| EUROPE-LEGAL-299657840/1 106322-0233 AstraZeneca PLC Legal & Secretary’s Department 1 Francis Crick Avenue Cambridge Biomedical Campus Cambridge CB2 0AA For the attention of Adrian Kemp By email & by post February 18, 2025 Dear Ladies and Gentlemen BUREAU VERITAS STATEMENT OF ASSURANCE FOR ANNUAL REPORT AND FORM 20-F INFORMATION 2024 In connection with the anticipated filing by AstraZeneca PLC (“AstraZeneca”) of a Form 20-F with the U.S. Securities and Exchange Commission, Bureau Veritas hereby authorizes AstraZeneca to refer to Bureau Veritas’s external assurance on corporate responsibility related information as stated on page 233 and identified (highlighted in yellow) on the pages of the Annual Report and Form 20-F Information for the fiscal year ended December 31, 2024 (the “Annual Report”) annexed as Annex A, each of which is incorporated by reference in the registration statement No. 333-253315 on Form F-4 for AstraZeneca, in the registration statement No. 333-278067 for AstraZeneca on Form F-3, and in the registration statements No. 333-277197, No. 333-240298, No. 333-226830, No. 333-21 6901, No. 333-170381, No. 333-152767, No. 333-124689 and No. 333-09062 on Form S-8 for AstraZeneca. Our authorization is subject to AstraZeneca’s acknowledgement and agreement that: 1) Bureau Veritas has undertaken an independent review of the corporate responsibility information disclosed in the Annual Report and provided an opinion as to the accuracy and reliability of the information subject to the scope, objectives and limitations defined in the full assurance statement posted on AstraZeneca’s responsibility website; 2) AstraZeneca acknowledges and agrees that Bureau Veritas shall not be deemed an “Expert” in respect of AstraZeneca’s securities filings, and AstraZeneca agrees that it shall not characterize Bureau Veritas as such; and 3) AstraZeneca accepts full responsibility for the disclosure of all information and data, including that relating to Bureau Veritas, set forth in the Annual Report as filed with the SEC and agrees to indemnify Bureau Veritas from any third party claims that may arise therefrom. |

| EUROPE-LEGAL-299657840/1 106322-0233 Please indicate your agreement to the foregoing by signing in the space indicated below. Our authorization will not become effective until accepted and agreed by AstraZeneca. Very truly yours, /s/ D Murray Name: David Murray Title: Sustainability Services Manager. For and on behalf of Bureau Veritas U.K. Ltd ACCEPTED AND AGREED This 18th day of February 2025 AstraZeneca PLC /s/ Adrian Kemp Name: Adrian Kemp Title: Company Secretary |

