1Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation THE PATHWARD STORY UPDATED JANUARY 22, 2026

2Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation FORWARD LOOKING STATEMENTS This investor update contains “forward-looking statements” which are made in good faith by Pathward Financial, Inc. (the “Company”) pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future,” “target,” or the negative of those terms, or other words of similar meaning or similar expressions. You should carefully read statements that contain these words because they discuss our future expectations or state other “forward-looking” information. These forward-looking statements are based on information currently available to us and assumptions about future events, and include statements with respect to the Company’s beliefs, expectations, estimates, and intentions, which are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond the Company’s control. Such risks, uncertainties and other factors may cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Such statements address, among others, the following subjects: future operating results, including our performance expectations and fiscal 2026 financial guidance; our fiscal 2026 goals and strategy; progress on key strategic initiatives; our value proposition, including opportunities for revenue growth; expected results of our partnerships; impacts of our improved data analytics, underwriting and monitoring processes; impacts of our evolved operating model; expected nonperforming loan resolutions and net charge-off rates; the performance of our securities portfolio; the impact of card balances related to government stimulus programs; customer retention; loan and other product demand; new products and services; credit quality; the level of net charge-offs and the adequacy of the allowance for credit losses; and technology, including impacts of technology investments. The following factors, among others, could cause the Company's financial performance and results of operations to differ materially from the expectations, estimates, and intentions expressed in such forward-looking statements; maintaining our executive management team; expected growth opportunities may not be realized or may take longer to realize than expected; our ability to successfully implement measures designed to reduce expenses and increase efficiencies; changes in trade, monetary, and fiscal policies and laws, including actual changes in interest rates and the Fed Funds rate, and changes in international trade policies, tariffs and treaties affecting imports and exports, and their related impacts on macroeconomic conditions, customer behavior, funding costs and loan and securities portfolios; changes in tax laws; trade disputes, barriers to trade or the emergence of trade restrictions; the strength of the United States' economy, and the local economies in which the Company operates; adverse developments in the financial services industry generally such as bank failures, responsive measures to mitigate and manage such developments, related supervisory and regulatory actions and costs, and related impacts on customer behavior; inflation, market, and monetary fluctuations; our liquidity and capital positions, including the sufficiency of our liquidity; the timely and efficient development of, new products and services offered by the Company or its strategic partners, as well as risks (including reputational and litigation) attendant thereto, and the perceived overall value and acceptance of these products and services by users; the ability of the Company’s subsidiary Pathward®, N.A. (“Pathward”) to maintain its Durbin Amendment exemption; the risks of dealing with or utilizing third parties, including, in connection with the Company’s prepaid card and tax refund advance businesses, the risk of reduced volume of refund advance loans as a result of reduced customer demand for or usage of the Company’s strategic partners’ refund advance products; our relationship with and any actions which may be initiated by our regulators, and any related increases in compliance and other costs; changes in financial services laws and regulations, including laws and regulations relating to the tax refund industry; technological changes, including, but not limited to, the protection of our electronic systems and information; the impact of acquisitions and divestitures; litigation risk; the growth of the Company’s business, as well as expenses related thereto; continued maintenance by Pathward of its status as a well-capitalized institution, changes in consumer borrowing, spending and saving habits; losses from fraudulent or illegal activity, technological risks and developments and cyber threats, attacks or events; the success of the Company at maintaining its high quality asset level and managing and collecting assets of borrowers in default should problem assets increase; the potential adverse effects of unusual and infrequently occurring events, including the impact on financial markets from geopolitical conflicts such as the military conflicts in Ukraine and the Middle East, government shutdowns, weather-related disasters, or public health events, such as pandemics and any governmental or societal responses thereto; and the other factors described under the caption “Risk Factors” and in other sections of the Company’s Annual Report on Form 10-K for the Company's fiscal year ended September 30, 2025 and in other filings made by the Company with the Securities and Exchange Commission (“SEC”). The foregoing list of factors is not exclusive. We caution you not to place undue reliance on these forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in or referred to in this section.The forward-looking statements included herein speak only as of the date of this investor update. The Company expressly disclaims any intent or obligation to update, revise or clarify any forward-looking statements, whether written or oral, that may be made from time to time by or on behalf of the Company or its subsidiaries, whether as a result of new information, changed circumstances or future events or for any other reason.

3Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Since our founding, we have worked to advance financial inclusion. We seek out diverse partners, including fintechs, affinity groups, government agencies, and other banks and work with them to identify markets where people and businesses are underserved. Our national bank charter, coordination with regulators, and deep understanding of risk mitigation and compliance allow us to guide our partners and deliver financial products, services and funding to the people and businesses who need them the most. We are powering financial inclusion. AT PATHWARD®, LEADING THE WAY TO FINANCIAL ACCESS IS THE HEART OF OUR BUSINESS.

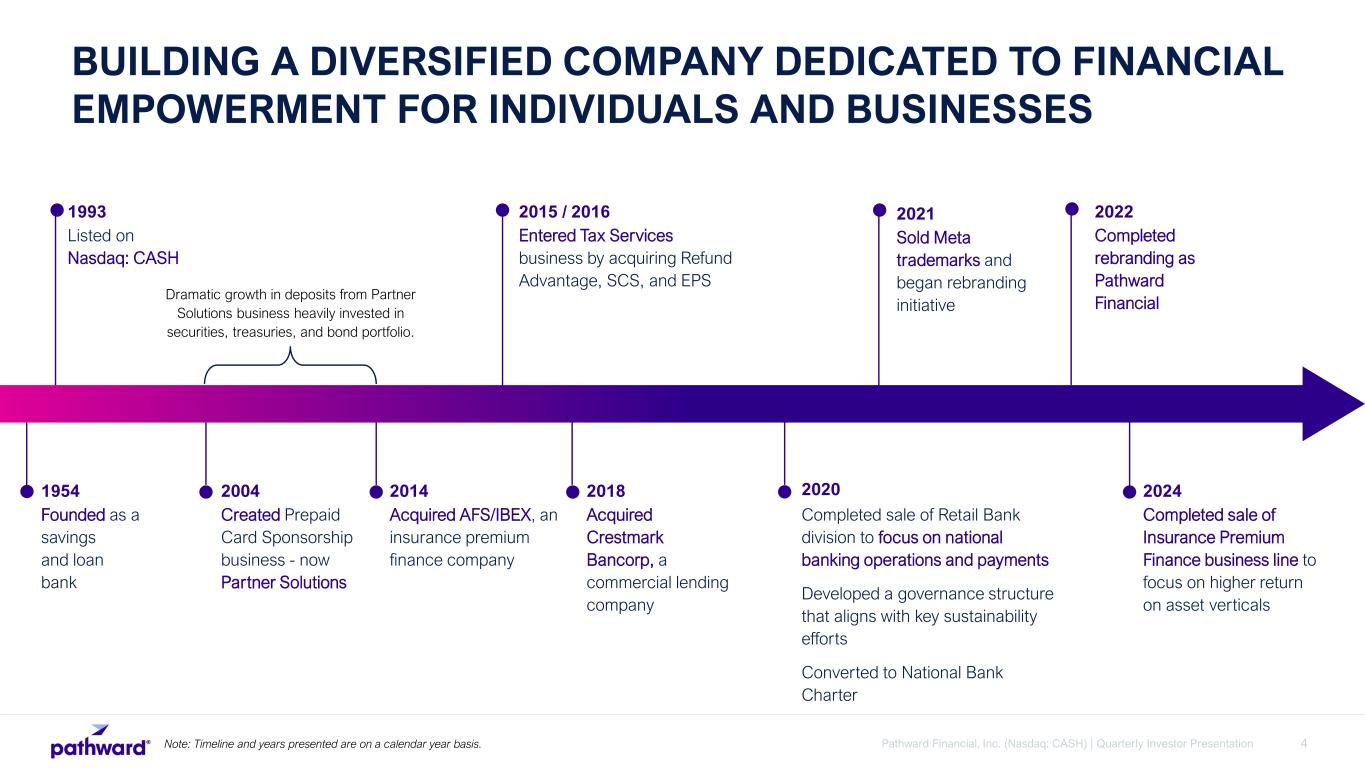

4Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation BUILDING A DIVERSIFIED COMPANY DEDICATED TO FINANCIAL EMPOWERMENT FOR INDIVIDUALS AND BUSINESSES 1993 Listed on Nasdaq: CASH 2015 / 2016 Entered Tax Services business by acquiring Refund Advantage, SCS, and EPS 2020 Completed sale of Retail Bank division to focus on national banking operations and payments Developed a governance structure that aligns with key sustainability efforts Converted to National Bank Charter 2004 Created Prepaid Card Sponsorship business - now Partner Solutions 2014 Acquired AFS/IBEX, an insurance premium finance company 2018 Acquired Crestmark Bancorp, a commercial lending company Dramatic growth in deposits from Partner Solutions business heavily invested in securities, treasuries, and bond portfolio. 1954 Founded as a savings and loan bank 2021 Sold Meta trademarks and began rebranding initiative 2022 Completed rebranding as Pathward Financial 2024 Completed sale of Insurance Premium Finance business line to focus on higher return on asset verticals Note: Timeline and years presented are on a calendar year basis.

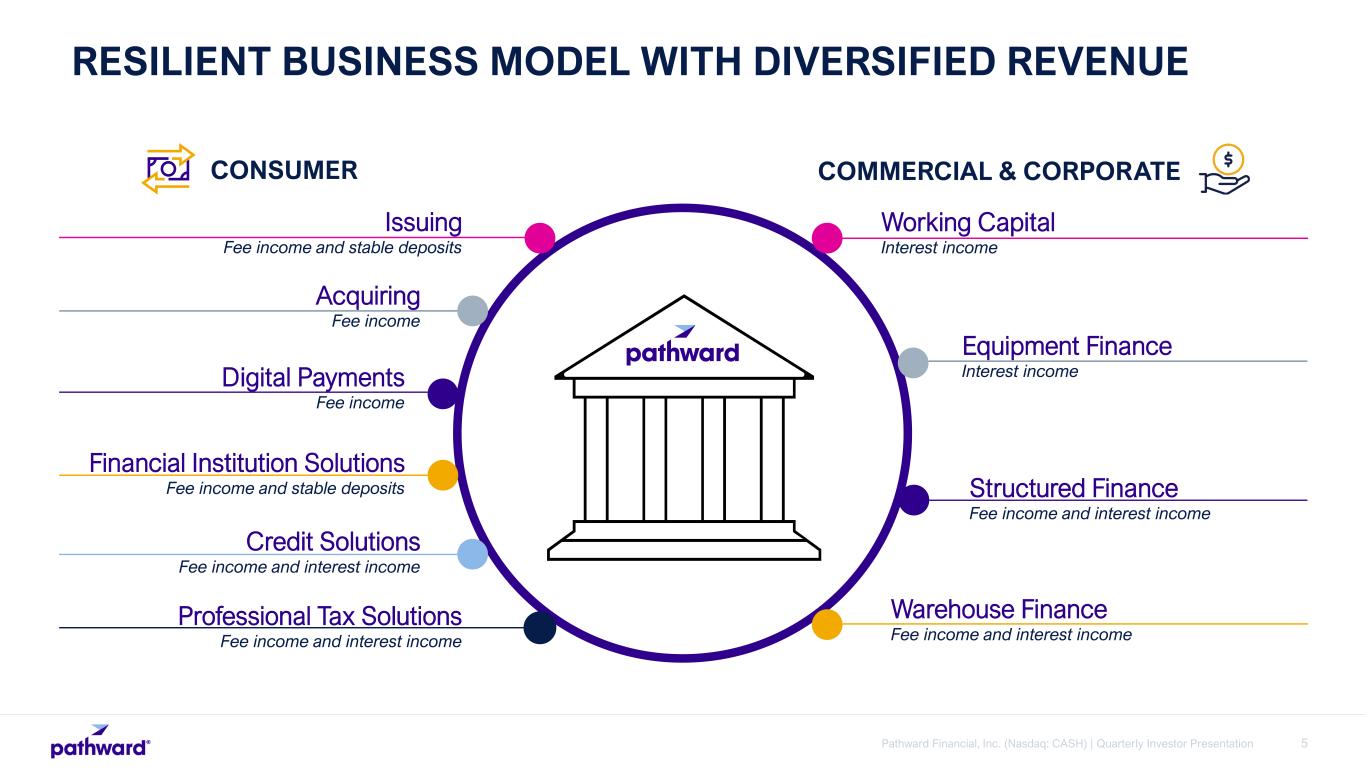

5Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation RESILIENT BUSINESS MODEL WITH DIVERSIFIED REVENUE Issuing Fee income and stable deposits Acquiring Fee income Digital Payments Fee income Financial Institution Solutions Fee income and stable deposits Credit Solutions Fee income and interest income Professional Tax Solutions Fee income and interest income Working Capital Interest income Equipment Finance Interest income Structured Finance Fee income and interest income Warehouse Finance Fee income and interest income CONSUMER COMMERCIAL & CORPORATE

6Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Issuing Acquiring Digital Payments Financial Institution Solutions Credit Solutions Professional Tax Solutions A leading debit and prepaid card issuer sponsoring partner programs Enable partners’ lending solutions to serve diverse credit needs Partner with a network of tax preparers offering a variety of products Partner with financial institutions to offer additional financial services Enable partners to move money quickly, efficiently and at a large scale across multiple payment rails Accepting and processing merchant payments with our partners PARTNER SOLUTIONS COLLABORATES WITH PARTNERS TO INNOVATE

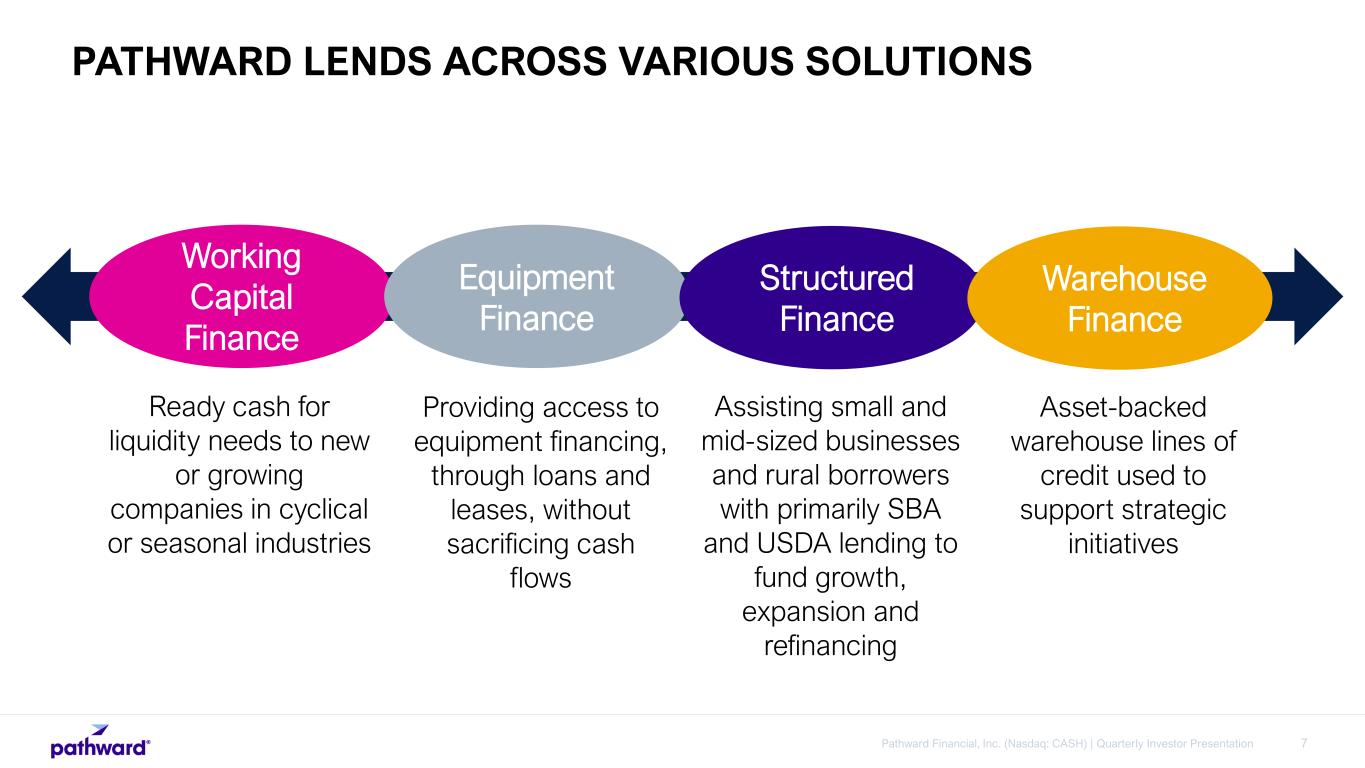

7Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Working Capital Finance Equipment Finance Structured Finance Ready cash for liquidity needs to new or growing companies in cyclical or seasonal industries Providing access to equipment financing, through loans and leases, without sacrificing cash flows Assisting small and mid-sized businesses and rural borrowers with primarily SBA and USDA lending to fund growth, expansion and refinancing Warehouse Finance Asset-backed warehouse lines of credit used to support strategic initiatives PATHWARD LENDS ACROSS VARIOUS SOLUTIONS

