FLAMENCO Lender Due Diligence May 2025 QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group

Contents 1 Background and Terms of Reference 2 Key Findings and Considerations 3 Data Integrity 4 File Completeness 5 Policies and Procedures 6 Underwriting 7 Loan Servicing 8 Vulnerable Customers 9 Complaints Log 10 Compliance 11 Cash Management QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 2

Background and Terms of Reference Terms of Reference The report is in relation to a due diligence exercise established and scoped by Goldman Sachs International ("GS") in respect of a Spanish performing and re-performing portfolio originated by a number of Spanish banks, that have merged into Banco Santander ("the Seller"). Quadrin Financial Services Limited ("Quadrin") conducted the assessment onsite at the Seller's offices in Juan Ignacio Luca de Tena 9, Madrid. Sampling The sample comprise of 100 loans. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 3

Contents 1 Background and Terms of Reference 2 Key Findings and Considerations 3 Data Integrity 4 File Completeness 5 Policies and Procedures 6 Underwriting 7 Loan Servicing 8 Vulnerable Customers 9 Complaints Log 10 Compliance 11 Cash Management QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 4

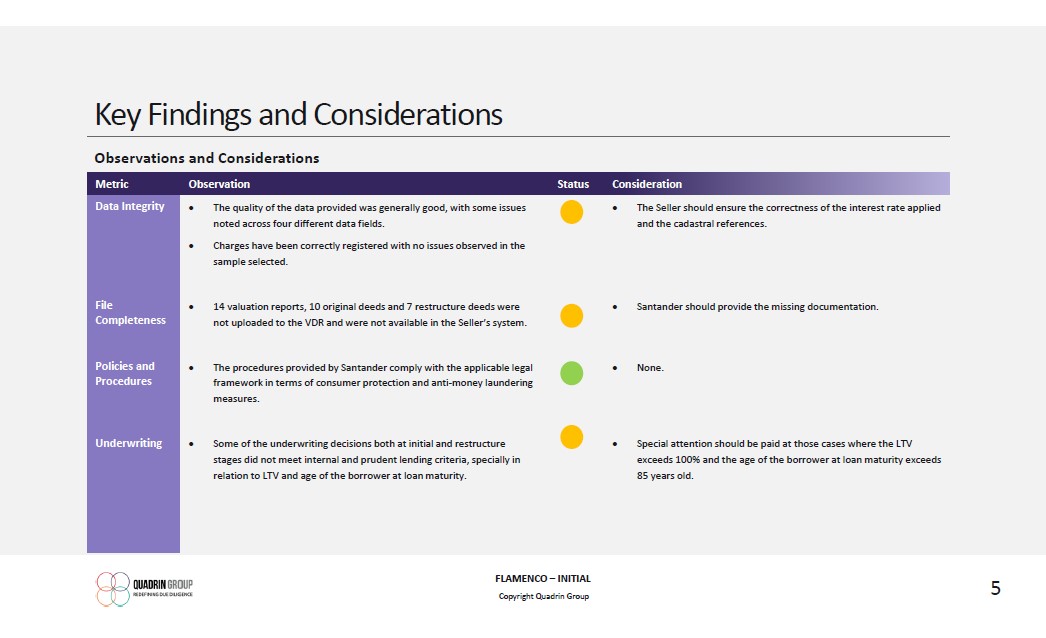

Key Findings and Considerations Observations and Considerations Metric Observation Status Consideration Data Integrity The quality of the data provided was generally good, with some issues noted across four different data fields. Charges have been correctly registered with no issues observed in the sample selected. The Seller should ensure the correctness of the interest rate applied and the cadastral references. File Completeness 14 valuation reports, 10 original deeds and 7 restructure deeds were not uploaded to the VDR and were not available in the Seller's system. Santander should provide the missing documentation. Policies and Procedures The procedures provided by Santander comply with the applicable legal framework in terms of consumer protection and anti-money laundering measures. None. Underwriting Some of the underwriting decisions both at initial and restructure stages did not meet internal and prudent lending criteria, specially in relation to LTV and age of the borrower at loan maturity. Special attention should be paid at those cases where the LTV exceeds 100% and the age of the borrower at loan maturity exceeds 85 years old. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 5

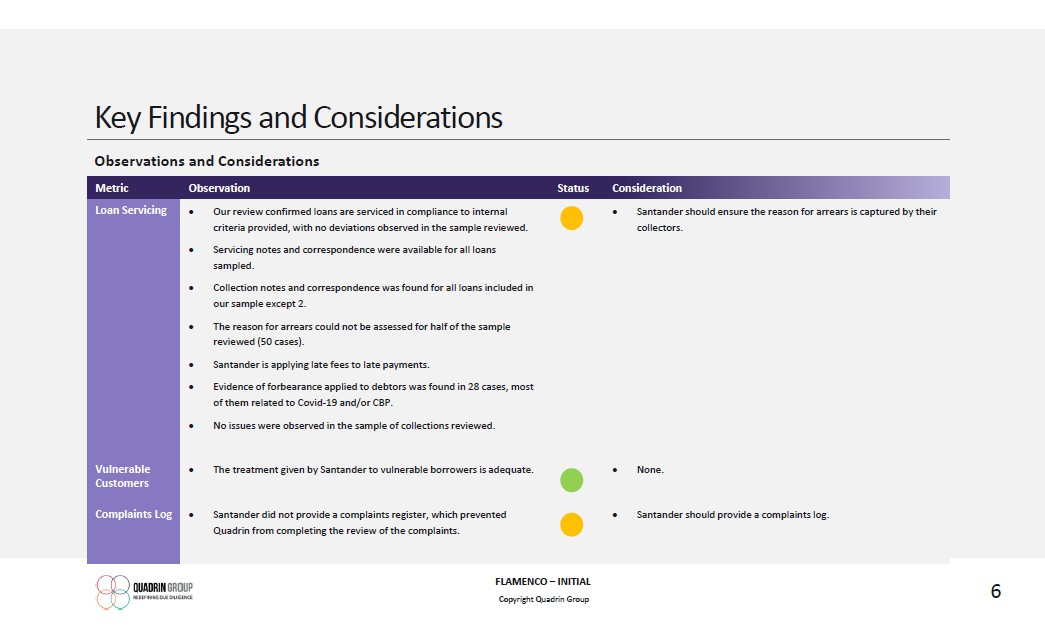

Key Findings and Considerations Observations and Considerations Metric Observation Status Consideration Loan Servicing Our review confirmed loans are serviced in compliance to internal criteria provided, with no deviations observed in the sample reviewed. Servicing notes and correspondence were available for all loans sampled. Collection notes and correspondence was found for all loans included in our sample except 2. The reason for arrears could not be assessed for half of the sample reviewed (50 cases). Santander is applying late fees to late payments. Evidence of forbearance applied to debtors was found in 28 cases, most of them related to Covid-19 and/or CBP. No issues were observed in the sample of collections reviewed. Santander should ensure the reason for arrears is captured by their collectors. Vulnerable Customers The treatment given by Santander to vulnerable borrowers is adequate. None. Complaints Log Santander did not provide a complaints register, which prevented Quadrin from completing the review of the complaints. Santander should provide a complaints log. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 6

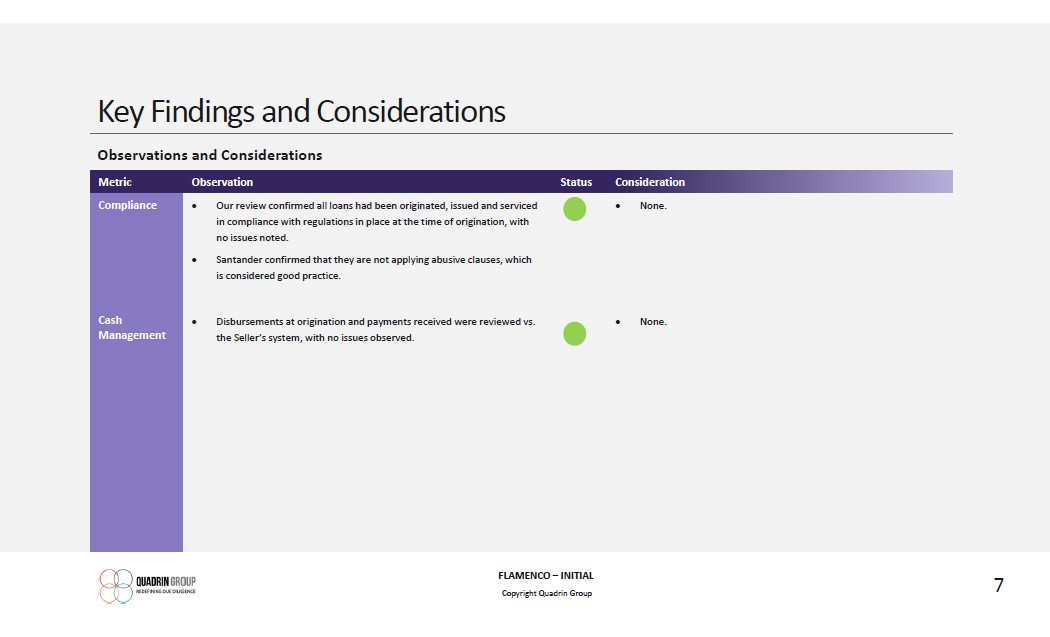

Key Findings and Considerations Observations and Considerations Metric Observation Status Consideration Compliance Our review confirmed all loans had been originated, issued and serviced in compliance with regulations in place at the time of origination, with no issues noted. Santander confirmed that they are not applying abusive clauses, which is considered good practice. None. Cash Management Disbursements at origination and payments received were reviewed vs. the Seller's system, with no issues observed. None. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 7

Contents 1 Background and Terms of Reference 2 Key Findings and Considerations 3 Data Integrity 4 File Completeness 5 Policies and Procedures 6 Underwriting 7 Loan Servicing 8 Vulnerable Customers 9 Complaints Log 10 Compliance 11 Cash Management QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 8

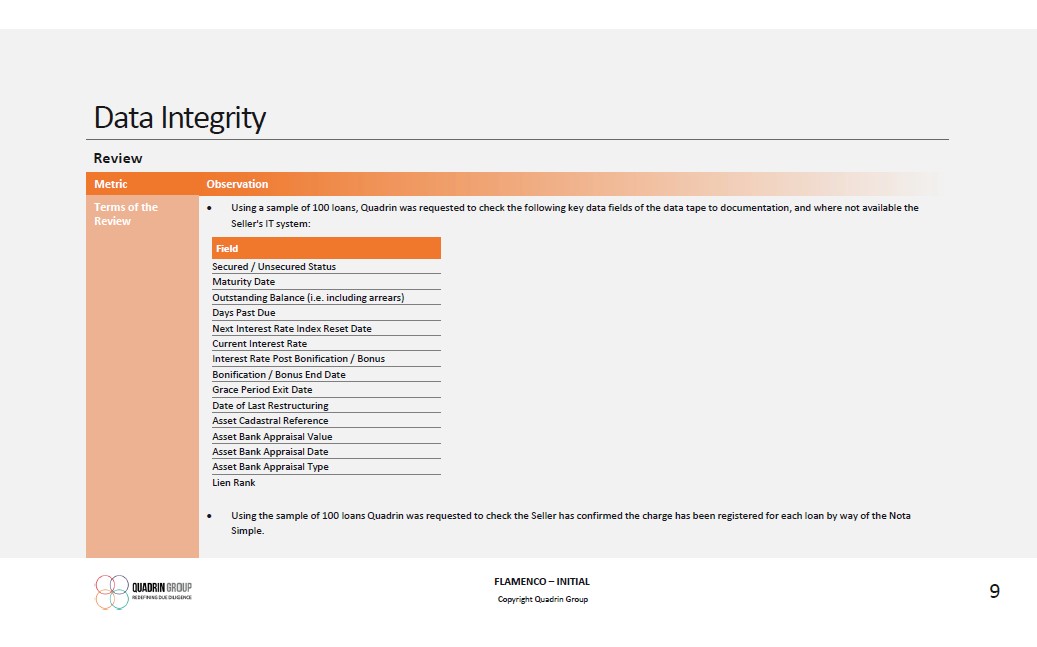

Data Integrity Review Metric Observation Terms of the Review Using a sample of 100 loans, Quadrin was requested to check the following key data fields of the data tape to documentation, and where not available the Seller's IT system: Field Secured / Unsecured Status Maturity Date Outstanding Balance (i.e. including arrears) Days Past Due Next Interest Rate Index Reset Date Current Interest Rate Interest Rate Post Bonification / Bonus Bonification / Bonus End Date Grace Period Exit Date Date of Last Restructuring Asset Cadastral Reference Asset Bank Appraisal Value Asset Bank Appraisal Date Asset Bank Appraisal Type Lien Rank Using the sample of 100 loans Quadrin was requested to check the Seller has confirmed the charge has been registered for each loan by way of the Nota Simple. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 9

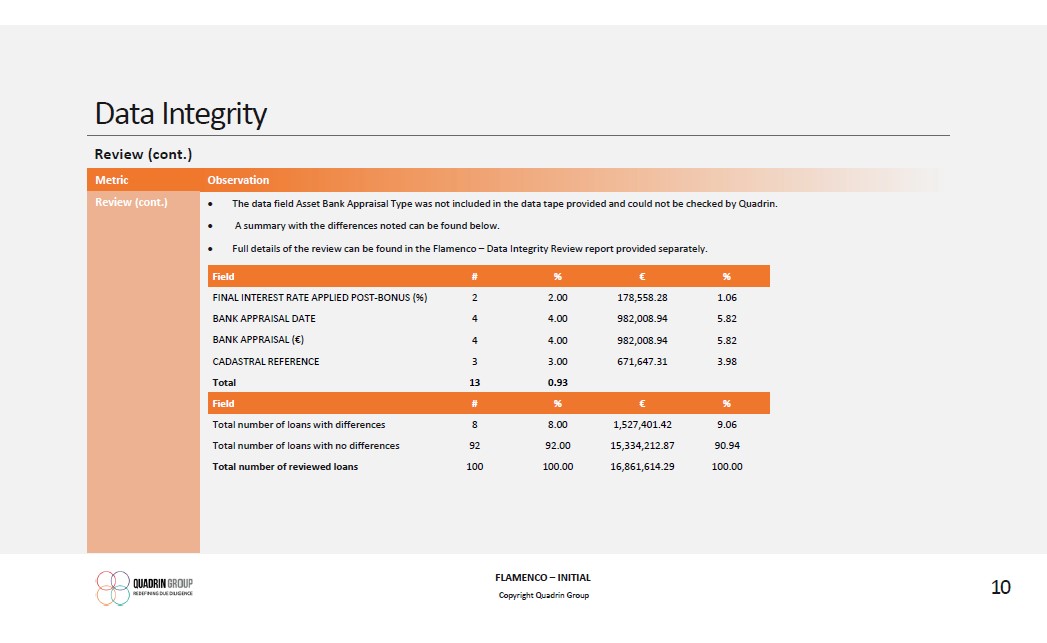

Data Integrity Review (cont.) Metric Observation Review (cont.) The data field Asset Bank Appraisal Type was not included in the data tape provided and could not be checked by Quadrin. A summary with the differences noted can be found below. Full details of the review can be found in the Flamenco - Data Integrity Review report provided separately. Field # % € % FINAL INTEREST RATE APPLIED POST-BONUS (%) 2 2.00 178,558.28 1.06 BANK APPRAISAL DATE 4 4.00 982,008.94 5.82 BANK APPRAISAL (€) 4 4.00 982,008.94 5.82 CADASTRAL REFERENCE 3 3.00 671,647.31 3.98 Total 13 0.93 Field # % € % Total number of loans with differences 8 8.00 1,527,401.42 9.06 Total number of loans with no differences 92 92.00 15,334,212.87 90.94 Total number of reviewed loans 100 100.00 16,861,614.29 100.00 QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 10

