Q3 2025 Earnings Release October 29, 2025

2Littelfuse, Inc. © 2025 DISCLAIMERS Important Information About Littelfuse, Inc. This presentation does not constitute or form part of, and should not be construed as, an offer or solicitation to purchase or sell securities of Littelfuse, Inc. and no investment decision should be made based upon the information provided herein. Littelfuse strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at investor.littelfuse.com. This website also provides additional information about Littelfuse. “Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995. These risks, uncertainties and other factors include, but are not limited to, risks and uncertainties relating to general economic conditions; product demand and market acceptance; economic conditions; the impact of competitive products and pricing; product quality problems or product recalls; capacity and supply difficulties or constraints; coal mining exposures reserves; cybersecurity matters; failure of an indemnification for environmental liability; changes in import and export duty and tariff rates; exchange rate fluctuations; commodity price fluctuations; the effect of the Company's accounting policies; labor disputes and shortages; restructuring costs in excess of expectations; pension plan asset returns less than assumed; uncertainties related to political or regulatory changes; integration of acquisitions may not be achieved in a timely manner, or at all; limited realization of the expected benefits from investment and strategic plans; the ability to satisfy the conditions to closing of the proposed transaction discussed, on the expected timing or at all; the ability to obtain required regulatory approvals for the proposed transaction, on the expected timing or at all; the risk that the closing of the proposed transaction is delayed or does not occur at all, for reasons beyond Littelfuse’s control; the risk of stockholder litigation relating to the proposed transaction, including resulting expense or delay; higher than expected or unexpected costs associated with or relating to the proposed transaction; the risk that expected benefits, synergies and growth prospects of the proposed transaction may not be achieved in a timely manner, or at all; the risk that Basler’s business may not be successfully integrated with Littelfuse’s following the closing; the risk that Littelfuse and Basler will be unable to retain and hire key personnel; the risk that disruption from the proposed transaction may adversely affect Littelfuse’s or Basler’s business and its relationships with its customers, suppliers or employees; and other risks which may be detailed in the company's Securities and Exchange Commission filings. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual results and outcomes may differ materially from those indicated or implied in the forward-looking statements. This presentation should be read in conjunction with information provided in the financial statements appearing in the company's Annual Report on Form 10-K for the year ended December 28, 2024. Further discussion of the risk factors of the company can be found under the caption "Risk Factors" in the company's Annual Report on Form 10-K for the year ended December 28, 2024, and in other filings and submissions with the SEC, each of which are available free of charge on the company’s investor relations website at investor.littelfuse.com and on the SEC’s website at http://www.sec.gov. These forward-looking statements are made as of the date hereof. The company does not undertake any obligation to update, amend or clarify these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the availability of new information. Non-GAAP Financial Measures. The information included in this presentation includes the non-GAAP financial measures of organic net sales growth, adjusted operating margin, adjusted EBITDA margin, adjusted diluted earnings per share, adjusted effective tax rate, free cash flow, and consolidated net leverage ratio (as defined in the credit agreement). A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures are set forth in the appendix. The company believes that these non-GAAP financial measures provide useful information to investors regarding its operational performance, ability to generate cash and its credit position enhancing an investor’s overall understanding of its core financial performance. The company believes that free cash flow is a useful measure of its ability to generate cash. The company believes that these non-GAAP financial measures are commonly used by financial analysts and provide useful information to analysts. Management uses these measures when assessing the performance of the business and for business planning purposes. Note that the definitions of these non-GAAP financial measures may differ from those terms as defined or used by other companies.

3Littelfuse, Inc. © 2025 STRATEGIC PRIORITIES Enhance our Focus to Capitalize on Future Growth Opportunities Provide More Complete Solutions for a Broader Set of Customers Drive Further Operational Excellence to Amplify Long-Term Performance More structured evaluation of secular growth opportunities Better leverage teams & technology leadership Expand higher voltage & energy density application opportunities More collaborative approach across businesses Further align technology capabilities and sales structure Enhance customer support for next gen product development Better leverage operating practices across businesses Further optimize operating structure for scale Enhance long-term profitability 01 02 03

4Littelfuse, Inc. © 2025 WHY LITTELFUSE WINS Enabling Long-Term Growth Opportunities Core Market Leadership Market leaders in enabling safe and efficient electrical energy transfer Global scale and engineering expertise Customer partnerships with leading innovators across broad end market exposures Broad Multi-Technology Product Offering Core circuit protection leadership augmented by high value-add power semiconductor, switching and sensing capabilities Meaningful brand equity across product lines Providing more complete solutions for a broad set of customers Trusted and Essential Expertise Seasoned global teams embedded with our customers Solving increasingly challenging specifications to enable secular growth trends Driving improved power efficiency and safety Partnering with customers to architect next-gen solutions OUR VALUE PROPOSITION

