Gentherm to Combine with Modine Performance Technologies Building scale in thermal management solutions January 29, 2026 Gentherm © 2026 .2

Forward-Looking Statements and RMT Disclaimer Gentherm © 2026 Additional Information and Where to Find It In connection with the proposed transaction among Gentherm, Modine and SpinCo, the parties intend to file relevant materials with the SEC, including, among other filings, a registration statement on Form S-4 to be filed by Gentherm (the “Form S-4”) that will include a preliminary proxy statement/prospectus of Gentherm and a definitive proxy statement/prospectus of Gentherm, the latter of which will be mailed to shareholders of Gentherm, and a registration statement on Form 10 to be filed by SpinCo that will incorporate by reference certain portions of the Form S-4 and will serve as an information statement/prospectus in connection with the spin-off of SpinCo from Modine. INVESTORS AND SECURITY HOLDERS OF Gentherm AND Modine ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THE INFORMATION STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT Gentherm, Modine, SPINCO, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Form S-4 and the proxy statement/prospectus (when available) and other documents filed with the SEC by Gentherm, Modine or SpinCo through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Gentherm will be available free of charge on Gentherm's website at ir.Gentherm.com under the tab “Financial Info” and under the heading “SEC Filings.” Copies of the documents filed with the SEC by Modine and SpinCo will be available free of charge on Modine's website at investors.Modine.com under the tab “Financials” and under the heading “SEC Filings.” Participants in the Solicitation Gentherm and Modine and their respective directors and executive officers and other members of management and employees may be considered participants in the solicitation of proxies from Gentherm’s shareholders in connection with the Proposed Transaction. Information about the directors and executive officers of Gentherm is set forth in its Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on February 19, 2025, and its proxy statement for its 2025 annual meeting of shareholders, which was filed with the SEC on March 27, 2025. To the extent holdings of Gentherm’s securities by its directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. Information about the directors and executive officers of Gentherm and other information regarding the potential participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Proposed Transaction. Information about the directors and executive officers of Modine is set forth in its Annual Report on Form 10-K for the year ended March 31, 2025, which was filed with the SEC on May 21, 2025, and its proxy statement for its 2025 annual meeting of shareholders, which was filed with the SEC on July 9, 2025. To the extent holdings of Modine’s securities by its directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. You may obtain these documents (when they become available) free of charge through the website maintained by the SEC at www.sec.gov and from Gentherm’s website and Modine’s website as described above. No offer or solicitation This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. It does not constitute a prospectus or prospectus equivalent document. No offering or sale of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the "Securities Act"), and otherwise in accordance with applicable law. Performance Technologies + Cautionary Statement Regarding Forward-Looking Statements This communication includes “forward-looking statements” as that term is defined in Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the Proposed Transaction among Gentherm, Modine and SpinCo. All statements, other than historical facts, including, but not limited to, statements regarding the expected timing, structure, benefits, tax consequences and financing of the Proposed Transaction, the ability of the parties to complete the Proposed Transaction, the combined company’s plans, objectives, expectations, intentions, valuation, and financial performance, and legal, economic and regulatory conditions, and any assumptions underlying any of the foregoing, are forward-looking statements. These forward-looking statements are based on Gentherm’s and Modine’s current expectations. None of Gentherm, Modine, SpinCo or any of their respective directors, executive officers, advisors or representatives make any representation or provide any assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur, or if any of them do occur, what impact they will have on the business, results of operations or financial condition of Gentherm, Modine or the combined business. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements, including developments that could have a material adverse effect on Gentherm’s and Modine’s businesses and the ability to successfully complete the Proposed Transaction and realize its benefits. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) that one or more closing conditions to the Proposed Transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the Proposed Transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the shareholders of Gentherm may not be obtained; (2) the risk that the Proposed Transaction may not be completed on the terms or in the time frame expected by Gentherm, Modine and SpinCo, or at all; (3) unexpected costs, charges or expenses resulting from the Proposed Transaction; (4) uncertainty of the expected financial performance of the combined company following completion of the Proposed Transaction; (5) failure to realize the anticipated benefits of the Proposed Transaction, including as a result of delay in completing the Proposed Transaction or integrating the businesses of Gentherm and SpinCo, on the expected timeframe or at all; (6) the ability of the combined company to implement its business strategy; (7) difficulties and delays in the combined company achieving revenue and cost synergies; (8) inability of the combined company to retain and hire key personnel; (9) the occurrence of any event that could give rise to termination of the Proposed Transaction; (10) the risk that shareholder litigation in connection with the Proposed Transaction or other litigation, settlements or investigations may affect the timing or occurrence of the Proposed Transaction or result in significant costs of defense, indemnification and liability; (11) evolving legal, regulatory and tax regimes; (12) changes in general economic and/or industry specific conditions or any volatility resulting from the imposition of and changing policies, including those policies with respect to tariffs; (13) actions by third parties, including government agencies; (14) the risk that the anticipated tax treatment of the Proposed Transaction is not obtained; (15) the risk of greater than expected difficulty in separating the business of SpinCo from the other businesses of Modine; (16) risks related to the disruption of management time from ongoing business operations due to the pendency of the Proposed Transaction, or other effects of the pendency of the Proposed Transaction on the relationship of any of the parties to the Proposed Transaction with their employees, customers, suppliers, or other counterparties; and (17) other risk factors detailed from time to time in Gentherm’s and Modine’s reports filed with the SEC, including documents that will be filed with the SEC in connection with the Proposed Transaction. The foregoing list of important factors is not exclusive. Any forward-looking statements speak only as of the date of this communication. None of Gentherm, Modine or SpinCo undertakes, and each party expressly disclaims, any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements. Use of Non-GAAP Financial Measures In addition to the financial measures presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), this communication includes certain non-GAAP financial measures (collectively, the “Non-GAAP Measures”), such as adjusted EBITDA, adjusted EBITDA margin, net leverage ratio, and adjusted EPS. These Non-GAAP Measures should not be used in isolation or as a substitute or alternative to results determined in accordance with U.S. GAAP. In addition, Gentherm’s and Modine’s definitions of these Non-GAAP Measures may not be comparable to similarly titled non-GAAP financial measures reported by other companies. Gentherm has presented its expectations regarding Adjusted EBITDA without the corresponding GAAP metric or a reconciliation to a corresponding GAAP metric as such information is not available without unreasonable effort at the time of the release of this preliminary financial information.