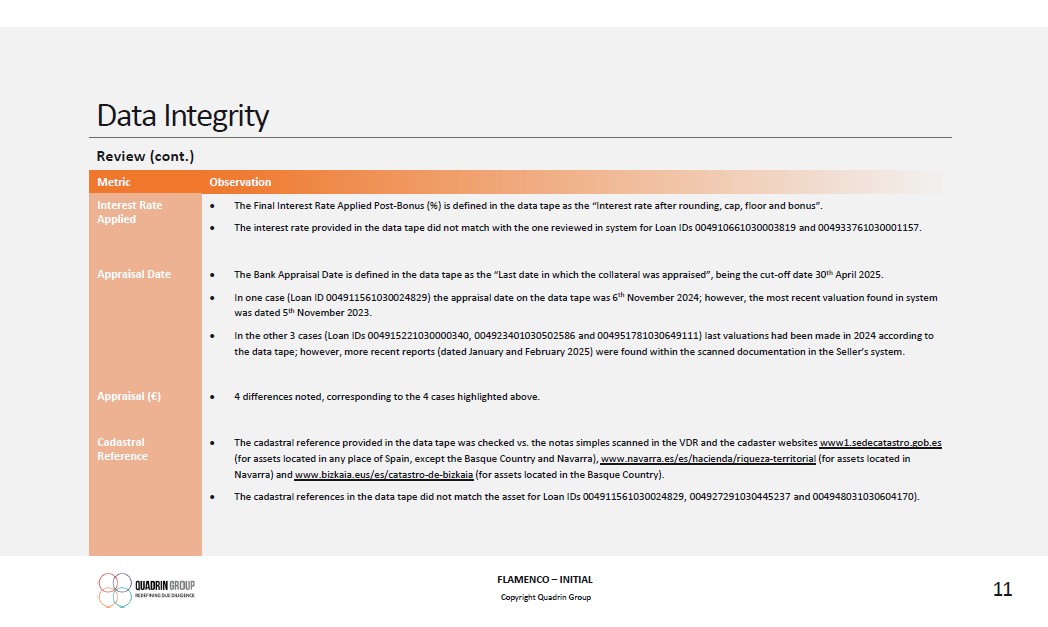

Data Integrity Review (cont.) Metric Observation Interest Rate Applied The Final Interest Rate Applied Post-Bonus (%) is defined in the data tape as the "Interest rate after rounding, cap, floor and bonus". The interest rate provided in the data tape did not match with the one reviewed in system for Loan IDs 004910661030003819 and 004933761030001157. Appraisal Date The Bank Appraisal Date is defined in the data tape as the "Last date in which the collateral was appraised", being the cut-off date 30th April 2025. In one case (Loan ID 004911561030024829) the appraisal date on the data tape was 6th November 2024; however, the most recent valuation found in system was dated 5th November 2023. In the other 3 cases (Loan IDs 004915221030000340, 004923401030502586 and 004951781030649111) last valuations had been made in 2024 according to the data tape; however, more recent reports (dated January and February 2025) were found within the scanned documentation in the Seller's system. Appraisal (€) 4 differences noted, corresponding to the 4 cases highlighted above. Cadastral Reference The cadastral reference provided in the data tape was checked vs. the notas simples scanned in the VDR and the cadaster websites www1.sedecatastro.gob.es (for assets located in any place of Spain, except the Basque Country and Navarra), www.navarra.es/es/hacienda/riqueza-territorial (for assets located in Navarra) and www.bizkaia.eus/es/catastro-de-bizkaia (for assets located in the Basque Country). The cadastral references in the data tape did not match the asset for Loan IDs 004911561030024829, 004927291030445237 and 004948031030604170). QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 11

Data Integrity Charge Registration Metric Observation Review The Seller provided an updated nota simple for each of the assets included in our sample. Our review confirmed charges have been correctly registered with no issues observed in the sample selected. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 12

Contents 1 Background and Terms of Reference 2 Key Findings and Considerations 3 Data Integrity 4 File Completeness 5 Policies and Procedures 6 Underwriting 7 Loan Servicing 8 Vulnerable Customers 9 Complaints Log 10 Compliance 11 Cash Management QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 13

File Completeness Review Metric Observations Terms of the Review Using the Sample of 100 loans, Quadrin was requested to check the completeness of mortgage documentation including application form, credit report, customer DD records, valuation report and mortgage deed. Quadrin was requested to confirm that the loan agreements were consistent with the templates provided for each product type / refinancing / restructure type. Within this sample, Quadrin was requested to check up to 50 loans to assess if interest rates had been reset according to the corresponding loan agreement and rate setting policy and law. The details of the review can be found in the following slides. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 14

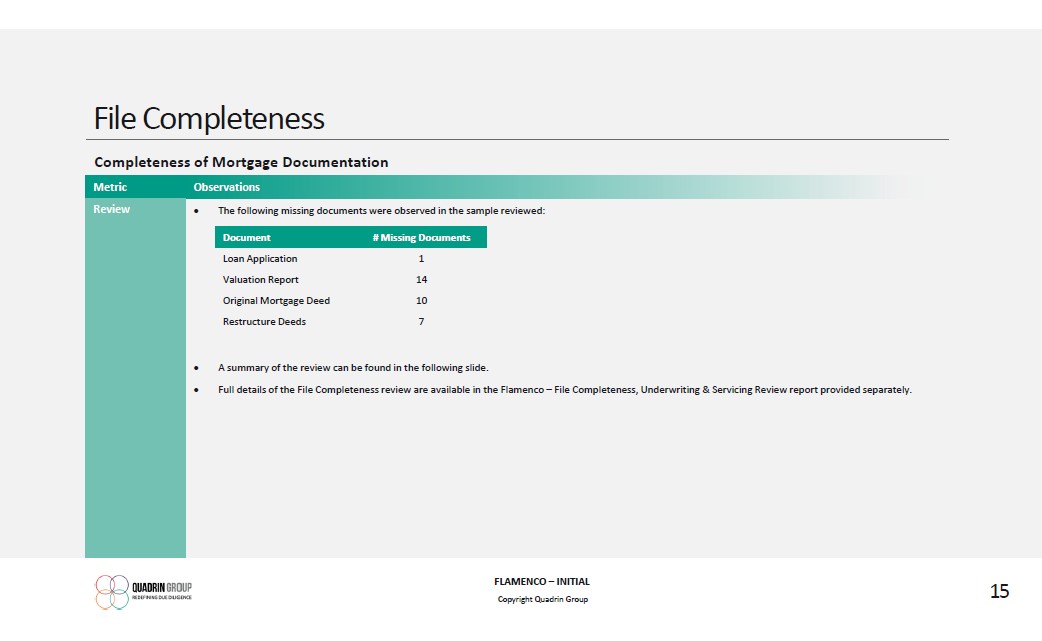

File Completeness Completeness of Mortgage Documentation Metric Observations Review The following missing documents were observed in the sample reviewed: Document # Missing Documents Loan Application 1 Valuation Report 14 Original Mortgage Deed 10 Restructure Deeds 7 A summary of the review can be found in the following slide. Full details of the File Completeness review are available in the Flamenco - File Completeness, Underwriting & Servicing Review report provided separately. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 15

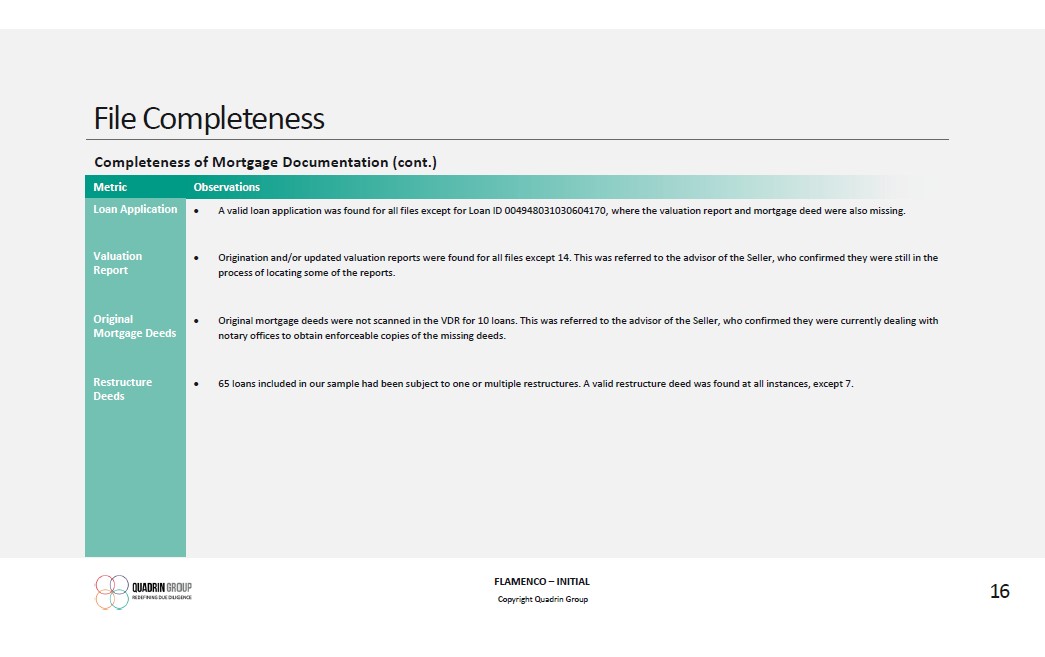

File Completeness Completeness of Mortgage Documentation (cont.) Metric Observations Loan Application A valid loan application was found for all files except for Loan ID 004948031030604170, where the valuation report and mortgage deed were also missing. Valuation Report Origination and/or updated valuation reports were found for all files except 14. This was referred to the advisor of the Seller, who confirmed they were still in the process of locating some of the reports. Original Mortgage Deeds Original mortgage deeds were not scanned in the VDR for 10 loans. This was referred to the advisor of the Seller, who confirmed they were currently dealing with notary offices to obtain enforceable copies of the missing deeds. Restructure Deeds 65 loans included in our sample had been subject to one or multiple restructures. A valid restructure deed was found at all instances, except 7. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 16

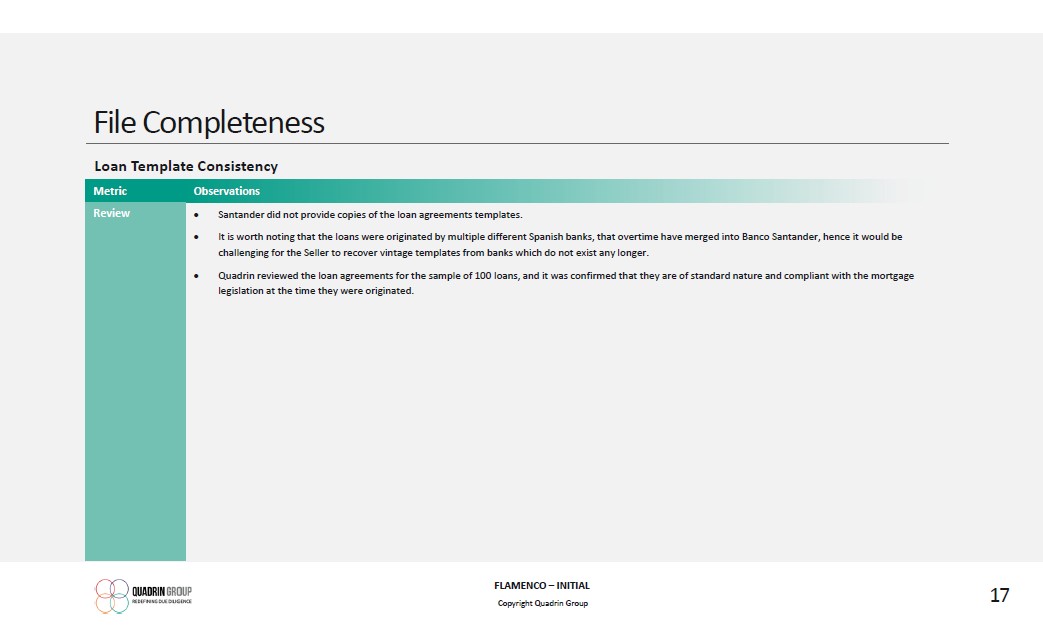

File Completeness Loan Template Consistency Metric Observations Review Santander did not provide copies of the loan agreements templates. It is worth noting that the loans were originated by multiple different Spanish banks, that overtime have merged into Banco Santander, hence it would be challenging for the Seller to recover vintage templates from banks which do not exist any longer. Quadrin reviewed the loan agreements for the sample of 100 loans, and it was confirmed that they are of standard nature and compliant with the mortgage legislation at the time they were originated. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 17

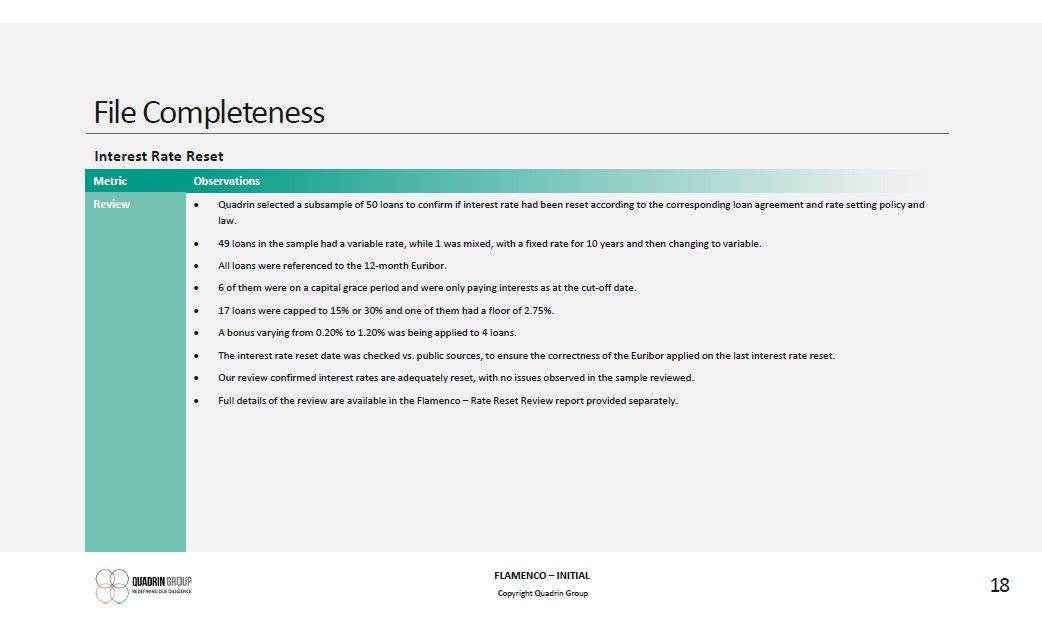

File Completeness Interest Rate Reset Metric Observations Review Quadrin selected a subsample of 50 loans to confirm if interest rate had been reset according to the corresponding loan agreement and rate setting policy and law. 49 loans in the sample had a variable rate, while 1 was mixed, with a fixed rate for 10 years and then changing to variable. All loans were referenced to the 12-month Euribor. 6 of them were on a capital grace period and were only paying interests as at the cut-off date. 17 loans were capped to 15% or 30% and one of them had a floor of 2.75%. A bonus varying from 0.20% to 1.20% was being applied to 4 loans. The interest rate reset date was checked vs. public sources, to ensure the correctness of the Euribor applied on the last interest rate reset. Our review confirmed interest rates are adequately reset, with no issues observed in the sample reviewed. Full details of the review are available in the Flamenco - Rate Reset Review report provided separately. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 18

