| 1 |

.2

Q1 2025 Match Group Prepared Remarks

This is my first full-quarter earnings call as

CEO, and I want to start by saying how

proud I am to be here, and how

energized I am by the opportunity ahead.

We're a company with a powerful mission

– to spark meaningful connections. Our

job is to deliver on that mission with

urgency, excellence, and a consumer-first

mindset by building products that reflect

how people want to connect today.

Over the last three months, I have visited

many of our offices around the world,

spoken with hundreds of employees, and

gathered insights from thousands of

users across our apps. Each conversation

with a Match Group team member has

reinforced how deeply our people believe

in this mission. That mission-orientation,

combined with our product innovation

and platform scale, puts us in a strong

position to act decisively as we chart the

future of personal connection.

One of my priorities is evolving Match Group from a collection of independently

managed brands into a unified product-led organization that prioritizes innovation

and user outcomes and operates as one company, not four divisions, to gain the full

benefits of our scale and multi-brand portfolio. Today we announced a

reorganization centralizing key functions including select technology & data services,

customer care and content moderation, media buying, and international go-to-

market functions – while still allowing each brand to maintain their independence

and product roadmaps.

We’ve also taken some hard, but appropriate, steps today to sharpen our focus,

including a planned 13% reduction of our workforce, as well as closing a number of

open roles, and further tightening operating expenses. These actions position us to

achieve more than $100 million in annualized savings, including approximately $45

million of in-year savings in 2025. But more importantly, these changes make us

more nimble, more focused, and better aligned – enabling faster decision-making,

reducing management layers (including around 1 in 5 managers overall) so

individuals can have greater impact, and accelerating our ability to ship products

| 2 |

and features that deliver meaningful user outcomes. These savings will enable us to

deliver the margin goals we outlined at our December Investor Day while also

providing the ability to invest in ways that we believe will return us to growth.

I want to acknowledge the extraordinary contributions from, and give thanks to,

those who will be leaving the company as a result of these decisions. Their hard work

helped strengthen our position and make future success more possible.

We’re acting with urgency, making bold, long-term decisions, and relentlessly

prioritizing user outcomes. The best tech companies operate in product-first, builder

mode – and this next chapter at Match Group is about getting back to that: fewer

layers, faster execution, and a culture focused on creating value through innovation.

This is a big change, and the company is responding positively to this culture shift.

We are already operating with greater clarity, discipline, and speed.

In fact, our solid financial and operating performance to start the year reflects the

focus and resilience of our teams. In Q1, both Match Group Total Revenue and

Adjusted Operating Income (“AOI”) came in above the high end of our guidance,

driven by business performance that was in-line with our expectations, favorable

foreign exchange (“FX”) trends, and ongoing rigorous cost management.

1 Source: Sensor Tower. Combined downloads across Apple App Store and Google Play Store.

| 3 |

Tinder®

Turning now to Tinder, our biggest brand and the #1 most downloaded dating app

worldwide1. We’re making tangible progress on our product roadmap and starting to

see green shoots.

Our priorities at Tinder are to rebuild trust on the platform through a cleaner

ecosystem; deliver better user outcomes; and re-energize the user experience, all of

which are foundational to driving long-term engagement and sustainable growth.

While our Hinge brand leads the category for those looking for a serious relationship,

or what we call “intentioned dating,” Tinder is the leading app for younger users

looking for lighter, lower-pressure connections. To meet the needs of this Gen Z

audience (age 18-27), we’re focused on building features that feel more fun and more

spontaneous. Our effort is on reducing friction in how people engage with one

another and evolving the experience to reflect a broader definition of connection.

We’re already seeing traction with this approach. Let me give you a few examples of

how this is already showing up in Tinder:

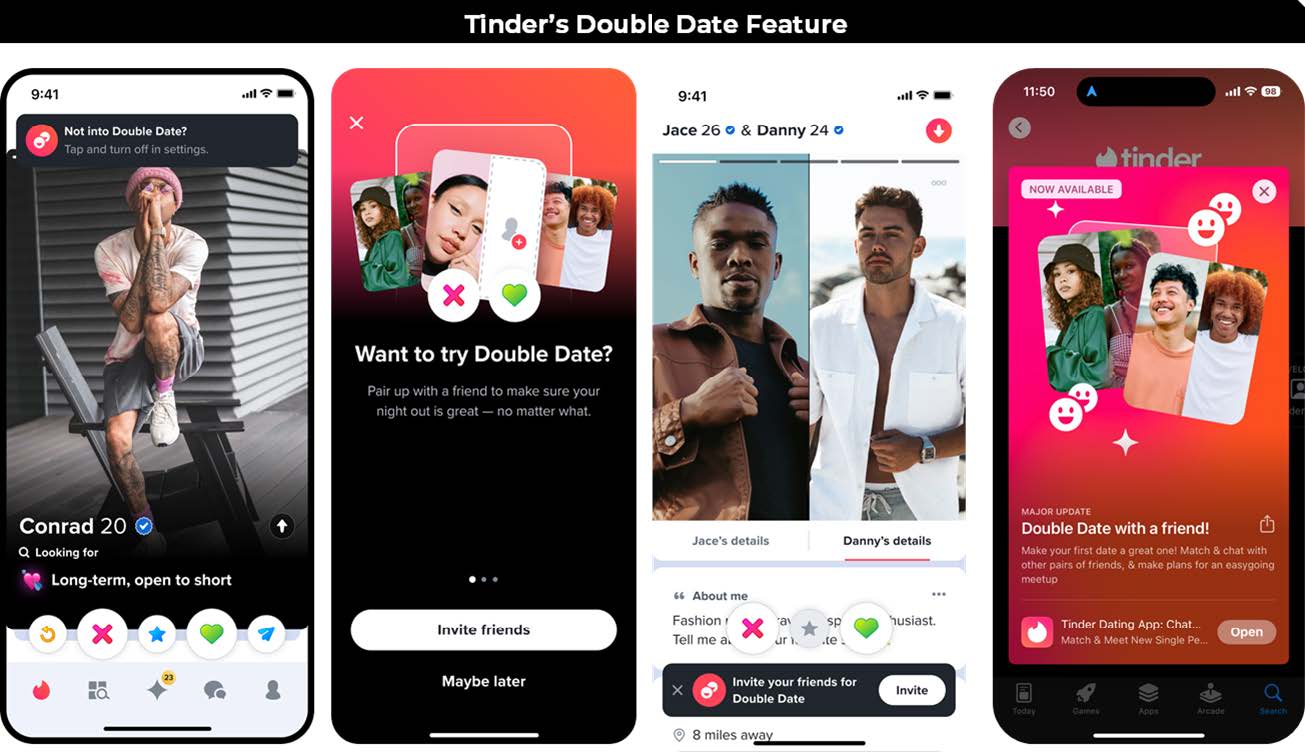

We recently launched our Double Date feature in several European markets,

allowing users to team up with a friend and match with other pairs. It’s resonating

with our younger audience – nearly 90% of Double Date profiles are from users

under 29, and women using Double Date are three times as likely to swipe right on a

pair than an individual. The feature isn’t just driving engagement; it’s also growing

our audience, with nearly 12% of invited users in these markets representing new

registrations or reactivations. We plan to launch in several additional European,

Asian, and LatAm markets soon as we seek to create more fun opportunities for

connection. The U.S. launch is planned for later this year.

| 4 |

In addition, we launched The Game Game™ on iOS in numerous markets worldwide.

This voice-based experience was only out for the month of April, and it let users

practice flirting with an artificial intelligence (“AI”) date to learn to break the ice

through humor, storytelling, and playful interaction. Approximately three-quarters of

a million Tinder users played it last month, demonstrating its ability to tackle one of

the most common challenges we hear: just starting a conversation can feel

intimidating. In addition to demonstrating our leading edge use of AI, The Game

Game drove significant viral awareness and reconsideration of Tinder, and gave us

deep insights into how our users interact with voice AI, which will inform future

product development.

And while we have been utilizing AI and machine learning for years in our core

matching algorithm and in trust & safety, we are bringing AI deeper into our product

experience. We are testing a new AI-enabled discovery experience in New Zealand

that marks a major leap in utilizing AI in a new way to improve dating outcomes.

With permission of our users, it takes in more attributes – such as insights gleaned

from their phone’s camera roll and responses to dynamic questions about what they

are seeking – to generate a curated, personalized daily match. Early signals are

promising, and we see this as a clear example of how AI can drive more relevant,

higher-quality connections, and reflects our commitment to reimagining the

experience beyond the Swipe® feature.

Each of these features is a clear example of how we’re reshaping the experience to

better serve our target audiences. We’re listening, learning, and building with their

needs in mind. We’re encouraged by our progress to date and I look forward to

sharing more as we move forward.

Finally, we continue to invest in our industry-leading trust & safety initiatives to

ensure that Tinder and other Match Group apps are the safest way to meet new

people. We’ve been testing several new features aimed at validating the authenticity

of users. In tests of these features, we’ve seen a more than 15% reduction in bad actor

reports. Last week we announced another cutting-edge innovation aimed at

ensuring user authenticity – our collaboration as the first dating or consumer social

company to integrate with World ID. We will start with Tinder in Japan and then

plan to roll out to other geographies and brands. Our broad scale, global reach,

multi-brand portfolio, and ability to invest more in trust & safety than anyone in our

category is an advantage that also improves user outcomes.

| 5 |

Hinge®

At Hinge, user momentum remains

strong and we’re seeing continued

great product traction. Since

launching globally in late March, our

new AI-powered recommendation

algorithm has driven a greater than

15% increase in matches and contact

exchanges, demonstrating the ability

of our investment in AI to significantly

improve user outcomes.

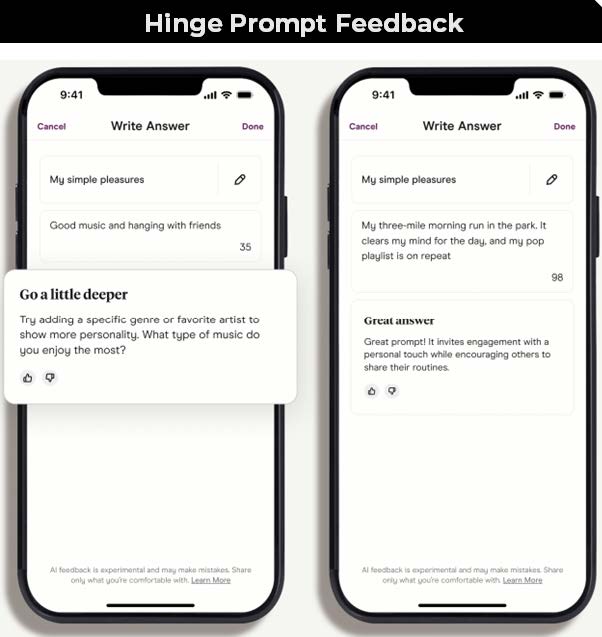

We’re also continuing to enhance in-

app coaching, including by providing

Prompt Feedback – an AI-powered

feature that suggests improvements to

profile prompts in real time – in the

onboarding flow to increase its impact

and exposure. We’re planning to test

Warm Introductions in the coming months, which will highlight shared interests to

improve match quality. With continued innovation, strong brand resonance, and

global expansion underway, we’re confident Hinge is well positioned to continue its

leadership in intentioned dating.

