| 83 Wooster Heights Road Danbury, Connecticut 06810 iqvia.com February 18, 2025 AstraZeneca PLC Legal & Secretary’s Department 1 Francis Crick Avenue Cambridge Biomedical Campus Cambridge CB2 0AA Dear Ladies and Gentlemen: IQVIA DATA DISCLOSURE FOR ANNUAL REPORT AND FORM 20-F INFORMATION 2024 In connection with the anticipated filing by AstraZeneca PLC (“AstraZeneca”) of a Form 20-F with the U.S. Securities and Exchange Commission, IQVIA Inc. (“IQVIA”) hereby authorizes AstraZeneca to refer to IQVIA and certain pharmaceutical industry data derived by IQVIA, as identified (highlighted in green) on the pages annexed hereto as Annex A, which are a selection of pages from AstraZeneca’s Annual Report and Form 20-F Information for the fiscal year ended December 31, 2024 (the “Annual Report”), each of which is incorporated by reference in the registration statement No. 333-278067 for AstraZeneca on Form F-3, and in the registration statements No. 333-277197, No. 333-240298, No. 333-226830, No. 333-216901, No. 333- 170381, No. 333-1 52767, No. 333-124689 and No. 333-09062 on Form S-8 for AstraZeneca. IQVIA’s authorization is subject to AstraZeneca’s acknowledgement and agreement that: 1) IQVIA has not undertaken an independent review of the information disclosed in the Annual Report or the Form 20-F other than to discuss its observations as to the accuracy of the information relating to IQVIA and certain pharmaceutical industry data derived by IQVIA; 2) AstraZeneca acknowledges and agrees that IQVIA shall not be deemed an “Expert” in respect of AstraZeneca’s securities filings, and AstraZeneca agrees that it shall not characterize IQVIA as such; and 3) AstraZeneca accepts full responsibility for the disclosure of all information and data, including that relating to IQVIA, set forth in the Annual Report and Form 20-F as filed with the SEC and agrees to indemnify IQVIA from any third party claims that may arise therefrom. Please indicate your agreement to the foregoing by signing in the space indicated below. Our authorization will not become effective until accepted and agreed by AstraZeneca. |

| Very truly yours, /s/ M Gilmartin Name: Matthew Gilmartin Title: SVP, Deputy General Counsel ACCEPTED AND AGREED This 18th day of February 2025 AstraZeneca PLC /s/ Adrian Kemp Name: Adrian Kemp Title: Company Secretary |

| Annex A (See attached) |

| 2024 2023 2022 107 100 111 Established RoW ($bn) $111bn $111bn (+4.3%) (+4.3%) 686 608 762 US ($bn) 2024 2023 2022 $762bn $762bn ((++11.1 11.1%%)) 290 269 318 Emerging Markets ($bn) 2024 2023 2022 $318bn $318bn (+9.7%) (+9.7%) 259 240 280 Europe ($bn) 2024 2023 2022 $280bn $280bn (+8.2%) (+8.2%) 1,343 1,219 1,473 World ($bn) 2024 2023 2022 The external environment presents both challenges and opportunities that require us to adapt, innovate and build trust. Global pharmaceutical sales In 2024, Established Markets1 saw an average revenue increase of 9.7% and Emerging Markets revenue grew by 9.7%. The US, China, Japan, Germany and France are the world’s top five pharmaceutical markets by 2023 sales. In 2024, the US had 51.8% (2023: 51.1%; 2022: 49.9%) of global sales, while China had around 7%. Data based on world market sales using AstraZeneca Market definitions as set out on page 240. Changes in data subscriptions, exchange rates and subscription coverage, as well as restated IQVIA data, have led to the restatement of total market values for prior years. Source: IQVIA, IQVIA Midas Quantum Q3 2024 (including US data). Reported values and growth are based on CER. Value figures are rounded to the nearest billion and growth percentages are rounded to the nearest tenth. We expect both developed and developing markets, including North America, Other (Non-EU) Europe, the Indian subcontinent and Latin America to fuel pharmaceutical growth. Market growth in China is expected to remain below historical levels at a compound annual growth rate of 2.6% (±1.5%). This is due to the continued slowdown of the major hospital sector. 1 Established Markets means US, Europe and Established RoW. 2 North America means US. 3 Non-EU countries; including the UK. 4 Commonwealth of Independent States; includes Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan and Uzbekistan and excludes Ukraine. $1,473bn(+9.7%) Estimated pharmaceutical sales 2028. Data is based on ex-manufacturer prices at CER. Source: IQVIA. Estimated pharmaceutical market growth. Data is based on the compound annual growth rate from 2023 to 2028. Source: IQVIA Market Prognosis Global 2023–2028. Other Europe3 $71.7bn 11.8% Japan $66.7bn 0.9% China $159.9bn 2.6% Oceania $18.1bn 3.3% Southeast and East Asia $222.0bn 3.6% Middle East $26.8bn 7.7% Africa $22.7bn 5.7% Indian subcontinent $37.8bn 9.4% CIS4 $28.9bn 6.8% EU $290.1bn 6.3% North America2 $853.1bn 8.2% Latin America $94.1bn 14.3% Estimated pharmaceutical sales and market growth to 2028 A growing pharmaceutical sector The pharmaceutical sector continues to grow against a backdrop of increasing demand for healthcare. Global pharmaceutical sales grew by 9.7% in 2024. Global healthcare spending is projected to increase at an annual rate of 7.4% from 2023 to 2028. Healthcare in a Changing World Strategic Report Corporate Governance Financial Statements Additional Information Healthcare in a Changing World AstraZeneca Annual Report & Form 20-F Information 2024 7 |

