Investor Presentation September 2025

2Investor Presentation Patterson-UTI This material and any oral statements made in connection with this material include "forward-looking statements" within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. Statements made which provide the Company’s or management’s intentions, beliefs, expectations or predictions for the future are forward-looking statements and are inherently uncertain. The opinions, forecasts, projections or other statements other than statements of historical fact, including, without limitation, plans and objectives of management of the Company are forward-looking statements. It is important to note that actual results could differ materially from those discussed in such forward-looking statements. Important factors that could cause actual results to differ materially include the risk factors and other cautionary statements contained from time to time in the Company’s SEC filings, which may be obtained by contacting the Company or the SEC. These filings are also available through the Company’s web site at http://www.patenergy.com or through the SEC’s Electronic Data Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov. We undertake no obligation to publicly update or revise any forward-looking statement. Reconciliation of Non-GAAP Financial Measures Statements made in this presentation include non-U.S. GAAP financial measures. The required reconciliations to U.S. GAAP financial measures are included on our website and/or at the end of this presentation. Forward Looking Statements & Disclosures

3Investor Presentation Patterson-UTI Z Z For purposes of the shareholder return target, the Company defines adjusted free cash flow as net cash provided by operating activities less capital expenditures plus proceeds from asset sales. The shareholder return target, including the amount and timing of any dividend payments and/or share repurchases are subject to the discretion of the Company’s Board of Directors and will depend upon business conditions, results of operations, financial condition, terms of the Company’s debt agreements and other factors. Z Business Activity Update Drilling Services Segment ▪ Expect to have averaged 96 rigs in the United States through the first two months of the third quarter of 2025 ▪ Currently operating 93 rigs in the United States and expect relatively steady activity from current levels into the fourth quarter Completion Services Segment ▪ Expect steady activity and adjusted gross profit in the third quarter of 2025 compared to the second quarter of 2025 ▪ High utilization of our natural gas-powered assets, including our 100% natural gas-powered Emerald fleets and Tier IV dual fuel General Business Update ▪ Since the start of 2025, nearly all activity reductions have been in the Permian Basin, with relatively steady or higher activity in all other basins ▪ Natural gas directed activity has been steady since our July 2025 earnings update ▪ Still expect to see stronger adjusted free cash flow in the second half of 2025 compared to the first half of 2025 ▪ Used $22 million to repurchase 4 million shares so far in the third quarter of 2025

4Investor Presentation Patterson-UTI Z For purposes of the shareholder return target, the Company defines adjusted free cash flow as net cash provided by operating activities less capital expenditures plus proceeds from asset sales. The shareholder return target, including the amount and timing of any dividend payments and/or share repurchases are subject to the discretion of the Company’s Board of Directors and will depend upon business conditions, results of operations, financial condition, terms of the Company’s debt agreements and other factors. Z Overall Market ▪ We are planning for U.S. shale drilling activity to remain relatively steady from current levels into 2026, with continued bifurcation in activity and financial performance between our highest quality assets and the lower tier equipment Priorities are: ▪ Continuing to structurally reduce operating costs and maintenance capital expenditures while fully maintaining our highest quality active equipment ▪ Selectively investing in long-term strategic technology opportunities that have a return on capital that exceeds our cost of capital and have a positive net present value ▪ Improving relative performance to be best-in-class in drilling and completions ▪ Maximizing long-term adjusted free cash flow per share ▪ Returning at least 50% of adjusted free cash flow to shareholders, including through our dividend (currently $0.08 per share per quarter) and share repurchases Patterson-UTI Priorities

5Investor Presentation Patterson-UTI Z Z Z Executive Summary For purposes of the shareholder return target, the Company defines adjusted free cash flow as net cash provided by operating activities less capital expenditures plus proceeds from asset sales. The shareholder return target, including the amount and timing of any dividend payments and/or share repurchases are subject to the discretion of the Company’s Board of Directors and will depend upon business conditions, results of operations, financial condition, terms of the Company’s debt agreements and other factors. Differentiated operating capability with premier Drilling and Completions franchise Integrated service offerings improve well delivery for customers and create value for investors High-quality asset base with strong utilization on top-tier assets Tier-1 drilling rigs and natural gas-powered frac assets are preferred by customers given differentiated performance Focus on optimizing resources and maximizing margins Aim to use technology to streamline processes to deliver the most cost-effective solutions Predictable capital allocation strategy Capital expenditures can be scaled with activity; Expect to return at least 50% of adjusted FCF to investors Strong capital structure No Senior Note maturities until 2028; Investment Grade credit rating at all 3 major rating agencies

Who We Are

7Investor Presentation Patterson-UTI Z Z Z Hydraulic Fracturing Wireline Operations Natural Gas Fueling Oilfield Logistics Cementing 2.9 Million Hydraulic Horsepower1 Other business includes Patterson Petroleum. 1Reflects deployed and idle equipment capacity during the second quarter of 2025. 2Drilling Products revenue from reported non-U.S. operations from close of Ulterra acquisition through June 30, 2025. 136 Tier-1 Super-Spec Drilling Rigs1 APEX® Drilling Fleet Wellbore Navigation Drilling TechnologyElectronics ManufacturingDirectional Drilling Torque Control Bits High-Flow Rate Bits Vibration-Dampening Bits High Efficiency Bits Downhole Tools ~30% Drilling Products Revenue from Non-U.S.2 Patterson-UTI | Company Overview An Integrated OFS Company Drilling Services Completion Services Drilling Products

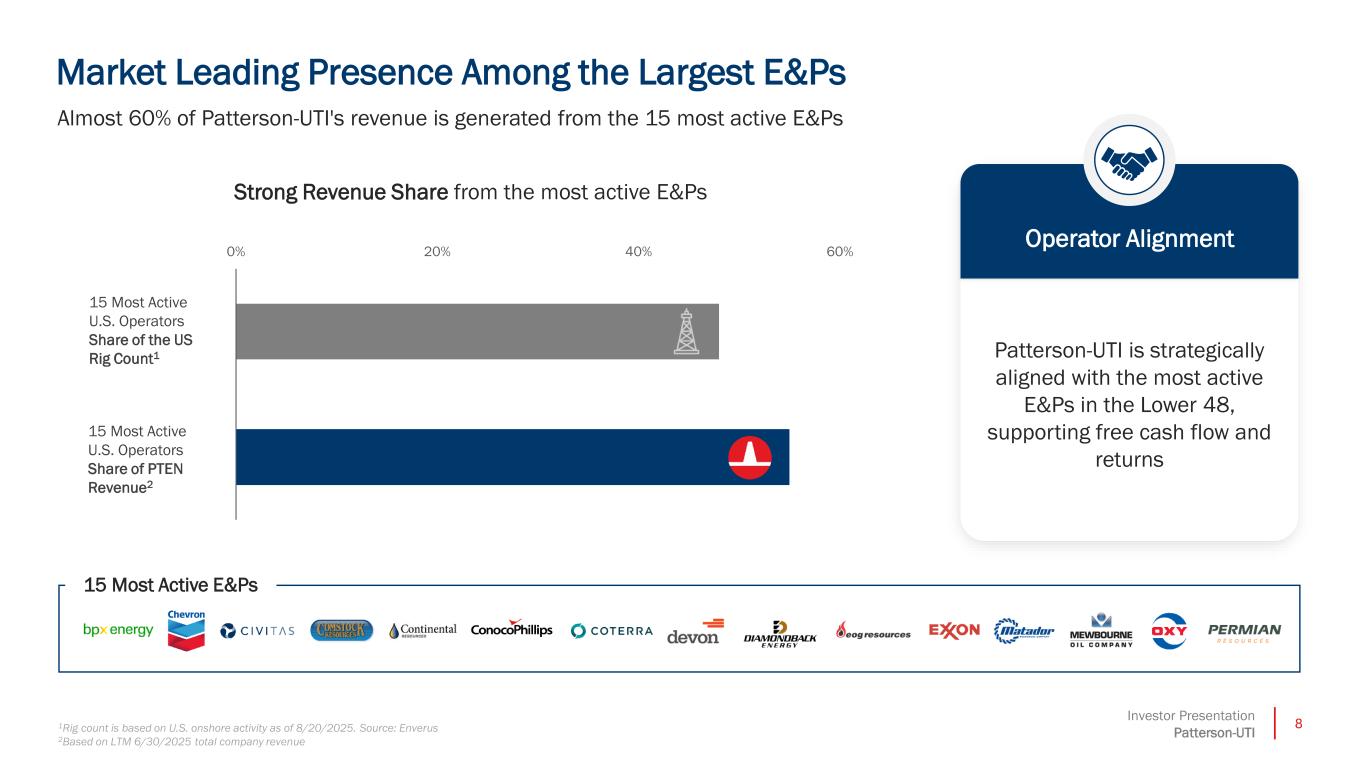

8Investor Presentation Patterson-UTI Market Leading Presence Among the Largest E&Ps Almost 60% of Patterson-UTI's revenue is generated from the 15 most active E&Ps 1Rig count is based on U.S. onshore activity as of 8/20/2025. Source: Enverus 2Based on LTM 6/30/2025 total company revenue 15 Most Active E&Ps 0% 20% 40% 60% 15 Most Active U.S. Operators Share of the US Rig Count1 15 Most Active U.S. Operators Share of PTEN Revenue2 Operator Alignment Strong Revenue Share from the most active E&Ps Patterson-UTI is strategically aligned with the most active E&Ps in the Lower 48, supporting free cash flow and returns