Today’s Speakers Gentherm © 2026 Introduction | Transaction Overview | Modine Performance Technologies Background | Strategic and Financial Benefits | Summary Bill Presley President and Chief Executive Officer Jon Douyard Executive Vice President and Chief Financial Officer Jeremy Patten President, Modine Performance Technologies Performance Technologies +

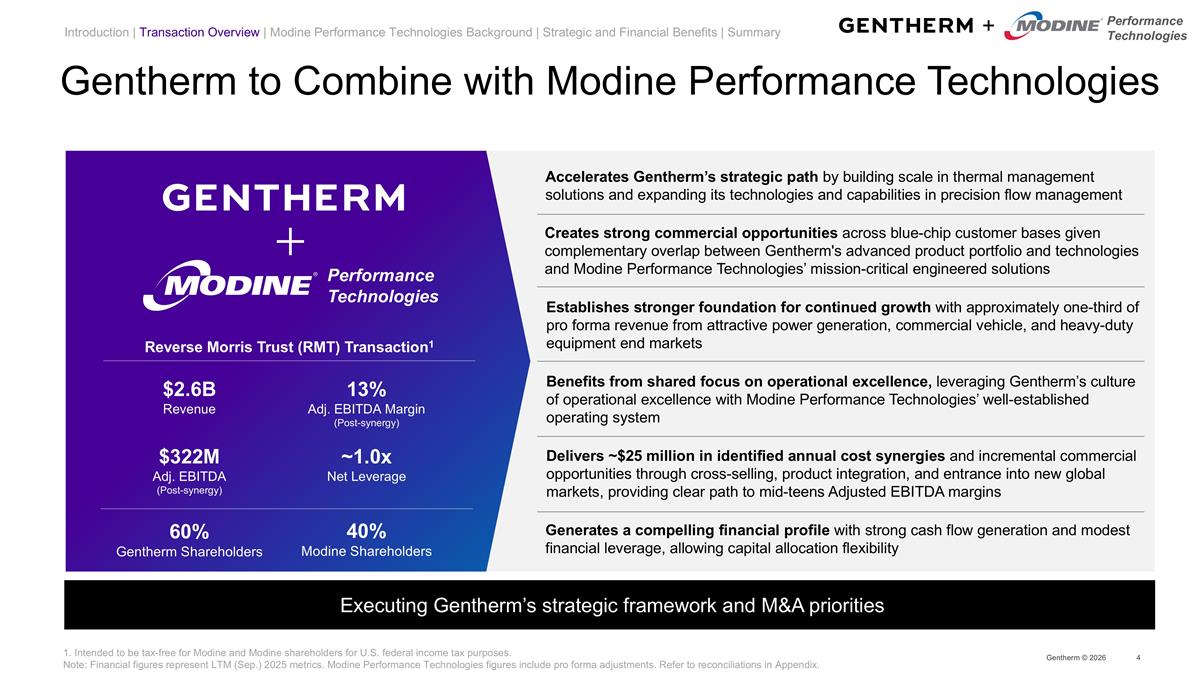

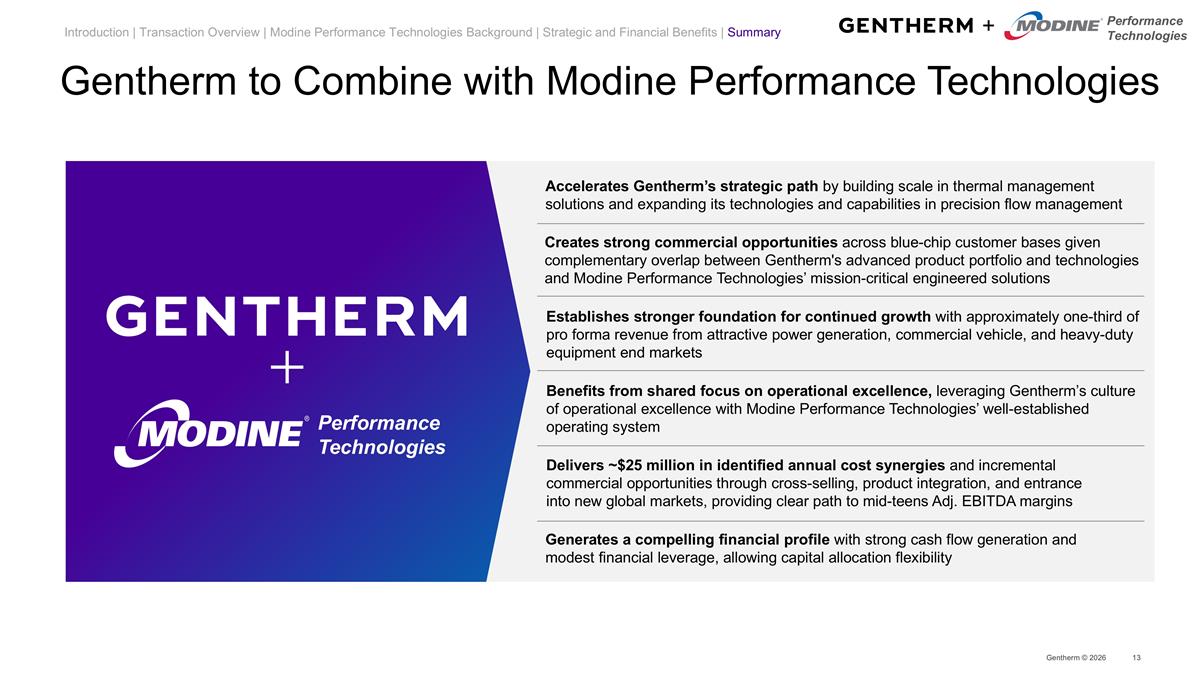

Gentherm to Combine with Modine Performance Technologies Executing Gentherm’s strategic framework and M&A priorities Performance Technologies Introduction | Transaction Overview | Modine Performance Technologies Background | Strategic and Financial Benefits | Summary Generates a compelling financial profile with strong cash flow generation and modest financial leverage, allowing capital allocation flexibility Delivers ~$25 million in identified annual cost synergies and incremental commercial opportunities through cross-selling, product integration, and entrance into new global markets, providing clear path to mid-teens Adjusted EBITDA margins Creates strong commercial opportunities across blue-chip customer bases given complementary overlap between Gentherm's advanced product portfolio and technologies and Modine Performance Technologies’ mission-critical engineered solutions Accelerates Gentherm’s strategic path by building scale in thermal management solutions and expanding its technologies and capabilities in precision flow management Establishes stronger foundation for continued growth with approximately one-third of pro forma revenue from attractive power generation, commercial vehicle, and heavy-duty equipment end markets Benefits from shared focus