The Integrated Firm: Executing on a Higher Plane Ted Pick, Chairman and Chief Executive Officer January 15, 2026

2 The information provided herein includes certain non-GAAP financial measures. The definition of such measures and/or the reconciliation of such measures to the comparable U.S. GAAP figures are included in this presentation, or in Morgan Stanley's (the ‘Company’) Annual Report on Form 10-K, Definitive Proxy Statement, Quarterly Reports on Form 10-Q and the Company’s Current Reports on Form 8-K, as applicable, including any amendments thereto, which are available on www.morganstanley.com. This presentation may contain forward-looking statements including the attainment of certain financial and other targets, and objectives and goals. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made, which reflect management’s current estimates, projections, expectations, assumptions, interpretation or beliefs and which are subject to risks and uncertainties that may cause actual results to differ materially. The Company does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of forward-looking statements. For a discussion of risks and uncertainties that may affect the future results of the Company, please see the Company’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as applicable, which are available on www.morganstanley.com. This presentation is not an offer to buy or sell any security. The End Notes are an integral part of this presentation. See Slides 17 – 20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation. For information and impact of the Company’s acquisitions, please refer to prior period filings of the Company’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. Please note this presentation is available at www.morganstanley.com. Notice

3 The End Notes are an integral part of this Presentation. See slides 17-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation. Trusted Advisor Franchise: Scale, Earnings and Returns 21.6% ROTCE $9.3Tn Total Client Assets $10.21 Earnings per Share

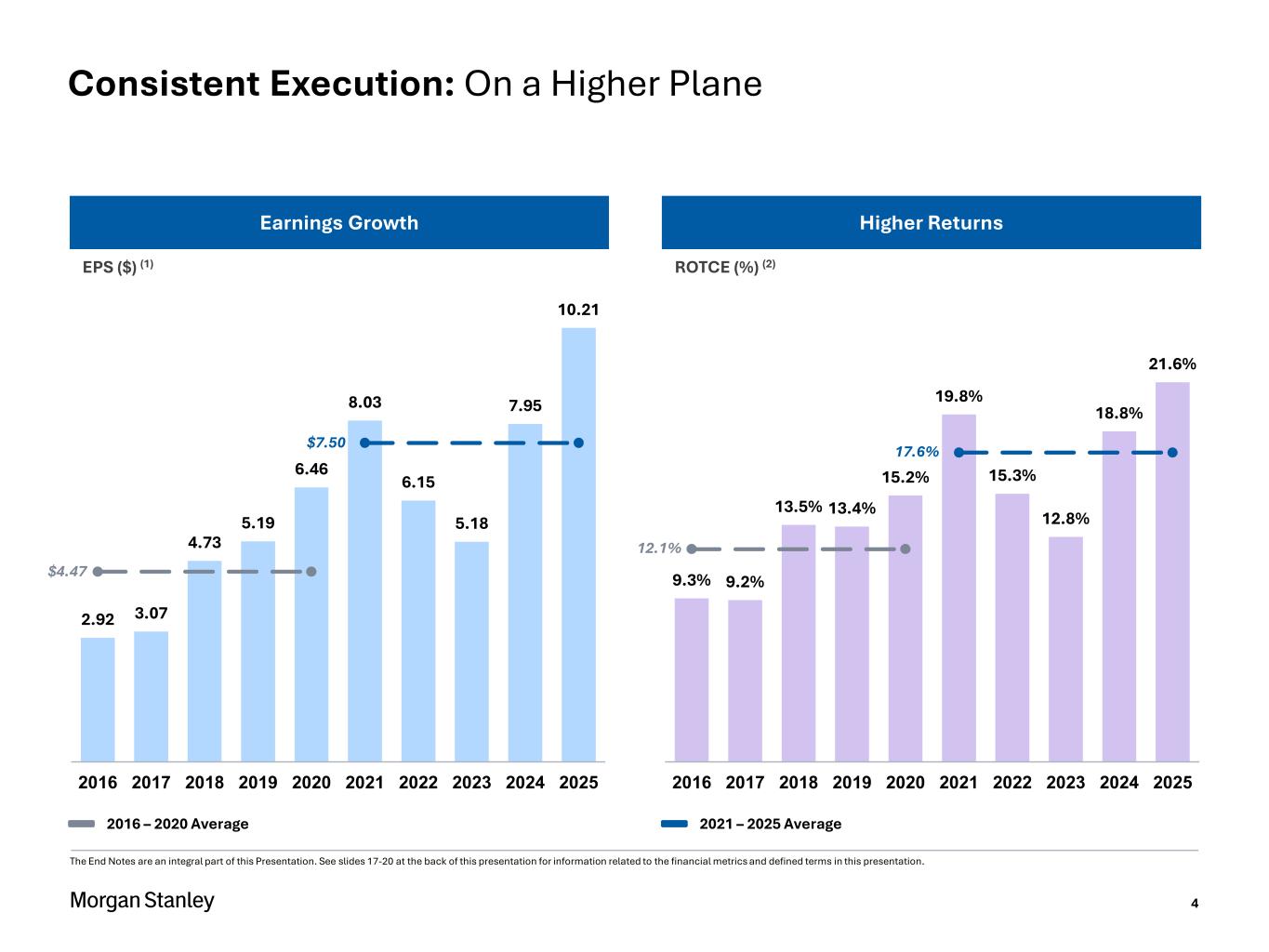

4 2.92 3.07 4.73 5.19 6.46 8.03 6.15 5.18 7.95 10.21 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Earnings Growth EPS ($) (1) $7.50 $4.47 2016 – 2020 Average 2021 – 2025 Average Consistent Execution: On a Higher Plane 9.3% 9.2% 13.5% 13.4% 15.2% 19.8% 15.3% 12.8% 18.8% 21.6% 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Higher Returns ROTCE (%) (2) 17.6% 12.1% The End Notes are an integral part of this Presentation. See slides 17-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation.