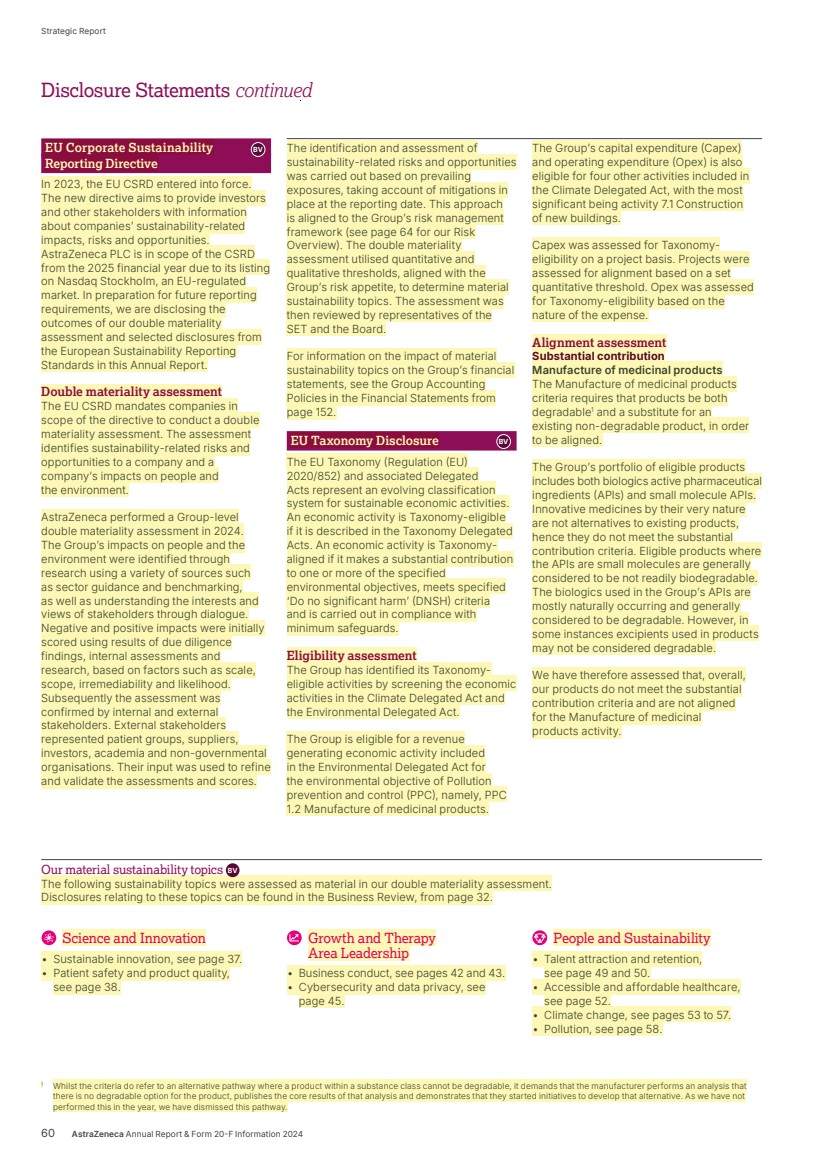

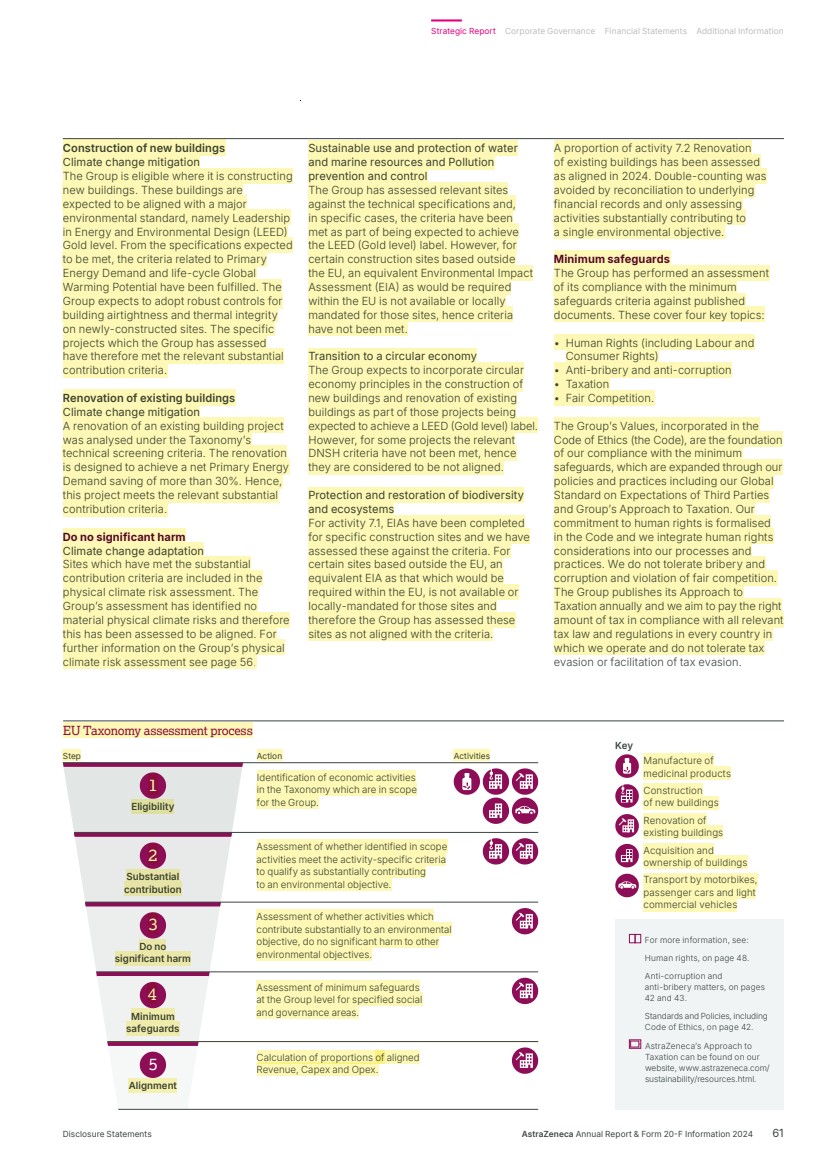

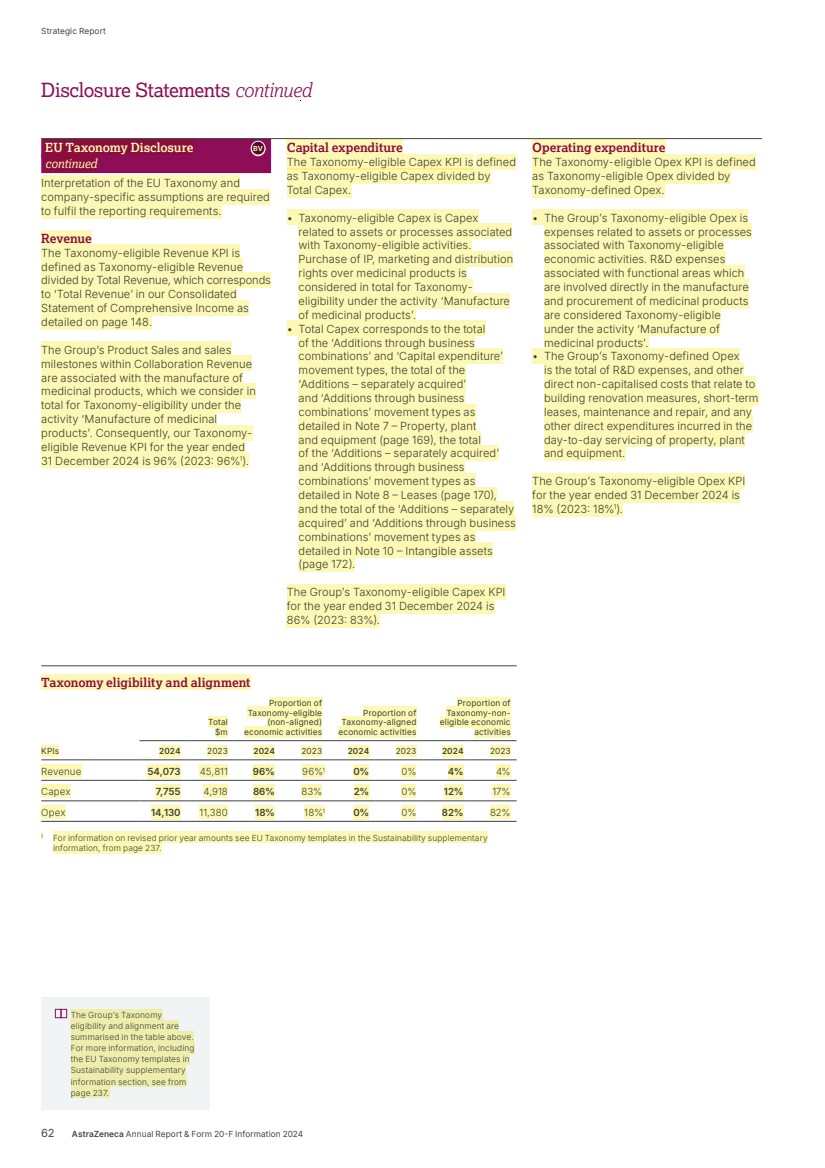

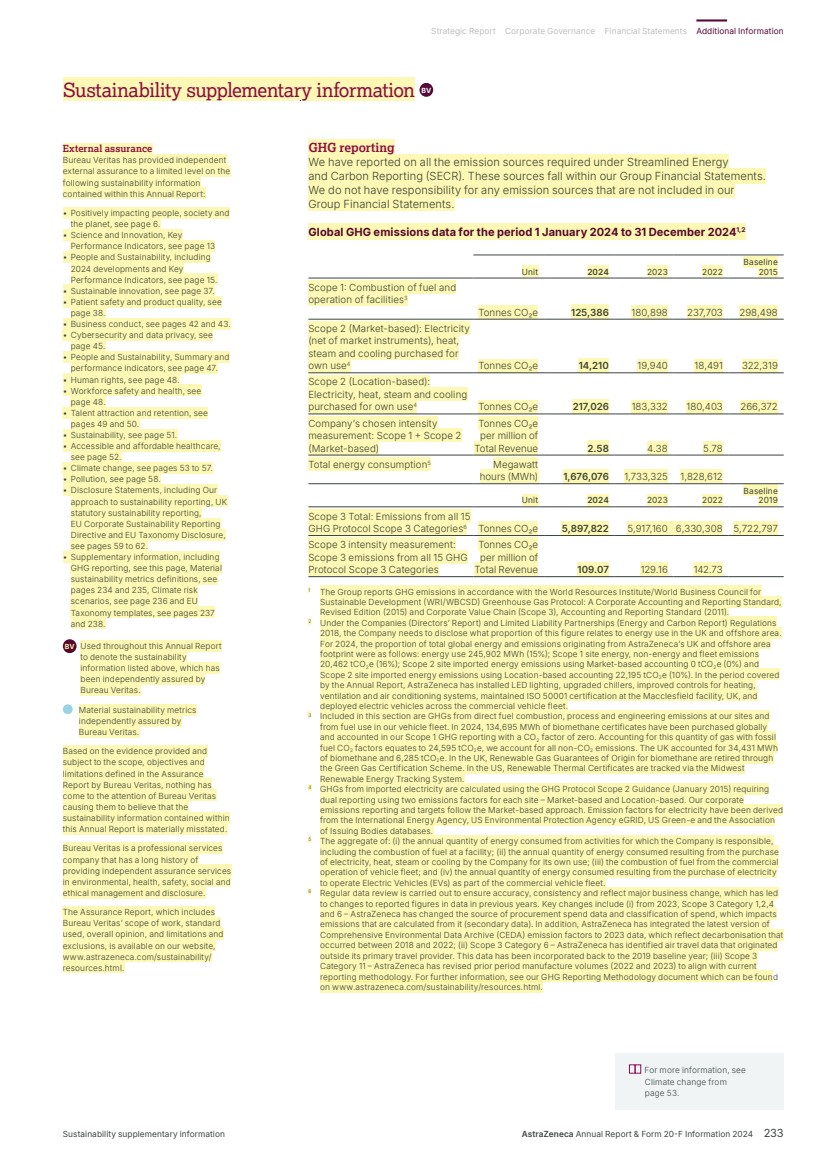

| Our strategic priorities Our priorities reflect how we are working to deliver our Growth Through Innovation strategy and achieve our Purpose of pushing the boundaries of science to deliver life‑changing medicines. 1. Science and Innovation 2. Growth and Therapy Area Leadership 3. People and Sustainability Science and innovation-led We invest in new technologies and modalities to deliver the next wave of pipeline innovation and life-changing medicines. 191 projects in our development pipeline1 19 new molecular entities (NMEs) in our late-stage pipeline 130 NME or major life-cycle management (LCM) projects in Phase II and Phase III $13.6bn invested in our science 1 Includes NME and major LCM projects up to launch in all applicable major markets. Leading in our therapy areas We focus on areas where we can transform patient outcomes through novel medicines and combinations. Total Revenue by therapy area2 $22.4bn, 41% Oncology $21.9bn, 40% BioPharmaceuticals $8.8bn, 16% Rare Disease $1.1bn, 2% Other Medicines Total Revenue $54.1bn $54.1bn $45.8bn $44.4bn 2024 2023 2022 2 Due to rounding, the sum of subtotals and percentages may not agree to totals. Diversified portfolio and global reach We deliver a diversified portfolio of medicines across primary care, specialty care and rare diseases through our broad-based network and increasing presence in emerging markets. Total Revenue by reporting region $23.2bn, 43% $13.7bn, 25% $12.2bn, 23% $5.0bn, 9% Total Revenue growth by reporting region3 22% 14% 27% -2% 3 Actual growth percentage. Positively impacting the health of people, society and the planet BV We operate responsibly, harnessing the power of science and innovation, and our global reach, to help build a healthier, more sustainable future. 90.5m people reached by our access to healthcare programmes 77.5% reduction in Scope 1 and 2 GHG emissions since 2015 Rating of AA in the MSCI ESG Ratings assessment Ranked in the top five of the Access to Medicine Index 2024 Key US Emerging Markets Europe Established Rest of World 6 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report AstraZeneca at a Glance We are a global, science-led, patient-focused pharmaceutical company. We are dedicated to transforming the future of healthcare by unlocking the power of what science can do for people, society and the planet. |

| 241 302 293 241 241 Pipeline progression events 2024 2023 2022 2024 2023 2022 741 562 723 741 74 1 Regulatory events 1 The target of 20 reflects medicines approved since October 2022 and replaces the goal of delivering 15 new medicines between 2023 and 2030 referred to in our 2023 annual report. Three NME approvals 74 regulatory events 24 pipeline progression events 191 projects included in our pipeline, of which 169 are in the clinical phase of development 19 NME projects in pivotal trials or under regulatory review covering 29 indications 17 projects were discontinued 2024 developments For more information, see: Research & Development from page 34 of the Business Review. AI from page 44 of the Business Review. 2024 Group scorecard assessment on page 121 for performance against the Group scorecard. Key Performance Indicators BV Our science measures incentivise the development of NMEs and the maximisation of the potential of existing medicines. Pipeline progression events (Phase II NME starts/progressions and Phase III investment decisions) measure innovation and sustainability. Regulatory events (regulatory submissions and approvals) demonstrate the advancement of this innovation to patients and the value to the Group. 1 24 against our Group scorecard for determining annual bonus. 2 30 against our Group scorecard for determining annual bonus. 3 25 against our Group scorecard for determining annual bonus. 1 52 against our Group scorecard for determining annual bonus. 2 46 against our Group scorecard for determining annual bonus. 3 50 against our Group scorecard for determining annual bonus. Accelerate platform of therapeutic modalities By harnessing innovation from around the world, we are pioneering new ways of targeting the drivers of disease and accelerating promising therapeutic modalities, including novel radioconjugates, cell therapy and genomic medicines. This breadth of research and clinical development exemplifies the diversity of approaches and technologies we are applying across our growing pipeline, alongside pipeline combinations that strengthen our therapy area leadership. Transform R&D ways of working We are transforming processes, data and how we work across R&D and reimagining patient recruitment and retention to help meet our portfolio ambition and deliver medicines to patients faster. We continue to expand our capabilities by making our ways of working smarter, and by introducing new digital tools, connected data and simpler processes. Advances in science and technology are revolutionising the way we work, enabling us to push the boundaries to deliver new and better medicines and treatments more quickly to more patients. Our strategic focus areas Deliver the next wave of pipeline innovation We are rapidly advancing an industry-leading pipeline and investing in new technologies and modalities to deliver the next wave of medicines across therapy areas. Our diverse pipeline comprises around 200 projects spanning multiple mechanisms and modalities, designed to improve outcomes, drive clinical remission and provide cures for patients around the world. Science and Innovation Eight new molecular entities delivered against our Ambition 2030 of launching at least 20 new medicines.1 AstraZeneca Annual Report & Form 20-F Information 2024 13 Strategic Report Corporate Governance Financial Statements Additional Information Our Strategy and Key Performance Indicators |

