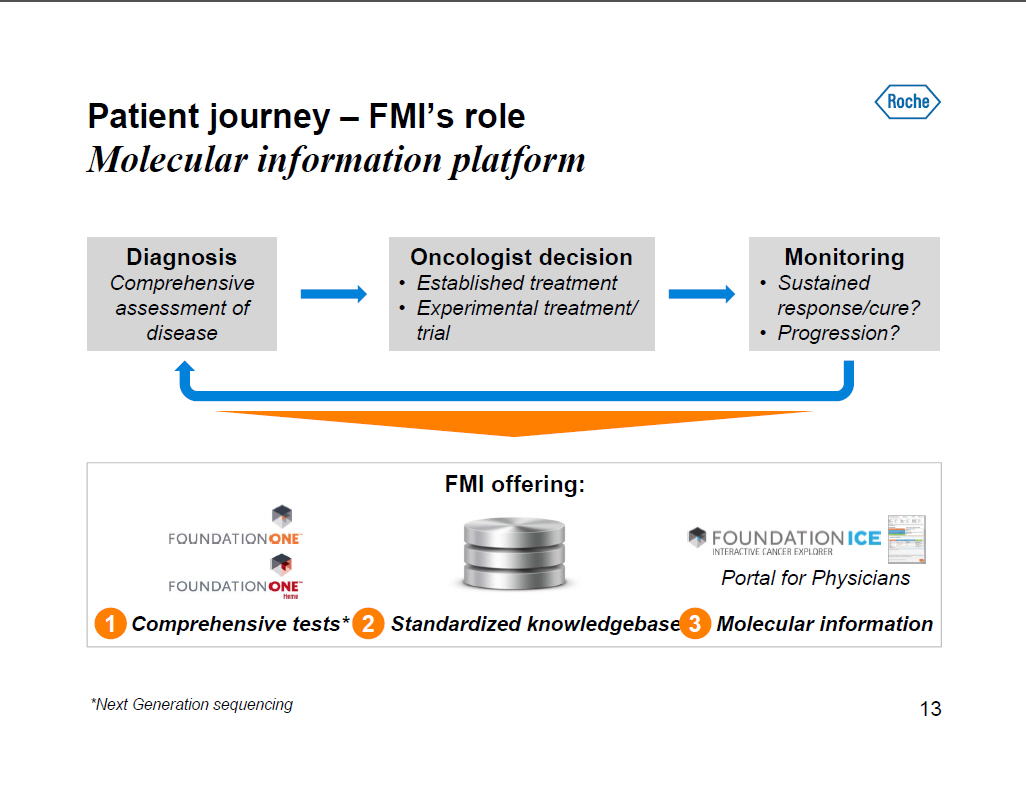

Patient journey -- FMI's role Molecular information platform Diagnosis Comprehensive assessment of disease Oncologist decision [] Established treatment [] Experimental treatment/ trial Monitoring [] Sustained response/cure? [] Progression? FMI offering: 1 Comprehensive tests* 2 Standardized knowledgebase 3 Molecular information *Next Generation sequencing [GRAPHIC OMITTED] 13 |

|

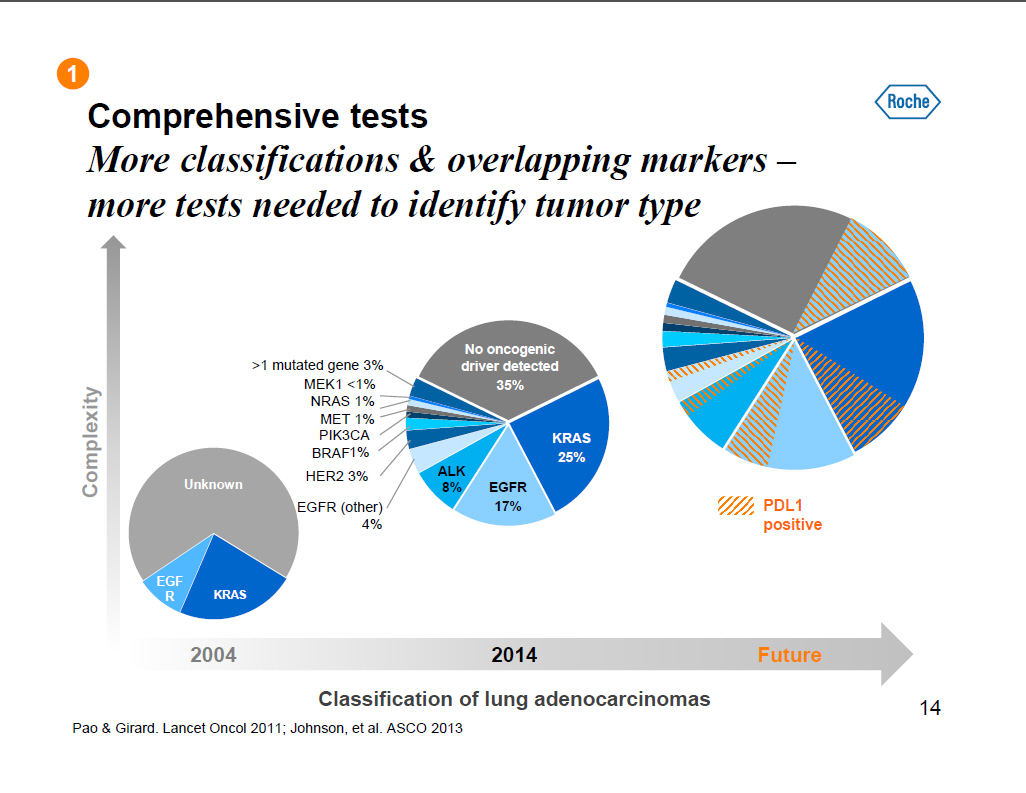

Comprehensive tests More classifications and overlapping markers --more tests needed to identify tumor type >1 mutated gene 3% MEK1 <1% NRAS 1% MET 1% PIK3CA BRAF1% HER2 3% EGFR (other) 4% No oncogenic driver detected 35% KRAS 25% ALK 8% EGFR 17% PDL1 positive Unknown EGF R KRAS 2004 2014 Future Classification of lung adenocarcinomas Pao and Girard. Lancet Oncol 2011; Johnson, et al. ASCO 2013 14 |