Business Overview

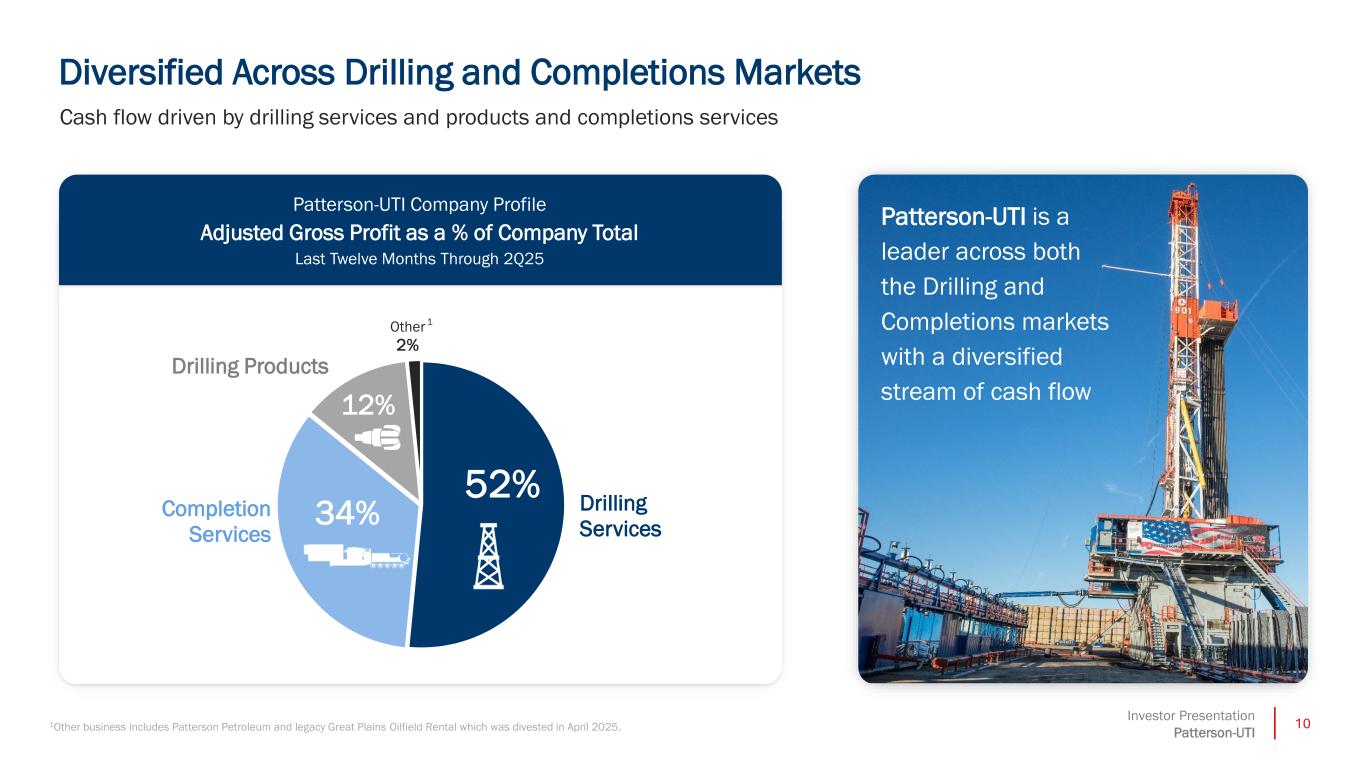

10Investor Presentation Patterson-UTI Diversified Across Drilling and Completions Markets 1Other business includes Patterson Petroleum and legacy Great Plains Oilfield Rental which was divested in April 2025. Cash flow driven by drilling services and products and completions services Drilling Services Completion Services Drilling Products Other 2% 52% 12% 34% 1 Patterson-UTI is a leader across both the Drilling and Completions markets with a diversified stream of cash flow Patterson-UTI Company Profile Adjusted Gross Profit as a % of Company Total Last Twelve Months Through 2Q25

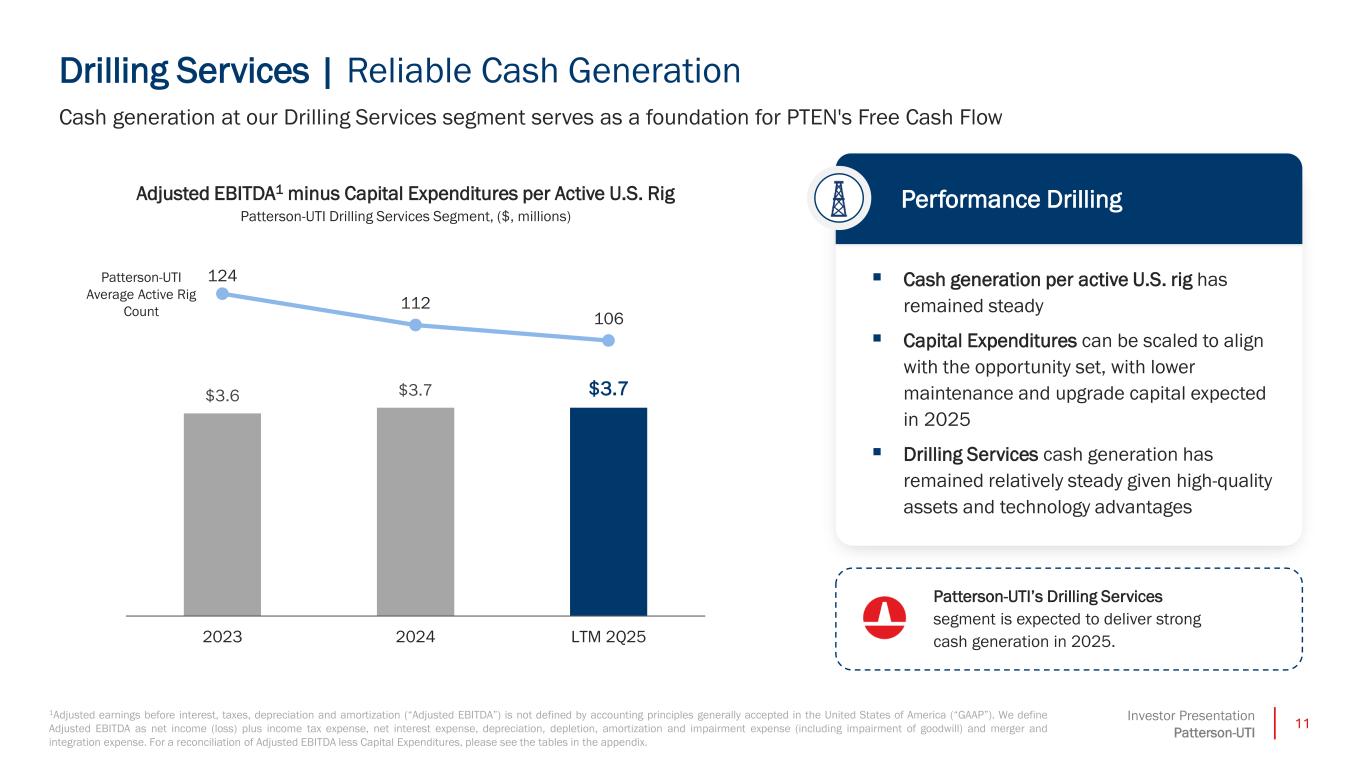

11Investor Presentation Patterson-UTI Drilling Services | Reliable Cash Generation Adjusted EBITDA1 minus Capital Expenditures per Active U.S. Rig Patterson-UTI Drilling Services Segment, ($, millions) Cash generation at our Drilling Services segment serves as a foundation for PTEN's Free Cash Flow 1Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) is not defined by accounting principles generally accepted in the United States of America (“GAAP”). We define Adjusted EBITDA as net income (loss) plus income tax expense, net interest expense, depreciation, depletion, amortization and impairment expense (including impairment of goodwill) and merger and integration expense. For a reconciliation of Adjusted EBITDA less Capital Expenditures, please see the tables in the appendix. $3.6 $3.7 $3.7 124 112 106 2023 2024 LTM 2Q25 Patterson-UTI Average Active Rig Count Performance Drilling ▪ Cash generation per active U.S. rig has remained steady ▪ Capital Expenditures can be scaled to align with the opportunity set, with lower maintenance and upgrade capital expected in 2025 ▪ Drilling Services cash generation has remained relatively steady given high-quality assets and technology advantages Patterson-UTI’s Drilling Services segment is expected to deliver strong cash generation in 2025.