International Expansion

One of Match Group’s core strengths is our ability to build and acquire compelling

consumer apps. Our strategy has been consistent: first, we establish product-market

fit, then we monetize, and finally we scale globally with a proven go-to-market

playbook. In 2025, we’re leaning into this playbook with a number of global

expansion efforts across the portfolio. For example, Hinge is on track to launch in

Brazil and Mexico in the second half of the year, as it seeks to serve intentioned

daters in new markets. The League is planning to launch in the Middle East and

India to meet the demand for premium experiences in these regions. Azar is

continuing its U.S. and Western Europe expansion, and Pairs recently launched in

South Korea. These moves highlight our focus on further unlocking growth by

extending our reach, and we’re confident that by executing our playbook across our

brands and new markets, we are well-positioned to create long-term value for both

users and our company.

| 6 |

Closing Thoughts

We are in the early days of a transformation. Small, focused teams across the

company are fueling a wave of innovation – from college-focused concepts out of

our New York office, to a group meetup experience built by our Korea team, to offline

event experimentation in Japan, to changes to the core of the Tinder app. And by

leveraging AI, staying relentlessly user-first, and moving with speed, we have a real

opportunity to reignite, and redefine, the future of human connection. The impact of

deep learning is already reshaping our matching algorithms across the entire

company, powering more personalized, more relevant, and more effective

experiences for our users. And this is just the beginning.

The management team and I believe in our mission. I believe in our team. And I

believe we will execute to drive growth and ultimately shareholder value over time.

Following our last earnings call – just four days into my role – I personally purchased

$2 million of Match Group stock at an average price of $34 per share. One quarter

later, today, my conviction in our mission, our strategy, and our team has only

strengthened. Given my confidence in our company, I plan to purchase an additional

$1 million of stock soon after our trading window opens.

2 Source: Sensor Tower. Combined downloads across Apple App Store and Google Play Store. Rank among all dating

apps, as defined by Match Group.

| 7 |

Q1 2025 Financial Performance

We’re pleased with our start to the year and with our Q1 financial results. As Spencer

mentioned, both Match Group Total Revenue and AOI exceeded the high-end of our

guidance range in the quarter, driven by business performance that was in-line with

our expectations, favorable FX trends, and ongoing cost discipline.

