| What science can do AstraZeneca Annual Report and Form 20-F Information 2024 |

| What science can do We are a global, science-led, patient-focused pharmaceutical business, committed to excellence in the research, development and commercialisation of prescription medicines. We aim to transform the lives of patients with improved outcomes and a better quality of life. Our Supplements Detailed information on our Development Pipeline, Patent Expiries of Key Marketed Products and Risk. See our website, www.astrazeneca.com/annualreport2024. Our sustainability reporting Our sustainability reporting is prepared in line with the UK Companies Act 2006, sections 414CA and 414CB. In anticipation of the EU Corporate Sustainability Reporting Directive (CSRD), we have started to incorporate selected disclosures in this Annual Report. Our key topics covered include material sustainability topics, which have been identified through our double materiality assessment, see page 60 for more information. Front cover image: Oncology research and development (R&D) strategy. In Oncology R&D, we have a breadth of scientific platforms to attack cancer from multiple angles, and we are harnessing the power of combinations to drive even deeper responses and bring potential for cure to more patients. Use of terms: In this Annual Report, unless the context otherwise requires, ‘AstraZeneca’, ‘the Group’, ‘we’, ‘us’ and ‘our’ refer to AstraZeneca PLC and its consolidated entities. Welcome |

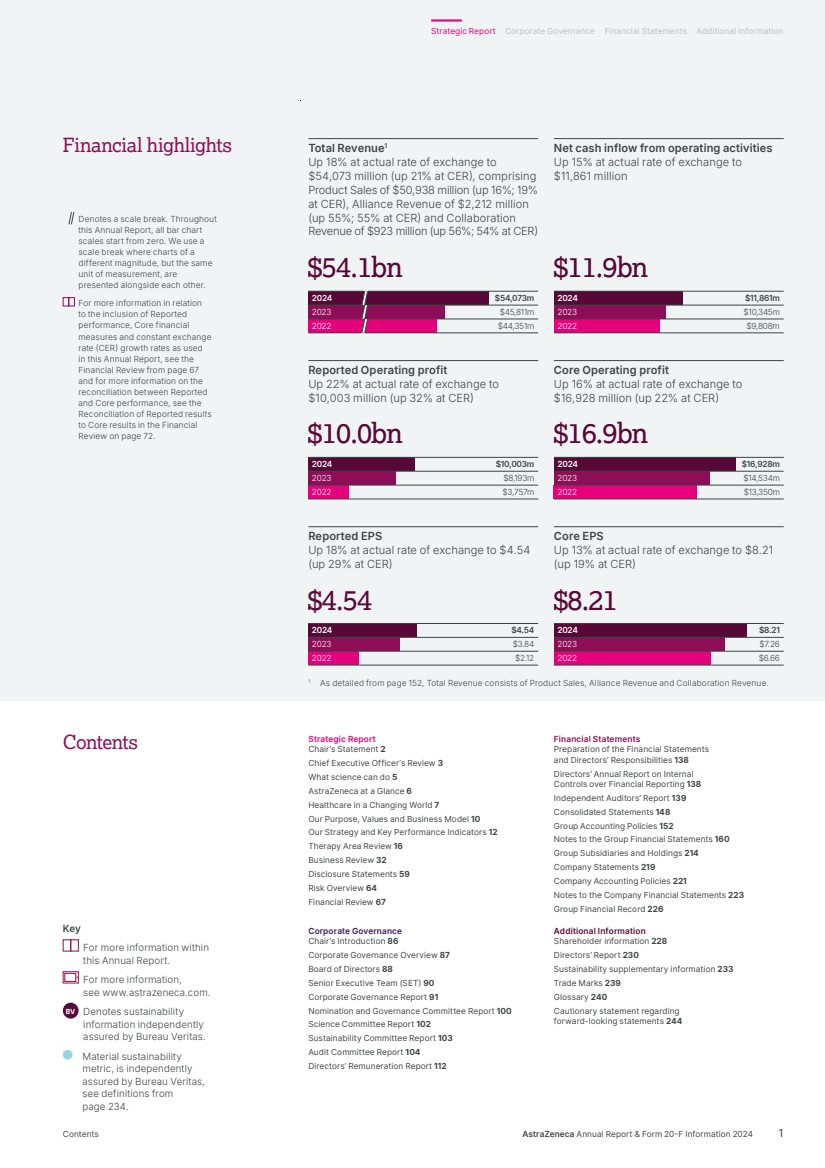

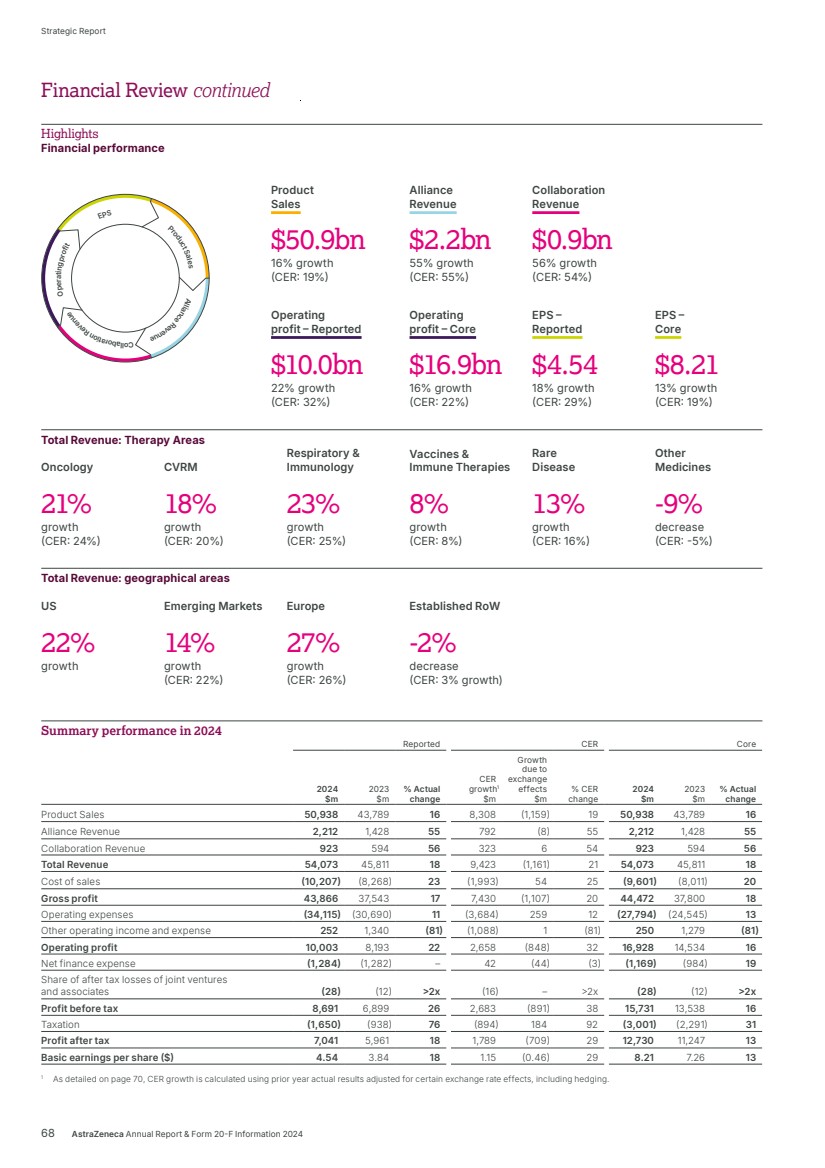

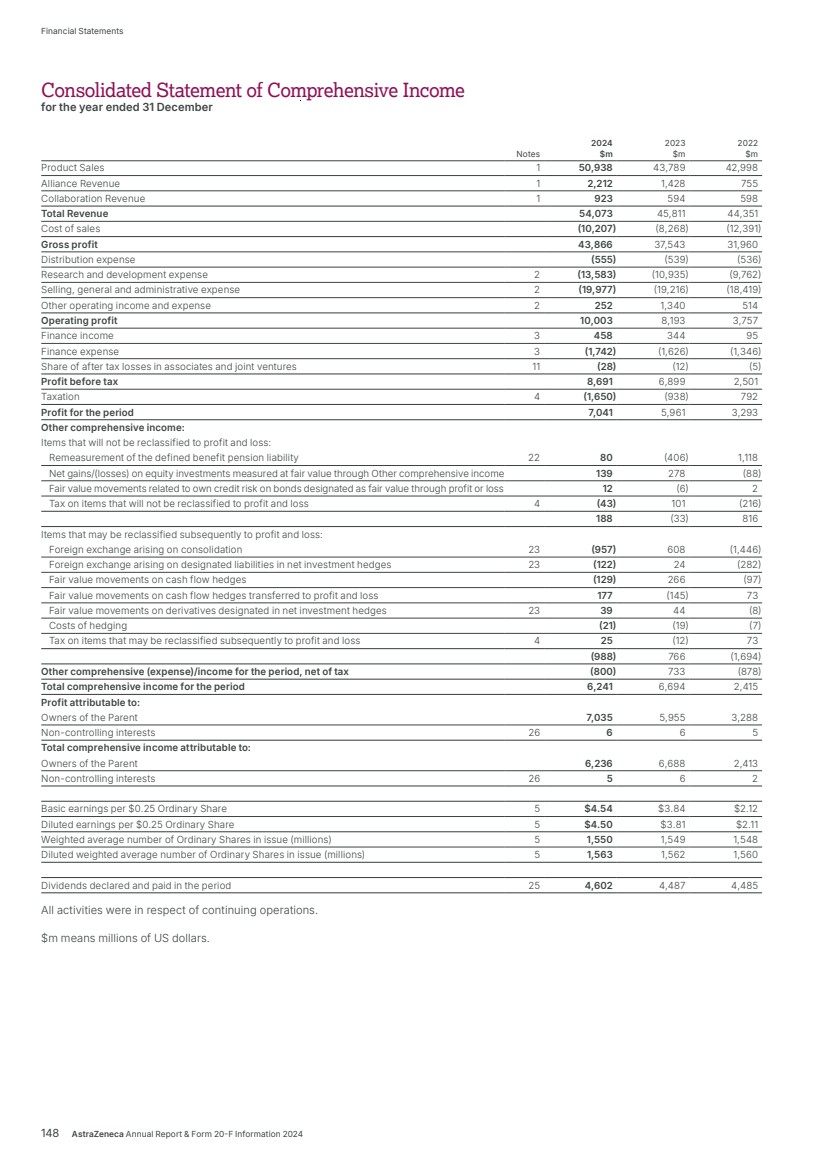

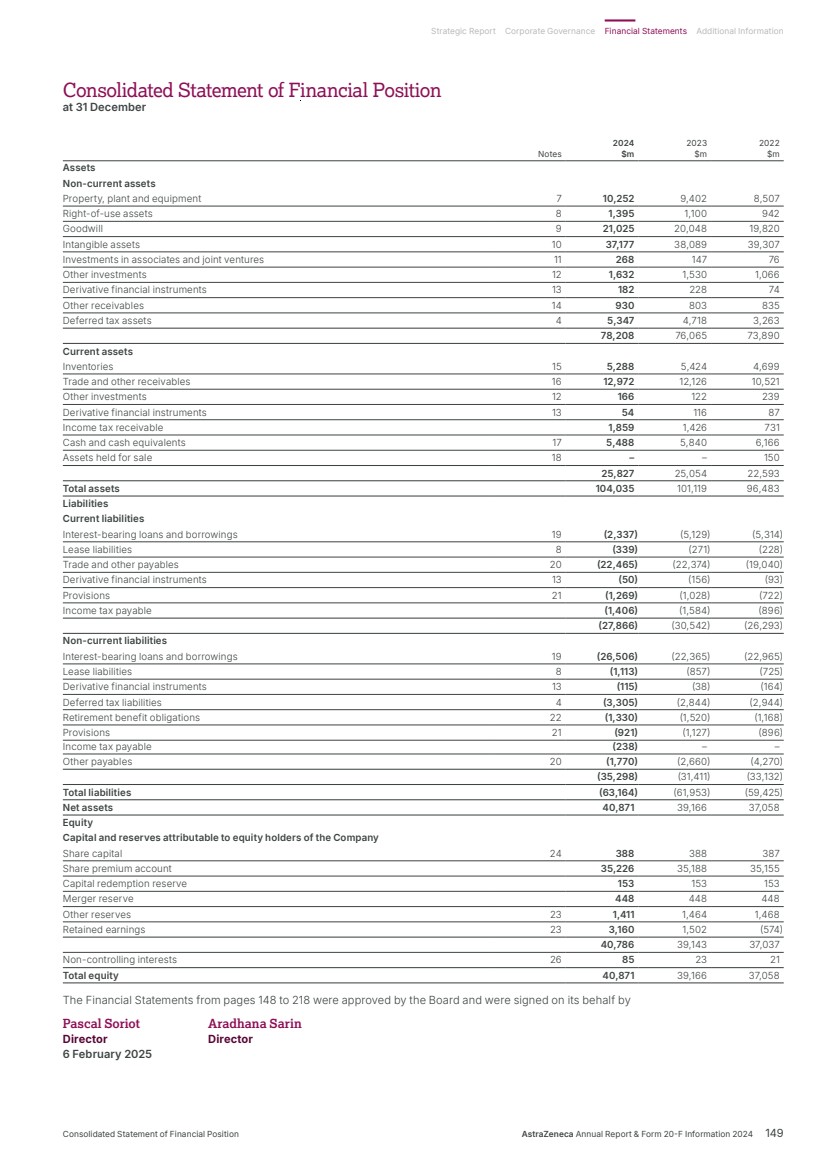

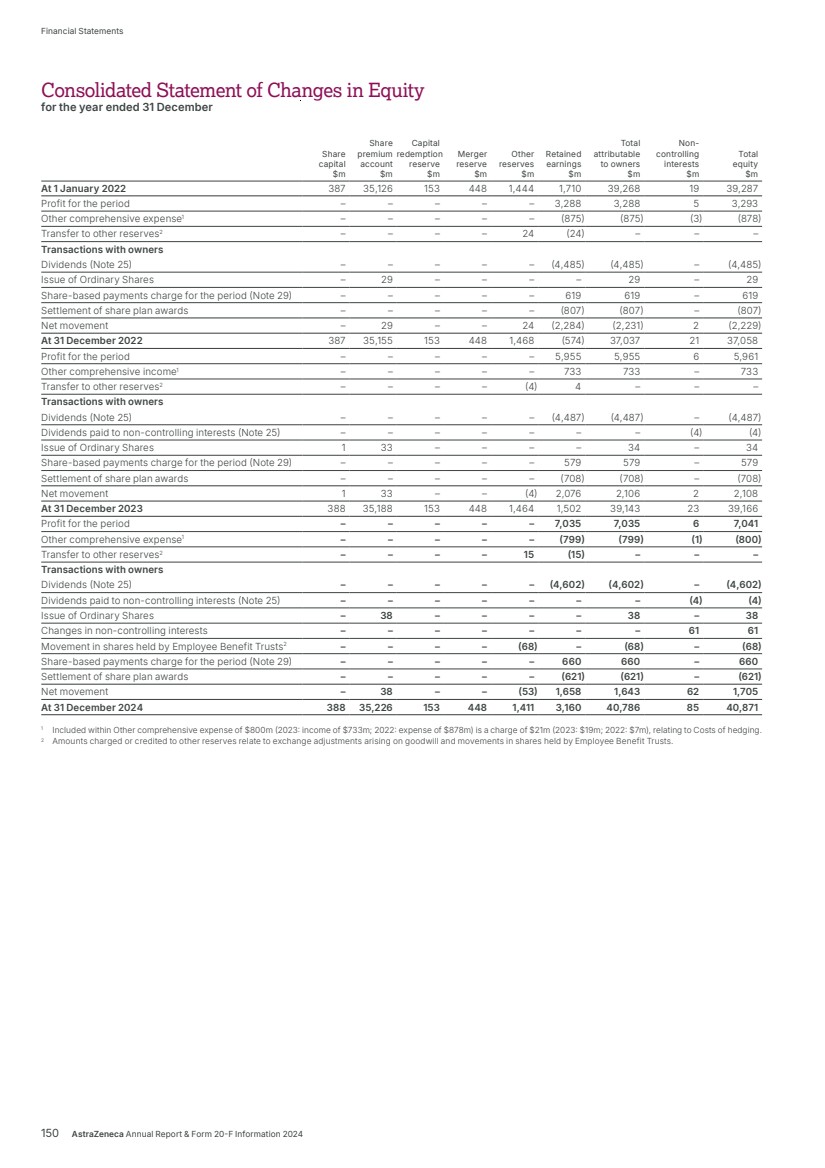

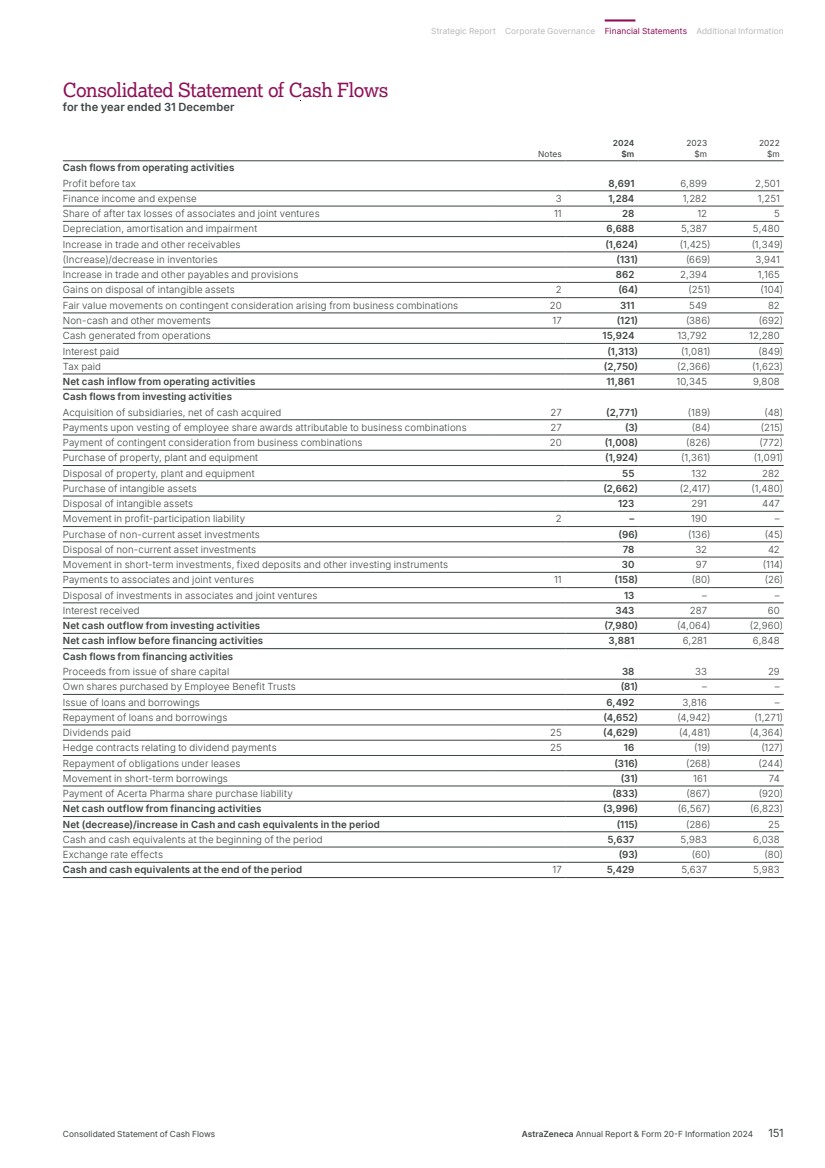

| Strategic Report Chair’s Statement 2 Chief Executive Officer’s Review 3 What science can do 5 AstraZeneca at a Glance 6 Healthcare in a Changing World 7 Our Purpose, Values and Business Model 10 Our Strategy and Key Performance Indicators 12 Therapy Area Review 16 Business Review 32 Disclosure Statements 59 Risk Overview 64 Financial Review 67 Financial Statements Preparation of the Financial Statements and Directors’ Responsibilities 138 Directors’ Annual Report on Internal Controls over Financial Reporting 138 Independent Auditors’ Report 139 Consolidated Statements 148 Group Accounting Policies 152 Notes to the Group Financial Statements 160 Group Subsidiaries and Holdings 214 Company Statements 219 Company Accounting Policies 221 Notes to the Company Financial Statements 223 Group Financial Record 226 Corporate Governance Chair’s Introduction 86 Corporate Governance Overview 87 Board of Directors 88 Senior Executive Team (SET) 90 Corporate Governance Report 91 Nomination and Governance Committee Report 100 Science Committee Report 102 Sustainability Committee Report 103 Audit Committee Report 104 Directors’ Remuneration Report 112 Additional Information Shareholder information 228 Directors’ Report 230 Sustainability supplementary information 233 Trade Marks 239 Glossary 240 Cautionary statement regarding forward-looking statements 244 Contents Key For more information within this Annual Report. For more information, see www.astrazeneca.com. BV Denotes sustainability information independently assured by Bureau Veritas. Material sustainability metric, is independently assured by Bureau Veritas, see definitions from page 234. Total Revenue1 Up 18% at actual rate of exchange to $54,073 million (up 21% at CER), comprising Product Sales of $50,938 million (up 16%; 19% at CER), Alliance Revenue of $2,212 million (up 55%; 55% at CER) and Collaboration Revenue of $923 million (up 56%; 54% at CER) Net cash inflow from operating activities Up 15% at actual rate of exchange to $11,861 million 2024 2023 2022 $45,811m $44,351m $54,073m $54.1bn $54.1bn $11,861m $10,345m $9,808m 2024 2023 2022 $11.9bn $11.9bn Reported Operating profit Up 22% at actual rate of exchange to $10,003 million (up 32% at CER) Core Operating profit Up 16% at actual rate of exchange to $16,928 million (up 22% at CER) $10,003m $8,193m $3,757m 2024 2023 2022 $10.0bn $10.0bn $16.9bn $16.9bn $16,928m $14,534m $13,350m 2024 2023 2022 Reported EPS Up 18% at actual rate of exchange to $4.54 (up 29% at CER) Core EPS Up 13% at actual rate of exchange to $8.21 (up 19% at CER) $4.54 $3.84 $2.12 2024 2023 2022 $4.54 $4.54 $8.21 $7.26 $6.66 2024 2023 2022 $8.21 $8.21 1 As detailed from page 152, Total Revenue consists of Product Sales, Alliance Revenue and Collaboration Revenue. Denotes a scale break. Throughout this Annual Report, all bar chart scales start from zero. We use a scale break where charts of a different magnitude, but the same unit of measurement, are presented alongside each other. For more information in relation to the inclusion of Reported performance, Core financial measures and constant exchange rate (CER) growth rates as used in this Annual Report, see the Financial Review from page 67 and for more information on the reconciliation between Reported and Core performance, see the Reconciliation of Reported results to Core results in the Financial Review on page 72. Financial highlights AstraZeneca Annual Report & Form 20-F Information 2024 1 Strategic Report Corporate Governance Financial Statements Additional Information Contents |

| $3.10 Full-year dividend of $3.10 per share (2023: $2.90) “2025 marks the beginning of an unprecedented, catalyst-rich period for AstraZeneca, an important step on our Ambition 2030 journey.” It starts with our science, and is a powerful vindication of the value of innovation. It is also a source of great pride, as it holds the hope of improving care for millions of people. Likewise, what we are doing resonates with the stakeholders I speak to – healthcare professionals, patient advocacy groups, policymakers and investors. Whatever their perspective, they want to see us succeed and deliver the value of better health for people, society and the planet. A world in flux Geopolitical shifts, crises and conflict are changing the world around us. They interact with economic, demographic, societal, environmental and technological transformations, constantly changing the conditions in which we operate. Business cannot hope to predict every event or outcome but we can strengthen, through active risk management, our capabilities to absorb shocks and adapt our operations. Appropriate risk management enables us to continue implementing our overall strategy to achieve growth, drive innovation and reach more patients. We are, for example, seeing a more economically diverse landscape with the rise of key emerging markets and a relative decline of economic concentration in the West. In addition, governments are increasingly focused on strategic autonomy, driven by concern over national security, crisis preparedness, economic competitiveness and sovereignty in key sectors. There is also strong pressure to build resilient supply chains, particularly in response to climate change. Such trends are interlinked, presenting challenges and risks we need to mitigate. But they also present opportunities for growth and innovation. A strategic approach to healthcare Given the well-evidenced societal and economic benefits, we believe governments must prioritise investment in Health and develop sustainable financing solutions. This requires public and private sectors to collaborate to ensure healthcare investments are strategic and targeted to maximise positive impact, transform service delivery and generate long-term savings for health systems. By prioritising investment in screening and treating disease early, by keeping people healthy, out of hospital and economically productive, we can reduce healthcare costs. At the same time, investing in more climate-resilient, net-zero health systems can help build a more sustainable and equitable future. And, eventually, it will considerably improve health equity and leave nobody behind. Finally, strengthening health systems will help them be more resilient, ensuring they are prepared for future crises and able to adapt to changing needs. Global collaborations like the Partnership for Health System Sustainability and Resilience (PHSSR) are driving this transformation. AstraZeneca is a founding member of the PHSSR, now active in more than 30 countries, which commissions independent research and develops evidence-based policy recommendations for change. Outlook 2025 marks the beginning of an unprecedented, catalyst-rich period for AstraZeneca, an important step on our Ambition 2030 journey. We are also investing in and making significant progress with transformative technologies that have the potential to drive our growth well beyond 2030. Michel Demaré Chair From my perspective, as AstraZeneca’s Chair, I have once again witnessed first-hand the impact we are making for patients and communities across the globe. We are making a real difference. Performance AstraZeneca sustained strong momentum in 2024, with Total Revenue up 18% (21% at CER) and Reported EPS up 18% (29% at CER). Core EPS was up 13% (19% at CER). Following the announcement at our Annual General Meeting in April, the Board has declared a second interim dividend of $2.10 per share, making a total dividend declared for the full year of $3.10 per share. The increase, of 7%, over 2023 underscores our confidence in future growth. A dedicated team Of course, every global company is from time to time exposed to difficulties and 2024 was no different for AstraZeneca, as we navigated some challenging geopolitical circumstances. These included investigations by the Chinese authorities, with whom we continue to cooperate fully. However, it is in times such as these that we can really appreciate the team ethos and dedication of our people and the Board to deliver for patients. On behalf of the Directors, I extend my thanks to Pascal, the Senior Executive Team and everyone for the contributions they made to our success. Strategic ambition At our Investor Day, we set out our Ambition 2030, an exercise in which the Board was deeply involved and supportive, and which demonstrates the trust in our pipeline. AstraZeneca has ambitious plans and is working in collaboration for healthier people, society and the planet. 2 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report Chair’s Statement |

