ANNUAL REPORT 2024

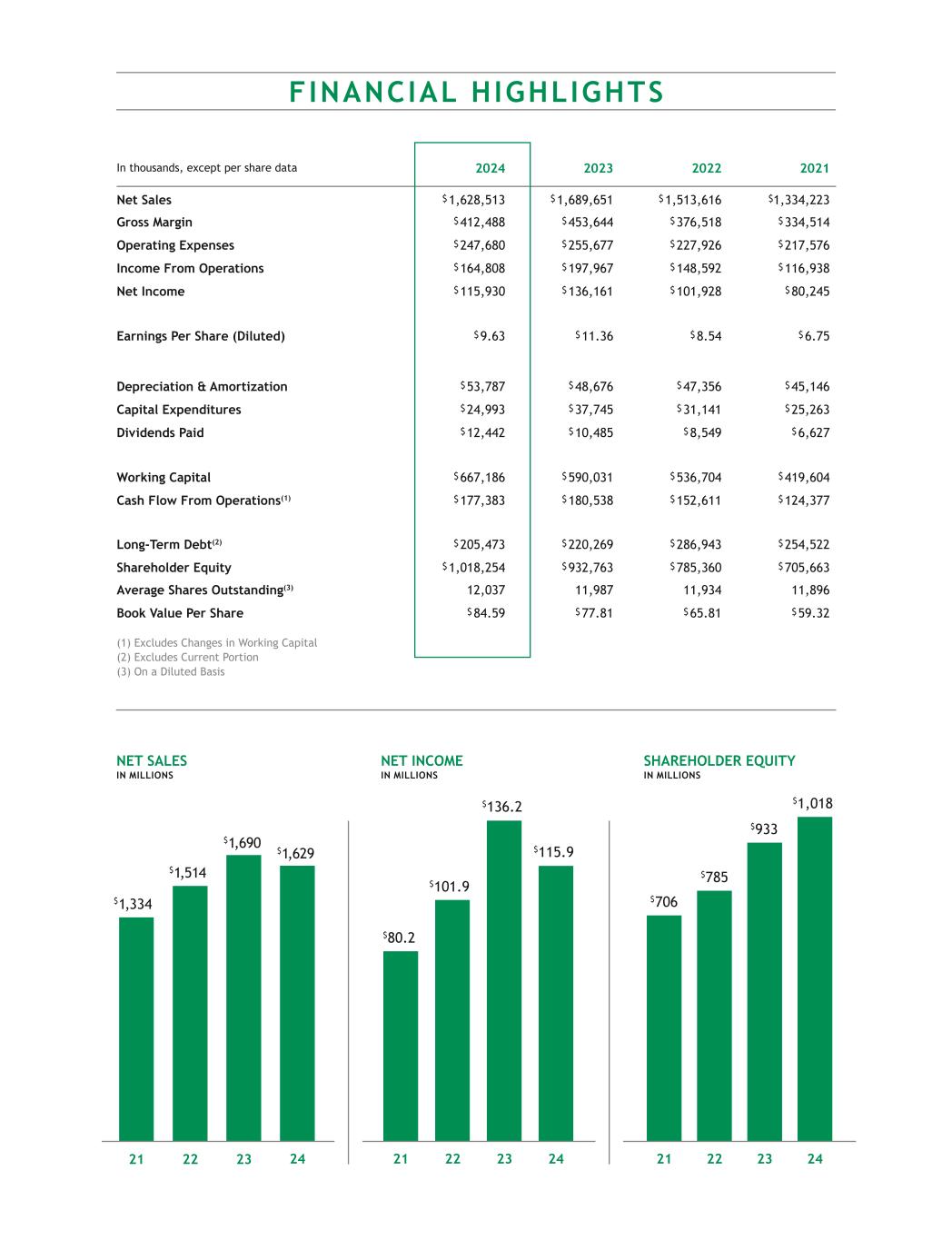

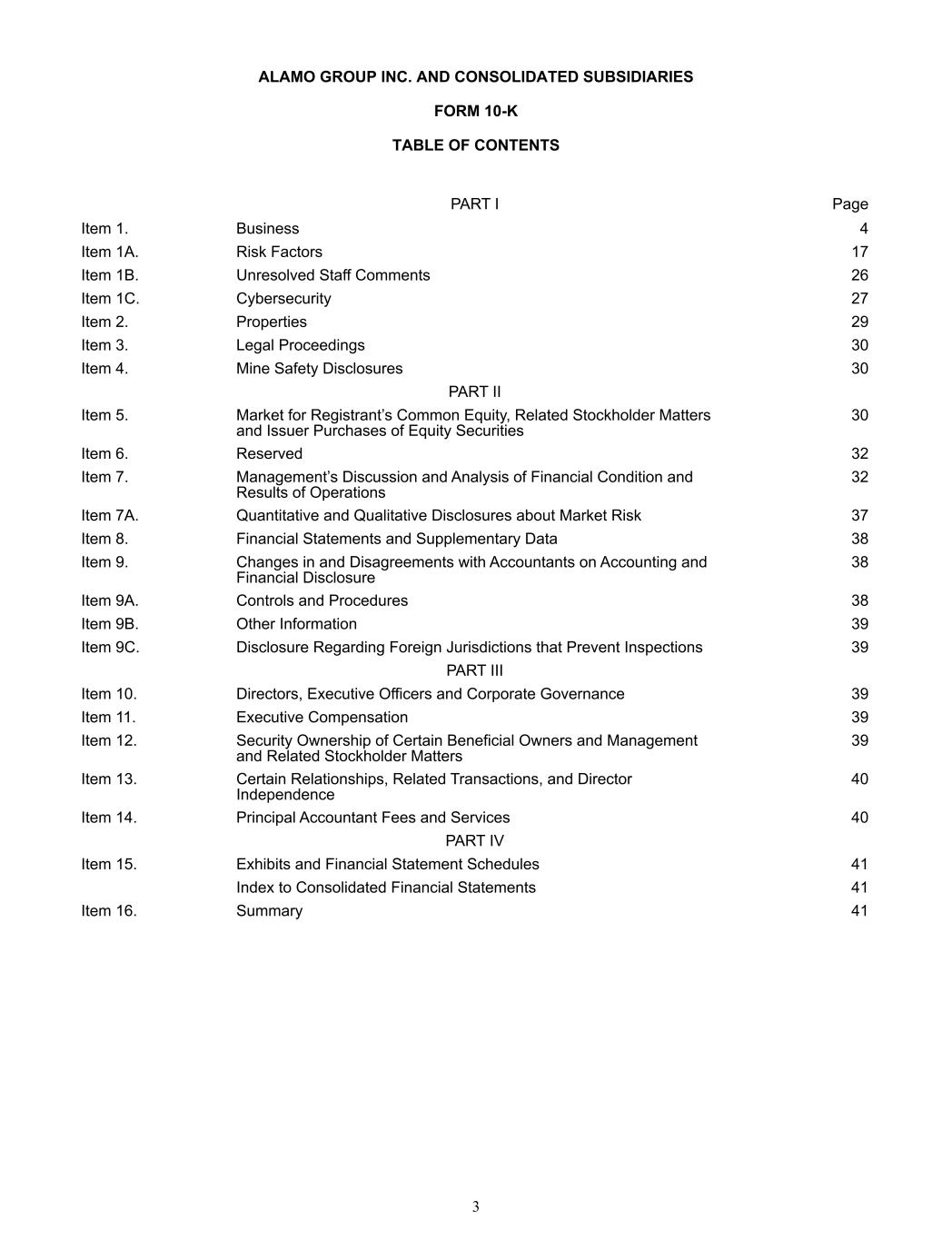

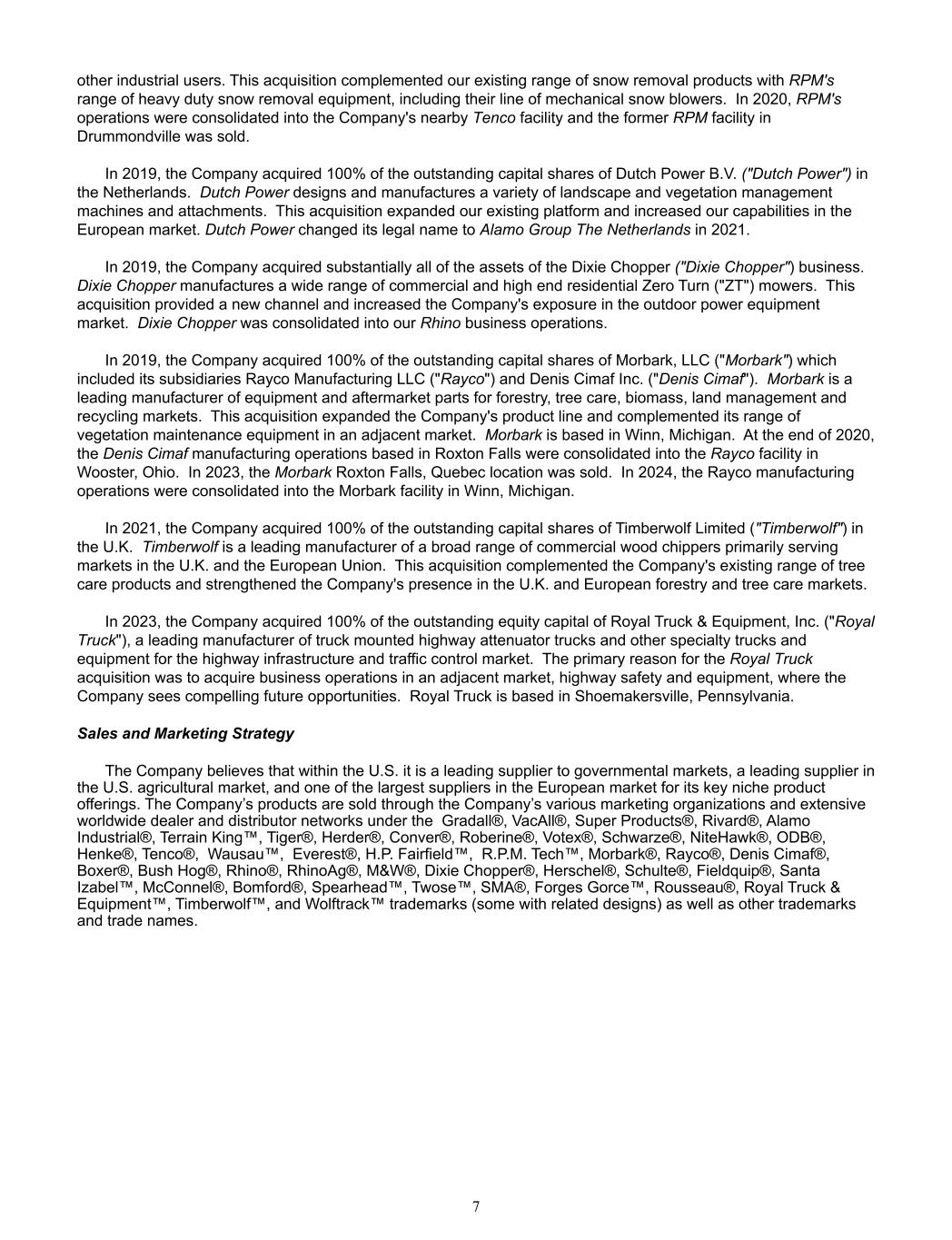

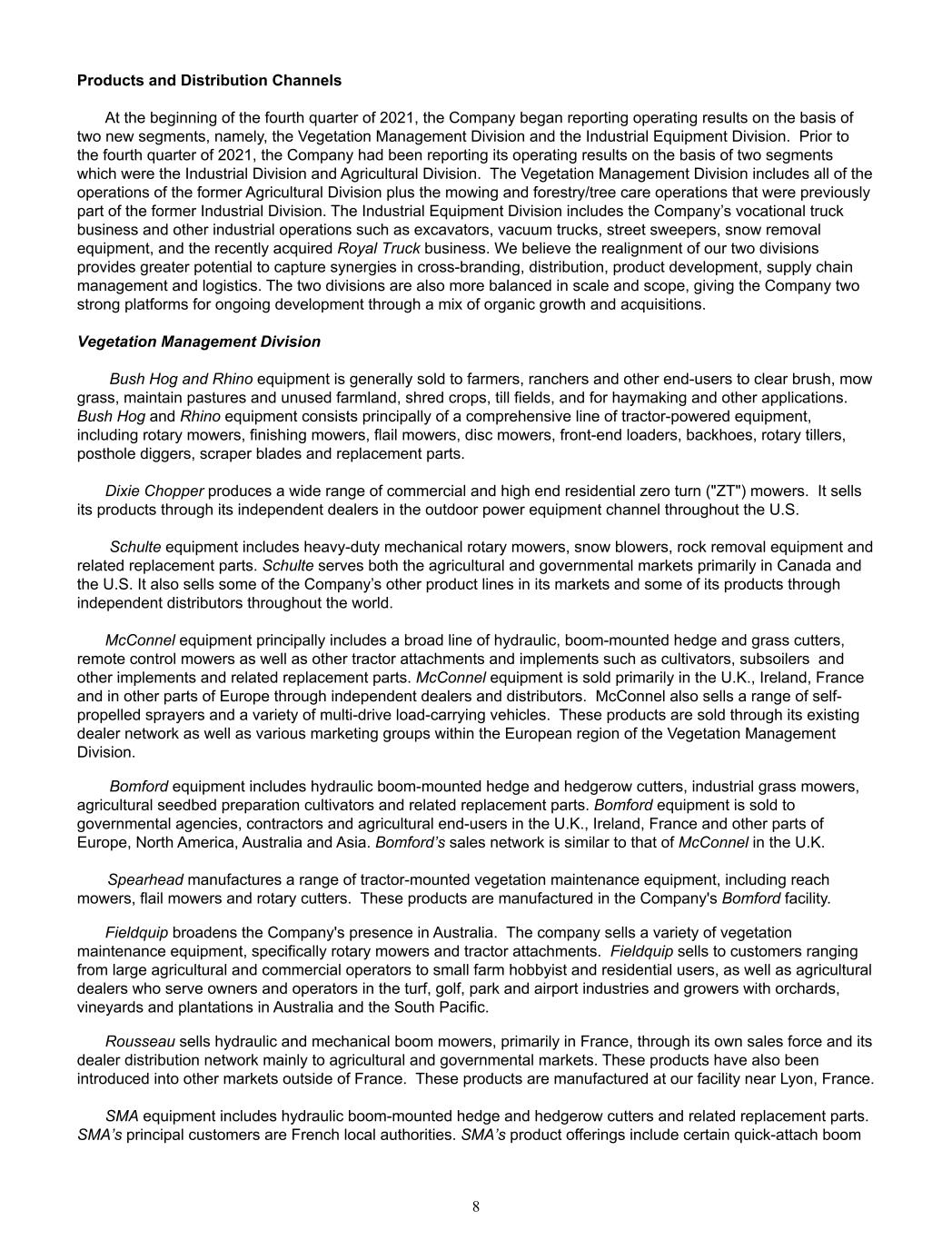

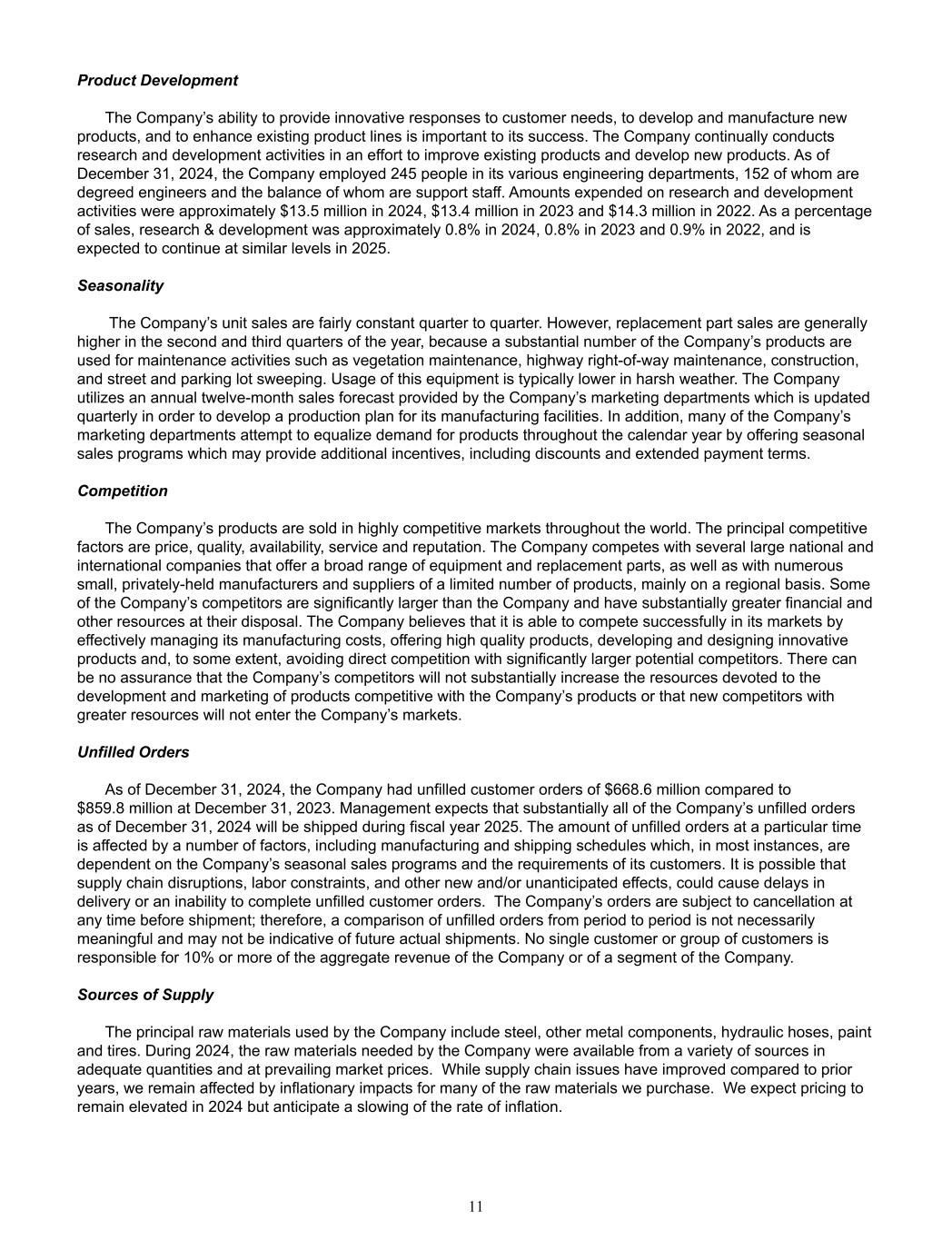

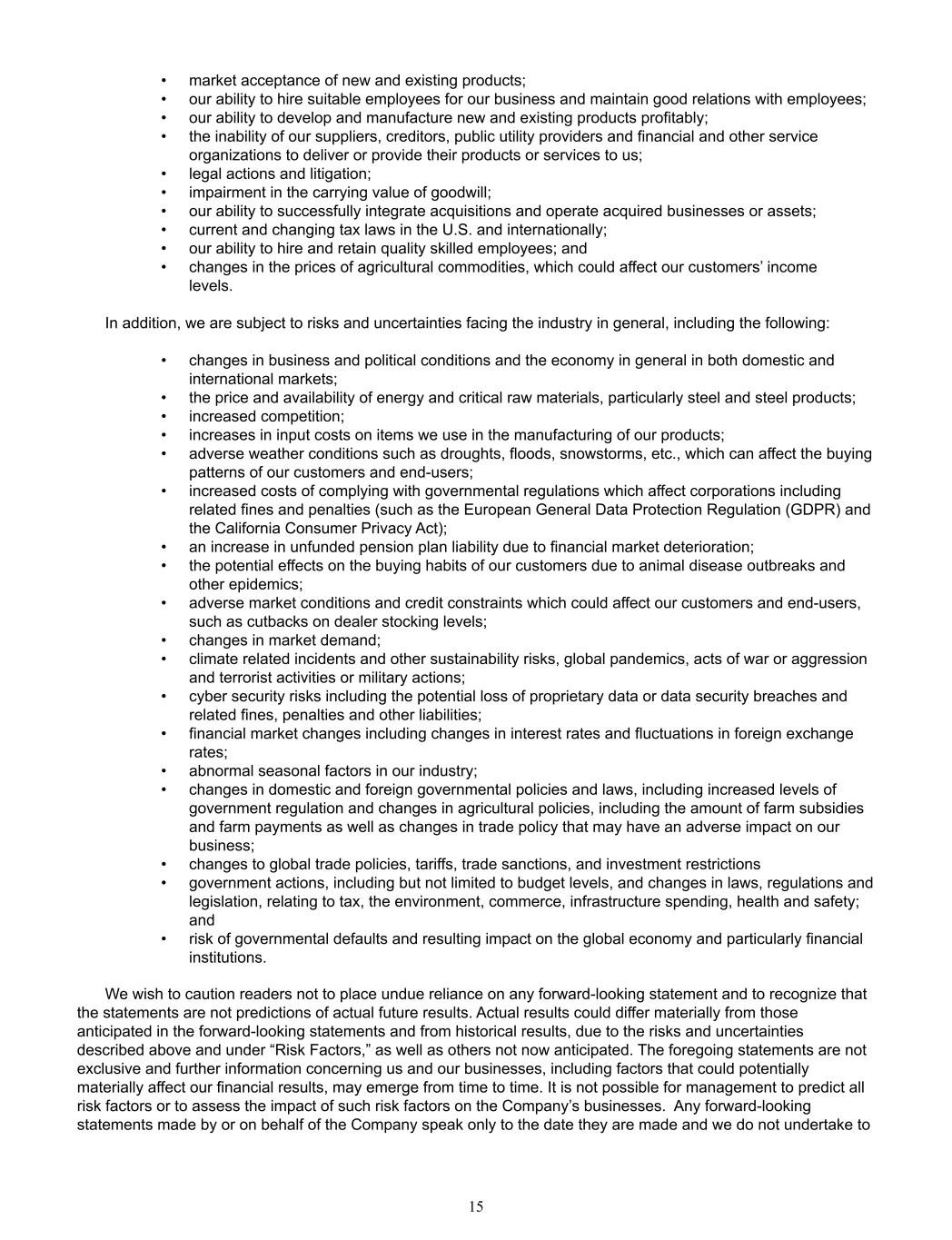

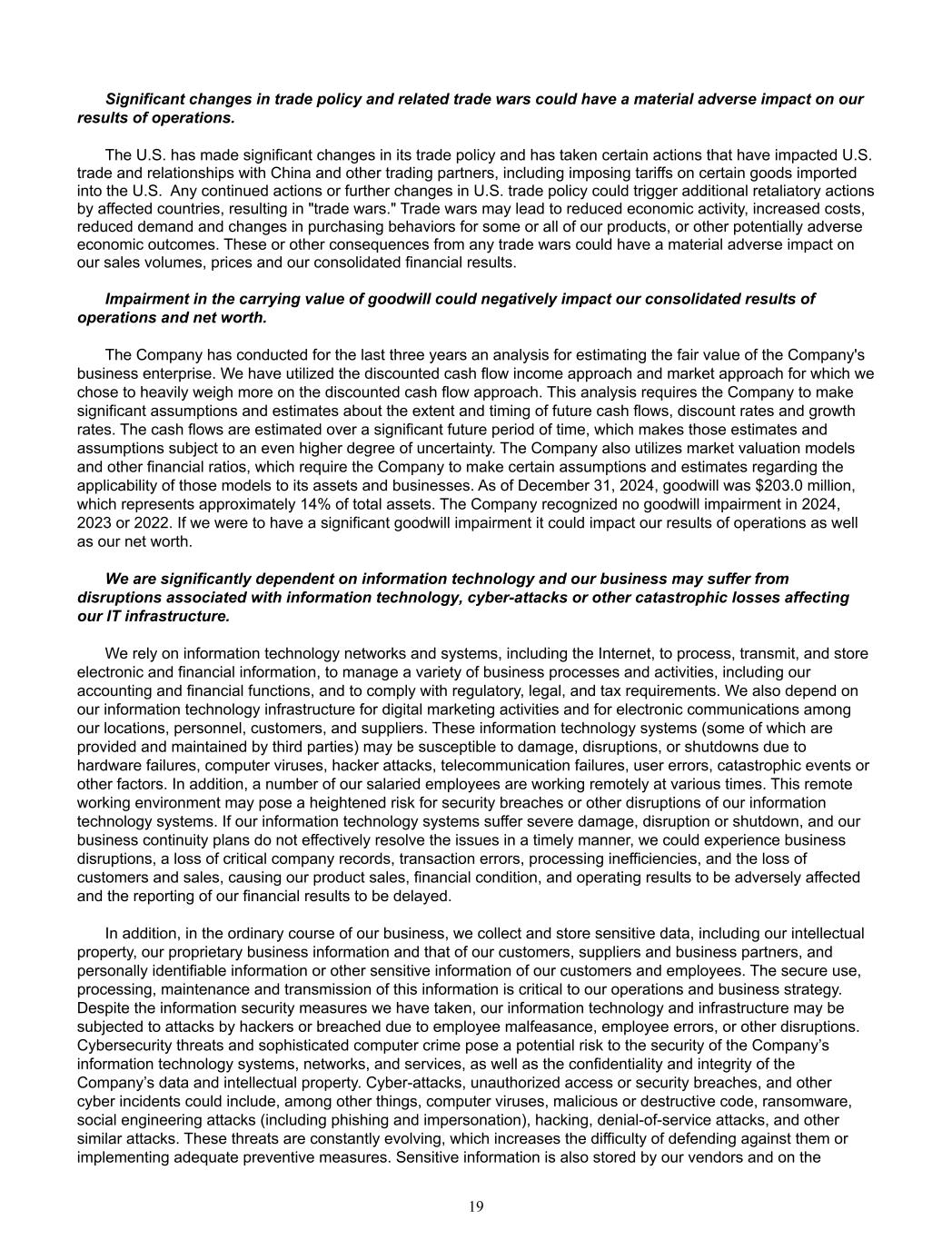

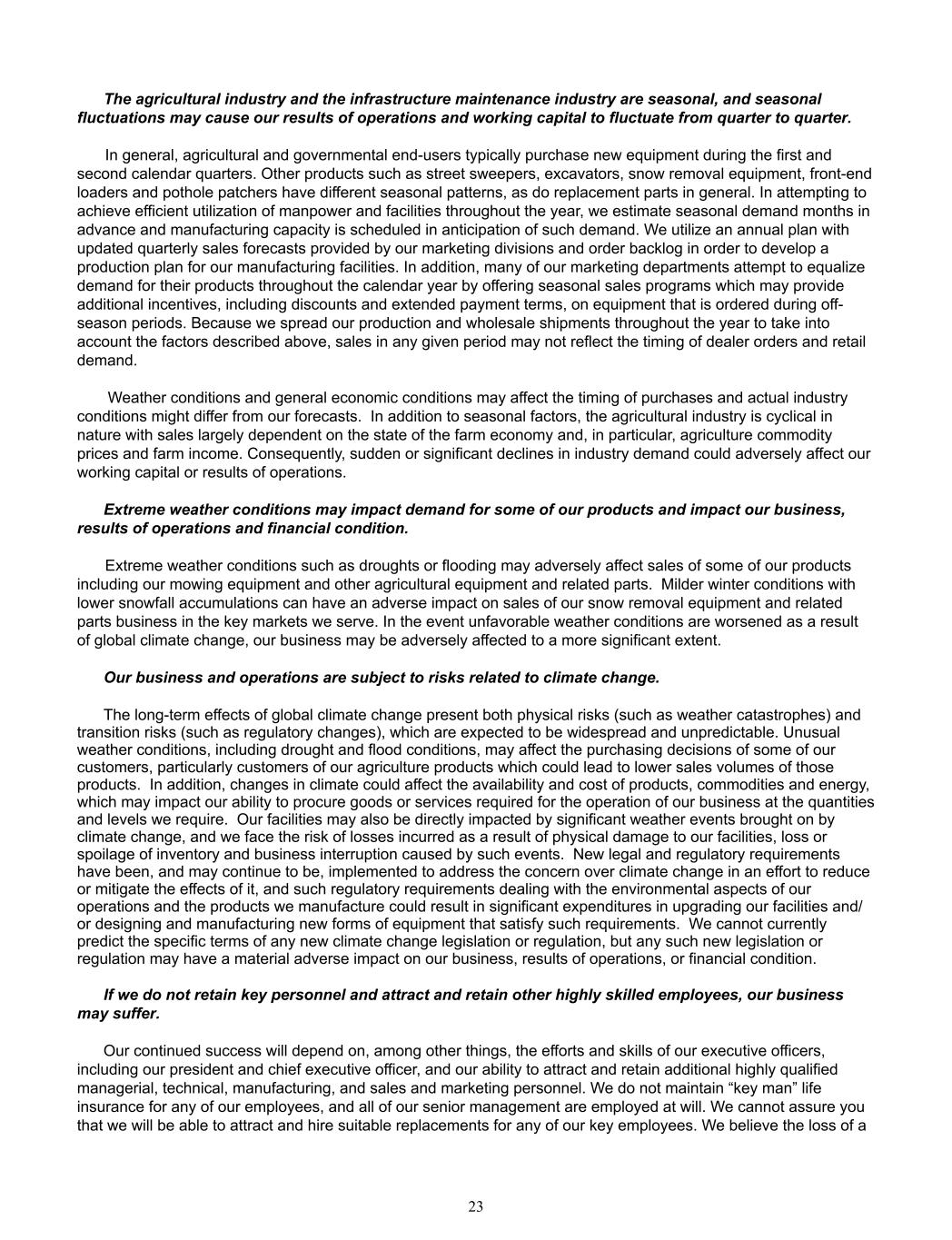

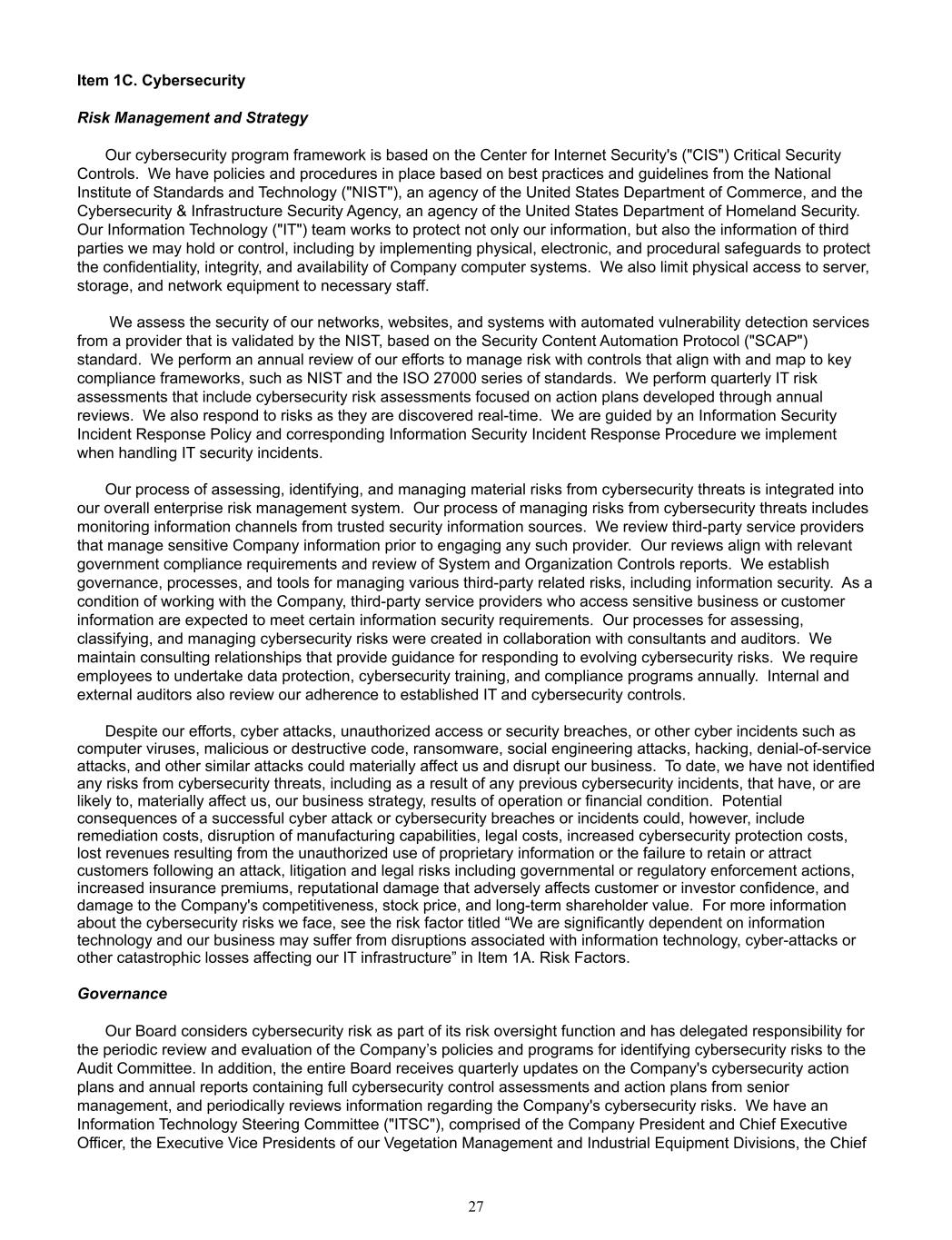

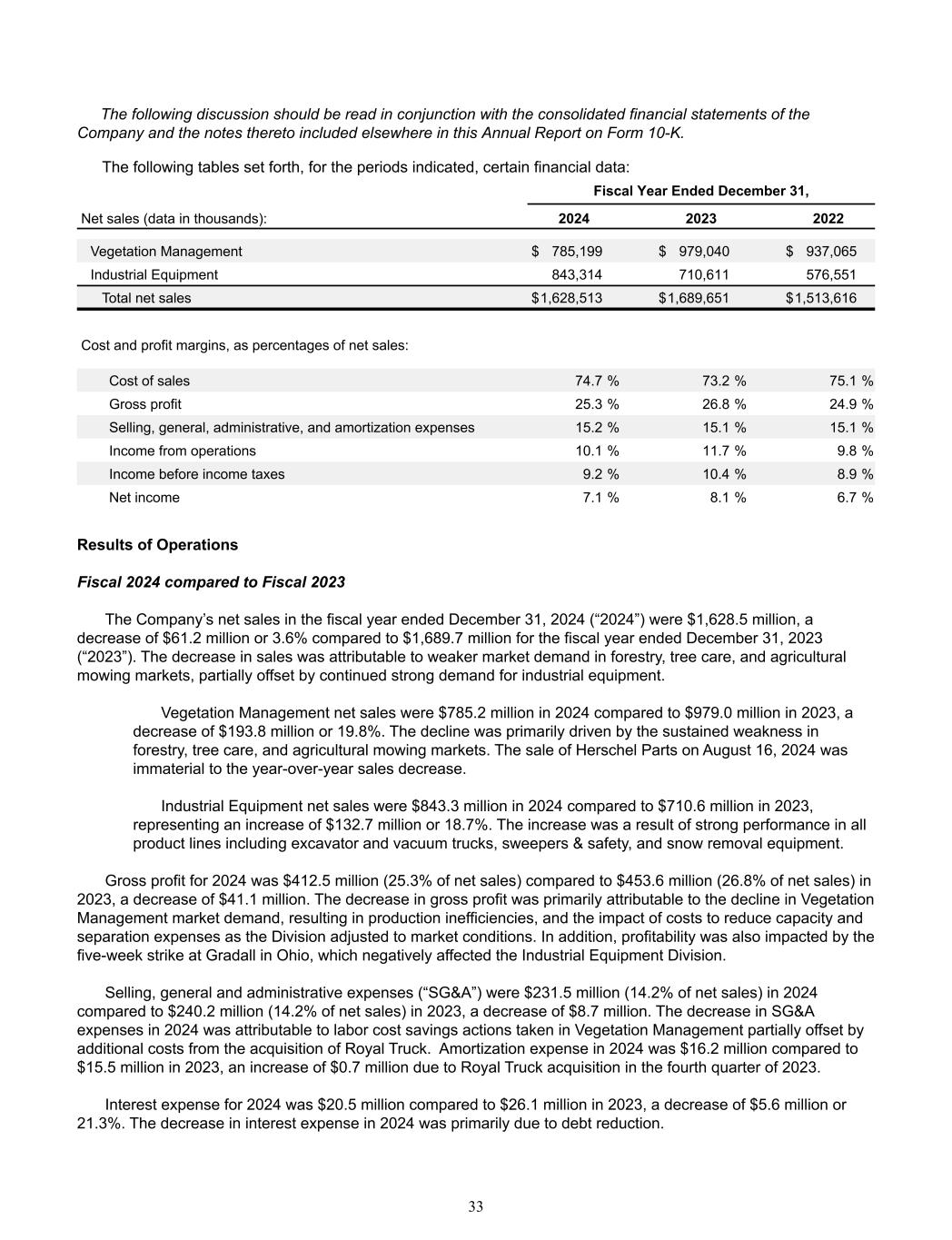

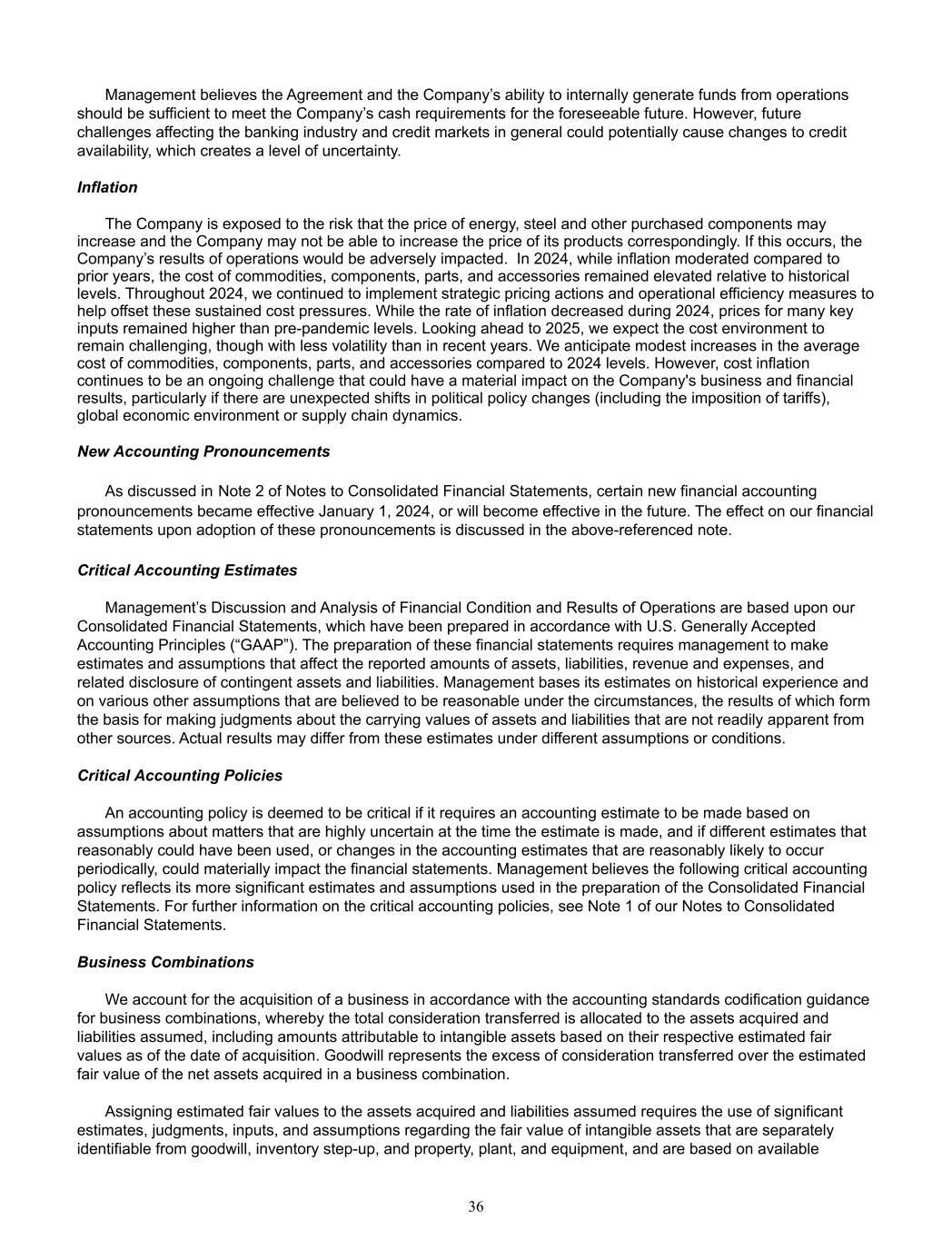

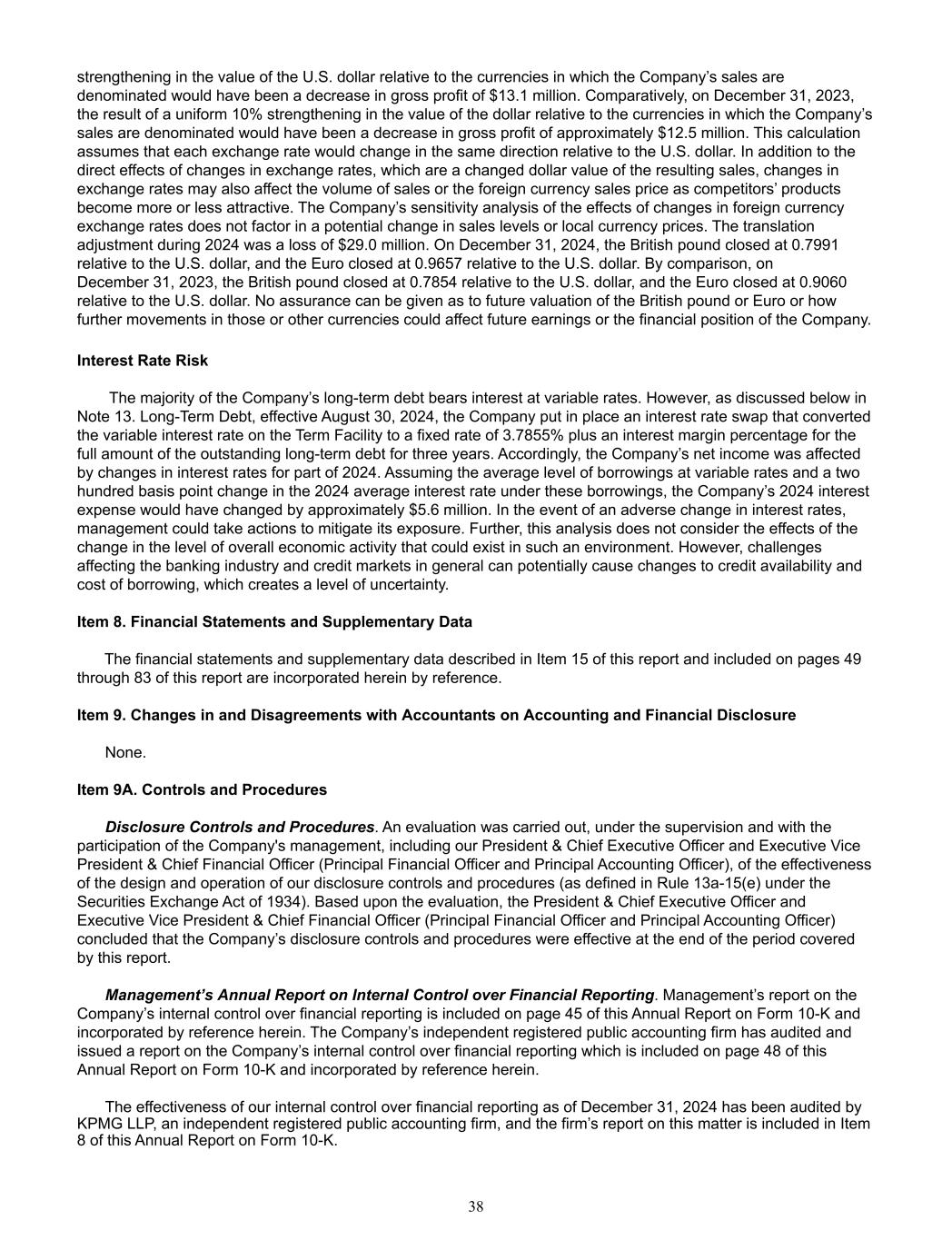

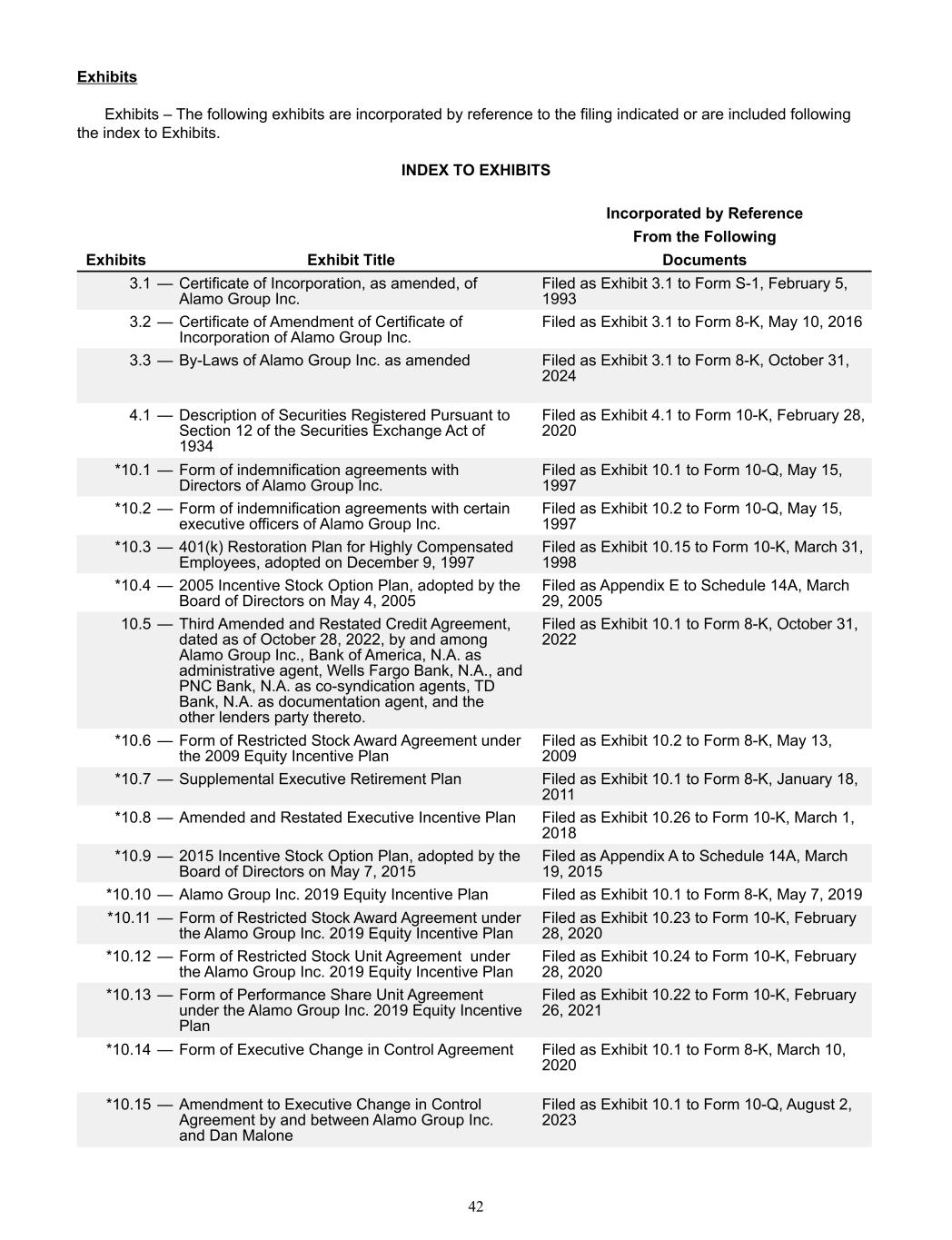

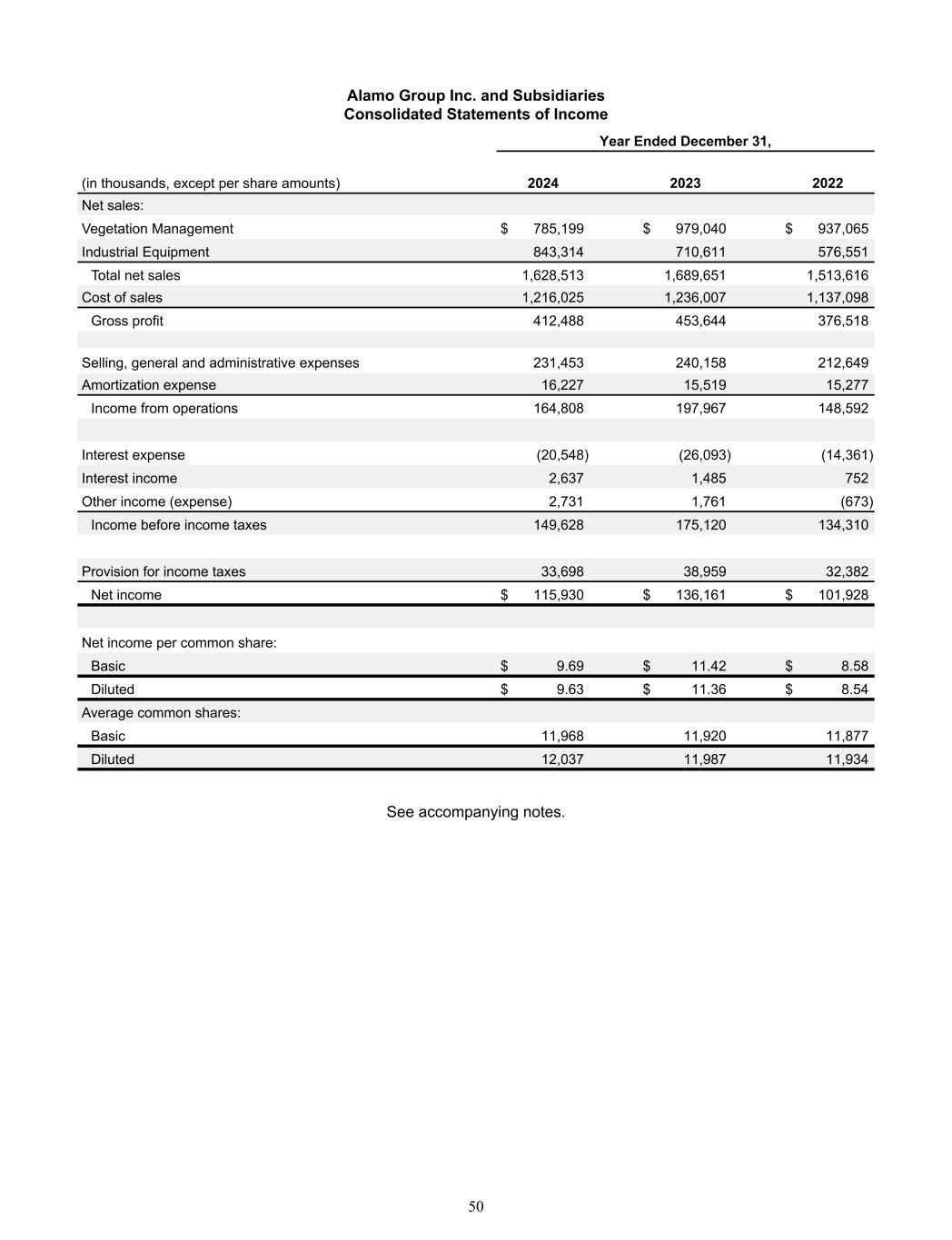

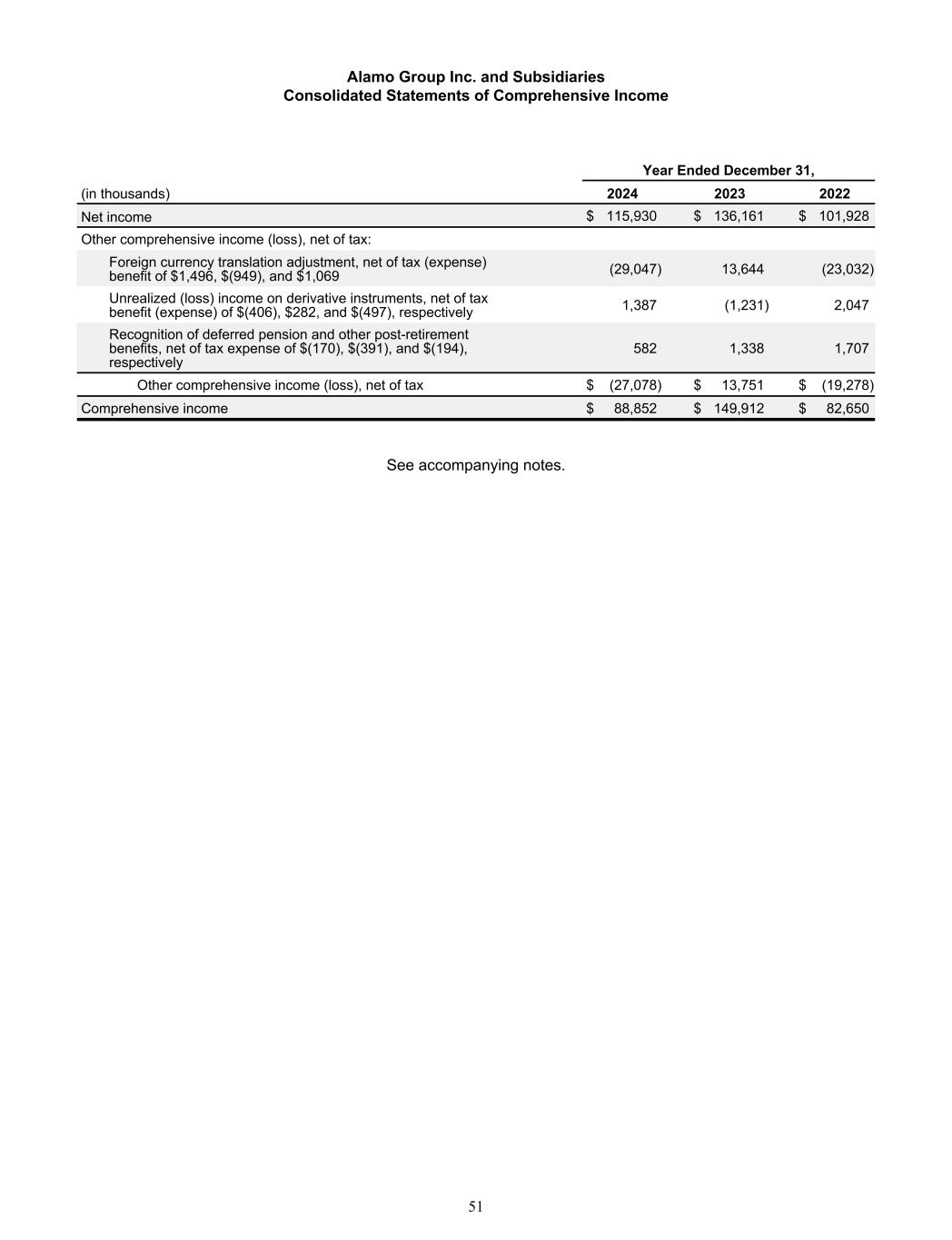

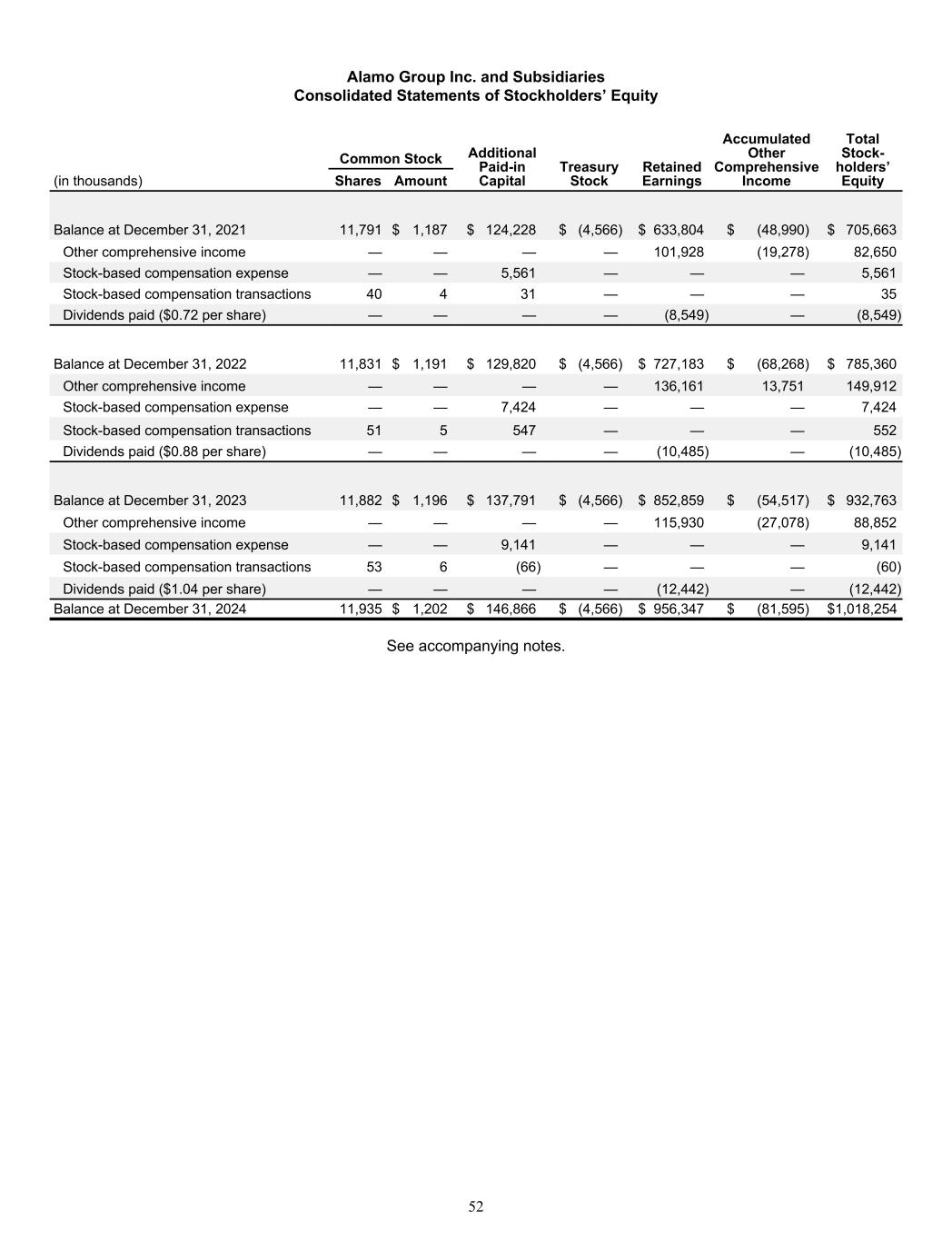

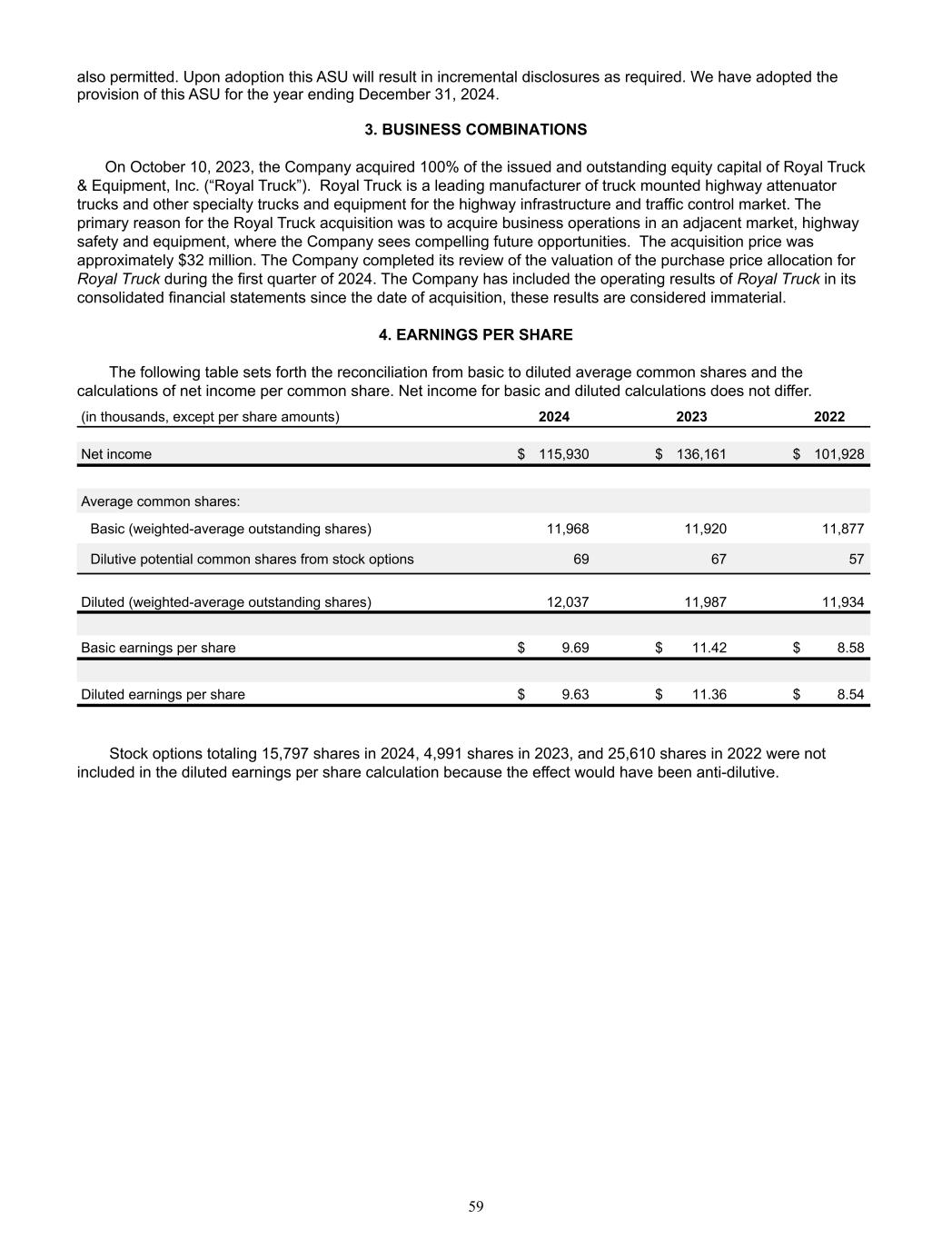

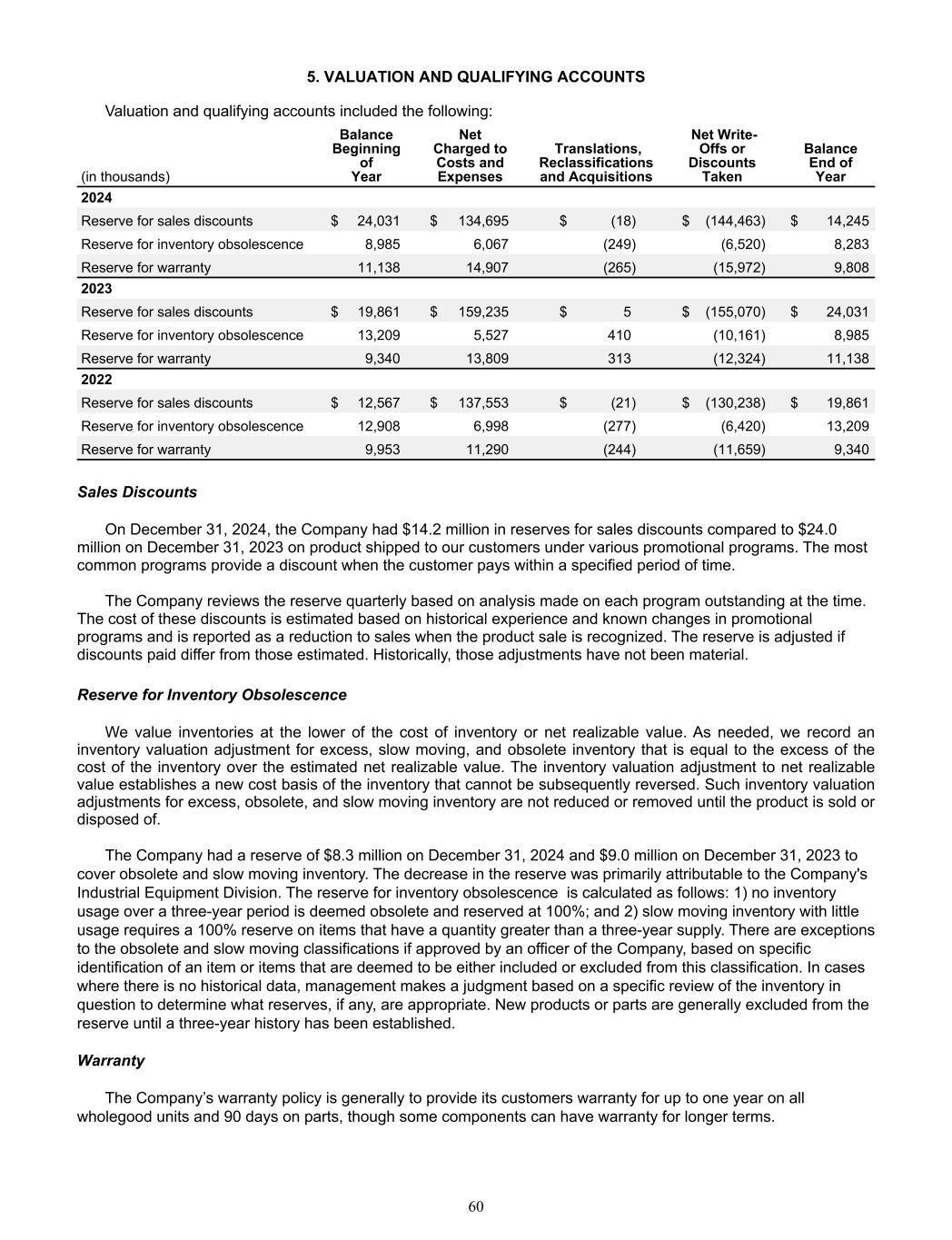

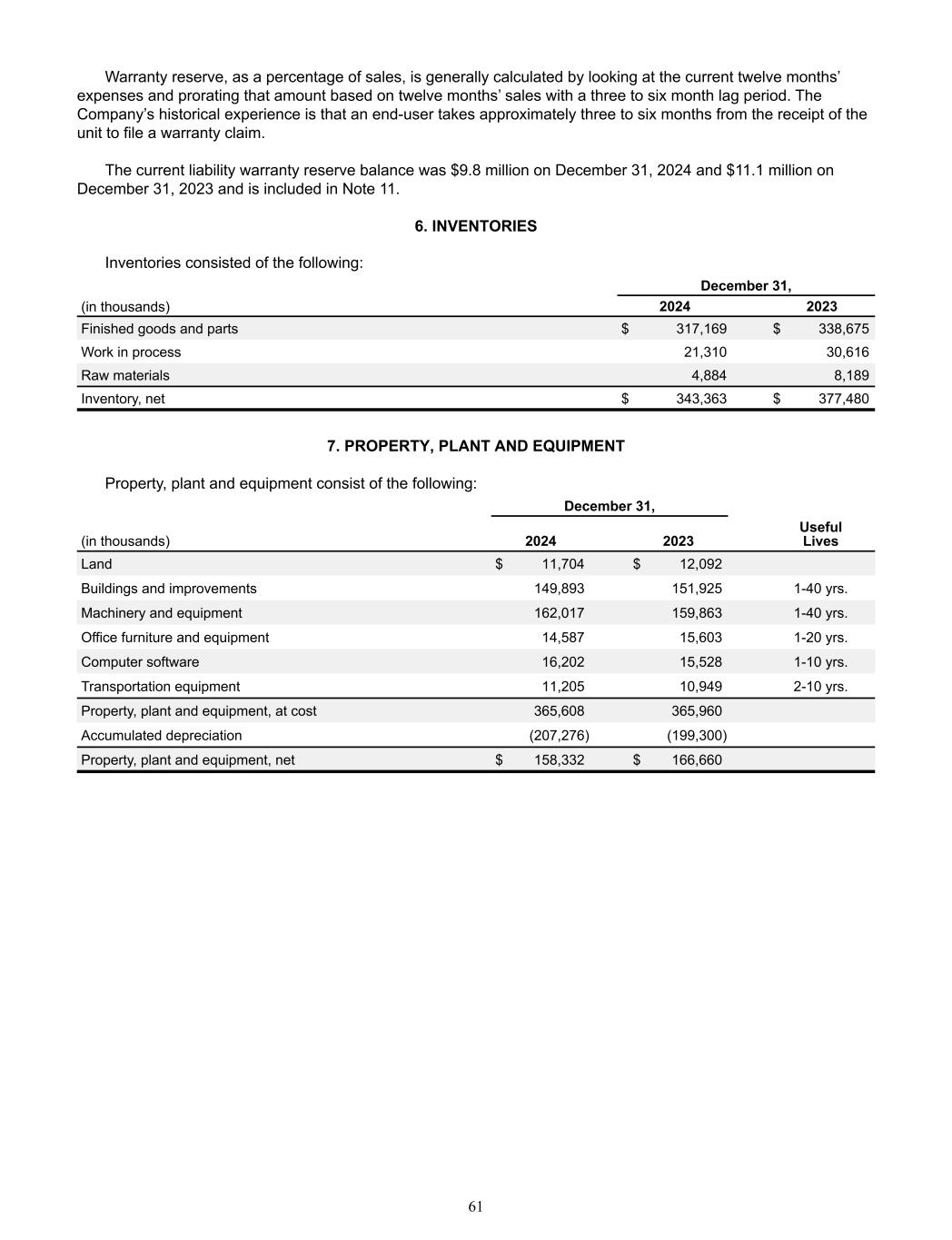

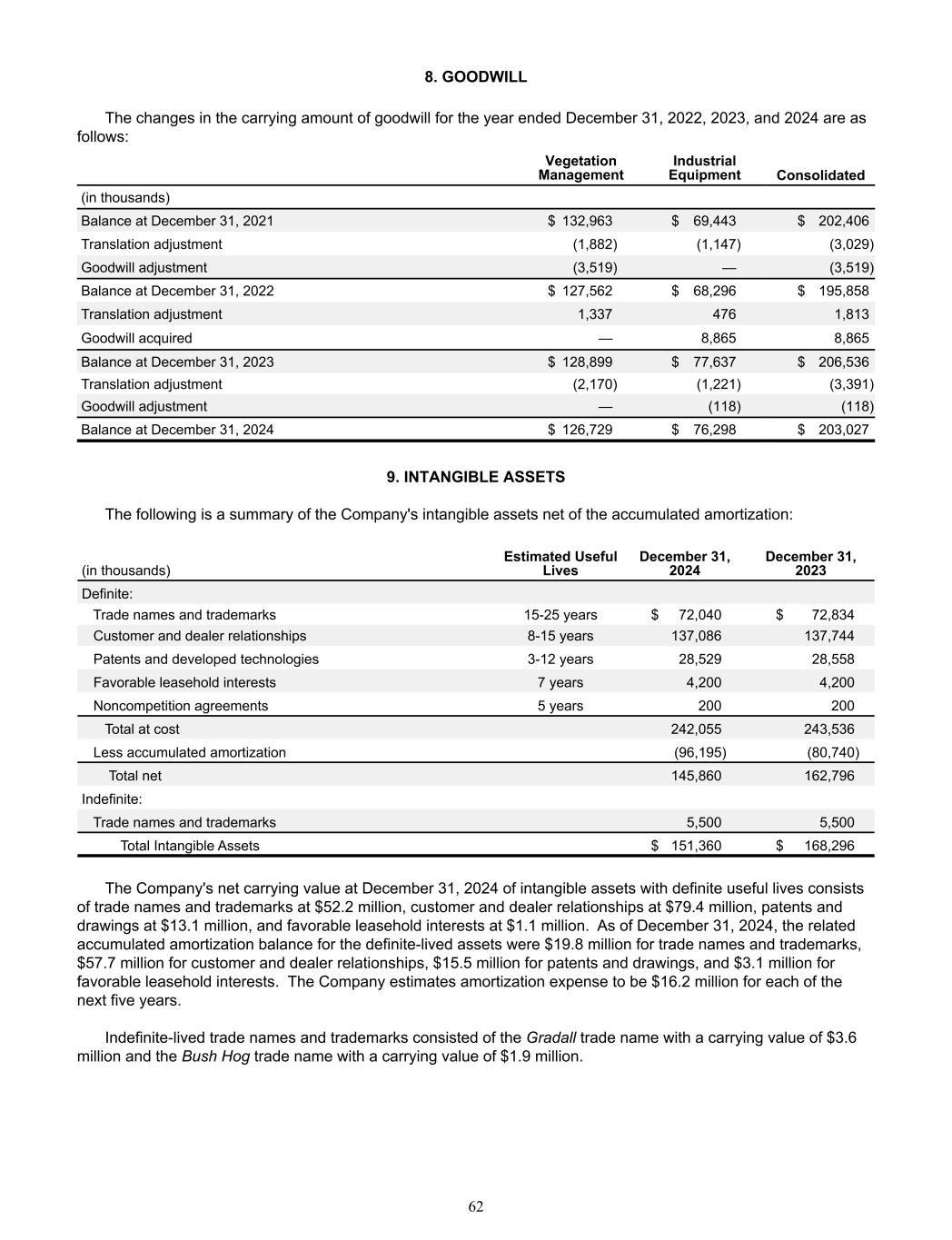

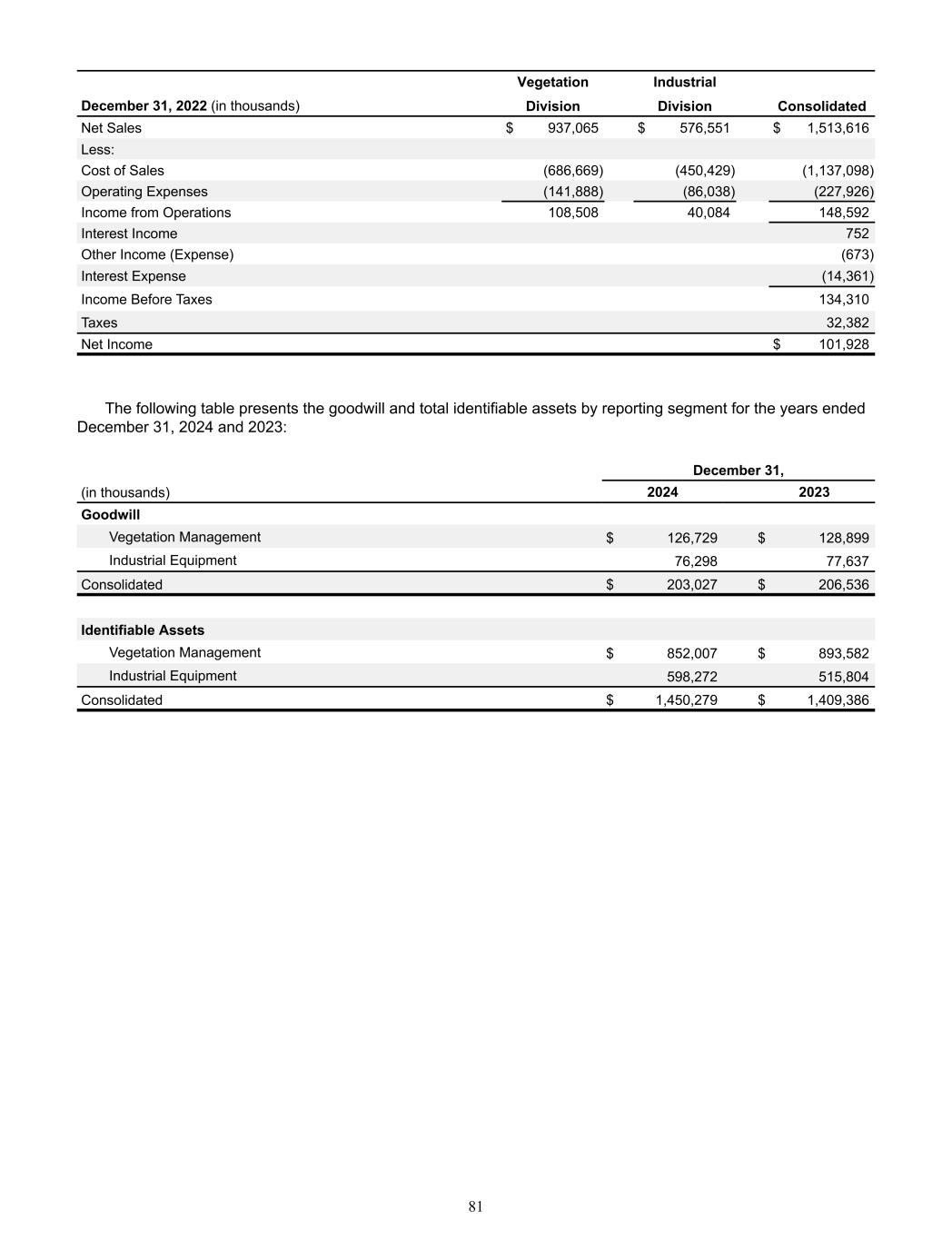

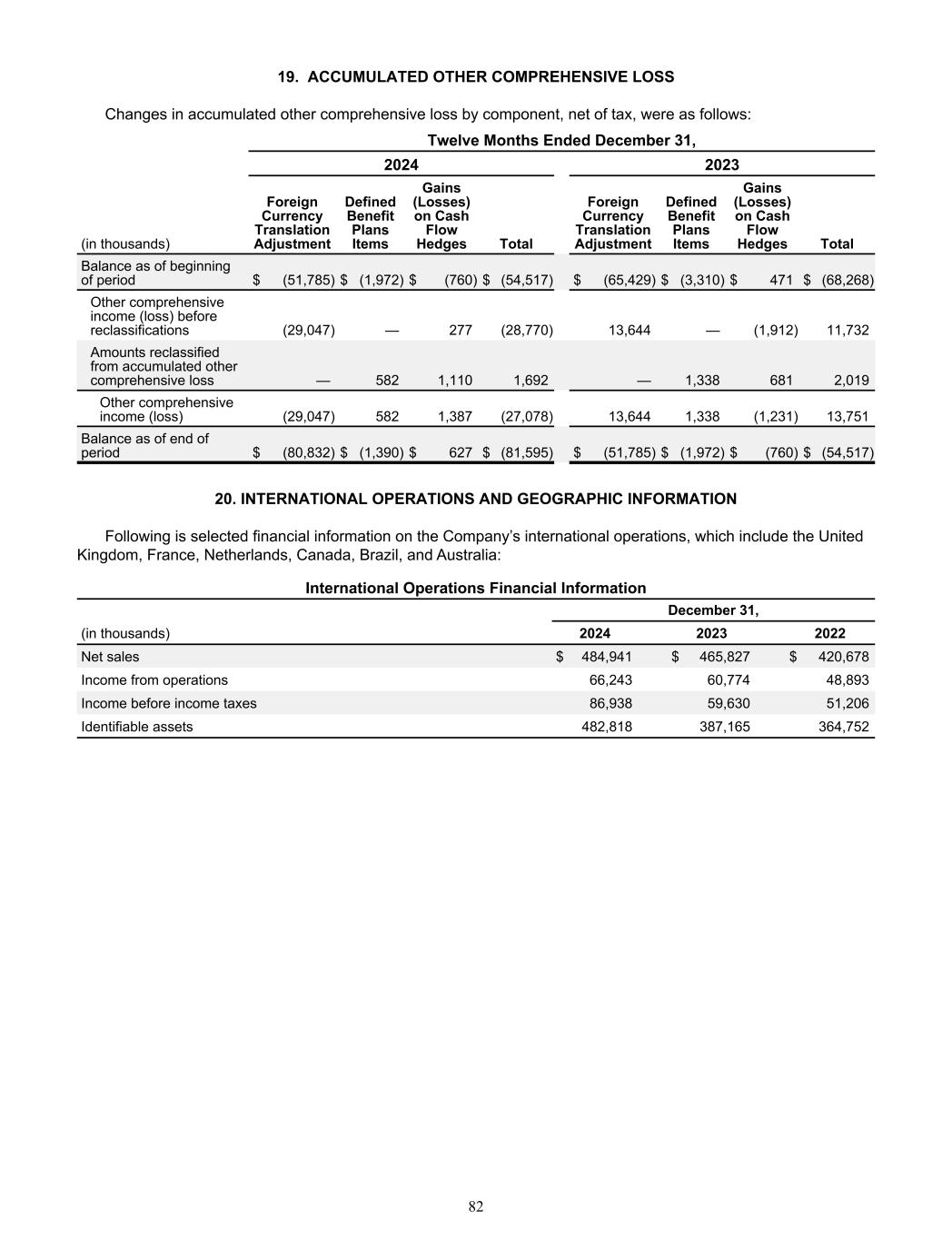

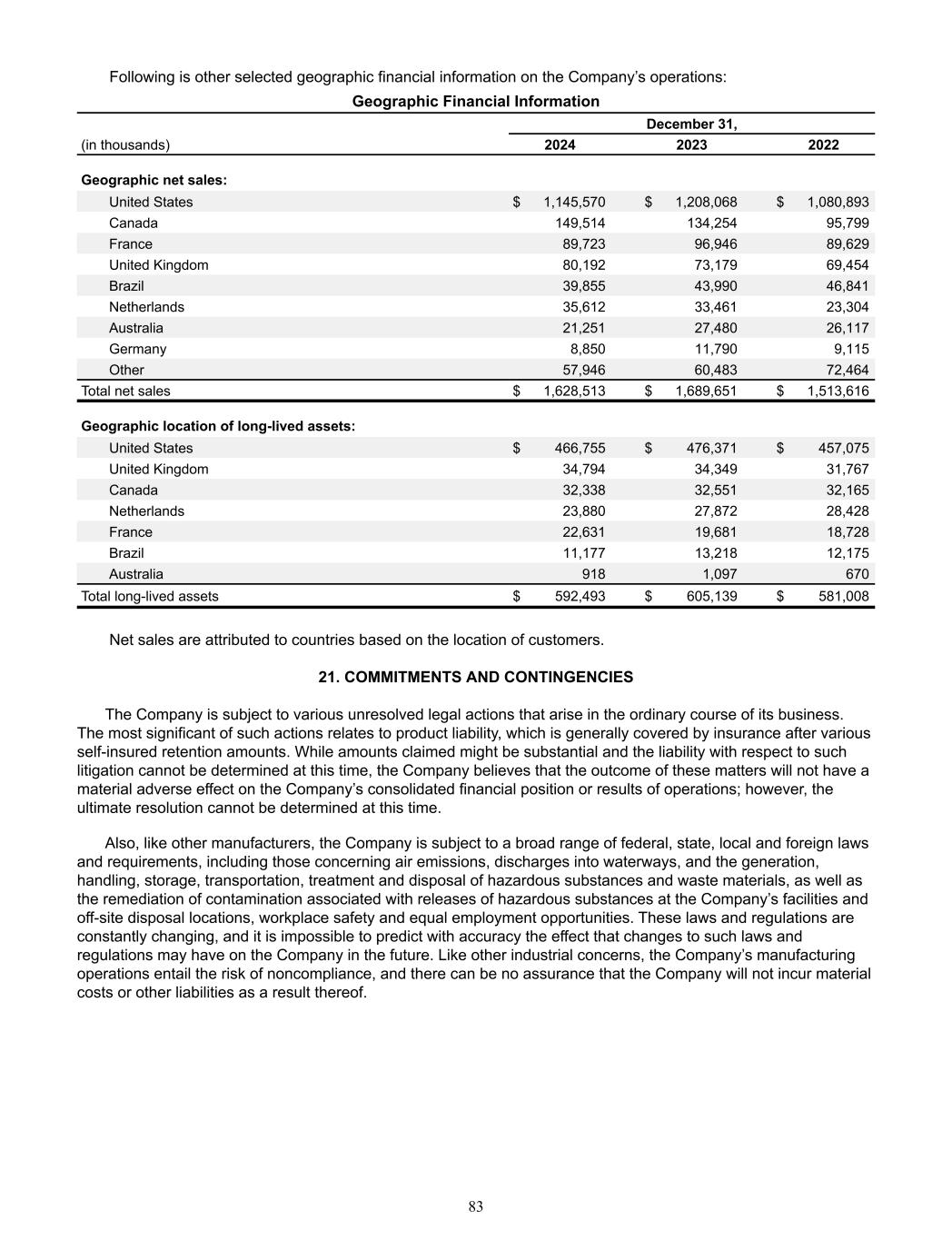

FINANCIAL HIGHLIGHTS In thousands, except per share data 2024 2023 2022 2021 Net Sales $1,628,513 $1,689,651 $1,513,616 $1,334,223 Gross Margin $412,488 $453,644 $376,518 $334,514 Operating Expenses $247,680 $255,677 $227,926 $217,576 Income From Operations $164,808 $197,967 $148,592 $116,938 Net Income $115,930 $136,161 $101,928 $80,245 Earnings Per Share (Diluted) $9.63 $11.36 $8.54 $6.75 Depreciation & Amortization $53,787 $48,676 $47,356 $45,146 Capital Expenditures $24,993 $37,745 $31,141 $25,263 Dividends Paid $12,442 $10,485 $8,549 $6,627 Working Capital $667,186 $590,031 $536,704 $419,604 Cash Flow From Operations(1) $177,383 $180,538 $152,611 $124,377 Long-Term Debt(2) $205,473 $220,269 $286,943 $254,522 Shareholder Equity $1,018,254 $932,763 $785,360 $705,663 Average Shares Outstanding(3) 12,037 11,987 11,934 11,896 Book Value Per Share $84.59 $77.81 $65.81 $59.32 (1) Excludes Changes in Working Capital (2) Excludes Current Portion (3) On a Diluted Basis NET SALES NET INCOME SHAREHOLDER EQUITY IN MILLIONS IN MILLIONS IN MILLIONS 24 $1,629 $115.9 24 $1,018 2422 23 $ $1,514 $1,690 1,334 21 $101.9 $136.2 $80.2 22 2321 $785 $933 $706 22 2321

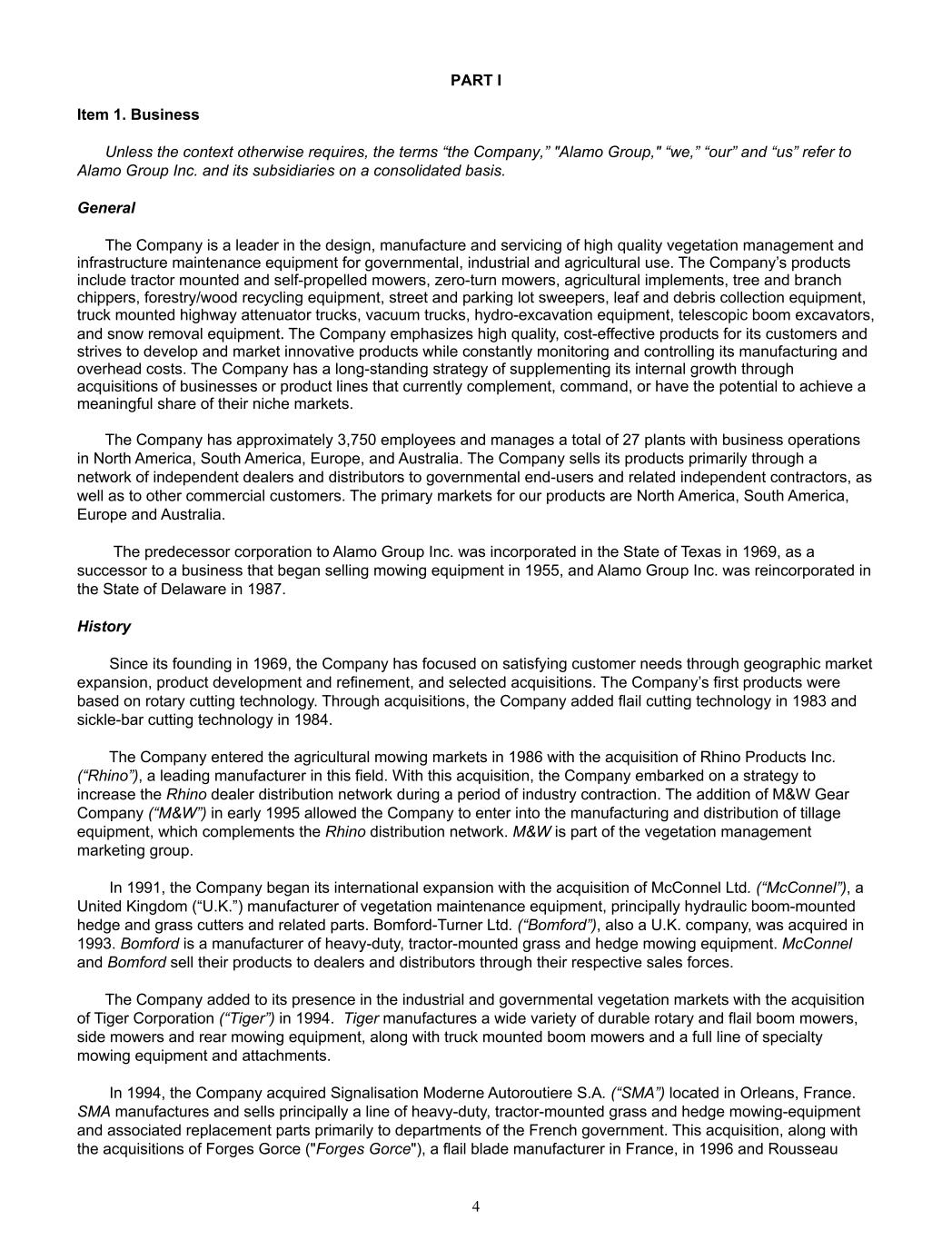

What a difference a year makes. We entered 2024 following the best year in company history, with strong momentum across all of our markets and high expectations for another record year. However, as the year progressed, the combined effects of elevated interest rates and excess channel inventories drove activity levels sharply lower in several markets served by our Vegetation Management Division. Concurrently, demand within our Industrial Equipment Division remained historically strong as the governmental and industrial contractor markets continued to display significant strength throughout the year despite it being an election year in the United States. Sales in the Vegetation Management Division declined 19.8% due to lower demand from the agricultural and forestry/tree care sectors, while sales in the Industrial Equipment Division increased by 18.7%, sustained by historically strong demand from governmental agencies and industrial contractors. As a result of these divergent market forces and the sale of the Herschel parts business in August, the company’s consolidated 2024 sales declined $61.1 million or 3.6% compared to the prior year. To address the impact of the softness in Vegetation Management, we implemented a series of measures to eliminate excess capacity, reduce operating costs, and reduce working capital. These actions included two large manufacturing facility consolidations in the USA, a series of initiatives to reduce inventory across the company, and a focus at all levels