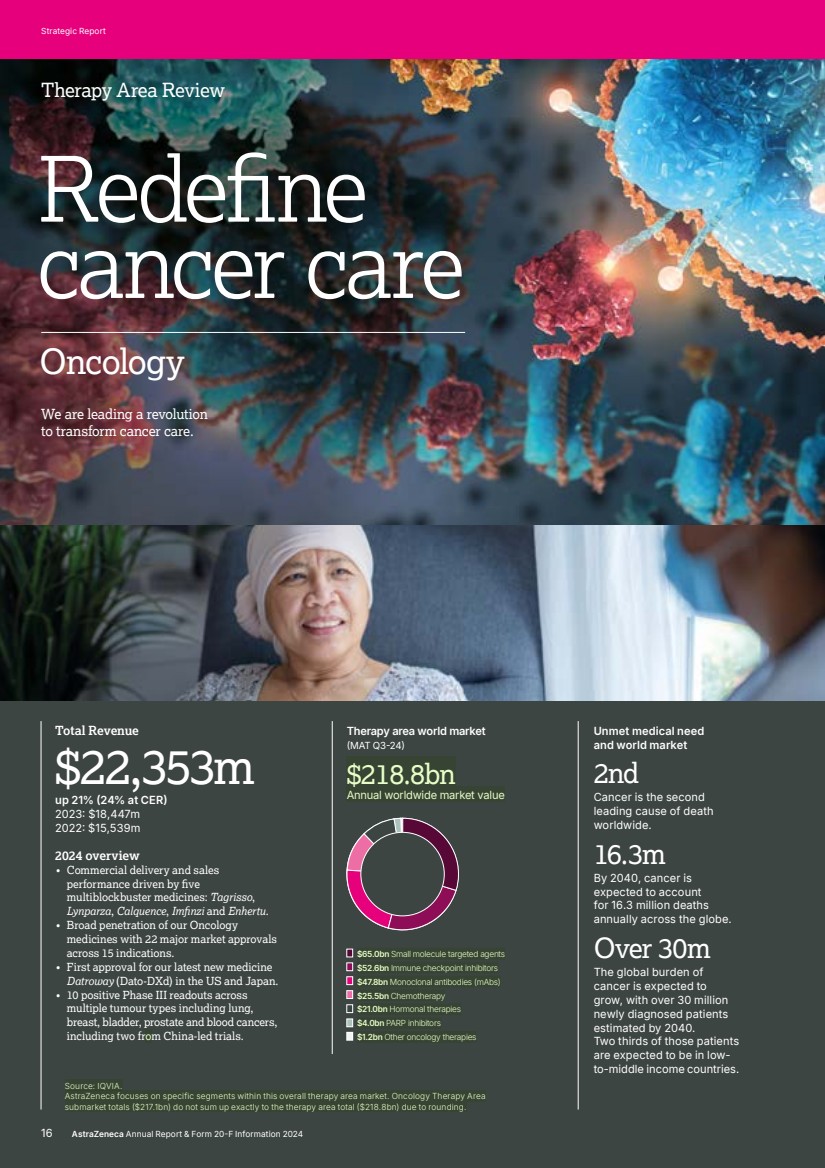

| Redefine cancer care Oncology Source: IQVIA. AstraZeneca focuses on specific segments within this overall therapy area market. Oncology Therapy Area submarket totals ($217.1bn) do not sum up exactly to the therapy area total ($218.8bn) due to rounding. 2024 overview • Commercial delivery and sales performance driven by five multiblockbuster medicines: Tagrisso, Lynparza, Calquence, Imfinzi and Enhertu. • Broad penetration of our Oncology medicines with 22 major market approvals across 15 indications. • First approval for our latest new medicine Datroway (Dato-DXd) in the US and Japan. • 10 positive Phase III readouts across multiple tumour types including lung, breast, bladder, prostate and blood cancers, including two from China-led trials. Total Revenue $22,353m up 21% (24% at CER) 2023: $18,447m 2022: $15,539m $65.0bn Small molecule targeted agents $52.6bn Immune checkpoint inhibitors $47.8bn Monoclonal antibodies (mAbs) $25.5bn Chemotherapy $21.0bn Hormonal therapies $4.0bn PARP inhibitors $1.2bn Other oncology therapies $218.8bn Annual worldwide market value Therapy area world market (MAT Q3-24) Therapy Area Review Unmet medical need and world market 2nd Cancer is the second leading cause of death worldwide. 16.3m By 2040, cancer is expected to account for 16.3 million deaths annually across the globe. Over 30m The global burden of cancer is expected to grow, with over 30 million newly diagnosed patients estimated by 2040. Two thirds of those patients are expected to be in low-to-middle income countries. We are leading a revolution to transform cancer care. 16 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report |