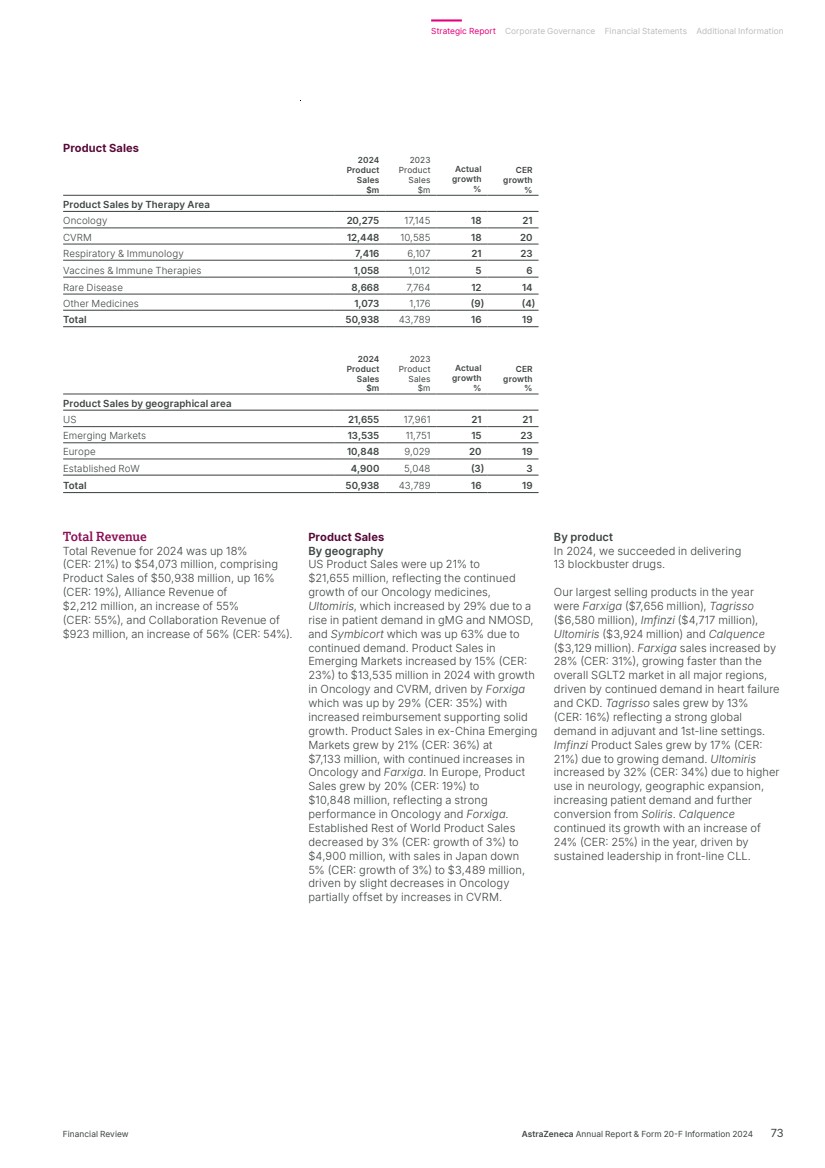

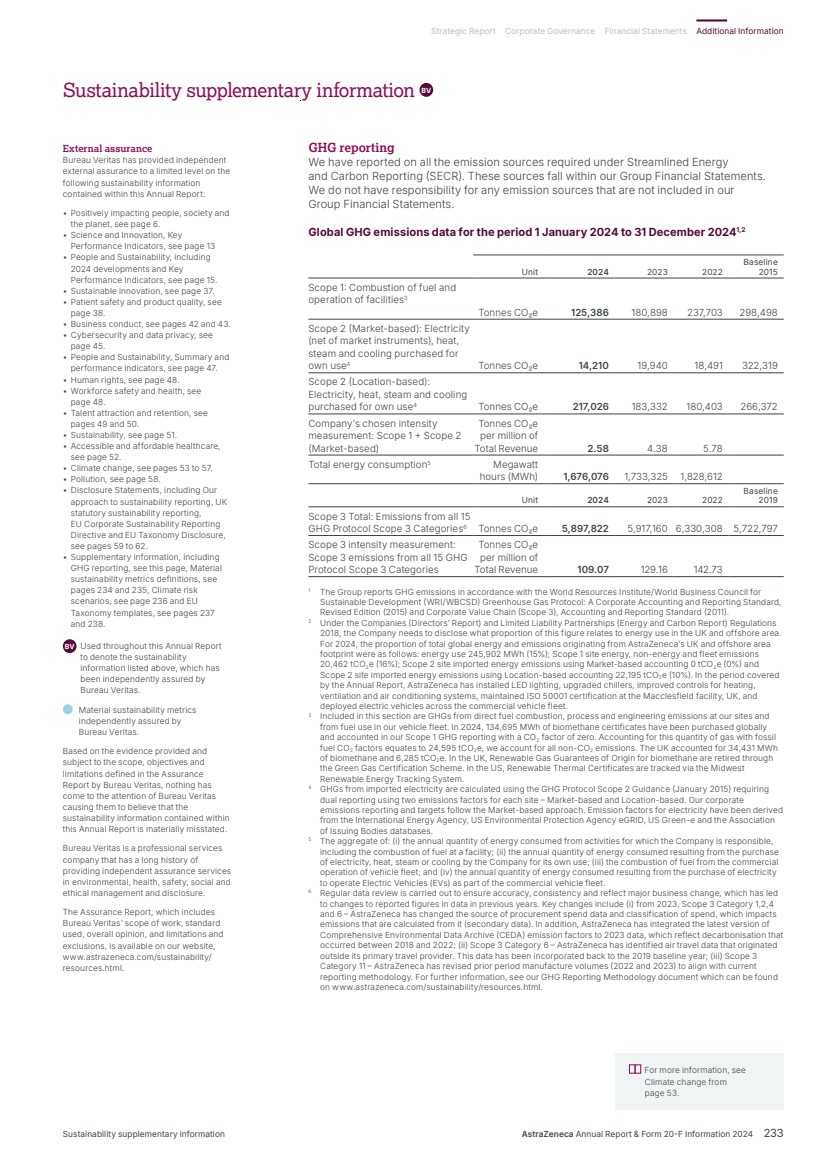

| $54.1bn Total Revenue (2023: $45.8bn) 74 Regulatory events – submissions or approvals in major markets “By 2030, we aim to launch at least 20 new medicines and achieve $80 billion in Total Revenue, with sustained growth thereafter.” against our 2030 target. Our science was selected for plenary sessions at the annual meeting of the American Society of Clinical Oncology, for the sixth year running, as well as a remarkable five Presidential Plenary sessions at lung cancer and European oncology congresses. We also continued to move earlier in the treatment of disease, where there is greatest chance of success, and stepped up efforts to improve patient outcomes by harnessing the power of combinations, not only in oncology but prospectively in weight management, as well as through patient-friendly devices and formulations. Our focus on patients is demonstrated by Airsupra, where the readout from the BATURA trial both showed overwhelming efficacy in treating asthma but importantly was the first pivotal study to eliminate all in-person clinic visits. Growing and leading We delivered a very strong performance in 2024, with Total Revenue increasing to $54.1 billion. In our therapy areas, Total Revenue for Oncology increased 21% (24% at CER), Cardiovascular, Renal & Metabolism by 18% (20% at CER), Respiratory & Immunology by 23% (25% at CER), Vaccines & Immune Therapies by 8% (8% at CER) and Rare Disease grew by 13% (16% at CER). In our regions, Total Revenue increased by 22% in the US, 14% (22% at CER) in Emerging Markets and by 27% (26% at CER) in Europe. Total Revenue decreased by 2% (increased by 3% at CER) in Established RoW. In 2024, the US represented 43% of Total Revenue. Across the world, our therapy area leadership is reflected in the fact that, for the first time, we are the number one pharmaceutical company across our 2024 was a truly memorable year for AstraZeneca. First, it was yet another year in which we advanced our high-quality pipeline, successfully delivered medicines to millions of patients and further increased our contribution to society and the planet. Secondly, it was the year in which we were able to look back and celebrate 25 years of pioneering science since the formation of AstraZeneca in 1999. Additionally, it was the year in which we took the opportunity to look forward to 2030 and beyond as we outlined the scale of our ambition and what we aim to achieve today, tomorrow, and the day after. That ambition, set out in our Investor Day in May, is to be pioneers in science, lead in our disease areas and transform patient outcomes. By 2030, we aim to launch at least 20 new medicines and achieve $80 billion in Total Revenue, with sustained growth thereafter. We are also pursuing ambitious science-based decarbonisation targets in support of achieving net zero by 2045. Achieving today Outstanding science 2024 was a year of scientific breakthroughs. For example, we received approvals for Voydeya (danicopan), Kavigale (sipavibart) and Datroway (datopotamab deruxtecan), taking us to a total of eight medicines A year in which we delivered medicines to millions of patients, looked back on 25 years of pioneering science and outlined the scale of our ambition for the future. Emerging Markets, achieving this milestone one year ahead of plan. This includes China, where we are committed to contributing to the long-term development of the life sciences sector. We are also one of the top three pharmaceutical companies across our Europe and Canada region and are making great progress to become the number one company in Japan, where we are already number one in oncology. Talented people working sustainably Our strong progress is made possible by the commitment and efforts of our team, not least by the way they are embracing digital, data and AI to speed our progress and improve how we work. And, as we grow, we have increased our focus on learning and development – building the skills and capabilities that will sustain our success – as well as continuing to cultivate an inclusive culture that reflects our patients and communities, and supports innovation. As mentioned by Michel Demaré, our Chair, in 2024 we continued to invest in collaborations and initiatives to strengthen health systems. We are also investing in climate and nature action, and maintain a leading role in industry efforts to address the effects of climate change and accelerate the delivery of net-zero sustainable healthcare, while improving health outcomes and decreasing our impact on the planet, reducing carbon emissions, water consumption and waste generation. Our sustained progress in reducing greenhouse gas emissions has enabled a 77.5% reduction in Scope 1 and 2 emissions from our 2015 baseline. AstraZeneca Annual Report & Form 20-F Information 2024 3 Strategic Report Corporate Governance Financial Statements Additional Information Chief Executive Officer’s Review Chief Executive Officer’s Review |

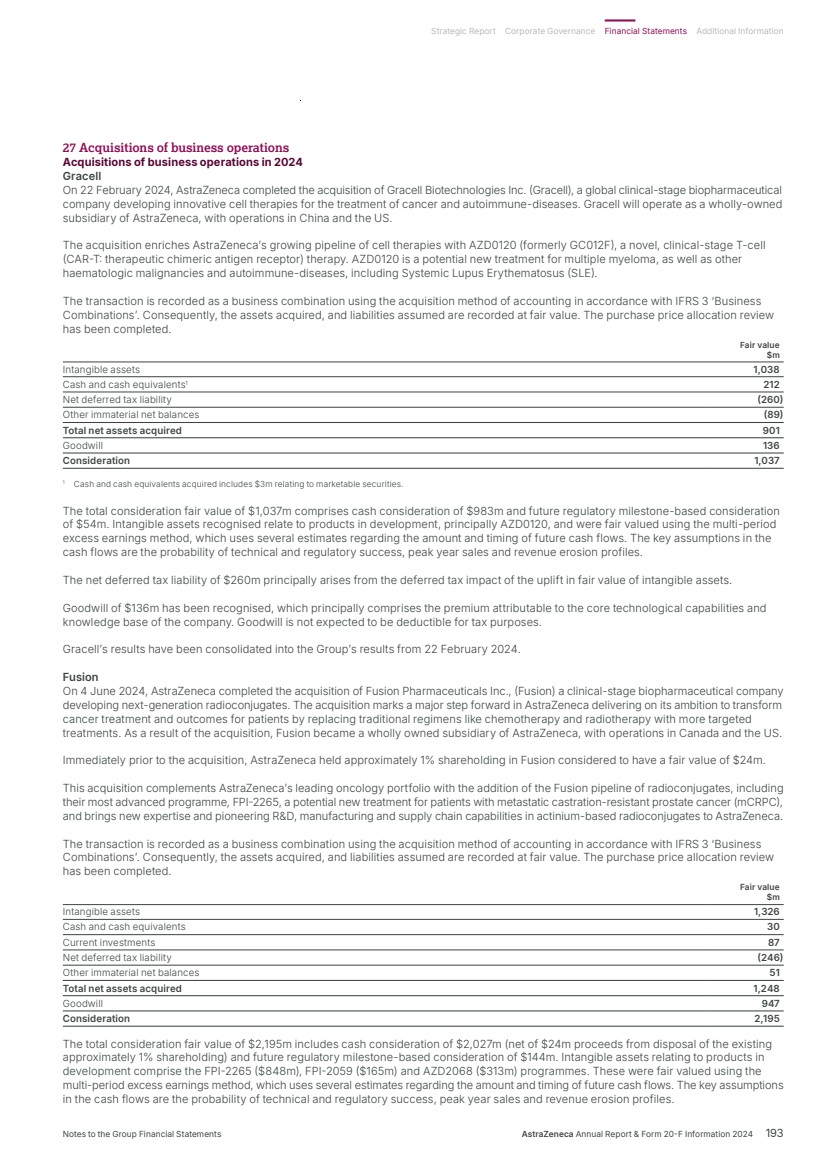

| Delivering tomorrow Industry-leading pipeline Our ability to deliver for patients tomorrow was underlined in 2024 by our pipeline which saw a record number of 74 regulatory events, namely submissions or approvals for our medicines in a major market, an increase of almost one third over 2023. The year also saw nine positive high-value Phase III readouts. In Oncology, Imfinzi’s further potential was apparent in two trials: NIAGARA demonstrated that immunotherapy could significantly extend the lives of patients with bladder cancer while, in ADRIATIC, it was the first and only immuno-oncology to show survival benefit in limited-stage small cell lung cancer. The ECHO and AMPLIFY trials demonstrated the potential for Calquence in mantle cell lymphoma and chronic lymphocytic leukaemia. It was also great to see positive results from LAURA, which cemented Tagrisso as the standard of care in unresectable EGFRm non-small cell lung cancer. DESTINY-Breast06 confirmed Enhertu’s potential to evolve the current HR-positive breast cancer treatment landscape. In BioPharmaceuticals, the WAYPOINT trial showed Tezspire’s potential as an important new treatment option for patients with nasal polyps while, in Rare Disease, the KOMET trial results for Koselugo support its potential expanded use in adults living with NF1 PN – a devastating rare genetic disease. Additionally, we had 24 pipeline progressions in 2024, being Phase II starts/progressions and Phase III investment decisions. Once again, the strength and quality of our pipeline was recognised in the granting by regulators of 28 designations across 18 projects, including Breakthrough Therapy, Priority Review or Fast Track designations. Even in such a year of success, when pushing the boundaries of science, it is normal to experience setbacks which included the termination of the vemircopan (ALXN2050) Phase II development programme for rare diseases. On such occasions, we are committed to living our Values of following the science and putting patients first, by learning from what challenges tell us and how they can help us in realising the full potential of our medicines and benefit as many patients as possible. We also share data with the wider scientific community. Datroway exemplifies our approach. While we voluntarily withdrew applications in the US and EU for the treatment of non-squamous non-small cell lung cancer (NSCLC), it was subsequently granted Breakthrough Therapy Designation in the US for patients with previously treated advanced EGFR-mutated NSCLC. In January 2025, it was also granted Priority Review, given by the FDA to applications for medicines that, if approved, would offer significant improvements over available options. I was also delighted when, in December, our partner, Daiichi Sankyo, received the first approval for Datroway for the treatment of patients with metastatic HR-positive, HER2-negative breast cancer in Japan. This was swiftly followed in January by the approval in the US of the similar AstraZeneca-led application. Datroway offers patients an effective and better tolerated alternative to traditional chemotherapy and the approvals underscore the potential of the medicine to replace chemotherapy and deliver improved outcomes across multiple cancer types. Health equity and climate In Rare Disease, as part of our ambition for 2030, we are committed to reaching six times as many patients as 2022 across 100 countries with our transformative rare disease medicines. We are on track to reach this commitment – in 2024, our medicines were available in more than 70 countries. As we grow across new and existing markets, we are working with local rare disease advocates, healthcare systems and policy makers to help shape the rare disease ecosystem to shorten the diagnostic journey, improve access to treatment and ensure stakeholders understand the societal value of rare disease innovation. Our efforts in Rare Disease complement those across all our therapy areas to close healthcare gaps and give people everywhere the chance to be as healthy as possible. We are doing so by embedding health equity across the whole enterprise, from science to the delivery of care. We want to better understand the factors that drive poor health outcomes among diverse populations, partnering with governments, health systems and communities to co-create solutions. The climate crisis is the largest health crisis of our time and has a significant impact on respiratory diseases which can be complex, difficult to treat, often poorly controlled and associated with a higher carbon footprint of care. We are focused on addressing this challenge by optimising care with our portfolio of respiratory medicines. At the same time, we are transitioning our inhaled medicines to a next-generation propellant (NGP) with near-zero global warming potential – 99.9% lower than current propellants, and were proud to make our first regulatory submission for Breztri NGP in the EU in 2024. Preparing for the day after tomorrow Our ambition for AstraZeneca extends beyond 2030 and, as shown on the next page, we are working on technologies that will, we believe, shape the future of medicine and sustain our growth. Our work is built on our internal efforts but we have also leveraged external innovation to expand and accelerate our pipeline. For example, the acquisition of Fusion brought new expertise in actinium-based radioconjugates, including one for prostate cancer, as well as state-of-the-art manufacturing capabilities, while our acquisition of Gracell in China allows us to accelerate our ambitions in cell therapy, particularly in haematology and autoimmune disease. Weight management is a particular challenge as many affected people are living with complex, interconnected diseases. Treating each disease separately without addressing obesity as a root cause does not optimise outcomes for them or healthcare systems. Building on our existing expertise, our rapidly developing weight management portfolio looks beyond short-term weight loss to address individual patient needs. Our aim with these therapies is to provide durable weight loss, with cardiometabolic benefit and new options for patients by targeting linked disease biology. Appreciation AstraZeneca only achieved what we did in 2024, and can only deliver our ambition for 2030 – and beyond – with great people in high-performing teams. On behalf of the Senior Executive Team, I would like to thank everyone in AstraZeneca for all they accomplished in 2024 and for their focus on realising our goals for people, society and the planet. Pascal Soriot Chief Executive Officer 4 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report |

| For more information, see Research & Development from page 34. Investing in transformative new technologies and modalities that will shape the future of medicine and sustain AstraZeneca’s growth post 2030. Our investments in transformative R&D technologies include: Antibody drug conjugates and radioconjugates that aim to replace systemic chemotherapy and radiotherapy, see page 36. Cell therapy and T-cell engagers that are more scalable across therapy areas, see page 44. Gene therapy and gene editing that could make cures possible for a range of rare diseases, see page 49. Next-generation immuno-oncology bispecifics that establish new immuno-oncology segments, see page 55. Weight management that looks beyond short-term weight loss to address individual patient needs, see page 46. What science can do Medicines for today, tomorrow and the day after. Strategic Report Corporate Governance Financial Statements Additional Information What Science Can Do AstraZeneca Annual Report & Form 20-F Information 2024 5 |

| Our strategic priorities Our priorities reflect how we are working to deliver our Growth Through Innovation strategy and achieve our Purpose of pushing the boundaries of science to deliver life‑changing medicines. 1. Science and Innovation 2. Growth and Therapy Area Leadership 3. People and Sustainability Science and innovation-led We invest in new technologies and modalities to deliver the next wave of pipeline innovation and life-changing medicines. 191 projects in our development pipeline1 19 new molecular entities (NMEs) in our late-stage pipeline 130 NME or major life-cycle management (LCM) projects in Phase II and Phase III $13.6bn invested in our science 1 Includes NME and major LCM projects up to launch in all applicable major markets. Leading in our therapy areas We focus on areas where we can transform patient outcomes through novel medicines and combinations. Total Revenue by therapy area2 $22.4bn, 41% Oncology $21.9bn, 40% BioPharmaceuticals $8.8bn, 16% Rare Disease $1.1bn, 2% Other Medicines Total Revenue $54.1bn $54.1bn $45.8bn $44.4bn 2024 2023 2022 2 Due to rounding, the sum of subtotals and percentages may not agree to totals. Diversified portfolio and global reach We deliver a diversified portfolio of medicines across primary care, specialty care and rare diseases through our broad-based network and increasing presence in emerging markets. Total Revenue by reporting region $23.2bn, 43% $13.7bn, 25% $12.2bn, 23% $5.0bn, 9% Total Revenue growth by reporting region3 22% 14% 27% -2% 3 Actual growth percentage. Positively impacting the health of people, society and the planet BV We operate responsibly, harnessing the power of science and innovation, and our global reach, to help build a healthier, more sustainable future. 90.5m people reached by our access to healthcare programmes 77.5% reduction in Scope 1 and 2 GHG emissions since 2015 Rating of AA in the MSCI ESG Ratings assessment Ranked in the top five of the Access to Medicine Index 2024 Key US Emerging Markets Europe Established Rest of World 6 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report AstraZeneca at a Glance We are a global, science-led, patient-focused pharmaceutical company. We are dedicated to transforming the future of healthcare by unlocking the power of what science can do for people, society and the planet. |

| 2024 2023 2022 107 100 111 Established RoW ($bn) $111bn $111bn (+4.3%) (+4.3%) 686 608 762 US ($bn) 2024 2023 2022 $762bn $762bn ((++11.1 11.1%%)) 290 269 318 Emerging Markets ($bn) 2024 2023 2022 $318bn $318bn (+9.7%) (+9.7%) 259 240 280 Europe ($bn) 2024 2023 2022 $280bn $280bn (+8.2%) (+8.2%) 1,343 1,219 1,473 World ($bn) 2024 2023 2022 The external environment presents both challenges and opportunities that require us to adapt, innovate and build trust. Global pharmaceutical sales In 2024, Established Markets1 saw an average revenue increase of 9.7% and Emerging Markets revenue grew by 9.7%. The US, China, Japan, Germany and France are the world’s top five pharmaceutical markets by 2023 sales. In 2024, the US had 51.8% (2023: 51.1%; 2022: 49.9%) of global sales, while China had around 7%. Data based on world market sales using AstraZeneca Market definitions as set out on page 240. Changes in data subscriptions, exchange rates and subscription coverage, as well as restated IQVIA data, have led to the restatement of total market values for prior years. Source: IQVIA, IQVIA Midas Quantum Q3 2024 (including US data). Reported values and growth are based on CER. Value figures are rounded to the nearest billion and growth percentages are rounded to the nearest tenth. We expect both developed and developing markets, including North America, Other (Non-EU) Europe, the Indian subcontinent and Latin America to fuel pharmaceutical growth. Market growth in China is expected to remain below historical levels at a compound annual growth rate of 2.6% (±1.5%). This is due to the continued slowdown of the major hospital sector. 1 Established Markets means US, Europe and Established RoW. 2 North America means US. 3 Non-EU countries; including the UK. 4 Commonwealth of Independent States; includes Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan and Uzbekistan and excludes Ukraine. $1,473bn(+9.7%) Estimated pharmaceutical sales 2028. Data is based on ex-manufacturer prices at CER. Source: IQVIA. Estimated pharmaceutical market growth. Data is based on the compound annual growth rate from 2023 to 2028. Source: IQVIA Market Prognosis Global 2023–2028. Other Europe3 $71.7bn 11.8% Japan $66.7bn 0.9% China $159.9bn 2.6% Oceania $18.1bn 3.3% Southeast and East Asia $222.0bn 3.6% Middle East $26.8bn 7.7% Africa $22.7bn 5.7% Indian subcontinent $37.8bn 9.4% CIS4 $28.9bn 6.8% EU $290.1bn 6.3% North America2 $853.1bn 8.2% Latin America $94.1bn 14.3% Estimated pharmaceutical sales and market growth to 2028 A growing pharmaceutical sector The pharmaceutical sector continues to grow against a backdrop of increasing demand for healthcare. Global pharmaceutical sales grew by 9.7% in 2024. Global healthcare spending is projected to increase at an annual rate of 7.4% from 2023 to 2028. Healthcare in a Changing World Strategic Report Corporate Governance Financial Statements Additional Information Healthcare in a Changing World AstraZeneca Annual Report & Form 20-F Information 2024 7 |

| The pharmaceutical sector faces economic challenges, geopolitical uncertainty and the impacts of ageing populations and the climate crisis. Rapidly-advancing technologies offer many benefits, while demographic change is driving an increased demand for healthcare. Successful organisations are transparent, accessible, and build trust with their stakeholders. Impact of global trends Escalating geopolitical tensions present profound challenges and opportunities for global business. Global growth remains low but stable after decline in inflation and rising protectionist policies. Accelerating pace of ageing populations in low- and middle-income countries. The world continues to shift from a period of global cooperation to one of heightened competition and discord, producing a more volatile and confrontational geopolitical environment. This trend has acute consequences for security, trade and global collaboration. In this fragmented climate, new forms of conflict are emerging. With the rise of emerging powers such as India and Brazil, sustained strategic rivalry between the US and China, as well as conflicts, such as the war in Ukraine, adversaries are beginning to wield new weapons of disinformation, cyber threats and competition space which are emerging alongside traditional warfare. Some are choosing to exploit economic interdependence to create geopolitical dependencies, which can impact supply chains of both traditional and emerging sectors vital for the digital and green transitions. However, such trends also present opportunities as companies are encouraged to localise operations to mitigate supply chain risks. (Source: ESPAS Global Trends to 2040: Choosing Europe’s Future, April 2024) These growth projections remain below pre-pandemic averages. For advanced economies, GDP is expected to rise from 1.7% in 2023 to 1.8% in both 2024 and 2025. Growth in emerging markets and developing economies is projected to slow from 4.4% in 2023 to 4.2% in both 2024 and 2025, generally as a result of increased regional conflicts and extreme weather events. Forecasts for global growth over the medium term remain at 3.1%, with low productivity growth, investment and ageing populations hindering advancement. Recent election results, particularly in the US, also pose potentially significant consequences for the global economy. Prospective trade tariffs and other protectionist policies could exacerbate inflation, trade tensions and supply chain disruption across the world, and could hamper medium-term growth. Global inflation is forecast to further decline, from a peak of 9.4% in 2022 to 3.5% by the end of 2025. (Source: IMF World Economic Outlook, October 2024; Reuters, November 2024) By 2050, two thirds of the world’s ageing population is expected to live in low- and middle-income countries (LMICs). LMICs are disproportionately affected by non-communicable diseases (NCDs). In total, NCDs represent 75% of non-pandemic related deaths globally. Cardiovascular diseases account for the most NCD deaths annually (19 million in 2021), followed by cancers (10 million), chronic respiratory diseases (four million) and diabetes (two million). Nearly 75% of these global NCD deaths (32 million) occur in LMICs. This rise places increasing strain on poverty-reduction initiatives and on already-stretched healthcare systems. Increasing demand for healthcare is putting pressure on healthcare budgets which, exacerbated by the impact of the COVID-19 pandemic, is leading to downward pressure on pricing. The pandemic also saw rising concern around vaccines and the proliferation of vaccine misinformation which has potentially significant consequences for public health. (Source: WHO; The Lancet, Volume 401, Issue 10380, 967-970) Two billion Approximately two billion people were eligible to vote in national elections held in over 70 countries in 2024. (Source: Statista, November 2024) 3.2% Global GDP growth forecast to stabilise from 3.3% in 2023 to 3.2% in both 2024 and 2025. (Source: International Monetary Fund (IMF) World Economic Outlook, October 2024) 426 million Between 2020 and 2050, the number of people aged 80 years or older is expected to triple to 426 million. (Source: World Health Organization (WHO)) Political Increasing geopolitical friction Economic Activity remains below pre-pandemic levels Societal Growing population ageing and downward pressure on pricing These risks are explored further in the Risk Overview from page 64 and Accessible and affordable healthcare from page 52. Strategic Report 8 AstraZeneca Annual Report & Form 20-F Information 2024 Healthcare in a Changing World continued |

| The significant potential of AI is already transforming the pharmaceutical industry. The climate crisis is the greatest public health crisis of our time, increasing ill health and jeopardising access to healthcare. In research and early discovery, data and AI could accelerate the identification processes for potential new drugs and increase our understanding of the underlying conditions, helping new medicines to be approved and marketed for use more quickly. For medical professionals, data and AI could also boost productivity and reduce errors and costs by automating the more time-consuming exercises of record keeping and document creation. However, these new technologies have inherent risks. For example, the dangers of IP infringement and data privacy, AI hallucination and inaccuracy. Against the backdrop of the evolving uncharted regulatory landscape and high stakes associated with developing treatments for disease, these risks mean that companies will need to put strong controls and policies in place to manage data and AI and to fully realise the benefits. (Source: McKinsey & Company, January 2024) The impacts of the climate emergency, coupled with ageing populations and a rise in chronic diseases, are worsening health inequities and adding further pressure to health systems. Certain populations are disproportionately impacted including women, the elderly, children, those with existing health issues and the most marginalised in society, who have often contributed least to the climate crisis, making this a health equity crisis. The immediate health impacts of climate change could also limit the ability of primary care resources to treat longer-term, complex diseases. Furthermore, there is a growing recognition of the importance of nature and acting to protect and restore ecosystems for the health of people and the planet. (Source: The Lancet, Volume 404, Issue 10465, 1847-1896) The accelerating pace of innovation offers potential for success but may exacerbate issues with trust. With the continued advancements in science and digital technologies, the rate of innovation in society is accelerating at an unprecedented pace. With the rise of AI, multi-omics, gene-based therapies and functional genomics, the scientific industry is flourishing. Pharmaceutical companies are using these innovations to uncover novel drivers of disease and progress new drug modalities, ultimately leading to more successful outcomes for patients. While offering the potential to revolutionise the healthcare industry, this rapid rise could exacerbate already-present trust issues. Concerns around the politicisation of science and the regulation of these emerging innovations remain at the heart of discussions around the acceptance of these innovations. To succeed, pharmaceutical companies and the scientific industry as a whole need to more effectively communicate with the general public, engaging them in dialogue and making science more transparent and accessible. (Source: 2024 Edelman Trust Barometer) $110 billion Generative AI is estimated to produce $60 billion to $110 billion in economic value annually for the pharmaceutical industry. (Source: McKinsey & Company, January 2024) 167% Record-breaking increase in heat-related deaths among those over 65 years old in 2023. (Source: The Lancet, Volume 404, Issue 10465, 1847-1896) 73% In a 28-country survey, 73% of people questioned rated the healthcare industry trustworthy, but only 50% trusted gene-based medicine. (Source: 2024 Edelman Trust Barometer) Technological Emerging opportunities and risks with data and AI Environmental Deep interconnection between climate and health Outlook Opportunities and challenges for the sector Strategic Report Corporate Governance Financial Statements Additional Information Healthcare in a Changing World AstraZeneca Annual Report & Form 20-F Information 2024 9 |

| How we deliver on our business model How we add value Improved health Continuous scientific innovation is vital to achieving sustainable healthcare, which creates value by: • Improving health outcomes and transforming the lives of patients who use our medicines. • Enabling healthcare systems to reduce costs and increase efficiency. • Improving access to healthcare and healthcare infrastructure. • Helping develop the communities in which we operate through local employment and partnering. Financial value Revenue from our Product Sales and collaboration activities generates cash flow, which helps us: • Fund our investment in science and the business to drive long-term value. • Follow our progressive dividend policy. • Meet our debt service obligations. >134m1 Our main therapy area medicines impact more than 134 million patient lives annually. Inspired by our Values and what science can do, we are focused on accelerating the delivery of life-changing medicines that create enduring value for patients, society, the planet and our shareholders. Our Purpose Our Values Our business model We push the boundaries of science to deliver life-changing medicines. Our Values determine how we work together and the behaviours that drive our success. They guide our decision making and define our beliefs. • We follow the science • We put patients first • We play to win • We do the right thing • We are entrepreneurial We are a global pharmaceutical business with a science-led and patient-focused value proposition committed to excellence in the research, development, manufacturing and commercialisation of prescription medicines across primary care, specialty care and rare diseases. We are also committed to operating responsibly, and in an ethical and transparent way, to help build a healthier, more sustainable future. We invest resources to create financial and non‑financial value that benefits patients, society, the planet and our business. Our Purpose, Values and Business Model For more information, see Business Review from page 32. Strategic Report Ability to acquire, retain and develop a talented and diverse workforce. 50.6% of our senior middle management roles and above are filled by women Global commercial presence and skills that ensure our medicines are available to patients when needed. >80 countries in which we have an active presence A leadership position in science that enables us to deliver life-changing medicines. $13.6bn invested in our science in 2024 Patent protection for our intellectual property for a reasonable period of time to prevent our new medicines being copied. >90 countries where we obtained patent protection Reduction of Scope 1 and 2 GHG emissions from 2015 baseline year. 77.5% Ambition Zero Carbon (Scope 1 and 2) A supply of high-quality medicines, whether from our own operations or from suppliers. $26.1bn spent with suppliers Effective collaborations that supplement and strengthen our pipeline and our efforts to achieve scientific leadership. >1,000 collaborations worldwide Financial strength, including access to financing and ability to bear the financial risk of investing in the life‑cycle of a medicine. $11.9bn net cash inflow from operating activities 10 AstraZeneca Annual Report & Form 20-F Information 2024 |