on cash management. Associated with these actions, we reduced our global employee population by nearly 14%. Taken together, these actions will result in annual cost reduction of $25–30 million starting in the third quarter of 2024. Our cash management initiatives produced solid results. Year-over-year inventory declined by 9% and accounts receivable declined by 16%. I am also pleased to report that our balance sheet strengthened considerably during the second half of the year. Intense focus on working capital efficiency allowed the company to accelerate debt repayments such that we ended the year with net debt of just $23 million, a year-over-year debt reduction of $160 million. This was obviously a very busy year across the company. The combination of the strong performance of the Industrial Equipment Division and the aggressive cost reduction and efficiency measures taken in the Vegetation Management Division allowed the company to produce a double-digit operating margin for the year despite the significant market headwinds we encountered in Vegetation Management. As we enter 2025, we are optimistic that we will see a steady, if modest, improvement in markets for our Vegetation Management Division in the second half of the year. The Industrial Equipment Division enters the year with good momentum and a strong backlog that give us confidence of another strong performance in that part of the company. With the benefit of the actions taken in 2024 and supported by additional efficiency improvement measures to be taken in 2025, we anticipate that the company will produce improved top and bottom-line performance this year. As always, we are deeply grateful for the support of our shareholders and other stakeholders for your continued support. Jeffery A. Leonard President and CEO Alamo Group Inc. LETTER TO OUR SHAREHOLDERS