on operational excellence, leveraging Gentherm’s culture of operational excellence with Modine Performance Technologies’ well-established operating system $2.6B Revenue $322M Adj. EBITDA (Post-synergy) ~1.0x Net Leverage 60% Gentherm Shareholders 40% Modine Shareholders 13% Adj. EBITDA Margin (Post-synergy) 1. Intended to be tax-free for Modine and Modine shareholders for U.S. federal income tax purposes. Note: Financial figures represent LTM (Sep.) 2025 metrics. Modine Performance Technologies figures include pro forma adjustments. Refer to reconciliations in Appendix. Reverse Morris Trust (RMT) Transaction1 Gentherm © 2026 Performance Technologies +

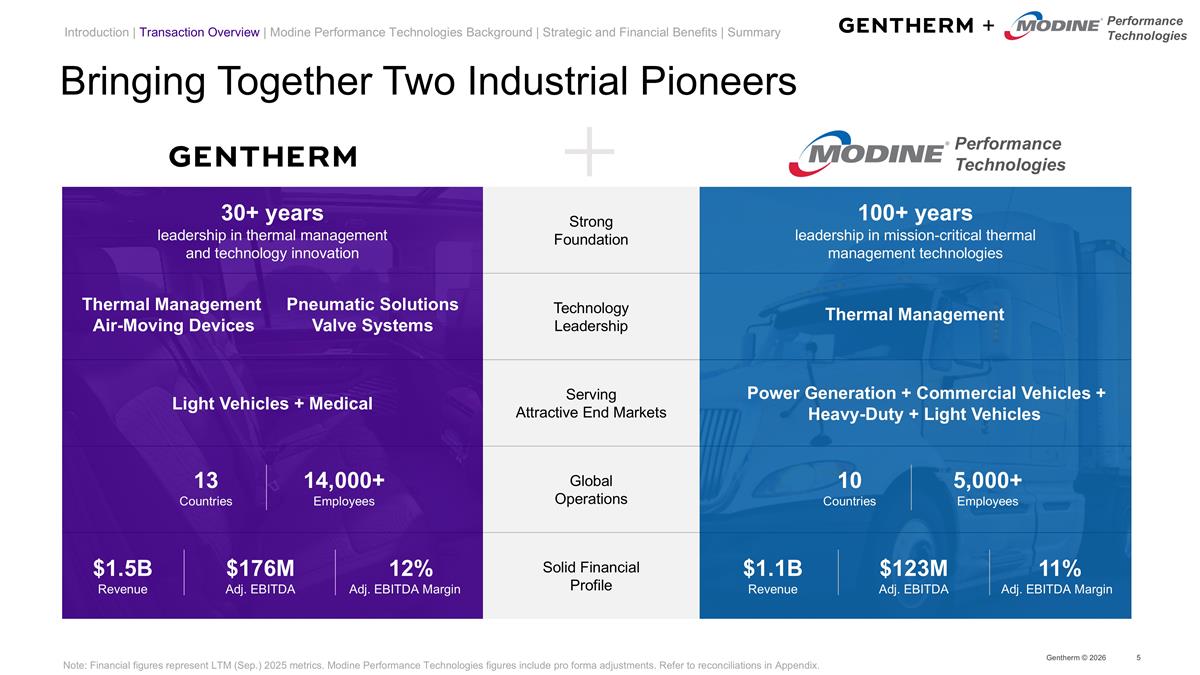

30+ years leadership in thermal management and technology innovation Strong Foundation 100+ years leadership in mission-critical thermal management technologies Technology Leadership Light Vehicles + Medical Serving Attractive End Markets Power Generation + Commercial Vehicles + Heavy-Duty + Light Vehicles Global Operations Solid Financial Profile Gentherm © 2026 Bringing Together Two Industrial Pioneers 13 Countries 14,000+ Employees 10 Countries 5,000+ Employees $1.5B Revenue $176M Adj. EBITDA 12% Adj. EBITDA Margin $1.1B Revenue $123M Adj. EBITDA 11% Adj. EBITDA Margin Performance Technologies Introduction | Transaction Overview | Modine Performance Technologies Background | Strategic and Financial Benefits | Summary Thermal Management Performance Technologies + Thermal Management Air-Moving Devices Pneumatic Solutions Valve Systems Note: Financial figures represent LTM (Sep.) 2025 metrics. Modine Performance Technologies figures include pro forma adjustments. Refer to reconciliations in Appendix.