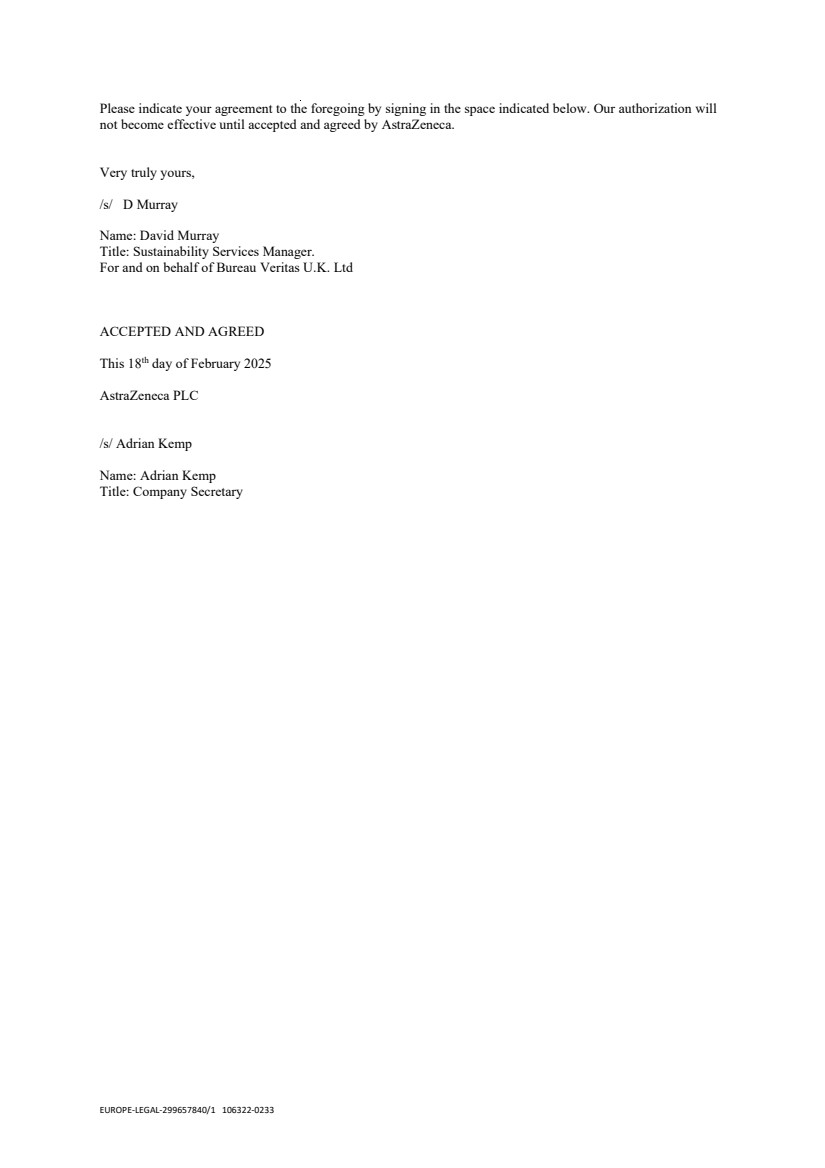

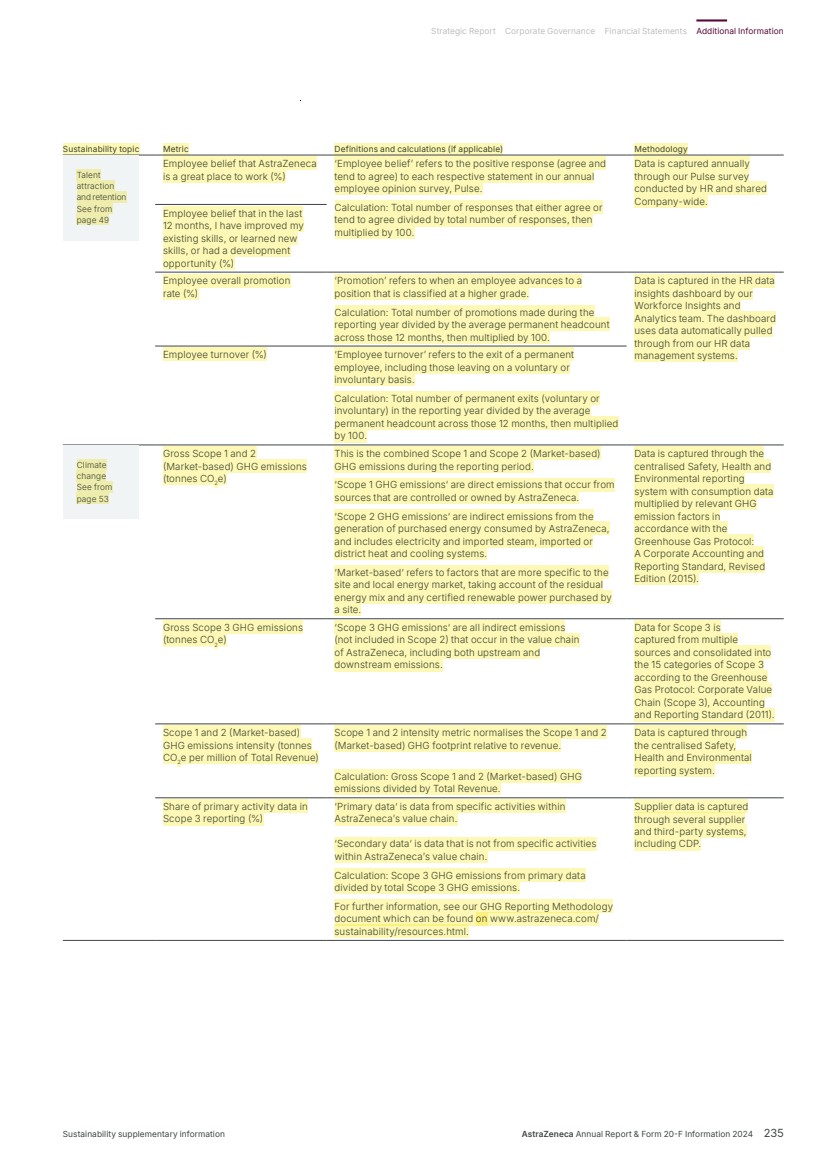

| 86% 84% 86% 84%84% Employee belief that AstraZeneca is a great place to work1 2024 2023 2022 2024 25/27 2023 25/27 2022 7/9 Green Amber Red 25/27 25/27 Sustainability KPIs performance2 2024 developments BV • We continued to invest in our people to ensure we recruit, retain and develop a talented workforce. • We continued to score highly in our Pulse survey for questions relating to our Purpose, direction, patient centricity and employee commitment. • We continued to invest in global collaborations, Group initiatives and local partnerships to strengthen health systems. • We maintained a leading role in industry efforts to address the impact of climate change and accelerate the delivery of net-zero healthcare, while improving health outcomes and minimising our environmental impact. • Our Ambition Zero Carbon strategy delivered further reductions in our GHG emissions across our operations – Scopes 1 and 2 – and we made progress on initiatives, including through supply chain decarbonisation, as we work towards achieving a 50% target reduction in Scope 3 emissions by 2030. • We announced the completion of the clinical programme for submissions in Europe, UK and China to support the transition of the first inhaled medicine delivered by pressurised metered-dose inhaler (Breztri/Trixeo) to a next-generation propellant (NGP) with near-zero Global Warming Potential. Key Performance Indicators BV Our People KPI is based on our Pulse survey measure of those employees who believe that AstraZeneca is a great place to work. Our Sustainability KPIs, including climate-related targets, reflect our success in achieving our sustainability goals. They are based on nine focus areas that have guided our sustainability strategy since 2021. Recognising the interconnection between business growth, the needs of society and our dependency on nature, we promote health equity and resilient healthcare, and play an active role in addressing the climate crisis. We cultivate an inclusive and diverse work environment where employees can thrive and are empowered to make an impact for people, society and the planet. Our strategic focus areas Deliver a great employee experience We are dedicated to being a great place to work by maintaining employee engagement, delivering our inclusion and diversity strategy, and offering learning and development programmes. Lead on climate, equity and resilience We are harnessing the power of science and innovation in ways that positively impact more patients and healthcare systems while reducing our impact on the environment. We are working towards absolute reductions in all our direct and indirect GHG emissions sources across the value chain – Scope 1, 2 and 3 – and decoupling carbon emissions from revenue growth. We are advancing our sustainability priorities across the interconnected dimensions of climate and nature, focusing on mitigating the impacts of climate change, restoring and protecting nature, building resilient health systems and improving health equity. Enable an agile organisation We are harnessing the potential of technology, simplifying how we work and scaling our business for the future. For more information, see: People and Sustainability from page 47 of the Business Review. For more information on our Sustainability KPIs, including definitions, methodology and restatements, see our Sustainability Data Annex at www.astrazeneca.com/ sustainability/resources.html. People and Sustainability Through science, we can drive positive change and help build a healthier future for people, society and the planet. 1 Source: November Pulse survey for each year. 2 In 2024, we assessed our performance against 27 publicly available targets. At least 90% of targets need to be ‘on plan’ or ‘target met’ to achieve a rating of green; at least 70% for amber; and red signifies any percentage below this. AstraZeneca Annual Report & Form 20-F Information 2024 15 Strategic Report Corporate Governance Financial Statements Additional Information Our Strategy and Key Performance Indicators |

| Delivering our strategic priorities sustainably, supporting scientific innovation and promoting commercial excellence. Our business is organised to deliver our Growth Through Innovation strategy. The success of our functions is built on recruiting, retaining and developing talented people. Our key topics covered include material sustainability topics, which have been identified through our double materiality assessment, see page 60 for more information. Science and Innovation We are focused on science and innovation, from discovery through to development and life-cycle management, and on transforming care and outcomes for patients. We have three therapy area focused R&D organisations – Oncology, BioPharmaceuticals and Rare Disease. Key topics covered Summary and performance indicators Research & Development Development pipeline overview Sustainable innovation BV Patient safety and product quality BV Growth and Therapy Area Leadership We are focused on launching medicines that deliver sustainable growth and realising the potential of our pipeline. Our Commercial regions align product strategy and commercial delivery while our Operations function manufactures and delivers our medicines. Key topics covered Summary and performance indicators Sales and marketing Operations Business conduct BV IT and IS resources Cybersecurity and data privacy BV Business development People and Sustainability We are committed to our people, ensuring that AstraZeneca remains a great place to work. We promote health equity and resilient healthcare, and play an active role in addressing the climate crisis. We operate in a responsible and sustainable way to build a healthy future for people, society and the planet. Key topics covered Summary and performance indicators BV People • Talent attraction and retention BV Sustainability • Accessible and affordable healthcare BV • Climate change BV • Pollution BV Material sustainability metric, is independently assured by Bureau Veritas. Strategic Report 32 AstraZeneca Annual Report & Form 20-F Information 2024 Business Review |