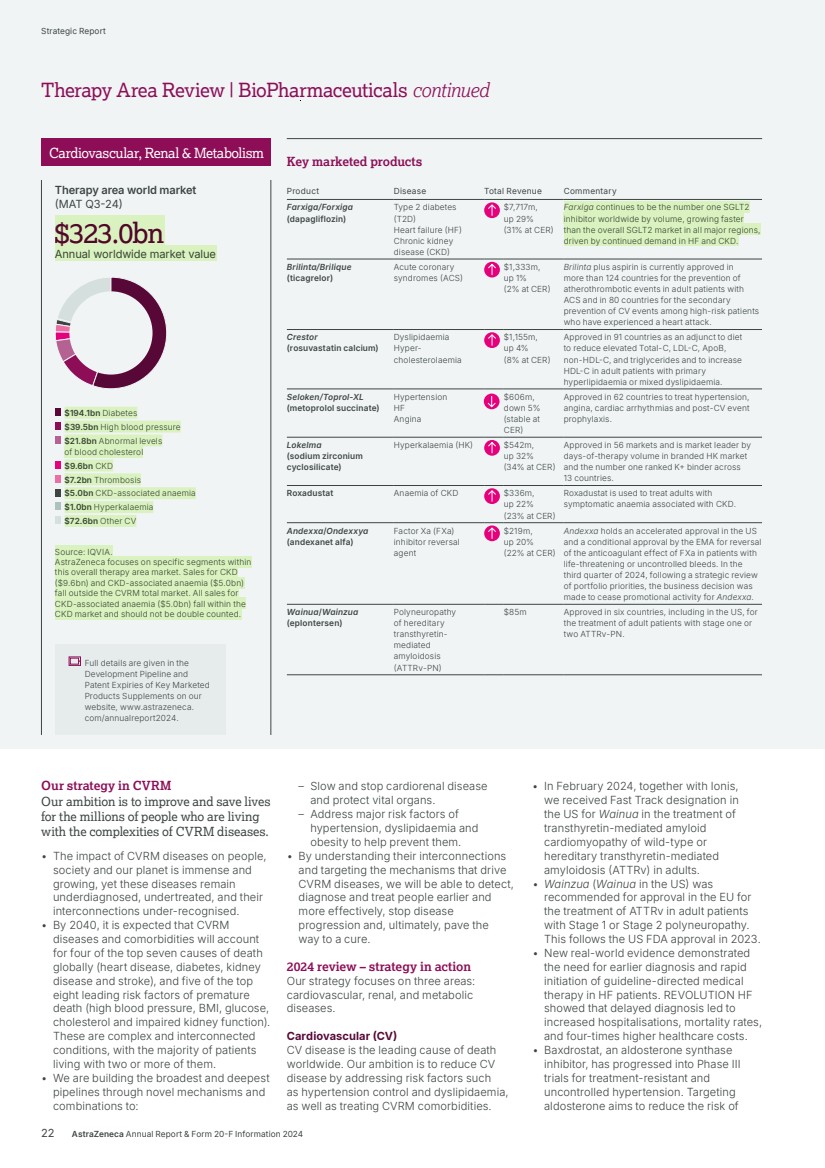

| $194.1bn Diabetes $39.5bn High blood pressure $21.8bn Abnormal levels of blood cholesterol $9.6bn CKD $7.2bn Thrombosis $5.0bn CKD-associated anaemia $1.0bn Hyperkalaemia $72.6bn Other CV $323.0bn $323.0bn Annual worldwide market value Therapy area world market (MAT Q3-24) Our strategy in CVRM Our ambition is to improve and save lives for the millions of people who are living with the complexities of CVRM diseases. • The impact of CVRM diseases on people, society and our planet is immense and growing, yet these diseases remain underdiagnosed, undertreated, and their interconnections under-recognised. • By 2040, it is expected that CVRM diseases and comorbidities will account for four of the top seven causes of death globally (heart disease, diabetes, kidney disease and stroke), and five of the top eight leading risk factors of premature death (high blood pressure, BMI, glucose, cholesterol and impaired kidney function). These are complex and interconnected conditions, with the majority of patients living with two or more of them. • We are building the broadest and deepest pipelines through novel mechanisms and combinations to: – Slow and stop cardiorenal disease and protect vital organs. – Address major risk factors of hypertension, dyslipidaemia and obesity to help prevent them. • By understanding their interconnections and targeting the mechanisms that drive CVRM diseases, we will be able to detect, diagnose and treat people earlier and more effectively, stop disease progression and, ultimately, pave the way to a cure. 2024 review – strategy in action Our strategy focuses on three areas: cardiovascular, renal, and metabolic diseases. Cardiovascular (CV) CV disease is the leading cause of death worldwide. Our ambition is to reduce CV disease by addressing risk factors such as hypertension control and dyslipidaemia, as well as treating CVRM comorbidities. • In February 2024, together with Ionis, we received Fast Track designation in the US for Wainua in the treatment of transthyretin-mediated amyloid cardiomyopathy of wild-type or hereditary transthyretin-mediated amyloidosis (ATTRv) in adults. • Wainzua (Wainua in the US) was recommended for approval in the EU for the treatment of ATTRv in adult patients with Stage 1 or Stage 2 polyneuropathy. This follows the US FDA approval in 2023. • New real-world evidence demonstrated the need for earlier diagnosis and rapid initiation of guideline-directed medical therapy in HF patients. REVOLUTION HF showed that delayed diagnosis led to increased hospitalisations, mortality rates, and four-times higher healthcare costs. • Baxdrostat, an aldosterone synthase inhibitor, has progressed into Phase III trials for treatment-resistant and uncontrolled hypertension. Targeting aldosterone aims to reduce the risk of Key marketed products Product Disease Total Revenue Commentary Farxiga/Forxiga (dapagliflozin) Type 2 diabetes (T2D) Heart failure (HF) Chronic kidney disease (CKD) $7,717m, up 29% (31% at CER) Farxiga continues to be the number one SGLT2 inhibitor worldwide by volume, growing faster than the overall SGLT2 market in all major regions, driven by continued demand in HF and CKD. Brilinta/Brilique (ticagrelor) Acute coronary syndromes (ACS) $1,333m, up 1% (2% at CER) Brilinta plus aspirin is currently approved in more than 124 countries for the prevention of atherothrombotic events in adult patients with ACS and in 80 countries for the secondary prevention of CV events among high-risk patients who have experienced a heart attack. Crestor (rosuvastatin calcium) Dyslipidaemia Hyper-cholesterolaemia $1,155m, up 4% (8% at CER) Approved in 91 countries as an adjunct to diet to reduce elevated Total-C, LDL-C, ApoB, non-HDL-C, and triglycerides and to increase HDL-C in adult patients with primary hyperlipidaemia or mixed dyslipidaemia. Seloken/Toprol-XL (metoprolol succinate) Hypertension HF Angina $606m, down 5% (stable at CER) Approved in 62 countries to treat hypertension, angina, cardiac arrhythmias and post-CV event prophylaxis. Lokelma (sodium zirconium cyclosilicate) Hyperkalaemia (HK) $542m, up 32% (34% at CER) Approved in 56 markets and is market leader by days-of-therapy volume in branded HK market and the number one ranked K+ binder across 13 countries. Roxadustat Anaemia of CKD $336m, up 22% (23% at CER) Roxadustat is used to treat adults with symptomatic anaemia associated with CKD. Andexxa/Ondexxya (andexanet alfa) Factor Xa (FXa) inhibitor reversal agent $219m, up 20% (22% at CER) Andexxa holds an accelerated approval in the US and a conditional approval by the EMA for reversal of the anticoagulant effect of FXa in patients with life-threatening or uncontrolled bleeds. In the third quarter of 2024, following a strategic review of portfolio priorities, the business decision was made to cease promotional activity for Andexxa. Wainua/Wainzua (eplontersen) Polyneuropathy of hereditary transthyretin-mediated amyloidosis (ATTRv-PN) $85m Approved in six countries, including in the US, for the treatment of adult patients with stage one or two ATTRv-PN. Source: IQVIA. AstraZeneca focuses on specific segments within this overall therapy area market. Sales for CKD ($9.6bn) and CKD-associated anaemia ($5.0bn) fall outside the CVRM total market. All sales for CKD-associated anaemia ($5.0bn) fall within the CKD market and should not be double counted. Full details are given in the Development Pipeline and Patent Expiries of Key Marketed Products Supplements on our website, www.astrazeneca. com/annualreport2024. Cardiovascular, Renal & Metabolism 22 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report Therapy Area Review | BioPharmaceuticals continued |