|

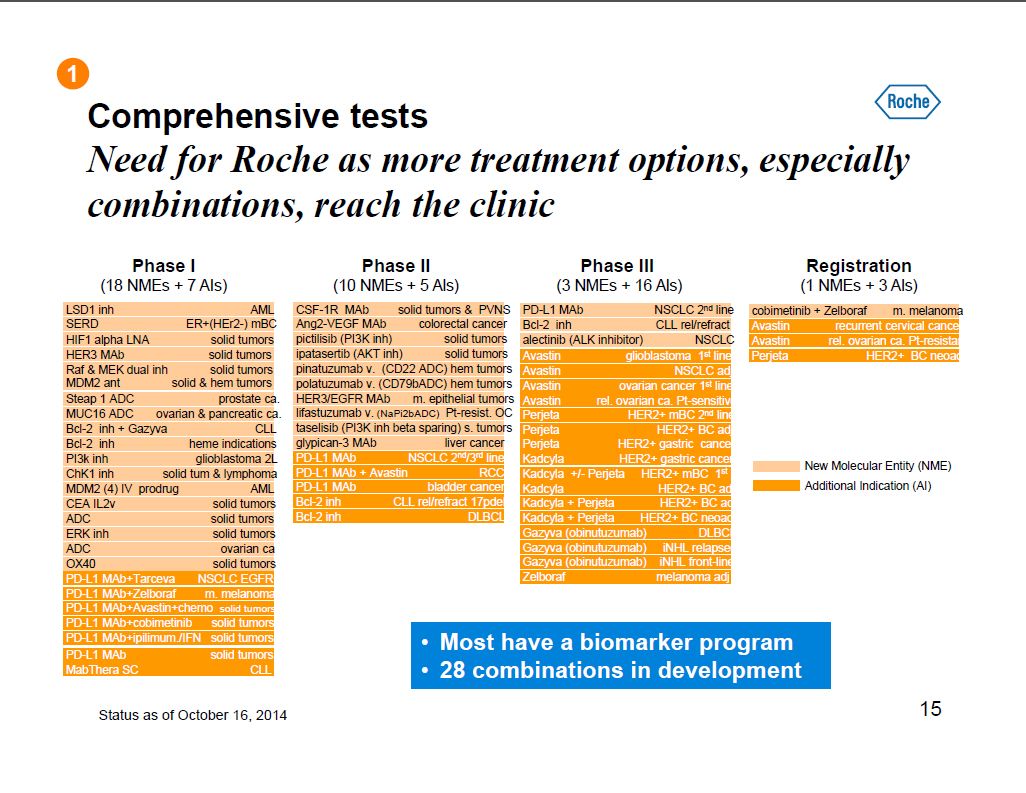

Comprehensive tests Need for Roche as more treatment options, especially combinations, reach the clinic Phase I (18 NMEs + 7 AIs) LSD1 inh AML SERD ER+(HEr2 -) mBC HIF1 alpha LNA solid tumors HER3 MAb solid tumors Raf and MEK dual inh solid tumors MDM2 ant solid and hem tumors Steap 1 ADC prostate ca. MUC16 ADC ovarian and pancreatic ca Bcl-2 inh + Gazyva CLL Bcl-2 inh heme indications PI3k inh glioblastoma 2L ChK1 inh solid tum and lymphoma MDM2 (4) IV prodrug AML CEA IL2v solid tumors ADC solid tumors ERK inh solid tumors ADC ovarian ca OX40 solid tumors PD-L1 MAb+Tarceva NSCLC EGFR+ PD-L1 MAb+Zelboraf m. melanoma PD-L1 MAb+Avastin+chemo solid tumors PD-L1 MAb+cobimetinib solid tumors PD-L1 MAb+ipilimum. /IFN solid tumors PD-L1 MAb solid tumors MabThera SC CLL Phase II (10 NMEs + 5 Als) CSF-1R MAb solid tumors and PVNS Ang2-VEGF MAb colorectal cancer pictilisib (PI3K inh) solid tumors ipatasertib (AKT inh) solid tumors pinatuzumab v. (CD22 ADC) hem tumors polatuzumab v. (CD79bADC) hem tumors HER3/EGFR MAb m. epithelial tumors lifastuzumab v. (NaPi2bADC) Pt-resist. OC taselisib (PI3K inh beta sparing) s. tumors glypican -3 MAb liver cancer PD-L1 MAb NSCLC 2(nd)/3(rd) line PD-L1 MAb + Avastin RCC PD-L1 MAb bladder cancer Bcl-2 inh CLL rel/refract 17pdel Bcl-2 inh DLBCL Phase III (3 NMEs + 16 Als) PD-L1 MAb NSCLC 2(nd) line Bcl-2 inh CLL rel/refract alectinib (ALK inhibitor) NSCLC Avastin glioblastoma 1(st) line Avastin NSCLC adj Avastin ovarian cancer 1(st) line Avastin rel. ovarian ca. Pt-sensitive Perjeta HER2+ mBC 2(nd) line Perjeta HER2+ BC adj Perjeta HER2+ gastric cancer Kadcyla HER2+ gastric cancer Kadcyla +/- Perjeta HER2+ mBC 1(st) l Kadcyla HER2+ BC adj Kadcyla + Perjeta HER2+ BC adj Kadcyla + Perjeta HER2+ BC neoadj Gazyva (obinutuzumab) DLBCL Gazyva (obinutuzumab) iNHL relapsed Gazyva (obinutuzumab) iNHL front-line Zelboraf melanoma adj Registration (1 NMEs + 3 Als) cobimetinib + Zelboraf m. melanoma Avastin recurrent cervical cancer Avastin rel. ovarian ca. Pt-resistant Perjeta HER2+ BC neoadj New Molecular Entity (NME) Additional Indication (AI) [] Most have a biomarker program [] 28 combinations in development Status as of October 16, 2014 15 |

|

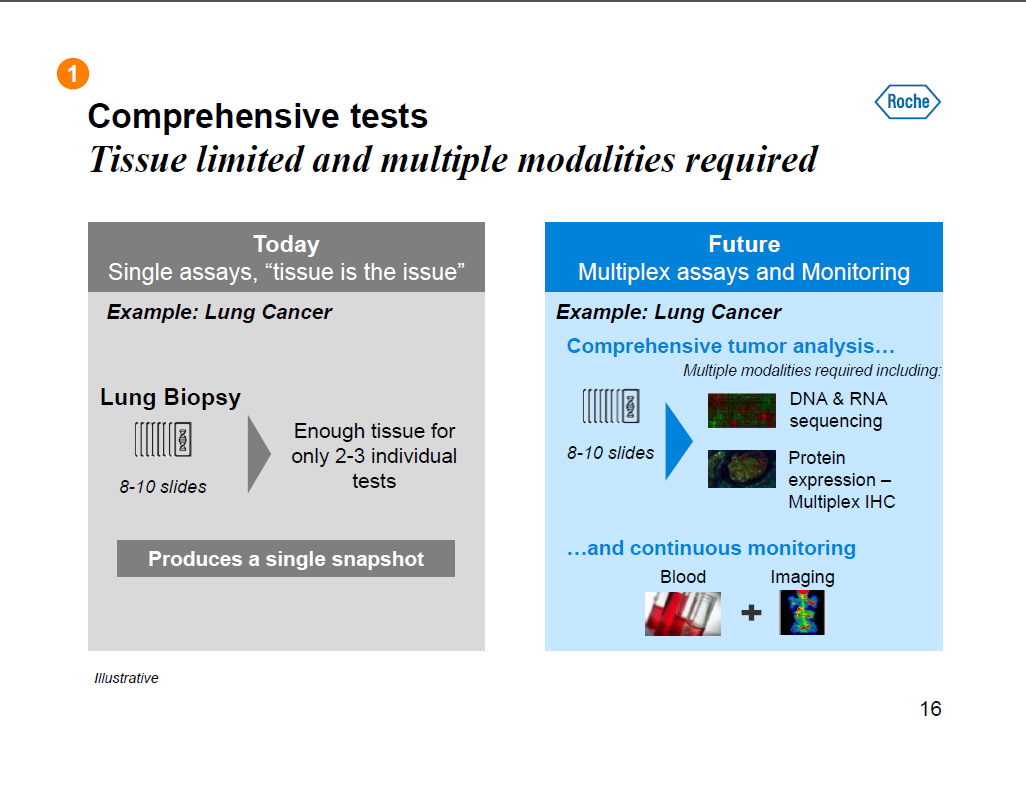

Comprehensive tests Tissue limited and multiple modalities required Today Single assays, "tissue is the issue" Example: Lung Cancer Lung Biopsy Enough tissue for only 2-3 individual 8-10 slides tests Produces a single snapshot Future Multiplex assays and Monitoring Example: Lung Cancer Comprehensive tumor analysis [] Multiple modalities required including: DNA and RNA sequencing 8-10 slides Protein expression --Multiplex IHC []and continuous monitoring Blood Imaging Illustrative 16 |