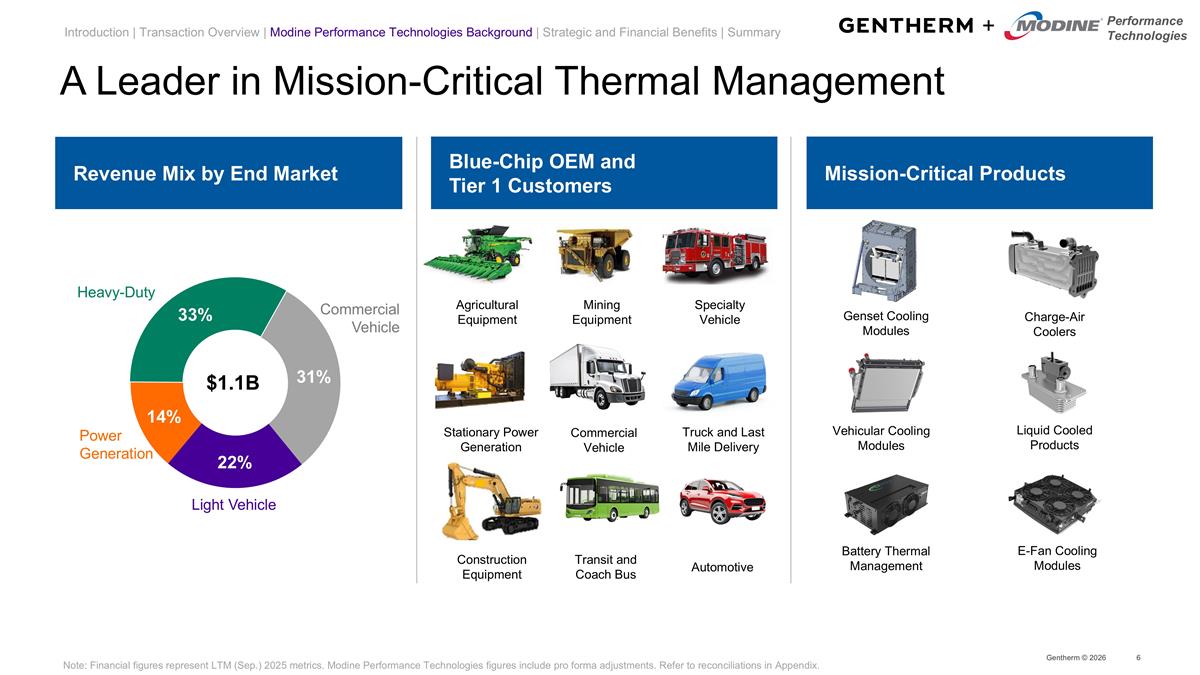

Gentherm © 2026 A Leader in Mission-Critical Thermal Management Revenue Mix by End Market Blue-Chip OEM and Tier 1 Customers Mission-Critical Products Charge-Air Coolers Genset Cooling Modules Vehicular Cooling Modules Liquid Cooled Products Battery Thermal Management E-Fan Cooling Modules Introduction | Transaction Overview | Modine Performance Technologies Background | Strategic and Financial Benefits | Summary Commercial Vehicle Light Vehicle Power Generation Heavy-Duty $1.1B Performance Technologies + Agricultural Equipment Mining Equipment Specialty Vehicle Stationary Power Generation Commercial Vehicle Truck and Last Mile Delivery Construction Equipment Automotive Transit and Coach Bus Note: Financial figures represent LTM (Sep.) 2025 metrics. Modine Performance Technologies figures include pro forma adjustments. Refer to reconciliations in Appendix.

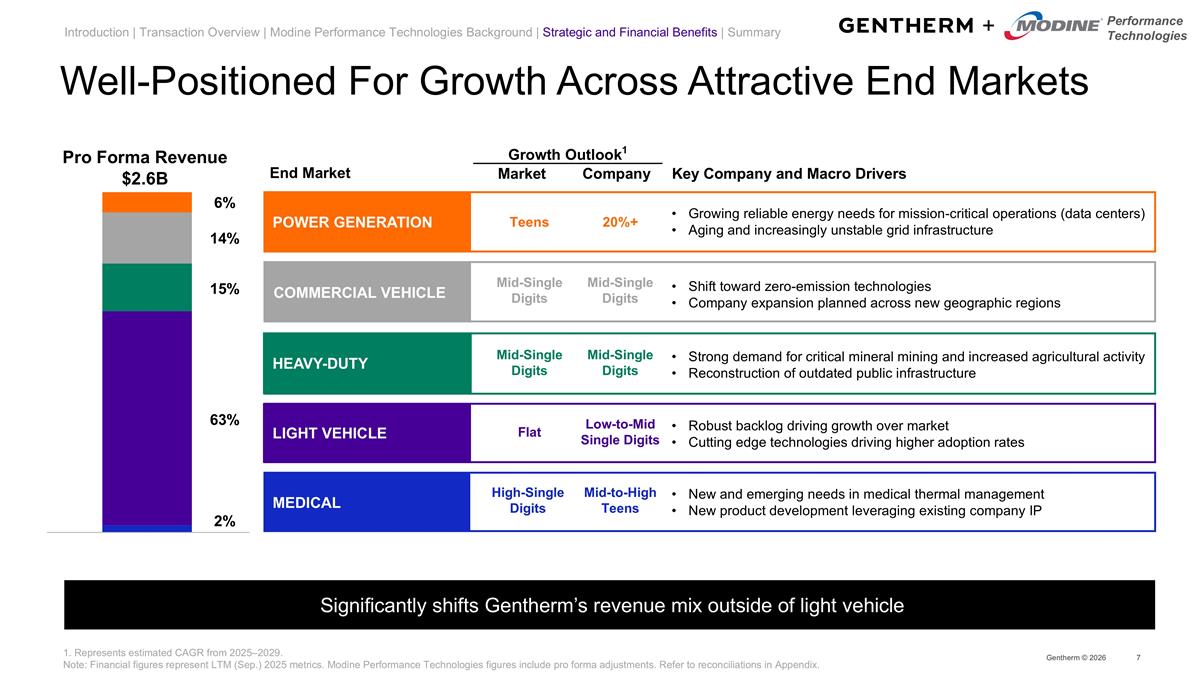

1. Represents estimated CAGR from 2025–2029. Note: Financial figures represent LTM (Sep.) 2025 metrics. Modine Performance Technologies figures include pro forma adjustments. Refer to reconciliations in Appendix. Well-Positioned For Growth Across Attractive End Markets Pro Forma Revenue Gentherm © 2026 Growth Outlook1 End Market Market Company Key Company and Macro Drivers Growing reliable energy needs for mission‑critical operations (data centers) Aging and increasingly unstable grid infrastructure POWER GENERATION 20%+ New and emerging needs in medical thermal management New product development leveraging existing company IP MEDICAL Mid-to-High Teens Shift toward zero‑emission technologies Company expansion planned across new geographic regions COMMERCIAL VEHICLE Mid-Single Digits Introduction | Transaction Overview | Modine Performance Technologies Background | Strategic and Financial Benefits | Summary HEAVY-DUTY Mid-Single Digits Strong demand for critical mineral mining and increased agricultural activity Reconstruction of outdated public infrastructure Robust backlog driving growth over market Cutting edge technologies driving higher adoption rates LIGHT VEHICLE Low-to-Mid Single Digits $2.6B 6% 14% 15% 63% 2% Significantly shifts Gentherm’s revenue mix outside of light vehicle Teens High-Single Digits Mid-Single Digits Mid-Single Digits Flat Performance Technologies +