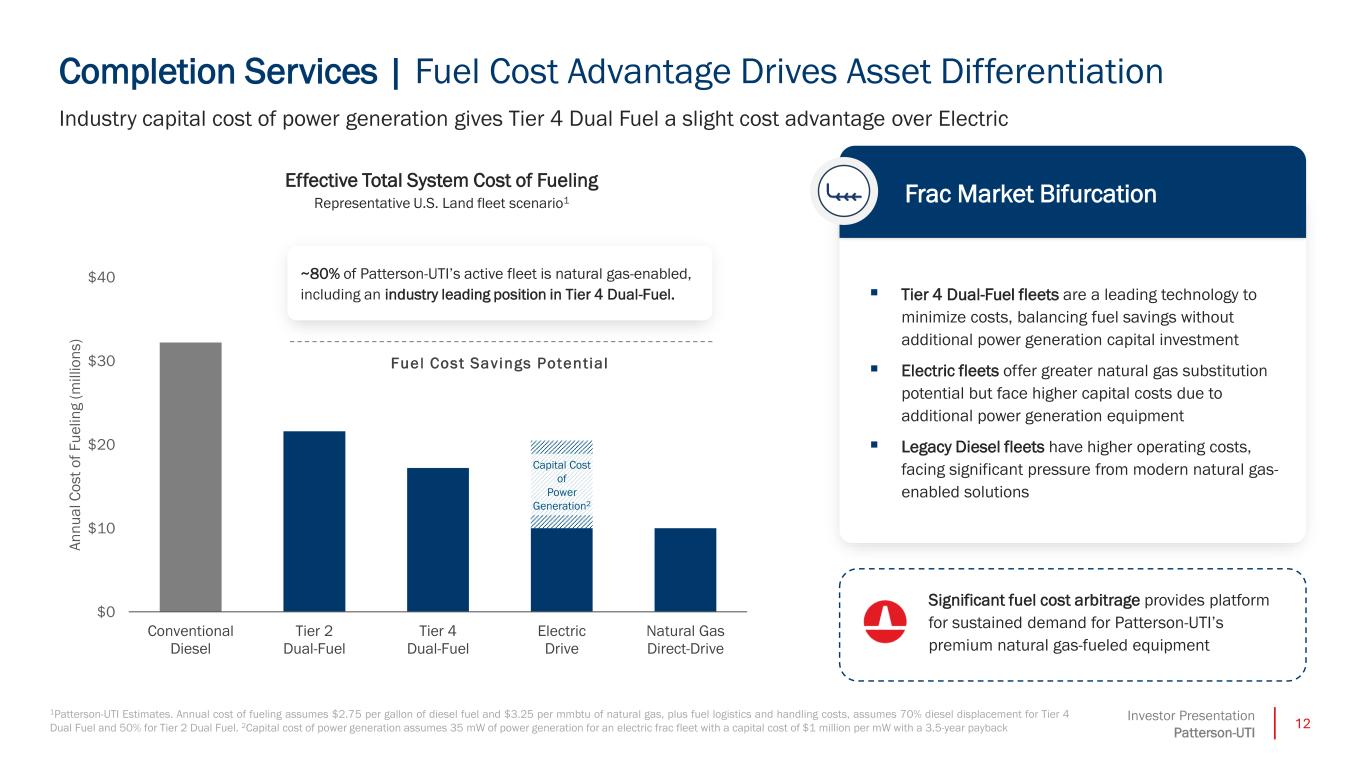

12Investor Presentation Patterson-UTI Completion Services | Fuel Cost Advantage Drives Asset Differentiation Effective Total System Cost of Fueling Representative U.S. Land fleet scenario1 1Patterson-UTI Estimates. Annual cost of fueling assumes $2.75 per gallon of diesel fuel and $3.25 per mmbtu of natural gas, plus fuel logistics and handling costs, assumes 70% diesel displacement for Tier 4 Dual Fuel and 50% for Tier 2 Dual Fuel. 2Capital cost of power generation assumes 35 mW of power generation for an electric frac fleet with a capital cost of $1 million per mW with a 3.5-year payback Industry capital cost of power generation gives Tier 4 Dual Fuel a slight cost advantage over Electric Frac Market Bifurcation ▪ Tier 4 Dual-Fuel fleets are a leading technology to minimize costs, balancing fuel savings without additional power generation capital investment ▪ Electric fleets offer greater natural gas substitution potential but face higher capital costs due to additional power generation equipment ▪ Legacy Diesel fleets have higher operating costs, facing significant pressure from modern natural gas- enabled solutions $0 $10 $20 $30 $40 Conventional Diesel Tier 2 Dual-Fuel Tier 4 Dual-Fuel Electric Drive Natural Gas Direct-Drive A n n u a l C o s t o f F u e li n g ( m il li o n s ) Capital Cost of Power Generation2 Fuel Cost Savings Potential ~80% of Patterson-UTI’s active fleet is natural gas-enabled, including an industry leading position in Tier 4 Dual-Fuel. Significant fuel cost arbitrage provides platform for sustained demand for Patterson-UTI’s premium natural gas-fueled equipment