|

Standardized knowledgebase Enables comparability of results both in RandD and in the clinic In RandD Comparability of results essential Early RandD Data Clinical Trial Data Produces a powerful knowledgebase and enables faster insightgeneration [] Comprehensive genomic profiling leads to better insights across programs: "bench to bedside to bench" [] Translates to the clinic as well: -- Same assay in RandD and the clinic improves confidence in results -- Results comparable across centers/ hospitals [GRAPHIC OMITTED] 17 |

|

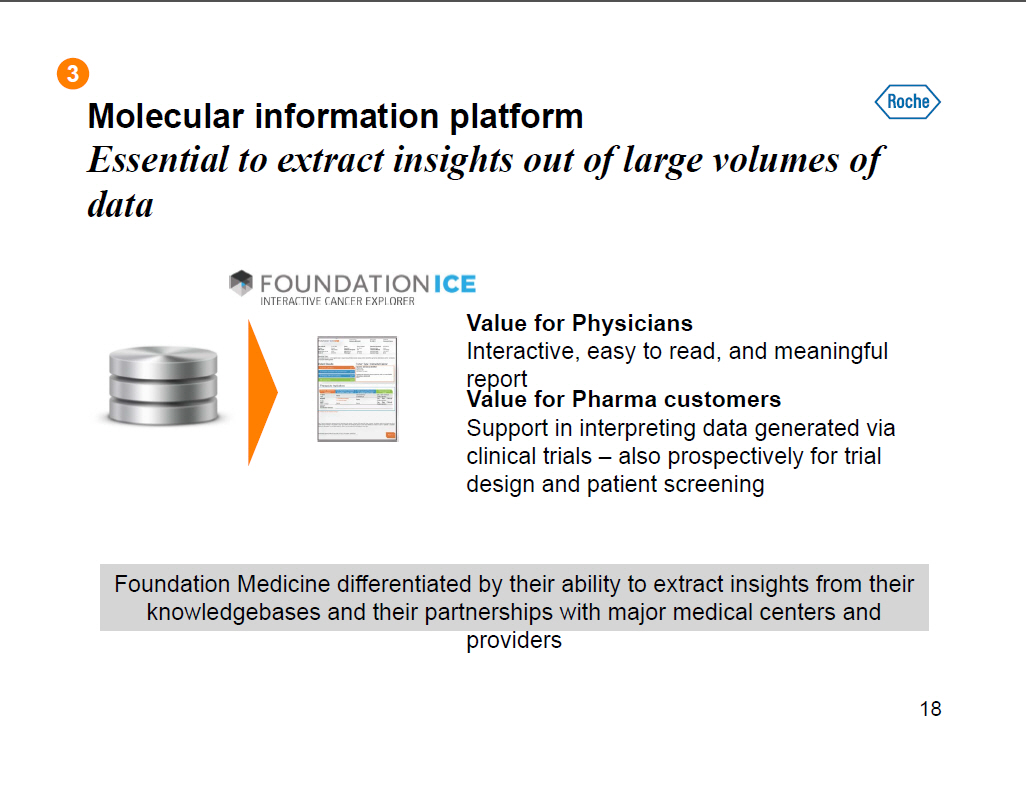

Molecular information platform Essential to extract insights out of large volumes of data [GRAPHIC OMITTED] Value for Physicians Interactive, easy to read, and meaningful report Value for Pharma customers Support in interpreting data generated via clinical trials -- also prospectively for trial design and patient screening Foundation Medicine differentiated by their ability to extract insights from their knowledgebases and their partnerships with major medical centers and providers 18 |

|

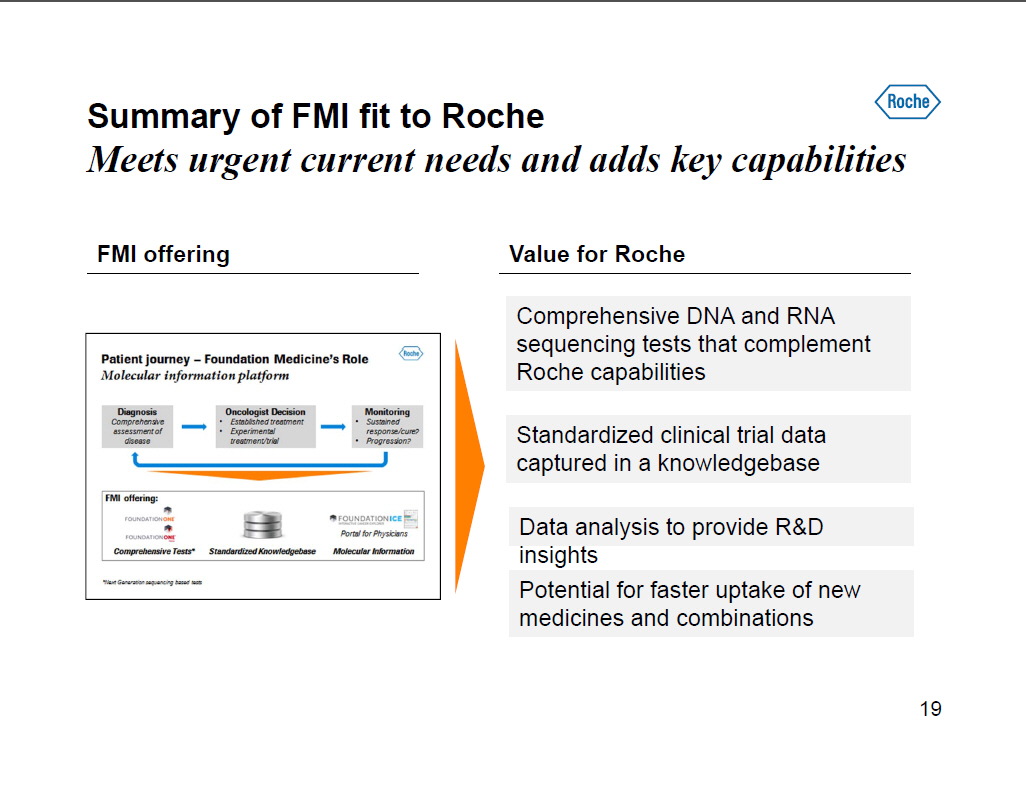

Summary of FMI fit to Roche Meets urgent current needs and adds key capabilities FMI offering [GRAPHIC OMITTED] Value for Roche Comprehensive DNA and RNA sequencing tests that complement Roche capabilities Standardized clinical trial data captured in a knowledgebase Data analysis to provide RandD insights Potential for faster uptake of new medicines and combinations 19 |