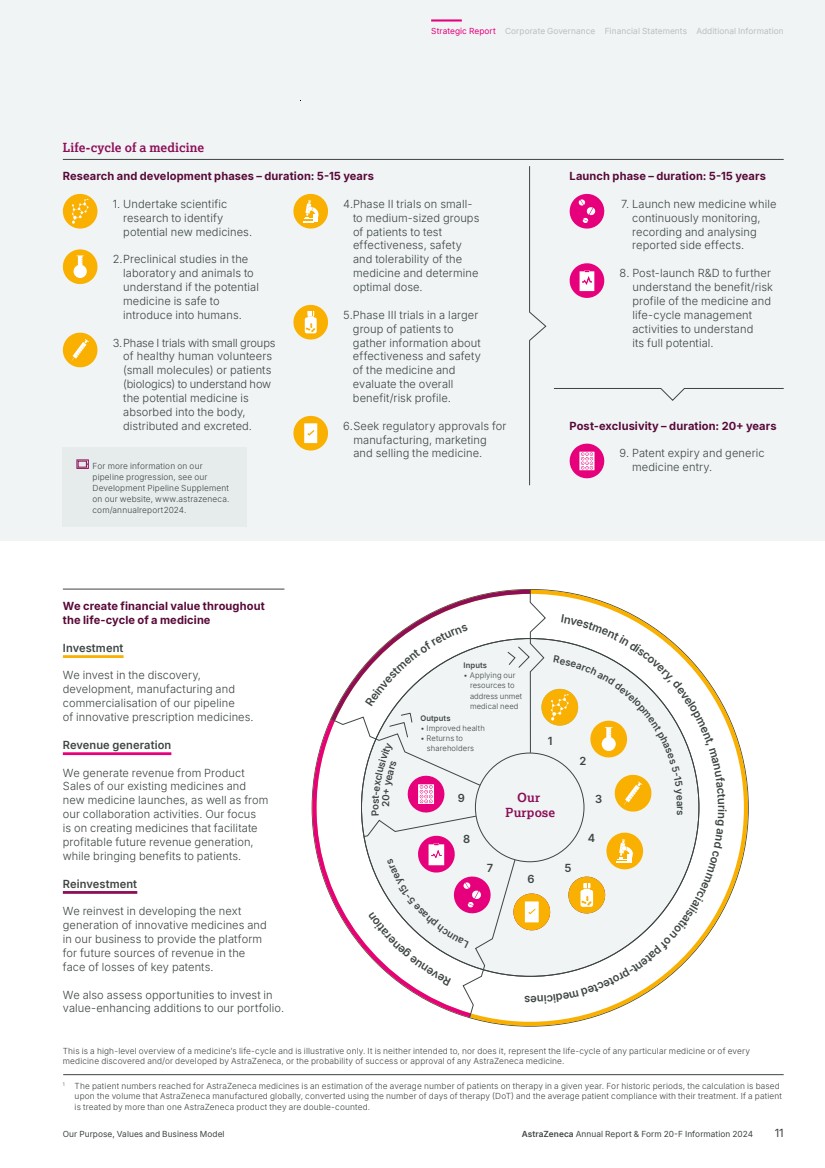

| Investment in discovery, development, man ufactur ni g and commerc ai l si at oi n of pa et n -t r p t o ce det ci de m seni eR ev nue generat oi n Reinvestment of returns Inputs • Applying our resources to address unmet medical need Outputs • Improved health • Returns to shareholders Our Purpose Research and development phases 5-15 years aL unch phase 5-15 years Post-exclusivity 20+ years 1 2 3 4 5 6 7 8 9 1 The patient numbers reached for AstraZeneca medicines is an estimation of the average number of patients on therapy in a given year. For historic periods, the calculation is based upon the volume that AstraZeneca manufactured globally, converted using the number of days of therapy (DoT) and the average patient compliance with their treatment. If a patient is treated by more than one AstraZeneca product they are double-counted. This is a high-level overview of a medicine’s life-cycle and is illustrative only. It is neither intended to, nor does it, represent the life-cycle of any particular medicine or of every medicine discovered and/or developed by AstraZeneca, or the probability of success or approval of any AstraZeneca medicine. We create financial value throughout the life-cycle of a medicine Investment We invest in the discovery, development, manufacturing and commercialisation of our pipeline of innovative prescription medicines. Revenue generation We generate revenue from Product Sales of our existing medicines and new medicine launches, as well as from our collaboration activities. Our focus is on creating medicines that facilitate profitable future revenue generation, while bringing benefits to patients. Reinvestment We reinvest in developing the next generation of innovative medicines and in our business to provide the platform for future sources of revenue in the face of losses of key patents. We also assess opportunities to invest in value-enhancing additions to our portfolio. Launch phase – duration: 5-15 years 7. Launch new medicine while continuously monitoring, recording and analysing reported side effects. 8. Post-launch R&D to further understand the benefit/risk profile of the medicine and life-cycle management activities to understand its full potential. Post-exclusivity – duration: 20+ years 9. Patent expiry and generic medicine entry. Research and development phases – duration: 5-15 years 1. Undertake scientific research to identify potential new medicines. 2. Preclinical studies in the laboratory and animals to understand if the potential medicine is safe to introduce into humans. 3. Phase I trials with small groups of healthy human volunteers (small molecules) or patients (biologics) to understand how the potential medicine is absorbed into the body, distributed and excreted. 4. Phase II trials on small-to medium-sized groups of patients to test effectiveness, safety and tolerability of the medicine and determine optimal dose. 5.Phase III trials in a larger group of patients to gather information about effectiveness and safety of the medicine and evaluate the overall benefit/risk profile. 6. Seek regulatory approvals for manufacturing, marketing and selling the medicine. Life-cycle of a medicine For more information on our pipeline progression, see our Development Pipeline Supplement on our website, www.astrazeneca. com/annualreport2024. AstraZeneca Annual Report & Form 20-F Information 2024 11 Strategic Report Corporate Governance Financial Statements Additional Information Our Purpose, Values and Business Model |

| 2024 2023 2022 $11,861m $10,345m $9,808m $11,861m $11,861m Net cash inflow from operating activities $8.21 $7.26 $6.66 Core EPS 2024 2023 2022 $8.21 $8.21 2024 2023 2022 $4.54 $3.84 $2.12 $4.54 $4.54 Key Performance Indicators Reported EPS Cash generation is a key driver of long-term shareholder returns and facilitates reinvestment in our pipeline, which is critical for delivering new medicines and future value. Earnings per share (EPS) is an important profitability metric and a key driver of shareholder value. Actual growth 2024 +15% 2023 +5% 2022 +64% Actual growth 2024 +13% 2023 +9% 2022 +26% CER growth 2024 +19% 2023 +15% 2022 +33% Actual growth 2024 +18% 2023 +81% 2022 n/m CER growth 2024 +29% 2023 +96% 2022 n/m Key Used for remuneration of Executive Directors Material sustainability metric, is independently assured by Bureau Veritas, see definitions from page 234. For more information on: Our Core measures see the Financial Review from page 67. How Group financial targets are considered when calculating the annual bonus, see page 121. Ambition 2030 Our ambition is to be pioneers in science, lead in our disease areas and transform patient outcomes. As announced at our Investor Day in May 2024, by 2030, we aim to launch at least 20 new medicines and achieve $80 billion in Total Revenue with sustained growth thereafter. Our Key Performance Indicators and remuneration We measure our productivity and success against our Key Performance Indicators (KPIs), which are aligned to our strategic priorities. Several KPIs in this section are used to measure the remuneration of Executive Directors, allowing us to disclose aggregated targets without disclosing sensitive commercial information at the individual KPI level. Any variances between the KPI and values used in determining remuneration are explained in the Directors’ Remuneration Report from page 112. Since 2021, we have included the delivery of our Ambition Zero Carbon commitments in our executive incentive arrangements. Achieve Group Financial Targets Our ambition is to launch at least 20 new medicines by 2030. AstraZeneca: • is science and innovation led • is focused on our chosen therapy areas: Oncology; BioPharmaceuticals (comprising Cardiovascular, Renal & Metabolism (CVRM), Respiratory & Immunology (R&I) and Vaccines & Immune Therapies (V&I)); and Rare Disease • is focused on patients and a diversified portfolio that spans across primary care, specialty care and rare disease • has global strength with a balanced presence across regions • has a commitment to people, society and the planet. Our Growth Through Innovation strategy has three priorities, whose effective delivery will help us achieve our financial targets. Our capital allocation priorities include: investing in the business and pipeline; maintaining a strong, investment-grade credit rating; potential value-enhancing business development opportunities; and supporting the progressive dividend policy. 1. Science and Innovation 3. People and Sustainability 2. Growth and Therapy Area Leadership Achieve Group Financial Targets 12 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report Our Strategy and Key Performance Indicators |

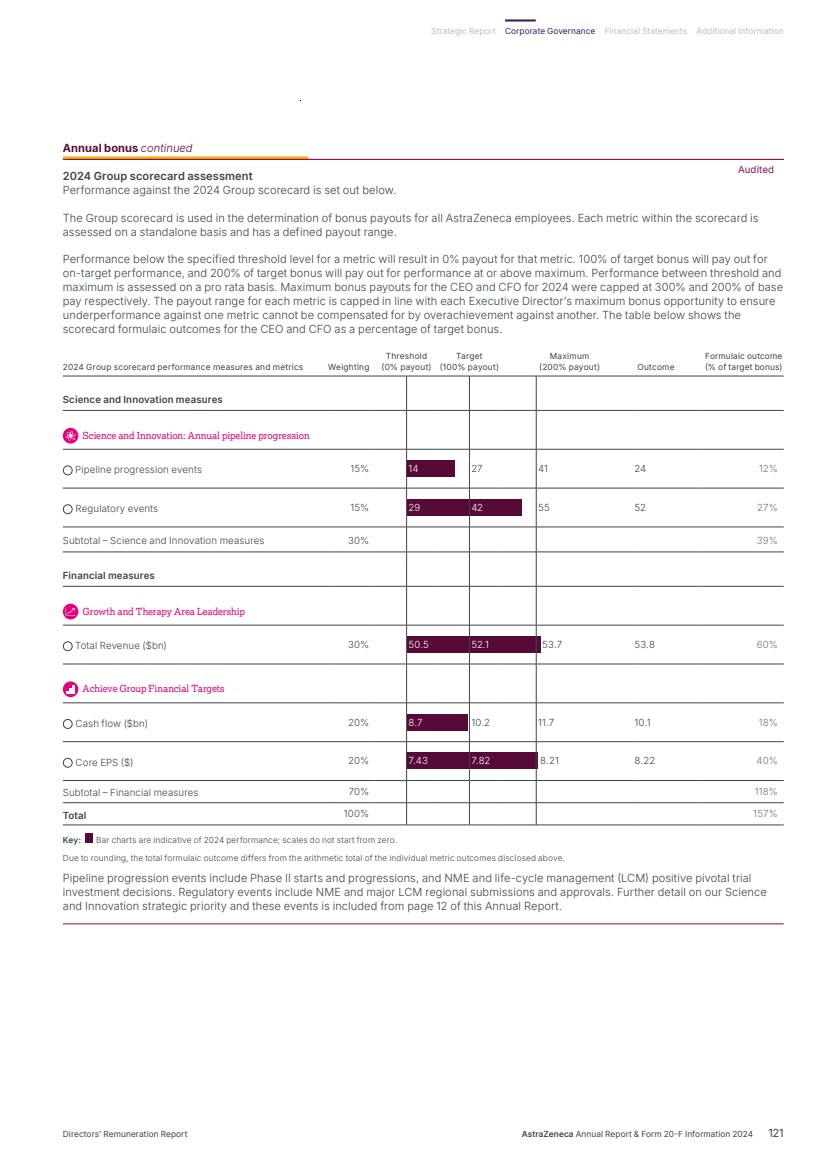

| 241 302 293 241 241 Pipeline progression events 2024 2023 2022 2024 2023 2022 741 562 723 741 74 1 Regulatory events 1 The target of 20 reflects medicines approved since October 2022 and replaces the goal of delivering 15 new medicines between 2023 and 2030 referred to in our 2023 annual report. Three NME approvals 74 regulatory events 24 pipeline progression events 191 projects included in our pipeline, of which 169 are in the clinical phase of development 19 NME projects in pivotal trials or under regulatory review covering 29 indications 17 projects were discontinued 2024 developments For more information, see: Research & Development from page 34 of the Business Review. AI from page 44 of the Business Review. 2024 Group scorecard assessment on page 121 for performance against the Group scorecard. Key Performance Indicators BV Our science measures incentivise the development of NMEs and the maximisation of the potential of existing medicines. Pipeline progression events (Phase II NME starts/progressions and Phase III investment decisions) measure innovation and sustainability. Regulatory events (regulatory submissions and approvals) demonstrate the advancement of this innovation to patients and the value to the Group. 1 24 against our Group scorecard for determining annual bonus. 2 30 against our Group scorecard for determining annual bonus. 3 25 against our Group scorecard for determining annual bonus. 1 52 against our Group scorecard for determining annual bonus. 2 46 against our Group scorecard for determining annual bonus. 3 50 against our Group scorecard for determining annual bonus. Accelerate platform of therapeutic modalities By harnessing innovation from around the world, we are pioneering new ways of targeting the drivers of disease and accelerating promising therapeutic modalities, including novel radioconjugates, cell therapy and genomic medicines. This breadth of research and clinical development exemplifies the diversity of approaches and technologies we are applying across our growing pipeline, alongside pipeline combinations that strengthen our therapy area leadership. Transform R&D ways of working We are transforming processes, data and how we work across R&D and reimagining patient recruitment and retention to help meet our portfolio ambition and deliver medicines to patients faster. We continue to expand our capabilities by making our ways of working smarter, and by introducing new digital tools, connected data and simpler processes. Advances in science and technology are revolutionising the way we work, enabling us to push the boundaries to deliver new and better medicines and treatments more quickly to more patients. Our strategic focus areas Deliver the next wave of pipeline innovation We are rapidly advancing an industry-leading pipeline and investing in new technologies and modalities to deliver the next wave of medicines across therapy areas. Our diverse pipeline comprises around 200 projects spanning multiple mechanisms and modalities, designed to improve outcomes, drive clinical remission and provide cures for patients around the world. Science and Innovation Eight new molecular entities delivered against our Ambition 2030 of launching at least 20 new medicines.1 AstraZeneca Annual Report & Form 20-F Information 2024 13 Strategic Report Corporate Governance Financial Statements Additional Information Our Strategy and Key Performance Indicators |

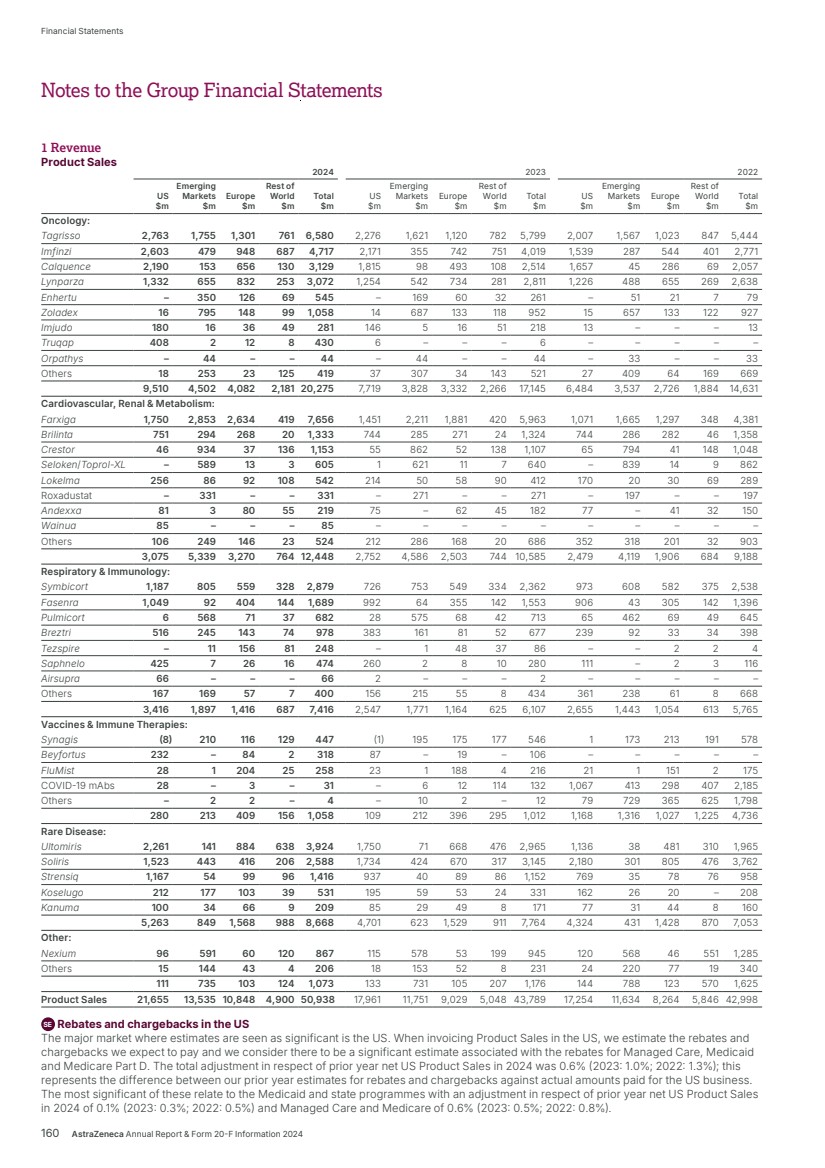

| $54,073m $45,811m $44,351m $54,073m $54,073m Total Revenue 2024 2023 2022 Realise world-class supply chains With next‑generation technologies and modalities, we aim to launch 20 new medicines and achieve industry-leading growth through sustainable world-class supply chains. We will harness AI-powered drug development, continuous, autonomous manufacturing techniques and real-time product release, taking us from smart to intelligent supply. We strive to leverage green technologies to drive low‑carbon products and sites by design, increase circularity by reducing waste across our manufacturing sites and accelerate our supply chain and supplier decarbonisation. 2024 developments Total Revenue, comprising Product Sales, Alliance Revenue and Collaboration Revenue, increased by 18% (21% at CER) to $54,073 million. • Alliance Revenue increased by 55% (55% at CER) to $2,212 million. • Collaboration Revenue increased by 56% (54% at CER) to $923 million. • Grew Total Revenue across our Therapy Areas: Oncology 21% (24% at CER) to $22,353 million; CVRM 18% (20% at CER) to $12,517 million; R&I 23% (25% at CER) to $7,876 million; V&I 8% (8% at CER) to $1,462 million; and Rare Disease 13% (16% at CER) to $8,768 million. • Total Revenue in the US grew by 22% to $23,235 million. In Emerging Markets it grew by 14% (22% at CER) to $13,675 million and in Europe it grew by 27% (26% at CER) to $12,188 million. Key Performance Indicators Our Total Revenue measure reflects the importance of incentivising sustainable growth in both the short and long term. We are working across our therapy areas to transform care and meet the increasing demand for healthcare by improving access to our medicines, expanding treatment options and enabling patients to take control of their own health. Our strategic focus areas Achieve industry-leading growth in our therapy areas Our diversified portfolio across therapy areas with broad geographic presence, will help us achieve industry-leading growth. Transform care AstraZeneca is collaborating with governments, healthcare systems and providers to make a positive impact on the global burden of disease and support healthcare systems to become more resilient for future generations, helping deliver better outcomes for all. In partnership with healthcare systems around the world, we aim to reduce disease progression, hospital admissions and premature deaths by half – enhancing the lives of millions of people. We envision a health system that is proactive and integrated with patient-centred care models. Our focus is on four key areas of healthcare delivery: • proactive screening and early diagnosis • guideline adoption at the practice level • specialist pathways and personalised care • building resilient health systems. Growth and Therapy Area Leadership Actual growth 2024 +18% 2023 +3% 2022 +19% CER growth 2024 +21% 2023 +6% 2022 +25% Through partnering with healthcare systems from more than 40 countries, our practice-changing initiatives have already enabled millions more people to gain access to guideline-directed care. For details of how Total Revenue is considered when calculating the annual bonus, see from page 121. For more information, see: Therapy Area Review from page 16. Affordability and pricing on page 52 and Operations from page 41 of the Business Review. Our Strategy and Key Performance Indicators continued 14 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report |

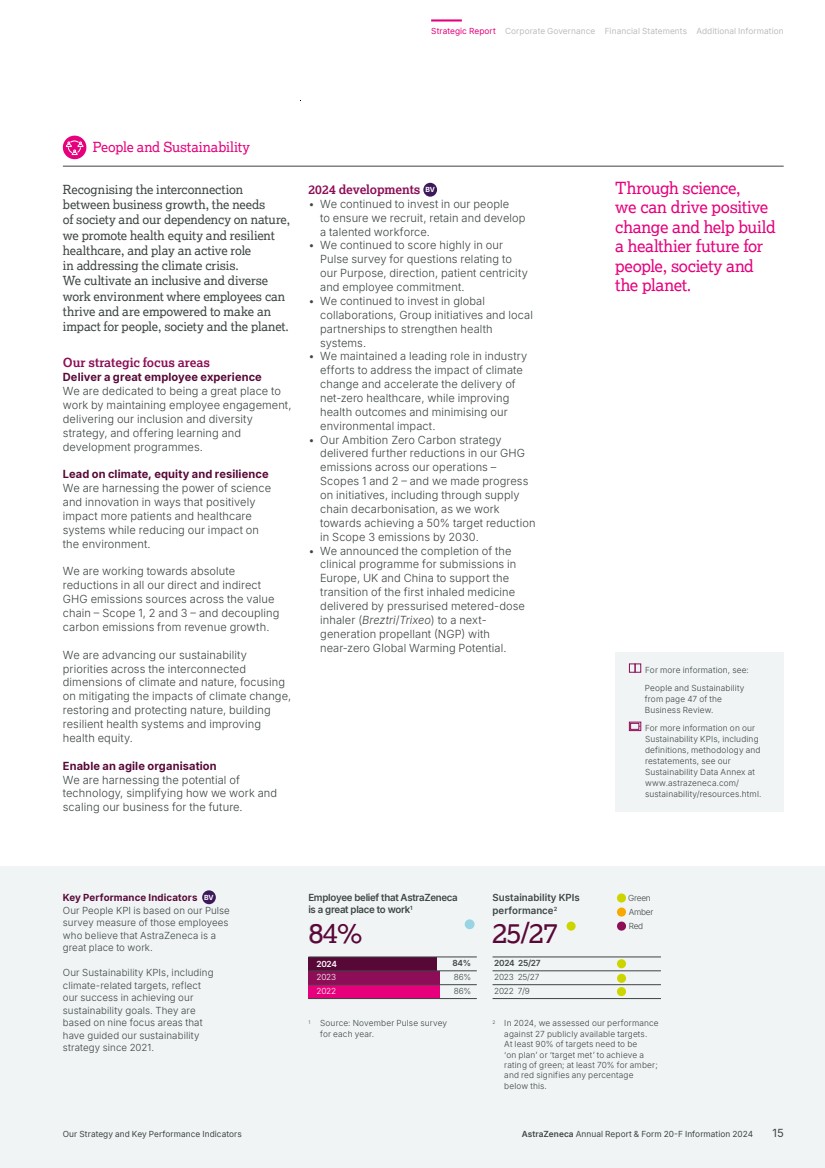

| 86% 84% 86% 84%84% Employee belief that AstraZeneca is a great place to work1 2024 2023 2022 2024 25/27 2023 25/27 2022 7/9 Green Amber Red 25/27 25/27 Sustainability KPIs performance2 2024 developments BV • We continued to invest in our people to ensure we recruit, retain and develop a talented workforce. • We continued to score highly in our Pulse survey for questions relating to our Purpose, direction, patient centricity and employee commitment. • We continued to invest in global collaborations, Group initiatives and local partnerships to strengthen health systems. • We maintained a leading role in industry efforts to address the impact of climate change and accelerate the delivery of net-zero healthcare, while improving health outcomes and minimising our environmental impact. • Our Ambition Zero Carbon strategy delivered further reductions in our GHG emissions across our operations – Scopes 1 and 2 – and we made progress on initiatives, including through supply chain decarbonisation, as we work towards achieving a 50% target reduction in Scope 3 emissions by 2030. • We announced the completion of the clinical programme for submissions in Europe, UK and China to support the transition of the first inhaled medicine delivered by pressurised metered-dose inhaler (Breztri/Trixeo) to a next-generation propellant (NGP) with near-zero Global Warming Potential. Key Performance Indicators BV Our People KPI is based on our Pulse survey measure of those employees who believe that AstraZeneca is a great place to work. Our Sustainability KPIs, including climate-related targets, reflect our success in achieving our sustainability goals. They are based on nine focus areas that have guided our sustainability strategy since 2021. Recognising the interconnection between business growth, the needs of society and our dependency on nature, we promote health equity and resilient healthcare, and play an active role in addressing the climate crisis. We cultivate an inclusive and diverse work environment where employees can thrive and are empowered to make an impact for people, society and the planet. Our strategic focus areas Deliver a great employee experience We are dedicated to being a great place to work by maintaining employee engagement, delivering our inclusion and diversity strategy, and offering learning and development programmes. Lead on climate, equity and resilience We are harnessing the power of science and innovation in ways that positively impact more patients and healthcare systems while reducing our impact on the environment. We are working towards absolute reductions in all our direct and indirect GHG emissions sources across the value chain – Scope 1, 2 and 3 – and decoupling carbon emissions from revenue growth. We are advancing our sustainability priorities across the interconnected dimensions of climate and nature, focusing on mitigating the impacts of climate change, restoring and protecting nature, building resilient health systems and improving health equity. Enable an agile organisation We are harnessing the potential of technology, simplifying how we work and scaling our business for the future. For more information, see: People and Sustainability from page 47 of the Business Review. For more information on our Sustainability KPIs, including definitions, methodology and restatements, see our Sustainability Data Annex at www.astrazeneca.com/ sustainability/resources.html. People and Sustainability Through science, we can drive positive change and help build a healthier future for people, society and the planet. 1 Source: November Pulse survey for each year. 2 In 2024, we assessed our performance against 27 publicly available targets. At least 90% of targets need to be ‘on plan’ or ‘target met’ to achieve a rating of green; at least 70% for amber; and red signifies any percentage below this. AstraZeneca Annual Report & Form 20-F Information 2024 15 Strategic Report Corporate Governance Financial Statements Additional Information Our Strategy and Key Performance Indicators |

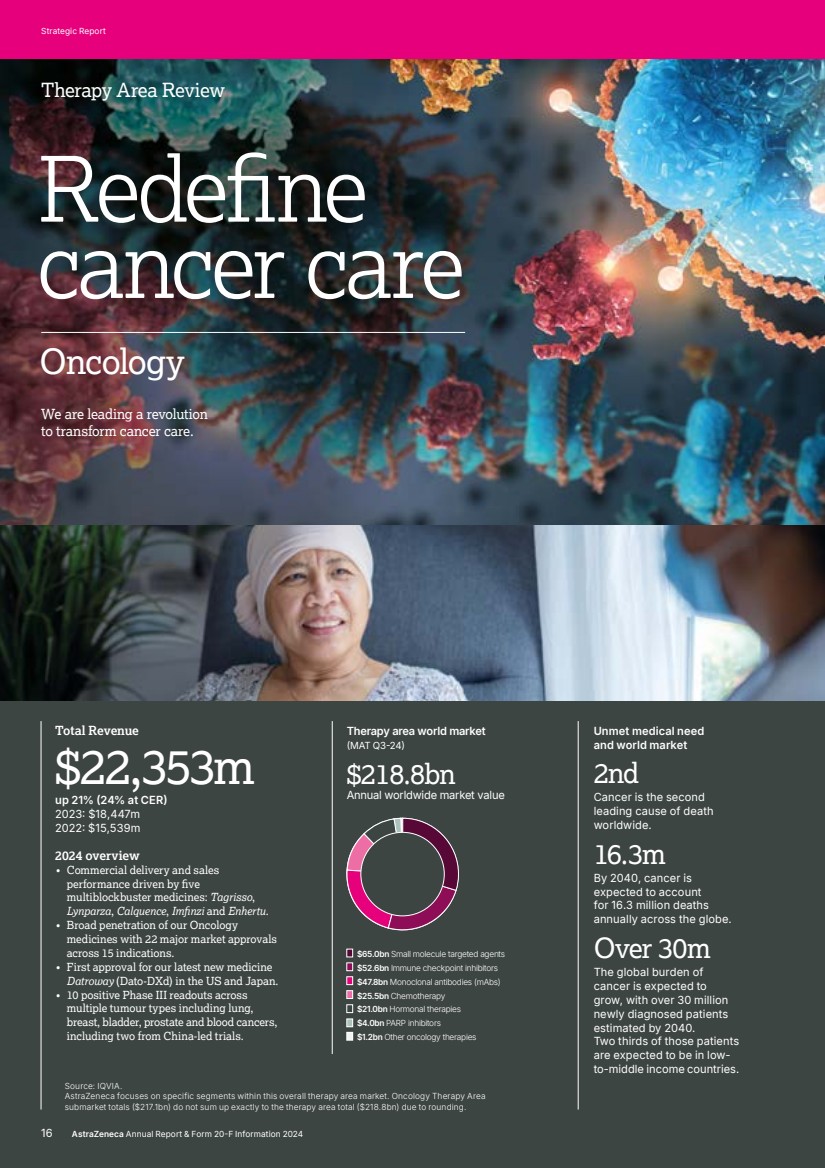

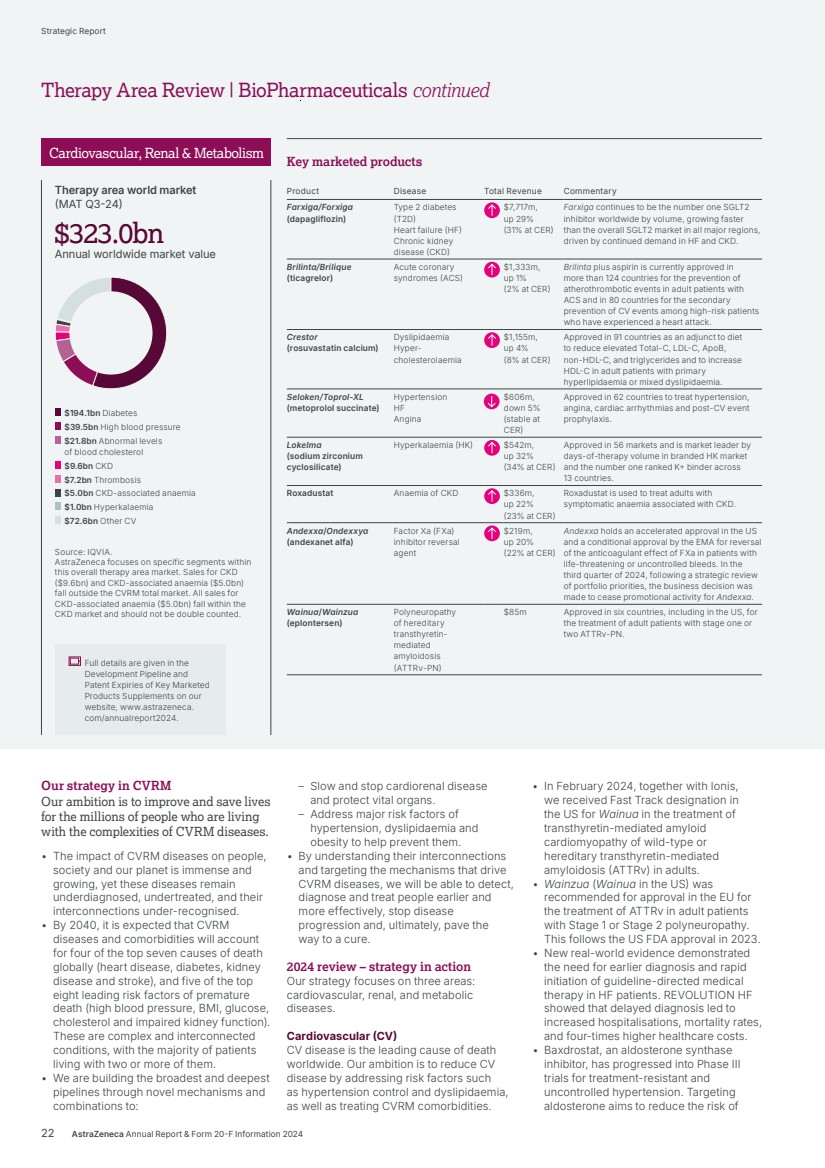

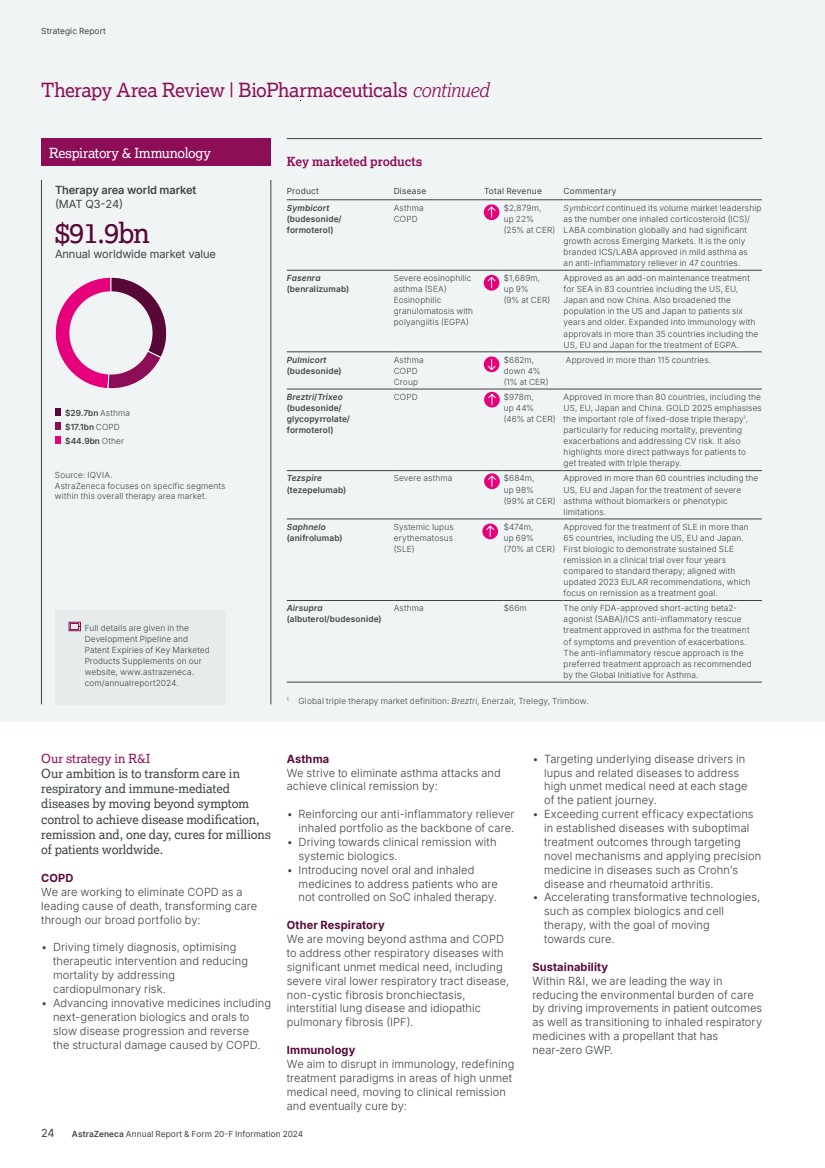

| Redefine cancer care Oncology Source: IQVIA. AstraZeneca focuses on specific segments within this overall therapy area market. Oncology Therapy Area submarket totals ($217.1bn) do not sum up exactly to the therapy area total ($218.8bn) due to rounding. 2024 overview • Commercial delivery and sales performance driven by five multiblockbuster medicines: Tagrisso, Lynparza, Calquence, Imfinzi and Enhertu. • Broad penetration of our Oncology medicines with 22 major market approvals across 15 indications. • First approval for our latest new medicine Datroway (Dato-DXd) in the US and Japan. • 10 positive Phase III readouts across multiple tumour types including lung, breast, bladder, prostate and blood cancers, including two from China-led trials. Total Revenue $22,353m up 21% (24% at CER) 2023: $18,447m 2022: $15,539m $65.0bn Small molecule targeted agents $52.6bn Immune checkpoint inhibitors $47.8bn Monoclonal antibodies (mAbs) $25.5bn Chemotherapy $21.0bn Hormonal therapies $4.0bn PARP inhibitors $1.2bn Other oncology therapies $218.8bn Annual worldwide market value Therapy area world market (MAT Q3-24) Therapy Area Review Unmet medical need and world market 2nd Cancer is the second leading cause of death worldwide. 16.3m By 2040, cancer is expected to account for 16.3 million deaths annually across the globe. Over 30m The global burden of cancer is expected to grow, with over 30 million newly diagnosed patients estimated by 2040. Two thirds of those patients are expected to be in low-to-middle income countries. We are leading a revolution to transform cancer care. 16 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report |

