Q4 2025 Earnings Release January 28, 2026

2Littelfuse, Inc. © 2026 DISCLAIMERS Important Information About Littelfuse, Inc. This presentation does not constitute or form part of, and should not be construed as, an offer or solicitation to purchase or sell securities of Littelfuse, Inc. and no investment decision should be made based upon the information provided herein. Littelfuse strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at investor.littelfuse.com. This website also provides additional information about Littelfuse. “Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995. These risks, uncertainties and other factors include, but are not limited to, risks and uncertainties relating to general economic conditions; product demand and market acceptance; economic conditions; the impact of competitive products and pricing; product quality problems or product recalls; capacity and supply difficulties or constraints; coal mining exposures reserves; cybersecurity matters; failure of an indemnification for environmental liability; changes in import and export duty and tariff rates; exchange rate fluctuations; commodity price fluctuations; the effect of the Company's accounting policies; labor disputes and shortages; restructuring costs in excess of expectations; pension plan asset returns less than assumed; uncertainties related to political or regulatory changes; integration of acquisitions may not be achieved in a timely manner, or at all; limited realization of the expected benefits from investment and strategic plans; the risk that expected benefits, synergies and growth prospects of the Basler acquisition may not be achieved in a timely manner, or at all; the risk that Basler’s business may not be successfully integrated with Littelfuse business following the closing; the risk that Littelfuse and Basler will be unable to retain and hire key personnel; the risk that disruption from the acquisition may adversely affect Littelfuse or Basler business and its relationships with its customers, suppliers or employees; and other risks which may be detailed in the company's Securities and Exchange Commission filings. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual results and outcomes may differ materially from those indicated or implied in the forward-looking statements. This presentation should be read in conjunction with information provided in the financial statements appearing in the company's Annual Report on Form 10-K for the year ended December 28, 2024. Further discussion of the risk factors of the company can be found under the caption "Risk Factors" in the company's Annual Report on Form 10-K for the year ended December 28, 2024, and in other filings and submissions with the SEC, each of which are available free of charge on the company’s investor relations website at investor.littelfuse.com and on the SEC’s website at http://www.sec.gov. These forward-looking statements are made as of the date hereof. The company does not undertake any obligation to update, amend or clarify these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the availability of new information. Non-GAAP Financial Measures. The information included in this presentation includes the non-GAAP financial measures of organic net sales growth, adjusted operating margin, adjusted EBITDA margin, adjusted diluted earnings per share, adjusted effective tax rate, free cash flow, and consolidated net leverage ratio (as defined in the credit agreement). A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures are set forth in the appendix. The company believes that these non-GAAP financial measures provide useful information to investors regarding its operational performance, ability to generate cash and its credit position enhancing an investor’s overall understanding of its core financial performance. The company believes that free cash flow is a useful measure of its ability to generate cash. The company believes that these non-GAAP financial measures are commonly used by financial analysts and provide useful information to analysts. Management uses these measures when assessing the performance of the business and for business planning purposes. Note that the definitions of these non-GAAP financial measures may differ from those terms as defined or used by other companies.

3Littelfuse, Inc. © 2026 SAVE THE DATE INVESTOR DAY May 14, 2026 | New York City A formal invitation to register for in-person or virtual attendance will be provided in the coming weeks. Due to space availability, the number of in-person participants will be limited and advance registration is required. Littelfuse, Inc. © 2026

4Littelfuse, Inc. © 2026 STRATEGIC PRIORITIES Enhance our Focus to Capitalize on Future Growth Opportunities Provide More Complete Solutions for a Broader Set of Customers Drive Further Operational Excellence to Amplify Long-Term Performance More structured evaluation of secular growth opportunities Better leverage teams & technology leadership Expand higher voltage & energy density application opportunities More collaborative approach across businesses Further align technology capabilities and sales structure Enhance customer support for next gen product development Better leverage operating practices across businesses Further optimize operating structure for scale Enhance long-term profitability 01 02 03

5Littelfuse, Inc. © 2026 WHY LITTELFUSE WINS Enabling Long-Term Growth Opportunities Core Market Leadership Market leaders in enabling safe and efficient electrical energy transfer Global scale and engineering expertise Customer partnerships with leading innovators across broad end market exposures Broad Multi-Technology Product Offering Core circuit protection leadership augmented by high value-add power semiconductor, switching and sensing capabilities Meaningful brand equity across product lines Providing more complete solutions for a broad set of customers Trusted and Essential Expertise Seasoned global teams embedded with our customers Solving increasingly challenging specifications to enable secular growth trends Driving improved power efficiency and safety Partnering with customers to architect next-gen solutions OUR VALUE PROPOSITION

6Littelfuse, Inc. © 2026 CLOSING OF THE BASLER ACQUISITION Enhances High-Growth Industrial Exposure Basler’s highly reliable and comprehensive controls and protection systems portfolio enhances Littelfuse high-power application capabilities Basler is integral to the generation and consumption of power with expertise in regulators & genset controls, excitation systems, protective relays, and custom transformers Basler plus Littelfuse industrial circuit protection, power semi and passive tech leadership to enable a more complete solution set for customers Basler expands Littelfuse presence in mission critical, secular growth industrial markets including grid & utility infrastructure, power generation and data center Basler brings +80-year history and longstanding relationships with market leaders Basler is a leading supplier to the retrofit market with ~70% replacement business for a large installed base with high barriers to entry Leveraging Leading Customer Relationships Financial Impact Anticipate 2026 revenue contribution of $130-135 million Estimate high-teens adjusted EBITDA margin in 2026 Estimate $0.10 - $0.15 adjusted EPS accretion in 2026

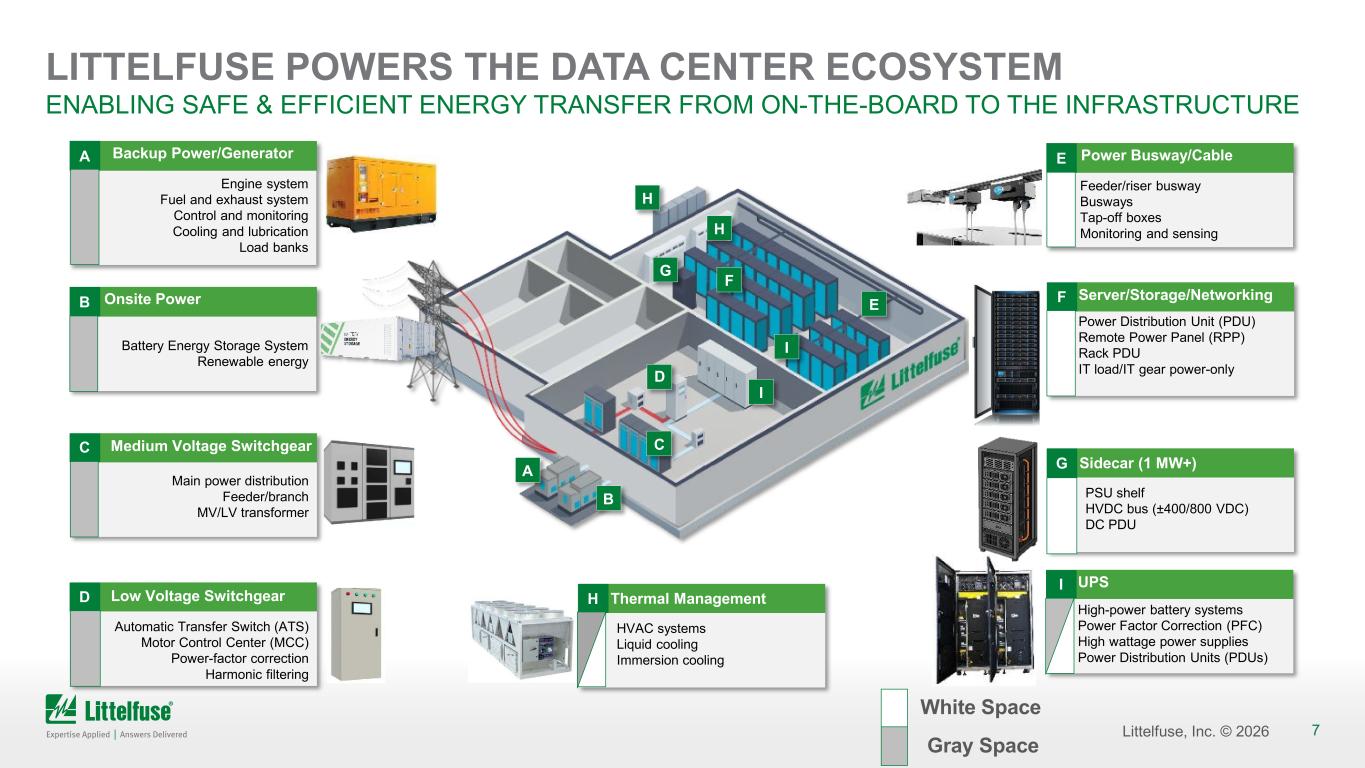

7Littelfuse, Inc. © 2026 H D C A B I G F E LITTELFUSE POWERS THE DATA CENTER ECOSYSTEM ENABLING SAFE & EFFICIENT ENERGY TRANSFER FROM ON-THE-BOARD TO THE INFRASTRUCTURE Server/Storage/NetworkingF Power Distribution Unit (PDU) Remote Power Panel (RPP) Rack PDU IT load/IT gear power-only Thermal Management HVAC systems Liquid cooling Immersion cooling HLow Voltage Switchgear Automatic Transfer Switch (ATS) Motor Control Center (MCC) Power-factor correction Harmonic filtering D Medium Voltage Switchgear Main power distribution Feeder/branch MV/LV transformer C UPS High-power battery systems Power Factor Correction (PFC) High wattage power supplies Power Distribution Units (PDUs) I A Backup Power/Generator Engine system Fuel and exhaust system Control and monitoring Cooling and lubrication Load banks E Power Busway/Cable Feeder/riser busway Busways Tap-off boxes Monitoring and sensing B Onsite Power Battery Energy Storage System Renewable energy Sidecar (1 MW+) PSU shelf HVDC bus (±400/800 VDC) DC PDU G I H White Space Gray Space

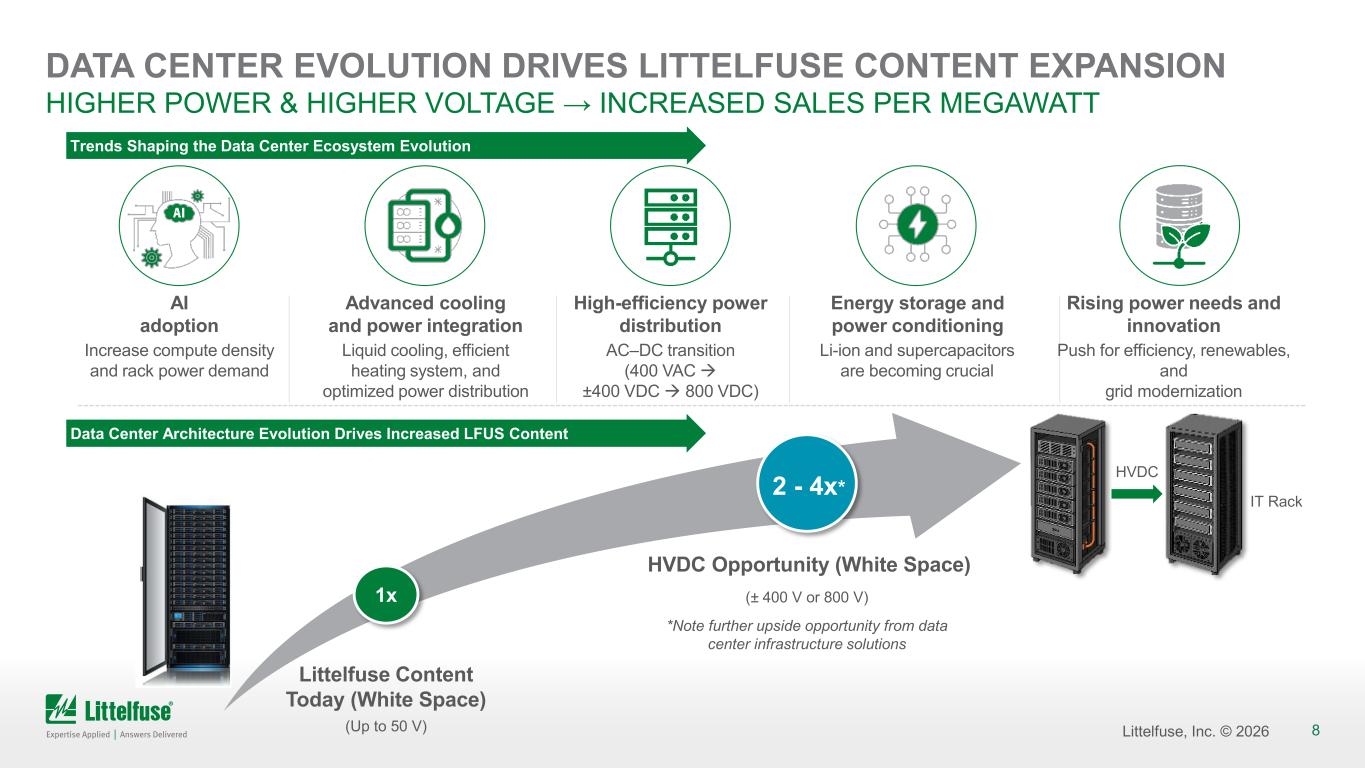

8Littelfuse, Inc. © 2026 DATA CENTER EVOLUTION DRIVES LITTELFUSE CONTENT EXPANSION HIGHER POWER & HIGHER VOLTAGE → INCREASED SALES PER MEGAWATT AI adoption Advanced cooling and power integration High-efficiency power distribution Energy storage and power conditioning Rising power needs and innovation Increase compute density and rack power demand Liquid cooling, efficient heating system, and optimized power distribution AC–DC transition (400 VAC ±400 VDC 800 VDC) Li-ion and supercapacitors are becoming crucial Push for efficiency, renewables, and grid modernization IT Rack HVDC 1x Littelfuse Content Today (White Space) (Up to 50 V) Trends Shaping the Data Center Ecosystem Evolution Data Center Architecture Evolution Drives Increased LFUS Content HVDC Opportunity (White Space) (± 400 V or 800 V) *Note further upside opportunity from data center infrastructure solutions 2 - 4x*