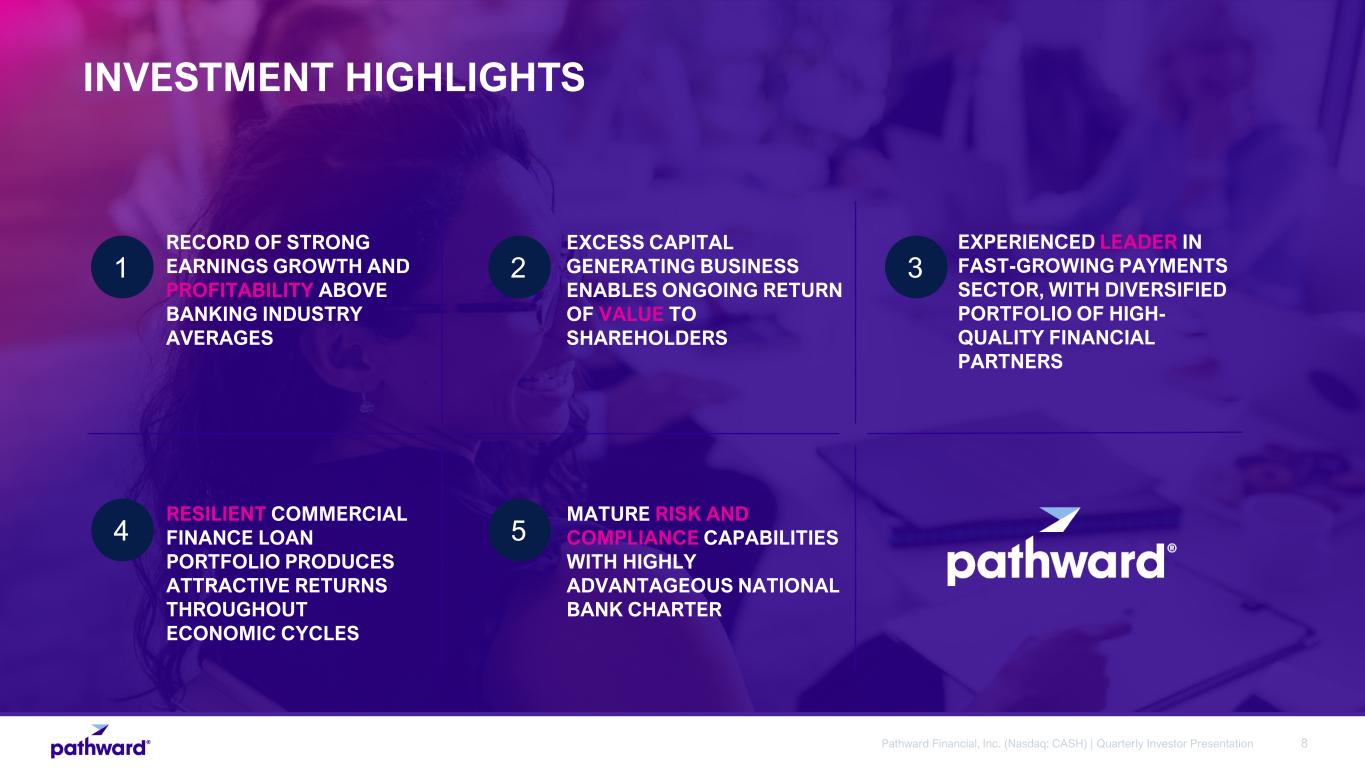

8Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation RECORD OF STRONG EARNINGS GROWTH AND PROFITABILITY ABOVE BANKING INDUSTRY AVERAGES EXCESS CAPITAL GENERATING BUSINESS ENABLES ONGOING RETURN OF VALUE TO SHAREHOLDERS INVESTMENT HIGHLIGHTS 2 3 4 1 5 EXPERIENCED LEADER IN FAST-GROWING PAYMENTS SECTOR, WITH DIVERSIFIED PORTFOLIO OF HIGH- QUALITY FINANCIAL PARTNERS RESILIENT COMMERCIAL FINANCE LOAN PORTFOLIO PRODUCES ATTRACTIVE RETURNS THROUGHOUT ECONOMIC CYCLES MATURE RISK AND COMPLIANCE CAPABILITIES WITH HIGHLY ADVANTAGEOUS NATIONAL BANK CHARTER

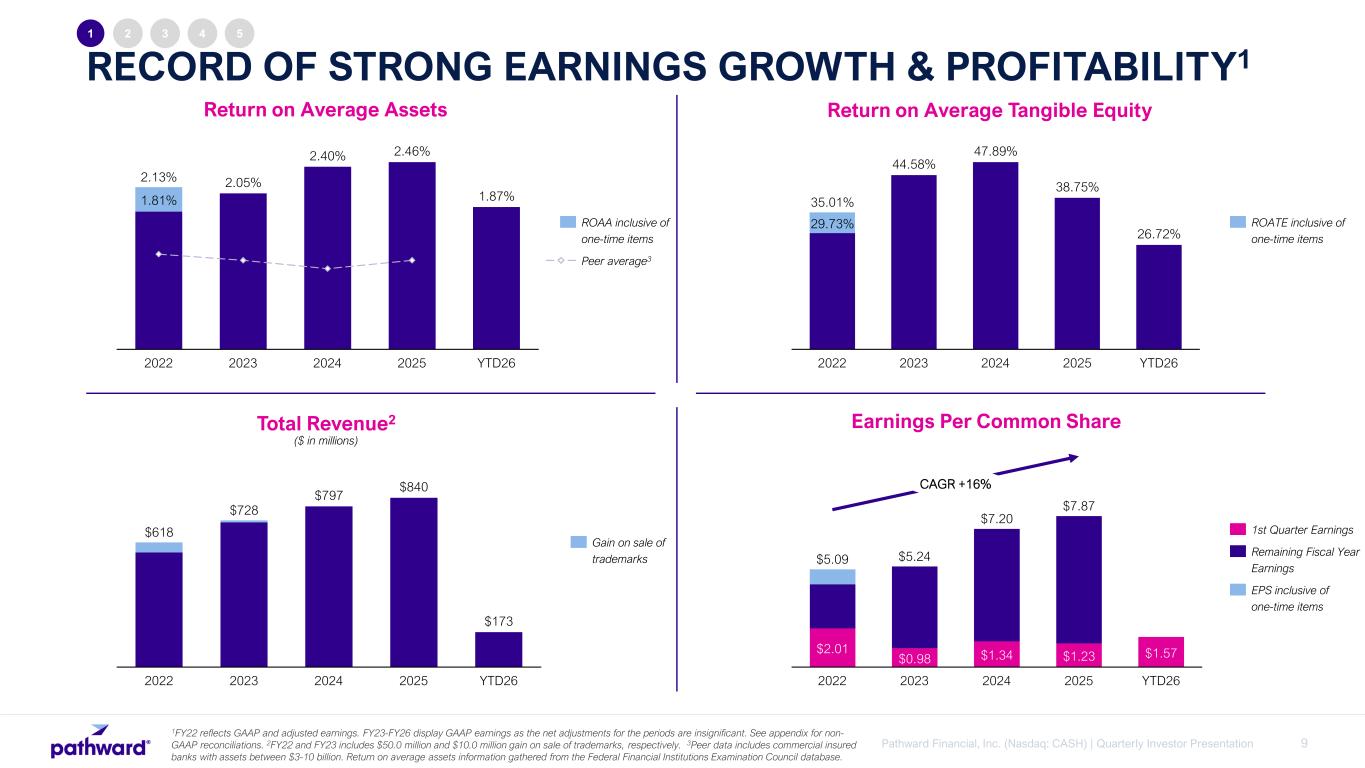

9Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Earnings Per Common Share RECORD OF STRONG EARNINGS GROWTH & PROFITABILITY1 Return on Average Assets Total Revenue2 ($ in millions) 1FY22 reflects GAAP and adjusted earnings. FY23-FY26 display GAAP earnings as the net adjustments for the periods are insignificant. See appendix for non- GAAP reconciliations. 2FY22 and FY23 includes $50.0 million and $10.0 million gain on sale of trademarks, respectively. 3Peer data includes commercial insured banks with assets between $3-10 billion. Return on average assets information gathered from the Federal Financial Institutions Examination Council database. 1 2 3 4 5 $797 $840 $173 2022 2023 2024 2025 YTD26 $618 $728 Gain on sale of trademarks $2.01 $0.98 $1.34 $1.23 $1.57 2022 2023 2024 2025 YTD26 $5.09 $5.24 $7.20 $7.87 CAGR +16% 2.05% 2.40% 2.46% 1.87%1.81% 2022 2023 2024 2025 YTD26 2.13% ROAA inclusive of one-time items Peer average3 44.58% 47.89% 38.75% 26.72% 29.73% 2022 2023 2024 2025 YTD26 35.01% ROATE inclusive of one-time items Return on Average Tangible Equity 1st Quarter Earnings Remaining Fiscal Year Earnings EPS inclusive of one-time items

10Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation TRACK RECORD OF STRONG EARNINGS GROWTH AND RIGHT-SIZED BALANCE SHEET ENABLES ONGOING RETURN OF CAPITAL 1 2 3 4 5 $823.8M TOTAL SHARE REPURCHASES 2Q19 TO 1Q26 $41.6M TOTAL DIVIDENDS PAID 2Q19 TO 1Q26

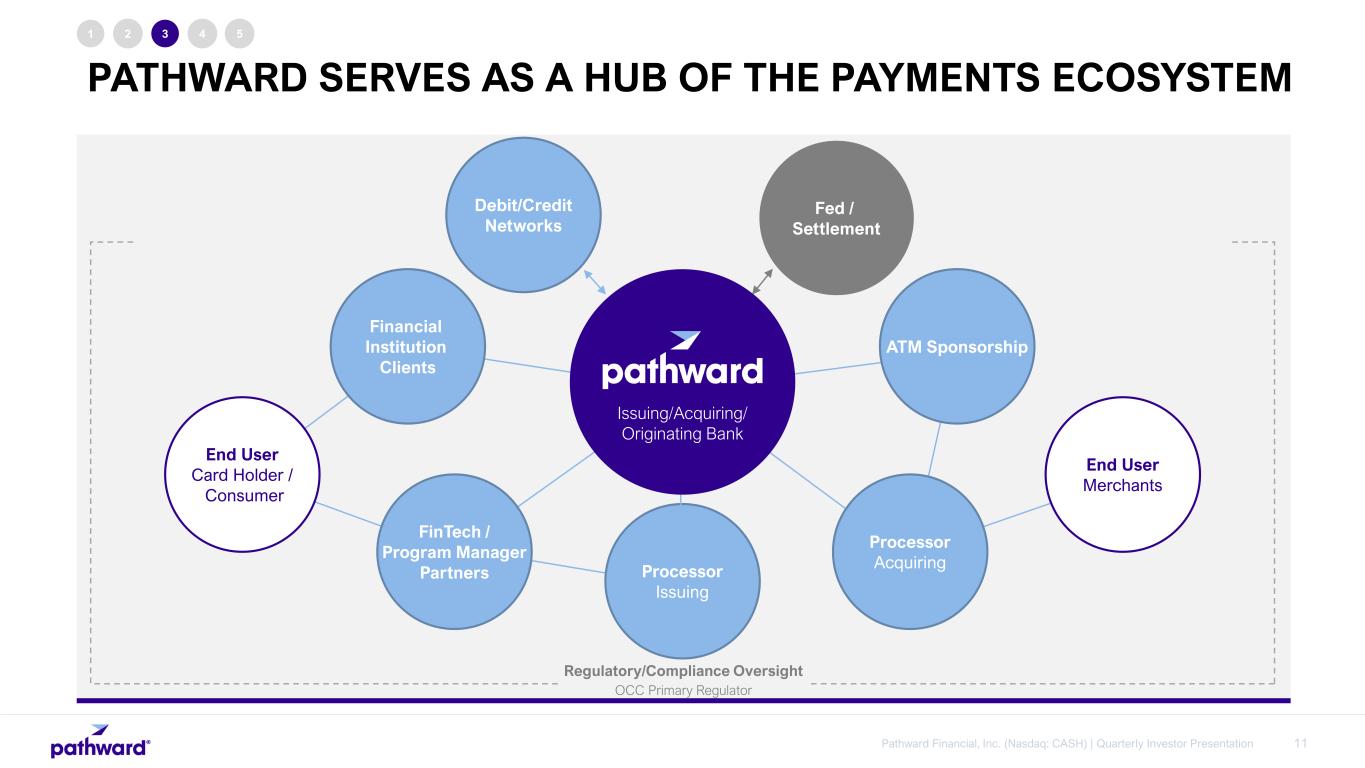

11Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation 1 2 3 4 5 Fed / Settlement ATM Sponsorship Processor AcquiringProcessor Issuing FinTech / Program Manager Partners Financial Institution Clients Debit/Credit Networks End User Card Holder / Consumer End User Merchants Issuing/Acquiring/ Originating Bank Regulatory/Compliance Oversight OCC Primary Regulator PATHWARD SERVES AS A HUB OF THE PAYMENTS ECOSYSTEM

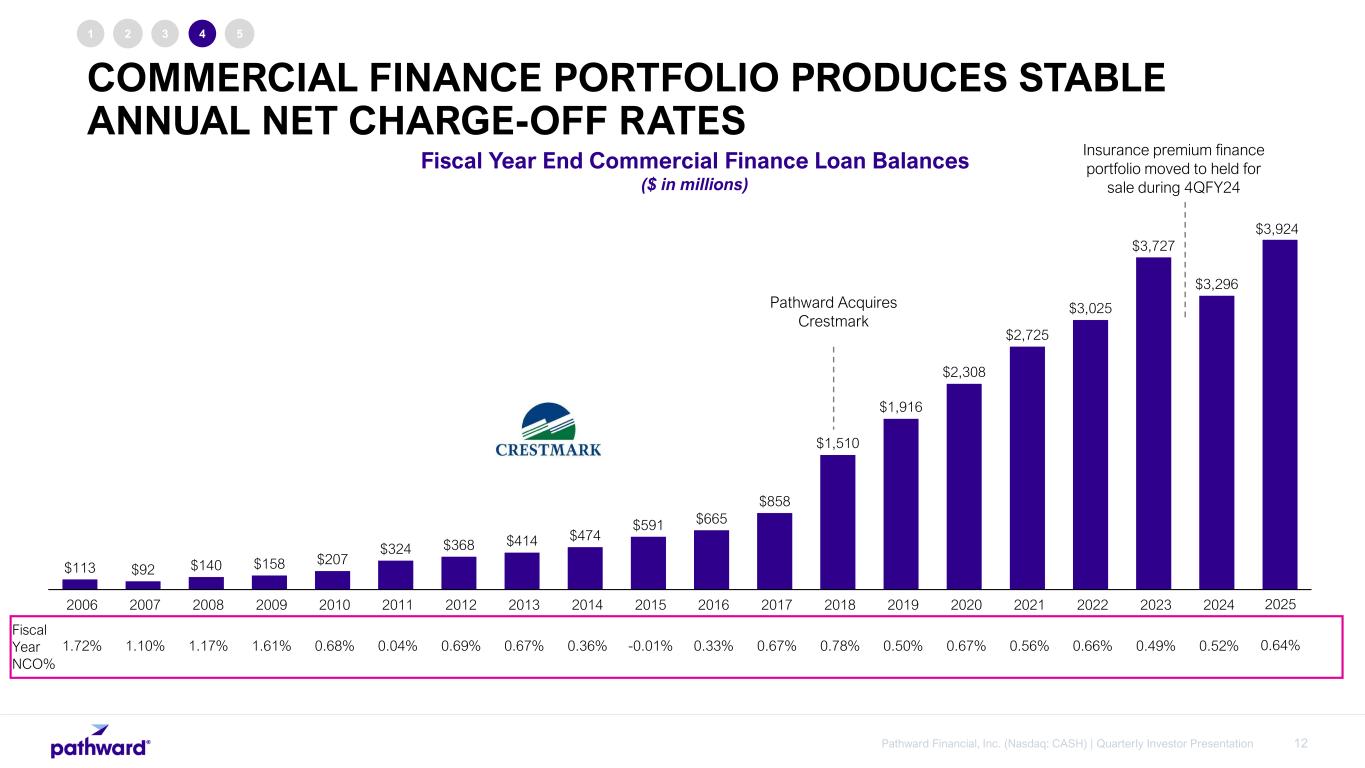

12Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Fiscal Year End Commercial Finance Loan Balances ($ in millions) $113 $92 $140 $158 $207 $324 $368 $414 $474 $591 $665 $858 $1,510 $1,916 $2,308 $2,725 $3,025 $3,727 $3,296 $3,924 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 2006 1.72% 2007 1.10% 2008 1.17% 2009 1.61% 2010 0.68% 2011 0.04% 2012 0.69% 2013 0.67% 2014 0.36% 2015 -0.01% 2016 0.33% 2017 0.67% 2018 0.78% 2019 0.50% 2020 0.67% 2021 0.56% 2022 0.66% 2023 0.49% 2024 0.52% Fiscal Year NCO% 1 2 3 4 5 Pathward Acquires Crestmark Insurance premium finance portfolio moved to held for sale during 4QFY24 2025 0.64% COMMERCIAL FINANCE PORTFOLIO PRODUCES STABLE ANNUAL NET CHARGE-OFF RATES

13Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation 1 2 3 4 5 Enterprise Risk Management Our Enterprise Risk Management (ERM) program applies corporate governance to risk-taking activities. The ERM program sets strategy across the enterprise and works closely with the lines of business to ensure that risks are appropriately identified and managed. Third-Party Risk Management Just as Pathward’s ERM program oversees our own actions, our Third- Party Risk Management program ensures that our third-party relationships are controlled and mitigated. Our policy and strategy encourage us to protect our company from risk, monitor third-party activities, and report risk events. Business Continuity Management Business Continuity Management (BCM) sets standards and testing to ensure our company remains resilient in case of disaster. Our standards comply with Federal Financial Institutions Examination Council (FFIEC) and Office of the Comptroller of the Currency (OCC) guidance. Bank Secrecy Act / Anti- Money Laundering To protect our customers, partners and company from the risks of fraud, money laundering, terrorist financing and other illicit activity, Pathward’s compliance programs are designed to keep us compliant with all federal programs and sanctions. MATURE RISK AND COMPLIANCE CAPABILITIES

14Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation QUARTERLY INVESTOR UPDATE FIRST QUARTER F ISCAL YEAR 2026