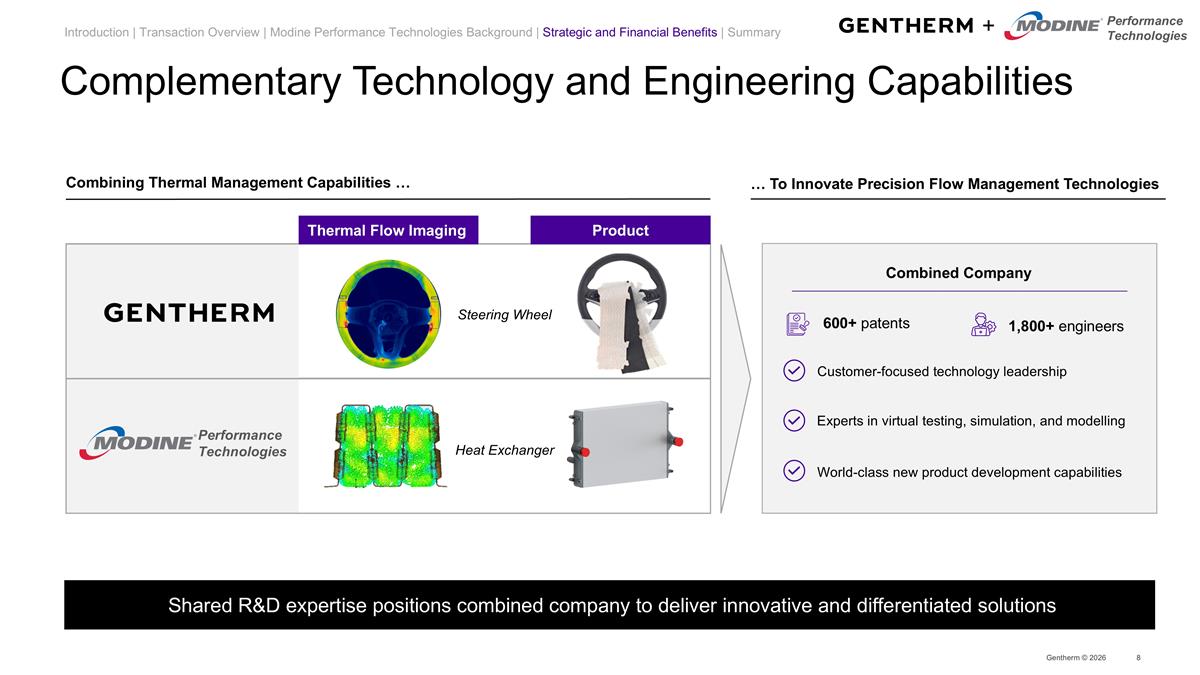

Complementary Technology and Engineering Capabilities Introduction | Transaction Overview | Modine Performance Technologies Background | Strategic and Financial Benefits | Summary Gentherm © 2026 Combining Thermal Management Capabilities … … To Innovate Precision Flow Management Technologies Steering Wheel Customer-focused technology leadership World-class new product development capabilities Experts in virtual testing, simulation, and modelling 1,800+ engineers 600+ patents Combined Company Shared R&D expertise positions combined company to deliver innovative and differentiated solutions Performance Technologies Product Thermal Flow Imaging Performance Technologies + Heat Exchanger