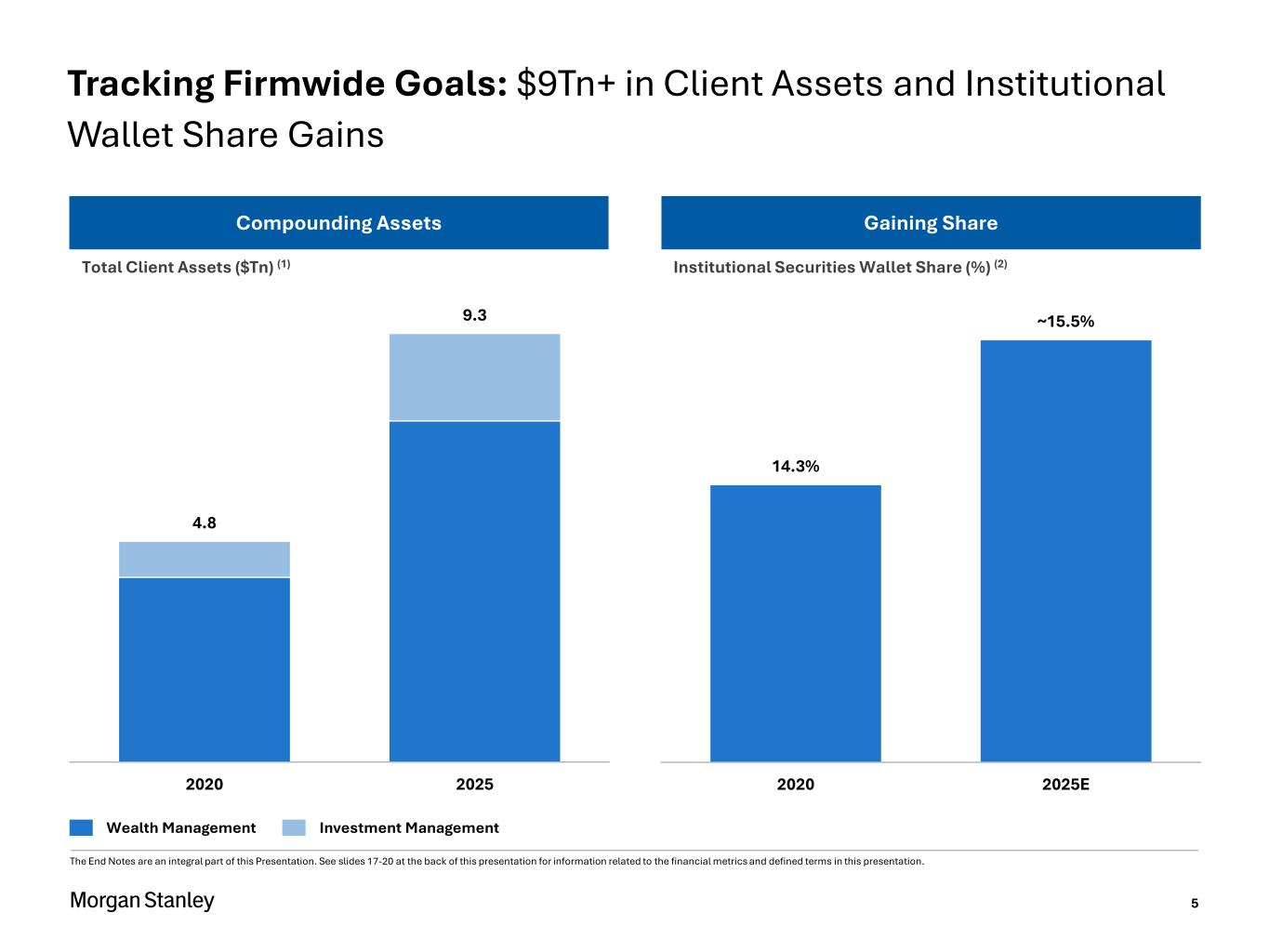

5 14.3% ~15.5% 2020 2025E 4.8 9.3 2020 2025 Wealth Management Investment Management Tracking Firmwide Goals: $9Tn+ in Client Assets and Institutional Wallet Share Gains Institutional Securities Wallet Share (%) (2) Gaining ShareCompounding Assets Total Client Assets ($Tn) (1) The End Notes are an integral part of this Presentation. See slides 17-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation.