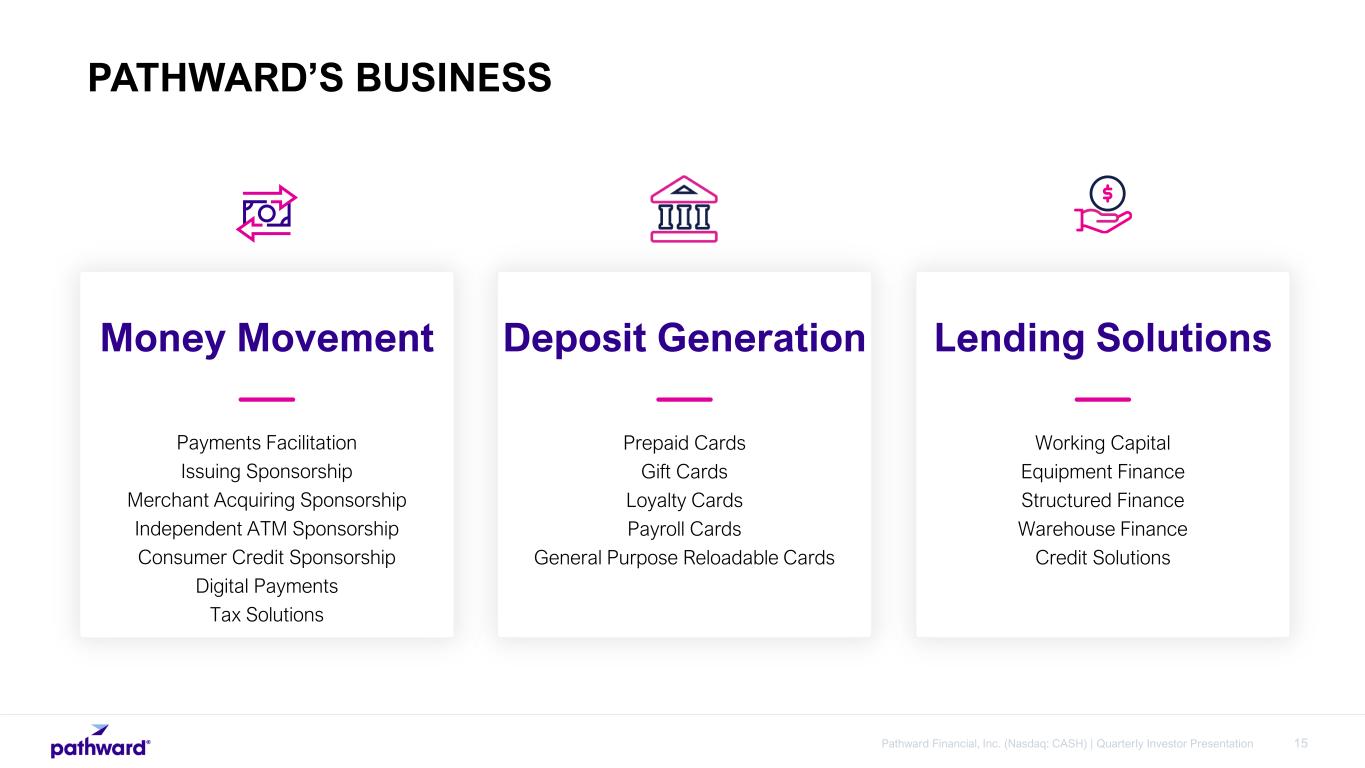

15Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Money Movement Payments Facilitation Issuing Sponsorship Merchant Acquiring Sponsorship Independent ATM Sponsorship Consumer Credit Sponsorship Digital Payments Tax Solutions Deposit Generation Prepaid Cards Gift Cards Loyalty Cards Payroll Cards General Purpose Reloadable Cards Lending Solutions Working Capital Equipment Finance Structured Finance Warehouse Finance Credit Solutions PATHWARD’S BUSINESS

16Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Maintain an optimized balance sheet Technology to facilitate evolution and scalability People and culture are important assets Mature risk and compliance framework Client experience TRUSTED PLATFORM THAT ENABLES OUR PARTNERS TO THRIVE

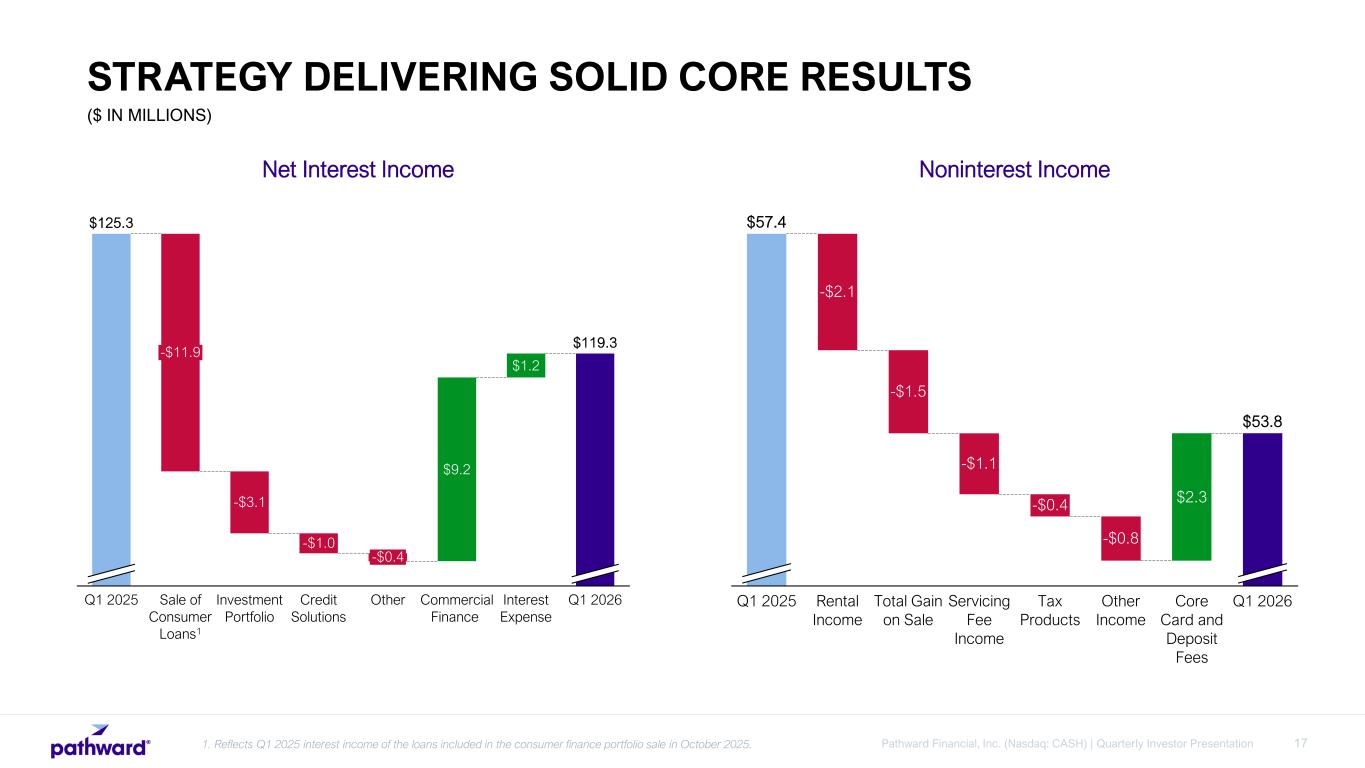

17Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation ($ IN MILLIONS) Net Interest Income Noninterest Income STRATEGY DELIVERING SOLID CORE RESULTS $9.2 $1.2 Q1 2025 -$11.9 Sale of Consumer Loans1 -$3.1 Investment Portfolio -$1.0 Credit Solutions -$0.4 Other Commercial Finance Interest Expense Q1 2026 $125.3 $119.3 $2.3 Q1 2025 -$2.1 Rental Income -$1.5 Total Gain on Sale -$1.1 Servicing Fee Income -$0.4 Tax Products -$0.8 Other Income Core Card and Deposit Fees Q1 2026 $57.4 $53.8 1. Reflects Q1 2025 interest income of the loans included in the consumer finance portfolio sale in October 2025.

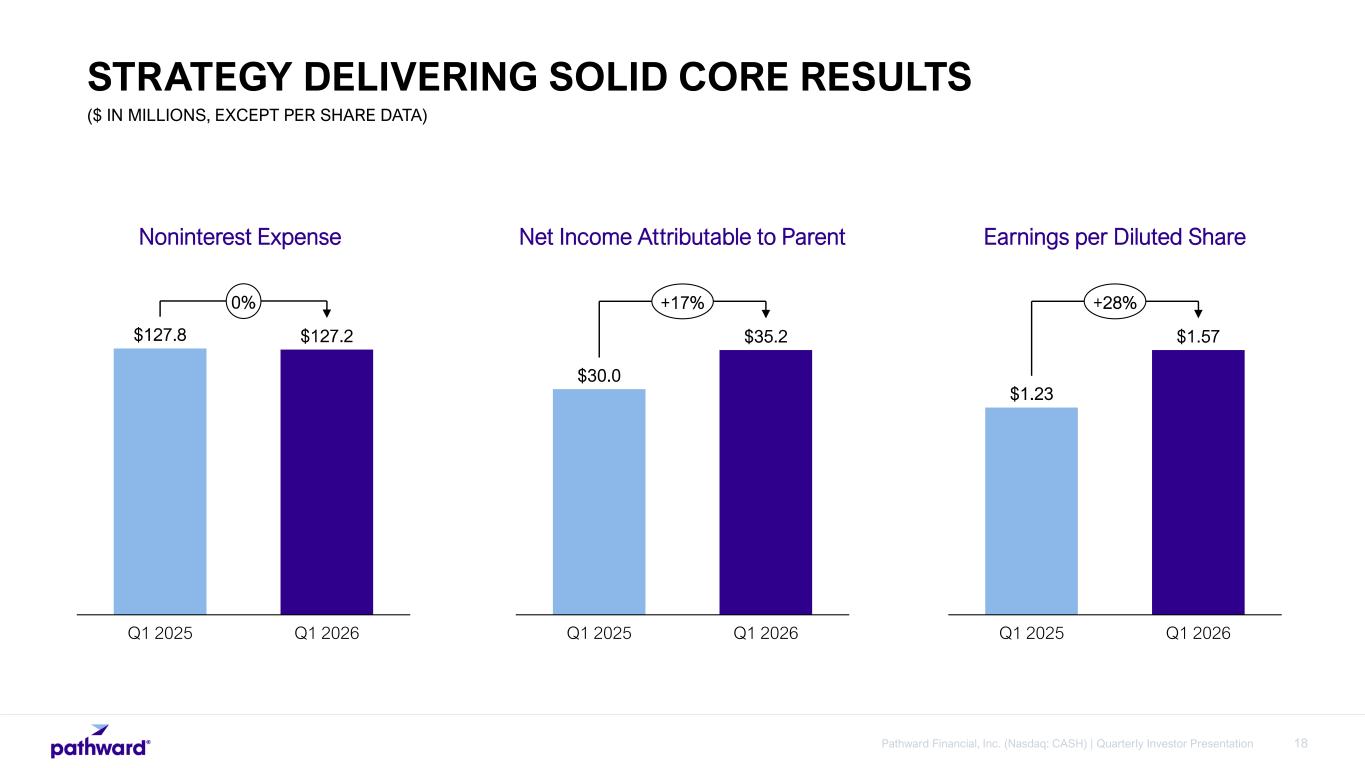

18Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation $30.0 $35.2 Q1 2025 Q1 2026 +17% Net Income Attributable to Parent $1.23 $1.57 Q1 2025 Q1 2026 +28% Earnings per Diluted Share $127.8 $127.2 Q1 2025 Q1 2026 0% Noninterest Expense ($ IN MILLIONS, EXCEPT PER SHARE DATA) STRATEGY DELIVERING SOLID CORE RESULTS

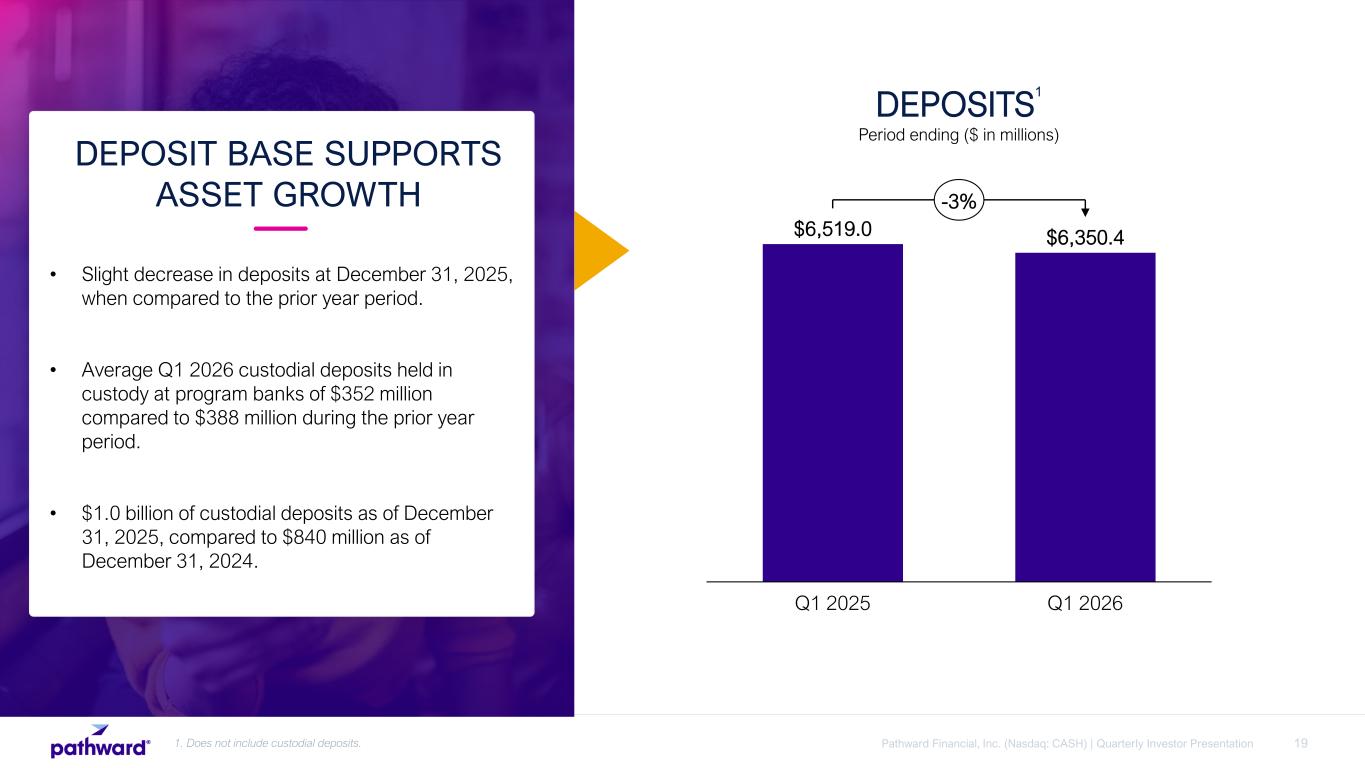

19Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation • Slight decrease in deposits at December 31, 2025, when compared to the prior year period. • Average Q1 2026 custodial deposits held in custody at program banks of $352 million compared to $388 million during the prior year period. • $1.0 billion of custodial deposits as of December 31, 2025, compared to $840 million as of December 31, 2024. DEPOSIT BASE SUPPORTS ASSET GROWTH $6,519.0 $6,350.4 Q1 2025 Q1 2026 -3% DEPOSITS 1 Period ending ($ in millions) 1. Does not include custodial deposits.