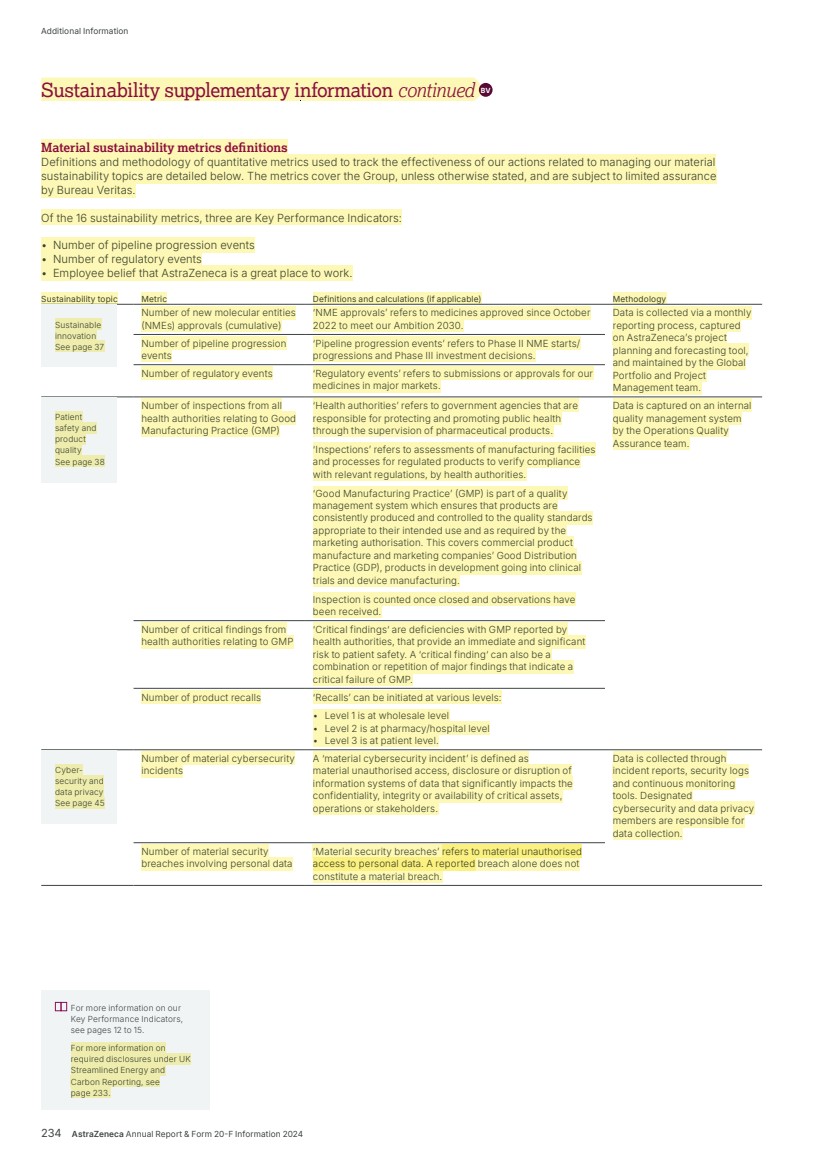

| Sustainable innovation We are focused on accelerating the delivery of life-changing medicines that create enduring value, pushing the boundaries of science to discover innovations that transform and sustain health. BV In our Code of Ethics, we outline our belief that science is at the core of everything we do; it is the heart of our business and our Values. By leading in science, we improve the lives of patients around the world. We conduct innovative research, development and manufacturing to high standards of ethics and integrity everywhere we operate, following the laws, regulations, codes, guidelines, and good practice standards related to safety, quality, research and bioethics. Our holistic health equity strategy is built on science and embedded across the entire R&D process. We are committed to improving diversity through inclusive and accessible studies, to develop innovative medicines that work for all patient groups. We are also strengthening the research ecosystem by increasing the breadth and diversity of human data, and sharing our science and capabilities with researchers, recognising that scientific breakthroughs only happen through open collaboration. Pipeline governance The pipeline governance and review processes follow AstraZeneca’s Product to Patient (P2P) Pathway. The P2P Pathway comprises vital investment decisions and other key development milestones from the Candidate Drug Investment Decision to health authority approval. The framework relies on empowered teams supported by cross-functional governance committees and review bodies to enable investment decisions and optimise clinical delivery to advance the pipeline, to the benefit of both patients and AstraZeneca. These committees, comprised of executive and senior leaders, play an integral role in a range of key decisions throughout the development pathway. Presentations to the committees are given to enable the right decisions at any given stage. Key decision factors include R&D resource allocation, based on overall therapeutic considerations and strategy. The P2P Pathway is managed by the Pipeline and Portfolio Operations team within Global Portfolio and Project Management. The Early-Stage Product Committee and Late-Stage Product Committee are governance advisory bodies that review, debate, endorse and make recommendations in support of investment decisions. Our drug discovery and development is informed by our 5R Framework – (right target, right patient, right tissue/right exposure, right safety, right commercial potential) which champions quality over quantity and has helped transform the For more information, see: Life-cycle of a medicine, page 11. Standards and policies, including Code of Ethics, page 42. Material sustainability metrics associated with Sustainable innovation, page 234. Accessible and affordable healthcare on page 52, for more information on IP. Details of the Science Committee’s activities during 2024, page 102. Screening for better patient outcomes Up to 59% of patients attending lung cancer screening programmes globally have evidence of COPD and many are missing opportunities for earlier diagnosis, treatment and participation in clinical research. As a pilot, we collaborated with two National Health Service sites in the UK delivering targeted lung health checks to a general population to determine if we could identify more patients with COPD and increase enrolment in our Phase II COPD trial (CRESCENDO). As a result, 33% (17 of 51), of those randomised for the CRESCENDO trial in the UK were identified directly from targeted lung health checks, triple the average site randomisation rate for the study from other sources (such as referral from primary care physicians). Based on this successful pilot, we are scaling the initiative more broadly in the UK and expanding to the US and Canada to accelerate clinical trial delivery and broaden diversity of participants within our studies, also helping identify undiagnosed symptomatic patients with COPD within this high-risk group to support optimised intervention with guidelines-based therapy. culture of R&D and our business. Looking at our productivity and success rates over the past five years we can see a transformation in our productivity, enabling us to discover more innovative therapies for patients than ever before. Intellectual property IP rights provide the incentives our industry needs to do R&D that leads to new medicines. Developing a drug is a long process and bringing a new drug to market is typically a lengthy and cost-intensive process, considering the cost of failures. Thousands and sometimes millions of compounds may be screened and assessed early in the R&D process to get the few that will ultimately receive regulatory approval. AstraZeneca innovates to make discoveries that improve patients’ lives and may one day eliminate disease altogether. The ability to obtain and maintain patent protection, under a robust IP protection and enforcement framework, is an important part of a sustainable framework for innovations in R&D that result in life-changing medicines. Strategic Report Corporate Governance Financial Statements Additional Information Business Review | Science and Innovation AstraZeneca Annual Report & Form 20-F Information 2024 37 |

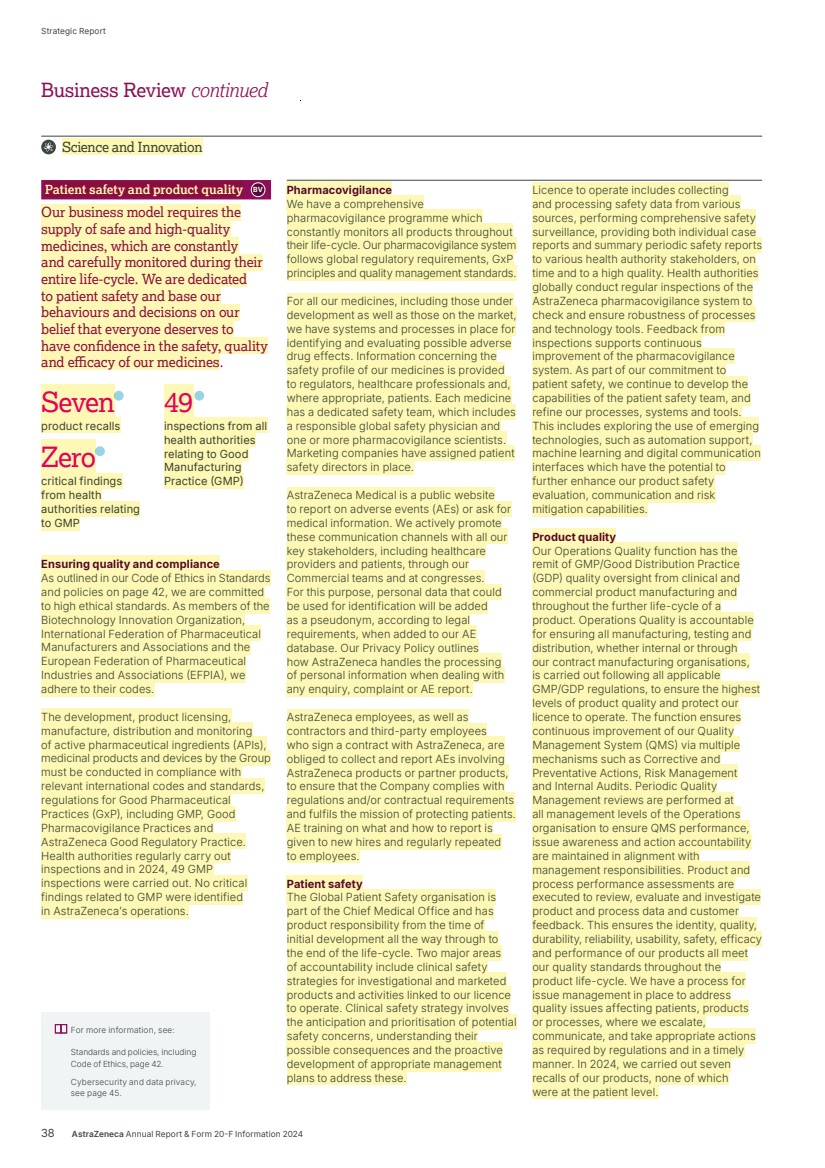

| 49 inspections from all health authorities relating to Good Manufacturing Practice (GMP) Seven product recalls Zero critical findings from health authorities relating to GMP Patient safety and product quality Our business model requires the supply of safe and high-quality medicines, which are constantly and carefully monitored during their entire life-cycle. We are dedicated to patient safety and base our behaviours and decisions on our belief that everyone deserves to have confidence in the safety, quality and efficacy of our medicines. BV Science and Innovation Pharmacovigilance We have a comprehensive pharmacovigilance programme which constantly monitors all products throughout their life-cycle. Our pharmacovigilance system follows global regulatory requirements, GxP principles and quality management standards. For all our medicines, including those under development as well as those on the market, we have systems and processes in place for identifying and evaluating possible adverse drug effects. Information concerning the safety profile of our medicines is provided to regulators, healthcare professionals and, where appropriate, patients. Each medicine has a dedicated safety team, which includes a responsible global safety physician and one or more pharmacovigilance scientists. Marketing companies have assigned patient safety directors in place. AstraZeneca Medical is a public website to report on adverse events (AEs) or ask for medical information. We actively promote these communication channels with all our key stakeholders, including healthcare providers and patients, through our Commercial teams and at congresses. For this purpose, personal data that could be used for identification will be added as a pseudonym, according to legal requirements, when added to our AE database. Our Privacy Policy outlines how AstraZeneca handles the processing of personal information when dealing with any enquiry, complaint or AE report. AstraZeneca employees, as well as contractors and third-party employees who sign a contract with AstraZeneca, are obliged to collect and report AEs involving AstraZeneca products or partner products, to ensure that the Company complies with regulations and/or contractual requirements and fulfils the mission of protecting patients. AE training on what and how to report is given to new hires and regularly repeated to employees. Patient safety The Global Patient Safety organisation is part of the Chief Medical Office and has product responsibility from the time of initial development all the way through to the end of the life-cycle. Two major areas of accountability include clinical safety strategies for investigational and marketed products and activities linked to our licence to operate. Clinical safety strategy involves the anticipation and prioritisation of potential safety concerns, understanding their possible consequences and the proactive development of appropriate management plans to address these. Licence to operate includes collecting and processing safety data from various sources, performing comprehensive safety surveillance, providing both individual case reports and summary periodic safety reports to various health authority stakeholders, on time and to a high quality. Health authorities globally conduct regular inspections of the AstraZeneca pharmacovigilance system to check and ensure robustness of processes and technology tools. Feedback from inspections supports continuous improvement of the pharmacovigilance system. As part of our commitment to patient safety, we continue to develop the capabilities of the patient safety team, and refine our processes, systems and tools. This includes exploring the use of emerging technologies, such as automation support, machine learning and digital communication interfaces which have the potential to further enhance our product safety evaluation, communication and risk mitigation capabilities. Product quality Our Operations Quality function has the remit of GMP/Good Distribution Practice (GDP) quality oversight from clinical and commercial product manufacturing and throughout the further life-cycle of a product. Operations Quality is accountable for ensuring all manufacturing, testing and distribution, whether internal or through our contract manufacturing organisations, is carried out following all applicable GMP/GDP regulations, to ensure the highest levels of product quality and protect our licence to operate. The function ensures continuous improvement of our Quality Management System (QMS) via multiple mechanisms such as Corrective and Preventative Actions, Risk Management and Internal Audits. Periodic Quality Management reviews are performed at all management levels of the Operations organisation to ensure QMS performance, issue awareness and action accountability are maintained in alignment with management responsibilities. Product and process performance assessments are executed to review, evaluate and investigate product and process data and customer feedback. This ensures the identity, quality, durability, reliability, usability, safety, efficacy and performance of our products all meet our quality standards throughout the product life-cycle. We have a process for issue management in place to address quality issues affecting patients, products or processes, where we escalate, communicate, and take appropriate actions as required by regulations and in a timely manner. In 2024, we carried out seven recalls of our products, none of which were at the patient level. Ensuring quality and compliance As outlined in our Code of Ethics in Standards and policies on page 42, we are committed to high ethical standards. As members of the Biotechnology Innovation Organization, International Federation of Pharmaceutical Manufacturers and Associations and the European Federation of Pharmaceutical Industries and Associations (EFPIA), we adhere to their codes. The development, product licensing, manufacture, distribution and monitoring of active pharmaceutical ingredients (APIs), medicinal products and devices by the Group must be conducted in compliance with relevant international codes and standards, regulations for Good Pharmaceutical Practices (GxP), including GMP, Good Pharmacovigilance Practices and AstraZeneca Good Regulatory Practice. Health authorities regularly carry out inspections and in 2024, 49 GMP inspections were carried out. No critical findings related to GMP were identified in AstraZeneca’s operations. For more information, see: Standards and policies, including Code of Ethics, page 42. Cybersecurity and data privacy, see page 45. 38 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report Business Review continued |