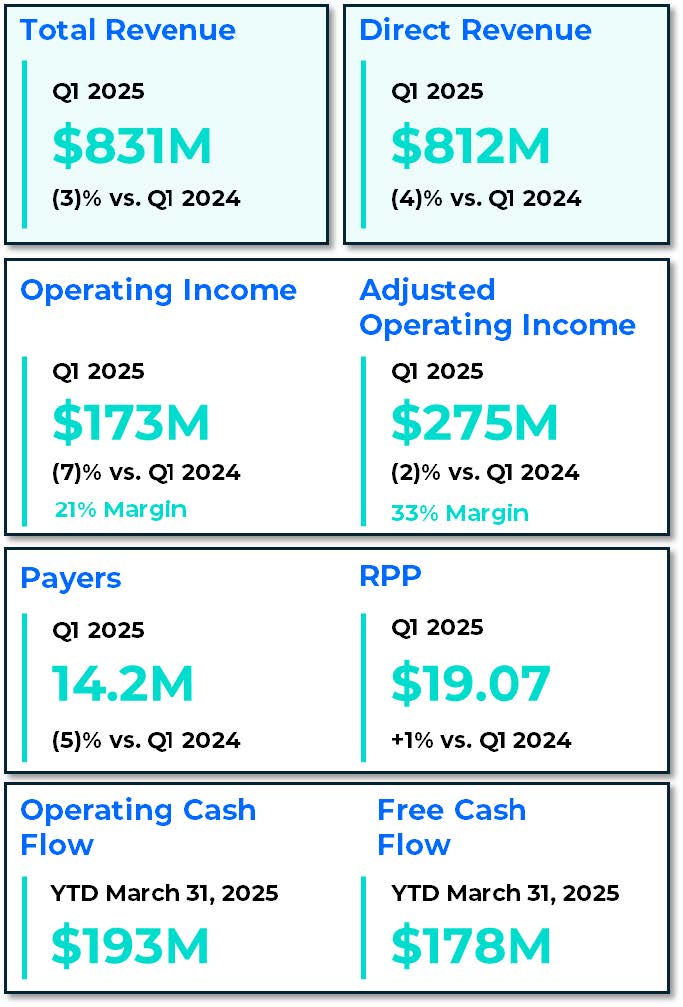

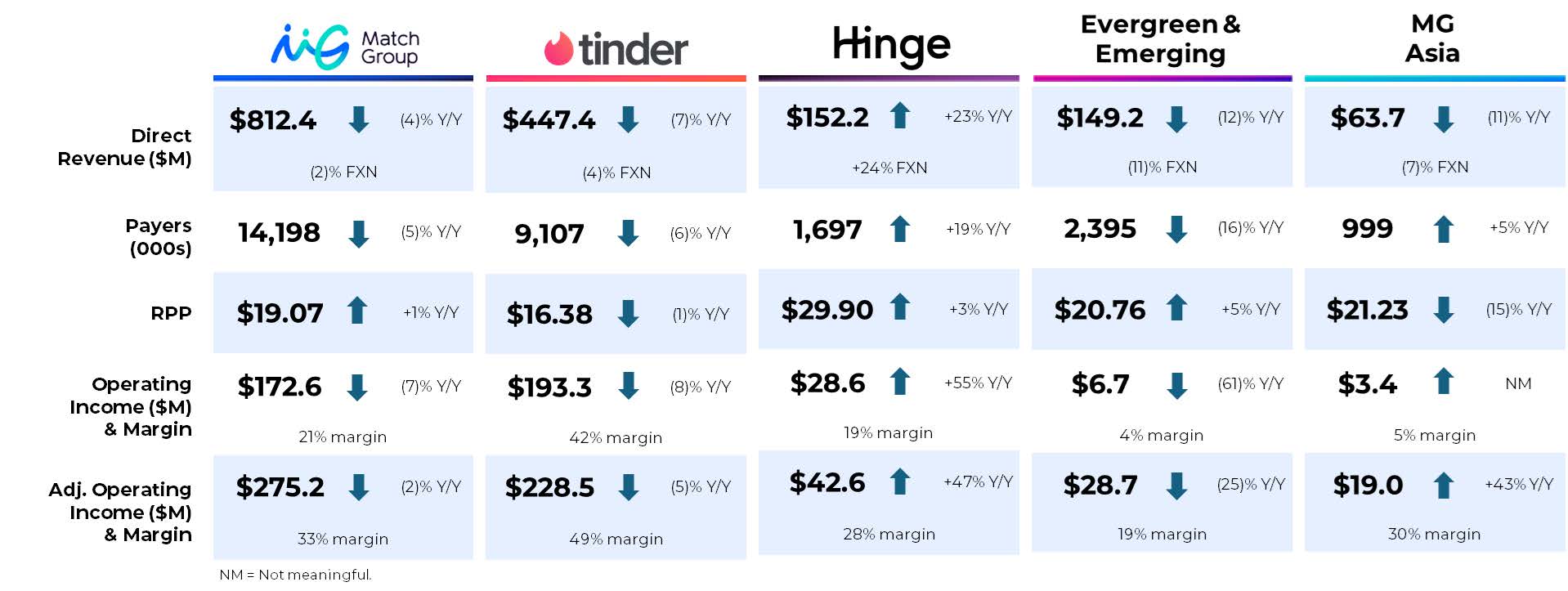

In Q1, Match Group’s Total Revenue was $831 million, down 3% year-over-year (“Y/Y”),

down 1% Y/Y FX neutral (“FXN”). FX headwinds were $5 million less than we

anticipated at the time of our last earnings call. Excluding the exit of our live

streaming businesses (“Ex-Live”), Total Revenue was down 2% Y/Y, up 1% Y/Y FXN.

RPP grew 1% to $19.07, while Payers declined 5% Y/Y to 14.2 million. Indirect revenue

was a record quarter, up 31% Y/Y, driven by an increase in spend from our top

advertisers.

•Tinder Direct Revenue in Q1 was $447 million, down 7% Y/Y, down 4% FXN.

Tinder Payers declined 6% Y/Y to 9.1 million and RPP declined 1% Y/Y to $16.38.

Y/Y Payer declines were impacted by user trends, which are still declining Y/Y,

but at a stable rate. Tinder’s monthly active users declined 9% Y/Y in Q1.

Operating Income (“OI”) in the quarter was $193 million, down 8% Y/Y,

representing an OI margin of 42%. AOI in the quarter was $228 million, down

5% Y/Y, representing an AOI margin of 49%.

•Hinge continued its strong momentum in Q1 with Direct Revenue of $152

million, up 23% Y/Y, up 24% FXN. Hinge’s strong download performance

continued across both core English-speaking and Western European markets.

Hinge maintained its number one ranking across 10 countries and the

number two ranking in its Western European markets overall in the quarter2.

| 8 |

Payers grew 19% Y/Y to 1.7 million, driven by strong user growth. RPP grew 3%

to $29.90, driven largely by subscription price optimizations across several

core markets. OI was $29 million in the quarter, up 55% Y/Y, representing an

OI margin of 19%. AOI was $43 million, up 47% Y/Y, representing an AOI

margin of 28%.

•E&E Direct Revenue was $149 million, down 12% Y/Y, down 11% FXN, driven by

Evergreen brands’ declines of 15% Y/Y, partially offset by a 3% Y/Y increase at

Emerging brands. Ex-Live, E&E Direct Revenue was down 8% Y/Y, down 7% Y/Y

FXN. E&E is executing on its consolidation plans and is on track to migrate

Plenty of Fish and Meetic, its final two brands, later this year. Payers declined

16% Y/Y to 2.4 million, while RPP rose 5% Y/Y to $20.76. In Q1, E&E delivered OI

of $7 million, down 61% Y/Y, representing an OI margin of 4%. AOI of $29

million was down 25% Y/Y, partially due to the timing of marketing spend, for

an AOI margin of 19%.

•MG Asia delivered Direct Revenue of $64 million, down 11% Y/Y, down 7% FXN.