5Littelfuse, Inc. © 2025 GLOBAL FOOTPRINT, FLEXIBLE OPERATING MODEL Global footprint strategically positioned to support customers in-region – Balanced revenue exposure – Strategically positioned close to customers and supply chains – Local teams in local markets Flexible operating model – History of footprint diversification – Asset-light manufacturing (2024 CapEx % of sales ~3.5%) – Ability to quickly flex cost structure; playbook for uncertain environment Strong tariff mitigation playbook for a dynamic environment – Working with customers to flex logistics and sourcing options – Implementing pricing actions when necessary 2024 Revenue Mix by Region China, 15% Mexico, 60% Europe, 5% All Other, 20% 2024 US Sales Sourcing by Region* *Company estimate Note: MX ~90% tariff exempt Littelfuse Global Operating Footprint US, 37% China, 23% Europe, 21% ROW, 19%

6Littelfuse, Inc. © 2025 Q3 2025 FINANCIAL SUMMARY +10% revenue growth vs. PY while EPS exceeded the high end of our guidance range01 Continued strong record of cash generation with YTD FCF conversion of 145%02 Announced the strategic acquisition of Basler Electric, enhancing high growth industrial market presence03 We are executing on our strategic priorities with a goal to scale our business for long-term growth and outperformance04

7Littelfuse, Inc. © 2025 Acquisition of Basler Electric Overview Enhances high-growth industrial market positioning *Note subject to the satisfaction of customary closing conditions, including the receipt of required regulatory approvals. Transaction Highlights Purchase Price ~$350M all cash; ~13.5x multiple on forecasted full year 2025 Adj. EBITDA when adjusted for the present value of expected tax benefits of ~$30M Expected Close By the end of Q4 2025* Contribution Expected to be accretive to Adj. EPS in 2026 Expands presence in mission critical, secular growth industrial markets including grid and utility infrastructure, power generation and data center Enhances high-power application capabilities with a highly reliable and comprehensive controls and protection systems portfolio Complements industrial technology offering, resulting in a more complete solution set and broader customer access globally Expected to deliver long-term value creation through growth and margin capture

8Littelfuse, Inc. © 2025 Q3 2025 TOTAL COMPANY FINANCIAL PERFORMANCE GAAP EPS $2.77 $2.32 Adj. EPS $2.95 $2.71 Adj. EBITDA% 21.5% 21.7% (in millions) Revenue +10% reported and +6.5% organic vs. PY Note +2% Dortmund acq. contribution and +1% from FX Adj. EBITDA Margin of 21.5% -20 bps y/y as operational leverage was offset by the impact of higher stock and variable compensation GAAP EPS of $2.77, +19% vs. PY Adj. EPS of $2.95, +9% vs. PY Q3 Op cash flow $147m; Free cash flow $131m, +102% vs PY YTD FCF conversion of 145% See appendix for GAAP to non-GAAP reconciliation