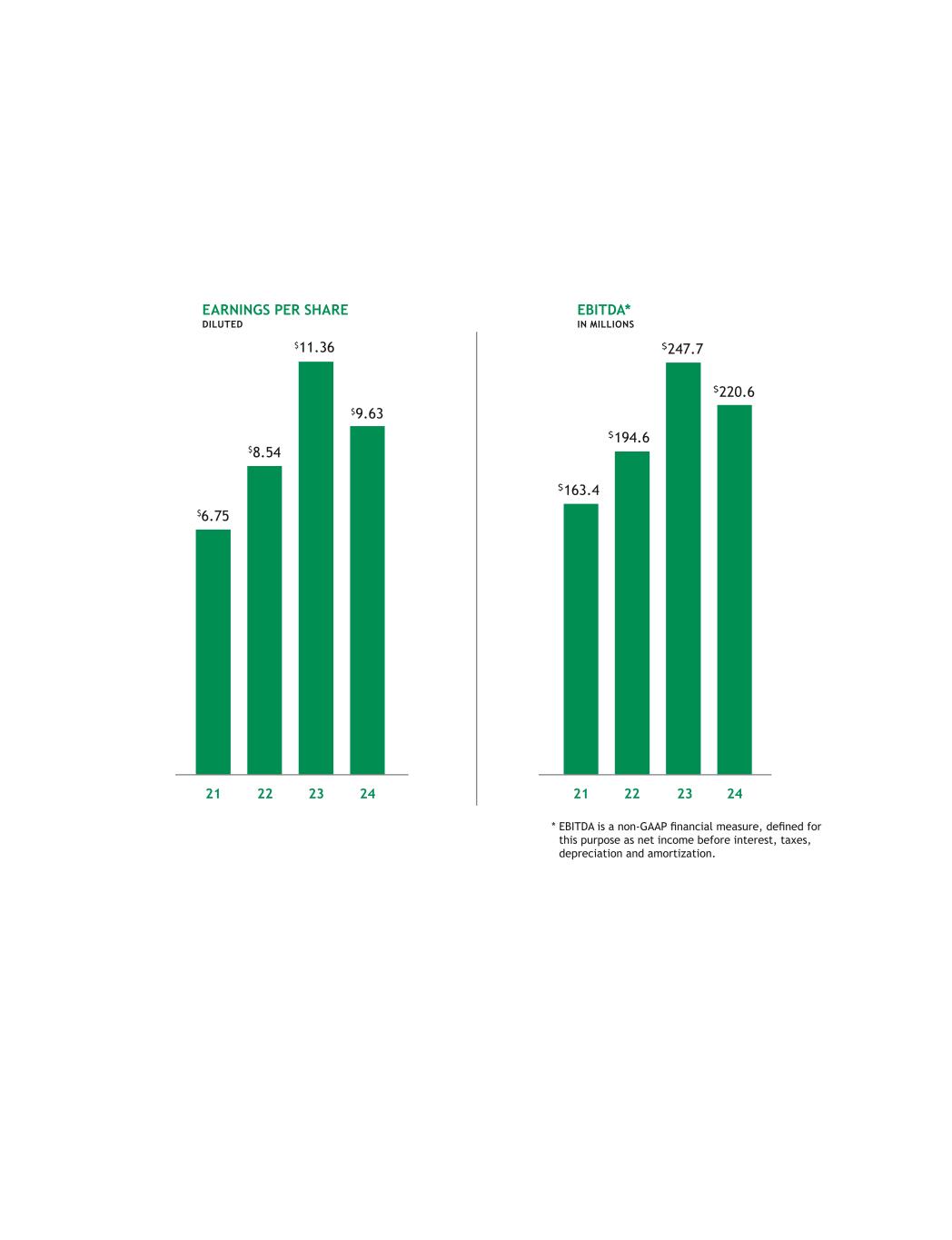

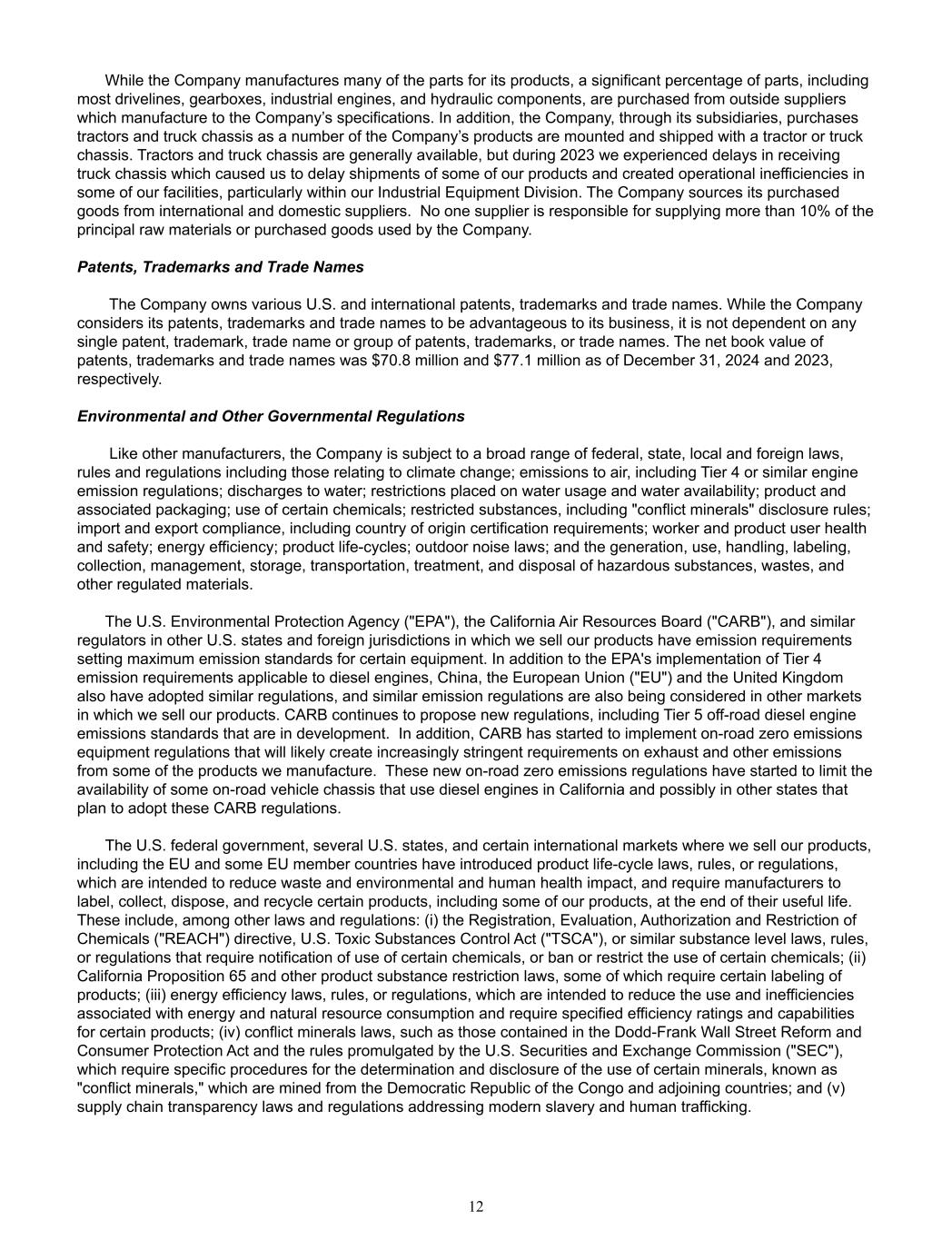

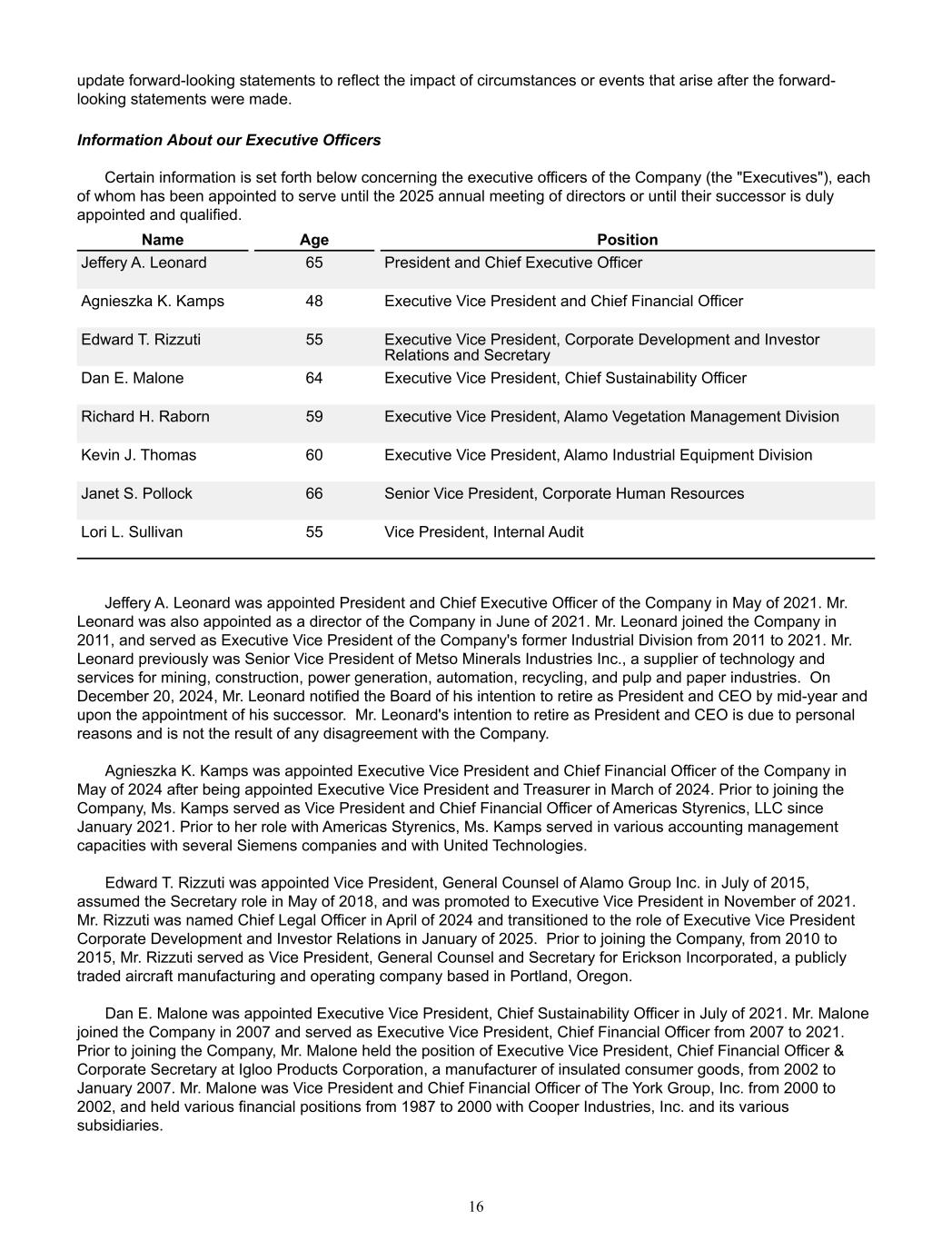

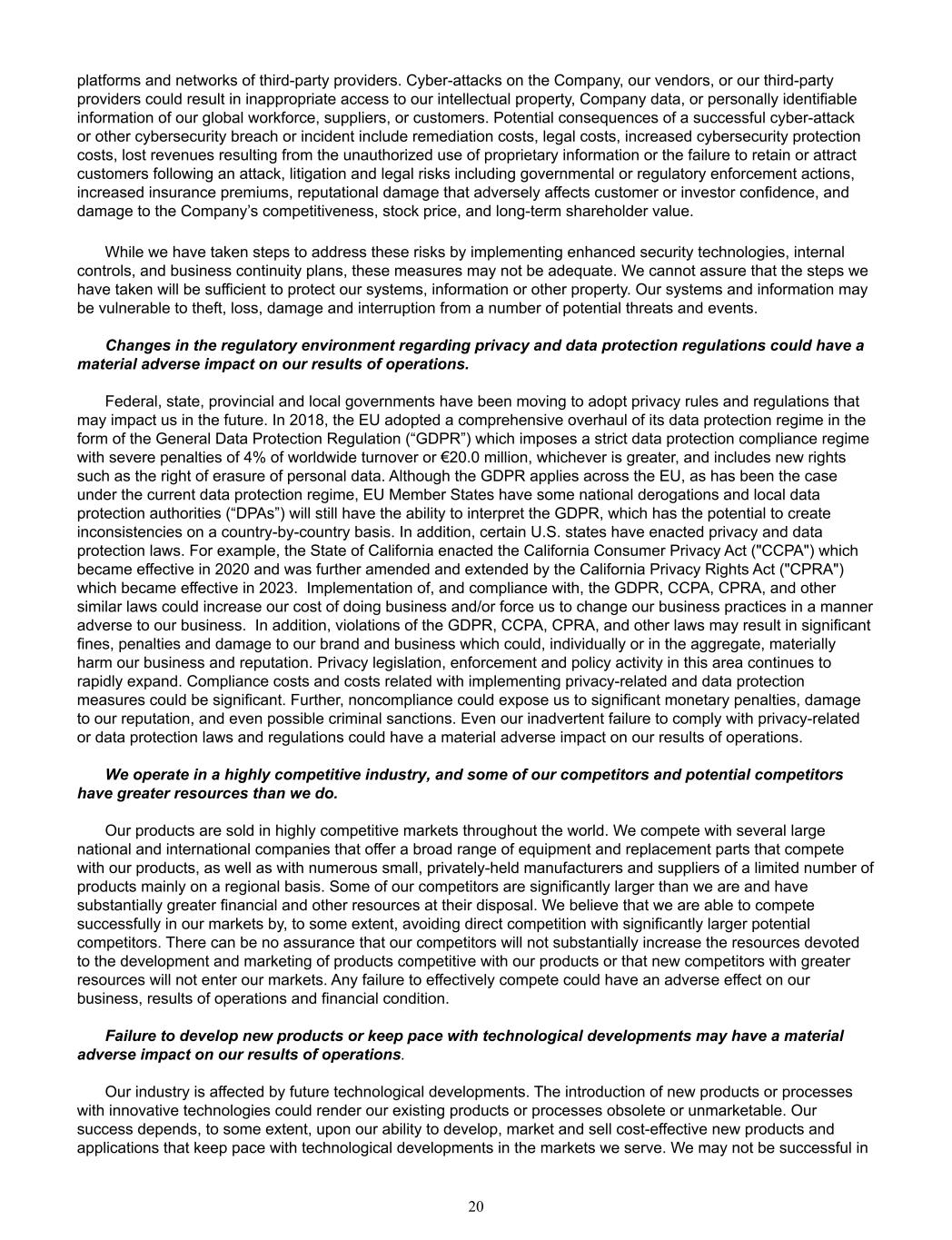

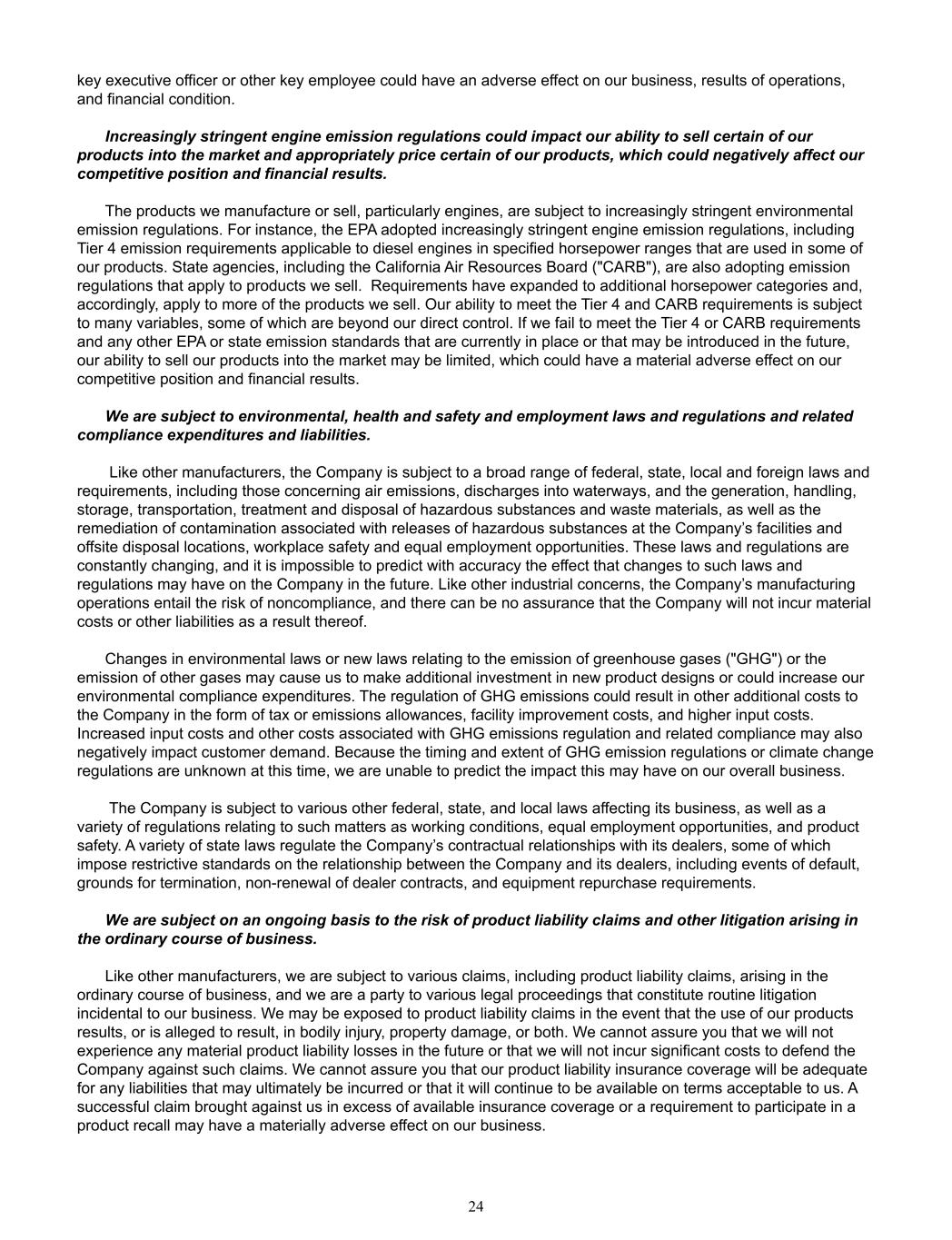

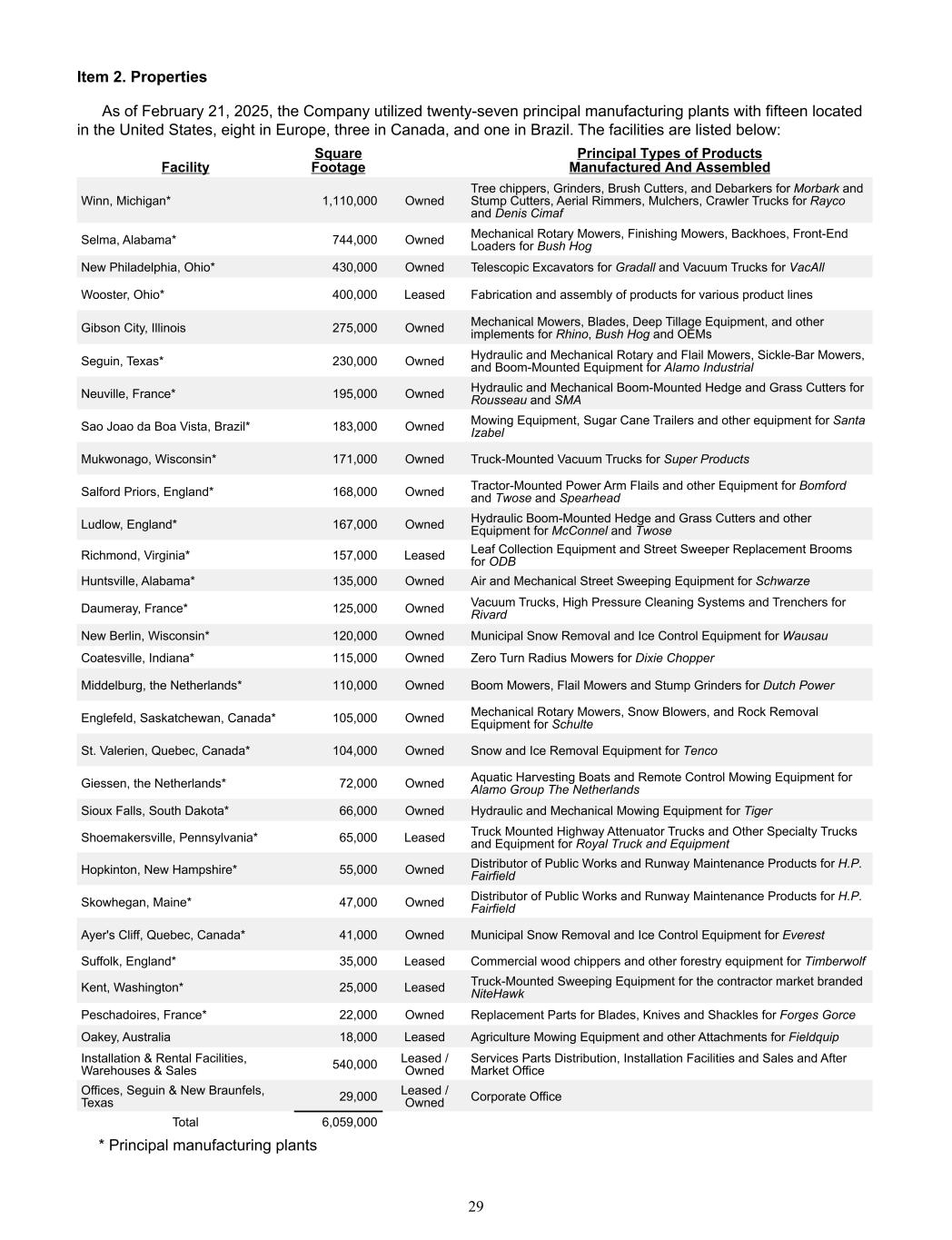

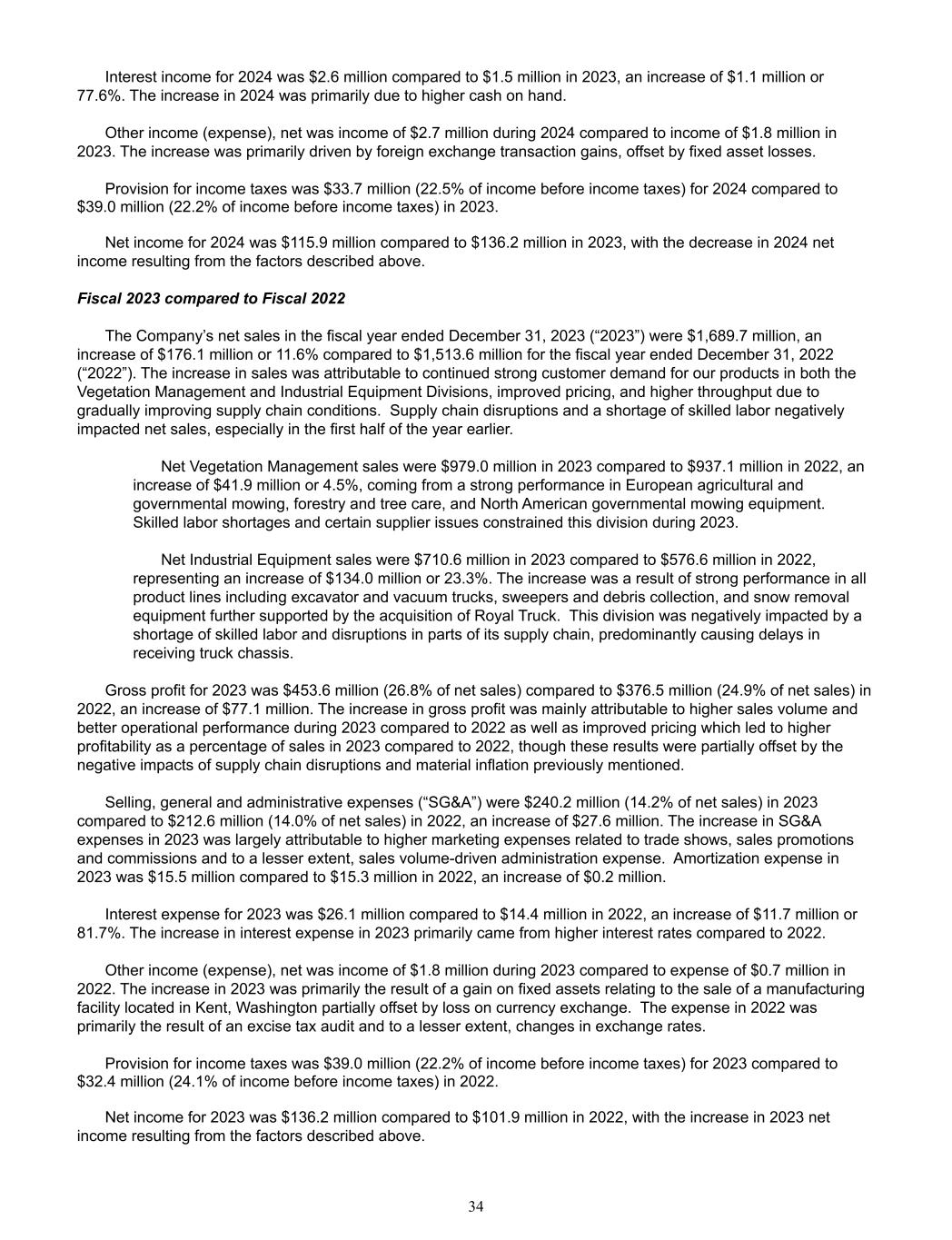

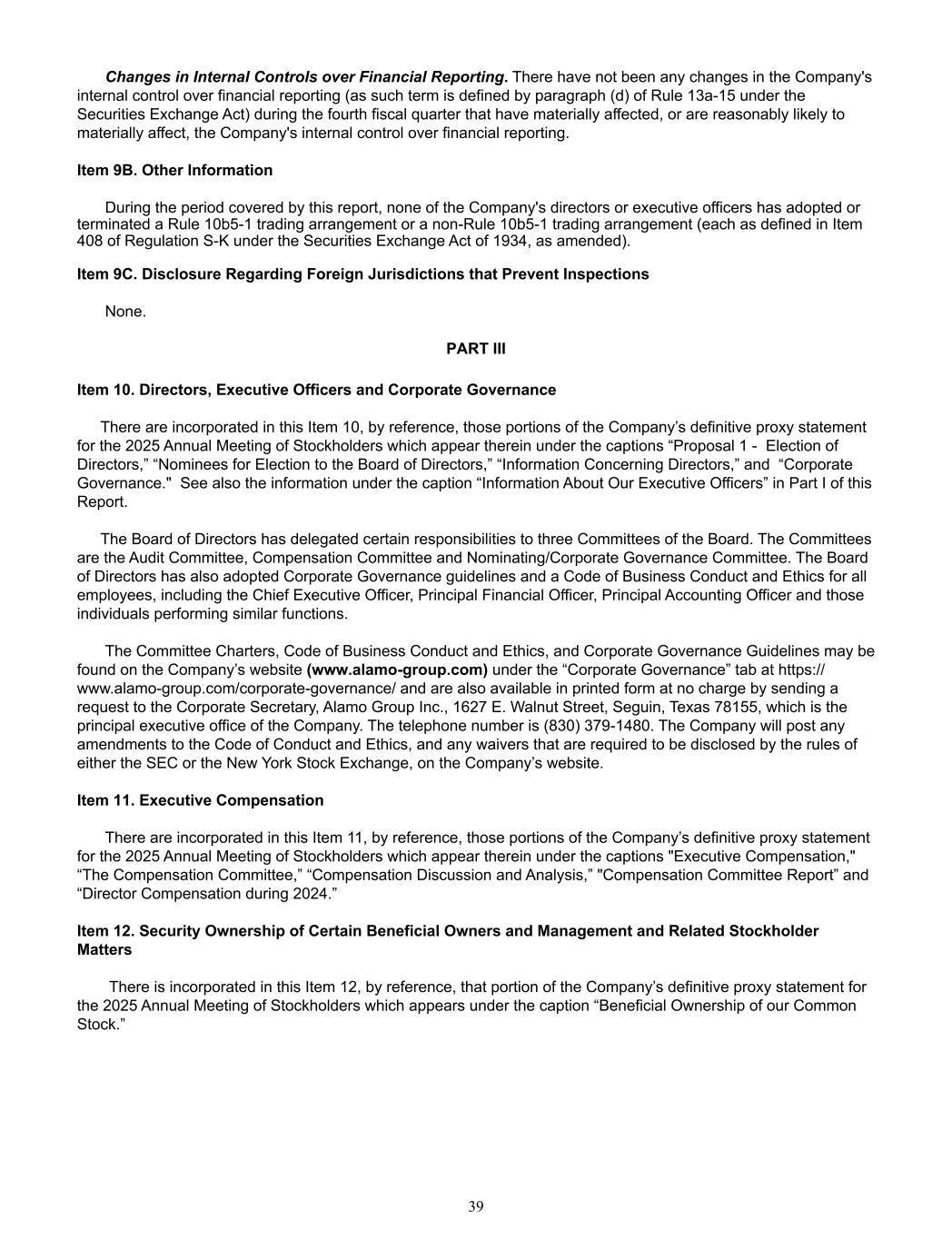

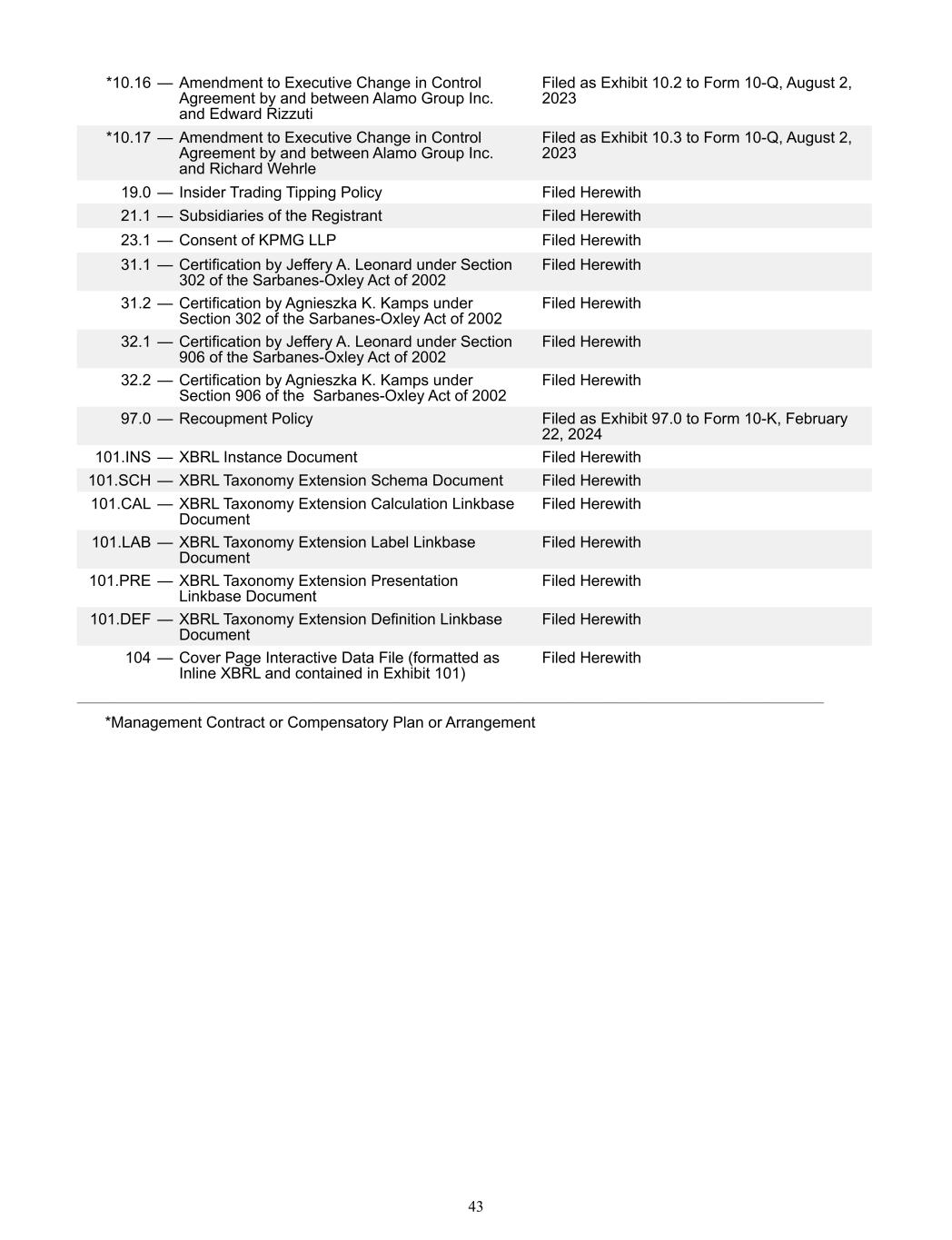

EARNINGS PER SHARE EBITDA* DILUTED IN MILLIONS * EBITDA is a non-GAAP financial measure, defined for this purpose as net income before interest, taxes, depreciation and amortization. 2322 $6.75 $8.54 $11.36 22 23 $194.6 $220.6 $247.7 $163.4 2124 $9.63 21 24