Contents 1 Background and Terms of Reference 2 Key Findings and Considerations 3 Data Integrity 4 File Completeness 5 Policies and Procedures 6 Underwriting 7 Loan Servicing 8 Vulnerable Customers 9 Complaints Log 10 Compliance 11 Cash Management QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 19

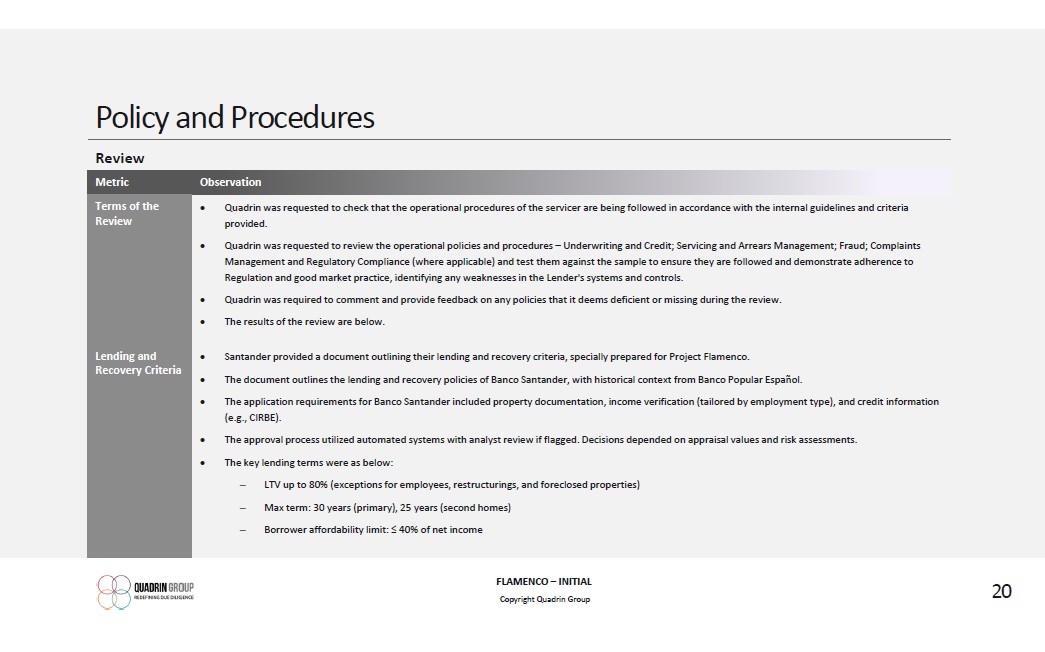

Policy and Procedures Review Metric Observation Terms of the Review Quadrin was requested to check that the operational procedures of the servicer are being followed in accordance with the internal guidelines and criteria provided. Quadrin was requested to review the operational policies and procedures - Underwriting and Credit; Servicing and Arrears Management; Fraud; Complaints Management and Regulatory Compliance (where applicable) and test them against the sample to ensure they are followed and demonstrate adherence to Regulation and good market practice, identifying any weaknesses in the Lender's systems and controls. Quadrin was required to comment and provide feedback on any policies that it deems deficient or missing during the review. The results of the review are below. Lending and Recovery Criteria Santander provided a document outlining their lending and recovery criteria, specially prepared for Project Flamenco. The document outlines the lending and recovery policies of Banco Santander, with historical context from Banco Popular Español. The application requirements for Banco Santander included property documentation, income verification (tailored by employment type), and credit information (e.g., CIRBE). The approval process utilized automated systems with analyst review if flagged. Decisions depended on appraisal values and risk assessments. The key lending terms were as below: LTV up to 80% (exceptions for employees, restructurings, and foreclosed properties) Max term: 30 years (primary), 25 years (second homes) Borrower affordability limit: ? 40% of net income QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 20

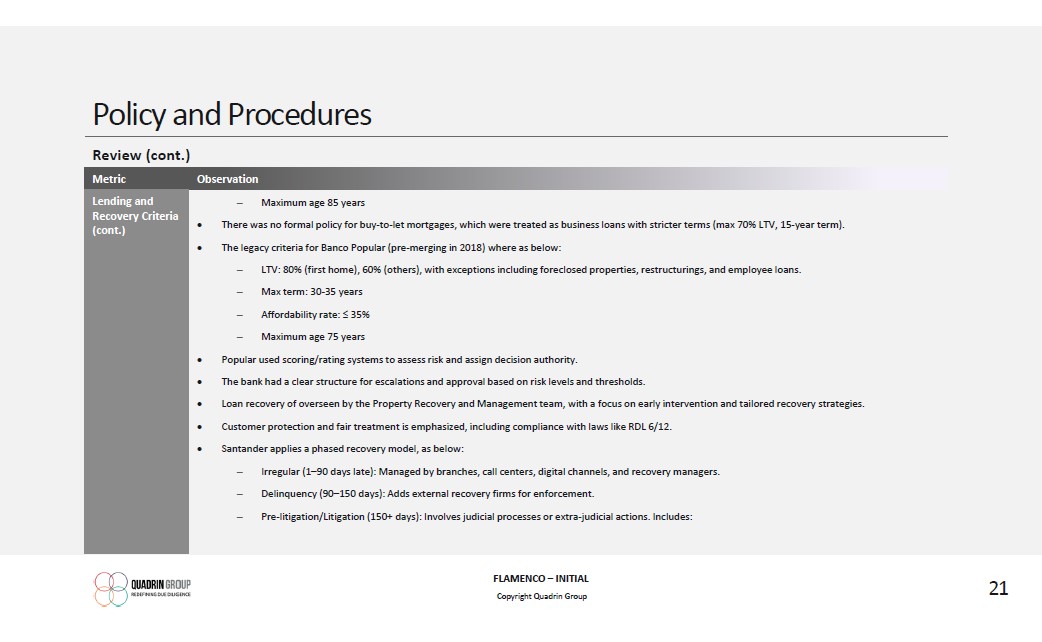

Policy and Procedures Review (cont.) Metric Observation Lending and Recovery Criteria (cont.) Maximum age 85 years There was no formal policy for buy-to-let mortgages, which were treated as business loans with stricter terms (max 70% LTV, 15-year term). The legacy criteria for Banco Popular (pre-merging in 2018) where as below: LTV: 80% (first home), 60% (others), with exceptions including foreclosed properties, restructurings, and employee loans. Max term: 30-35 years Affordability rate: ? 35% Maximum age 75 years Popular used scoring/rating systems to assess risk and assign decision authority. The bank had a clear structure for escalations and approval based on risk levels and thresholds. Loan recovery of overseen by the Property Recovery and Management team, with a focus on early intervention and tailored recovery strategies. Customer protection and fair treatment is emphasized, including compliance with laws like RDL 6/12. Santander applies a phased recovery model, as below: Irregular (1-90 days late): Managed by branches, call centers, digital channels, and recovery managers. Delinquency (90-150 days): Adds external recovery firms for enforcement. Pre-litigation/Litigation (150+ days): Involves judicial processes or extra-judicial actions. Includes: QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 21

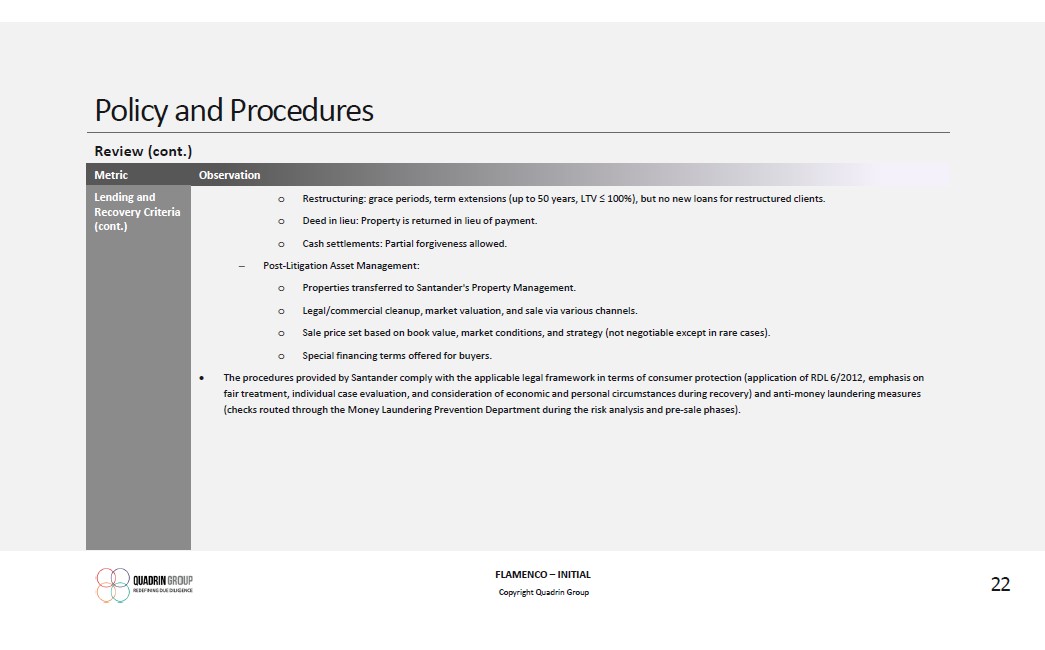

Policy and Procedures Review (cont.) Metric Observation Lending and Recovery Criteria (cont.) Restructuring: grace periods, term extensions (up to 50 years, LTV ? 100%), but no new loans for restructured clients. Deed in lieu: Property is returned in lieu of payment. Cash settlements: Partial forgiveness allowed. Post-Litigation Asset Management: Properties transferred to Santander's Property Management. Legal/commercial cleanup, market valuation, and sale via various channels. Sale price set based on book value, market conditions, and strategy (not negotiable except in rare cases). Special financing terms offered for buyers. The procedures provided by Santander comply with the applicable legal framework in terms of consumer protection (application of RDL 6/2012, emphasis on fair treatment, individual case evaluation, and consideration of economic and personal circumstances during recovery) and anti-money laundering measures (checks routed through the Money Laundering Prevention Department during the risk analysis and pre-sale phases). QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 22

Contents 1 Background and Terms of Reference 2 Key Findings and Considerations 3 Data Integrity 4 File Completeness 5 Policies and Procedures 6 Underwriting 7 Loan Servicing 8 Vulnerable Customers 9 Complaints Log 10 Compliance 11 Cash Management QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 23

Underwriting Review Metric Observation Terms of the Review Using the sample selected, Quadrin was requested to: Confirm the documents and underwriting decisions are in accordance with the lending and product guidelines provided; and Review the underwriting decisions made to confirm they meet with an underwriting standard commonly applied by a prudent lender in the jurisdiction. A summary with the results of the review is available in the following slide. Full details are available in the Flamenco - File Completeness, Underwriting and Servicing Review report provided separately. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 24

Underwriting Review (cont.) Metric Observation Compliance with Guidelines Provided Quadrin noted that underwriting decisions at origination did not meet the lending and product guidelines provided in 31 cases, due to the following reasons: Excessive LTV at loan origination. The policies of the lender establish a limit of 80% LTV (with exceptions for employees, restructurings, and foreclosed properties). Quadrin noted 25 cases where the LTV at loan origination exceeded 80%, in some cases going over 100% LTV, which does not comply with the guidelines provided. Excessive LTV at loan restructure. While the Seller's policy establish exceptions can apply for restructured loans, Quadrin noted 5 cases (which included restructures and new mortgage for debt consolidation) where the LTV exceeded 100% LTV. Age at maturity. The maximum age at maturity should not exceed 85 years old for Santander and 75 for Popular. In 7 cases the age at maturity at the time of originating the loan would exceed these burdens. Prudent Lending The following issues were noted in the sample reviewed: Loan term. The term of the loan should not exceed 40 years since loan origination. In 10 cases, the term exceeded 40 years after the loan was restructured. Terms exceeding 40 years due to Covid-19 or CBP extensions were not considered. LTV. The LTV at origination or after the loan was restructured was not considered prudent in 31 cases. Age at maturity. Prudent lending criteria recommend a maximum age at loan maturity of 75 years old. In 29 cases, the age at maturity of the loan will exceed 75 years old. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 25

Contents 1 Background and Terms of Reference 2 Key Findings and Considerations 3 Data Integrity 4 File Completeness 5 Policies and Procedures 6 Underwriting 7 Loan Servicing 8 Vulnerable Customers 9 Complaints Log 10 Compliance 11 Cash Management QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 26

Loan Servicing Review Metric Observations Terms of the Review Quadrin was requested to review up to 100 loans where the seller has taken remedial or enforcement action noting the lenders adherence to criteria and guidelines. This included a review of: Verify compliance and prudence to criteria and guidelines including standards expected of a prudent lender in the region; Review Servicing file notes & Correspondence; Collections correspondence - Reason for Arrears; Collections system notes; Collections approach to borrowers with multiple products; The application of fees and charges; Use of payment plans, arrears management techniques, loan modifications and any other forbearance measures including evidence of affordability and compliance with the Royal Decree 5/2017; Review policy on social housing/VPO; Use of litigation and any outsourced collections activities; and Review treatment of borrowers identified as vulnerable. For a sample of 20 loans, Quadrin was requested to check that the historical collections match the amounts due. A summary of the review can be found in the following slides. Full details are available in the Flamenco - File Completeness, Underwriting and Servicing Review report provided separately. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 27