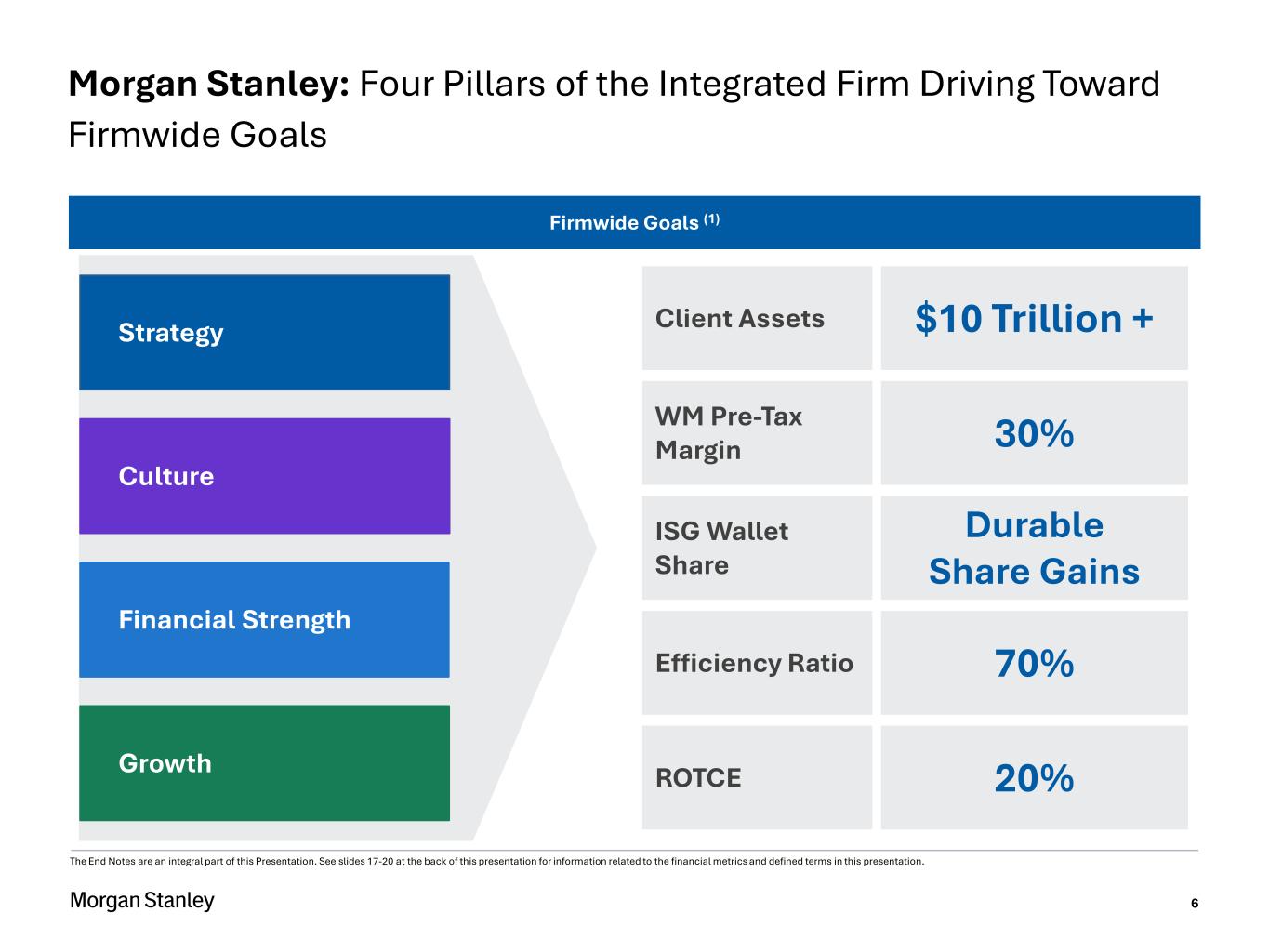

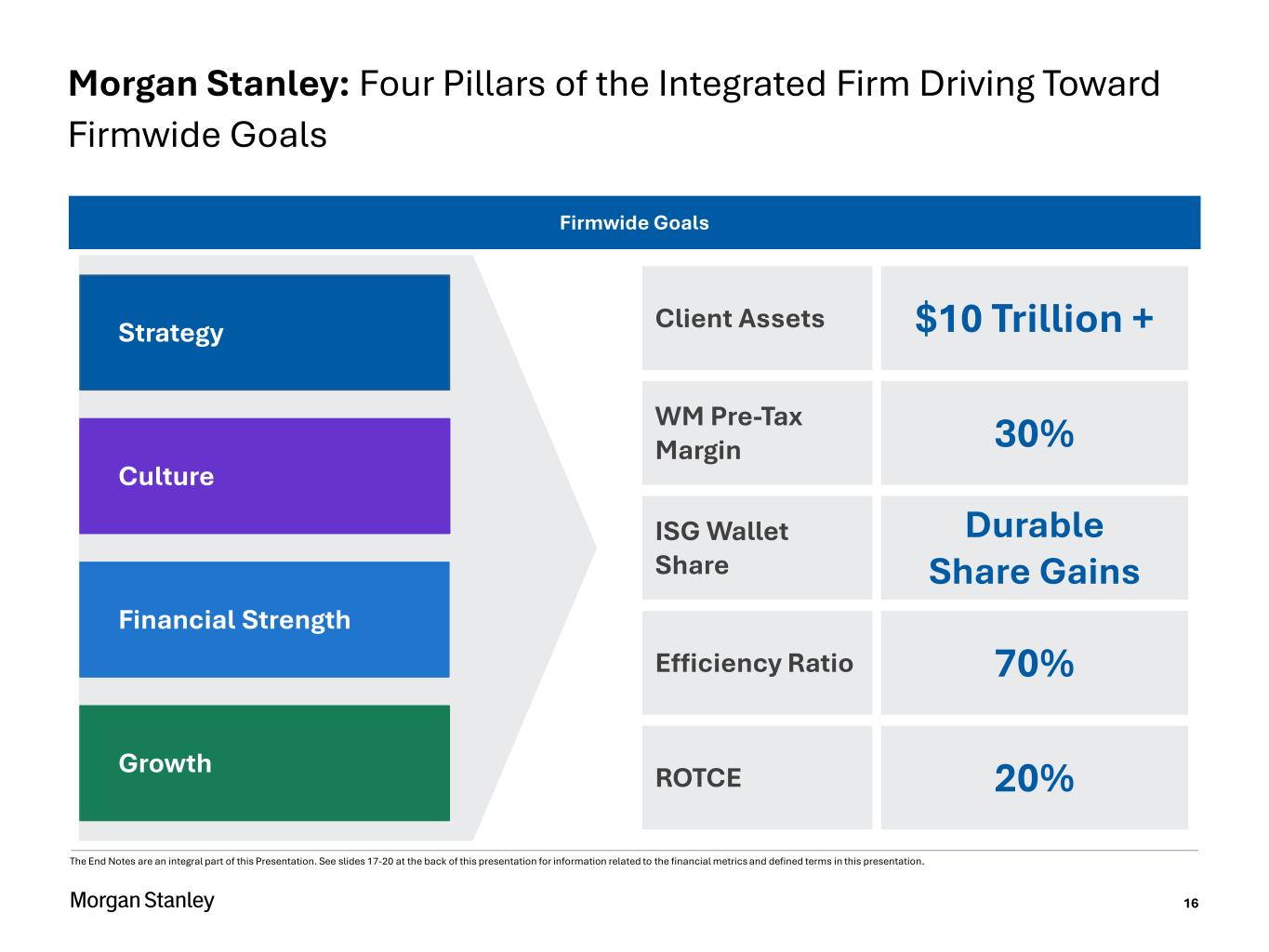

6 Strategy Culture Financial Strength Growth ISG Wallet Share Durable Share Gains WM Pre-Tax Margin 30% Client Assets $10 Trillion + ROTCE 20% Efficiency Ratio 70% Morgan Stanley: Four Pillars of the Integrated Firm Driving Toward Firmwide Goals Firmwide Goals (1) The End Notes are an integral part of this Presentation. See slides 17-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation.

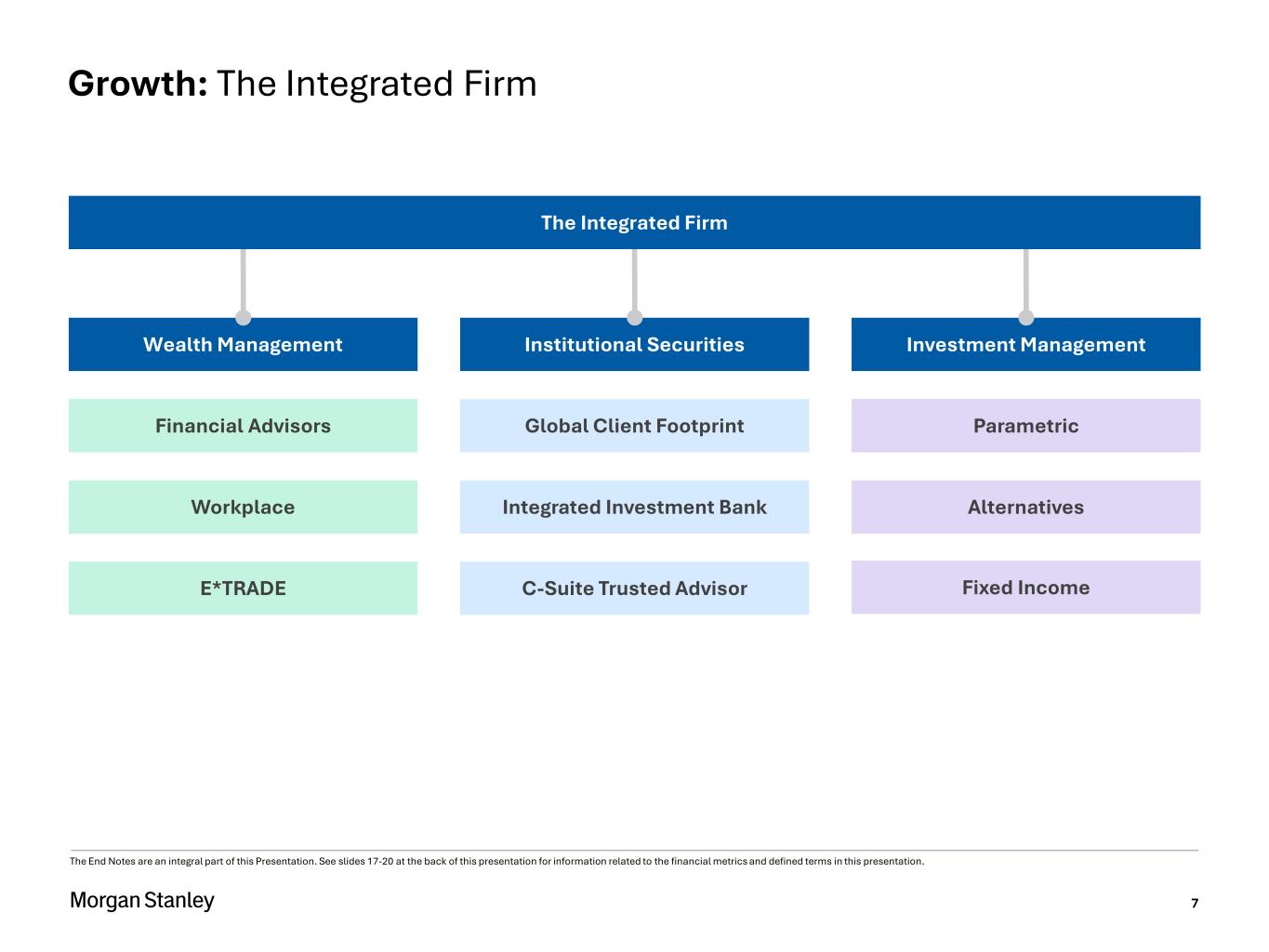

7 Institutional SecuritiesWealth Management Investment Management Growth: The Integrated Firm Global Client Footprint Integrated Investment Bank C-Suite Trusted AdvisorE*TRADE Workplace Financial Advisors Parametric Alternatives Fixed Income The Integrated Firm The End Notes are an integral part of this Presentation. See slides 17-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation.