|

Foundation Medicine overview Strategic rationale FMI fit with Roche What FMI and Roche can achieve together Transaction summary 20 |

|

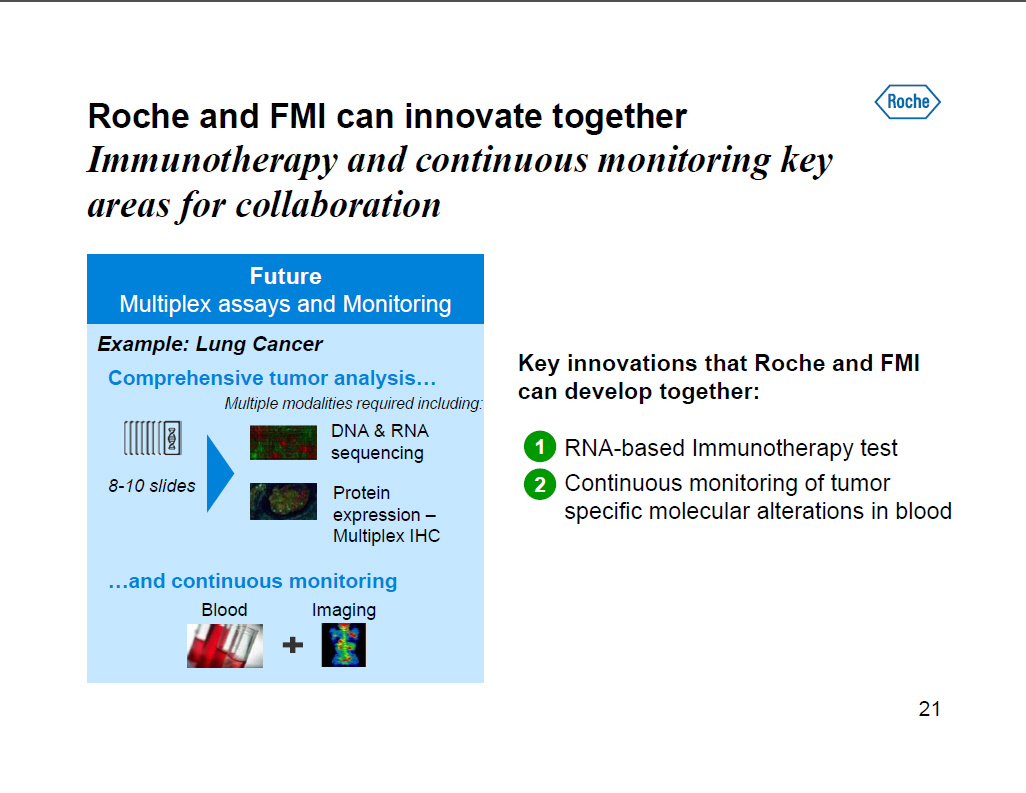

Roche and FMI can innovate together Immunotherapy and continuous monitoring key areas for collaboration Future Multiplex assays and Monitoring Example: Lung Cancer Comprehensive tumor analysis [] Multiple modalities required including: DNA and RNA sequencing 8-10 slides Protein expression --Multiplex IHC []and continuous monitoring Blood Imaging Key innovations that Roche and FMI can develop together: 1 RNA-based Immunotherapy test 2 Continuous monitoring of tumor specific molecular alterations in blood [GRAPHIC OMITTED] 21 |

|

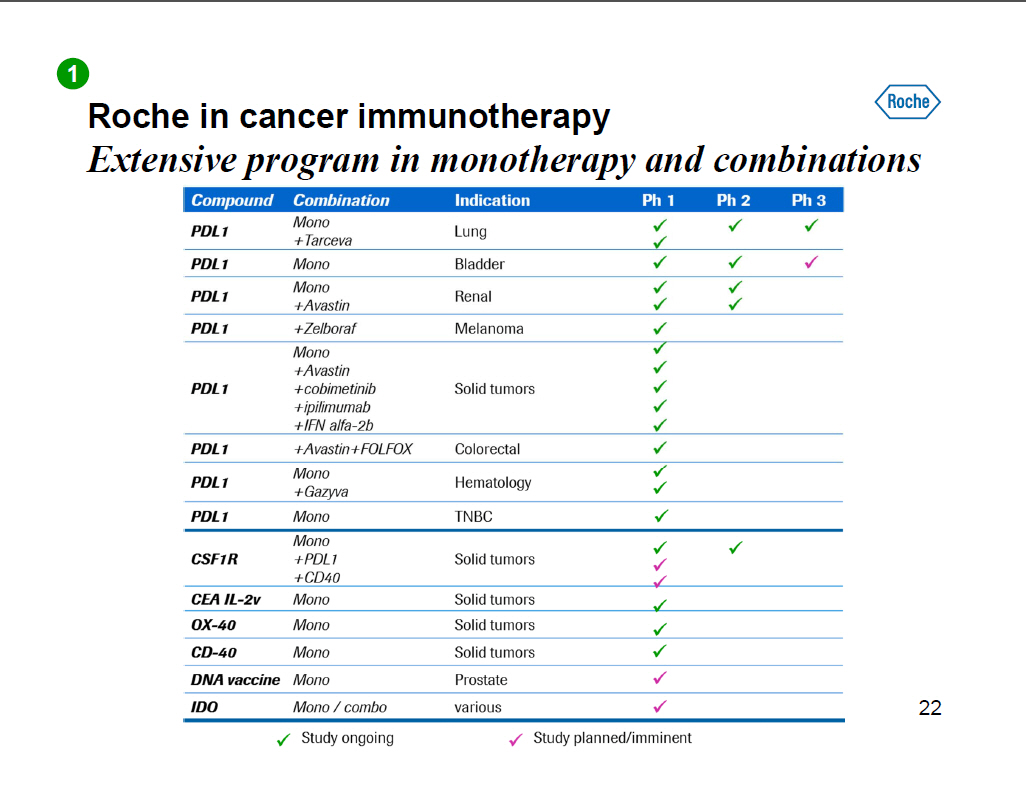

Roche in cancer immunotherapy Extensive program in monotherapy and combinations [GRAPHIC OMITTED] 22 |