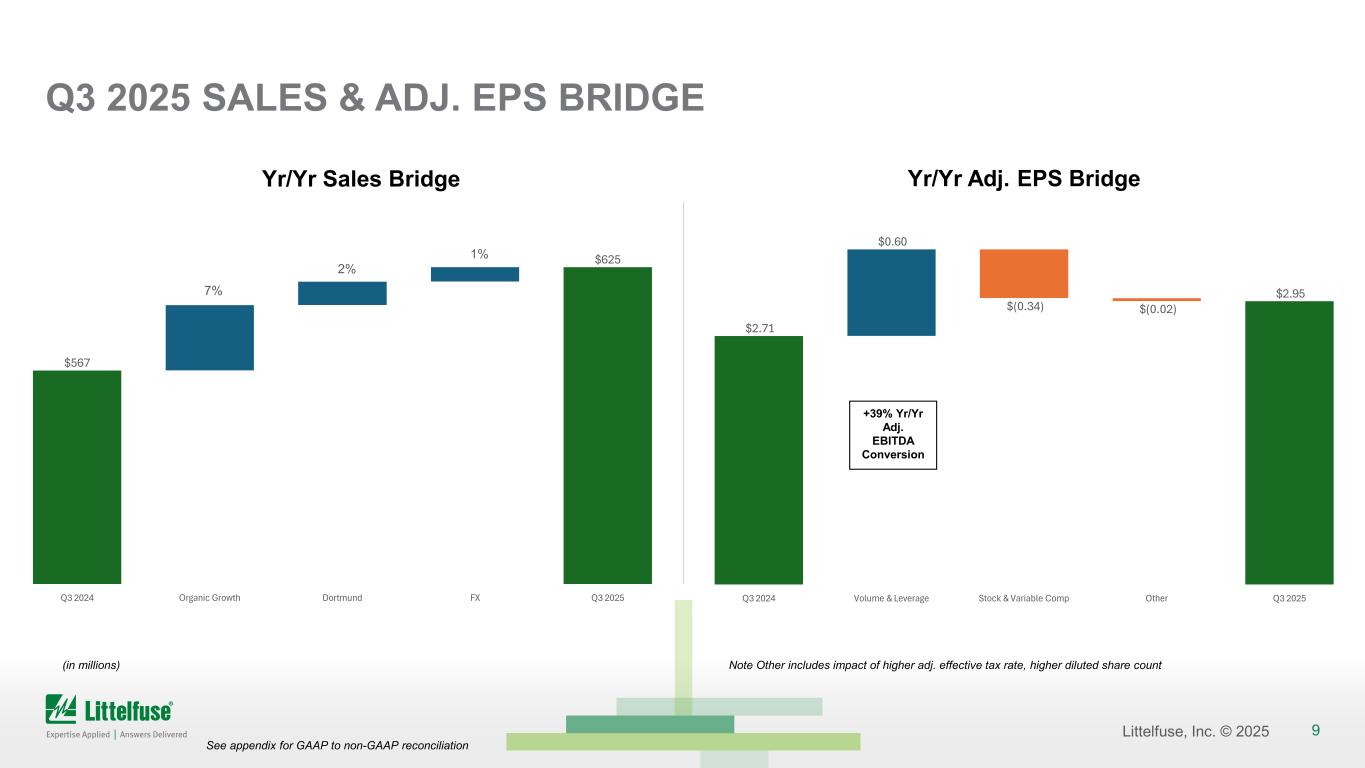

9Littelfuse, Inc. © 2025 $2.71 $0.60 $(0.34) $(0.02) $2.95 Q3 2024 Volume & Leverage Stock & Variable Comp Other Q3 2025 $567 $625 Q3 2024 Organic Growth Dortmund FX Q3 2025 Q3 2025 SALES & ADJ. EPS BRIDGE (in millions) See appendix for GAAP to non-GAAP reconciliation Yr/Yr Sales Bridge 7% 2% 1% Yr/Yr Adj. EPS Bridge +39% Yr/Yr Adj. EBITDA Conversion Note Other includes impact of higher adj. effective tax rate, higher diluted share count

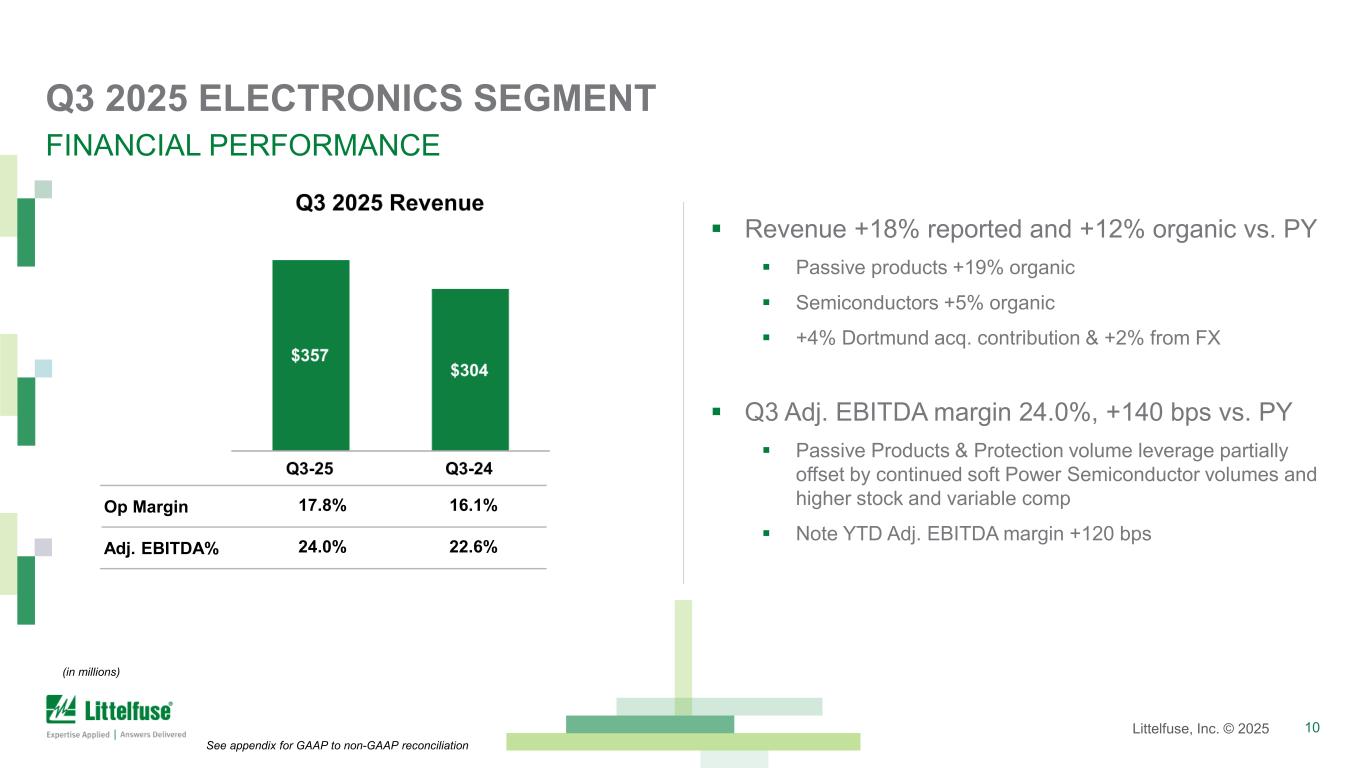

10Littelfuse, Inc. © 2025 10Littelfuse, Inc. © 2025 Q3 2025 ELECTRONICS SEGMENT FINANCIAL PERFORMANCE Op Margin 17.8% 16.1% Adj. EBITDA% 24.0% 22.6% (in millions) Revenue +18% reported and +12% organic vs. PY Passive products +19% organic Semiconductors +5% organic +4% Dortmund acq. contribution & +2% from FX Q3 Adj. EBITDA margin 24.0%, +140 bps vs. PY Passive Products & Protection volume leverage partially offset by continued soft Power Semiconductor volumes and higher stock and variable comp Note YTD Adj. EBITDA margin +120 bps See appendix for GAAP to non-GAAP reconciliation