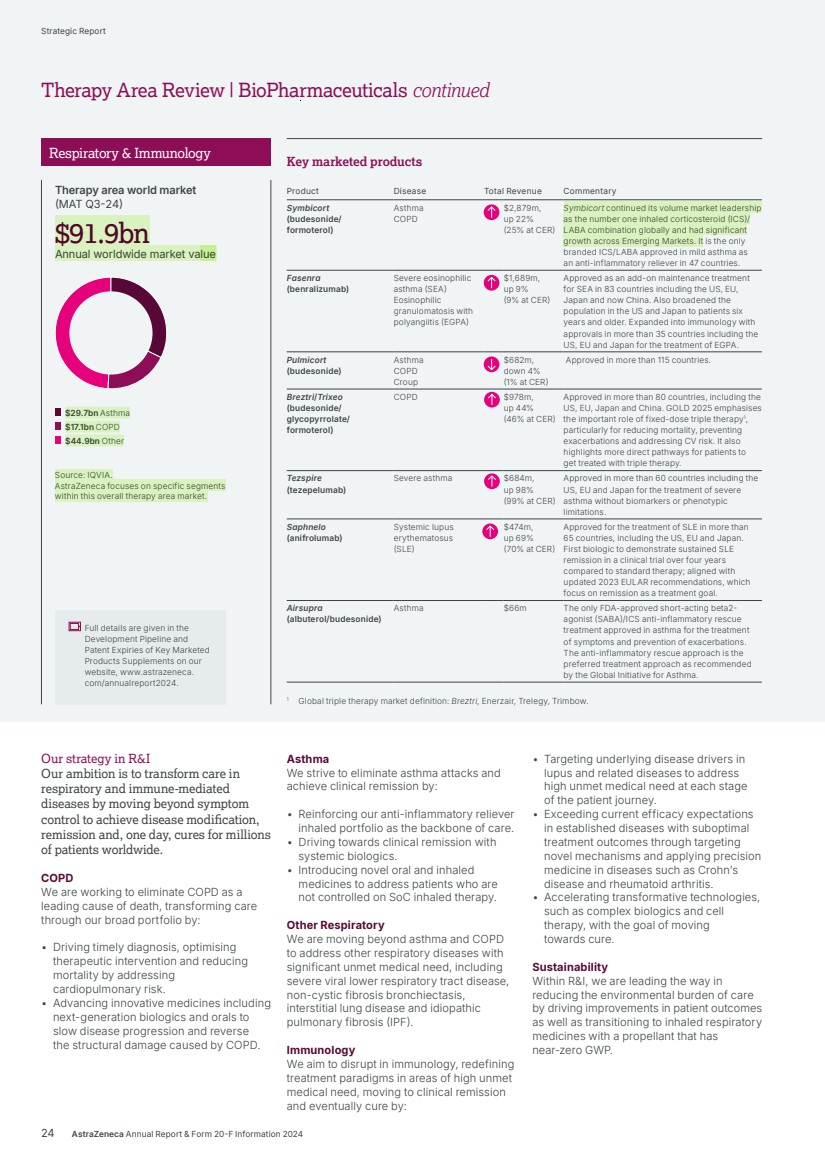

| $29.7bn Asthma $17.1bn COPD $44.9bn Other $91.9bn $91.9bn Annual worldwide market value Therapy area world market (MAT Q3-24) Our strategy in R&I Our ambition is to transform care in respiratory and immune-mediated diseases by moving beyond symptom control to achieve disease modification, remission and, one day, cures for millions of patients worldwide. COPD We are working to eliminate COPD as a leading cause of death, transforming care through our broad portfolio by: • Driving timely diagnosis, optimising therapeutic intervention and reducing mortality by addressing cardiopulmonary risk. • Advancing innovative medicines including next-generation biologics and orals to slow disease progression and reverse the structural damage caused by COPD. Asthma We strive to eliminate asthma attacks and achieve clinical remission by: • Reinforcing our anti-inflammatory reliever inhaled portfolio as the backbone of care. • Driving towards clinical remission with systemic biologics. • Introducing novel oral and inhaled medicines to address patients who are not controlled on SoC inhaled therapy. Other Respiratory We are moving beyond asthma and COPD to address other respiratory diseases with significant unmet medical need, including severe viral lower respiratory tract disease, non-cystic fibrosis bronchiectasis, interstitial lung disease and idiopathic pulmonary fibrosis (IPF). Immunology We aim to disrupt in immunology, redefining treatment paradigms in areas of high unmet medical need, moving to clinical remission and eventually cure by: • Targeting underlying disease drivers in lupus and related diseases to address high unmet medical need at each stage of the patient journey. • Exceeding current efficacy expectations in established diseases with suboptimal treatment outcomes through targeting novel mechanisms and applying precision medicine in diseases such as Crohn’s disease and rheumatoid arthritis. • Accelerating transformative technologies, such as complex biologics and cell therapy, with the goal of moving towards cure. Sustainability Within R&I, we are leading the way in reducing the environmental burden of care by driving improvements in patient outcomes as well as transitioning to inhaled respiratory medicines with a propellant that has near-zero GWP. Key marketed products Product Disease Total Revenue Commentary Symbicort (budesonide/ formoterol) Asthma COPD $2,879m, up 22% (25% at CER) Symbicort continued its volume market leadership as the number one inhaled corticosteroid (ICS)/ LABA combination globally and had significant growth across Emerging Markets. It is the only branded ICS/LABA approved in mild asthma as an anti-inflammatory reliever in 47 countries. Fasenra (benralizumab) Severe eosinophilic asthma (SEA) Eosinophilic granulomatosis with polyangiitis (EGPA) $1,689m, up 9% (9% at CER) Approved as an add-on maintenance treatment for SEA in 83 countries including the US, EU, Japan and now China. Also broadened the population in the US and Japan to patients six years and older. Expanded into immunology with approvals in more than 35 countries including the US, EU and Japan for the treatment of EGPA. Pulmicort (budesonide) Asthma COPD Croup $682m, down 4% (1% at CER) Approved in more than 115 countries. Breztri/Trixeo (budesonide/ glycopyrrolate/ formoterol) COPD $978m, up 44% (46% at CER) Approved in more than 80 countries, including the US, EU, Japan and China. GOLD 2025 emphasises the important role of fixed-dose triple therapy1 , particularly for reducing mortality, preventing exacerbations and addressing CV risk. It also highlights more direct pathways for patients to get treated with triple therapy. Tezspire (tezepelumab) Severe asthma $684m, up 98% (99% at CER) Approved in more than 60 countries including the US, EU and Japan for the treatment of severe asthma without biomarkers or phenotypic limitations. Saphnelo (anifrolumab) Systemic lupus erythematosus (SLE) $474m, up 69% (70% at CER) Approved for the treatment of SLE in more than 65 countries, including the US, EU and Japan. First biologic to demonstrate sustained SLE remission in a clinical trial over four years compared to standard therapy; aligned with updated 2023 EULAR recommendations, which focus on remission as a treatment goal. Airsupra (albuterol/budesonide) Asthma $66m The only FDA-approved short-acting beta2- agonist (SABA)/ICS anti-inflammatory rescue treatment approved in asthma for the treatment of symptoms and prevention of exacerbations. The anti-inflammatory rescue approach is the preferred treatment approach as recommended by the Global Initiative for Asthma. 1 Global triple therapy market definition: Breztri, Enerzair, Trelegy, Trimbow. Source: IQVIA. AstraZeneca focuses on specific segments within this overall therapy area market. Full details are given in the Development Pipeline and Patent Expiries of Key Marketed Products Supplements on our website, www.astrazeneca. com/annualreport2024. Respiratory & Immunology 24 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report Therapy Area Review | BioPharmaceuticals continued |