|

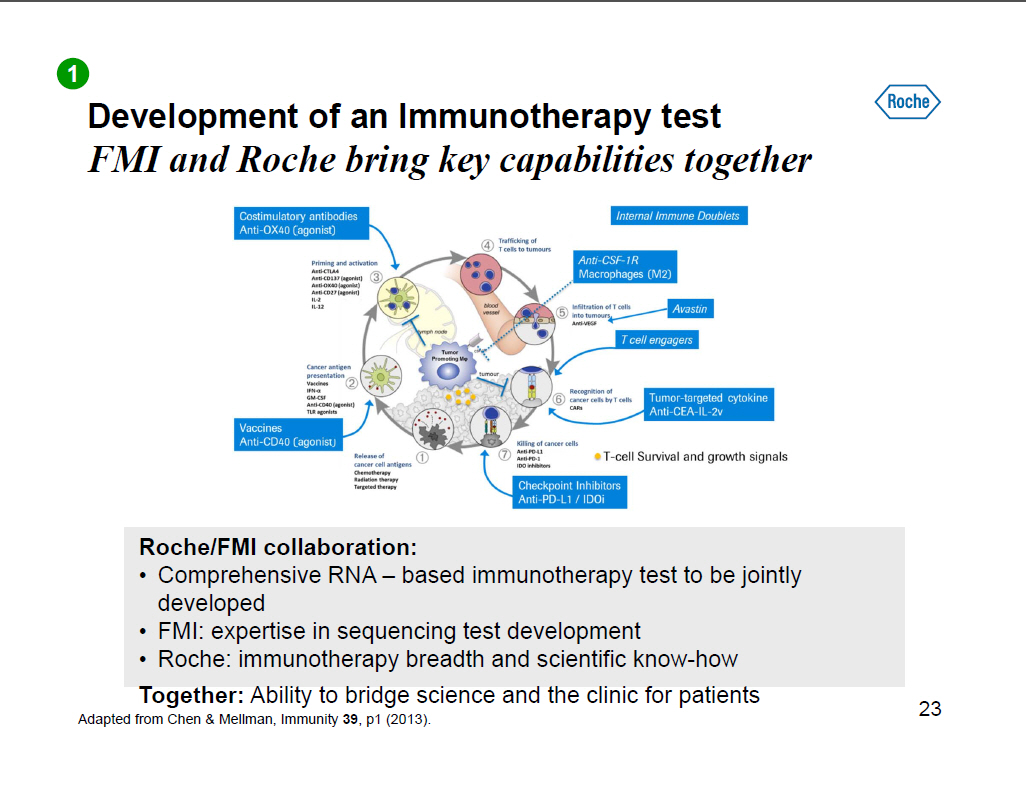

Development of an Immunotherapy test FMI and Roche bring key capabilities together [GRAPHIC OMITTED] Roche/FMI collaboration: [] Comprehensive RNA -- based immunotherapy test to be jointly developed [] FMI: expertise in sequencing test development [] Roche: immunotherapy breadth and scientific know-how Together: Ability to bridge science and the clinic for patients Adapted from Chen and Mellman, Immunity 39, p1 (2013). 23 |

|

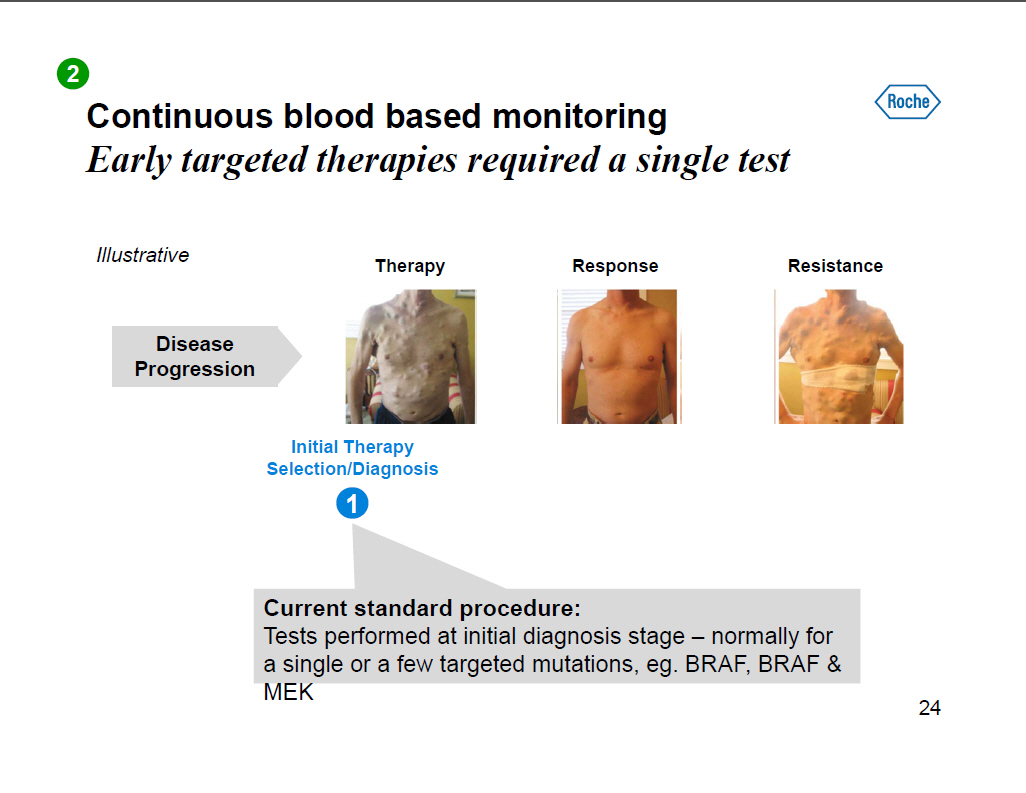

Continuous blood based monitoring Early targeted therapies required a single test Illustrative Disease Progression Therapy Response [GRAPHIC OMITTED] Resistance Initial Therapy Selection/Diagnosis Current standard procedure: Tests performed at initial diagnosis stage -- normally for a single or a few targeted mutations, eg. BRAF, BRAF and MEK 24 |

|

Continuous blood based monitoring As biology evolves, crucial to test multiple genes over time as disease progresses Illustrative Disease Progression Therapy [GRAPHIC OMITTED] Response Resistance Future Testing Initial Therapy Early measures Early measures Intervals Selection/Diagnosis of response of resistance 1 2 3 Early measures of response and resistance essential in the future both to guide RandD and clinical practice: [] Multiple resistance mechanisms* [] Comprehensive and blood based testing needed to avoid repeat biopsies *Lackner et al., Future Oncology 8: 999-1014, 2012 25 |