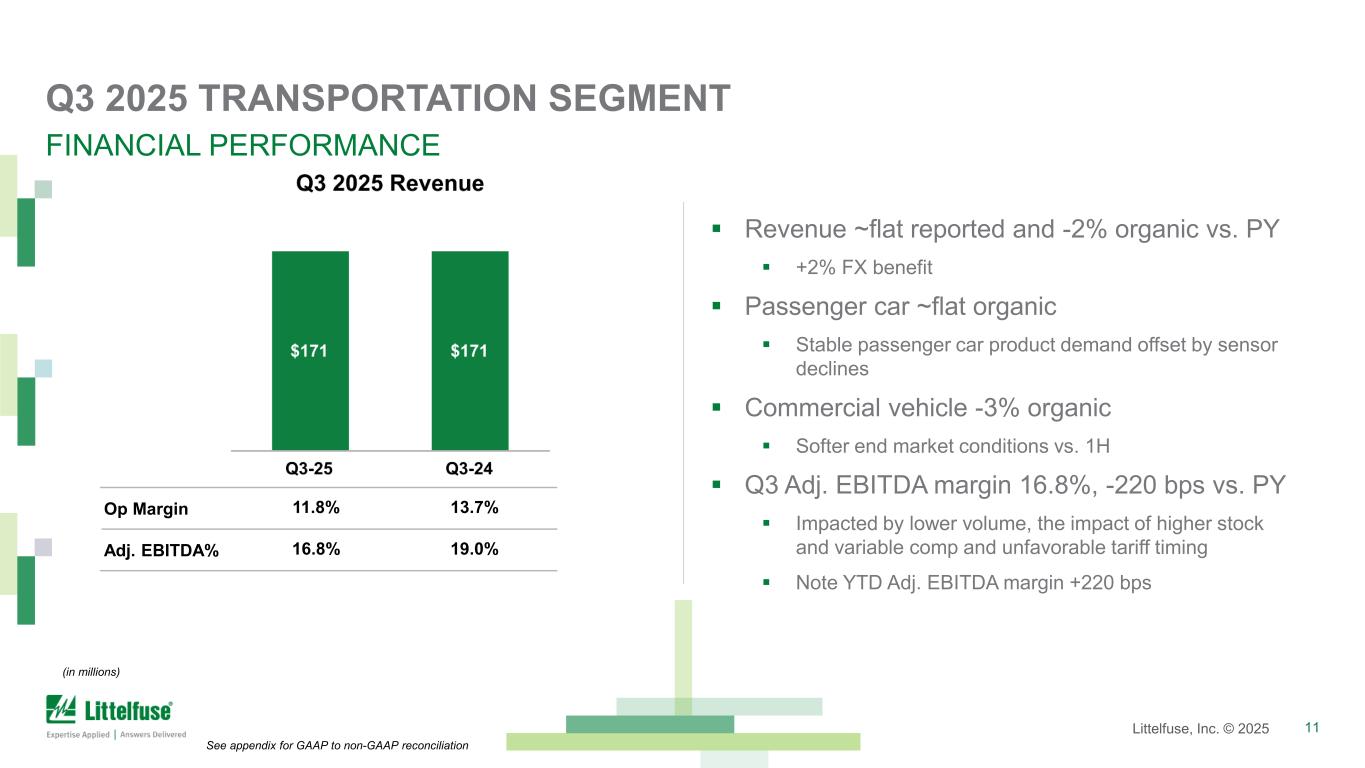

11Littelfuse, Inc. © 2025 11Littelfuse, Inc. © 2025 Q3 2025 TRANSPORTATION SEGMENT FINANCIAL PERFORMANCE Op Margin 11.8% 13.7% Adj. EBITDA% 16.8% 19.0% (in millions) Revenue ~flat reported and -2% organic vs. PY +2% FX benefit Passenger car ~flat organic Stable passenger car product demand offset by sensor declines Commercial vehicle -3% organic Softer end market conditions vs. 1H Q3 Adj. EBITDA margin 16.8%, -220 bps vs. PY Impacted by lower volume, the impact of higher stock and variable comp and unfavorable tariff timing Note YTD Adj. EBITDA margin +220 bps See appendix for GAAP to non-GAAP reconciliation

