2025 Earnings Release

2 Disclaimer This presentation has been prepared by KT Corp.(the “Company”) in accordance with K-IFRS. This presentation contains forward-looking statements, which are subject to risks, uncertainties, and assumptions. This presentation is being presented solely for your information and is subject to change without notice. No presentation or warranty, expressed or implied, is made and no reliance should be placed on the accuracy, actuality, fairness, or completeness of the information presented. The Company has applied new accounting standard of K-IFRS 1115 as of Jan 1st, 2018 and K-IFRS 1116 ‘Leases’ as of Jan 1st, 2019. There are no obligation to apply the new standard to previous financial statements. If you have any questions related to this material, please contact the IR department. Tel: +82-70-4193-4036

1 2025 Highlights 2 Financial Highlights 3 Business Overview 4 Appendix Contents

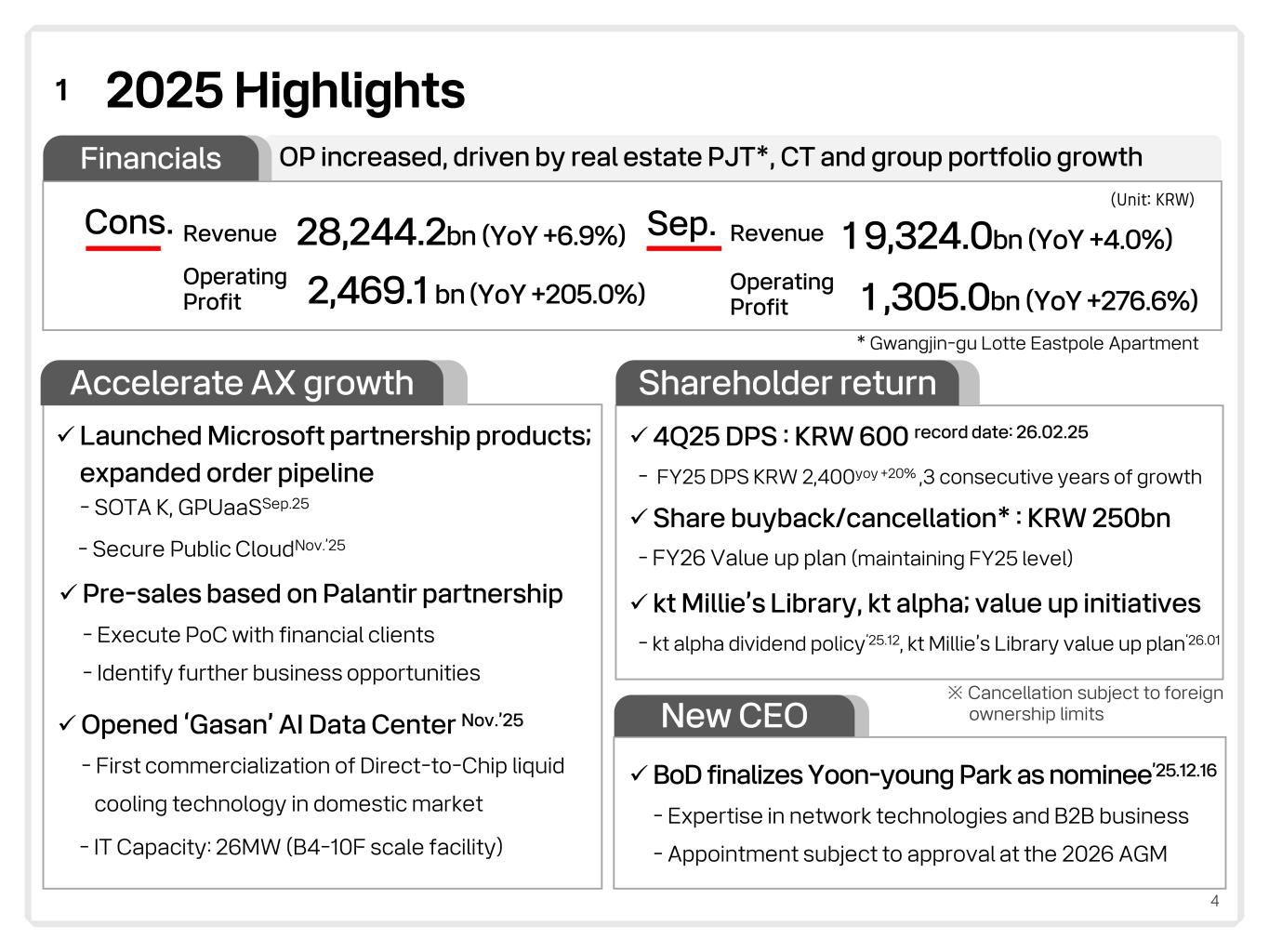

4 2025 Highlights1 28,244.2bn (YoY +6.9%) 2,469.1 bn (YoY +205.0%) 1 9,324.0bn (YoY +4.0%) 1 ,305.0bn (YoY +276.6%) OP increased, driven by real estate PJT*, CT and group portfolio growthFinancials Operating Profit RevenueCons. Sep. Operating Profit Revenue (Unit: KRW) * Gwangjin-gu Lotte Eastpole Apartment Accelerate AX growth Shareholder return New CEO ✓4Q25 DPS : KRW 600 record date: 26.02.25 - FY25 DPS KRW 2,400yoy +20% ,3 consecutive years of growth ✓Share buyback/cancellation* : KRW 250bn - FY26 Value up plan (maintaining FY25 level) ✓BoD finalizes Yoon-young Park as nominee’25.12.16 - Expertise in network technologies and B2B business - Appointment subject to approval at the 2026 AGM ※ Cancellation subject to foreign ownership limits ✓ kt Millie’s Library, kt alpha; value up initiatives - kt alpha dividend policy‘25.12, kt Millie’s Library value up plan‘26.01 ✓Launched Microsoft partnership products; expanded order pipeline - SOTA K, GPUaaSSep.25 - Secure Public CloudNov.’25 ✓Pre-sales based on Palantir partnership - Execute PoC with financial clients - Identify further business opportunities ✓Opened ‘Gasan’ AI Data Center Nov.’25 - First commercialization of Direct-to-Chip liquid cooling technology in domestic market - IT Capacity: 26MW (B4-10F scale facility)