| Our strategy in Oncology Our ambition is to eliminate cancer as a cause of death. We seek to transform outcomes for people living with cancer through innovative medicines, powerful combinations and a world-class, purpose-driven team. Our commercial strategy to transform patient outcomes centres on three key areas: • Medicines that matter: building transformative brands that raise the standard of care for patients. • Leveraging scale: strengthening leadership and expertise in key tumour types (lung, haematology, genitourinary/ gynaecological, breast and gastrointestinal). • Transforming patient care: closing the care gaps to deliver optimal care for every patient, improving access and building more resilient healthcare systems through partnerships. Our R&D strategy focuses on these key pillars: 1. Innovative science across seven scientific platforms that attack cancer from multiple angles: a. Tumour drivers and resistance – targeting genetic mutations and resistance mechanisms that can disrupt the ability of cancer cells to survive and proliferate. b. DNA damage response – targeting the DNA repair process to block cancer cells from reproducing. c. Antibody drug conjugates (ADCs) and radioconjugates – highly potent cancer-killing agents delivered directly to cancer cells via a linker attached to a targeting molecule such as an antibody, peptide or small molecule. d. Epigenetics – targeting changes to genome expression caused by cancer. e. Immuno-oncology – activating the body’s own immune system to help fight cancer. f. Cell therapies – harnessing living cells to target cancer. g. Immune engagers – redirecting the immune system’s T-cells to the tumour and amplifying that patient’s own anti-cancer immune response. 2. Treating cancer earlier and smarter with early detection and personalised treatments. 3. Pioneering new technologies to help us advance science and achieve the next wave of breakthroughs. Full details are given in the Development Pipeline and Patent Expiries of Key Marketed Products Supplements on our website, www.astrazeneca. com/annualreport2024. Key marketed products Product Disease Total Revenue Commentary Tagrisso (osimertinib) Lung cancer $6,580m, up 13% (16% at CER) Approved in 112 countries for adjuvant early-stage EGFRm NSCLC and in 113 countries for 1st- and 2nd-line treatment of advanced EGFRm NSCLC. Approved in combination with chemotherapy in 1st-line advanced EGFRm NSCLC in 27 countries and in several countries as a maintenance treatment after definitive chemoradiation in unresectable Stage III EGFRm NSCLC. Imfinzi (durvalumab) Lung cancer Biliary tract cancer (BTC) Liver cancer Endometrial cancer $4,717m, up 17% (21% at CER) Approved in 97 countries in the curative-intent setting of unresectable, Stage III NSCLC and in 63 countries for metastatic NSCLC. Approved in nine countries for resectable NSCLC. Approved in 97 countries for extensive-stage SCLC and in three countries including the US for limited-stage SCLC. Approved in 89 countries for locally advanced or metastatic BTC. Approved in 71 countries in combination with Imjudo for uHCC and 33 countries as monotherapy. Approved in 36 countries for advanced or recurrent endometrial cancer. Calquence (acalabrutinib) CLL MCL SLL $3,129m, up 24% (25% at CER) Approved in 92 countries for the treatment of chronic lymphocytic leukaemia (CLL) and in 47 countries for the treatment of adult patients with relapsed or refractory mantle cell lymphoma (MCL) who have received at least one prior therapy; approved in the US for previously untreated MCL patients. Approved in the US, Japan and China for small lymphocytic lymphoma (SLL). Lynparza (olaparib) Ovarian cancer Breast cancer Pancreatic cancer Prostate cancer Endometrial cancer $3,672m, up 20% (22% at CER) Approved in 101 countries as maintenance therapy for platinum-sensitive relapsed ovarian cancer, 101 countries for 1st-line BRCAm ovarian cancer, and in 100 countries with bevacizumab for HRD-positive advanced ovarian cancer. Approved in 101 countries for gBRCAm, HER2-negative early breast cancer and in the metastatic setting in 86 countries. Approved in 99 countries for gBRCAm metastatic pancreatic cancer. Approved in 101 countries for HRR gene-mutated mCRPC (BRCAm only in certain countries) and in 90 countries in combination with abiraterone for the 1st-line treatment of adult patients with mCRPC. Approved in 31 countries as maintenance therapy in advanced or recurrent endometrial cancer that is pMMR. Enhertu (trastuzumab deruxtecan) Breast cancer Lung cancer Gastric cancer Tumour agnostic $1,982m, up 54% (58% at CER) Approved in more than 75 countries for HER2-positive metastatic breast cancer following one or more prior anti-HER2-based regimens. Approved in more than 70 countries for HER2-low metastatic breast cancer following chemotherapy. Approved in more than 50 countries for previously treated HER2- mutant metastatic NSCLC and in 60 countries for previously treated HER2-positive advanced gastric or gastroesophageal junction adenocarcinoma. Approved in the US and several countries for previously treated metastatic HER2-positive (IHC 3+) solid tumours. Also approved in the US for HR-positive, HER2-low or HER2-ultralow metastatic breast cancer following one or more endocrine therapies. Zoladex (goserelin acetate implant) Prostate cancer Breast cancer $1,097m, up 11% (17% at CER) Approved in 122 countries for the treatment of prostate cancer and in 64 countries for the treatment of breast cancer in premenopausal women. Imjudo (tremelimumab) Liver cancer Lung cancer $281m, up 29% (31% at CER) Approved in 71 countries in combination with Imfinzi for unresectable HCC and in 63 countries in combination with Imfinzi and chemotherapy for metastatic NSCLC. Truqap (capivasertib) Breast cancer $430m, up $424m Approved in more than 45 countries in combination with Faslodex for HR- or ER-positive, HER2-negative locally advanced or metastatic breast cancer with one or more biomarker alterations (PIK3CA, AKT1 or PTEN) following recurrence or progression. Approved in Australia for HR-positive, HER2-negative locally advanced or metastatic breast cancer following recurrence or progression. Orpathys (savolitinib) Lung cancer $46m, stable (up 2% at CER) Approved in China and Macau for treatment of locally advanced or metastatic NSCLC with MET gene alterations. Datroway (datopotamab deruxtecan) Breast cancer n/a Approved in the US and Japan for patients with previously treated metastatic HR-positive, HER2-negative breast cancer. AstraZeneca Annual Report & Form 20-F Information 2024 17 Strategic Report Corporate Governance Financial Statements Additional Information Therapy Area Review | Oncology |

| 2024 review – strategy in action Lung cancer Scientific advances in early detection and precision medicine are strengthening the potential to offer meaningful patient outcomes and long-term survival in lung cancer. We have a comprehensive portfolio, along with a promising pipeline of potential new medicines and combinations across diverse mechanisms of action. By 2030, we aim to have an AstraZeneca medicine for more than half of all patients treated for lung cancer. • Tagrisso is the world-leading third-generation TKI and backbone therapy for EGFRm NSCLC across multiple stages. Across markets we see continued demand growth for Tagrisso in both the adjuvant and metastatic settings. Tagrisso with the addition of chemotherapy was approved in more than 45 countries, including the US, EU, China and Japan, for the 1st-line treatment of adult patients with locally advanced or metastatic EGFRm NSCLC. Approvals were based on positive results from the FLAURA2 Phase III trial, which showed Tagrisso in combination with chemotherapy demonstrated a statistically significant and clinically meaningful improvement in PFS. • Positive results from the LAURA Phase III trial showed Tagrisso demonstrated a statistically significant and highly clinically meaningful improvement in PFS in patients with unresectable, Stage III EGFRm NSCLC. Tagrisso is now approved for these patients in the US, Switzerland, the EU and China. • Since its first approval, more than 374,000 patients have been treated with Imfinzi and it’s the only approved immunotherapy in limited-stage SCLC and the global SoC in the curative-intent setting of unresectable, Stage III NSCLC in patients whose disease has not progressed after CRT. Imfinzi was approved in the US and several other countries for the perioperative treatment of resectable, early-stage (IIa-IIIb) NSCLC with no known EGFRm or ALK rearrangements, based on the AEGEAN Phase III trial. • Imfinzi was approved in the US and Switzerland and recommended for approval in the EU for patients with limited-stage SCLC whose disease had not progressed following platinum-based concurrent CRT based on the positive ADRIATIC Phase III trial results. • Results from the ADJUVANT BR.31 Phase III trial showed Imfinzi did not achieve statistical significance for disease-free survival in early-stage (Ib-IIIa) NSCLC after complete tumour resection in patients whose tumours express PD-L1 on 25% or more tumour cells. • Final OS results were announced from the TROPION-Lung01 Phase III trial which showed a favourable trend in OS with Datroway in patients with previously treated advanced or metastatic non-squamous NSCLC. Data from TROPION-Lung01 using a predictive computational pathology biomarker was also presented at the World Conference on Lung Cancer. Ongoing Phase III trials in 1st-line NSCLC have the potential to validate the use of this patient selection biomarker. Datroway is jointly developed and commercialised with Daiichi Sankyo. • Datroway was granted Priority Review in the US for the treatment of patients with locally advanced or metastatic EGFRm NSCLC who have received prior systemic therapies, including an EGFR-directed therapy, based on results from the TROPION-Lung05 Phase II trial and supported by data from the TROPION-Lung01 Phase III trial. The companies voluntarily withdrew an application in the US, as well as the marketing authorisation application in the EU, for Datroway for patients with advanced or metastatic non-squamous NSCLC. • Enhertu is the first HER2-directed therapy approved for patients with HER2-mutant metastatic NSCLC. In 2024, it received conditional approval in China in this setting based on the DESTINY-Lung02 and DESTINY-Lung05 Phase II trials. Enhertu is jointly developed and commercialised with Daiichi Sankyo. Breast cancer We are aiming to redefine clinical practice and transform outcomes across all subtypes and stages of breast cancer. Our portfolio of approved medicines and promising medicines in development leverage different mechanisms of action to address the biologically diverse breast cancer tumour environment. • Enhertu is the established SoC in HER2-positive (DESTINY-Breast03) and HER2-low (DESTINY-Breast04) metastatic breast cancer. Positive results from the DESTINY-Breast06 Phase III trial showed that Enhertu provided a statistically significant and clinically meaningful improvement in PFS for patients with HER2-low or HER2-ultralow metastatic breast cancer who had received at least one line of endocrine therapy. Enhertu is now approved in the US in this setting based on these results. • Continued strong demand growth with strong uptake for Truqap worldwide in a biomarker-altered subgroup of HR-positive, HER2-negative metastatic breast cancer. • Truqap was approved in the EU and Japan in combination with Faslodex as the first AKT-inhibitor for patients with HR-positive, HER2-negative locally advanced or metastatic breast cancer with one or more biomarker alterations (PIK3CA, AKT1 or PTEN) following disease progression or recurrence, based on the CAPItello-291 Phase III trial. • Truqap in combination with paclitaxel did not meet a primary endpoint of OS in the CAPItello-290 Phase III trial in patients with locally advanced or metastatic triple-negative breast cancer. • The TROPION-Breast01 Phase III trial of Datroway versus chemotherapy, which previously met the dual primary endpoint of PFS, did not meet its OS endpoint in patients with previously treated metastatic HR-positive, HER2-low or HER2-negative breast cancer. Datroway is approved in the US and Japan and recommended for approval in the EU in this setting. • Lynparza remains the first-in-class PARP inhibitor across four tumour types as measured by total prescription volume, achieving 10% growth in 2024 versus 2023, and is the only PARP inhibitor to improve survival in early breast cancer. Updated results from the OlympiA Phase III trial showed Lynparza demonstrated sustained, clinically meaningful improvements in OS, invasive disease-free survival and distant disease-free survival at six years for patients with germline BRCA-mutated (gBRCAm) HER2-negative high-risk early breast cancer. Lynparza was recently approved in China for these patients. Genitourinary/gynaecological cancers In genitourinary cancers, we aim to transform treatment paradigms with our portfolio of approved medicines and a diverse pipeline of innovative treatments to help more patients. This includes solidifying Lynparza plus abiraterone and prednisone as a SoC in 1st-line metastatic castration-resistant prostate cancer (mCRPC) and aiming to bring Imfinzi as a new treatment option for muscle-invasive bladder cancer (MIBC). In gynaecological cancers, we will continue to redefine survival expectations, maximising Lynparza’s position as a SoC in advanced ovarian cancer, and in combination with Imfinzi in endometrial cancer. • Imfinzi and Lynparza were approved in several countries for the treatment of patients with advanced or recurrent endometrial cancer based on the DUO-E Phase III results: – In the US, Imfinzi with platinum-based chemotherapy was approved as 1st-line treatment followed by Imfinzi monotherapy for patients with dMMR disease. 18 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report Therapy Area Review | Oncology continued |

| – In the EU, Imfinzi plus chemotherapy as 1st-line treatment followed by Lynparza and Imfinzi has been approved for patients with pMMR disease. Imfinzi plus chemotherapy followed by Imfinzi alone has also been approved for patients with dMMR disease. – In Japan, Imfinzi with platinum-based chemotherapy was approved as 1st-line treatment followed by Imfinzi monotherapy for patients regardless of mismatch repair status. Imfinzi plus chemotherapy as 1st-line treatment followed by Lynparza and Imfinzi has also been approved for patients with pMMR disease. • Results from the NIAGARA Phase III trial showed Imfinzi in combination with chemotherapy demonstrated a statistically significant and clinically meaningful improvement in event-free survival and OS for patients with MIBC. It is now under Priority Review in the US in this setting. • Positive results from the CAPItello-281 trial showed Truqap in combination with abiraterone and androgen deprivation therapy demonstrated a statistically significant and clinically meaningful improvement in radiographic PFS in PTEN-deficient metastatic hormone-sensitive prostate cancer (mHSPC). Gastrointestinal cancers We have a broad and robust portfolio and development programme for the treatment of gastrointestinal (GI) cancers in many stages and disease types across multiple approved and potential new medicines. Imfinzi in GI cancers was a major growth driver in 2024, based on market approvals in BTC (TOPAZ-1) and HCC (HIMALAYA) worldwide. • Enhertu received conditional approval in China for patients with previously treated HER2-positive advanced or metastatic gastric cancer based on the DESTINY-Gastric06 and DESTINY-Gastric01 trials. • Data from a Phase I trial of C-CAR31, a novel autologous armoured Glypican 3 (GPC3) targeting chimeric antigen receptor T-cell (CAR-T) therapy, showed encouraging safety and preliminary efficacy results in patients with HCC. Blood cancers In haematology, we are unleashing the potential of Calquence, the current SoC in multiple forms of blood cancer, while pushing the boundaries of science to redefine care through ambitious clinical development, deep clinical insights and a focus on improving the patient experience. • Positive results from the AMPLIFY Phase III trial showed a fixed-duration of Calquence in combination with venetoclax, with or without obinutuzumab, demonstrated a statistically significant and clinically meaningful improvement in PFS in previously untreated CLL. • Results from the ECHO Phase III trial showed that Calquence plus chemoimmunotherapy significantly improved PFS as a 1st-line treatment of patients with MCL. Calquence is now approved in the US in this setting. • Early data from our novel CD19xCD3 bispecific T-cell engager, surovatamig, (AZD0486) in follicular lymphoma and diffuse large B-cell lymphoma showed promising clinical efficacy and safety profile. Pan-tumour Together with Daiichi Sankyo, we are exploring the role of HER2-directed therapies in treating multiple solid tumour types. We see encouraging early uptake for Enhertu following tumour-agnostic approvals worldwide. • Enhertu was approved in the US for previously treated patients with metastatic HER2-positive solid tumours based on three Phase II trials (DESTINY-PanTumor02, DESTINY-Lung01 and DESTINY-CRC02) which showed clinically meaningful responses across a broad range of tumours. The approval marked the first tumour-agnostic approval of a HER2-directed therapy and an ADC. The transformative potential of cell therapies Cell therapies are one of the transformative technologies in which we are investing to bring their curative potential to patients. We accelerated their delivery with the acquisition of Gracell, whose FasTCAR platform significantly shortens manufacturing time and aims to improve the activity of therapeutic CAR-Ts, as well as reduce treatment waiting times. A collaboration with the Moffitt Cancer Center is designed to accelerate our cell therapy pipeline and we are also progressing our T-cell receptor therapies from our Neogene acquisition. We have announced a new manufacturing facility in Maryland, US, to expand capacity. AstraZeneca Annual Report & Form 20-F Information 2024 19 Strategic Report Corporate Governance Financial Statements Additional Information Therapy Area Review | Oncology |

