EXHIBIT 7

January 19, 2018

Dear Fellow NXP Shareholder:

Our firm, Elliott Advisors (UK) Limited (“Elliott”), advises funds which collectively hold an economic interest in NXP Semiconductors N.V. (“NXP”) of approximately 6.6%. Our increasing economic interest in NXP, which has current market value of approximately $2.7 billion, underscores our significant level of conviction in the value opportunity present at NXP today, as well as our alignment of interest with our fellow NXP shareholders.

In our December 11, 2017 letter, we wrote to you to outline our view that we believe NXP is worth $135 per share on a fundamental standalone basis, before any control premium that is customary in a takeover situation. This view is based on our own extensive research and that of our financial advisor, UBS Investment Bank (“UBS”), which we have shared on our website, www.FairValueForNXP.com.

Today, in order to provide additional perspectives on NXP, we are writing to you to outline our view that a take-out price that is fair and reasonable for both QUALCOMM Incorporated (“Qualcomm”) and NXP shareholders needs to include a customary change-of-control premium, and Qualcomm can afford to pay such premium. In short, we believe the current $110 offer is not even in the right zip-code and a credible offer from Qualcomm requires a price in excess of our estimate of NXP’s intrinsic standalone fair value of $135 per share1.

Our letter is organised as follows:

|

·

|

Our views on why NXP is uniquely able to fulfil Qualcomm’s long-term strategic aims;

|

|

·

|

Why we believe a price in excess of $135 per share for NXP is a fair and reasonable take-out price for an acquisition of NXP by Qualcomm; and

|

|

·

|

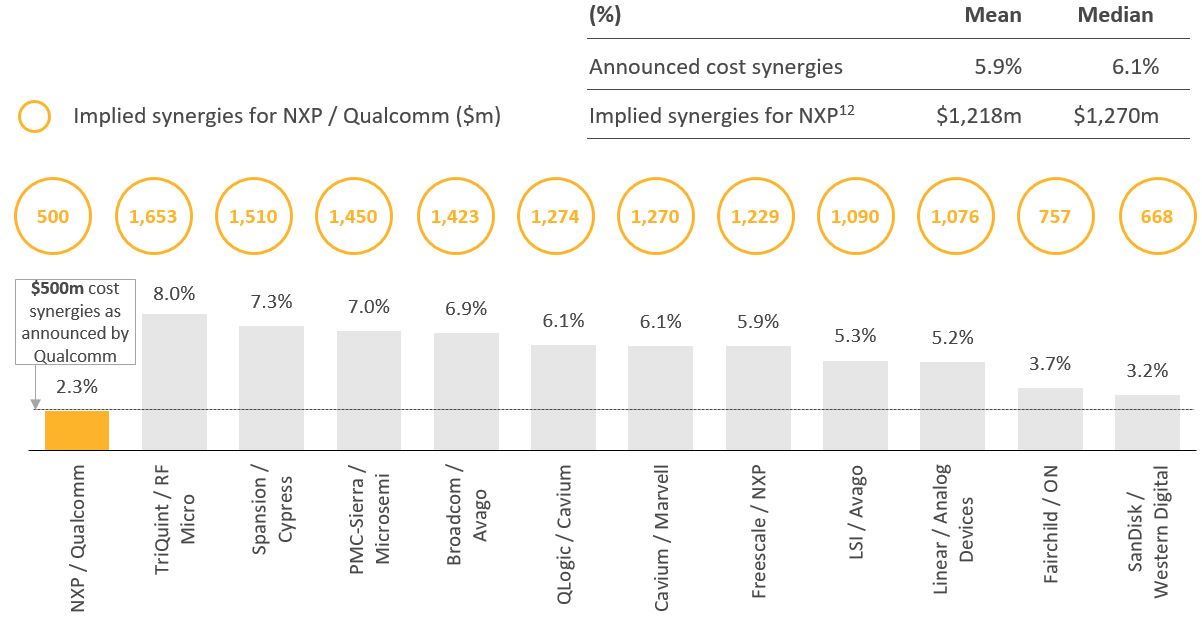

Why we believe the benefits of the transaction to Qualcomm: (i) justify a price not only well above its current offer of $110 per share, but also in excess of our view of NXP’s intrinsic standalone value of $135 per share, and (ii) deliver significant value to Qualcomm’s own shareholders.

|

Qualcomm’s current offer for NXP is $110 per share, well below NXP’s current trading price of $120 per share, as of the market close on January 18, 2018. Despite NXP trading above Qualcomm’s offer price since July 27, 2017, we believe it would trade even higher if not for the downward pressure imposed by Qualcomm’s highly opportunistic and unreasonably low offer. Given our analysis (further detailed at www.FairValueForNXP.com), we believe both Qualcomm and NXP shareholders stand to benefit from a credible offer for NXP — an offer which appropriately and fairly recognizes both NXP’s intrinsic value, the substantial value that will be delivered to Qualcomm and a control premium for NXP shareholders.

1 NXP’s standalone value is set out in Elliott’s press release and investor presentation, dated as of December 11, 2017, which can be viewed at www.FairValueforNXP.com