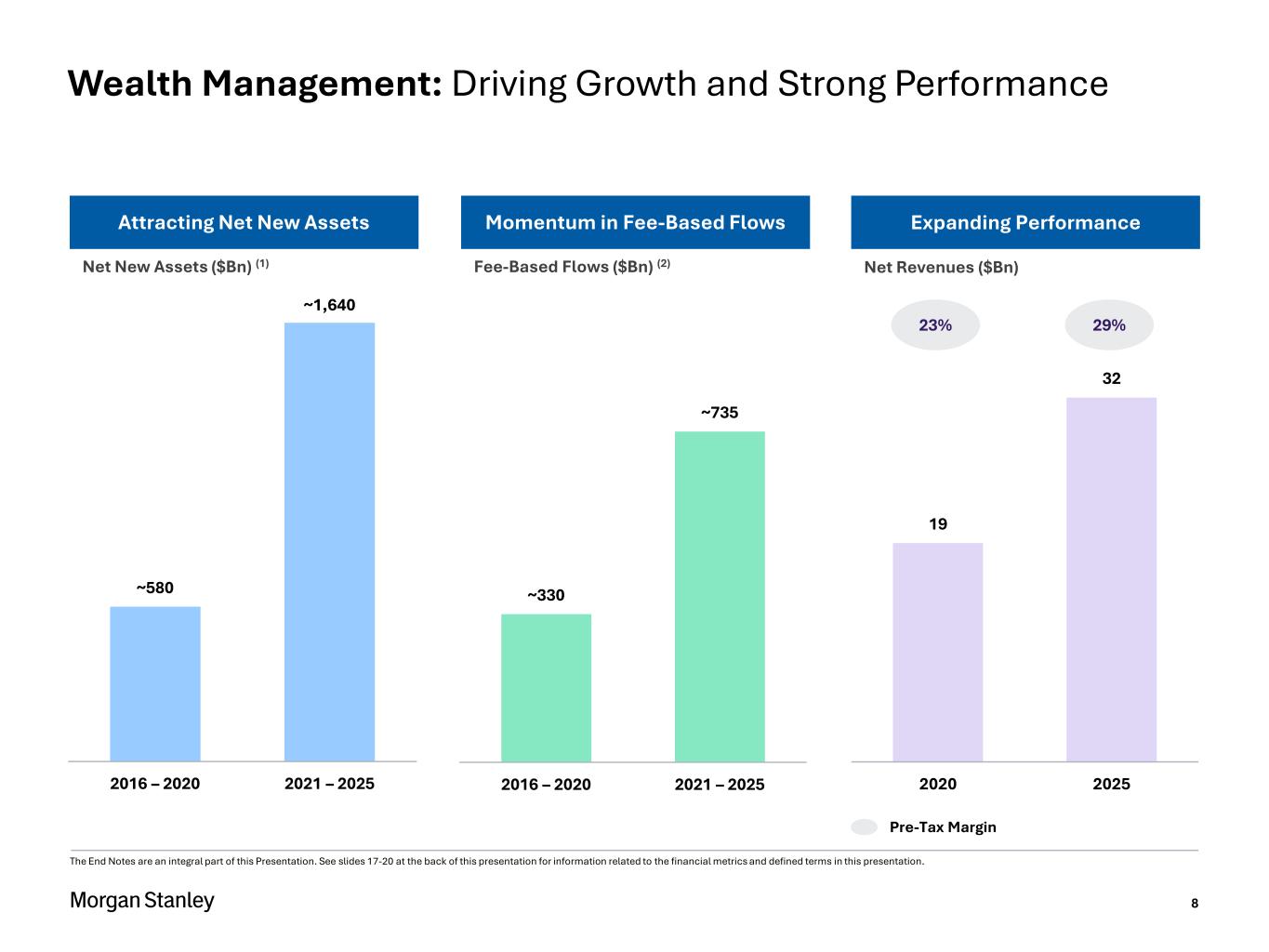

8 ~330 ~735 2016 – 2020 2021 – 2025 ~580 ~1,640 2016 – 2020 2021 – 2025 Wealth Management: Driving Growth and Strong Performance Momentum in Fee-Based Flows Fee-Based Flows ($Bn) (2) Attracting Net New Assets Net New Assets ($Bn) (1) Expanding Performance 19 32 2020 2025 Net Revenues ($Bn) 29%23% Pre-Tax Margin The End Notes are an integral part of this Presentation. See slides 17-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation.

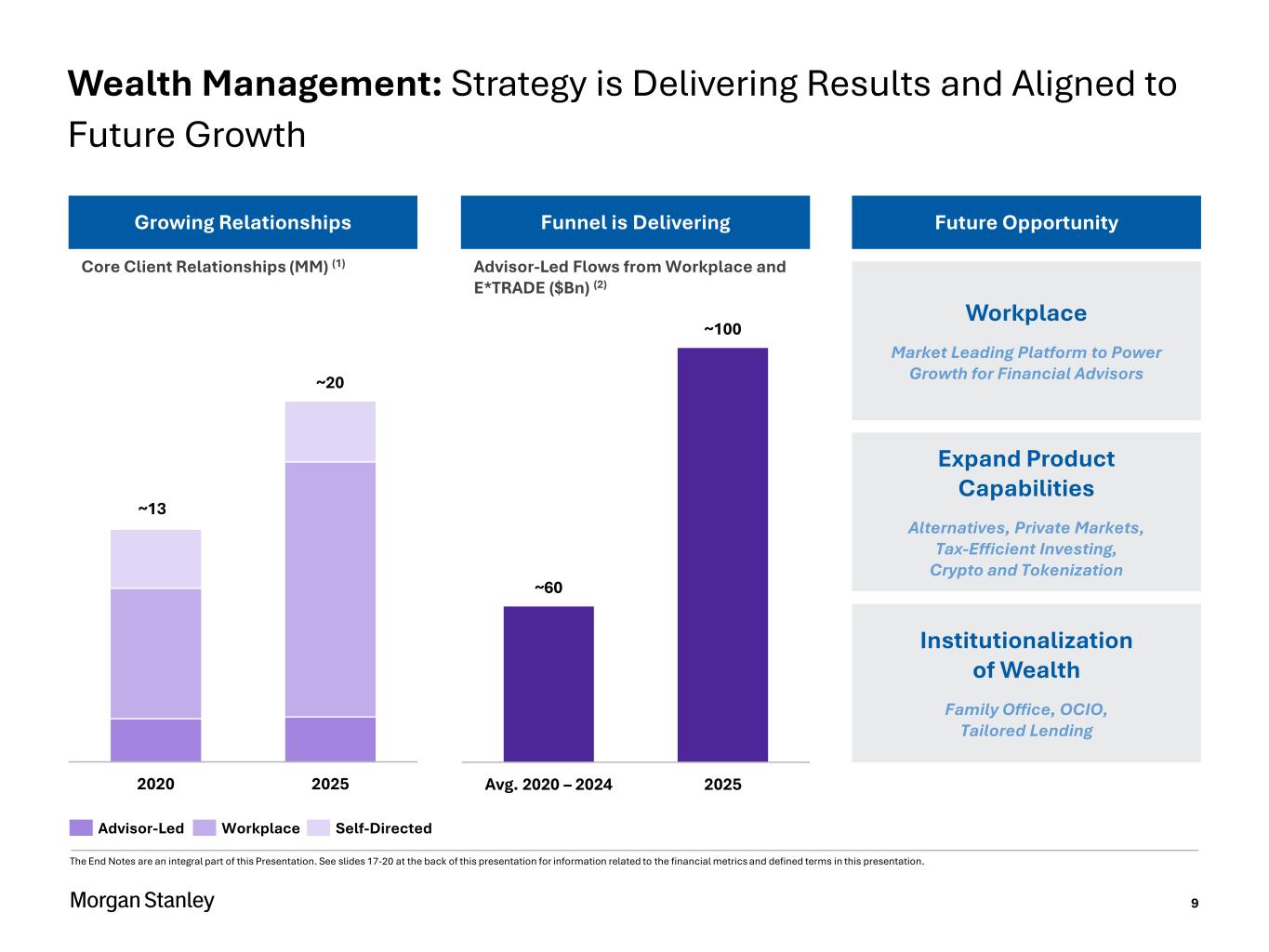

9 ~13 ~20 2020 2025 Wealth Management: Strategy is Delivering Results and Aligned to Future Growth Future Opportunity Expand Product Capabilities Alternatives, Private Markets, Tax-Efficient Investing, Crypto and Tokenization Institutionalization of Wealth Family Office, OCIO, Tailored Lending Workplace Market Leading Platform to Power Growth for Financial Advisors Funnel is Delivering ~60 ~100 Avg. 2020 – 2024 2025 Growing Relationships Core Client Relationships (MM) (1) The End Notes are an integral part of this Presentation. See slides 17-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation. Advisor-Led Flows from Workplace and E*TRADE ($Bn) (2) Advisor-Led Workplace Self-Directed