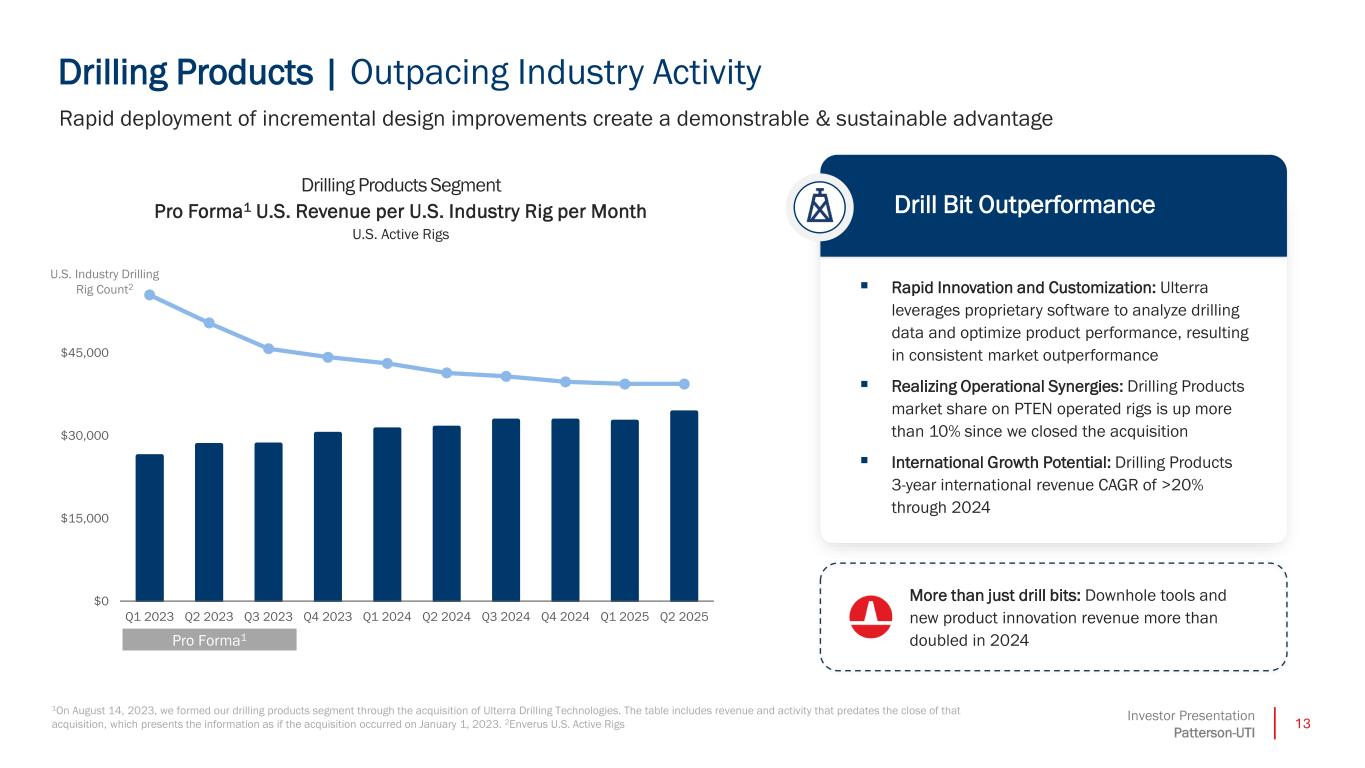

13Investor Presentation Patterson-UTI Drilling Products | Outpacing Industry Activity Rapid deployment of incremental design improvements create a demonstrable & sustainable advantage 1On August 14, 2023, we formed our drilling products segment through the acquisition of Ulterra Drilling Technologies. The table includes revenue and activity that predates the close of that acquisition, which presents the information as if the acquisition occurred on January 1, 2023. 2Enverus U.S. Active Rigs Drill Bit Outperformance ▪ Rapid Innovation and Customization: Ulterra leverages proprietary software to analyze drilling data and optimize product performance, resulting in consistent market outperformance ▪ Realizing Operational Synergies: Drilling Products market share on PTEN operated rigs is up more than 10% since we closed the acquisition ▪ International Growth Potential: Drilling Products 3-year international revenue CAGR of >20% through 2024 0 100 200 300 400 500 600 700 800 900 $0 $15,000 $30,000 $45,000 $60,000 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Pro Forma1 Drilling Products Segment Pro Forma1 U.S. Revenue per U.S. Industry Rig per Month U.S. Active Rigs U.S. Industry Drilling Rig Count2 More than just drill bits: Downhole tools and new product innovation revenue more than doubled in 2024

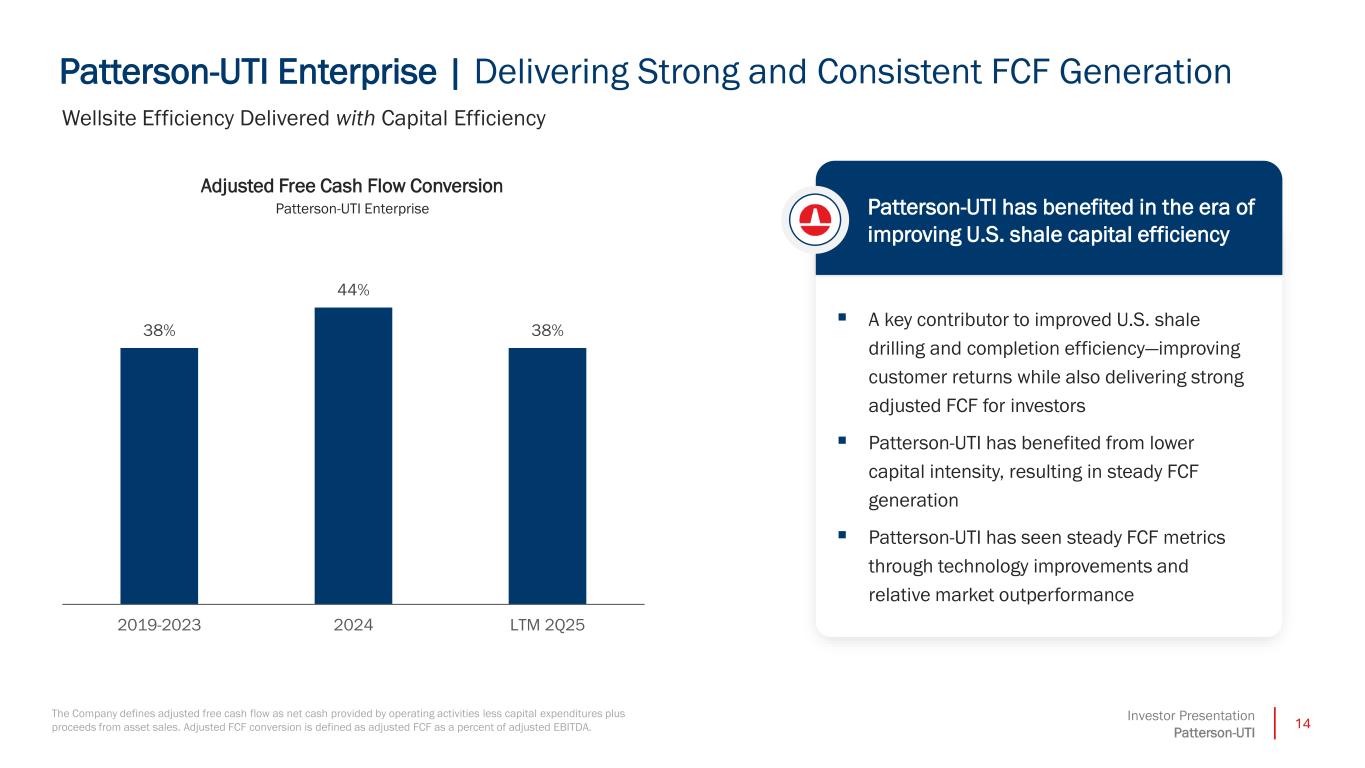

14Investor Presentation Patterson-UTI 38% 44% 38% $- 2019-2023 2024 LTM 2Q25 Patterson-UTI Enterprise | Delivering Strong and Consistent FCF Generation Patterson-UTI has benefited in the era of improving U.S. shale capital efficiency ▪ A key contributor to improved U.S. shale drilling and completion efficiency—improving customer returns while also delivering strong adjusted FCF for investors ▪ Patterson-UTI has benefited from lower capital intensity, resulting in steady FCF generation ▪ Patterson-UTI has seen steady FCF metrics through technology improvements and relative market outperformance Wellsite Efficiency Delivered with Capital Efficiency Adjusted Free Cash Flow Conversion Patterson-UTI Enterprise The Company defines adjusted free cash flow as net cash provided by operating activities less capital expenditures plus proceeds from asset sales. Adjusted FCF conversion is defined as adjusted FCF as a percent of adjusted EBITDA.

Operational Excellence

16Investor Presentation Patterson-UTI Harnessing Data to Enable Higher Impact Drilling & Completion Operations Patterson-UTI creates sustainable value with our end-to-end digital integration and data-driven optimization strategy Simplify workflows to increase scalability of the workforce Access to high quality, consistent and real-time data to run remote operations Edge processing for AI/ML deployments and job management Reduce third party costs, processing, and reliance Delivering powerful digital integration throughout the Drilling & Completion operations lifecycle Integrate Critical Applications Streamline Digital Products Quality Data for Operations Automation-Enabled Decisions

17Investor Presentation Patterson-UTI Patterson-UTI's integrated drilling platform can improve drilling days on pad, creating value for our customers and an opportunity for a performance-based returns premium for our investors. Integration Advantage: Drilling Services and Products Digitally enabled by: Contract Drilling | Patterson-UTI Drilling Diverse rig fleet complete with innovative software solutions Natural Gas Fueling, Well Cementing | NexTier Integrated solutions unlocked through merger Drill Bits | Ulterra Leading provider of PDC drill bits in North America Directional Services | MS Directional Directional drilling, MWD, well planning and downhole motors Survey Correction | Superior QC Leader in survey management technology and wellbore placement Power Generation | Patterson-UTI >1gW of mobile power generation capacity across our rig fleet Controls and Energy Management | Current Power Engineer electrical and automation equipment Rig Equipment Design and Manufacturing | Warrior Design and manufacture advanced pipe-handling equipment Fully integrated throughout the drill site