|

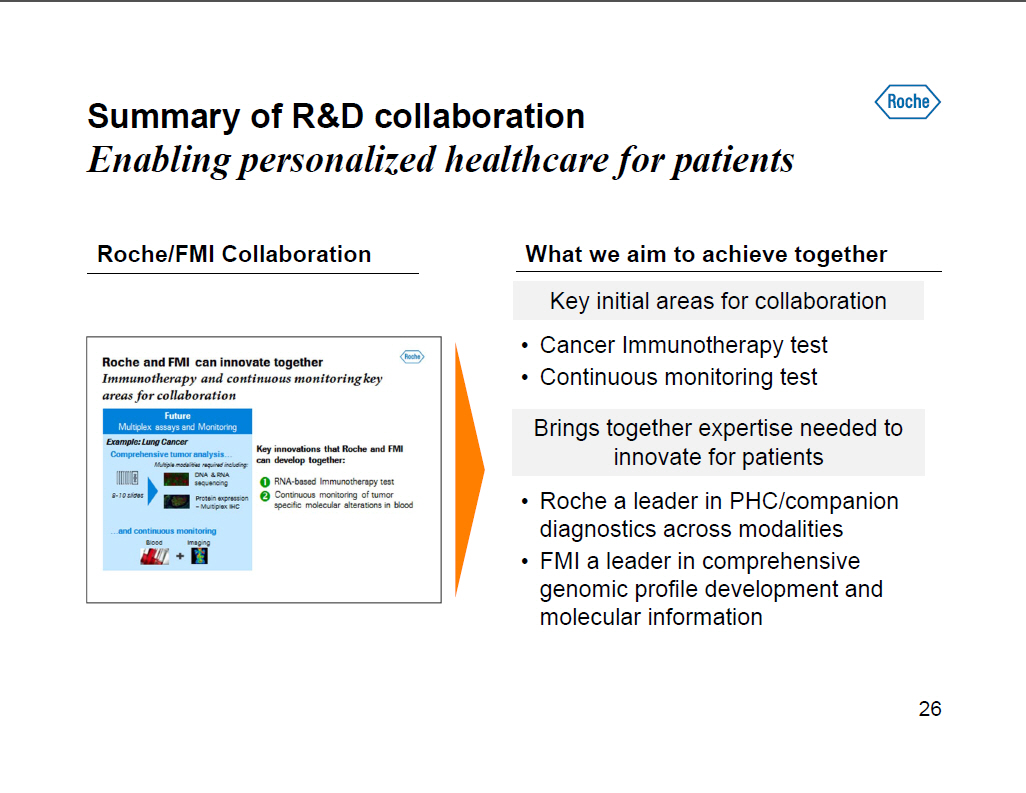

Summary of RandD collaboration

Enabling personalized healthcare for patients

Roche/FMI Collaboration

What we aim to achieve together

Key initial areas for collaboration [] Cancer Immunotherapy test []

Continuous monitoring test

Brings together expertise needed to innovate for patients [] Roche a leader

in PHC/companion diagnostics across modalities [] FMI a leader in comprehensive

genomic profile development and molecular information

[GRAPHIC OMITTED]

26

|

|

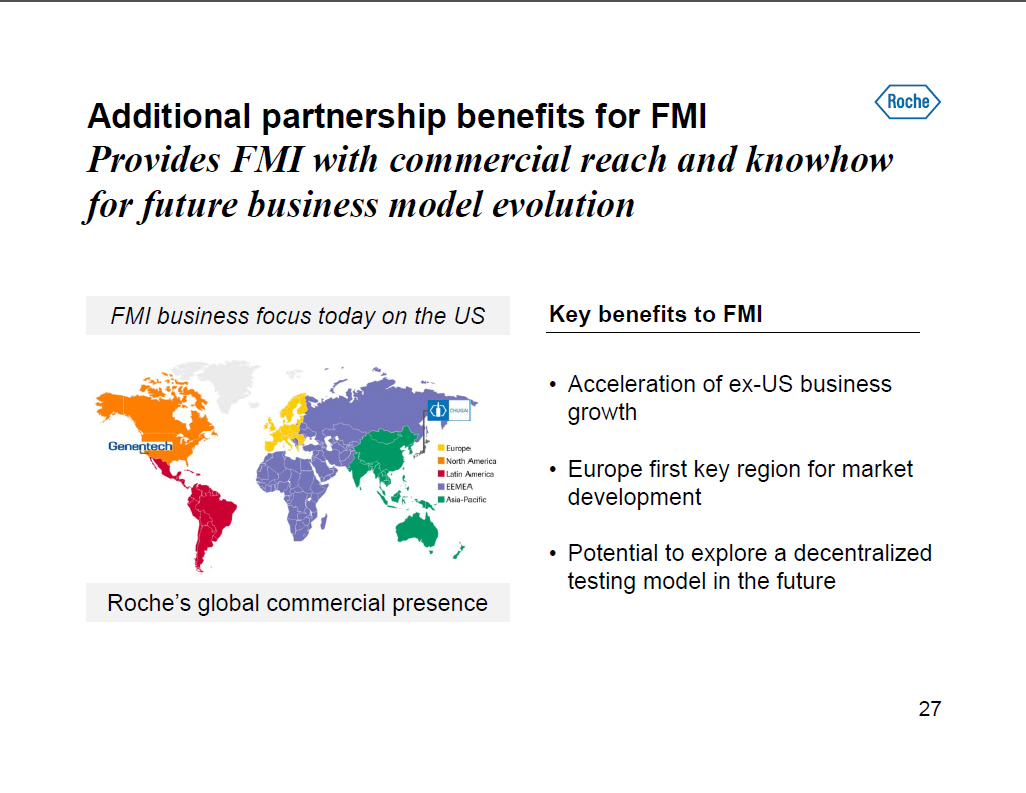

Additional partnership benefits for FMI Provides FMI with commercial reach and knowhow for future business model evolution FMI business focus today on the US [GRAPHIC OMITTED] Roche's global commercial presence Key benefits to FMI [] Acceleration of ex-US business growth [] Europe first key region for market development [] Potential to explore a decentralized testing model in the future 27 |