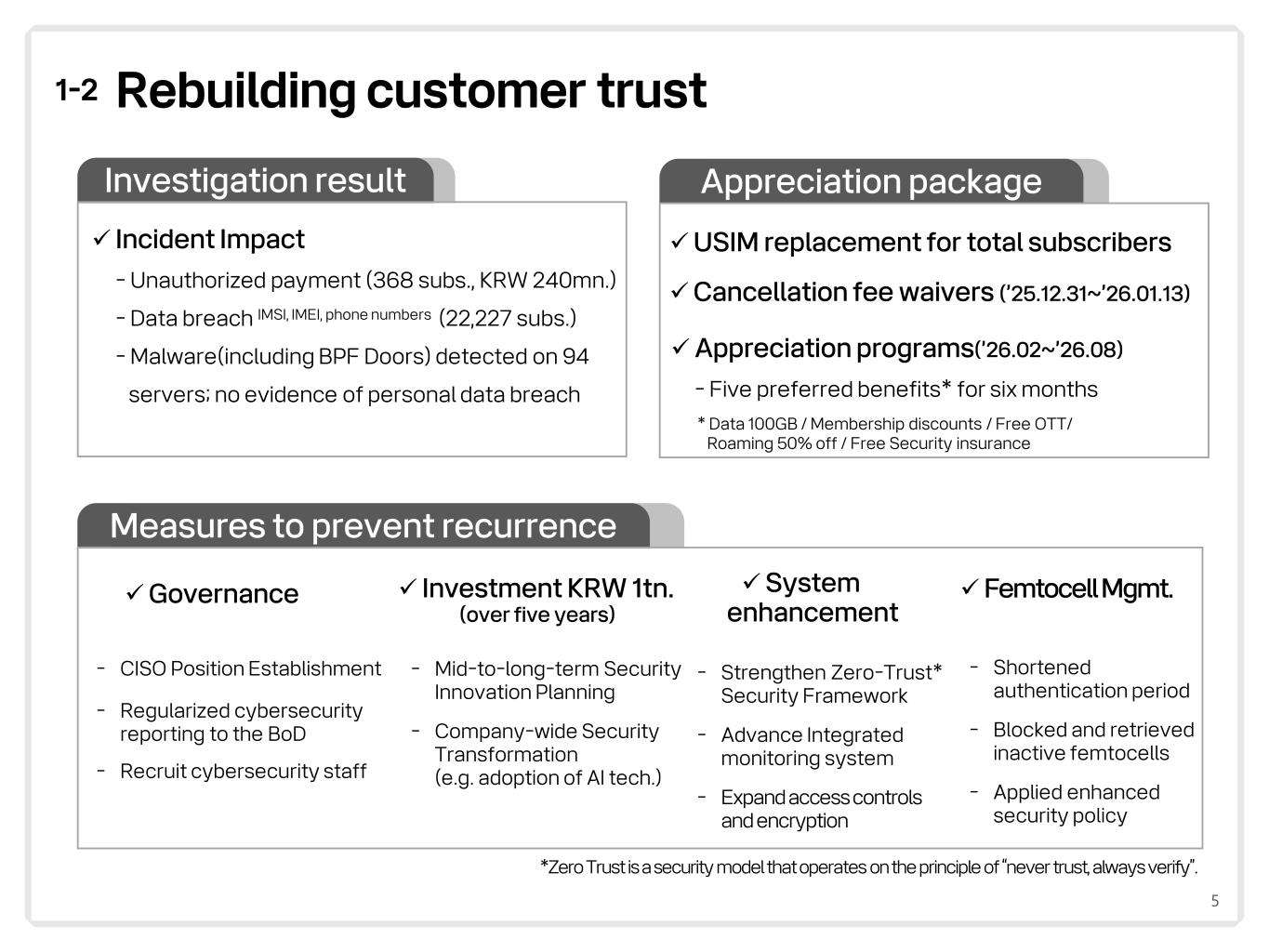

5 Rebuilding customer trust1-2 ✓ Incident Impact - Unauthorized payment (368 subs., KRW 240mn.) - Data breach IMSI, IMEI, phone numbers (22,227 subs.) - Malware(including BPF Doors) detected on 94 servers; no evidence of personal data breach ✓Appreciation programs(’26.02~’26.08) - Five preferred benefits* for six months Investigation result Appreciation package ✓USIM replacement for total subscribers ✓Cancellation fee waivers (’25.12.31~’26.01.13) * Data 100GB / Membership discounts / Free OTT/ Roaming 50% off / Free Security insurance Measures to prevent recurrence ✓Governance - CISO Position Establishment - Regularized cybersecurity reporting to the BoD - Recruit cybersecurity staff ✓System enhancement - Strengthen Zero-Trust* Security Framework - Advance Integrated monitoring system - Expand accesscontrols and encryption - Shortened authentication period - Blocked and retrieved inactive femtocells - Applied enhanced security policy ✓Femtocell Mgmt. - Mid-to-long-term Security Innovation Planning - Company-wide Security Transformation (e.g. adoption of AI tech.) ✓ Investment KRW 1tn. (over five years) *Zero Trust is a security model that operates on the principle of “never trust, always verify”.

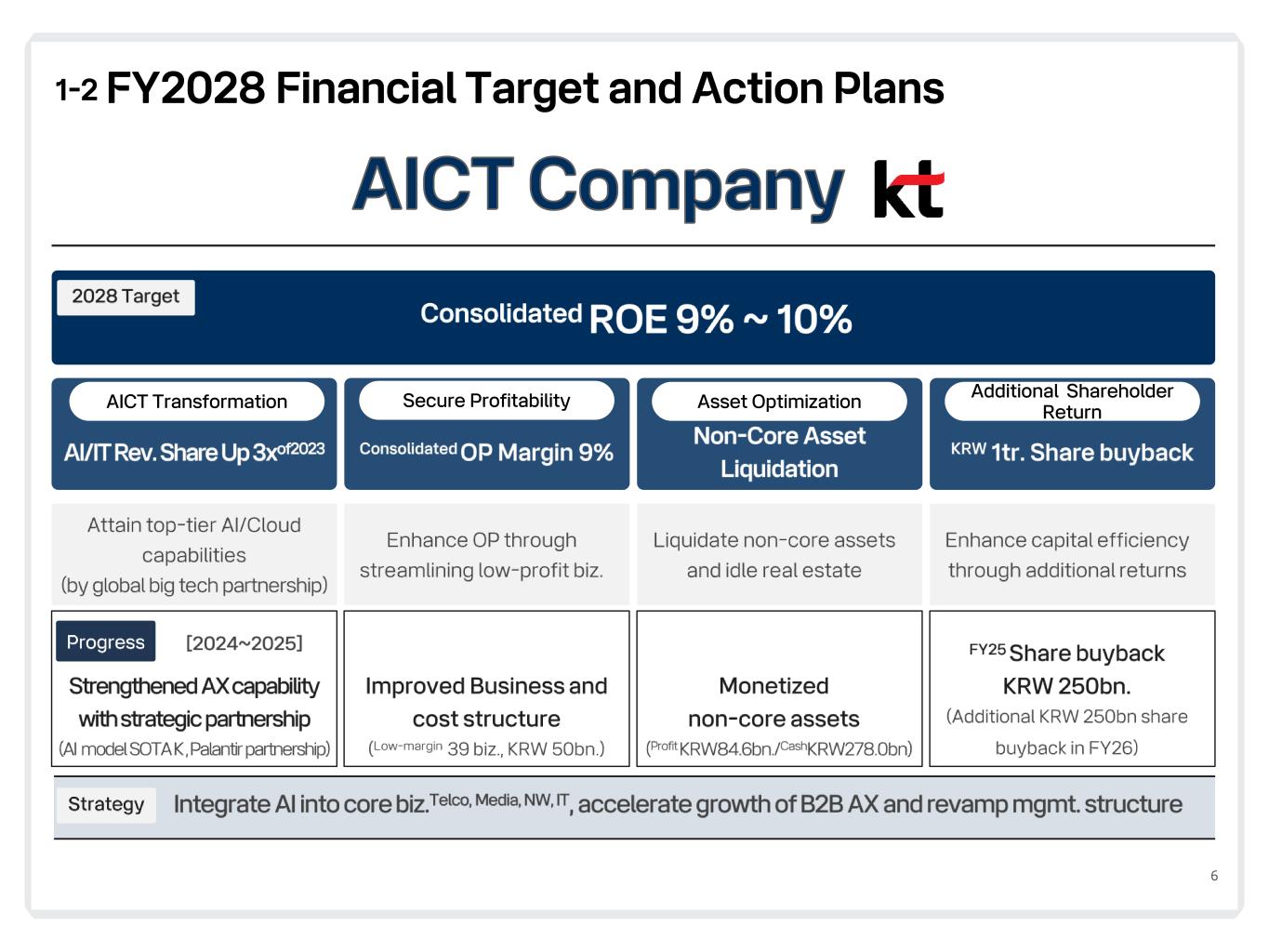

6 AICT Company AICT Transformation FY2028 Financial Target and Action Plans1-2 Secure Profitability Asset Optimization Additional Shareholder Return