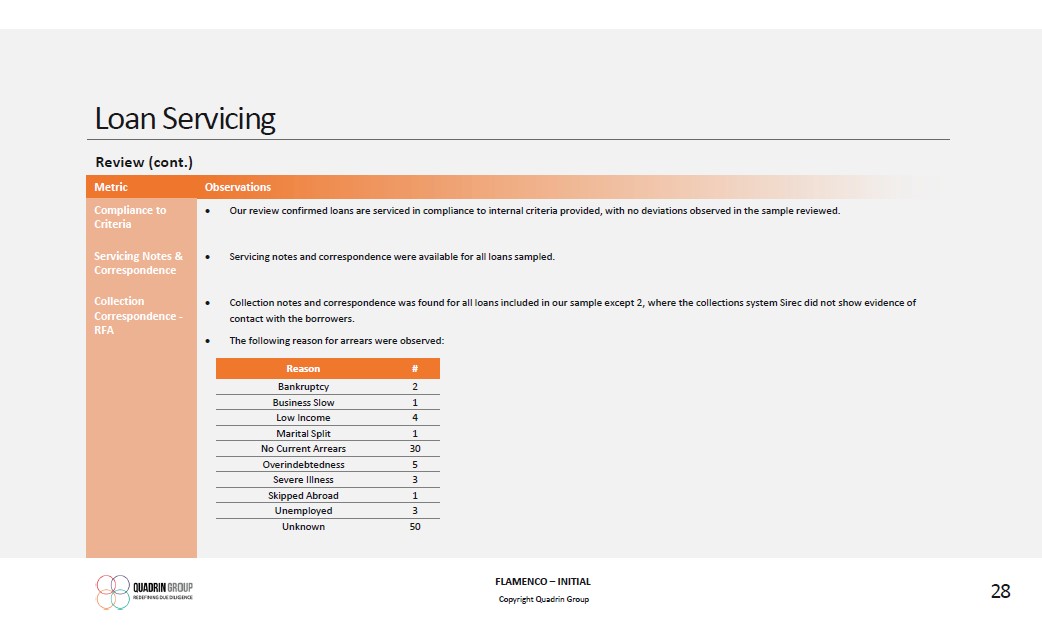

Loan Servicing Review (cont.) Metric Observations Compliance to Criteria Our review confirmed loans are serviced in compliance to internal criteria provided, with no deviations observed in the sample reviewed. Servicing Notes & Correspondence Servicing notes and correspondence were available for all loans sampled. Collection Correspondence - RFA Collection notes and correspondence was found for all loans included in our sample except 2, where the collections system Sirec did not show evidence of contact with the borrowers. The following reason for arrears were observed: Reason # Bankruptcy 2 Business Slow 1 Low Income 4 Marital Split 1 No Current Arrears 30 Overindebtedness 5 Severe Illness 3 Skipped Abroad 1 Unemployed 3 Unknown 50 QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 28

Loan Servicing Review (cont.) Metric Observations Fees and Charges Santander is applying late fees to late payments, that vary between €25 and €49. Several Spanish banks are currently not charging this after the Spanish courts and the Bank of Spain ruled that this fee is abusive if it is automatically charged without real action or service or is disproportionate or duplicative (e.g., charge in addition to the late interest). The Spanish Supreme Court clarified that in mortgage contracts, especially for consumers, this fee is not allowed unless a real, individualized action took place, and that action was clearly documented and disclosed. Our review confirmed late fees were charged to 47 loans. Forbearance Evidence of forbearance applied to debtors was found in 28 cases, most of them related to Covid-19 and/or CBP (Código de Buenas Prácticas Bancarias). Litigation & External DCAs The collections management system of Banco Santander showed evidence of activities outsourced to external DCAs in 87 cases. None of the loans included in our sample was in litigation as at the review date. Vulnerable Customers 9 borrowers included in our sample were considered vulnerable, according to system notes reviewed. The treatment given by the bank was adequate at all instances. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 29

Loan Servicing Historical Collections Metric Observations Metric Observations Review The historical collections included in the data tape for the last 12 months were reviewed vs. Santander's system, with no issues identified in the sample reviewed. Full details of the review are available in the Flamenco - Historical Collections Review report provided separately. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 30

Contents 1 Background and Terms of Reference 2 Key Findings and Considerations 3 Data Integrity 4 File Completeness 5 Policies and Procedures 6 Underwriting 7 Loan Servicing 8 Vulnerable Customers 9 Complaints Log 10 Compliance 11 Cash Management QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 31

Vulnerable Customers Review Metric Observation Terms of the Review Quadrin was requested to review up to 5 vulnerable customer cases to ensure appropriate policies or processes have been followed. Quadrin was required to review up to 5 social housing/social exclusion cases to ensure appropriate polices or processes have been followed. A summary of the results is provided in the next slide. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 32

Vulnerable Customers Review Metric Observation Vulnerable Customers The following loans were reviewed: Loan ID Comments 004905401030034571 Mortgage restructured as per the terms of CBP 6/2012 in October 2014, extending the term until July 2040 and providing 5 years interest only, approved by the mortgage unit on 16th October 2014. Borrower has a severe illness according to system notes. 004933101030000146 Mortgage restructured in February 2014 as per the terms of the RDL 6/2012 to protect borrowers in risk of social exclusion, increasing the capital to €123,627.52, the maturity of the loan until March 2046 with 5 years interest only, approved by the mortgage unit on 7th February 2014. Restructured again in March 2021 as per the terms of the RDL 6/2012, increasing the capital to €122,892, with 5 years interest only. Borrower in risk of social exclusion as per system notes. 004946171030609859 Mortgage restructured in June 2014 as per the terms of the CBP 6/2012, increasing the capital to €132,837 with 5 years interest only. Approved by the mortgage unit on 11th June 2014. Restructured again in May 2022 as per the terms of the CBP 6/2012 increasing the capital to €131,870 with 5 years interest only. Borrowers under severe vulnerability conditions. Both borrowers unemployed with no benefits and son living at the security working part- time with a monthly income of €650. 004943621030000007 Mortgage restructured in December 2014 as per the terms of the CBP RDL 6/2012, increasing the capital to €99,000 and the maturity of the loan until February 2046, with 5 years interest only, approved by the mortgage unit on 25th November 2014. Restructured again as per the terms of the RDL 6/2012 in May 2020, increasing the capital until €98,577, and providing 5 years interest only. Borrowers in a situation of severe vulnerability according to system notes. B2 disable and B1 with a very low income. They have also a dependant son living at the house. 004960141030614904 CBP 6/2012 applied, borrowers identified as vulnerable family unit with 2 unemployed adults and 2 children, comply with conditions, signed restructure as per decree, including 5 years interest only. The management of the vulnerable customers made by Santander is adequate in our opinion. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 33

Contents 1 Background and Terms of Reference 2 Key Findings and Considerations 3 Data Integrity 4 File Completeness 5 Policies and Procedures 6 Underwriting 7 Loan Servicing 8 Vulnerable Customers 9 Complaints Log 10 Compliance 11 Cash Management QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 34

Complaints Log Review Metric Observation Terms of the Review Quadrin was requested to review the complaints log and comment on any material or thematic issues that have arisen, including what, if any, steps have been taken to remediate. Review Santander has not provided a complaints log as at the issuance of this report, which prevented Quadrin from completing the review of a sample of complaints. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 35

Contents 1 Background and Terms of Reference 2 Key Findings and Considerations 3 Data Integrity 4 File Completeness 5 Policies and Procedures 6 Underwriting 7 Loan Servicing 8 Vulnerable Customers 9 Complaints Log 10 Compliance 11 Cash Management QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 36

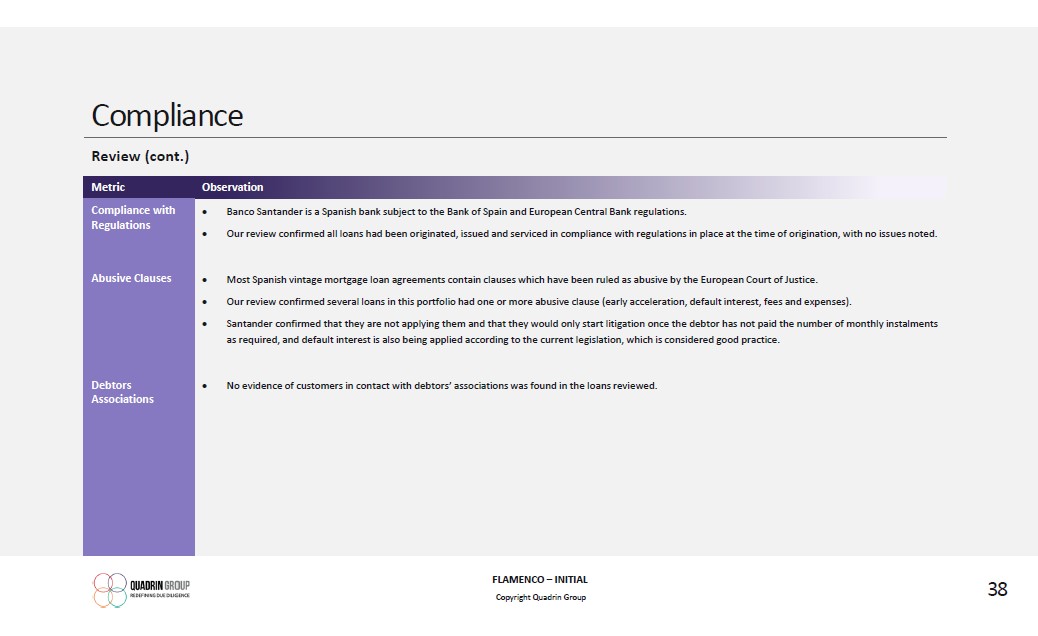

Compliance Review Metric Observation Terms of the Review Quadrin was requested to verify that all loans have been underwritten and serviced in compliance with Spanish regulations (including any Bank of Spain / ECB regulation) and with KYC and AML regulations. Quadrin was required to identify any mortgage deeds that contain abusive clauses such as interest rounding up, floors, default interest rates, multicurrency clauses, early termination or 365/360 Interest rate calculation method. Quadrin sought to compare the procedures with good practice in the market. Quadrin was requested to note if there was any evidence that borrowers had been in touch with debtors' associations, such as PAH (Anti Eviction Platform). The results of the review can be found in the following slide. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 37

Compliance Review (cont.) Metric Observation Compliance with Regulations Banco Santander is a Spanish bank subject to the Bank of Spain and European Central Bank regulations. Our review confirmed all loans had been originated, issued and serviced in compliance with regulations in place at the time of origination, with no issues noted. Abusive Clauses Most Spanish vintage mortgage loan agreements contain clauses which have been ruled as abusive by the European Court of Justice. Our review confirmed several loans in this portfolio had one or more abusive clause (early acceleration, default interest, fees and expenses). Santander confirmed that they are not applying them and that they would only start litigation once the debtor has not paid the number of monthly instalments as required, and default interest is also being applied according to the current legislation, which is considered good practice. Debtors Associations No evidence of customers in contact with debtors' associations was found in the loans reviewed. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 38

Contents 1 Background and Terms of Reference 2 Key Findings and Considerations 3 Data Integrity 4 File Completeness 5 Policies and Procedures 6 Underwriting 7 Loan Servicing 8 Vulnerable Customers 9 Complaints Log 10 Compliance 11 Cash Management QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 39

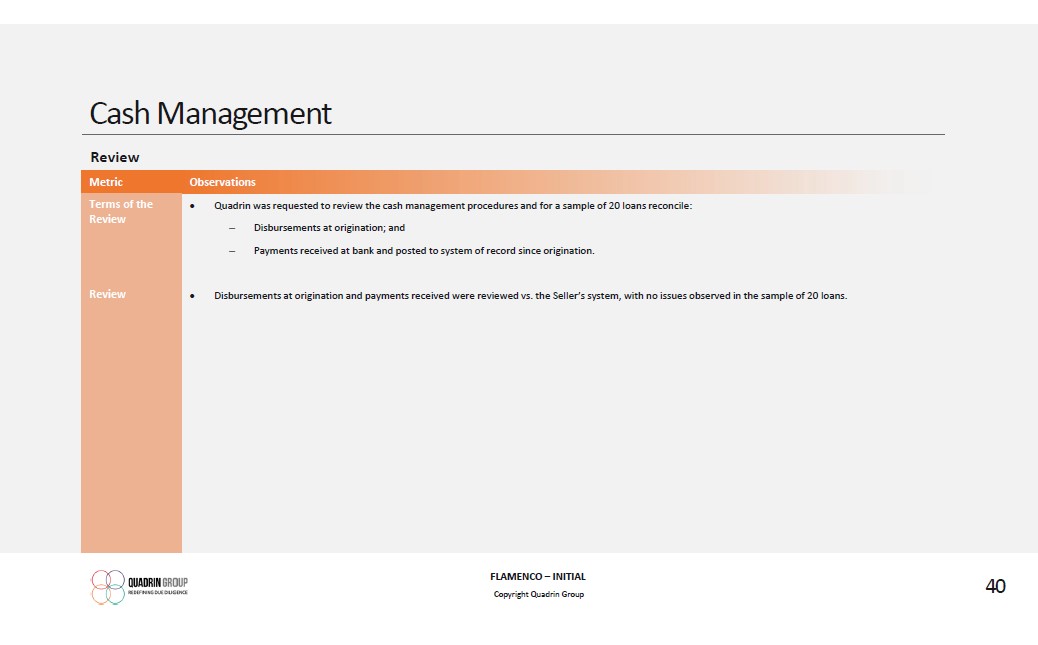

Cash Management Review Metric Observations Terms of the Review Quadrin was requested to review the cash management procedures and for a sample of 20 loans reconcile: Disbursements at origination; and Payments received at bank and posted to system of record since origination. Review Disbursements at origination and payments received were reviewed vs. the Seller's system, with no issues observed in the sample of 20 loans. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 40

FLAMENCO 2 Brunel Way Slough Berkshire SL1 1FQ United Kingdom www.quadringroup.com +44 1753 900914 Disclaimer This report is intended for general guidance and information purposes only. This report is under no circumstances intended to be used or considered as financial or investment advice, a recommendation or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset. Please note that this is not an offer document. The report is not to be considered as investment research or an objective or independent explanation of the matters contained herein, and is not prepared in accordance with the regulation regarding investment analysis. QUADRIN GROUP REDEFINING DUE DILIGENCE FLAMENCO - INITIAL Copyright Quadrin Group 41

QUADRIN: Redefining due diligence LENDER DUE DILIGENCE Quadrin Group For advice or support not covered in these pages please contact: Suleman Baig, Partner t. +44 (0)175 370 8510 m. +44 (0) 795 691 6886 e.suleman@quadringroup.com QUADRIN GROUP REDEFINING DUE DILIGENCE