| Growth and Therapy Area Leadership Building trust by demonstrating integrity, transparency and fair treatment is central to everything we do, and supports our ability to operate, innovate and bring healthcare to patients. Our shared Values underpin all our activities and serve as a compass to guide us. Standards and policies Our Code of Ethics (the Code), and its supporting Standards, embodies our Values, including expected behaviours, principles and policies, and is the foundation of our global compliance programme. The Code covers global policies on: Science, Interactions, Workplace and Sustainability. It applies to all Executive and Non-Executive Directors, officers, employees and contract staff of our Group, empowering them to make the right decisions in the best interests of the Group, our communities and those we serve. The Code is implemented through our Chief Compliance Officer and Chief Executive Officer and supported by all members of the Senior Executive Team (SET). In 2024, 100% of active employees, including the SET, completed mandatory annual training on the Code. A Finance Code complements the Code of Ethics and applies to the Chief Financial Officer (CFO), the Group’s principal accounting officers (including key finance staff in all overseas subsidiaries) and all managers in the Finance function. This reinforces the importance of the integrity of the Group’s Financial Statements, the reliability of the accounting records on which they are based, and the robustness of the relevant controls and processes. The Code of Ethics and Finance Code ask employees to report possible violations and provide information on how to do so, including via the AZ Ethics helpline and website which are also available to third parties, including anonymously where permitted by local law. Anyone who raises a potential breach in good faith is fully supported by management on a confidential basis (subject to disclosure obligations in local markets) and we do not tolerate retaliation. Most cases are reported through line managers, local Human Resources (HR), Legal or Compliance functions. Cases are investigated by HR, Compliance Assurance, or the Global Compliance Investigations (GCI) team, an above-market investigatory unit within the Global Compliance function, depending on the nature of the matter. There were 3,853 instances (instances can involve multiple people) of employee and third-party non-compliance with our policies (2023: 3,756). A total of 401 employees and third parties were removed from their role as a result of a breach (2023: 296) and 2,498 received warnings (2023: 2,968). We brief the Audit Committee quarterly on breach statistics, serious incidents and corresponding remediation. Breaches primarily consist of low-impact incidents. We continue to foster a culture where employees can speak their minds, with strong first-line oversight (and related reporting) as well as targeted second-line monitoring to identify concerns early and use learnings to improve our programme. Our Pulse survey enables management and Board Directors to understand the views and sentiments of our employees, including the proportion of employees who feel comfortable speaking up at work. The resulting report also demonstrates how our Values and behaviours are embedded across the workforce, including a summary metric dashboard organised by category, with remedial action taken on any concerns identified and discussed as necessary. Anti-bribery and anti-corruption We do not tolerate bribery or any other form of corruption. Potential bribery and corruption risk factors vary, for example by geography, the nature of the business, and the role of third-party vendors, as well as over time. Preventing bribery and corruption is a focus of our third-party risk management (3PRM) and due diligence processes, as well as our monitoring and audit programmes. Our Anti-Bribery and Anti-Corruption Global Standard outlines our key anti-bribery and anti-corruption principles and is complemented by additional Global Standards and local requirements. Through our Global Compliance programme and associated policies and other controls, we strive to comply with all applicable anti-bribery and anti-corruption legislation, including the UK Bribery Act 2010 which is aligned with the United Nations Convention against Corruption. There are three lines of defence in our risk management framework: line management, Risk and Global Compliance functions and Group Internal Audit (GIA). GIA is responsible for reporting significant risk exposures and control issues to the Board and senior management, including matters that are referred by the Audit Committee. In addition to the GIA review of risk, Global Compliance provides overviews of significant incidents and their outcomes to the Audit Committee. Business conduct We seek to create positive societal impact beyond the direct benefit of our life-changing medicines. We embed ethical behaviour in all our business activities, markets and across our value chain. We promote ethical, transparent and inclusive policies, both internally and with our partners and suppliers. BV 42 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report Business Review continued |

| As outlined, we provide various methods by which ethical concerns can be confidentially reported to the Group and these are centrally recorded within our incident reporting systems. Any whistleblower will have the opportunity to report violations inside and outside of the organisation (to the designated authority or to the media), and we ensure that the level of protection is the same, regardless of the means of reporting. The most material incident reports from whistleblowers – those implicating senior leaders or involving other allegations of serious misconduct (including alleged bribery or corruption) – are promptly, independently and objectively investigated by our GCI team. We maintain confidentiality and separation between reporters and implicated parties during our compliance investigations to ensure a safe environment that encourages employees to feel comfortable speaking up. Learning pathways are available to Global Ethics & Compliance and Employee Relations employees focusing on the principles of conducting an investigation. Modules include connecting with the reporter, planning and fact gathering, interview techniques, credibility assessments, reporting and case closure. In 2024, work was undertaken to update and improve our global investigations Standard Operating Procedure and develop a global investigations playbook to enhance the consistency and quality of the investigations our employees conduct. Material government investigations or proceedings including material investigations related to anti-bribery and anti-corruption are detailed in Note 30 to the Financial Statements on page 203. Responsible sales and marketing Our compliance professionals advise on, and monitor adherence to, our Code and policies, and work with local staff to ensure we meet our commitment to high ethical standards. Nominated signatories review product promotional materials and activities to ensure compliance with applicable regulations and codes of practice, and that information is accurate and balanced. GIA conducts audits of selected marketing companies. In 2024, we identified 12 confirmed external breaches across our Commercial business (2023: four). Confirmed external breaches comprise cases where AstraZeneca has been found to violate a law, industry code, or regulation by an external authority. Animals in research The responsible use of animals is a vital part of biomedical research and product safety testing, where suitable alternatives are not available. At the centre of our commitment to quality science and animal welfare are the Replacement, Reduction and Refinement of animals in research (the 3Rs). All animal studies are undertaken in compliance with all relevant local and national laws and regulations, and with the principles of the ‘Guide for the Care and Use of Laboratory Animals’ 8th Edition (Institute for Laboratory Animal Research). Wherever possible, we work with third parties accredited by the Association for the Assessment and Accreditation of Laboratory Animal Care International. Animals were needed for in-house studies 141,947 times in 2024 (2023: 122,768), and on our behalf in contract research studies 63,810 times (2023: 59,690). In total, over 97% were rodents or fish, with the majority being mice (86%). The remainder is made up of rabbits, camelids, ferrets, dogs, pigs, non-human primates, chickens and sheep. Dogs and non-human primates make up less than 1% of the total. AstraZeneca does not conduct research using wild-caught non-human primates or great ape species. AstraZeneca is committed to transparency and is signatory to the Concordat on Openness on Animal Research (UK), the Openness Agreement on Animal Research and Teaching (Australia/New Zealand) and has endorsed the statement of intent for a U.S. Animal Research Openness Agreement. AstraZeneca has an animal welfare assurance programme that ensures research conducted by third parties meets our high standards. Supplier management All employees and contractors who source goods and services on behalf of AstraZeneca are expected to follow our Global Standard for Procuring Goods and Services. Through assessments and improvement programmes, including our 3PRM system, we monitor supplier compliance with our published Expectations of Third Parties policy. Before and after we contract with third parties, we assess whether their reputation and actions align with our expectations and any concerns or changes are addressed. As a member of the Pharmaceutical Supply Chain Initiative (PSCI), AstraZeneca supports the PSCI Principles for Responsible Supply Chain Management, which outline industry expectations of the supply chain in ethics, human rights and labour, health and safety, environment, and related management systems. We have a 3PRM process in place to identify and assess potential risks with our suppliers. This includes human and labour rights as a standalone risk area and assessing risks such as forced or bonded labour, child labour, wages and benefits, hours/rest periods and leave, collective bargaining, grievance procedures, discrimination and harassment. Relevant commitments and policies are detailed in our published Modern Slavery Statement. The 3PRM process also identifies and assesses supplier activities across multiple other risk areas, including safety, health and environment, anti-bribery and anti-corruption, data privacy and IT security. In 2024, we conducted 59 audits (2023: 47) on high-risk commercial suppliers (external manufacturing partners) to ensure appropriate practices and controls. Of these, 48% fully met our expectations while 52% had improvement plans for minor instances of non-compliance. There were two audits indicating a high risk to AstraZeneca and action has been taken to mitigate these supply and/or reputational risks. Our Global Procurement function uses the EcoVadis platform to assess the sustainability performance of our suppliers, rating their environmental, social and governance (ESG) performance against four themes: Environment, Labour & Human Rights, Ethics, and Sustainable Procurement. Our Sustainable Procurement programme embeds responsible sourcing practices through our procurement activity and promotes ethical behaviour by our suppliers in support of our own procurement policies, targets and commitments. Our Supplier Diversity Programme maximises opportunities for small and diverse businesses to be part of our value chain and supports their growth. As part of our Ambition Zero Carbon strategy, we aim to engage with the top 95% of our suppliers by spend covering purchased goods and services and capital goods, and 50% of our suppliers by spend covering upstream transportation and distribution and business travel, to support them to set validated science-based GHG emissions targets (SBTs) by end of 2025. AstraZeneca Annual Report & Form 20-F Information 2024 43 Strategic Report Corporate Governance Financial Statements Additional Information Business Review | Growth and Therapy Area Leadership |