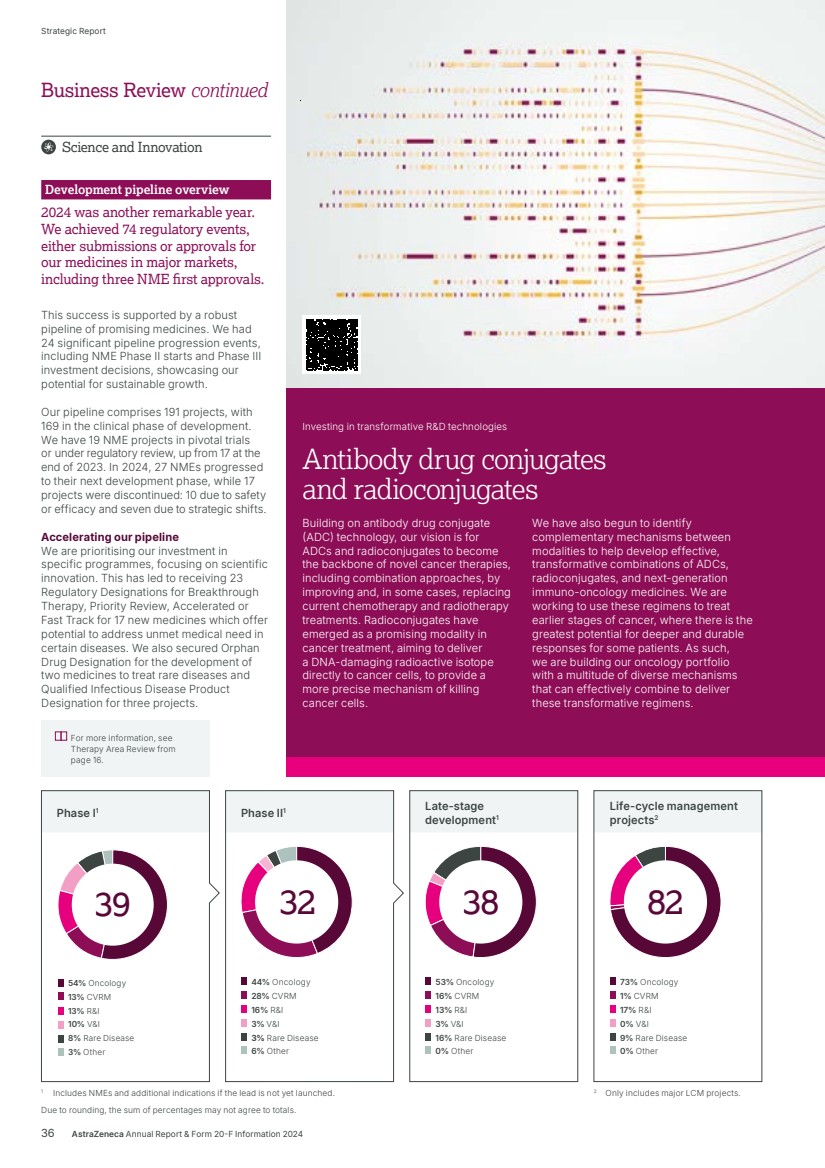

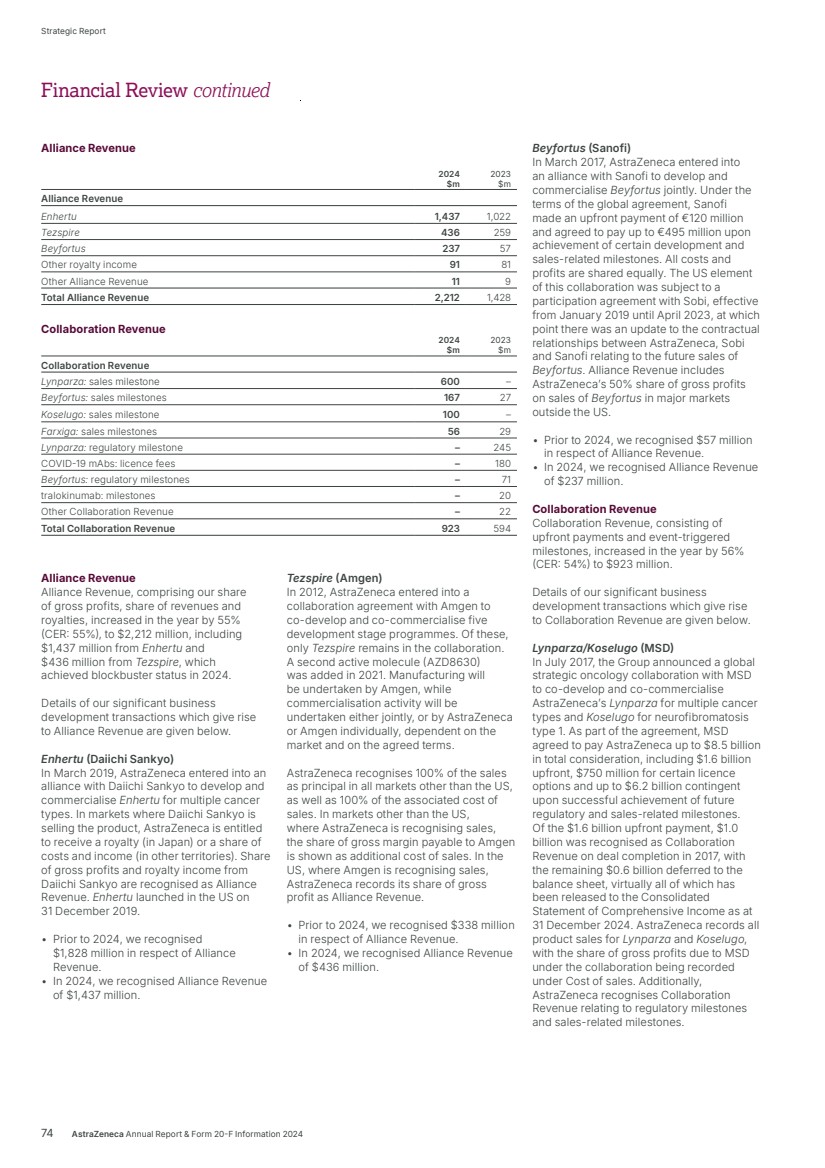

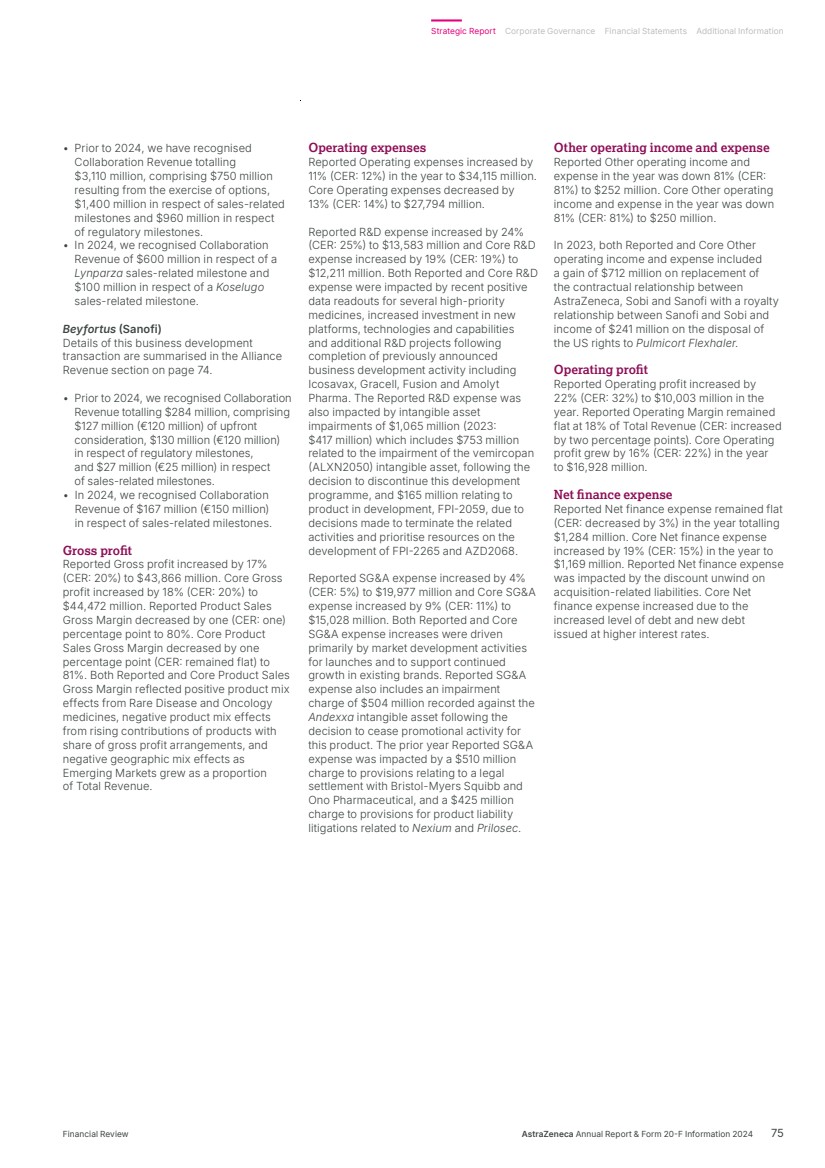

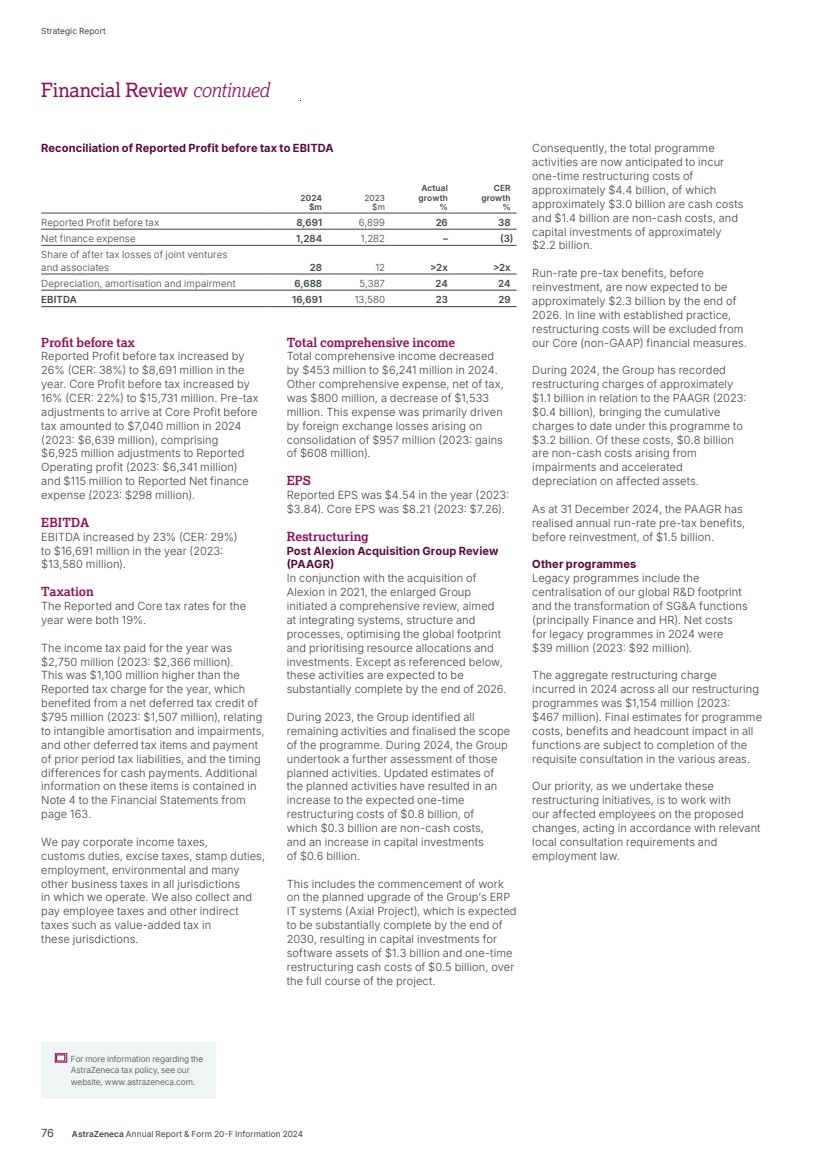

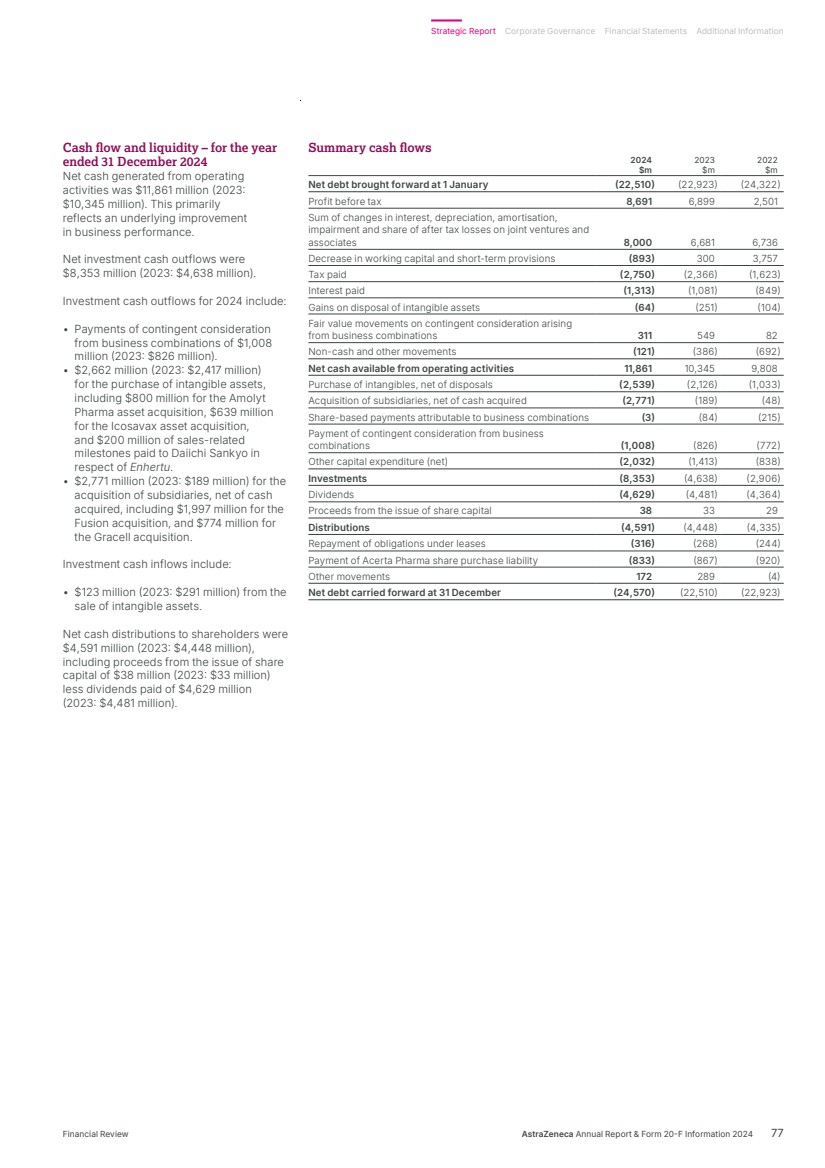

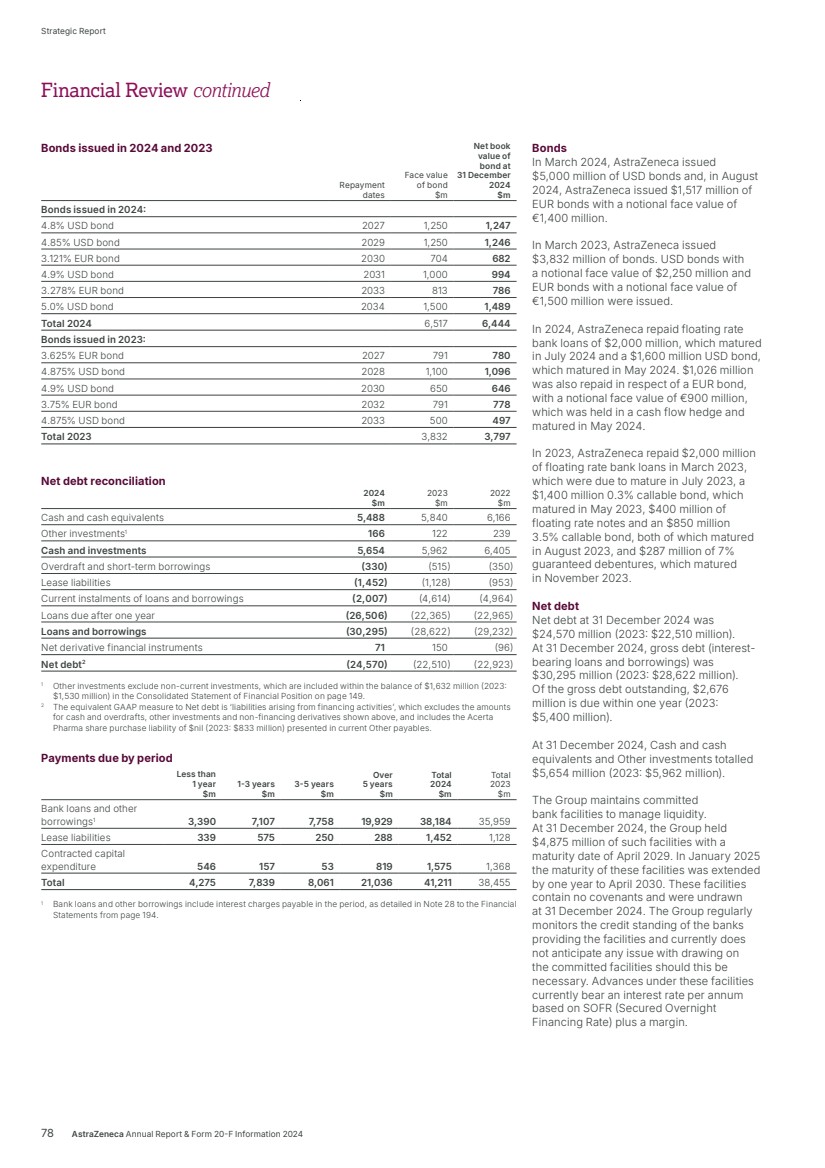

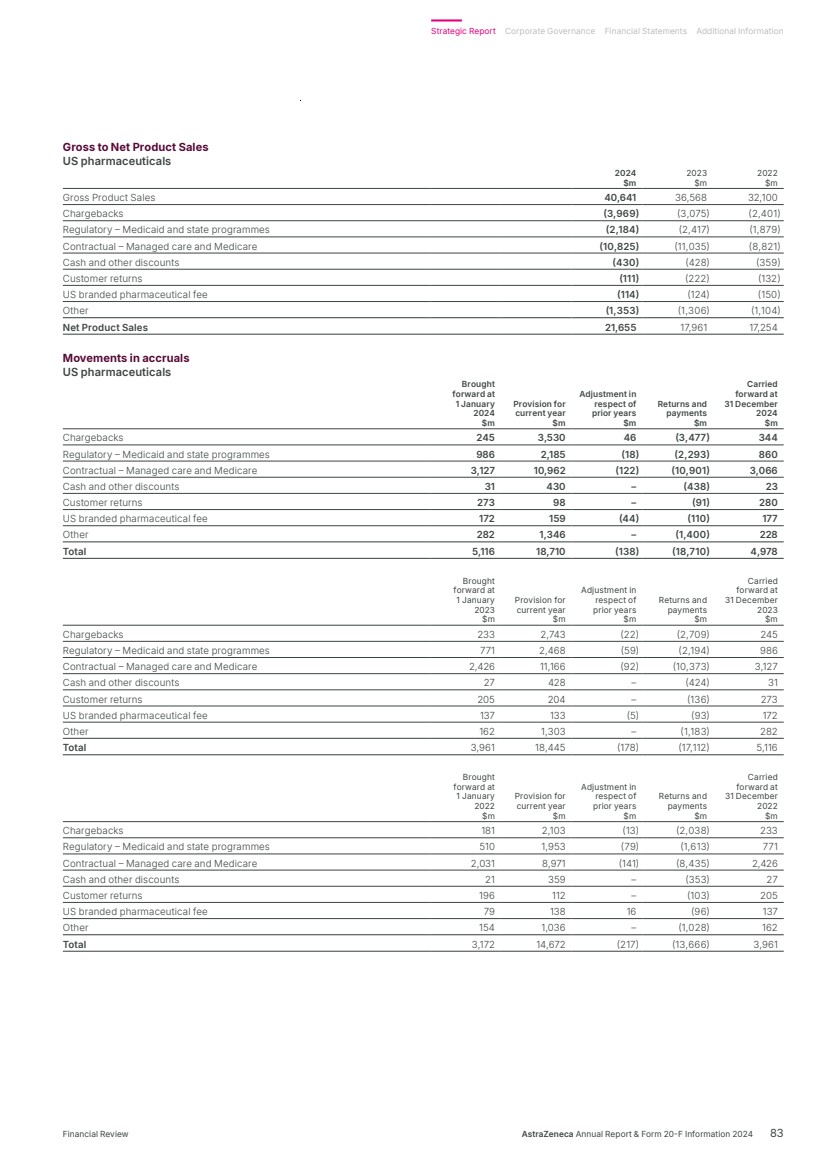

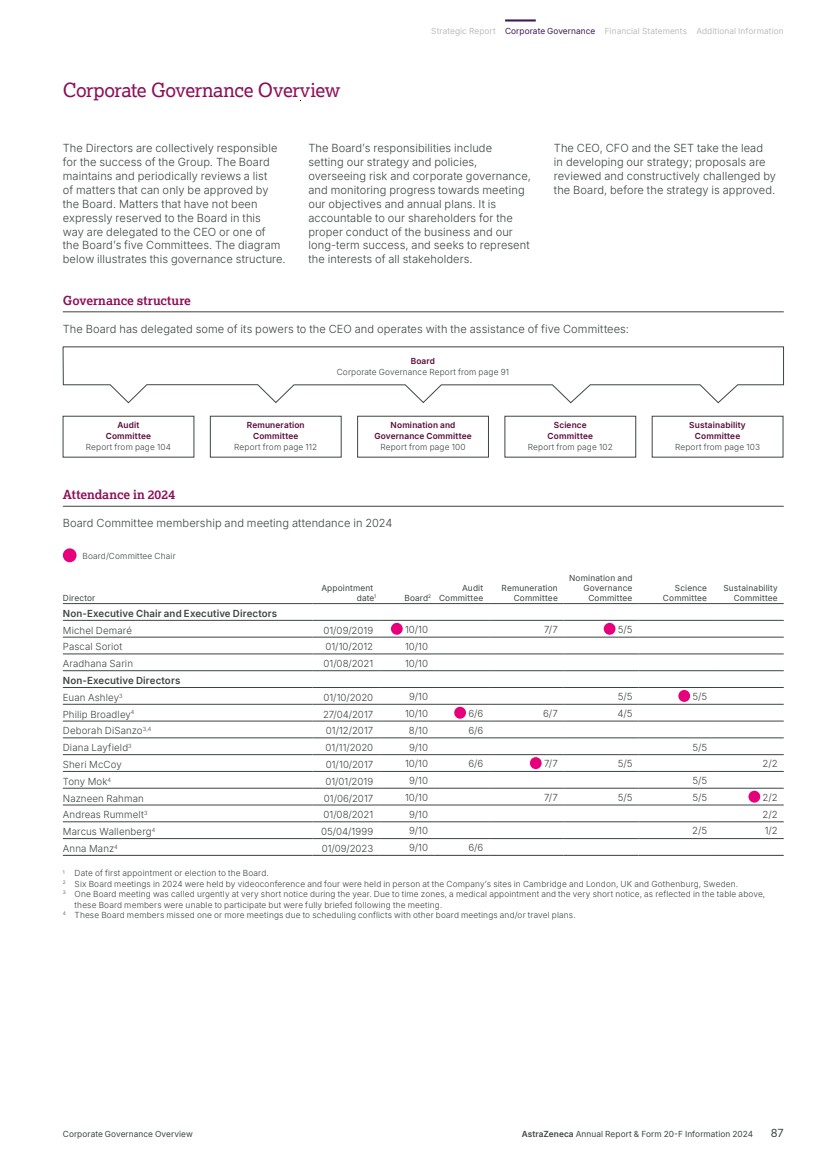

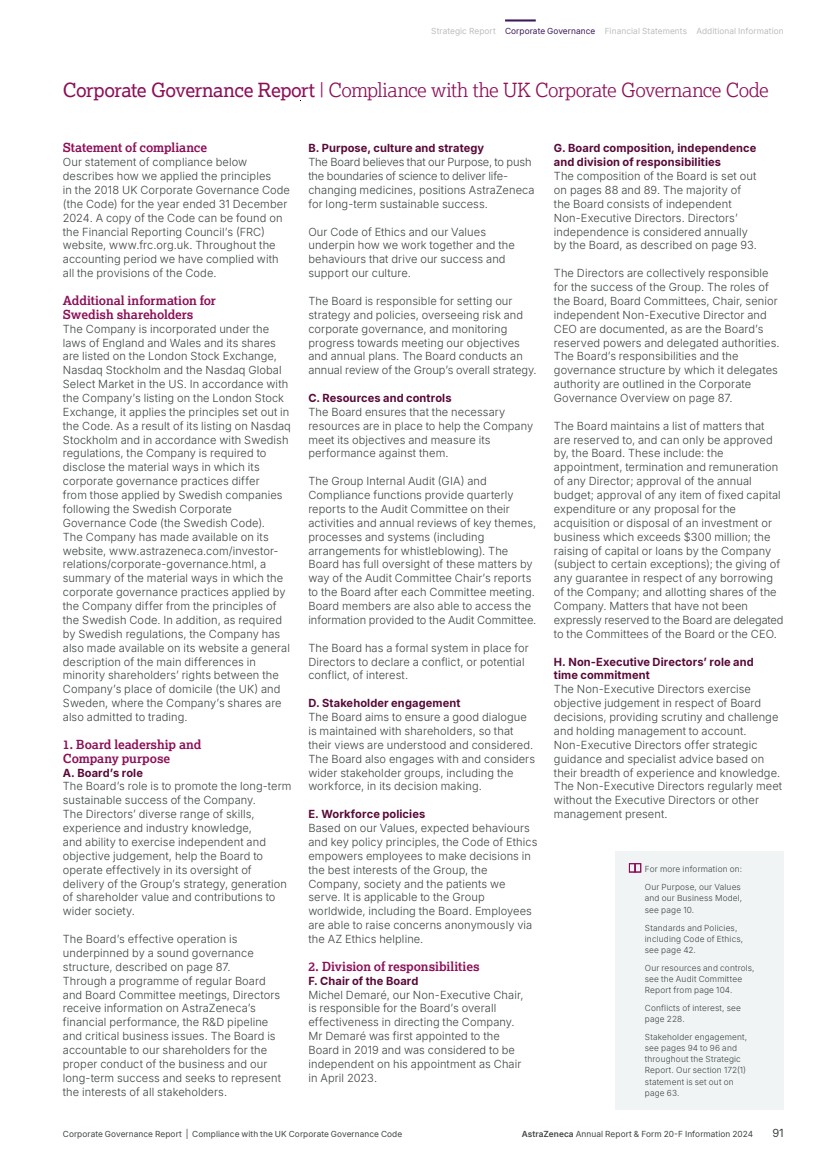

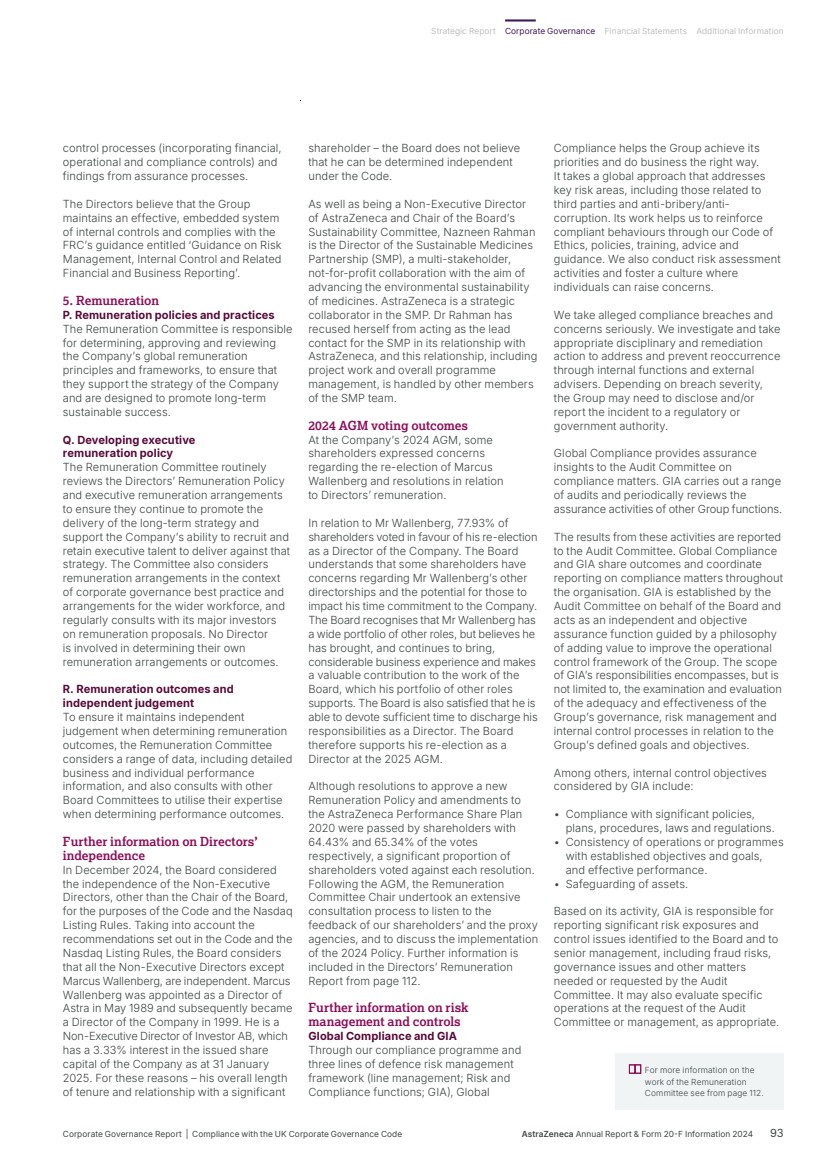

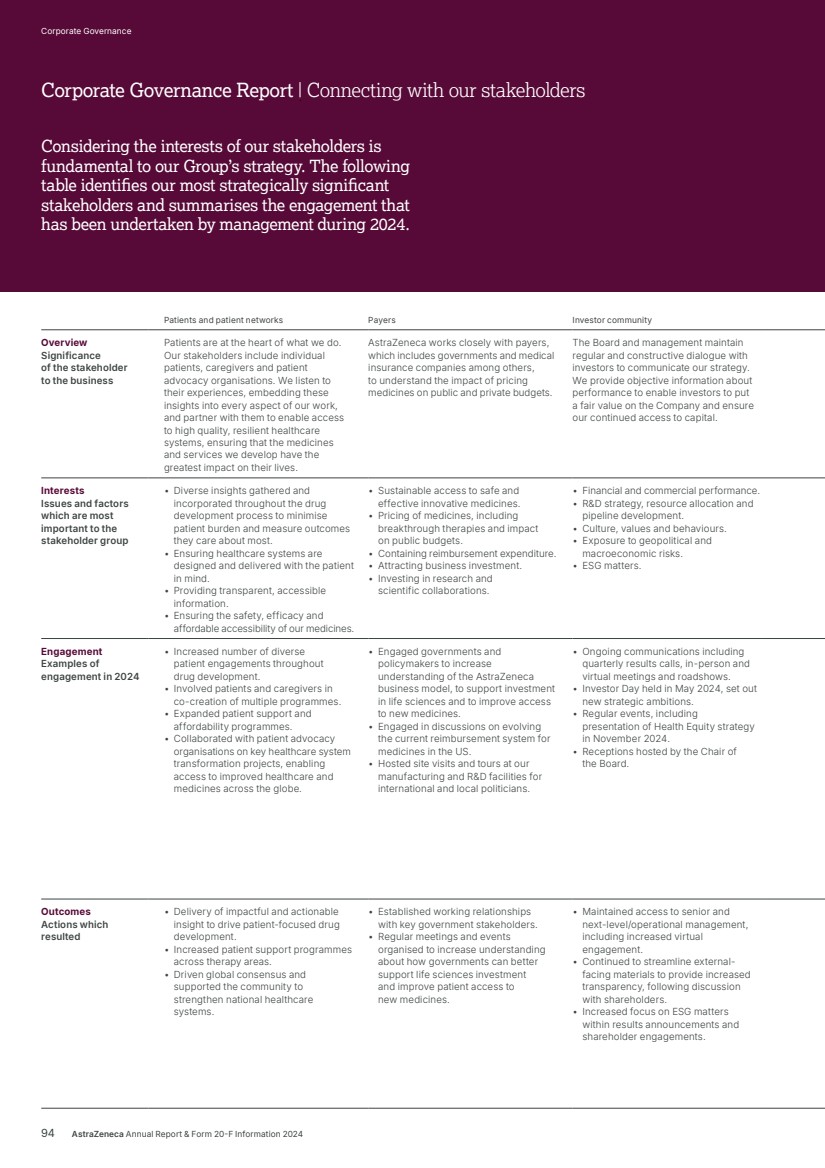

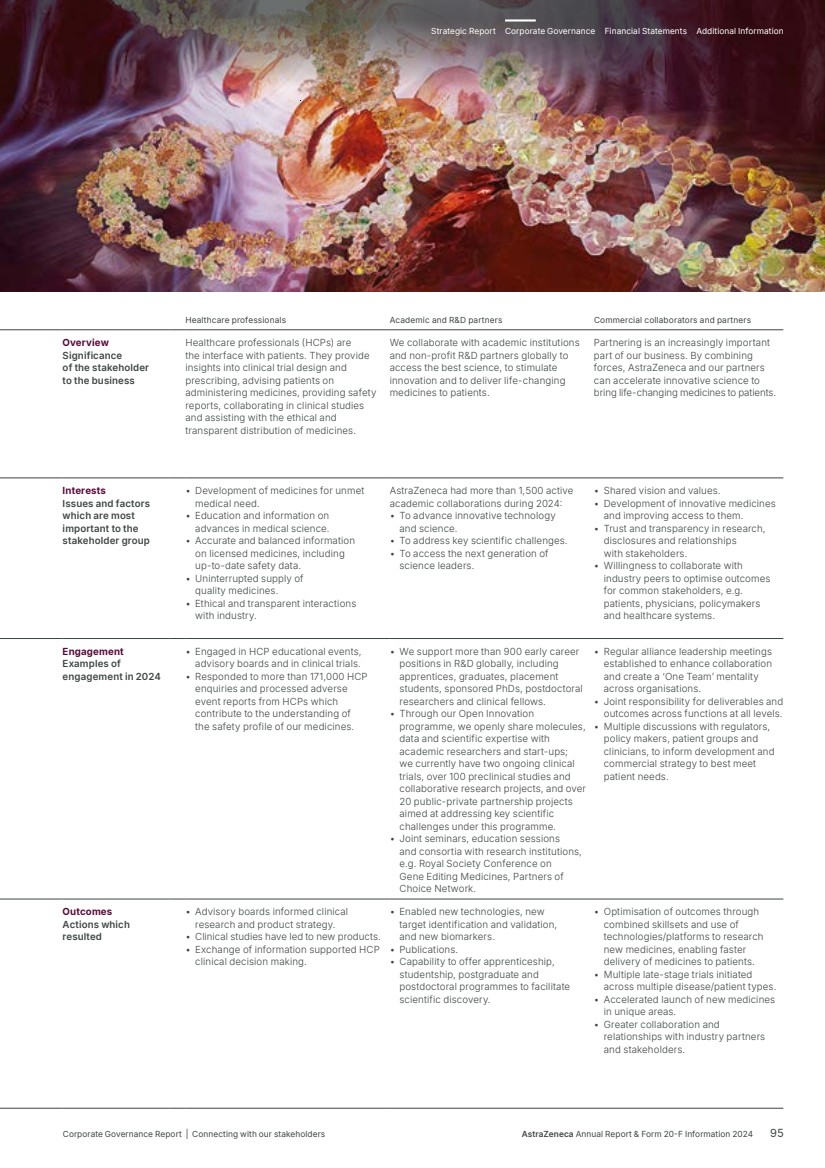

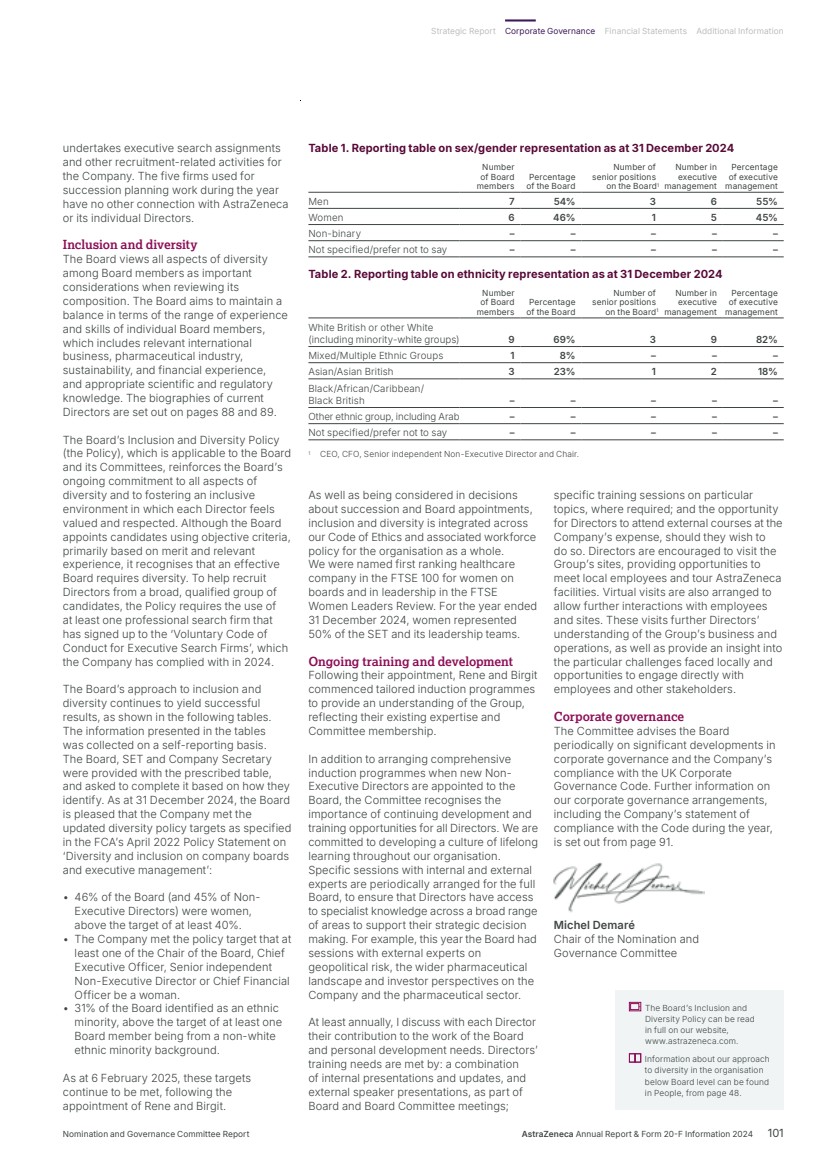

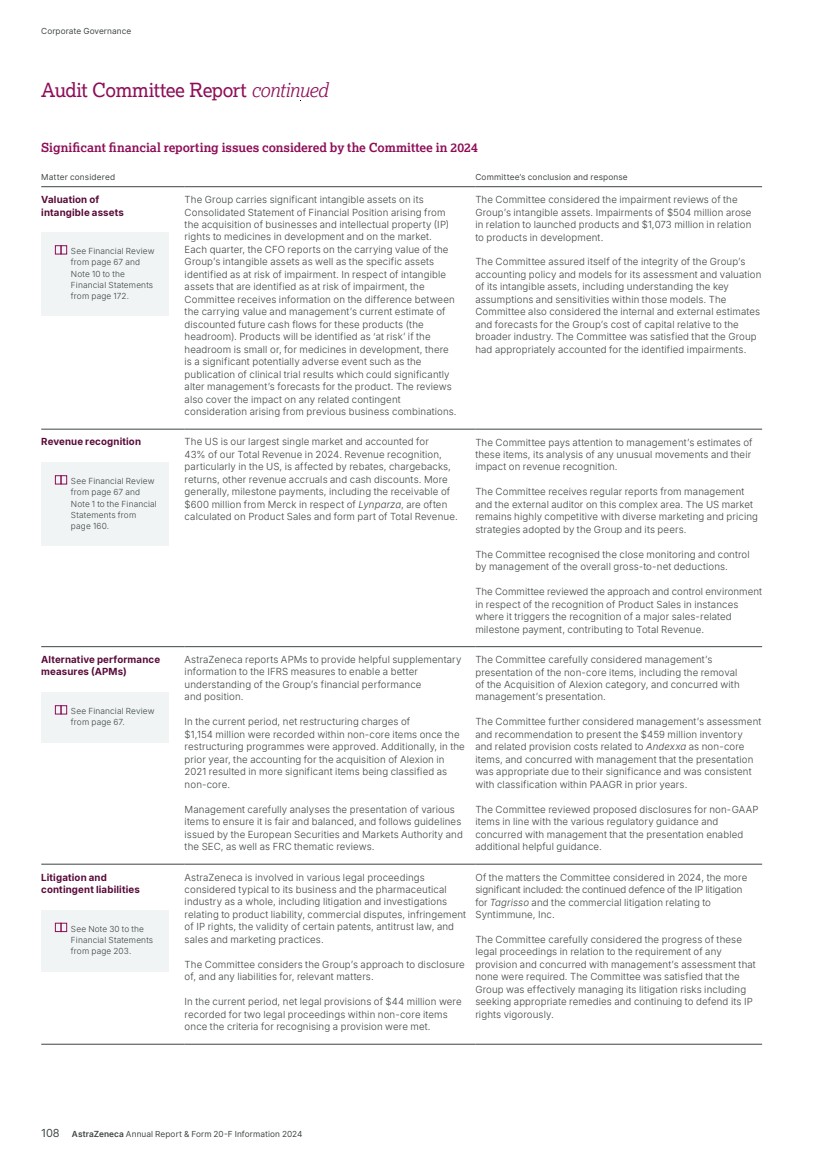