Ex-Live, Direct Revenue was down 2% Y/Y, up 3% FXN in Q1. Azar Direct

Revenue was down 1% Y/Y, up 5% Y/Y FXN, as it continued executing on its

European and U.S. expansion efforts. Pairs’ Direct Revenue was down 3% Y/Y,

flat Y/Y FXN, driven by ongoing stability in the Japanese market. Across MG

Asia, Payers increased 5% Y/Y to 1 million, while RPP declined 15% Y/Y to $21.23,

partially due to FX impacts. OI was $3 million in the quarter, representing an

OI margin of 5% and AOI was $19 million, up 43% Y/Y, representing an AOI

margin of 30%. OI and AOI benefitted from a tax reserve release in the quarter.

In Q1, Total Company OI was $173 million, down 7% Y/Y, representing a margin of 21%,

and AOI was $275 million, down 2% Y/Y, representing a margin of 33%.

Consolidated Operating Costs and Expenses

Including stock-based compensation (“SBC”) expense, total expenses were down 2%

Y/Y in Q1. Cost of revenue decreased 8% Y/Y, and represented 29% of Total Revenue,

down one point Y/Y, driven by lower IAP fees and reduced variable expenses from

the shutdown of our live streaming services mid-last year. Selling and marketing

costs decreased $8 million or 5% Y/Y, due to lower marketing spend at Tinder and

MG Asia, and was flat as a percentage of Total Revenue at 19%. General and

administrative costs increased 5% Y/Y, up one point Y/Y as a percentage of Total

Revenue to 13% driven primarily by severance and other employee compensation-

related costs. Product development costs grew 4% Y/Y as a result of higher SBC

expense, primarily at Tinder and Hinge, and were up one point as a percent of Total

Revenue to 15%. Depreciation and amortization increased by $1 million Y/Y to $32

million.

3 Leverage is calculated utilizing the non-GAAP measure Adjusted Operating Income as the denominator. For a

reconciliation of the non-GAAP measure for each period presented, see page 12.

| 9 |

Capital Allocation & Liquidity

Our gross leverage was 2.8x and net leverage3 was 2.4x at the end of Q1. We ended

the quarter with $414 million of cash, cash equivalents and short-term investments

on hand. In Q1, we repurchased 6.1 million of our shares at an average price of $32 per

share on a trade date basis for a total of $195 million and paid $48 million in

dividends, deploying over 135% of our free cash flow for capital return to

shareholders. We maintain our commitment to return 100% of free cash flow to

shareholders through share buybacks and the dividend. In late January, we repaid

the $425 million outstanding balance on our Term Loan with cash on hand.

Financial Guidance

Q2 2025

We expect Q2 Total Revenue for Match Group of $850 million to $860 million, down

2% to flat Y/Y. This range assumes a one-point Y/Y tailwind from FX and a one-point

Y/Y headwind from the exit of Hakuna and other of our live streaming businesses.

FXN Ex-Live, we expect Total Revenue to be down 2% to down 1% Y/Y.

We expect Match Group AOI of $295 million to $300 million in Q2, representing a Y/Y

decline of 3%, and AOI margin of approximately 35% at the midpoints of the ranges.

We expect costs associated with the restructuring of our operations to be $17 million

in the quarter. Excluding these restructuring costs, we expect AOI to increase Y/Y by

3% and AOI margins to be approximately 37% at the mid-point of the ranges.

Total Revenue | Adjusted Operating Income | |||

Q2 2025 | $850 to $860 million | $295 to $300 million |

| 10 |

Full Year 2025 Guidance

Our full year 2025 Match Group Total Revenue guidance of $3,375 to $3,500 million

remains unchanged.

Our full year results could be impacted by macroeconomic conditions or changes in

FX rates, both of which remain volatile and difficult to predict. Our business is not

directly subject to tariffs and because a significant portion of our revenue is derived

from subscriptions, which tend to be stickier than impulse purchases like à la carte

(“ALC”), our business has historically been relatively resilient to macroeconomic

impacts. We’ve seen some impact to ALC revenue in the past, especially at our

brands with younger users or those with less discretionary income, and we’ve started

to see some impact to ALC revenue at Tinder in recent weeks, which we are

monitoring closely. We are prepared to take pricing, merchandising, or other actions

to minimize the impact to our financial performance should these trends persist.

The recent decline in the dollar relative to other major currencies helped our Q1

results, and we expect FX to be a tailwind to Y/Y Total Revenue growth in Q2, helping

to offset any consumer spending-related headwinds.

We expect Match Group AOI to be within the previously disclosed full year guidance

range of $1,232 to $1,278 million on an as reported basis, and roughly in the middle of

the range when excluding approximately $25 million in costs associated with the

restructuring of our operations. We expect to achieve our full year AOI margin target

of 36.5%, excluding these restructuring costs.

We now expect SBC expense in 2025 of $280 to $290 million, meaningfully lower

than the range we provided at our last earnings call, due to restructuring of our

operations and our continued focus on managing headcount and SBC expense.