9Littelfuse, Inc. © 2026 Q4 2025 FINANCIAL SUMMARY Revenue and EPS exceeded the high end of our guidance range01 Continued strong record of cash generation with Q4 FCF of $120 million; Note 2025 FCF of $366 million, +26% vs. PY02 Closed the strategic acquisition of Basler Electric, enhancing high growth industrial market presence03 We are executing on our strategic priorities with a goal to scale our business for long-term growth and outperformance04

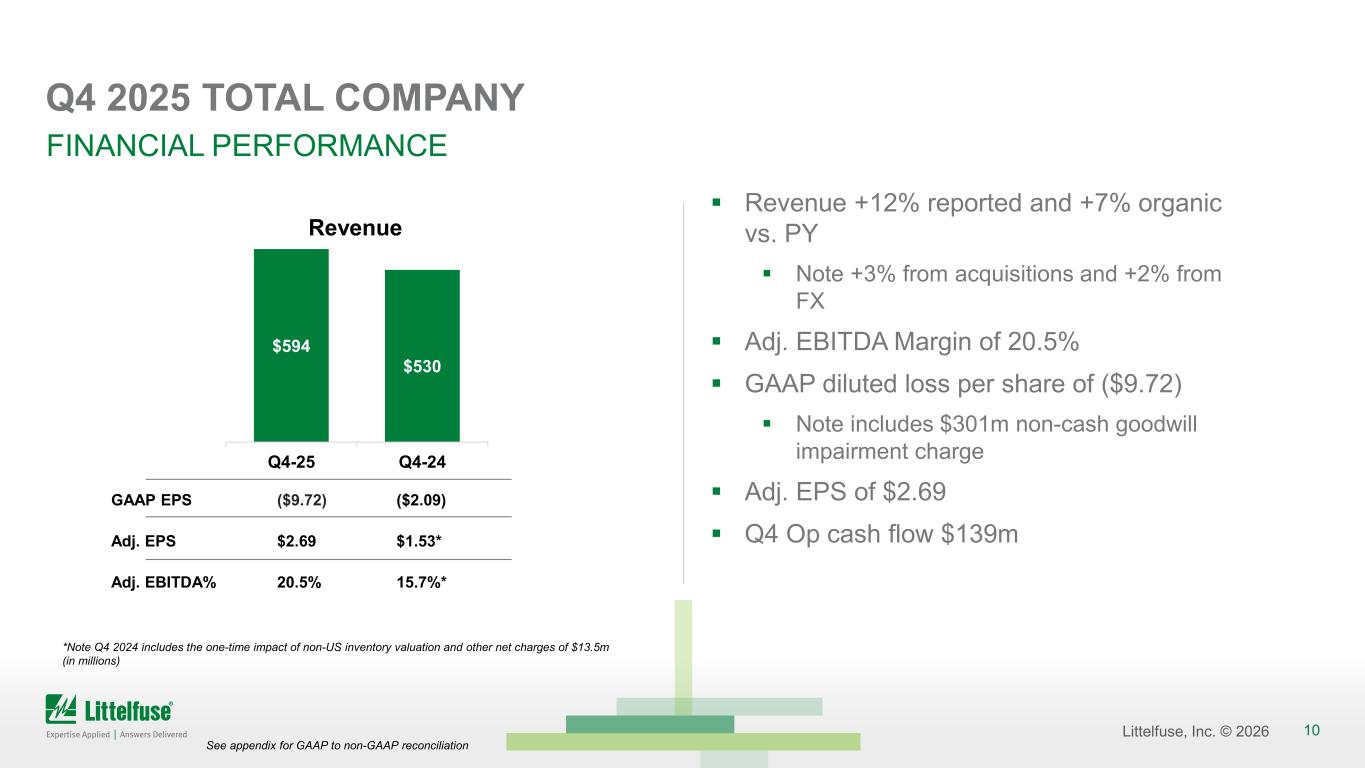

10Littelfuse, Inc. © 2026 Q4 2025 TOTAL COMPANY Revenue +12% reported and +7% organic vs. PY Note +3% from acquisitions and +2% from FX Adj. EBITDA Margin of 20.5% GAAP diluted loss per share of ($9.72) Note includes $301m non-cash goodwill impairment charge Adj. EPS of $2.69 Q4 Op cash flow $139m FINANCIAL PERFORMANCE GAAP EPS ($9.72) ($2.09) Adj. EPS $2.69 $1.53* Adj. EBITDA% 20.5% 15.7%* $594 $530 Q4-25 Q4-24 Revenue *Note Q4 2024 includes the one-time impact of non-US inventory valuation and other net charges of $13.5m (in millions) See appendix for GAAP to non-GAAP reconciliation

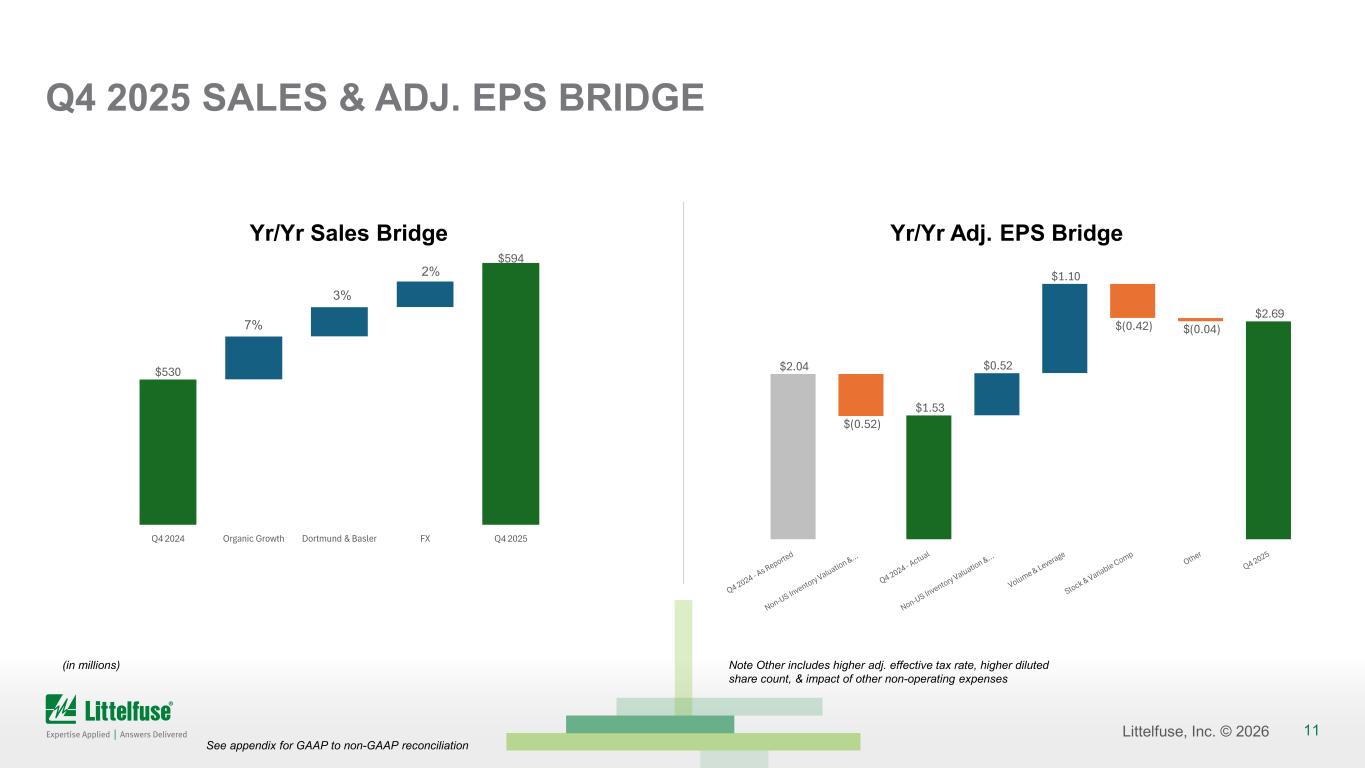

11Littelfuse, Inc. © 2026 $530 $594 Q4 2024 Organic Growth Dortmund & Basler FX Q4 2025 Q4 2025 SALES & ADJ. EPS BRIDGE (in millions) See appendix for GAAP to non-GAAP reconciliation Yr/Yr Sales Bridge 7% 3% 2% Yr/Yr Adj. EPS Bridge Note Other includes higher adj. effective tax rate, higher diluted share count, & impact of other non-operating expenses $2.04 $(0.52) $1.53 $0.52 $1.10 $(0.42) $(0.04) $2.69

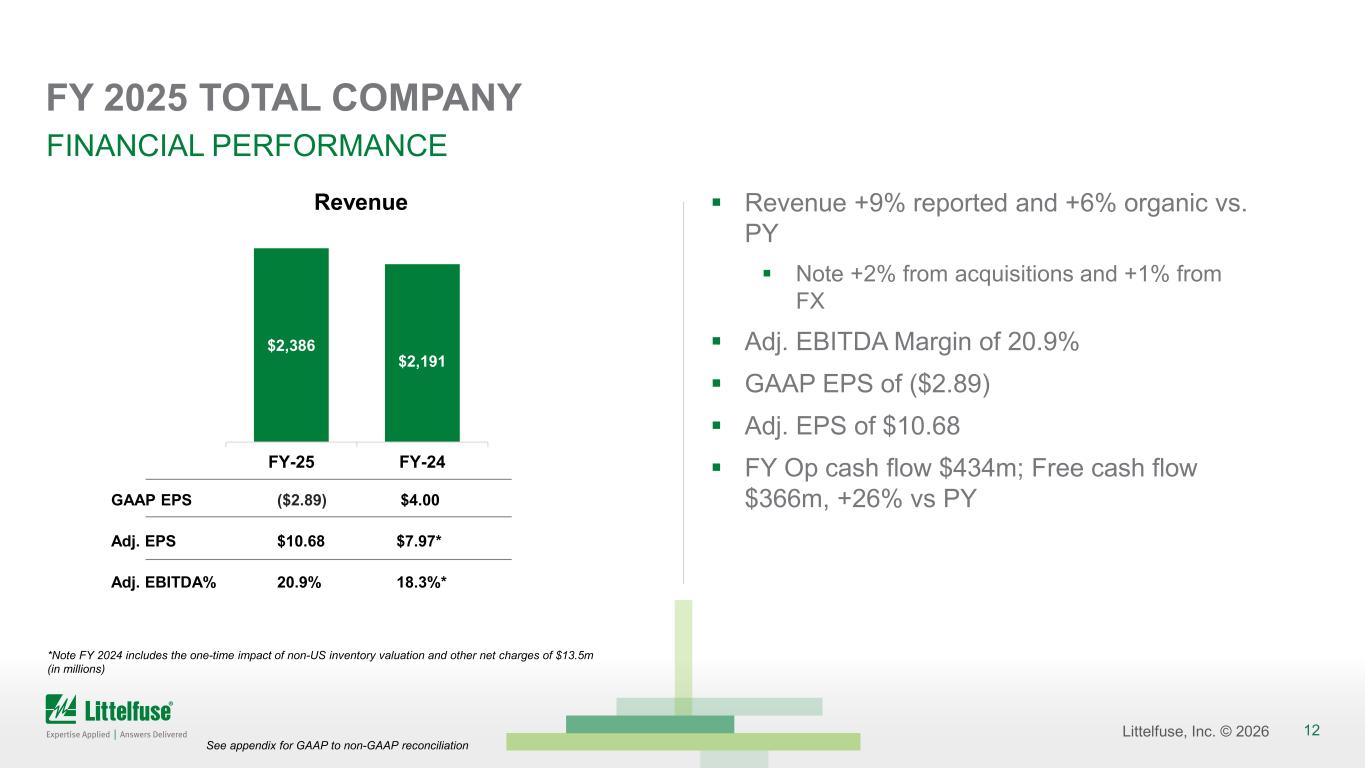

12Littelfuse, Inc. © 2026 FY 2025 TOTAL COMPANY Revenue +9% reported and +6% organic vs. PY Note +2% from acquisitions and +1% from FX Adj. EBITDA Margin of 20.9% GAAP EPS of ($2.89) Adj. EPS of $10.68 FY Op cash flow $434m; Free cash flow $366m, +26% vs PY FINANCIAL PERFORMANCE GAAP EPS ($2.89) $4.00 Adj. EPS $10.68 $7.97* Adj. EBITDA% 20.9% 18.3%* $2,386 $2,191 FY-25 FY-24 Revenue See appendix for GAAP to non-GAAP reconciliation *Note FY 2024 includes the one-time impact of non-US inventory valuation and other net charges of $13.5m (in millions)