| Zero material cybersecurity incidents Zero material security breaches involving personal data Cybersecurity and data privacy Innovative technology platforms are transforming the way we work, and we have measures in place to address the related cybersecurity and data privacy risks. BV Cybersecurity We operate an evergreen cybersecurity training and awareness programme that is mandatory for all employees and is designed to reduce risk and improve resilience. Cybersecurity performance is reviewed monthly and based on standardised service delivery, programme management, and operational performance metrics, with recurring oversight presentations to the SET, the Audit Committee and Board of Directors. There were no material business disruptions due to a cybersecurity incident in 2024, and we have recruited a third-party alert triage partner to free up capacity in our cyber team for forensic investigations and proactive threat detection. This year we also launched a process to re-baseline and prioritise critical business applications for our disaster recovery plans over a three-year period to 2026. This will improve resilience and preparedness for unexpected or uncontrolled events. Effectiveness is measured through standardised service delivery, programme management and operational performance metrics. We emphasise cybersecurity culture and workforce awareness via mandatory annual training, phishing tests and communication on internal social media. Recognising the elevated threat and risk environment, we have delivered workforce-wide messaging regarding each person’s responsibility to protect AstraZeneca. Data privacy Our three principles of data privacy are: 1. We respect and protect privacy by collecting, using, retaining, sharing and/or disclosing personal data lawfully, fairly, transparently and securely. 2. We respect data subject rights and respond to queries and requests made by individuals about their personal data in a timely manner. 3. We hold third parties with whom we work to the same expectations set out in the Global Privacy Standard. Enhanced data governance practices are in place through our Enterprise Data Office (EDO), established in 2023, and sponsored by our Enterprise Data Council (EDC). The EDO strengthens and standardises data governance, including by partnering with other data functions across the Company and acting as a central hub for data management and related regulatory compliance. This approach also ensures that our data policies and standards are streamlined, clear and effective. Key privacy compliance concerns are reported via the SET data governance boards, EDO, EDC and appointed senior leaders. Breaches and policy deviations can also be reported to AZ Ethics via the helpline or website. In 2024, our data privacy focus has been to develop a set of new standards, aligned to evolving global privacy legislation and those of the EDO; the format standardisation and updating of content for global privacy notices; and enhancement and refinement of privacy risk assessments and management process. In 2025, we will focus on continued alignment and refinement of processes with the EDO and Global Business Services, in particular regulatory intelligence and readiness, privacy risk management and reporting, and the automation and refinement of privacy operational activities. For more information, see: Cybersecurity in the Risk overview, page 64. AZ Ethics, page 42. AstraZeneca Annual Report & Form 20-F Information 2024 45 Strategic Report Corporate Governance Financial Statements Additional Information Business Review | Growth and Therapy Area Leadership |

| People and Sustainability Summary and performance indicators Our team values diversity and high performance, using technology and AI to make our work easier and more efficient. We focus on climate, nature and healthcare challenges in an ethical and transparent way. Our performance in 2024 BV People • Received 1.3 million applications and hired 23,000 employees (7,700 internal and 15,300 external). • 4,300 of these hires were a direct result of our employee referral scheme. • Over 5,900 employees participated in a development programme. • 50.6% of our senior middle management roles and above are filled by women. Sustainability • Reached 90.5 million people through our flagship access to healthcare programmes. • Conducted climate and water risk assessments at 40 sites to improve resilience. • Reduced Scope 1 and 2 GHG emissions by 77.5% from 2015 baseline year. -77.5% -67.6% -58.7% 2024 2023 2022 -77.5% -77.5% Ambition Zero Carbon (Scope 1 and 2)1 2024 2023 2022 82% 83% 83% 82%82% Speak up culture2 2024 2023 2022 90.5m 66.4m 44.6m 90.5m 90.5m People reached by our access to healthcare programmes3 Performance indicators BV People This priority is built on being a great place to work, patient-oriented, advancing a culture of lifelong learning, and achieving inclusion and diversity goals. Performance indicators BV Sustainability Achieving a healthier, more sustainable future requires tackling the biggest challenges of our time – from climate change and nature loss to health equity and health system resilience – and doing so in a way that is ethical, transparent and inclusive. 1 Reduction of Scope 1 and 2 GHG emissions from 2015 baseline year. 2 Based on an internal survey which asked all AstraZeneca employees if they felt comfortable to speak up/speak my mind and express my opinion at work. 3 Cumulative data including current and historical programmes: Healthy Heart Africa, Young Health Programme, Healthy Lung and Phakamisa. For more information, see People from page 48 and Sustainability from page 51. Great place to work 84% believe that AstraZeneca is a great place to work Patient-oriented 87% believe that AstraZeneca is patient-oriented Advance culture of lifelong learning 84% receive coaching to improve contribution Achieve inclusion and diversity goals 80% feel valued for diverse opinions and thinking AstraZeneca Annual Report & Form 20-F Information 2024 47 Strategic Report Corporate Governance Financial Statements Additional Information Business Review | People and Sustainability |

| People and Sustainability Achieving our inclusion and diversity goals At AstraZeneca, we place Inclusion before Diversity. That is because we first focus on creating a culture of inclusion and belonging, which enables us to attract and retain a rich and diverse workforce. Our global commitment to inclusion and diversity is woven into what we do, and is reflected in our Values and the behaviours that underpin them. Women comprise 54% (approximately 51,000) of our global workforce and men 46% (approximately 43,000). At the end of 2024, there were six women on our Board (46% of the total). Five out of 10 SET members (50%) were women and five were men (50%). Directors of the Company’s subsidiaries comprised of 136 women (30%) and 310 men (70%).1 Our employees represent a diverse range of backgrounds and we recognise that everyone plays a role in inclusion and diversity. Our Global Inclusion and Diversity Ambassador Group, sponsored by our CEO, reflects the diversity of our global workforce and organisational structure. They are responsible for collaborating with local leaders to customise approaches that address local needs and drive progress towards our global inclusion and diversity commitments. Our Board of Directors and the SET conduct biannual and quarterly reviews, respectively, of our workforce composition, covering gender, ethnicity and age representation. In the US, where we have more comprehensive data available, 37.9% of our workforce identify as an ethnic minority (2023: 36.8%). We are committed to hiring and promoting talent ethically and in compliance with applicable laws. Our Code of Ethics and its supporting Standards are designed to help protect against unlawful discrimination on any grounds, including disability. The Code covers recruitment and selection, performance management, career development and promotion, transfer, training (including, if needed, for people who have become disabled), and reward. AstraZeneca embraces the cognitive differences of neurodivergent employees and supports employees with both seen and unseen disabilities in line with their country-specific laws and regulations. Where risk assessments can be performed, we will consider accommodating adjustments to the working environment that support an inclusive and safe workplace. Our Global Standard for Inclusion and Diversity sets out how we foster an inclusive and diverse workforce where everyone feels valued and respected because of their individual abilities and perspectives. In 2024, our inclusion and diversity efforts earned recognition externally. We were featured in: • Forbes World’s Top Companies for Women • Forbes World’s Best Employers • Financial Times, Diversity Leaders 2025 • TIME World’s Best Companies. Human rights BV Our human rights principles support the basic rights of all people, such as the right to health, freedom from slavery, and privacy. Our Code of Ethics, Human Rights Statement and Expectations of Third Parties commit us to respecting and promoting international human rights, both within our own operations and our wider spheres of influence. To that end, we integrate human rights considerations into our processes and practices. We are also committed to ensuring that there is no modern slavery or human trafficking in any part of our business, including our value chain. Our human rights policies are designed to ensure we consider the impact of our operations on all human rights including those of the communities around our operations. The output of our work to mitigate human rights risks is detailed in our Modern Slavery Statement, which is published annually. We also provide assurance annually to the Audit Committee. Workforce safety and health BV We are committed to providing a safe and healthy working environment for our employees and partners. Our Global Safety, Health and Environment (SHE) Standard describes our commitment to, management of, and accountability for SHE. We set and monitor our safety and health targets to support our workforce and aim to achieve the highest performance standards. In 2024, our work-related injury rate reduced by 58% and our collision rate reduced 51% from the 2015 baselines. We are also committed to supporting employee mental health and wellness and there are several resources available. This includes our Safe Space Employee Resource Group and our Healthy Minds app, which provides access to mental health and wellbeing support anytime in 24 languages. People We rely on our global workforce to uphold our Code of Ethics and behaviours in line with our Values, to deliver our strategic priorities and work to sustain and improve short-and long-term performance. For more information on our standards and Code of Ethics and for our full statement detailing how we work to mitigate the risks of modern slavery, see our website, www.astrazeneca.com/ sustainability/resources.html. 1 For the purposes of section 414C(8)(c)(ii) of the Companies Act 2006, ‘Senior Managers’ are the SET, the Directors of all of the subsidiaries of the Company and other individuals holding named positions within those subsidiaries. Individuals on multiple boards are counted once. Enabling an agile organisation In 2024, we continued to build talent internally by developing critical skills across our workforce, ensuring we have the capabilities to achieve our Ambition 2030. Key highlights: • Increased focus on building capability at our Global hubs: Mississauga, Lisbon, Barcelona and Warsaw. In 2024, 1,700 external hires were made in these locations. • Continued to develop internal talent and made 5,800 promotions during 2024. • Received external recognition for our female leaders: Sharon Barr and Susan Galbraith were awarded in the Women in Biopharma 2024 report, Pam Cheng was recognised in the TIME100 Health leaders and Iskra Reic was acknowledged by Fierce Pharma. Listening to our workforce Encouraging employees to provide continuous feedback through various mechanisms helps us to foster an inclusive culture and be a great place to work. We collect feedback through onboarding surveys, exit interviews and our global employee engagement survey. We encourage managers to listen to the workforce by providing them with access to the aggregated results for their teams and, in 2024, we launched a new reporting tool to further support managers with understanding engagement across their teams. To ensure we are fully transparent we share our global results with the Board of Directors, the SET, line managers and employees. 48 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report Business Review continued |

| 84% employee belief that AstraZeneca is a great place to work 10.9% employee turnover 6.5% employee overall promotion rate 88% employee belief that in the last 12 months, I have improved my existing skills, or learned new skills, or had a development opportunity Central to our success is ensuring all our employees have the potential to develop and grow and we are committed to being a great place to work. We face increasing external competition for market-leading talent. We must attract and retain highly skilled personnel to support critical position succession planning and the implementation of our strategic objectives and business operations. Our recruitment, deployment, reward and development practices, and our approach to working arrangements, are designed to attract and retain diverse individual talent at different career and life stages. As a Group, our global footprint, bolstered by the locations of our strategic sites and Global hubs, provides AstraZeneca with access to a greater diversity of talent to strengthen market and global teams. Talent acquisition We target our recruitment and retention activities to secure critical skills and capabilities and invest in innovative technology (such as AI-automated interview scheduling and job advert writing tools) to reduce administrative tasks and enable Talent attraction and retention Attracting, retaining and developing talented individuals is key to our growth and success. We achieve this by cultivating a great place to work that values and rewards innovation, entrepreneurship and outstanding performance. BV positive candidate and employee experiences. Our deployment team is focused on providing an exceptional talent acquisition partnering service to secure the best talent for our business from the 1.3 million applications we receive for 24,800 roles each year. Talent scouts are an integral part of our approach. Working globally, their deep understanding of business needs develops robust capability pipelines, ensuring that engaged, validated candidates are available when needed. They also build external succession plans for critical senior executive roles, sourcing market-leading talent, particularly where internal succession plans do not fully meet business requirements, thus mitigating risk to business continuity. In 2024, we expanded the remit of our talent scout organisation to include niche and critical skill hiring and pipeline-building, and proactive engagement with top talent to share opportunities and provide expert coaching and guidance throughout the hiring experience. Gene therapy and gene editing Investing in transformative R&D technologies Gene therapy and gene editing have the potential to transform patient outcomes by directly addressing the underlying cause of genetic diseases, which represent an estimated 80% of rare diseases. We are focusing on diseases with a well-established genetic basis and indications where we can apply our expertise, including diseases affecting the liver, heart, muscle and brain. We are developing and advancing new technologies to improve the precision and delivery of gene therapies and gene editing, opening new possibilities to meet the needs of patients with few, if any, treatment options. AstraZeneca Annual Report & Form 20-F Information 2024 49 Strategic Report Corporate Governance Financial Statements Additional Information Business Review | People and Sustainability |