As Spencer outlined, we’ve taken meaningful steps to become a flatter, more

efficient, product-first organization. We expect these changes to help us achieve our

margin goals (excluding costs associated with the restructuring of our operations)

and better position the company to weather any macro headwinds. We expect them

to also greatly improve product execution and accelerate innovation, which in turn

should lead to improved growth and shareholder value over time.

| 11 |

Appendix

Reconciliations of GAAP to Non-GAAP Measures

Reconciliation of Operating Income to Adjusted Operating Income

Three Months Ended March 31, 2025 | |||||||||||||

Tinder | Hinge | E&E | MG Asia | Corporate & unallocated costs | Eliminations | Total Match Group | |||||||

(Dollars in thousands) | |||||||||||||

Operating Income (Loss) | $193,348 | $28,625 | $6,678 | $3,447 | $(59,505) | $— | $172,593 | ||||||

Stock-based compensation expense | 25,315 | 13,232 | 12,227 | 4,834 | 14,786 | — | 70,394 | ||||||

Depreciation | 9,805 | 718 | 6,317 | 3,674 | 1,215 | — | 21,729 | ||||||

Amortization of intangibles | — | — | 3,453 | 7,025 | — | — | 10,478 | ||||||

Adjusted Operating Income (Loss) | $228,468 | $42,575 | $28,675 | $18,980 | $(43,504) | $— | $275,194 | ||||||

Revenue | $463,416 | $152,243 | $152,429 | $63,823 | $— | $(733) | $831,178 | ||||||

Operating Income Margin | 42% | 19% | 4% | 5% | NA | NA | 21% | ||||||

Adjusted Operating Income Margin | 49% | 28% | 19% | 30% | NA | NA | 33% | ||||||

Three Months Ended March 31, 2024 | |||||||||||||

Tinder | Hinge | E&E | MG Asia | Corporate & unallocated costs | Eliminations | Total Match Group | |||||||

(Dollars in thousands) | |||||||||||||

Operating Income (Loss) | $210,042 | $18,505 | $17,321 | $(7,667) | $(53,463) | $— | $184,738 | ||||||

Stock-based compensation expense | 20,541 | 9,915 | 14,048 | 8,081 | 11,235 | — | 63,820 | ||||||

Depreciation | 9,253 | 535 | 4,838 | 4,590 | 1,305 | — | 20,521 | ||||||

Amortization of intangibles | — | — | 2,069 | 8,298 | — | — | 10,367 | ||||||

Adjusted Operating Income | $239,836 | $28,955 | $38,276 | $13,302 | $(40,923) | $— | $279,446 | ||||||

Revenue | $493,110 | $123,753 | $171,136 | $71,648 | $— | $— | $859,647 | ||||||

Operating Income (Loss) Margin | 43% | 15% | 10% | (11)% | NA | NA | 21% | ||||||

Adjusted Operating Income Margin | 49% | 23% | 22% | 19% | NA | NA | 33% | ||||||

| 12 |

Reconciliation of Operating Income to Adjusted Operating Income used

in Leverage Ratios

Twelve months ended March 31, 2025 | |

(In thousands) | |

Operating Income | 811,167 |

Stock-based compensation expense | 273,955 |

Depreciation | 88,707 |

Impairments and amortization of intangibles | 74,286 |

Adjusted Operating Income | $1,248,115 |

Reconciliation of Forecasted Operating Income to Forecasted Adjusted

Operating Income

Three Months Ended June 30, 2025 | Year Ended December 31, 2025 | ||

(In millions) | |||

Operating Income | $195 to $200 | $837 to $868 | |

Stock-based compensation expense | 71 | 280 to 290 | |

Depreciation and amortization of intangibles | 29 | 115 to 120 | |

Adjusted Operating Income | $295 to $300 | $1,232 to $1,278 | |

Revenue | $850 to $860 | $3,375 to $3,500 | |

Operating Income Margin (at the mid-point of the ranges) | 23% | 25% | |

Adjusted Operating Income Margin (at the mid-point of the ranges) | 35% | 36.5% | |

Reconciliation of Operating Cash Flow to Free Cash Flow

Three Months Ended March 31, | |||

2025 | 2024 | ||

(In thousands) | |||

Net cash provided by operating activities | $193,117 | $284,103 | |

Capital expenditures | (15,427) | (17,234) | |

Free Cash Flow | $177,690 | $266,869 | |

| 13 |

Reconciliation of GAAP Revenue to Non-GAAP Revenue, Excluding

Foreign Exchange Effects

Three Months Ended March 31, | |||||||

2025 | $ Change | % Change | 2024 | ||||

(Dollars in millions, rounding differences may occur) | |||||||

Total Revenue, as reported | $831.2 | $(28.5) | (3)% | $859.6 | |||

Foreign exchange effects | 19.4 | ||||||

Total Revenue, excluding foreign exchange effects | $850.6 | $(9.0) | (1)% | $859.6 | |||

Total Revenue, excluding Hakuna and other of our live streaming services, as reported | $831.2 | $(15.1) | (2)% | $846.3 | |||

Foreign exchange effects | 19.4 | ||||||

Total Revenue, excluding Hakuna and other of our live streaming services, excluding foreign exchange effects | $850.6 | $4.3 | 1% | $846.3 | |||

Direct Revenue, as reported | $812.4 | $(32.9) | (4)% | $845.3 | |||

Foreign exchange effects | 19.0 | ||||||

Direct Revenue, excluding foreign exchange effects | $831.5 | $(13.8) | (2)% | $845.3 | |||

Tinder Direct Revenue, as reported | $447.4 | $(34.1) | (7)% | $481.5 | |||

Foreign exchange effects | 13.0 | ||||||

Tinder Direct Revenue, excluding foreign exchange effects | $460.4 | $(21.1) | (4)% | $481.5 | |||

Hinge Direct Revenue, as reported | $152.2 | $28.5 | 23% | $123.8 | |||

Foreign exchange effects | 1.5 | ||||||

Hinge Direct Revenue, excluding foreign exchange effects | $153.7 | $30.0 | 24% | $123.8 | |||