12Littelfuse, Inc. © 2025 Q3 2025 INDUSTRIAL SEGMENT FINANCIAL PERFORMANCE Op Margin 17.6% 19.3% Adj. EBITDA% 20.7% 23.8% (in millions) Revenue +4% reported and +4% organic vs. PY Strong energy storage, renewables, and data center growth Lower residential HVAC demand while construction markets remained soft YTD organic growth of +12%; Remain confident in long- term growth positioning Q3 Adj. EBITDA margin 20.7%, -310 bps vs. PY Unfavorable mix and higher stock and variable comp Note YTD Adj. EBITDA margin +290 bps Continuing to balance profitability with long-term growth investments See appendix for GAAP to non-GAAP reconciliation

13Littelfuse, Inc. © 2025 13Littelfuse, Inc. © 2025 Q4 2025 GUIDANCE (in millions) GAAP EPS $— $2.77 ($2.09) Adj. EPS $2.40 - $2.60 $2.95 $1.53 $570 - $590 Entered Q4 with a strong backlog but expecting continued mixed end market conditions Focus on execution, traction on strategic priorities Q4 sales guidance: $570m - $590m +10% yr/yr; +5% organic +2% yr/yr growth from Dortmund acquisition +3% yr/yr from favorable FX Adj. EPS $2.40 - $2.60 Expected adj. effective tax rate ~22% Includes ~($0.25) headwind from FX and commodities Guidance See appendix for GAAP to non-GAAP reconciliation

14Littelfuse, Inc. © 2025 $2.04 $(0.52) $1.53 $0.52 $1.00 $(0.40) $(0.15) $2.50 $530 $580 Q4 2024 Organic Growth Dortmund FX Q4 2025 Q4 2025 SALES & ADJ. EPS GUIDANCE BRIDGE Note Q4 2025 represents guidance midpoints (in millions) See appendix for GAAP to non-GAAP reconciliation Yr/Yr Sales Bridge 5% 2% 3% Yr/Yr Adj. EPS Bridge +60% Yr/Yr Adj. EBITDA Conversion Note Other includes higher adjusted effective tax rate

15Littelfuse, Inc. © 2025 FULL YEAR 2025 CONSIDERATIONS / EXPECTATIONS FY Dortmund acquisition impact… +2% growth to Company sales, Neutral EPS impact Other Assumptions – $59m amortization expense – $34m interest expense, expect to offset ~2/3 with interest income from cash investment strategies – Adj. effective tax rate 23-25% Expect +100% free cash flow conversion – Projecting ~$80-85m in capital expenditures Focused on Executing on Strategic Priorities to Drive Growth and Long-Term Shareholder Value

16Littelfuse, Inc. © 2025 APPENDIX

17Littelfuse, Inc. © 2025 17Littelfuse, Inc. © 2025 SUPPLEMENTAL FINANCIAL INFORMATION Note: Total will not always foot due to rounding. (a) reflected in selling, general and administrative expenses ("SG&A"). (b) reflected in cost of sales. (c) reflected in restructuring, impairment and other charges. (d) 2024 amount reflected a gain of $0.5 million ($1.5 million year-to-date) recorded for the sale of two buildings within the Transportation segment. (e) Q3 2025 amount reflected $0.3 million loss related to the sale of Marine business within the Transportation segment. (f) 2024 year-to-date included a reversal of $0.5 million for an asset retirement obligation charge related the disposal of a business in 2019 and $0.2 million increase in coal mining reserves. (g) reflected the tax impact associated with the non-GAAP adjustments. Non-GAAP EPS reconciliation Q3-25 Q3-24 YTD-25 YTD-24 GAAP diluted EPS $ 2.77 $ 2.32 $ 6.82 $ 6.07 EPS impact of Non-GAAP adjustments (below) 0.18 0.39 1.17 0.37 Adjusted diluted EPS $ 2.95 $ 2.71 $ 7.99 $ 6.44 Non-GAAP adjustments - (income) / expense (in millions) Q3-25 Q3-24 YTD-25 YTD-24 Acquisition-related and integration costs (a) $ 1.4 $ 1.0 $ 3.0 $ 2.8 Purchase accounting inventory adjustments (b) — — (0.5) — Restructuring, impairment and other charges (c) 1.6 1.8 13.2 10.3 Gain on sale of fixed assets (d) — (0.5) — (1.5) Loss on sale of Marine business (e) 0.3 — 0.3 — Non-GAAP adjustments to operating income 3.3 2.3 16.0 11.6 Other income, net (f) — — — (0.3) Non-operating foreign exchange loss 0.2 9.6 15.5 4.3 Non-GAAP adjustments to income before income taxes 3.5 11.9 31.5 15.6 Income taxes (g) (1.0) 2.1 2.2 6.2 Non-GAAP adjustments to net income $ 4.5 $ 9.8 $ 29.3 $ 9.4 Total EPS impact $ 0.18 $ 0.39 $ 1.17 $ 0.37