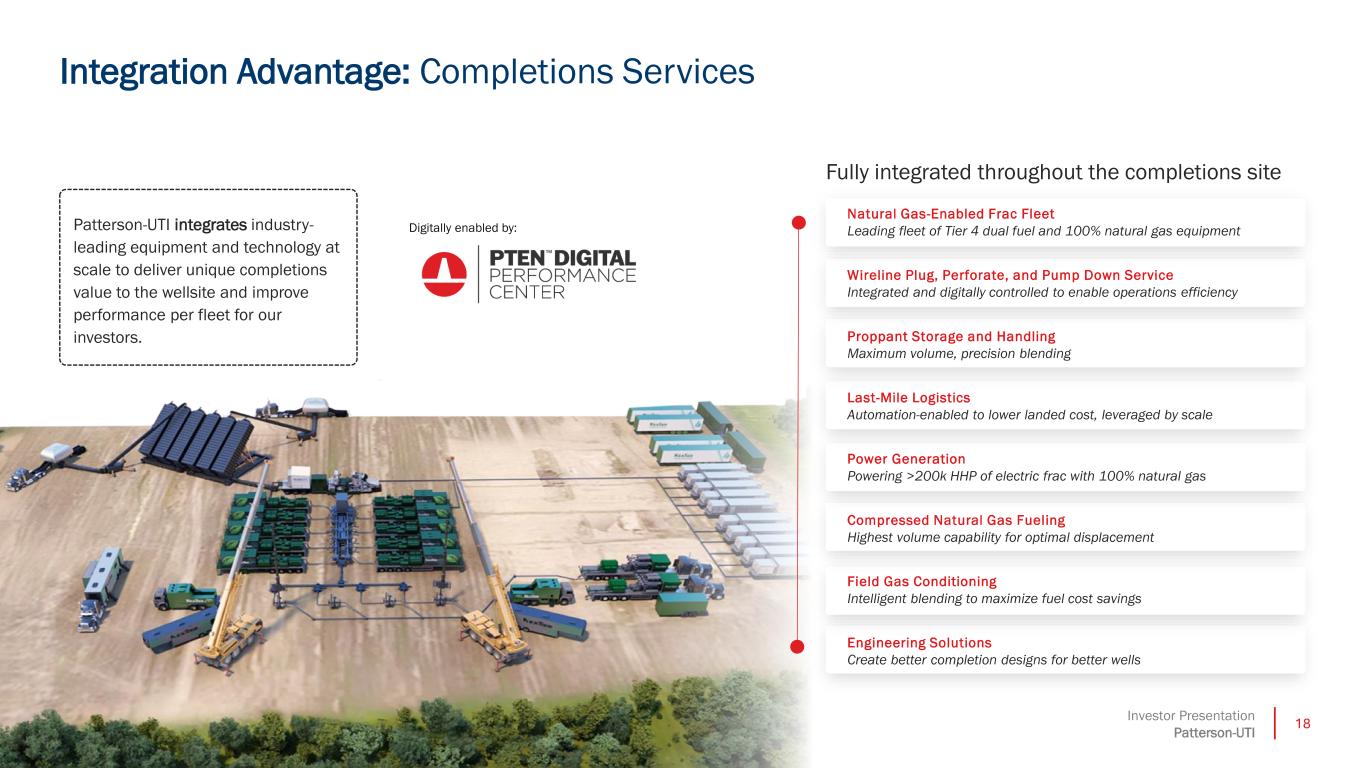

18Investor Presentation Patterson-UTI Integration Advantage: Completions Services Patterson-UTI integrates industry- leading equipment and technology at scale to deliver unique completions value to the wellsite and improve performance per fleet for our investors. Digitally enabled by: Proppant Storage and Handling Maximum volume, precision blending Field Gas Conditioning Intelligent blending to maximize fuel cost savings Natural Gas-Enabled Frac Fleet Leading fleet of Tier 4 dual fuel and 100% natural gas equipment Wireline Plug, Perforate, and Pump Down Service Integrated and digitally controlled to enable operations efficiency Power Generation Powering >200k HHP of electric frac with 100% natural gas Engineering Solutions Create better completion designs for better wells Compressed Natural Gas Fueling Highest volume capability for optimal displacement Last-Mile Logistics Automation-enabled to lower landed cost, leveraged by scale Fully integrated throughout the completions site

Capital Allocation Framework

20Investor Presentation Patterson-UTI Organic Investing Strategy Targets Strong FCF Conversion Invest to protect and extend our operational advantage Strategic Allocation Target strategic high-return investments that drive returns accretion for PTEN shareholders Winning Foundation Allocation Strategy Strong Balance Sheet Investment Grade Credit Rating; Low Leverage and Strong Liquidity; No Senior Note maturities until 2028 Repeatable Shareholder Return Program Expect to return at least 50% of adjusted Free Cash Flow annually to shareholders1 through dividends and repurchases Capital Allocation Framework Maximize Shareholder Value and Financial Returns 1For purposes of the shareholder return target, the Company defines adjusted free cash flow as net cash provided by operating activities less capital expenditures plus proceeds from asset sales. The shareholder return target, including the amount and timing of any dividend payments and/or share repurchases are subject to the discretion of the Company’s Board of Directors and will depend upon business conditions, results of operations, financial condition, terms of the Company’s debt agreements and other factors

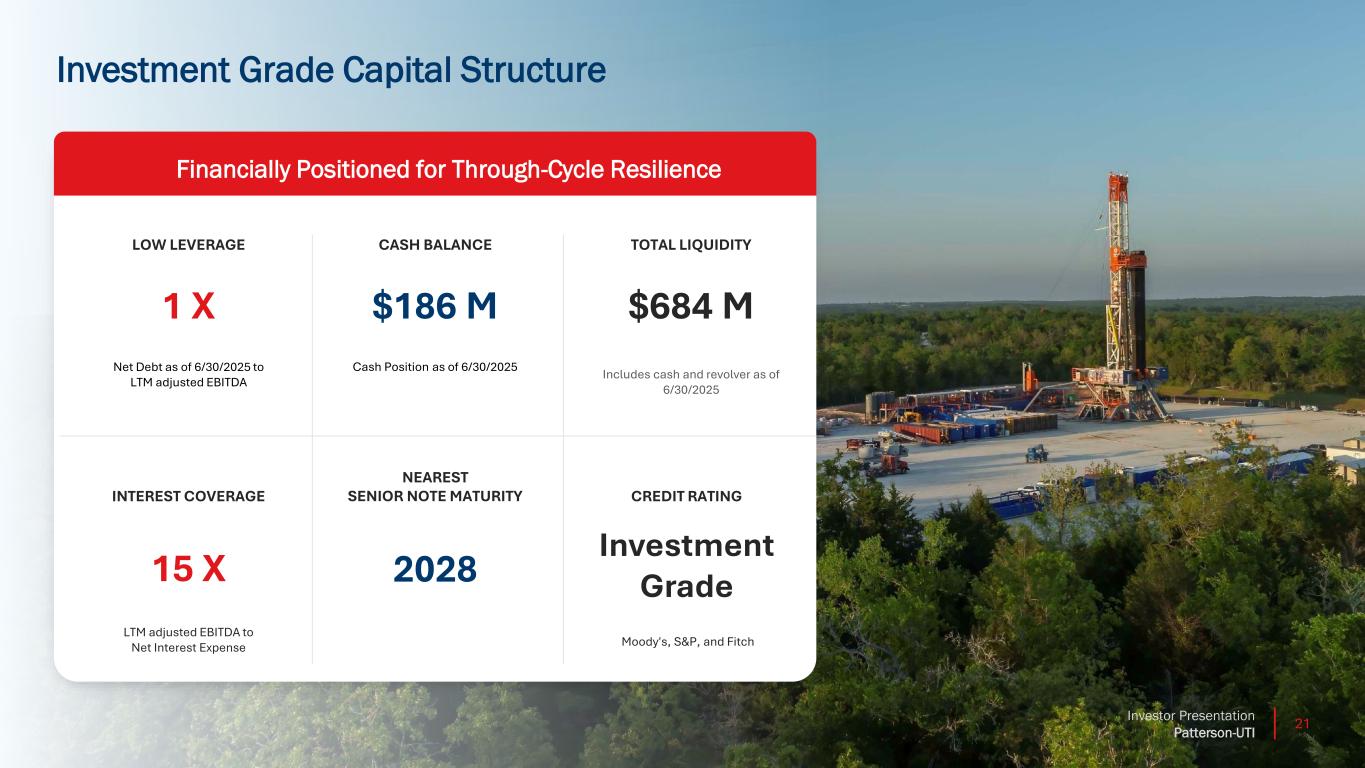

21Investor Presentation Patterson-UTI Z TOTAL LIQUIDITY $684 M Includes cash and revolver as of 6/30/2025 LOW LEVERAGE 1 X Net Debt as of 6/30/2025 to LTM adjusted EBITDA CASH BALANCE $186 M Cash Position as of 6/30/2025 INTEREST COVERAGE 15 X LTM adjusted EBITDA to Net Interest Expense NEAREST SENIOR NOTE MATURITY 2028 CREDIT RATING Investment Grade Moody's, S&P, and Fitch Investment Grade Capital Structure Financially Positioned for Through-Cycle Resilience