E&E Direct Revenue, as reported | $149.2 | $(19.5) | (12)% | $168.6 | |||

Foreign exchange effects | 1.4 | ||||||

E&E Direct Revenue, excluding foreign exchange effects | $150.6 | $(18.0) | (11)% | $168.6 | |||

E&E, excluding live streaming, Direct Revenue, as reported | $149.2 | $(12.7) | (8)% | $161.8 | |||

Foreign exchange effects | 1.4 | ||||||

E&E, excluding live streaming, Direct Revenue, excluding foreign exchange effects | $150.6 | $(11.2) | (7)% | $161.8 | |||

MG Asia Direct Revenue, as reported | $63.7 | $(7.8) | (11)% | $71.5 | |||

Foreign exchange effects | 3.1 | ||||||

MG Asia Direct Revenue, excluding foreign exchange effects | $66.8 | $(4.7) | (7)% | $71.5 | |||

MG Asia Direct Revenue excluding Hakuna, as reported | $63.7 | $(1.2) | (2)% | $64.9 | |||

Foreign exchange effects | 3.1 | ||||||

MG Asia Direct Revenue excluding Hakuna, excluding foreign exchange effects | $66.8 | $1.9 | 3% | $64.9 | |||

Azar Direct Revenue | $36.5 | $(0.5) | (1)% | $37.0 | |||

Foreign exchange effects | 2.4 | ||||||

Azar Direct Revenue, excluding foreign exchange effects | $38.9 | $1.9 | 5% | $37.0 | |||

Pairs Direct Revenue, as reported | $27.1 | $(0.7) | (3)% | $27.8 | |||

Foreign exchange effects | 0.7 | ||||||

Pairs Direct Revenue, excluding foreign exchange effects | $27.9 | $0.1 | —% | $27.8 | |||

| 14 |

Non-GAAP Financial Measures

Match Group reports Adjusted Operating Income, Adjusted Operating Income Margin, Free Cash Flow,

and Revenue Excluding Foreign Exchange Effects, all of which are supplemental measures to U.S.

generally accepted accounting principles (“GAAP”). The Adjusted Operating Income, Adjusted

Operating Income Margin, and Free Cash Flow measures are among the primary metrics by which we

evaluate the performance of our business, on which our internal budget is based and by which

management is compensated. Revenue Excluding Foreign Exchange Effects provides a comparable

framework for assessing the performance of our business without the effect of exchange rate

differences when compared to prior periods. We believe that investors should have access to the same

set of tools that we use in analyzing our results. These non-GAAP measures should be considered in

addition to results prepared in accordance with GAAP but should not be considered a substitute for or

superior to GAAP results. Match Group endeavors to compensate for the limitations of the non-GAAP

measures presented by providing the comparable GAAP measures and descriptions of the reconciling

items, including quantifying such items, to derive the non-GAAP measures. We encourage investors to

examine the reconciling adjustments between the GAAP and non-GAAP measures, which we describe

below. Interim results are not necessarily indicative of the results that may be expected for a full year.

Definitions of Non-GAAP Measures

Adjusted Operating Income is defined as operating income excluding: (1) stock-based compensation

expense; (2) depreciation; and (3) acquisition-related items consisting of (i) amortization of intangible

assets and impairments of goodwill and intangible assets, if applicable, and (ii) gains and losses

recognized on changes in the fair value of contingent consideration arrangements, as applicable. We

believe Adjusted Operating Income is useful to analysts and investors as this measure allows a more

meaningful comparison between our performance and that of our competitors. The above items are

excluded from our Adjusted Operating Income measure because they are non-cash in nature. Adjusted

Operating Income has certain limitations because it excludes certain expenses.

Adjusted Operating Income Margin is defined as Adjusted Operating Income divided by revenues. We

believe Adjusted Operating Income Margin is useful for analysts and investors as this measure allows a

more meaningful comparison between our performance and that of our competitors. Adjusted

Operating Income Margin has certain limitations in that it does not take into account the impact to our

consolidated statement of operations of certain expenses.

Free Cash Flow is defined as net cash provided by operating activities, less capital expenditures. We

believe Free Cash Flow is useful to investors because it represents the cash that our operating

businesses generate, before taking into account non-operational cash movements. Free Cash Flow has

certain limitations in that it does not represent the total increase or decrease in the cash balance for the

period, nor does it represent the residual cash flow for discretionary expenditures. Therefore, we think it

is important to evaluate Free Cash Flow along with our consolidated statement of cash flows.

We look at Free Cash Flow as a measure of the strength and performance of our businesses, not for

valuation purposes. In our view, applying “multiples” to Free Cash Flow is inappropriate because it is

subject to timing, seasonality and one-time events. We manage our business for cash, and we think it is

of utmost importance to maximize cash – but our primary valuation metric is Adjusted Operating

Income.

Revenue Excluding Foreign Exchange Effects is calculated by translating current period revenues

using prior period exchange rates. The percentage change in Revenue Excluding Foreign Exchange

Effects is calculated by determining the change in current period revenues over prior period revenues

where current period revenues are translated using prior period exchange rates. We believe the impact

of foreign exchange rates on Match Group, due to its global reach, may be an important factor in

| 15 |

understanding period over period comparisons if movement in rates is significant. Since our results are

reported in U.S. dollars, international revenues are favorably impacted as the U.S. dollar weakens relative

to other currencies, and unfavorably impacted as the U.S. dollar strengthens relative to other currencies.