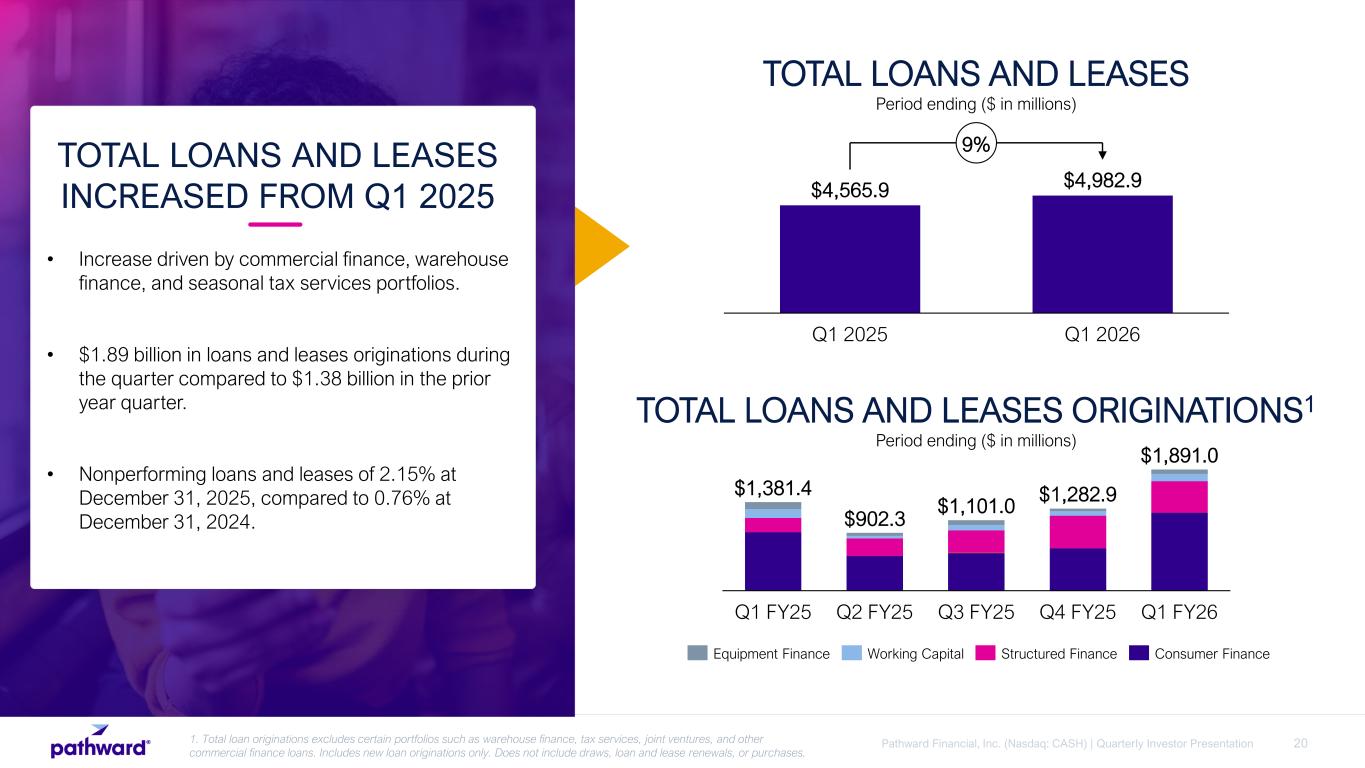

20Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation TOTAL LOANS AND LEASES INCREASED FROM Q1 2025 • Increase driven by commercial finance, warehouse finance, and seasonal tax services portfolios. • $1.89 billion in loans and leases originations during the quarter compared to $1.38 billion in the prior year quarter. • Nonperforming loans and leases of 2.15% at December 31, 2025, compared to 0.76% at December 31, 2024. $4,565.9 $4,982.9 Q1 2025 Q1 2026 9% TOTAL LOANS AND LEASES Period ending ($ in millions) Q1 FY25 Q2 FY25 Q3 FY25 Q4 FY25 Q1 FY26 $1,381.4 $902.3 $1,101.0 $1,282.9 $1,891.0 TOTAL LOANS AND LEASES ORIGINATIONS1 Period ending ($ in millions) Equipment Finance Working Capital Structured Finance Consumer Finance 1. Total loan originations excludes certain portfolios such as warehouse finance, tax services, joint ventures, and other commercial finance loans. Includes new loan originations only. Does not include draws, loan and lease renewals, or purchases.

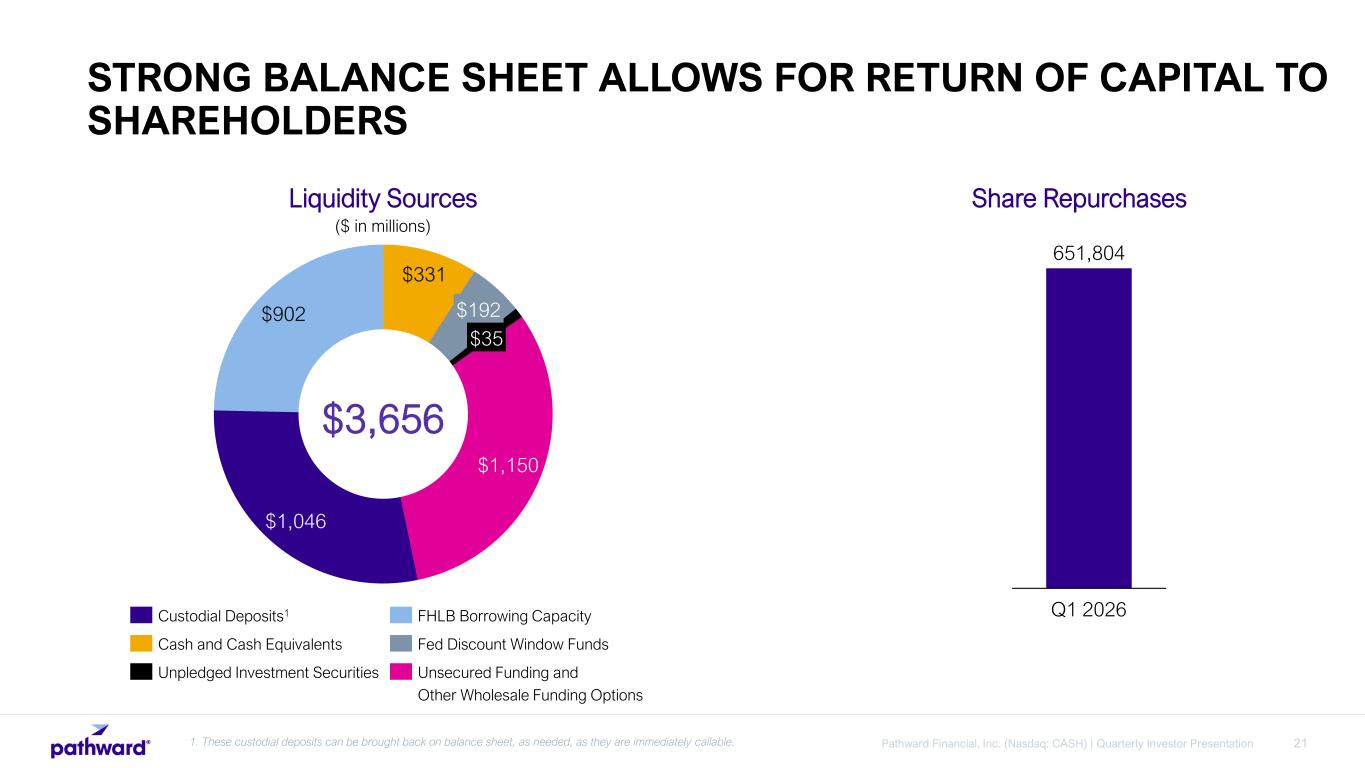

21Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation $1,150 $1,046 $902 $331 $192 $35 1. These custodial deposits can be brought back on balance sheet, as needed, as they are immediately callable. ($ in millions) 651,804 Q1 2026 Share RepurchasesLiquidity Sources $3,656 Custodial Deposits1 Cash and Cash Equivalents Unpledged Investment Securities FHLB Borrowing Capacity Fed Discount Window Funds Unsecured Funding and Other Wholesale Funding Options STRONG BALANCE SHEET ALLOWS FOR RETURN OF CAPITAL TO SHAREHOLDERS

22Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation 1. Information on this slide is presented as of January 22, 2026, reflects the Company’s updated financial outlook, certain of the Company’s financial targets, and key assumptions, and will not be updated or affirmed unless and until the Company publicly announces such an update or affirmation. The guidance for fiscal 2026, the Company’s financial targets and key economic assumptions contain forward-looking statements and actual results or conditions may differ materially. See the information set forth below the heading "Forward Looking Statements" on slide 2 of this presentation. $8.55 - $9.05 EPS Assumes no additional rate cuts during the year Effective tax rate of 18% to 22% Includes expected share repurchases FISCAL YEAR 2026 GUIDANCE1

23Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Q&A

24Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Net Income $35.2 million in net income; an increase of 17% compared to Q1 FY 2025 Diluted Earnings Per Share $1.57 in diluted earnings per share; an increase of 28% compared to Q1 FY 2025 Net Interest Margin Net interest margin (“NIM”) of 6.95% compared to 7.38% in prior year; Adjusted NIM1, including contractual, rate- related processing expenses associated with deposits on the Company’s balance sheet, of 5.61% compared to 5.95% in prior year period Return Metrics Q1 FY 2026 return on average assets (“ROAA”) of 1.87% compared to 1.61% in prior year period; Q1 FY 2026 return on average tangible equity (“ROATE”) of 26.72% compared to 25.45% in prior year period Q1 FY 2026 HIGHLIGHTS 24 1. See slide 41 for reconciliation to most directly comparable GAAP measure.

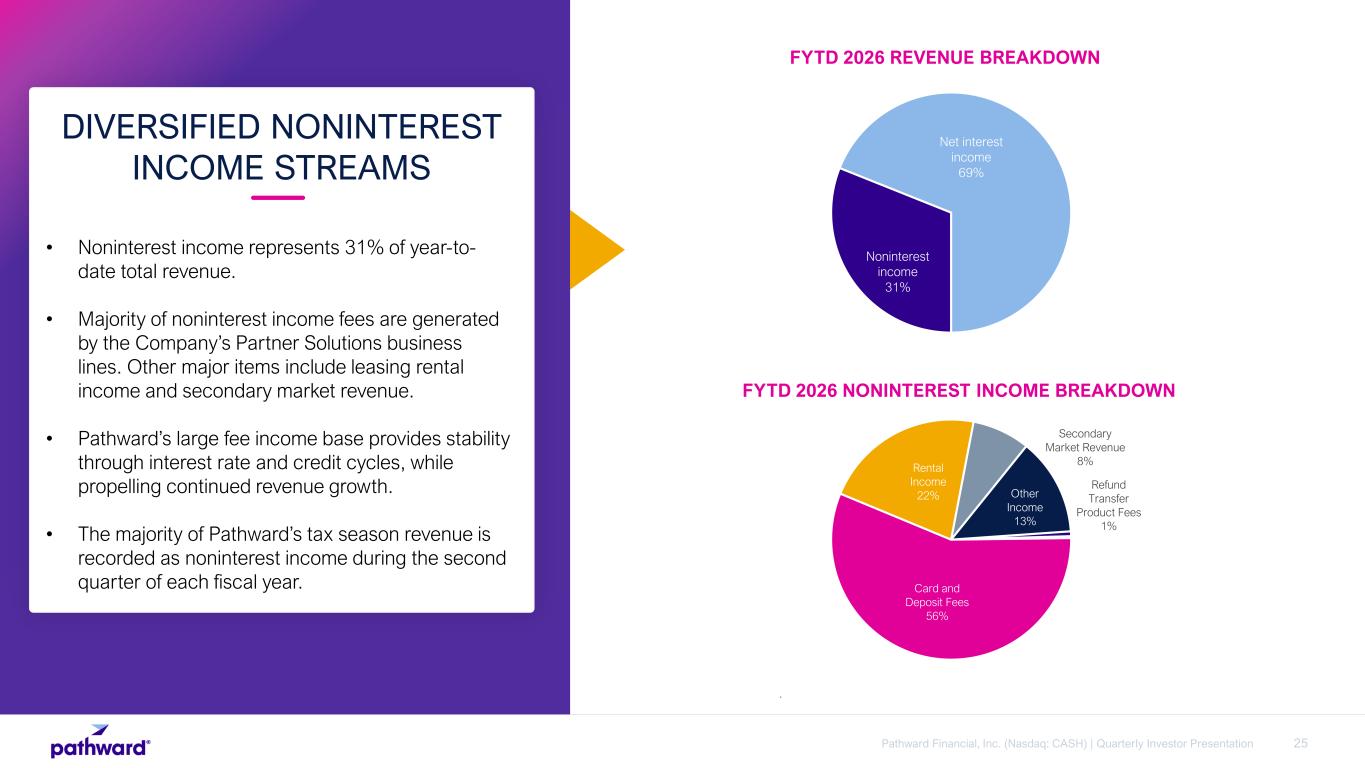

25Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation • Noninterest income represents 31% of year-to- date total revenue. • Majority of noninterest income fees are generated by the Company’s Partner Solutions business lines. Other major items include leasing rental income and secondary market revenue. • Pathward’s large fee income base provides stability through interest rate and credit cycles, while propelling continued revenue growth. • The majority of Pathward’s tax season revenue is recorded as noninterest income during the second quarter of each fiscal year. DIVERSIFIED NONINTEREST INCOME STREAMS Refund Transfer Product Fees 1% Card and Deposit Fees 56% Rental Income 22% Secondary Market Revenue 8% Other Income 13% FYTD 2026 NONINTEREST INCOME BREAKDOWN . Noninterest income 31% Net interest income 69% FYTD 2026 REVENUE BREAKDOWN

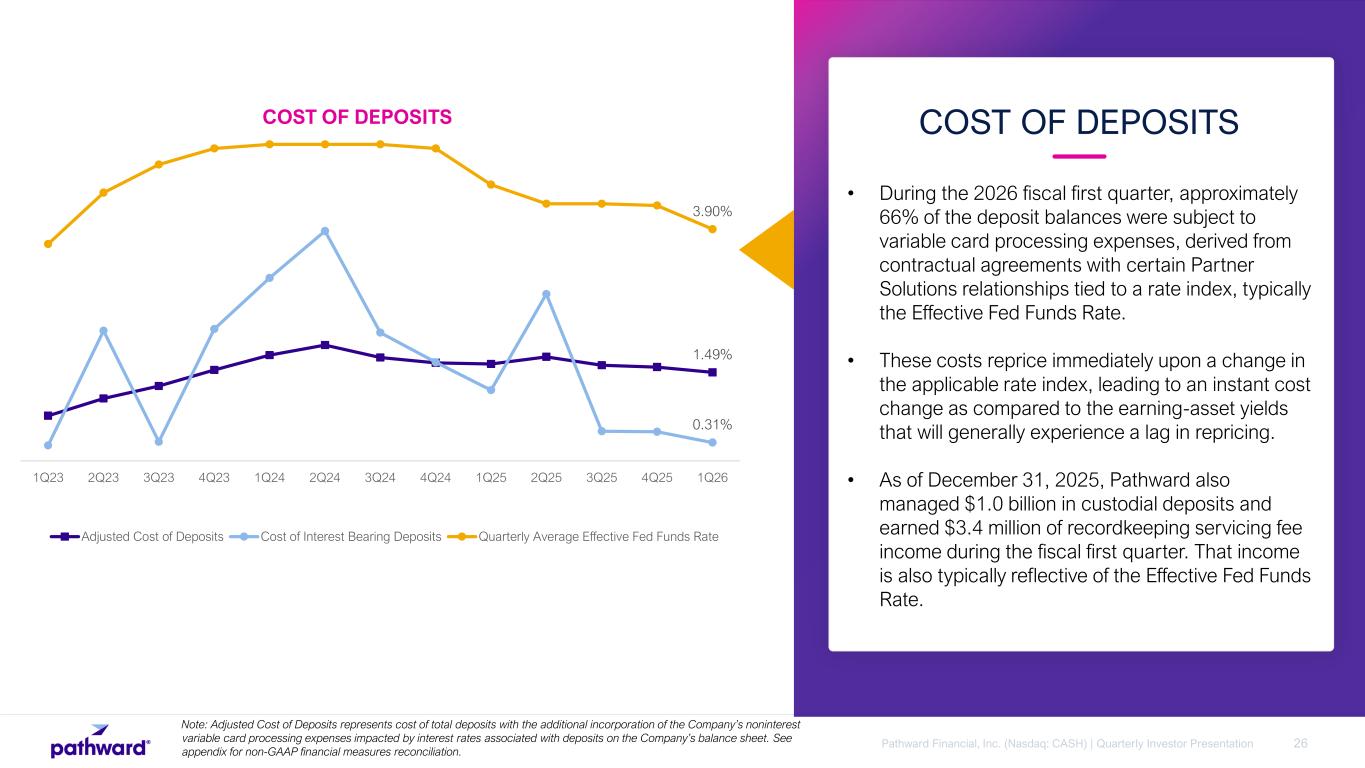

26Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation • During the 2026 fiscal first quarter, approximately 66% of the deposit balances were subject to variable card processing expenses, derived from contractual agreements with certain Partner Solutions relationships tied to a rate index, typically the Effective Fed Funds Rate. • These costs reprice immediately upon a change in the applicable rate index, leading to an instant cost change as compared to the earning-asset yields that will generally experience a lag in repricing. • As of December 31, 2025, Pathward also managed $1.0 billion in custodial deposits and earned $3.4 million of recordkeeping servicing fee income during the fiscal first quarter. That income is also typically reflective of the Effective Fed Funds Rate. COST OF DEPOSITS COST OF DEPOSITS 1.49% 0.31% 3.90% 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 1Q26 Adjusted Cost of Deposits Cost of Interest Bearing Deposits Quarterly Average Effective Fed Funds Rate Note: Adjusted Cost of Deposits represents cost of total deposits with the additional incorporation of the Company’s noninterest variable card processing expenses impacted by interest rates associated with deposits on the Company’s balance sheet. See appendix for non-GAAP financial measures reconciliation.