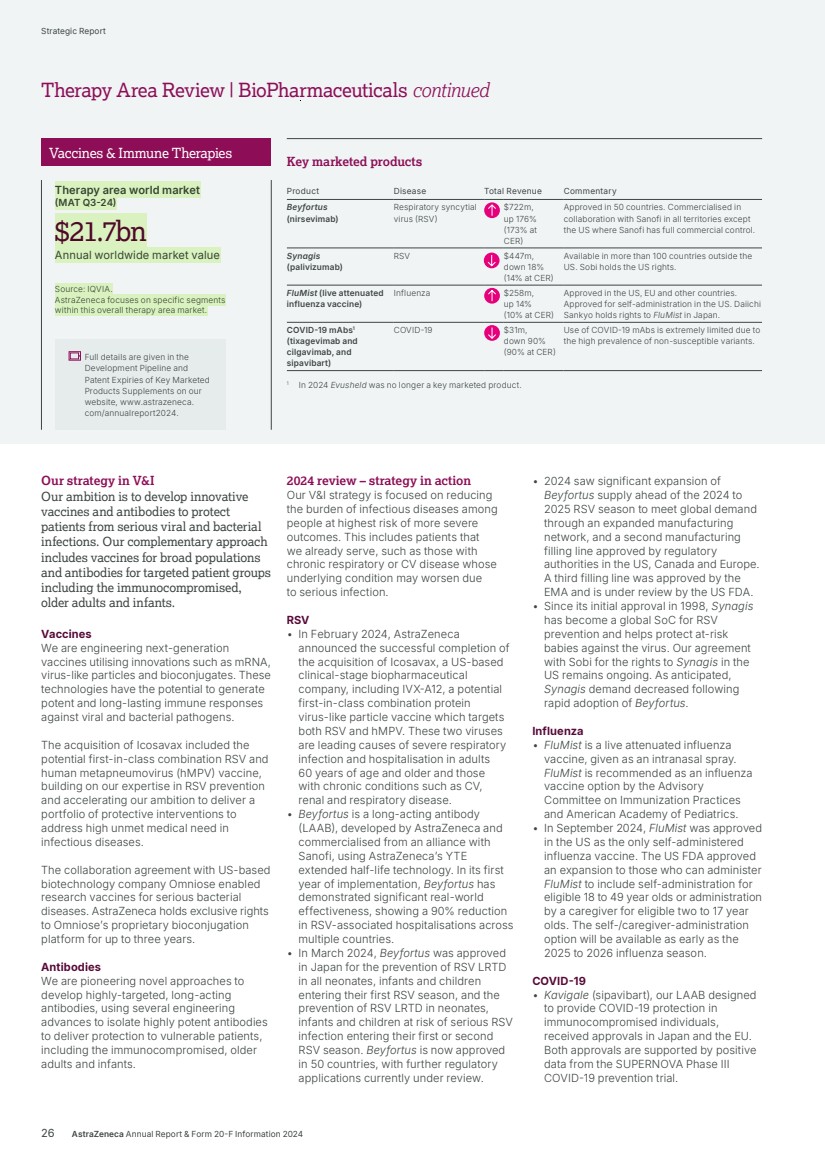

| Key marketed products Product Disease Total Revenue Commentary Beyfortus (nirsevimab) Respiratory syncytial virus (RSV) $722m, up 176% (173% at CER) Approved in 50 countries. Commercialised in collaboration with Sanofi in all territories except the US where Sanofi has full commercial control. Synagis (palivizumab) RSV $447m, down 18% (14% at CER) Available in more than 100 countries outside the US. Sobi holds the US rights. FluMist (live attenuated influenza vaccine) Influenza $258m, up 14% (10% at CER) Approved in the US, EU and other countries. Approved for self-administration in the US. Daiichi Sankyo holds rights to FluMist in Japan. COVID-19 mAbs1 (tixagevimab and cilgavimab, and sipavibart) COVID-19 $31m, down 90% (90% at CER) Use of COVID-19 mAbs is extremely limited due to the high prevalence of non-susceptible variants. 1 In 2024 Evusheld was no longer a key marketed product. Source: IQVIA. AstraZeneca focuses on specific segments within this overall therapy area market. Therapy area world market (MAT Q3-24) $21.7bn Annual worldwide market value 26 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report Our strategy in V&I Our ambition is to develop innovative vaccines and antibodies to protect patients from serious viral and bacterial infections. Our complementary approach includes vaccines for broad populations and antibodies for targeted patient groups including the immunocompromised, older adults and infants. Vaccines We are engineering next-generation vaccines utilising innovations such as mRNA, virus-like particles and bioconjugates. These technologies have the potential to generate potent and long-lasting immune responses against viral and bacterial pathogens. The acquisition of Icosavax included the potential first-in-class combination RSV and human metapneumovirus (hMPV) vaccine, building on our expertise in RSV prevention and accelerating our ambition to deliver a portfolio of protective interventions to address high unmet medical need in infectious diseases. The collaboration agreement with US-based biotechnology company Omniose enabled research vaccines for serious bacterial diseases. AstraZeneca holds exclusive rights to Omniose’s proprietary bioconjugation platform for up to three years. Antibodies We are pioneering novel approaches to develop highly-targeted, long-acting antibodies, using several engineering advances to isolate highly potent antibodies to deliver protection to vulnerable patients, including the immunocompromised, older adults and infants. 2024 review – strategy in action Our V&I strategy is focused on reducing the burden of infectious diseases among people at highest risk of more severe outcomes. This includes patients that we already serve, such as those with chronic respiratory or CV disease whose underlying condition may worsen due to serious infection. RSV • In February 2024, AstraZeneca announced the successful completion of the acquisition of Icosavax, a US-based clinical-stage biopharmaceutical company, including IVX-A12, a potential first-in-class combination protein virus-like particle vaccine which targets both RSV and hMPV. These two viruses are leading causes of severe respiratory infection and hospitalisation in adults 60 years of age and older and those with chronic conditions such as CV, renal and respiratory disease. • Beyfortus is a long-acting antibody (LAAB), developed by AstraZeneca and commercialised from an alliance with Sanofi, using AstraZeneca’s YTE extended half-life technology. In its first year of implementation, Beyfortus has demonstrated significant real-world effectiveness, showing a 90% reduction in RSV-associated hospitalisations across multiple countries. • In March 2024, Beyfortus was approved in Japan for the prevention of RSV LRTD in all neonates, infants and children entering their first RSV season, and the prevention of RSV LRTD in neonates, infants and children at risk of serious RSV infection entering their first or second RSV season. Beyfortus is now approved in 50 countries, with further regulatory applications currently under review. • 2024 saw significant expansion of Beyfortus supply ahead of the 2024 to 2025 RSV season to meet global demand through an expanded manufacturing network, and a second manufacturing filling line approved by regulatory authorities in the US, Canada and Europe. A third filling line was approved by the EMA and is under review by the US FDA. • Since its initial approval in 1998, Synagis has become a global SoC for RSV prevention and helps protect at-risk babies against the virus. Our agreement with Sobi for the rights to Synagis in the US remains ongoing. As anticipated, Synagis demand decreased following rapid adoption of Beyfortus. Influenza • FluMist is a live attenuated influenza vaccine, given as an intranasal spray. FluMist is recommended as an influenza vaccine option by the Advisory Committee on Immunization Practices and American Academy of Pediatrics. • In September 2024, FluMist was approved in the US as the only self-administered influenza vaccine. The US FDA approved an expansion to those who can administer FluMist to include self-administration for eligible 18 to 49 year olds or administration by a caregiver for eligible two to 17 year olds. The self-/caregiver-administration option will be available as early as the 2025 to 2026 influenza season. COVID-19 • Kavigale (sipavibart), our LAAB designed to provide COVID-19 protection in immunocompromised individuals, received approvals in Japan and the EU. Both approvals are supported by positive data from the SUPERNOVA Phase III COVID-19 prevention trial. Full details are given in the Development Pipeline and Patent Expiries of Key Marketed Products Supplements on our website, www.astrazeneca. com/annualreport2024. Vaccines & Immune Therapies Therapy Area Review | BioPharmaceuticals continued |