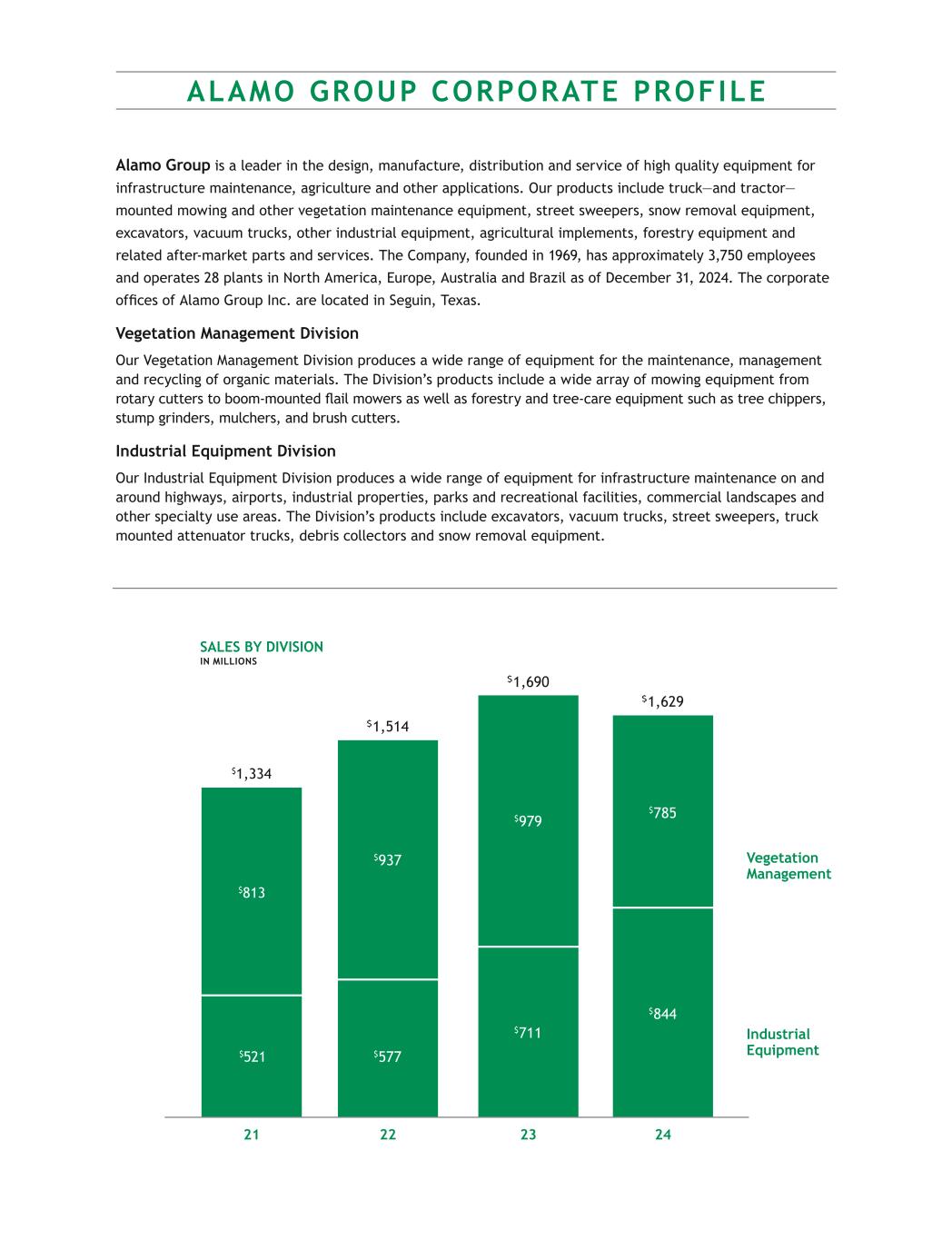

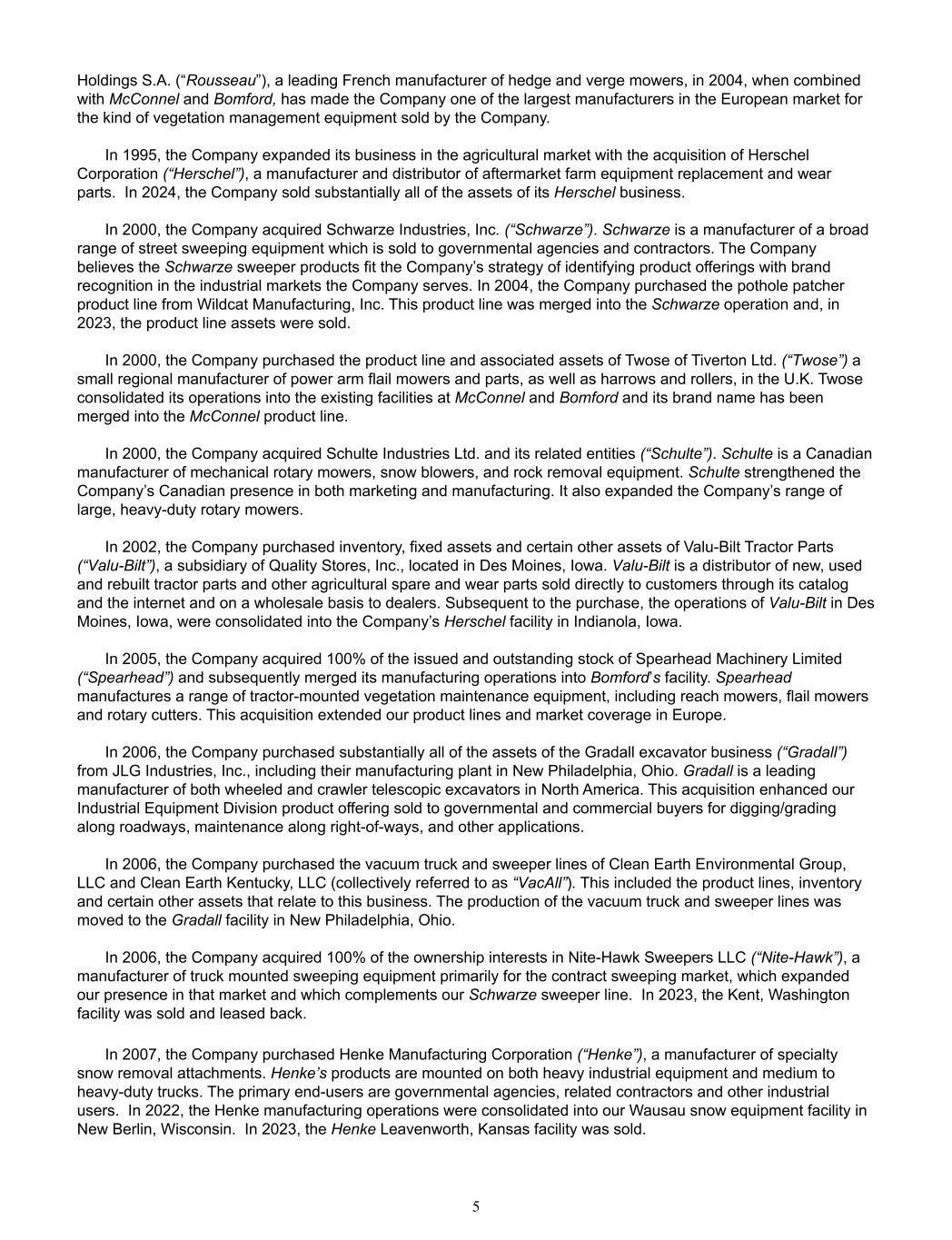

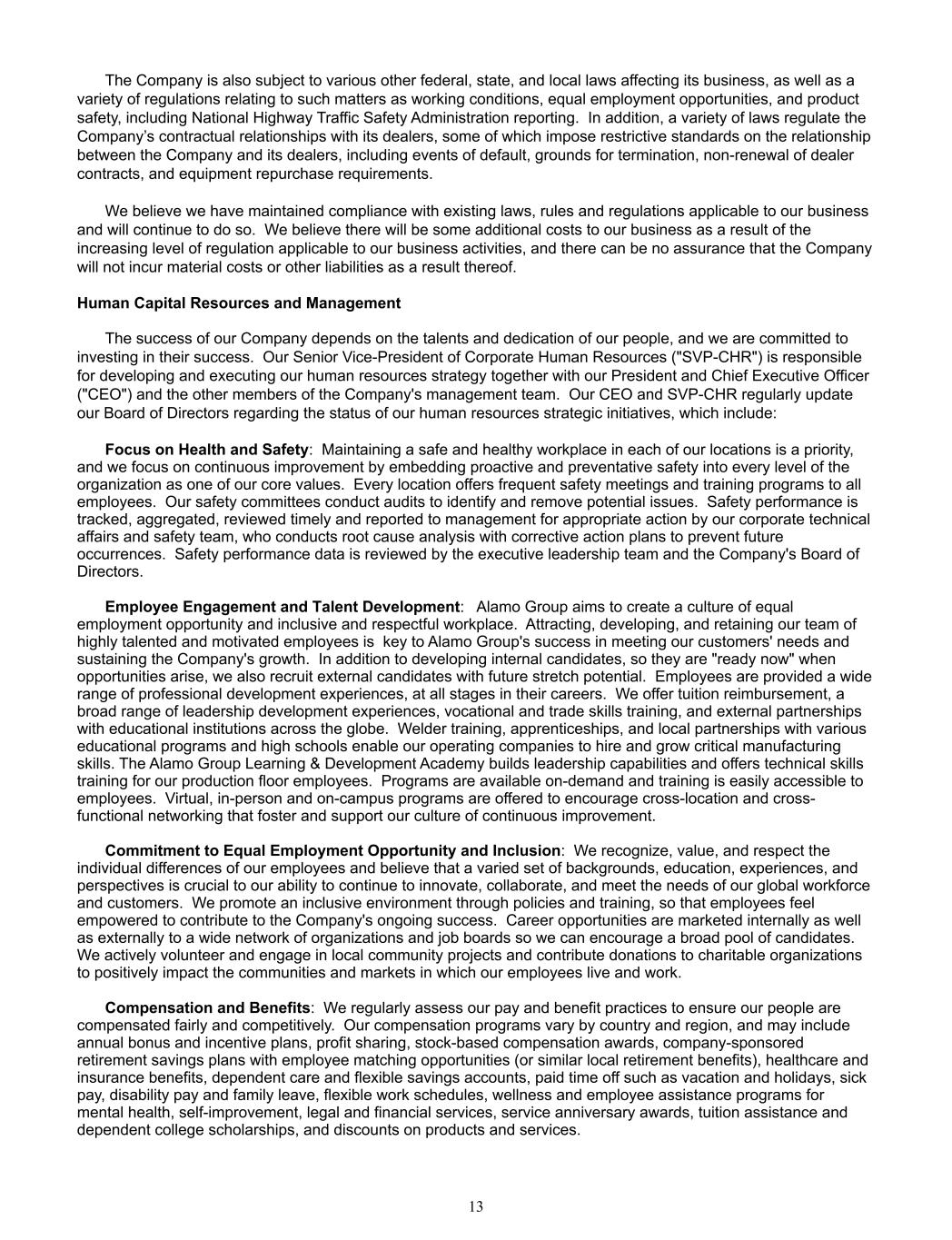

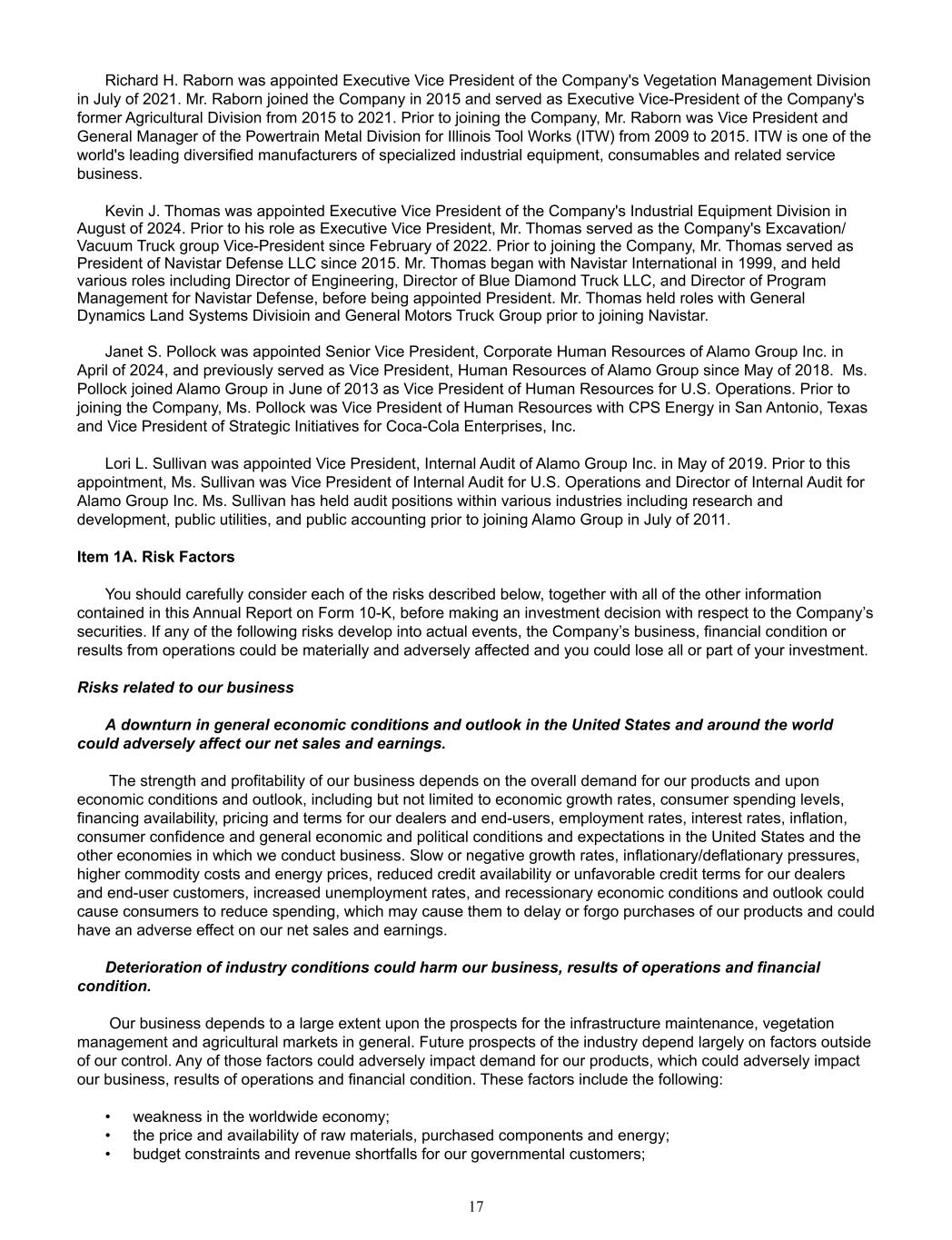

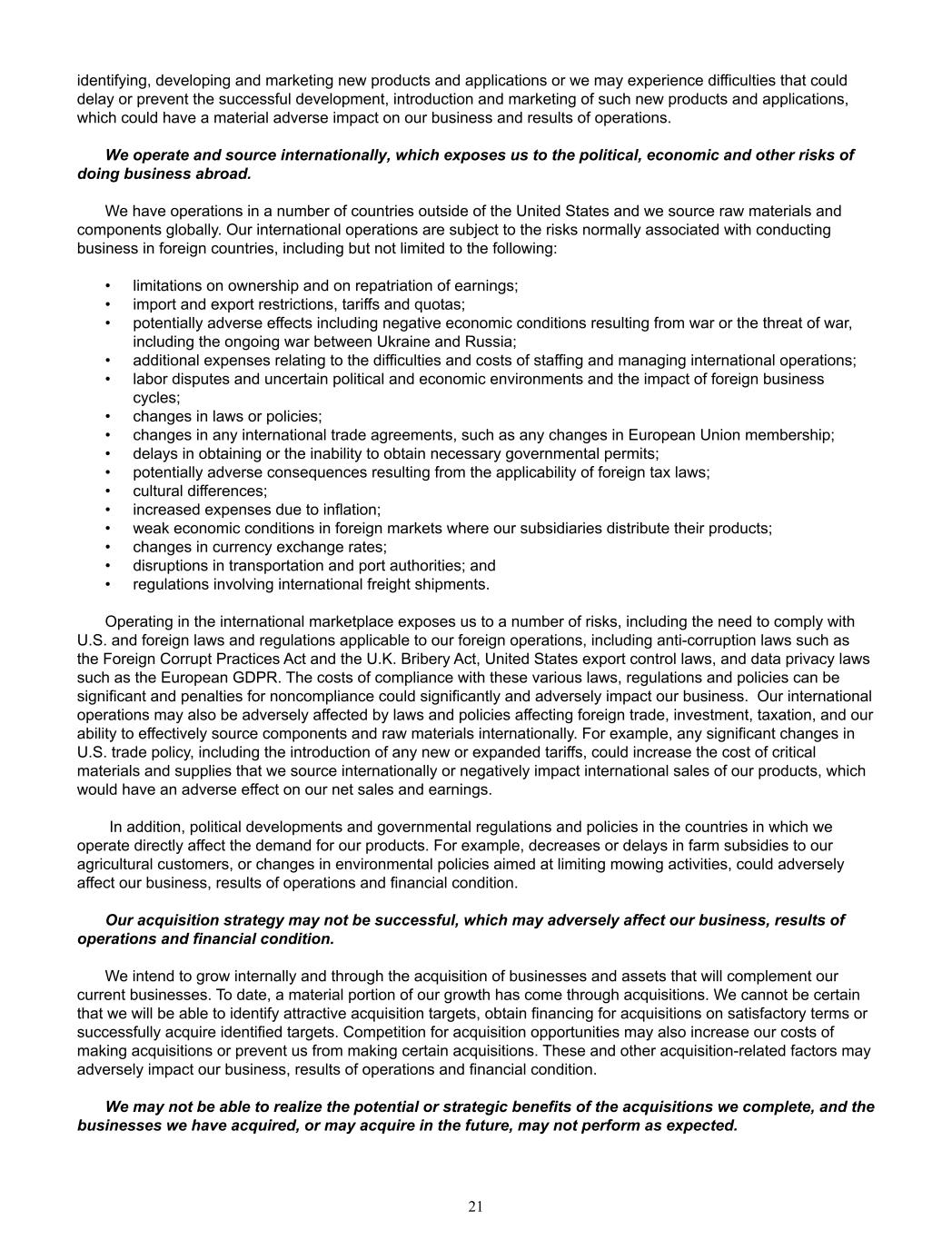

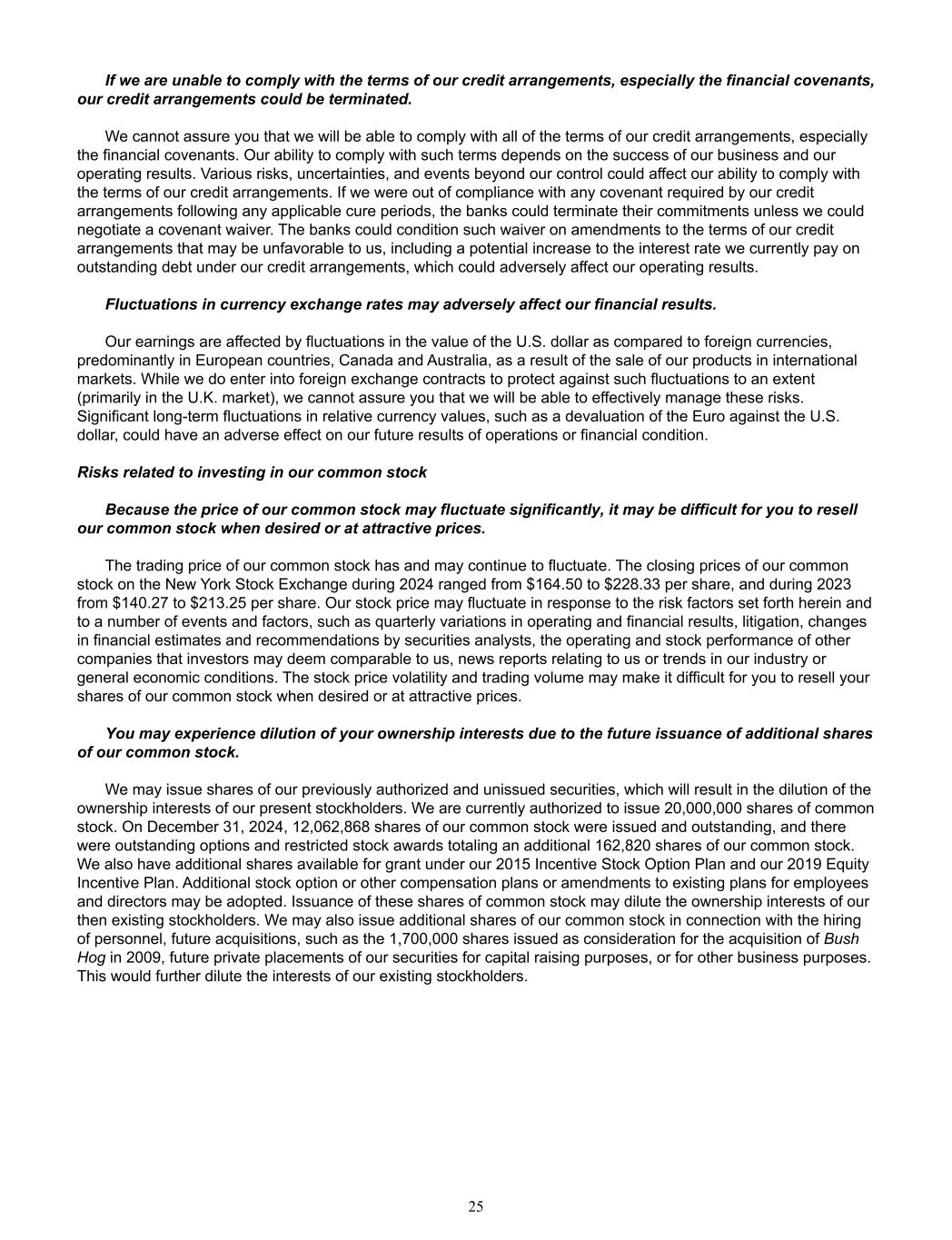

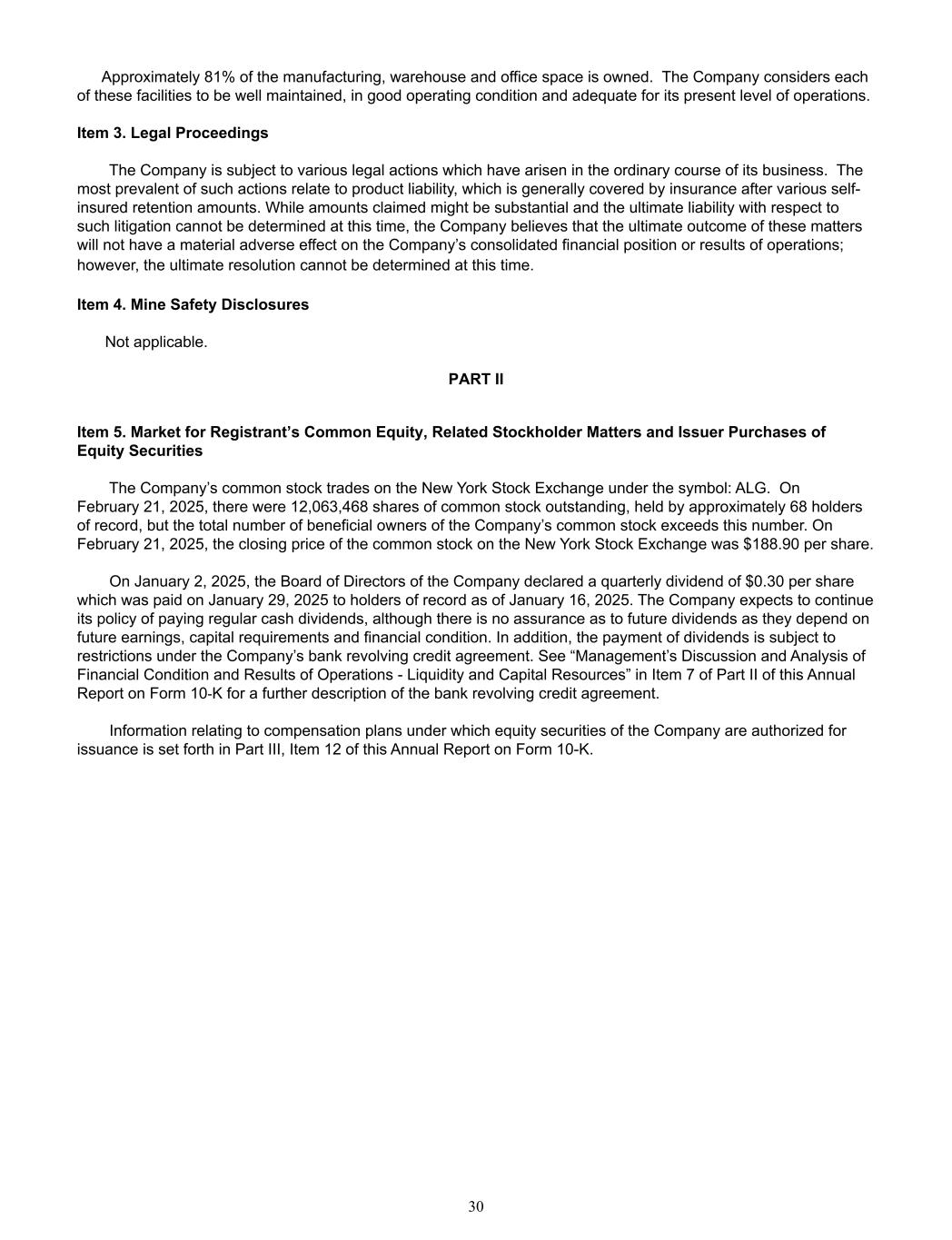

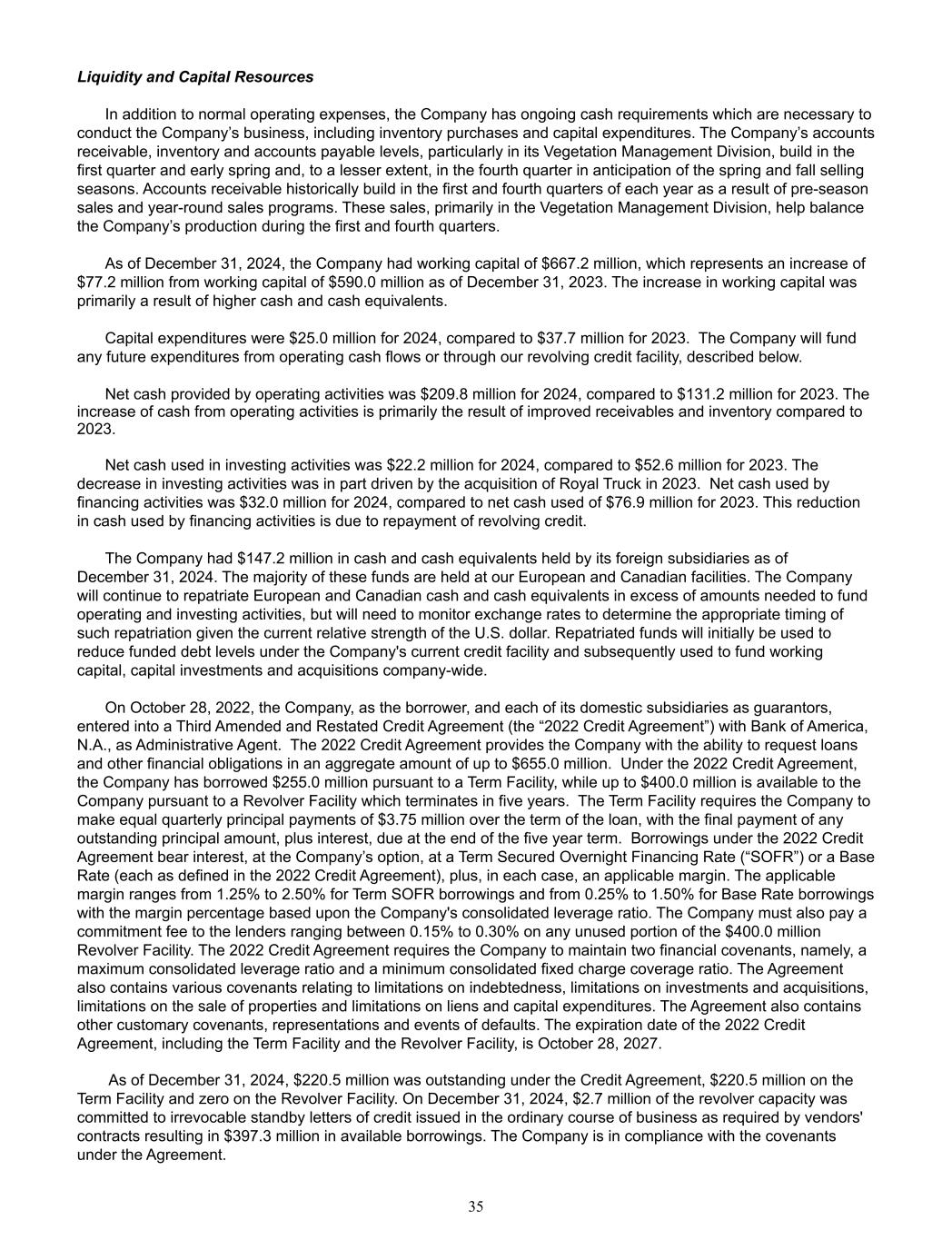

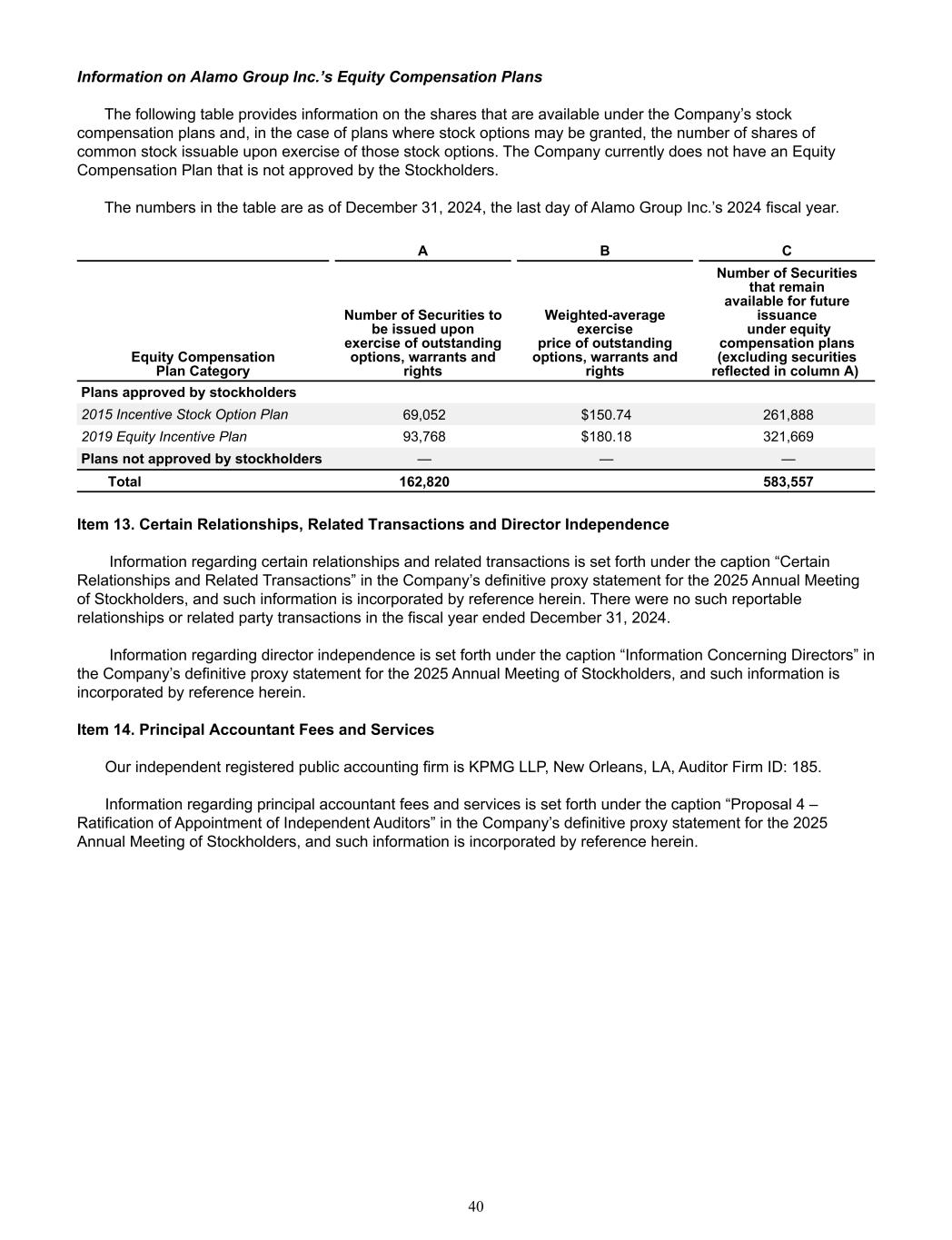

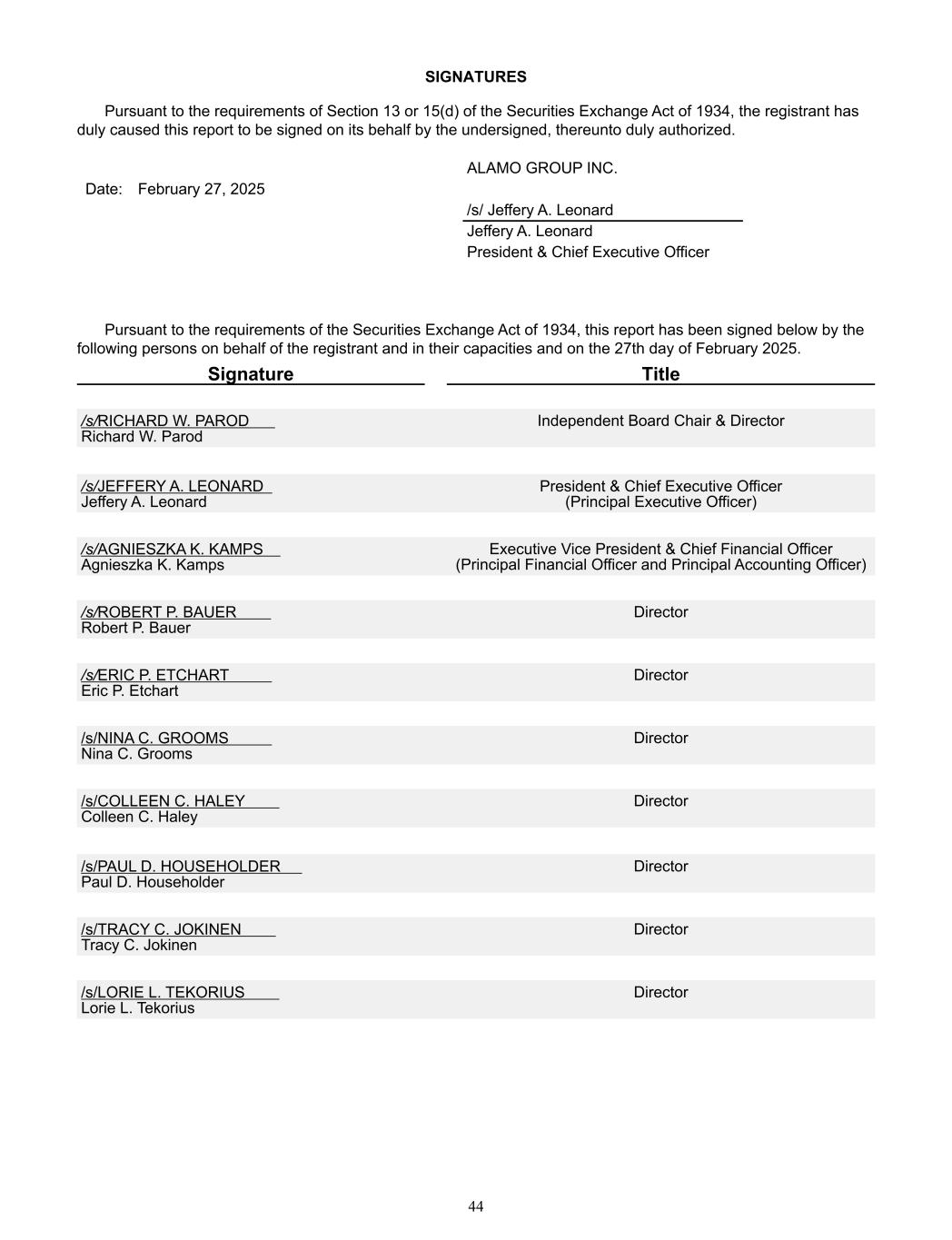

ALAMO GROUP CORPORATE PROFILE Alamo Group is a leader in the design, manufacture, distribution and service of high quality equipment for infrastructure maintenance, agriculture and other applications. Our products include truck—and tractor— mounted mowing and other vegetation maintenance equipment, street sweepers, snow removal equipment, excavators, vacuum trucks, other industrial equipment, agricultural implements, forestry equipment and related after-market parts and services. The Company, founded in 1969, has approximately 3,750 employees and operates 28 plants in North America, Europe, Australia and Brazil as of December 31, 2024. The corporate offices of Alamo Group Inc. are located in Seguin, Texas. Vegetation Management Division Our Vegetation Management Division produces a wide range of equipment for the maintenance, management and recycling of organic materials. The Division’s products include a wide array of mowing equipment from rotary cutters to boom-mounted flail mowers as well as forestry and tree-care equipment such as tree chippers, stump grinders, mulchers, and brush cutters. Industrial Equipment Division Our Industrial Equipment Division produces a wide range of equipment for infrastructure maintenance on and around highways, airports, industrial properties, parks and recreational facilities, commercial landscapes and other specialty use areas. The Division’s products include excavators, vacuum trucks, street sweepers, truck mounted attenuator trucks, debris collectors and snow removal equipment. SALES BY DIVISION IN MILLIONS Vegetation Management Industrial Equipment $1,334 $1,514 $1,690 2221 $521 $813 $937 $577 $979 $711 23 $1,629 $785 $844 24

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 Form 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE YEAR ENDED DECEMBER 31, 2024 ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 0-21220 ALAMO GROUP INC. (Exact name of registrant as specified in its charter) Delaware 74-1621248 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) 1627 East Walnut, Seguin, Texas 78155 (Address of principal executive offices, including zip code) 830-379-1480 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbol(s) Name of each exchange Common Stock, par value $.10 per share ALG on which registered New York Stock Exchange SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐ Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and an "emerging growth company" in Rule 12b-2 of the Exchange Act. Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒ If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐ Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant §240.10D-1(b). ☐ Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒ The aggregate market value of the voting stock (which consists solely of shares of common stock) held by non-affiliates of the registrant as of June 30, 2024 (based upon the last reported sale price of $173.00 per share) was approximately $1,770,634,586 on such date.

The number of shares of the registrant’s common stock, par value $.10 per share, outstanding as of February 21, 2025 was 12,063,468 shares. DOCUMENTS INCORPORATED BY REFERENCE Portions of the registrant’s proxy statement relating to the 2025 Annual Meeting of Stockholders have been incorporated by reference herein in response to Part III.

ALAMO GROUP INC. AND CONSOLIDATED SUBSIDIARIES FORM 10-K TABLE OF CONTENTS PART I Page Item 1. Business 4 Item 1A. Risk Factors 17 Item 1B. Unresolved Staff Comments 26 Item 1C. Cybersecurity 27 Item 2. Properties 29 Item 3. Legal Proceedings 30 Item 4. Mine Safety Disclosures 30 PART II Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities 30 Item 6. Reserved 32 Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations 32 Item 7A. Quantitative and Qualitative Disclosures about Market Risk 37 Item 8. Financial Statements and Supplementary Data 38 Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure 38 Item 9A. Controls and Procedures 38 Item 9B. Other Information 39 Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections 39 PART III Item 10. Directors, Executive Officers and Corporate Governance 39 Item 11. Executive Compensation 39 Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters 39 Item 13. Certain Relationships, Related Transactions, and Director Independence 40 Item 14. Principal Accountant Fees and Services 40 PART IV Item 15. Exhibits and Financial Statement Schedules 41 Index to Consolidated Financial Statements 41 Item 16. Summary 41 3

PART I Item 1. Business Unless the context otherwise requires, the terms “the Company,” "Alamo Group," “we,” “our” and “us” refer to Alamo Group Inc. and its subsidiaries on a consolidated basis. General The Company is a leader in the design, manufacture and servicing of high quality vegetation management and infrastructure maintenance equipment for governmental, industrial and agricultural use. The Company’s products include tractor mounted and self-propelled mowers, zero-turn mowers, agricultural implements, tree and branch chippers, forestry/wood recycling equipment, street and parking lot sweepers, leaf and debris collection equipment, truck mounted highway attenuator trucks, vacuum trucks, hydro-excavation equipment, telescopic boom excavators, and snow removal equipment. The Company emphasizes high quality, cost-effective products for its customers and strives to develop and market innovative products while constantly monitoring and controlling its manufacturing and overhead costs. The Company has a long-standing strategy of supplementing its internal growth through acquisitions of businesses or product lines that currently complement, command, or have the potential to achieve a meaningful share of their niche markets. The Company has approximately 3,750 employees and manages a total of 27 plants with business operations in North America, South America, Europe, and Australia. The Company sells its products primarily through a network of independent dealers and distributors to governmental end-users and related independent contractors, as well as to other commercial customers. The primary markets for our products are North America, South America, Europe and Australia. The predecessor corporation to Alamo Group Inc. was incorporated in the State of Texas in 1969, as a successor to a business that began selling mowing equipment in 1955, and Alamo Group Inc. was reincorporated in the State of Delaware in 1987. History Since its founding in 1969, the Company has focused on satisfying customer needs through geographic market expansion, product development and refinement, and selected acquisitions. The Company’s first products were based on rotary cutting technology. Through acquisitions, the Company added flail cutting technology in 1983 and sickle-bar cutting technology in 1984. The Company entered the agricultural mowing markets in 1986 with the acquisition of Rhino Products Inc. (“Rhino”), a leading manufacturer in this field. With this acquisition, the Company embarked on a strategy to increase the Rhino dealer distribution network during a period of industry contraction. The addition of M&W Gear Company (“M&W”) in early 1995 allowed the Company to enter into the manufacturing and distribution of tillage equipment, which complements the Rhino distribution network. M&W is part of the vegetation management marketing group. In 1991, the Company began its international expansion with the acquisition of McConnel Ltd. (“McConnel”), a United Kingdom (“U.K.”) manufacturer of vegetation maintenance equipment, principally hydraulic boom-mounted hedge and grass cutters and related parts. Bomford-Turner Ltd. (“Bomford”), also a U.K. company, was acquired in 1993. Bomford is a manufacturer of heavy-duty, tractor-mounted grass and hedge mowing equipment. McConnel and Bomford sell their products to dealers and distributors through their respective sales forces. The Company added to its presence in the industrial and governmental vegetation markets with the acquisition of Tiger Corporation (“Tiger”) in 1994. Tiger manufactures a wide variety of durable rotary and flail boom mowers, side mowers and rear mowing equipment, along with truck mounted boom mowers and a full line of specialty mowing equipment and attachments. In 1994, the Company acquired Signalisation Moderne Autoroutiere S.A. (“SMA”) located in Orleans, France. SMA manufactures and sells principally a line of heavy-duty, tractor-mounted grass and hedge mowing-equipment and associated replacement parts primarily to departments of the French government. This acquisition, along with the acquisitions of Forges Gorce ("Forges Gorce"), a flail blade manufacturer in France, in 1996 and Rousseau 4