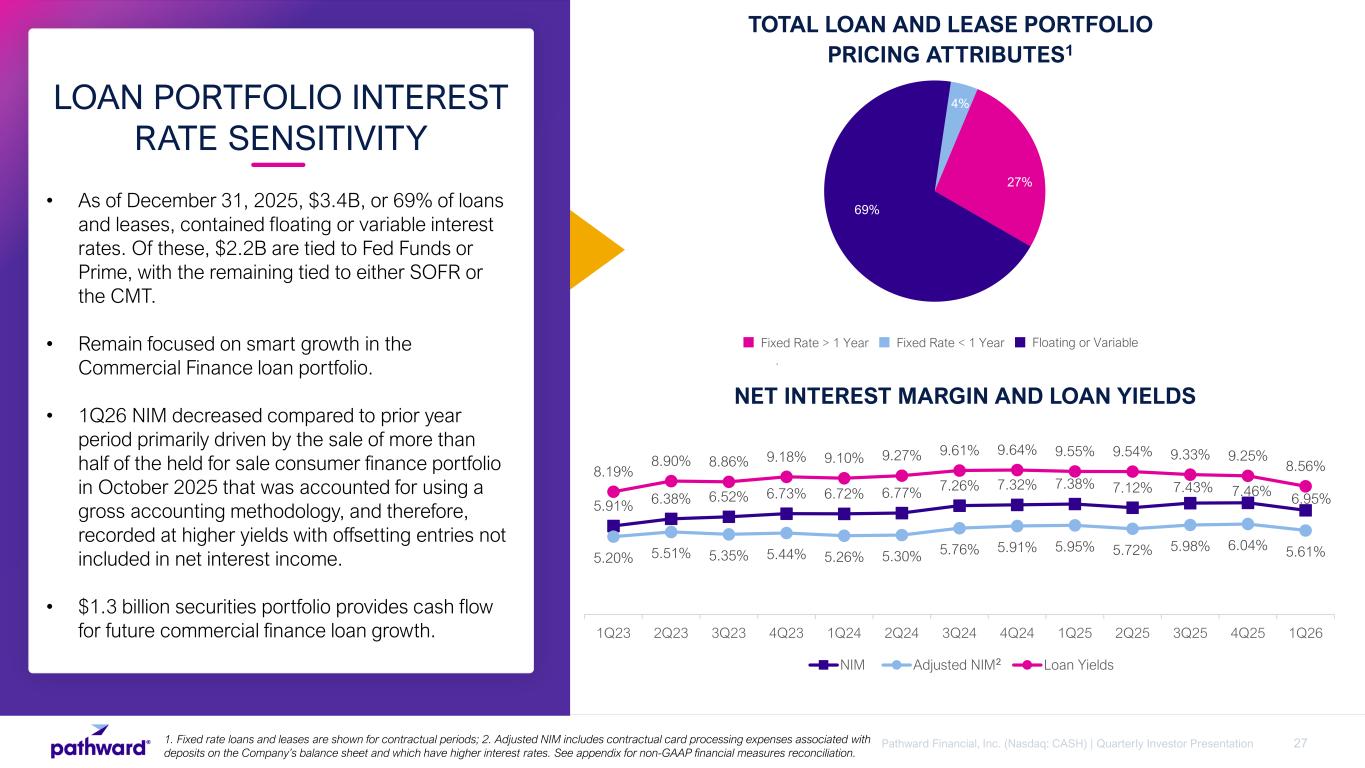

27Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation • As of December 31, 2025, $3.4B, or 69% of loans and leases, contained floating or variable interest rates. Of these, $2.2B are tied to Fed Funds or Prime, with the remaining tied to either SOFR or the CMT. • Remain focused on smart growth in the Commercial Finance loan portfolio. • 1Q26 NIM decreased compared to prior year period primarily driven by the sale of more than half of the held for sale consumer finance portfolio in October 2025 that was accounted for using a gross accounting methodology, and therefore, recorded at higher yields with offsetting entries not included in net interest income. • $1.3 billion securities portfolio provides cash flow for future commercial finance loan growth. LOAN PORTFOLIO INTEREST RATE SENSITIVITY . 69% 4% 27% Fixed Rate > 1 Year TOTAL LOAN AND LEASE PORTFOLIO PRICING ATTRIBUTES1 Fixed Rate < 1 Year Floating or Variable NET INTEREST MARGIN AND LOAN YIELDS 5.91% 6.38% 6.52% 6.73% 6.72% 6.77% 7.26% 7.32% 7.38% 7.12% 7.43% 7.46% 6.95% 5.20% 5.51% 5.35% 5.44% 5.26% 5.30% 5.76% 5.91% 5.95% 5.72% 5.98% 6.04% 5.61% 8.19% 8.90% 8.86% 9.18% 9.10% 9.27% 9.61% 9.64% 9.55% 9.54% 9.33% 9.25% 8.56% 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 1Q26 NIM Adjusted NIM Loan Yields 1. Fixed rate loans and leases are shown for contractual periods; 2. Adjusted NIM includes contractual card processing expenses associated with deposits on the Company’s balance sheet and which have higher interest rates. See appendix for non-GAAP financial measures reconciliation. 2

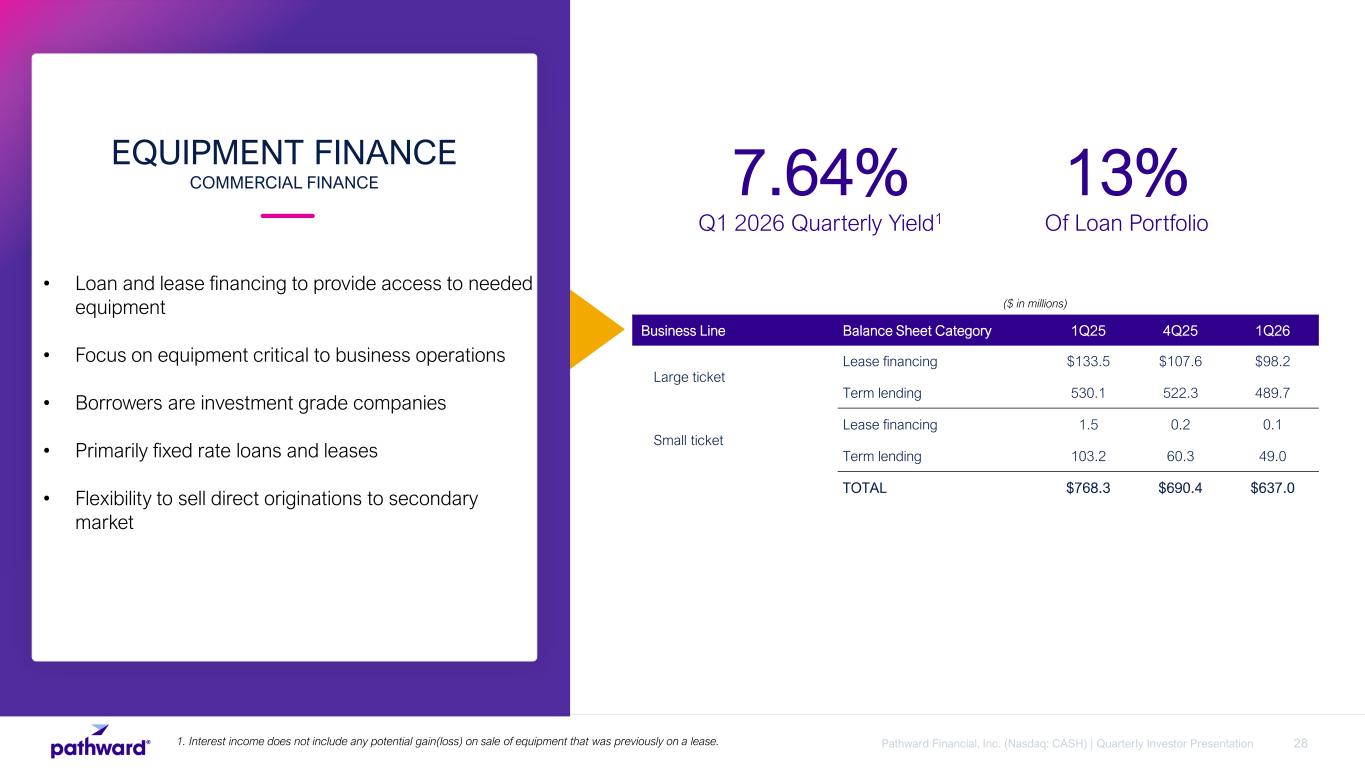

28Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation • Loan and lease financing to provide access to needed equipment • Focus on equipment critical to business operations • Borrowers are investment grade companies • Primarily fixed rate loans and leases • Flexibility to sell direct originations to secondary market EQUIPMENT FINANCE COMMERCIAL FINANCE 7.64% Q1 2026 Quarterly Yield1 13% Of Loan Portfolio Business Line Balance Sheet Category 1Q25 4Q25 1Q26 Large ticket Lease financing $133.5 $107.6 $98.2 Term lending 530.1 522.3 489.7 Small ticket Lease financing 1.5 0.2 0.1 Term lending 103.2 60.3 49.0 TOTAL $768.3 $690.4 $637.0 1. Interest income does not include any potential gain(loss) on sale of equipment that was previously on a lease. ($ in millions)

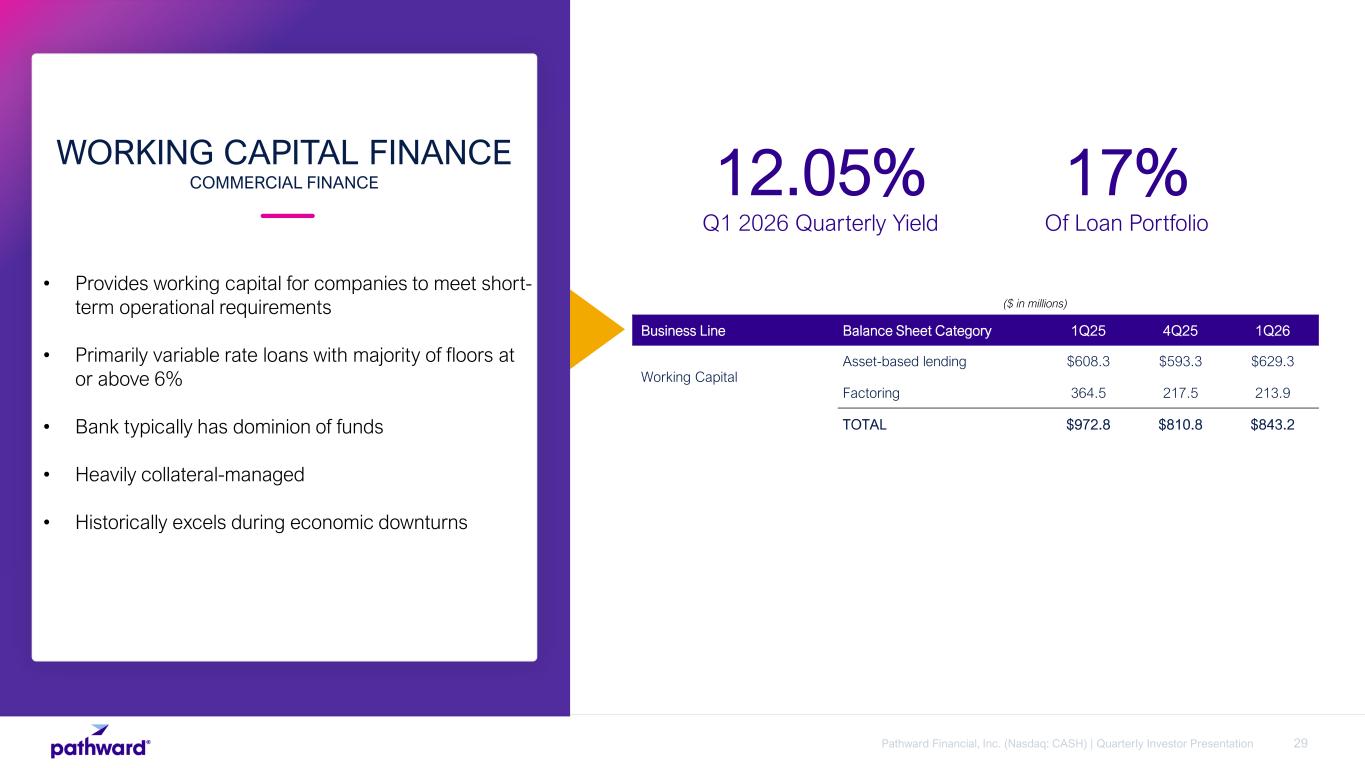

29Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation • Provides working capital for companies to meet short- term operational requirements • Primarily variable rate loans with majority of floors at or above 6% • Bank typically has dominion of funds • Heavily collateral-managed • Historically excels during economic downturns WORKING CAPITAL FINANCE COMMERCIAL FINANCE 12.05% Q1 2026 Quarterly Yield 17% Of Loan Portfolio Business Line Balance Sheet Category 1Q25 4Q25 1Q26 Working Capital Asset-based lending $608.3 $593.3 $629.3 Factoring 364.5 217.5 213.9 TOTAL $972.8 $810.8 $843.2 ($ in millions)

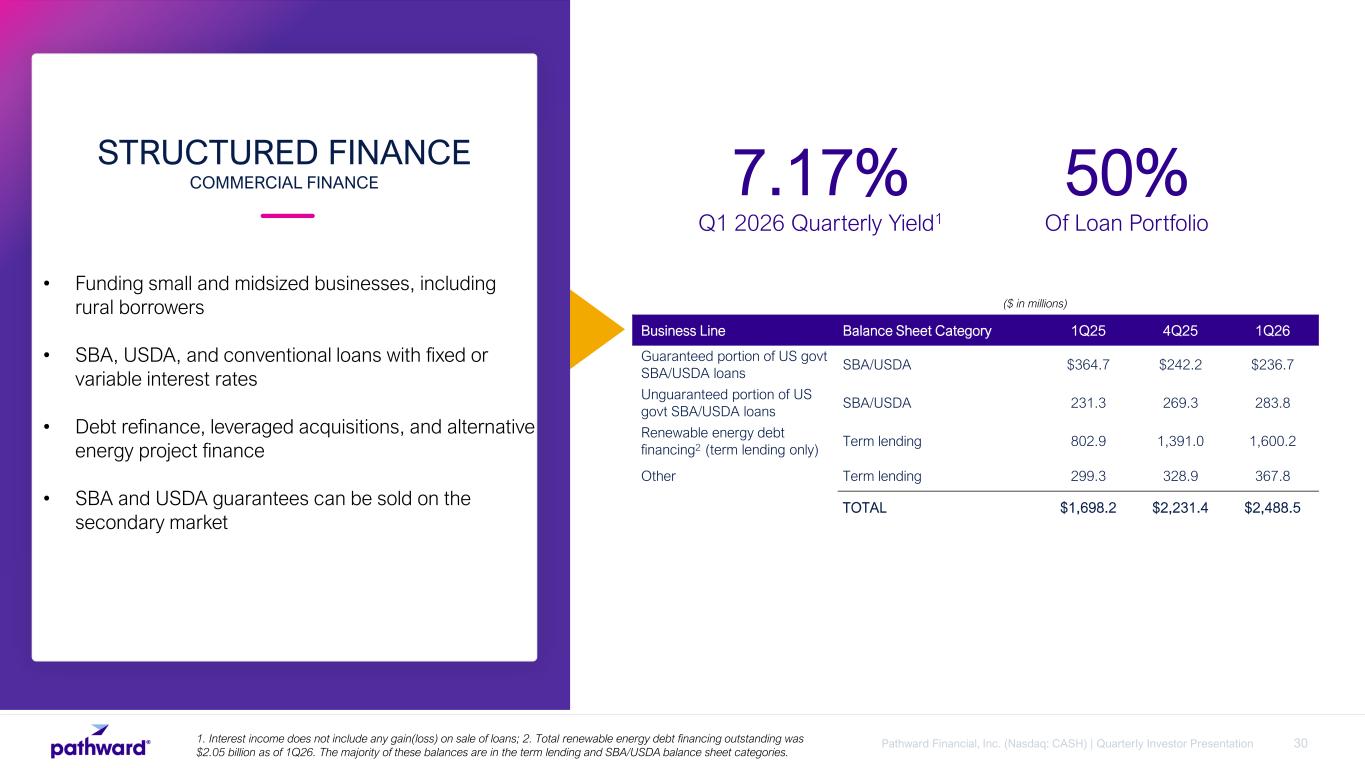

30Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation • Funding small and midsized businesses, including rural borrowers • SBA, USDA, and conventional loans with fixed or variable interest rates • Debt refinance, leveraged acquisitions, and alternative energy project finance • SBA and USDA guarantees can be sold on the secondary market STRUCTURED FINANCE COMMERCIAL FINANCE 7.17% Q1 2026 Quarterly Yield1 50% Of Loan Portfolio ($ in millions) Business Line Balance Sheet Category 1Q25 4Q25 1Q26 Guaranteed portion of US govt SBA/USDA loans SBA/USDA $364.7 $242.2 $236.7 Unguaranteed portion of US govt SBA/USDA loans SBA/USDA 231.3 269.3 283.8 Renewable energy debt financing2 (term lending only) Term lending 802.9 1,391.0 1,600.2 Other Term lending 299.3 328.9 367.8 TOTAL $1,698.2 $2,231.4 $2,488.5 1. Interest income does not include any gain(loss) on sale of loans; 2. Total renewable energy debt financing outstanding was $2.05 billion as of 1Q26. The majority of these balances are in the term lending and SBA/USDA balance sheet categories.