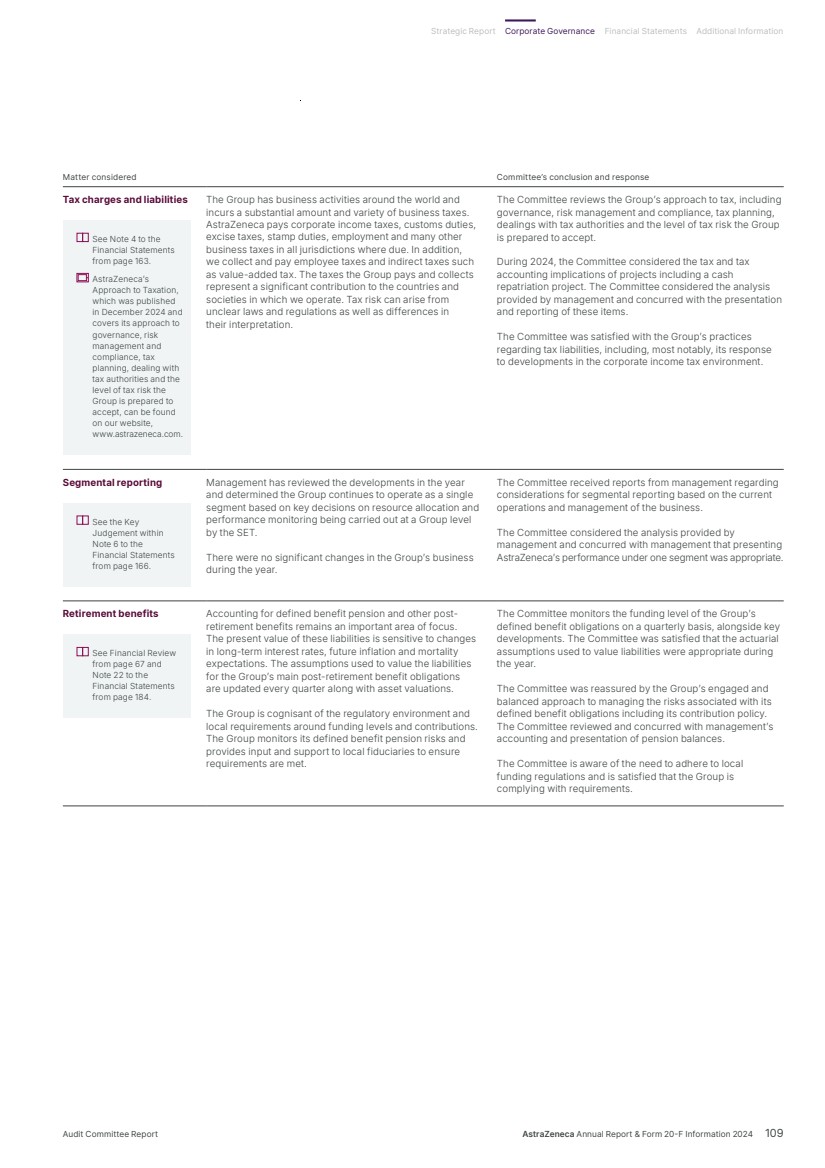

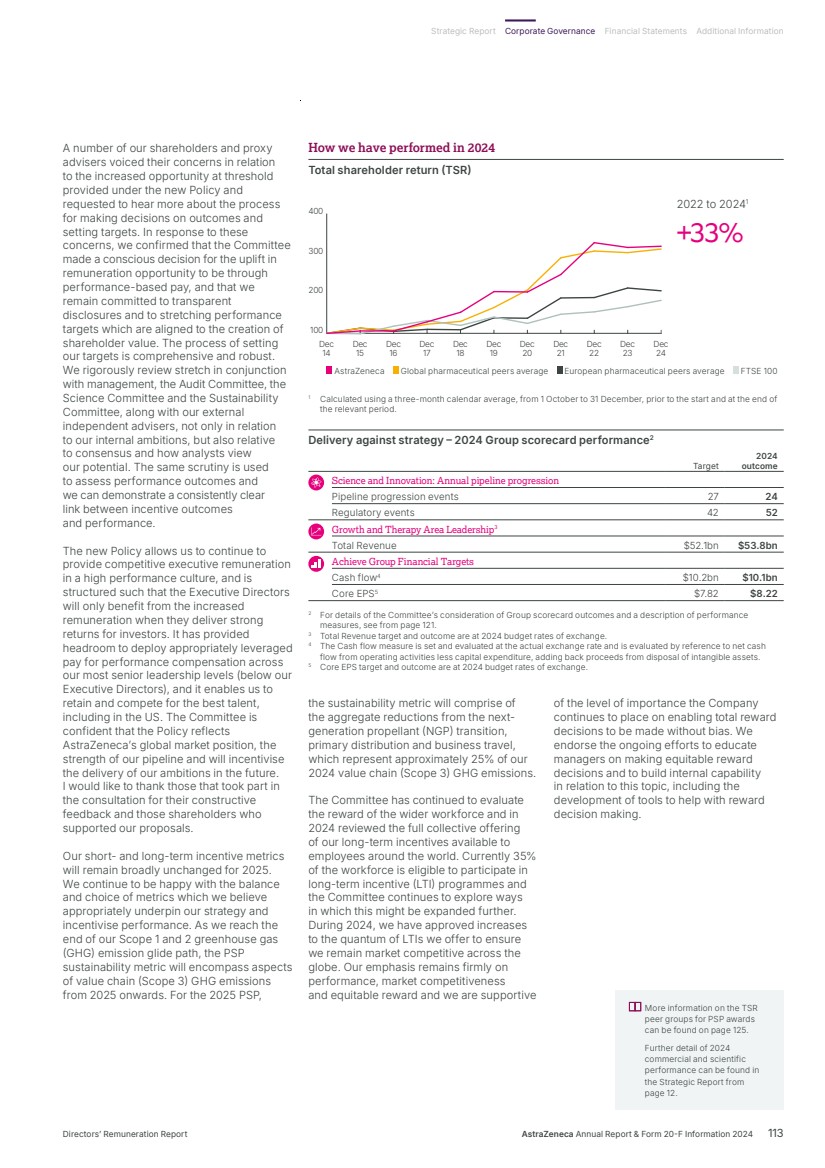

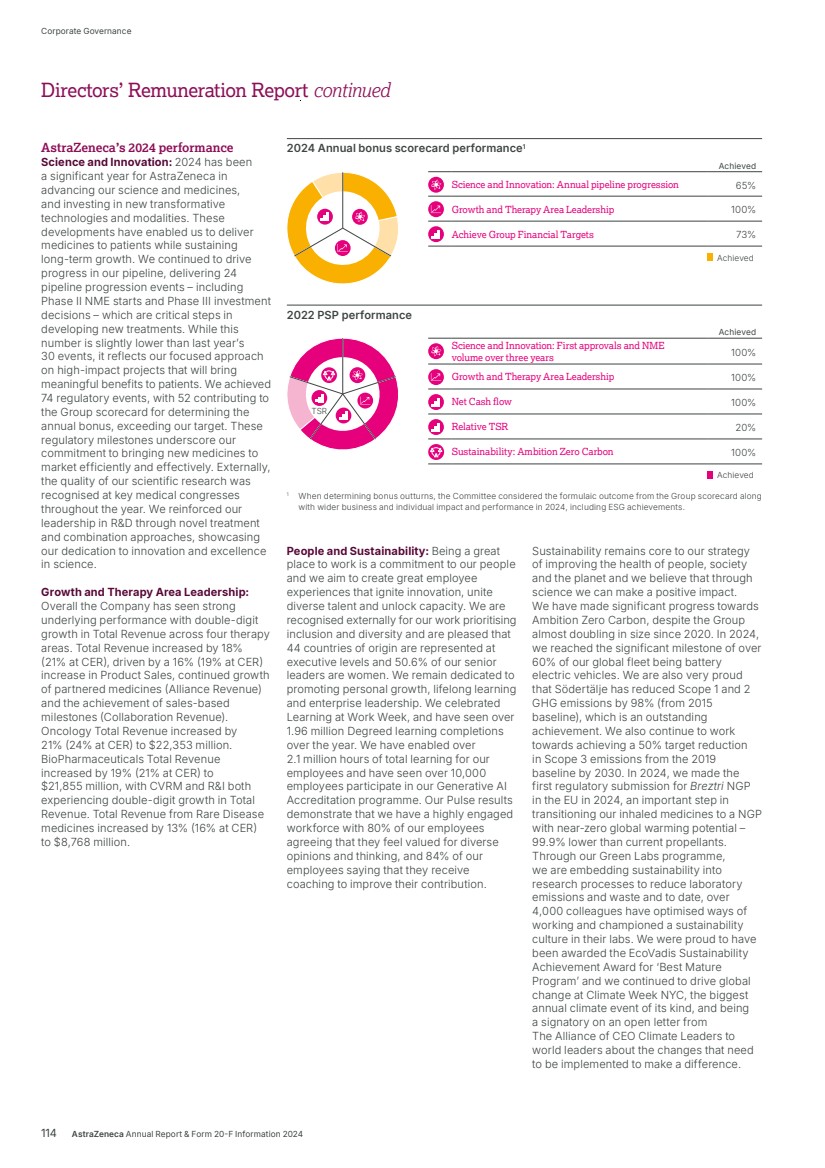

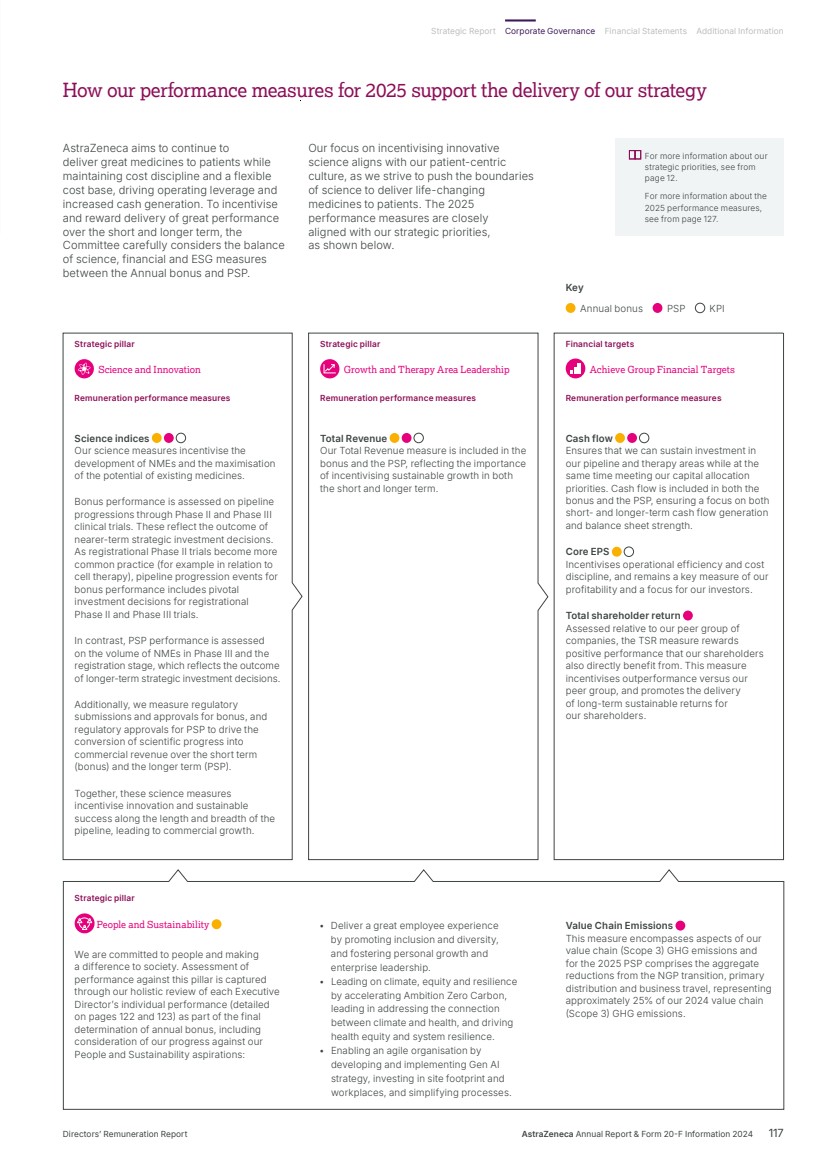

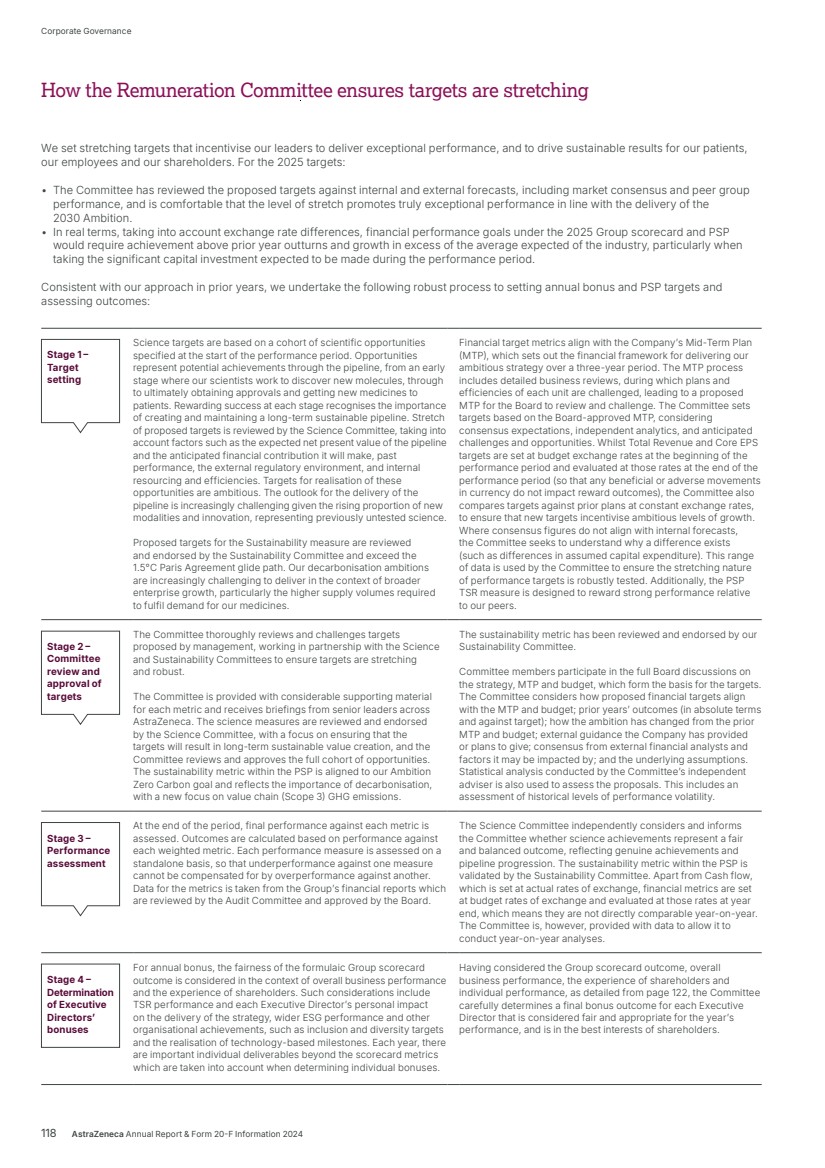

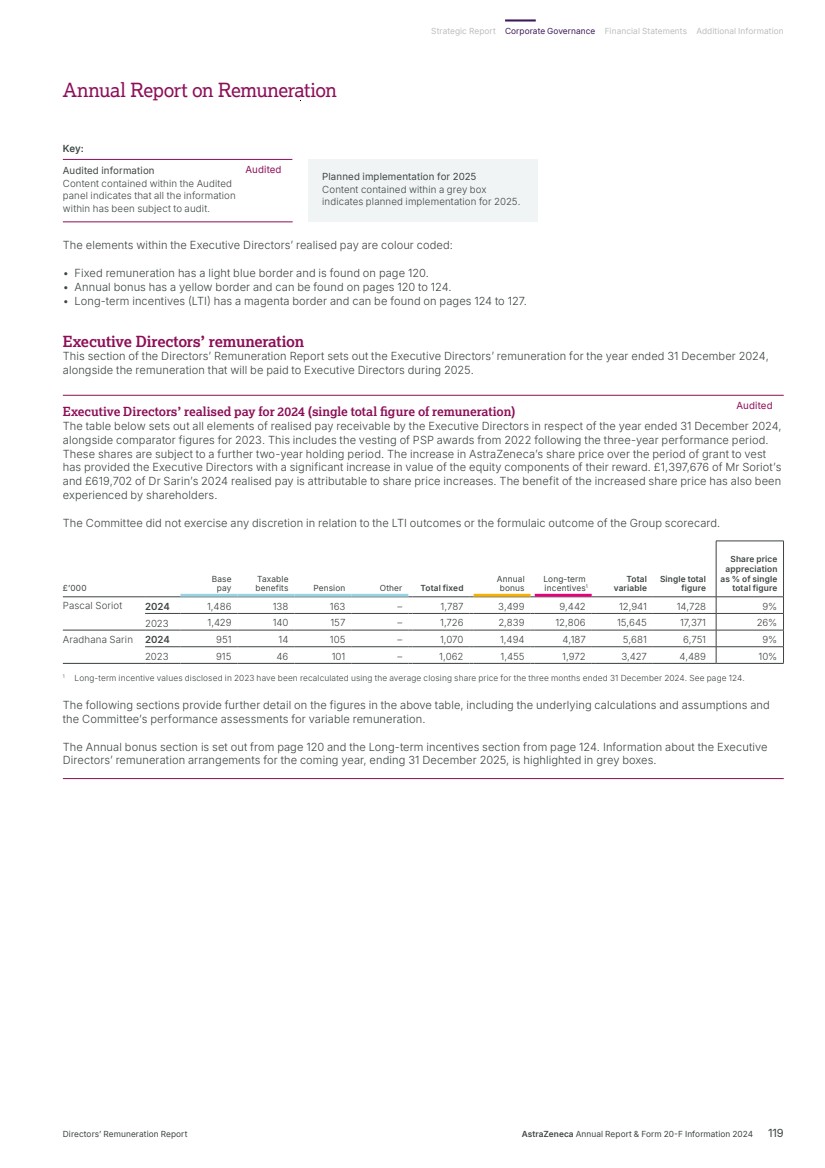

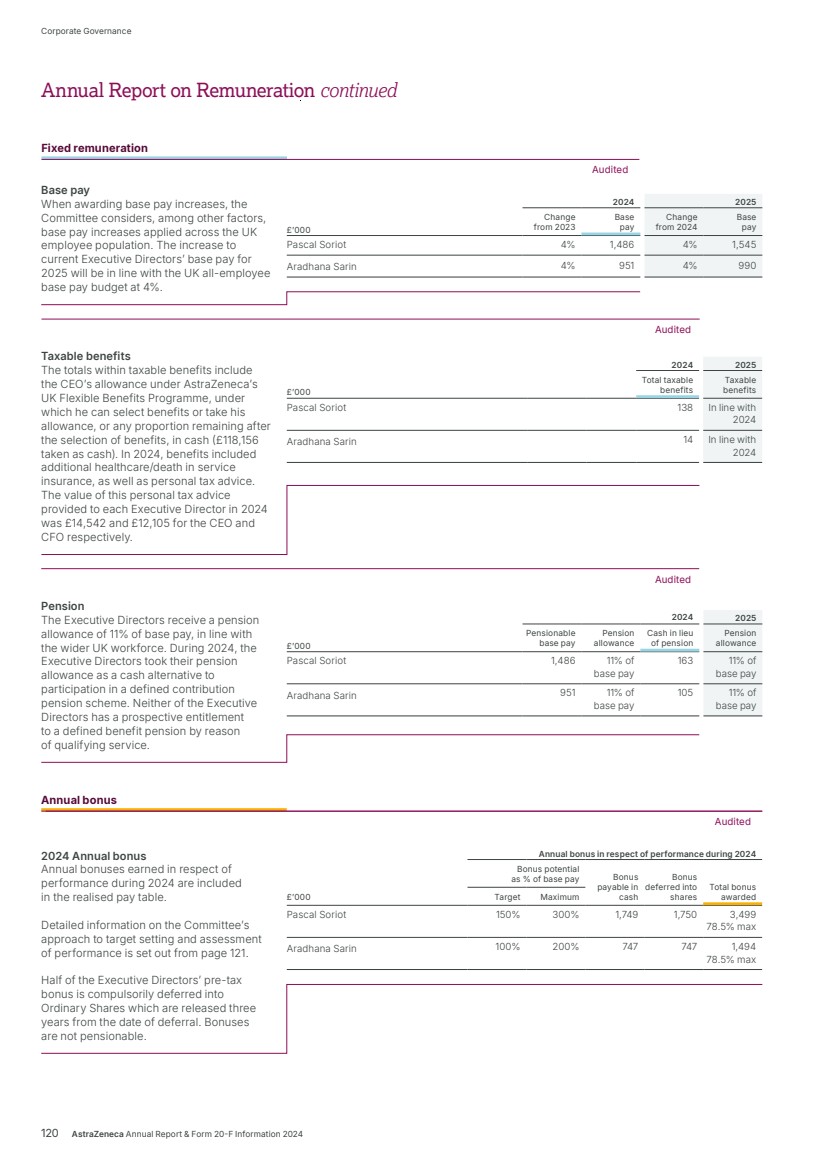

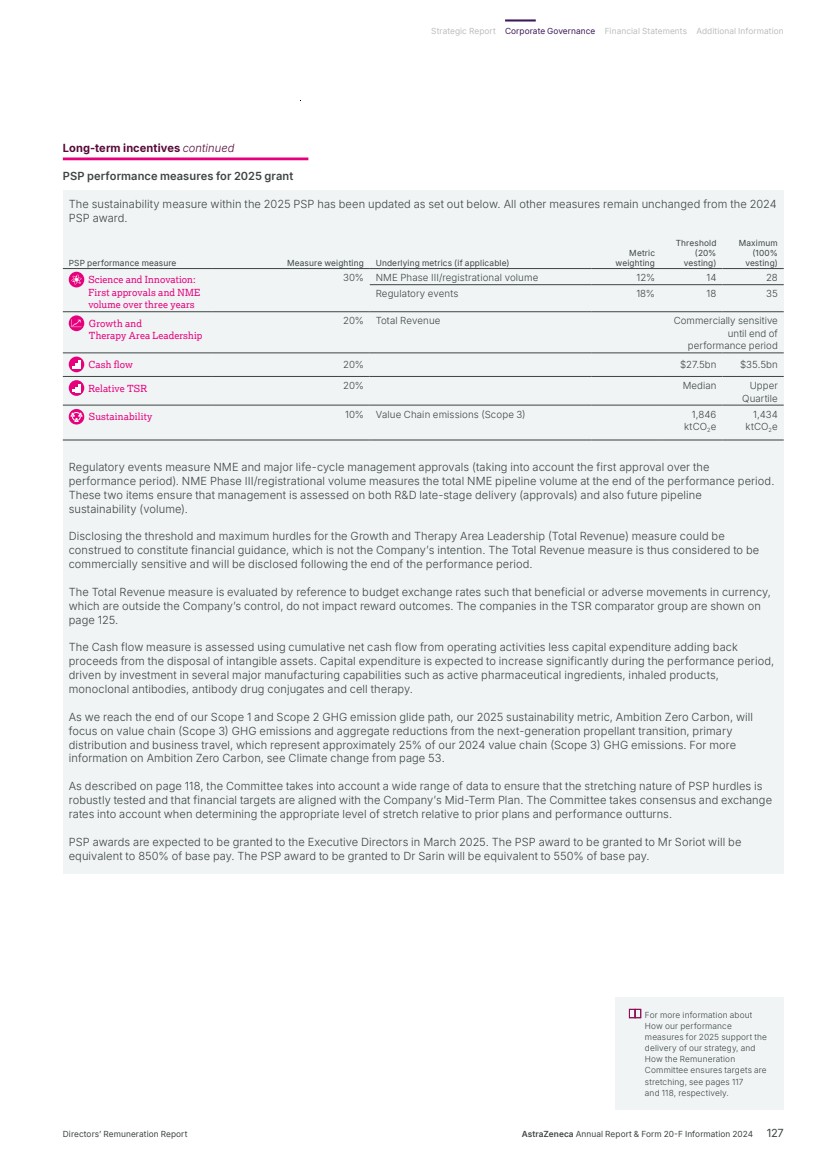

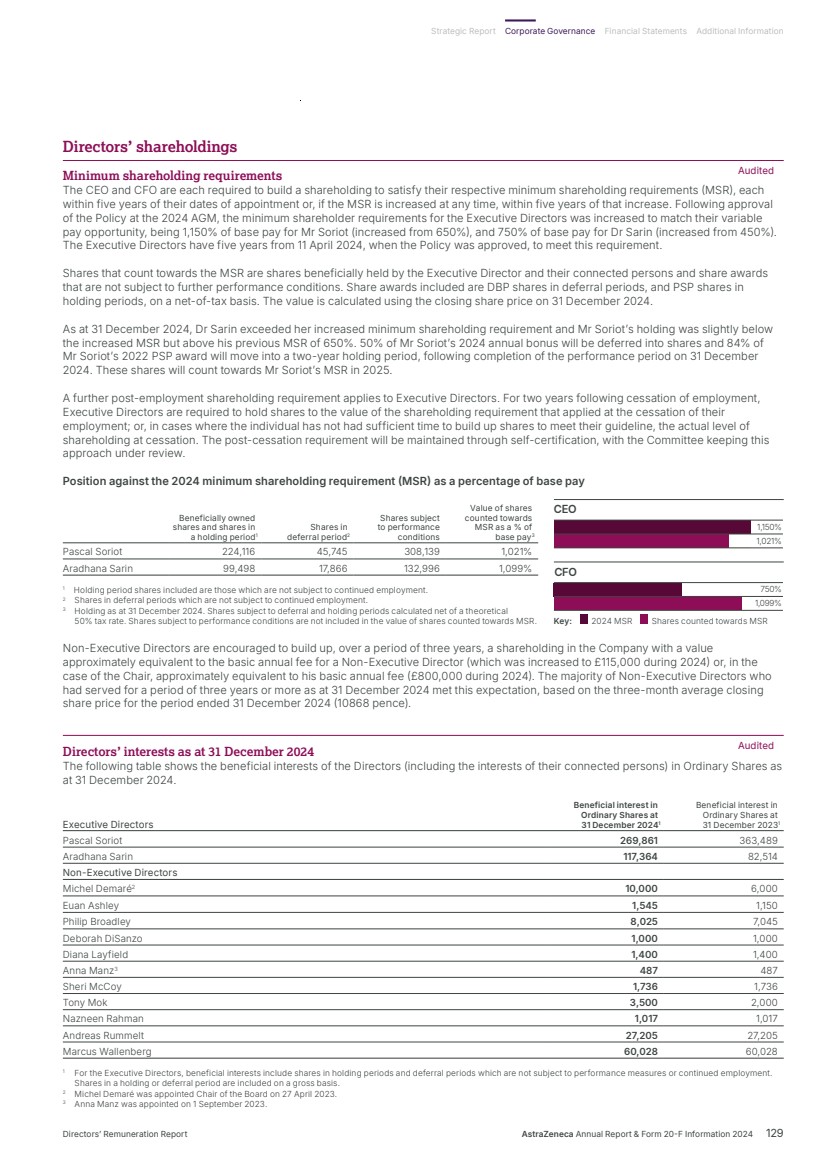

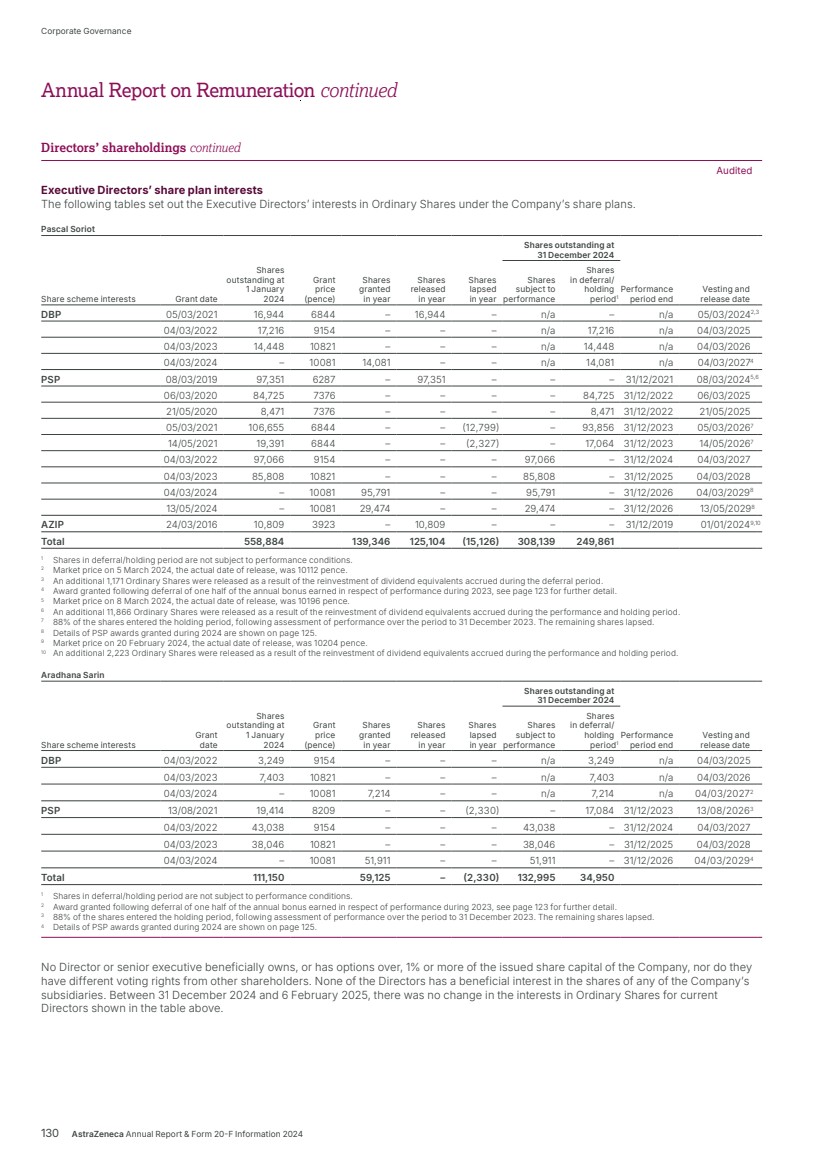

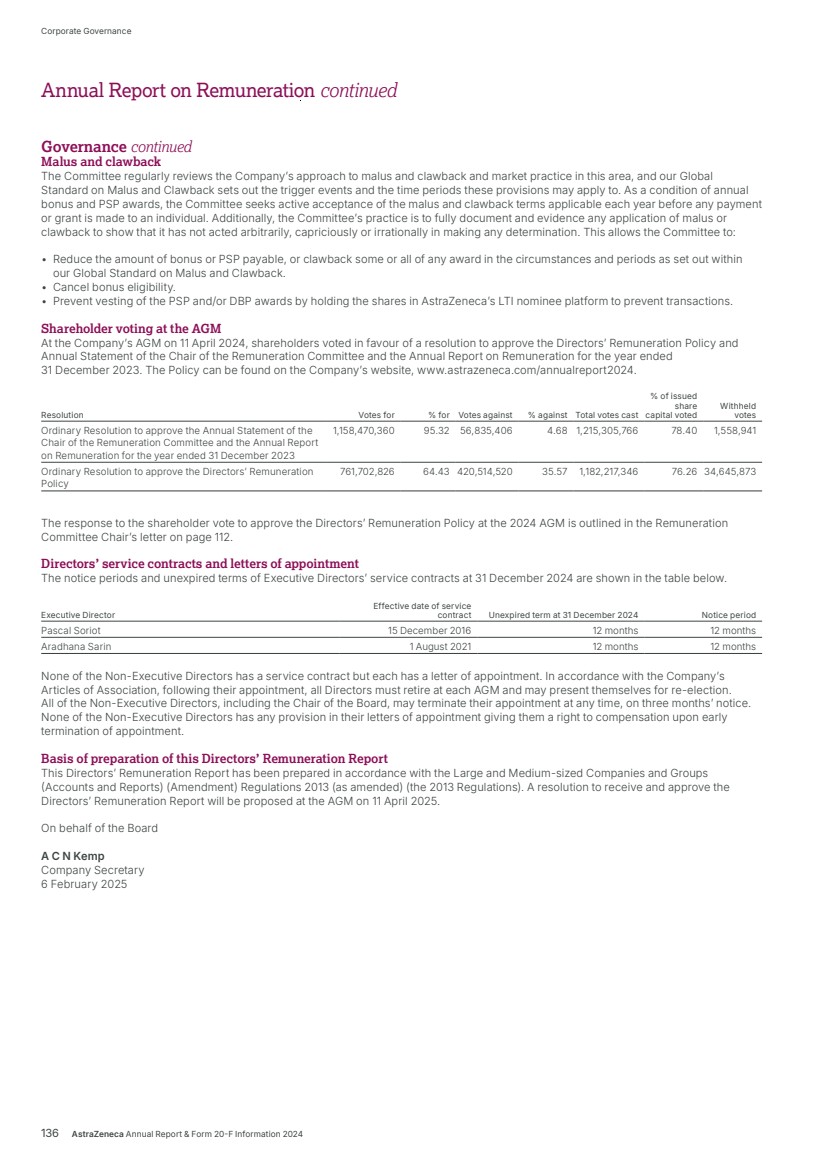

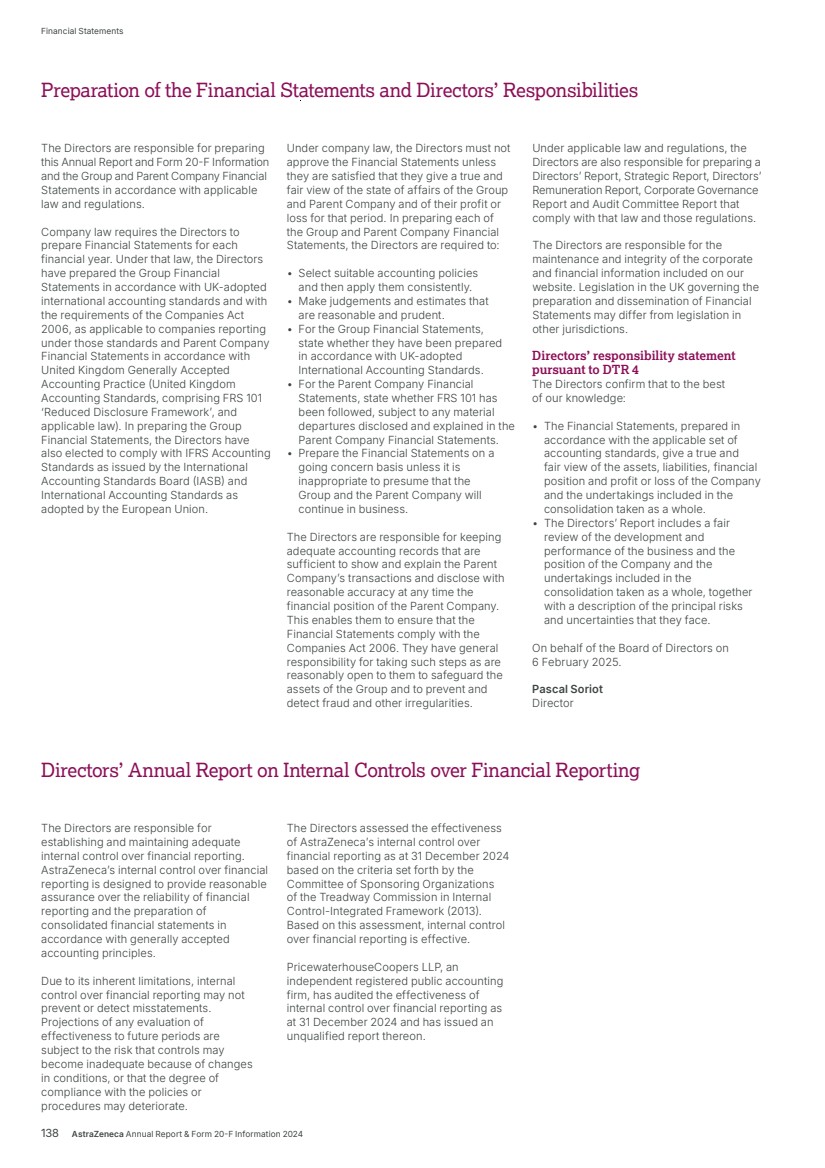

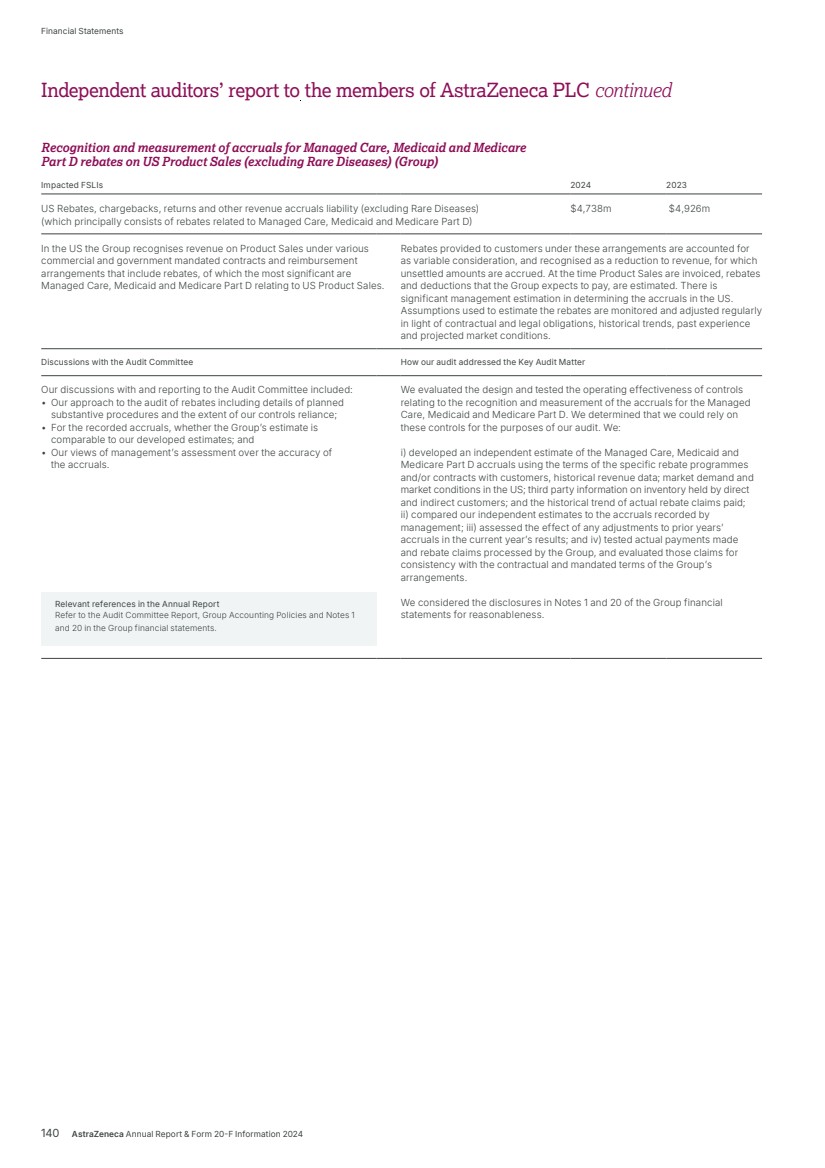

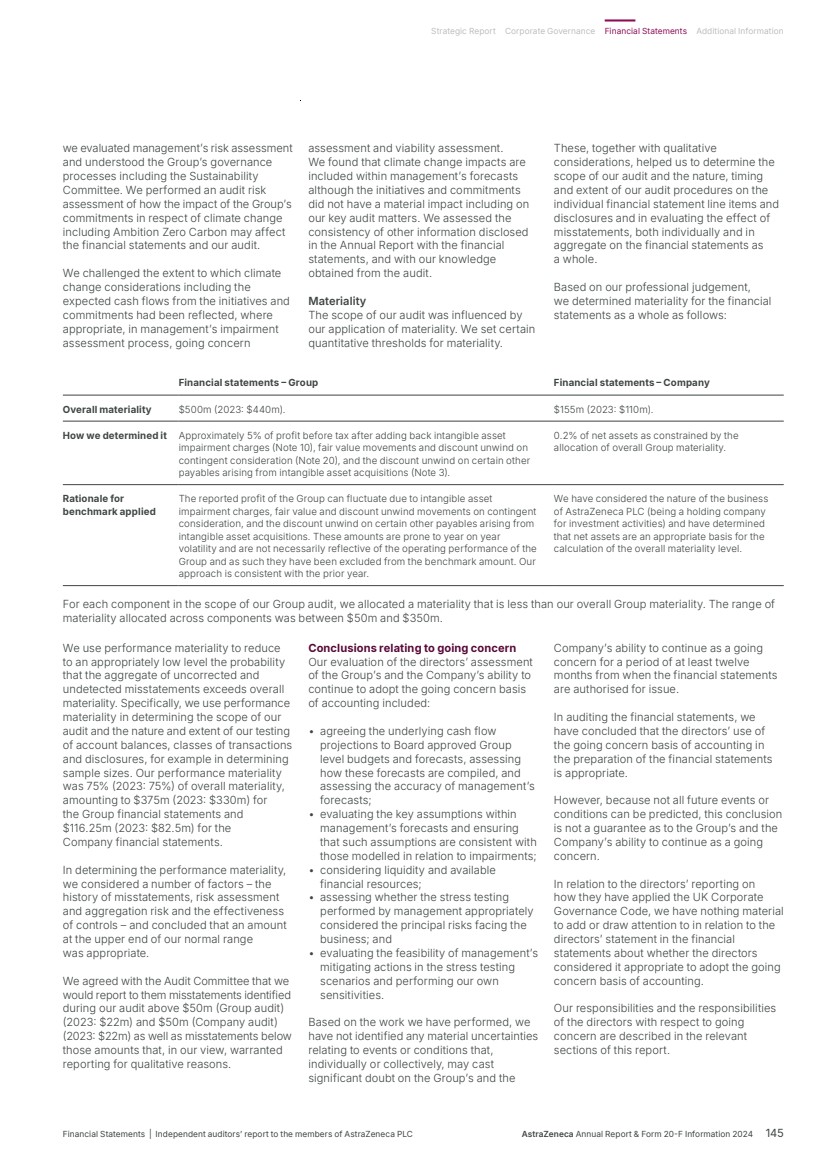