Holdings S.A. (“Rousseau”), a leading French manufacturer of hedge and verge mowers, in 2004, when combined with McConnel and Bomford, has made the Company one of the largest manufacturers in the European market for the kind of vegetation management equipment sold by the Company. In 1995, the Company expanded its business in the agricultural market with the acquisition of Herschel Corporation (“Herschel”), a manufacturer and distributor of aftermarket farm equipment replacement and wear parts. In 2024, the Company sold substantially all of the assets of its Herschel business. In 2000, the Company acquired Schwarze Industries, Inc. (“Schwarze”). Schwarze is a manufacturer of a broad range of street sweeping equipment which is sold to governmental agencies and contractors. The Company believes the Schwarze sweeper products fit the Company’s strategy of identifying product offerings with brand recognition in the industrial markets the Company serves. In 2004, the Company purchased the pothole patcher product line from Wildcat Manufacturing, Inc. This product line was merged into the Schwarze operation and, in 2023, the product line assets were sold. In 2000, the Company purchased the product line and associated assets of Twose of Tiverton Ltd. (“Twose”) a small regional manufacturer of power arm flail mowers and parts, as well as harrows and rollers, in the U.K. Twose consolidated its operations into the existing facilities at McConnel and Bomford and its brand name has been merged into the McConnel product line. In 2000, the Company acquired Schulte Industries Ltd. and its related entities (“Schulte”). Schulte is a Canadian manufacturer of mechanical rotary mowers, snow blowers, and rock removal equipment. Schulte strengthened the Company’s Canadian presence in both marketing and manufacturing. It also expanded the Company’s range of large, heavy-duty rotary mowers. In 2002, the Company purchased inventory, fixed assets and certain other assets of Valu-Bilt Tractor Parts (“Valu-Bilt”), a subsidiary of Quality Stores, Inc., located in Des Moines, Iowa. Valu-Bilt is a distributor of new, used and rebuilt tractor parts and other agricultural spare and wear parts sold directly to customers through its catalog and the internet and on a wholesale basis to dealers. Subsequent to the purchase, the operations of Valu-Bilt in Des Moines, Iowa, were consolidated into the Company’s Herschel facility in Indianola, Iowa. In 2005, the Company acquired 100% of the issued and outstanding stock of Spearhead Machinery Limited (“Spearhead”) and subsequently merged its manufacturing operations into Bomford’s facility. Spearhead manufactures a range of tractor-mounted vegetation maintenance equipment, including reach mowers, flail mowers and rotary cutters. This acquisition extended our product lines and market coverage in Europe. In 2006, the Company purchased substantially all of the assets of the Gradall excavator business (“Gradall”) from JLG Industries, Inc., including their manufacturing plant in New Philadelphia, Ohio. Gradall is a leading manufacturer of both wheeled and crawler telescopic excavators in North America. This acquisition enhanced our Industrial Equipment Division product offering sold to governmental and commercial buyers for digging/grading along roadways, maintenance along right-of-ways, and other applications. In 2006, the Company purchased the vacuum truck and sweeper lines of Clean Earth Environmental Group, LLC and Clean Earth Kentucky, LLC (collectively referred to as “VacAll”). This included the product lines, inventory and certain other assets that relate to this business. The production of the vacuum truck and sweeper lines was moved to the Gradall facility in New Philadelphia, Ohio. In 2006, the Company acquired 100% of the ownership interests in Nite-Hawk Sweepers LLC (“Nite-Hawk”), a manufacturer of truck mounted sweeping equipment primarily for the contract sweeping market, which expanded our presence in that market and which complements our Schwarze sweeper line. In 2023, the Kent, Washington facility was sold and leased back. In 2007, the Company purchased Henke Manufacturing Corporation (“Henke”), a manufacturer of specialty snow removal attachments. Henke’s products are mounted on both heavy industrial equipment and medium to heavy-duty trucks. The primary end-users are governmental agencies, related contractors and other industrial users. In 2022, the Henke manufacturing operations were consolidated into our Wausau snow equipment facility in New Berlin, Wisconsin. In 2023, the Henke Leavenworth, Kansas facility was sold. 5

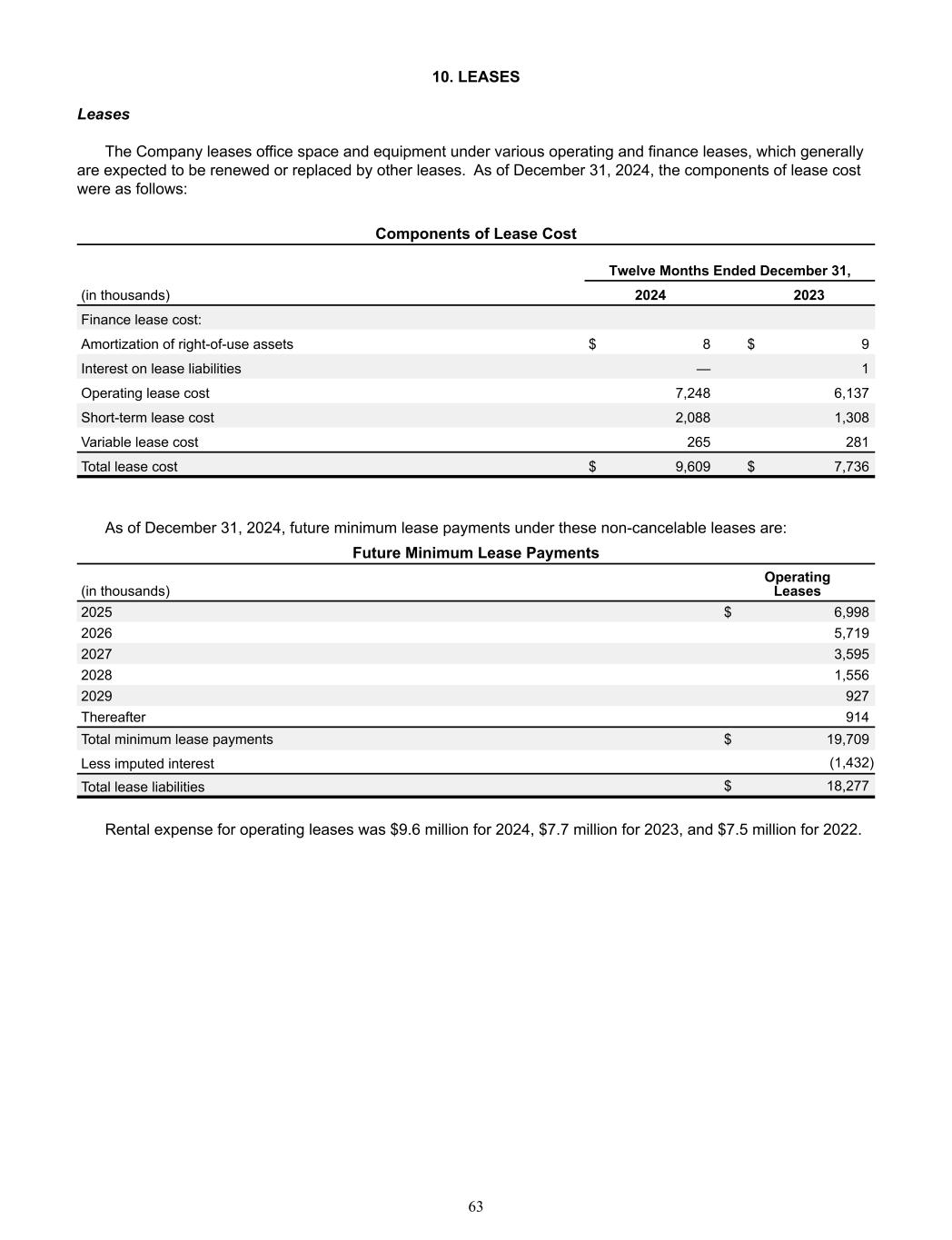

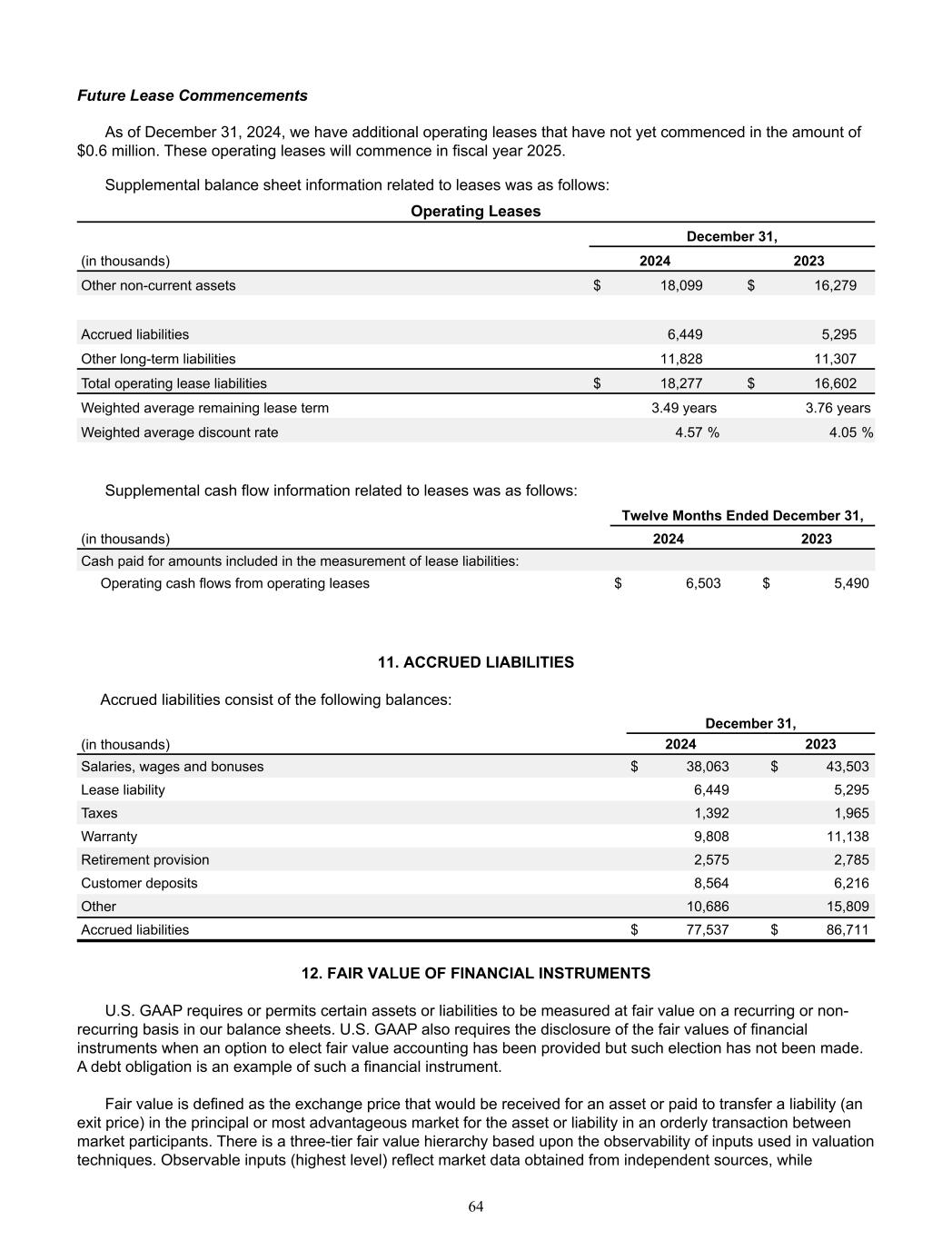

In 2008, the Company acquired Rivard Developpement S.A.S. (“Rivard”), a leading French manufacturer of vacuum trucks, high pressure cleaning systems and trenchers. The acquisition broadened the Company’s product offering to our customers in Europe and other markets we serve. In 2009, the Company acquired substantially all the assets of Bush Hog, LLC (“Bush Hog”), a leading manufacturer of rotary cutters, finishing mowers, zero turn radius mowers, front-end loaders, backhoes, landscape equipment and a variety of other implements. This acquisition, combined with the Company’s existing range of rotary mowers, established the Company as one of the largest manufacturers of rotary mowers in the world. In 2024, the Rhino manufacturing operations were consolidated into our Bush Hog facility in Selma, Alabama. In 2011, the Company acquired substantially all of the assets and assumed certain specified liabilities of Tenco Group, Inc. ("Tenco") and its subsidiaries. Tenco is a Canadian-based manufacturer of snow removal equipment including snow blades, blowers, dump bodies, spreaders and associated parts and service. Tenco has operations in Quebec and New York. The equipment is sold primarily through dealers to governmental end-users as well as snow removal contractors. In 2013, the Company acquired substantially all of the assets and assumed certain specified liabilities of Superior Equipment Australia Pty Ltd ("Superior"). Superior is a small Australian-based manufacturer of agricultural mowing equipment and other attachments, parts, and services. The equipment is sold through dealers primarily to agricultural end-users with some sold to governmental entities in Australia. The Superior operations have been consolidated with the Company's Fieldquip location. In 2014, the Company acquired Kellands Agricultural Ltd. and its subsidiary Multidrive Tractors Ltd. ("Kellands"). Kellands is a U.K.-based manufacturer of self-propelled sprayers and a range of multi-purpose load-carrying tractor vehicles. This acquisition enhanced our manufacture and distribution of our agricultural machinery in Europe and allowed the Company to enter into the self-propelled sprayer market. The Kellands operations were consolidated into the Company's Salford Priors facility and its products are sold under the McConnel brand name. In 2014, the Company acquired Fieldquip Australia Pty Ltd ("Fieldquip"), a manufacturer of rotary cutters as well as a distributor of various lifestyle products. This acquisition allowed the Company to broaden its presence in both the manufacturing and distribution of vegetation management machinery in Australia. In 2014, the Company acquired all of the operating units of Specialized Industries LP. The purchase included the businesses of Super Products LLC ("Super Products"), Wausau-Everest LP ("Wausau" & "Everest") and Howard P. Fairfield LLC ("H.P. Fairfield") as well as several related entities ("Specialized"), including all brand names and related product names and trademarks. The primary reason for the Specialized acquisition was to broaden the Company's existing equipment lines. This acquisition increased our product offering and enhanced our market position both in vacuum trucks and snow removal equipment primarily in North America. In 2015, the Company acquired Herder Implementos e Maquinas Agricolas Ltda. ("Herder"). Herder is a manufacturer of flail mowers which are sold direct and through dealers to a wide variety of agricultural markets as well as the roadside maintenance market. This acquisition established a presence for the Company in Brazil, one of the largest agricultural markets in the world. The Herder manufacturing operations have been consolidated into our Santa Izabel facility and the Herder Matao facility was subsequently sold in 2023. In 2017, the Company acquired 100% of the outstanding shares of Santa Izabel Agro Industria Ltda. ("Santa Izabel"). Santa Izabel designs, manufactures and markets a variety of agricultural implements, sugar cane trailers and other vegetation management products sold throughout Brazil. This acquisition, along with Herder, augmented our product portfolio and improved our manufacturing capabilities in one of the world's largest agricultural markets. In 2017, the Company acquired substantially all of the assets and assumed certain specified liabilities of Old Dominion Brush Company, Inc. ("ODB"). ODB manufactures leaf collection equipment as well as replacement brooms for street sweepers, both of which are sold to municipalities, contractors and commercial landscape markets in North America. ODB is based in Richmond, Virginia. This acquisition provided new and complementary products to our existing range of infrastructure maintenance equipment and parts. In 2017, the Company acquired R.P.M. Tech Inc. ("RPM"), a manufacturer of heavy duty snow removal equipment and associated parts. RPM primarily sells to governmental agencies, related contractors, airports and 6