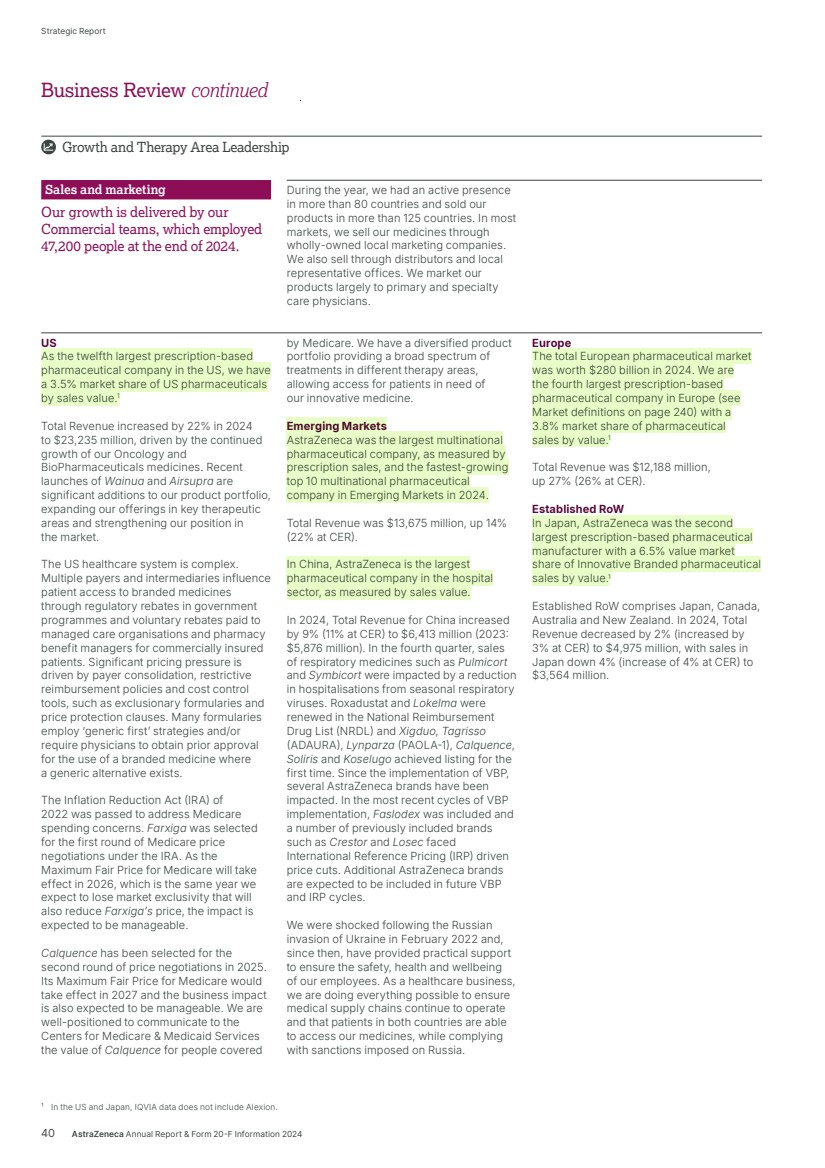

| Sales and marketing Our growth is delivered by our Commercial teams, which employed 47,200 people at the end of 2024. During the year, we had an active presence in more than 80 countries and sold our products in more than 125 countries. In most markets, we sell our medicines through wholly-owned local marketing companies. We also sell through distributors and local representative offices. We market our products largely to primary and specialty care physicians. Growth and Therapy Area Leadership US As the twelfth largest prescription-based pharmaceutical company in the US, we have a 3.5% market share of US pharmaceuticals by sales value.1 Total Revenue increased by 22% in 2024 to $23,235 million, driven by the continued growth of our Oncology and BioPharmaceuticals medicines. Recent launches of Wainua and Airsupra are significant additions to our product portfolio, expanding our offerings in key therapeutic areas and strengthening our position in the market. The US healthcare system is complex. Multiple payers and intermediaries influence patient access to branded medicines through regulatory rebates in government programmes and voluntary rebates paid to managed care organisations and pharmacy benefit managers for commercially insured patients. Significant pricing pressure is driven by payer consolidation, restrictive reimbursement policies and cost control tools, such as exclusionary formularies and price protection clauses. Many formularies employ ‘generic first’ strategies and/or require physicians to obtain prior approval for the use of a branded medicine where a generic alternative exists. The Inflation Reduction Act (IRA) of 2022 was passed to address Medicare spending concerns. Farxiga was selected for the first round of Medicare price negotiations under the IRA. As the Maximum Fair Price for Medicare will take effect in 2026, which is the same year we expect to lose market exclusivity that will also reduce Farxiga’s price, the impact is expected to be manageable. Calquence has been selected for the second round of price negotiations in 2025. Its Maximum Fair Price for Medicare would take effect in 2027 and the business impact is also expected to be manageable. We are well-positioned to communicate to the Centers for Medicare & Medicaid Services the value of Calquence for people covered by Medicare. We have a diversified product portfolio providing a broad spectrum of treatments in different therapy areas, allowing access for patients in need of our innovative medicine. Emerging Markets AstraZeneca was the largest multinational pharmaceutical company, as measured by prescription sales, and the fastest-growing top 10 multinational pharmaceutical company in Emerging Markets in 2024. Total Revenue was $13,675 million, up 14% (22% at CER). In China, AstraZeneca is the largest pharmaceutical company in the hospital sector, as measured by sales value. In 2024, Total Revenue for China increased by 9% (11% at CER) to $6,413 million (2023: $5,876 million). In the fourth quarter, sales of respiratory medicines such as Pulmicort and Symbicort were impacted by a reduction in hospitalisations from seasonal respiratory viruses. Roxadustat and Lokelma were renewed in the National Reimbursement Drug List (NRDL) and Xigduo, Tagrisso (ADAURA), Lynparza (PAOLA-1), Calquence, Soliris and Koselugo achieved listing for the first time. Since the implementation of VBP, several AstraZeneca brands have been impacted. In the most recent cycles of VBP implementation, Faslodex was included and a number of previously included brands such as Crestor and Losec faced International Reference Pricing (IRP) driven price cuts. Additional AstraZeneca brands are expected to be included in future VBP and IRP cycles. We were shocked following the Russian invasion of Ukraine in February 2022 and, since then, have provided practical support to ensure the safety, health and wellbeing of our employees. As a healthcare business, we are doing everything possible to ensure medical supply chains continue to operate and that patients in both countries are able to access our medicines, while complying with sanctions imposed on Russia. Europe The total European pharmaceutical market was worth $280 billion in 2024. We are the fourth largest prescription-based pharmaceutical company in Europe (see Market definitions on page 240) with a 3.8% market share of pharmaceutical sales by value.1 Total Revenue was $12,188 million, up 27% (26% at CER). Established RoW In Japan, AstraZeneca was the second largest prescription-based pharmaceutical manufacturer with a 6.5% value market share of Innovative Branded pharmaceutical sales by value.1 Established RoW comprises Japan, Canada, Australia and New Zealand. In 2024, Total Revenue decreased by 2% (increased by 3% at CER) to $4,975 million, with sales in Japan down 4% (increase of 4% at CER) to $3,564 million. ¹ In the US and Japan, IQVIA data does not include Alexion. 40 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report Business Review continued |