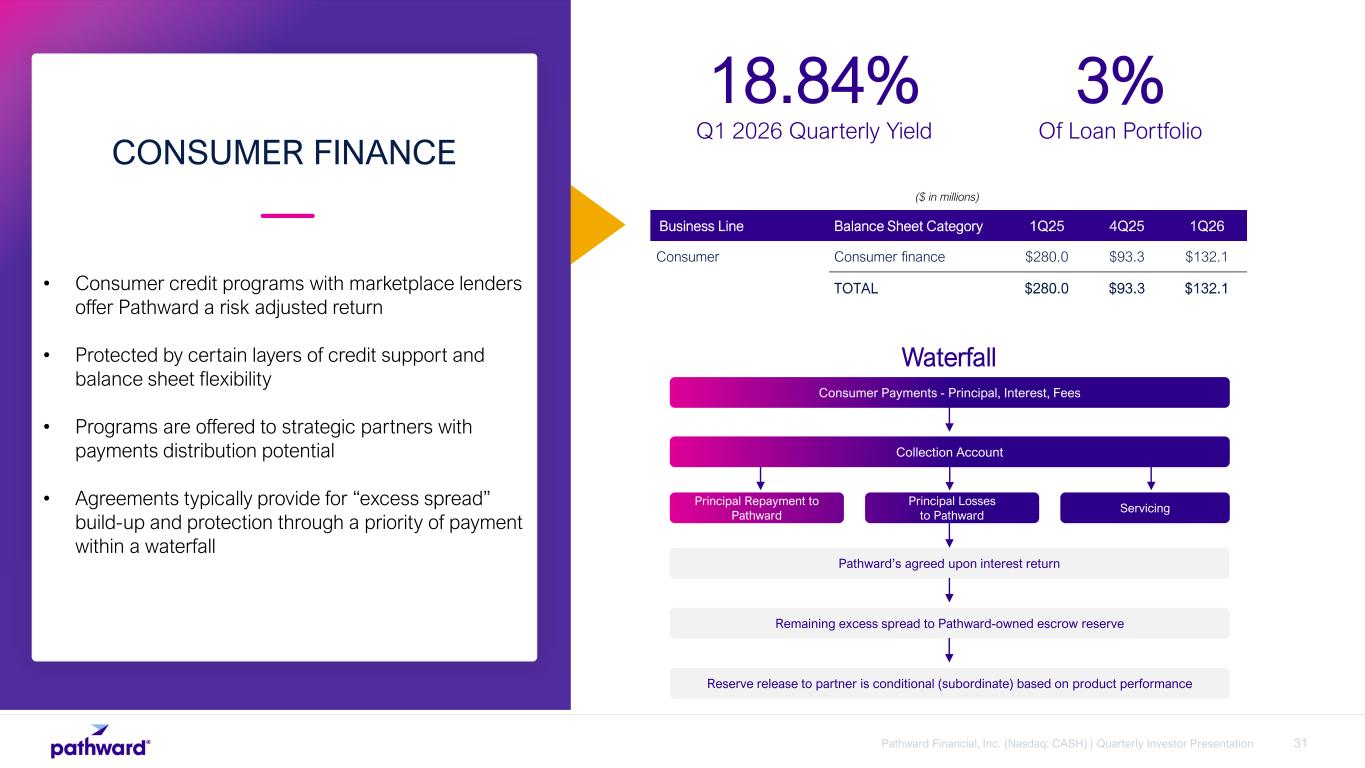

31Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation • Consumer credit programs with marketplace lenders offer Pathward a risk adjusted return • Protected by certain layers of credit support and balance sheet flexibility • Programs are offered to strategic partners with payments distribution potential • Agreements typically provide for “excess spread” build-up and protection through a priority of payment within a waterfall CONSUMER FINANCE 18.84% Q1 2026 Quarterly Yield 3% Of Loan Portfolio ($ in millions) Business Line Balance Sheet Category 1Q25 4Q25 1Q26 Consumer Consumer finance $280.0 $93.3 $132.1 TOTAL $280.0 $93.3 $132.1 Consumer Payments - Principal, Interest, Fees Collection Account Servicing Principal Losses to Pathward Principal Repayment to Pathward Pathward’s agreed upon interest return Remaining excess spread to Pathward-owned escrow reserve Reserve release to partner is conditional (subordinate) based on product performance Waterfall

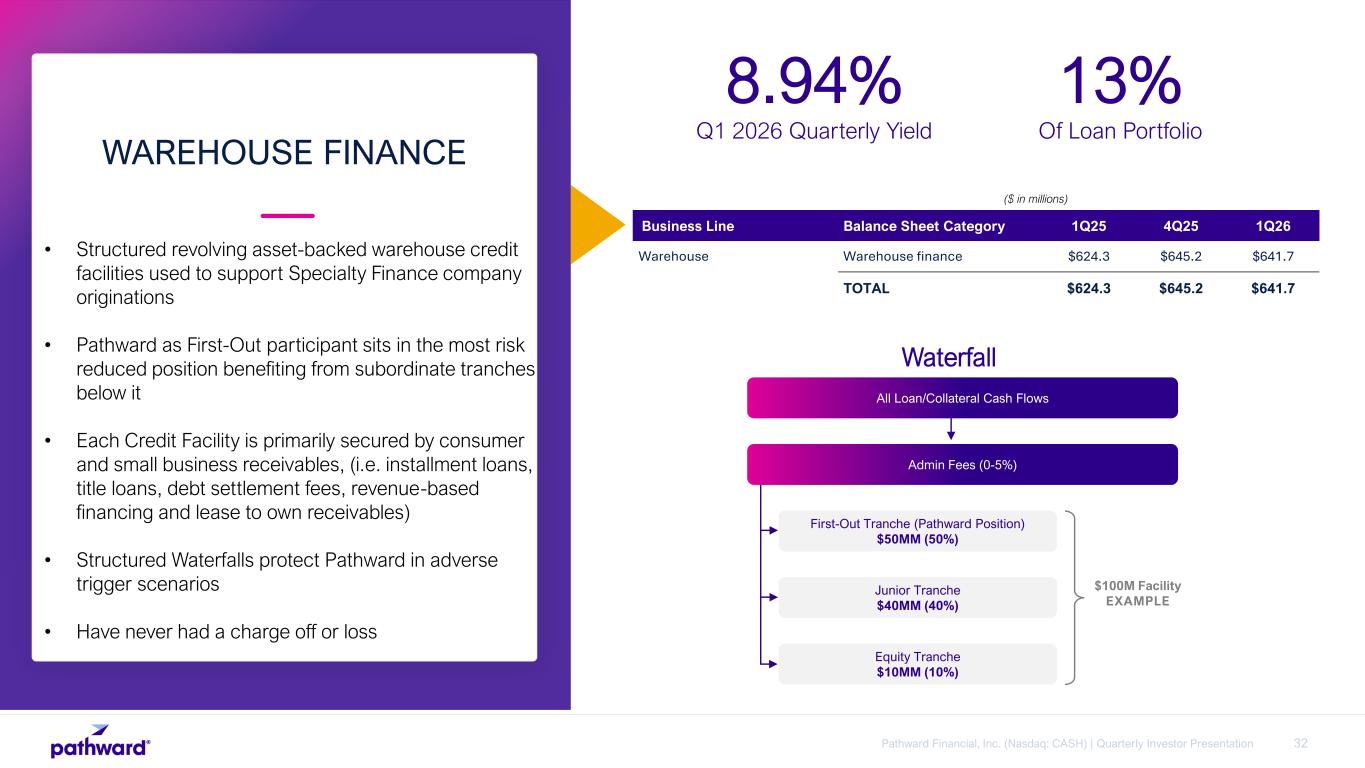

32Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation • Structured revolving asset-backed warehouse credit facilities used to support Specialty Finance company originations • Pathward as First-Out participant sits in the most risk reduced position benefiting from subordinate tranches below it • Each Credit Facility is primarily secured by consumer and small business receivables, (i.e. installment loans, title loans, debt settlement fees, revenue-based financing and lease to own receivables) • Structured Waterfalls protect Pathward in adverse trigger scenarios • Have never had a charge off or loss WAREHOUSE FINANCE 8.94% Q1 2026 Quarterly Yield 13% Of Loan Portfolio ($ in millions) Business Line Balance Sheet Category 1Q25 4Q25 1Q26 Warehouse Warehouse finance $624.3 $645.2 $641.7 TOTAL $624.3 $645.2 $641.7 Waterfall All Loan/Collateral Cash Flows Admin Fees (0-5%) Junior Tranche $40MM (40%) Equity Tranche $10MM (10%) First-Out Tranche (Pathward Position) $50MM (50%) $100M Facility EXAMPLE

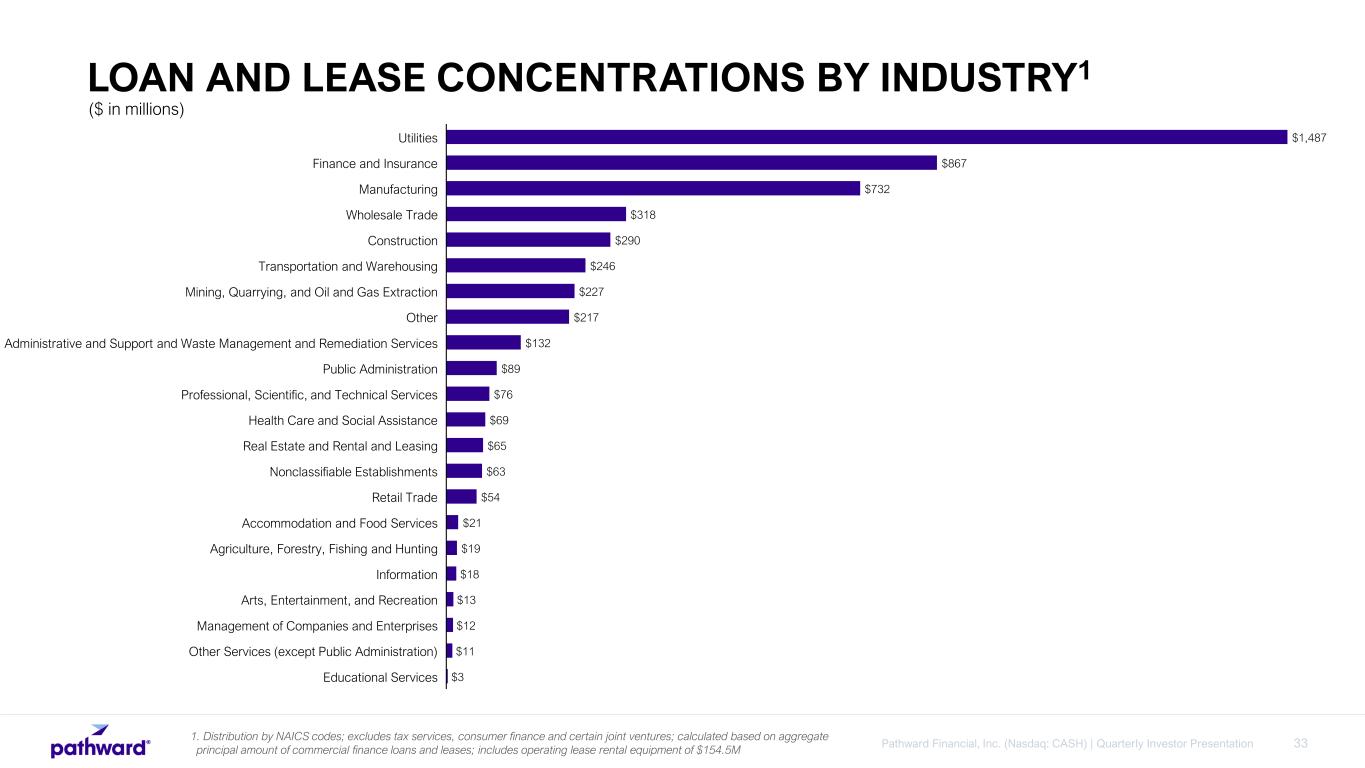

33Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation 1. Distribution by NAICS codes; excludes tax services, consumer finance and certain joint ventures; calculated based on aggregate principal amount of commercial finance loans and leases; includes operating lease rental equipment of $154.5M $1,487 $867 $732 $318 $290 $246 $227 $217 $132 $89 $76 $69 $65 $63 $54 $21 $19 $18 $13 $12 $11 $3 Utilities Finance and Insurance Manufacturing Wholesale Trade Construction Transportation and Warehousing Mining, Quarrying, and Oil and Gas Extraction Other Administrative and Support and Waste Management and Remediation Services Public Administration Professional, Scientific, and Technical Services Health Care and Social Assistance Real Estate and Rental and Leasing Nonclassifiable Establishments Retail Trade Accommodation and Food Services Agriculture, Forestry, Fishing and Hunting Information Arts, Entertainment, and Recreation Management of Companies and Enterprises Other Services (except Public Administration) Educational Services ($ in millions) LOAN AND LEASE CONCENTRATIONS BY INDUSTRY1

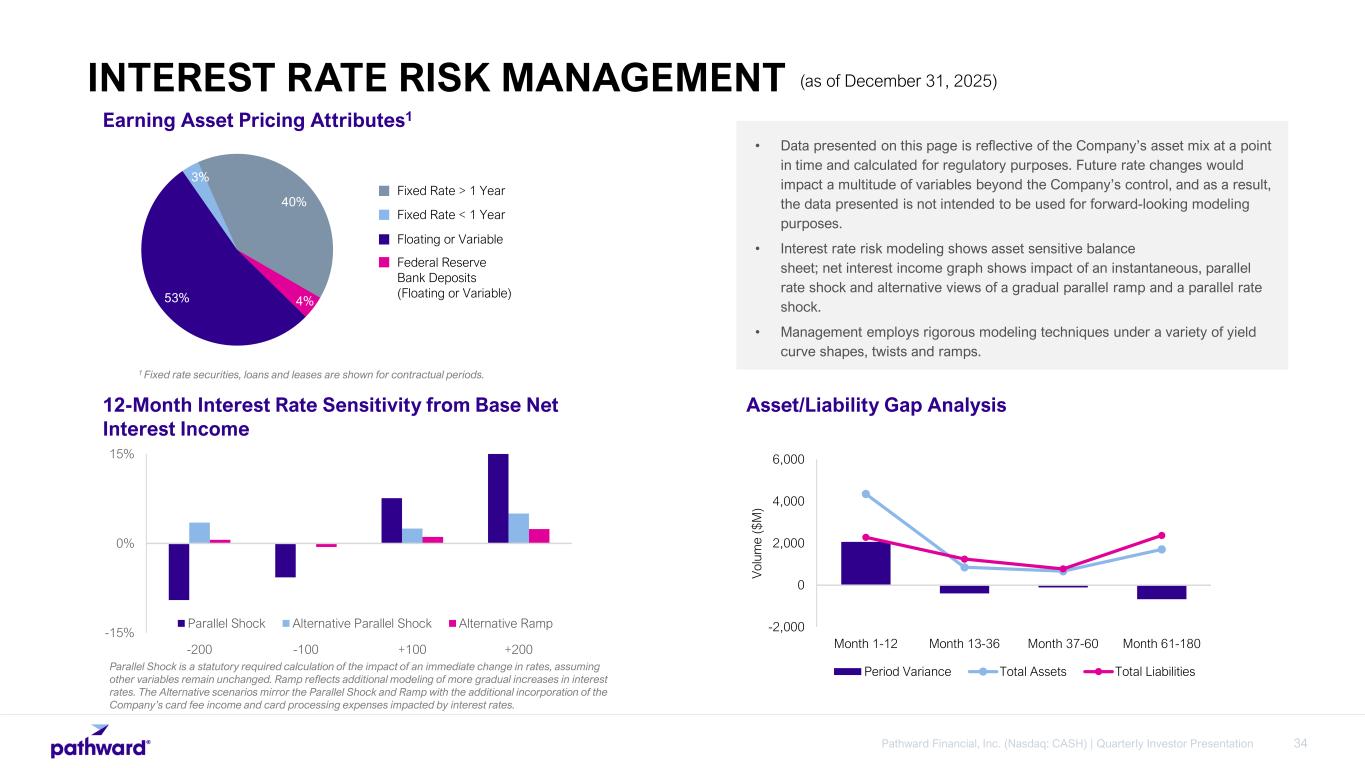

34Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Asset/Liability Gap Analysis 1 Fixed rate securities, loans and leases are shown for contractual periods. 4%53% 3% 40% Fixed Rate > 1 Year Earning Asset Pricing Attributes1 Fixed Rate < 1 Year Floating or Variable Federal Reserve Bank Deposits (Floating or Variable) • Data presented on this page is reflective of the Company’s asset mix at a point in time and calculated for regulatory purposes. Future rate changes would impact a multitude of variables beyond the Company’s control, and as a result, the data presented is not intended to be used for forward-looking modeling purposes. • Interest rate risk modeling shows asset sensitive balance sheet; net interest income graph shows impact of an instantaneous, parallel rate shock and alternative views of a gradual parallel ramp and a parallel rate shock. • Management employs rigorous modeling techniques under a variety of yield curve shapes, twists and ramps. -15% 0% 15% -200 -100 +100 +200 Parallel Shock Alternative Parallel Shock Alternative Ramp 12-Month Interest Rate Sensitivity from Base Net Interest Income Parallel Shock is a statutory required calculation of the impact of an immediate change in rates, assuming other variables remain unchanged. Ramp reflects additional modeling of more gradual increases in interest rates. The Alternative scenarios mirror the Parallel Shock and Ramp with the additional incorporation of the Company’s card fee income and card processing expenses impacted by interest rates. -2,000 0 2,000 4,000 6,000 Month 1-12 Month 13-36 Month 37-60 Month 61-180 V ol um e ($ M ) Period Variance Total Assets Total Liabilities INTEREST RATE RISK MANAGEMENT (as of December 31, 2025)