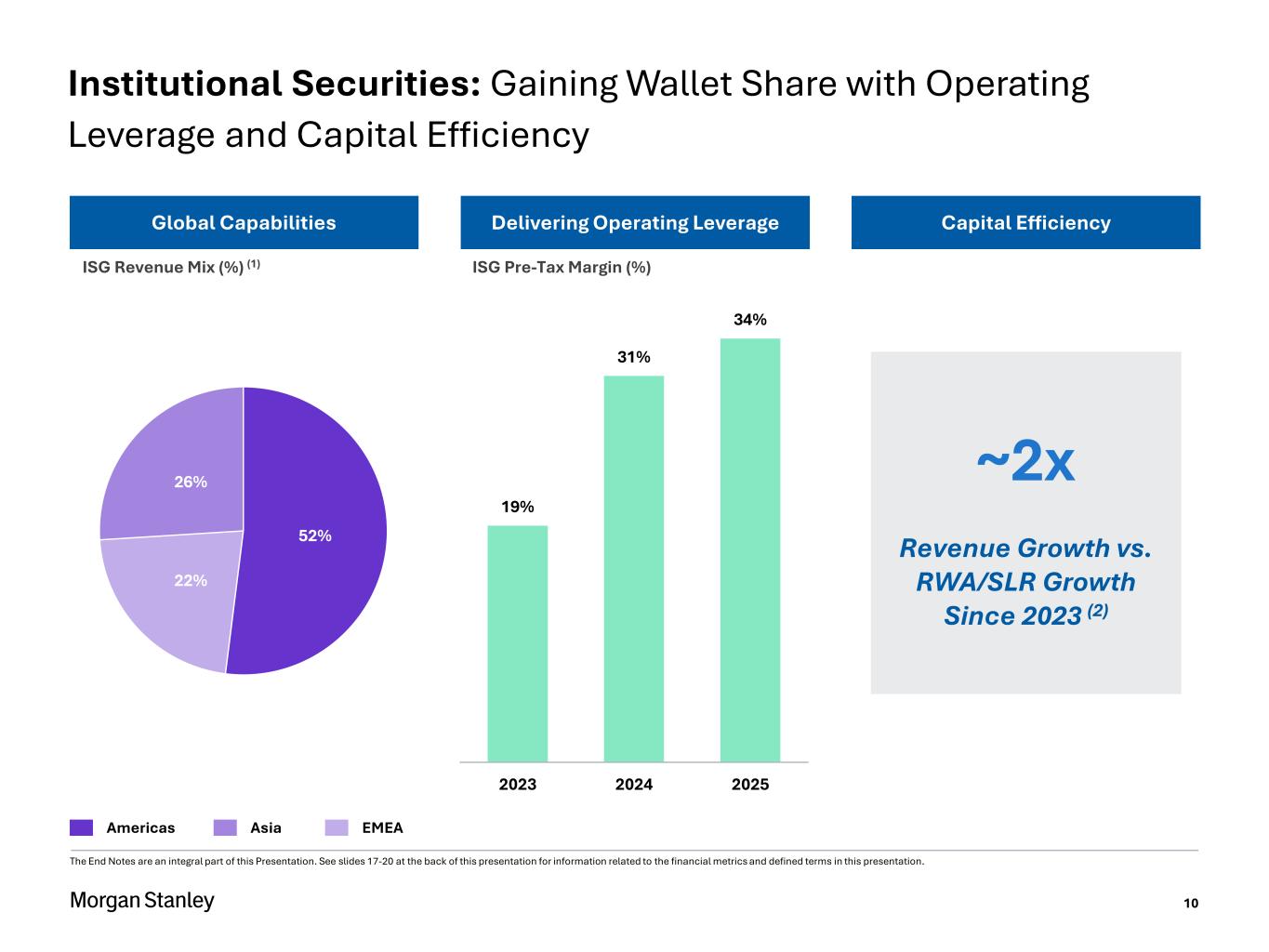

10 52% 22% 26% ISG Revenue Mix (%) (1) 19% 31% 34% 2023 2024 2025 ISG Pre-Tax Margin (%) Global Capabilities Americas Asia EMEA Delivering Operating Leverage Capital Efficiency Revenue Growth vs. RWA/SLR Growth Since 2023 (2) ~2x Institutional Securities: Gaining Wallet Share with Operating Leverage and Capital Efficiency The End Notes are an integral part of this Presentation. See slides 17-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation.

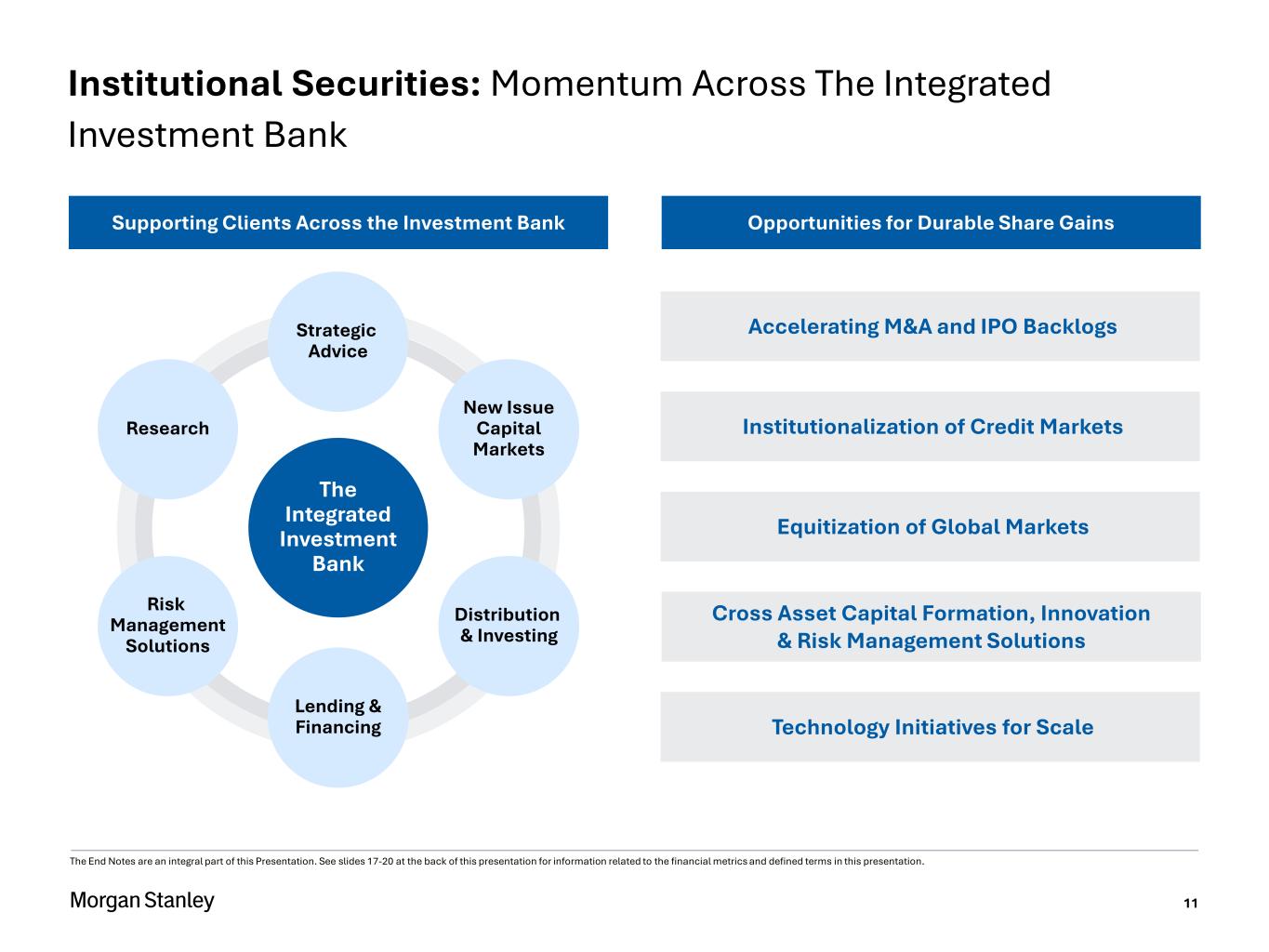

11 Institutional Securities: Momentum Across The Integrated Investment Bank Opportunities for Durable Share Gains Institutionalization of Credit Markets Equitization of Global Markets Cross Asset Capital Formation, Innovation & Risk Management Solutions Technology Initiatives for Scale Supporting Clients Across the Investment Bank Risk Management Solutions The Integrated Investment Bank Strategic Advice New Issue Capital Markets Distribution & Investing Lending & Financing Research Accelerating M&A and IPO Backlogs The End Notes are an integral part of this Presentation. See slides 17-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation.