1 2025 Highlights 2 Financial Highlights 3 Business Overview 4 Appendix Contents

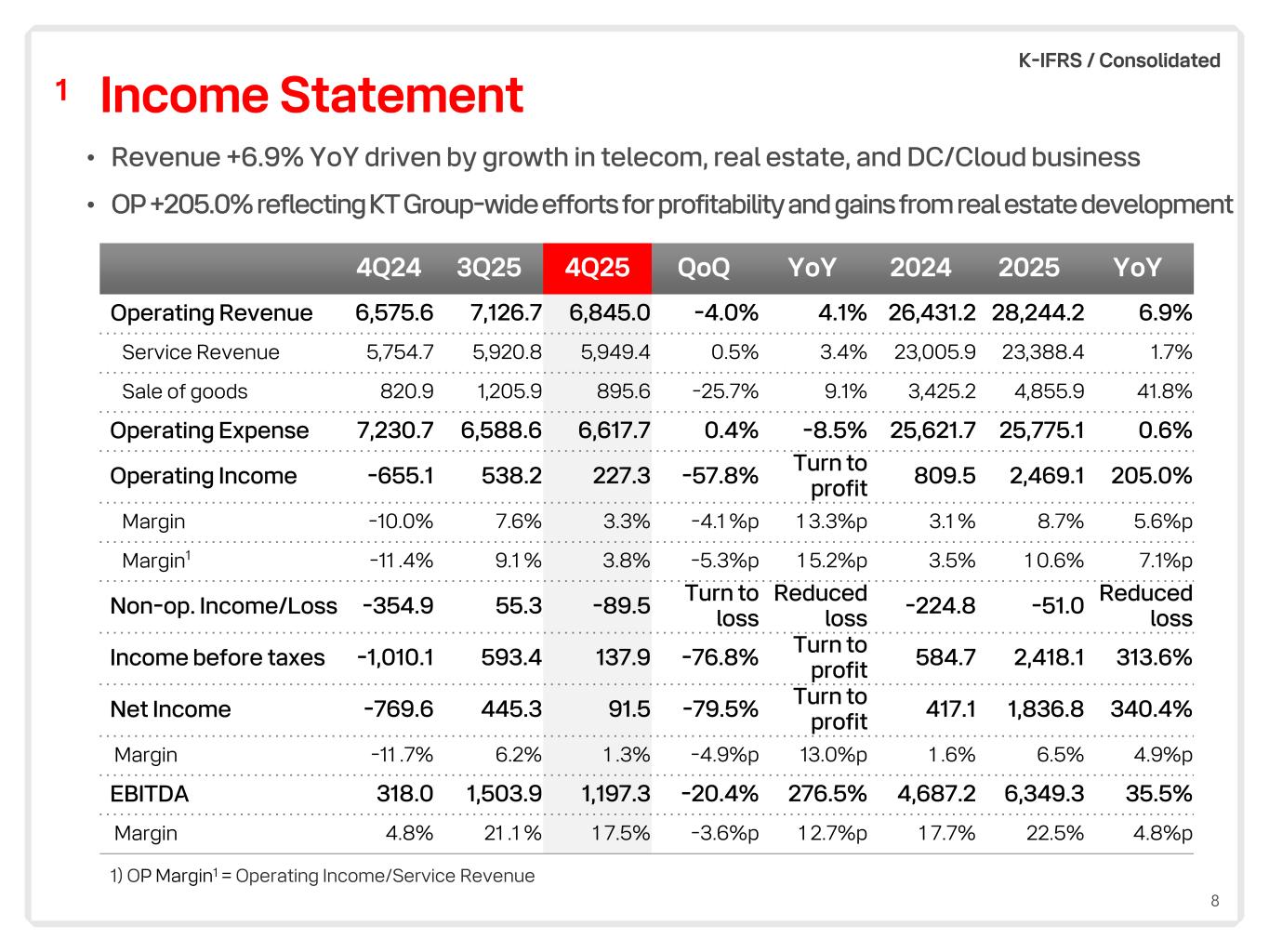

8 Income Statement1 (Unit: KRW bn) 1) OP Margin1 = Operating Income/Service Revenue 4Q24 3Q25 4Q25 QoQ YoY 2024 2025 YoY Operating Revenue 6,575.6 7,126.7 6,845.0 -4.0% 4.1% 26,431.2 28,244.2 6.9% Service Revenue 5,754.7 5,920.8 5,949.4 0.5% 3.4% 23,005.9 23,388.4 1.7% Sale of goods 820.9 1,205.9 895.6 -25.7% 9.1% 3,425.2 4,855.9 41.8% Operating Expense 7,230.7 6,588.6 6,617.7 0.4% -8.5% 25,621.7 25,775.1 0.6% Operating Income -655.1 538.2 227.3 -57.8% Turn to profit 809.5 2,469.1 205.0% Margin -10.0% 7.6% 3.3% -4.1 %p 1 3.3%p 3.1 % 8.7% 5.6%p Margin1 -11 .4% 9.1 % 3.8% -5.3%p 1 5.2%p 3.5% 1 0.6% 7.1%p Non-op. Income/Loss -354.9 55.3 -89.5 Turn to loss Reduced loss -224.8 -51.0 Reduced loss Income before taxes -1,010.1 593.4 137.9 -76.8% Turn to profit 584.7 2,418.1 313.6% Net Income -769.6 445.3 91.5 -79.5% Turn to profit 417.1 1,836.8 340.4% Margin -11 .7% 6.2% 1 .3% -4.9%p 13.0%p 1 .6% 6.5% 4.9%p EBITDA 318.0 1,503.9 1,197.3 -20.4% 276.5% 4,687.2 6,349.3 35.5% Margin 4.8% 21 .1 % 1 7.5% -3.6%p 1 2.7%p 1 7.7% 22.5% 4.8%p • Revenue +6.9% YoY driven by growth in telecom, real estate, and DC/Cloud business • OP +205.0% reflecting KT Group-wide efforts for profitability and gains from real estate development K-IFRS / Consolidated

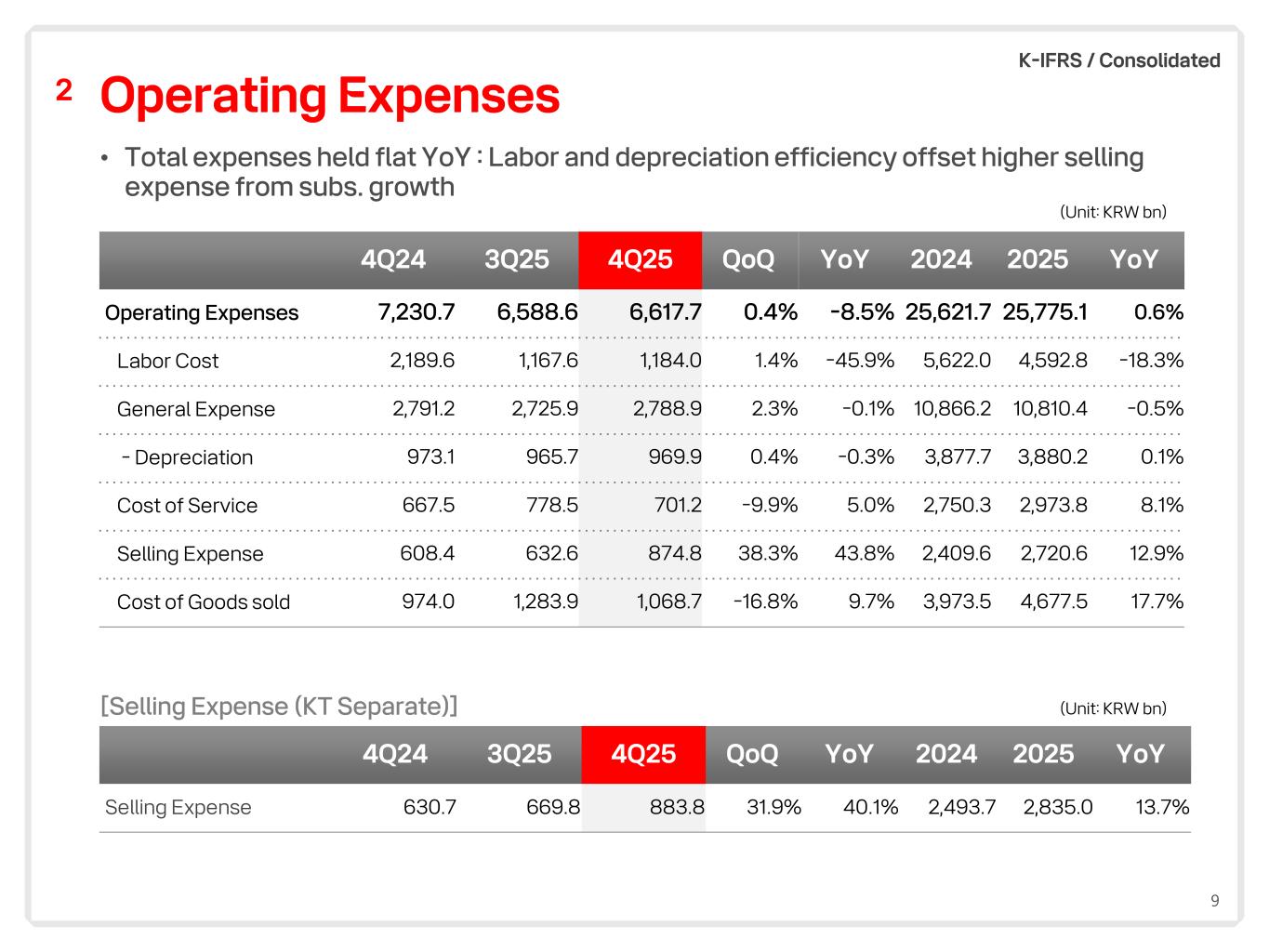

9 Operating Expenses2 (Unit: KRW bn) [Selling Expense (KT Separate)] (Unit: KRW bn) • Total expenses held flat YoY : Labor and depreciation efficiency offset higher selling expense from subs. growth K-IFRS / Consolidated 4Q24 3Q25 4Q25 QoQ YoY 2024 2025 YoY Operating Expenses 7,230.7 6,588.6 6,617.7 0.4% -8.5% 25,621.7 25,775.1 0.6% Labor Cost 2,189.6 1,167.6 1,184.0 1.4% -45.9% 5,622.0 4,592.8 -18.3% General Expense 2,791.2 2,725.9 2,788.9 2.3% -0.1% 10,866.2 10,810.4 -0.5% - Depreciation 973.1 965.7 969.9 0.4% -0.3% 3,877.7 3,880.2 0.1% Cost of Service 667.5 778.5 701.2 -9.9% 5.0% 2,750.3 2,973.8 8.1% Selling Expense 608.4 632.6 874.8 38.3% 43.8% 2,409.6 2,720.6 12.9% Cost of Goods sold 974.0 1,283.9 1,068.7 -16.8% 9.7% 3,973.5 4,677.5 17.7% 4Q24 3Q25 4Q25 QoQ YoY 2024 2025 YoY Selling Expense 630.7 669.8 883.8 31.9% 40.1% 2,493.7 2,835.0 13.7%