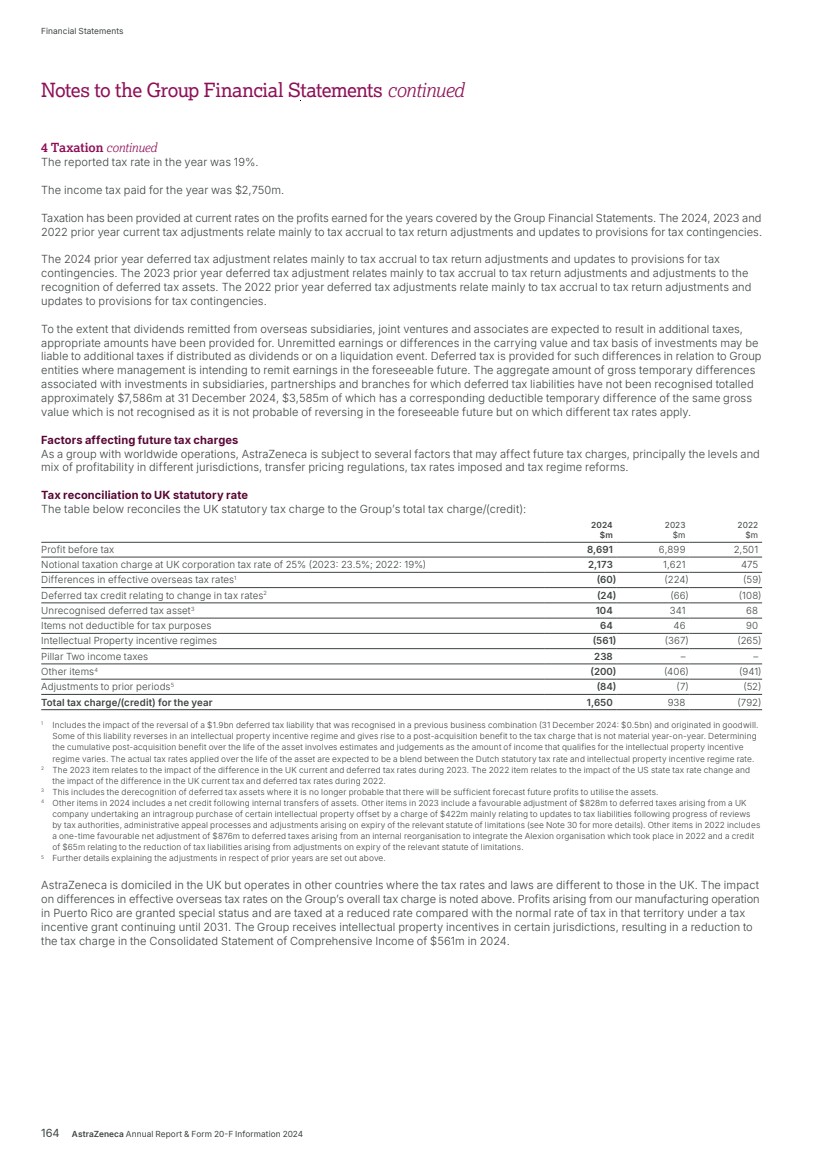

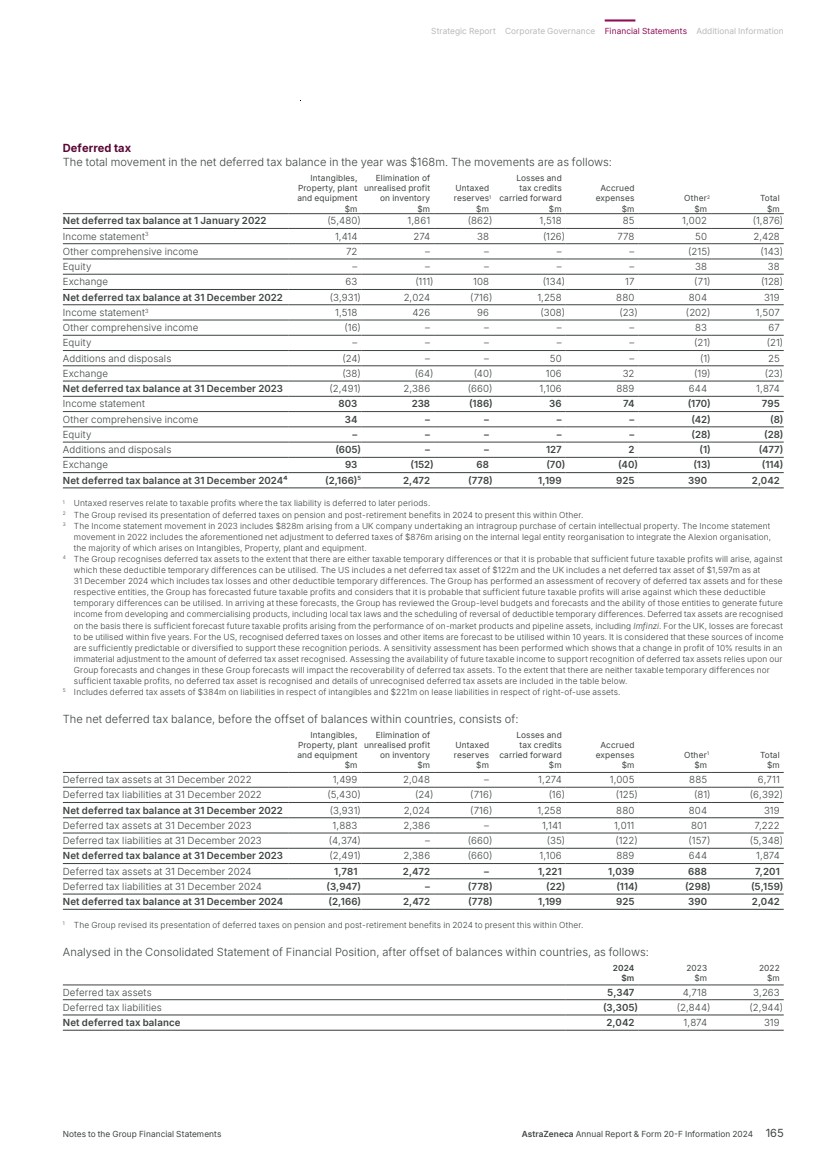

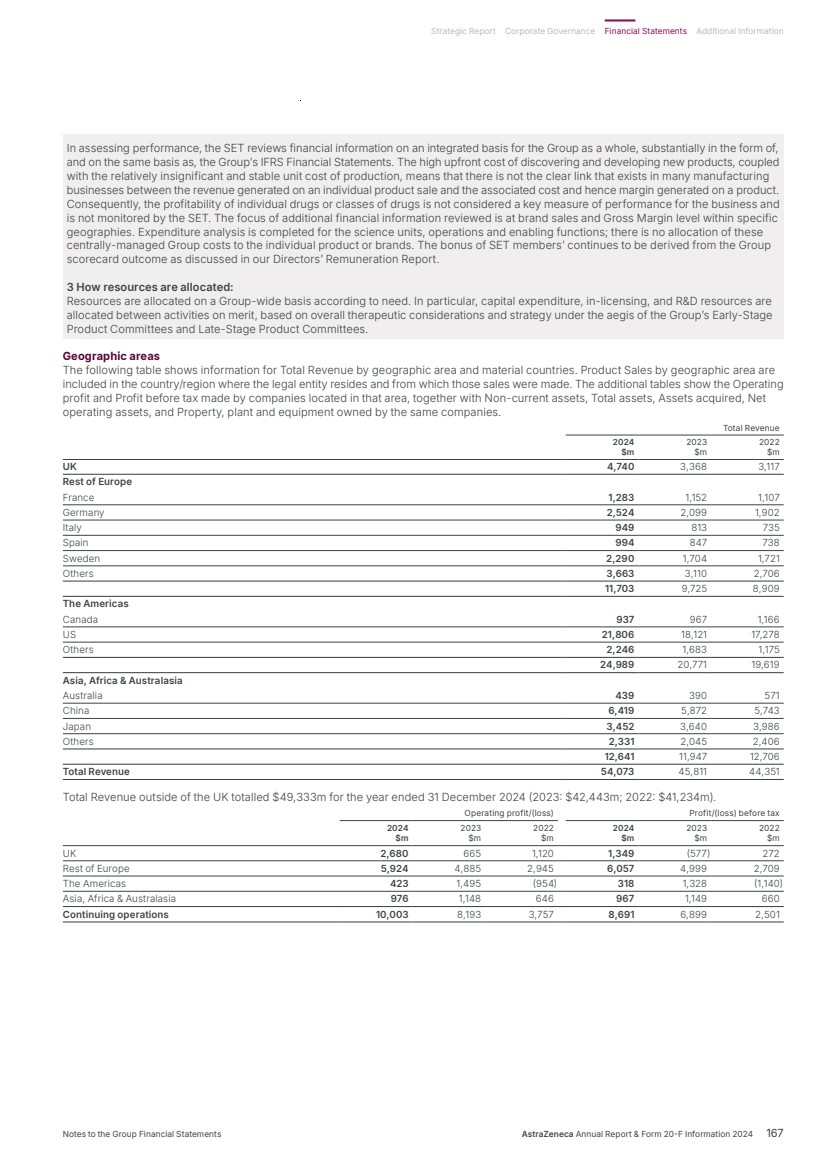

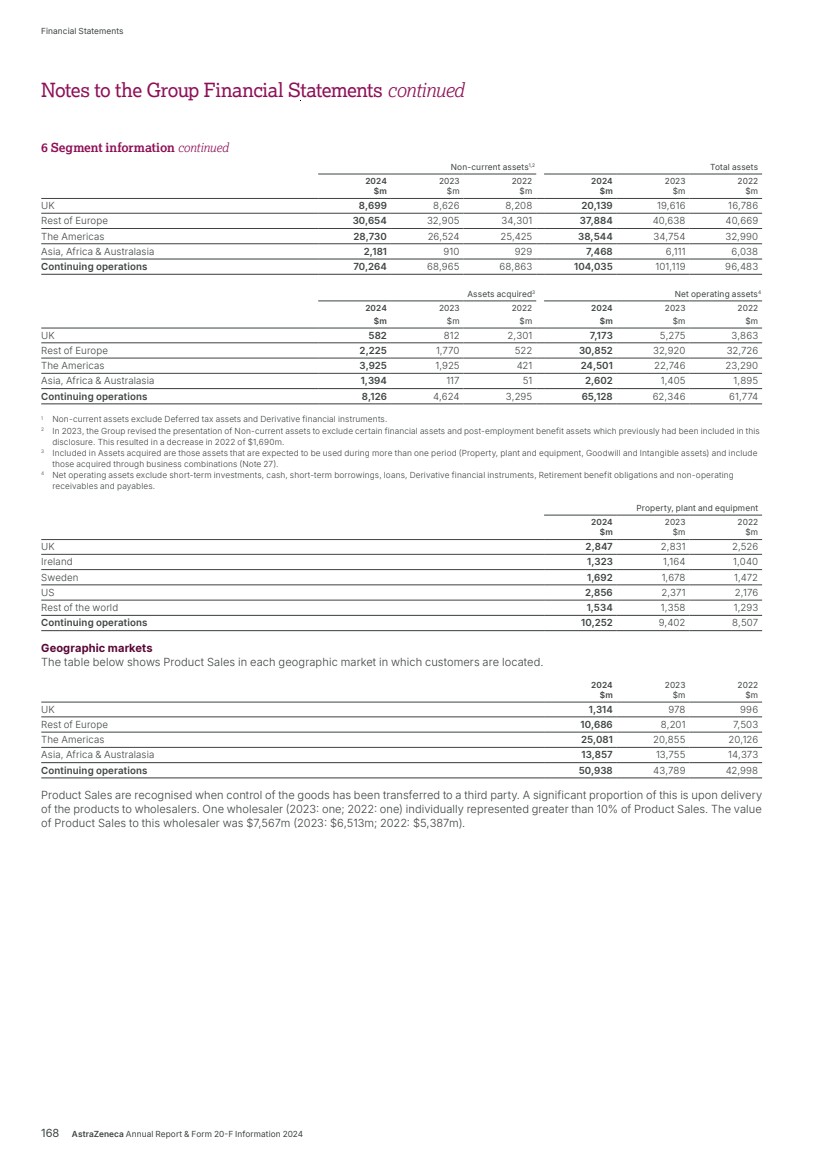

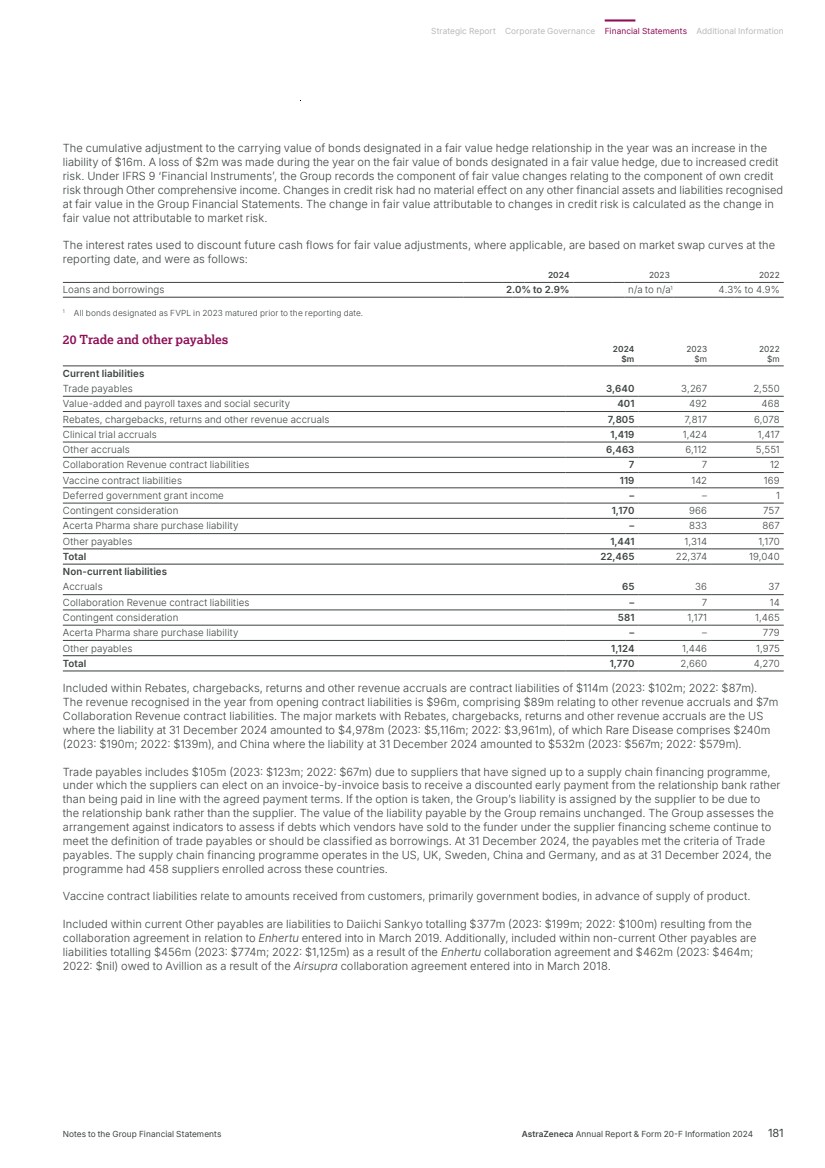

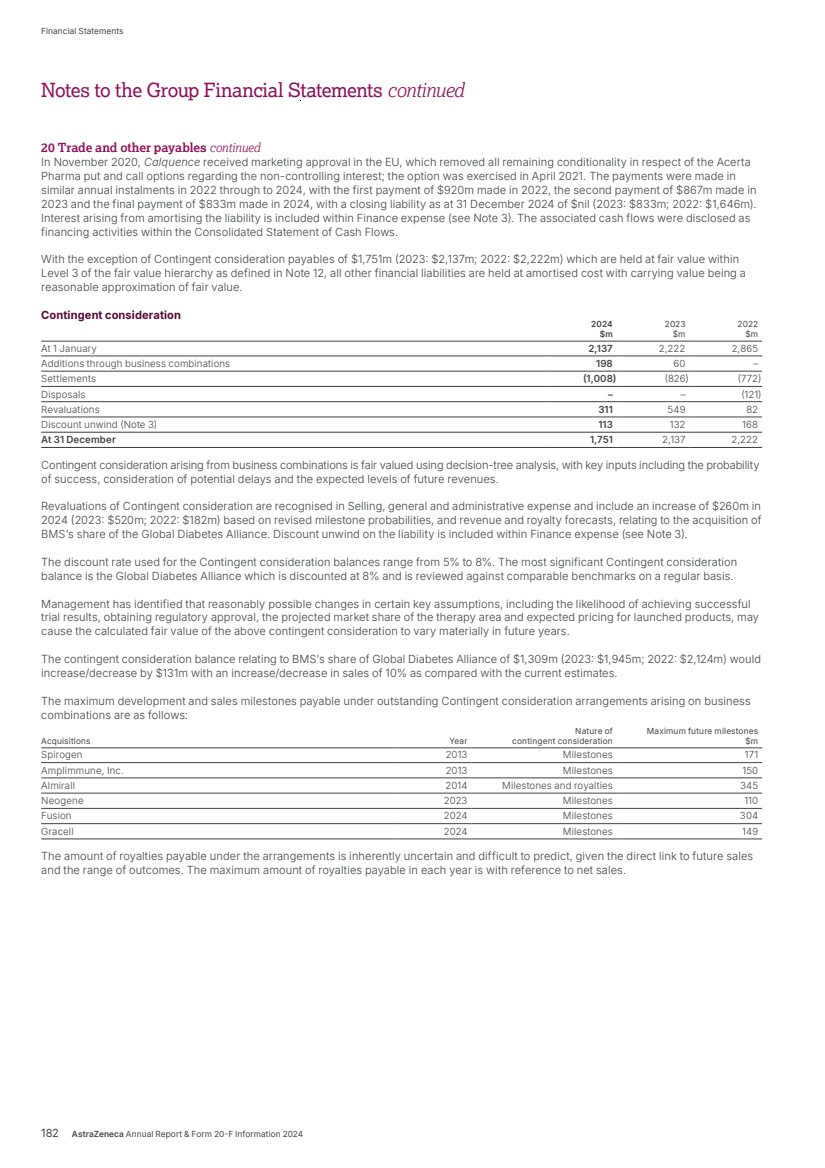

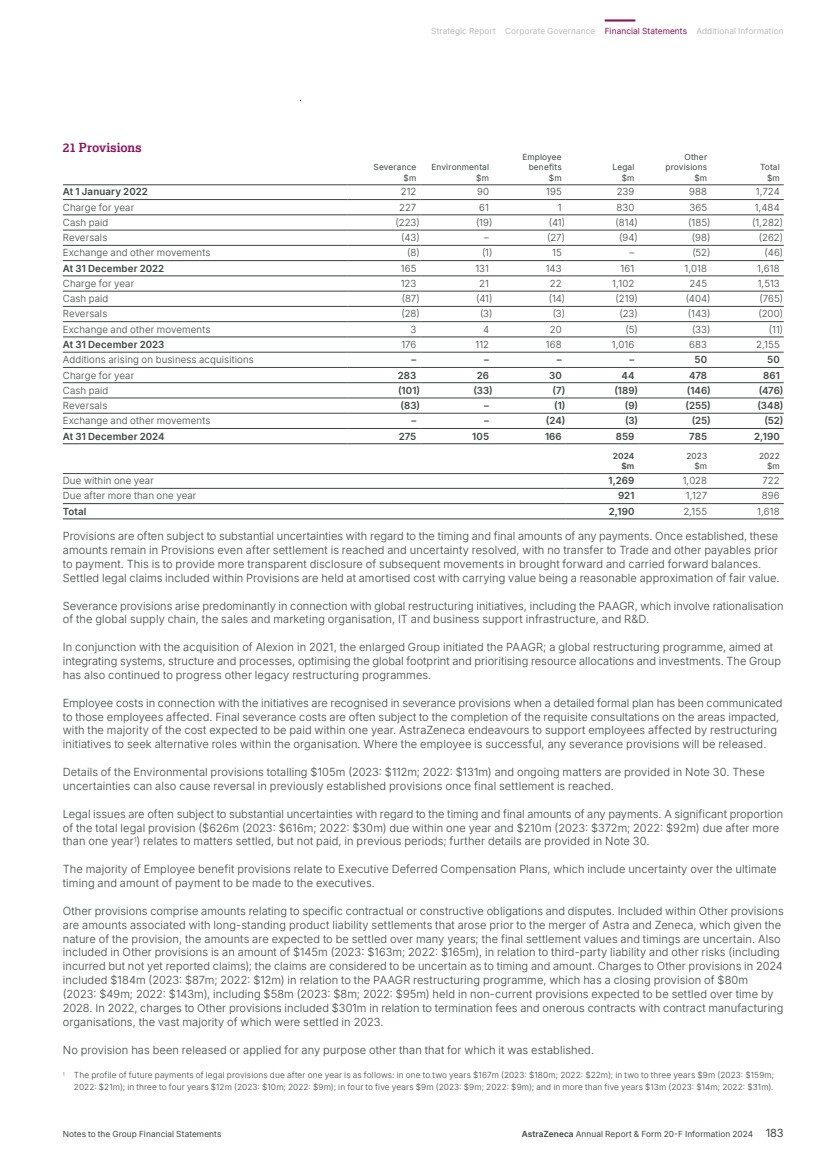

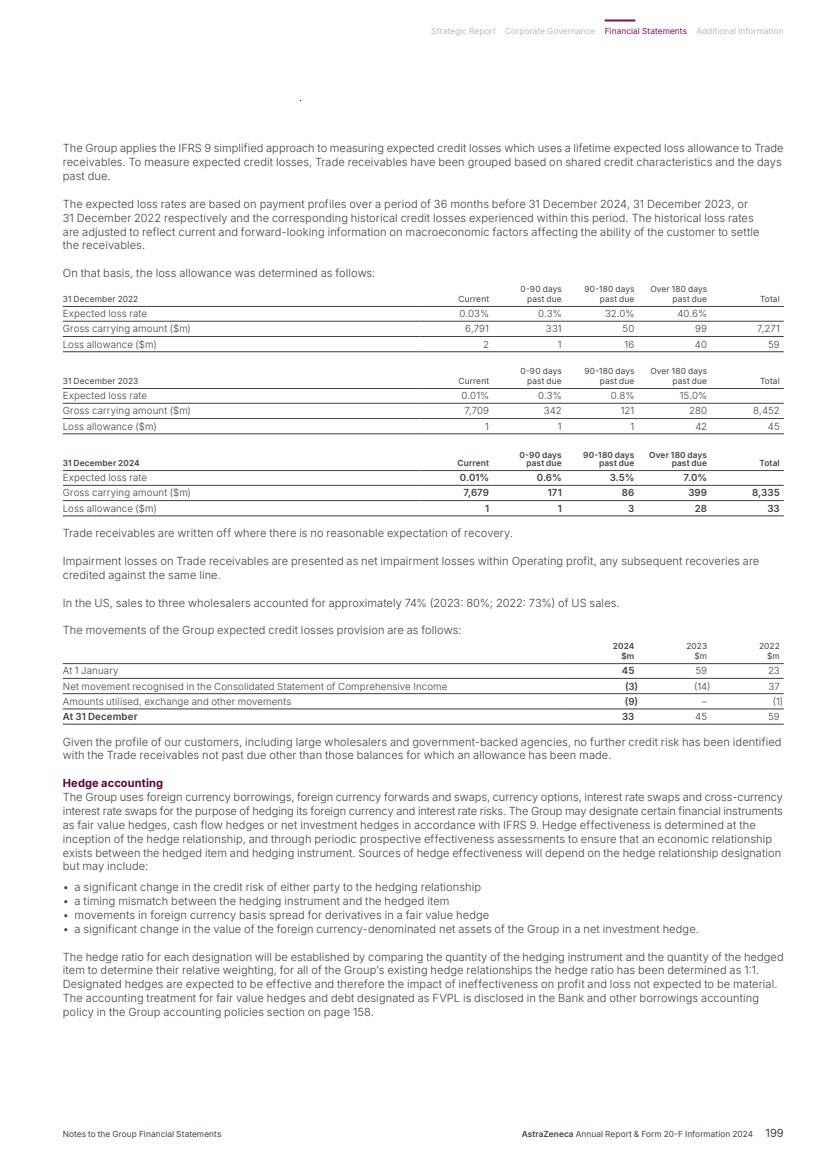

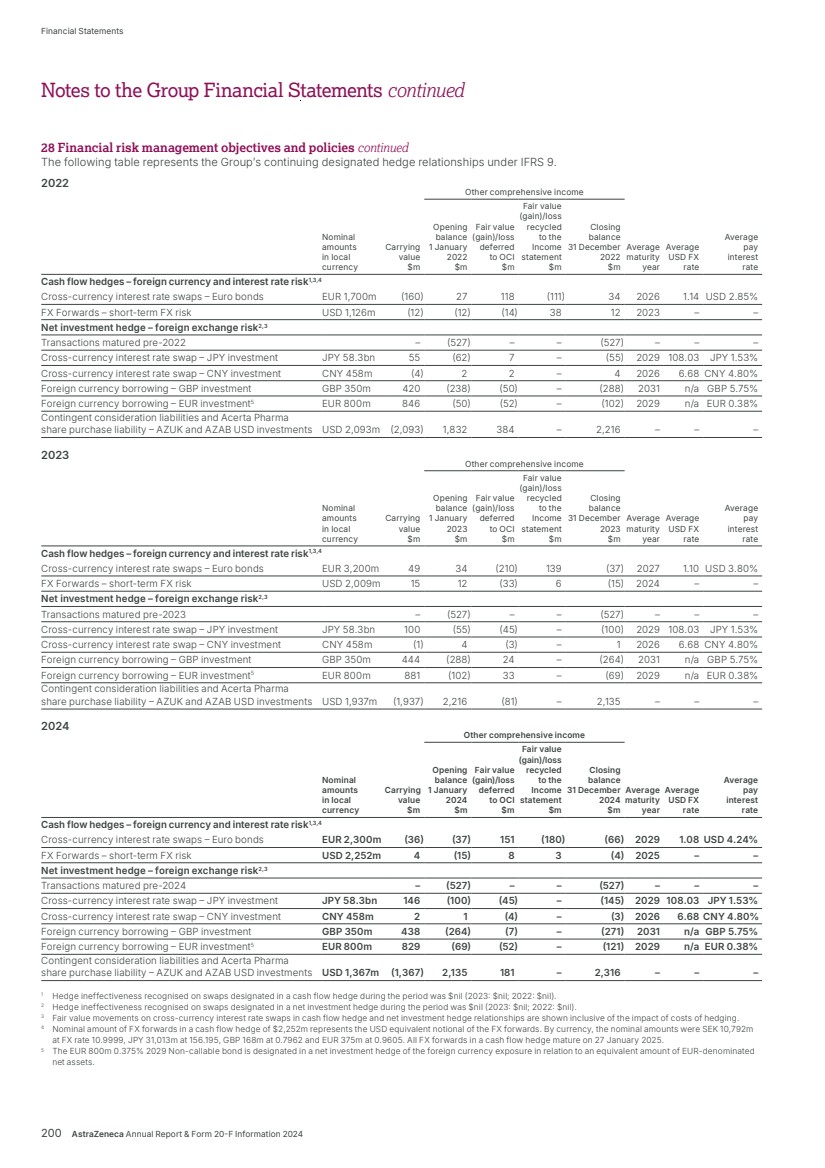

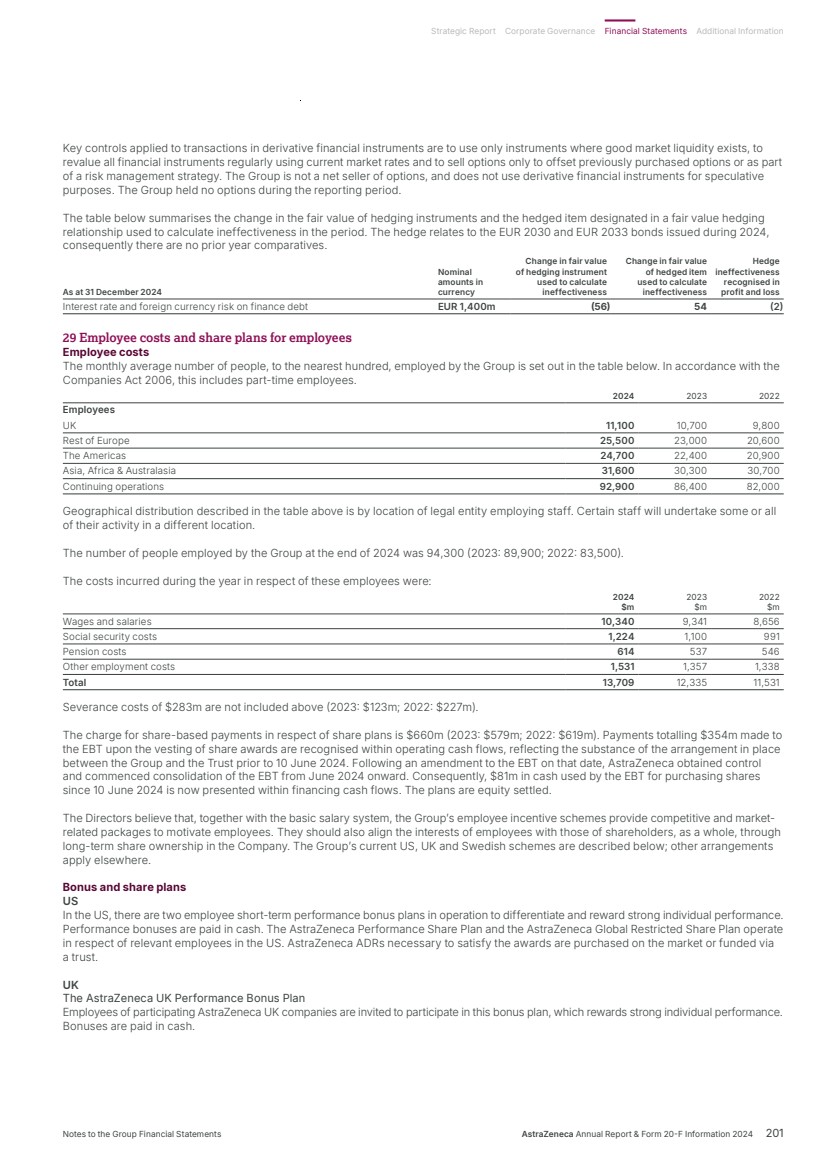

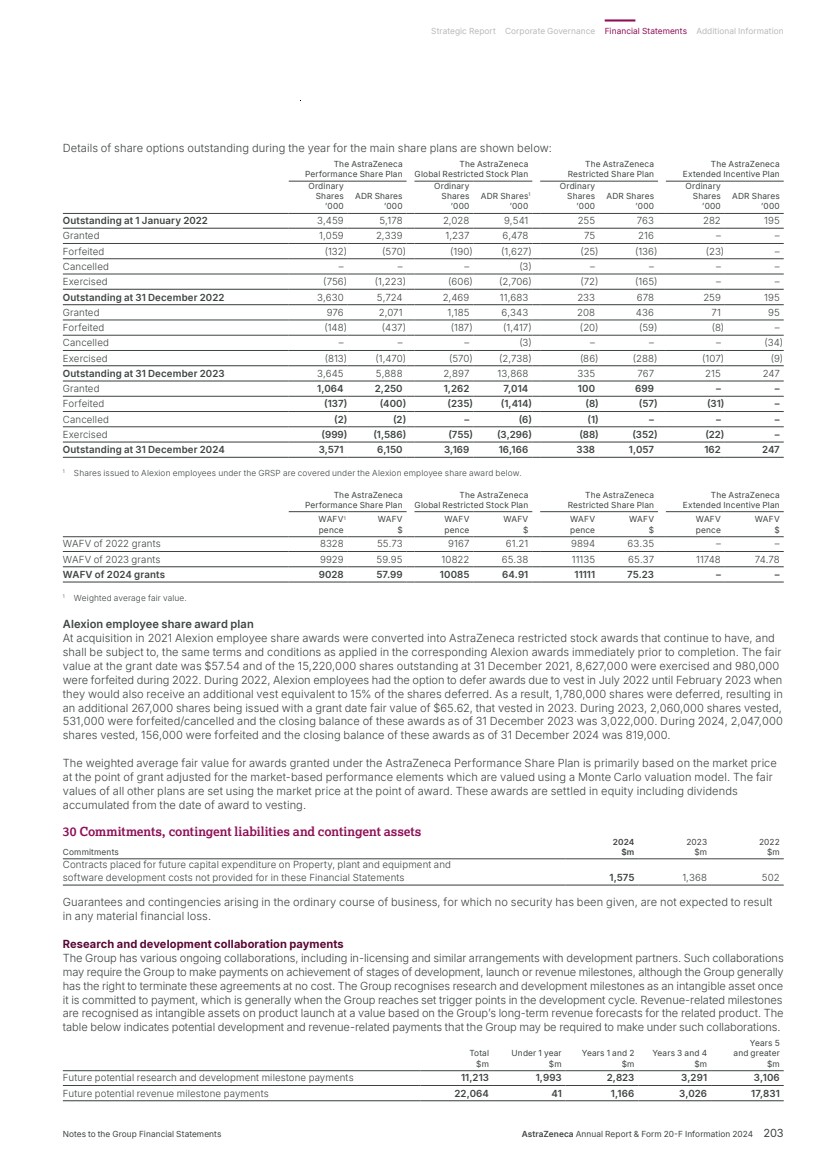

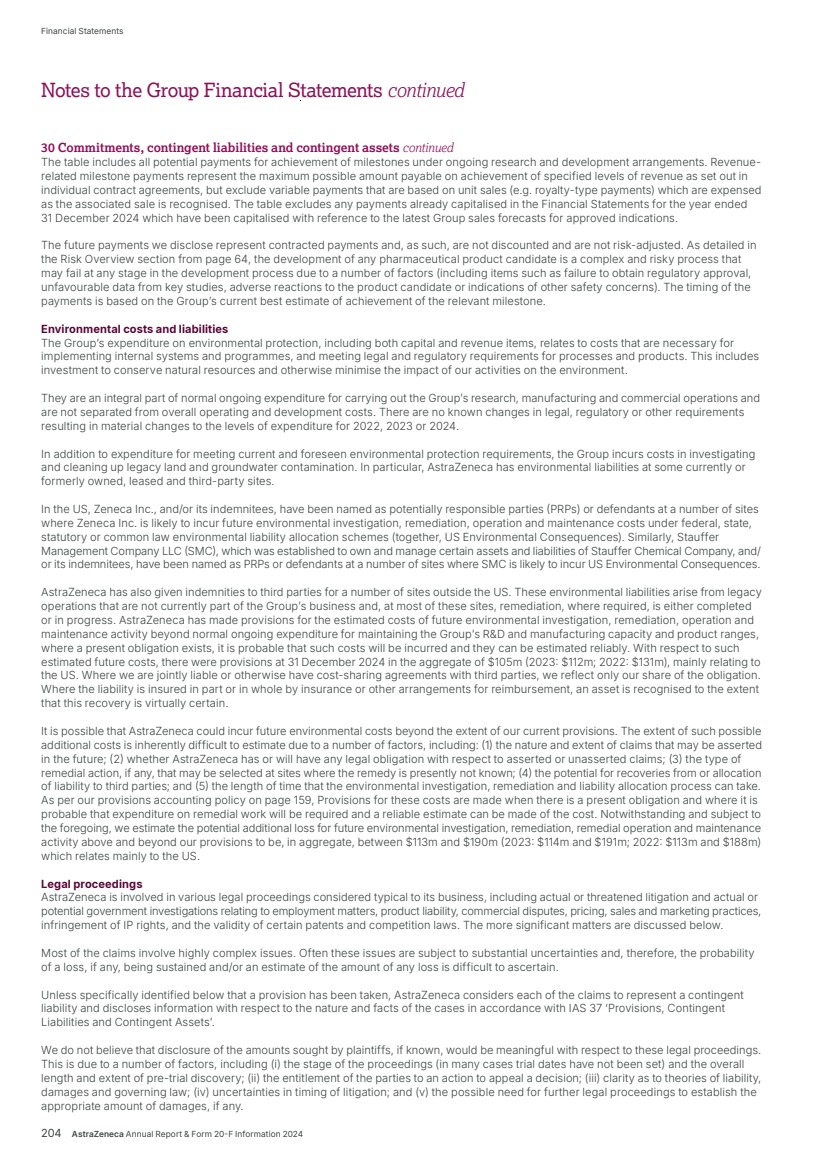

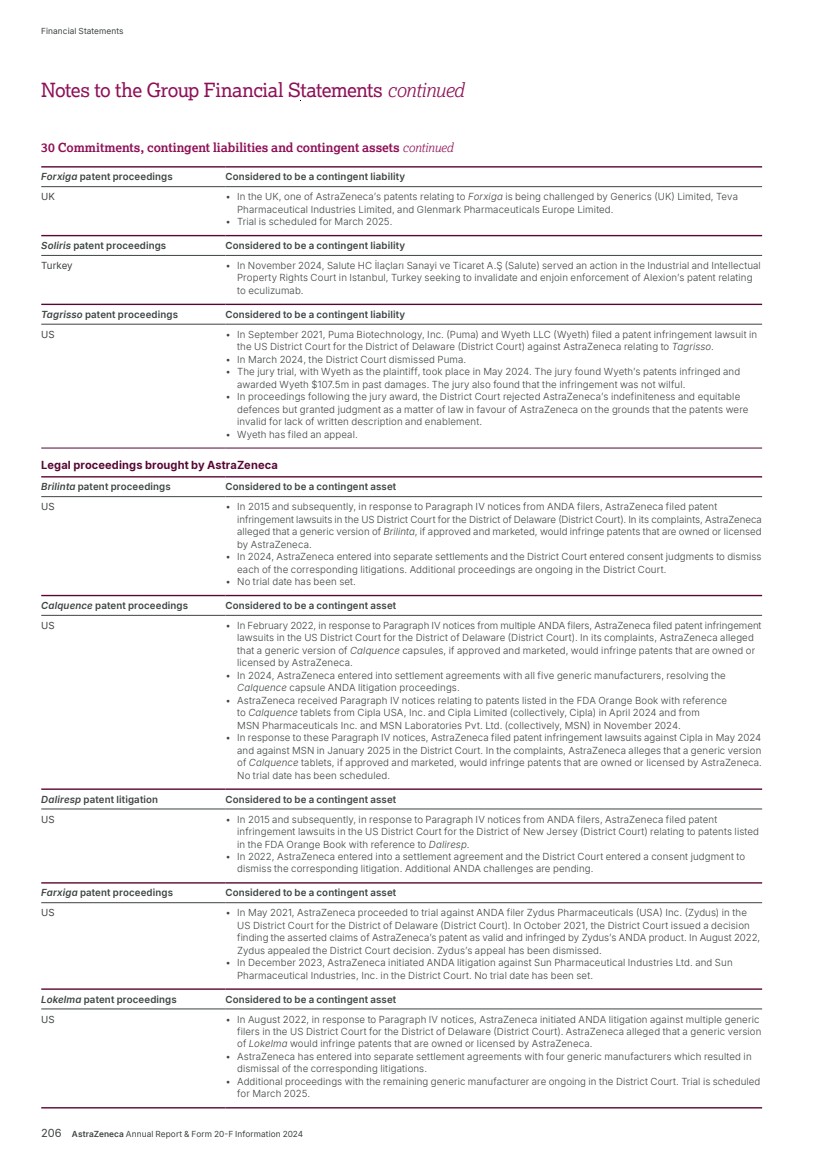

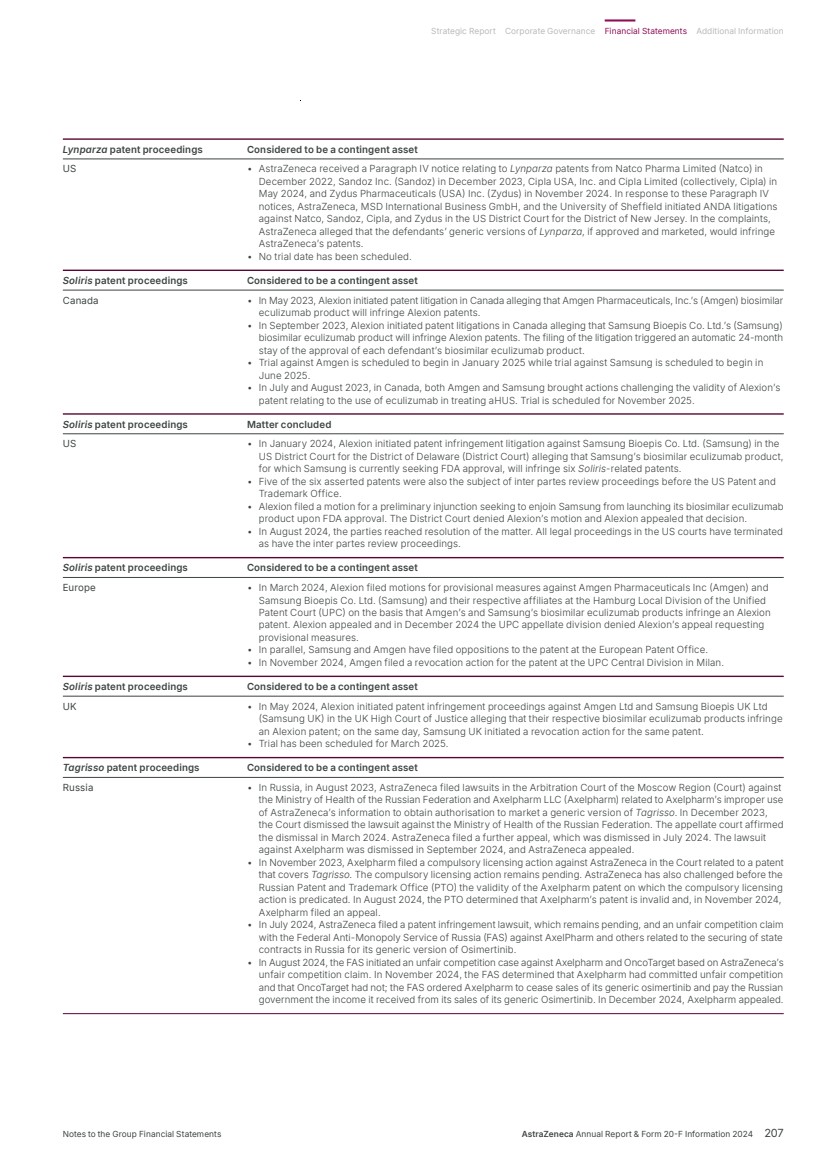