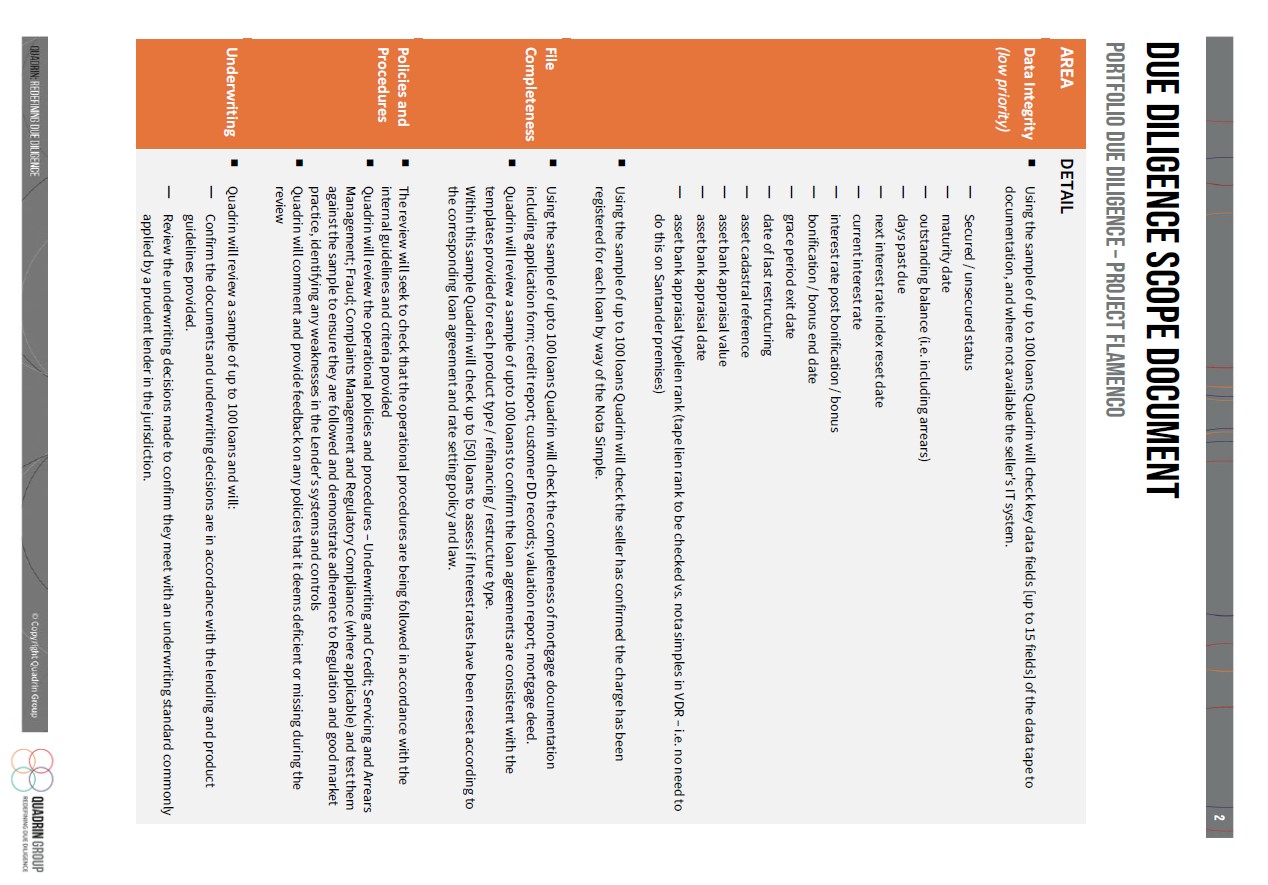

DUE DILIGENCE SCOPE DOCUMENT PORTFOLIO DUE DILIGENCE - PROJECT flamenco AREA DETAIL Data Integrity (low priority) o Using the sample of up to 100 loans Quadrin will check key data fields [up to 15 fields] of the data tape to documentation, and where not available the seller's IT system. Secured / unsecured status maturity date outstanding balance (i.e. including arrears) days past due next interest rate index reset date current interest rate interest rate post bonification / bonus bonification / bonus end date grace period exit date date of last restructuring asset cadastral reference asset bank appraisal value asset bank appraisal date asset bank appraisal typelien rank (tape lien rank to be checked vs. nota simples in VDR - i.e. no need to do this on Santander premises) o Using the sample of up to 100 loans Quadrin will check the seller has confirmed the charge has been registered for each loan by way of the Nota Simple. File Completeness o Using the sample of upto 100 loans Quadrin will check the completeness of mortgage documentation including application form; credit report; customer DD records; valuation report; mortgage deed. o Quadrin will review a sample of upto 100 loans to confirm the loan agreements are consistent with the templates provided for each product type / refinancing / restructure type. Within this sample Quadrin will check up to [50] loans to assess if Interest rates have been reset according to the corresponding loan agreement and rate setting policy and law. Policies and Procedures o The review will seek to check that the operational procedures are being followed in accordance with the internal guidelines and criteria provided o Quadrin will review the operational policies and procedures - Underwriting and Credit; Servicing and Arrears Management; Fraud; Complaints Management and Regulatory Compliance (where applicable) and test them against the sample to ensure they are followed and demonstrate adherence to Regulation and good market practice, identifying any weaknesses in the Lender's systems and controls o Quadrin will comment and provide feedback on any policies that it deems deficient or missing during the review Underwriting o Quadrin will review a sample of up to 100 loans and will: Confirm the documents and underwriting decisions are in accordance with the lending and product guidelines provided. Review the underwriting decisions made to confirm they meet with an underwriting standard commonly applied by a prudent lender in the jurisdiction.

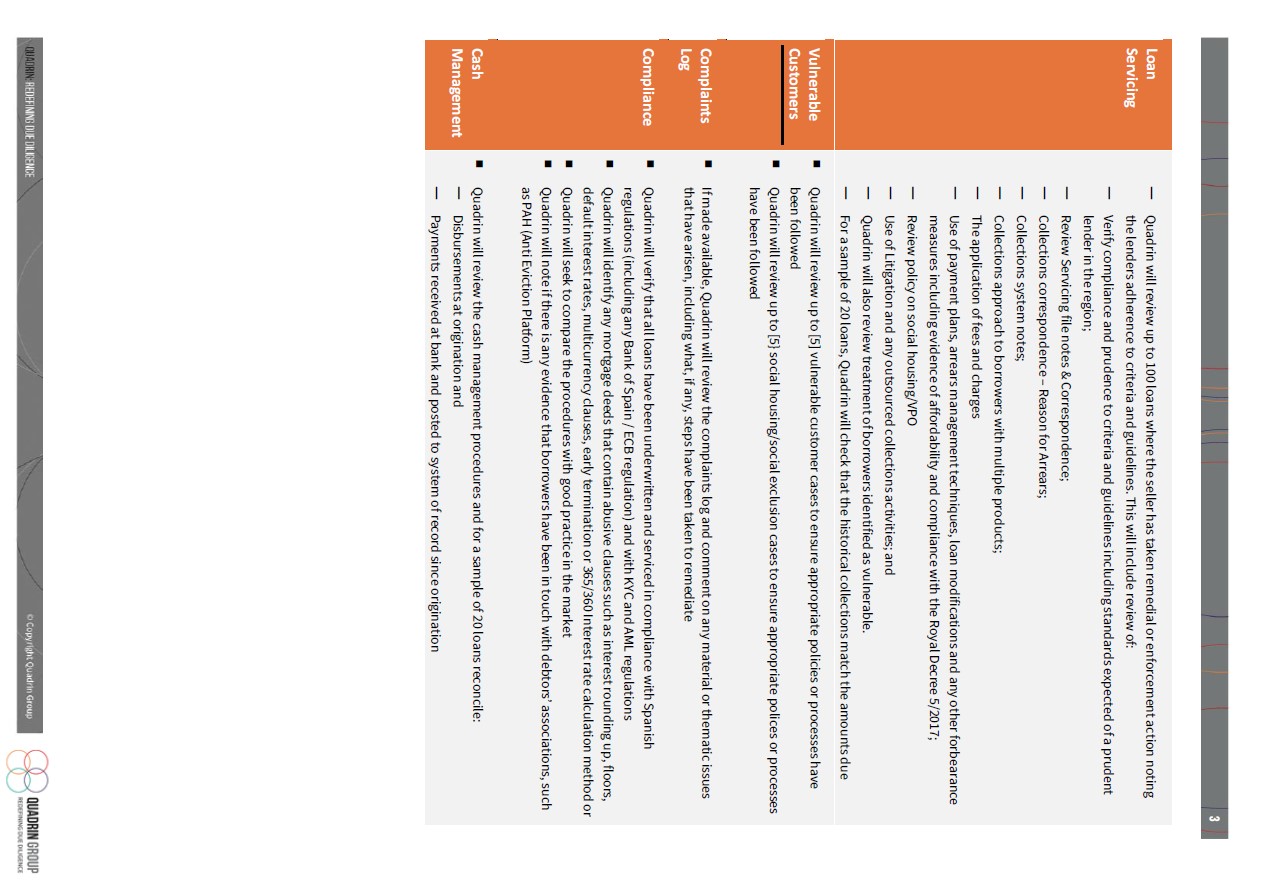

Loan Servicing Quadrin will review up to 100 loans where the seller has taken remedial or enforcement action noting the lenders adherence to criteria and guidelines. This will include review of: Verify compliance and prudence to criteria and guidelines including standards expected of a prudent lender in the region; Review Servicing file notes and Correspondence; Collections correspondence - Reason for Arrears; Collections system notes; Collections approach to borrowers with multiple products; The application of fees and charges Use of payment plans, arrears management techniques, loan modifications and any other forbearance measures including evidence of affordability and compliance with the Royal Decree 5/2017; Review policy on social housing/VPO Use of Litigation and any outsourced collections activities; and Quadrin will also review treatment of borrowers identified as vulnerable. For a sample of 20 loans, Quadrin will check that the historical collections match the amounts due Vulnerable Customers Quadrin will review up to [5] vulnerable customer cases to ensure appropriate policies or processes have been followed o Quadrin will review up to [5] social housing/social exclusion cases to ensure appropriate polices or processes have been followed Complaints Log o If made available, Quadrin will review the complaints log and comment on any material or thematic issues that have arisen, including what, if any, steps have been taken to remediate Compliance o Quadrin will verify that all loans have been underwritten and serviced in compliance with Spanish regulations (including any Bank of Spain / ECB regulation) and with KYC and AML regulations o Quadrin will identify any mortgage deeds that contain abusive clauses such as interest rounding up, floors, default interest rates, multicurrency clauses, early termination or 365/360 Interest rate calculation method or o Quadrin will seek to compare the procedures with good practice in the market o Quadrin will note if there is any evidence that borrowers have been in touch with debtors' associations, such as PAH (Anti Eviction Platform) Cash Management o Quadrin will review the cash management procedures and for a sample of 20 loans reconcile: Disbursements at origination and Payments received at bank and posted to system of record since origination

ITEM 5

Scope Item – Data Integrity

Using a sample of 100 loans, Quadrin was requested to check the following key data fields of the data tape to documentation, and where not available the Seller’s IT system:

| - | Secured/Unsecured Status |

| - | Maturity Date |

| - | Outstanding Balance |

| - | Days Past Due |

| - | Next Interest Rate Index Reset Date |

| - | Current Interest Rate |

| - | Interest Rate Post Bonus |

| - | Bonification/Bonus End Date |

| - | Grace Period Exit Date |

| - | Date of Last Restructuring |

| - | Cadestral Reference |

| - | Bank Appraisal Value |

| - | Bank Appraisal Date |

| - | Lien Rank |

Our findings are as follows:

| - | Interest Rate Post Bonus – 2 mismatches |

| - | Cadestral Reference – 3 mismatches |

| - | Bank Appraisal Value – 4 mismatches |

| - | Bank Appraisal Date – 4 mismatches |

Using the sample of 100 loans Quadrin was requested to check the Seller has confirmed the charge has been registered for each loan by way of the Nota Simple.

All charges were seen to have been correctly registered.

|

The quality of the data provided was generally good, with some issues noted across four different data fields. Charges have been correctly registered with no issues observed in the sample selected. |

Scope Item – File Completeness

Using the sample of 100 loans, Quadrin was requested to check the completeness of mortgage documentation.

Within this sample, Quadrin was requested to check up to 50 loans to assess if interest rates had been reset according to the corresponding loan agreement and rate setting policy and law.

The following missing documents were observed:

| - | Loan Application – 1 |

| - | Valuation Report – 14 |

| - | Original Mortgage Deed – 10 |

| - | Restructure Deeds – 7 |

Quadrin selected a subsample of 50 loans to confirm if interest rate had been reset according to the corresponding loan agreement and rate setting policy and law.

| - | 49 loans in the sample had a variable rate, while 1 was mixed, with a fixed rate for 10 years and then changing to variable. |

| - | All loans were referenced to the 12-month Euribor. |

| - | 6 of them were on a capital grace period and were only paying interests as at the cut-off date. |

| - | 17 loans were capped to 15% or 30% and one of them had a floor of 2.75%. |

| - | A bonus varying from 0.20% to 1.20% was being applied to 4 loans. |

| - | The interest rate reset date was checked vs. public sources, to ensure the correctness of the Euribor applied on the last interest rate reset. |

Our review confirmed interest rates are adequately reset, with no issues observed in the sample reviewed.

The completeness of files was generally good and in line with similar Spanish RPL portfolios. |

Scope Item – Policies and Procedures

Quadrin was requested to check that the operational procedures of the servicer are being followed in accordance with the internal guidelines and criteria provided and test them against the sample to ensure they are followed and demonstrate adherence to regulation and good market practice, identifying any weaknesses in systems and controls.