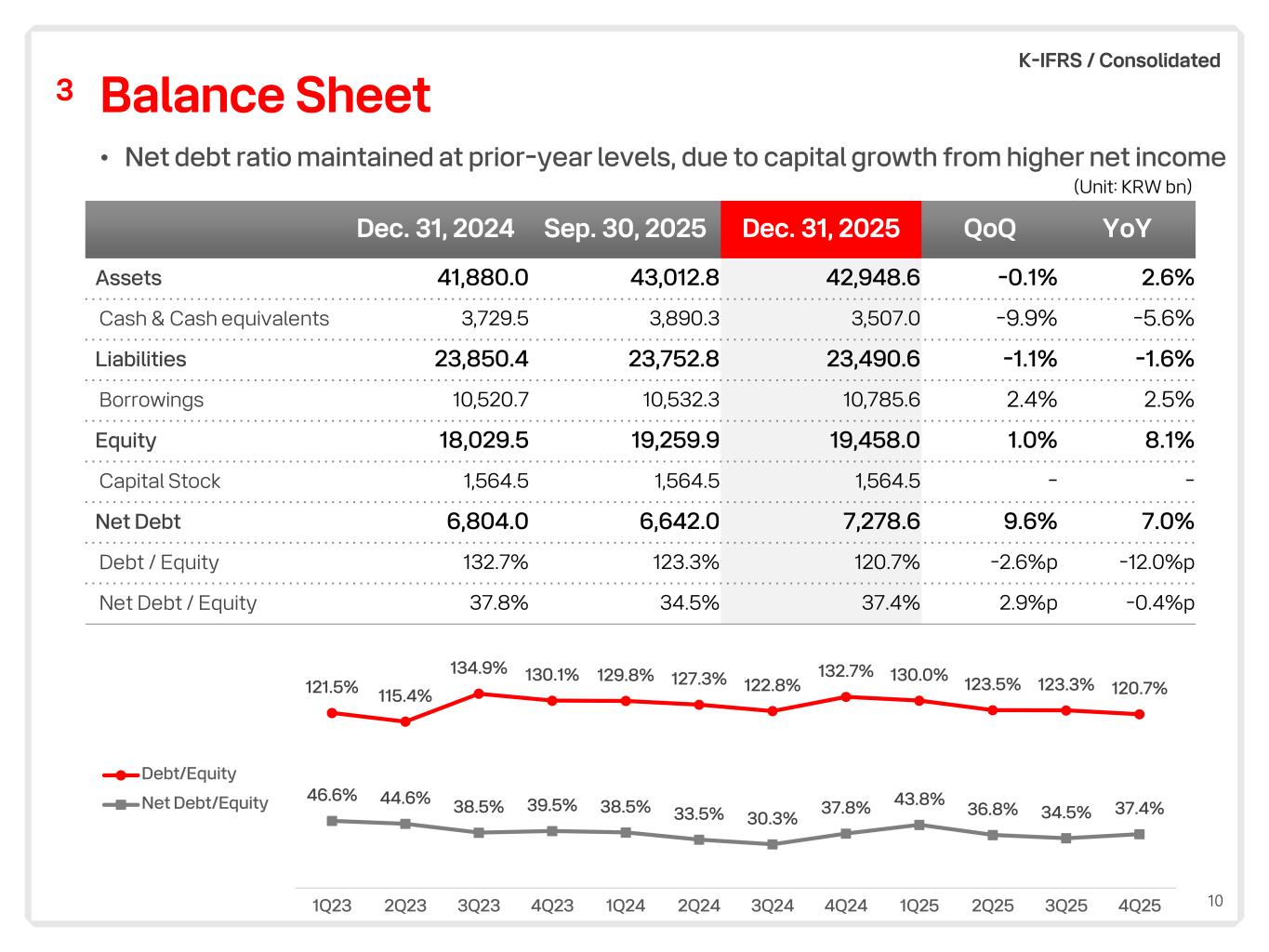

10 Balance Sheet3 • Net debt ratio maintained at prior-year levels, due to capital growth from higher net income (Unit: KRW bn) K-IFRS / Consolidated 121.5% 115.4% 134.9% 130.1% 129.8% 127.3% 122.8% 132.7% 130.0% 123.5% 123.3% 120.7% 46.6% 44.6% 38.5% 39.5% 38.5% 33.5% 30.3% 37.8% 43.8% 36.8% 34.5% 37.4% 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Debt/Equity Net Debt/Equity Dec. 31, 2024 Sep. 30, 2025 Dec. 31, 2025 QoQ YoY Assets 41,880.0 43,012.8 42,948.6 -0.1% 2.6% Cash & Cash equivalents 3,729.5 3,890.3 3,507.0 -9.9% -5.6% Liabilities 23,850.4 23,752.8 23,490.6 -1.1% -1.6% Borrowings 10,520.7 10,532.3 10,785.6 2.4% 2.5% Equity 18,029.5 19,259.9 19,458.0 1.0% 8.1% Capital Stock 1,564.5 1,564.5 1,564.5 - - Net Debt 6,804.0 6,642.0 7,278.6 9.6% 7.0% Debt / Equity 132.7% 123.3% 120.7% -2.6%p -12.0%p Net Debt / Equity 37.8% 34.5% 37.4% 2.9%p -0.4%p

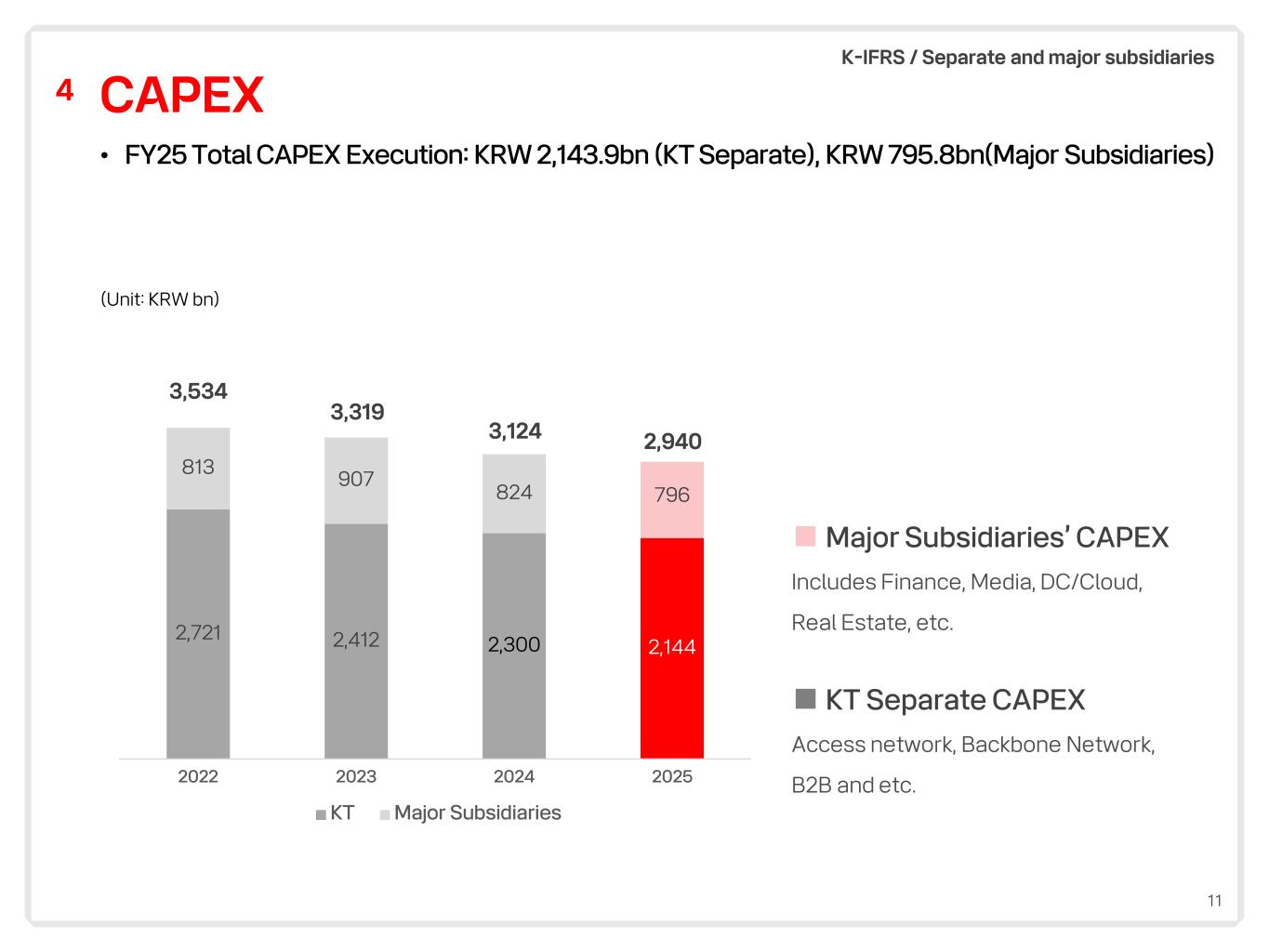

11 CAPEX4 ■ Major Subsidiaries’ CAPEX Includes Finance, Media, DC/Cloud, Real Estate, etc. ■ KT Separate CAPEX Access network, Backbone Network, B2B and etc. K-IFRS / Separate and major subsidiaries (Unit: KRW bn) • FY25 Total CAPEX Execution: KRW 2,143.9bn (KT Separate), KRW 795.8bn(Major Subsidiaries) 3,534 3,319 3,124 2,940 2,721 2,412 2,300 2,144 813 907 824 796 2022 2023 2024 2025 KT Major Subsidiaries