18Littelfuse, Inc. © 2025 18Littelfuse, Inc. © 2025 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D Adjusted operating margin / Adjusted EBITDA reconciliation (in milions) Q3-25 Q3-24 YTD-25 YTD-24 Net income $ 69.5 $ 58.1 $ 170.4 $ 152.0 Add: Income taxes 25.2 19.7 62.4 42.6 Interest expense 8.6 9.8 26.0 29.4 Foreign exchange loss 0.2 9.6 15.5 4.3 Other income, net (6.1) (9.3) (14.0) (19.9) GAAP operating income $ 97.4 $ 87.8 $ 260.3 $ 208.3 Non-GAAP adjustments to operating income 3.3 2.3 16.0 11.6 Adjusted operating income $ 100.7 $ 90.1 $ 276.3 $ 219.9 Amortization of intangibles 15.0 15.9 44.2 47.4 Depreciation expense 18.6 17.3 56.4 51.0 Adjusted EBITDA $ 134.3 $ 123.3 $ 376.9 $ 318.3 Net sales $ 624.6 $ 567.4 $ 1,792.4 $ 1,661.3 Net income as a percentage of net sales 11.1 % 10.2 % 9.5 % 9.1 % Operating margin 15.6 % 15.5 % 14.5 % 12.5 % Adjusted operating margin 16.1 % 15.9 % 15.4 % 13.2 % Adjusted EBITDA margin 21.5 % 21.7 % 21.0 % 19.2 %

19Littelfuse, Inc. © 2025 19Littelfuse, Inc. © 2025 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D Adjusted EBITDA by Segment (in millions) Q3-25 Q3-24 Electronics Transportation Industrial Electronics Transportation Industrial GAAP operating income $ 63.6 $ 20.2 $ 16.9 $ 48.9 $ 23.5 $ 17.7 Add: Add back amortization 10.2 3.4 1.4 9.9 3.4 2.6 Add back depreciation 12.0 5.1 1.5 10.1 5.7 1.5 Adjusted EBITDA $ 85.8 $ 28.7 $ 19.8 $ 68.9 $ 32.6 $ 21.8 Adjusted EBITDA Margin 24.0 % 16.8 % 20.7 % 22.6 % 19.0 % 23.8 % Net sales (in thousands) Q3-25 Q3-24 Electronics Transportation Industrial Electronics Transportation Industrial Electronics – Semiconductor $ 174,073 $ — $ — $ 151,954 $ — $ — Electronics – Passive Products and Sensors 183,384 — — 152,234 — — Commercial Vehicle Products — 80,272 — — 82,077 — Passenger Car Products — 75,636 — — 71,299 — Automotive Sensors — 15,403 — — 18,005 — Industrial Products — — 95,872 — — 91,821 Total $ 357,457 $ 171,311 $ 95,872 $ 304,188 $ 171,381 $ 91,821