| This extended model has created capacity for business partnerships beyond executive search and succession planning, strengthening the business’s overall talent agenda and allowing us to move at pace to fill niche roles where competition for talent is high. We are also building talent attraction and sourcing centres in Guadalajara, Lisbon and Chennai, and expanding our scouting model across the new global hub locations, enabling pipeline-building and sourcing of top talent and reducing the time taken to fill key roles, working enterprise-wide to enhance the service offered. Future initiatives as part of our employee experience workstream include deploying a talent intelligence platform, which will connect people to opportunities by leveraging data-led insights, breaking barriers to internal mobility and democratising how our employees discover and prepare for their next career move. Another future initiative is Onboarding 2030, which aims to deliver inspiring onboarding experiences that accelerate performance, foster connection and unlock potential. Development programmes We develop capabilities for the future through targeted and inclusive development programmes, from early talent to enterprise leaders. Our digital learning portal supports a continuous learning mindset underpinning a high-performing and innovative organisation. Our development programmes help us to unlock potential, drive innovation and foster an inclusive culture, building the capabilities of diverse future leaders in support of our People strategy. All employees (and contingent workers) have access to our global learning platform. Global learning and development opportunities are provided alongside high potential talent initiatives, such as our talent development centres. We evaluate the impact of our development programmes two years after attendance, looking at promotions, talent moves and retention. During 2024, we launched foreign language skills development in 70 languages to support talent mobility and employee progression. We also offered all employees the opportunity to join a generative AI programme and have seen over 10,000 enrolments. We have a global operating model and governance in place which includes all our SET areas. We can therefore measure the impact of our global development programmes, experiences and platforms across all our geographies and stakeholders. In 2024, 88% of employees believe they have improved their existing skills, learned new skills or had a development opportunity. Coaching and recognition We focus on performance coaching, development and continuous recognition of the contributions of our employees. Our approach’s effectiveness can be seen in the completion rate of end-of-year insights by managers and employees, which consider deliverables, impacts and key learnings to carry forward which were completed by over 90% of employees. This is reinforced through quarterly coaching check-ins between employees and their manager and regular coaching conversations, the frequency of which is measured in our Pulse survey, where 84% of employees said that they have regular coaching from their line manager. Our Values are central to employee reward and performance, and are the basis of our CatAlyZe global recognition platform. Employee relations We have a Global Employee Relations team that supports the application of our global employment standards and policies, ensuring consistency in managing issues such as sexual harassment, and bullying and harassment. In addition, our local Employee Relations resource applies these Standards in the context of local law and practices, and provides advice on country-specific policies. Many markets within AstraZeneca have a dedicated Employee Relations function engaging with employee representative groups and trade unions. Our ambition is to build a positive and safe working environment for employees. To achieve this, Employee Relations works in partnership with Legal, Compliance and HR functions and employee representative groups, such as the European Consultation Committee, Works Councils and, where applicable, our nationally recognised trade unions. According to our internal Human Rights survey carried out in 2024, we have a relationship with trade unions in 29% of the countries in which AstraZeneca operates. Where trade unions do not exist, all countries have established arrangements for similar workforce engagement. Accountability for these processes is with the Chief Human Resources Officer and delegated to members of the leadership team. On a day-to-day basis, this is managed by senior leaders. We regularly receive feedback on engagement with our workforce through a range of sources including team meetings, townhall meetings, and our internal social media platform. Our annual Pulse survey also provides structured employee feedback and we use a Pulse GPT tool to analyse comments and provide additional insights into themes raised. We also hear the views of employee representatives and trade unions in relevant countries, and from our Employee Resource Groups (ERGs), which are voluntary, employee-led groups based on shared identities and other diversity cohorts. We have seven Global ERGs with chapters in more than 15 countries as well as 12 country-specific ERGs. Examples of ERGs include Network of Women and Allies, TH!NK Neurodiversity and AZ Pride. Leadership teams work with their HR functions to drive employee engagement activity in their areas. Engagement feedback gives us a good understanding of employees’ views and priorities and is an important input as we develop and review our employment policies and practices. We have pledged our commitment to the United Nations Global LGBTI Standards of Conduct and United Nations Women’s Empowerment Principles. We are committed to equal pay and regularly monitor the reward of employees at all levels in the organisation to ensure that it is equitable. People and Sustainability For more information, see: Standards and Policies, including Code of Ethics, on page 42. Engaging with our workforce, on page 98. Talent attraction and retention continued BV 50 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report Business Review continued |

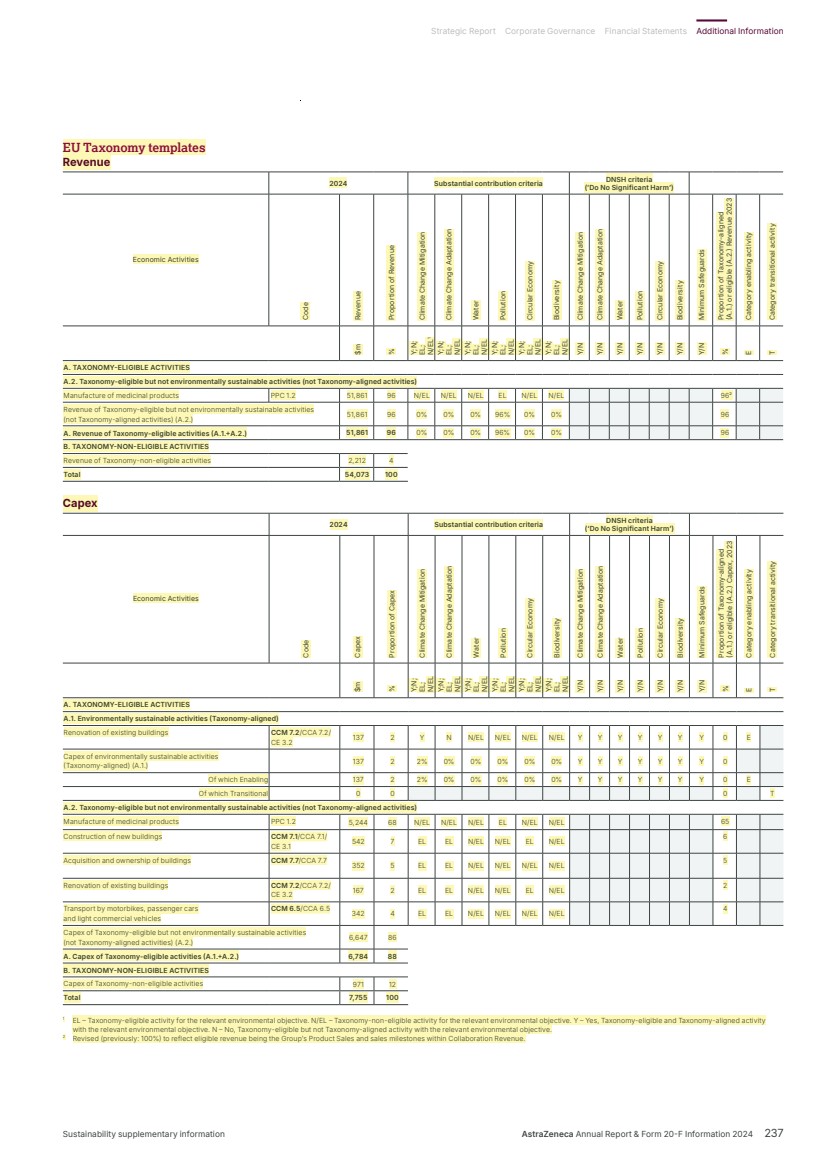

| Overview We seek to create value beyond the impact of our medicines by embedding sustainability into everything we do – from the lab to the patient – supporting health system resilience and increasing access to sustainable healthcare. During 2024, we were recognised for our efforts across all our sustainability priorities, including: • Received a rating of AA (on a scale of AAA-CCC) in the MSCI ESG Ratings assessment. • Included in the Dow Jones Sustainability World Enlarged and Europe Index. • Included in the 2024 Access to Medicine Index top five. • Listed in the Financial Times European Climate Leaders for the third consecutive year. Our approach to sustainability Our Purpose, to push the boundaries of science to deliver life-changing medicines, is underpinned by our commitment to contribute to the health of people, society and the planet. As a global business, we are playing our part by operating ethically and responsibly, and helping tackle the biggest challenges of our time, including climate change, nature loss and health equity. These challenges are interdependent and require collaboration to be successfully addressed, implementing a variety of approaches across a network of relationships. By working together to find science-based solutions, we believe we can drive real change and build a better future. Governance Our sustainability strategy is developed by the SET, which reviews our Group scorecard quarterly, and is approved by the Board, whose Sustainability Committee monitors the execution of the strategy, overseeing our approach to communicating sustainability activities with stakeholders, and providing input to the Board and other Board Committees on sustainability matters as required. The Audit Committee is responsible for overseeing sustainability reporting in the Company’s Annual Reports, Form 20-F filings and quarterly results announcements. For further details on Corporate Governance, see from page 85. Our executive Sustainability Reporting Steering Committee is comprised of leaders representing functions relevant to the sustainability strategy and reporting. The Committee is co-chaired by the SVP, Finance, Group Controller and Head of Global Finance Services and the VP, Global Sustainability and SHE, and reports on progress to the Audit and Sustainability Committees and keeps the SET updated on current developments. Sustainability Sustainability at AstraZeneca means harnessing the power of science and innovation and our global reach, to build a healthier future for people, society and the planet. BV Benchmarking and assurance We contribute to key global ESG performance evaluations, recognising the value of independent third-party assessment and insights. Our performance is also assessed independently based on the information and data we make publicly available. Bureau Veritas has provided limited independent assurance for the sustainability information contained within this Annual Report and Form 20-F. Assurance is in accordance with the International Standard on Assurance Engagements (ISAE) 3000 (Revised) and ISAE 3410 Assurance Engagements on Greenhouse Gas (GHG) Statements. Community investment Community investment at AstraZeneca is built upon the principles of equity, transparency and partnership, and we work together to build healthy and resilient communities. In 2024, we contributed $126.8 million in financial and non-financial donations, including product donations, to 928 non-profit organisations across 65 countries. We also donated $4.6 billion (2023: $4.7 billion) of medicines through patient assistance programmes around the world, the largest of which is our AZ&Me Prescription Savings Program in the US. AstraZeneca Annual Report & Form 20-F Information 2024 51 Strategic Report Corporate Governance Financial Statements Additional Information Business Review | People and Sustainability |