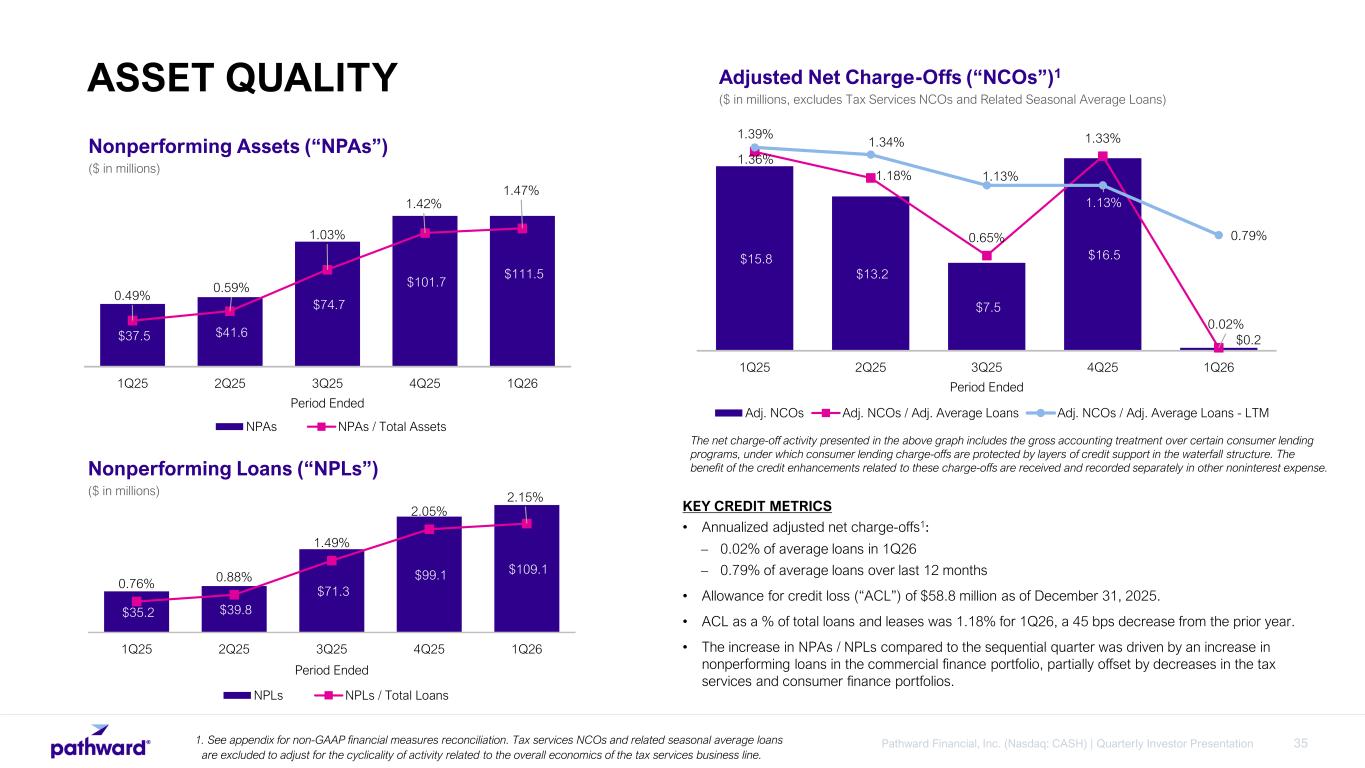

35Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation $15.8 $13.2 $7.5 $16.5 $0.2 1.36% 1.18% 0.65% 1.33% 0.02% 1.39% 1.34% 1.13% 1.13% 0.79% 1Q25 2Q25 3Q25 4Q25 1Q26 Period Ended Adj. NCOs Adj. NCOs / Adj. Average Loans Adj. NCOs / Adj. Average Loans - LTM Adjusted Net Charge-Offs (“NCOs”)1 ($ in millions, excludes Tax Services NCOs and Related Seasonal Average Loans) KEY CREDIT METRICS • Annualized adjusted net charge-offs1: – 0.02% of average loans in 1Q26 – 0.79% of average loans over last 12 months • Allowance for credit loss (“ACL”) of $58.8 million as of December 31, 2025. • ACL as a % of total loans and leases was 1.18% for 1Q26, a 45 bps decrease from the prior year. • The increase in NPAs / NPLs compared to the sequential quarter was driven by an increase in nonperforming loans in the commercial finance portfolio, partially offset by decreases in the tax services and consumer finance portfolios. 1. See appendix for non-GAAP financial measures reconciliation. Tax services NCOs and related seasonal average loans are excluded to adjust for the cyclicality of activity related to the overall economics of the tax services business line. $35.2 $39.8 $71.3 $99.1 $109.1 0.76% 0.88% 1.49% 2.05% 2.15% 1Q25 2Q25 3Q25 4Q25 1Q26 Period Ended NPLs NPLs / Total Loans Nonperforming Assets (“NPAs”) ($ in millions) Nonperforming Loans (“NPLs”) ($ in millions) $37.5 $41.6 $74.7 $101.7 $111.5 0.49% 0.59% 1.03% 1.42% 1.47% 1Q25 2Q25 3Q25 4Q25 1Q26 Period Ended NPAs NPAs / Total Assets The net charge-off activity presented in the above graph includes the gross accounting treatment over certain consumer lending programs, under which consumer lending charge-offs are protected by layers of credit support in the waterfall structure. The benefit of the credit enhancements related to these charge-offs are received and recorded separately in other noninterest expense. ASSET QUALITY

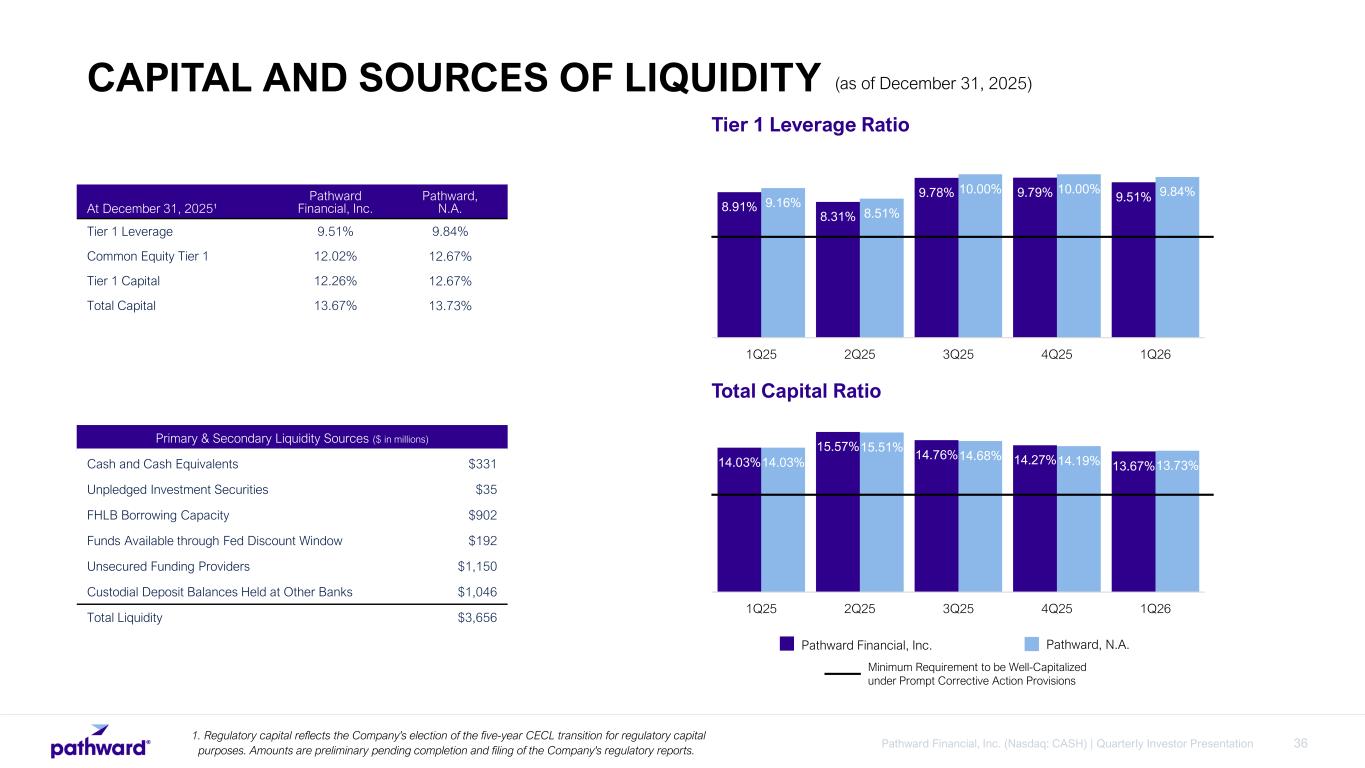

36Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation At December 31, 2025¹ Pathward Financial, Inc. Pathward, N.A. Tier 1 Leverage 9.51% 9.84% Common Equity Tier 1 12.02% 12.67% Tier 1 Capital 12.26% 12.67% Total Capital 13.67% 13.73% Primary & Secondary Liquidity Sources ($ in millions) Cash and Cash Equivalents $331 Unpledged Investment Securities $35 FHLB Borrowing Capacity $902 Funds Available through Fed Discount Window $192 Unsecured Funding Providers $1,150 Custodial Deposit Balances Held at Other Banks $1,046 Total Liquidity $3,656 8.91% 8.31% 9.78% 9.79% 9.51%9.16% 8.51% 10.00% 10.00% 9.84% 1Q25 2Q25 3Q25 4Q25 1Q26 Tier 1 Leverage Ratio 14.03% 15.57% 14.76% 14.27% 13.67%14.03% 15.51% 14.68% 14.19% 13.73% 1Q25 2Q25 3Q25 4Q25 1Q26 Total Capital Ratio Pathward Financial, Inc. Pathward, N.A. Minimum Requirement to be Well-Capitalized under Prompt Corrective Action Provisions 1. Regulatory capital reflects the Company's election of the five-year CECL transition for regulatory capital purposes. Amounts are preliminary pending completion and filing of the Company's regulatory reports. CAPITAL AND SOURCES OF LIQUIDITY (as of December 31, 2025)

37Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation APPENDIX

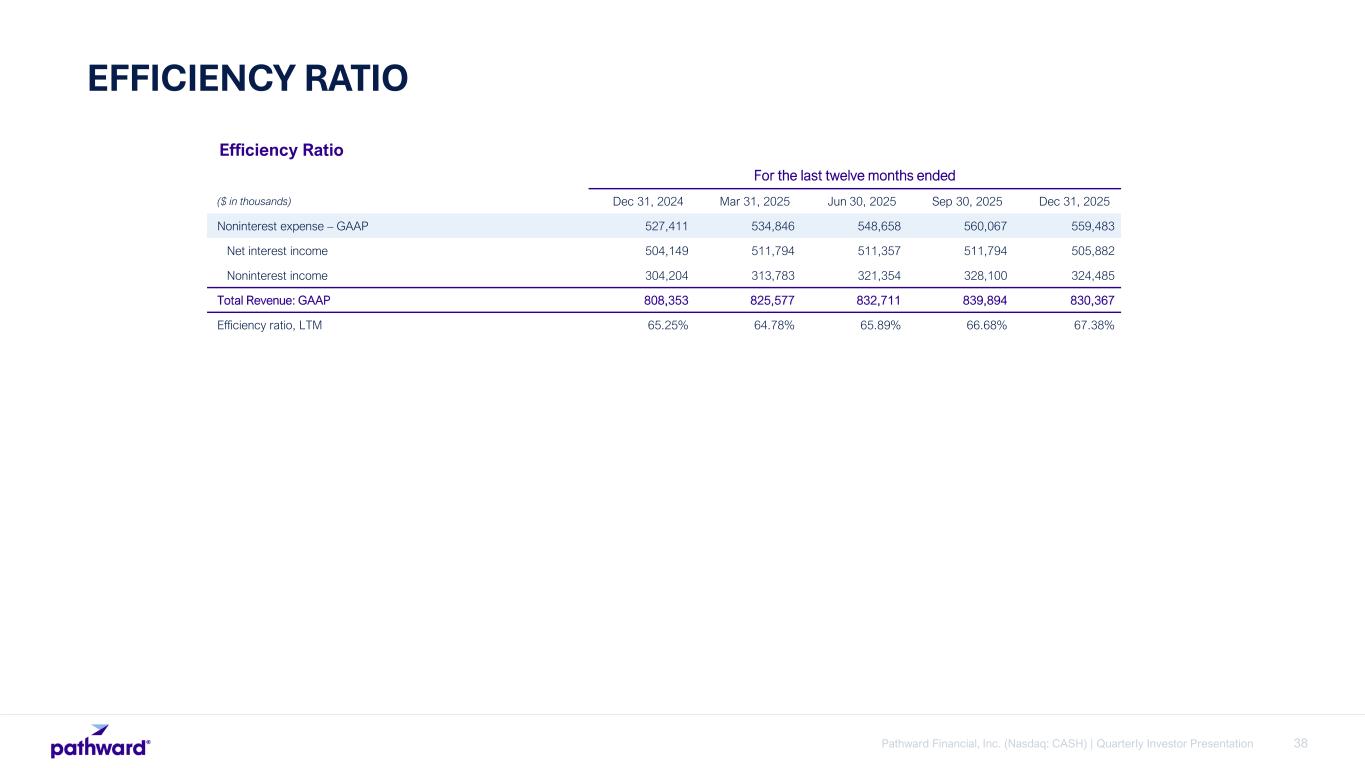

38Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation EFFICIENCY RATIO For the last twelve months ended ($ in thousands) Dec 31, 2024 Mar 31, 2025 Jun 30, 2025 Sep 30, 2025 Dec 31, 2025 Noninterest expense – GAAP 527,411 534,846 548,658 560,067 559,483 Net interest income 504,149 511,794 511,357 511,794 505,882 Noninterest income 304,204 313,783 321,354 328,100 324,485 Total Revenue: GAAP 808,353 825,577 832,711 839,894 830,367 Efficiency ratio, LTM 65.25% 64.78% 65.89% 66.68% 67.38% Efficiency Ratio

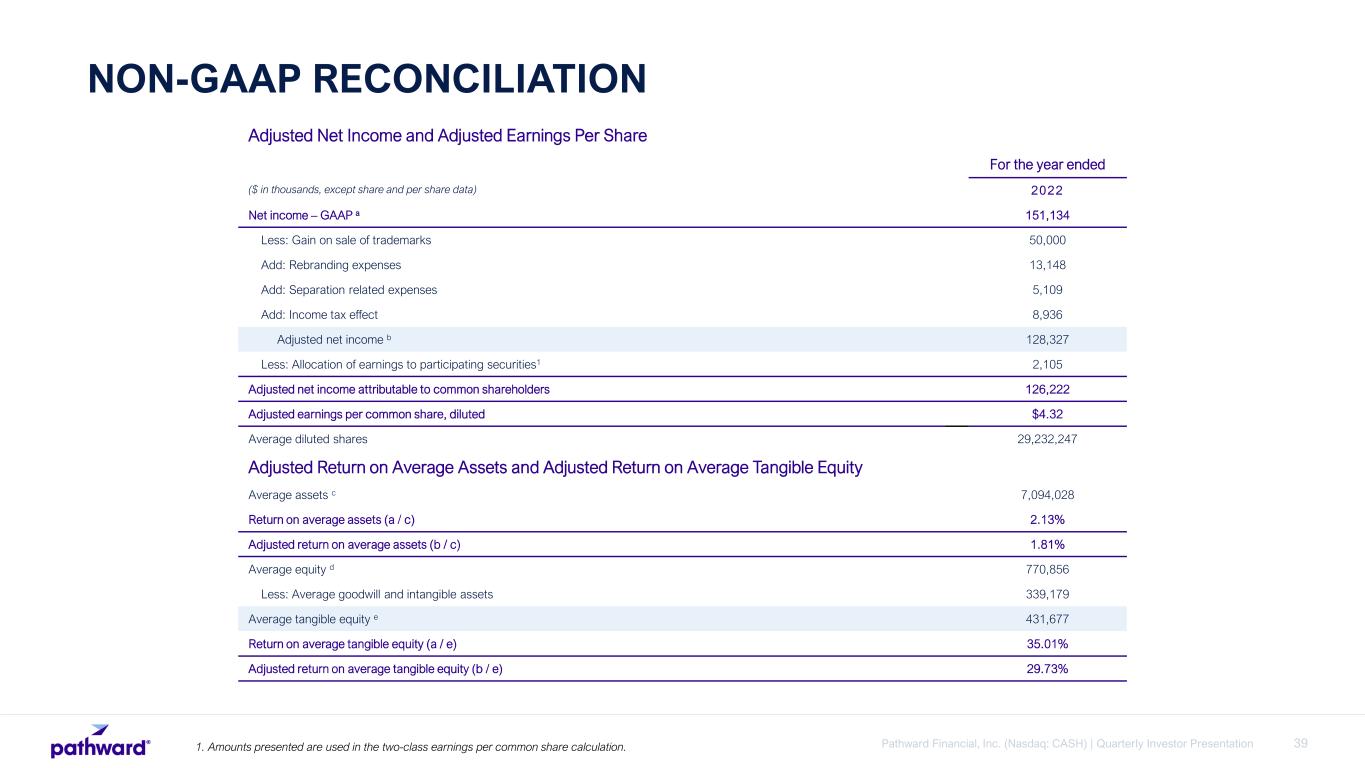

39Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation NON-GAAP RECONCILIATION 1. Amounts presented are used in the two-class earnings per common share calculation. Adjusted Net Income and Adjusted Earnings Per Share For the year ended ($ in thousands, except share and per share data) 2022 Net income – GAAP a 151,134 Less: Gain on sale of trademarks 50,000 Add: Rebranding expenses 13,148 Add: Separation related expenses 5,109 Add: Income tax effect 8,936 Adjusted net income b 128,327 Less: Allocation of earnings to participating securities1 2,105 Adjusted net income attributable to common shareholders 126,222 Adjusted earnings per common share, diluted $4.32 Average diluted shares 29,232,247 Adjusted Return on Average Assets and Adjusted Return on Average Tangible Equity Average assets c 7,094,028 Return on average assets (a / c) 2.13% Adjusted return on average assets (b / c) 1.81% Average equity d 770,856 Less: Average goodwill and intangible assets 339,179 Average tangible equity e 431,677 Return on average tangible equity (a / e) 35.01% Adjusted return on average tangible equity (b / e) 29.73%