Quadrin was required to comment and provide feedback on any policies that it deems deficient or missing during the review.

| - | Santander provided a document outlining their lending and recovery criteria, specially prepared for Project Flamenco. |

| - | The document outlines the lending and recovery policies of Banco Santander, with historical context from Banco Popular Español. |

| - | The application requirements for Banco Santander included property documentation, income verification (tailored by employment type), and credit information (e.g., CIRBE). |

| - | The approval process utilized automated systems with analyst review if flagged. Decisions depended on appraisal values and risk assessments. |

| - | The key lending terms were as below: |

| o | LTV up to 80% (exceptions for employees, restructurings, and foreclosed properties) |

| o | Max term: 30 years (primary), 25 years (second homes) |

| o | Borrower affordability limit: ≤ 40% of net income |

| o | Maximum age 85 years |

| - | There was no formal policy for buy-to-let mortgages, which were treated as business loans with stricter terms (max 70% LTV, 15-year term). |

| - | The legacy criteria for Banco Popular (pre-merging in 2018) were as below: |

| o | LTV: 80% (first home), 60% (others), with exceptions including foreclosed properties, restructurings, and employee loans. |

| o | Max term: 30-35 years |

| o | Affordability rate: ≤ 35% |

| o | Maximum age 75 years |

| - | Popular used scoring/rating systems to assess risk and assign decision authority. |

| - | The bank had a clear structure for escalations and approval based on risk levels and thresholds. |

| - | Loan recovery of overseen by the Property Recovery and Management team, with a focus on early intervention and tailored recovery strategies. |

| - | Customer protection and fair treatment is emphasized, including compliance with laws like RDL 6/12. |

| - | Santander applies a phased recovery model, as below: |

| o | Irregular (1–90 days late): Managed by branches, call centers, digital channels, and recovery managers. |

| o | Delinquency (90–150 days): Adds external recovery firms for enforcement. |

| o | Pre-litigation/Litigation (150+ days): Involves judicial processes or extra-judicial actions. Includes: |

| ▪ | Restructuring: grace periods, term extensions (up to 50 years, LTV ≤ 100%), but no new loans for restructured clients. |

| ▪ | Deed in lieu: Property is returned in lieu of payment. |

| ▪ | Cash settlements: Partial forgiveness allowed. |

| o | Post-Litigation Asset Management: |

| ▪ | Properties transferred to Santander’s Property Management. |

| ▪ | Legal/commercial cleanup, market valuation, and sale via various channels. |

| ▪ | Sale price set based on book value, market conditions, and strategy (not negotiable except in rare cases). |

| ▪ | Special financing terms offered for buyers. |

The procedures provided by Santander comply with the applicable legal framework in terms of consumer protection (application of RDL 6/2012, emphasis on fair treatment, individual case evaluation, and consideration of economic and personal circumstances during recovery) and anti- money laundering measures (checks routed through the Money Laundering Prevention Department during the risk analysis and pre-sale phases). |

Scope Item – Underwriting

Using the sample selected, Quadrin was requested to:

| - | Confirm the documents and underwriting decisions are in accordance with the lending and product guidelines provided; and |

| - | Review the underwriting decisions made to confirm they meet with an underwriting standard commonly applied by a prudent lender in the jurisdiction. |

Quadrin noted that underwriting decisions at origination did not meet the lending and product guidelines provided in 31 cases, due to the following reasons:

| - | Excessive LTV at loan origination. The policies of the lender establish a limit of 80% LTV (with exceptions for employees, restructurings, and foreclosed properties). Quadrin noted 25 cases where the LTV at loan origination exceeded 80%, in some cases going over 100% LTV, which does not comply with the guidelines provided. |

| - | Excessive LTV at loan restructure. While the Seller’s policy establish exceptions can apply for restructured loans, Quadrin noted 5 cases (which included restructures and new mortgage for debt consolidation) where the LTV exceeded 100% LTV. |

| - | Age at maturity. The maximum age at maturity should not exceed 85 years old for Santander and 75 for Popular. In 7 cases the age at maturity at the time of originating the loan would exceed these burdens. |

The following issues were noted in the sample reviewed:

| - | Loan term. The term of the loan should not exceed 40 years since loan origination. In 10 cases, the term exceeded 40 years after the loan was restructured. Terms exceeding 40 years due to Covid-19 or CBP extensions were not considered. |

| - | LTV. The LTV at origination or after the loan was restructured was not considered prudent in 31 cases. |

| - | Age at maturity. Prudent lending criteria recommend a maximum age at loan maturity of 75 years old. In 29 cases, the age at maturity of the loan will exceed 75 years old. |

The results are generally in line with what is expected of a Spanish RPL portfolio, however some of the underwriting decisions both at initial and restructure stages did not meet internal and prudent lending criteria, particularly in relation to LTV and age of the borrower at loan maturity. Special attention should be paid at those cases where the LTV exceeds 100% and the age of the borrower at loan maturity exceeds 85 years old. |

Scope Item – Loan Servicing

Quadrin was requested to review up to 100 loans where the seller has taken remedial or enforcement action noting the lenders adherence to criteria and guidelines. This included a review of:

| - | Verify compliance and prudence to criteria and guidelines including standards expected of a prudent lender in the region; |

| - | Review Servicing file notes & Correspondence; |

| - | Collections correspondence – Reason for Arrears; |

| - | Collections system notes; |

| - | Collections approach to borrowers with multiple products; |

| - | The application of fees and charges; |

| - | Use of payment plans, arrears management techniques, loan modifications and any other forbearance measures including evidence of affordability and compliance with the Royal Decree 5/2017; |

| - | Review policy on social housing/VPO; |

| - | Use of litigation and any outsourced collections activities; and |

| - | Review treatment of borrowers identified as vulnerable. |

For a sample of 20 loans, Quadrin was requested to check that the historical collections match the amounts due.

Our review confirmed loans are serviced in compliance to internal criteria provided, with no deviations observed in the sample reviewed.

Servicing notes and correspondence were available for all loans sampled.

Collection notes and correspondence was found for all loans included in our sample except 2, where the collections system Sirec did not show evidence of contact with the borrowers.

Santander is applying late fees to late payments, that vary between €25 and €49.

Several Spanish banks are currently not charging this after the Spanish courts and the Bank of Spain ruled that this fee is abusive if it is automatically charged without real action or service or is disproportionate or duplicative (e.g., charge in addition to the late interest).

The Spanish Supreme Court clarified that in mortgage contracts, especially for consumers, this fee is not allowed unless a real, individualized action took place, and that action was clearly documented and disclosed.

Our review confirmed late fees were charged to 47 loans.

Evidence of forbearance applied to debtors was found in 28 cases, most of them related to Covid-19 and/or CBP (Código de Buenas Prácticas Bancarias).

The collections management system of Banco Santander showed evidence of activities outsourced to external DCAs in 87 cases.

None of the loans included in our sample were in litigation as at the review date.

The Servicing performed by Santander is in line with good market practice and with the internal guidelines provided, with no breaches identified against regulations. |

Scope Item – Vulnerable Customers

Quadrin was requested to review upto 5 vulnerable customer cases to ensure appropriate policies or processes have been followed.

The treatment given by Santander to vulnerable customers is adequate. |

Scope Item – Complaints Log

Quadrin was requested to review the complaints log and comment on any material or thematic issues that have arisen, including what, if any, steps have been taken to remediate.

Santander provided a Claims Tracker which contained all claims received by Santander from 2020 to February 2025 totalling 1,498 in total.

385 of these were received in the last 12 months, of which 359 were received by Servicio de Reclamaciones y Atención al Cliente.

39 were totally or partially upheld with a total redress of €132,828.72 made to 26 borrowers in the last 12 months

The nature and volume of complaints for a Spanish RPL portfolio of this size were not considered material or concerning. |

Scope Item – Regulatory Compliance

Quadrin was requested to verify that all loans have been underwritten and serviced in compliance with Spanish regulations (including any Bank of Spain / ECB regulation) and with KYC and AML regulations.

Quadrin was required to identify any mortgage deeds that contain abusive clauses such as interest rounding up, floors, default interest rates, multicurrency clauses, early termination or 365/360 Interest rate calculation method.

Quadrin sought to compare the procedures with good practice in the market.

Quadrin was requested to note if there was any evidence that borrowers had been in touch with debtors’ associations, such as PAH (Anti Eviction Platform).

Our review confirmed all loans had been originated, issued and serviced in compliance with regulations in place at the time of origination, with no issues noted

Most Spanish vintage mortgage loan agreements contain clauses which have been ruled as abusive by the European Court of Justice.

Our review confirmed several loans in this portfolio had one or more abusive clause (early acceleration, default interest, fees and expenses).

Santander confirmed that they are not applying them and that they would only start litigation once the debtor has not paid the number of monthly instalments as required, and default interest is also being applied according to the current legislation, which is considered good practice.

No evidence of customers in contact with debtors’ associations was found in the loans reviewed.

Our review confirmed all loans had been originated, issued and serviced in compliance with regulations in place at the time of origination, with no issues noted. Santander confirmed that they are not applying abusive clauses, which is considered good practice. |

Scope Item – Cash Management

Quadrin was requested to review the cash management procedures and for a sample of 20 loans reconcile:

| - | Disbursements at origination; and |

| - | Payments received at bank and posted to system of record since origination. |

Disbursements at origination and payments received were reviewed vs. the Seller’s system, with no issues observed in the sample of 20 loans. |

Flamenco - Data Integrity Review

Integrity

| Loan ID | TYPE OF DEBT (SECURED/UNSECURED) | MATURITY DATE [as of 30/04/2025] |

DAYS PAST DUE | GRACE PERIOD END DATE [Enriched 14/04/2025] |

LAST RESTRUCTURING DATE [Enriched 07/05/2025] |

OUTSTANDING BALANCE (€) [as of 30/04/2025] |

CURRENT INTEREST INDEX NEXT RESET DATE | CURRENT INDEX REFERENCE RATE (%) | FINAL INTEREST RATE APPLIED POST-BONUS (%) | REGISTRY LIEN RANK [Enriched 07/05/2025] |

BANK APPRAISAL DATE | BANK APPRAISAL (€) | CADASTRAL REFERENCE | ||||||||||||||||||||||||||||||

| Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Exceptions | Status |

| 004900321030162717 | TRUE | SECURED | TRUE | 7/1/2047 | TRUE | 90 | TRUE | -- | TRUE | N/A | TRUE | 106,500.87 | TRUE | 6/30/2025 | TRUE | 3.680% | TRUE | 5.380% | TRUE | 1 | TRUE | 4/22/2024 | TRUE | 68,014.35 | TRUE | 3886309XL1738N0015XP | TRUE | FALSE | Completed | ||||||||||||||

| 004900521030001846 | TRUE | SECURED | TRUE | 4/17/2048 | TRUE | 74 | TRUE | -- | TRUE | 12/14/2023 | TRUE | 207,826.25 | TRUE | 4/16/2025 | TRUE | 3.609% | TRUE | 4.359% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 216,027.99 | TRUE | 3363505DG0236S0020BG | TRUE | FALSE | Completed | ||||||||||||||

| 004900541030238196 | TRUE | SECURED | TRUE | 3/31/2037 | TRUE | 30 | TRUE | -- | TRUE | N/A | TRUE | 603,132.42 | TRUE | 4/29/2025 | TRUE | 3.609% | TRUE | 6.459% | TRUE | 1 | TRUE | 2/14/2024 | TRUE | 1,484,506.95 | TRUE | 001001100WF48D0001HQ | TRUE | FALSE | Completed | ||||||||||||||

| 004900591030109164 | TRUE | SECURED | TRUE | 2/28/2048 | TRUE | 0 | TRUE | -- | TRUE | N/A | TRUE | 57,711.04 | TRUE | 2/27/2026 | TRUE | 2.506% | TRUE | 7.506% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 141,050.36 | TRUE | 8752701QE4385B0039QI | TRUE | FALSE | Completed | ||||||||||||||

| 004901221030180962 | TRUE | SECURED | TRUE | 6/1/2045 | TRUE | 120 | TRUE | -- | TRUE | 1/26/2016 | TRUE | 69,006.76 | TRUE | 2/1/2026 | TRUE | 2.506% | TRUE | 4.906% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 60,188.49 | TRUE | 9051402QA4595A0015ZR | TRUE | FALSE | Completed | ||||||||||||||

| 004901221030182652 | TRUE | SECURED | TRUE | 11/1/2046 | TRUE | 127 | TRUE | 3/1/2025 | TRUE | 2/25/2020 | TRUE | 176,274.71 | TRUE | 2/28/2025 | TRUE | 3.679% | TRUE | 3.929% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 46,156.38 | TRUE | 7655602QA4575F0004DP | TRUE | FALSE | Completed | ||||||||||||||

| 004901421030107978 | TRUE | SECURED | TRUE | 1/31/2034 | TRUE | 0 | TRUE | -- | TRUE | 2/9/2021 | TRUE | 301,822.52 | TRUE | 1/3/2026 | TRUE | 2.506% | TRUE | 5.256% | TRUE | 1 | TRUE | 3/18/2024 | TRUE | 333,263.05 | TRUE | 23005A011001470000HW | TRUE | FALSE | Completed | ||||||||||||||

| 004901421030108314 | TRUE | SECURED | TRUE | 7/29/2047 | TRUE | 62 | TRUE | -- | TRUE | N/A | TRUE | 104,667.88 | TRUE | 11/28/2025 | TRUE | 2.691% | TRUE | 2.941% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 73,027.17 | TRUE | 7802002VH0170S0001PS | TRUE | FALSE | Completed | ||||||||||||||

| 004901421030108319 | TRUE | SECURED | TRUE | 6/19/2046 | TRUE | 163 | TRUE | -- | TRUE | 9/19/2014 | TRUE | 53,890.59 | TRUE | 9/18/2025 | TRUE | 3.166% | TRUE | 3.416% | TRUE | 1 | TRUE | 11/7/2024 | TRUE | 31,629.88 | TRUE | 2736058VH0023N0001PU | TRUE | FALSE | Completed | ||||||||||||||

| 004902481030092700 | TRUE | SECURED | TRUE | 7/2/2036 | TRUE | 0 | TRUE | -- | TRUE | N/A | TRUE | 428,558.88 | TRUE | 7/1/2025 | TRUE | 3.680% | TRUE | 5.430% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 840,622.80 | TRUE | 3109102DF2830G0001UY | TRUE | FALSE | Completed | ||||||||||||||

| 004904161030012703 | TRUE | SECURED | TRUE | 2/28/2053 | TRUE | 91 | TRUE | -- | TRUE | 8/3/2016 | TRUE | 34,857.47 | TRUE | 2/27/2026 | TRUE | 2.506% | TRUE | 9.006% | TRUE | 2 | TRUE | 5/2/2024 | TRUE | 312,511.06 | TRUE | 38031A011001590001SG | TRUE | FALSE | Completed | ||||||||||||||

| 004904561030061062 | TRUE | SECURED | TRUE | 2/25/2051 | TRUE | 66 | TRUE | -- | TRUE | N/A | TRUE | 151,910.37 | TRUE | 2/24/2026 | TRUE | 2.525% | TRUE | 4.025% | TRUE | 1 | TRUE | 4/27/2020 | TRUE | 189,330.81 | TRUE | 3265679VK2436N0001MD | TRUE | FALSE | Completed | ||||||||||||||

| 004905401030034301 | TRUE | SECURED | TRUE | 2/24/2032 | TRUE | 128 | TRUE | -- | TRUE | 3/6/2012 | TRUE | 101,484.69 | TRUE | 2/23/2026 | TRUE | 2.506% | TRUE | 4.506% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 271,150.20 | TRUE | 4274501DG2047S0020XR | TRUE | FALSE | Completed | ||||||||||||||

| 004905401030034571 | TRUE | SECURED | TRUE | 5/24/2048 | TRUE | 128 | TRUE | -- | TRUE | 1/31/2024 | TRUE | 185,018.20 | TRUE | 9/23/2025 | TRUE | 3.650% | TRUE | 5.150% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 197,485.68 | TRUE | 4809614DF1740H0012RP | TRUE | FALSE | Completed | ||||||||||||||

| 004907921030079852 | TRUE | SECURED | TRUE | 12/17/2037 | TRUE | 43 | TRUE | -- | TRUE | 12/21/2023 | TRUE | 74,755.15 | TRUE | 3/16/2025 | TRUE | 2.506% | TRUE | 3.106% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 102,642.34 | TRUE | 1238601VK9913N0053YI | TRUE | FALSE | Completed | ||||||||||||||

| 004909751030000571 | TRUE | SECURED | TRUE | 6/30/2046 | TRUE | 0 | TRUE | -- | TRUE | 7/8/2020 | TRUE | 409,059.57 | TRUE | 2/27/2026 | TRUE | 2.525% | TRUE | 3.775% | TRUE | 1 | TRUE | 2/4/2022 | TRUE | 650,378.38 | TRUE | 4310806DG5041S0014XR | TRUE | FALSE | Completed | ||||||||||||||