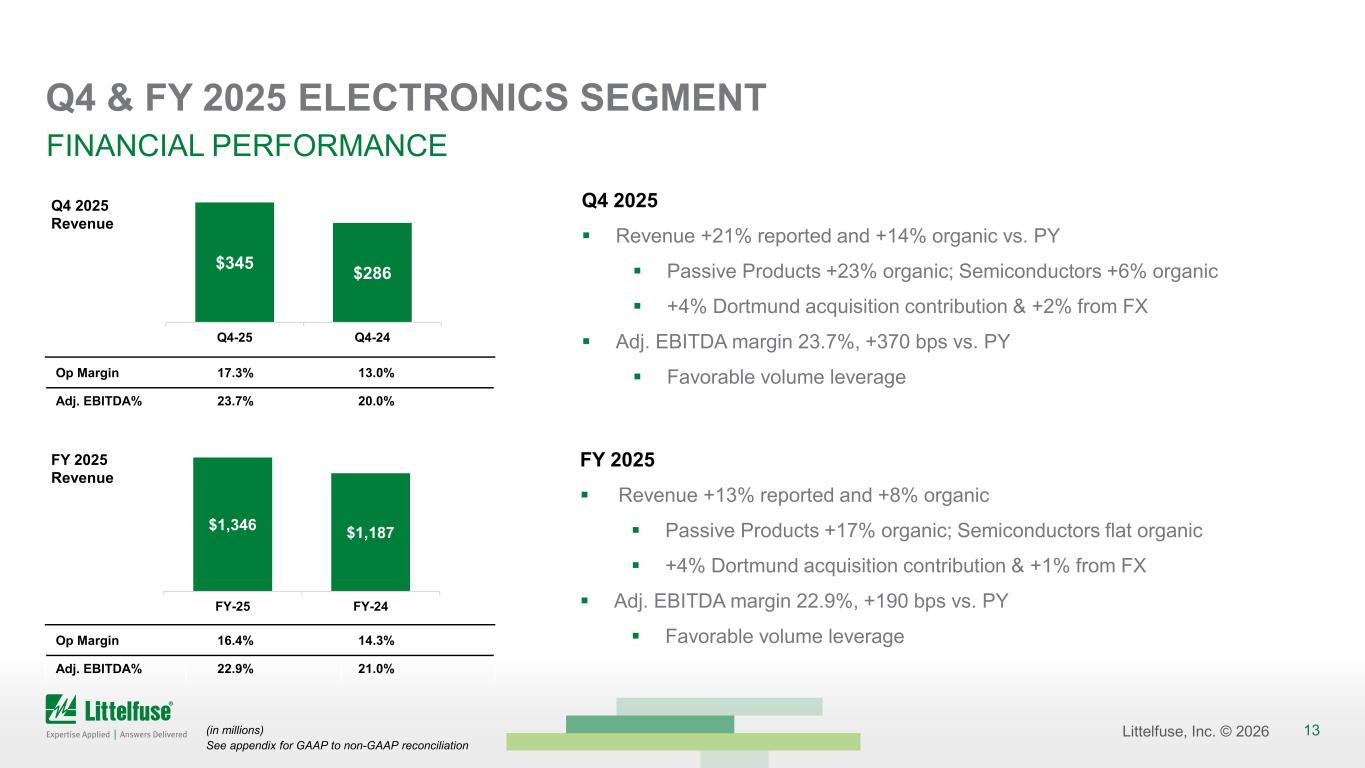

13Littelfuse, Inc. © 2026 Q4 & FY 2025 ELECTRONICS SEGMENT FINANCIAL PERFORMANCE Op Margin 17.3% 13.0% Adj. EBITDA% 23.7% 20.0% $345 $286 Q4-25 Q4-24 See appendix for GAAP to non-GAAP reconciliation $1,346 $1,187 FY-25 FY-24 Op Margin 16.4% 14.3% Adj. EBITDA% 22.9% 21.0% Q4 2025 Revenue +21% reported and +14% organic vs. PY Passive Products +23% organic; Semiconductors +6% organic +4% Dortmund acquisition contribution & +2% from FX Adj. EBITDA margin 23.7%, +370 bps vs. PY Favorable volume leverage FY 2025 Revenue +13% reported and +8% organic Passive Products +17% organic; Semiconductors flat organic +4% Dortmund acquisition contribution & +1% from FX Adj. EBITDA margin 22.9%, +190 bps vs. PY Favorable volume leverage (in millions) Q4 2025 Revenue FY 2025 Revenue

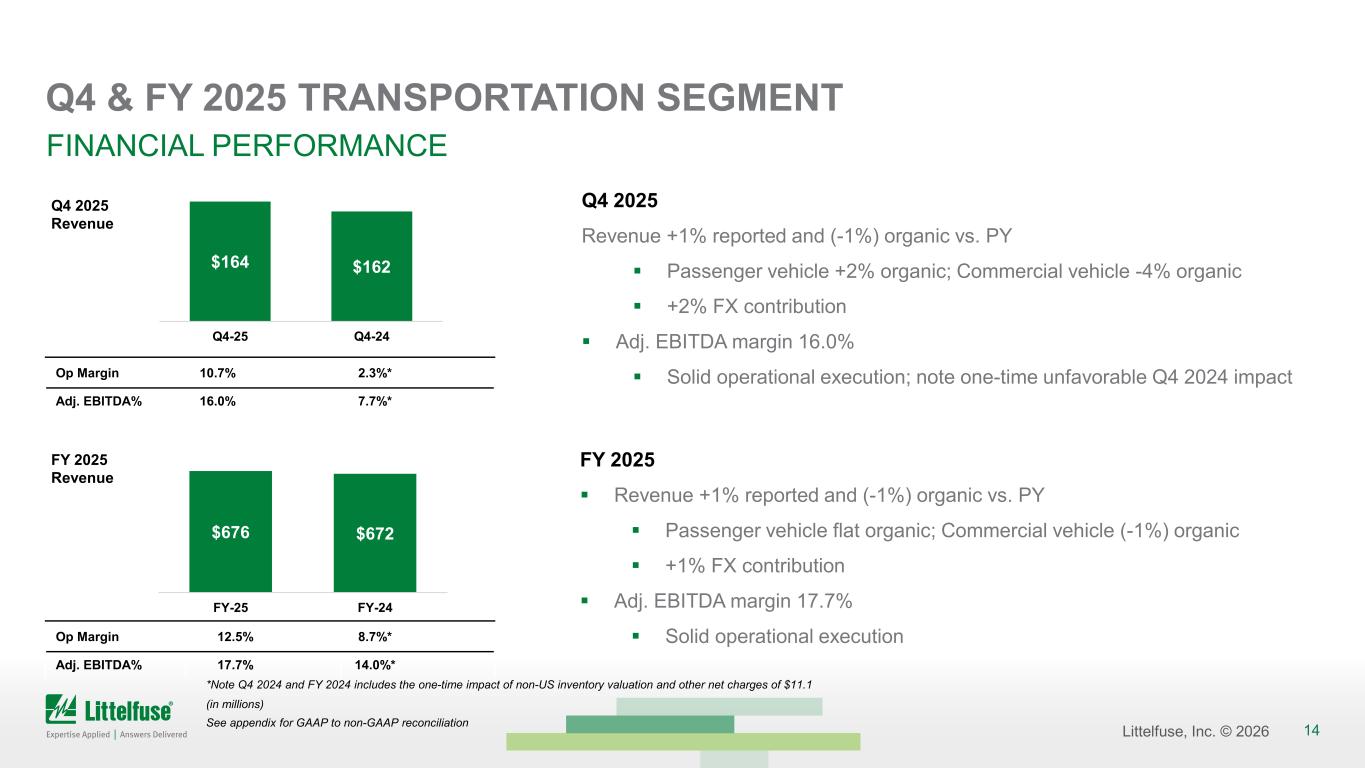

14Littelfuse, Inc. © 2026 Q4 & FY 2025 TRANSPORTATION SEGMENT FINANCIAL PERFORMANCE Op Margin 10.7% 2.3%* Adj. EBITDA% 16.0% 7.7%* (in millions) See appendix for GAAP to non-GAAP reconciliation Op Margin 12.5% 8.7%* Adj. EBITDA% 17.7% 14.0%* Q4 2025 Revenue +1% reported and (-1%) organic vs. PY Passenger vehicle +2% organic; Commercial vehicle -4% organic +2% FX contribution Adj. EBITDA margin 16.0% Solid operational execution; note one-time unfavorable Q4 2024 impact FY 2025 Revenue +1% reported and (-1%) organic vs. PY Passenger vehicle flat organic; Commercial vehicle (-1%) organic +1% FX contribution Adj. EBITDA margin 17.7% Solid operational execution *Note Q4 2024 and FY 2024 includes the one-time impact of non-US inventory valuation and other net charges of $11.1 $676 $672 FY-25 FY-24 $164 $162 Q4-25 Q4-24 Q4 2025 Revenue FY 2025 Revenue

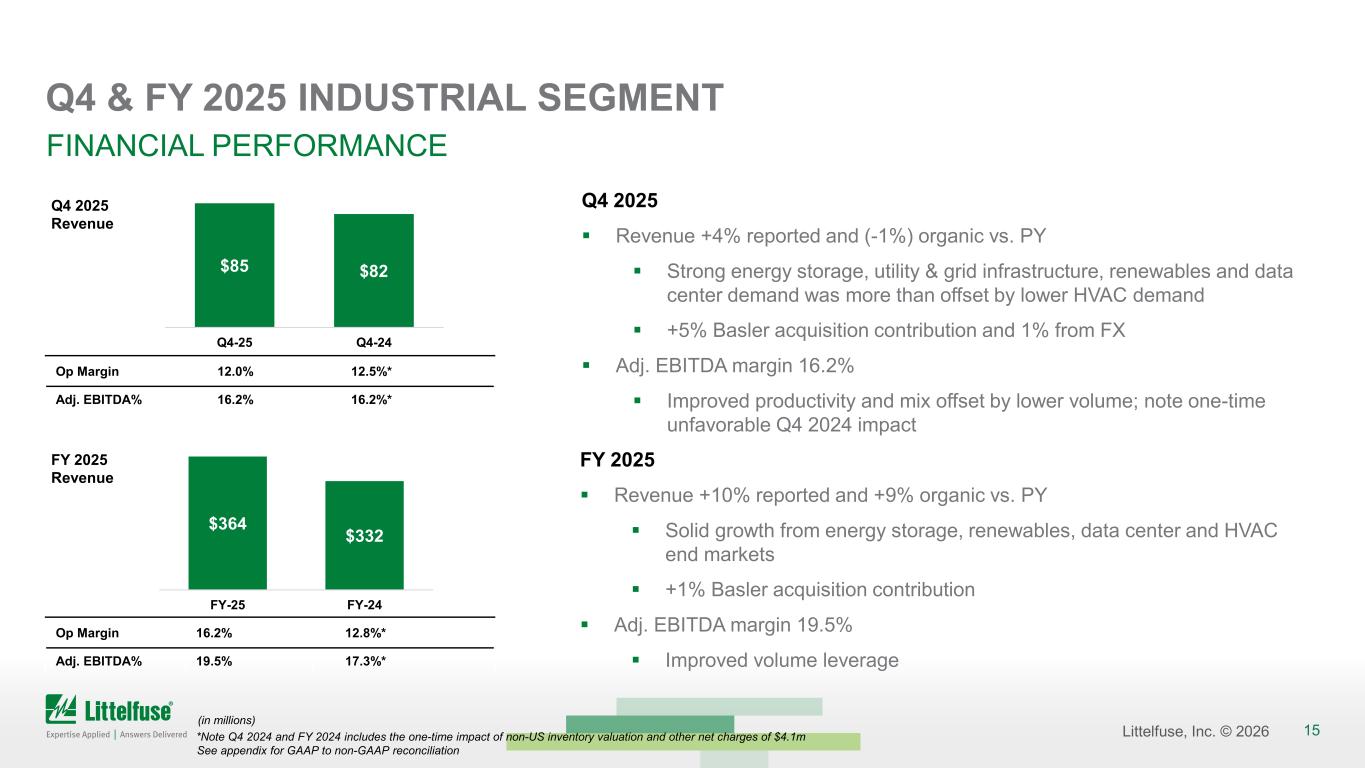

15Littelfuse, Inc. © 2026 Q4 & FY 2025 INDUSTRIAL SEGMENT FINANCIAL PERFORMANCE Op Margin 12.0% 12.5%* Adj. EBITDA% 16.2% 16.2%* See appendix for GAAP to non-GAAP reconciliation Op Margin 16.2% 12.8%* Adj. EBITDA% 19.5% 17.3%* Q4 2025 Revenue +4% reported and (-1%) organic vs. PY Strong energy storage, utility & grid infrastructure, renewables and data center demand was more than offset by lower HVAC demand +5% Basler acquisition contribution and 1% from FX Adj. EBITDA margin 16.2% Improved productivity and mix offset by lower volume; note one-time unfavorable Q4 2024 impact FY 2025 Revenue +10% reported and +9% organic vs. PY Solid growth from energy storage, renewables, data center and HVAC end markets +1% Basler acquisition contribution Adj. EBITDA margin 19.5% Improved volume leverage (in millions) *Note Q4 2024 and FY 2024 includes the one-time impact of non-US inventory valuation and other net charges of $4.1m $85 $82 Q4-25 Q4-24 $364 $332 FY-25 FY-24 Q4 2025 Revenue FY 2025 Revenue