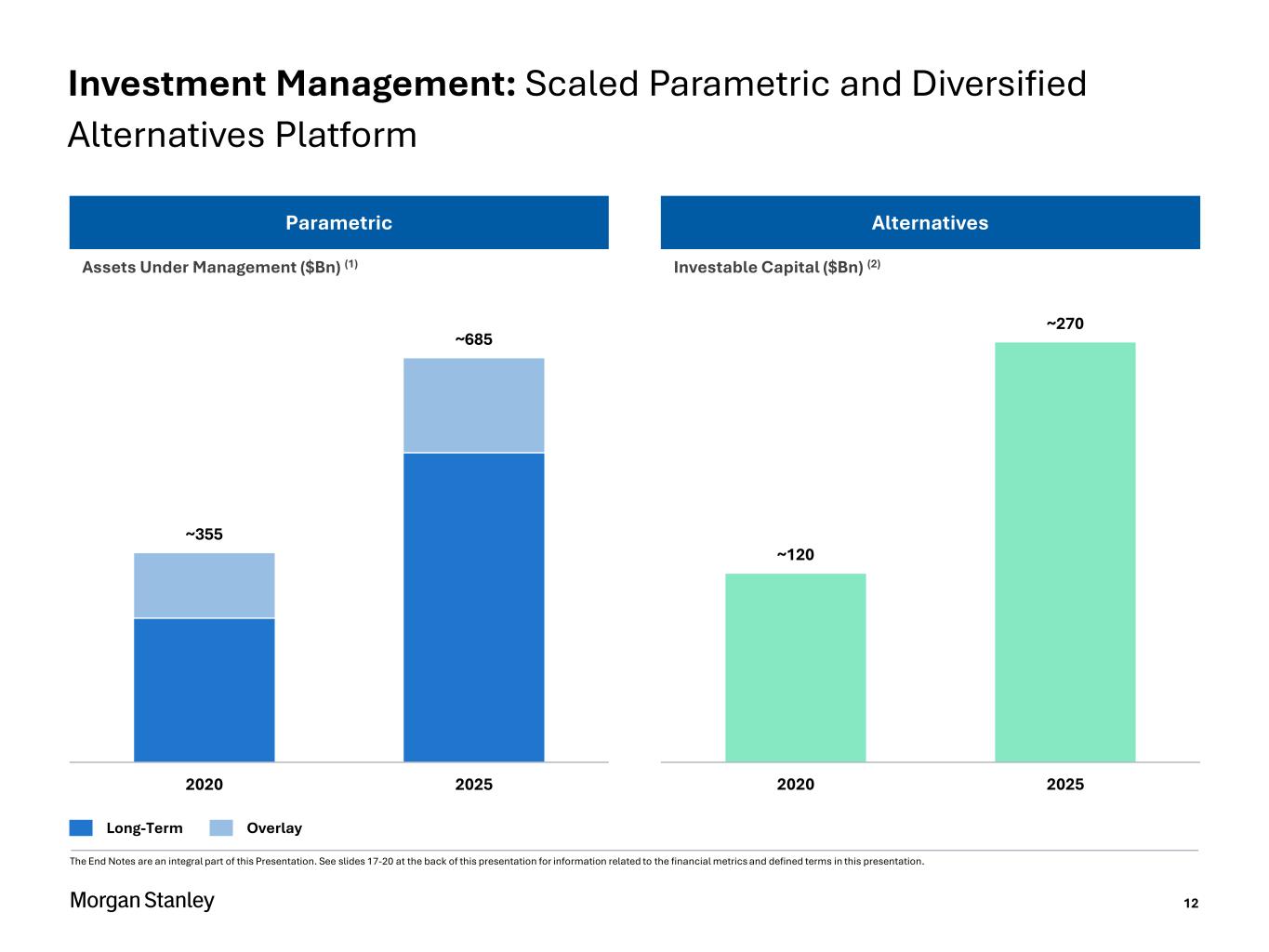

12 ~355 ~685 2020 2025 Investment Management: Scaled Parametric and Diversified Alternatives Platform OverlayLong-Term ~120 ~270 2020 2025 AlternativesParametric Investable Capital ($Bn) (2) Assets Under Management ($Bn) (1) The End Notes are an integral part of this Presentation. See slides 17-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation.