| 004909781030005678 | TRUE | SECURED | TRUE | 2/15/2050 | TRUE | 0 | TRUE | -- | TRUE | 4/25/2012 | TRUE | 120,384.80 | TRUE | 2/14/2026 | TRUE | 2.506% | TRUE | 3.256% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 125,169.20 | TRUE | 2522903VP8022S0120IG | TRUE | FALSE | Completed | ||||||||||||||

| 004910661030000201 | TRUE | SECURED | TRUE | 5/4/2056 | TRUE | 87 | TRUE | -- | TRUE | N/A | TRUE | 125,977.06 | TRUE | 4/3/2025 | TRUE | 3.718% | TRUE | 4.968% | TRUE | 1 | TRUE | 2/27/2024 | TRUE | 161,010.54 | TRUE | 6087201VG4168G0048OE | TRUE | FALSE | Completed | ||||||||||||||

| 004910661030003819 | TRUE | SECURED | TRUE | 4/9/2054 | TRUE | 173 | TRUE | -- | TRUE | N/A | TRUE | 37,832.87 | TRUE | 4/8/2025 | TRUE | N/A | TRUE | 5.000% | FALSE | 7.00% | 2 | TRUE | 2/27/2024 | TRUE | 161,010.54 | TRUE | 6087201VG4168G0048OE | TRUE | TRUE | Completed | |||||||||||||

| 004911561030024829 | TRUE | SECURED | TRUE | 4/30/2034 | TRUE | 0 | TRUE | -- | TRUE | 9/30/2021 | TRUE | 304,813.11 | TRUE | 12/3/2025 | TRUE | 2.936% | TRUE | 5.686% | TRUE | 1 | TRUE | 11/6/2024 | FALSE | 05/11/2023 | 539,075.08 | FALSE | 771,314.08 | 35022A002000200000AK | FALSE | 001001600DS50A0001GJ | TRUE | Completed | |||||||||||

| 004911561030025252 | TRUE | SECURED | TRUE | 8/31/2052 | TRUE | 29 | TRUE | -- | TRUE | 8/1/2024 | TRUE | 71,896.44 | TRUE | N/A | TRUE | N/A | TRUE | 3.650% | TRUE | 1 | TRUE | 6/24/2024 | TRUE | 92,410.98 | TRUE | 5902012CS7550S0001HT | TRUE | FALSE | Completed | ||||||||||||||

| 004913091030001847 | TRUE | SECURED | TRUE | 6/25/2044 | TRUE | 66 | TRUE | -- | TRUE | 6/25/2014 | TRUE | 90,992.76 | TRUE | 6/24/2025 | TRUE | 3.680% | TRUE | 5.680% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 74,901.54 | TRUE | 7160701YJ0876S0001OA | TRUE | FALSE | Completed | ||||||||||||||

| 004913741030000849 | TRUE | SECURED | TRUE | 2/28/2039 | TRUE | 61 | TRUE | -- | TRUE | N/A | TRUE | 165,622.55 | TRUE | 2/27/2026 | TRUE | 2.506% | TRUE | 4.006% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 237,750.87 | TRUE | 2167013DG7126N0001OM | TRUE | FALSE | Completed | ||||||||||||||

| 004913821030000454 | TRUE | SECURED | TRUE | 6/19/2060 | TRUE | 10 | TRUE | 5/19/2025 | TRUE | 5/17/2024 | TRUE | 156,000.00 | TRUE | 2/18/2026 | TRUE | 2.525% | TRUE | 3.775% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 119,525.55 | TRUE | 6041823BE8864A0012EW | TRUE | FALSE | Completed | ||||||||||||||

| 004913911330000157 | TRUE | SECURED | TRUE | 6/30/2036 | TRUE | 0 | TRUE | -- | TRUE | 10/8/2021 | TRUE | 254,570.43 | TRUE | 10/30/2025 | TRUE | 3.526% | TRUE | 6.776% | TRUE | 1 | TRUE | 10/10/2024 | TRUE | 211,025.22 | TRUE | 13005A027000370000EG | TRUE | FALSE | Completed | ||||||||||||||

| 004914401030002353 | TRUE | SECURED | TRUE | 2/9/2047 | TRUE | 168 | TRUE | -- | TRUE | 11/14/2019 | TRUE | 75,798.15 | TRUE | 12/8/2025 | TRUE | 2.936% | TRUE | 3.936% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 59,426.41 | TRUE | 7558403XG7675N0009LP | TRUE | FALSE | Completed | ||||||||||||||

| 004915201030001375 | TRUE | SECURED | TRUE | 3/26/2043 | TRUE | 0 | TRUE | -- | TRUE | 4/22/2016 | TRUE | 130,400.56 | TRUE | 2/25/2026 | TRUE | 2.506% | TRUE | 5.006% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 159,264.90 | TRUE | 1425802CG1312N0001SF | TRUE | FALSE | Completed | ||||||||||||||

| 004915221030000340 | TRUE | SECURED | TRUE | 2/29/2032 | TRUE | 29 | TRUE | -- | TRUE | N/A | TRUE | 29,107.92 | TRUE | 2/27/2026 | TRUE | 2.506% | TRUE | 6.406% | TRUE | 1 | TRUE | 2/19/2024 | FALSE | 20/01/2025 | 38,629.25 | FALSE | 43,916.44 | 13039A044000890000AU | TRUE | TRUE | Completed | ||||||||||||

| 004915871030064910 | TRUE | SECURED | TRUE | 1/16/2059 | TRUE | 136 | TRUE | 5/16/2025 | TRUE | 10/11/2011 | TRUE | 154,648.84 | TRUE | 1/15/2026 | TRUE | N/A | TRUE | 5.000% | TRUE | 1 | TRUE | 11/4/2024 | TRUE | 153,043.45 | TRUE | 4073720BE8947C0004PJ | TRUE | FALSE | Completed | ||||||||||||||

| 004917371030006268 | TRUE | SECURED | TRUE | 8/30/2063 | TRUE | 122 | TRUE | -- | TRUE | 7/12/2024 | TRUE | 356,479.72 | TRUE | 11/29/2025 | TRUE | 3.166% | TRUE | 4.416% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 484,010.35 | TRUE | 3342306VK2734S0072YY | TRUE | FALSE | Completed | ||||||||||||||

| 004917401030004293 | TRUE | SECURED | TRUE | 4/1/2047 | TRUE | 90 | TRUE | -- | TRUE | 3/16/2021 | TRUE | 188,095.00 | TRUE | 12/31/2025 | TRUE | 2.506% | TRUE | 3.706% | TRUE | 1 | TRUE | 4/26/2024 | TRUE | 153,795.12 | TRUE | 4688901UF6542N0080AG | TRUE | FALSE | Completed | ||||||||||||||

| 004917751030000501 | TRUE | SECURED | TRUE | 3/26/2048 | TRUE | 3 | TRUE | 1/26/2028 | TRUE | 6/28/2023 | TRUE | 189,553.90 | TRUE | 2/25/2026 | TRUE | 2.406% | TRUE | 2.406% | TRUE | 1 | TRUE | 7/11/2024 | TRUE | 154,360.02 | TRUE | 2174072WF6727S0066ID | TRUE | FALSE | Completed | ||||||||||||||

| 004923181030548379 | TRUE | SECURED | TRUE | 8/4/2035 | TRUE | 91 | TRUE | -- | TRUE | 12/7/2020 | TRUE | 49,349.66 | TRUE | 5/3/2025 | TRUE | 3.671% | TRUE | 7.671% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 46,639.68 | TRUE | 0282204YH2408A0001BR | TRUE | FALSE | Completed | ||||||||||||||

| 004923401030502586 | TRUE | SECURED | TRUE | 11/25/2049 | TRUE | 96 | TRUE | -- | TRUE | 2/6/2019 | TRUE | 222,426.66 | TRUE | 6/24/2025 | TRUE | 3.718% | TRUE | 4.568% | TRUE | 1 | TRUE | 5/20/2024 | FALSE | 24/02/2025 | 156,807.38 | FALSE | 210,371.69 | 6440409DF4964S0005SY | TRUE | TRUE | Completed | ||||||||||||

| 004924561030476480 | TRUE | SECURED | TRUE | 1/31/2046 | TRUE | 0 | TRUE | -- | TRUE | 12/10/2024 | TRUE | 66,752.58 | TRUE | 1/30/2026 | TRUE | 2.691% | TRUE | 5.591% | TRUE | 1 | TRUE | 10/7/2024 | TRUE | 238,493.68 | TRUE | 3883002YM1638D0003GE | TRUE | FALSE | Completed | ||||||||||||||

| 004924671030484054 | TRUE | SECURED | TRUE | 7/31/2047 | TRUE | 152 | TRUE | -- | TRUE | 3/18/2009 | TRUE | 66,658.02 | TRUE | 9/29/2025 | TRUE | 3.526% | TRUE | 4.376% | TRUE | 1 | TRUE | 7/8/2024 | TRUE | 40,040.66 | TRUE | 0973010TM6807S0005EP | TRUE | FALSE | Completed | ||||||||||||||

| 004924961030485060 | TRUE | SECURED | TRUE | 8/28/2042 | TRUE | 93 | TRUE | 8/28/2025 | TRUE | 8/5/2024 | TRUE | 350,464.72 | TRUE | 8/27/2025 | TRUE | N/A | TRUE | 5.180% | TRUE | 1 | TRUE | 4/15/2024 | TRUE | 213,115.76 | TRUE | 9451618DG2195S0004FI | TRUE | FALSE | Completed | ||||||||||||||

| 004925321030000415 | TRUE | SECURED | TRUE | 3/31/2041 | TRUE | 0 | TRUE | -- | TRUE | 11/9/2023 | TRUE | 892,560.96 | TRUE | 4/29/2025 | TRUE | 3.669% | TRUE | 6.669% | TRUE | 1 | TRUE | 10/31/2024 | TRUE | 115,002.63 | TRUE | 36051A009005260000FD | TRUE | FALSE | Completed | ||||||||||||||

| 004926601030458050 | TRUE | SECURED | TRUE | 9/30/2046 | TRUE | 152 | TRUE | -- | TRUE | 7/29/2014 | TRUE | 171,682.71 | TRUE | 3/30/2025 | TRUE | 3.679% | TRUE | 4.429% | TRUE | 1 | TRUE | 11/27/2019 | TRUE | 102,494.85 | TRUE | 5142303VK3554S0014RX | TRUE | FALSE | Completed | ||||||||||||||

| 004927291030445237 | TRUE | SECURED | TRUE | 5/1/2047 | TRUE | 151 | TRUE | -- | TRUE | 4/30/2013 | TRUE | 209,749.23 | TRUE | 4/30/2025 | TRUE | 3.718% | TRUE | 5.168% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 124,228.15 | TRUE | 31201050453010060000 | FALSE | 310000000001955647TG | TRUE | Completed | |||||||||||||

| 004929771030413961 | TRUE | SECURED | TRUE | 2/28/2053 | TRUE | 0 | TRUE | -- | TRUE | N/A | TRUE | 77,951.87 | TRUE | 2/27/2026 | TRUE | 2.506% | TRUE | 6.506% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 195,912.10 | TRUE | 4982901CF7648B0001JM | TRUE | FALSE | Completed | ||||||||||||||

| 004930111830427276 | TRUE | SECURED | TRUE | 2/9/2037 | TRUE | 0 | TRUE | -- | TRUE | 4/29/2020 | TRUE | 304,586.12 | TRUE | 1/8/2026 | TRUE | 2.438% | TRUE | 2.938% | TRUE | 1 | TRUE | 4/29/2024 | TRUE | 220,986.00 | TRUE | 0944101UF1304N0095IZ | TRUE | FALSE | Completed | ||||||||||||||

| 004930351030000861 | TRUE | SECURED | TRUE | 9/4/2038 | TRUE | 0 | TRUE | -- | TRUE | 5/15/2020 | TRUE | 303,998.95 | TRUE | 2/3/2026 | TRUE | 2.525% | TRUE | 3.325% | TRUE | 1 | TRUE | 3/4/2024 | TRUE | 56,858.81 | TRUE | 07045A002002830000QJ | TRUE | FALSE | Completed | ||||||||||||||

| 004932241030403991 | TRUE | SECURED | TRUE | 4/19/2049 | TRUE | 133 | TRUE | 4/19/2026 | TRUE | 3/30/2022 | TRUE | 151,958.90 | TRUE | 4/18/2025 | TRUE | 3.609% | TRUE | 3.859% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 144,954.01 | TRUE | 7512415TG3471S0001FH | TRUE | FALSE | Completed | ||||||||||||||

| 004933101030000146 | TRUE | SECURED | TRUE | 11/1/2046 | TRUE | 59 | TRUE | -- | TRUE | 10/25/2021 | TRUE | 119,161.27 | TRUE | 2/17/2026 | TRUE | 2.506% | TRUE | 2.756% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 47,763.37 | TRUE | 0407201WF5800N0131XO | TRUE | FALSE | Completed | ||||||||||||||

| 004933761030001157 | TRUE | SECURED | TRUE | 6/29/2051 | TRUE | 126 | TRUE | 3/29/2025 | TRUE | 3/26/2024 | TRUE | 140,725.41 | TRUE | 3/28/2025 | TRUE | 3.650% | TRUE | 3.900% | FALSE | 6.15% | 1 | TRUE | 5/20/2024 | TRUE | 115,136.11 | TRUE | 7372401YJ1077C0008PG | TRUE | TRUE | Completed | |||||||||||||

| 004938411030469741 | TRUE | SECURED | TRUE | 2/18/2048 | TRUE | 134 | TRUE | -- | TRUE | 2/15/2019 | TRUE | 156,719.26 | TRUE | 2/17/2026 | TRUE | 2.506% | TRUE | 3.506% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 196,572.36 | TRUE | 1589007DF3918N0035LO | TRUE | FALSE | Completed | ||||||||||||||

| 004939711030422729 | TRUE | SECURED | TRUE | 3/1/2047 | TRUE | 59 | TRUE | 9/1/2026 | TRUE | N/A | TRUE | 216,331.71 | TRUE | 8/31/2025 | TRUE | 3.650% | TRUE | 3.900% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 108,836.75 | TRUE | 4156710WF7845N0001LK | TRUE | FALSE | Completed | ||||||||||||||

| 004942761030000780 | TRUE | SECURED | TRUE | 9/21/2046 | TRUE | 161 | TRUE | -- | TRUE | 7/29/2016 | TRUE | 140,639.96 | TRUE | 4/15/2025 | TRUE | 3.609% | TRUE | 6.109% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 115,889.62 | TRUE | 2998101DF5929N0003EI | TRUE | FALSE | Completed | ||||||||||||||

| 004943621030000007 | TRUE | SECURED | TRUE | 2/20/2046 | TRUE | 40 | TRUE | -- | TRUE | 5/12/2020 | TRUE | 98,442.67 | TRUE | 2/19/2026 | TRUE | 2.506% | TRUE | 3.506% | TRUE | 1 | TRUE | 4/16/2024 | TRUE | 86,077.59 | TRUE | 0307516YH2500G0010JW | TRUE | FALSE | Completed | ||||||||||||||

| Loan ID | TYPE OF DEBT (SECURED/UNSECURED) | MATURITY DATE [as of 30/04/2025] |

DAYS PAST DUE | GRACE PERIOD END DATE [Enriched 14/04/2025] |

LAST RESTRUCTURING DATE [Enriched 07/05/2025] |

OUTSTANDING BALANCE (€) [as of 30/04/2025] |

CURRENT INTEREST INDEX NEXT RESET DATE | CURRENT INDEX REFERENCE RATE (%) | FINAL INTEREST RATE APPLIED POST-BONUS (%) | REGISTRY LIEN RANK [Enriched 07/05/2025] |