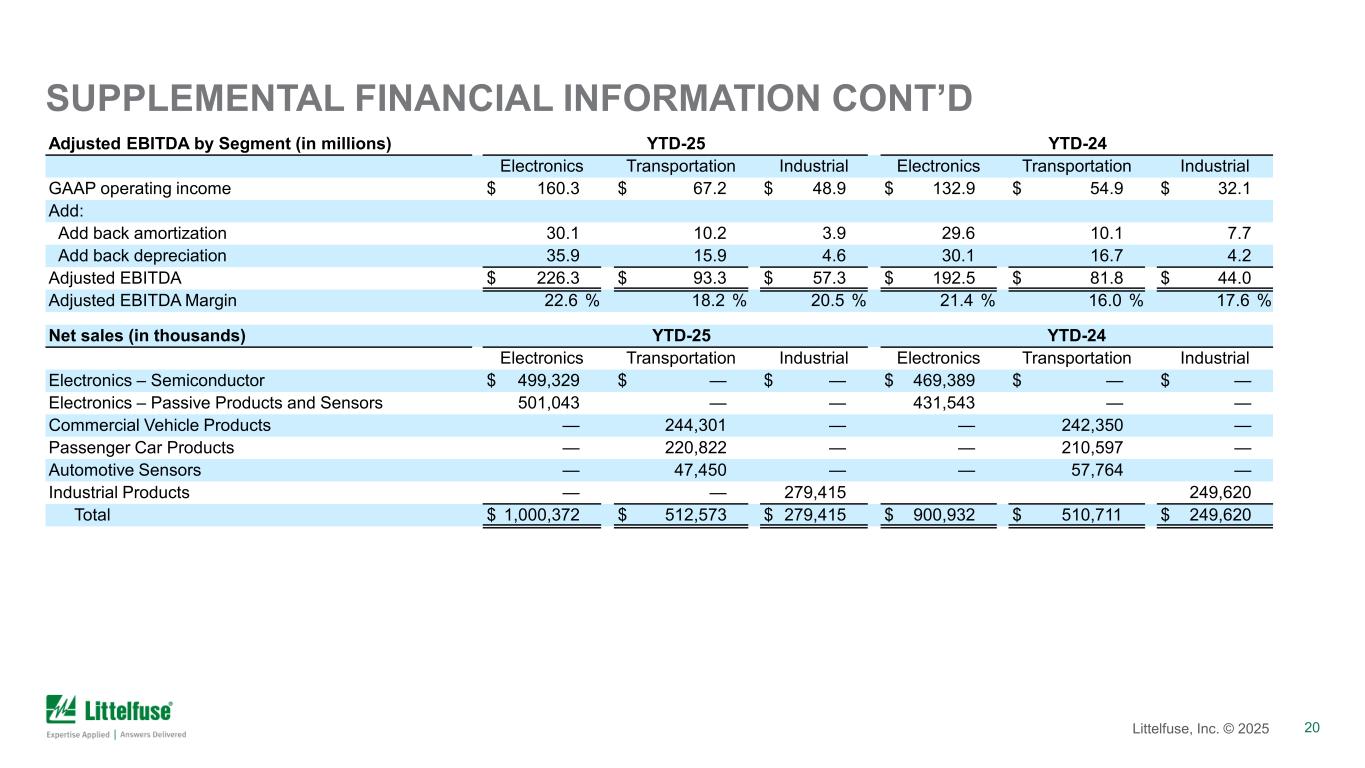

20Littelfuse, Inc. © 2025 20Littelfuse, Inc. © 2025 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D Adjusted EBITDA by Segment (in millions) YTD-25 YTD-24 Electronics Transportation Industrial Electronics Transportation Industrial GAAP operating income $ 160.3 $ 67.2 $ 48.9 $ 132.9 $ 54.9 $ 32.1 Add: Add back amortization 30.1 10.2 3.9 29.6 10.1 7.7 Add back depreciation 35.9 15.9 4.6 30.1 16.7 4.2 Adjusted EBITDA $ 226.3 $ 93.3 $ 57.3 $ 192.5 $ 81.8 $ 44.0 Adjusted EBITDA Margin 22.6 % 18.2 % 20.5 % 21.4 % 16.0 % 17.6 % Net sales (in thousands) YTD-25 YTD-24 Electronics Transportation Industrial Electronics Transportation Industrial Electronics – Semiconductor $ 499,329 $ — $ — $ 469,389 $ — $ — Electronics – Passive Products and Sensors 501,043 — — 431,543 — — Commercial Vehicle Products — 244,301 — — 242,350 — Passenger Car Products — 220,822 — — 210,597 — Automotive Sensors — 47,450 — — 57,764 — Industrial Products — — 279,415 249,620 Total $ 1,000,372 $ 512,573 $ 279,415 $ 900,932 $ 510,711 $ 249,620

21Littelfuse, Inc. © 2025 21Littelfuse, Inc. © 2025 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D (1) Passenger vehicle business (PVB) includes passenger car and auto sensor products. Net sales reconciliation Q3-25 vs. Q3-24 Electronics Transportation Industrial Total Net sales growth 18 % — % 4 % 10 % Less: Acquisitions 4 % — % — % 2 % FX impact 2 % 2 % — % 1 % Organic net sales growth (decline) 12 % (2)% 4 % 7 % Electronics segment net sales reconciliation Q3-25 vs. Q3-24 Electronics - Semiconductor Electronics - Passive Products and Sensors Total Electronics Net sales growth 15 % 20 % 18 % Less: Acquisitions 9 % — % 4 % FX impact 1 % 1 % 2 % Organic net sales growth 5 % 19 % 12 % Transportation segment net sales reconciliation Q3-25 vs. Q3-24 Commercial Vehicle Products Passenger Car Products (1) Auto Sensor Products (1) Total Transportation Net sales growth (2)% 6 % (14)% — % Less: FX impact 1 % 2 % 4 % 2 % Organic net sales (decline) growth (3)% 4 % (18)% (2)%

22Littelfuse, Inc. © 2025 22Littelfuse, Inc. © 2025 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D (1) Passenger vehicle business (PVB) includes passenger car and auto sensor products. Net sales reconciliation YTD-25 vs. YTD-24 Electronics Transportation Industrial Total Net sales growth 11 % — % 12 % 8 % Less: Acquisitions 4 % — % — % 2 % FX impact — % — % — % 1 % Organic net sales growth 7 % — % 12 % 5 %

23Littelfuse, Inc. © 2025 23Littelfuse, Inc. © 2025 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D Income tax reconciliation Q3-25 Q3-24 YTD-25 YTD-24 Income taxes $ 25.2 $ 19.7 $ 62.4 $ 42.6 Effective rate 26.6 % 25.3 % 26.8 % 21.9 % Non-GAAP adjustments - income taxes (1.0) 2.1 2.2 6.2 Adjusted income taxes $ 24.2 $ 21.8 $ 64.6 $ 48.8 Adjusted effective rate 24.6 % 24.3 % 24.5 % 23.2 % Free cash flow reconciliation Q3-25 Q3-24 YTD-25 YTD-24 Net cash provided by operating activities $ 146.9 $ 80.4 $ 295.1 $ 207.0 Less: Purchases of property, plant, and equipment (15.7) (15.4) (48.7) (50.1) Free cash flow $ 131.2 $ 65.0 $ 246.4 $ 156.9 Free cash flow conversion Q3-25 Q3-24 YTD-25 YTD-24 Net income $ 69.5 $ 58.1 $ 170.4 $ 152.0 Free cash flow 131.2 65.0 246.4 156.9 Free cash flow conversion 189 % 112 % 145 % 103 %