1 2025 Highlights 2 Financial Highlights 3 Business Overview 4 Appendix Contents

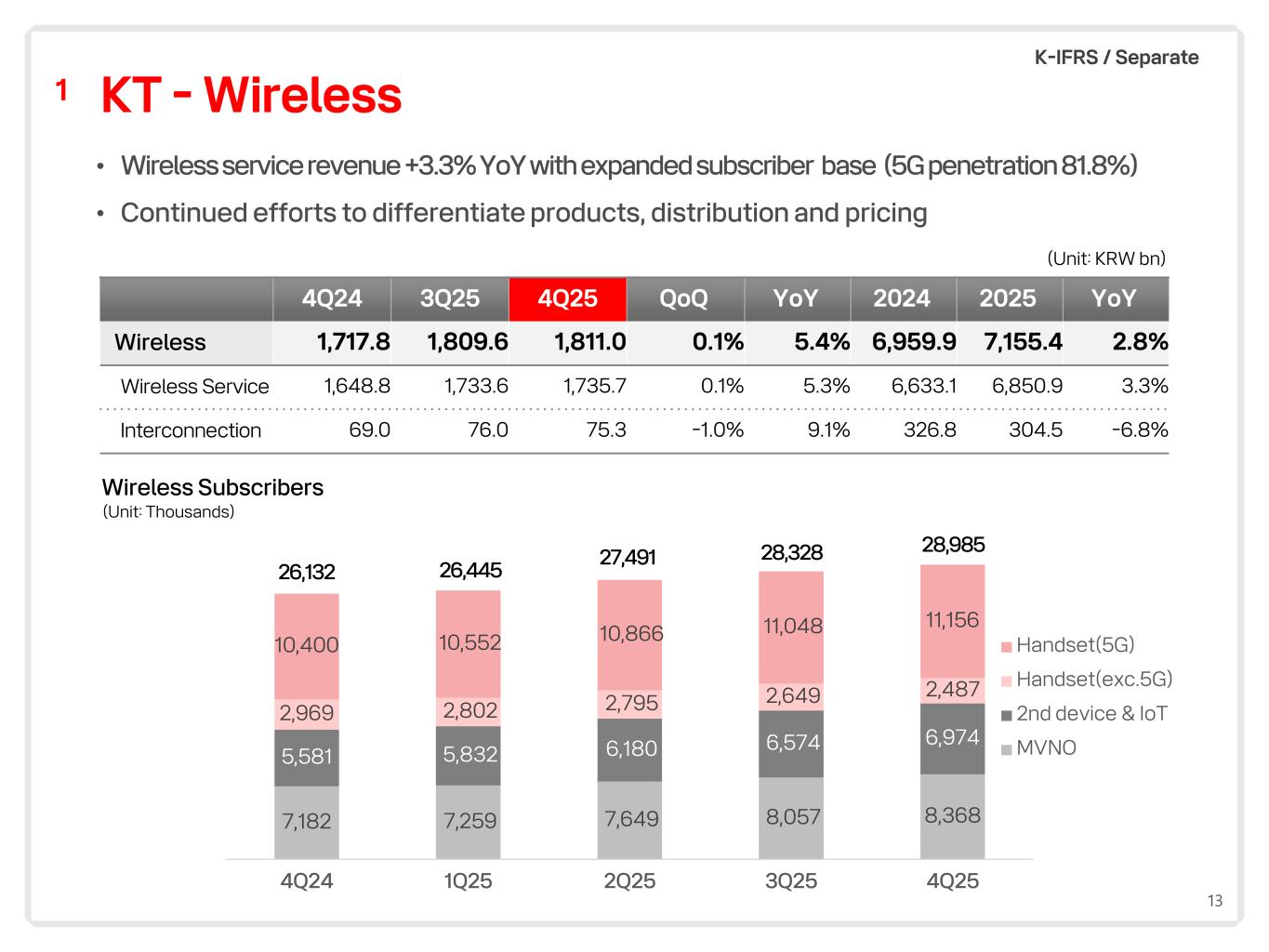

13 KT - Wireless • Wireless service revenue +3.3% YoY with expanded subscriber base (5G penetration 81.8%) • Continued efforts to differentiate products, distribution and pricing 1 (Unit: KRW bn) 4Q24 3Q25 4Q25 QoQ YoY 2024 2025 YoY Wireless 1,717.8 1,809.6 1,811.0 0.1% 5.4% 6,959.9 7,155.4 2.8% Wireless Service 1,648.8 1,733.6 1,735.7 0.1% 5.3% 6,633.1 6,850.9 3.3% Interconnection 69.0 76.0 75.3 -1.0% 9.1% 326.8 304.5 -6.8% Wireless Subscribers (Unit: Thousands) K-IFRS / Separate 7,182 7,259 7,649 8,057 8,368 5,581 5,832 6,180 6,574 6,974 2,969 2,802 2,795 2,649 2,487 10,400 10,552 10,866 11,048 11,156 4Q24 1Q25 2Q25 3Q25 4Q25 Handset(5G) Handset(exc.5G) 2nd device & IoT MVNO 26,132 26,445 27,491 28,328 28,985

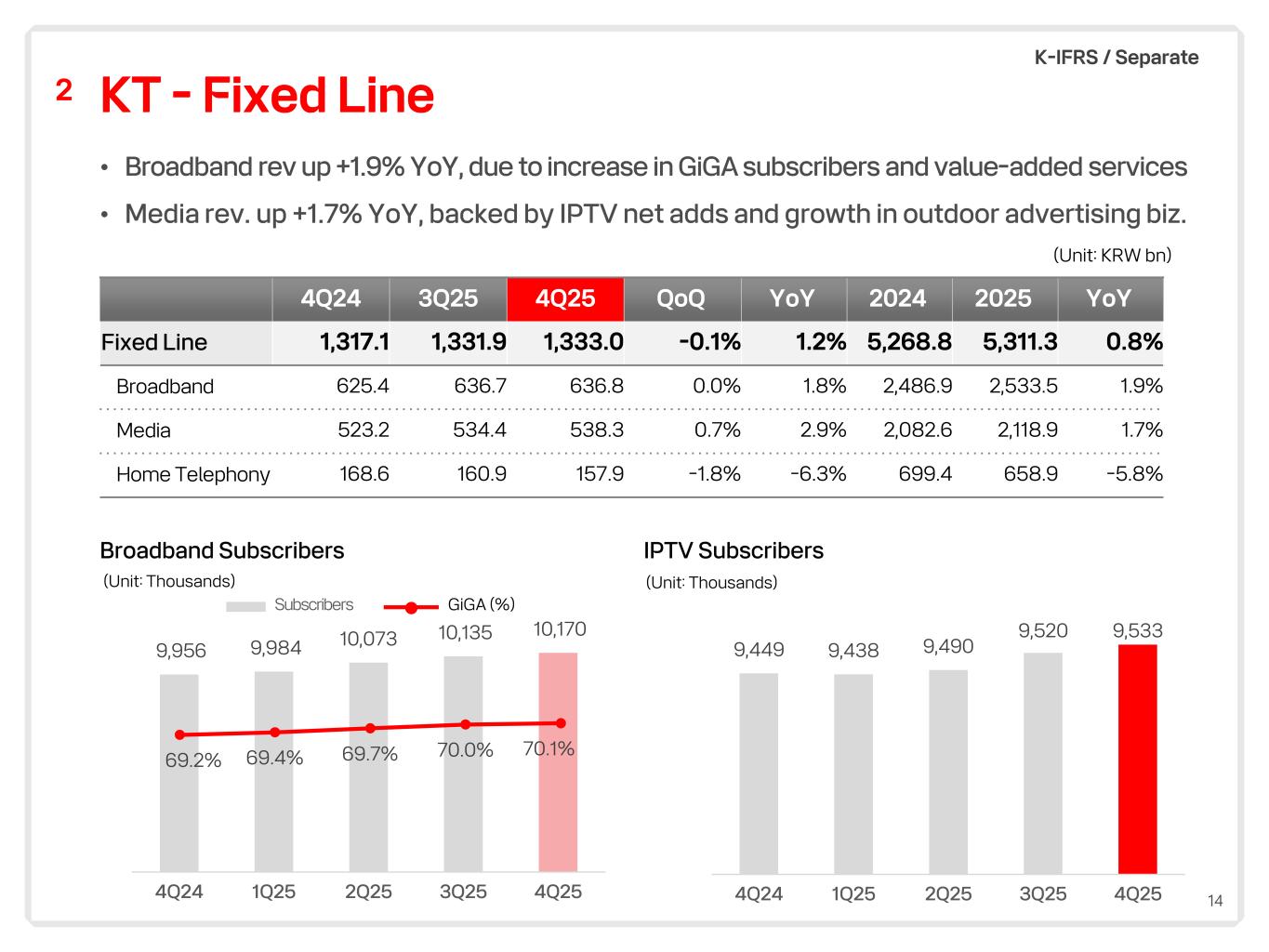

14 KT - Fixed Line • Broadband rev up +1.9% YoY, due to increase in GiGA subscribers and value-added services • Media rev. up +1.7% YoY, backed by IPTV net adds and growth in outdoor advertising biz. 2 (Unit: Thousands) Broadband Subscribers (Unit: Thousands) IPTV Subscribers 4Q24 3Q25 4Q25 QoQ YoY 2024 2025 YoY Fixed Line 1,317.1 1,331.9 1,333.0 -0.1% 1.2% 5,268.8 5,311.3 0.8% Broadband 625.4 636.7 636.8 0.0% 1.8% 2,486.9 2,533.5 1.9% Media 523.2 534.4 538.3 0.7% 2.9% 2,082.6 2,118.9 1.7% Home Telephony 168.6 160.9 157.9 -1.8% -6.3% 699.4 658.9 -5.8% Subscribers GiGA (%) (Unit: KRW bn) K-IFRS / Separate 9,956 9,984 10,073 10,135 10,170 4Q24 1Q25 2Q25 3Q25 4Q25 69.2% 69.4% 69.7% 70.0% 70.1% 9,449 9,438 9,490 9,520 9,533 4Q24 1Q25 2Q25 3Q25 4Q25