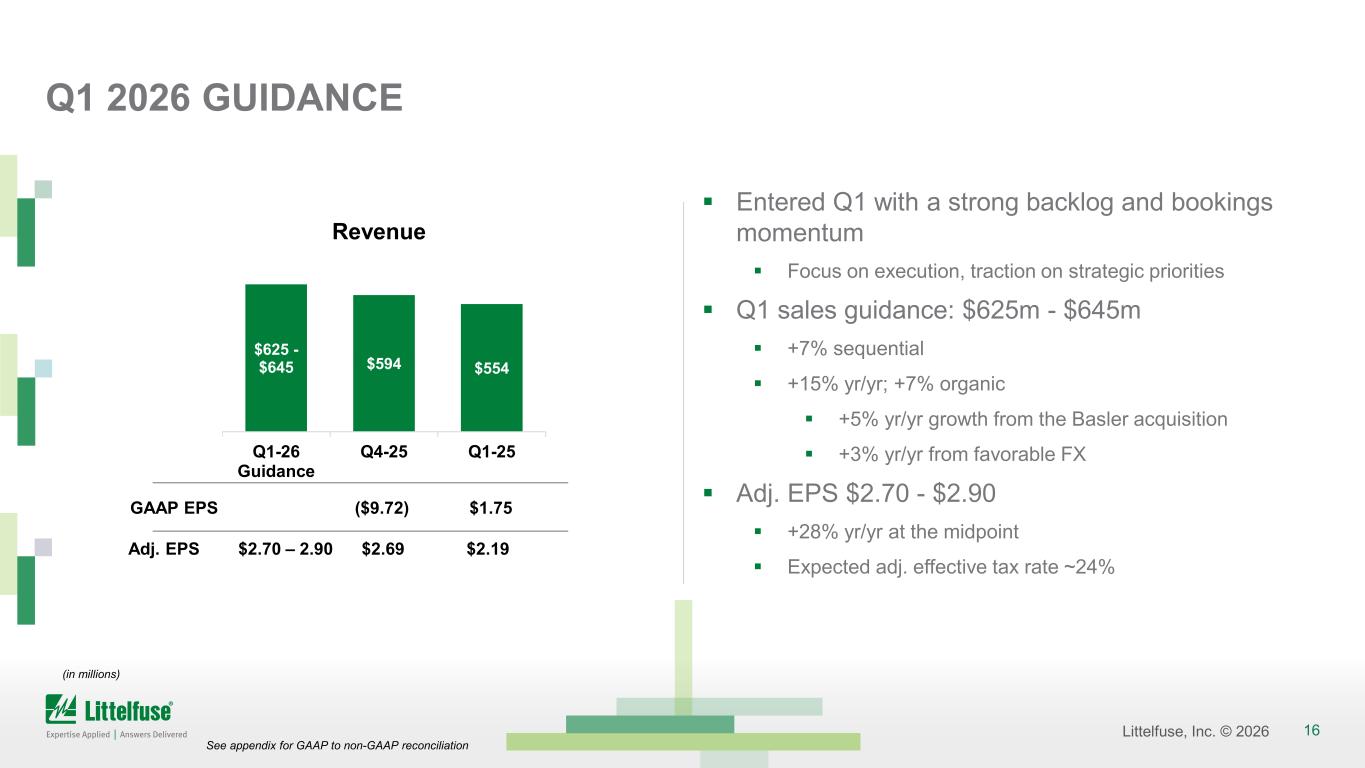

16Littelfuse, Inc. © 2026 Q1 2026 GUIDANCE Entered Q1 with a strong backlog and bookings momentum Focus on execution, traction on strategic priorities Q1 sales guidance: $625m - $645m +7% sequential +15% yr/yr; +7% organic +5% yr/yr growth from the Basler acquisition +3% yr/yr from favorable FX Adj. EPS $2.70 - $2.90 +28% yr/yr at the midpoint Expected adj. effective tax rate ~24% (in millions) $625 - $645 $594 $554 Q1-26 Guidance Q4-25 Q1-25 Revenue Adj. EPS $2.70 – 2.90 $2.69 $2.19 GAAP EPS ($9.72) $1.75 See appendix for GAAP to non-GAAP reconciliation

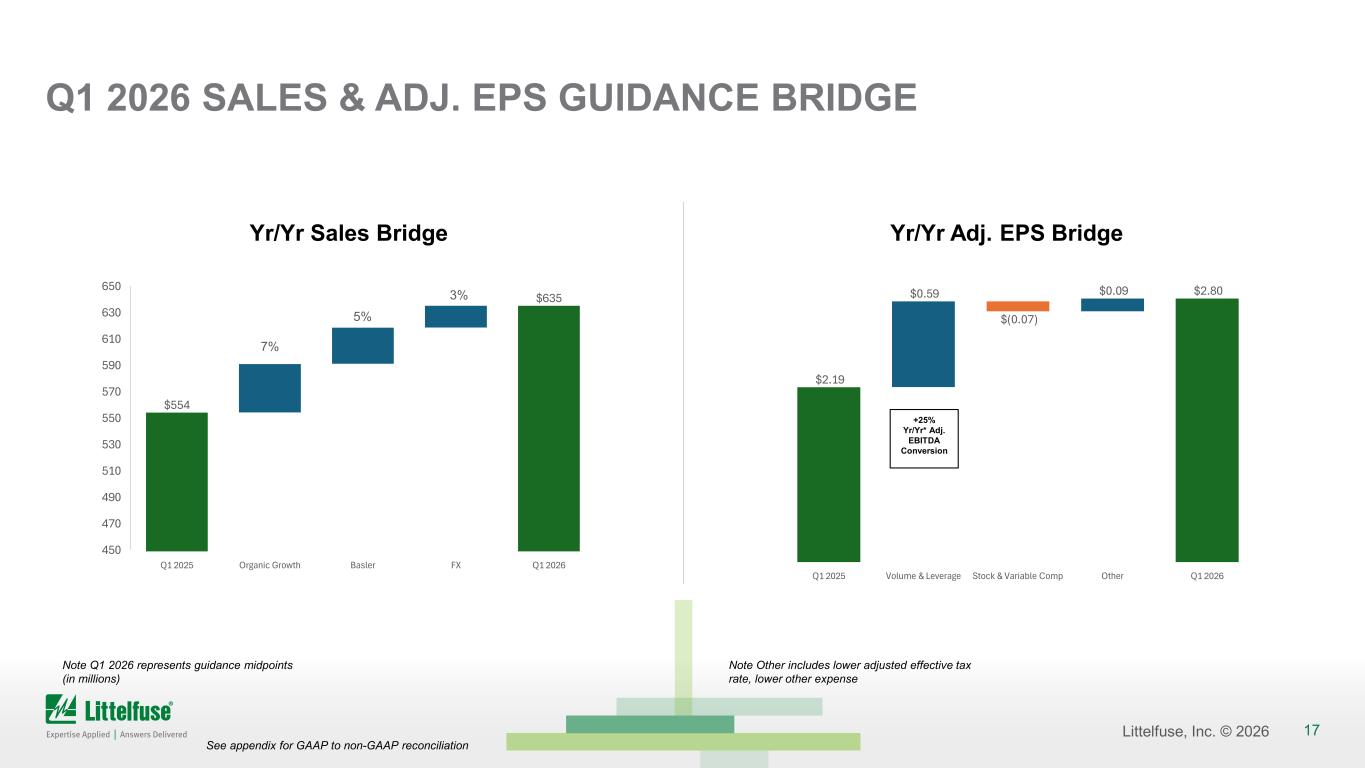

17Littelfuse, Inc. © 2026 $2.19 $0.59 $(0.07) $0.09 $2.80 Q1 2025 Volume & Leverage Stock & Variable Comp Other Q1 2026 $554 $635 Q1 2025 Organic Growth Basler FX Q1 2026 450 470 490 510 530 550 570 590 610 630 650 Q1 2026 SALES & ADJ. EPS GUIDANCE BRIDGE Note Q1 2026 represents guidance midpoints (in millions) See appendix for GAAP to non-GAAP reconciliation Yr/Yr Sales Bridge 7% 5% 3% Yr/Yr Adj. EPS Bridge +25% Yr/Yr* Adj. EBITDA Conversion Note Other includes lower adjusted effective tax rate, lower other expense

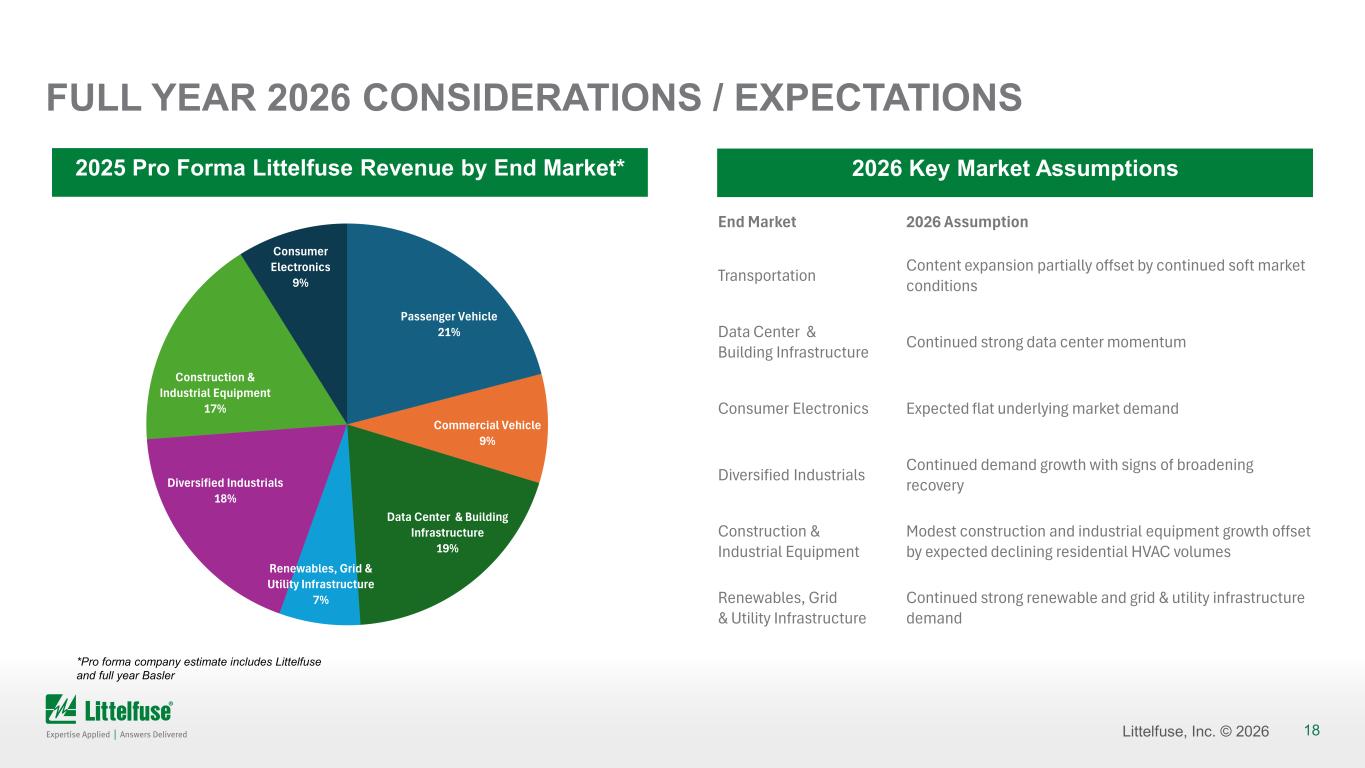

18Littelfuse, Inc. © 2026 FULL YEAR 2026 CONSIDERATIONS / EXPECTATIONS 2025 Pro Forma Littelfuse Revenue by End Market* 2026 Key Market Assumptions *Pro forma company estimate includes Littelfuse and full year Basler End Market 2026 Assumption Transportation Content expansion partially offset by continued soft market conditions Data Center & Building Infrastructure Continued strong data center momentum Consumer Electronics Expected flat underlying market demand Diversified Industrials Continued demand growth with signs of broadening recovery Construction & Industrial Equipment Modest construction and industrial equipment growth offset by expected declining residential HVAC volumes Renewables, Grid & Utility Infrastructure Continued strong renewable and grid & utility infrastructure demand Passenger Vehicle 21% Commercial Vehicle 9% Data Center & Building Infrastructure 19% Renewables, Grid & Utility Infrastructure 7% Diversified Industrials 18% Construction & Industrial Equipment 17% Consumer Electronics 9%