| People and Sustainability In support of our commitments and approach, AstraZeneca engages in ongoing access initiatives enterprise-wide. We continue to implement innovative solutions to optimise affordability and accessibility, where necessary, addressing barriers beyond a medicine’s price. Each market makes decisions based on their local context to implement initiatives or access strategies that ensure broader access to our medicines, tracking and evaluating outcomes to assess their effectiveness and impact. Affordability and pricing The price of a medicine should reflect its value, maximise patient access and provide flexibility to accommodate variation in global health systems and economic realities for patients. Working closely with payers and policymakers, we tailor approaches and programmes to address local health system resilience and patient needs to deliver locally affordable medicines. We work with payers to conclude value-based reimbursement models that improve patient outcomes and enable access to medicines across key therapeutic areas and geographic regions, adapting our prices across the countries in which we operate. For patients, this includes offering local solutions to help bridge out-of-pocket payment gaps, enabling patients to begin and continue their prescribed treatments. We also have various initiatives which provide discounts and assistance. At a market level, we offer training to healthcare providers, promote health education and awareness-raising activities and facilitate access to treatment where appropriate. Since 2017, we have implemented and evolved a tiered pricing model to support broader and accelerated patient access to medicines in low- and middle-income countries (LMICs). This establishes four tiers of countries based on standardised Gross National Income per capita aligned to the World Bank classifications and allows us to recognise income and ability to pay differences across countries, providing price flexibility in a commercially sustainable way. Patent protection and access We are committed to not filing patent applications in any low-income or least-developed countries and many LMICs. We will consider approaches from third parties seeking non-exclusive voluntary IP licences in developing countries. We are committed to providing transparency about where our patents are filed and enforced. Where we maintain patent protection for assets which may have relevance to Access to Medicine Index diseases, we provide patent identity and expiry information. We also provide patent expiry information for the US, China, the EU and Japan. The best way to address the healthcare challenges faced by LMICs is through the engagement of our industry with other stakeholders to find constructive ways to improve access to medicines and delivery of healthcare. However, we recognise the right of countries to use the provisions of the World Trade Organization Agreement on Trade-Related Aspects of Intellectual Property Rights, and we support the principles outlined in the Doha Declaration, including compulsory licensing in a ‘national emergency or other circumstances of extreme urgency’ where no appropriate alternative is available. Early and post-trial access to medicines We will provide access in certain circumstances to a medicine before approval within a country where other treatments are not available. As such, prior to commercial availability of our medicines, we prioritise access to our medicinal products through participation in a clinical trial. We have ongoing clinical trials across our therapy areas, details of which are given in the Development Pipeline Supplement on our website, www.astrazeneca.com/ annualreport2024. Promoting access to healthcare products for priority diseases and in priority countries For our access initiatives we had a 2025 target of 50 million people reached, which was met in 2023, two years ahead of schedule. In 2024, we continue to track progress in reaching people through our patient access programmes and new targets relating to health equity will be communicated in 2025. We work across our main disease areas to address non-communicable diseases (NCDs) for patients with unmet medical needs and collaborate with experts within health systems to improve outcomes for patients. Our ongoing access programmes include: • Oncology: Cancer Care Africa, the Lung Ambition Alliance • BioPharmaceuticals (CVRM): Accelerate Change Together on Chronic Kidney Disease, Healthy Heart Africa • BioPharmaceuticals (R&I): PUMUA (Africa), Breeze of Air (Egypt), Healthy Lungs • Rare Disease: BeginNGS Consortium, deciphEHR, Genomenon. Disease prevention Our Young Health Programme, which is active in 41 countries and has directly reached more than 19 million young people, advances disease prevention and awareness with the aim to prevent the most common NCDs such as cancer, diabetes, heart disease and respiratory disease among young people. Health system strengthening We participate in the Partnership for Health System Sustainability and Resilience (PHSSR), which is a non-profit, multisector, global collaboration with a unified goal of building more sustainable and resilient health systems, active in more than 30 countries. PHSSR has commissioned over 20 research reports to date, providing independent, evidence-based recommendations to strengthen health systems and facilitate cross-border best practice sharing, working with national experts with first-hand experience. Accessible and affordable healthcare We are committed to addressing barriers to access to healthcare and innovating to deliver our life-changing medicines in a sustainable and equitable way. Our approach includes integrating health equity within our core business and therapy areas, understanding the factors that drive poor outcomes in certain populations, and addressing health equity issues along the entire patient pathway. BV For more information, see Patent Expiries of Key Marketed Products Supplement on our website: www.astrazeneca.com/ annualreport2024. 52 AstraZeneca Annual Report & Form 20-F Information 2024 Strategic Report Business Review continued |

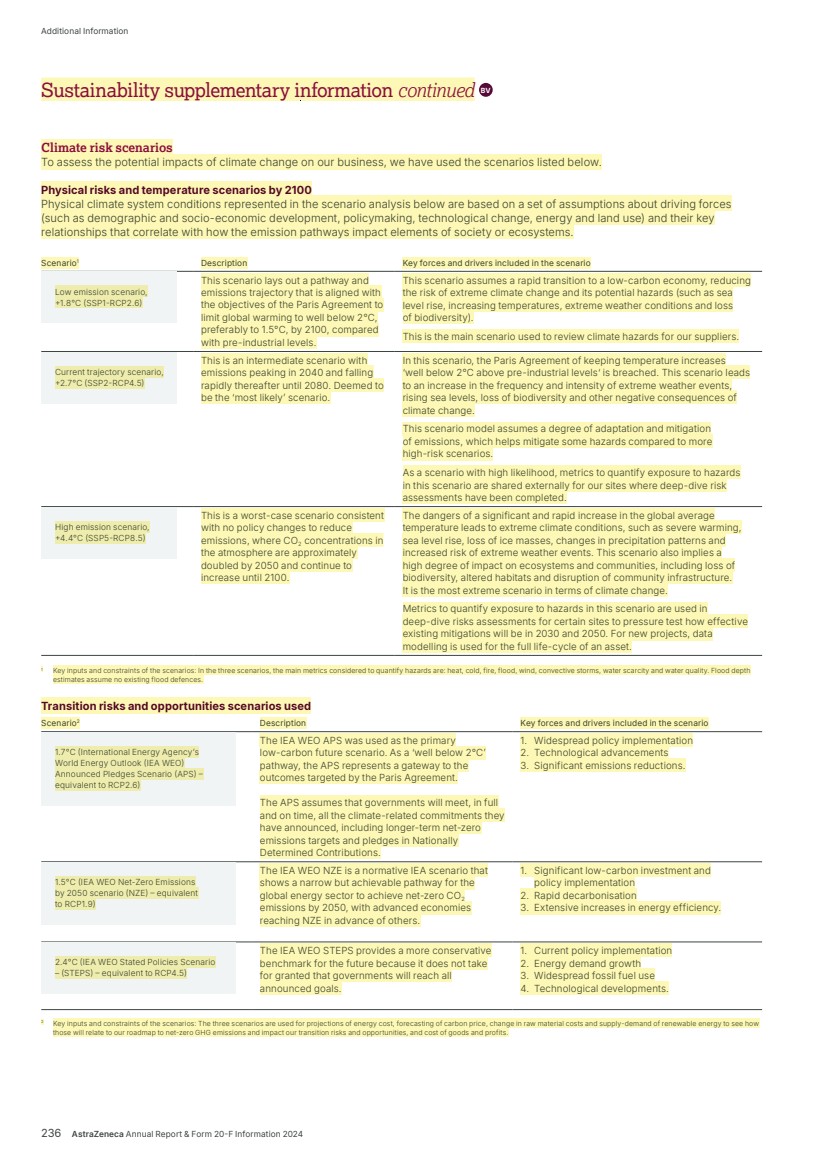

| 139,594 gross Scope 1 and 2 GHG emissions (market-based) (tonnes CO2e) 2.58 Scope 1 and 2 GHG emissions intensity (tCO2 per million of Total Revenue) 5,897,822 gross Scope 3 GHG emissions (tonnes CO2e) 59% primary activity data in Scope 3 reporting In 2020, we launched our Ambition Zero Carbon strategy, through which we are pursuing ambitious science-based decarbonisation targets and making progress towards achieving net zero by 2045. We also aim to become carbon negative from 2030 for all residual GHG emissions. Transition plan for climate change Achieving our verified Science Based Targets initiative (SBTi) Net-Zero Corporate standard targets will require decarbonisation across the whole value chain. We are using decarbonisation levers to address every aspect of our GHG footprint, following a hierarchy (eliminate-reduce-substitute) to address each emission source across Scopes 1, 2 and 3. Specific decarbonisation levers are described below. Over 95% of our total GHG emissions are in the upstream and downstream value chain, reported under Scope 3. Target achievement will therefore require extensive decarbonisation across our supply chain, including our product portfolios. We are progressing towards our SBTi near-term target of 98% absolute reduction in Scope 1 and 2 GHG emissions by 2026 from a 2015 baseline, having already doubled our energy productivity since 2015 (unit revenue per unit of energy consumed at our sites), continuing the transition to electric vehicles in our road fleet (EV100) by the end of 2025 and using 100% renewable energy (RE100) for electricity and heat by 2026. To support delivery of our longer-term target of 50% reduction in total Scope 3 GHG emissions by 2030 and 90% reduction by 2045, from a 2019 baseline, we are engaging with suppliers for them to set validated SBTs to cover most of our supplier spend by the end of 2025. Pharmaceutical products have a long development cycle, which makes it critical to design and embed climate considerations at an early stage. To achieve our goals, we must tackle emissions from our existing commercial portfolio, which creates challenges with heavily regulated production processes and materials. Climate governance The guide for our Environmental Management System is embedded in our Code of Ethics and supported by our already defined SHE Standard, together with our OneSHE Framework of internal standards, procedures and guidelines. Our SHE management system ensures the environmental risks of our activities are assessed, operational controls are in place, checks are completed through a risk-based audit programme guided by an independent organisation and there is an annual Climate change As part of our Ambition 2030, we are focused on leading on climate, equity and resilience, including strategic initiatives to address the interconnection between climate and health. BV management review process. Climate change adaptation is managed under our Standards on Business Continuity Process, Enterprise Risk, Management of Change, Minimum Environmental Requirements for the Built Environment and SHE Assurance. The Sustainability Committee monitors progress on Ambition Zero Carbon. Sustainability reporting is overseen by the Audit Committee. The CEO’s responsibilities to the Board include the development and performance of the Ambition Zero Carbon strategy and related risks and opportunities. The EVP, Global Operations, IT & Chief Sustainability Officer is responsible for the Ambition Zero Carbon strategy and its execution, and all SET members have responsibility for working with their teams to ensure alignment of the Ambition Zero Carbon strategy with business priorities and climate risks and opportunities. Our executive-led Ambition Zero Carbon Governance Group is accountable for the delivery of Ambition Zero Carbon. Regular governance updates and proposals are provided to the Governance Group, which in 2024 included our CEO, CFO, and the EVP, Global Operations, IT & Chief Sustainability Officer. The Climate and Nature Steering Group co-ordinates the management of physical and transitional climate risks and opportunities and supports the Group’s adaptation and resilience actions. Our Ambition Zero Carbon investment is now being embedded into business financial planning, which is being adapted to incorporate the choices that will be made across our global portfolio and the impacts on the cost of goods. As our sites and markets develop their zero carbon roadmaps, they are identifying potential investments and embedding them into the annual long-range budgeting process. Scope 1 and 2 Decarbonisation levers Electrification (road fleet) At the end of 2024 we had successfully transitioned 63% of our total owned and leased road vehicle fleet (over 20,000 vehicles) to battery electric vehicles (BEVs). Our fleet accounts for 23% of our Scope 1 and 2 GHG footprint in 2024 and switching to BEVs contributes to our Ambition Zero Carbon target through eliminating tailpipe GHG emissions and procuring renewable electricity certificates equivalent to the charging electricity requirements. For more information, see: Standards and Policies, including Code of Ethics, on page 42. Streamlined Energy and Carbon Reporting, on page 233. Remuneration Report, from page 112. AstraZeneca Annual Report & Form 20-F Information 2024 53 Strategic Report Corporate Governance Financial Statements Additional Information Business Review | People and Sustainability |