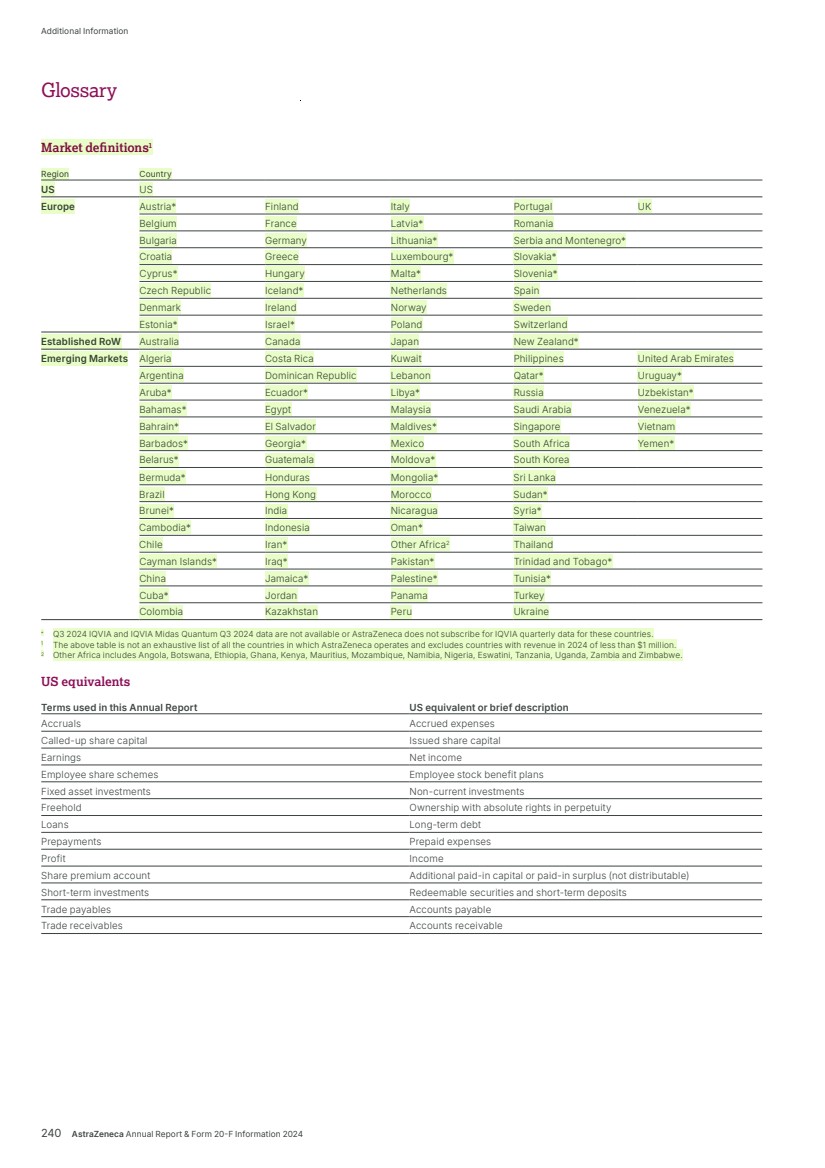

| Market definitions1 Region Country US US Europe Austria* Finland Italy Portugal UK Belgium France Latvia* Romania Bulgaria Germany Lithuania* Serbia and Montenegro* Croatia Greece Luxembourg* Slovakia* Cyprus* Hungary Malta* Slovenia* Czech Republic Iceland* Netherlands Spain Denmark Ireland Norway Sweden Estonia* Israel* Poland Switzerland Established RoW Australia Canada Japan New Zealand* Emerging Markets Algeria Costa Rica Kuwait Philippines United Arab Emirates Argentina Dominican Republic Lebanon Qatar* Uruguay* Aruba* Ecuador* Libya* Russia Uzbekistan* Bahamas* Egypt Malaysia Saudi Arabia Venezuela* Bahrain* El Salvador Maldives* Singapore Vietnam Barbados* Georgia* Mexico South Africa Yemen* Belarus* Guatemala Moldova* South Korea Bermuda* Honduras Mongolia* Sri Lanka Brazil Hong Kong Morocco Sudan* Brunei* India Nicaragua Syria* Cambodia* Indonesia Oman* Taiwan Chile Iran* Other Africa2 Thailand Cayman Islands* Iraq* Pakistan* Trinidad and Tobago* China Jamaica* Palestine* Tunisia* Cuba* Jordan Panama Turkey Colombia Kazakhstan Peru Ukraine * Q3 2024 IQVIA and IQVIA Midas Quantum Q3 2024 data are not available or AstraZeneca does not subscribe for IQVIA quarterly data for these countries. 1 The above table is not an exhaustive list of all the countries in which AstraZeneca operates and excludes countries with revenue in 2024 of less than $1 million. 2 Other Africa includes Angola, Botswana, Ethiopia, Ghana, Kenya, Mauritius, Mozambique, Namibia, Nigeria, Eswatini, Tanzania, Uganda, Zambia and Zimbabwe. US equivalents Terms used in this Annual Report US equivalent or brief description Accruals Accrued expenses Called-up share capital Issued share capital Earnings Net income Employee share schemes Employee stock benefit plans Fixed asset investments Non-current investments Freehold Ownership with absolute rights in perpetuity Loans Long-term debt Prepayments Prepaid expenses Profit Income Share premium account Additional paid-in capital or paid-in surplus (not distributable) Short-term investments Redeemable securities and short-term deposits Trade payables Accounts payable Trade receivables Accounts receivable 240 AstraZeneca Annual Report & Form 20-F Information 2024 Additional Information Glossary |

| • the risk of failure to collect and manage data and AI in line with legal and regulatory requirements and strategic objectives • the risk of failure to attract, develop, engage and retain a diverse, talented and capable workforce • the risk of failure to meet our sustainability targets, regulatory requirements or stakeholder expectations with respect to the environment • the risk of the safety and efficacy of marketed medicines being questioned • the risk of adverse outcome of litigation and/or governmental investigations • intellectual property-related risks to the Group’s products • the risk of failure to achieve strategic plans or meet targets or expectations • the risk of failure in financial control or the occurrence of fraud • the risk of unexpected deterioration in the Group’s financial position • the impact that global and/or geopolitical events may have or continue to have on these risks, on the Group’s ability to continue to mitigate these risks, and on the Group’s operations, financial results or financial condition. Certain of these factors are discussed in more detail, without limitation, in the Risk Supplement available on our website, www.astrazeneca.com/annualreport2024, and reproduced in AstraZeneca’s Form 20-F filing for 2024, available on the SEC website www.sec.gov. Nothing in this Annual Report should be construed as a profit forecast. Inclusion of Reported performance, Core financial measures and constant exchange rate growth rates AstraZeneca’s determination of non-GAAP measures, together with our presentation of them within our financial information, may differ from similarly titled non-GAAP measures of other companies. Statements of competitive position, growth rates and sales In this Annual Report, except as otherwise stated, market information regarding the position of our business or products relative to its or their competition is based upon published statistical sales data for the 12 months ended 30 September 2024 obtained from IQVIA, a leading supplier of statistical data to the pharmaceutical industry. Unless otherwise noted, for the US, dispensed new