19Littelfuse, Inc. © 2026 APPENDIX

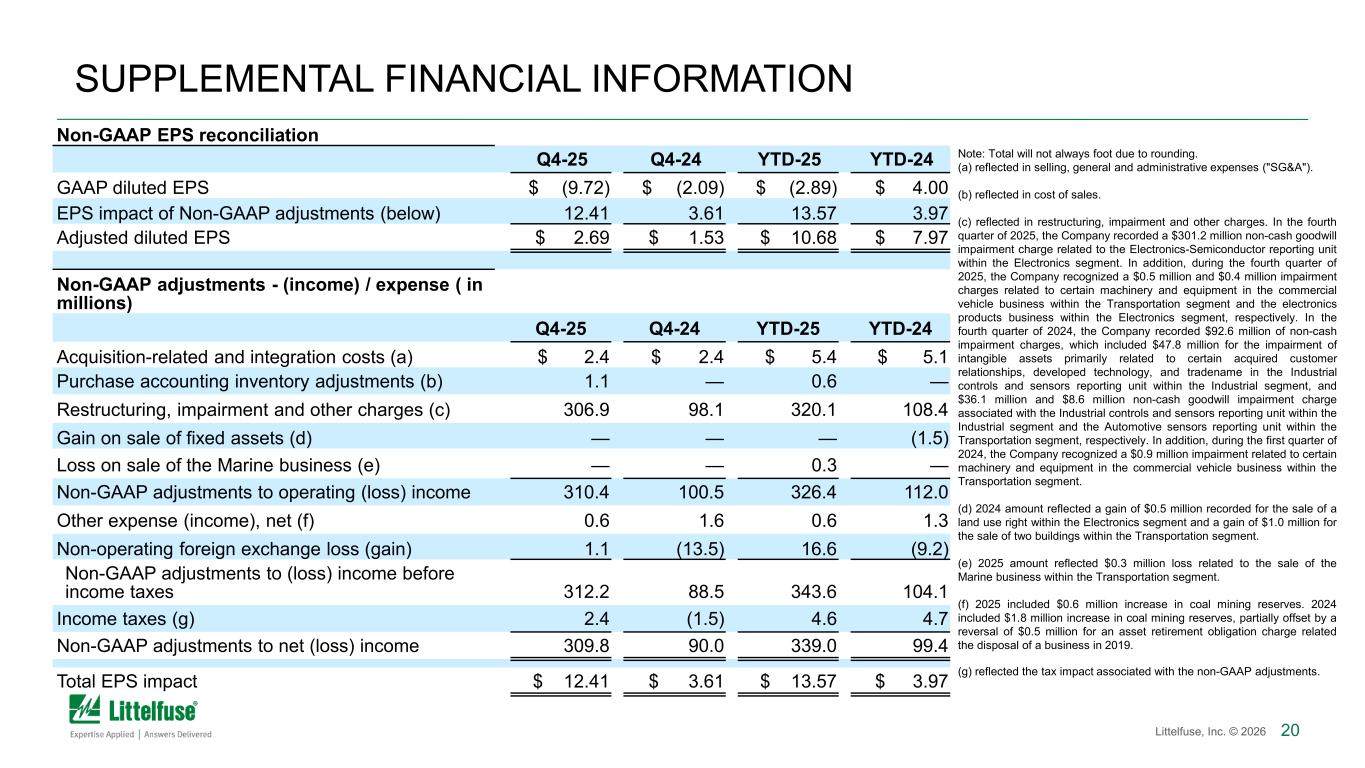

20Littelfuse, Inc. © 2026 SUPPLEMENTAL FINANCIAL INFORMATION Non-GAAP EPS reconciliation Q4-25 Q4-24 YTD-25 YTD-24 GAAP diluted EPS $ (9.72) $ (2.09) $ (2.89) $ 4.00 EPS impact of Non-GAAP adjustments (below) 12.41 3.61 13.57 3.97 Adjusted diluted EPS $ 2.69 $ 1.53 $ 10.68 $ 7.97 Non-GAAP adjustments - (income) / expense ( in millions) Q4-25 Q4-24 YTD-25 YTD-24 Acquisition-related and integration costs (a) $ 2.4 $ 2.4 $ 5.4 $ 5.1 Purchase accounting inventory adjustments (b) 1.1 — 0.6 — Restructuring, impairment and other charges (c) 306.9 98.1 320.1 108.4 Gain on sale of fixed assets (d) — — — (1.5) Loss on sale of the Marine business (e) — — 0.3 — Non-GAAP adjustments to operating (loss) income 310.4 100.5 326.4 112.0 Other expense (income), net (f) 0.6 1.6 0.6 1.3 Non-operating foreign exchange loss (gain) 1.1 (13.5) 16.6 (9.2) Non-GAAP adjustments to (loss) income before income taxes 312.2 88.5 343.6 104.1 Income taxes (g) 2.4 (1.5) 4.6 4.7 Non-GAAP adjustments to net (loss) income 309.8 90.0 339.0 99.4 Total EPS impact $ 12.41 $ 3.61 $ 13.57 $ 3.97 Note: Total will not always foot due to rounding. (a) reflected in selling, general and administrative expenses ("SG&A"). (b) reflected in cost of sales. (c) reflected in restructuring, impairment and other charges. In the fourth quarter of 2025, the Company recorded a $301.2 million non-cash goodwill impairment charge related to the Electronics-Semiconductor reporting unit within the Electronics segment. In addition, during the fourth quarter of 2025, the Company recognized a $0.5 million and $0.4 million impairment charges related to certain machinery and equipment in the commercial vehicle business within the Transportation segment and the electronics products business within the Electronics segment, respectively. In the fourth quarter of 2024, the Company recorded $92.6 million of non-cash impairment charges, which included $47.8 million for the impairment of intangible assets primarily related to certain acquired customer relationships, developed technology, and tradename in the Industrial controls and sensors reporting unit within the Industrial segment, and $36.1 million and $8.6 million non-cash goodwill impairment charge associated with the Industrial controls and sensors reporting unit within the Industrial segment and the Automotive sensors reporting unit within the Transportation segment, respectively. In addition, during the first quarter of 2024, the Company recognized a $0.9 million impairment related to certain machinery and equipment in the commercial vehicle business within the Transportation segment. (d) 2024 amount reflected a gain of $0.5 million recorded for the sale of a land use right within the Electronics segment and a gain of $1.0 million for the sale of two buildings within the Transportation segment. (e) 2025 amount reflected $0.3 million loss related to the sale of the Marine business within the Transportation segment. (f) 2025 included $0.6 million increase in coal mining reserves. 2024 included $1.8 million increase in coal mining reserves, partially offset by a reversal of $0.5 million for an asset retirement obligation charge related the disposal of a business in 2019. (g) reflected the tax impact associated with the non-GAAP adjustments.

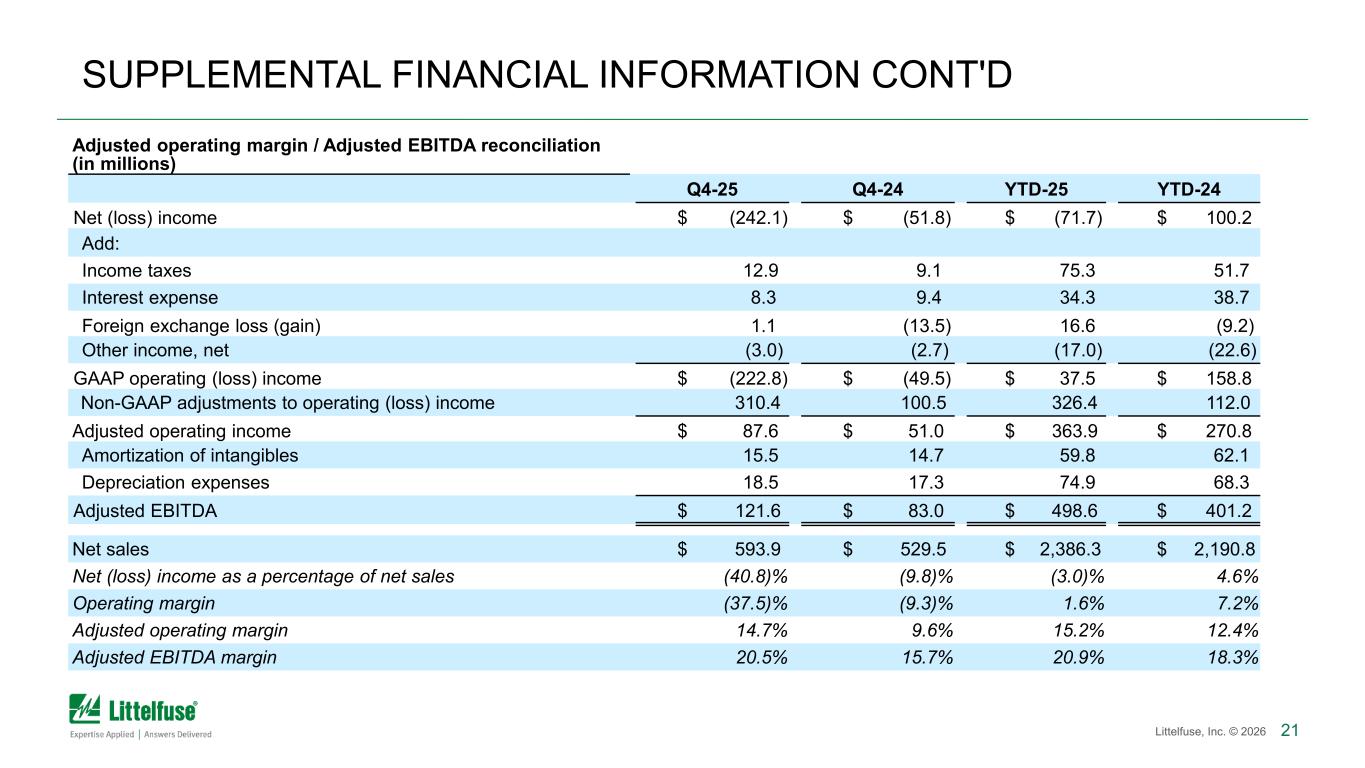

21Littelfuse, Inc. © 2026 SUPPLEMENTAL FINANCIAL INFORMATION CONT'D Adjusted operating margin / Adjusted EBITDA reconciliation (in millions) Q4-25 Q4-24 YTD-25 YTD-24 Net (loss) income $ (242.1) $ (51.8) $ (71.7) $ 100.2 Add: Income taxes 12.9 9.1 75.3 51.7 Interest expense 8.3 9.4 34.3 38.7 Foreign exchange loss (gain) 1.1 (13.5) 16.6 (9.2) Other income, net (3.0) (2.7) (17.0) (22.6) GAAP operating (loss) income $ (222.8) $ (49.5) $ 37.5 $ 158.8 Non-GAAP adjustments to operating (loss) income 310.4 100.5 326.4 112.0 Adjusted operating income $ 87.6 $ 51.0 $ 363.9 $ 270.8 Amortization of intangibles 15.5 14.7 59.8 62.1 Depreciation expenses 18.5 17.3 74.9 68.3 Adjusted EBITDA $ 121.6 $ 83.0 $ 498.6 $ 401.2 Net sales $ 593.9 $ 529.5 $ 2,386.3 $ 2,190.8 Net (loss) income as a percentage of net sales (40.8)% (9.8)% (3.0)% 4.6% Operating margin (37.5)% (9.3)% 1.6% 7.2% Adjusted operating margin 14.7% 9.6% 15.2% 12.4% Adjusted EBITDA margin 20.5% 15.7% 20.9% 18.3%

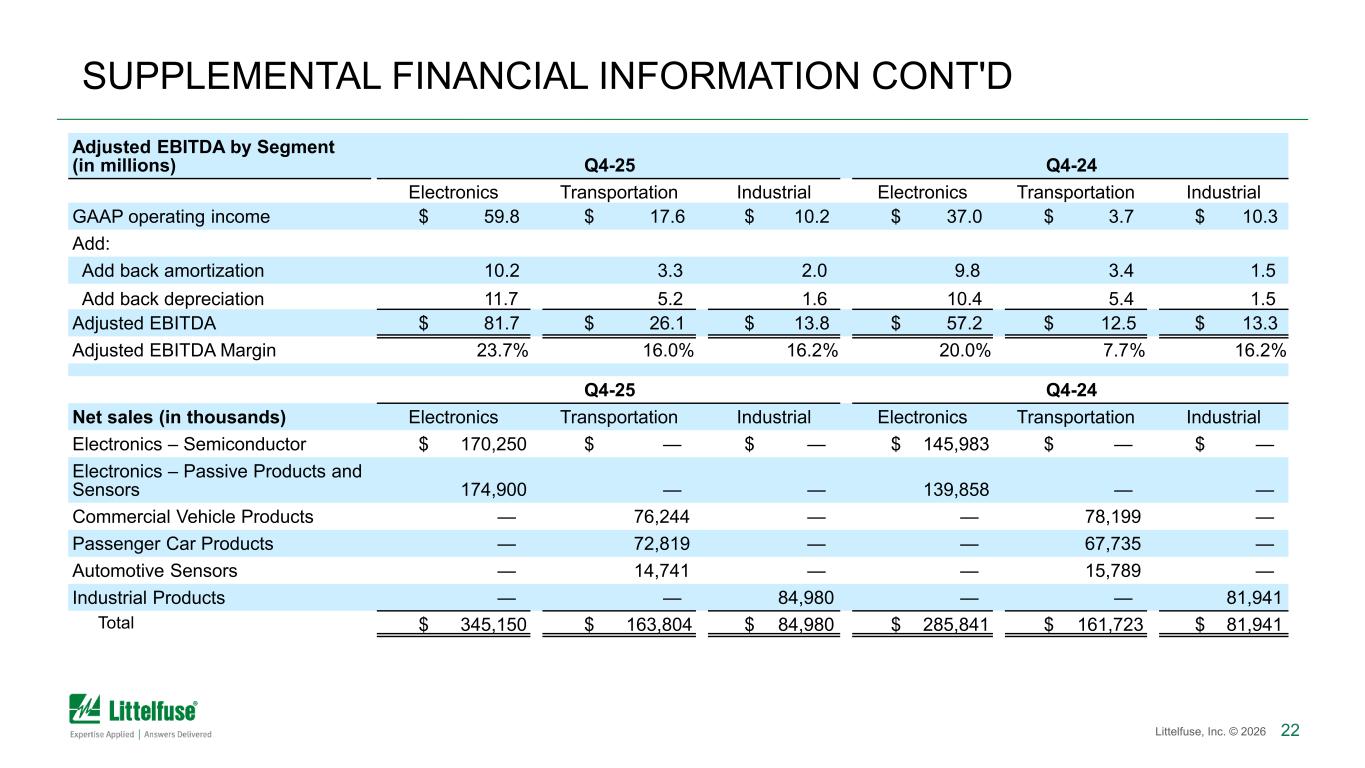

22Littelfuse, Inc. © 2026 SUPPLEMENTAL FINANCIAL INFORMATION CONT'D Adjusted EBITDA by Segment (in millions) Q4-25 Q4-24 Electronics Transportation Industrial Electronics Transportation Industrial GAAP operating income $ 59.8 $ 17.6 $ 10.2 $ 37.0 $ 3.7 $ 10.3 Add: Add back amortization 10.2 3.3 2.0 9.8 3.4 1.5 Add back depreciation 11.7 5.2 1.6 10.4 5.4 1.5 Adjusted EBITDA $ 81.7 $ 26.1 $ 13.8 $ 57.2 $ 12.5 $ 13.3 Adjusted EBITDA Margin 23.7% 16.0% 16.2% 20.0% 7.7% 16.2% Q4-25 Q4-24 Net sales (in thousands) Electronics Transportation Industrial Electronics Transportation Industrial Electronics – Semiconductor $ 170,250 $ — $ — $ 145,983 $ — $ — Electronics – Passive Products and Sensors 174,900 — — 139,858 — — Commercial Vehicle Products — 76,244 — — 78,199 — Passenger Car Products — 72,819 — — 67,735 — Automotive Sensors — 14,741 — — 15,789 — Industrial Products — — 84,980 — — 81,941 Total $ 345,150 $ 163,804 $ 84,980 $ 285,841 $ 161,723 $ 81,941