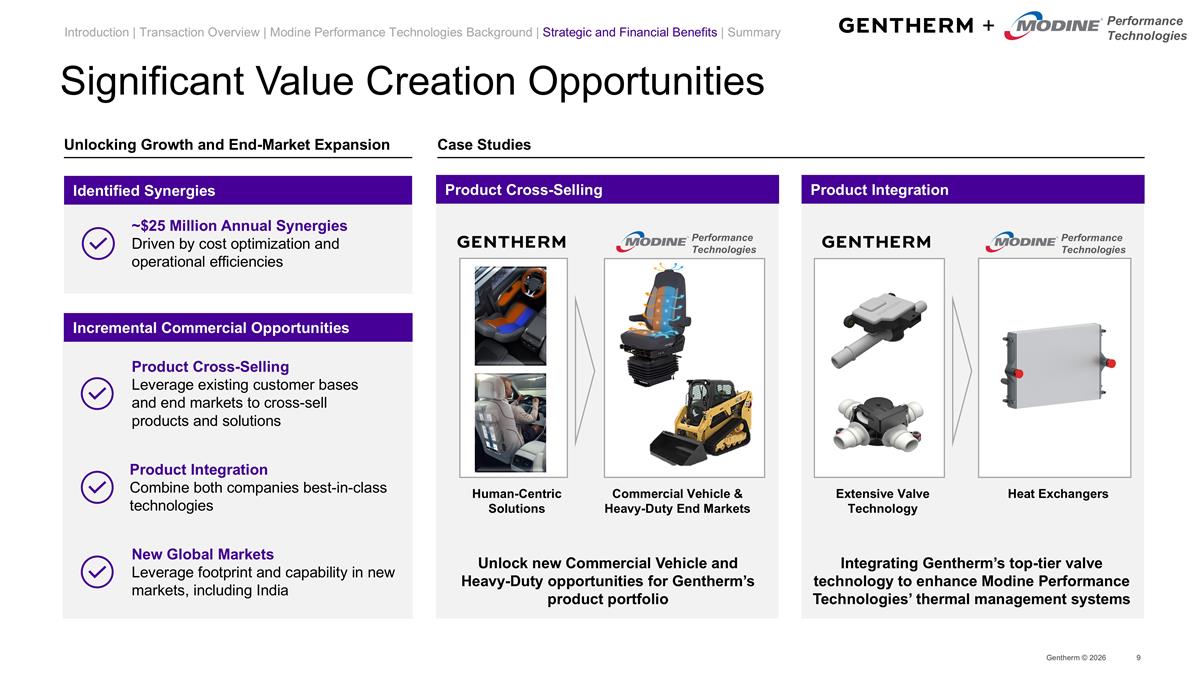

Gentherm © 2026 Significant Value Creation Opportunities Unlock new Commercial Vehicle and Heavy-Duty opportunities for Gentherm’s product portfolio Human-Centric Solutions Commercial Vehicle & Heavy-Duty End Markets Product Cross-Selling Case Studies Identified Synergies Incremental Commercial Opportunities ~$25 Million Annual Synergies Driven by cost optimization and operational efficiencies New Global Markets Leverage footprint and capability in new markets, including India Product Integration Combine both companies best-in-class technologies Product Cross-Selling Leverage existing customer bases and end markets to cross-sell products and solutions Integrating Gentherm’s top-tier valve technology to enhance Modine Performance Technologies’ thermal management systems Extensive Valve Technology Product Integration Introduction | Transaction Overview | Modine Performance Technologies Background | Strategic and Financial Benefits | Summary Unlocking Growth and End-Market Expansion Performance Technologies + Performance Technologies Heat Exchangers Performance Technologies

Shared Commitment to Operational Excellence Gentherm © 2026 Well-established operating system and continuous improvement culture Aligning inventory and supply chain Standardizing operating system and key performance indicators Transforming footprint and maximizing plant and equipment utilization Cultivating a culture of operational excellence Combined company will focus on increased efficiency, scalability, and quality Performance Technologies Exited low-margin, non-strategic products Lean cost structure and improved efficiency Shifted capital and resources to higher-return opportunities Leveraging Modine Performance Technologies’ process-oriented culture to accelerate operational excellence initiatives Operational excellence and appropriate cost structure will drive margin expansion and long‑term resilience Introduction | Transaction Overview | Modine Performance Technologies Background | Strategic and Financial Benefits | Summary Performance Technologies +

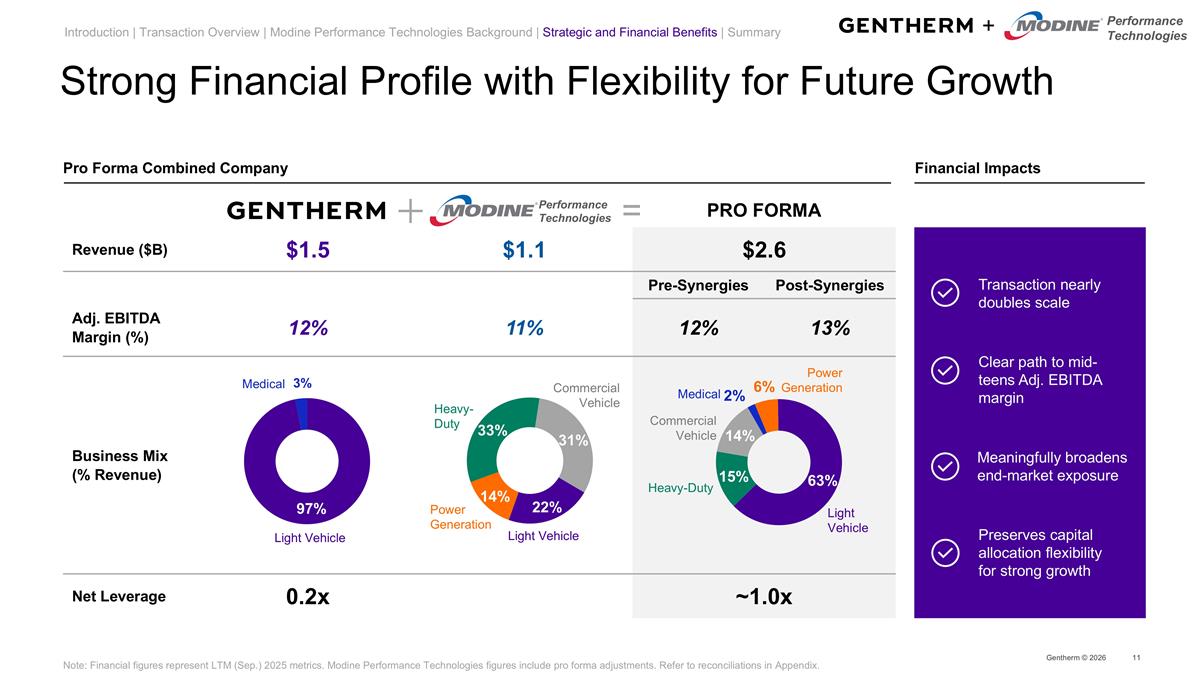

Gentherm © 2026 Strong Financial Profile with Flexibility for Future Growth Financial Impacts Introduction | Transaction Overview | Modine Performance Technologies Background | Strategic and Financial Benefits | Summary Revenue ($B) $1.5 $1.1 $2.6 Pre-Synergies Post-Synergies Adj. EBITDA Margin (%) 12% 11% 12% 13% Business Mix (% Revenue) Net Leverage 0.2x ~1.0x Performance Technologies = PRO FORMA Pro Forma Combined Company Medical Light Vehicle Commercial Vehicle Heavy-Duty Power Generation Commercial Vehicle Light Vehicle Power Generation Heavy-Duty Medical Light Vehicle Performance Technologies + Preserves capital allocation flexibility for strong growth Clear path to mid-teens Adj. EBITDA margin Transaction nearly doubles scale Meaningfully broadens end-market exposure Note: Financial figures represent LTM (Sep.) 2025 metrics. Modine Performance Technologies figures include pro forma adjustments. Refer to reconciliations in Appendix.