22Investor Presentation Patterson-UTI Deliver a Repeatable Shareholder Return Program For purposes of the shareholder return target, the Company defines adjusted free cash flow as net cash provided by operating activities less capital expenditures plus proceeds from asset sales. The shareholder return target, including the amount and timing of any dividend payments and/or share repurchases are subject to the discretion of the Company’s Board of Directors and will depend upon business conditions, results of operations, financial condition, terms of the Company’s debt agreements and other factors. Patterson-UTI targets returning at least 50% of its adjusted Free Cash Flow to shareholders annually through the cycle ▪ For 2024 we exceeded our shareholder return target of 50% of our adjusted free cash flow – returned more than $417 million to shareholders ▪ PTEN will have paid a $0.08 per share quarterly dividend for twelve consecutive quarters including September 2025 dividend ▪ We plan to remain flexible with our method of distribution over time to maximize shareholder value

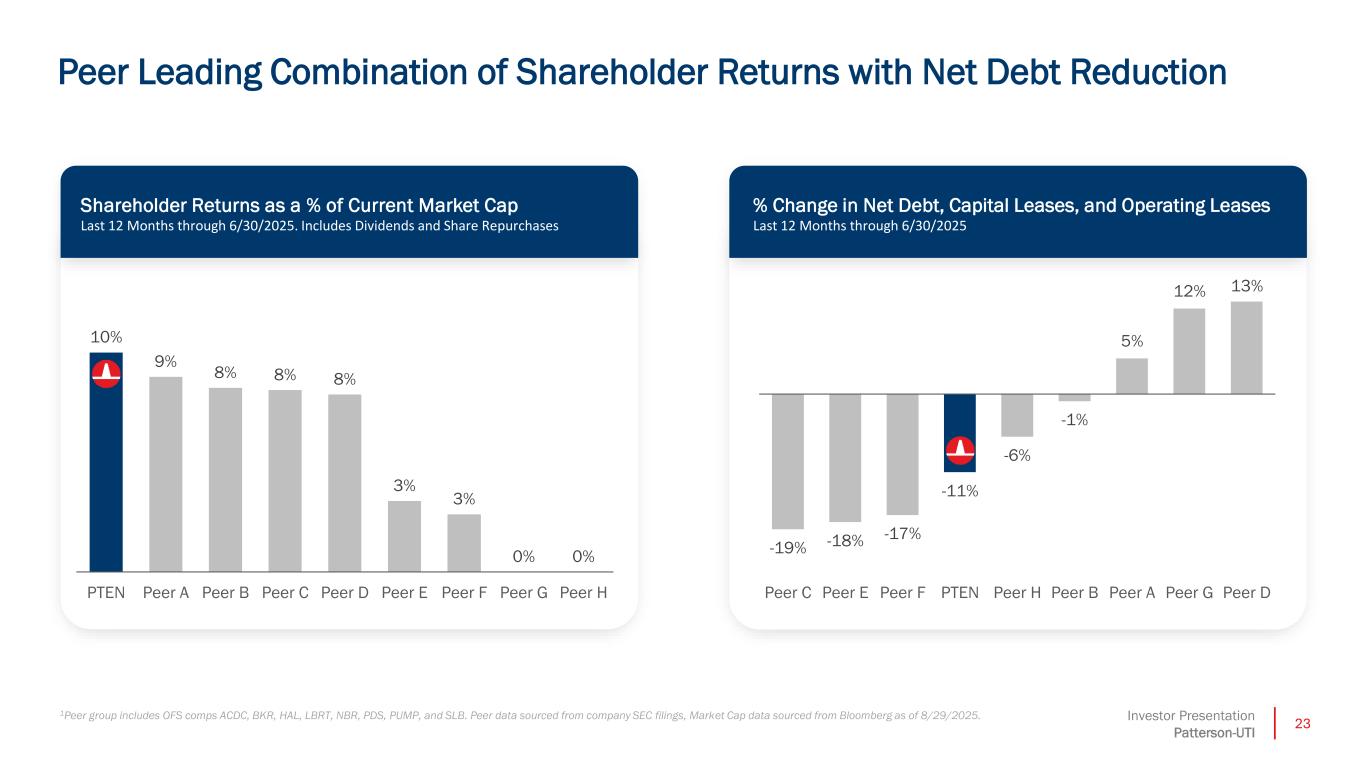

23Investor Presentation Patterson-UTI Shareholder Returns as a % of Current Market Cap Last 12 Months through 6/30/2025. Includes Dividends and Share Repurchases Shareholder Returns as a % of Current Market Cap Includes Dividends and Share Repurchases 1Peer group includes OFS comps ACDC, BKR, HAL, LBRT, NBR, PDS, PUMP, and SLB. Peer data sourced from company SEC filings, Market Cap data sourced from Bloomberg as of 8/29/2025. Peer Leading Combination of Shareholder Returns with Net Debt Reduction 10% 9% 8% 8% 8% 3% 3% 0% 0% PTEN Peer A Peer B Peer C Peer D Peer E Peer F Peer G Peer H % Change i Net Debt, C pital Leases, and Operating Leases Last 12 Months through 6/30/2025 -19% -18% -17% -11% -6% -1% 5% 12% 13% Peer C Peer E Peer F PTEN Peer H Peer B Peer A Peer G Peer D

24Investor Presentation Patterson-UTI Sustainability as a Strategy Our Vision: To safely and responsibly help provide the world with oil and gas for the products that make people’s lives better in a sustainable and profitable manner Find out more in our Sustainability Report at: https://esg.patenergy.com/ Patterson-UTI has demonstrated a resilient commitment to long-term sustainability Our Timeline of Innovation in Sustainability 2006 Introduced High-Line Power 2010 First Dual Fuel Engine on Drilling Rig 2012 Developed and Fielded First Dual Fuel Frac Spread 2018 Acquired Controls and Automation Specialists, Current Power 2019 Deployed Industry’s First Tier-4 Dual Fuel Frac Spread 2021 Launched Power Solutions Natural Gas Fuel Service 2022 First Demonstration Of Hydrogen Blending On Drilling Rig 2023 Deployed GridAssist® 2024 Launched iFGS Intelligent Field Gas Solutions 2013 First Natural Gas Generator on Drilling Rig 2019 Introduced Automated Engine Management System for Rigs 2020 Deployed EcoCell® Lithium Hybrid Power Management System 2021 Real-Time Fuel and Emissions Monitoring 2023 Deployed First Electric Frac Spread 2023 Deployed EcoCell® With Natural Gas Generators