other industrial users. This acquisition complemented our existing range of snow removal products with RPM's range of heavy duty snow removal equipment, including their line of mechanical snow blowers. In 2020, RPM's operations were consolidated into the Company's nearby Tenco facility and the former RPM facility in Drummondville was sold. In 2019, the Company acquired 100% of the outstanding capital shares of Dutch Power B.V. ("Dutch Power") in the Netherlands. Dutch Power designs and manufactures a variety of landscape and vegetation management machines and attachments. This acquisition expanded our existing platform and increased our capabilities in the European market. Dutch Power changed its legal name to Alamo Group The Netherlands in 2021. In 2019, the Company acquired substantially all of the assets of the Dixie Chopper ("Dixie Chopper") business. Dixie Chopper manufactures a wide range of commercial and high end residential Zero Turn ("ZT") mowers. This acquisition provided a new channel and increased the Company's exposure in the outdoor power equipment market. Dixie Chopper was consolidated into our Rhino business operations. In 2019, the Company acquired 100% of the outstanding capital shares of Morbark, LLC ("Morbark") which included its subsidiaries Rayco Manufacturing LLC ("Rayco") and Denis Cimaf Inc. ("Denis Cimaf"). Morbark is a leading manufacturer of equipment and aftermarket parts for forestry, tree care, biomass, land management and recycling markets. This acquisition expanded the Company's product line and complemented its range of vegetation maintenance equipment in an adjacent market. Morbark is based in Winn, Michigan. At the end of 2020, the Denis Cimaf manufacturing operations based in Roxton Falls were consolidated into the Rayco facility in Wooster, Ohio. In 2023, the Morbark Roxton Falls, Quebec location was sold. In 2024, the Rayco manufacturing operations were consolidated into the Morbark facility in Winn, Michigan. In 2021, the Company acquired 100% of the outstanding capital shares of Timberwolf Limited ("Timberwolf") in the U.K. Timberwolf is a leading manufacturer of a broad range of commercial wood chippers primarily serving markets in the U.K. and the European Union. This acquisition complemented the Company's existing range of tree care products and strengthened the Company's presence in the U.K. and European forestry and tree care markets. In 2023, the Company acquired 100% of the outstanding equity capital of Royal Truck & Equipment, Inc. ("Royal Truck"), a leading manufacturer of truck mounted highway attenuator trucks and other specialty trucks and equipment for the highway infrastructure and traffic control market. The primary reason for the Royal Truck acquisition was to acquire business operations in an adjacent market, highway safety and equipment, where the Company sees compelling future opportunities. Royal Truck is based in Shoemakersville, Pennsylvania. Sales and Marketing Strategy The Company believes that within the U.S. it is a leading supplier to governmental markets, a leading supplier in the U.S. agricultural market, and one of the largest suppliers in the European market for its key niche product offerings. The Company’s products are sold through the Company’s various marketing organizations and extensive worldwide dealer and distributor networks under the Gradall®, VacAll®, Super Products®, Rivard®, Alamo Industrial®, Terrain King™, Tiger®, Herder®, Conver®, Roberine®, Votex®, Schwarze®, NiteHawk®, ODB®, Henke®, Tenco®, Wausau™, Everest®, H.P. Fairfield™, R.P.M. Tech™, Morbark®, Rayco®, Denis Cimaf®, Boxer®, Bush Hog®, Rhino®, RhinoAg®, M&W®, Dixie Chopper®, Herschel®, Schulte®, Fieldquip®, Santa Izabel™, McConnel®, Bomford®, Spearhead™, Twose™, SMA®, Forges Gorce™, Rousseau®, Royal Truck & Equipment™, Timberwolf™, and Wolftrack™ trademarks (some with related designs) as well as other trademarks and trade names. 7

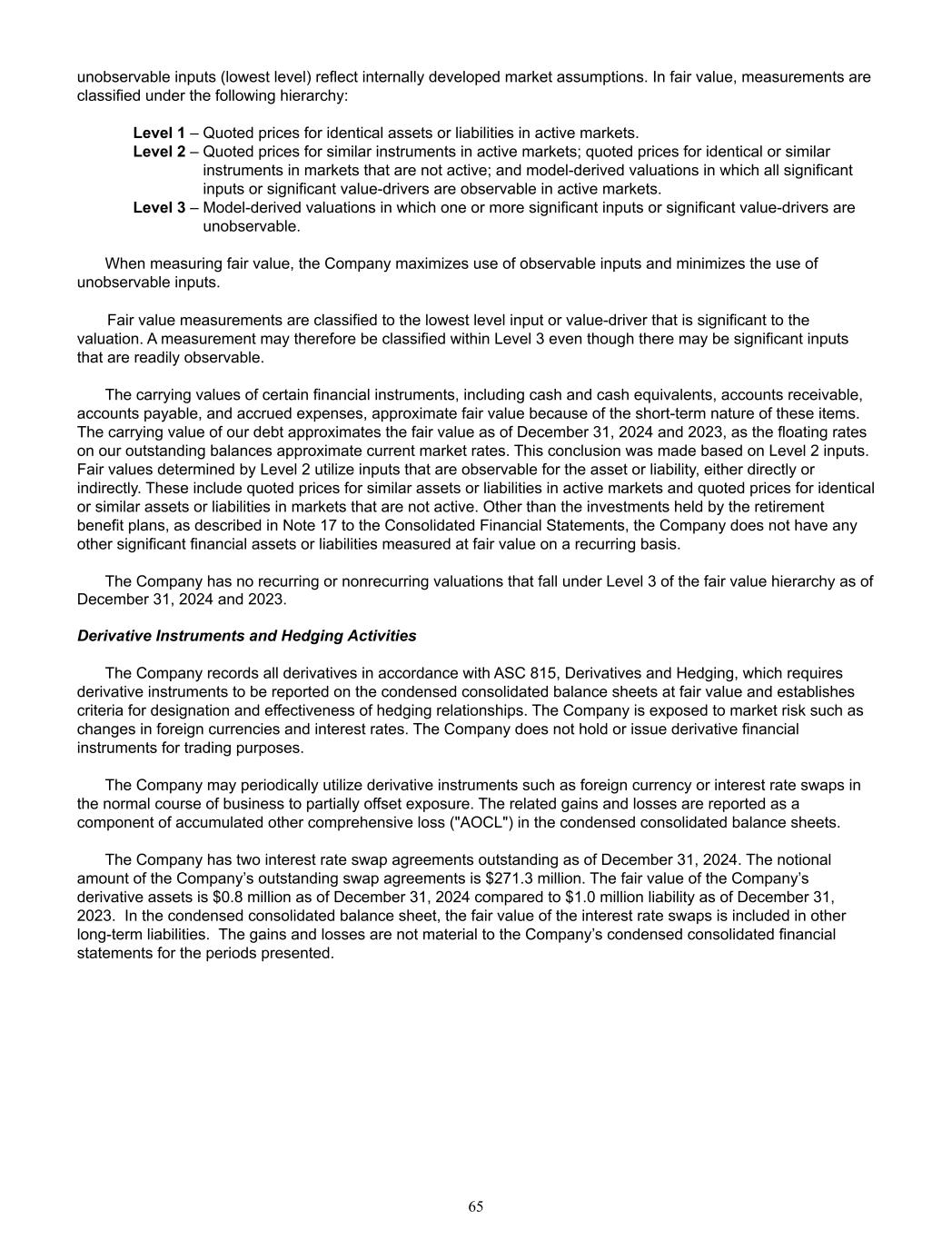

Products and Distribution Channels At the beginning of the fourth quarter of 2021, the Company began reporting operating results on the basis of two new segments, namely, the Vegetation Management Division and the Industrial Equipment Division. Prior to the fourth quarter of 2021, the Company had been reporting its operating results on the basis of two segments which were the Industrial Division and Agricultural Division. The Vegetation Management Division includes all of the operations of the former Agricultural Division plus the mowing and forestry/tree care operations that were previously part of the former Industrial Division. The Industrial Equipment Division includes the Company’s vocational truck business and other industrial operations such as excavators, vacuum trucks, street sweepers, snow removal equipment, and the recently acquired Royal Truck business. We believe the realignment of our two divisions provides greater potential to capture synergies in cross-branding, distribution, product development, supply chain management and logistics. The two divisions are also more balanced in scale and scope, giving the Company two strong platforms for ongoing development through a mix of organic growth and acquisitions. Vegetation Management Division Bush Hog and Rhino equipment is generally sold to farmers, ranchers and other end-users to clear brush, mow grass, maintain pastures and unused farmland, shred crops, till fields, and for haymaking and other applications. Bush Hog and Rhino equipment consists principally of a comprehensive line of tractor-powered equipment, including rotary mowers, finishing mowers, flail mowers, disc mowers, front-end loaders, backhoes, rotary tillers, posthole diggers, scraper blades and replacement parts. Dixie Chopper produces a wide range of commercial and high end residential zero turn ("ZT") mowers. It sells its products through its independent dealers in the outdoor power equipment channel throughout the U.S. Schulte equipment includes heavy-duty mechanical rotary mowers, snow blowers, rock removal equipment and related replacement parts. Schulte serves both the agricultural and governmental markets primarily in Canada and the U.S. It also sells some of the Company’s other product lines in its markets and some of its products through independent distributors throughout the world. McConnel equipment principally includes a broad line of hydraulic, boom-mounted hedge and grass cutters, remote control mowers as well as other tractor attachments and implements such as cultivators, subsoilers and other implements and related replacement parts. McConnel equipment is sold primarily in the U.K., Ireland, France and in other parts of Europe through independent dealers and distributors. McConnel also sells a range of self- propelled sprayers and a variety of multi-drive load-carrying vehicles. These products are sold through its existing dealer network as well as various marketing groups within the European region of the Vegetation Management Division. Bomford equipment includes hydraulic boom-mounted hedge and hedgerow cutters, industrial grass mowers, agricultural seedbed preparation cultivators and related replacement parts. Bomford equipment is sold to governmental agencies, contractors and agricultural end-users in the U.K., Ireland, France and other parts of Europe, North America, Australia and Asia. Bomford’s sales network is similar to that of McConnel in the U.K. Spearhead manufactures a range of tractor-mounted vegetation maintenance equipment, including reach mowers, flail mowers and rotary cutters. These products are manufactured in the Company's Bomford facility. Fieldquip broadens the Company's presence in Australia. The company sells a variety of vegetation maintenance equipment, specifically rotary mowers and tractor attachments. Fieldquip sells to customers ranging from large agricultural and commercial operators to small farm hobbyist and residential users, as well as agricultural dealers who serve owners and operators in the turf, golf, park and airport industries and growers with orchards, vineyards and plantations in Australia and the South Pacific. Rousseau sells hydraulic and mechanical boom mowers, primarily in France, through its own sales force and its dealer distribution network mainly to agricultural and governmental markets. These products have also been introduced into other markets outside of France. These products are manufactured at our facility near Lyon, France. SMA equipment includes hydraulic boom-mounted hedge and hedgerow cutters and related replacement parts. SMA’s principal customers are French local authorities. SMA’s product offerings include certain quick-attach boom 8

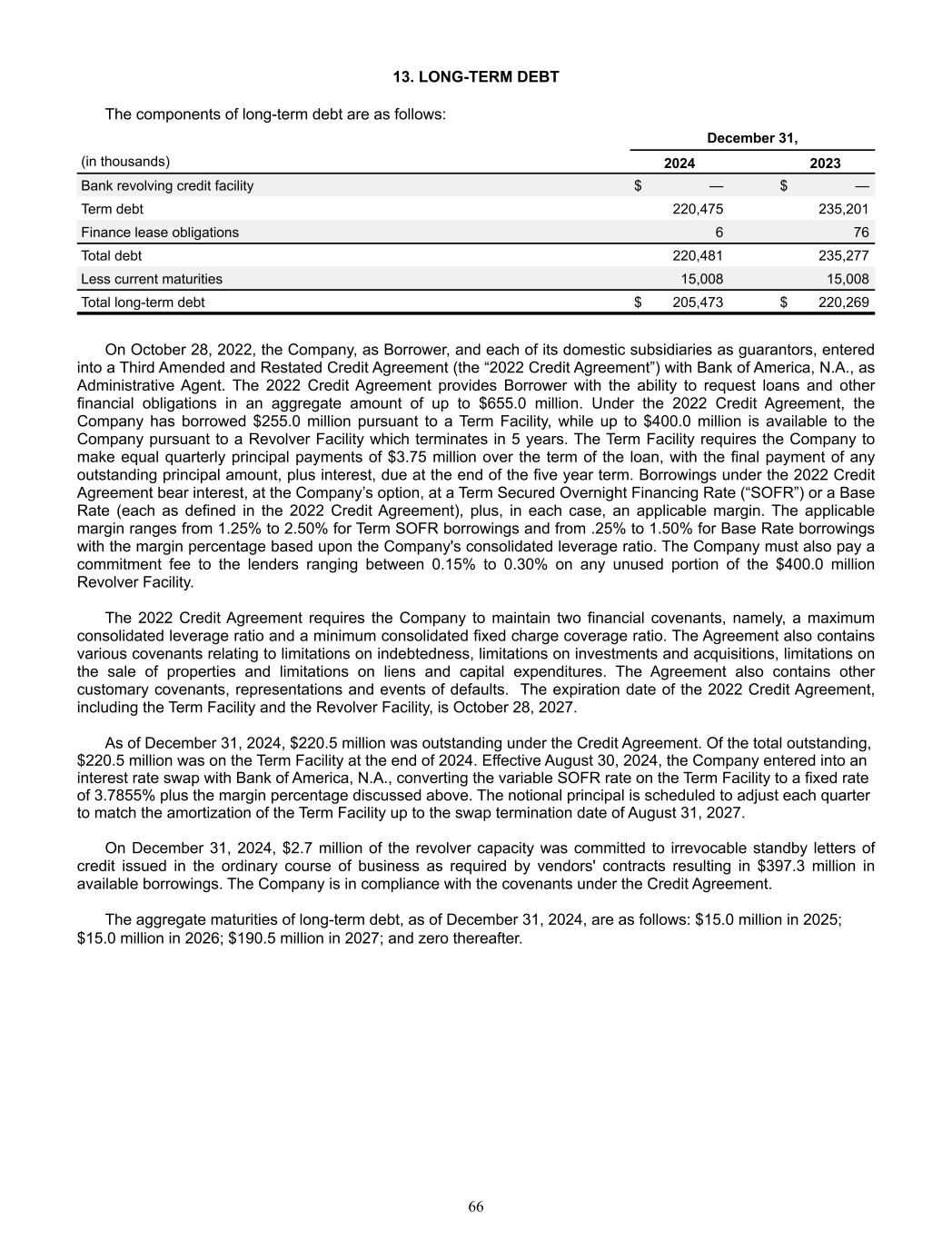

mowers manufactured by the Company in the U.K. to expand its presence in agricultural dealerships. The SMA product line is manufactured at our facility near Lyon, France. Forges Gorce manufactures cutting blades which are sold to some of the Company’s subsidiaries as well as to other third party customers and distributors. Morbark manufactures a broad range of tree chippers, stump grinders, mulchers, brush cutters, flails and debarkers sold under the Morbark, Rayco, Denis Cimaf and Boxer brand names. Its products are sold to industrial and commercial contractors mainly through a network of independent dealers and distributors and, to a lesser extent, direct sales to end-users. Timberwolf produces a variety of commercial tree care and forestry equipment and attachments under several brand names including Timberwolf and Wolftrack. Timberwolf sells its products primarily to commercial customers through a comprehensive network of dealers. Alamo Industrial equipment is principally sold through independent dealers to governmental end-users, related independent contractors and utility and other dealers serving infrastructure maintenance operators and other applications in the U.S. and other countries. Governmental agencies and contractors that perform services for such agencies purchase primarily hydraulically-powered, tractor - and off-road chassis mounted mowers, including boom- mounted mowers, other types of cutters and replacement parts for heavy-duty, intensive use applications, including maintenance around highway, airport, recreational and other public areas. A portion of Alamo Industrial’s sales includes tractors, which are not manufactured by Alamo Industrial. Tiger equipment includes heavy duty, tractor- and truck-mounted mowing and vegetation maintenance equipment and replacement parts. Tiger sells to state, county and local governmental entities and related contractors, primarily through a network of independent dealers. Tiger’s dealer distribution network is independent of Alamo Industrial’s dealer distribution network. A portion of Tiger’s sales includes tractors, which are not manufactured by Tiger. Alamo Group The Netherlands produces a variety of landscape and vegetation maintenance equipment and attachments under several brand names including Herder, Conver, Roberine, and Votex. Alamo Group The Netherlands primarily sells to contractors who perform infrastructure maintenance for governmental agencies and private landowners. Herder and Santa Izabel give the Company a presence in the Brazilian agricultural market. Herder manufactures and distributes flail and rotary mowers and various other agricultural equipment, direct and through dealers. Its products are used in a wide variety of agricultural and governmental markets. Santa Izabel designs, manufactures and markets a variety of agricultural implements, including sugar cane trailers sold throughout Brazil. Industrial Equipment Division Gradall produces a range of excavators based on high-pressure hydraulic telescoping booms which are sold through dealers primarily to governmental agencies and, to a lesser extent, the mining industry, steel mills and other specialty applications in the U.S. and other countries. Many of these products are designed for excavation, grading, shaping and similar tasks involved in land clearing, road building, grading or maintenance. These products are available mounted on various types of undercarriages: wheels for full-speed highway travel, wheels for on/off road use, and crawlers. A portion of Gradall’s sales includes truck chassis which are not manufactured by Gradall. VacAll produces catch basin cleaners and roadway debris vacuum systems. These units are powerful and versatile with uses including, but not limited to, removal of wet and dry debris, spill elimination, and cleaning of sludge beds. VacAll also offers a line of sewer cleaners. Its products are primarily sold through dealers to industrial and commercial contractors as well as governmental agencies. A portion of VacAll’s sales includes truck chassis which are not manufactured by the Company. Super Products produces truck-mounted vacuum machines, combination sewer cleaners and hydro excavators. Its products are sold to municipalities, utilities and contractors through a nationwide distributor network. Super Products also operates a network of rental stores that provides short and long-term rental contracts for its products. 9

Rental customers are primarily contractors serving the petrochemical, petroleum production and refining industries. A portion of the sales of Super Products includes truck chassis which are not manufactured by the Company. Rivard manufactures vacuum trucks, high pressure cleaning systems and trenchers. Rivard’s equipment is sold primarily in France and certain other markets, mainly in Europe, the Middle East and North Africa, and to governmental entities and related contractors. This business also complements our product offerings in North America. The majority of Rivard's customers provide their own truck chassis. Tenco and RPM both design and manufacture a heavy-duty line of snow removal equipment, including truck- mounted snow plows, snow blowers, dump bodies and spreaders. Their products are primarily sold through independent dealers. End-users are governmental agencies, contractors, airports and other industrial users. Wausau designs and manufactures a comprehensive range of snow removal and ice control products. Products include snowplows, snow blowers, snow throwers, brooms, deicers, brine sprayers and other related accessories and parts. Wausau sells its products through its established dealer network to both governmental and non-governmental end-users and sells directly to airports and fixed-base operators. Everest designs and manufactures a range of snow removal and ice control products including snowplows, wing systems, spreader bodies, and other related accessories and parts. Everest also manufactures custom-engineered underground construction forms for tunnels. Henke designs and manufactures snow plows and heavy duty snow removal equipment, hitches and attachments for trucks, loaders and graders sold primarily through independent truck and industrial equipment dealers. Henke’s primary end-users are governmental agencies, related contractors and other industrial users. H.P. Fairfield is a full-service distributor of public works and runway maintenance products, parts and service, whose sales and service outlets are located in the northeastern part of the U.S. H.P. Fairfield’s offerings include custom municipal snow and ice removal equipment, a range of salt spreaders and truck bodies, street sweepers, a line of industrial rotary, flail and boom mowers, solid waste and recycling equipment, water and sewer maintenance equipment, municipal tractors and attachments, and asphalt maintenance patchers, some of which are sourced from other Alamo Group companies. H.P. Fairfield also provides truck up-fitting services as part of its business. Schwarze equipment includes truck-mounted air vacuum, mechanical broom, and regenerative air sweepers, and replacement parts. Schwarze sells its products primarily to governmental agencies and independent contractors, either directly or through its independent dealer network. A portion of Schwarze’s sales includes truck chassis which are not manufactured by Schwarze. ODB manufactures and sells leaf and debris collection equipment and replacement brooms for street sweepers, both of which are sold to municipalities, contractors and commercial landscape markets in North America. Nite-Hawk manufactures parking lot sweepers with unique and innovative hydraulic designs. By eliminating the auxiliary engine, Nite-Hawk sweepers have proven to be fuel-efficient, environmentally conscious, and cost-effective to operate. Nite-Hawk focuses mainly on and sells direct to parking lot contractors. A portion of Nite-Hawk’s sales includes truck chassis which are not manufactured by Nite-Hawk. Royal Truck manufactures and sells truck mounted highway crash attenuator trucks, cone safety and traffic control trucks, and a broad range of other equipment focused on highway safety. Royal Truck sells its products directly to a diverse base of customers in the traffic control services, equipment rental, and construction businesses, as well as to governmental agencies. A portion of Royal Truck's sales includes truck chassis which are not manufactured by Royal Truck. Replacement Parts The Company derives a significant portion of its revenues from sales of replacement parts for each of its wholegoods lines. Replacement parts represented approximately 17%, 17% and 19% of the Company’s total sales for the years ended December 31, 2024, 2023 and 2022, respectively. 10

Product Development The Company’s ability to provide innovative responses to customer needs, to develop and manufacture new products, and to enhance existing product lines is important to its success. The Company continually conducts research and development activities in an effort to improve existing products and develop new products. As of December 31, 2024, the Company employed 245 people in its various engineering departments, 152 of whom are degreed engineers and the balance of whom are support staff. Amounts expended on research and development activities were approximately $13.5 million in 2024, $13.4 million in 2023 and $14.3 million in 2022. As a percentage of sales, research & development was approximately 0.8% in 2024, 0.8% in 2023 and 0.9% in 2022, and is expected to continue at similar levels in 2025. Seasonality The Company’s unit sales are fairly constant quarter to quarter. However, replacement part sales are generally higher in the second and third quarters of the year, because a substantial number of the Company’s products are used for maintenance activities such as vegetation maintenance, highway right-of-way maintenance, construction, and street and parking lot sweeping. Usage of this equipment is typically lower in harsh weather. The Company utilizes an annual twelve-month sales forecast provided by the Company’s marketing departments which is updated quarterly in order to develop a production plan for its manufacturing facilities. In addition, many of the Company’s marketing departments attempt to equalize demand for products throughout the calendar year by offering seasonal sales programs which may provide additional incentives, including discounts and extended payment terms. Competition The Company’s products are sold in highly competitive markets throughout the world. The principal competitive factors are price, quality, availability, service and reputation. The Company competes with several large national and international companies that offer a broad range of equipment and replacement parts, as well as with numerous small, privately-held manufacturers and suppliers of a limited number of products, mainly on a regional basis. Some of the Company’s competitors are significantly larger than the Company and have substantially greater financial and other resources at their disposal. The Company believes that it is able to compete successfully in its markets by effectively managing its manufacturing costs, offering high quality products, developing and designing innovative products and, to some extent, avoiding direct competition with significantly larger potential competitors. There can be no assurance that the Company’s competitors will not substantially increase the resources devoted to the development and marketing of products competitive with the Company’s products or that new competitors with greater resources will not enter the Company’s markets. Unfilled Orders As of December 31, 2024, the Company had unfilled customer orders of $668.6 million compared to $859.8 million at December 31, 2023. Management expects that substantially all of the Company’s unfilled orders as of December 31, 2024 will be shipped during fiscal year 2025. The amount of unfilled orders at a particular time is affected by a number of factors, including manufacturing and shipping schedules which, in most instances, are dependent on the Company’s seasonal sales programs and the requirements of its customers. It is possible that supply chain disruptions, labor constraints, and other new and/or unanticipated effects, could cause delays in delivery or an inability to complete unfilled customer orders. The Company’s orders are subject to cancellation at any time before shipment; therefore, a comparison of unfilled orders from period to period is not necessarily meaningful and may not be indicative of future actual shipments. No single customer or group of customers is responsible for 10% or more of the aggregate revenue of the Company or of a segment of the Company. Sources of Supply The principal raw materials used by the Company include steel, other metal components, hydraulic hoses, paint and tires. During 2024, the raw materials needed by the Company were available from a variety of sources in adequate quantities and at prevailing market prices. While supply chain issues have improved compared to prior years, we remain affected by inflationary impacts for many of the raw materials we purchase. We expect pricing to remain elevated in 2024 but anticipate a slowing of the rate of inflation. 11

While the Company manufactures many of the parts for its products, a significant percentage of parts, including most drivelines, gearboxes, industrial engines, and hydraulic components, are purchased from outside suppliers which manufacture to the Company’s specifications. In addition, the Company, through its subsidiaries, purchases tractors and truck chassis as a number of the Company’s products are mounted and shipped with a tractor or truck chassis. Tractors and truck chassis are generally available, but during 2023 we experienced delays in receiving truck chassis which caused us to delay shipments of some of our products and created operational inefficiencies in some of our facilities, particularly within our Industrial Equipment Division. The Company sources its purchased goods from international and domestic suppliers. No one supplier is responsible for supplying more than 10% of the principal raw materials or purchased goods used by the Company. Patents, Trademarks and Trade Names The Company owns various U.S. and international patents, trademarks and trade names. While the Company considers its patents, trademarks and trade names to be advantageous to its business, it is not dependent on any single patent, trademark, trade name or group of patents, trademarks, or trade names. The net book value of patents, trademarks and trade names was $70.8 million and $77.1 million as of December 31, 2024 and 2023, respectively. Environmental and Other Governmental Regulations Like other manufacturers, the Company is subject to a broad range of federal, state, local and foreign laws, rules and regulations including those relating to climate change; emissions to air, including Tier 4 or similar engine emission regulations; discharges to water; restrictions placed on water usage and water availability; product and associated packaging; use of certain chemicals; restricted substances, including "conflict minerals" disclosure rules; import and export compliance, including country of origin certification requirements; worker and product user health and safety; energy efficiency; product life-cycles; outdoor noise laws; and the generation, use, handling, labeling, collection, management, storage, transportation, treatment, and disposal of hazardous substances, wastes, and other regulated materials. The U.S. Environmental Protection Agency ("EPA"), the California Air Resources Board ("CARB"), and similar regulators in other U.S. states and foreign jurisdictions in which we sell our products have emission requirements setting maximum emission standards for certain equipment. In addition to the EPA's implementation of Tier 4 emission requirements applicable to diesel engines, China, the European Union ("EU") and the United Kingdom also have adopted similar regulations, and similar emission regulations are also being considered in other markets in which we sell our products. CARB continues to propose new regulations, including Tier 5 off-road diesel engine emissions standards that are in development. In addition, CARB has started to implement on-road zero emissions equipment regulations that will likely create increasingly stringent requirements on exhaust and other emissions from some of the products we manufacture. These new on-road zero emissions regulations have started to limit the availability of some on-road vehicle chassis that use diesel engines in California and possibly in other states that plan to adopt these CARB regulations. The U.S. federal government, several U.S. states, and certain international markets where we sell our products, including the EU and some EU member countries have introduced product life-cycle laws, rules, or regulations, which are intended to reduce waste and environmental and human health impact, and require manufacturers to label, collect, dispose, and recycle certain products, including some of our products, at the end of their useful life. These include, among other laws and regulations: (i) the Registration, Evaluation, Authorization and Restriction of Chemicals ("REACH") directive, U.S. Toxic Substances Control Act ("TSCA"), or similar substance level laws, rules, or regulations that require notification of use of certain chemicals, or ban or restrict the use of certain chemicals; (ii) California Proposition 65 and other product substance restriction laws, some of which require certain labeling of products; (iii) energy efficiency laws, rules, or regulations, which are intended to reduce the use and inefficiencies associated with energy and natural resource consumption and require specified efficiency ratings and capabilities for certain products; (iv) conflict minerals laws, such as those contained in the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules promulgated by the U.S. Securities and Exchange Commission ("SEC"), which require specific procedures for the determination and disclosure of the use of certain minerals, known as "conflict minerals," which are mined from the Democratic Republic of the Congo and adjoining countries; and (v) supply chain transparency laws and regulations addressing modern slavery and human trafficking. 12