|

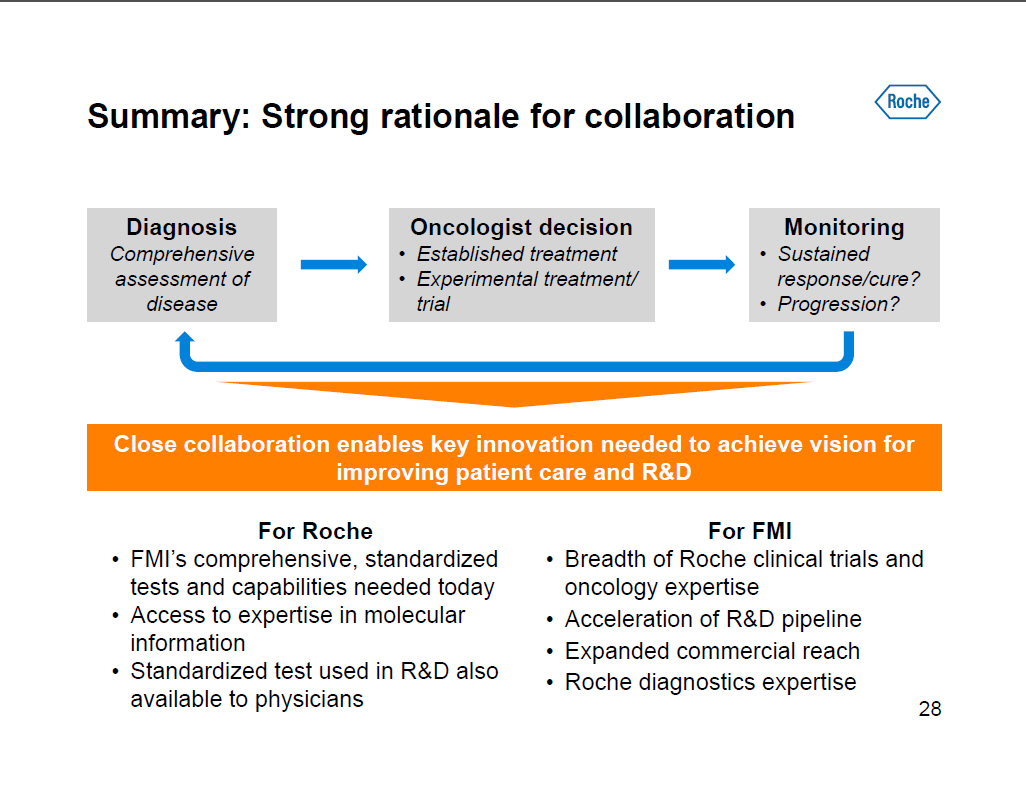

Summary: Strong rationale for collaboration Diagnosis Comprehensive assessment of disease Oncologist decision [] Established treatment [] Experimental treatment/ trial Monitoring [] Sustained response/cure? [] Progression? Close collaboration enables key innovation needed to achieve vision for improving patient care and RandD For Roche [] FMI's comprehensive, standardized tests and capabilities needed today [] Access to expertise in molecular information [] Standardized test used in RandD also available to physicians For FMI [] Breadth of Roche clinical trials and oncology expertise [] Acceleration of RandD pipeline [] Expanded commercial reach [] Roche diagnostics expertise 28 |

|

Foundation Medicine overview Strategic rationale Transaction summary 29 |

|

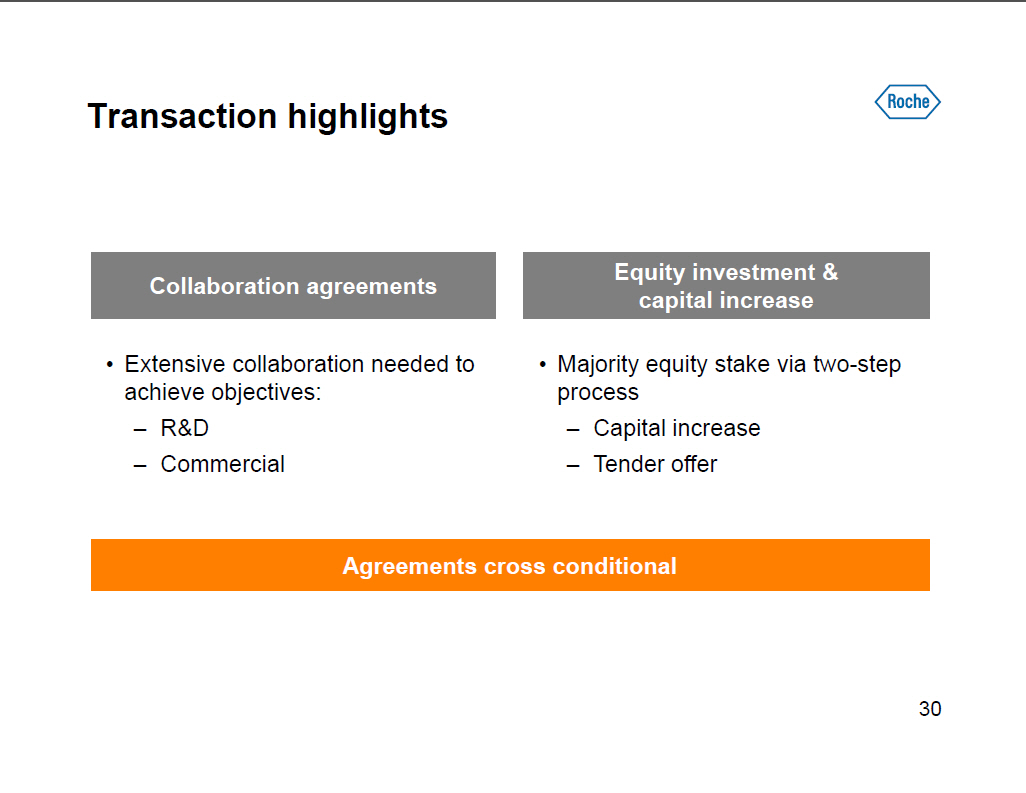

Transaction highlights Collaboration agreements [] Extensive collaboration needed to achieve objectives: --RandD-- Commercial Equity investment and capital increase [] Majority equity stake via two-step process -- Capital increase -- Tender offer Agreements cross conditional 30 |

|

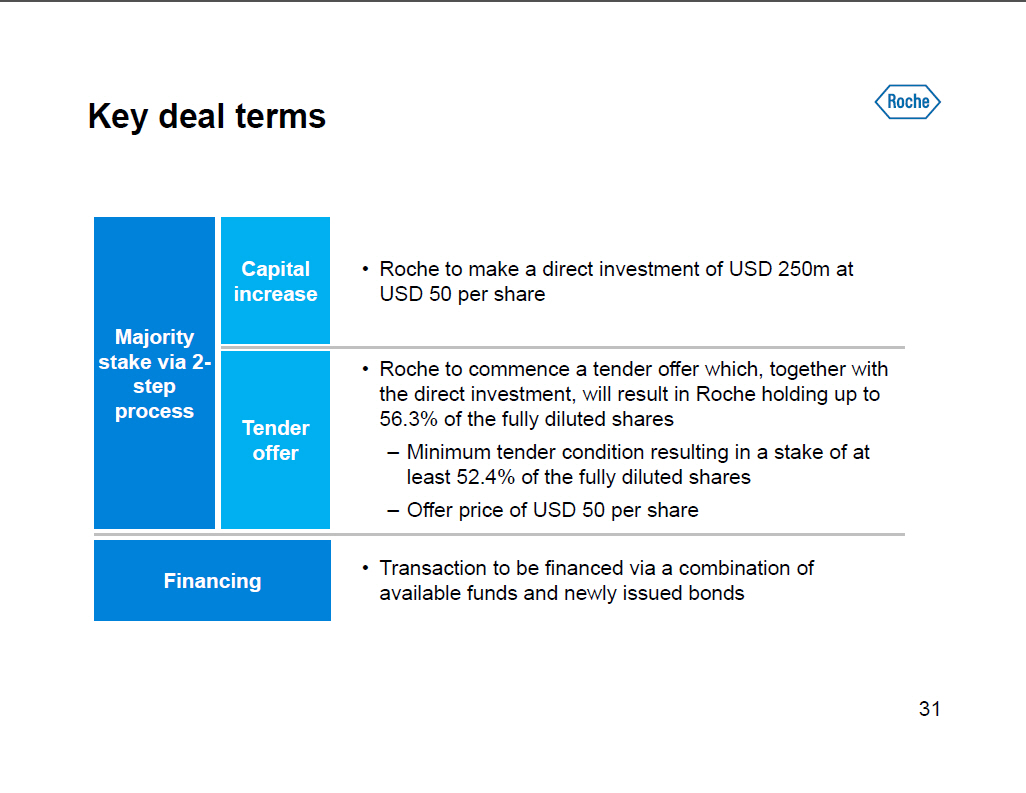

Key deal terms Majority stake via 2-step process Capital [] Roche to make a direct investment of USD 250m at increase USD 50 per share [] Roche to commence a tender offer which, together with the direct investment, will result in Roche holding up to Tender 56.3% of the fully diluted shares offer -- Minimum tender condition resulting in a stake of at least 52.4% of the fully diluted shares -- Offer price of USD 50 per share [] Transaction to be financed via a combination of Financing available funds and newly issued bonds [GRAPHIC OMITTED] 31 |