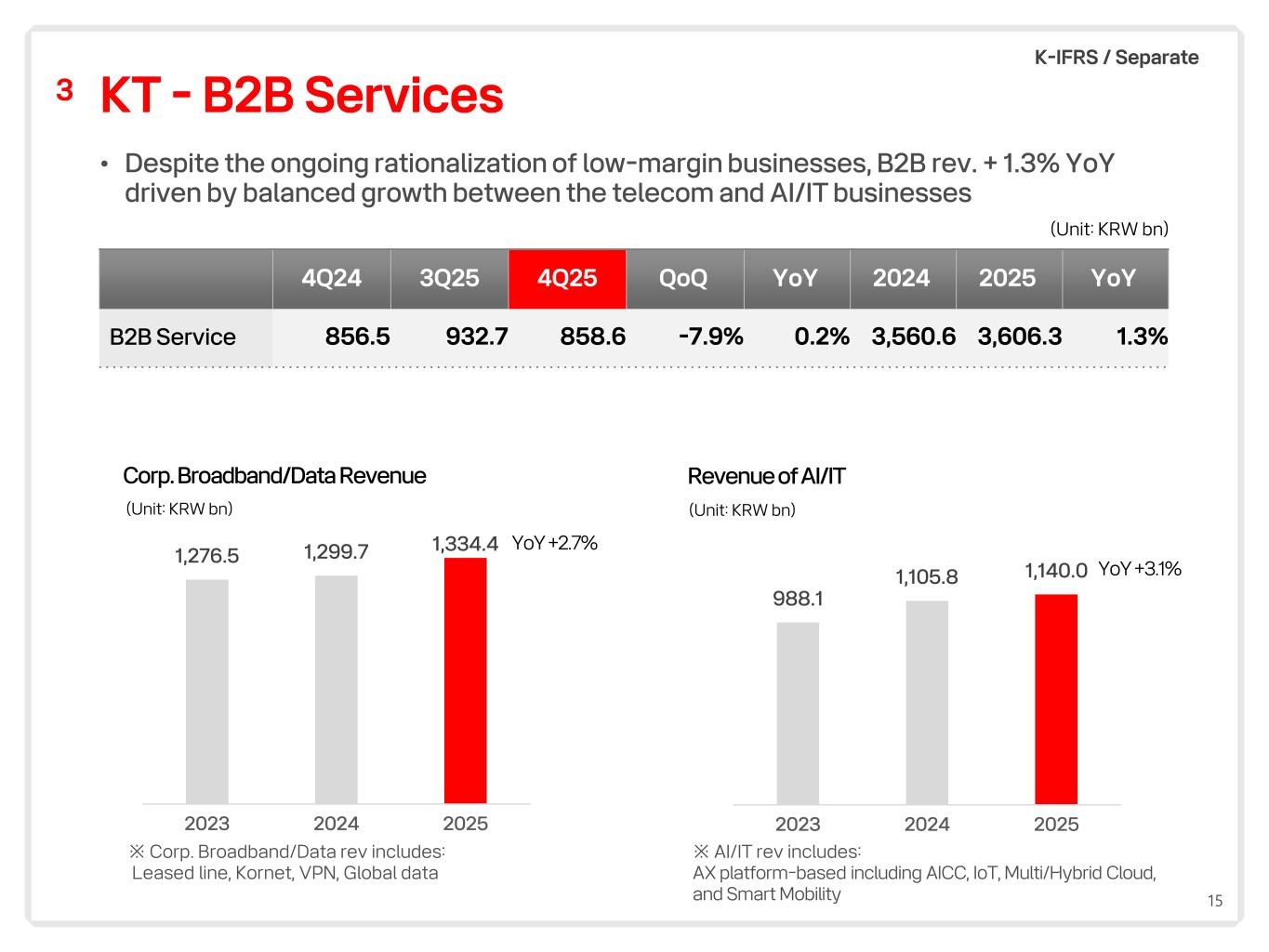

15 KT - B2B Services3 (Unit: KRW bn) Corp.Broadband/Data Revenue Revenue of AI/IT ※ AI/IT rev includes: AX platform-based including AICC, IoT, Multi/Hybrid Cloud, and Smart Mobility 4Q24 3Q25 4Q25 QoQ YoY 2024 2025 YoY B2B Service 856.5 932.7 858.6 -7.9% 0.2% 3,560.6 3,606.3 1.3% (Unit: KRW bn) (Unit: KRW bn) ※ Corp. Broadband/Data rev includes: Leased line, Kornet, VPN, Global data K-IFRS / Separate • Despite the ongoing rationalization of low-margin businesses, B2B rev. + 1.3% YoY driven by balanced growth between the telecom and AI/IT businesses YoY +3.1% YoY +2.7% 1,276.5 1,299.7 1,334.4 2023 2024 2025 988.1 1,105.8 1,140.0 2023 2024 2025

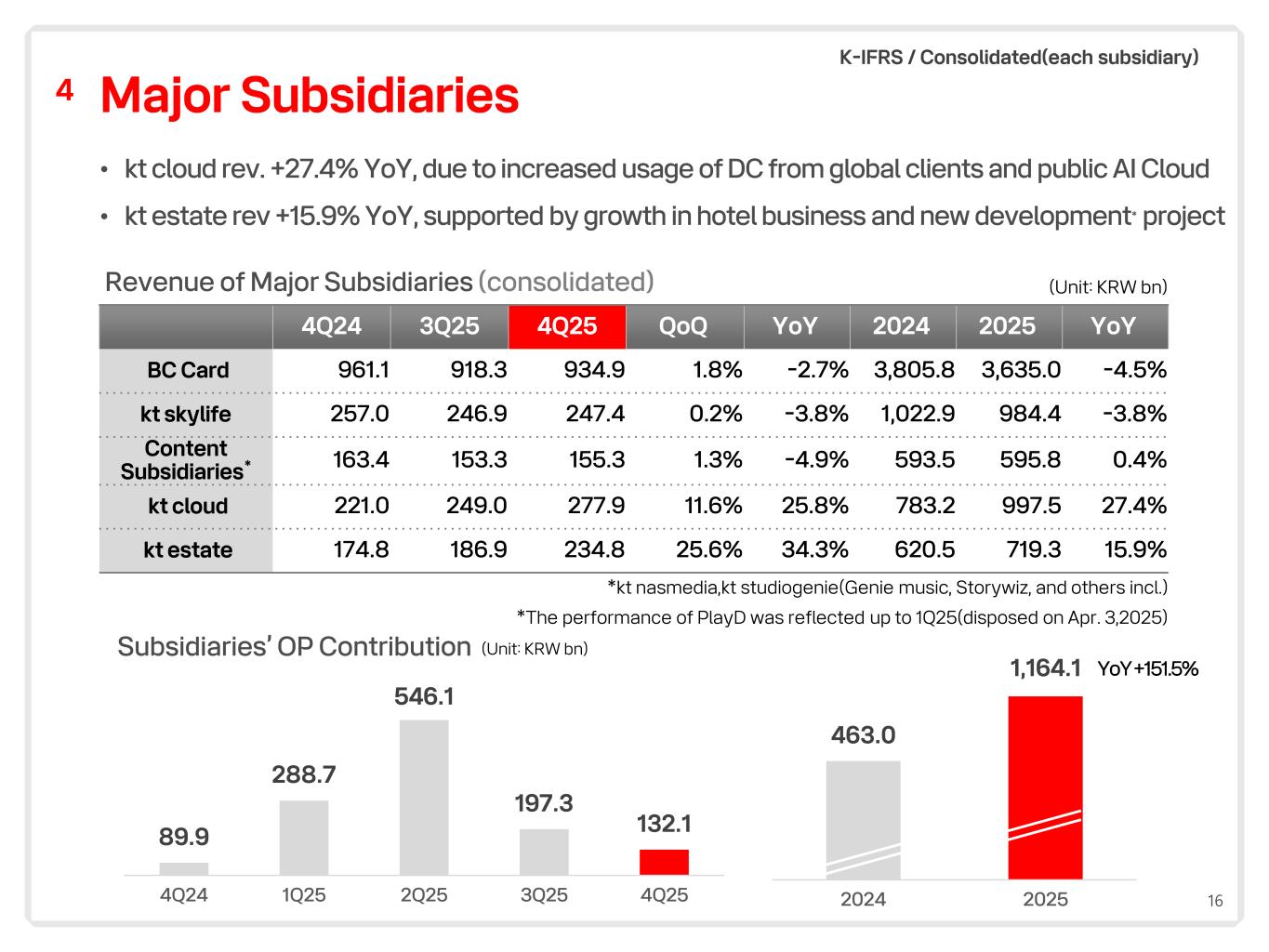

16 Major Subsidiaries4 • kt cloud rev. +27.4% YoY, due to increased usage of DC from global clients and public AI Cloud • kt estate rev +15.9% YoY, supported by growth in hotel business and new development* project Revenue of Major Subsidiaries (consolidated) 4Q24 3Q25 4Q25 QoQ YoY 2024 2025 YoY BC Card 961.1 918.3 934.9 1.8% -2.7% 3,805.8 3,635.0 -4.5% kt skylife 257.0 246.9 247.4 0.2% -3.8% 1,022.9 984.4 -3.8% Content Subsidiaries* 163.4 153.3 155.3 1.3% -4.9% 593.5 595.8 0.4% kt cloud 221.0 249.0 277.9 11.6% 25.8% 783.2 997.5 27.4% kt estate 174.8 186.9 234.8 25.6% 34.3% 620.5 719.3 15.9% *kt nasmedia,kt studiogenie(Genie music, Storywiz, and others incl.) *The performance of PlayD was reflected up to 1Q25(disposed on Apr. 3,2025) Subsidiaries’ OP Contribution (Unit: KRW bn) K-IFRS / Consolidated(each subsidiary) (Unit: KRW bn) 89.9 288.7 546.1 197.3 132.1 4Q24 1Q25 2Q25 3Q25 4Q25 463.0 1,164.1 2024 2025 YoY +151.5%