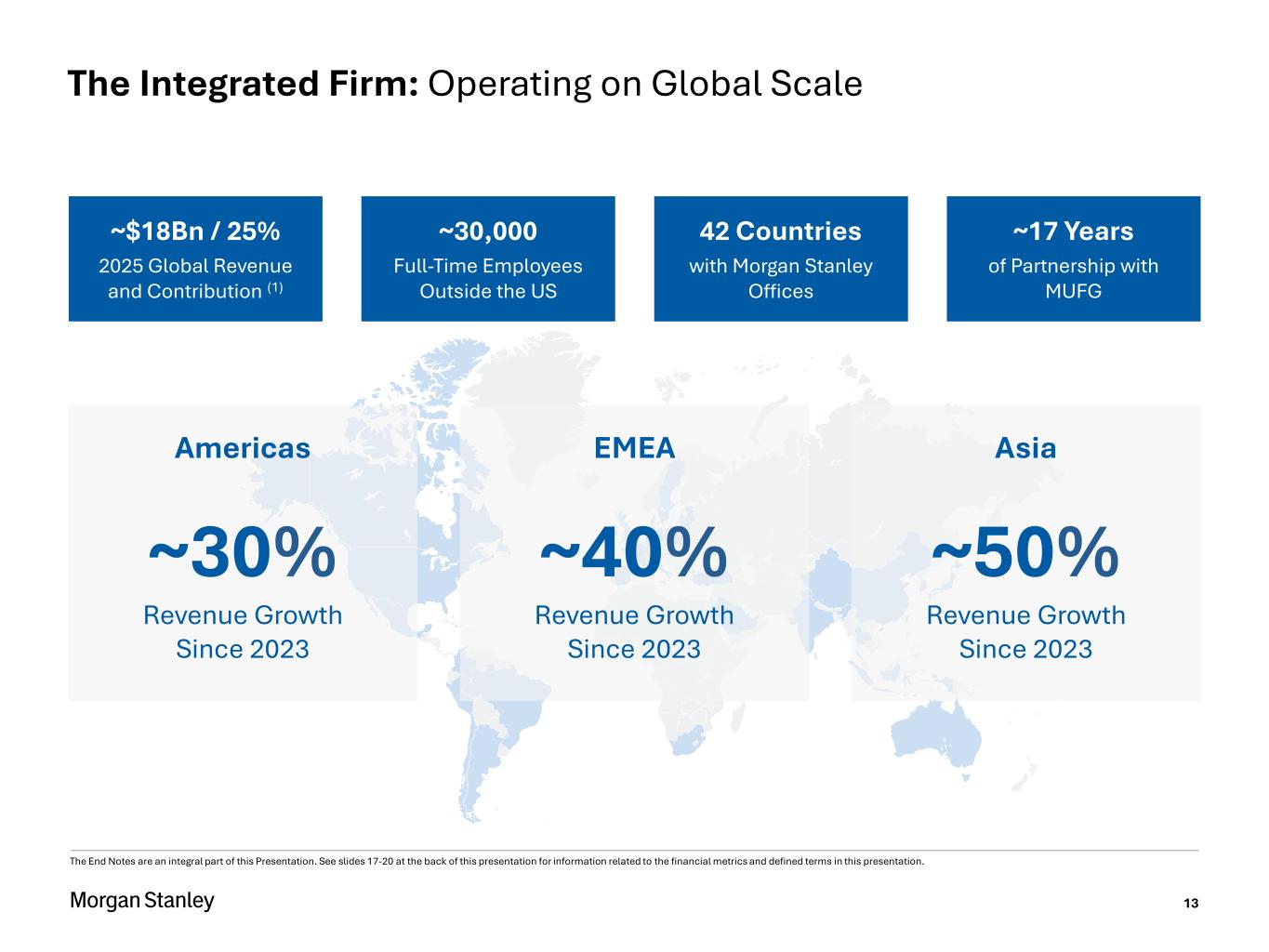

13 Asia ~50% Revenue Growth Since 2023 EMEA ~40% Revenue Growth Since 2023 Americas ~30% Revenue Growth Since 2023 ~30,000 Full-Time Employees Outside the US 42 Countries with Morgan Stanley Offices ~$18Bn / 25% 2025 Global Revenue and Contribution (1) ~17 Years of Partnership with MUFG The Integrated Firm: Operating on Global Scale The End Notes are an integral part of this Presentation. See slides 17-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation.

14 Corporates Founders / Employees Early Stage Public Company Invest for the Future Financial Wellness and Employee Benefits Founders Wealth Strategies Preserve Wealth Full-Service Wealth Advice and Asset Allocation Family Office Solutions, Trust & Estate Planning Unlock Liquidity Private Shares Trading & Lending IPO Execution and Support Services Optimize for Growth Sustained GrowthAccess to Capital MS at Work: Cap Table Management Cash Mgmt Solutions Private Capital Markets, Tenders, Financing and IPO Private Equity and Credit Investments Strategic Advice, Financing Risk Management Solutions MS at Work: Stock Plan and 401k Why Morgan Stanley Wins: The Integrated Firm Delivers Unmatched Capabilities Throughout Clients Growth Cycles Late Stage / IPO The End Notes are an integral part of this Presentation. See slides 17-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation.

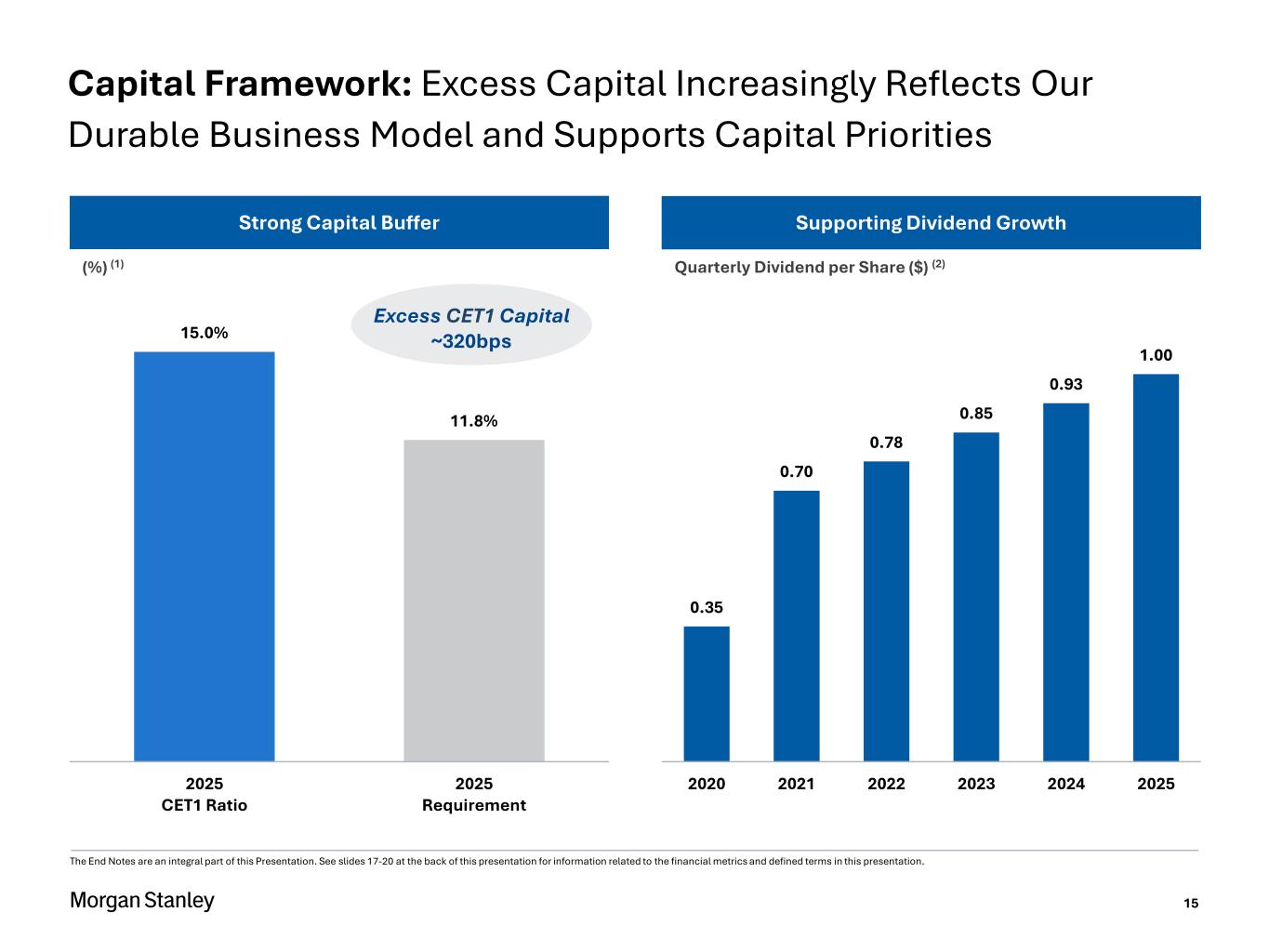

15 15.0% 11.8% 2025 CET1 Ratio 2025 Requirement Capital Framework: Excess Capital Increasingly Reflects Our Durable Business Model and Supports Capital Priorities Strong Capital Buffer (%) (1) Excess CET1 Capital ~320bps 0.35 0.70 0.78 0.85 0.93 1.00 2020 2021 2022 2023 2024 2025 Supporting Dividend Growth Quarterly Dividend per Share ($) (2) The End Notes are an integral part of this Presentation. See slides 17-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation.

16 Strategy Culture Financial Strength Growth ISG Wallet Share Durable Share Gains WM Pre-Tax Margin 30% Client Assets $10 Trillion + ROTCE 20% Efficiency Ratio 70% Morgan Stanley: Four Pillars of the Integrated Firm Driving Toward Firmwide Goals Firmwide Goals The End Notes are an integral part of this Presentation. See slides 17-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation.