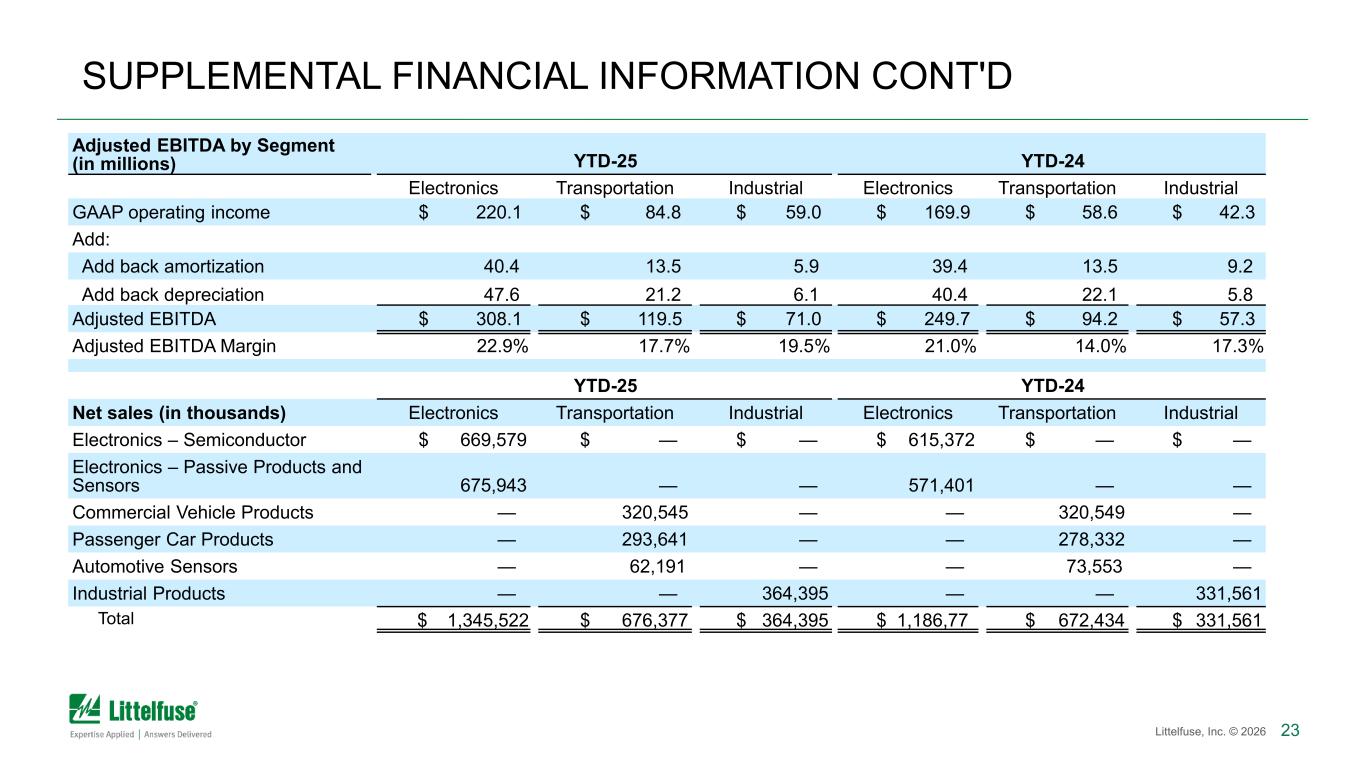

23Littelfuse, Inc. © 2026 SUPPLEMENTAL FINANCIAL INFORMATION CONT'D Adjusted EBITDA by Segment (in millions) YTD-25 YTD-24 Electronics Transportation Industrial Electronics Transportation Industrial GAAP operating income $ 220.1 $ 84.8 $ 59.0 $ 169.9 $ 58.6 $ 42.3 Add: Add back amortization 40.4 13.5 5.9 39.4 13.5 9.2 Add back depreciation 47.6 21.2 6.1 40.4 22.1 5.8 Adjusted EBITDA $ 308.1 $ 119.5 $ 71.0 $ 249.7 $ 94.2 $ 57.3 Adjusted EBITDA Margin 22.9% 17.7% 19.5% 21.0% 14.0% 17.3% YTD-25 YTD-24 Net sales (in thousands) Electronics Transportation Industrial Electronics Transportation Industrial Electronics – Semiconductor $ 669,579 $ — $ — $ 615,372 $ — $ — Electronics – Passive Products and Sensors 675,943 — — 571,401 — — Commercial Vehicle Products — 320,545 — — 320,549 — Passenger Car Products — 293,641 — — 278,332 — Automotive Sensors — 62,191 — — 73,553 — Industrial Products — — 364,395 — — 331,561 Total $ 1,345,522 $ 676,377 $ 364,395 $ 1,186,77 $ 672,434 $ 331,561

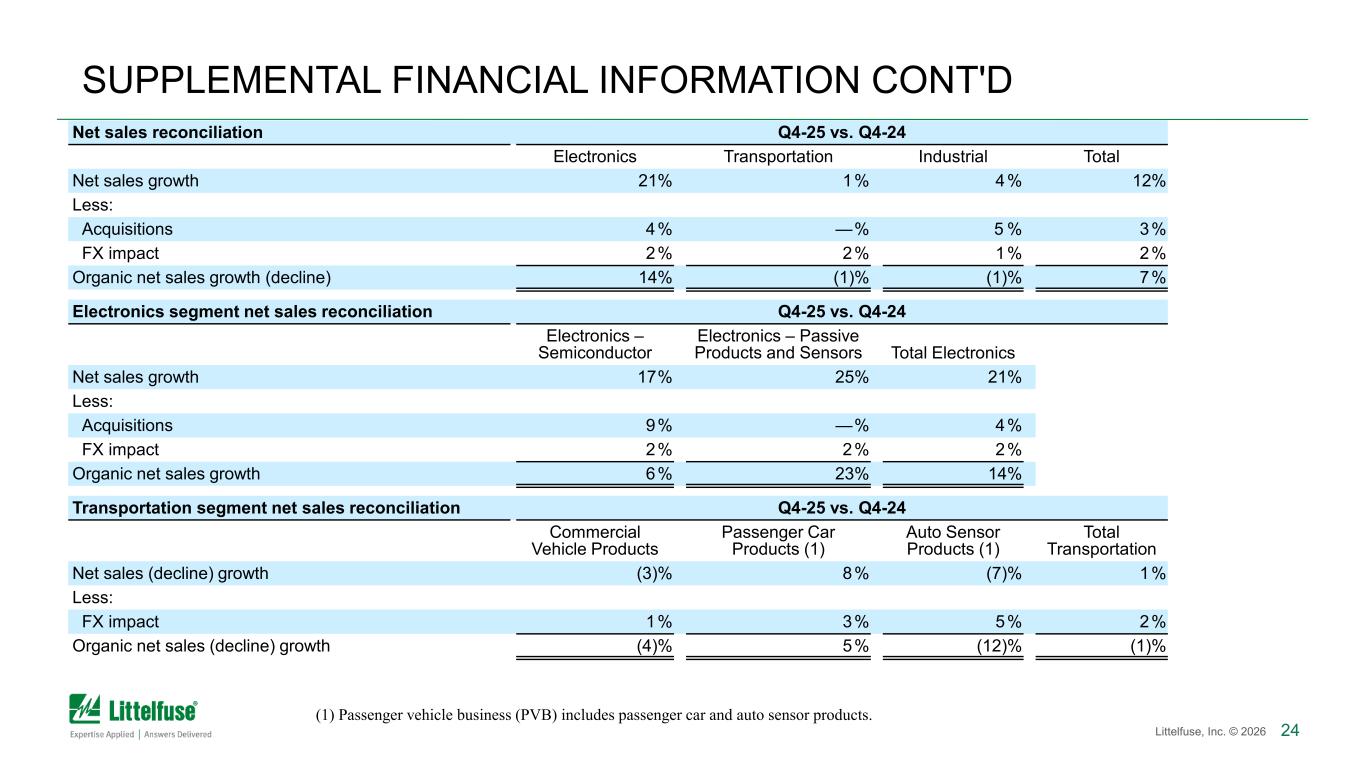

24Littelfuse, Inc. © 2026 SUPPLEMENTAL FINANCIAL INFORMATION CONT'D Net sales reconciliation Q4-25 vs. Q4-24 Electronics Transportation Industrial Total Net sales growth 21% 1% 4% 12% Less: Acquisitions 4% —% 5 % 3% FX impact 2% 2% 1% 2% Organic net sales growth (decline) 14% (1)% (1)% 7% Electronics segment net sales reconciliation Q4-25 vs. Q4-24 Electronics – Semiconductor Electronics – Passive Products and Sensors Total Electronics Net sales growth 17% 25% 21% Less: Acquisitions 9% —% 4% FX impact 2% 2% 2% Organic net sales growth 6% 23% 14% Transportation segment net sales reconciliation Q4-25 vs. Q4-24 Commercial Vehicle Products Passenger Car Products (1) Auto Sensor Products (1) Total Transportation Net sales (decline) growth (3)% 8% (7)% 1% Less: FX impact 1% 3% 5% 2% Organic net sales (decline) growth (4)% 5% (12)% (1)% (1) Passenger vehicle business (PVB) includes passenger car and auto sensor products.

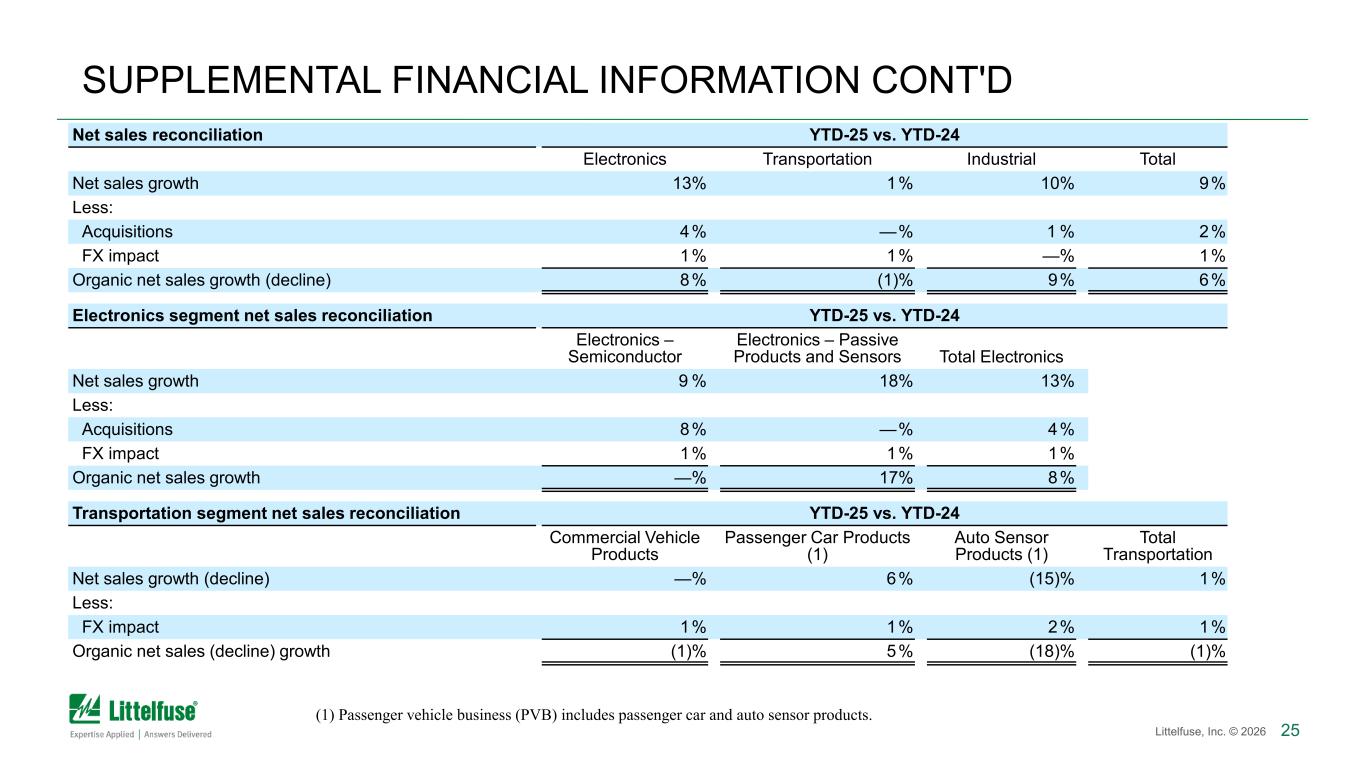

25Littelfuse, Inc. © 2026 SUPPLEMENTAL FINANCIAL INFORMATION CONT'D Net sales reconciliation YTD-25 vs. YTD-24 Electronics Transportation Industrial Total Net sales growth 13% 1% 10% 9% Less: Acquisitions 4% —% 1 % 2% FX impact 1% 1% —% 1% Organic net sales growth (decline) 8% (1)% 9% 6% Electronics segment net sales reconciliation YTD-25 vs. YTD-24 Electronics – Semiconductor Electronics – Passive Products and Sensors Total Electronics Net sales growth 9 % 18% 13% Less: Acquisitions 8% —% 4% FX impact 1% 1% 1% Organic net sales growth —% 17% 8% Transportation segment net sales reconciliation YTD-25 vs. YTD-24 Commercial Vehicle Products Passenger Car Products (1) Auto Sensor Products (1) Total Transportation Net sales growth (decline) —% 6% (15)% 1% Less: FX impact 1% 1% 2% 1% Organic net sales (decline) growth (1)% 5% (18)% (1)% (1) Passenger vehicle business (PVB) includes passenger car and auto sensor products.