1 2025 Highlights 2 Financial Highlights 3 Business Overview 4 Appendix Contents

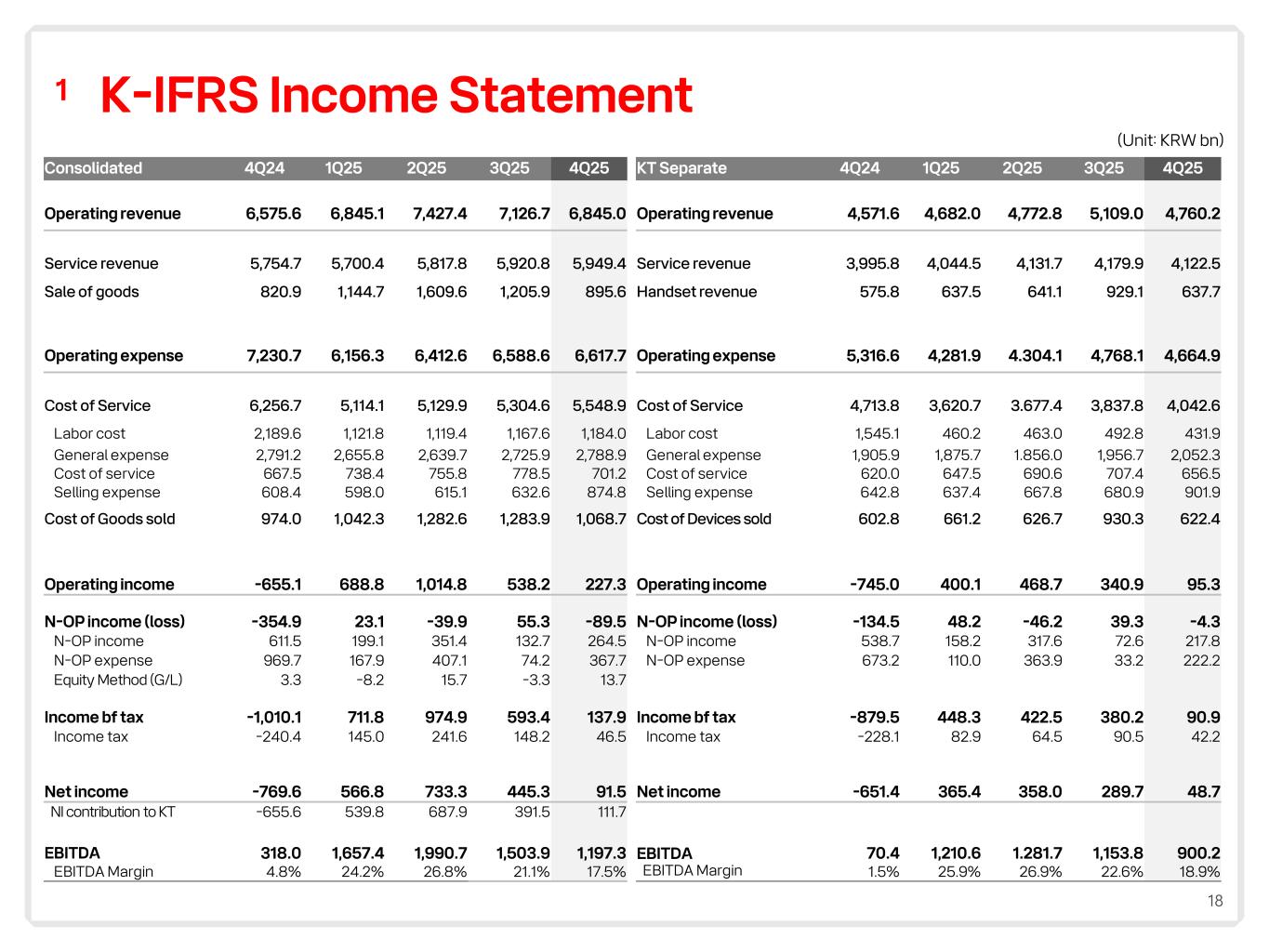

18 K-IFRS Income Statement1 (Unit: KRW bn) Consolidated 4Q24 1Q25 2Q25 3Q25 4Q25 KT Separate 4Q24 1Q25 2Q25 3Q25 4Q25 Operating revenue 6,575.6 6,845.1 7,427.4 7,126.7 6,845.0 Operating revenue 4,571.6 4,682.0 4,772.8 5,109.0 4,760.2 Service revenue 5,754.7 5,700.4 5,817.8 5,920.8 5,949.4 Service revenue 3,995.8 4,044.5 4,131.7 4,179.9 4,122.5 Sale of goods 820.9 1,144.7 1,609.6 1,205.9 895.6 Handset revenue 575.8 637.5 641.1 929.1 637.7 Operating expense 7,230.7 6,156.3 6,412.6 6,588.6 6,617.7 Operating expense 5,316.6 4,281.9 4.304.1 4,768.1 4,664.9 Cost of Service 6,256.7 5,114.1 5,129.9 5,304.6 5,548.9 Cost of Service 4,713.8 3,620.7 3.677.4 3,837.8 4,042.6 Labor cost 2,189.6 1,121.8 1,119.4 1,167.6 1,184.0 Labor cost 1,545.1 460.2 463.0 492.8 431.9 General expense 2,791.2 2,655.8 2,639.7 2,725.9 2,788.9 General expense 1,905.9 1,875.7 1.856.0 1,956.7 2,052.3 Cost of service 667.5 738.4 755.8 778.5 701.2 Cost of service 620.0 647.5 690.6 707.4 656.5 Selling expense 608.4 598.0 615.1 632.6 874.8 Selling expense 642.8 637.4 667.8 680.9 901.9 Cost of Goods sold 974.0 1,042.3 1,282.6 1,283.9 1,068.7 Cost of Devices sold 602.8 661.2 626.7 930.3 622.4 Operating income -655.1 688.8 1,014.8 538.2 227.3 Operating income -745.0 400.1 468.7 340.9 95.3 N-OP income (loss) -354.9 23.1 -39.9 55.3 -89.5 N-OP income (loss) -134.5 48.2 -46.2 39.3 -4.3 N-OP income 611.5 199.1 351.4 132.7 264.5 N-OP income 538.7 158.2 317.6 72.6 217.8 N-OP expense 969.7 167.9 407.1 74.2 367.7 N-OP expense 673.2 110.0 363.9 33.2 222.2 Equity Method (G/L) 3.3 -8.2 15.7 -3.3 13.7 Income bf tax -1,010.1 711.8 974.9 593.4 137.9 Income bf tax -879.5 448.3 422.5 380.2 90.9 Income tax -240.4 145.0 241.6 148.2 46.5 Income tax -228.1 82.9 64.5 90.5 42.2 Net income -769.6 566.8 733.3 445.3 91.5 Net income -651.4 365.4 358.0 289.7 48.7 NI contribution to KT -655.6 539.8 687.9 391.5 111.7 EBITDA 318.0 1,657.4 1,990.7 1,503.9 1,197.3 EBITDA EBITDA Margin 70.4 1,210.6 1.281.7 1,153.8 900.2 EBITDA Margin 4.8% 24.2% 26.8% 21.1% 17.5% 1.5% 25.9% 26.9% 22.6% 18.9%