We believe the presentation of revenue excluding foreign exchange effects in addition to reported

revenue helps improve the ability to understand Match Group’s performance because it excludes the

impact of foreign currency volatility that is not indicative of Match Group’s core operating results.

Non-Cash Expenses That Are Excluded From Our Non-GAAP Measures

Stock-based compensation expense consists principally of expense associated with the grants of

RSUs, performance-based RSUs, and market-based awards. These expenses are not paid in cash, and

we include the related shares in our fully diluted shares outstanding using the treasury stock method;

however, performance-based RSUs and market-based awards are included only to the extent the

applicable performance or market condition(s) have been met (assuming the end of the reporting

period is the end of the contingency period). To the extent stock-based awards are settled on a net

basis, we remit the required tax-withholding amounts from our current funds.

Depreciation is a non-cash expense relating to our property and equipment and is computed using the

straight-line method to allocate the cost of depreciable assets to operations over their estimated useful

lives, or, in the case of leasehold improvements, the lease term, if shorter.

Amortization of intangible assets and impairments of goodwill and intangible assets are non-cash

expenses related primarily to acquisitions. At the time of an acquisition, the identifiable definite-lived

intangible assets of the acquired company, such as customer lists, trade names and technology, are

valued and amortized over their estimated lives. Value is also assigned to (i) acquired indefinite-lived

intangible assets, which consist of trade names and trademarks, and (ii) goodwill, which are not subject

to amortization. An impairment is recorded when the carrying value of an intangible asset or goodwill

exceeds its fair value. We believe that intangible assets represent costs incurred by the acquired

company to build value prior to acquisition and the related amortization and impairment charges of

intangible assets or goodwill, if applicable, are not ongoing costs of doing business.

Additional Definitions

Tinder consists of the world-wide activity of the brand Tinder®.

Hinge consists of the world-wide activity of the brand Hinge®.

Evergreen & Emerging (“E&E”) consists of the world-wide activity of our Evergreen brands including

Match®, Meetic®, OkCupid®, Plenty Of Fish®, and a number of demographically focused brands and our

Emerging brands including BLK®, ChispaTM, The League®, Archer®, Upward®, YuzuTM, and other smaller

brands.

Match Group Asia (“MG Asia”) consists of the world-wide activity of the brands Pairs® and Azar®.

Direct Revenue is revenue that is received directly from end users of our services and includes both

subscription and à la carte revenue.

Indirect Revenue is revenue that is not received directly from end users of our services, substantially all

of which is advertising revenue.

Payers are unique users at a brand level in a given month from whom we earned Direct Revenue.

When presented as a quarter-to-date or year-to-date value, Payers represents the average of the

monthly values for the respective period presented. At a consolidated level and a business unit level to

the extent a business unit consists of multiple brands, duplicate Payers may exist when we earn

| 16 |

revenue from the same individual at multiple brands in a given month, as we are unable to identify

unique individuals across brands in the Match Group portfolio.

Revenue Per Payer (“RPP”) is the average monthly revenue earned from a Payer and is Direct Revenue

for a period divided by the Payers in the period, further divided by the number of months in the period.

Monthly Active User (“MAU”) is a unique registered user at a brand level who has visited the brand’s

app or, if applicable, their website in the last 28 days as of the measurement date. At a consolidated

level and a business unit level to the extent a business unit consists of multiple brands, duplicate users

will exist within MAU when the same individual visits multiple brands in a given month.

Leverage on a gross basis is calculated as principal debt balance divided by Adjusted Operating

Income for the period referenced.

Leverage on a net basis is calculated as principal debt balance less cash and cash equivalents and

short-term investments divided by Adjusted Operating Income for the period referenced.

Safe Harbor Statement Under the Private Securities Litigation Reform Act

of 1995

These prepared remarks and our conference call, which will be held at 8:30 a.m. Eastern Time on May 8,

2025, may contain “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements that are not historical facts are “forward looking statements.” The use

of words such as “anticipates,” “estimates,” “expects,” “plans” and “believes,” among others, generally

identify forward-looking statements. These forward-looking statements include, among others,

statements relating to: Match Group’s future financial performance, Match Group’s business prospects

and strategy, anticipated trends, and other similar matters. These forward-looking statements are

based on management’s current expectations and assumptions about future events, which are

inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict.

Actual results could differ materially from those contained in these forward-looking statements for a

variety of reasons, including, among others: our ability to maintain or grow the size of our user base and

convert users to paying users, competition, the limited operating history of some of our brands, our

ability to attract users to our services through cost-effective marketing and related efforts, our ability to

distribute our services through third parties and offset related fees, risks relating to our use of artificial

intelligence, foreign currency exchange rate fluctuations, the integrity and scalability of our systems

and infrastructure (and those of third parties) and our ability to adapt ours to changes in a timely and

cost-effective manner, our ability to protect our systems from cyberattacks and to protect personal and

confidential user information, impacts to our offices and employees from more frequent extreme

weather events, risks relating to certain of our international operations and acquisitions, damage to our

brands' reputations as a result of inappropriate actions by users of our services, and macroeconomic

conditions. Certain of these and other risks and uncertainties are discussed in Match Group’s filings with

the Securities and Exchange Commission. Other unknown or unpredictable factors that could also

adversely affect Match Group’s business, financial condition and results of operations may arise from

time to time. In light of these risks and uncertainties, these forward-looking statements may not prove

to be accurate. Accordingly, you should not place undue reliance on these forward-looking statements,

which only reflect the views of Match Group management as of the date of this press release. Match

Group does not undertake to update these forward-looking statements.