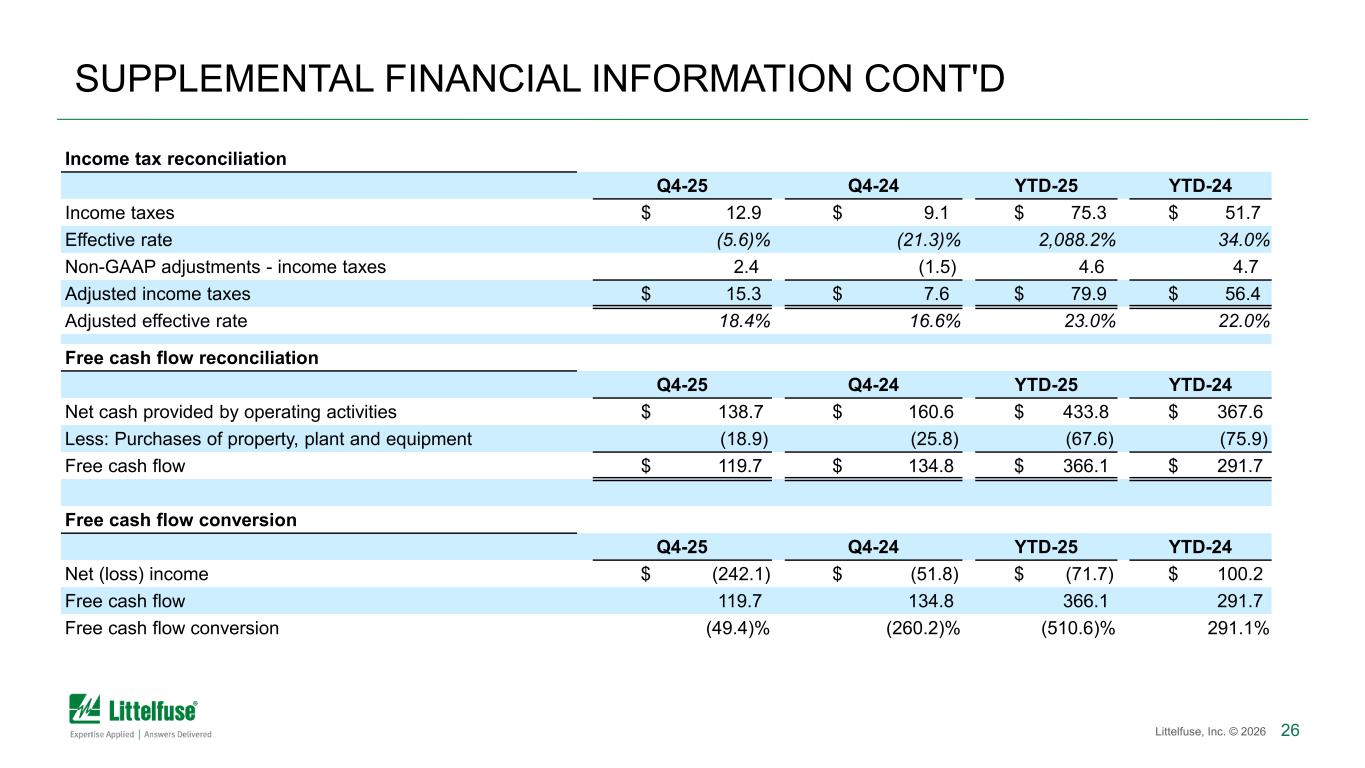

26Littelfuse, Inc. © 2026 SUPPLEMENTAL FINANCIAL INFORMATION CONT'D Income tax reconciliation Q4-25 Q4-24 YTD-25 YTD-24 Income taxes $ 12.9 $ 9.1 $ 75.3 $ 51.7 Effective rate (5.6)% (21.3)% 2,088.2% 34.0% Non-GAAP adjustments - income taxes 2.4 (1.5) 4.6 4.7 Adjusted income taxes $ 15.3 $ 7.6 $ 79.9 $ 56.4 Adjusted effective rate 18.4% 16.6% 23.0% 22.0% Free cash flow reconciliation Q4-25 Q4-24 YTD-25 YTD-24 Net cash provided by operating activities $ 138.7 $ 160.6 $ 433.8 $ 367.6 Less: Purchases of property, plant and equipment (18.9) (25.8) (67.6) (75.9) Free cash flow $ 119.7 $ 134.8 $ 366.1 $ 291.7 Free cash flow conversion Q4-25 Q4-24 YTD-25 YTD-24 Net (loss) income $ (242.1) $ (51.8) $ (71.7) $ 100.2 Free cash flow 119.7 134.8 366.1 291.7 Free cash flow conversion (49.4)% (260.2)% (510.6)% 291.1%

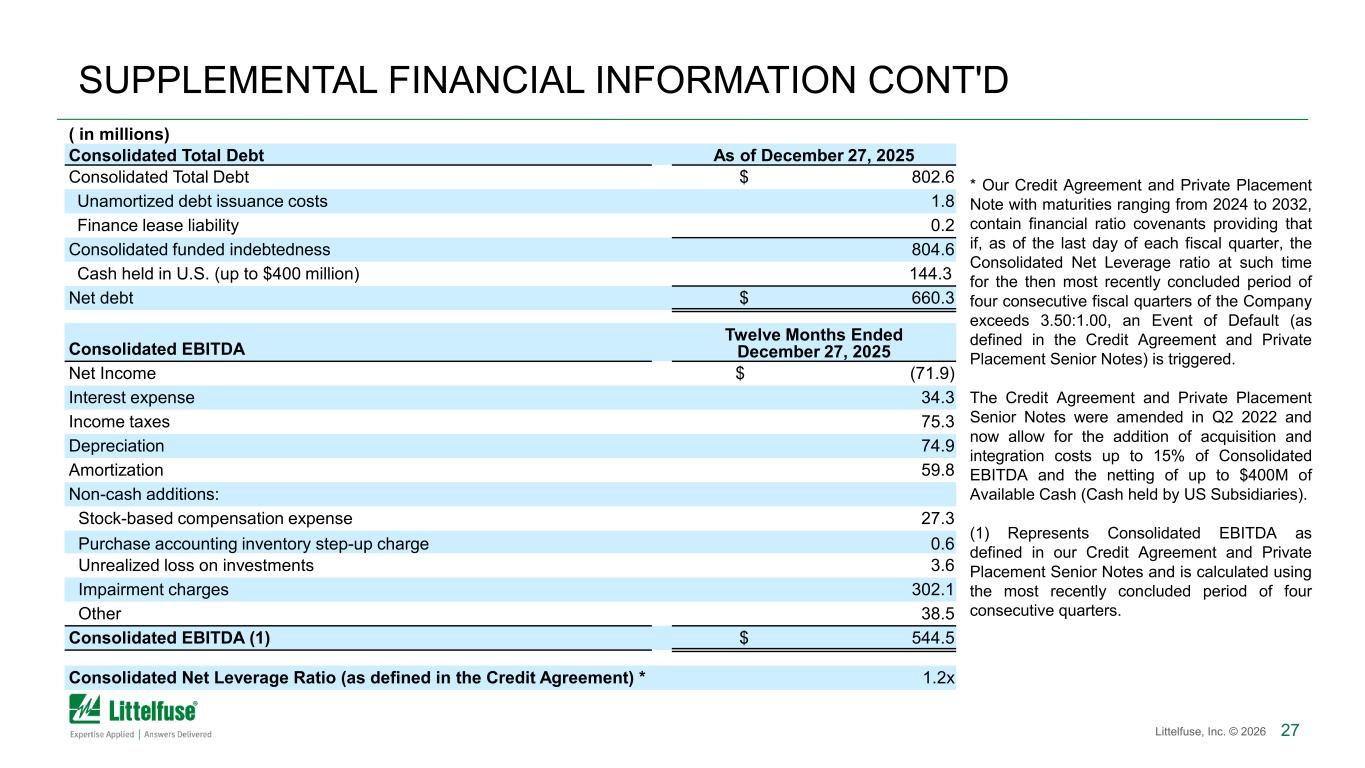

27Littelfuse, Inc. © 2026 SUPPLEMENTAL FINANCIAL INFORMATION CONT'D ( in millions) Consolidated Total Debt As of December 27, 2025 Consolidated Total Debt $ 802.6 Unamortized debt issuance costs 1.8 Finance lease liability 0.2 Consolidated funded indebtedness 804.6 Cash held in U.S. (up to $400 million) 144.3 Net debt $ 660.3 Consolidated EBITDA Twelve Months Ended December 27, 2025 Net Income $ (71.9) Interest expense 34.3 Income taxes 75.3 Depreciation 74.9 Amortization 59.8 Non-cash additions: Stock-based compensation expense 27.3 Purchase accounting inventory step-up charge 0.6 Unrealized loss on investments 3.6 Impairment charges 302.1 Other 38.5 Consolidated EBITDA (1) $ 544.5 Consolidated Net Leverage Ratio (as defined in the Credit Agreement) * 1.2x * Our Credit Agreement and Private Placement Note with maturities ranging from 2024 to 2032, contain financial ratio covenants providing that if, as of the last day of each fiscal quarter, the Consolidated Net Leverage ratio at such time for the then most recently concluded period of four consecutive fiscal quarters of the Company exceeds 3.50:1.00, an Event of Default (as defined in the Credit Agreement and Private Placement Senior Notes) is triggered. The Credit Agreement and Private Placement Senior Notes were amended in Q2 2022 and now allow for the addition of acquisition and integration costs up to 15% of Consolidated EBITDA and the netting of up to $400M of Available Cash (Cash held by US Subsidiaries). (1) Represents Consolidated EBITDA as defined in our Credit Agreement and Private Placement Senior Notes and is calculated using the most recently concluded period of four consecutive quarters.