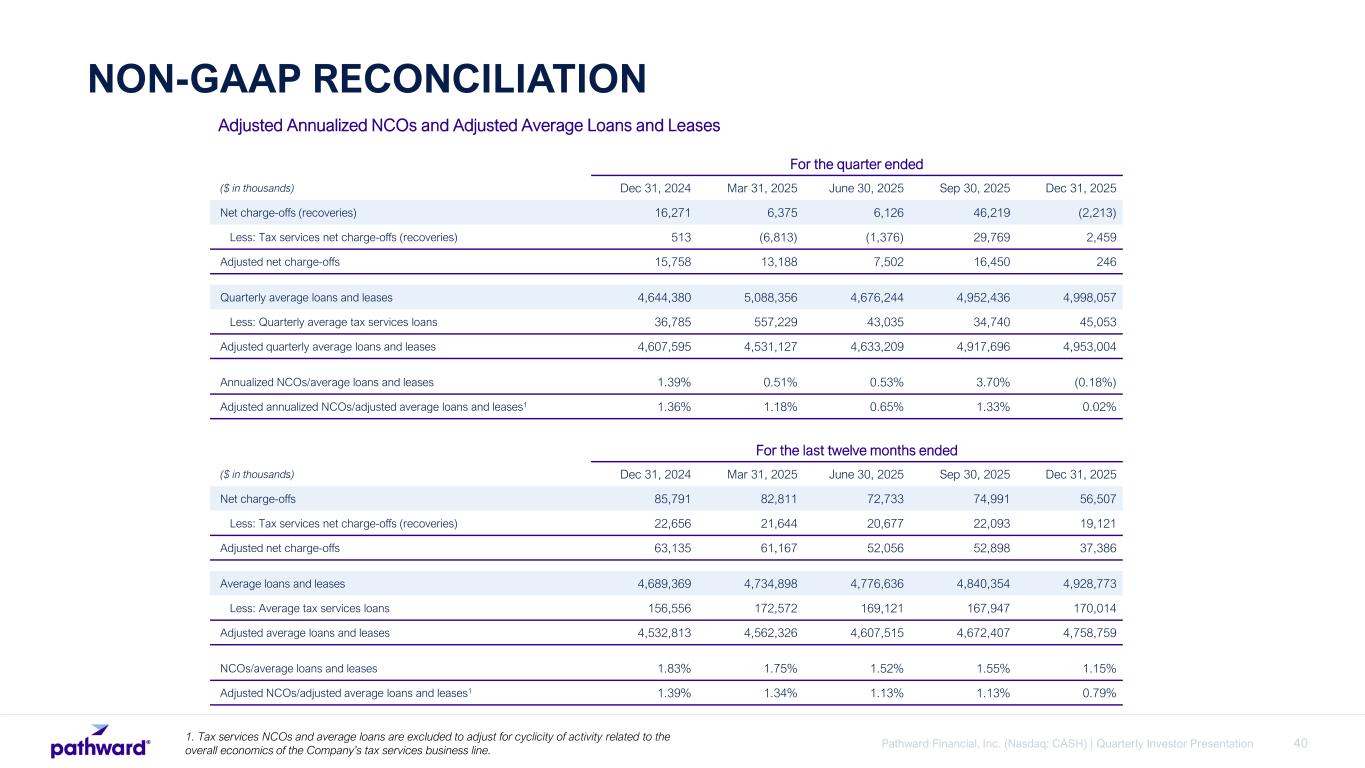

40Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation NON-GAAP RECONCILIATION For the quarter ended ($ in thousands) Dec 31, 2024 Mar 31, 2025 June 30, 2025 Sep 30, 2025 Dec 31, 2025 Net charge-offs (recoveries) 16,271 6,375 6,126 46,219 (2,213) Less: Tax services net charge-offs (recoveries) 513 (6,813) (1,376) 29,769 2,459 Adjusted net charge-offs 15,758 13,188 7,502 16,450 246 Quarterly average loans and leases 4,644,380 5,088,356 4,676,244 4,952,436 4,998,057 Less: Quarterly average tax services loans 36,785 557,229 43,035 34,740 45,053 Adjusted quarterly average loans and leases 4,607,595 4,531,127 4,633,209 4,917,696 4,953,004 Annualized NCOs/average loans and leases 1.39% 0.51% 0.53% 3.70% (0.18%) Adjusted annualized NCOs/adjusted average loans and leases1 1.36% 1.18% 0.65% 1.33% 0.02% Adjusted Annualized NCOs and Adjusted Average Loans and Leases For the last twelve months ended ($ in thousands) Dec 31, 2024 Mar 31, 2025 June 30, 2025 Sep 30, 2025 Dec 31, 2025 Net charge-offs 85,791 82,811 72,733 74,991 56,507 Less: Tax services net charge-offs (recoveries) 22,656 21,644 20,677 22,093 19,121 Adjusted net charge-offs 63,135 61,167 52,056 52,898 37,386 Average loans and leases 4,689,369 4,734,898 4,776,636 4,840,354 4,928,773 Less: Average tax services loans 156,556 172,572 169,121 167,947 170,014 Adjusted average loans and leases 4,532,813 4,562,326 4,607,515 4,672,407 4,758,759 NCOs/average loans and leases 1.83% 1.75% 1.52% 1.55% 1.15% Adjusted NCOs/adjusted average loans and leases1 1.39% 1.34% 1.13% 1.13% 0.79% 1. Tax services NCOs and average loans are excluded to adjust for cyclicity of activity related to the overall economics of the Company’s tax services business line.

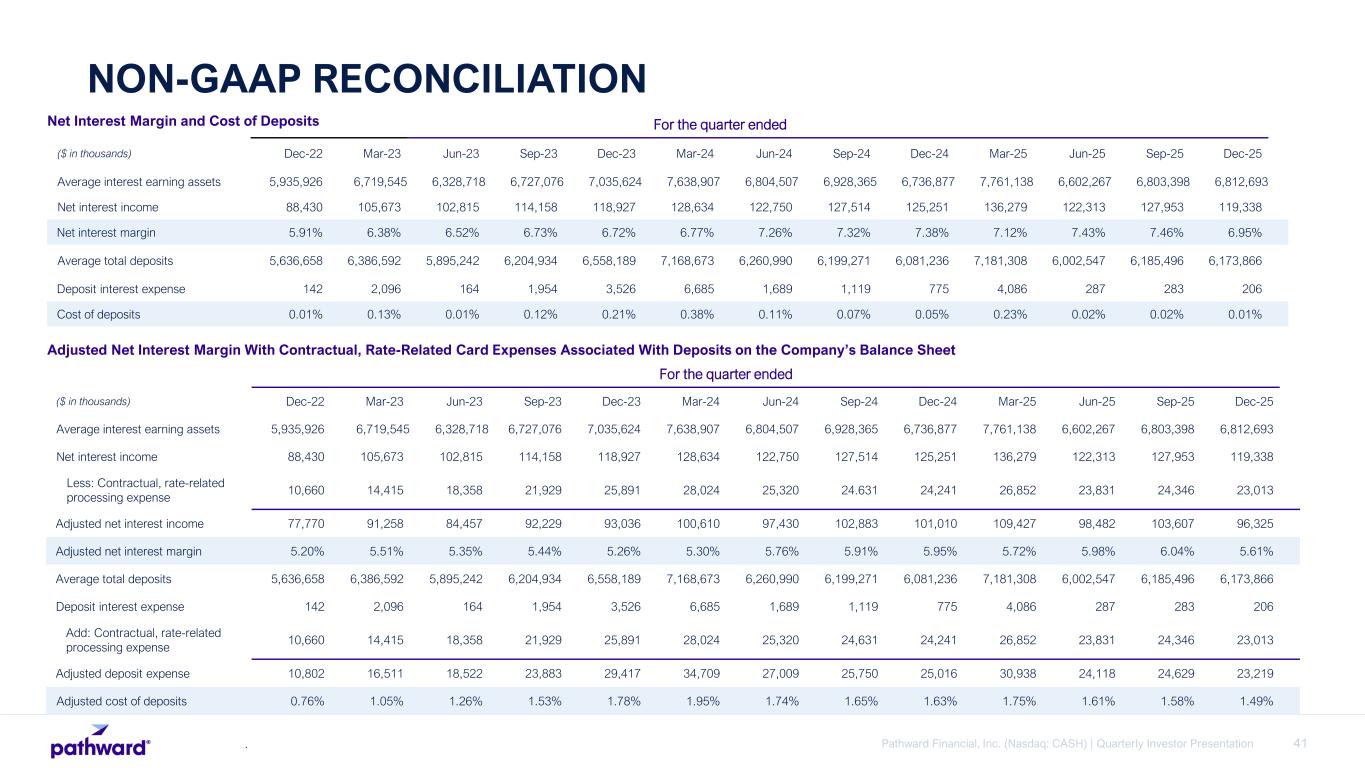

41Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation NON-GAAP RECONCILIATION . For the quarter ended ($ in thousands) Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Dec-24 Mar-25 Jun-25 Sep-25 Dec-25 Average interest earning assets 5,935,926 6,719,545 6,328,718 6,727,076 7,035,624 7,638,907 6,804,507 6,928,365 6,736,877 7,761,138 6,602,267 6,803,398 6,812,693 Net interest income 88,430 105,673 102,815 114,158 118,927 128,634 122,750 127,514 125,251 136,279 122,313 127,953 119,338 Net interest margin 5.91% 6.38% 6.52% 6.73% 6.72% 6.77% 7.26% 7.32% 7.38% 7.12% 7.43% 7.46% 6.95% Average total deposits 5,636,658 6,386,592 5,895,242 6,204,934 6,558,189 7,168,673 6,260,990 6,199,271 6,081,236 7,181,308 6,002,547 6,185,496 6,173,866 Deposit interest expense 142 2,096 164 1,954 3,526 6,685 1,689 1,119 775 4,086 287 283 206 Cost of deposits 0.01% 0.13% 0.01% 0.12% 0.21% 0.38% 0.11% 0.07% 0.05% 0.23% 0.02% 0.02% 0.01% Net Interest Margin and Cost of Deposits Adjusted Net Interest Margin With Contractual, Rate-Related Card Expenses Associated With Deposits on the Company’s Balance Sheet For the quarter ended ($ in thousands) Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Dec-24 Mar-25 Jun-25 Sep-25 Dec-25 Average interest earning assets 5,935,926 6,719,545 6,328,718 6,727,076 7,035,624 7,638,907 6,804,507 6,928,365 6,736,877 7,761,138 6,602,267 6,803,398 6,812,693 Net interest income 88,430 105,673 102,815 114,158 118,927 128,634 122,750 127,514 125,251 136,279 122,313 127,953 119,338 Less: Contractual, rate-related processing expense 10,660 14,415 18,358 21,929 25,891 28,024 25,320 24.631 24,241 26,852 23,831 24,346 23,013 Adjusted net interest income 77,770 91,258 84,457 92,229 93,036 100,610 97,430 102,883 101,010 109,427 98,482 103,607 96,325 Adjusted net interest margin 5.20% 5.51% 5.35% 5.44% 5.26% 5.30% 5.76% 5.91% 5.95% 5.72% 5.98% 6.04% 5.61% Average total deposits 5,636,658 6,386,592 5,895,242 6,204,934 6,558,189 7,168,673 6,260,990 6,199,271 6,081,236 7,181,308 6,002,547 6,185,496 6,173,866 Deposit interest expense 142 2,096 164 1,954 3,526 6,685 1,689 1,119 775 4,086 287 283 206 Add: Contractual, rate-related processing expense 10,660 14,415 18,358 21,929 25,891 28,024 25,320 24,631 24,241 26,852 23,831 24,346 23,013 Adjusted deposit expense 10,802 16,511 18,522 23,883 29,417 34,709 27,009 25,750 25,016 30,938 24,118 24,629 23,219 Adjusted cost of deposits 0.76% 1.05% 1.26% 1.53% 1.78% 1.95% 1.74% 1.65% 1.63% 1.75% 1.61% 1.58% 1.49%

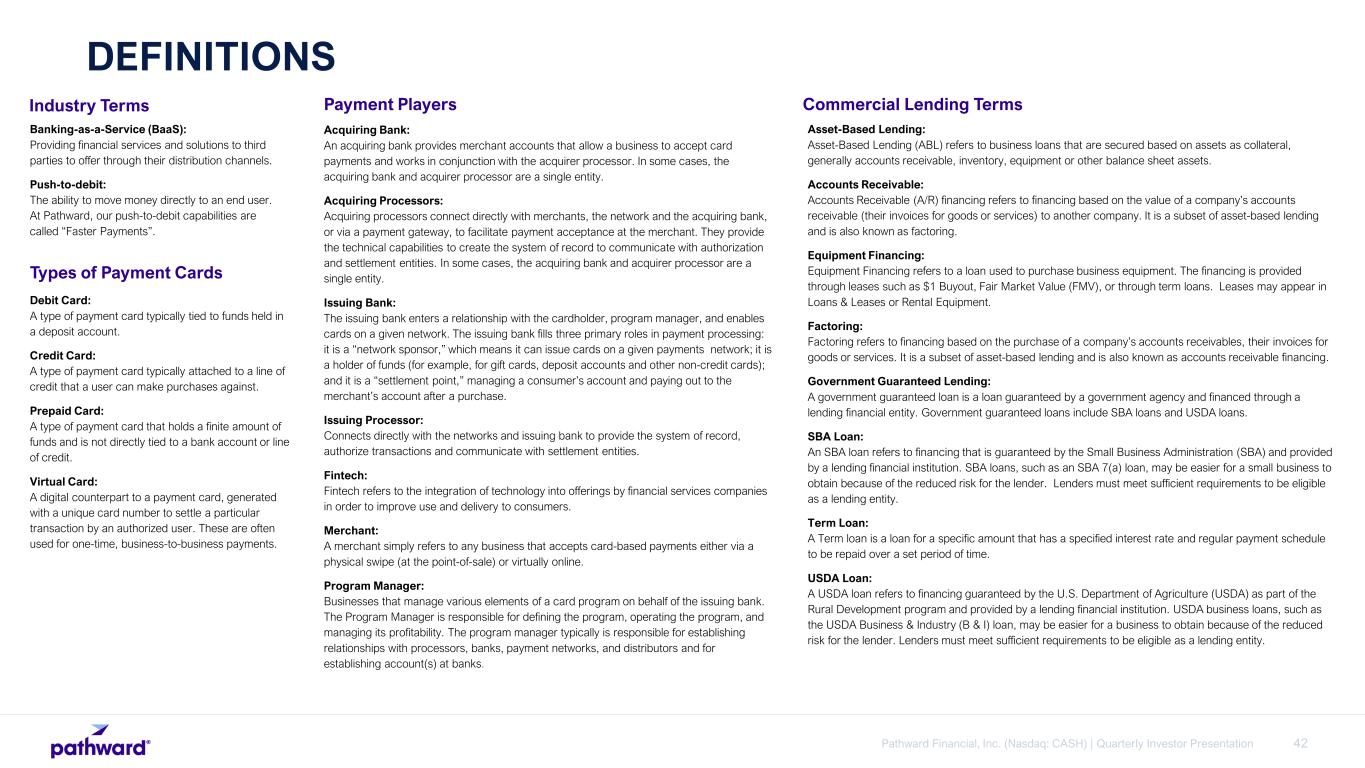

42Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Industry Terms Types of Payment Cards Banking-as-a-Service (BaaS): Providing financial services and solutions to third parties to offer through their distribution channels. Push-to-debit: The ability to move money directly to an end user. At Pathward, our push-to-debit capabilities are called “Faster Payments”. Debit Card: A type of payment card typically tied to funds held in a deposit account. Credit Card: A type of payment card typically attached to a line of credit that a user can make purchases against. Prepaid Card: A type of payment card that holds a finite amount of funds and is not directly tied to a bank account or line of credit. Virtual Card: A digital counterpart to a payment card, generated with a unique card number to settle a particular transaction by an authorized user. These are often used for one-time, business-to-business payments. Payment Players Acquiring Bank: An acquiring bank provides merchant accounts that allow a business to accept card payments and works in conjunction with the acquirer processor. In some cases, the acquiring bank and acquirer processor are a single entity. Acquiring Processors: Acquiring processors connect directly with merchants, the network and the acquiring bank, or via a payment gateway, to facilitate payment acceptance at the merchant. They provide the technical capabilities to create the system of record to communicate with authorization and settlement entities. In some cases, the acquiring bank and acquirer processor are a single entity. Issuing Bank: The issuing bank enters a relationship with the cardholder, program manager, and enables cards on a given network. The issuing bank fills three primary roles in payment processing: it is a “network sponsor,” which means it can issue cards on a given payments network; it is a holder of funds (for example, for gift cards, deposit accounts and other non-credit cards); and it is a “settlement point,” managing a consumer’s account and paying out to the merchant’s account after a purchase. Issuing Processor: Connects directly with the networks and issuing bank to provide the system of record, authorize transactions and communicate with settlement entities. Fintech: Fintech refers to the integration of technology into offerings by financial services companies in order to improve use and delivery to consumers. Merchant: A merchant simply refers to any business that accepts card-based payments either via a physical swipe (at the point-of-sale) or virtually online. Program Manager: Businesses that manage various elements of a card program on behalf of the issuing bank. The Program Manager is responsible for defining the program, operating the program, and managing its profitability. The program manager typically is responsible for establishing relationships with processors, banks, payment networks, and distributors and for establishing account(s) at banks. DEFINITIONS Commercial Lending Terms Asset-Based Lending: Asset-Based Lending (ABL) refers to business loans that are secured based on assets as collateral, generally accounts receivable, inventory, equipment or other balance sheet assets. Accounts Receivable: Accounts Receivable (A/R) financing refers to financing based on the value of a company’s accounts receivable (their invoices for goods or services) to another company. It is a subset of asset-based lending and is also known as factoring. Equipment Financing: Equipment Financing refers to a loan used to purchase business equipment. The financing is provided through leases such as $1 Buyout, Fair Market Value (FMV), or through term loans. Leases may appear in Loans & Leases or Rental Equipment. Factoring: Factoring refers to financing based on the purchase of a company’s accounts receivables, their invoices for goods or services. It is a subset of asset-based lending and is also known as accounts receivable financing. Government Guaranteed Lending: A government guaranteed loan is a loan guaranteed by a government agency and financed through a lending financial entity. Government guaranteed loans include SBA loans and USDA loans. SBA Loan: An SBA loan refers to financing that is guaranteed by the Small Business Administration (SBA) and provided by a lending financial institution. SBA loans, such as an SBA 7(a) loan, may be easier for a small business to obtain because of the reduced risk for the lender. Lenders must meet sufficient requirements to be eligible as a lending entity. Term Loan: A Term loan is a loan for a specific amount that has a specified interest rate and regular payment schedule to be repaid over a set period of time. USDA Loan: A USDA loan refers to financing guaranteed by the U.S. Department of Agriculture (USDA) as part of the Rural Development program and provided by a lending financial institution. USDA business loans, such as the USDA Business & Industry (B & I) loan, may be easier for a business to obtain because of the reduced risk for the lender. Lenders must meet sufficient requirements to be eligible as a lending entity.