or total prescription data and audited sales data are taken, respectively, from IQVIA National Prescription Audit and IQVIA National Sales Perspectives for the 12 months ended 30 September 2024; such data are not adjusted for Medicaid and similar rebates. Except as otherwise stated, these market share and industry data from IQVIA have been derived by comparing our sales revenue with competitors’ and total market sales revenues for that period, and except as otherwise stated, growth rates are given at CER. For the purposes of this Annual Report, unless otherwise stated, references to the world pharmaceutical market or similar phrases are to the 58 countries contained in the IQVIA database, which amounted to approximately 95% (in value) of the countries audited by IQVIA. Changes in data subscriptions, exchange rates and subscription coverage, as well as restated IQVIA data, have led to the restatement of total market values for prior years. AstraZeneca websites Information on or information accessible through our websites, including www.astrazeneca.com, www.astrazenecaclinicaltrials.com and on any websites referenced in this Annual Report, does not form part of and is not incorporated into this Annual Report. External/third-party websites Information on or information accessible through any third-party or external website does not form part of and is not incorporated into this Annual Report. Figures Figures in parentheses in tables and in the Financial Statements are used to represent negative numbers. Supplements For detailed information on our Development Pipeline, Patent Expiries of Key Marketed Products and Risk, see our website, www.astrazeneca.com/ annualreport2024. Cautionary statement regarding forward‑looking statements The purpose of this Annual Report is to provide information to the members of the Company. The Company and its Directors, employees, agents and advisers do not accept or assume responsibility for any other person to whom this Annual Report is shown or into whose hands it may come and any such responsibility or liability is expressly disclaimed. In order, among other things, to utilise the ‘safe harbour’ provisions of the US Private Securities Litigation Reform Act of 1995 and the UK Companies Act 2006, we are providing the following cautionary statement: This Annual Report contains certain forward-looking statements with respect to the operations, performance and financial condition of the Group, including, among other things, statements about expected revenues, margins, earnings per share or other financial or other measures. Forward-looking statements are statements relating to the future which are based on information available at the time such statements are made, including information relating to risks and uncertainties. Although we believe that the forward-looking statements in this Annual Report are based on reasonable assumptions, the matters discussed in the forward-looking statements may be influenced by factors that could cause actual outcomes and results to be materially different from those predicted. The forward-looking statements reflect knowledge and information available at the date of the preparation of this Annual Report and the Company undertakes no obligation to update these forward-looking statements. We identify the forward-looking statements by using the words ‘anticipates’, ‘believes’, ‘expects’, ‘intends’ and similar expressions in such statements. Important factors that could cause actual results to differ materially from those contained in forward-looking statements, certain of which are beyond our control, include, among other things: • the risk of failure or delay in delivery of pipeline or launch of new medicines • the risk of failure to meet regulatory or ethical requirements for medicine development or approval • the risk of failures or delays in the quality or execution of the Group’s commercial strategies • the risk of pricing, affordability, access and competitive pressures • the risk of failure to maintain supply of compliant, quality medicines • the risk of illegal trade in our Group’s medicines • the impact of reliance on third-party goods and services • the risk of failure in IT or cybersecurity • the risk of failure of critical processes 244 AstraZeneca Annual Report & Form 20-F Information 2024 Additional Information Important information for readers of this Annual Report |