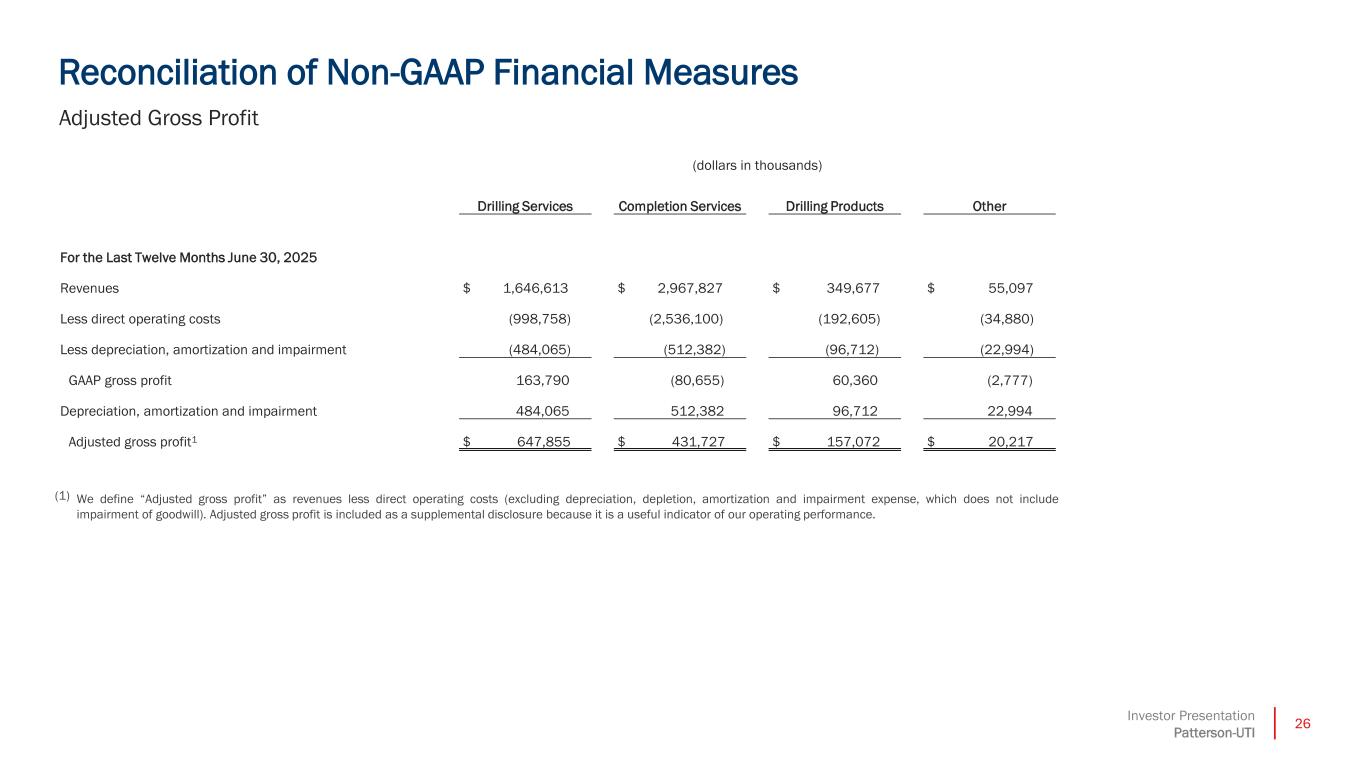

26Investor Presentation Patterson-UTI Reconciliation of Non-GAAP Financial Measures Adjusted Gross Profit (dollars in thousands) Drilling Services Completion Services Drilling Products Other For the Last Twelve Months June 30, 2025 Revenues $ 1,646,613 $ 2,967,827 $ 349,677 $ 55,097 Less direct operating costs (998,758) (2,536,100) (192,605) (34,880) Less depreciation, amortization and impairment (484,065) (512,382) (96,712) (22,994) GAAP gross profit 163,790 (80,655) 60,360 (2,777) Depreciation, amortization and impairment 484,065 512,382 96,712 22,994 Adjusted gross profit1 $ 647,855 $ 431,727 $ 157,072 $ 20,217 (1) We define “Adjusted gross profit” as revenues less direct operating costs (excluding depreciation, depletion, amortization and impairment expense, which does not include impairment of goodwill). Adjusted gross profit is included as a supplemental disclosure because it is a useful indicator of our operating performance.

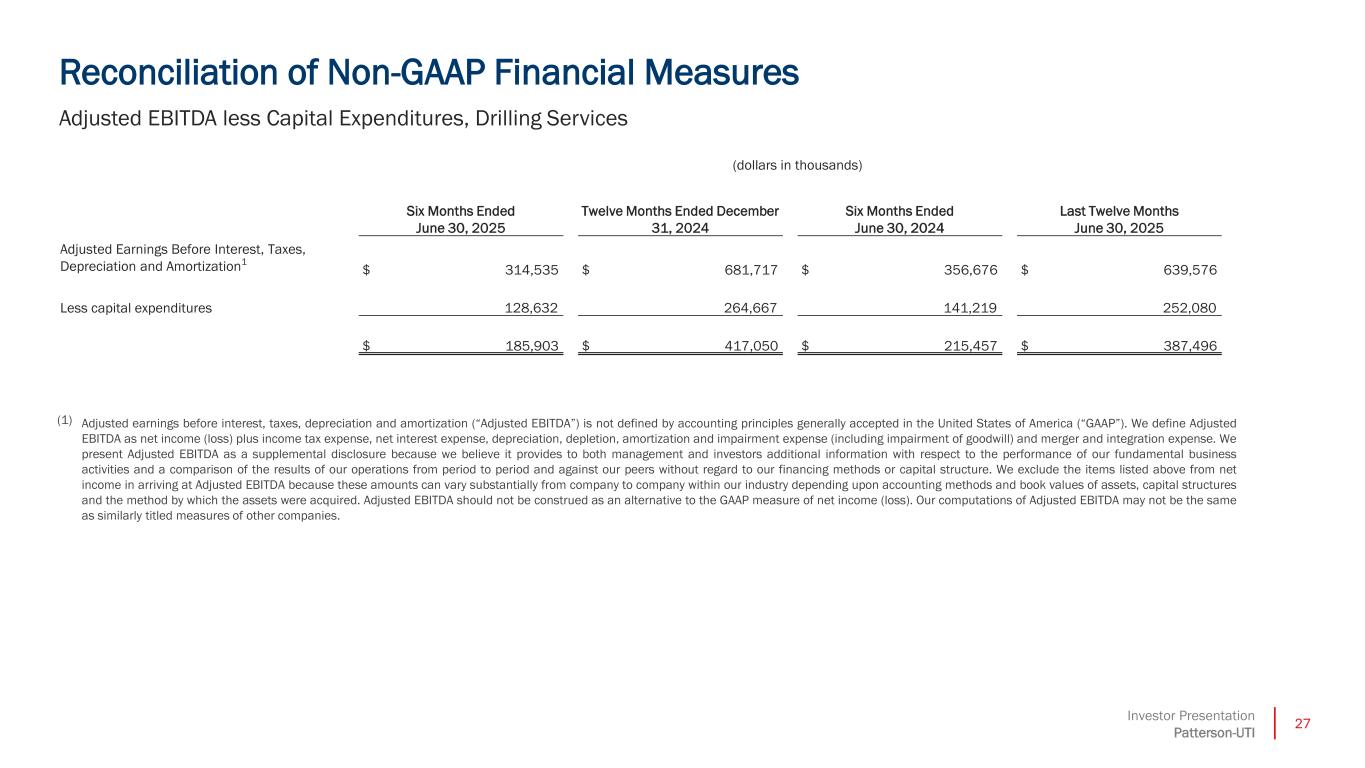

27Investor Presentation Patterson-UTI Reconciliation of Non-GAAP Financial Measures Adjusted EBITDA less Capital Expenditures, Drilling Services (1) Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) is not defined by accounting principles generally accepted in the United States of America (“GAAP”). We define Adjusted EBITDA as net income (loss) plus income tax expense, net interest expense, depreciation, depletion, amortization and impairment expense (including impairment of goodwill) and merger and integration expense. We present Adjusted EBITDA as a supplemental disclosure because we believe it provides to both management and investors additional information with respect to the performance of our fundamental business activities and a comparison of the results of our operations from period to period and against our peers without regard to our financing methods or capital structure. We exclude the items listed above from net income in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be construed as an alternative to the GAAP measure of net income (loss). Our computations of Adjusted EBITDA may not be the same as similarly titled measures of other companies. (dollars in thousands) Six Months Ended June 30, 2025 Twelve Months Ended December 31, 2024 Six Months Ended June 30, 2024 Last Twelve Months June 30, 2025 Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization1 $ 314,535 $ 681,717 $ 356,676 $ 639,576 Less capital expenditures 128,632 264,667 141,219 252,080 $ 185,903 $ 417,050 $ 215,457 $ 387,496