17 The Firm’s financial presentations, earnings releases, earnings conference calls, and other communications may include certain metrics, including non-GAAP financial measures, which we believe to be useful to us, investors, analysts and other stakeholders by providing further transparency about, or an additional means of assessing, our financial condition and operating results. The End Notes are an integral part of our presentations and other communications. For additional information, refer to the Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations (includes reconciliation of GAAP to non-GAAP), and Legal Notice in the Morgan Stanley Fourth Quarter 2025 Financial Supplement included in the Current Report on Form 8-K dated January 15, 2026 (‘Morgan Stanley Fourth Quarter 2025 Financial Supplement’). Morgan Stanley closed its acquisition of E*TRADE on October 2, 2020, impacting annual comparisons for the Firm and Wealth Management, and closed its acquisition of Eaton Vance on March 1, 2021, impacting period over period comparisons for the Firm and Investment Management. For information and impact of the Company’s acquisitions, please refer to prior period filings of the Company’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. End Notes

18 End Notes These notes refer to the financial metrics and/or defined terms presented on Slide 4 1. Earnings per Share (‘EPS’) represents diluted earnings per share. 2. Return on average tangible common equity (‘ROTCE’) represents net income applicable to Morgan Stanley less preferred dividends as a percentage of average tangible common equity. Average tangible common equity represents average common equity adjusted to exclude goodwill and intangible assets net of allowable mortgage servicing rights deduction. ROTCE and average tangible common equity are non-GAAP financial measures that the Firm considers useful for analysts, investors and other stakeholders to assess operating performance. These notes refer to the financial metrics and / or defined terms presented on Slide 5 1. Total Client Assets represent the sum of the reported Wealth Management (‘WM’) client assets and Investment Management (‘IM’) assets under management (‘AuM’). WM client assets represent those assets for which WM is providing services including financial advisor‐led brokerage, custody, administrative and investment advisory services; self‐directed brokerage and investment advisory services; financial and wealth planning services; workplace services, including stock plan administration and retirement plan services. Certain WM client assets are invested in IM products and are also included in IM’s AuM. 2. Institutional Securities Wallet Share represents the percentage of Morgan Stanley’s Institutional Securities (‘ISG’) segment net revenues to the Wallet. The Wallet represents Investment Banking (‘IBD’), Equity Sales & Trading and Fixed Income Sales & Trading net revenues, where applicable, for Morgan Stanley and the following peer set: Bank of America, Barclays, Citigroup, Deutsche Bank, Goldman Sachs, JP Morgan, and UBS. For 2020, the peer set includes Credit Suisse, prior to UBS’ acquisition completed in June 2023. For peers that disclose results between multiple segments, assumptions have been made based on company disclosures. European peer results were translated to USD using average exchange rates for the appropriate period, sourced from Bloomberg. The analysis utilizes data for peers that have reported full-year 2025 results as of January 14, 2026. For peers that have not yet reported, a full-year 2025 results estimate is derived assuming the aggregate share of those peers of the Wallet for the first nine months of 2025 remains constant in the fourth quarter of 2025. These notes refer to the financial metrics and / or defined terms presented on Slide 6 1. Pre-Tax Margin represents income before provision for income taxes as a percentage of net revenues. 2. Efficiency Ratio represents total non-interest expenses as a percentage of net revenues. The attainment of these objectives assumes a normal market environment and may be impacted by external factors that cannot be predicted at this time, including geopolitical, macroeconomic and market conditions and future legislation and regulations and any changes thereto. Please also refer to the Notice on Slide 2 of this presentation. These notes refer to the financial metrics and/or defined terms presented on Slide 8 1. Net New Assets (‘NNA’) represent client asset inflows, inclusive of interest, dividends and asset acquisitions, less client asset outflows, and exclude the impact of business combinations/divestitures and the impact of fees and commissions. For further discussion regarding NNA, see Business Segments in Morgan Stanley’s Annual Report on Form 10-K for the year ended December 31, 2024. NNA shown are aggregated across the stated five-year time periods. 2020 NNA is Pro Forma for E*TRADE, representing the addition of NNA for Morgan Stanley and E*TRADE for the full year.

19 End Notes These notes refer to the financial metrics and/or defined terms presented on Slide 8 2. Fee-Based Flows represent net new fee-based assets (including asset acquisitions), net account transfers, dividends, interest, and client fees, and exclude institutional cash management related activity. For a description of the Inflows and Outflows included in Fee-Based Flows, see Fee-based client assets in Morgan Stanley’s Annual Report on Form 10-K for the year ended December 31, 2024. Fee-Based Flows shown are aggregated across the stated five-year time periods. 2021 and 2022 include NNA and Fee-Based flows acquired in asset acquisitions previously disclosed in the third quarter of 2021 and first quarter of 2022. Refer to Quarterly Reports on Form 10-Q for the respective quarters. These notes refer to the financial metrics and/or defined terms presented on Slide 9 1. Core Client Relationships represent Advisor-Led Households, Self-Directed Households, and Workplace Participants, excluding overlap, as of 4Q 2020 and 4Q 2025. Where there is overlap between relationships across channels, relationships are included in this order: Workplace, Advisor-Led and Self-Directed. • Advisor-Led Households represent the total number of households that include at least one account with Advisor-Led Clients Assets. Advisor-Led Client Assets represent client assets in accounts that have a WM representative assigned. • Self-Directed Households represent the total number of households that include at least one active account with Self-Directed Client Assets. Self-Directed Client Assets represent active accounts which are not advisor-led. Active accounts are defined as having at least $25 in assets. • Workplace Participants represent Stock Plan Participants, Institutional Consulting Participants, and Retirement and Financial Wellness Participants, excluding overlap. • Stock Plan Participants represent total accounts with vested and/or unvested stock plan assets in the workplace channel. Individuals with accounts in multiple plans are counted as participants in each plan. • Institutional Consulting Participants represent participants of corporate clients with institutional consulting plans serviced by Morgan Stanley at Work. • Retirement and Financial Wellness Participants represent participants of corporate clients with financial wellness and retirement plans serviced by Morgan Stanley at Work. 2. Advisor-Led Flows from Workplace and E*TRADE represent assets brought into advisor‐led relationships, where the initial account was workplace or self-directed. These have been averaged across the 5-year time period of 2020, 2021, 2022, 2023 and 2024. These notes refer to the financial metrics and/or defined terms presented on Slide 10 1. ISG Revenue Mix represents the regional view of ISG’s consolidated net revenues on a managed basis, based on the following methodology: client location for advisory and equity underwriting, syndicate desk location for debt underwriting, trading desk location for sales and trading. 2. Revenue Growth vs. RWA/SLR Growth represents Morgan Stanley’s ISG segment net revenue percentage growth since the year ended December 31, 2023 divided by the average of ISG’s Standardized Risk-weighted assets growth and ISG’s Supplementary Leverage Exposure growth, for the same period. These notes refer to the financial metrics and/or defined terms presented on Slide 12 1. Parametric Long-Term and Parametric Overlay represent AuM reported under the “Alternatives and Solutions” and “Liquidity and Overlay Services” categories, respectively, in the Morgan Stanley Fourth Quarter 2025 Financial Supplement. AuM is as of period end. 2020 data is prior to the close of the Eaton Vance acquisition.

20 End Notes These notes refer to the financial metrics and/or defined terms presented on Slide 12 2. Investable Capital includes AuM, unfunded commitments, co-investments and leverage across private alternative and liquid alternative strategies. The AuM portion of investable capital for 2025 is reported under the “Alternatives and Solutions”, “Equities” and “Fixed Income” categories in the Morgan Stanley Fourth Quarter 2025 Financial Supplement. AuM is as of period end. These notes refer to the financial metrics and/or defined terms presented on Slide 13 1. Global Revenue represents Morgan Stanley’s EMEA and Asia regional revenues. Contribution represents Global Revenue as a percentage of the Firmwide total consolidated net revenues. Firmwide regional revenues reflect our consolidated net revenues on a managed basis. Further discussion regarding the geographic methodology for net revenues is disclosed in Note 22 to the consolidated financial statements included in Morgan Stanley’s Annual Report on Form 10-K for the year ended December 31, 2024. These notes refer to the financial metrics and/or defined terms presented on Slide 15 1. Common Equity Tier 1 (‘CET1’) Requirement includes the regulatory minimum, Stress Capital Buffer and G-SIB capital surcharge. Excess CET1 Capital represents the difference between the CET1 ratio and the CET1 requirement. Metrics are as of year-end and are based on the Basel III Standardized Approach Fully Phased-in rules. 2. Quarterly Dividend Per Share represents the dividend per share in the fourth quarter of each respective year.

The Integrated Firm: Executing on a Higher Plane Ted Pick, Chairman and Chief Executive Officer January 15, 2026