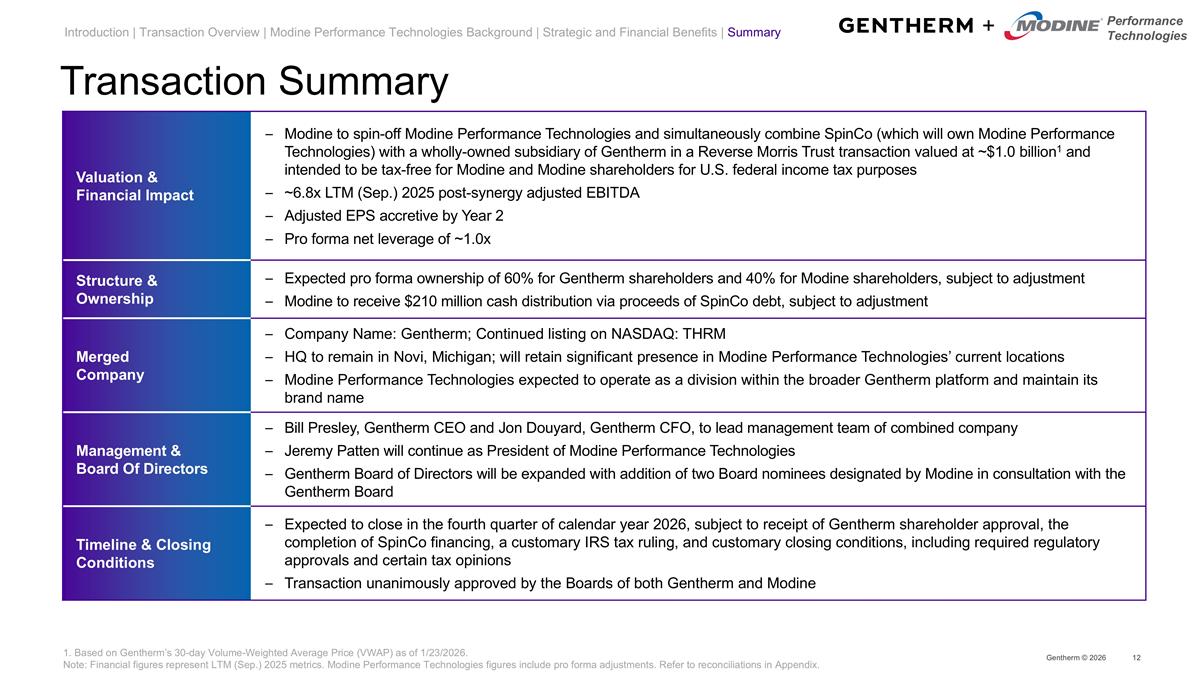

Gentherm © 2026 Transaction Summary Introduction | Transaction Overview | Modine Performance Technologies Background | Strategic and Financial Benefits | Summary Valuation & Financial Impact Modine to spin-off Modine Performance Technologies and simultaneously combine SpinCo (which will own Modine Performance Technologies) with a wholly-owned subsidiary of Gentherm in a Reverse Morris Trust transaction valued at ~$1.0 billion1 and intended to be tax-free for Modine and Modine shareholders for U.S. federal income tax purposes ~6.8x LTM (Sep.) 2025 post-synergy adjusted EBITDA Adjusted EPS accretive by Year 2 Pro forma net leverage of ~1.0x Structure & Ownership Expected pro forma ownership of 60% for Gentherm shareholders and 40% for Modine shareholders, subject to adjustment Modine to receive $210 million cash distribution via proceeds of SpinCo debt, subject to adjustment Merged Company Company Name: Gentherm; Continued listing on NASDAQ: THRM HQ to remain in Novi, Michigan; will retain significant presence in Modine Performance Technologies’ current locations Modine Performance Technologies expected to operate as a division within the broader Gentherm platform and maintain its brand name Management & Board Of Directors Bill Presley, Gentherm CEO and Jon Douyard, Gentherm CFO, to lead management team of combined company Jeremy Patten will continue as President of Modine Performance Technologies Gentherm Board of Directors will be expanded with addition of two Board nominees designated by Modine in consultation with the Gentherm Board Timeline & Closing Conditions Expected to close in the fourth quarter of calendar year 2026, subject to receipt of Gentherm shareholder approval, the completion of SpinCo financing, a customary IRS tax ruling, and customary closing conditions, including required regulatory approvals and certain tax opinions Transaction unanimously approved by the Boards of both Gentherm and Modine Performance Technologies + 1. Based on Gentherm’s 30-day Volume-Weighted Average Price (VWAP) as of 1/23/2026. Note: Financial figures represent LTM (Sep.) 2025 metrics. Modine Performance Technologies figures include pro forma adjustments. Refer to reconciliations in Appendix.

Gentherm to Combine with Modine Performance Technologies Gentherm © 2026 Introduction | Transaction Overview | Modine Performance Technologies Background | Strategic and Financial Benefits | Summary Performance Technologies Performance Technologies + Generates a compelling financial profile with strong cash flow generation and modest financial leverage, allowing capital allocation flexibility Delivers ~$25 million in identified annual cost synergies and incremental commercial opportunities through cross-selling, product integration, and entrance into new global markets, providing clear path to mid-teens Adj. EBITDA margins Creates strong commercial opportunities across blue-chip customer bases given complementary overlap between Gentherm's advanced product portfolio and technologies and Modine Performance Technologies’ mission-critical engineered solutions Accelerates Gentherm’s strategic path by building scale in thermal management solutions and expanding its technologies and capabilities in precision flow management Establishes stronger foundation for continued growth with approximately one-third of pro forma revenue from attractive power generation, commercial vehicle, and heavy-duty equipment end markets Benefits from shared focus on operational excellence, leveraging Gentherm’s culture of operational excellence with Modine Performance Technologies’ well-established operating system