24Littelfuse, Inc. © 2025 24Littelfuse, Inc. © 2025 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D * Our Credit Agreement and Private Placement Note with maturities ranging from 2025 to 2032, contain financial ratio covenants providing that if, as of the last day of each fiscal quarter, the Consolidated Net Leverage ratio at such time for the then most recently concluded period of four consecutive fiscal quarters of the Company exceeds 3.50:1.00, an Event of Default (as defined in the Credit Agreement and Private Placement Senior Notes) is triggered. The Credit Agreement and Private Placement Senior Notes were amended in Q2 2022 and now allow for the addition of acquisition and integration costs up to 15% of Consolidated EBITDA and the netting of up to $400M of Available Cash (Cash held by US Subsidiaries). (1) Represents Consolidated EBITDA as defined in our Credit Agreement and Private Placement Senior Notes and is calculated using the most recently concluded period of four consecutive quarters. Consolidated Total Debt (in millions) As of September 27, 2025 Consolidated Total Debt $ 805.8 Unamortized debt issuance costs 2.1 Finance lease liability 0.3 Consolidated funded indebtedness 808.2 Cash held in U.S. (up to $400 million) 345.0 Net debt $ 463.2 Consolidated EBITDA (in millions) Twelve Months Ended September 27, 2025 Net Income $ 118.5 Interest expense 35.4 Income taxes 71.5 Depreciation 73.7 Amortization 58.9 Non-cash additions: Stock-based compensation expense 26.3 Unrealized loss on investments 3.9 Impairment charges 92.7 Other 29.9 Consolidated EBITDA (1) $ 510.8 Consolidated Net Leverage Ratio (as defined in the Credit Agreement) * 0.9x

25Littelfuse, Inc. © 2025 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D Note: Total will not always foot due to rounding. * As reported is based on Q4 2024 results filed on January 28, 2025. Actual is based on 10-K filed on March 13, 2025 During the year ended December 28, 2024, the Company identified certain errors in its previously issued financial statements that have now been corrected through cumulative out-of-period adjustments in the financial statements as of and for the year ended December 28, 2024. The error was identified by management and related to the valuation and existence of inventory that originated in prior periods at certain of our non-U.S. manufacturing locations within the Transportation and Industrial segments. As a result, the Company recorded an out-of-period adjustment to the prior years of $12.3 million in the year ended December 28, 2024. The adjustment increased cost of sales, offset by a reduction in inventory. The out-of-period adjustment resulted in a decrease to net income of $12.3 million. The Company evaluated the impact of the error and out-of-period adjustment and concluded it was not material to any previously issued financial statements and the adjustment was not material to the year ended December 28, 2024. Q4 2024 reconciliation Q4-2024 GAAP Diluted EPS Operating income Operating Margin (Per share) (In millions) ( Percentage) As reported in 8-K* $ (1.57) $ (36.7) (6.9)% Out-of-period adjustments related to periods prior to 2024 (0.50) (12.3) (2.3)% Out-of-period adjustments related to 2024 (0.05) (1.2) (0.2)% Annual incentive compensation adjustment 0.03 0.7 0.1 % As reported in 10K* $ (2.09) $ (49.5) (9.3)%

26Littelfuse, Inc. © 2025 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D Note: Total will not always foot due to rounding. * As reported is based on Q4 2024 result published on January 28, 2025. Actual is based on the final 10-K report. (a) reflected in selling, general and administrative expenses ("SG&A"). (b) reflected in restructuring, impairment and other charges. In the fourth quarter 2024, the Company recorded $92.6 million of non-cash impairment charges, which included $47.8 million for the impairment of intangible assets primarily related to certain acquired customer relationships, developed technology, and tradename in the Industrial controls and sensors reporting unit within the Industrial segment, and $36.1 million and $8.6 million non-cash goodwill impairment charge associated with the Industrial controls and sensors reporting unit within the Industrial segment and the Automotive sensors reporting unit within the Transportation segment, respectively. (c) 2024 included $1.6 million increase in coal mining reserves. (d) reflected the tax impact associated with the non-GAAP adjustments. Non-GAAP EPS reconciliation Q4-24 Q4-24 Actual* As Reported* GAAP diluted EPS $ (2.09) $ (1.57) EPS impact of Non-GAAP adjustments (below) 3.61 3.61 Adjusted diluted EPS $ 1.53 $ 2.04 Non-GAAP adjustments - (income) / expense Q4-24 Q4-24 Acquisition-related and integration costs (a) $ 2.3 $ 2.3 Restructuring, impairment and other charges (b) 98.1 98.1 Non-GAAP adjustments to operating income 100.4 100.4 Other income, net (c) 1.6 1.6 Non-operating foreign exchange gain (13.5) (13.5) Non-GAAP adjustments to income before income taxes 88.5 88.5 Income taxes (d) (1.5) (1.5) Non-GAAP adjustments to net income $ 90.0 $ 90.0 Total EPS impact $ 3.61 $ 3.61