BANK APPRAISAL DATE | BANK APPRAISAL (€) | CADASTRAL REFERENCE | ||||||||||||||||||||||||||||||

| Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Data | Match | System | Exceptions | Status |

| 004943851030000090 | TRUE | SECURED | TRUE | 12/30/2043 | TRUE | 122 | TRUE | -- | TRUE | 9/28/2023 | TRUE | 17,438.82 | TRUE | 12/29/2025 | TRUE | 2.936% | TRUE | 7.186% | TRUE | 3 | TRUE | 5/20/2024 | TRUE | 180,132.11 | TRUE | 3038016DF1933N0001EZ | TRUE | FALSE | Completed | ||||||||||||||

| 004945721030000864 | TRUE | SECURED | TRUE | 2/28/2052 | TRUE | 91 | TRUE | -- | TRUE | 5/17/2012 | TRUE | 212,358.05 | TRUE | 2/27/2026 | TRUE | 2.506% | TRUE | 4.006% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 313,844.61 | TRUE | 1375123VK4417N0001EM | TRUE | FALSE | Completed | ||||||||||||||

| 004946171030609859 | TRUE | SECURED | TRUE | 4/1/2049 | TRUE | 120 | TRUE | -- | TRUE | 5/19/2022 | TRUE | 133,294.91 | TRUE | 5/31/2025 | TRUE | 3.718% | TRUE | 5.499% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 69,385.98 | TRUE | 5937307WF3653N0008OY | TRUE | FALSE | Completed | ||||||||||||||

| 004946591030612152 | TRUE | SECURED | TRUE | 8/4/2055 | TRUE | 117 | TRUE | -- | TRUE | N/A | TRUE | 95,339.34 | TRUE | 5/3/2025 | TRUE | 3.702% | TRUE | 5.452% | TRUE | 1 | TRUE | 4/30/2024 | TRUE | 9,331.10 | TRUE | 7702001WF1770S0144BW | TRUE | FALSE | Completed | ||||||||||||||

| 004948031030604170 | TRUE | SECURED | TRUE | 7/1/2047 | TRUE | 120 | TRUE | -- | TRUE | N/A | TRUE | 157,084.97 | TRUE | 6/30/2025 | TRUE | 3.680% | TRUE | 5.330% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 146,856.31 | TRUE | U1214571K | FALSE | U1214564K | TRUE | Completed | |||||||||||||

| 004948461030642186 | TRUE | SECURED | TRUE | 12/30/2044 | TRUE | 0 | TRUE | 12/30/2025 | TRUE | N/A | TRUE | 309,000.00 | TRUE | N/A | TRUE | N/A | TRUE | 5.500% | TRUE | 1 | TRUE | 11/11/2024 | TRUE | 147,942.00 | TRUE | 9589129VK9298H0001HX | TRUE | FALSE | Completed | ||||||||||||||

| 004948591030604925 | TRUE | SECURED | TRUE | 7/1/2053 | TRUE | 151 | TRUE | 6/1/2026 | TRUE | 3/30/2022 | TRUE | 98,063.23 | TRUE | 8/16/2025 | TRUE | 3.680% | TRUE | 3.930% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 151,207.58 | TRUE | 4206610VK1940N0040BQ | TRUE | FALSE | Completed | ||||||||||||||

| 004948661030629346 | TRUE | SECURED | TRUE | 7/27/2040 | TRUE | 125 | TRUE | -- | TRUE | 4/18/2012 | TRUE | 65,267.74 | TRUE | 10/26/2025 | TRUE | 3.526% | TRUE | 4.526% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 61,996.76 | TRUE | 4192111QC1849S0001OF | TRUE | FALSE | Completed | ||||||||||||||

| 004949341030604607 | TRUE | SECURED | TRUE | 1/25/2047 | TRUE | 96 | TRUE | 12/25/2025 | TRUE | 7/22/2022 | TRUE | 102,113.66 | TRUE | 12/24/2025 | TRUE | 2.691% | TRUE | 2.941% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 165,053.15 | TRUE | 5772535WF0757S0001DZ | TRUE | FALSE | Completed | ||||||||||||||

| 004949341030604613 | TRUE | SECURED | TRUE | 11/18/2048 | TRUE | 73 | TRUE | 12/18/2025 | TRUE | 7/22/2022 | TRUE | 67,263.36 | TRUE | 11/17/2025 | TRUE | 3.166% | TRUE | 3.416% | TRUE | 2 | TRUE | 5/20/2024 | TRUE | 165,053.15 | TRUE | 5772535WF0757S0001DZ | TRUE | FALSE | Completed | ||||||||||||||

| 004949461030699199 | TRUE | SECURED | TRUE | 7/29/2050 | TRUE | 123 | TRUE | -- | TRUE | N/A | TRUE | 110,148.94 | TRUE | 6/28/2025 | TRUE | 3.680% | TRUE | 4.930% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 104,121.50 | TRUE | 0273702DG4007E0024OL | TRUE | FALSE | Completed | ||||||||||||||

| 004949751030797383 | TRUE | SECURED | TRUE | 1/31/2048 | TRUE | 152 | TRUE | -- | TRUE | 3/15/2012 | TRUE | 169,475.02 | TRUE | 1/29/2026 | TRUE | 2.691% | TRUE | 3.441% | TRUE | 1 | TRUE | 9/5/2024 | TRUE | 153,324.81 | TRUE | 6034801QA5663C0001GT | TRUE | FALSE | Completed | ||||||||||||||

| 004949821030611154 | TRUE | SECURED | TRUE | 5/14/2037 | TRUE | 46 | TRUE | -- | TRUE | 5/5/2020 | TRUE | 73,132.03 | TRUE | 2/13/2026 | TRUE | 2.506% | TRUE | 3.256% | TRUE | 1 | TRUE | 10/28/2024 | TRUE | 174,276.96 | TRUE | 3899321CS7439N0003WQ | TRUE | FALSE | Completed | ||||||||||||||

| 004950101030726995 | TRUE | SECURED | TRUE | 12/31/2048 | TRUE | 152 | TRUE | -- | TRUE | 2/27/2023 | TRUE | 108,383.13 | TRUE | 2/27/2026 | TRUE | 2.506% | TRUE | 7.506% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 180,250.07 | TRUE | 4515105WN4041N0037AZ | TRUE | FALSE | Completed | ||||||||||||||

| 004950551030637636 | TRUE | SECURED | TRUE | 2/28/2049 | TRUE | 0 | TRUE | -- | TRUE | 2/21/2017 | TRUE | 33,846.28 | TRUE | 2/27/2026 | TRUE | 2.506% | TRUE | 4.006% | TRUE | 2 | TRUE | 4/25/2024 | TRUE | 94,950.64 | TRUE | 4990401YJ1148H0043YQ | TRUE | FALSE | Completed | ||||||||||||||

| 004950741030607338 | TRUE | SECURED | TRUE | 12/4/2049 | TRUE | 178 | TRUE | -- | TRUE | 6/2/2016 | TRUE | 133,007.04 | TRUE | 8/3/2025 | TRUE | 3.526% | TRUE | 4.776% | TRUE | 1 | TRUE | 9/13/2024 | TRUE | 118,049.92 | TRUE | 1579107DG4017N0003AB | TRUE | FALSE | Completed | ||||||||||||||

| 004951771030616655 | TRUE | SECURED | TRUE | 10/1/2045 | TRUE | 151 | TRUE | -- | TRUE | N/A | TRUE | 146,856.55 | TRUE | 5/31/2025 | TRUE | 3.718% | TRUE | 4.568% | TRUE | 1 | TRUE | 11/11/2014 | TRUE | 136,463.58 | TRUE | 8713823VK4381S0010FR | TRUE | FALSE | Completed | ||||||||||||||

| 004951781030649111 | TRUE | SECURED | TRUE | 10/31/2044 | TRUE | 29 | TRUE | -- | TRUE | 3/23/2021 | TRUE | 425,661.25 | TRUE | 1/30/2026 | TRUE | 2.691% | TRUE | 7.191% | TRUE | 1 | TRUE | 2/22/2024 | FALSE | 21/02/2025 | 279,714.28 | FALSE | 202,675.00 | 8339601VL1083N0017QQ | TRUE | TRUE | Completed | ||||||||||||

| 004951811030644474 | TRUE | SECURED | TRUE | 8/4/2052 | TRUE | 56 | TRUE | -- | TRUE | 5/29/2024 | TRUE | 224,401.45 | TRUE | 7/3/2025 | TRUE | 3.650% | TRUE | 5.150% | TRUE | 1 | TRUE | 4/25/2024 | TRUE | 395,838.98 | TRUE | 3837601VK4633N0008KE | TRUE | FALSE | Completed | ||||||||||||||

| 004951821030637166 | TRUE | SECURED | TRUE | 11/30/2061 | TRUE | 0 | TRUE | -- | TRUE | 2/20/2024 | TRUE | 140,131.47 | TRUE | 2/27/2026 | TRUE | 2.506% | TRUE | 6.206% | TRUE | 1 | TRUE | 9/24/2024 | TRUE | 292,982.11 | TRUE | 6432202VK2863S0005IY | TRUE | FALSE | Completed | ||||||||||||||

| 004952631030694306 | TRUE | SECURED | TRUE | 1/1/2048 | TRUE | 151 | TRUE | -- | TRUE | N/A | TRUE | 118,755.41 | TRUE | 12/31/2025 | TRUE | 2.506% | TRUE | 3.456% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 50,874.93 | TRUE | 1618404QH1211N0006YM | TRUE | FALSE | Completed | ||||||||||||||

| 004952861030604183 | TRUE | SECURED | TRUE | 9/30/2064 | TRUE | 91 | TRUE | -- | TRUE | 9/10/2024 | TRUE | 122,627.44 | TRUE | 9/29/2025 | TRUE | 3.166% | TRUE | 4.526% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 134,087.44 | TRUE | 8160604YJ3986S0009UK | TRUE | FALSE | Completed | ||||||||||||||

| 004953221030632526 | TRUE | SECURED | TRUE | 12/26/2046 | TRUE | 65 | TRUE | -- | TRUE | 7/13/2020 | TRUE | 202,963.73 | TRUE | 12/25/2025 | TRUE | 2.936% | TRUE | 3.686% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 157,849.80 | TRUE | 0951707CS3015S032GM | TRUE | FALSE | Completed | ||||||||||||||

| 004954831030642868 | TRUE | SECURED | TRUE | 6/23/2038 | TRUE | 6 | TRUE | -- | TRUE | 12/28/2023 | TRUE | 200,610.87 | TRUE | 6/22/2025 | TRUE | 3.718% | TRUE | 4.298% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 185,056.46 | TRUE | 2071859XM7027S0032FF | TRUE | FALSE | Completed | ||||||||||||||

| 004957381030618897 | TRUE | SECURED | TRUE | 4/10/2048 | TRUE | 142 | TRUE | -- | TRUE | 12/14/2011 | TRUE | 107,631.10 | TRUE | 4/9/2025 | TRUE | 3.609% | TRUE | 4.359% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 75,266.73 | TRUE | 8599143VG3189N0027GK | TRUE | FALSE | Completed | ||||||||||||||

| 004957491030000016 | TRUE | SECURED | TRUE | 11/22/2033 | TRUE | 69 | TRUE | -- | TRUE | 10/8/2013 | TRUE | 39,904.92 | TRUE | 2/21/2026 | TRUE | 2.506% | TRUE | 5.006% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 151,768.32 | TRUE | 4944802YJ2744D0010DU | TRUE | FALSE | Completed | ||||||||||||||

| 004957501030604080 | TRUE | SECURED | TRUE | 3/4/2053 | TRUE | 117 | TRUE | -- | TRUE | 12/5/2023 | TRUE | 280,171.86 | TRUE | 3/3/2025 | TRUE | 3.679% | TRUE | 4.429% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 234,843.26 | TRUE | 0777714DF3807F0009GO | TRUE | FALSE | Completed | ||||||||||||||

| 004957691030000178 | TRUE | SECURED | TRUE | 11/1/2053 | TRUE | 90 | TRUE | -- | TRUE | 2/26/2016 | TRUE | 137,206.15 | TRUE | 1/31/2026 | TRUE | 2.436% | TRUE | 3.686% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 105,325.06 | TRUE | 3645984VN5534N0066ZB | TRUE | FALSE | Completed | ||||||||||||||

| 004957921030602960 | TRUE | SECURED | TRUE | 2/4/2058 | TRUE | 178 | TRUE | -- | TRUE | 10/6/2021 | TRUE | 226,578.72 | TRUE | 12/3/2025 | TRUE | 2.506% | TRUE | 3.756% | TRUE | 1 | TRUE | 12/28/2016 | TRUE | 184,391.63 | TRUE | 4082104UF1348S0002HQ | TRUE | FALSE | Completed | ||||||||||||||

| 004959091030604284 | TRUE | SECURED | TRUE | 7/29/2048 | TRUE | 0 | TRUE | -- | TRUE | 7/20/2017 | TRUE | 294,107.09 | TRUE | No reset | TRUE | 2.506% | TRUE | 1.519% | TRUE | 1 | TRUE | 2/10/2024 | TRUE | 736,145.49 | TRUE | 345341H | TRUE | FALSE | Completed | ||||||||||||||

| 004959431030633467 | TRUE | SECURED | TRUE | 12/31/2034 | TRUE | 29 | TRUE | -- | TRUE | 4/29/2015 | TRUE | 61,411.10 | TRUE | 2/27/2026 | TRUE | 2.525% | TRUE | 4.525% | TRUE | 1 | TRUE | 2/8/2024 | TRUE | 96,040.94 | TRUE | 6396410YJ2769N0001LM | TRUE | FALSE | Completed | ||||||||||||||

| 004960071030603725 | TRUE | SECURED | TRUE | 7/31/2040 | TRUE | 90 | TRUE | -- | TRUE | 4/30/2020 | TRUE | 183,489.77 | TRUE | 7/31/2025 | TRUE | 3.526% | TRUE | 5.066% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 182,141.37 | TRUE | 3473510UF7637S0001YB | TRUE | FALSE | Completed | ||||||||||||||

| 004960141030614904 | TRUE | SECURED | TRUE | 9/4/2041 | TRUE | 56 | TRUE | 3/4/2026 | TRUE | 7/20/2021 | TRUE | 205,225.42 | TRUE | 3/3/2025 | TRUE | 3.679% | TRUE | 3.929% | TRUE | 1 | TRUE | 5/20/2024 | TRUE | 144,012.85 | TRUE | 9038001VL6093N0001LY | TRUE | FALSE | Completed | ||||||||||||||