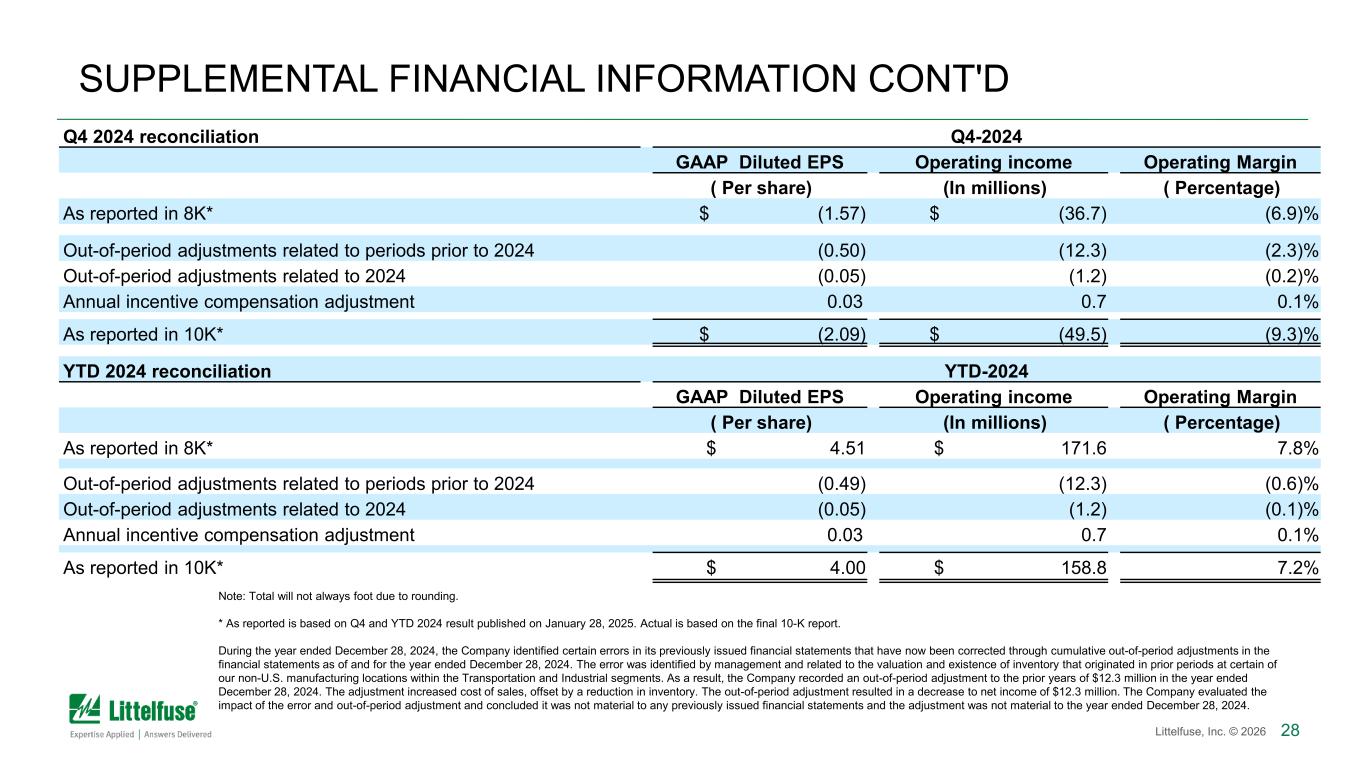

28Littelfuse, Inc. © 2026 SUPPLEMENTAL FINANCIAL INFORMATION CONT'D Q4 2024 reconciliation Q4-2024 GAAP Diluted EPS Operating income Operating Margin ( Per share) (In millions) ( Percentage) As reported in 8K* $ (1.57) $ (36.7) (6.9)% Out-of-period adjustments related to periods prior to 2024 (0.50) (12.3) (2.3)% Out-of-period adjustments related to 2024 (0.05) (1.2) (0.2)% Annual incentive compensation adjustment 0.03 0.7 0.1% As reported in 10K* $ (2.09) $ (49.5) (9.3)% YTD 2024 reconciliation YTD-2024 GAAP Diluted EPS Operating income Operating Margin ( Per share) (In millions) ( Percentage) As reported in 8K* $ 4.51 $ 171.6 7.8% Out-of-period adjustments related to periods prior to 2024 (0.49) (12.3) (0.6)% Out-of-period adjustments related to 2024 (0.05) (1.2) (0.1)% Annual incentive compensation adjustment 0.03 0.7 0.1% As reported in 10K* $ 4.00 $ 158.8 7.2% Note: Total will not always foot due to rounding. * As reported is based on Q4 and YTD 2024 result published on January 28, 2025. Actual is based on the final 10-K report. During the year ended December 28, 2024, the Company identified certain errors in its previously issued financial statements that have now been corrected through cumulative out-of-period adjustments in the financial statements as of and for the year ended December 28, 2024. The error was identified by management and related to the valuation and existence of inventory that originated in prior periods at certain of our non-U.S. manufacturing locations within the Transportation and Industrial segments. As a result, the Company recorded an out-of-period adjustment to the prior years of $12.3 million in the year ended December 28, 2024. The adjustment increased cost of sales, offset by a reduction in inventory. The out-of-period adjustment resulted in a decrease to net income of $12.3 million. The Company evaluated the impact of the error and out-of-period adjustment and concluded it was not material to any previously issued financial statements and the adjustment was not material to the year ended December 28, 2024.

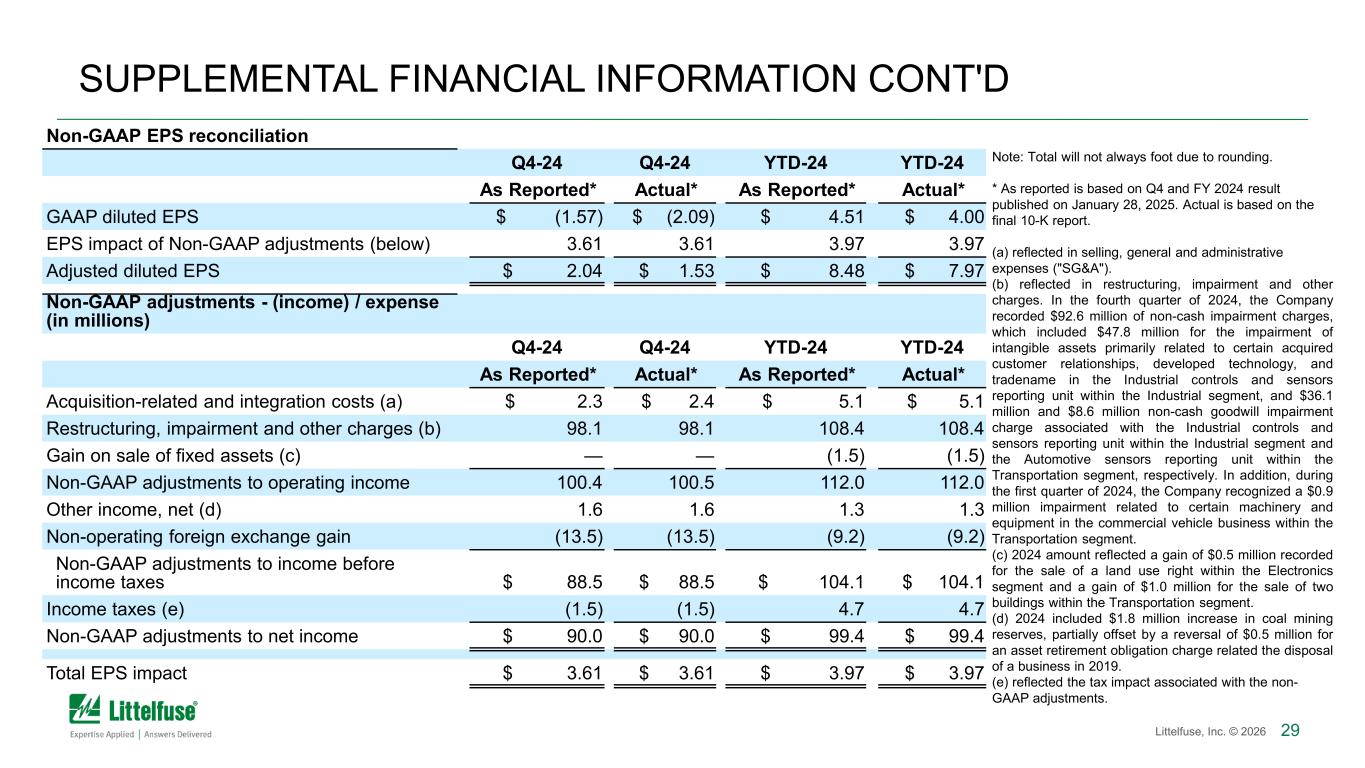

29Littelfuse, Inc. © 2026 SUPPLEMENTAL FINANCIAL INFORMATION CONT'D Non-GAAP EPS reconciliation Q4-24 Q4-24 YTD-24 YTD-24 As Reported* Actual* As Reported* Actual* GAAP diluted EPS $ (1.57) $ (2.09) $ 4.51 $ 4.00 EPS impact of Non-GAAP adjustments (below) 3.61 3.61 3.97 3.97 Adjusted diluted EPS $ 2.04 $ 1.53 $ 8.48 $ 7.97 Non-GAAP adjustments - (income) / expense (in millions) Q4-24 Q4-24 YTD-24 YTD-24 As Reported* Actual* As Reported* Actual* Acquisition-related and integration costs (a) $ 2.3 $ 2.4 $ 5.1 $ 5.1 Restructuring, impairment and other charges (b) 98.1 98.1 108.4 108.4 Gain on sale of fixed assets (c) — — (1.5) (1.5) Non-GAAP adjustments to operating income 100.4 100.5 112.0 112.0 Other income, net (d) 1.6 1.6 1.3 1.3 Non-operating foreign exchange gain (13.5) (13.5) (9.2) (9.2) Non-GAAP adjustments to income before income taxes $ 88.5 $ 88.5 $ 104.1 $ 104.1 Income taxes (e) (1.5) (1.5) 4.7 4.7 Non-GAAP adjustments to net income $ 90.0 $ 90.0 $ 99.4 $ 99.4 Total EPS impact $ 3.61 $ 3.61 $ 3.97 $ 3.97 Note: Total will not always foot due to rounding. * As reported is based on Q4 and FY 2024 result published on January 28, 2025. Actual is based on the final 10-K report. (a) reflected in selling, general and administrative expenses ("SG&A"). (b) reflected in restructuring, impairment and other charges. In the fourth quarter of 2024, the Company recorded $92.6 million of non-cash impairment charges, which included $47.8 million for the impairment of intangible assets primarily related to certain acquired customer relationships, developed technology, and tradename in the Industrial controls and sensors reporting unit within the Industrial segment, and $36.1 million and $8.6 million non-cash goodwill impairment charge associated with the Industrial controls and sensors reporting unit within the Industrial segment and the Automotive sensors reporting unit within the Transportation segment, respectively. In addition, during the first quarter of 2024, the Company recognized a $0.9 million impairment related to certain machinery and equipment in the commercial vehicle business within the Transportation segment. (c) 2024 amount reflected a gain of $0.5 million recorded for the sale of a land use right within the Electronics segment and a gain of $1.0 million for the sale of two buildings within the Transportation segment. (d) 2024 included $1.8 million increase in coal mining reserves, partially offset by a reversal of $0.5 million for an asset retirement obligation charge related the disposal of a business in 2019. (e) reflected the tax impact associated with the non- GAAP adjustments.

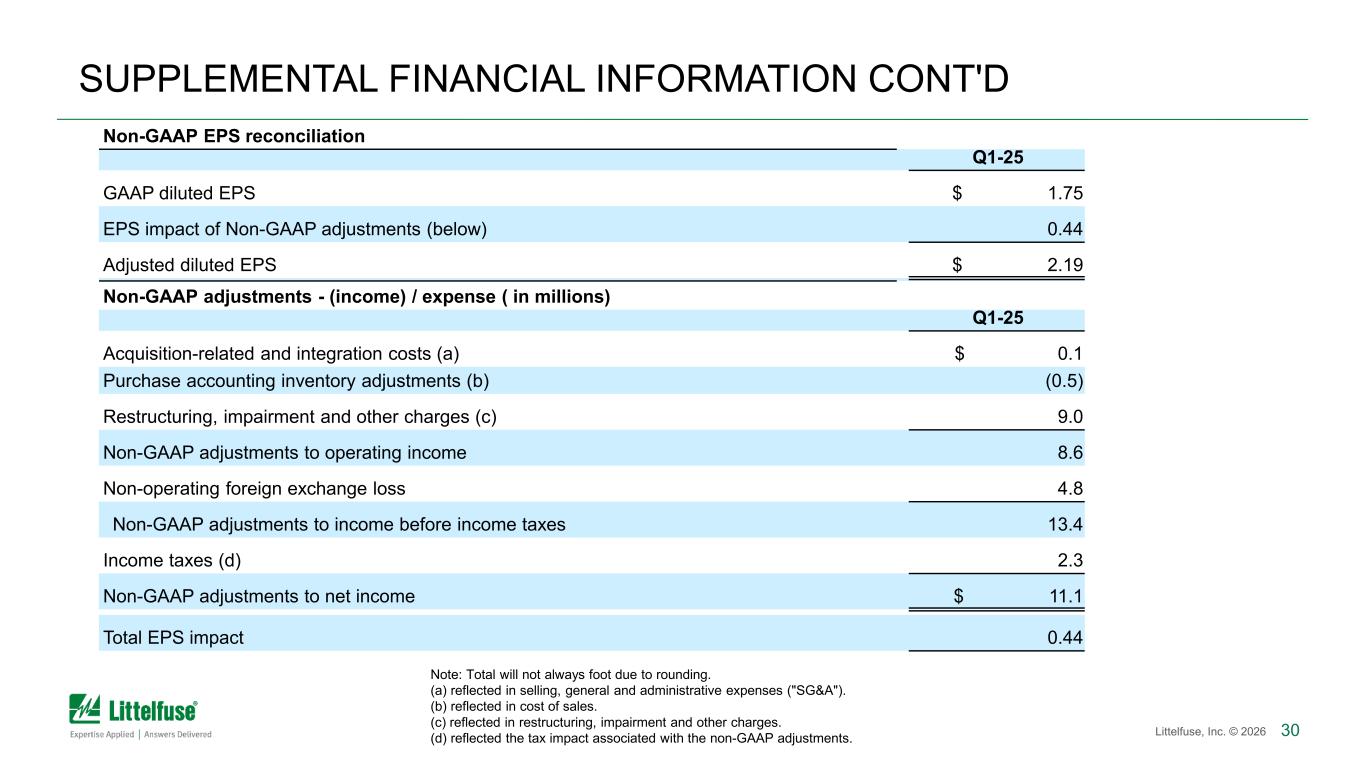

30Littelfuse, Inc. © 2026 SUPPLEMENTAL FINANCIAL INFORMATION CONT'D Non-GAAP EPS reconciliation Q1-25 GAAP diluted EPS $ 1.75 EPS impact of Non-GAAP adjustments (below) 0.44 Adjusted diluted EPS $ 2.19 Non-GAAP adjustments - (income) / expense ( in millions) Q1-25 Acquisition-related and integration costs (a) $ 0.1 Purchase accounting inventory adjustments (b) (0.5) Restructuring, impairment and other charges (c) 9.0 Non-GAAP adjustments to operating income 8.6 Non-operating foreign exchange loss 4.8 Non-GAAP adjustments to income before income taxes 13.4 Income taxes (d) 2.3 Non-GAAP adjustments to net income $ 11.1 Total EPS impact 0.44 Note: Total will not always foot due to rounding. (a) reflected in selling, general and administrative expenses ("SG&A"). (b) reflected in cost of sales. (c) reflected in restructuring, impairment and other charges. (d) reflected the tax impact associated with the non-GAAP adjustments.