Appendix Performance Technologies +

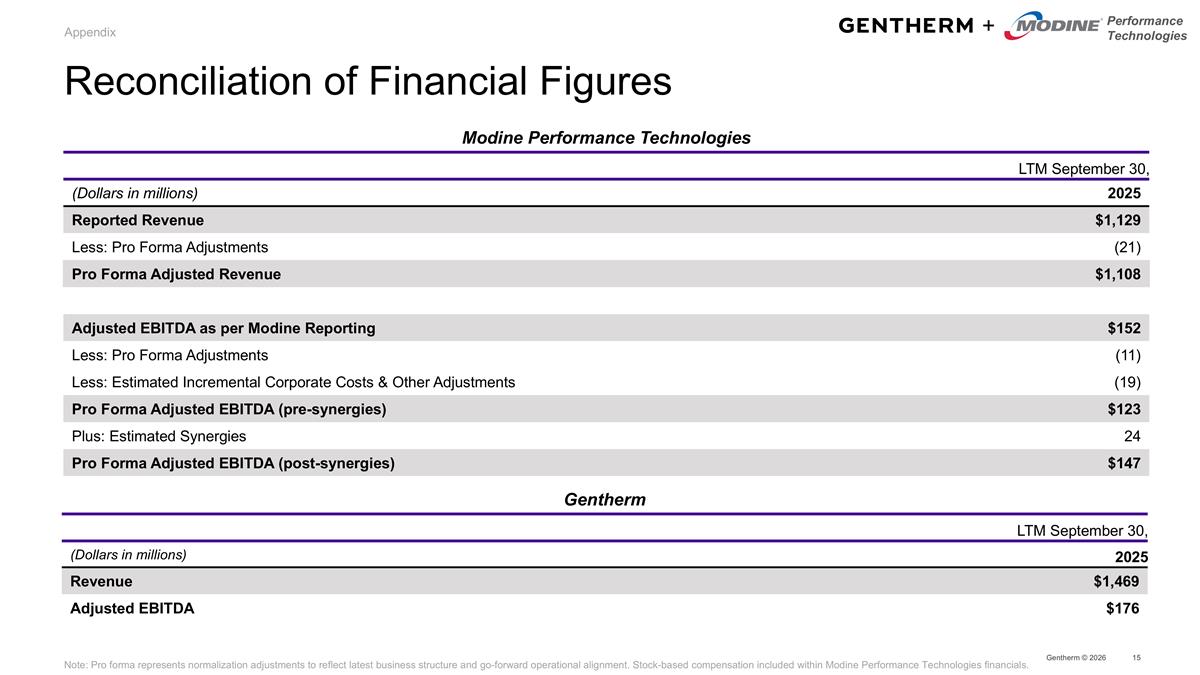

Reconciliation of Financial Figures Gentherm © 2026 Gentherm LTM September 30, (Dollars in millions) 2025 Revenue $1,469 Adjusted EBITDA $176 Note: Pro forma represents normalization adjustments to reflect latest business structure and go-forward operational alignment. Stock-based compensation included within Modine Performance Technologies financials. Performance Technologies + Modine Performance Technologies LTM September 30, (Dollars in millions) 2025 Reported Revenue $1,129 Less: Pro Forma Adjustments (21) Pro Forma Adjusted Revenue $1,108 Adjusted EBITDA as per Modine Reporting $152 Less: Pro Forma Adjustments (11) Less: Estimated Incremental Corporate Costs & Other Adjustments (19) Pro Forma Adjusted EBITDA (pre-synergies) $123 Plus: Estimated Synergies 24 Pro Forma Adjusted EBITDA (post-synergies) $147 Appendix

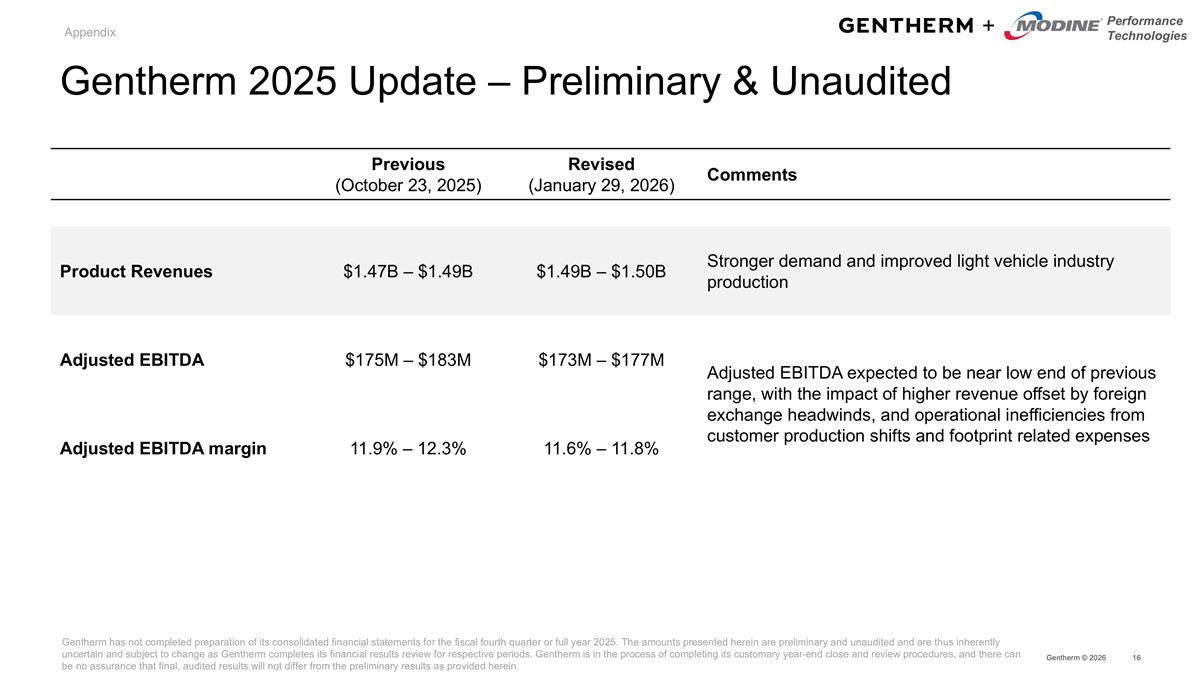

Gentherm has not completed preparation of its consolidated financial statements for the fiscal fourth quarter or full year 2025. The amounts presented herein are preliminary and unaudited and are thus inherently uncertain and subject to change as Gentherm completes its financial results review for respective periods. Gentherm is in the process of completing its customary year-end close and review procedures, and there can be no assurance that final, audited results will not differ from the preliminary results as provided herein. Gentherm 2025 Update – Preliminary & Unaudited Gentherm © 2026 Performance Technologies + Previous (October 23, 2025) Revised (January 29, 2026) Comments Product Revenues $1.47B – $1.49B $1.49B – $1.50B Stronger demand and improved light vehicle industry production Adjusted EBITDA $175M – $183M $173M – $177M Adjusted EBITDA expected to be near low end of previous range, with the impact of higher revenue offset by foreign exchange headwinds, and operational inefficiencies from customer production shifts and footprint related expenses Adjusted EBITDA margin 11.9% – 12.3% 11.6% – 11.8% Appendix