|

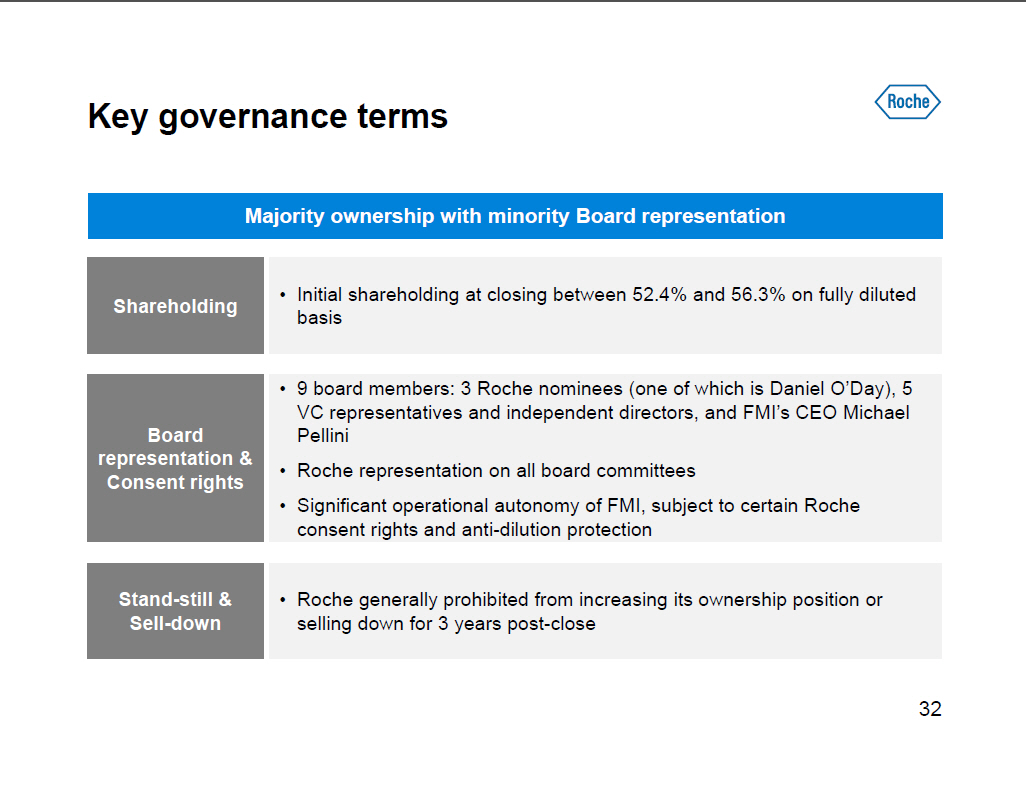

Key governance terms Majority ownership with minority Board representation [] Initial shareholding at closing between 52.4% and 56.3% on fully diluted Shareholding basis [] 9 board members: 3 Roche nominees (one of which is Daniel O'Day), 5 VC representatives and independent directors, and FMI's CEO Michael Board Pellini representation and [] Roche representation on all board committees Consent rights [] Significant operational autonomy of FMI, subject to certain Roche consent rights and anti-dilution protection Stand-still and [] Roche generally prohibited from increasing its ownership position or Sell-down selling down for 3 years post-close [GRAPHIC OMITTED] 32 |

|

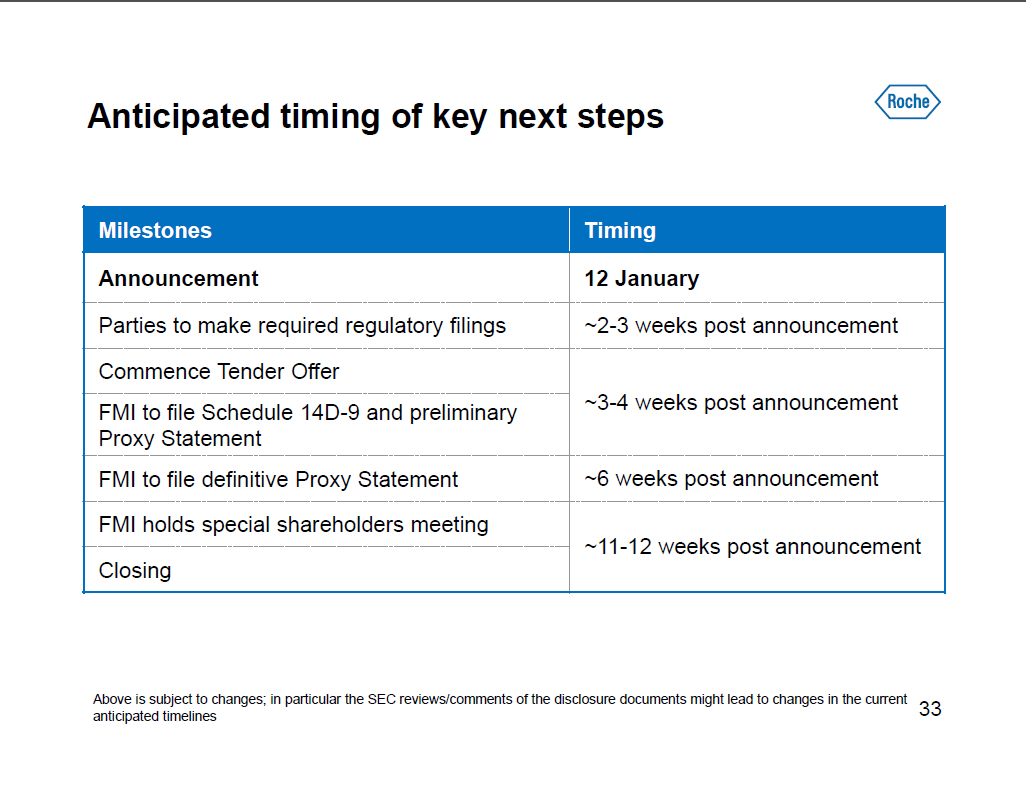

Anticipated timing of key next steps

Milestones Timing

------------------------------------------- ------------------------------

Announcement 12 January

------------------------------------------- ------------------------------

Parties to make required regulatory filings ~2-3 weeks post announcement

------------------------------------------- ------------------------------

Commence Tender Offer

-------------------------------------------

FMI to file Schedule 14D-9 and preliminary ~3-4 weeks post announcement

Proxy Statement

------------------------------------------- ------------------------------

FMI to file definitive Proxy Statement ~6 weeks post announcement

------------------------------------------- ------------------------------

FMI holds special shareholders meeting

-------------------------------------------

~11-12 weeks post announcement

Closing

Above is subject to changes; in particular the SEC reviews/comments of the

disclosure documents might lead to changes in the current anticipated

timelines

33

|

|

Doing now what patients need next 34 |