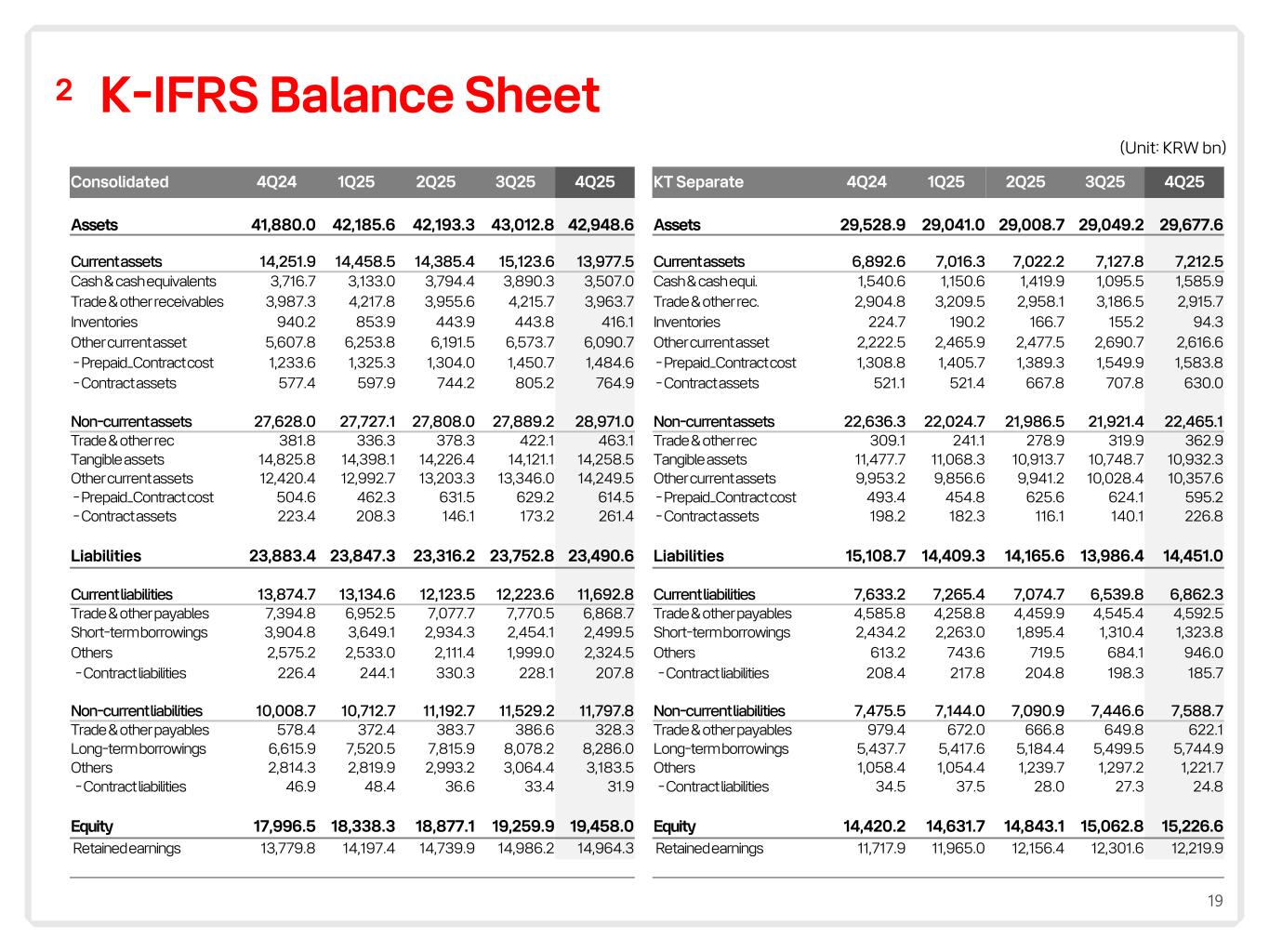

19 K-IFRS Balance Sheet2 Consolidated 4Q24 1Q25 2Q25 3Q25 4Q25 KT Separate 4Q24 1Q25 2Q25 3Q25 4Q25 Assets 41,880.0 42,185.6 42,193.3 43,012.8 42,948.6 Assets 29,528.9 29,041.0 29,008.7 29,049.2 29,677.6 Current assets 14,251.9 14,458.5 14,385.4 15,123.6 13,977.5 Current assets 6,892.6 7,016.3 7,022.2 7,127.8 7,212.5 Cash & cash equivalents 3,716.7 3,133.0 3,794.4 3,890.3 3,507.0 Cash & cash equi. 1,540.6 1,150.6 1,419.9 1,095.5 1,585.9 Trade & other receivables 3,987.3 4,217.8 3,955.6 4,215.7 3,963.7 Trade & other rec. 2,904.8 3,209.5 2,958.1 3,186.5 2,915.7 Inventories 940.2 853.9 443.9 443.8 416.1 Inventories 224.7 190.2 166.7 155.2 94.3 Other current asset 5,607.8 6,253.8 6,191.5 6,573.7 6,090.7 Other current asset 2,222.5 2,465.9 2,477.5 2,690.7 2,616.6 - Prepaid_Contract cost 1,233.6 1,325.3 1,304.0 1,450.7 1,484.6 - Prepaid_Contract cost 1,308.8 1,405.7 1,389.3 1,549.9 1,583.8 - Contract assets 577.4 597.9 744.2 805.2 764.9 - Contract assets 521.1 521.4 667.8 707.8 630.0 Non-current assets 27,628.0 27,727.1 27,808.0 27,889.2 28,971.0 Non-current assets 22,636.3 22,024.7 21,986.5 21,921.4 22,465.1 Trade & other rec 381.8 336.3 378.3 422.1 463.1 Trade & other rec 309.1 241.1 278.9 319.9 362.9 Tangible assets 14,825.8 14,398.1 14,226.4 14,121.1 14,258.5 Tangible assets 11,477.7 11,068.3 10,913.7 10,748.7 10,932.3 Other current assets 12,420.4 12,992.7 13,203.3 13,346.0 14,249.5 Other current assets 9,953.2 9,856.6 9,941.2 10,028.4 10,357.6 - Prepaid_Contract cost 504.6 462.3 631.5 629.2 614.5 - Prepaid_Contract cost 493.4 454.8 625.6 624.1 595.2 - Contract assets 223.4 208.3 146.1 173.2 261.4 - Contract assets 198.2 182.3 116.1 140.1 226.8 Liabilities 23,883.4 23,847.3 23,316.2 23,752.8 23,490.6 Liabilities 15,108.7 14,409.3 14,165.6 13,986.4 14,451.0 Current liabilities 13,874.7 13,134.6 12,123.5 12,223.6 11,692.8 Current liabilities 7,633.2 7,265.4 7,074.7 6,539.8 6,862.3 Trade & other payables 7,394.8 6,952.5 7,077.7 7,770.5 6,868.7 Trade & other payables 4,585.8 4,258.8 4,459.9 4,545.4 4,592.5 Short-term borrowings 3,904.8 3,649.1 2,934.3 2,454.1 2,499.5 Short-term borrowings 2,434.2 2,263.0 1,895.4 1,310.4 1,323.8 Others 2,575.2 2,533.0 2,111.4 1,999.0 2,324.5 Others 613.2 743.6 719.5 684.1 946.0 - Contract liabilities 226.4 244.1 330.3 228.1 207.8 - Contract liabilities 208.4 217.8 204.8 198.3 185.7 Non-current liabilities 10,008.7 10,712.7 11,192.7 11,529.2 11,797.8 Non-current liabilities 7,475.5 7,144.0 7,090.9 7,446.6 7,588.7 Trade & other payables 578.4 372.4 383.7 386.6 328.3 Trade & other payables 979.4 672.0 666.8 649.8 622.1 Long-term borrowings 6,615.9 7,520.5 7,815.9 8,078.2 8,286.0 Long-term borrowings 5,437.7 5,417.6 5,184.4 5,499.5 5,744.9 Others 2,814.3 2,819.9 2,993.2 3,064.4 3,183.5 Others 1,058.4 1,054.4 1,239.7 1,297.2 1,221.7 - Contract liabilities 46.9 48.4 36.6 33.4 31.9 - Contract liabilities 34.5 37.5 28.0 27.3 24.8 Equity 17,996.5 18,338.3 18,877.1 19,259.9 19,458.0 Equity 14,420.2 14,631.7 14,843.1 15,062.8 15,226.6 Retained earnings 13,779.8 14,197.4 14,739.9 14,986.2 14,964.3 Retained earnings 11,717.9 11,965.0 12,156.4 12,301.6 12,219.9 (Unit: KRW bn)

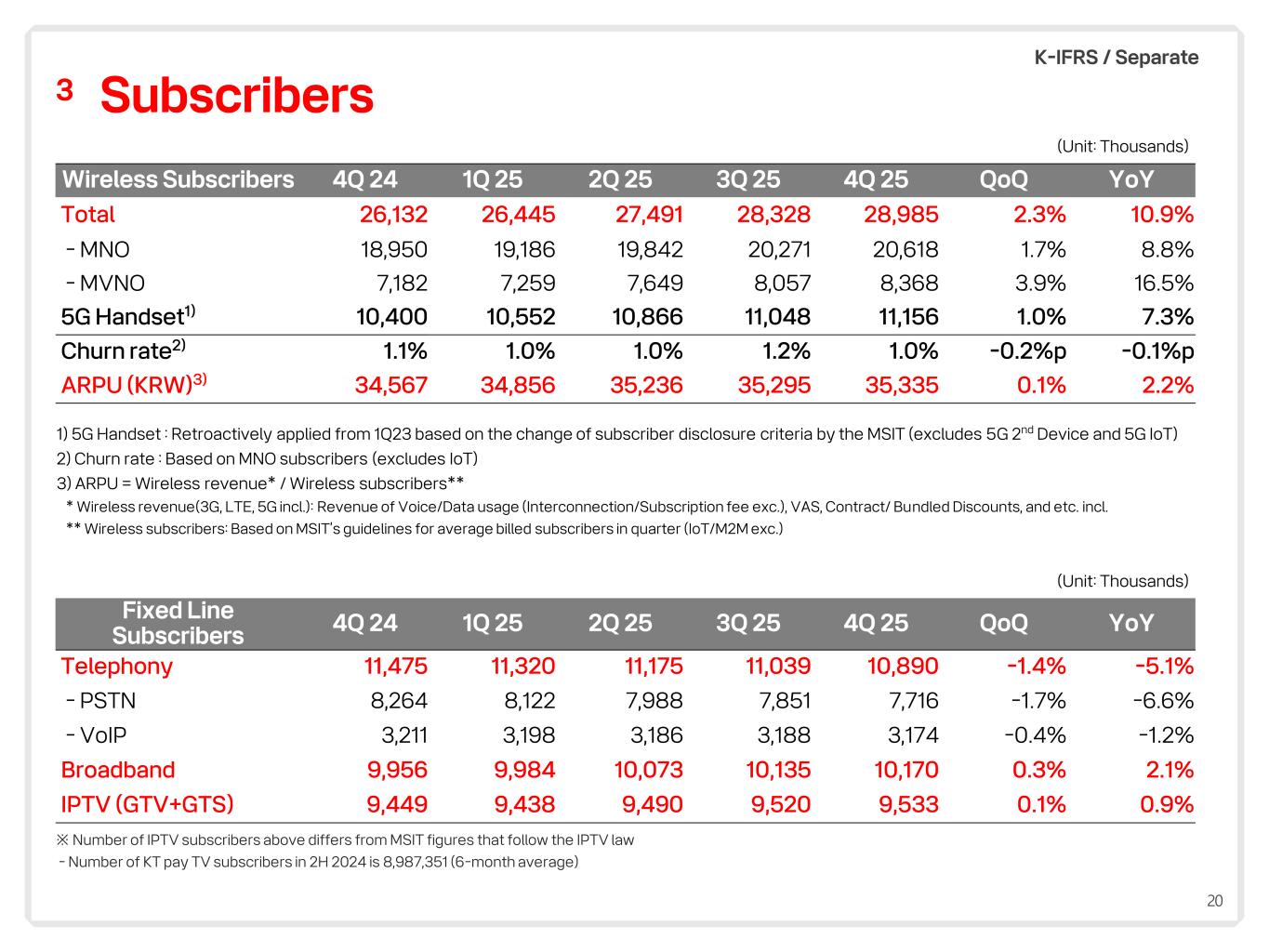

20 Subscribers3 Wireless Subscribers 4Q 24 1Q 25 2Q 25 3Q 25 4Q 25 QoQ YoY Total 26,132 26,445 27,491 28,328 28,985 2.3% 10.9% - MNO 18,950 19,186 19,842 20,271 20,618 1.7% 8.8% - MVNO 7,182 7,259 7,649 8,057 8,368 3.9% 16.5% 5G Handset1) 10,400 10,552 10,866 11,048 11,156 1.0% 7.3% Churn rate2) 1.1% 1.0% 1.0% 1.2% 1.0% -0.2%p -0.1%p ARPU (KRW)3) 34,567 34,856 35,236 35,295 35,335 0.1% 2.2% 1) 5G Handset : Retroactively applied from 1Q23 based on the change of subscriber disclosure criteria by the MSIT (excludes 5G 2nd Device and 5G IoT) 2) Churn rate : Based on MNO subscribers (excludes IoT) 3) ARPU = Wireless revenue* / Wireless subscribers** * Wireless revenue(3G, LTE, 5G incl.): Revenue of Voice/Data usage (Interconnection/Subscription fee exc.), VAS, Contract/ Bundled Discounts, and etc. incl. ** Wireless subscribers: Based on MSIT’s guidelines for average billed subscribers in quarter (IoT/M2M exc.) Fixed Line Subscribers 4Q 24 1Q 25 2Q 25 3Q 25 4Q 25 QoQ YoY Telephony 11,475 11,320 11,175 11,039 10,890 -1.4% -5.1% - PSTN 8,264 8,122 7,988 7,851 7,716 -1.7% -6.6% - VoIP 3,211 3,198 3,186 3,188 3,174 -0.4% -1.2% Broadband 9,956 9,984 10,073 10,135 10,170 0.3% 2.1% IPTV (GTV+GTS) 9,449 9,438 9,490 9,520 9,533 0.1% 0.9% (Unit: Thousands) K-IFRS / Separate (Unit: Thousands) ※ Number of IPTV subscribers above differs from MSIT figures that follow the IPTV law - Number of KT pay TV subscribers in 2H 2024 is 8,987,351 (6-month average)