The Company is also subject to various other federal, state, and local laws affecting its business, as well as a variety of regulations relating to such matters as working conditions, equal employment opportunities, and product safety, including National Highway Traffic Safety Administration reporting. In addition, a variety of laws regulate the Company’s contractual relationships with its dealers, some of which impose restrictive standards on the relationship between the Company and its dealers, including events of default, grounds for termination, non-renewal of dealer contracts, and equipment repurchase requirements. We believe we have maintained compliance with existing laws, rules and regulations applicable to our business and will continue to do so. We believe there will be some additional costs to our business as a result of the increasing level of regulation applicable to our business activities, and there can be no assurance that the Company will not incur material costs or other liabilities as a result thereof. Human Capital Resources and Management The success of our Company depends on the talents and dedication of our people, and we are committed to investing in their success. Our Senior Vice-President of Corporate Human Resources ("SVP-CHR") is responsible for developing and executing our human resources strategy together with our President and Chief Executive Officer ("CEO") and the other members of the Company's management team. Our CEO and SVP-CHR regularly update our Board of Directors regarding the status of our human resources strategic initiatives, which include: Focus on Health and Safety: Maintaining a safe and healthy workplace in each of our locations is a priority, and we focus on continuous improvement by embedding proactive and preventative safety into every level of the organization as one of our core values. Every location offers frequent safety meetings and training programs to all employees. Our safety committees conduct audits to identify and remove potential issues. Safety performance is tracked, aggregated, reviewed timely and reported to management for appropriate action by our corporate technical affairs and safety team, who conducts root cause analysis with corrective action plans to prevent future occurrences. Safety performance data is reviewed by the executive leadership team and the Company's Board of Directors. Employee Engagement and Talent Development: Alamo Group aims to create a culture of equal employment opportunity and inclusive and respectful workplace. Attracting, developing, and retaining our team of highly talented and motivated employees is key to Alamo Group's success in meeting our customers' needs and sustaining the Company's growth. In addition to developing internal candidates, so they are "ready now" when opportunities arise, we also recruit external candidates with future stretch potential. Employees are provided a wide range of professional development experiences, at all stages in their careers. We offer tuition reimbursement, a broad range of leadership development experiences, vocational and trade skills training, and external partnerships with educational institutions across the globe. Welder training, apprenticeships, and local partnerships with various educational programs and high schools enable our operating companies to hire and grow critical manufacturing skills. The Alamo Group Learning & Development Academy builds leadership capabilities and offers technical skills training for our production floor employees. Programs are available on-demand and training is easily accessible to employees. Virtual, in-person and on-campus programs are offered to encourage cross-location and cross- functional networking that foster and support our culture of continuous improvement. Commitment to Equal Employment Opportunity and Inclusion: We recognize, value, and respect the individual differences of our employees and believe that a varied set of backgrounds, education, experiences, and perspectives is crucial to our ability to continue to innovate, collaborate, and meet the needs of our global workforce and customers. We promote an inclusive environment through policies and training, so that employees feel empowered to contribute to the Company's ongoing success. Career opportunities are marketed internally as well as externally to a wide network of organizations and job boards so we can encourage a broad pool of candidates. We actively volunteer and engage in local community projects and contribute donations to charitable organizations to positively impact the communities and markets in which our employees live and work. Compensation and Benefits: We regularly assess our pay and benefit practices to ensure our people are compensated fairly and competitively. Our compensation programs vary by country and region, and may include annual bonus and incentive plans, profit sharing, stock-based compensation awards, company-sponsored retirement savings plans with employee matching opportunities (or similar local retirement benefits), healthcare and insurance benefits, dependent care and flexible savings accounts, paid time off such as vacation and holidays, sick pay, disability pay and family leave, flexible work schedules, wellness and employee assistance programs for mental health, self-improvement, legal and financial services, service anniversary awards, tuition assistance and dependent college scholarships, and discounts on products and services. 13

Labor Agreements: As of December 31, 2024, we employed approximately 3,750 employees. In the U.S., the Company has a collective bargaining agreement at its Gradall plant which covers 240 employees and will expire on April 22, 2029. In Canada, the Tenco bargaining agreement covers 130 employees and expires on December 31, 2025; RPM has an agreement covering 2 employees which expires on February 1, 2025; and Everest has a collective bargaining agreement covering 83 employees which expires on November 30, 2029. In the Company’s European locations, all employees are covered by the European Works Council agreements. McConnel, Bomford, Spearhead, AMS-UK, SMA, Faucheux, Forges Gorce, Rousseau, Rivard, and Alamo Group The Netherlands have various collective bargaining agreements covering approximately 852 employees. In addition, 214 employees in Brazil are covered by a collective bargaining agreement, which is renegotiated every calendar year. The Company considers its employee relations to be satisfactory. Available Information The Company files annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). The SEC maintains a website that contains annual, quarterly and current reports, proxy and information statements, and other information that issuers (including the Company) file electronically with the SEC. The SEC’s website is www.sec.gov. The Company’s website is www.alamo-group.com. The Company makes available free of charge through its website, via a link to the SEC’s website at www.sec.gov, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. The Company also makes available through its website, via a link to the SEC’s website, statements of beneficial ownership of the Company’s equity securities filed by its directors, officers, 10% or greater shareholders, and others required to file under Section 16 of the Exchange Act. The Company also makes available free of charge on its website its most recent annual report on Form 10-K, its quarterly reports on Form 10-Q for the current fiscal year, its most recent proxy statement and its most recent annual report to stockholders, although in some cases these documents are not available on our site as soon as they are available on the SEC’s site. You will need to have on your computer the Adobe Acrobat Reader® software to view the documents, which are in PDF format. In addition, the Company posts on its website its Charters for its Audit Committee, Compensation Committee and Nominating/Corporate Governance Committee, as well as its Corporate Governance Policies and its Code of Conduct and Ethics for its directors, officers and employees. You can obtain a written copy of these documents, excluding exhibits, at no cost, by sending your request to the Corporate Secretary, Alamo Group Inc., 1627 E. Walnut Street, Seguin, Texas 78155, which is the principal corporate office of the Company. The telephone number is 830-379-1480. The information on the Company’s website is not incorporated by reference into this report. Forward-Looking Information Part I of this Annual Report on Form 10-K and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Part II of this Annual Report contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. In addition, forward-looking statements may be made in other documents filed or furnished with the SEC, or by management orally or in press releases, conferences, reports or otherwise to analysts, investors, representatives of the media and others, in the future by or on behalf of the Company. Generally, forward-looking statements are not based on historical facts but instead represent the Company's and its management's beliefs regarding future events. Statements that are not historical are forward-looking. When used by us or on our behalf, the words "expect," “will,” “estimate,” “believe,” “intend,” "would," “could,” "predict," “should,” “anticipate,” "continue," “project,” “forecast,” “plan,” “may” and similar expressions generally identify forward-looking statements made by us or on our behalf. Forward-looking statements involve risks and uncertainties. These uncertainties include factors that affect all businesses operating in a global market, as well as matters specific to the Company and the markets we serve. Certain particular risks and uncertainties that continually face us include the following: • budget constraints and revenue shortfalls which could affect the purchases of our type of equipment by governmental customers and related contractors in both domestic and international markets; 14

• market acceptance of new and existing products; • our ability to hire suitable employees for our business and maintain good relations with employees; • our ability to develop and manufacture new and existing products profitably; • the inability of our suppliers, creditors, public utility providers and financial and other service organizations to deliver or provide their products or services to us; • legal actions and litigation; • impairment in the carrying value of goodwill; • our ability to successfully integrate acquisitions and operate acquired businesses or assets; • current and changing tax laws in the U.S. and internationally; • our ability to hire and retain quality skilled employees; and • changes in the prices of agricultural commodities, which could affect our customers’ income levels. In addition, we are subject to risks and uncertainties facing the industry in general, including the following: • changes in business and political conditions and the economy in general in both domestic and international markets; • the price and availability of energy and critical raw materials, particularly steel and steel products; • increased competition; • increases in input costs on items we use in the manufacturing of our products; • adverse weather conditions such as droughts, floods, snowstorms, etc., which can affect the buying patterns of our customers and end-users; • increased costs of complying with governmental regulations which affect corporations including related fines and penalties (such as the European General Data Protection Regulation (GDPR) and the California Consumer Privacy Act); • an increase in unfunded pension plan liability due to financial market deterioration; • the potential effects on the buying habits of our customers due to animal disease outbreaks and other epidemics; • adverse market conditions and credit constraints which could affect our customers and end-users, such as cutbacks on dealer stocking levels; • changes in market demand; • climate related incidents and other sustainability risks, global pandemics, acts of war or aggression and terrorist activities or military actions; • cyber security risks including the potential loss of proprietary data or data security breaches and related fines, penalties and other liabilities; • financial market changes including changes in interest rates and fluctuations in foreign exchange rates; • abnormal seasonal factors in our industry; • changes in domestic and foreign governmental policies and laws, including increased levels of government regulation and changes in agricultural policies, including the amount of farm subsidies and farm payments as well as changes in trade policy that may have an adverse impact on our business; • changes to global trade policies, tariffs, trade sanctions, and investment restrictions • government actions, including but not limited to budget levels, and changes in laws, regulations and legislation, relating to tax, the environment, commerce, infrastructure spending, health and safety; and • risk of governmental defaults and resulting impact on the global economy and particularly financial institutions. We wish to caution readers not to place undue reliance on any forward-looking statement and to recognize that the statements are not predictions of actual future results. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the risks and uncertainties described above and under “Risk Factors,” as well as others not now anticipated. The foregoing statements are not exclusive and further information concerning us and our businesses, including factors that could potentially materially affect our financial results, may emerge from time to time. It is not possible for management to predict all risk factors or to assess the impact of such risk factors on the Company’s businesses. Any forward-looking statements made by or on behalf of the Company speak only to the date they are made and we do not undertake to 15

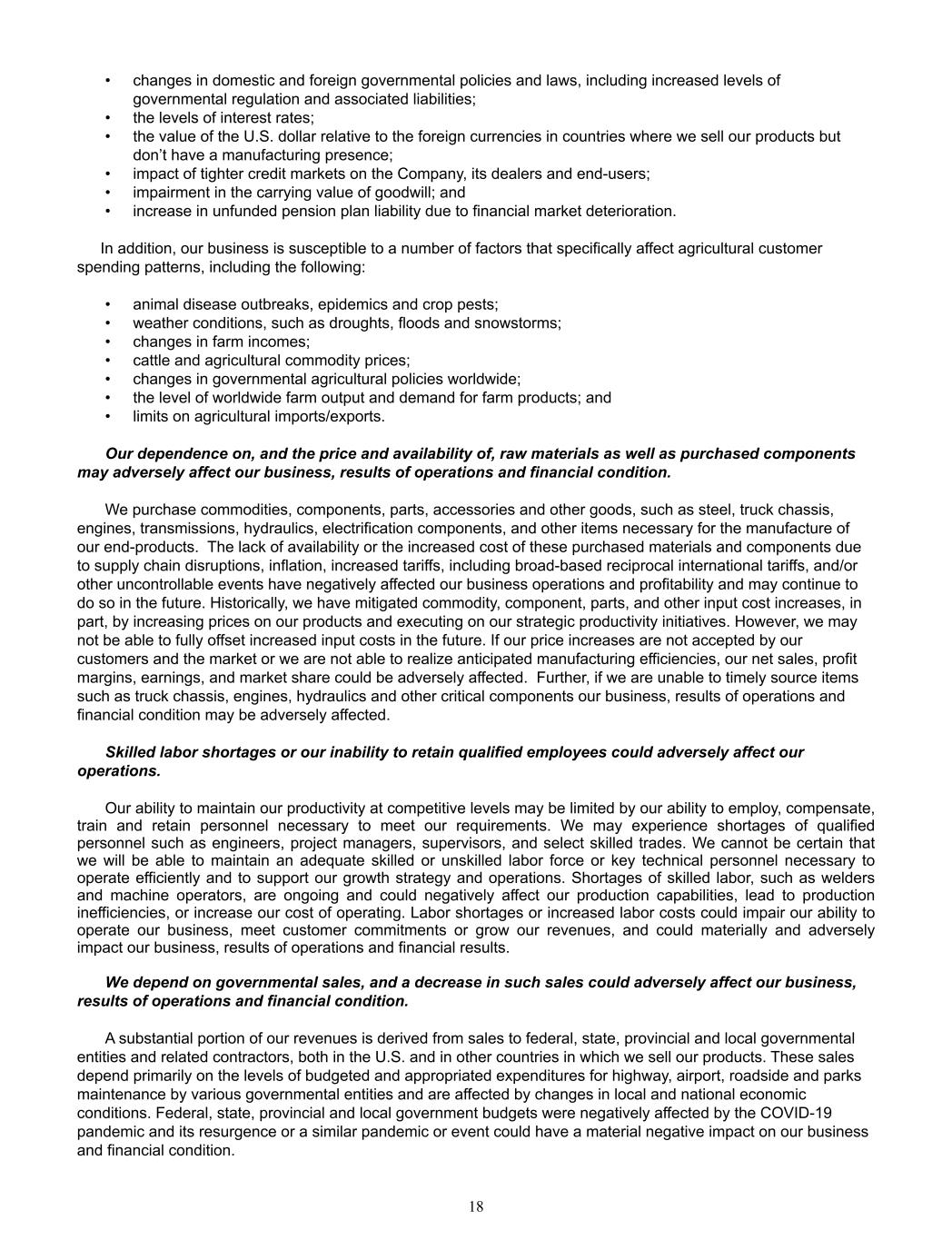

update forward-looking statements to reflect the impact of circumstances or events that arise after the forward- looking statements were made. Information About our Executive Officers Certain information is set forth below concerning the executive officers of the Company (the "Executives"), each of whom has been appointed to serve until the 2025 annual meeting of directors or until their successor is duly appointed and qualified. Name Age Position Jeffery A. Leonard 65 President and Chief Executive Officer Agnieszka K. Kamps 48 Executive Vice President and Chief Financial Officer Edward T. Rizzuti 55 Executive Vice President, Corporate Development and Investor Relations and Secretary Dan E. Malone 64 Executive Vice President, Chief Sustainability Officer Richard H. Raborn 59 Executive Vice President, Alamo Vegetation Management Division Kevin J. Thomas 60 Executive Vice President, Alamo Industrial Equipment Division Janet S. Pollock 66 Senior Vice President, Corporate Human Resources Lori L. Sullivan 55 Vice President, Internal Audit Jeffery A. Leonard was appointed President and Chief Executive Officer of the Company in May of 2021. Mr. Leonard was also appointed as a director of the Company in June of 2021. Mr. Leonard joined the Company in 2011, and served as Executive Vice President of the Company's former Industrial Division from 2011 to 2021. Mr. Leonard previously was Senior Vice President of Metso Minerals Industries Inc., a supplier of technology and services for mining, construction, power generation, automation, recycling, and pulp and paper industries. On December 20, 2024, Mr. Leonard notified the Board of his intention to retire as President and CEO by mid-year and upon the appointment of his successor. Mr. Leonard's intention to retire as President and CEO is due to personal reasons and is not the result of any disagreement with the Company. Agnieszka K. Kamps was appointed Executive Vice President and Chief Financial Officer of the Company in May of 2024 after being appointed Executive Vice President and Treasurer in March of 2024. Prior to joining the Company, Ms. Kamps served as Vice President and Chief Financial Officer of Americas Styrenics, LLC since January 2021. Prior to her role with Americas Styrenics, Ms. Kamps served in various accounting management capacities with several Siemens companies and with United Technologies. Edward T. Rizzuti was appointed Vice President, General Counsel of Alamo Group Inc. in July of 2015, assumed the Secretary role in May of 2018, and was promoted to Executive Vice President in November of 2021. Mr. Rizzuti was named Chief Legal Officer in April of 2024 and transitioned to the role of Executive Vice President Corporate Development and Investor Relations in January of 2025. Prior to joining the Company, from 2010 to 2015, Mr. Rizzuti served as Vice President, General Counsel and Secretary for Erickson Incorporated, a publicly traded aircraft manufacturing and operating company based in Portland, Oregon. Dan E. Malone was appointed Executive Vice President, Chief Sustainability Officer in July of 2021. Mr. Malone joined the Company in 2007 and served as Executive Vice President, Chief Financial Officer from 2007 to 2021. Prior to joining the Company, Mr. Malone held the position of Executive Vice President, Chief Financial Officer & Corporate Secretary at Igloo Products Corporation, a manufacturer of insulated consumer goods, from 2002 to January 2007. Mr. Malone was Vice President and Chief Financial Officer of The York Group, Inc. from 2000 to 2002, and held various financial positions from 1987 to 2000 with Cooper Industries, Inc. and its various subsidiaries. 16

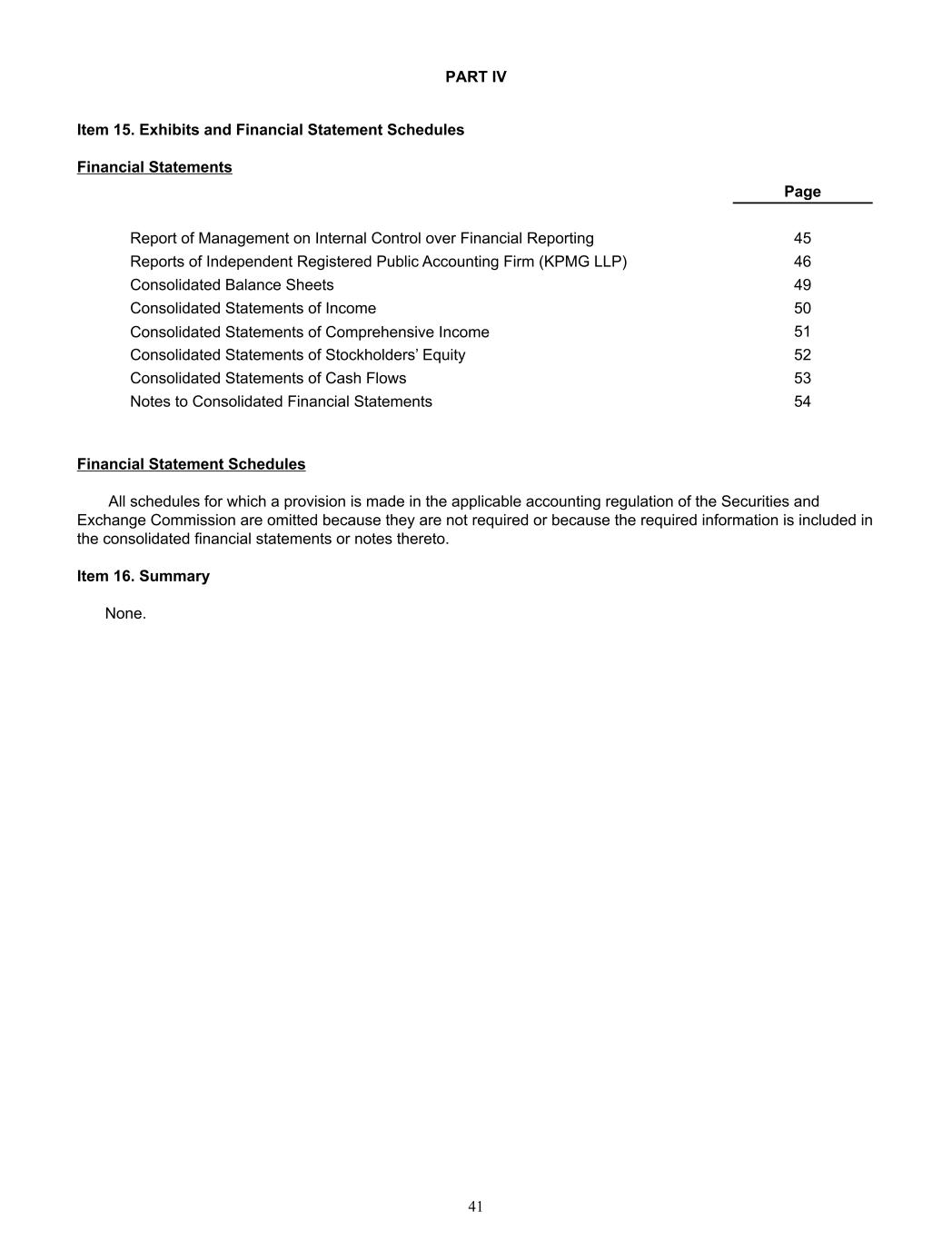

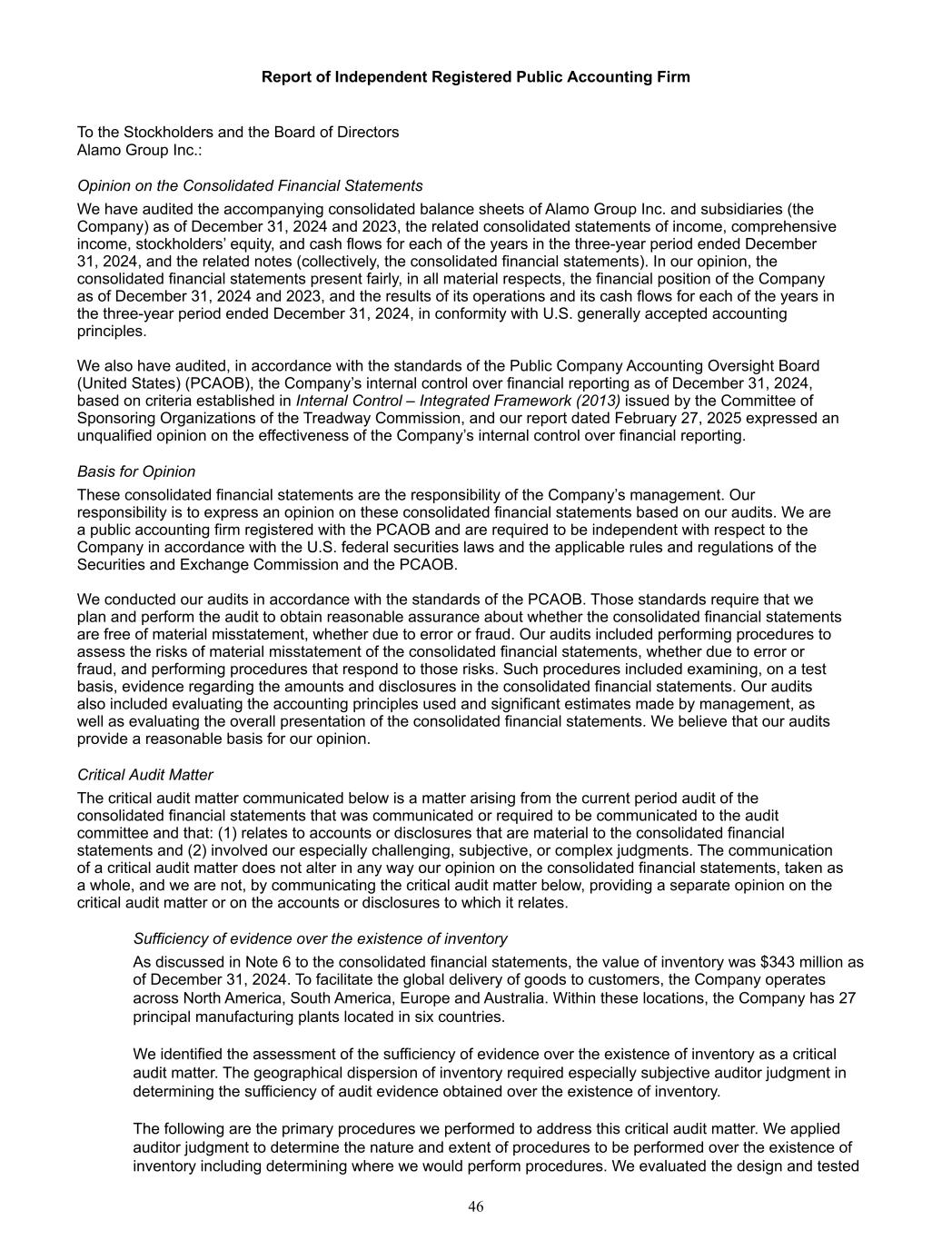

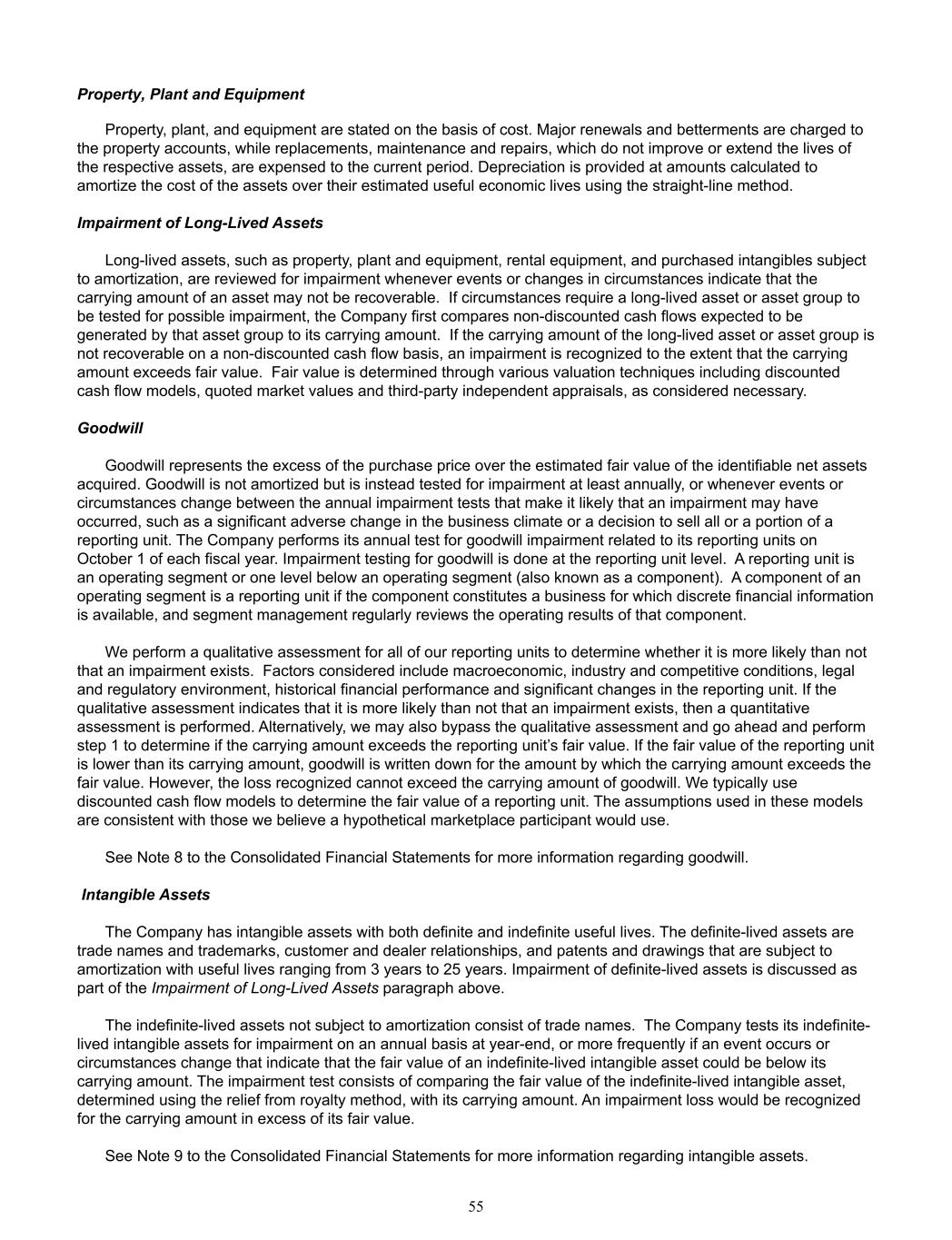

Richard H. Raborn was appointed Executive Vice President of the Company's Vegetation Management Division in July of 2021. Mr. Raborn joined the Company in 2015 and served as Executive Vice-President of the Company's former Agricultural Division from 2015 to 2021. Prior to joining the Company, Mr. Raborn was Vice President and General Manager of the Powertrain Metal Division for Illinois Tool Works (ITW) from 2009 to 2015. ITW is one of the world's leading diversified manufacturers of specialized industrial equipment, consumables and related service business. Kevin J. Thomas was appointed Executive Vice President of the Company's Industrial Equipment Division in August of 2024. Prior to his role as Executive Vice President, Mr. Thomas served as the Company's Excavation/ Vacuum Truck group Vice-President since February of 2022. Prior to joining the Company, Mr. Thomas served as President of Navistar Defense LLC since 2015. Mr. Thomas began with Navistar International in 1999, and held various roles including Director of Engineering, Director of Blue Diamond Truck LLC, and Director of Program Management for Navistar Defense, before being appointed President. Mr. Thomas held roles with General Dynamics Land Systems Divisioin and General Motors Truck Group prior to joining Navistar. Janet S. Pollock was appointed Senior Vice President, Corporate Human Resources of Alamo Group Inc. in April of 2024, and previously served as Vice President, Human Resources of Alamo Group since May of 2018. Ms. Pollock joined Alamo Group in June of 2013 as Vice President of Human Resources for U.S. Operations. Prior to joining the Company, Ms. Pollock was Vice President of Human Resources with CPS Energy in San Antonio, Texas and Vice President of Strategic Initiatives for Coca-Cola Enterprises, Inc. Lori L. Sullivan was appointed Vice President, Internal Audit of Alamo Group Inc. in May of 2019. Prior to this appointment, Ms. Sullivan was Vice President of Internal Audit for U.S. Operations and Director of Internal Audit for Alamo Group Inc. Ms. Sullivan has held audit positions within various industries including research and development, public utilities, and public accounting prior to joining Alamo Group in July of 2011. Item 1A. Risk Factors You should carefully consider each of the risks described below, together with all of the other information contained in this Annual Report on Form 10-K, before making an investment decision with respect to the Company’s securities. If any of the following risks develop into actual events, the Company’s business, financial condition or results from operations could be materially and adversely affected and you could lose all or part of your investment. Risks related to our business A downturn in general economic conditions and outlook in the United States and around the world could adversely affect our net sales and earnings. The strength and profitability of our business depends on the overall demand for our products and upon economic conditions and outlook, including but not limited to economic growth rates, consumer spending levels, financing availability, pricing and terms for our dealers and end-users, employment rates, interest rates, inflation, consumer confidence and general economic and political conditions and expectations in the United States and the other economies in which we conduct business. Slow or negative growth rates, inflationary/deflationary pressures, higher commodity costs and energy prices, reduced credit availability or unfavorable credit terms for our dealers and end-user customers, increased unemployment rates, and recessionary economic conditions and outlook could cause consumers to reduce spending, which may cause them to delay or forgo purchases of our products and could have an adverse effect on our net sales and earnings. Deterioration of industry conditions could harm our business, results of operations and financial condition. Our business depends to a large extent upon the prospects for the infrastructure maintenance, vegetation management and agricultural markets in general. Future prospects of the industry depend largely on factors outside of our control. Any of those factors could adversely impact demand for our products, which could adversely impact our business, results of operations and financial condition. These factors include the following: • weakness in the worldwide economy; • the price and availability of raw materials, purchased components and energy; • budget constraints and revenue shortfalls for our governmental customers; 17