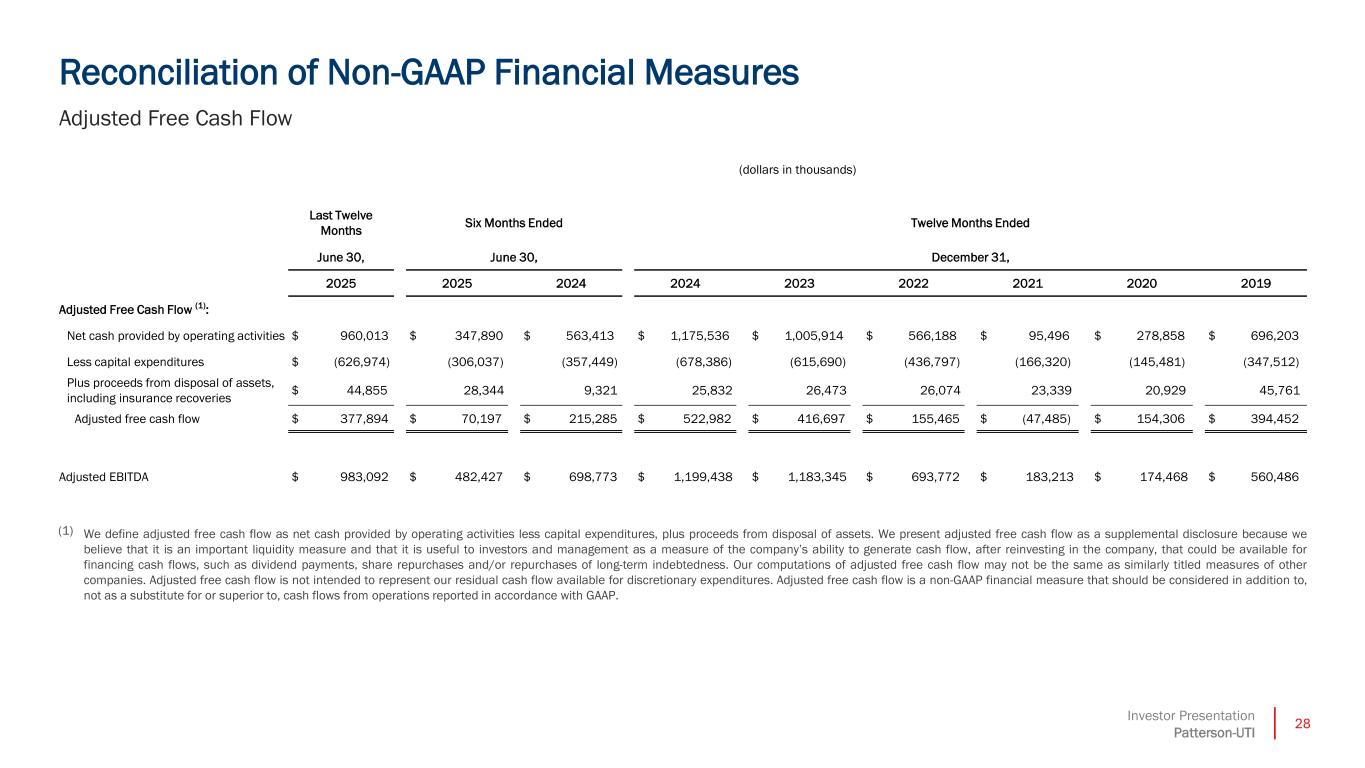

28Investor Presentation Patterson-UTI Reconciliation of Non-GAAP Financial Measures Adjusted Free Cash Flow (1) We define adjusted free cash flow as net cash provided by operating activities less capital expenditures, plus proceeds from disposal of assets. We present adjusted free cash flow as a supplemental disclosure because we believe that it is an important liquidity measure and that it is useful to investors and management as a measure of the company’s ability to generate cash flow, after reinvesting in the company, that could be available for financing cash flows, such as dividend payments, share repurchases and/or repurchases of long-term indebtedness. Our computations of adjusted free cash flow may not be the same as similarly titled measures of other companies. Adjusted free cash flow is not intended to represent our residual cash flow available for discretionary expenditures. Adjusted free cash flow is a non-GAAP financial measure that should be considered in addition to, not as a substitute for or superior to, cash flows from operations reported in accordance with GAAP. (dollars in thousands) Last Twelve Months Six Months Ended Twelve Months Ended June 30, June 30, December 31, 2025 2025 2024 2024 2023 2022 2021 2020 2019 Adjusted Free Cash Flow (1): Net cash provided by operating activities $ 960,013 $ 347,890 $ 563,413 $ 1,175,536 $ 1,005,914 $ 566,188 $ 95,496 $ 278,858 $ 696,203 Less capital expenditures $ (626,974) (306,037) (357,449) (678,386) (615,690) (436,797) (166,320) (145,481) (347,512) Plus proceeds from disposal of assets, including insurance recoveries $ 44,855 28,344 9,321 25,832 26,473 26,074 23,339 20,929 45,761 Adjusted free cash flow $ 377,894 $ 70,197 $ 215,285 $ 522,982 $ 416,697 $ 155,465 $ (47,485) $ 154,306 $ 394,452 Adjusted EBITDA $ 983,092 $ 482,427 $ 698,773 $ 1,199,438 $ 1,183,345 $ 693,772 $ 183,213 $ 174,468 $ 560,486

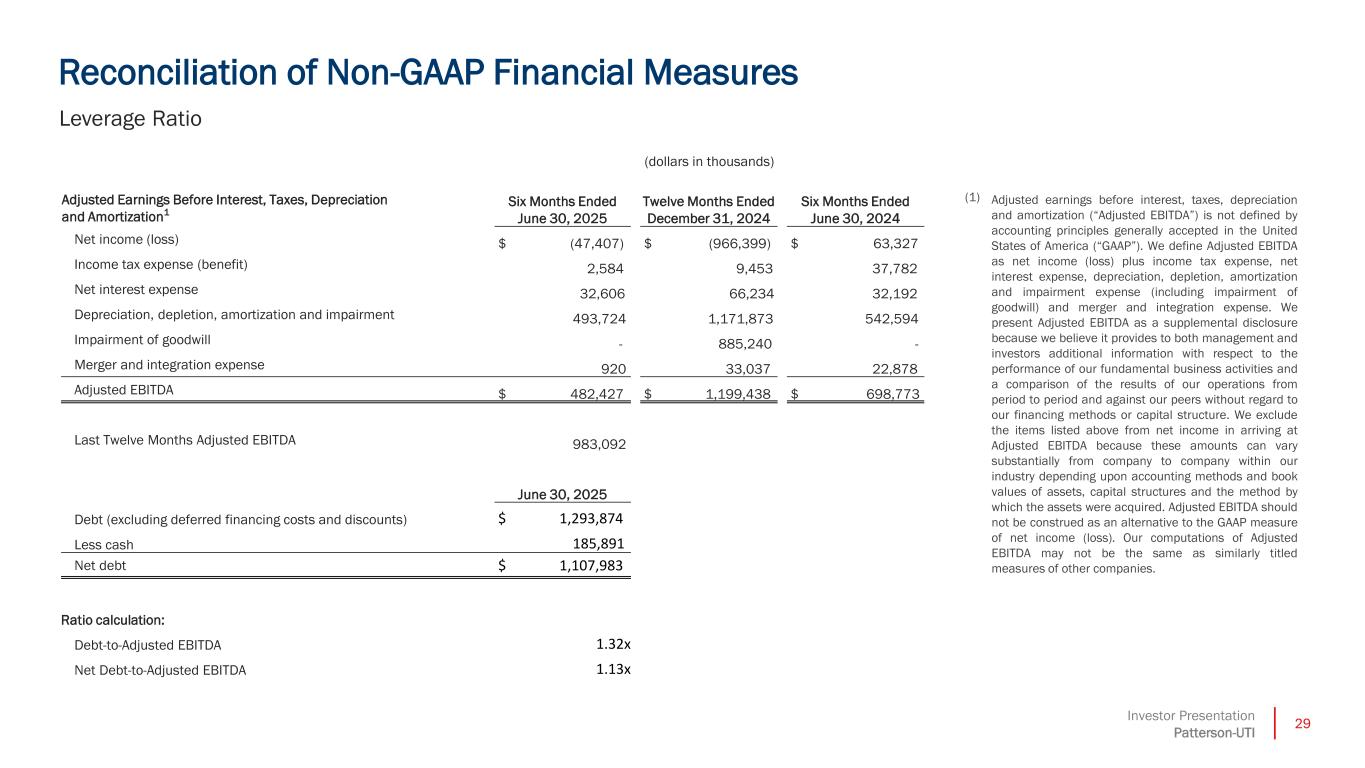

29Investor Presentation Patterson-UTI Reconciliation of Non-GAAP Financial Measures (1) Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) is not defined by accounting principles generally accepted in the United States of America (“GAAP”). We define Adjusted EBITDA as net income (loss) plus income tax expense, net interest expense, depreciation, depletion, amortization and impairment expense (including impairment of goodwill) and merger and integration expense. We present Adjusted EBITDA as a supplemental disclosure because we believe it provides to both management and investors additional information with respect to the performance of our fundamental business activities and a comparison of the results of our operations from period to period and against our peers without regard to our financing methods or capital structure. We exclude the items listed above from net income in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be construed as an alternative to the GAAP measure of net income (loss). Our computations of Adjusted EBITDA may not be the same as similarly titled measures of other companies. Leverage Ratio (dollars in thousands) Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization1 Six Months Ended June 30, 2025 Twelve Months Ended December 31, 2024 Six Months Ended June 30, 2024 Net income (loss) $ (47,407) $ (966,399) $ 63,327 Income tax expense (benefit) 2,584 9,453 37,782 Net interest expense 32,606 66,234 32,192 Depreciation, depletion, amortization and impairment 493,724 1,171,873 542,594 Impairment of goodwill - 885,240 - Merger and integration expense 920 33,037 22,878 Adjusted EBITDA $ 482,427 $ 1,199,438 $ 698,773 Last Twelve Months Adjusted EBITDA 983,092 June 30, 2025 Debt (excluding deferred financing costs and discounts) $ 1,293,874 Less cash 185,891 Net debt $ 1,107,983 Ratio calculation: Debt-to-Adjusted EBITDA 1.32x Net Debt-to-Adjusted EBITDA 1.13x