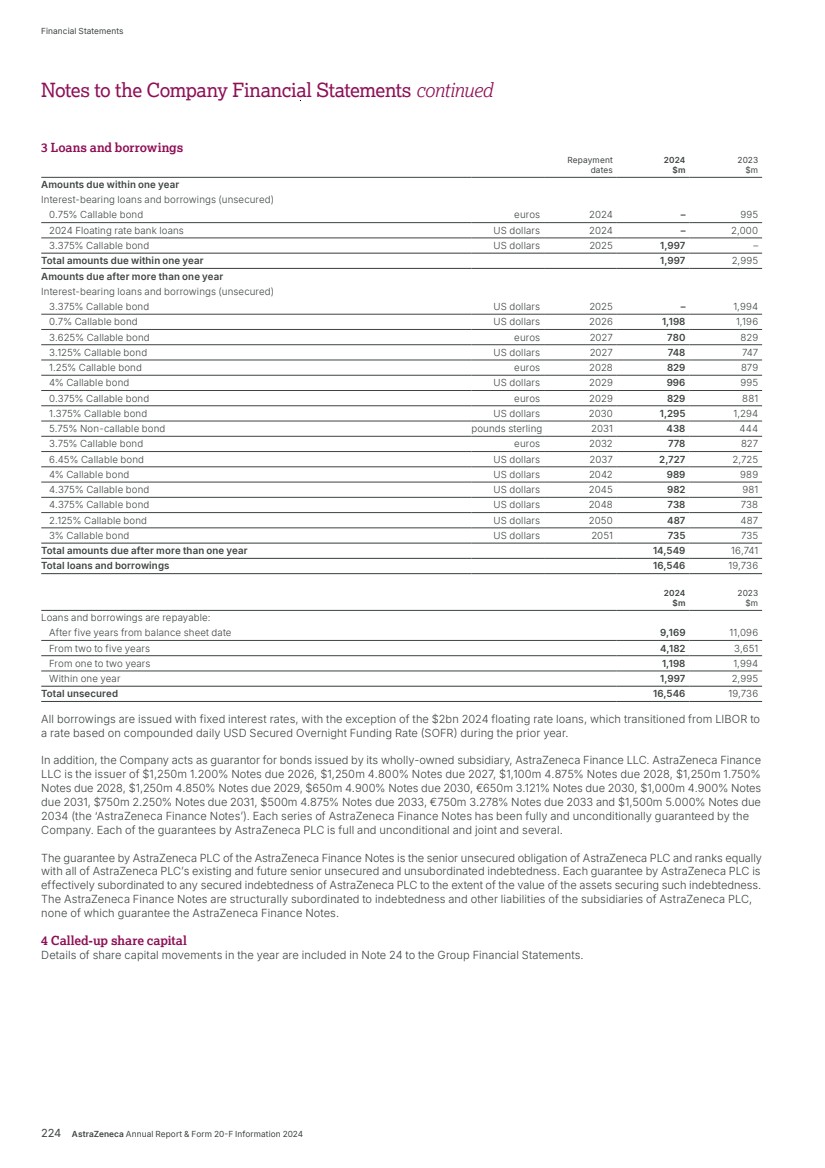

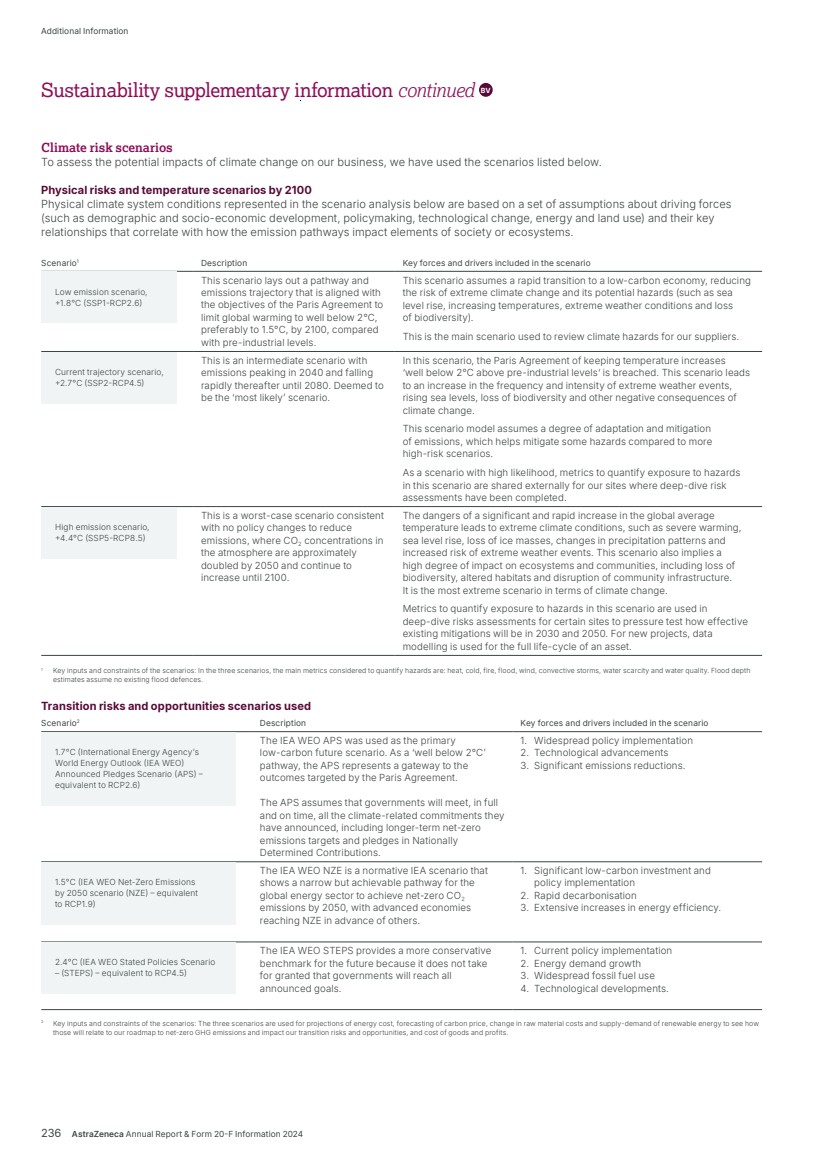

| Our ambition is to transform care for billions of people living with chronic diseases and deliver long-lasting immunity. We are working to intervene earlier to protect vital organs, slow or reverse disease progression, and achieve remission for often degenerative, debilitating and life-threatening conditions, so many more people can live better, healthier lives. Transform care for billions BioPharmaceuticals Therapy Area Review 20 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report |